RBA and the Threat of Deflation: An Economic Analysis of Australia

VerifiedAdded on 2023/06/08

|14

|3046

|419

Essay

AI Summary

This essay examines the role of the Reserve Bank of Australia (RBA) in managing the threat of deflation, drawing on the article "Is the deflation bugbear heading down under?". It discusses Australia's recent economic conditions, including GDP growth, inflation, and interest rates over the past decade. The essay explores the RBA's functions, available monetary tools such as cash rate and open market operations, and its efforts to stabilize the financial system and achieve targeted inflation rates. It also addresses the relationship between recession and inflation, the negative implications of deflation, and the monetary policies implemented by the RBA to maintain economic stability, particularly in the context of potential deflationary pressures.

Running head: ECONOMICS FOR MANAGER

Economics for Manager

Name of the University

Name of the Student

Author Note

Economics for Manager

Name of the University

Name of the Student

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS FOR MANAGER

Executive Summary:

Based on the article “Is the deflation bugbear heading down under?”, the essay has tried to

observe the role of Reserve Bank of Australia an its available tools for carrying out its

functions related to money market. For this, the essay has discussed about recent economic

condition of Australia considering its economic growth, inflation and interest rate for the last

10 years. Moreover, it has discussed about the relation between inflation and recession and

negative impact of deflation on an economy.

Executive Summary:

Based on the article “Is the deflation bugbear heading down under?”, the essay has tried to

observe the role of Reserve Bank of Australia an its available tools for carrying out its

functions related to money market. For this, the essay has discussed about recent economic

condition of Australia considering its economic growth, inflation and interest rate for the last

10 years. Moreover, it has discussed about the relation between inflation and recession and

negative impact of deflation on an economy.

2ECONOMICS FOR MANAGER

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

The role of RBA:....................................................................................................................3

Available tools of the RBA to carry out its functions:...........................................................5

Present Economic Environment in Australia:........................................................................6

Monetary Policy implemented by the RBA:..........................................................................8

Relation between Recession and Inflation:............................................................................9

Negative implication of Deflation:.......................................................................................10

Conclusion:..............................................................................................................................11

References:...............................................................................................................................12

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

The role of RBA:....................................................................................................................3

Available tools of the RBA to carry out its functions:...........................................................5

Present Economic Environment in Australia:........................................................................6

Monetary Policy implemented by the RBA:..........................................................................8

Relation between Recession and Inflation:............................................................................9

Negative implication of Deflation:.......................................................................................10

Conclusion:..............................................................................................................................11

References:...............................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS FOR MANAGER

Introduction:

Deflation is a macroeconomic term that represents decrease in price level for goods

and services and during this situation, inflation rate becomes less than 0 percent. The chief

reason of deflation is fixed supply of money and this in turn increases purchasing power of a

country’s currency through allowing consumers to purchase more products compare to before

(Dinga 2017). In addition to this, deflation within an economy can occur if total supply

exceeds total demand. This economic phenomenon has generated significant problem for the

modern economy, as it leads real value of debt to increase further. This report will discuss

about the threat of deflation that the Reserve Bank of Australia (RBA) has experienced since

global financial crisis (Reserve Bank of Australia. 2018). The RBA is known as the

Australia’s central bank that performs various activities to stabilise currency, economic

prosperity, welfare of citizens and full employment. The bank has various monetary tools like

cash rate or open market operations with the help of which it can meet the targeted rate of

medium-term inflation for achieving a strong financial system along with a system of

efficient payments. The report will focus about the role of RBA in Australian economy

through analysing these monetary tools for carrying out its functions. In addition to this, the

report will also discuss about the present economic condition of this country considering

inflation and interest rates within the country. Moreover, the article, named, “Is the deflation

bugbear heading Down Under?” will be discussed further to understand about the relation

between inflation and recession (Morningstar.com.au. 2018).

Discussion:

The role of RBA:

The RBA controls the entire money market of Australia through implementing

various monetary policies to keep a strong financial system. In addition to this, the bank

posses the responsibility of note issue while it also provides various services related to

Introduction:

Deflation is a macroeconomic term that represents decrease in price level for goods

and services and during this situation, inflation rate becomes less than 0 percent. The chief

reason of deflation is fixed supply of money and this in turn increases purchasing power of a

country’s currency through allowing consumers to purchase more products compare to before

(Dinga 2017). In addition to this, deflation within an economy can occur if total supply

exceeds total demand. This economic phenomenon has generated significant problem for the

modern economy, as it leads real value of debt to increase further. This report will discuss

about the threat of deflation that the Reserve Bank of Australia (RBA) has experienced since

global financial crisis (Reserve Bank of Australia. 2018). The RBA is known as the

Australia’s central bank that performs various activities to stabilise currency, economic

prosperity, welfare of citizens and full employment. The bank has various monetary tools like

cash rate or open market operations with the help of which it can meet the targeted rate of

medium-term inflation for achieving a strong financial system along with a system of

efficient payments. The report will focus about the role of RBA in Australian economy

through analysing these monetary tools for carrying out its functions. In addition to this, the

report will also discuss about the present economic condition of this country considering

inflation and interest rates within the country. Moreover, the article, named, “Is the deflation

bugbear heading Down Under?” will be discussed further to understand about the relation

between inflation and recession (Morningstar.com.au. 2018).

Discussion:

The role of RBA:

The RBA controls the entire money market of Australia through implementing

various monetary policies to keep a strong financial system. In addition to this, the bank

posses the responsibility of note issue while it also provides various services related to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS FOR MANAGER

selected banking and registry activities on behalf of Austrian government along with some

foreign central banks and other official institutions (Ellis 2018). Moreover, the RBA also

manages country’s reserves for gold and foreign exchange. For various monetary policies, the

bank can change its cash rate accordingly. The RBA conducts various operations in both

domestic and international markets for undertaking different market analysis along as well as

institutional developments to support its own policy objectives. These objectives consider

sufficient amount of money supply within the domestic market on a regular basis, assistance

of monetary policy of banks and objectives to stable financial system. The RBA also

performs in foreign exchange market to achieve the requirement of foreign exchange to its

clients while the biggest customer is Australian government. The bank also helps the

economy to manage its liquidity in domestic markets. In addition to this, the RBA keeps and

manages foreign currency reserves of Australia and posses the power to intervene into the

market of foreign exchange for addressing any obvious dysfunction (Ellis and Littrell 2017).

Hence, the Reserve Bank of Australia has significant role to ensure market stability,

competitiveness and efficiency based on the payments system by the Payments System Board

that was formed in 1998.

The RBA also possesses an operational role in the economy’s payments system

because it performs as the manager and owner of the country’s high-value payments system.

Consequently, a part of the RBA charges the Reserve bank Information and Transfer System

(RITS) against international standards on an annual basis (Du, Tepper and Verdelhan 2018).

Thus, it can be said that the central bank provides some special banking services to Australian

government as well as foreign official institutions through providing payments, maintenance

of general account, reporting and collections.

selected banking and registry activities on behalf of Austrian government along with some

foreign central banks and other official institutions (Ellis 2018). Moreover, the RBA also

manages country’s reserves for gold and foreign exchange. For various monetary policies, the

bank can change its cash rate accordingly. The RBA conducts various operations in both

domestic and international markets for undertaking different market analysis along as well as

institutional developments to support its own policy objectives. These objectives consider

sufficient amount of money supply within the domestic market on a regular basis, assistance

of monetary policy of banks and objectives to stable financial system. The RBA also

performs in foreign exchange market to achieve the requirement of foreign exchange to its

clients while the biggest customer is Australian government. The bank also helps the

economy to manage its liquidity in domestic markets. In addition to this, the RBA keeps and

manages foreign currency reserves of Australia and posses the power to intervene into the

market of foreign exchange for addressing any obvious dysfunction (Ellis and Littrell 2017).

Hence, the Reserve Bank of Australia has significant role to ensure market stability,

competitiveness and efficiency based on the payments system by the Payments System Board

that was formed in 1998.

The RBA also possesses an operational role in the economy’s payments system

because it performs as the manager and owner of the country’s high-value payments system.

Consequently, a part of the RBA charges the Reserve bank Information and Transfer System

(RITS) against international standards on an annual basis (Du, Tepper and Verdelhan 2018).

Thus, it can be said that the central bank provides some special banking services to Australian

government as well as foreign official institutions through providing payments, maintenance

of general account, reporting and collections.

5ECONOMICS FOR MANAGER

Available tools of the RBA to carry out its functions:

Market Operations of the RBA:

The chief responsibility of the Reserve Bank of Australia is to implement monetary

policy through adjusting the cash rate. At this rate, banks can borrow money from others or

can lend money overnight to each other on an unsecured basis. With the help of demand and

supply concepts related to exchange settlement, this rate is determined (Reserve Bank of

Australia 2018). With the help of open market operations, the RBA alters the amount of these

balances that commercial banks keep in the central bank s that the central bank can maintain

its cash rate closer to its possible target. In addition to this, the central bank takes

responsibilities related to transitions in the market of foreign exchange and markets of foreign

asset to maintaining foreign currency reserves within the country. The reserve of foreign

currency is considered as assets that are mentioned in the bank’s balance sheet by allocating

currency, asset and risks of interest rate based on investment management to achieve targets

(Robertson 2017). Reserves of foreign currency are organized timely to influence policy

operations in the market of domestic cash and foreign exchange.

Financial Stability of the RBA:

The other important function of the Reserve Bank of Australia is to maintain stable

financial system during long term. With the help of stable financial system, any financial

institutions along with market infrastructure can facilitate the smooth flow of funds between

investors and savers. This further can promote economic activity to grow further (Reserve

Bank of Australia 2018). The central bank, in this context, has played vital role to mitigate

the risks related to financial disturbances, which have some systemic consequences and this

further provide responses to the financial system. The bank performs on these issues along

with other agencies like the Council of Financial Regulators (CFR). The chief function of the

Available tools of the RBA to carry out its functions:

Market Operations of the RBA:

The chief responsibility of the Reserve Bank of Australia is to implement monetary

policy through adjusting the cash rate. At this rate, banks can borrow money from others or

can lend money overnight to each other on an unsecured basis. With the help of demand and

supply concepts related to exchange settlement, this rate is determined (Reserve Bank of

Australia 2018). With the help of open market operations, the RBA alters the amount of these

balances that commercial banks keep in the central bank s that the central bank can maintain

its cash rate closer to its possible target. In addition to this, the central bank takes

responsibilities related to transitions in the market of foreign exchange and markets of foreign

asset to maintaining foreign currency reserves within the country. The reserve of foreign

currency is considered as assets that are mentioned in the bank’s balance sheet by allocating

currency, asset and risks of interest rate based on investment management to achieve targets

(Robertson 2017). Reserves of foreign currency are organized timely to influence policy

operations in the market of domestic cash and foreign exchange.

Financial Stability of the RBA:

The other important function of the Reserve Bank of Australia is to maintain stable

financial system during long term. With the help of stable financial system, any financial

institutions along with market infrastructure can facilitate the smooth flow of funds between

investors and savers. This further can promote economic activity to grow further (Reserve

Bank of Australia 2018). The central bank, in this context, has played vital role to mitigate

the risks related to financial disturbances, which have some systemic consequences and this

further provide responses to the financial system. The bank performs on these issues along

with other agencies like the Council of Financial Regulators (CFR). The chief function of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS FOR MANAGER

CFR is to contribute effective and efficient regulation and stability within the financial

system.

Inflation Target:

Controlling inflation within the economy is considered as other important activity of

the Reserve Bank of Australia. According to the Treasurer and Governor, appropriate target

of the country’s monetary policy is to obtain an average inflation rate between 2 percent to 3

percent over the year (Reserve Bank of Australia 2018). The low rate of inflation cannot

adversely affect the economic condition of any country and consequently economic decisions

remain almost unchanged. To obtain this targeted rate of inflation, the RBA follows some

monetary policies regarding decision-making. To manage this situation, the central bank

alters its cash rate based on requirements. This implies that the bank increases its cash rate

during inflation while reduces it during the period of deflation.

Present Economic Environment in Australia:

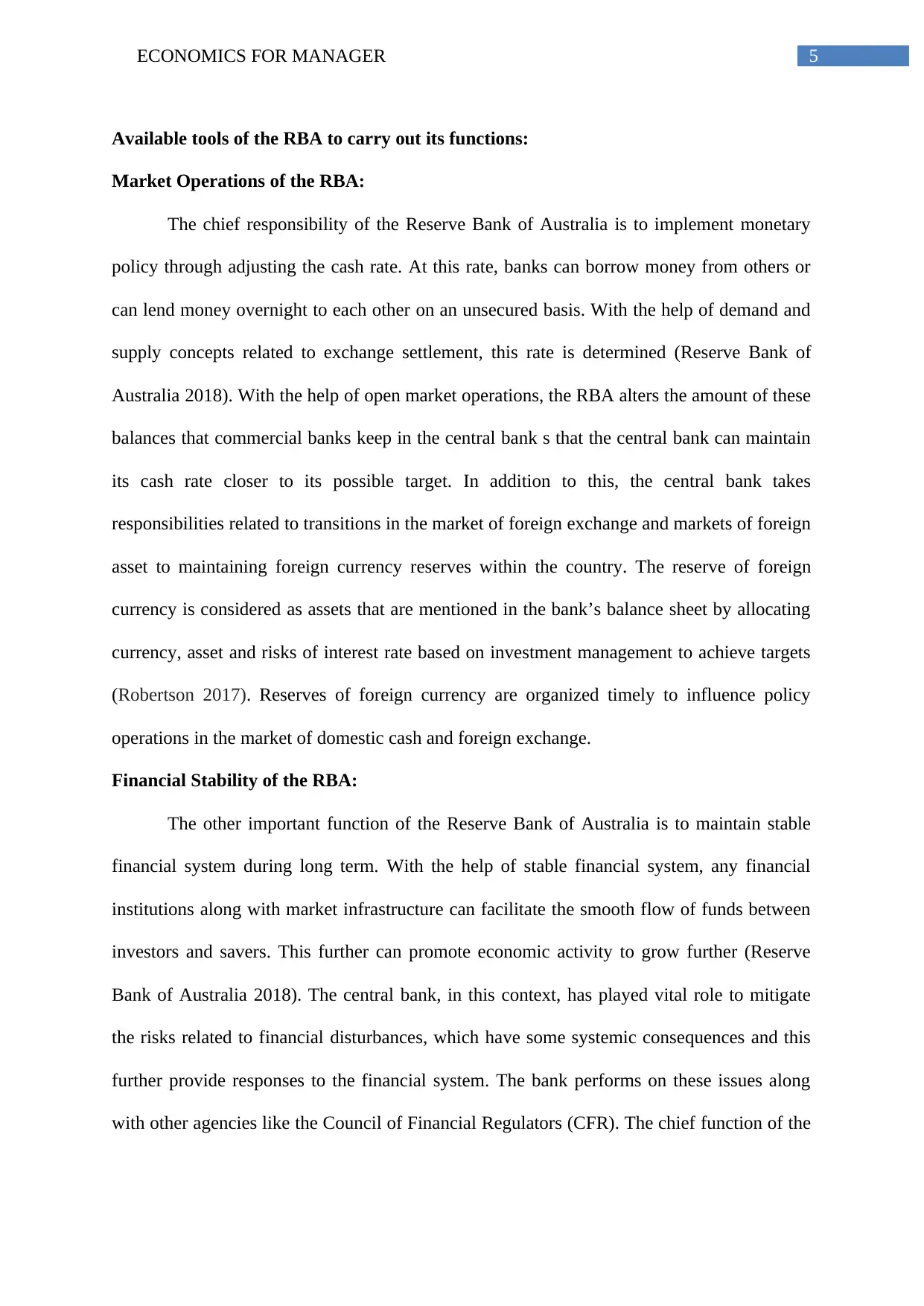

According to present data of the World Bank, it can be stated that Australian

economy has fluctuated over the years and at present it has started to decline drastically.

During global financial crisis, the annual GDP growth rate of the country fallen by large

extend became less than 2% in 2008 (Data.worldbank.org 2018). Afther this year, the country

again started to recover its economic growth and consequently it increased by more than

3.5% during 2012 (Tradingeconomics.com 2018). However, after this year, the growth rate of

this counry has again started to fall at a contious rate. The chief reason behind the fall in

annual GDP growth rate of Australia can be described further. During global finacial crisis,

China and the U.S.A and other countries have experienced drastic fall in their economic

growth and this further affected Australia, as these countries are cosnidered as the biggest

trading parterns of it. Morover, recent economic slowdown of China has adversly affect

Australian economy to grow further. Decreasing demand of Australia’s agricutural products

CFR is to contribute effective and efficient regulation and stability within the financial

system.

Inflation Target:

Controlling inflation within the economy is considered as other important activity of

the Reserve Bank of Australia. According to the Treasurer and Governor, appropriate target

of the country’s monetary policy is to obtain an average inflation rate between 2 percent to 3

percent over the year (Reserve Bank of Australia 2018). The low rate of inflation cannot

adversely affect the economic condition of any country and consequently economic decisions

remain almost unchanged. To obtain this targeted rate of inflation, the RBA follows some

monetary policies regarding decision-making. To manage this situation, the central bank

alters its cash rate based on requirements. This implies that the bank increases its cash rate

during inflation while reduces it during the period of deflation.

Present Economic Environment in Australia:

According to present data of the World Bank, it can be stated that Australian

economy has fluctuated over the years and at present it has started to decline drastically.

During global financial crisis, the annual GDP growth rate of the country fallen by large

extend became less than 2% in 2008 (Data.worldbank.org 2018). Afther this year, the country

again started to recover its economic growth and consequently it increased by more than

3.5% during 2012 (Tradingeconomics.com 2018). However, after this year, the growth rate of

this counry has again started to fall at a contious rate. The chief reason behind the fall in

annual GDP growth rate of Australia can be described further. During global finacial crisis,

China and the U.S.A and other countries have experienced drastic fall in their economic

growth and this further affected Australia, as these countries are cosnidered as the biggest

trading parterns of it. Morover, recent economic slowdown of China has adversly affect

Australian economy to grow further. Decreasing demand of Australia’s agricutural products

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS FOR MANAGER

have also led the economic growth of this country to decline further. However, during the

first and second quarter of 2018, this growth rate has increased significntly.

Figure 1: Annual GDP growth rate of Australia

Source: (Tradingeconomics.com 2018)

Figure 2: Inflation rate in Australia

Source: (Tradingeconomics.com 2018)

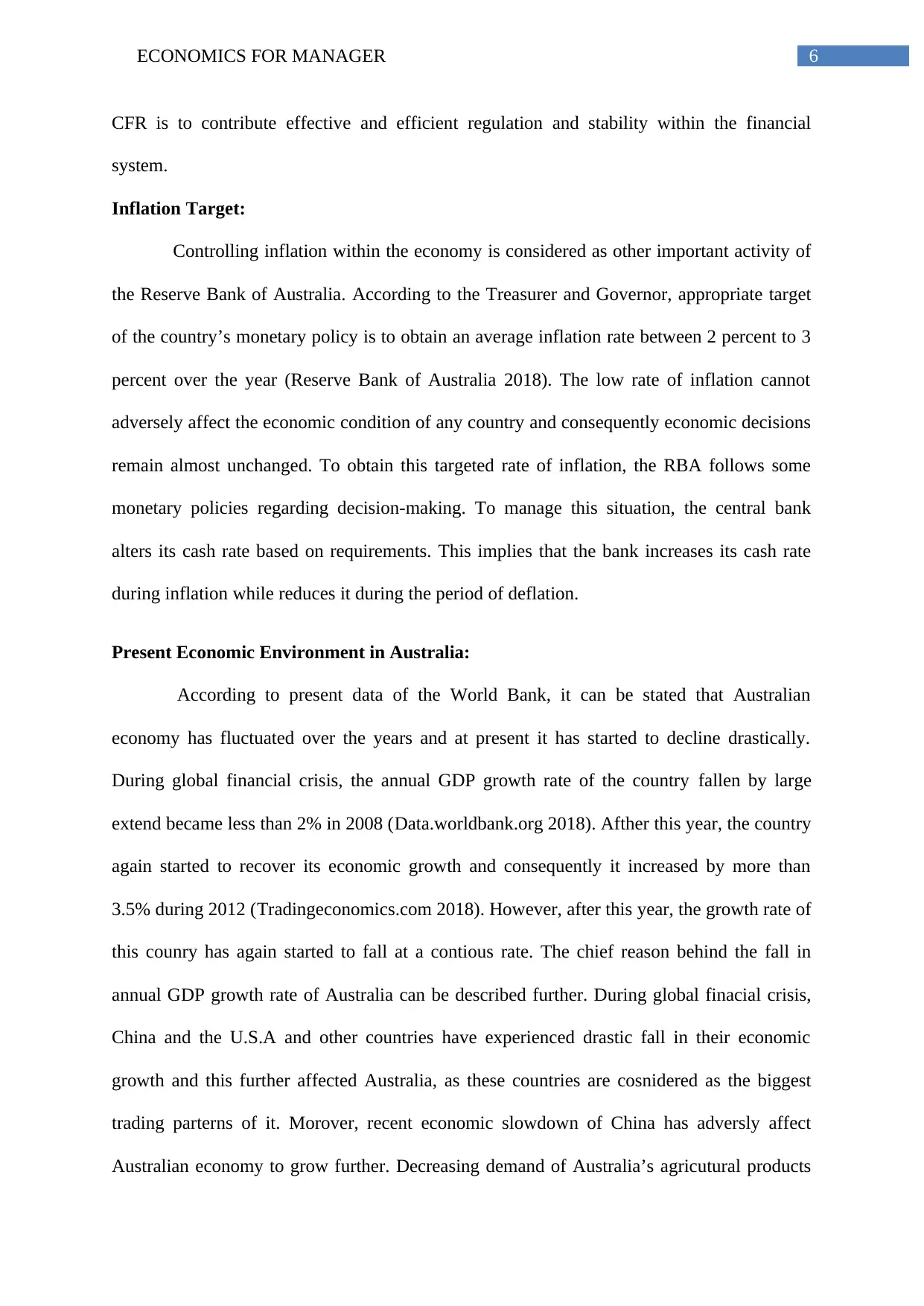

According to figure 2, it is seen that inflation rate of Australia has reduced over the

year since global financial crisis. During global financial crisis, the rate fallen drastically

though after the year, this rate started to increase further. However, at present, the inflation

rate of this country becomes more than 2% (Tradingeconomics.com 2018).

have also led the economic growth of this country to decline further. However, during the

first and second quarter of 2018, this growth rate has increased significntly.

Figure 1: Annual GDP growth rate of Australia

Source: (Tradingeconomics.com 2018)

Figure 2: Inflation rate in Australia

Source: (Tradingeconomics.com 2018)

According to figure 2, it is seen that inflation rate of Australia has reduced over the

year since global financial crisis. During global financial crisis, the rate fallen drastically

though after the year, this rate started to increase further. However, at present, the inflation

rate of this country becomes more than 2% (Tradingeconomics.com 2018).

8ECONOMICS FOR MANAGER

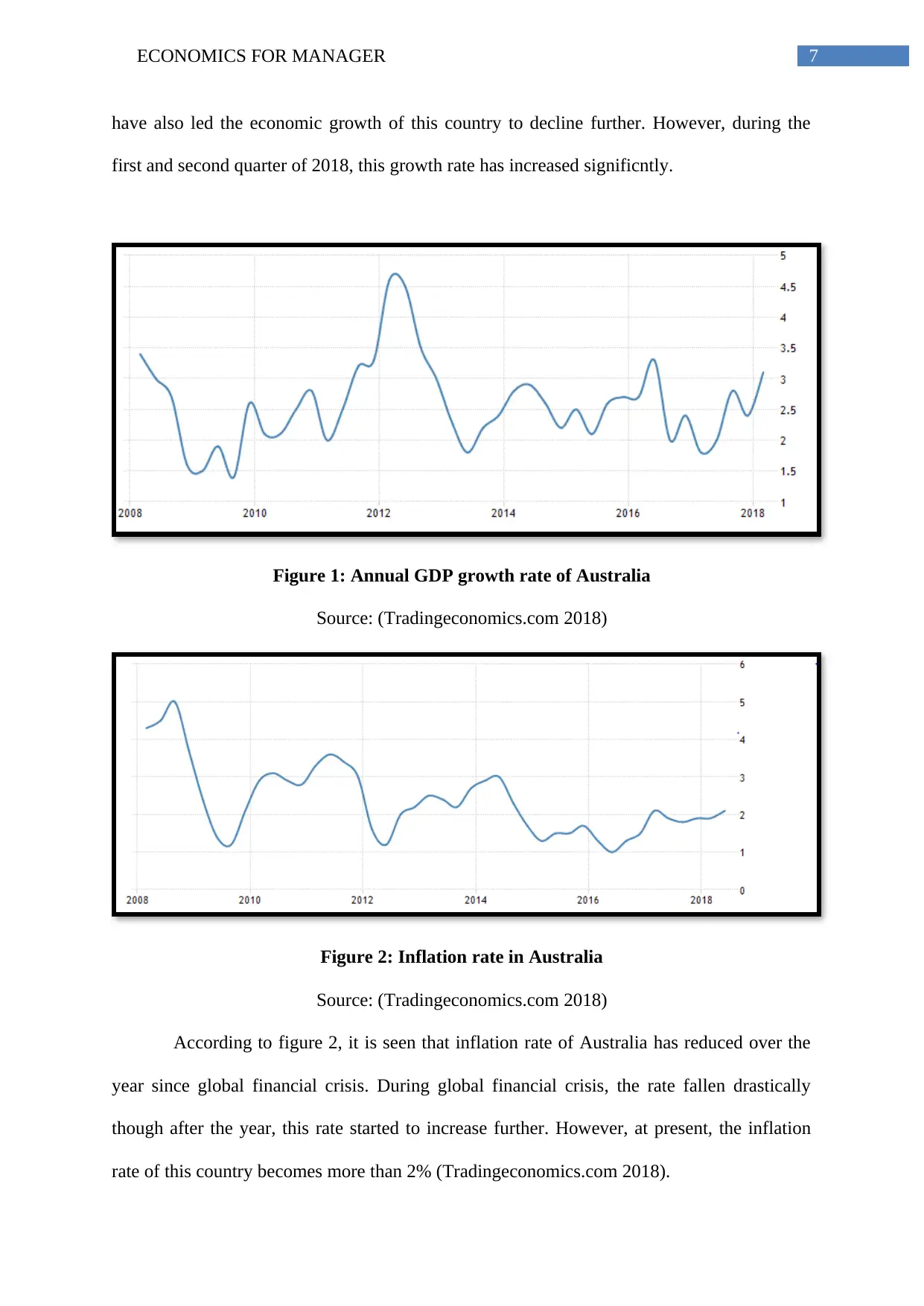

Figure 3: Interest rate in Australia

Source: (Tradingeconomics.com 2018)

The RBA of Australia has kept the interest rate of Australia at 1.5% since 2016. This

can be stated as the longest policy pause of the Australian government due to slow growth of

inflation and wages within the economy.

Monetary Policy implemented by the RBA:

At present, the Domestic Markets Department of RBA maintains the money market of

this county through keeping the cash rate at its target level. Through changing cash rates, the

bank can influence the banking interest rate indirectly and for this cash rate is considered as

one of the powerful tool to control inflation or deflation (Fabris 2018). Thus, changing

monetary policy indicates that the bank is changing its cash rate. As the inflation rate of

Australia presently represents 2%, the bank keeps its interest rate as stable because increasing

inflation can cause deflation within the economy while decreasing rate of interest can bring

inflation in future.

Moreover, changing cash rate can influence other interest rates within the capital

market, such as, bond and money market rates. In Australia, most of the loans and deposits

have short-term fixed rates or variable rates and for this changing cash rate can significantly

influence these deposit and lending rates (Reserve Bank of Australia 2018). In addition to

Figure 3: Interest rate in Australia

Source: (Tradingeconomics.com 2018)

The RBA of Australia has kept the interest rate of Australia at 1.5% since 2016. This

can be stated as the longest policy pause of the Australian government due to slow growth of

inflation and wages within the economy.

Monetary Policy implemented by the RBA:

At present, the Domestic Markets Department of RBA maintains the money market of

this county through keeping the cash rate at its target level. Through changing cash rates, the

bank can influence the banking interest rate indirectly and for this cash rate is considered as

one of the powerful tool to control inflation or deflation (Fabris 2018). Thus, changing

monetary policy indicates that the bank is changing its cash rate. As the inflation rate of

Australia presently represents 2%, the bank keeps its interest rate as stable because increasing

inflation can cause deflation within the economy while decreasing rate of interest can bring

inflation in future.

Moreover, changing cash rate can influence other interest rates within the capital

market, such as, bond and money market rates. In Australia, most of the loans and deposits

have short-term fixed rates or variable rates and for this changing cash rate can significantly

influence these deposit and lending rates (Reserve Bank of Australia 2018). In addition to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS FOR MANAGER

this, changing rate of interest influences business organizations and individuals to adjust their

activity. For instance, it can affect expenditure and saving pattern of individuals and firms

along with credit supply, cash flow exchange rate and asset prices for which aggregate

demand of the country affects. Consequently, this phenomenon further influences interest

rates and imported goods through affecting exchange rate.

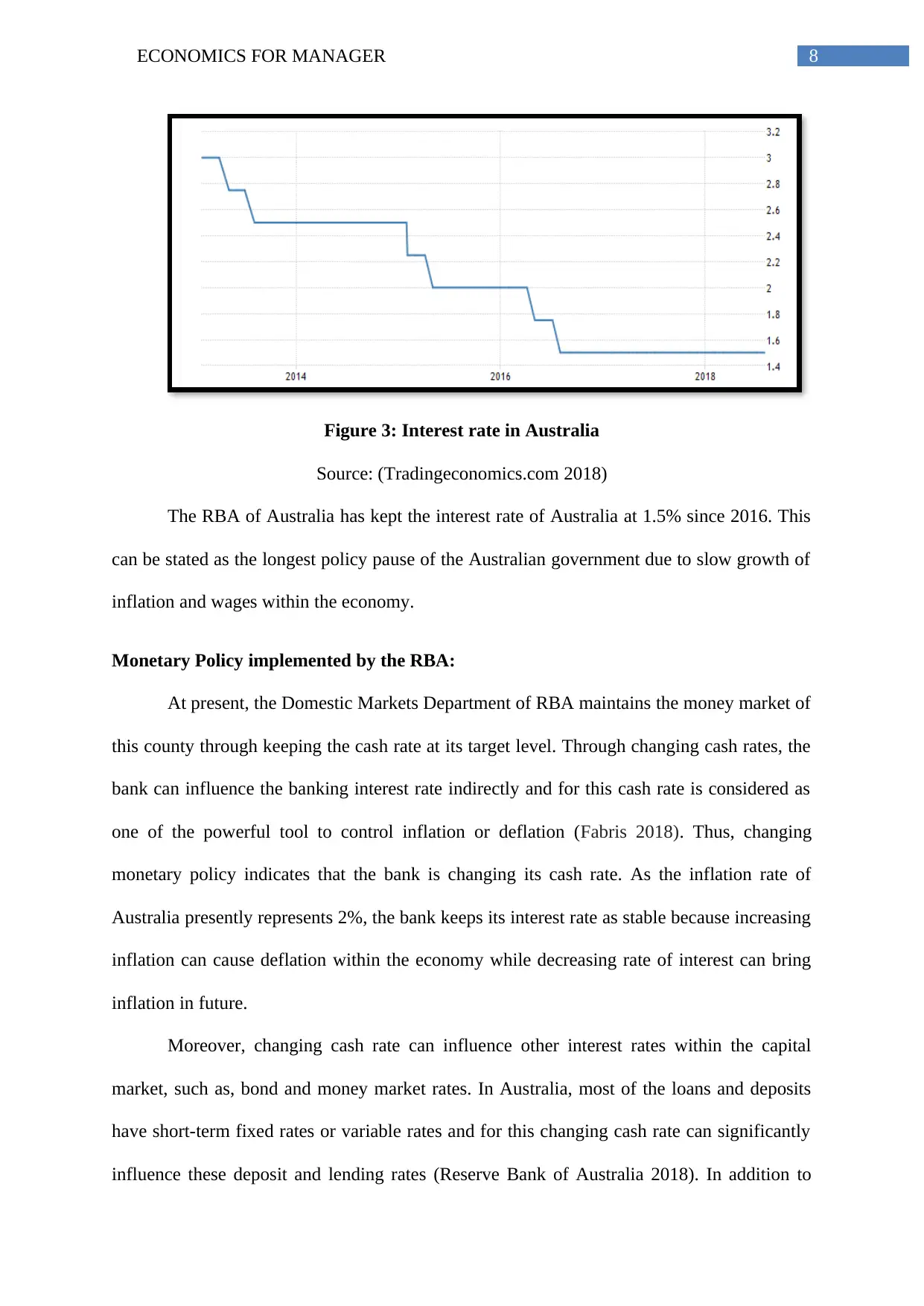

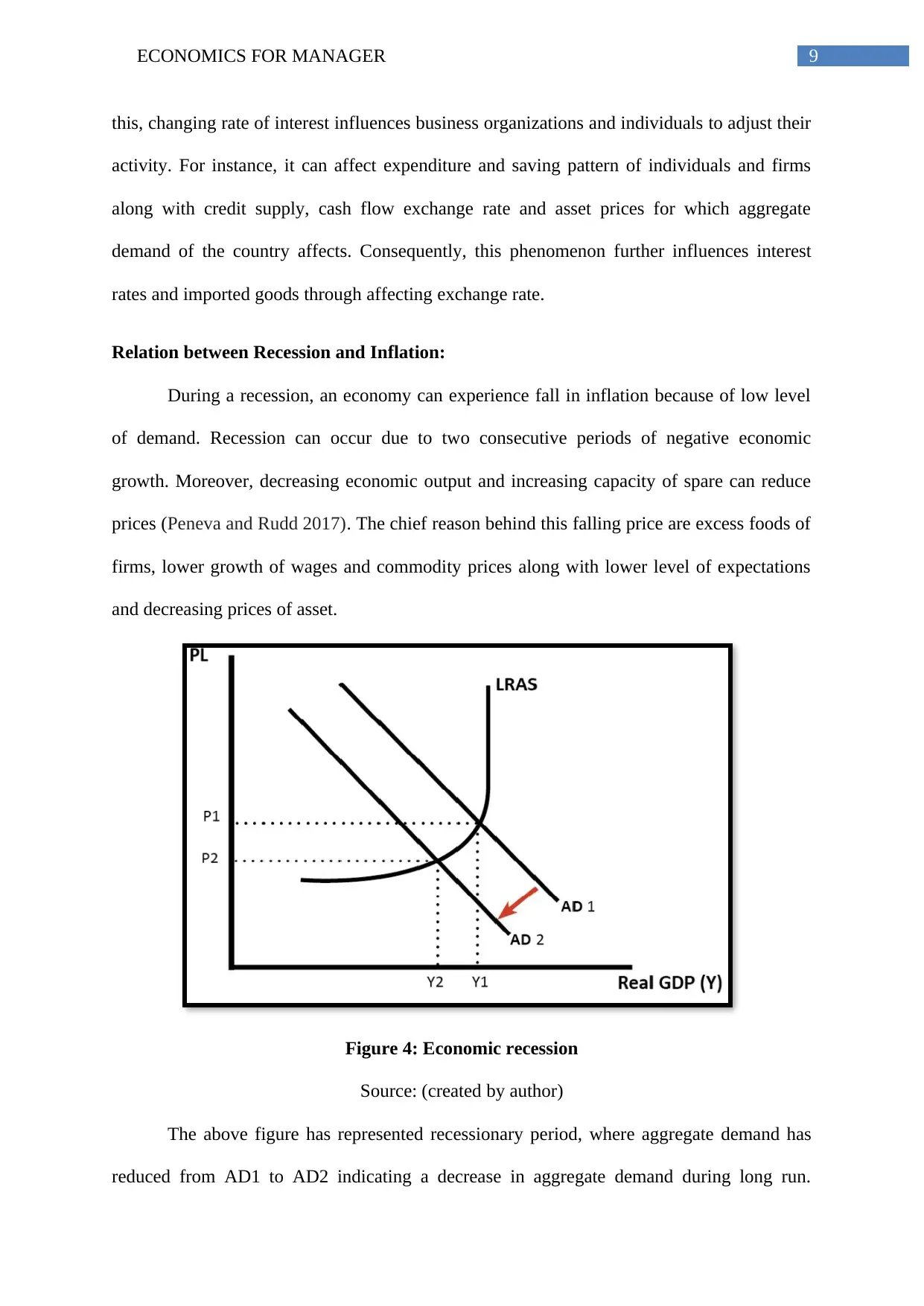

Relation between Recession and Inflation:

During a recession, an economy can experience fall in inflation because of low level

of demand. Recession can occur due to two consecutive periods of negative economic

growth. Moreover, decreasing economic output and increasing capacity of spare can reduce

prices (Peneva and Rudd 2017). The chief reason behind this falling price are excess foods of

firms, lower growth of wages and commodity prices along with lower level of expectations

and decreasing prices of asset.

Figure 4: Economic recession

Source: (created by author)

The above figure has represented recessionary period, where aggregate demand has

reduced from AD1 to AD2 indicating a decrease in aggregate demand during long run.

this, changing rate of interest influences business organizations and individuals to adjust their

activity. For instance, it can affect expenditure and saving pattern of individuals and firms

along with credit supply, cash flow exchange rate and asset prices for which aggregate

demand of the country affects. Consequently, this phenomenon further influences interest

rates and imported goods through affecting exchange rate.

Relation between Recession and Inflation:

During a recession, an economy can experience fall in inflation because of low level

of demand. Recession can occur due to two consecutive periods of negative economic

growth. Moreover, decreasing economic output and increasing capacity of spare can reduce

prices (Peneva and Rudd 2017). The chief reason behind this falling price are excess foods of

firms, lower growth of wages and commodity prices along with lower level of expectations

and decreasing prices of asset.

Figure 4: Economic recession

Source: (created by author)

The above figure has represented recessionary period, where aggregate demand has

reduced from AD1 to AD2 indicating a decrease in aggregate demand during long run.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS FOR MANAGER

Consequently, real GDP and price level of the country decreases from Y1 to Y2 and P1 to P2,

respectively. Thus, inflation of the country can reduce further. However, cost-push inflation

can increase inflation during short-run.

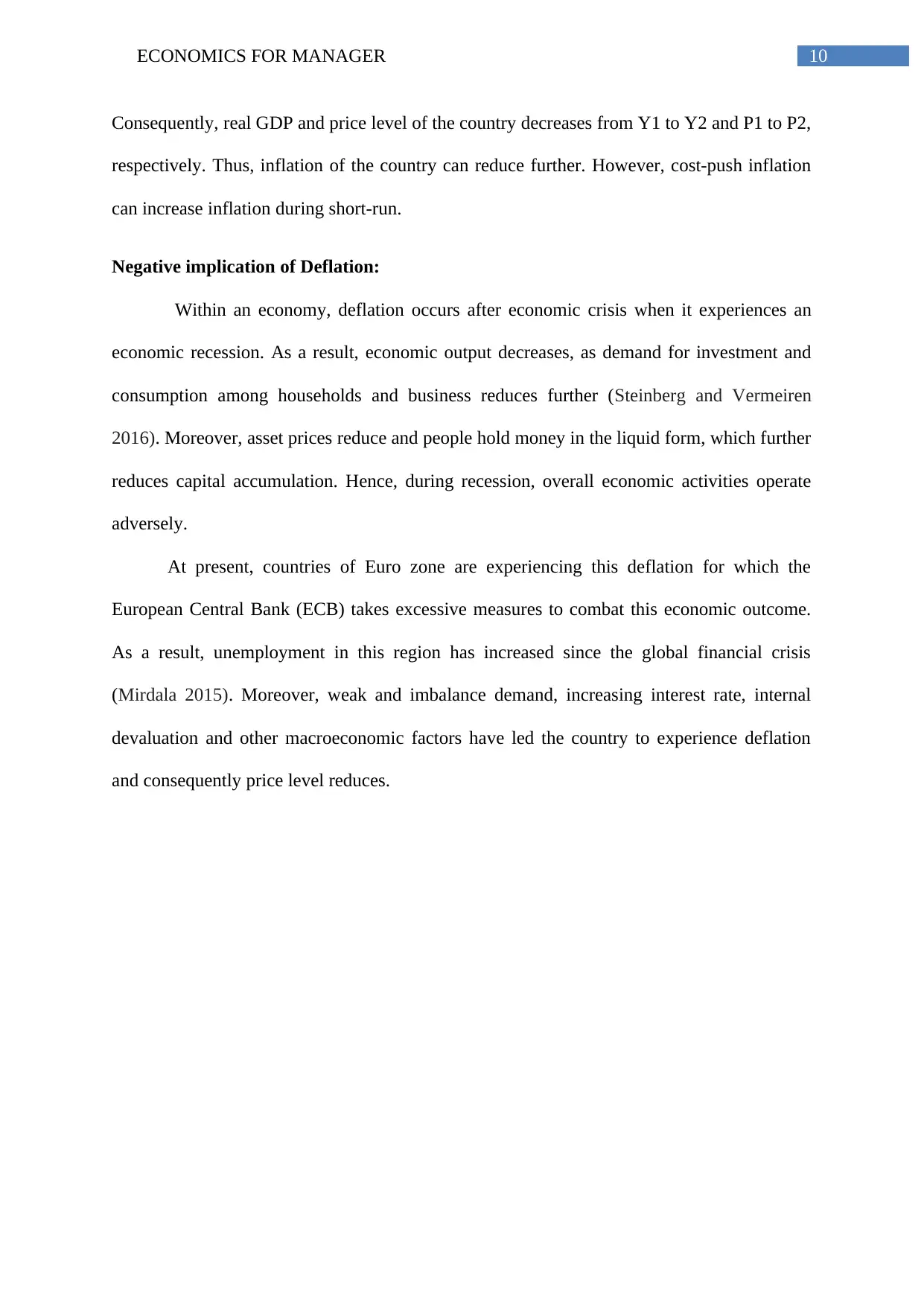

Negative implication of Deflation:

Within an economy, deflation occurs after economic crisis when it experiences an

economic recession. As a result, economic output decreases, as demand for investment and

consumption among households and business reduces further (Steinberg and Vermeiren

2016). Moreover, asset prices reduce and people hold money in the liquid form, which further

reduces capital accumulation. Hence, during recession, overall economic activities operate

adversely.

At present, countries of Euro zone are experiencing this deflation for which the

European Central Bank (ECB) takes excessive measures to combat this economic outcome.

As a result, unemployment in this region has increased since the global financial crisis

(Mirdala 2015). Moreover, weak and imbalance demand, increasing interest rate, internal

devaluation and other macroeconomic factors have led the country to experience deflation

and consequently price level reduces.

Consequently, real GDP and price level of the country decreases from Y1 to Y2 and P1 to P2,

respectively. Thus, inflation of the country can reduce further. However, cost-push inflation

can increase inflation during short-run.

Negative implication of Deflation:

Within an economy, deflation occurs after economic crisis when it experiences an

economic recession. As a result, economic output decreases, as demand for investment and

consumption among households and business reduces further (Steinberg and Vermeiren

2016). Moreover, asset prices reduce and people hold money in the liquid form, which further

reduces capital accumulation. Hence, during recession, overall economic activities operate

adversely.

At present, countries of Euro zone are experiencing this deflation for which the

European Central Bank (ECB) takes excessive measures to combat this economic outcome.

As a result, unemployment in this region has increased since the global financial crisis

(Mirdala 2015). Moreover, weak and imbalance demand, increasing interest rate, internal

devaluation and other macroeconomic factors have led the country to experience deflation

and consequently price level reduces.

11ECONOMICS FOR MANAGER

AS2

AS1

AD1

AD2

Real GDP

GPL

O

PL1

PL2

Y2 Y1

Figure 5: Price deflation

Source: (created by author)

Leverage is an important concept that helps an economy to borrow money for

increasing investment return. If the amount of return on the total invested value is higher

compare to the interest paid for borrowing funds, then it can bring profit for the individual.

Conclusion:

In conclusion it can be said that Australian economy has experienced adverse

economic growth though the inflation level has remained lower. For this, the RBS has

maintained a stable rate of interest. The RBA plays significant role to control inflation

through applying its monetary policies. Deflation is not good for an economy as it brings

negative implication on economy by reducing aggregate demand and general price level.

AS2

AS1

AD1

AD2

Real GDP

GPL

O

PL1

PL2

Y2 Y1

Figure 5: Price deflation

Source: (created by author)

Leverage is an important concept that helps an economy to borrow money for

increasing investment return. If the amount of return on the total invested value is higher

compare to the interest paid for borrowing funds, then it can bring profit for the individual.

Conclusion:

In conclusion it can be said that Australian economy has experienced adverse

economic growth though the inflation level has remained lower. For this, the RBS has

maintained a stable rate of interest. The RBA plays significant role to control inflation

through applying its monetary policies. Deflation is not good for an economy as it brings

negative implication on economy by reducing aggregate demand and general price level.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.