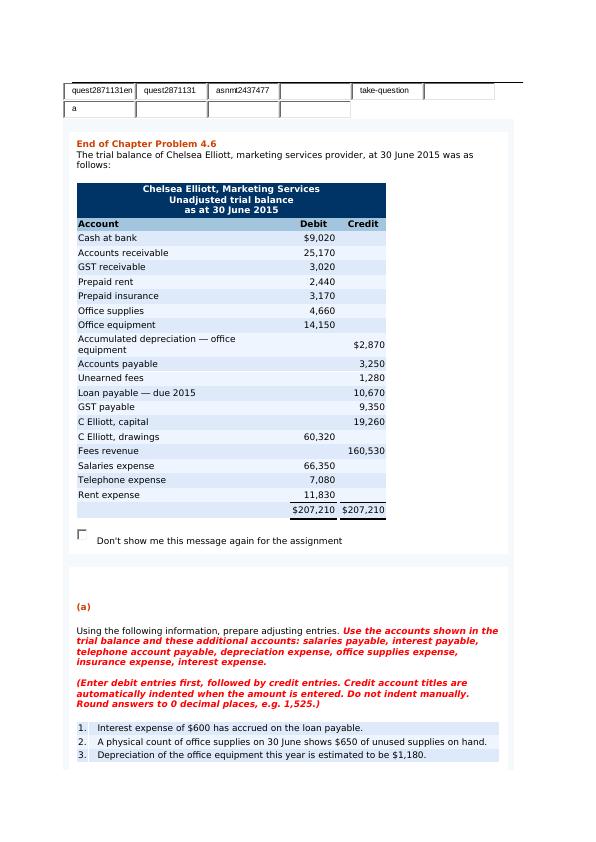

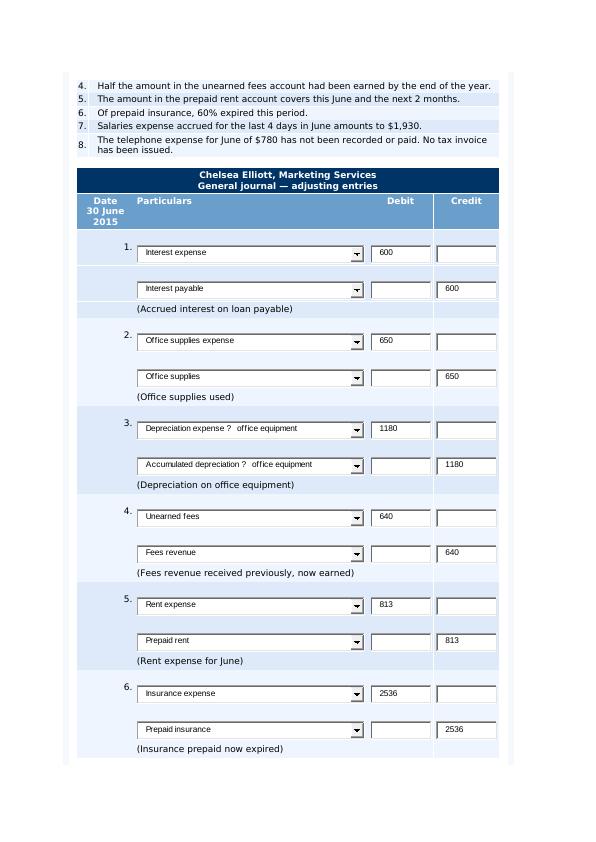

End of Chapter Problem 4.6

Added on 2023-04-04

4 Pages512 Words139 Views

End of preview

Want to access all the pages? Upload your documents or become a member.

Accounting Theory and Application

|16

|1751

|348

Principles of Accounting: Preparation of Financial Statements and Closing Entries

|17

|3154

|90

Adjustment Transactions Of Paul Services

|6

|844

|119

Business Report Writing Skills

|12

|2898

|85

Accounting Principles: Financial Statement Analysis of Vinhomes

|15

|2401

|63

Exercise 3.5: No.

|2

|204

|55