Financial Ratio Analysis and Company Performance Evaluation

VerifiedAdded on 2019/09/26

|4

|944

|631

Homework Assignment

AI Summary

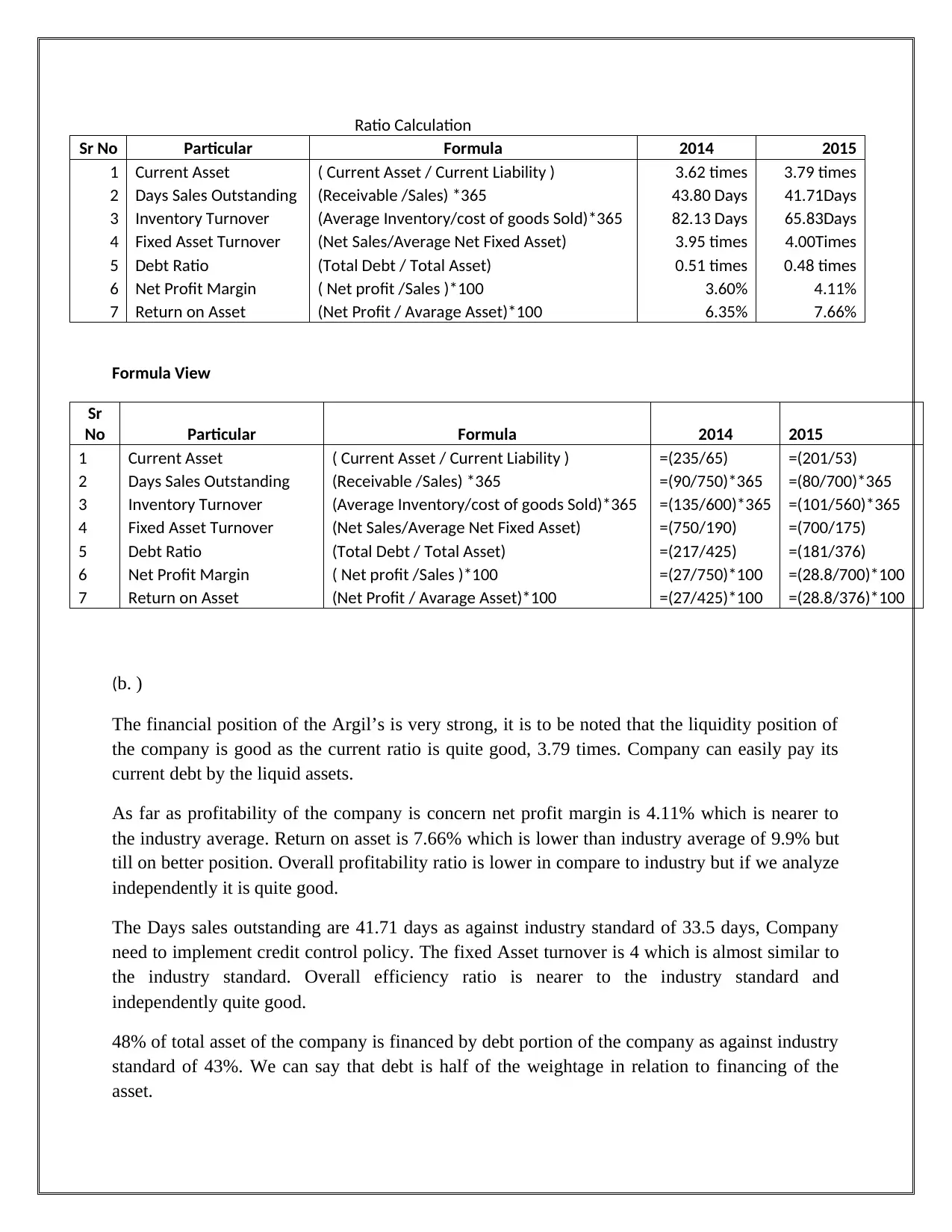

This assignment presents a comprehensive ratio analysis of Argil's financial performance for the years 2014 and 2015. It computes and interprets various financial ratios, including current ratio, days sales outstanding, inventory turnover, fixed asset turnover, debt ratio, net profit margin, and return on assets. The analysis evaluates the company's profitability, efficiency, liquidity, and capital structure, comparing the trends between the two years and against industry standards. Furthermore, the assignment discusses the financial position of the company, highlighting areas of strength and weakness, and provides insights into potential improvements or deterioration in the future. Finally, it suggests additional information, such as government policies, consumer preferences, competitor analysis, and management expertise, that would be valuable for projecting the company's future financial position. This assignment is a great resource for students studying finance and accounting.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)