Analyzing Financial Health: Ratio Analysis of ANZ & Commonwealth

VerifiedAdded on 2021/06/15

|20

|4434

|60

Report

AI Summary

This report analyzes the financial statements of The Australia and New Zealand Banking Group Limited (ANZ) and Commonwealth Bank of Australia using ratio analysis. It assesses their long-term solvency, short-term solvency (liquidity), asset utilization, profitability, and market value. For ANZ, the debt-to-equity ratio indicates a high debt component, while the interest coverage ratio suggests no issues in paying interest expenses. Liquidity ratios are low, which could be a concern. Asset turnover is constant, and return on assets has increased. Profitability ratios show a significant increase in net margin. Market value ratios show an increase in earnings per share, but a low dividend yield. For Commonwealth Bank, both current and quick ratios have improved slightly. A low debt equity ratio is preferred. The report concludes with a comparison of the ratios between the two banks, providing insights into their relative financial positions. Desklib offers similar solved assignments and past papers for students.

Ratio analysis

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction......................................................................................................................................3

The Australia and New Zealand Banking Group Limited...............................................................4

Long term solvency.....................................................................................................................4

Short term solvency (Liquidity ratio)..........................................................................................4

Asset utilization ratio...................................................................................................................5

Profitability ratio..........................................................................................................................6

Market value ratios......................................................................................................................7

Commonwealth Bank of Australia..................................................................................................8

Short term solvency (Liquidity ratios).........................................................................................8

Long term solvency ratio (Financial leverage ratio)..................................................................10

Asset utilization ratio.................................................................................................................12

Profitability ratio........................................................................................................................14

Market value ratios-...................................................................................................................15

Comparison between ratios of two banking companies................................................................16

Conclusion.....................................................................................................................................18

References......................................................................................................................................19

2

Introduction......................................................................................................................................3

The Australia and New Zealand Banking Group Limited...............................................................4

Long term solvency.....................................................................................................................4

Short term solvency (Liquidity ratio)..........................................................................................4

Asset utilization ratio...................................................................................................................5

Profitability ratio..........................................................................................................................6

Market value ratios......................................................................................................................7

Commonwealth Bank of Australia..................................................................................................8

Short term solvency (Liquidity ratios).........................................................................................8

Long term solvency ratio (Financial leverage ratio)..................................................................10

Asset utilization ratio.................................................................................................................12

Profitability ratio........................................................................................................................14

Market value ratios-...................................................................................................................15

Comparison between ratios of two banking companies................................................................16

Conclusion.....................................................................................................................................18

References......................................................................................................................................19

2

Introduction

Main objective of this report is to analyze financial statement of two companies with the help of

ratio analysis. Ratio analysis helps in giving a sense of understandability to the financial

information provided in financial statements of a company (David, 2011). Analysis of financial

statement is one of the very important function that can help in determining actual progress of

company as comparison can be made with its past year performances and other companies

working in similar industry (). This ratio analysis and comparison with other organization helps

in making plans related to business finance, operation and other strategic business areas. The role

of financial statement analysis increases where the level of competition among various

companies is very high. In such scenarios, a company can gain competitive advantage over other

companies with the help of financial statement analysis (Wheelen et.al, 2017). Here ratio

analysis has been used to analyze financial position of two major banking sector companies in

Australia that are Commonwealth Bank of Australia and The Australia and New Zealand

Banking Group Limited. Ratio analysis has been done in two parts. Firstly each of the two

companies are analyzed on individual basis and then comparison has been made between ratios

of these companies.

3

Main objective of this report is to analyze financial statement of two companies with the help of

ratio analysis. Ratio analysis helps in giving a sense of understandability to the financial

information provided in financial statements of a company (David, 2011). Analysis of financial

statement is one of the very important function that can help in determining actual progress of

company as comparison can be made with its past year performances and other companies

working in similar industry (). This ratio analysis and comparison with other organization helps

in making plans related to business finance, operation and other strategic business areas. The role

of financial statement analysis increases where the level of competition among various

companies is very high. In such scenarios, a company can gain competitive advantage over other

companies with the help of financial statement analysis (Wheelen et.al, 2017). Here ratio

analysis has been used to analyze financial position of two major banking sector companies in

Australia that are Commonwealth Bank of Australia and The Australia and New Zealand

Banking Group Limited. Ratio analysis has been done in two parts. Firstly each of the two

companies are analyzed on individual basis and then comparison has been made between ratios

of these companies.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The Australia and New Zealand Banking Group Limited

The Australia and New Zealand Banking Group Limited

This analysis has been sub categories into four subjective analysis of company that are

profitability, efficiency, liquidity and market analysis.

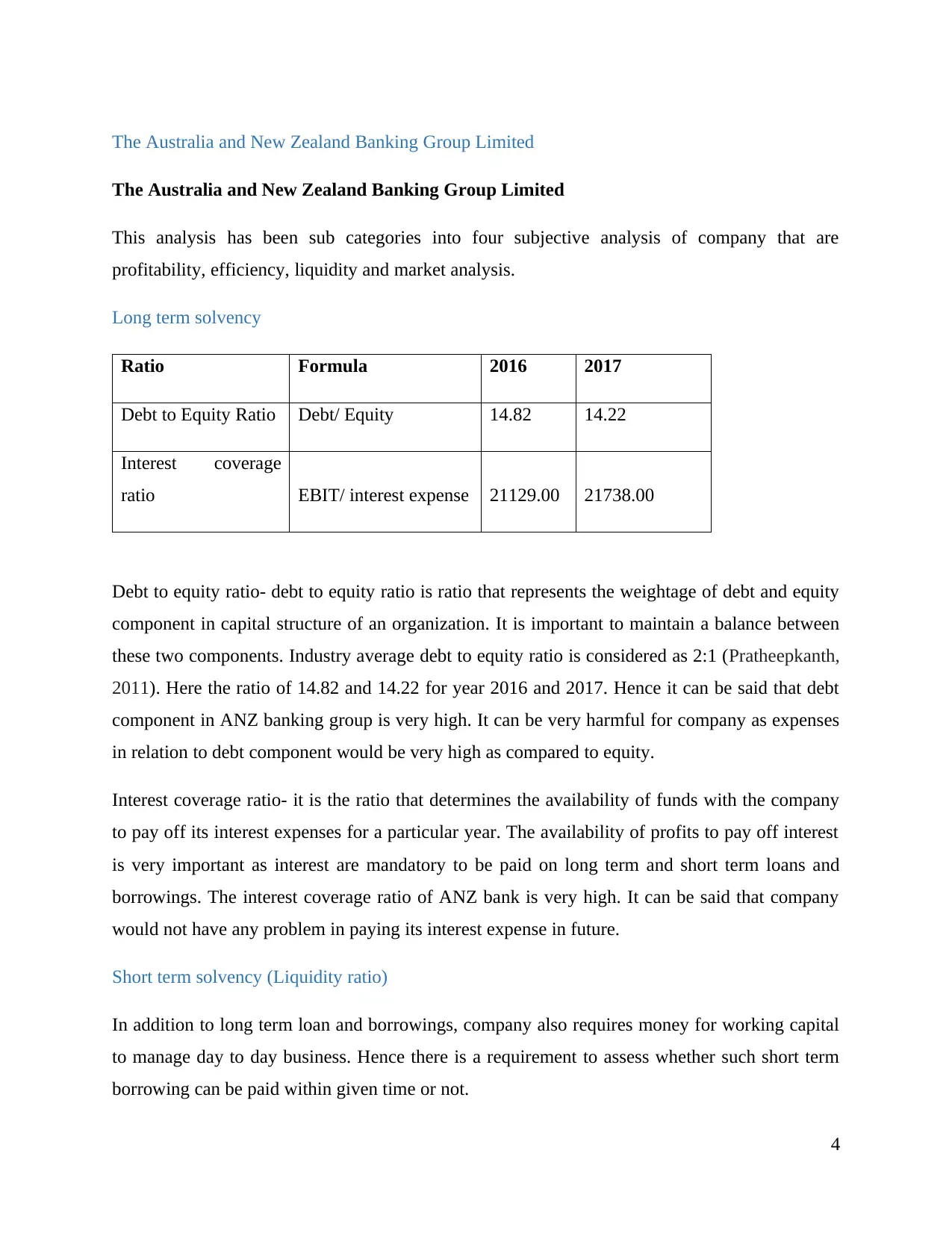

Long term solvency

Ratio Formula 2016 2017

Debt to Equity Ratio Debt/ Equity 14.82 14.22

Interest coverage

ratio EBIT/ interest expense 21129.00 21738.00

Debt to equity ratio- debt to equity ratio is ratio that represents the weightage of debt and equity

component in capital structure of an organization. It is important to maintain a balance between

these two components. Industry average debt to equity ratio is considered as 2:1 (Pratheepkanth,

2011). Here the ratio of 14.82 and 14.22 for year 2016 and 2017. Hence it can be said that debt

component in ANZ banking group is very high. It can be very harmful for company as expenses

in relation to debt component would be very high as compared to equity.

Interest coverage ratio- it is the ratio that determines the availability of funds with the company

to pay off its interest expenses for a particular year. The availability of profits to pay off interest

is very important as interest are mandatory to be paid on long term and short term loans and

borrowings. The interest coverage ratio of ANZ bank is very high. It can be said that company

would not have any problem in paying its interest expense in future.

Short term solvency (Liquidity ratio)

In addition to long term loan and borrowings, company also requires money for working capital

to manage day to day business. Hence there is a requirement to assess whether such short term

borrowing can be paid within given time or not.

4

The Australia and New Zealand Banking Group Limited

This analysis has been sub categories into four subjective analysis of company that are

profitability, efficiency, liquidity and market analysis.

Long term solvency

Ratio Formula 2016 2017

Debt to Equity Ratio Debt/ Equity 14.82 14.22

Interest coverage

ratio EBIT/ interest expense 21129.00 21738.00

Debt to equity ratio- debt to equity ratio is ratio that represents the weightage of debt and equity

component in capital structure of an organization. It is important to maintain a balance between

these two components. Industry average debt to equity ratio is considered as 2:1 (Pratheepkanth,

2011). Here the ratio of 14.82 and 14.22 for year 2016 and 2017. Hence it can be said that debt

component in ANZ banking group is very high. It can be very harmful for company as expenses

in relation to debt component would be very high as compared to equity.

Interest coverage ratio- it is the ratio that determines the availability of funds with the company

to pay off its interest expenses for a particular year. The availability of profits to pay off interest

is very important as interest are mandatory to be paid on long term and short term loans and

borrowings. The interest coverage ratio of ANZ bank is very high. It can be said that company

would not have any problem in paying its interest expense in future.

Short term solvency (Liquidity ratio)

In addition to long term loan and borrowings, company also requires money for working capital

to manage day to day business. Hence there is a requirement to assess whether such short term

borrowing can be paid within given time or not.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

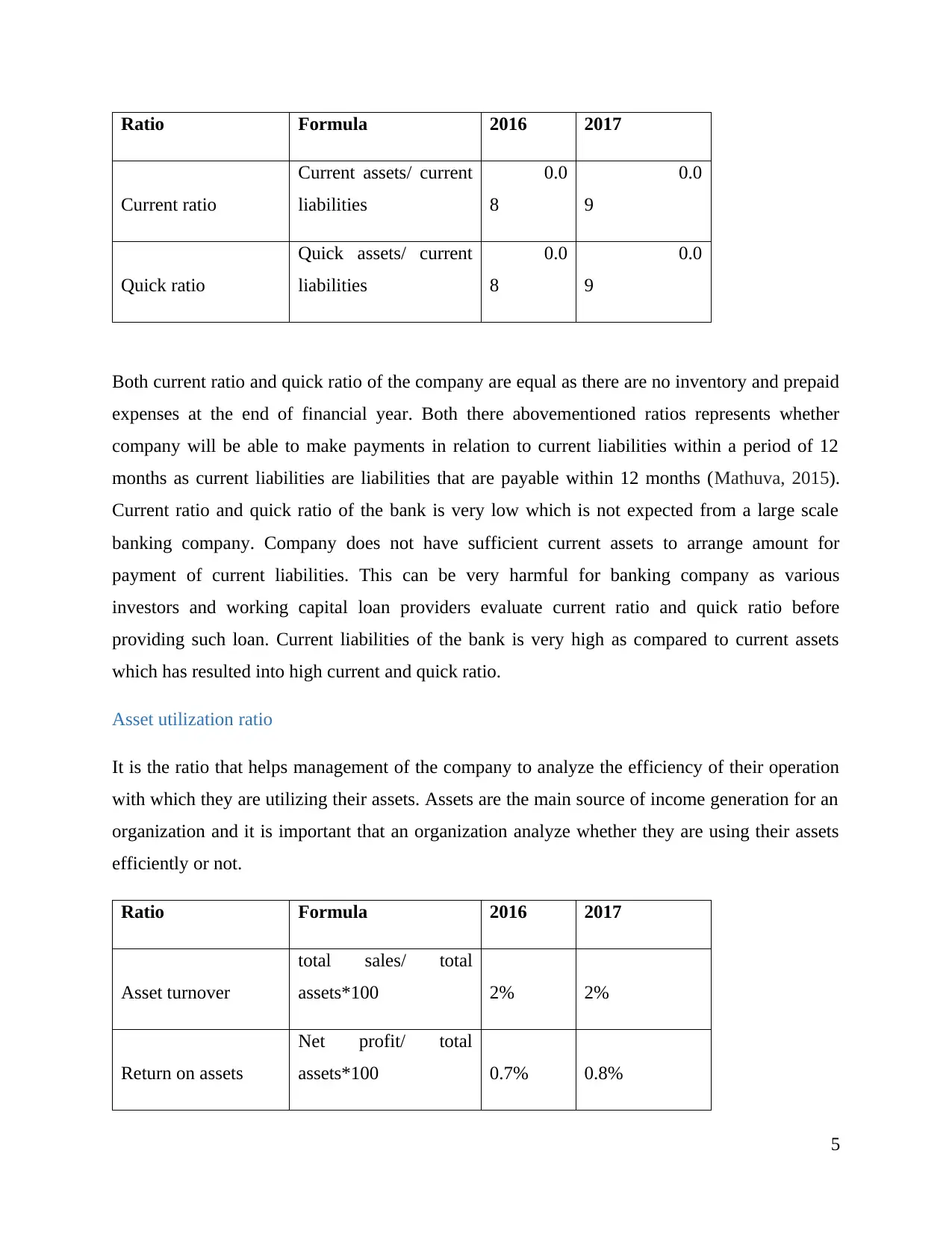

Ratio Formula 2016 2017

Current ratio

Current assets/ current

liabilities

0.0

8

0.0

9

Quick ratio

Quick assets/ current

liabilities

0.0

8

0.0

9

Both current ratio and quick ratio of the company are equal as there are no inventory and prepaid

expenses at the end of financial year. Both there abovementioned ratios represents whether

company will be able to make payments in relation to current liabilities within a period of 12

months as current liabilities are liabilities that are payable within 12 months (Mathuva, 2015).

Current ratio and quick ratio of the bank is very low which is not expected from a large scale

banking company. Company does not have sufficient current assets to arrange amount for

payment of current liabilities. This can be very harmful for banking company as various

investors and working capital loan providers evaluate current ratio and quick ratio before

providing such loan. Current liabilities of the bank is very high as compared to current assets

which has resulted into high current and quick ratio.

Asset utilization ratio

It is the ratio that helps management of the company to analyze the efficiency of their operation

with which they are utilizing their assets. Assets are the main source of income generation for an

organization and it is important that an organization analyze whether they are using their assets

efficiently or not.

Ratio Formula 2016 2017

Asset turnover

total sales/ total

assets*100 2% 2%

Return on assets

Net profit/ total

assets*100 0.7% 0.8%

5

Current ratio

Current assets/ current

liabilities

0.0

8

0.0

9

Quick ratio

Quick assets/ current

liabilities

0.0

8

0.0

9

Both current ratio and quick ratio of the company are equal as there are no inventory and prepaid

expenses at the end of financial year. Both there abovementioned ratios represents whether

company will be able to make payments in relation to current liabilities within a period of 12

months as current liabilities are liabilities that are payable within 12 months (Mathuva, 2015).

Current ratio and quick ratio of the bank is very low which is not expected from a large scale

banking company. Company does not have sufficient current assets to arrange amount for

payment of current liabilities. This can be very harmful for banking company as various

investors and working capital loan providers evaluate current ratio and quick ratio before

providing such loan. Current liabilities of the bank is very high as compared to current assets

which has resulted into high current and quick ratio.

Asset utilization ratio

It is the ratio that helps management of the company to analyze the efficiency of their operation

with which they are utilizing their assets. Assets are the main source of income generation for an

organization and it is important that an organization analyze whether they are using their assets

efficiently or not.

Ratio Formula 2016 2017

Asset turnover

total sales/ total

assets*100 2% 2%

Return on assets

Net profit/ total

assets*100 0.7% 0.8%

5

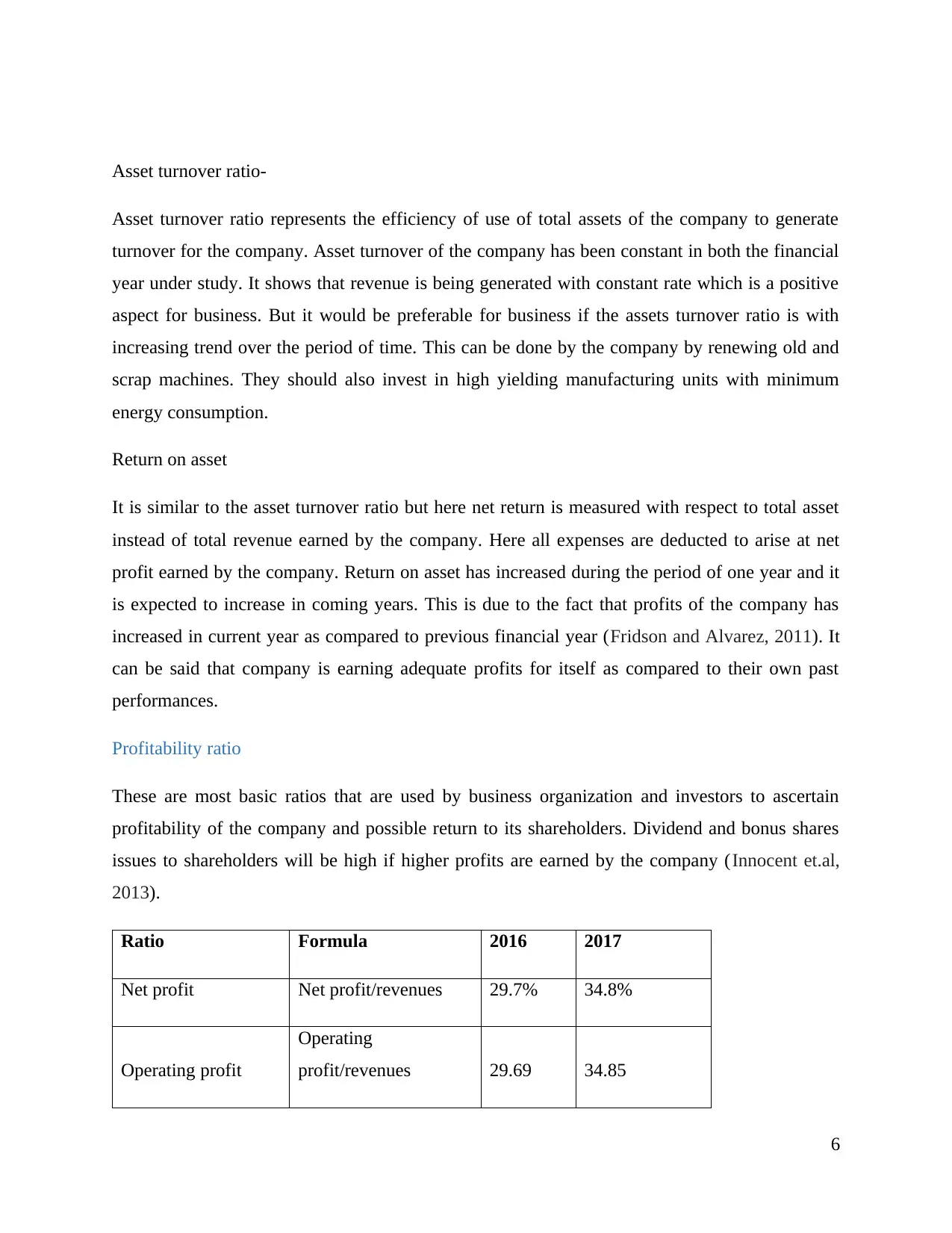

Asset turnover ratio-

Asset turnover ratio represents the efficiency of use of total assets of the company to generate

turnover for the company. Asset turnover of the company has been constant in both the financial

year under study. It shows that revenue is being generated with constant rate which is a positive

aspect for business. But it would be preferable for business if the assets turnover ratio is with

increasing trend over the period of time. This can be done by the company by renewing old and

scrap machines. They should also invest in high yielding manufacturing units with minimum

energy consumption.

Return on asset

It is similar to the asset turnover ratio but here net return is measured with respect to total asset

instead of total revenue earned by the company. Here all expenses are deducted to arise at net

profit earned by the company. Return on asset has increased during the period of one year and it

is expected to increase in coming years. This is due to the fact that profits of the company has

increased in current year as compared to previous financial year (Fridson and Alvarez, 2011). It

can be said that company is earning adequate profits for itself as compared to their own past

performances.

Profitability ratio

These are most basic ratios that are used by business organization and investors to ascertain

profitability of the company and possible return to its shareholders. Dividend and bonus shares

issues to shareholders will be high if higher profits are earned by the company (Innocent et.al,

2013).

Ratio Formula 2016 2017

Net profit Net profit/revenues 29.7% 34.8%

Operating profit

Operating

profit/revenues 29.69 34.85

6

Asset turnover ratio represents the efficiency of use of total assets of the company to generate

turnover for the company. Asset turnover of the company has been constant in both the financial

year under study. It shows that revenue is being generated with constant rate which is a positive

aspect for business. But it would be preferable for business if the assets turnover ratio is with

increasing trend over the period of time. This can be done by the company by renewing old and

scrap machines. They should also invest in high yielding manufacturing units with minimum

energy consumption.

Return on asset

It is similar to the asset turnover ratio but here net return is measured with respect to total asset

instead of total revenue earned by the company. Here all expenses are deducted to arise at net

profit earned by the company. Return on asset has increased during the period of one year and it

is expected to increase in coming years. This is due to the fact that profits of the company has

increased in current year as compared to previous financial year (Fridson and Alvarez, 2011). It

can be said that company is earning adequate profits for itself as compared to their own past

performances.

Profitability ratio

These are most basic ratios that are used by business organization and investors to ascertain

profitability of the company and possible return to its shareholders. Dividend and bonus shares

issues to shareholders will be high if higher profits are earned by the company (Innocent et.al,

2013).

Ratio Formula 2016 2017

Net profit Net profit/revenues 29.7% 34.8%

Operating profit

Operating

profit/revenues 29.69 34.85

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Operating profit is equal to net profit earned as a company working is banking sector does not

have major expenses and all expenses in such companies are indirect expenses. The net margin

ratio has increased by 17 % which can be considered as a significant increase in profits. There

can be various reasons for such increase in profitability such as operational efficiency, brand

value, established name etc. all of these factors has contributed towards this operating and net

profit margin. Strategic planning should be done by the management of the company to study the

current operating strategy (Ongore and Kusa, 2013). These strategies should be documented and

followed in near futures so that same ratio proportion of profitability can be maintained in future.

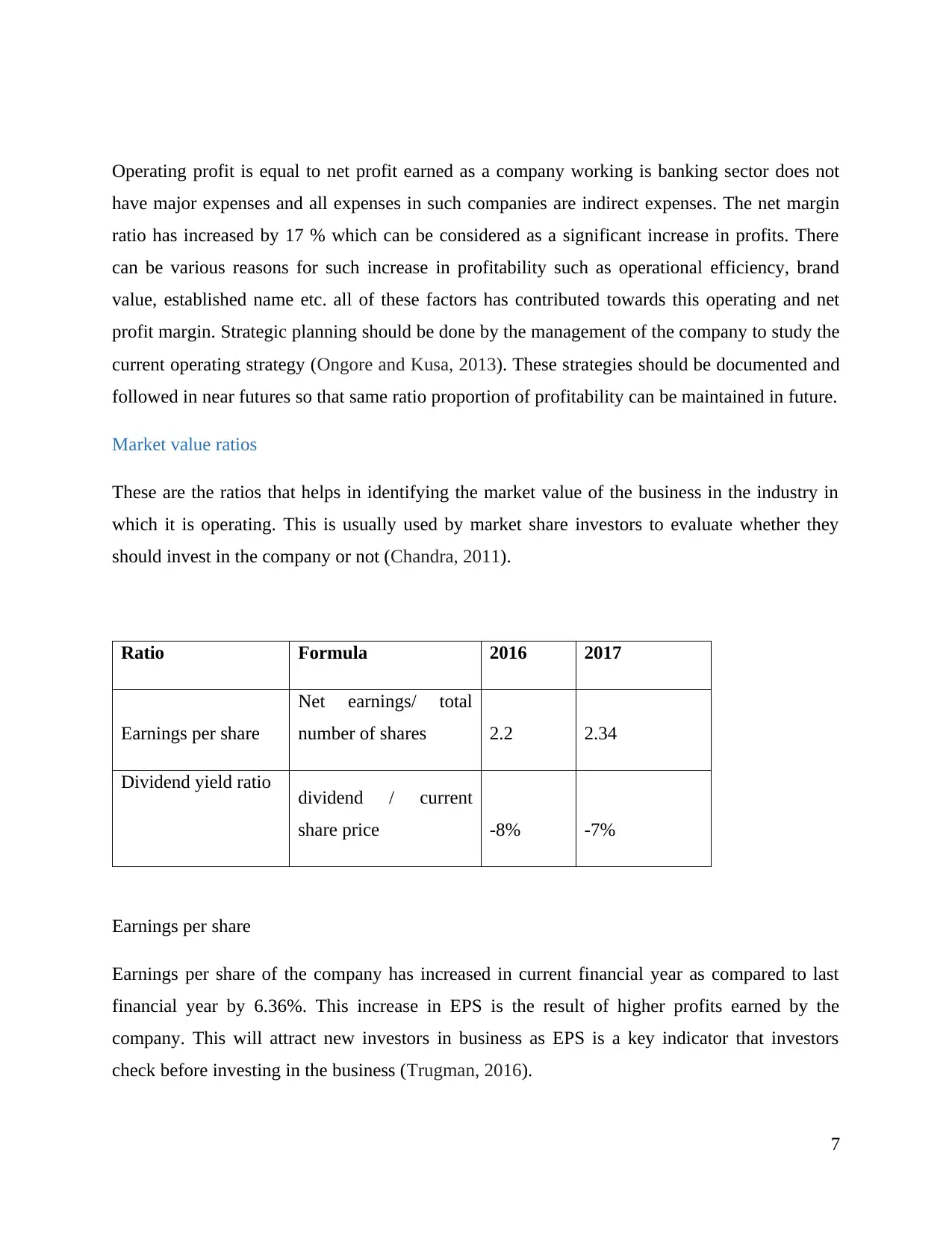

Market value ratios

These are the ratios that helps in identifying the market value of the business in the industry in

which it is operating. This is usually used by market share investors to evaluate whether they

should invest in the company or not (Chandra, 2011).

Ratio Formula 2016 2017

Earnings per share

Net earnings/ total

number of shares 2.2 2.34

Dividend yield ratio dividend / current

share price -8% -7%

Earnings per share

Earnings per share of the company has increased in current financial year as compared to last

financial year by 6.36%. This increase in EPS is the result of higher profits earned by the

company. This will attract new investors in business as EPS is a key indicator that investors

check before investing in the business (Trugman, 2016).

7

have major expenses and all expenses in such companies are indirect expenses. The net margin

ratio has increased by 17 % which can be considered as a significant increase in profits. There

can be various reasons for such increase in profitability such as operational efficiency, brand

value, established name etc. all of these factors has contributed towards this operating and net

profit margin. Strategic planning should be done by the management of the company to study the

current operating strategy (Ongore and Kusa, 2013). These strategies should be documented and

followed in near futures so that same ratio proportion of profitability can be maintained in future.

Market value ratios

These are the ratios that helps in identifying the market value of the business in the industry in

which it is operating. This is usually used by market share investors to evaluate whether they

should invest in the company or not (Chandra, 2011).

Ratio Formula 2016 2017

Earnings per share

Net earnings/ total

number of shares 2.2 2.34

Dividend yield ratio dividend / current

share price -8% -7%

Earnings per share

Earnings per share of the company has increased in current financial year as compared to last

financial year by 6.36%. This increase in EPS is the result of higher profits earned by the

company. This will attract new investors in business as EPS is a key indicator that investors

check before investing in the business (Trugman, 2016).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dividend yield ratio

This is the ratio that forms a relationship between dividend paid to shareholders of the company

and market prices of the share of the company prevailing in share market. In simple words it can

be said dividend yield shows the proportion of market share of the company that is distributed by

the company in form of dividend. Dividend yield of the company is very low in both the

financial years under consideration. Hence it can be said that company should increase the

amount of dividend paid to equity shareholders of the company.

Commonwealth Bank of Australia

Short term solvency (Liquidity ratios)

Current Ratio: represents a company’s liquidity i.e. A company’s ability to meets its short term

obligations from its short term assets.

The higher the current ratio, higher will be financial viability of the company. .

Current Ratio = Current Assets

Current Liabilities (Sharma and Kumar, 2011).

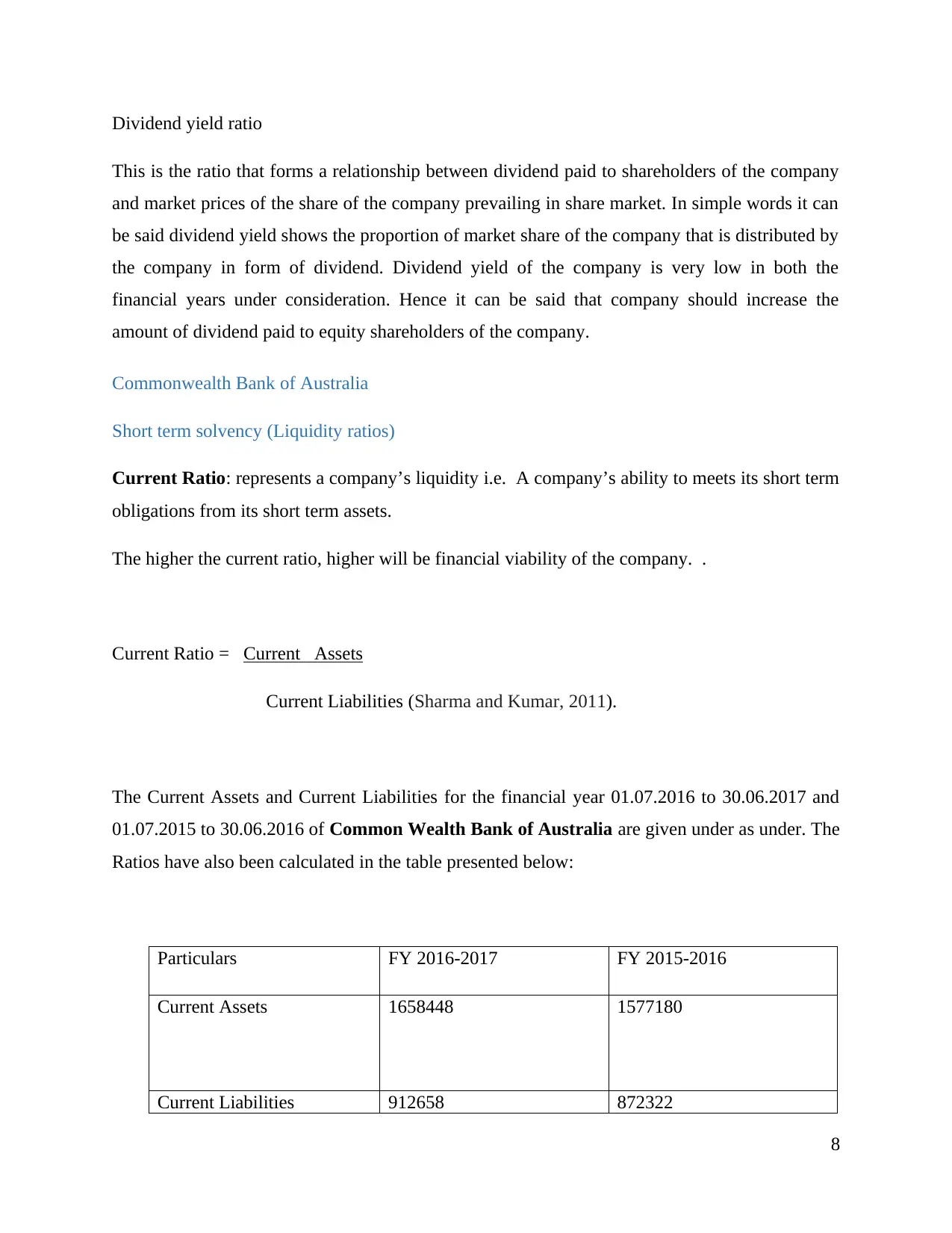

The Current Assets and Current Liabilities for the financial year 01.07.2016 to 30.06.2017 and

01.07.2015 to 30.06.2016 of Common Wealth Bank of Australia are given under as under. The

Ratios have also been calculated in the table presented below:

Particulars FY 2016-2017 FY 2015-2016

Current Assets 1658448 1577180

Current Liabilities 912658 872322

8

This is the ratio that forms a relationship between dividend paid to shareholders of the company

and market prices of the share of the company prevailing in share market. In simple words it can

be said dividend yield shows the proportion of market share of the company that is distributed by

the company in form of dividend. Dividend yield of the company is very low in both the

financial years under consideration. Hence it can be said that company should increase the

amount of dividend paid to equity shareholders of the company.

Commonwealth Bank of Australia

Short term solvency (Liquidity ratios)

Current Ratio: represents a company’s liquidity i.e. A company’s ability to meets its short term

obligations from its short term assets.

The higher the current ratio, higher will be financial viability of the company. .

Current Ratio = Current Assets

Current Liabilities (Sharma and Kumar, 2011).

The Current Assets and Current Liabilities for the financial year 01.07.2016 to 30.06.2017 and

01.07.2015 to 30.06.2016 of Common Wealth Bank of Australia are given under as under. The

Ratios have also been calculated in the table presented below:

Particulars FY 2016-2017 FY 2015-2016

Current Assets 1658448 1577180

Current Liabilities 912658 872322

8

Current Ratio 1.82 Times 1.81 Times

% Change 0.55%

(1.82-1.81/1.81)*100

Analysis: The Current Ratio in the FY 2016-2017 has improved from the previous FY 2015-

2016 by 0.55% .This means that the company will be in a better position to meets its short term

debts from its currents assets.

The reason for improvement in the current ratio is the increase in current assets by AUD $ 81268

and similarly the current liabilities have also increased by AUD$ 40336

Hence the net increase in the Current Ratio shall be 0.55%.

Quick Ratio: Quick ratio means how quickly a company can meet its short term liabilities, it is

also known as acid test ratio. Stock and current assets are the two components which are

excluded from current assets while calculating the Quick ratio. The reason why these are

excluded is because stocks and prepaid expenses cannot be converted into cash as easily and

quickly as other current assets like Investment in banks/shares.

Quick Ratio= Current assets- (stock +Prepaid expenses)

Current Liabilities

The Current Assets, Stocks and prepaid expenses and Current Liabilities for the financial year

01.07.2016 to 30.06.2017 and 01.07.2015 to 30.06.2016 of Common Wealth Bank of

9

% Change 0.55%

(1.82-1.81/1.81)*100

Analysis: The Current Ratio in the FY 2016-2017 has improved from the previous FY 2015-

2016 by 0.55% .This means that the company will be in a better position to meets its short term

debts from its currents assets.

The reason for improvement in the current ratio is the increase in current assets by AUD $ 81268

and similarly the current liabilities have also increased by AUD$ 40336

Hence the net increase in the Current Ratio shall be 0.55%.

Quick Ratio: Quick ratio means how quickly a company can meet its short term liabilities, it is

also known as acid test ratio. Stock and current assets are the two components which are

excluded from current assets while calculating the Quick ratio. The reason why these are

excluded is because stocks and prepaid expenses cannot be converted into cash as easily and

quickly as other current assets like Investment in banks/shares.

Quick Ratio= Current assets- (stock +Prepaid expenses)

Current Liabilities

The Current Assets, Stocks and prepaid expenses and Current Liabilities for the financial year

01.07.2016 to 30.06.2017 and 01.07.2015 to 30.06.2016 of Common Wealth Bank of

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

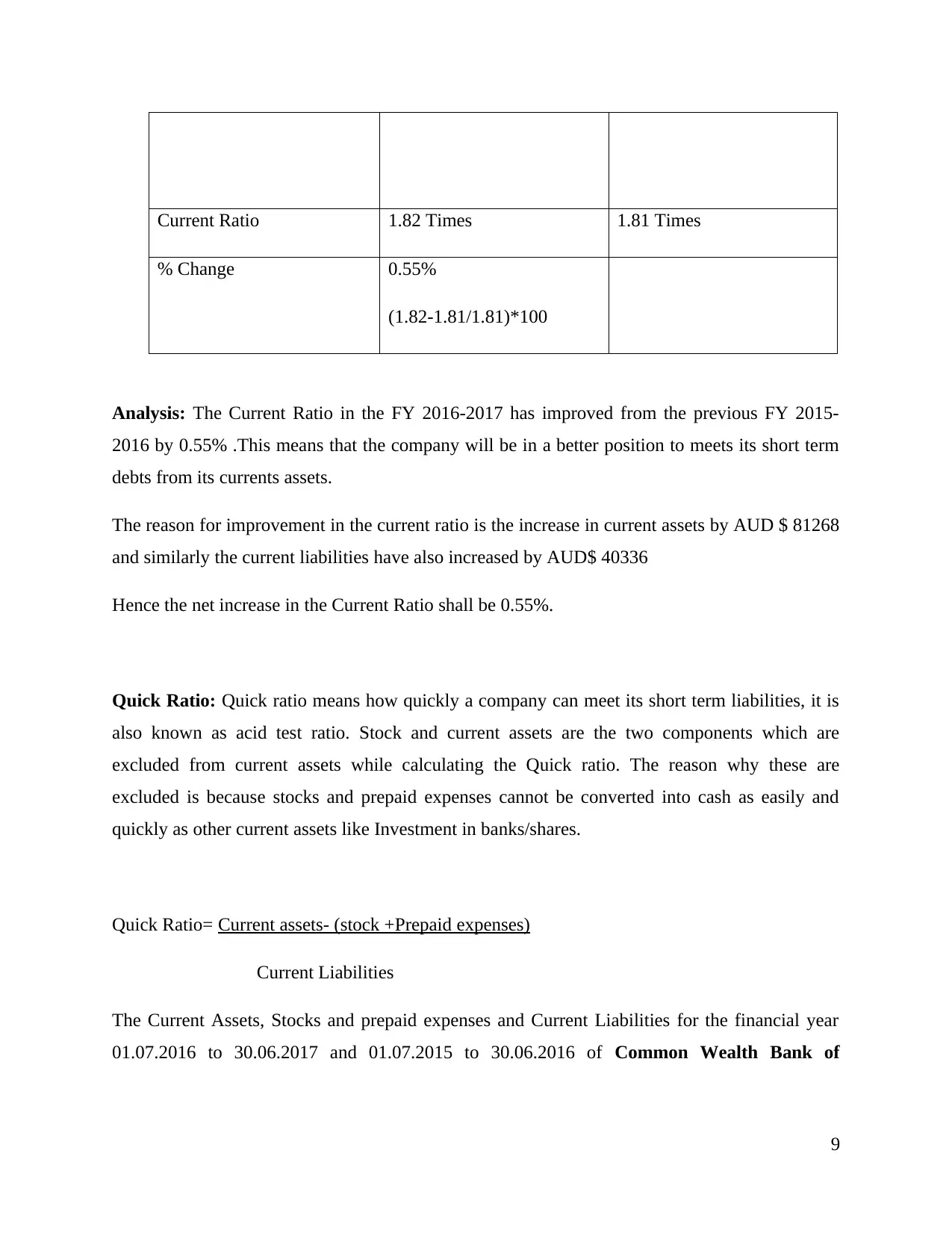

Australia are given under as under. The Ratios have also been calculated in the table presented

below:

Particulars FY 2016-2017 FY 2015-2016

Current Assets 1658448 1577180

Current Liabilities 912658 872322

Current Ratio 1.82 Times* 1.81 Times*

% Change 0.55%

(1.82-1.81/1.81)*100

*Since Common Wealth Bank of Australia is a financial service provider, hence there will be no

trading stocks. Also there are no prepaid expenses explicitly mentioned in the financial

statements.

Analysis: The Quick Ratio in the FY 2016-2017 has improved from the previous FY 2015-2016

by 0.55% .This means that the company will be in a better position to meets its short term debts

from its Quick assets.

The reason for improvement in the Quick ratio is the increase in current assets by AUD $ 81268

and similarly the current liabilities have also increased by AUD$ 40336

Hence the net increase in the Current Ratio shall be 0.55%.

10

below:

Particulars FY 2016-2017 FY 2015-2016

Current Assets 1658448 1577180

Current Liabilities 912658 872322

Current Ratio 1.82 Times* 1.81 Times*

% Change 0.55%

(1.82-1.81/1.81)*100

*Since Common Wealth Bank of Australia is a financial service provider, hence there will be no

trading stocks. Also there are no prepaid expenses explicitly mentioned in the financial

statements.

Analysis: The Quick Ratio in the FY 2016-2017 has improved from the previous FY 2015-2016

by 0.55% .This means that the company will be in a better position to meets its short term debts

from its Quick assets.

The reason for improvement in the Quick ratio is the increase in current assets by AUD $ 81268

and similarly the current liabilities have also increased by AUD$ 40336

Hence the net increase in the Current Ratio shall be 0.55%.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

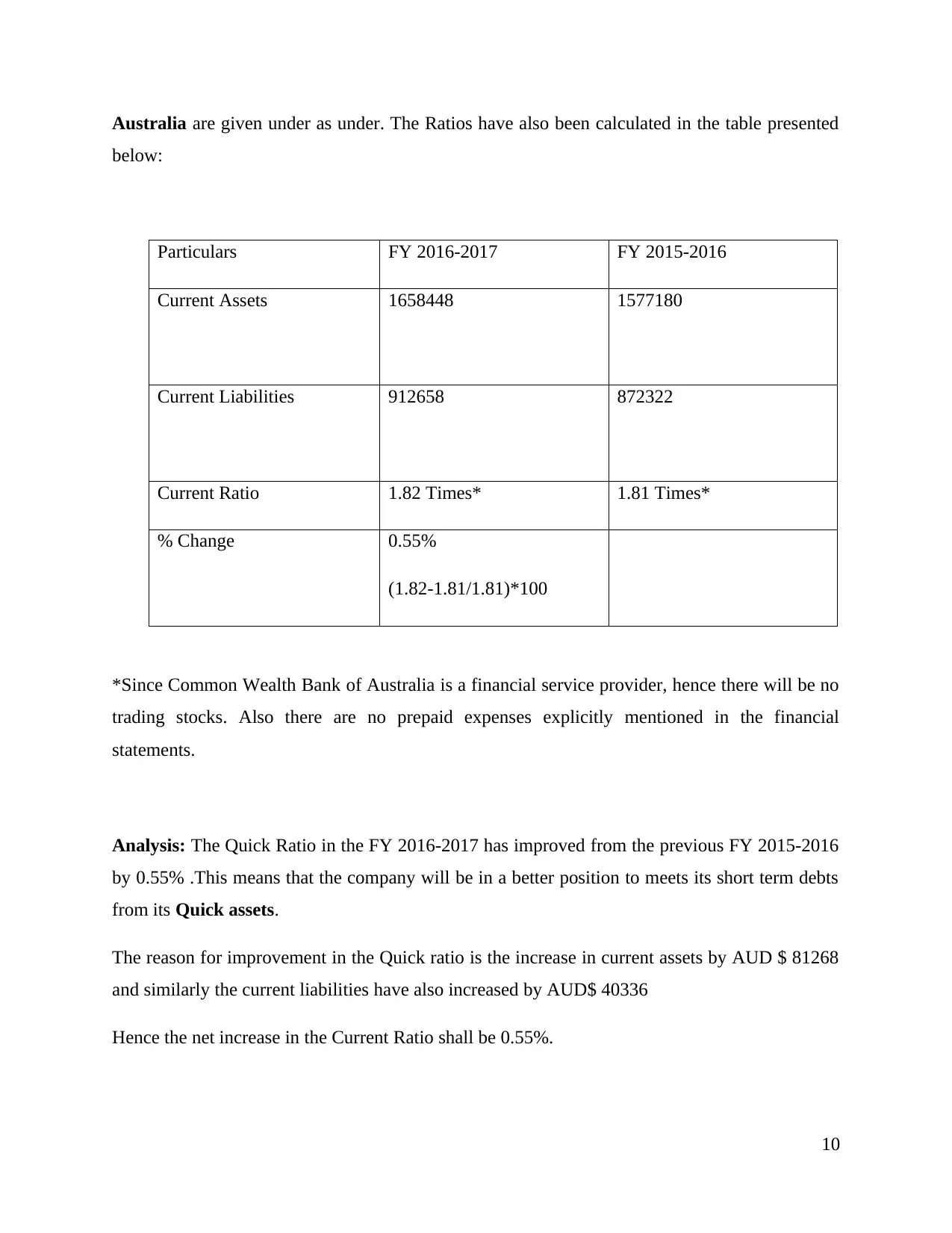

Long term solvency ratio (Financial leverage ratio)

Debt Equity ratio: Debt Equity ratio means the proportionate of the liabilities of a company to

its equity or the shareholder’s funds. Which further means, Debt equity ratio represents the ratio

of the funds used by the company to source its assets (Feld et.al, 2013)

A high debt equity ratio means outside borrowings from creditors are more than borrowings from

shareholders made by the company to source its assets. However a low Debt Equity ratio means

the involvement of shareholder’s funds is more than the outside borrowings. Hence a Low Debt

Equity ratio is always preferred.

The Relevant financial figures for calculation of debt equity ratio are as follows:

Particulars FY 2016-2017 FY 2015-2016

Debt ( Total Liabilities) 912658 872322

Equity (Shareholders funds) 63170 60206

Debt Equity ratio 14.45 14.49

% Change 0.28%

{(14.49-14.45)/14.49}*100

Analysis: In the FY 2015-2016 Debt Equity ratio is 14.49 times which implies that outside

borrowings are 14.49 times more than shareholder’s funds involved in the business. However in

the year 2016-2017 the ratio is 14.45 times.

The debt equity ratio has improved in the year 2016-2017, but it is still very high. The

involvement of such high outside funds (debts) is not good from the financial perspective.

Such situations can lead to bankruptcy in the business.

11

Debt Equity ratio: Debt Equity ratio means the proportionate of the liabilities of a company to

its equity or the shareholder’s funds. Which further means, Debt equity ratio represents the ratio

of the funds used by the company to source its assets (Feld et.al, 2013)

A high debt equity ratio means outside borrowings from creditors are more than borrowings from

shareholders made by the company to source its assets. However a low Debt Equity ratio means

the involvement of shareholder’s funds is more than the outside borrowings. Hence a Low Debt

Equity ratio is always preferred.

The Relevant financial figures for calculation of debt equity ratio are as follows:

Particulars FY 2016-2017 FY 2015-2016

Debt ( Total Liabilities) 912658 872322

Equity (Shareholders funds) 63170 60206

Debt Equity ratio 14.45 14.49

% Change 0.28%

{(14.49-14.45)/14.49}*100

Analysis: In the FY 2015-2016 Debt Equity ratio is 14.49 times which implies that outside

borrowings are 14.49 times more than shareholder’s funds involved in the business. However in

the year 2016-2017 the ratio is 14.45 times.

The debt equity ratio has improved in the year 2016-2017, but it is still very high. The

involvement of such high outside funds (debts) is not good from the financial perspective.

Such situations can lead to bankruptcy in the business.

11

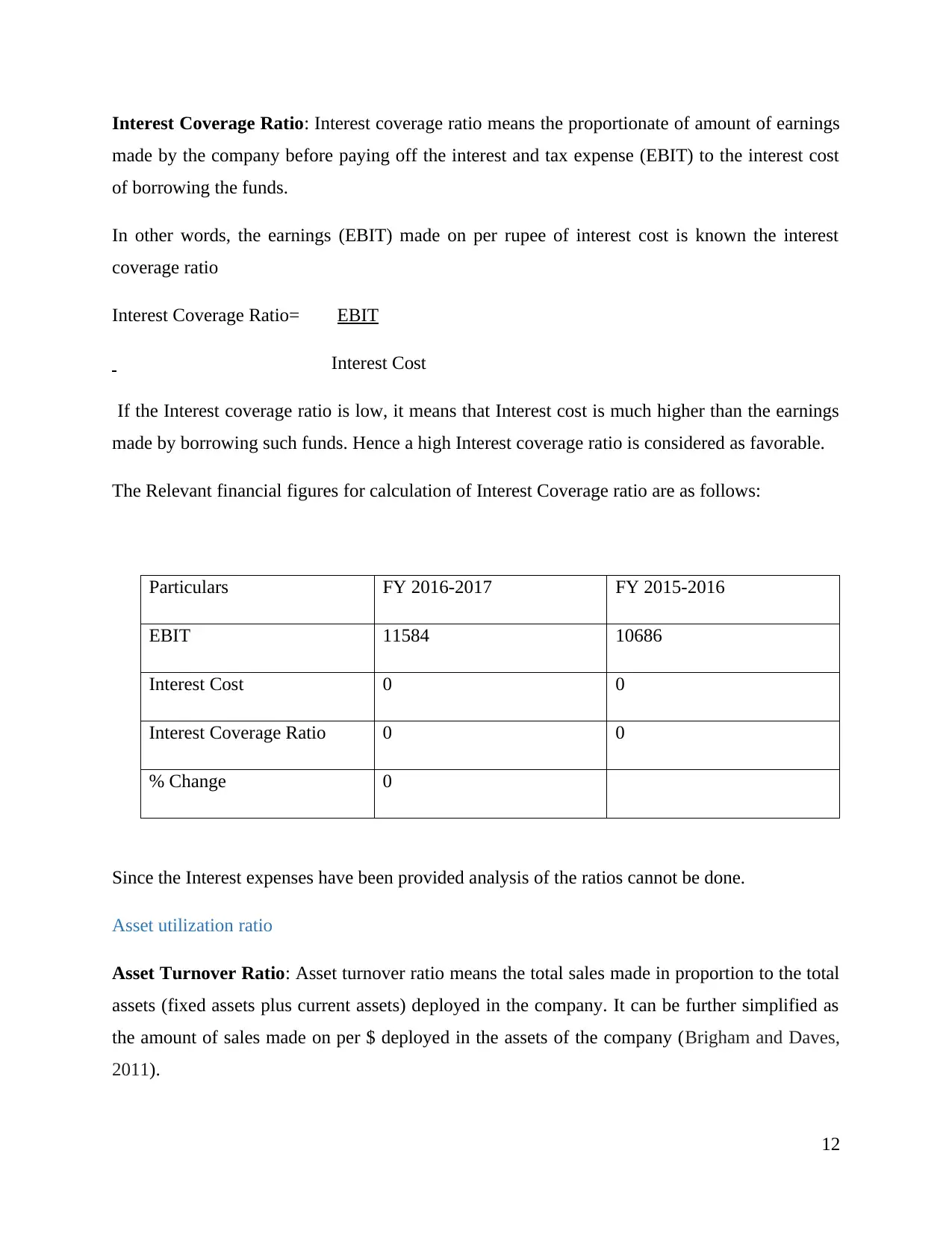

Interest Coverage Ratio: Interest coverage ratio means the proportionate of amount of earnings

made by the company before paying off the interest and tax expense (EBIT) to the interest cost

of borrowing the funds.

In other words, the earnings (EBIT) made on per rupee of interest cost is known the interest

coverage ratio

Interest Coverage Ratio= EBIT

Interest Cost

If the Interest coverage ratio is low, it means that Interest cost is much higher than the earnings

made by borrowing such funds. Hence a high Interest coverage ratio is considered as favorable.

The Relevant financial figures for calculation of Interest Coverage ratio are as follows:

Particulars FY 2016-2017 FY 2015-2016

EBIT 11584 10686

Interest Cost 0 0

Interest Coverage Ratio 0 0

% Change 0

Since the Interest expenses have been provided analysis of the ratios cannot be done.

Asset utilization ratio

Asset Turnover Ratio: Asset turnover ratio means the total sales made in proportion to the total

assets (fixed assets plus current assets) deployed in the company. It can be further simplified as

the amount of sales made on per $ deployed in the assets of the company (Brigham and Daves,

2011).

12

made by the company before paying off the interest and tax expense (EBIT) to the interest cost

of borrowing the funds.

In other words, the earnings (EBIT) made on per rupee of interest cost is known the interest

coverage ratio

Interest Coverage Ratio= EBIT

Interest Cost

If the Interest coverage ratio is low, it means that Interest cost is much higher than the earnings

made by borrowing such funds. Hence a high Interest coverage ratio is considered as favorable.

The Relevant financial figures for calculation of Interest Coverage ratio are as follows:

Particulars FY 2016-2017 FY 2015-2016

EBIT 11584 10686

Interest Cost 0 0

Interest Coverage Ratio 0 0

% Change 0

Since the Interest expenses have been provided analysis of the ratios cannot be done.

Asset utilization ratio

Asset Turnover Ratio: Asset turnover ratio means the total sales made in proportion to the total

assets (fixed assets plus current assets) deployed in the company. It can be further simplified as

the amount of sales made on per $ deployed in the assets of the company (Brigham and Daves,

2011).

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.