Calculate Payroll Register

VerifiedAdded on 2023/01/10

|4

|674

|62

AI Summary

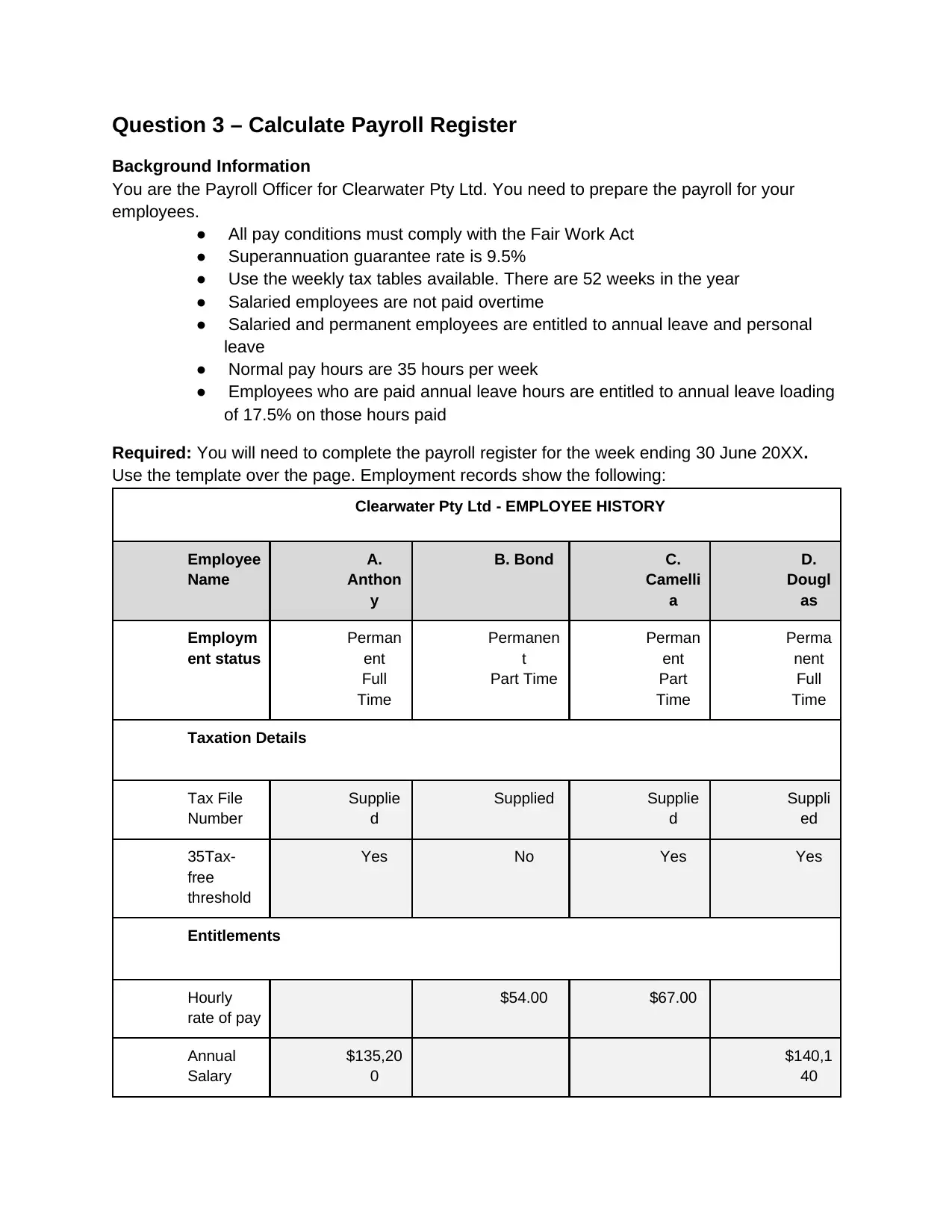

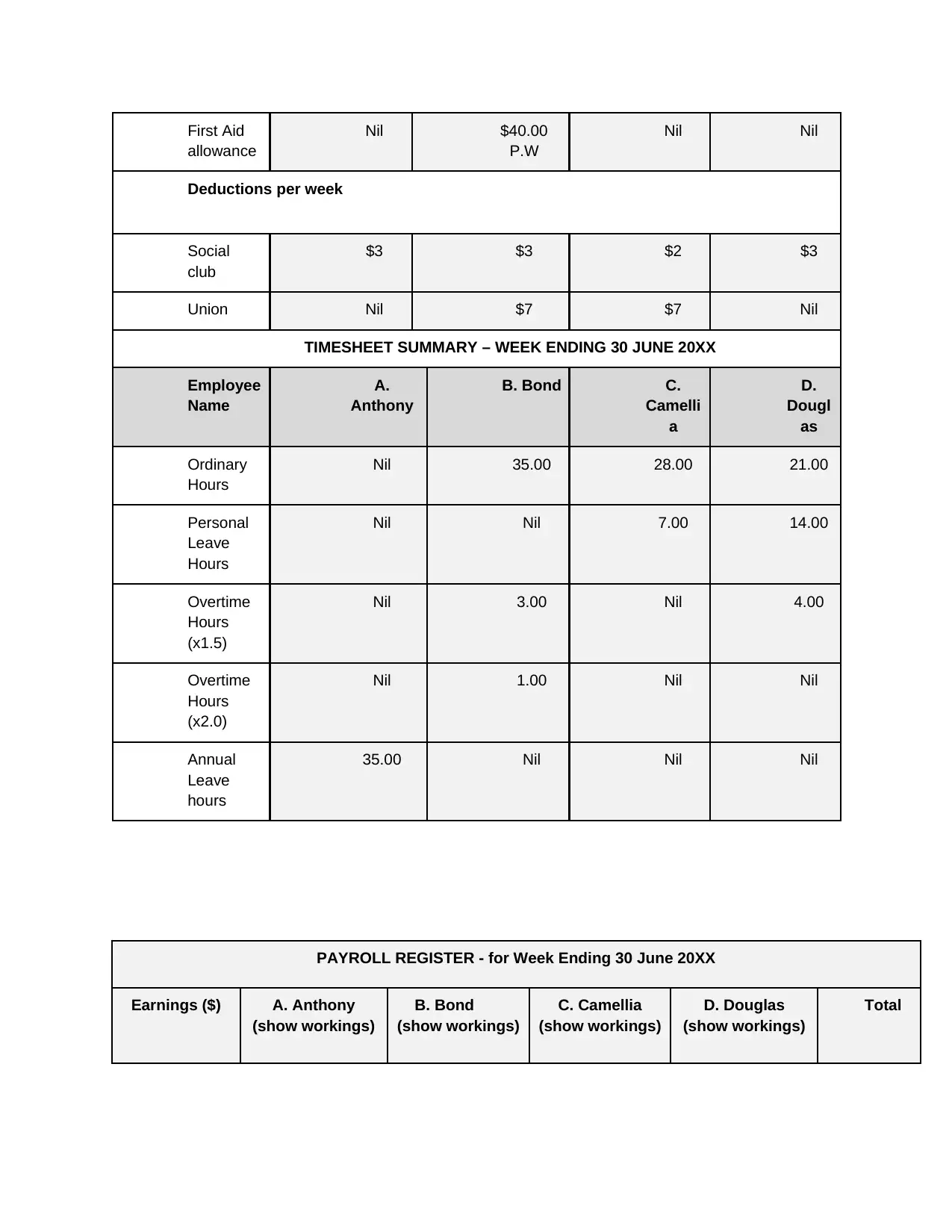

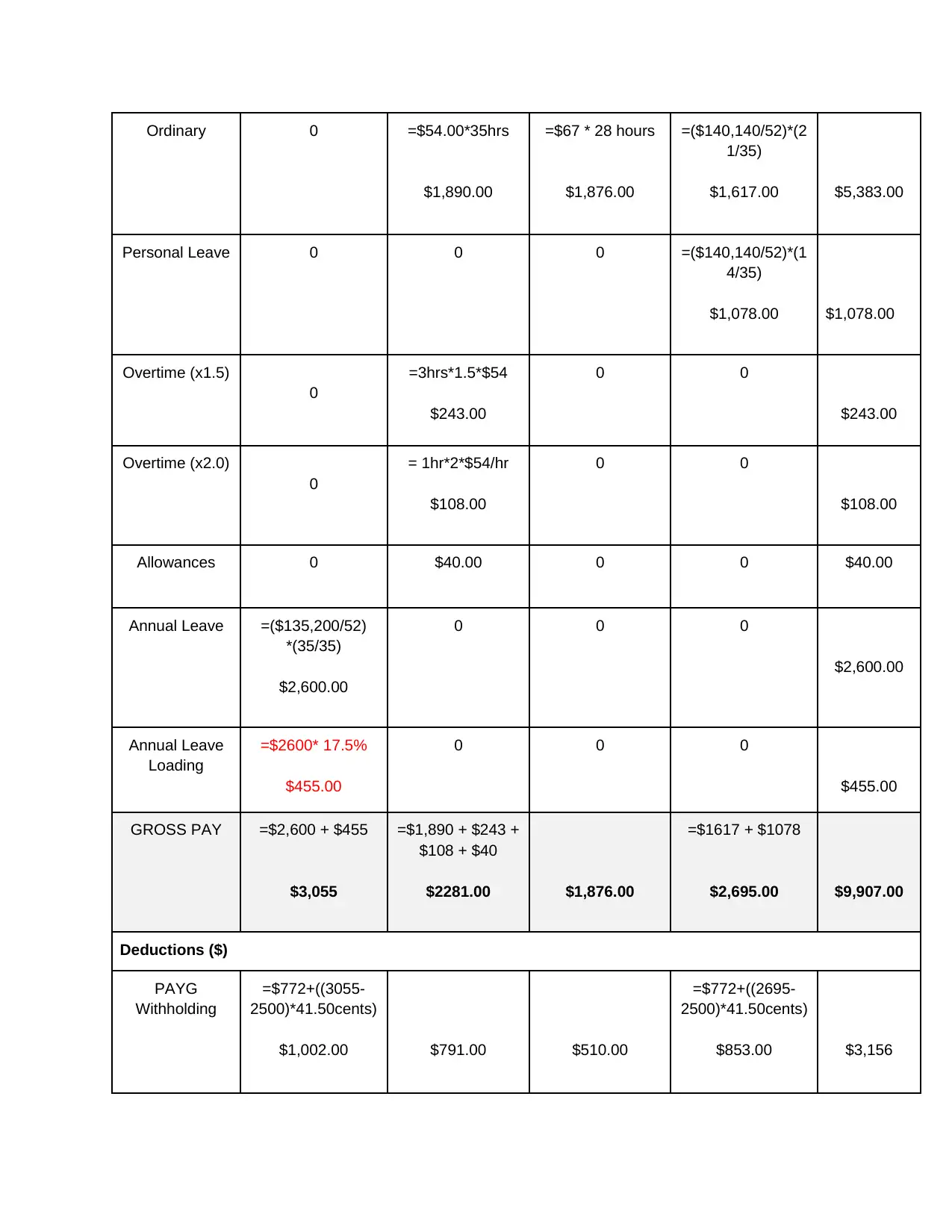

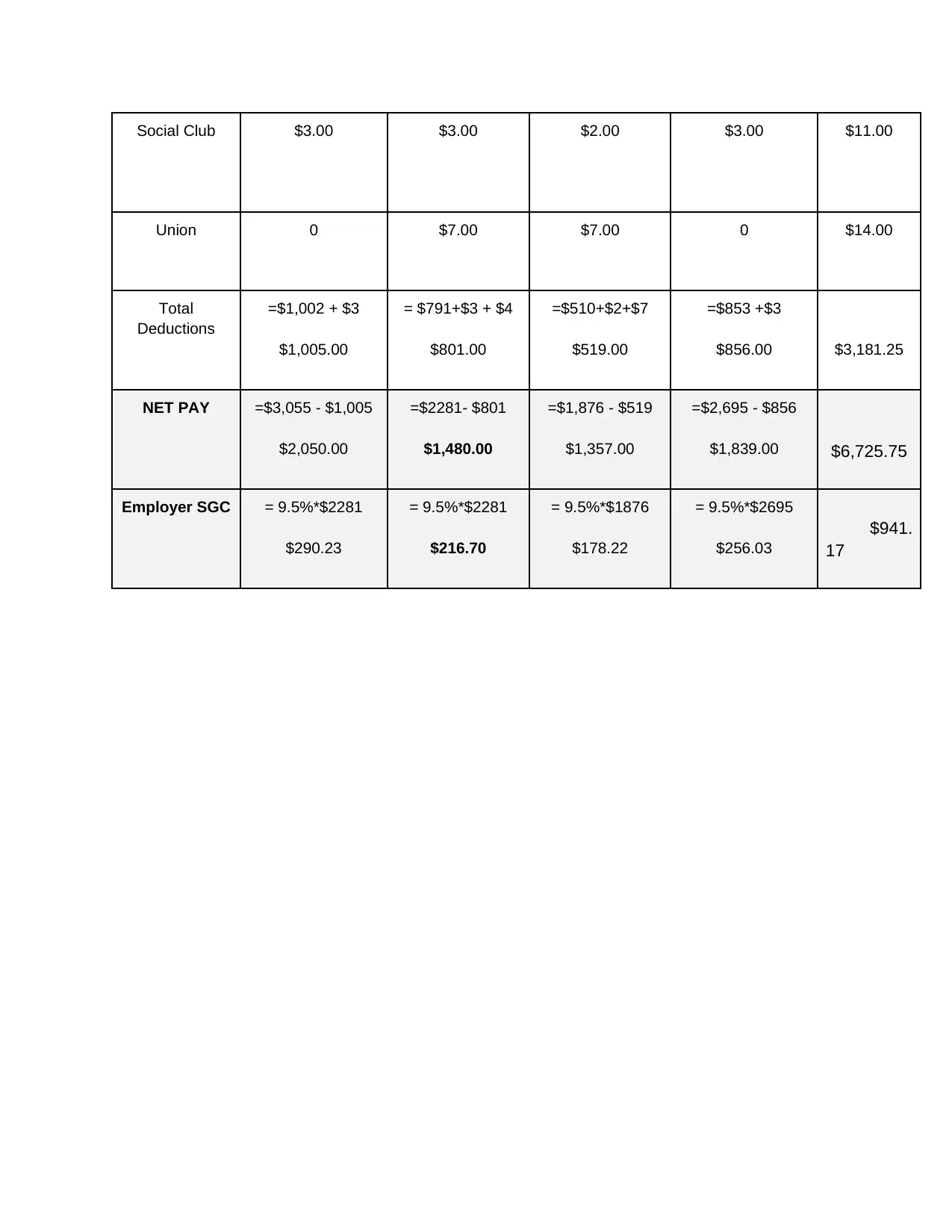

This document provides instructions on how to calculate the payroll register for employees of Clearwater Pty Ltd. It includes information on pay conditions, superannuation guarantee rate, tax tables, and entitlements. The document also includes a template for recording employee details and a step-by-step guide for calculating earnings, deductions, and net pay.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)