Analyzing Financial Health: Ratio Analysis of RIO Tinto & BHP Billiton

VerifiedAdded on 2023/06/13

|15

|2562

|144

Report

AI Summary

This report provides a comprehensive ratio analysis of RIO Tinto and BHP Billiton, focusing on liquidity, solvency, efficiency, and profitability from 2012 to 2017. It examines key financial ratios such as current ratio, quick ratio, debt ratio, debt to equity ratio, inventory turnover ratio, total asset turnover, and net profit margin. The analysis reveals that Rio Tinto generally reported a stronger financial performance compared to BHP Billiton, with robust current and quick ratios, and a profit margin reflecting better revenue generation from its assets. BHP Billiton, while showing improvements in some areas, experienced fluctuations in profitability and asset turnover. The report concludes that both companies have unique strengths and challenges in managing their financial performance.

Running head: RATIO ANALYSIS

Ratio Analysis

Name of the Student

Name of the University

Authors Note

Course ID

Ratio Analysis

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1RATIO ANALYSIS

Table of Contents

Introduction:...............................................................................................................................2

Liquidity ratios:..........................................................................................................................2

Current Ratio:.........................................................................................................................2

Quick Ratio:...........................................................................................................................3

Solvency ratio:...........................................................................................................................4

Debt Ratio:.............................................................................................................................4

Debt to Equity Ratio:.............................................................................................................5

Efficiency Ratio:........................................................................................................................6

Inventory Turnover Ratio:......................................................................................................6

Total Asset Turnover:............................................................................................................7

Profitability ratio:.......................................................................................................................8

Net Profit Margin:..................................................................................................................9

Return on Assets:...................................................................................................................9

Conclusion:..............................................................................................................................10

Reference List:.........................................................................................................................12

Appendix:.................................................................................................................................13

Table of Contents

Introduction:...............................................................................................................................2

Liquidity ratios:..........................................................................................................................2

Current Ratio:.........................................................................................................................2

Quick Ratio:...........................................................................................................................3

Solvency ratio:...........................................................................................................................4

Debt Ratio:.............................................................................................................................4

Debt to Equity Ratio:.............................................................................................................5

Efficiency Ratio:........................................................................................................................6

Inventory Turnover Ratio:......................................................................................................6

Total Asset Turnover:............................................................................................................7

Profitability ratio:.......................................................................................................................8

Net Profit Margin:..................................................................................................................9

Return on Assets:...................................................................................................................9

Conclusion:..............................................................................................................................10

Reference List:.........................................................................................................................12

Appendix:.................................................................................................................................13

2RATIO ANALYSIS

Introduction:

The current report is based on the analysis of the ratio for RIO Tinto and BHP

Billiton. The ratios will be based on the areas of profitability, solvency, liquidity and

efficiency ratio. Figures extracted are from the annual published statements of the respective

companies.

Liquidity ratios:

Liquidity ratio can be defined as the ratio that is used to determine the ability of the

company in meeting its ability to pay debt (Gitman et al., 2015).

Current Ratio:

The current ratio is generally used to determine the ability of the company in paying

back its liabilities with the assets (Henderson et al., 2015).

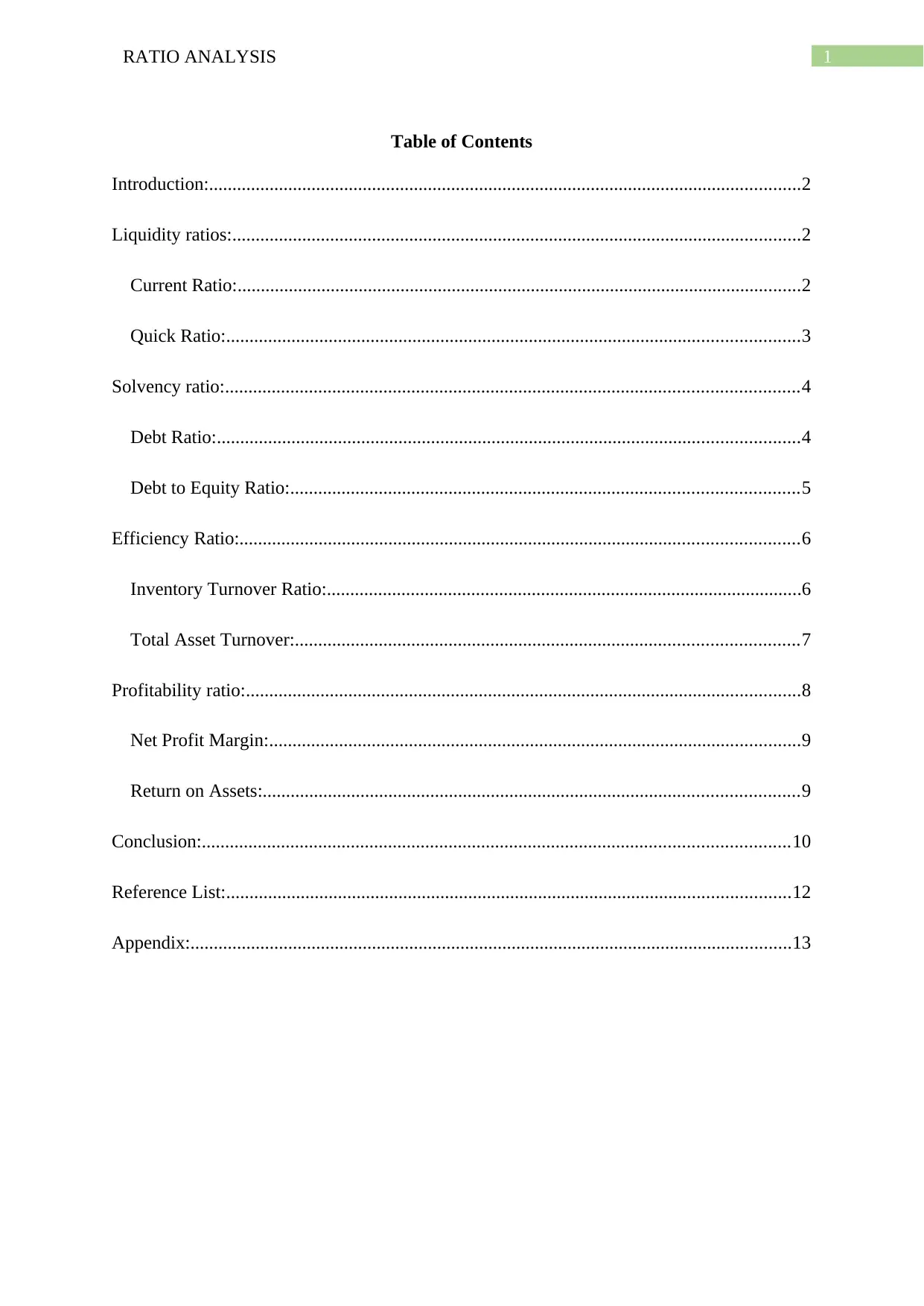

As evident the current ratio for Rio Tinto has represented a rising trend as the

company in the year 2012 reported current ratio of 1.42 whereas in the year 2017 the current

increased to 1.71 representing that Rio Tinto has been utilizing its assets to meet its debt

obligations. Rio Tinto on the other hand reported a strong set of results with higher operating

cash flow of US $13.9 billion and reflected a robust operational performance.

BHP Billiton in 2012 reported a current ratio of 0.93 however over the span of six

years the current ratio stood strongly to 1.85. This provides an overview that BHP Billiton

has been able to pay its liabilities. The company posted a strong financial results with positive

operating cash flow of US $12.6 billion.

Introduction:

The current report is based on the analysis of the ratio for RIO Tinto and BHP

Billiton. The ratios will be based on the areas of profitability, solvency, liquidity and

efficiency ratio. Figures extracted are from the annual published statements of the respective

companies.

Liquidity ratios:

Liquidity ratio can be defined as the ratio that is used to determine the ability of the

company in meeting its ability to pay debt (Gitman et al., 2015).

Current Ratio:

The current ratio is generally used to determine the ability of the company in paying

back its liabilities with the assets (Henderson et al., 2015).

As evident the current ratio for Rio Tinto has represented a rising trend as the

company in the year 2012 reported current ratio of 1.42 whereas in the year 2017 the current

increased to 1.71 representing that Rio Tinto has been utilizing its assets to meet its debt

obligations. Rio Tinto on the other hand reported a strong set of results with higher operating

cash flow of US $13.9 billion and reflected a robust operational performance.

BHP Billiton in 2012 reported a current ratio of 0.93 however over the span of six

years the current ratio stood strongly to 1.85. This provides an overview that BHP Billiton

has been able to pay its liabilities. The company posted a strong financial results with positive

operating cash flow of US $12.6 billion.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3RATIO ANALYSIS

2012 2013 2014 2015 2016 2017

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

1.42 1.45

1.68

1.55 1.61 1.71

0.93 0.97

1.23 1.27

1.44

1.85

Current Ratio

Rio Tinto BHP

Figure 1: Figure representing Current Ratio

(Source: As Created by Author)

Quick Ratio:

Quick ratio determines how well the company measures the short term financial

liabilities (Narayanaswamy, 2017).

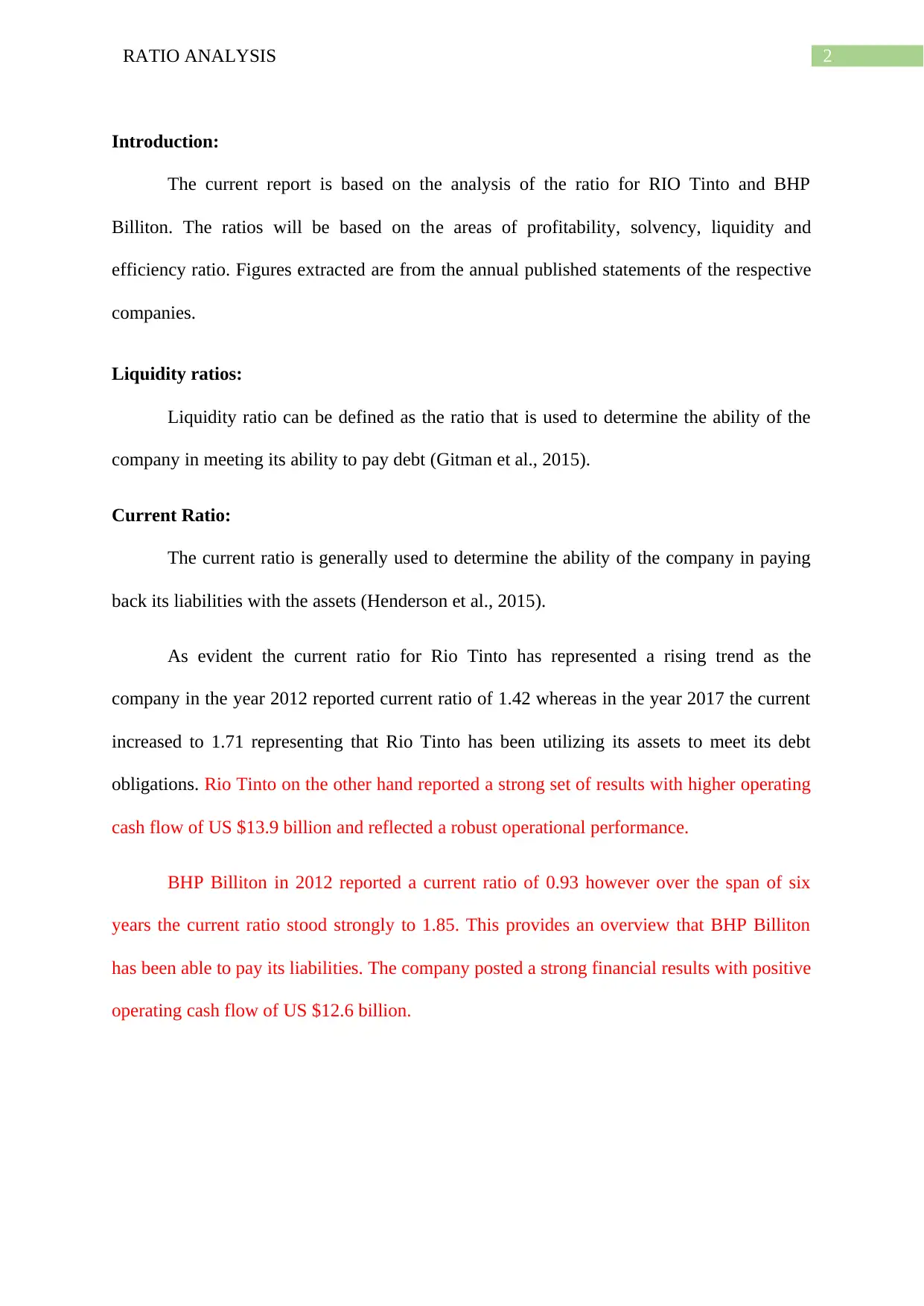

Accordingly, the quick ratio for Rio Tinto in 2012 stood 0.96 which subsequently

increased to 1.32 in 2014. Though the quick ratio declined in 2016 to 1.27 however in 2017

the quick ratio increased to 1.37. This reflects that the company has sufficient assets to meet

its short term obligations. The reason for increase in quick ratio is primarily because of strong

underlying EBITDA of US $18.6 billion and with a ten year record margin of 44% in 2017.

BHP reported a quick ratio of 0.91 in 2012 which increased over the span of five

years to 1.76. BHP reported a higher quick ratio than Rio Tinto as the company has better

managed to assets to pay short term obligations. The reason for rise in quick ratio is primarily

because of $12.6 billion cash demonstrating a continued progress in both the productivity and

efficiency.

2012 2013 2014 2015 2016 2017

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2.00

1.42 1.45

1.68

1.55 1.61 1.71

0.93 0.97

1.23 1.27

1.44

1.85

Current Ratio

Rio Tinto BHP

Figure 1: Figure representing Current Ratio

(Source: As Created by Author)

Quick Ratio:

Quick ratio determines how well the company measures the short term financial

liabilities (Narayanaswamy, 2017).

Accordingly, the quick ratio for Rio Tinto in 2012 stood 0.96 which subsequently

increased to 1.32 in 2014. Though the quick ratio declined in 2016 to 1.27 however in 2017

the quick ratio increased to 1.37. This reflects that the company has sufficient assets to meet

its short term obligations. The reason for increase in quick ratio is primarily because of strong

underlying EBITDA of US $18.6 billion and with a ten year record margin of 44% in 2017.

BHP reported a quick ratio of 0.91 in 2012 which increased over the span of five

years to 1.76. BHP reported a higher quick ratio than Rio Tinto as the company has better

managed to assets to pay short term obligations. The reason for rise in quick ratio is primarily

because of $12.6 billion cash demonstrating a continued progress in both the productivity and

efficiency.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4RATIO ANALYSIS

2012 2013 2014 2015 2016 2017

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

0.96 1.05 1.32 1.21 1.27 1.37

0.91 0.94

1.21 1.24 1.37

1.76

Quick Ratio

Rio Tinto BHP

Figure 2: Figure representing Quick Ratio

(Source: As Created by Author)

Solvency ratio:

Solvency ratio determines an organization ability to meet long term debts

(Schaltegger & Burritt, 2017).

Debt Ratio:

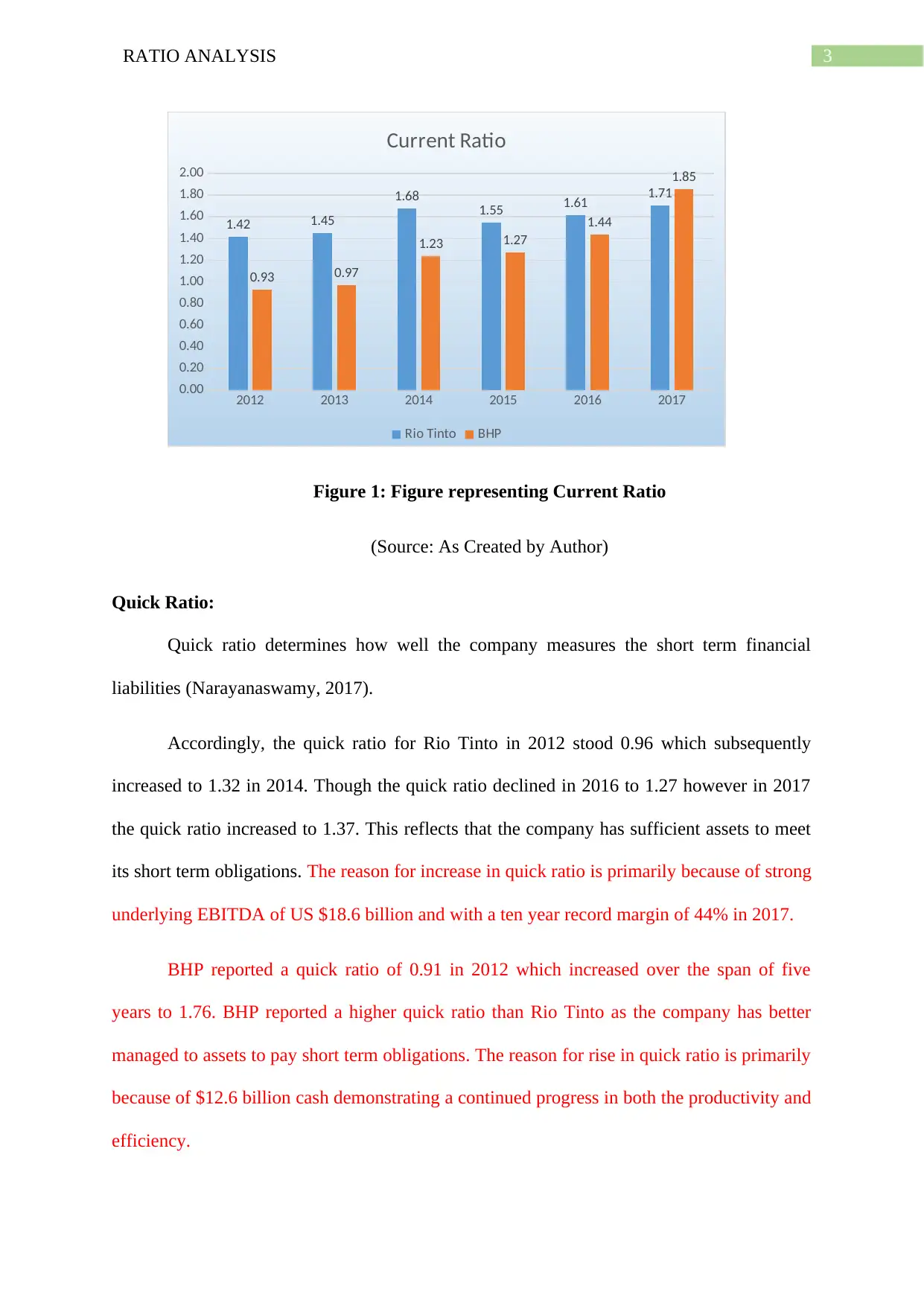

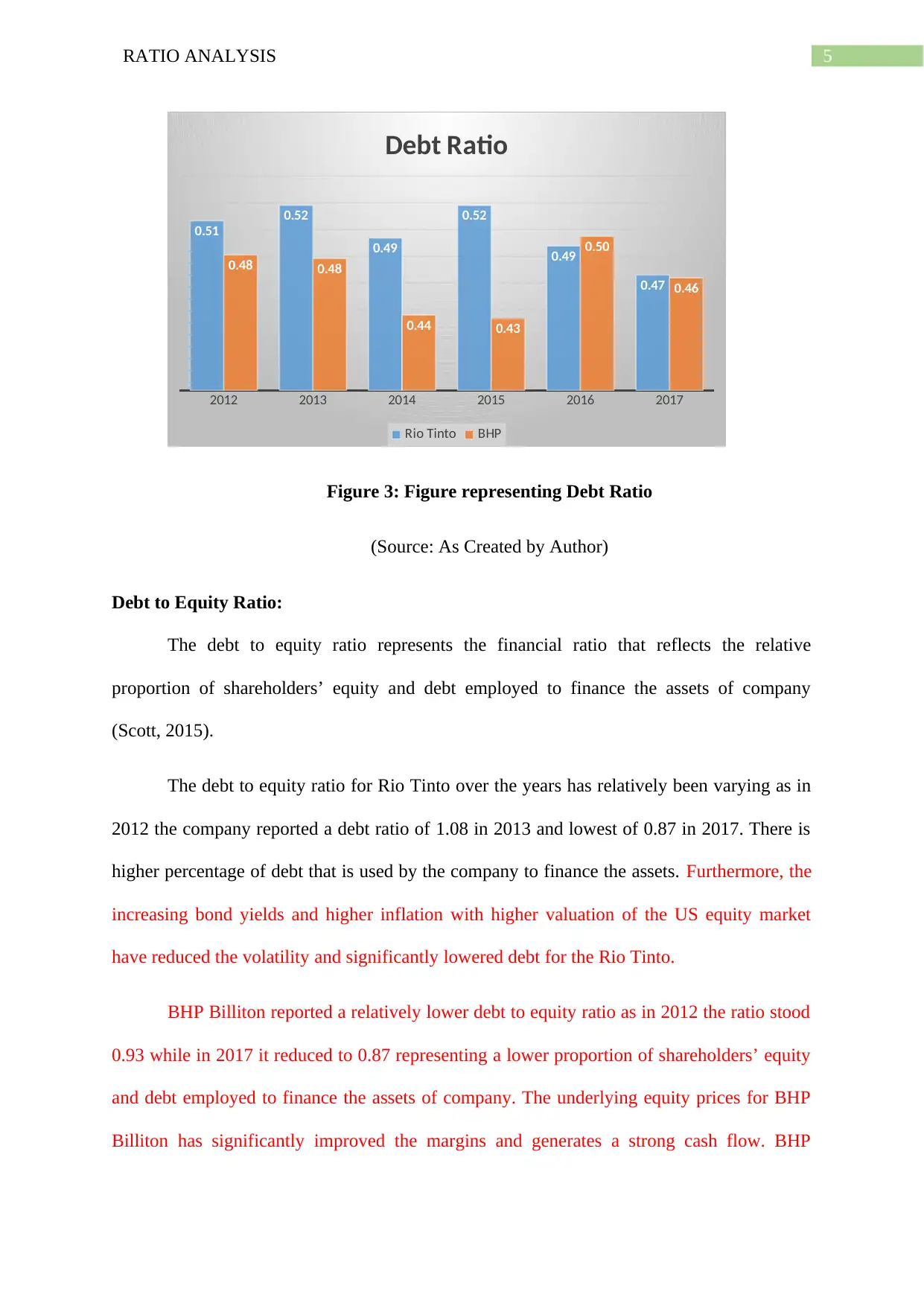

Rio Tinto reported a debt ratio a lower debt ratio of 0.47 in 2017 reflecting that the

company has lower proportion of assets financed by assets. The primary reason for lower

debt ratio is because the company took measures of lowering the debt to US $3.8 billion in

2017.

BHP Billiton stated a debt ratio of relatively stable debt ratio as the company reported

debt ratio of 0.46 in 2017. The debt ratio of BHP Billiton represented a lower percentage of

BHP’s assets that is offered by debt. Reasonably the lower debt ratio is largely because of

reduced net debt to US $9.8 billion from US $16.8 billion.

2012 2013 2014 2015 2016 2017

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

0.96 1.05 1.32 1.21 1.27 1.37

0.91 0.94

1.21 1.24 1.37

1.76

Quick Ratio

Rio Tinto BHP

Figure 2: Figure representing Quick Ratio

(Source: As Created by Author)

Solvency ratio:

Solvency ratio determines an organization ability to meet long term debts

(Schaltegger & Burritt, 2017).

Debt Ratio:

Rio Tinto reported a debt ratio a lower debt ratio of 0.47 in 2017 reflecting that the

company has lower proportion of assets financed by assets. The primary reason for lower

debt ratio is because the company took measures of lowering the debt to US $3.8 billion in

2017.

BHP Billiton stated a debt ratio of relatively stable debt ratio as the company reported

debt ratio of 0.46 in 2017. The debt ratio of BHP Billiton represented a lower percentage of

BHP’s assets that is offered by debt. Reasonably the lower debt ratio is largely because of

reduced net debt to US $9.8 billion from US $16.8 billion.

5RATIO ANALYSIS

2012 2013 2014 2015 2016 2017

0.51

0.52

0.49

0.52

0.49

0.47

0.48 0.48

0.44 0.43

0.50

0.46

Debt Ratio

Rio Tinto BHP

Figure 3: Figure representing Debt Ratio

(Source: As Created by Author)

Debt to Equity Ratio:

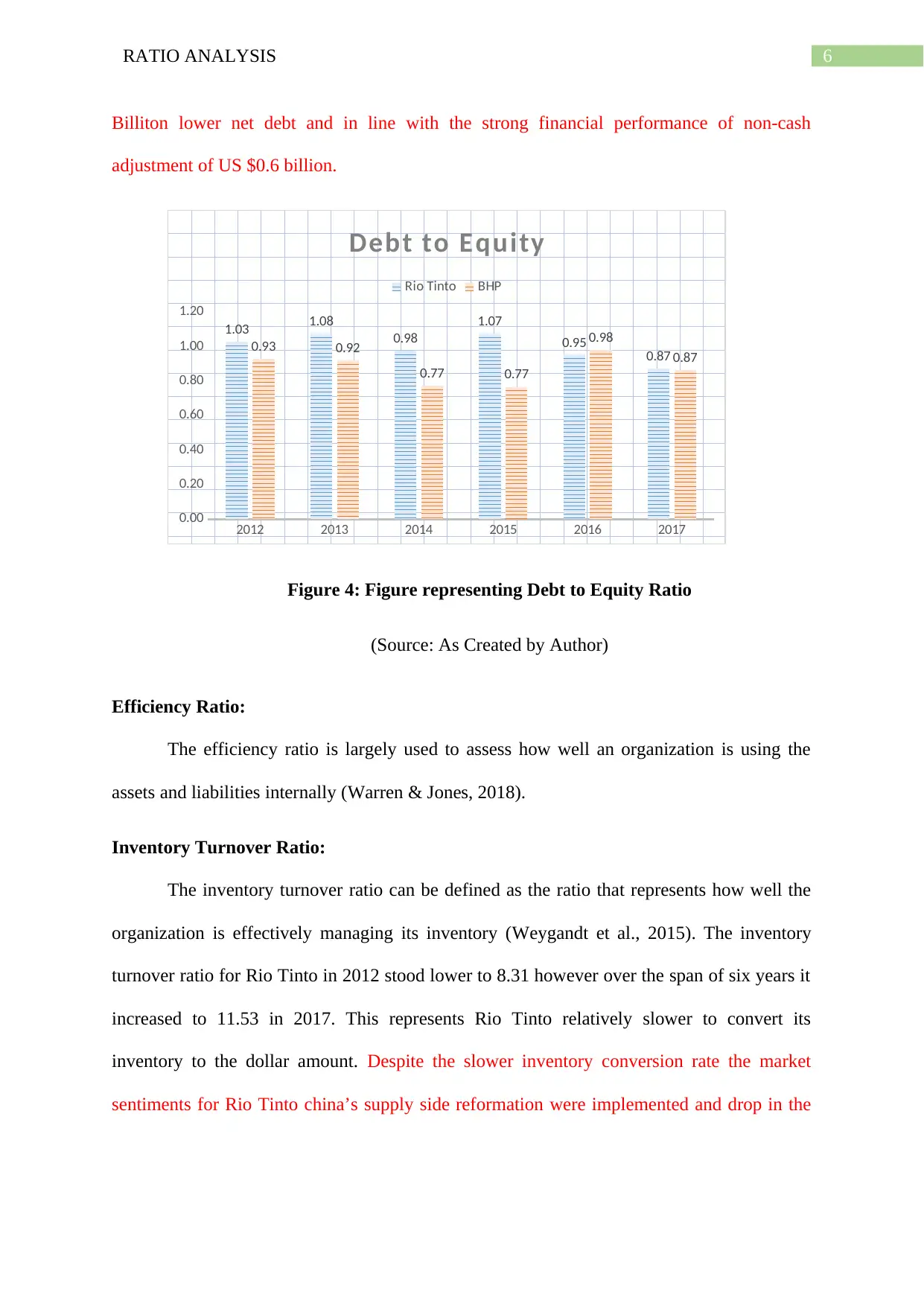

The debt to equity ratio represents the financial ratio that reflects the relative

proportion of shareholders’ equity and debt employed to finance the assets of company

(Scott, 2015).

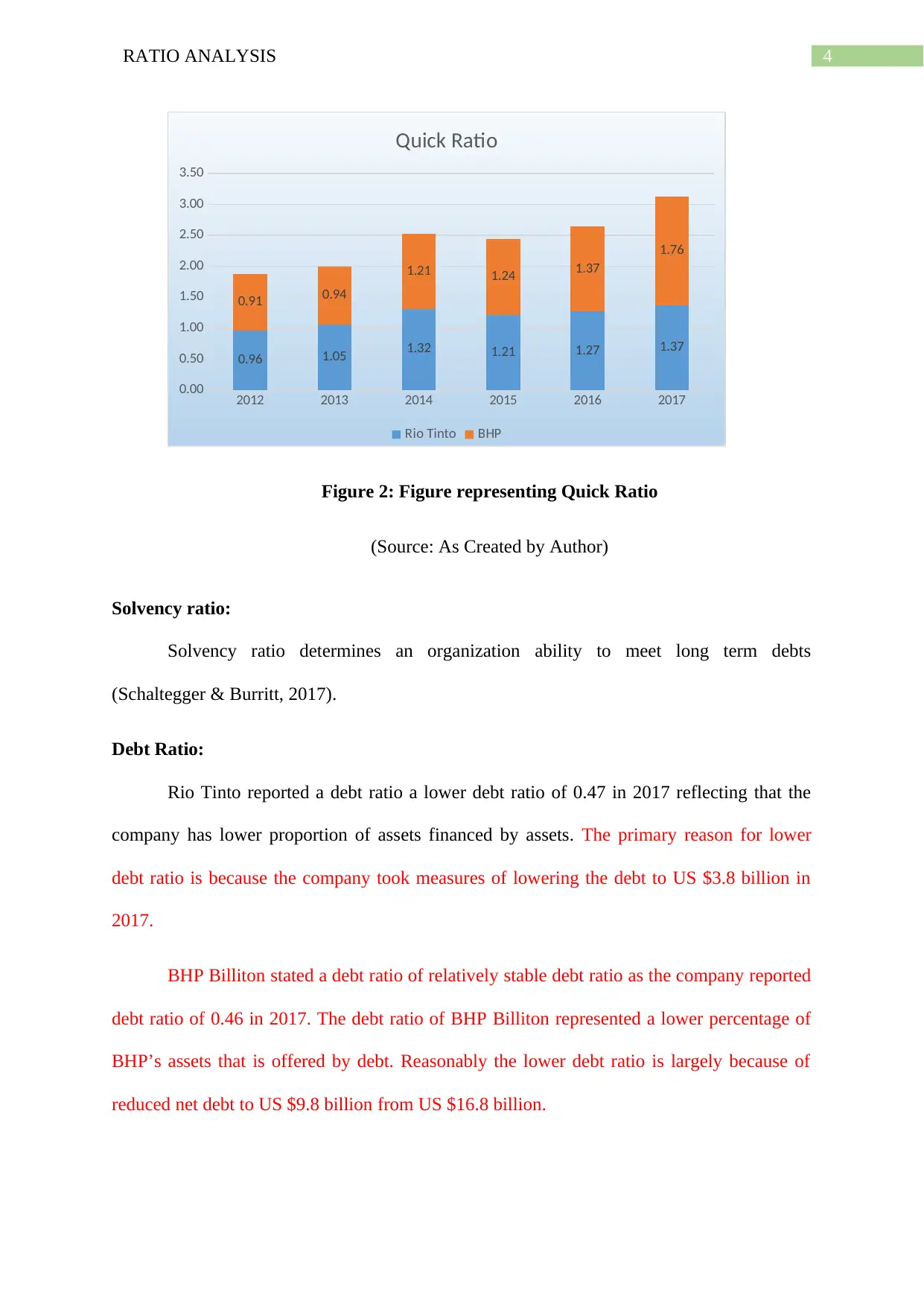

The debt to equity ratio for Rio Tinto over the years has relatively been varying as in

2012 the company reported a debt ratio of 1.08 in 2013 and lowest of 0.87 in 2017. There is

higher percentage of debt that is used by the company to finance the assets. Furthermore, the

increasing bond yields and higher inflation with higher valuation of the US equity market

have reduced the volatility and significantly lowered debt for the Rio Tinto.

BHP Billiton reported a relatively lower debt to equity ratio as in 2012 the ratio stood

0.93 while in 2017 it reduced to 0.87 representing a lower proportion of shareholders’ equity

and debt employed to finance the assets of company. The underlying equity prices for BHP

Billiton has significantly improved the margins and generates a strong cash flow. BHP

2012 2013 2014 2015 2016 2017

0.51

0.52

0.49

0.52

0.49

0.47

0.48 0.48

0.44 0.43

0.50

0.46

Debt Ratio

Rio Tinto BHP

Figure 3: Figure representing Debt Ratio

(Source: As Created by Author)

Debt to Equity Ratio:

The debt to equity ratio represents the financial ratio that reflects the relative

proportion of shareholders’ equity and debt employed to finance the assets of company

(Scott, 2015).

The debt to equity ratio for Rio Tinto over the years has relatively been varying as in

2012 the company reported a debt ratio of 1.08 in 2013 and lowest of 0.87 in 2017. There is

higher percentage of debt that is used by the company to finance the assets. Furthermore, the

increasing bond yields and higher inflation with higher valuation of the US equity market

have reduced the volatility and significantly lowered debt for the Rio Tinto.

BHP Billiton reported a relatively lower debt to equity ratio as in 2012 the ratio stood

0.93 while in 2017 it reduced to 0.87 representing a lower proportion of shareholders’ equity

and debt employed to finance the assets of company. The underlying equity prices for BHP

Billiton has significantly improved the margins and generates a strong cash flow. BHP

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6RATIO ANALYSIS

Billiton lower net debt and in line with the strong financial performance of non-cash

adjustment of US $0.6 billion.

2012 2013 2014 2015 2016 2017

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.03 1.08

0.98

1.07

0.95 0.87

0.93 0.92

0.77 0.77

0.98

0.87

Debt to Equity

Rio Tinto BHP

Figure 4: Figure representing Debt to Equity Ratio

(Source: As Created by Author)

Efficiency Ratio:

The efficiency ratio is largely used to assess how well an organization is using the

assets and liabilities internally (Warren & Jones, 2018).

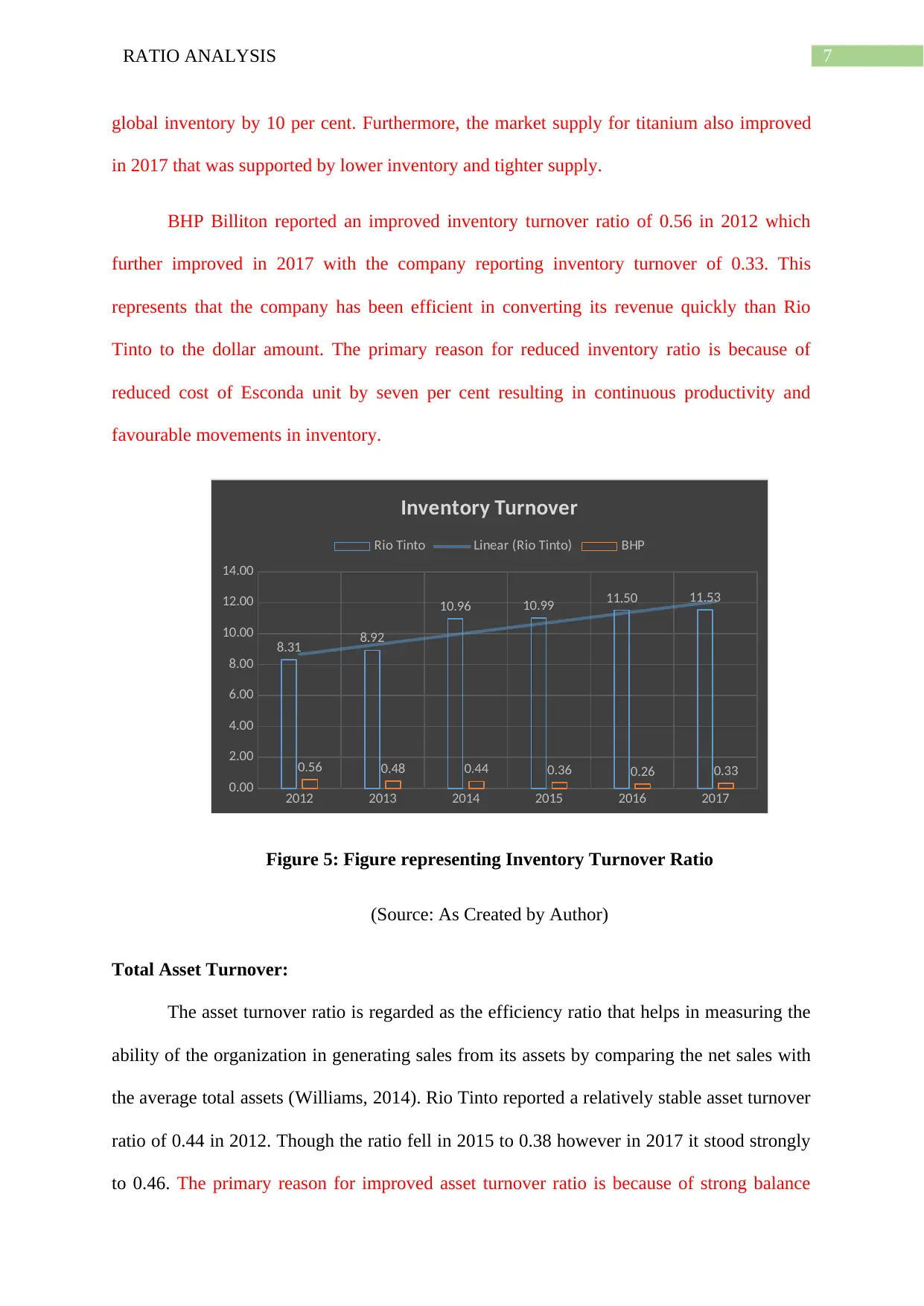

Inventory Turnover Ratio:

The inventory turnover ratio can be defined as the ratio that represents how well the

organization is effectively managing its inventory (Weygandt et al., 2015). The inventory

turnover ratio for Rio Tinto in 2012 stood lower to 8.31 however over the span of six years it

increased to 11.53 in 2017. This represents Rio Tinto relatively slower to convert its

inventory to the dollar amount. Despite the slower inventory conversion rate the market

sentiments for Rio Tinto china’s supply side reformation were implemented and drop in the

Billiton lower net debt and in line with the strong financial performance of non-cash

adjustment of US $0.6 billion.

2012 2013 2014 2015 2016 2017

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.03 1.08

0.98

1.07

0.95 0.87

0.93 0.92

0.77 0.77

0.98

0.87

Debt to Equity

Rio Tinto BHP

Figure 4: Figure representing Debt to Equity Ratio

(Source: As Created by Author)

Efficiency Ratio:

The efficiency ratio is largely used to assess how well an organization is using the

assets and liabilities internally (Warren & Jones, 2018).

Inventory Turnover Ratio:

The inventory turnover ratio can be defined as the ratio that represents how well the

organization is effectively managing its inventory (Weygandt et al., 2015). The inventory

turnover ratio for Rio Tinto in 2012 stood lower to 8.31 however over the span of six years it

increased to 11.53 in 2017. This represents Rio Tinto relatively slower to convert its

inventory to the dollar amount. Despite the slower inventory conversion rate the market

sentiments for Rio Tinto china’s supply side reformation were implemented and drop in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7RATIO ANALYSIS

global inventory by 10 per cent. Furthermore, the market supply for titanium also improved

in 2017 that was supported by lower inventory and tighter supply.

BHP Billiton reported an improved inventory turnover ratio of 0.56 in 2012 which

further improved in 2017 with the company reporting inventory turnover of 0.33. This

represents that the company has been efficient in converting its revenue quickly than Rio

Tinto to the dollar amount. The primary reason for reduced inventory ratio is because of

reduced cost of Esconda unit by seven per cent resulting in continuous productivity and

favourable movements in inventory.

2012 2013 2014 2015 2016 2017

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

8.31 8.92

10.96 10.99 11.50 11.53

0.56 0.48 0.44 0.36 0.26 0.33

Inventory Turnover

Rio Tinto Linear (Rio Tinto) BHP

Figure 5: Figure representing Inventory Turnover Ratio

(Source: As Created by Author)

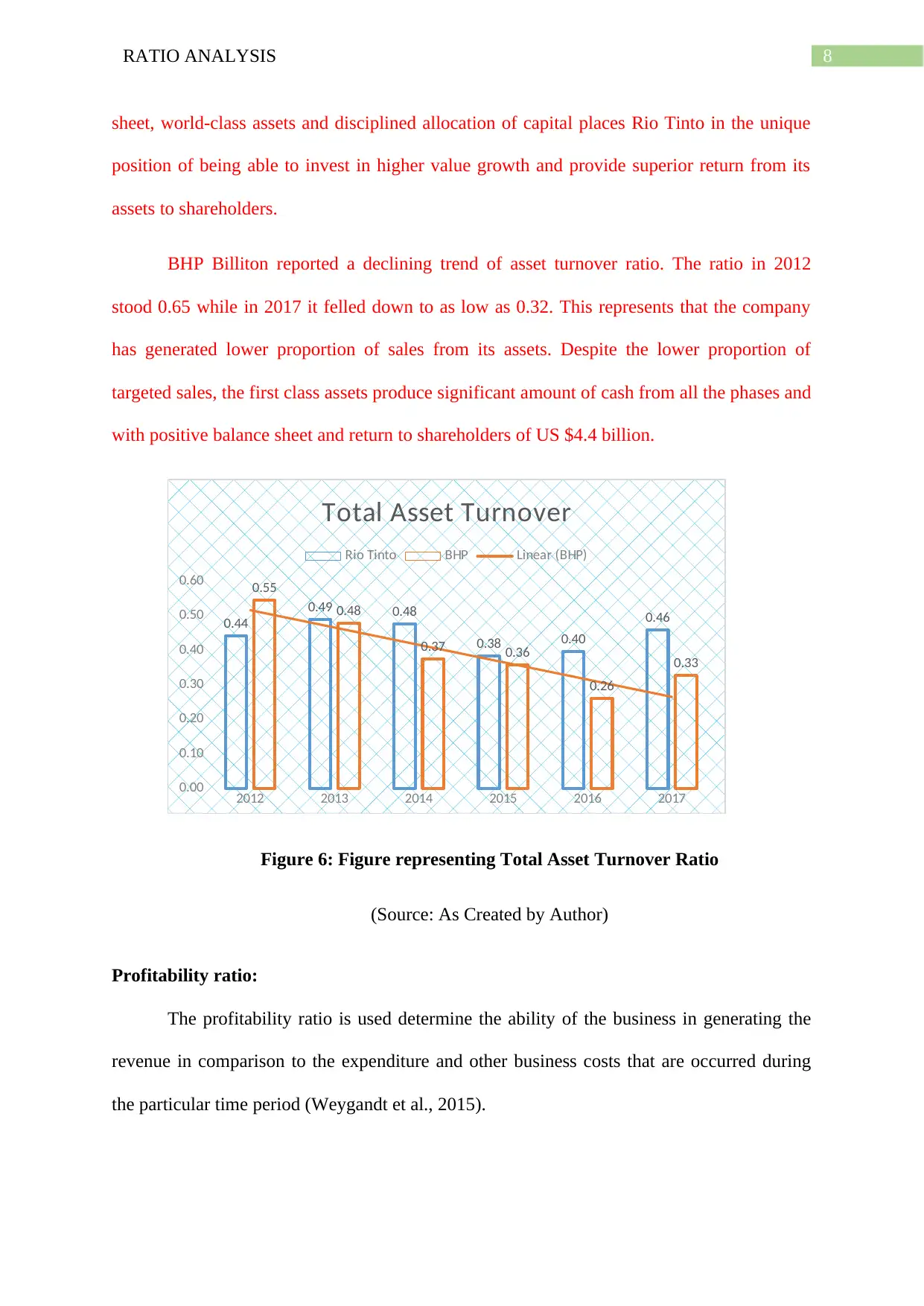

Total Asset Turnover:

The asset turnover ratio is regarded as the efficiency ratio that helps in measuring the

ability of the organization in generating sales from its assets by comparing the net sales with

the average total assets (Williams, 2014). Rio Tinto reported a relatively stable asset turnover

ratio of 0.44 in 2012. Though the ratio fell in 2015 to 0.38 however in 2017 it stood strongly

to 0.46. The primary reason for improved asset turnover ratio is because of strong balance

global inventory by 10 per cent. Furthermore, the market supply for titanium also improved

in 2017 that was supported by lower inventory and tighter supply.

BHP Billiton reported an improved inventory turnover ratio of 0.56 in 2012 which

further improved in 2017 with the company reporting inventory turnover of 0.33. This

represents that the company has been efficient in converting its revenue quickly than Rio

Tinto to the dollar amount. The primary reason for reduced inventory ratio is because of

reduced cost of Esconda unit by seven per cent resulting in continuous productivity and

favourable movements in inventory.

2012 2013 2014 2015 2016 2017

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

8.31 8.92

10.96 10.99 11.50 11.53

0.56 0.48 0.44 0.36 0.26 0.33

Inventory Turnover

Rio Tinto Linear (Rio Tinto) BHP

Figure 5: Figure representing Inventory Turnover Ratio

(Source: As Created by Author)

Total Asset Turnover:

The asset turnover ratio is regarded as the efficiency ratio that helps in measuring the

ability of the organization in generating sales from its assets by comparing the net sales with

the average total assets (Williams, 2014). Rio Tinto reported a relatively stable asset turnover

ratio of 0.44 in 2012. Though the ratio fell in 2015 to 0.38 however in 2017 it stood strongly

to 0.46. The primary reason for improved asset turnover ratio is because of strong balance

8RATIO ANALYSIS

sheet, world-class assets and disciplined allocation of capital places Rio Tinto in the unique

position of being able to invest in higher value growth and provide superior return from its

assets to shareholders.

BHP Billiton reported a declining trend of asset turnover ratio. The ratio in 2012

stood 0.65 while in 2017 it felled down to as low as 0.32. This represents that the company

has generated lower proportion of sales from its assets. Despite the lower proportion of

targeted sales, the first class assets produce significant amount of cash from all the phases and

with positive balance sheet and return to shareholders of US $4.4 billion.

2012 2013 2014 2015 2016 2017

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.44

0.49 0.48

0.38 0.40

0.46

0.55

0.48

0.37 0.36

0.26

0.33

Total Asset Turnover

Rio Tinto BHP Linear (BHP)

Figure 6: Figure representing Total Asset Turnover Ratio

(Source: As Created by Author)

Profitability ratio:

The profitability ratio is used determine the ability of the business in generating the

revenue in comparison to the expenditure and other business costs that are occurred during

the particular time period (Weygandt et al., 2015).

sheet, world-class assets and disciplined allocation of capital places Rio Tinto in the unique

position of being able to invest in higher value growth and provide superior return from its

assets to shareholders.

BHP Billiton reported a declining trend of asset turnover ratio. The ratio in 2012

stood 0.65 while in 2017 it felled down to as low as 0.32. This represents that the company

has generated lower proportion of sales from its assets. Despite the lower proportion of

targeted sales, the first class assets produce significant amount of cash from all the phases and

with positive balance sheet and return to shareholders of US $4.4 billion.

2012 2013 2014 2015 2016 2017

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.44

0.49 0.48

0.38 0.40

0.46

0.55

0.48

0.37 0.36

0.26

0.33

Total Asset Turnover

Rio Tinto BHP Linear (BHP)

Figure 6: Figure representing Total Asset Turnover Ratio

(Source: As Created by Author)

Profitability ratio:

The profitability ratio is used determine the ability of the business in generating the

revenue in comparison to the expenditure and other business costs that are occurred during

the particular time period (Weygandt et al., 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9RATIO ANALYSIS

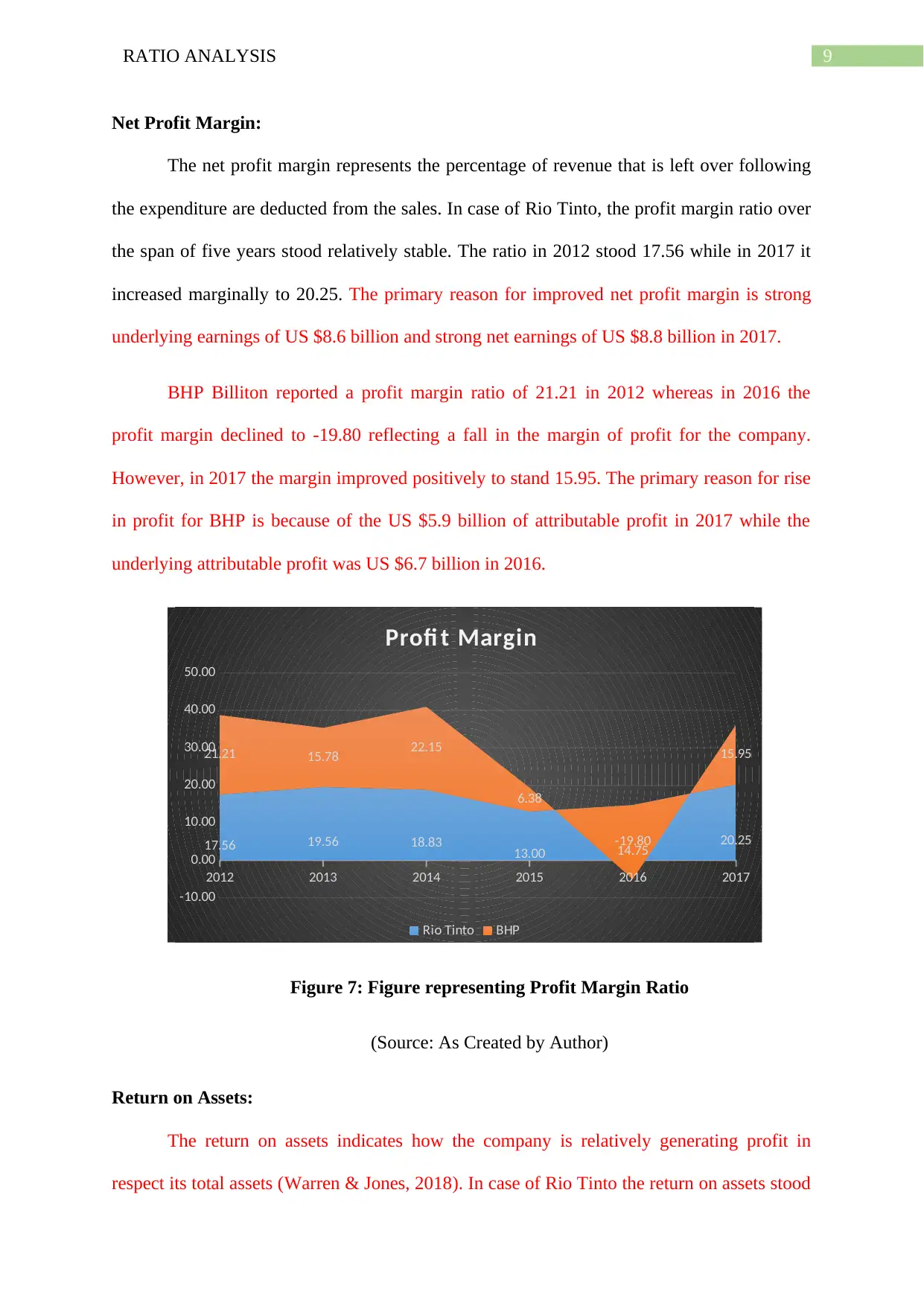

Net Profit Margin:

The net profit margin represents the percentage of revenue that is left over following

the expenditure are deducted from the sales. In case of Rio Tinto, the profit margin ratio over

the span of five years stood relatively stable. The ratio in 2012 stood 17.56 while in 2017 it

increased marginally to 20.25. The primary reason for improved net profit margin is strong

underlying earnings of US $8.6 billion and strong net earnings of US $8.8 billion in 2017.

BHP Billiton reported a profit margin ratio of 21.21 in 2012 whereas in 2016 the

profit margin declined to -19.80 reflecting a fall in the margin of profit for the company.

However, in 2017 the margin improved positively to stand 15.95. The primary reason for rise

in profit for BHP is because of the US $5.9 billion of attributable profit in 2017 while the

underlying attributable profit was US $6.7 billion in 2016.

2012 2013 2014 2015 2016 2017

-10.00

0.00

10.00

20.00

30.00

40.00

50.00

17.56 19.56 18.83 13.00 14.75 20.25

21.21 15.78 22.15

6.38

-19.80

15.95

Profi t Margin

Rio Tinto BHP

Figure 7: Figure representing Profit Margin Ratio

(Source: As Created by Author)

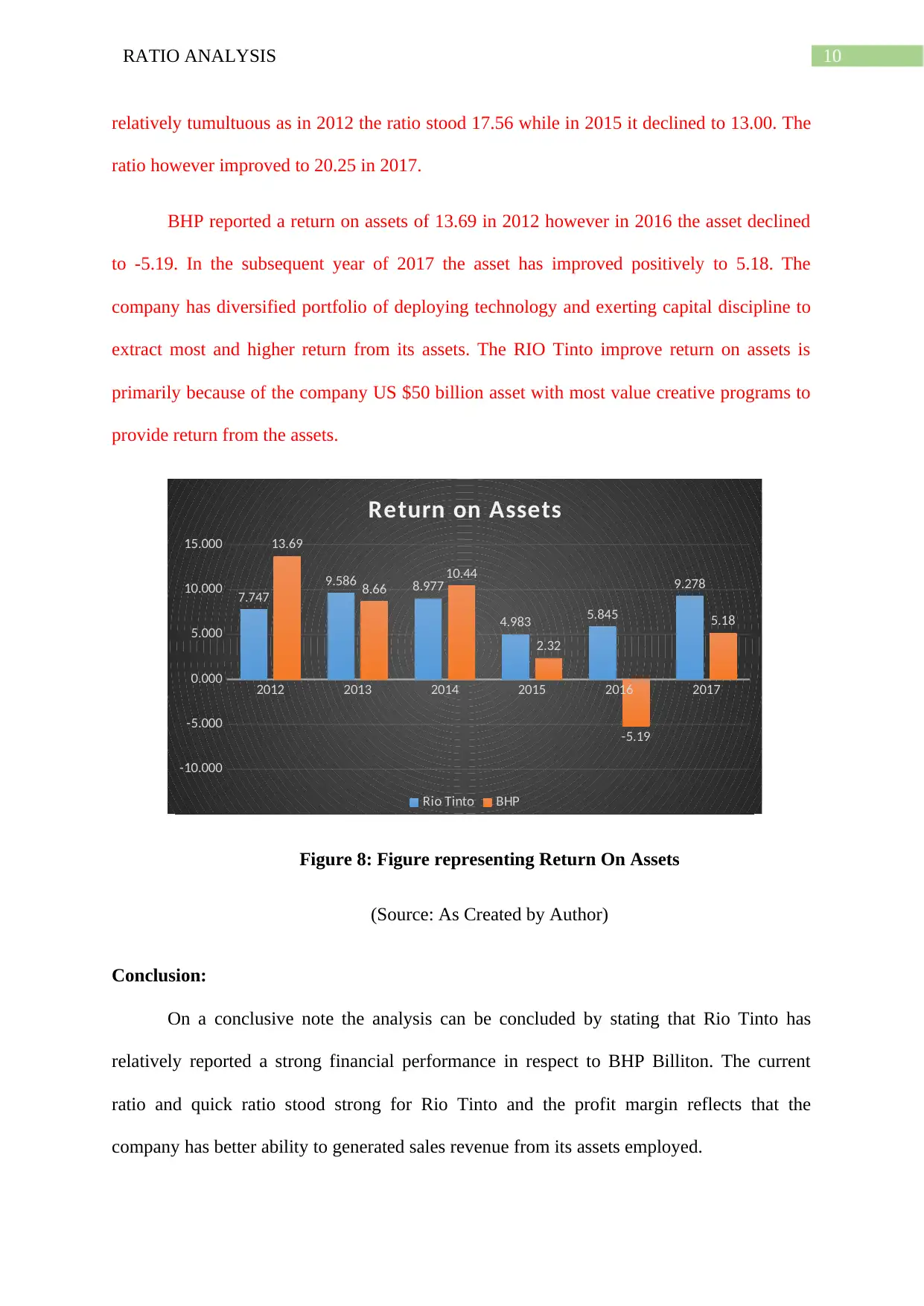

Return on Assets:

The return on assets indicates how the company is relatively generating profit in

respect its total assets (Warren & Jones, 2018). In case of Rio Tinto the return on assets stood

Net Profit Margin:

The net profit margin represents the percentage of revenue that is left over following

the expenditure are deducted from the sales. In case of Rio Tinto, the profit margin ratio over

the span of five years stood relatively stable. The ratio in 2012 stood 17.56 while in 2017 it

increased marginally to 20.25. The primary reason for improved net profit margin is strong

underlying earnings of US $8.6 billion and strong net earnings of US $8.8 billion in 2017.

BHP Billiton reported a profit margin ratio of 21.21 in 2012 whereas in 2016 the

profit margin declined to -19.80 reflecting a fall in the margin of profit for the company.

However, in 2017 the margin improved positively to stand 15.95. The primary reason for rise

in profit for BHP is because of the US $5.9 billion of attributable profit in 2017 while the

underlying attributable profit was US $6.7 billion in 2016.

2012 2013 2014 2015 2016 2017

-10.00

0.00

10.00

20.00

30.00

40.00

50.00

17.56 19.56 18.83 13.00 14.75 20.25

21.21 15.78 22.15

6.38

-19.80

15.95

Profi t Margin

Rio Tinto BHP

Figure 7: Figure representing Profit Margin Ratio

(Source: As Created by Author)

Return on Assets:

The return on assets indicates how the company is relatively generating profit in

respect its total assets (Warren & Jones, 2018). In case of Rio Tinto the return on assets stood

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10RATIO ANALYSIS

relatively tumultuous as in 2012 the ratio stood 17.56 while in 2015 it declined to 13.00. The

ratio however improved to 20.25 in 2017.

BHP reported a return on assets of 13.69 in 2012 however in 2016 the asset declined

to -5.19. In the subsequent year of 2017 the asset has improved positively to 5.18. The

company has diversified portfolio of deploying technology and exerting capital discipline to

extract most and higher return from its assets. The RIO Tinto improve return on assets is

primarily because of the company US $50 billion asset with most value creative programs to

provide return from the assets.

2012 2013 2014 2015 2016 2017

-10.000

-5.000

0.000

5.000

10.000

15.000

7.747

9.586 8.977

4.983 5.845

9.278

13.69

8.66

10.44

2.32

-5.19

5.18

Return on Assets

Rio Tinto BHP

Figure 8: Figure representing Return On Assets

(Source: As Created by Author)

Conclusion:

On a conclusive note the analysis can be concluded by stating that Rio Tinto has

relatively reported a strong financial performance in respect to BHP Billiton. The current

ratio and quick ratio stood strong for Rio Tinto and the profit margin reflects that the

company has better ability to generated sales revenue from its assets employed.

relatively tumultuous as in 2012 the ratio stood 17.56 while in 2015 it declined to 13.00. The

ratio however improved to 20.25 in 2017.

BHP reported a return on assets of 13.69 in 2012 however in 2016 the asset declined

to -5.19. In the subsequent year of 2017 the asset has improved positively to 5.18. The

company has diversified portfolio of deploying technology and exerting capital discipline to

extract most and higher return from its assets. The RIO Tinto improve return on assets is

primarily because of the company US $50 billion asset with most value creative programs to

provide return from the assets.

2012 2013 2014 2015 2016 2017

-10.000

-5.000

0.000

5.000

10.000

15.000

7.747

9.586 8.977

4.983 5.845

9.278

13.69

8.66

10.44

2.32

-5.19

5.18

Return on Assets

Rio Tinto BHP

Figure 8: Figure representing Return On Assets

(Source: As Created by Author)

Conclusion:

On a conclusive note the analysis can be concluded by stating that Rio Tinto has

relatively reported a strong financial performance in respect to BHP Billiton. The current

ratio and quick ratio stood strong for Rio Tinto and the profit margin reflects that the

company has better ability to generated sales revenue from its assets employed.

11RATIO ANALYSIS

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.