Ratio Analysis Report: Financial Performance Analysis of 2018 Data

VerifiedAdded on 2023/06/10

|12

|2287

|407

Report

AI Summary

This report presents a comprehensive ratio analysis of a company's financial performance, comparing 2015 and 2016 data. It delves into profitability ratios like Gross Profit Margin, Return on Total Assets (ROA), and Net Profit to Equity (ROE), alongside efficiency ratios such as Asset Turnover and Collec...

RATIO ANALYSIS

2018

2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By – Kamalpreet kaur

Instructor – Colleen lister

Date: 24th June 2018.

CONTENTS:

1 | P a g e

By – Kamalpreet kaur

Instructor – Colleen lister

Date: 24th June 2018.

CONTENTS:

1 | P a g e

2

Question 1...........…………………………………………………......................…...3

Question 2......................……………….....................................................................4

Question 3......................……………….....................................................................5

Question 4......................……………….....................................................................6

References......................……………….....................................................................7

Question 1

2 | P a g e

Question 1...........…………………………………………………......................…...3

Question 2......................……………….....................................................................4

Question 3......................……………….....................................................................5

Question 4......................……………….....................................................................6

References......................……………….....................................................................7

Question 1

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

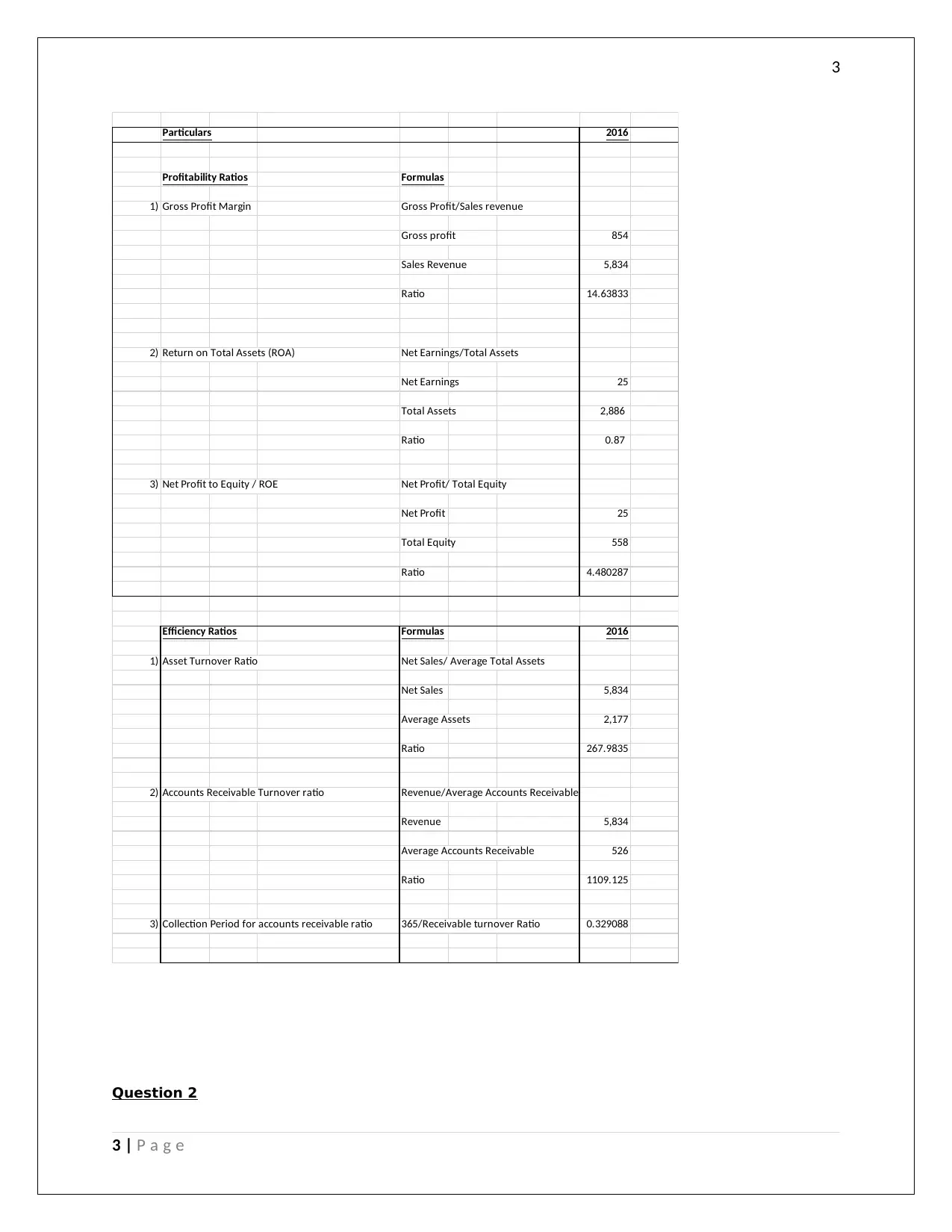

Particulars 2016

Profitability Ratios Formulas

1) Gross Profit Margin Gross Profit/Sales revenue

Gross profit 854

Sales Revenue 5,834

Ratio 14.63833

2) Return on Total Assets (ROA) Net Earnings/Total Assets

Net Earnings 25

Total Assets 2,886

Ratio 0.87

3) Net Profit to Equity / ROE Net Profit/ Total Equity

Net Profit 25

Total Equity 558

Ratio 4.480287

Efficiency Ratios Formulas 2016

1) Asset Turnover Ratio Net Sales/ Average Total Assets

Net Sales 5,834

Average Assets 2,177

Ratio 267.9835

2) Accounts Receivable Turnover ratio Revenue/Average Accounts Receivable

Revenue 5,834

Average Accounts Receivable 526

Ratio 1109.125

3) Collection Period for accounts receivable ratio 365/Receivable turnover Ratio 0.329088

Question 2

3 | P a g e

Particulars 2016

Profitability Ratios Formulas

1) Gross Profit Margin Gross Profit/Sales revenue

Gross profit 854

Sales Revenue 5,834

Ratio 14.63833

2) Return on Total Assets (ROA) Net Earnings/Total Assets

Net Earnings 25

Total Assets 2,886

Ratio 0.87

3) Net Profit to Equity / ROE Net Profit/ Total Equity

Net Profit 25

Total Equity 558

Ratio 4.480287

Efficiency Ratios Formulas 2016

1) Asset Turnover Ratio Net Sales/ Average Total Assets

Net Sales 5,834

Average Assets 2,177

Ratio 267.9835

2) Accounts Receivable Turnover ratio Revenue/Average Accounts Receivable

Revenue 5,834

Average Accounts Receivable 526

Ratio 1109.125

3) Collection Period for accounts receivable ratio 365/Receivable turnover Ratio 0.329088

Question 2

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

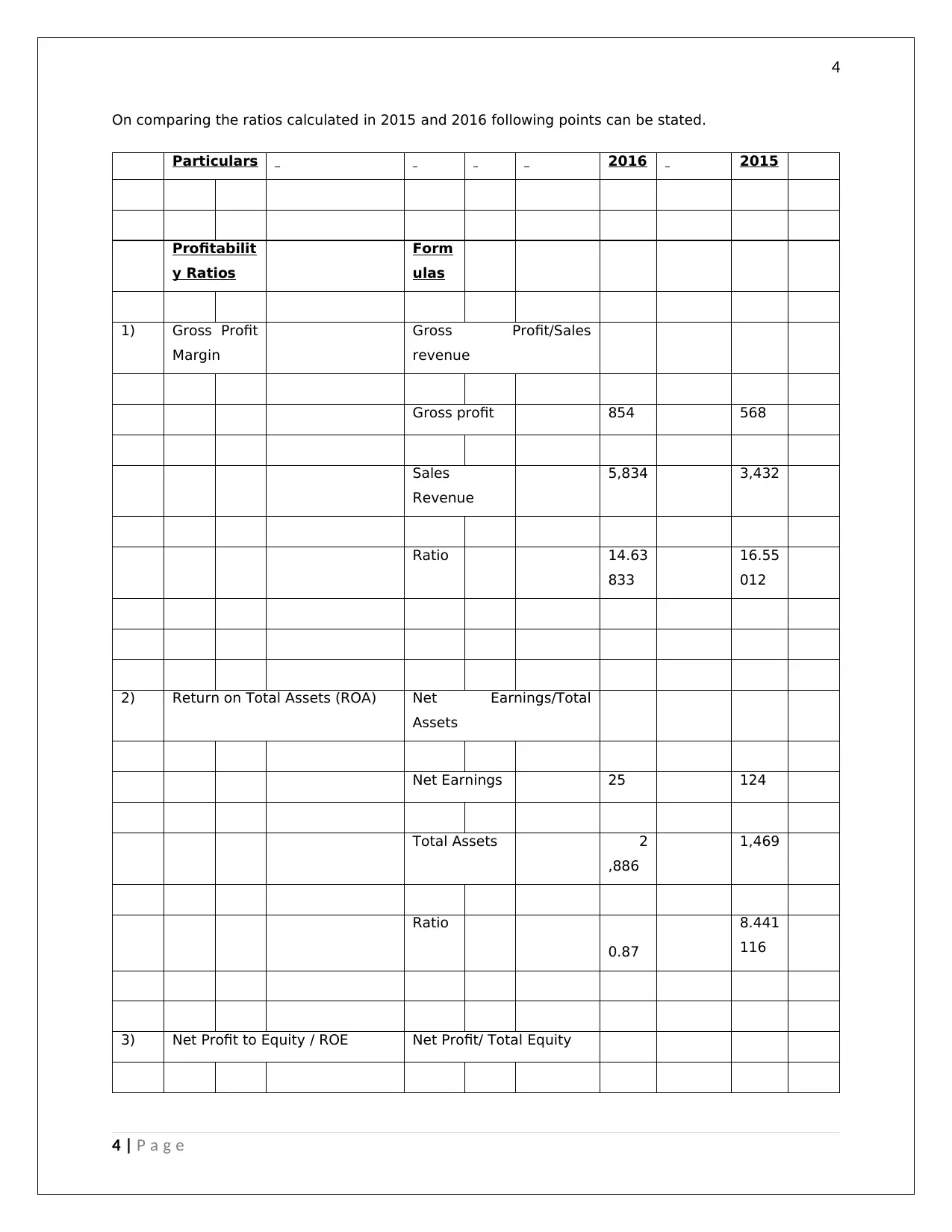

On comparing the ratios calculated in 2015 and 2016 following points can be stated.

Particulars 2016 2015

Profitabilit

y Ratios

Form

ulas

1) Gross Profit

Margin

Gross Profit/Sales

revenue

Gross profit 854 568

Sales

Revenue

5,834 3,432

Ratio 14.63

833

16.55

012

2) Return on Total Assets (ROA) Net Earnings/Total

Assets

Net Earnings 25 124

Total Assets 2

,886

1,469

Ratio

0.87

8.441

116

3) Net Profit to Equity / ROE Net Profit/ Total Equity

4 | P a g e

On comparing the ratios calculated in 2015 and 2016 following points can be stated.

Particulars 2016 2015

Profitabilit

y Ratios

Form

ulas

1) Gross Profit

Margin

Gross Profit/Sales

revenue

Gross profit 854 568

Sales

Revenue

5,834 3,432

Ratio 14.63

833

16.55

012

2) Return on Total Assets (ROA) Net Earnings/Total

Assets

Net Earnings 25 124

Total Assets 2

,886

1,469

Ratio

0.87

8.441

116

3) Net Profit to Equity / ROE Net Profit/ Total Equity

4 | P a g e

5

Net

Profit

25 124

Total Equity 558 664

Ratio 4.480

287

18.67

47

1. Gross Profit Margin – This ratio helps in showing how much profit the company is making in

comparison to the total sales of the company.The higher the gross profit ratio, the better it is.

It reflects the overall policies of the company which comes from cost of goods sold and other

credit giving facilities that the company have (Alsagoff, 2010). In the given case of the

company in comparing both the given years 2016 and 2015 we see that in 2016 the ratio was

14.63% and in 2015 the ratio was 16.55%, so this an adverse condition and the company

needs to see why there is a detoriation in the ratios from the prior years and how it can be

improved.

2. Return on Total Assets – The ROA shows the overall return on the assets of the company by

comparing the net profit of the company with the total assets. The higher the ratio the better it

is as it shows that the company is earning enough profit in comparison to the total money that

it has invested in its assets. Thus it can be said that the company is making good use of all its

assets for generating effective revenue for the company. In comparing the given years 2016

and 2015, it can be seen that in 2015 the ratio was 8.44% and in 2016 the ratio is 0.87 %, so

that is a darastic fall and it shows that the company is not functioning to the best of its abilities

as the net profit is less in comparison to the amount of assets the company is having. From

2015 to 2016, there has been a lot of fall in the ROA and thus this shows that the financial

health of the company is not in the best condition and in case the company wants to do better

they need to analyse the reasons for such discripancies and make effective use of the assets

(Kusolpalalert, 2018).

3. ROE/ Net Profit to the Equity – This ratio shows the overall return on the equity of the company

by comparing it with the net profit of the company. This is one of the most important

profitability ratios for the investors as it helps them to understand whether the company is

paying good returns on the equity investment to the shareholders of the company. A high ROE

is better as it reflects a better financial position and which means that the company is making

better returns and thus this puts the shareholders in a good position. On comparing the ROE of

2015 and 2016, we see that in 2016 the ration was 4.4 % and in 2015 the ratio was 18.67 %,

thus we see that there was a detoriation from the prior year, and thus there should be an

5 | P a g e

Net

Profit

25 124

Total Equity 558 664

Ratio 4.480

287

18.67

47

1. Gross Profit Margin – This ratio helps in showing how much profit the company is making in

comparison to the total sales of the company.The higher the gross profit ratio, the better it is.

It reflects the overall policies of the company which comes from cost of goods sold and other

credit giving facilities that the company have (Alsagoff, 2010). In the given case of the

company in comparing both the given years 2016 and 2015 we see that in 2016 the ratio was

14.63% and in 2015 the ratio was 16.55%, so this an adverse condition and the company

needs to see why there is a detoriation in the ratios from the prior years and how it can be

improved.

2. Return on Total Assets – The ROA shows the overall return on the assets of the company by

comparing the net profit of the company with the total assets. The higher the ratio the better it

is as it shows that the company is earning enough profit in comparison to the total money that

it has invested in its assets. Thus it can be said that the company is making good use of all its

assets for generating effective revenue for the company. In comparing the given years 2016

and 2015, it can be seen that in 2015 the ratio was 8.44% and in 2016 the ratio is 0.87 %, so

that is a darastic fall and it shows that the company is not functioning to the best of its abilities

as the net profit is less in comparison to the amount of assets the company is having. From

2015 to 2016, there has been a lot of fall in the ROA and thus this shows that the financial

health of the company is not in the best condition and in case the company wants to do better

they need to analyse the reasons for such discripancies and make effective use of the assets

(Kusolpalalert, 2018).

3. ROE/ Net Profit to the Equity – This ratio shows the overall return on the equity of the company

by comparing it with the net profit of the company. This is one of the most important

profitability ratios for the investors as it helps them to understand whether the company is

paying good returns on the equity investment to the shareholders of the company. A high ROE

is better as it reflects a better financial position and which means that the company is making

better returns and thus this puts the shareholders in a good position. On comparing the ROE of

2015 and 2016, we see that in 2016 the ration was 4.4 % and in 2015 the ratio was 18.67 %,

thus we see that there was a detoriation from the prior year, and thus there should be an

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

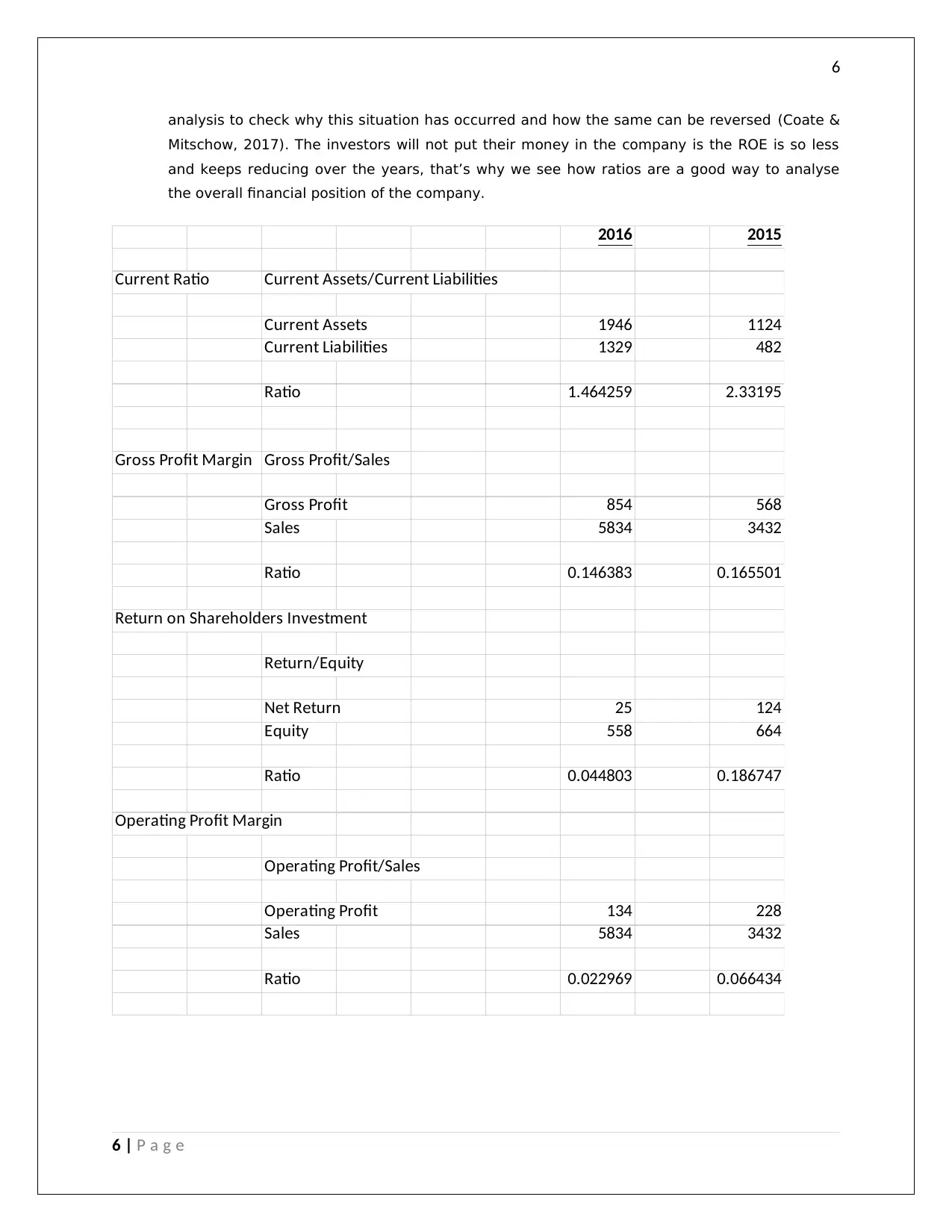

analysis to check why this situation has occurred and how the same can be reversed (Coate &

Mitschow, 2017). The investors will not put their money in the company is the ROE is so less

and keeps reducing over the years, that’s why we see how ratios are a good way to analyse

the overall financial position of the company.

2016 2015

Current Ratio Current Assets/Current Liabilities

Current Assets 1946 1124

Current Liabilities 1329 482

Ratio 1.464259 2.33195

Gross Profit Margin Gross Profit/Sales

Gross Profit 854 568

Sales 5834 3432

Ratio 0.146383 0.165501

Return on Shareholders Investment

Return/Equity

Net Return 25 124

Equity 558 664

Ratio 0.044803 0.186747

Operating Profit Margin

Operating Profit/Sales

Operating Profit 134 228

Sales 5834 3432

Ratio 0.022969 0.066434

6 | P a g e

analysis to check why this situation has occurred and how the same can be reversed (Coate &

Mitschow, 2017). The investors will not put their money in the company is the ROE is so less

and keeps reducing over the years, that’s why we see how ratios are a good way to analyse

the overall financial position of the company.

2016 2015

Current Ratio Current Assets/Current Liabilities

Current Assets 1946 1124

Current Liabilities 1329 482

Ratio 1.464259 2.33195

Gross Profit Margin Gross Profit/Sales

Gross Profit 854 568

Sales 5834 3432

Ratio 0.146383 0.165501

Return on Shareholders Investment

Return/Equity

Net Return 25 124

Equity 558 664

Ratio 0.044803 0.186747

Operating Profit Margin

Operating Profit/Sales

Operating Profit 134 228

Sales 5834 3432

Ratio 0.022969 0.066434

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

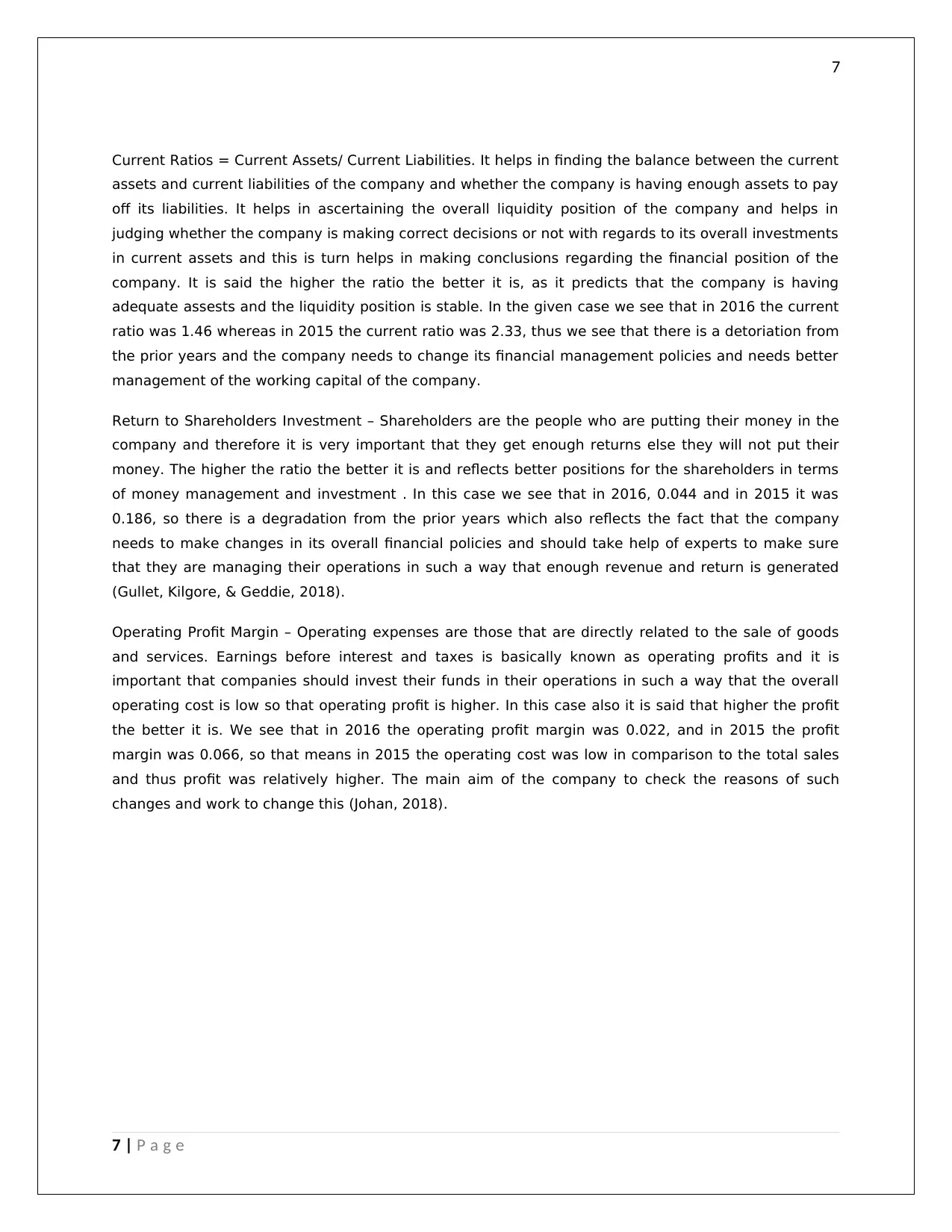

Current Ratios = Current Assets/ Current Liabilities. It helps in finding the balance between the current

assets and current liabilities of the company and whether the company is having enough assets to pay

off its liabilities. It helps in ascertaining the overall liquidity position of the company and helps in

judging whether the company is making correct decisions or not with regards to its overall investments

in current assets and this is turn helps in making conclusions regarding the financial position of the

company. It is said the higher the ratio the better it is, as it predicts that the company is having

adequate assests and the liquidity position is stable. In the given case we see that in 2016 the current

ratio was 1.46 whereas in 2015 the current ratio was 2.33, thus we see that there is a detoriation from

the prior years and the company needs to change its financial management policies and needs better

management of the working capital of the company.

Return to Shareholders Investment – Shareholders are the people who are putting their money in the

company and therefore it is very important that they get enough returns else they will not put their

money. The higher the ratio the better it is and reflects better positions for the shareholders in terms

of money management and investment . In this case we see that in 2016, 0.044 and in 2015 it was

0.186, so there is a degradation from the prior years which also reflects the fact that the company

needs to make changes in its overall financial policies and should take help of experts to make sure

that they are managing their operations in such a way that enough revenue and return is generated

(Gullet, Kilgore, & Geddie, 2018).

Operating Profit Margin – Operating expenses are those that are directly related to the sale of goods

and services. Earnings before interest and taxes is basically known as operating profits and it is

important that companies should invest their funds in their operations in such a way that the overall

operating cost is low so that operating profit is higher. In this case also it is said that higher the profit

the better it is. We see that in 2016 the operating profit margin was 0.022, and in 2015 the profit

margin was 0.066, so that means in 2015 the operating cost was low in comparison to the total sales

and thus profit was relatively higher. The main aim of the company to check the reasons of such

changes and work to change this (Johan, 2018).

7 | P a g e

Current Ratios = Current Assets/ Current Liabilities. It helps in finding the balance between the current

assets and current liabilities of the company and whether the company is having enough assets to pay

off its liabilities. It helps in ascertaining the overall liquidity position of the company and helps in

judging whether the company is making correct decisions or not with regards to its overall investments

in current assets and this is turn helps in making conclusions regarding the financial position of the

company. It is said the higher the ratio the better it is, as it predicts that the company is having

adequate assests and the liquidity position is stable. In the given case we see that in 2016 the current

ratio was 1.46 whereas in 2015 the current ratio was 2.33, thus we see that there is a detoriation from

the prior years and the company needs to change its financial management policies and needs better

management of the working capital of the company.

Return to Shareholders Investment – Shareholders are the people who are putting their money in the

company and therefore it is very important that they get enough returns else they will not put their

money. The higher the ratio the better it is and reflects better positions for the shareholders in terms

of money management and investment . In this case we see that in 2016, 0.044 and in 2015 it was

0.186, so there is a degradation from the prior years which also reflects the fact that the company

needs to make changes in its overall financial policies and should take help of experts to make sure

that they are managing their operations in such a way that enough revenue and return is generated

(Gullet, Kilgore, & Geddie, 2018).

Operating Profit Margin – Operating expenses are those that are directly related to the sale of goods

and services. Earnings before interest and taxes is basically known as operating profits and it is

important that companies should invest their funds in their operations in such a way that the overall

operating cost is low so that operating profit is higher. In this case also it is said that higher the profit

the better it is. We see that in 2016 the operating profit margin was 0.022, and in 2015 the profit

margin was 0.066, so that means in 2015 the operating cost was low in comparison to the total sales

and thus profit was relatively higher. The main aim of the company to check the reasons of such

changes and work to change this (Johan, 2018).

7 | P a g e

8

Question 3

On Comparison the industry’s ratio to the entity ratios following points are noticed.

1.In case of gross margin ratio, the industry ratio is 86.1 % in average and of the company in 2016 is

14.63%. A high gross margin ratio reflects higher efficiency of doing the core operations related to the

business and making sure that the overall profitability is more (Iggers, 2018). A low gross margin

ration reflects the fact that the overall cost of goods sold is more and that is having adverse effect on

the profitability of the company. Hence it can be said that the company is not in a good position on

comparison to standards of the industry.

8 | P a g e

Question 3

On Comparison the industry’s ratio to the entity ratios following points are noticed.

1.In case of gross margin ratio, the industry ratio is 86.1 % in average and of the company in 2016 is

14.63%. A high gross margin ratio reflects higher efficiency of doing the core operations related to the

business and making sure that the overall profitability is more (Iggers, 2018). A low gross margin

ration reflects the fact that the overall cost of goods sold is more and that is having adverse effect on

the profitability of the company. Hence it can be said that the company is not in a good position on

comparison to standards of the industry.

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

2. In case of return on total assets, it reflects how much after-tax profit the company is making in

comparison to every single amount of asset that it has. This ratio shows how asset intensive a

company is. In the given case the return on assets ratio of the company is 0.87 % and that of the

industry is 5.4, which shows that in comparison to the industry the company is less asset intensive

which is adverse in nature for the growth of the company.

3.Collection period of the receivable shows in how many days the company can rotate its receivable

based on its receivable turnover ratio. It reflects the overall credit policies of the company and its

overall standing in the financial system, a lower ratio is better because it reflects that the credit

policies of the management of the company is good enough and there is no delay in collection of cash.

In the given case the collection period of the industry is 14 days and that of the company is 32 days,

thus this shows that the company is in an adverse position (Wellmer, 2018).

4. Net profit to equity or ROE is a very important profitability ratio and helps in calculating how much

profit the company is earning in comparison to the amount of money the investors have put in. In the

given case we see that the ROE of the industry is 16.2 % and that of the company is 4.4%. The higher

the ROE the better it is, as it reflects that the investors will have more return on the amount that they

are investing in the company, so this means that the company is in an adverse position.

Question 4

Limitations of Ratio Analysis are-

In case the accounting datas are not correct then the ratios that are calculated are not

corrected, thus there is a lot of dependency on accounting data and financial statements and

the accounting policies that are followed by the companies (Shimamoto, 2018). Different

companies have different accounting policies and no common platforms based on which they

prepare their financial statements so cross comparison between the companies and their

competitors cannot be done.

Ratio analysis are calculated based on quantitative analysis and does not take into

consideration the quantitative factors that might affect the company’s performance also.

9 | P a g e

2. In case of return on total assets, it reflects how much after-tax profit the company is making in

comparison to every single amount of asset that it has. This ratio shows how asset intensive a

company is. In the given case the return on assets ratio of the company is 0.87 % and that of the

industry is 5.4, which shows that in comparison to the industry the company is less asset intensive

which is adverse in nature for the growth of the company.

3.Collection period of the receivable shows in how many days the company can rotate its receivable

based on its receivable turnover ratio. It reflects the overall credit policies of the company and its

overall standing in the financial system, a lower ratio is better because it reflects that the credit

policies of the management of the company is good enough and there is no delay in collection of cash.

In the given case the collection period of the industry is 14 days and that of the company is 32 days,

thus this shows that the company is in an adverse position (Wellmer, 2018).

4. Net profit to equity or ROE is a very important profitability ratio and helps in calculating how much

profit the company is earning in comparison to the amount of money the investors have put in. In the

given case we see that the ROE of the industry is 16.2 % and that of the company is 4.4%. The higher

the ROE the better it is, as it reflects that the investors will have more return on the amount that they

are investing in the company, so this means that the company is in an adverse position.

Question 4

Limitations of Ratio Analysis are-

In case the accounting datas are not correct then the ratios that are calculated are not

corrected, thus there is a lot of dependency on accounting data and financial statements and

the accounting policies that are followed by the companies (Shimamoto, 2018). Different

companies have different accounting policies and no common platforms based on which they

prepare their financial statements so cross comparison between the companies and their

competitors cannot be done.

Ratio analysis are calculated based on quantitative analysis and does not take into

consideration the quantitative factors that might affect the company’s performance also.

9 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Ratios cannot be considered as a single factor of analysis for the companies’ performance,

they provide a fraction of information only and thus it becomes important to understand that

they need to be used with other methods in combination for best results (Abdullah & Said,

2017).

Interpretation of the ratios is also a difficult task if people don’t have enough knowledge

regarding that. Thus, it is important that having financial knowledge and knowledge about the

ratios is imperative for best results.

References

Abdullah, W., & Said, R. (2017). Religious, Educational Background and Corporate Crime Tolerance by

Accounting Professionals. State-of-the-Art Theories and Empirical Evidence, 129-149.

Alsagoff, N. (2010). Microsoft Excel as a tool for digital forensic accounting.

10 | P a g e

Ratios cannot be considered as a single factor of analysis for the companies’ performance,

they provide a fraction of information only and thus it becomes important to understand that

they need to be used with other methods in combination for best results (Abdullah & Said,

2017).

Interpretation of the ratios is also a difficult task if people don’t have enough knowledge

regarding that. Thus, it is important that having financial knowledge and knowledge about the

ratios is imperative for best results.

References

Abdullah, W., & Said, R. (2017). Religious, Educational Background and Corporate Crime Tolerance by

Accounting Professionals. State-of-the-Art Theories and Empirical Evidence, 129-149.

Alsagoff, N. (2010). Microsoft Excel as a tool for digital forensic accounting.

10 | P a g e

11

Coate, C., & Mitschow, M. (2017). Luca Pacioli and the Role of Accounting and Business: Early Lessons in

Social Responsibility.

Gullet, N., Kilgore, R., & Geddie, M. (2018). USE OF FINANCIAL RATIOS TO MEASURE THE QUALITY OF

EARNINGS. Academy of Accounting and Financial Studies Journal, 22(2).

Iggers, J. (2018). Good News, Bad News: Journalism Ethics And The Public Interest.

Johan, S. (2018). The Relationship Between Economic Value Added, Market Value Added And Return On

Cost Of Capital In Measuring Corporate Performance. Jurnal Manajemen Bisnis dan

Kewirausahaan, 3(1).

Kusolpalalert, A. (2018). The relationships of financial assets in financial markets during recovery period

and financial crisis. AU Journal of Management, 11(1).

Shimamoto, D. (2018, JANUARY 29). Why Accountants Must Embrace Machine Learning. Retrieved from

global-knowledge-gateway:

https://www.ifac.org/global-knowledge-gateway/technology/discussion/why-accountants-

must-embrace-machine-learning

Wellmer, A. (2018). The Persistence of Modernity: Aesthetics, Ethics and Postmodernism (fourth ed.). UK:

Polity Press.

11 | P a g e

Coate, C., & Mitschow, M. (2017). Luca Pacioli and the Role of Accounting and Business: Early Lessons in

Social Responsibility.

Gullet, N., Kilgore, R., & Geddie, M. (2018). USE OF FINANCIAL RATIOS TO MEASURE THE QUALITY OF

EARNINGS. Academy of Accounting and Financial Studies Journal, 22(2).

Iggers, J. (2018). Good News, Bad News: Journalism Ethics And The Public Interest.

Johan, S. (2018). The Relationship Between Economic Value Added, Market Value Added And Return On

Cost Of Capital In Measuring Corporate Performance. Jurnal Manajemen Bisnis dan

Kewirausahaan, 3(1).

Kusolpalalert, A. (2018). The relationships of financial assets in financial markets during recovery period

and financial crisis. AU Journal of Management, 11(1).

Shimamoto, D. (2018, JANUARY 29). Why Accountants Must Embrace Machine Learning. Retrieved from

global-knowledge-gateway:

https://www.ifac.org/global-knowledge-gateway/technology/discussion/why-accountants-

must-embrace-machine-learning

Wellmer, A. (2018). The Persistence of Modernity: Aesthetics, Ethics and Postmodernism (fourth ed.). UK:

Polity Press.

11 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.