Corporate Accounting: Comparative Analysis of Equity Elements

VerifiedAdded on 2023/06/05

|9

|1762

|122

Report

AI Summary

This report provides an in-depth analysis of the capital structures and equity elements of four real estate companies: Divine Limited, Dexus, Centuria Metropolitan REIT, and Charter Hall Retail REIT. The analysis focuses on key equity components such as share capital, retained earnings, and reserves, examining their movements and trends over a four-year period. The report compares the debt-to-equity ratios of the companies, revealing insights into their financing strategies. Centuria Metropolitan REIT is highlighted for its effective capital structure management through share issuance, while Divine Limited and Charter Hall Retail REIT are noted for their ongoing accumulated losses. Dexus, despite generating profits, is cautioned about its higher debt levels. The report concludes that effective capital structure management is crucial for maintaining profitability and operational stability, emphasizing the importance of balancing debt and equity financing.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2CORPORATE ACCOUNTING

Table of Contents

Introduction:....................................................................................................................................3

Analysis of Equity Elements:..........................................................................................................3

Comparison of the Capital Structures:.............................................................................................7

Conclusion:......................................................................................................................................7

Reference:........................................................................................................................................9

Table of Contents

Introduction:....................................................................................................................................3

Analysis of Equity Elements:..........................................................................................................3

Comparison of the Capital Structures:.............................................................................................7

Conclusion:......................................................................................................................................7

Reference:........................................................................................................................................9

3CORPORATE ACCOUNTING

Introduction:

Capital structure of any business firm can be defined as the funding of its operating and

investing activities through various types of funds. These funds can be classified mainly into two

forms – equity capital and debt capital. Equity capital is accumulated from the owners of the

business, whereas, debt capital is collected from different third parties (Robb & Robinson, 2014).

It is very essential for a business firm to maintain a proper capital structure to continue the

operations properly.

The total equity, which is one of the most important source of capital financing, is the

liability to the owners of the business. For the company form of businesses, it is attributable to

the shareholders of the company (Jõeveer, 2013). The total equity is consisted of different

elements of equity capital. Some of the elements, such as, share capital, retained earnings,

general reserve etc. are directly attributed to the shareholders. On the other hand, some equity

funds, which are created for some specific purposes, for example, asset revaluation reserve,

capital reserve etc., are indirectly related to the owners and can only be paid back to them at the

time of liquidation of the business.

In this report, four real estate companies, namely, Divine Limited, Dexus, Centuria

Metropolitan Reit and Charter Hall Retail Reit, have been selected to analyse the capital

structures and the movements of various equity elements.

Analysis of Equity Elements:

As discussed above, the total equity is comprised of different types of equity funds.

However, it is not necessary that all the companies must have same elements. The two elements,

which are common for all companies, are share capital and retained earnings or accumulated

Introduction:

Capital structure of any business firm can be defined as the funding of its operating and

investing activities through various types of funds. These funds can be classified mainly into two

forms – equity capital and debt capital. Equity capital is accumulated from the owners of the

business, whereas, debt capital is collected from different third parties (Robb & Robinson, 2014).

It is very essential for a business firm to maintain a proper capital structure to continue the

operations properly.

The total equity, which is one of the most important source of capital financing, is the

liability to the owners of the business. For the company form of businesses, it is attributable to

the shareholders of the company (Jõeveer, 2013). The total equity is consisted of different

elements of equity capital. Some of the elements, such as, share capital, retained earnings,

general reserve etc. are directly attributed to the shareholders. On the other hand, some equity

funds, which are created for some specific purposes, for example, asset revaluation reserve,

capital reserve etc., are indirectly related to the owners and can only be paid back to them at the

time of liquidation of the business.

In this report, four real estate companies, namely, Divine Limited, Dexus, Centuria

Metropolitan Reit and Charter Hall Retail Reit, have been selected to analyse the capital

structures and the movements of various equity elements.

Analysis of Equity Elements:

As discussed above, the total equity is comprised of different types of equity funds.

However, it is not necessary that all the companies must have same elements. The two elements,

which are common for all companies, are share capital and retained earnings or accumulated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4CORPORATE ACCOUNTING

profit/loss. The other elements may vary from company to company (Ampenberger et al., 2013).

The equity capital structures of the four selected companies also indicate the same, which are

discussed below:

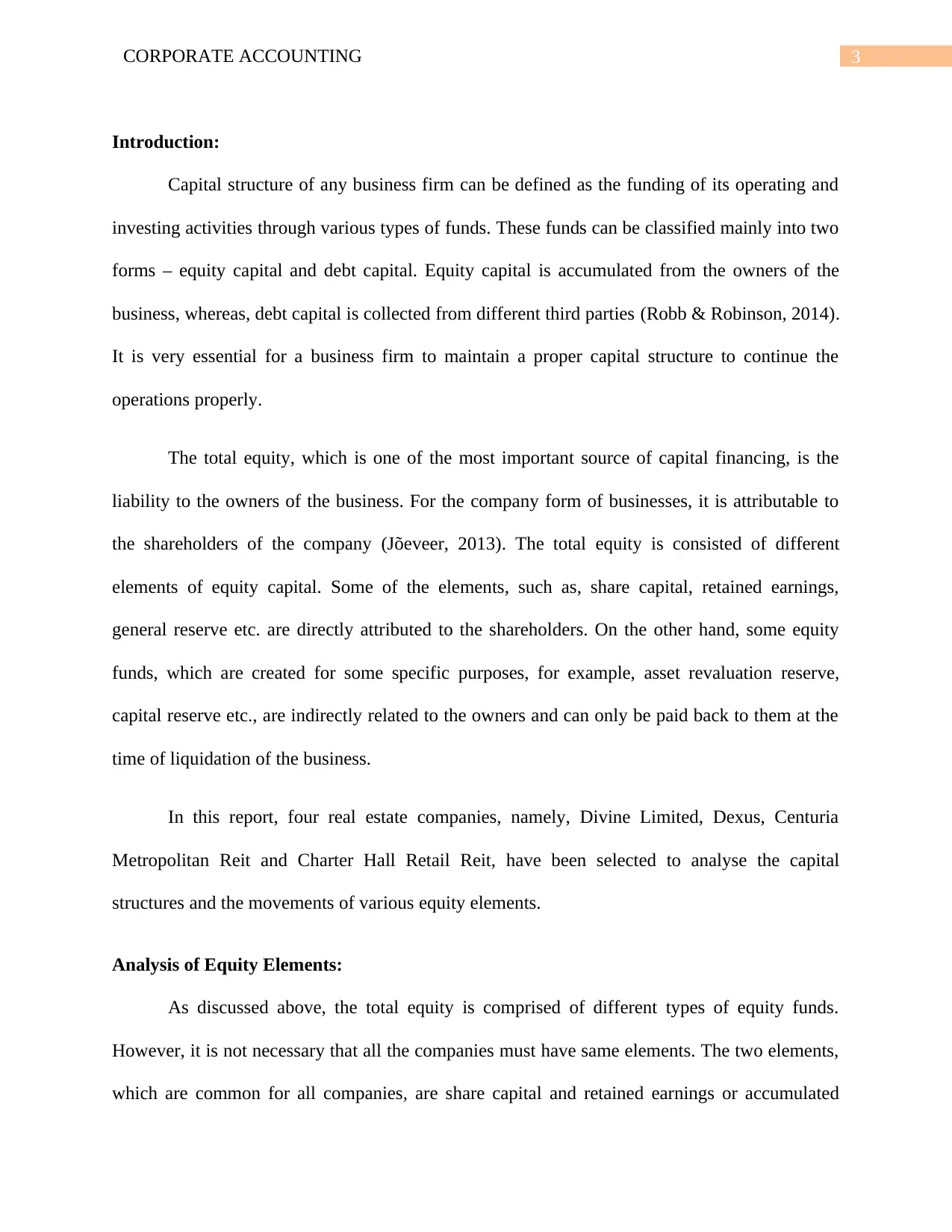

- Divine Limited:

The equity capital structure of Devine Limited includes contributed equity, reserves and

accumulated losses. Contributed equity is the capital fund, collected by issuing equity shares and

the reserve is created for the share based payment expenses and benefits. Accumulated losses

have been generated from the losses from the operating activities year by year.

Devine

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 292367 292367 292367 292367 0% 0.00% 0%

Reserves 161 355 331 336 -120% -6.76% 2%

Accumulated Losses -43893 -79917 -117806 -146198 82% 47.41% 24%

Total Equity 248635 212805 174892 146505 -14% -17.82% -16%

Trend

From the table, it can be stated that the company has not issued any equity share over the

four years and hence, share capital has remained unchanged. The reserves have increased, which

denotes that the company have paid more share based payment expenses over the years.

However, as the company has incurred net loss in every from 2014 to 2018, the accumulated

losses have rise up drastically, which is not a positive sign for the company.

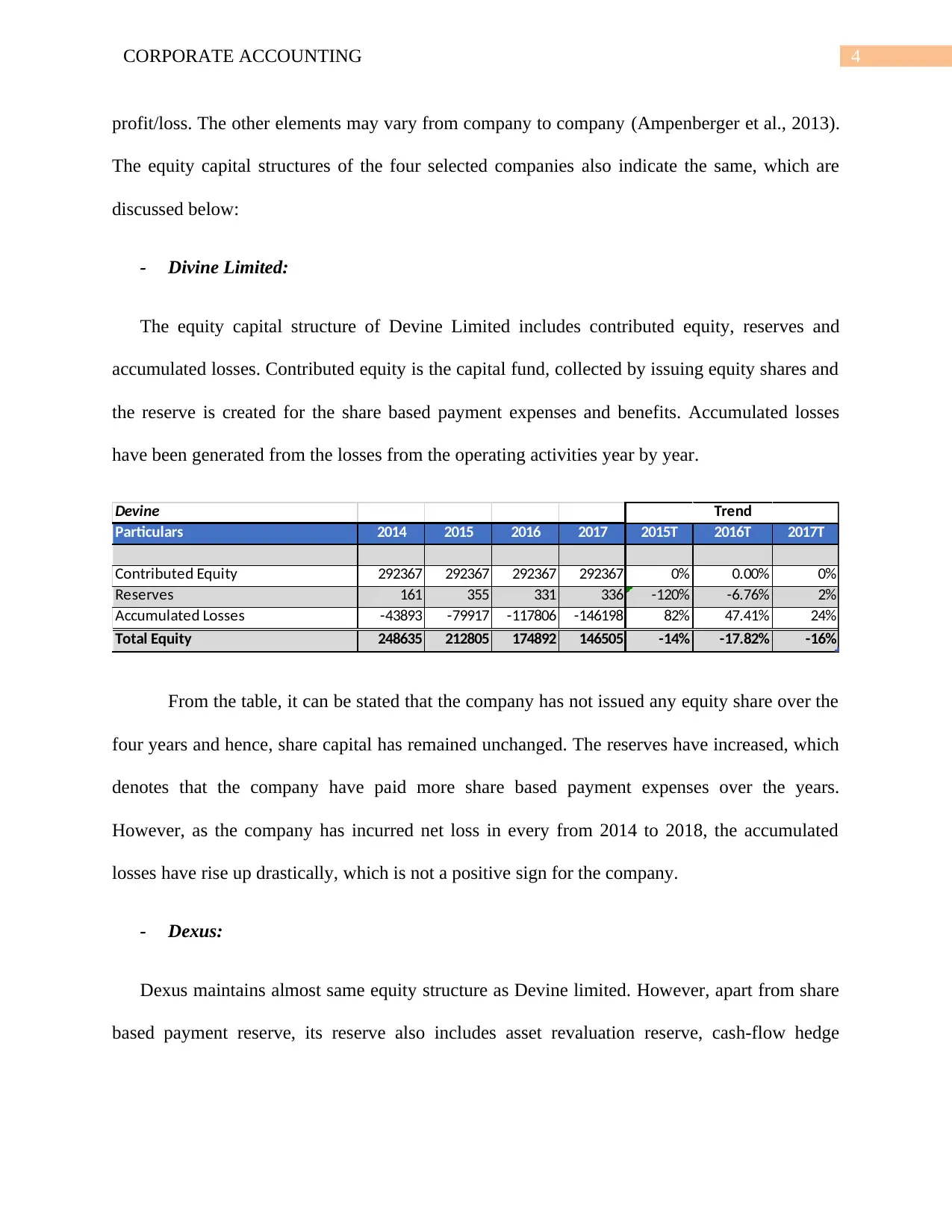

- Dexus:

Dexus maintains almost same equity structure as Devine limited. However, apart from share

based payment reserve, its reserve also includes asset revaluation reserve, cash-flow hedge

profit/loss. The other elements may vary from company to company (Ampenberger et al., 2013).

The equity capital structures of the four selected companies also indicate the same, which are

discussed below:

- Divine Limited:

The equity capital structure of Devine Limited includes contributed equity, reserves and

accumulated losses. Contributed equity is the capital fund, collected by issuing equity shares and

the reserve is created for the share based payment expenses and benefits. Accumulated losses

have been generated from the losses from the operating activities year by year.

Devine

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 292367 292367 292367 292367 0% 0.00% 0%

Reserves 161 355 331 336 -120% -6.76% 2%

Accumulated Losses -43893 -79917 -117806 -146198 82% 47.41% 24%

Total Equity 248635 212805 174892 146505 -14% -17.82% -16%

Trend

From the table, it can be stated that the company has not issued any equity share over the

four years and hence, share capital has remained unchanged. The reserves have increased, which

denotes that the company have paid more share based payment expenses over the years.

However, as the company has incurred net loss in every from 2014 to 2018, the accumulated

losses have rise up drastically, which is not a positive sign for the company.

- Dexus:

Dexus maintains almost same equity structure as Devine limited. However, apart from share

based payment reserve, its reserve also includes asset revaluation reserve, cash-flow hedge

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5CORPORATE ACCOUNTING

reserve and treasury securities reserve. The movements in the equity structure of Dexus over last

four years are shown below:

Dexus

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 1833.4 1990.6 1984 2126.7 9% -0.33% 7%

Reserves -9.3 8.6 9.1 6.9 192% 5.81% -24%

Retained Profits 193 190.3 321.7 427.2 -1% 69.05% 33%

Total Equity 2017.1 2189.5 2314.8 2560.8 9% 5.72% 11%

Trend

The company has issued equity shares in 2015 and 2017, which has led to increase in

contributed equity, whereas, due to share re-purchase on 2016, it has decreased from the

previous year. The amount of reserves has increased significantly from 2014 due to profits in

asset revaluation, cash flow hedge, security payment expenses and treasury securities (Jain,

Singh & Yadav, 2013). However, in 2017, the company has earned lower profits from cash flow

hedges and provided higher benefits for treasury securities in comparison to 20 6, which has

caused mild fall in reserve amount. As the result of the net profits, earned in 2016 and 2017, the

company has been able to increase its retained profits for the last two years.

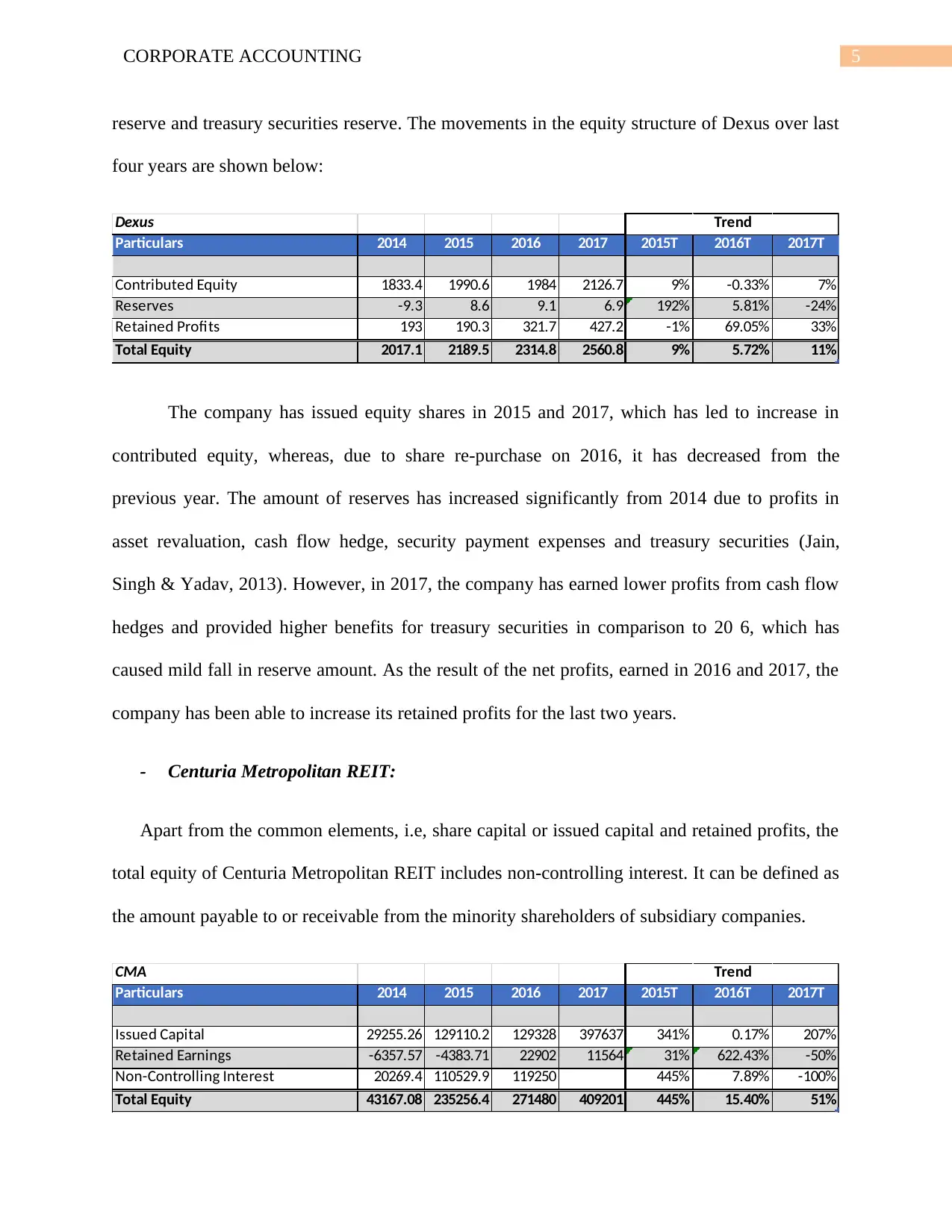

- Centuria Metropolitan REIT:

Apart from the common elements, i.e, share capital or issued capital and retained profits, the

total equity of Centuria Metropolitan REIT includes non-controlling interest. It can be defined as

the amount payable to or receivable from the minority shareholders of subsidiary companies.

CMA

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Issued Capital 29255.26 129110.2 129328 397637 341% 0.17% 207%

Retained Earnings -6357.57 -4383.71 22902 11564 31% 622.43% -50%

Non-Controlling Interest 20269.4 110529.9 119250 445% 7.89% -100%

Total Equity 43167.08 235256.4 271480 409201 445% 15.40% 51%

Trend

reserve and treasury securities reserve. The movements in the equity structure of Dexus over last

four years are shown below:

Dexus

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 1833.4 1990.6 1984 2126.7 9% -0.33% 7%

Reserves -9.3 8.6 9.1 6.9 192% 5.81% -24%

Retained Profits 193 190.3 321.7 427.2 -1% 69.05% 33%

Total Equity 2017.1 2189.5 2314.8 2560.8 9% 5.72% 11%

Trend

The company has issued equity shares in 2015 and 2017, which has led to increase in

contributed equity, whereas, due to share re-purchase on 2016, it has decreased from the

previous year. The amount of reserves has increased significantly from 2014 due to profits in

asset revaluation, cash flow hedge, security payment expenses and treasury securities (Jain,

Singh & Yadav, 2013). However, in 2017, the company has earned lower profits from cash flow

hedges and provided higher benefits for treasury securities in comparison to 20 6, which has

caused mild fall in reserve amount. As the result of the net profits, earned in 2016 and 2017, the

company has been able to increase its retained profits for the last two years.

- Centuria Metropolitan REIT:

Apart from the common elements, i.e, share capital or issued capital and retained profits, the

total equity of Centuria Metropolitan REIT includes non-controlling interest. It can be defined as

the amount payable to or receivable from the minority shareholders of subsidiary companies.

CMA

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Issued Capital 29255.26 129110.2 129328 397637 341% 0.17% 207%

Retained Earnings -6357.57 -4383.71 22902 11564 31% 622.43% -50%

Non-Controlling Interest 20269.4 110529.9 119250 445% 7.89% -100%

Total Equity 43167.08 235256.4 271480 409201 445% 15.40% 51%

Trend

6CORPORATE ACCOUNTING

Consecutive increase in the issued capital of the company indicates that it has generated

huge capital funds through issuance of share capital in last three years. Moreover, the profits,

generated in 2015 and 2016 has also helped the company to turn its negative retained earnings to

positive. However, though it has earned profits in 2017, the retained earnings has decreased,

comparing to last year, due to distribution of dividends to its shareholders (Serfling, 2016). The

non-controlling interest had increased in 2015 and 2016 and in 2017, it has become nil. It depicts

that the company has collected all the receivables from the minority shareholders of its

subsidiaries.

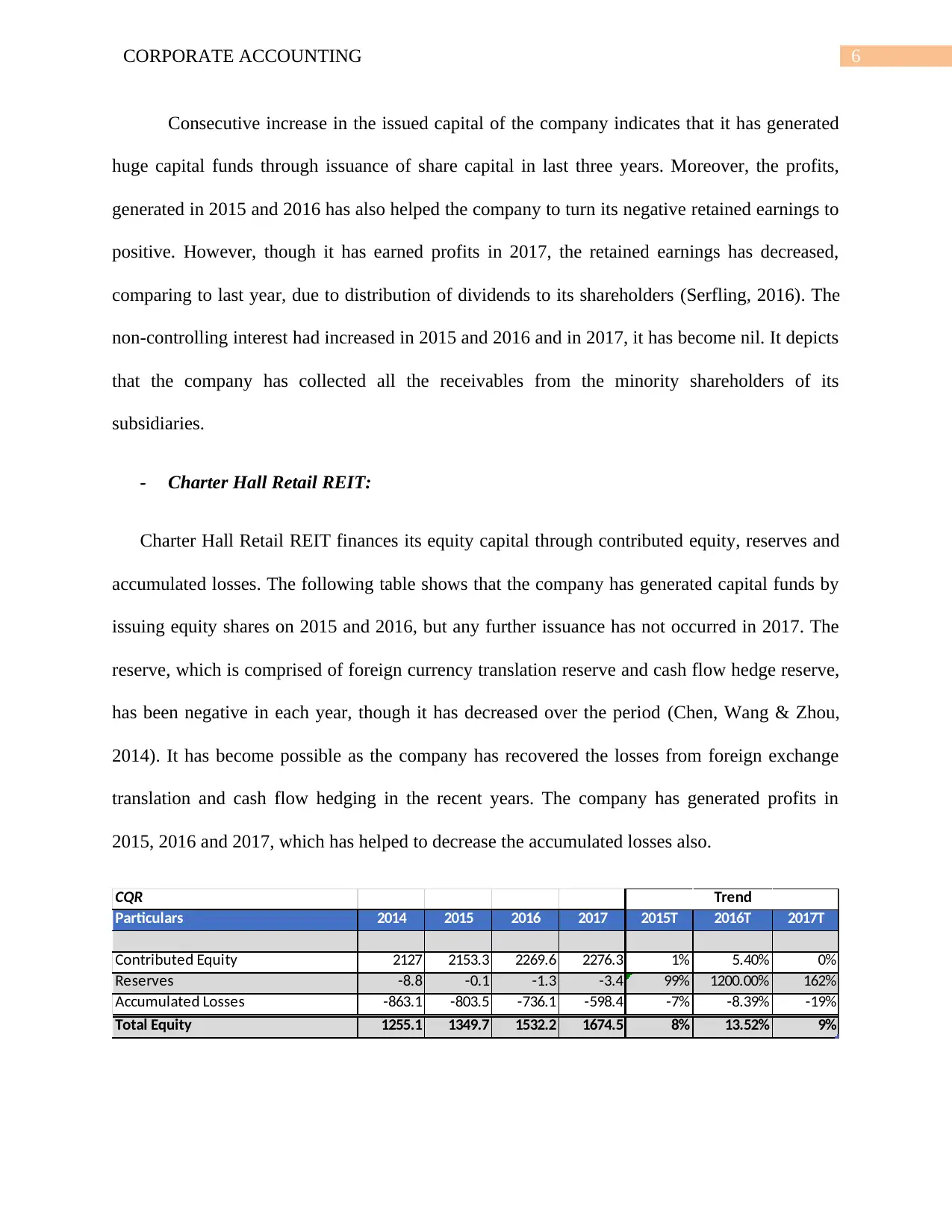

- Charter Hall Retail REIT:

Charter Hall Retail REIT finances its equity capital through contributed equity, reserves and

accumulated losses. The following table shows that the company has generated capital funds by

issuing equity shares on 2015 and 2016, but any further issuance has not occurred in 2017. The

reserve, which is comprised of foreign currency translation reserve and cash flow hedge reserve,

has been negative in each year, though it has decreased over the period (Chen, Wang & Zhou,

2014). It has become possible as the company has recovered the losses from foreign exchange

translation and cash flow hedging in the recent years. The company has generated profits in

2015, 2016 and 2017, which has helped to decrease the accumulated losses also.

CQR

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 2127 2153.3 2269.6 2276.3 1% 5.40% 0%

Reserves -8.8 -0.1 -1.3 -3.4 99% 1200.00% 162%

Accumulated Losses -863.1 -803.5 -736.1 -598.4 -7% -8.39% -19%

Total Equity 1255.1 1349.7 1532.2 1674.5 8% 13.52% 9%

Trend

Consecutive increase in the issued capital of the company indicates that it has generated

huge capital funds through issuance of share capital in last three years. Moreover, the profits,

generated in 2015 and 2016 has also helped the company to turn its negative retained earnings to

positive. However, though it has earned profits in 2017, the retained earnings has decreased,

comparing to last year, due to distribution of dividends to its shareholders (Serfling, 2016). The

non-controlling interest had increased in 2015 and 2016 and in 2017, it has become nil. It depicts

that the company has collected all the receivables from the minority shareholders of its

subsidiaries.

- Charter Hall Retail REIT:

Charter Hall Retail REIT finances its equity capital through contributed equity, reserves and

accumulated losses. The following table shows that the company has generated capital funds by

issuing equity shares on 2015 and 2016, but any further issuance has not occurred in 2017. The

reserve, which is comprised of foreign currency translation reserve and cash flow hedge reserve,

has been negative in each year, though it has decreased over the period (Chen, Wang & Zhou,

2014). It has become possible as the company has recovered the losses from foreign exchange

translation and cash flow hedging in the recent years. The company has generated profits in

2015, 2016 and 2017, which has helped to decrease the accumulated losses also.

CQR

Particulars 2014 2015 2016 2017 2015T 2016T 2017T

Contributed Equity 2127 2153.3 2269.6 2276.3 1% 5.40% 0%

Reserves -8.8 -0.1 -1.3 -3.4 99% 1200.00% 162%

Accumulated Losses -863.1 -803.5 -736.1 -598.4 -7% -8.39% -19%

Total Equity 1255.1 1349.7 1532.2 1674.5 8% 13.52% 9%

Trend

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7CORPORATE ACCOUNTING

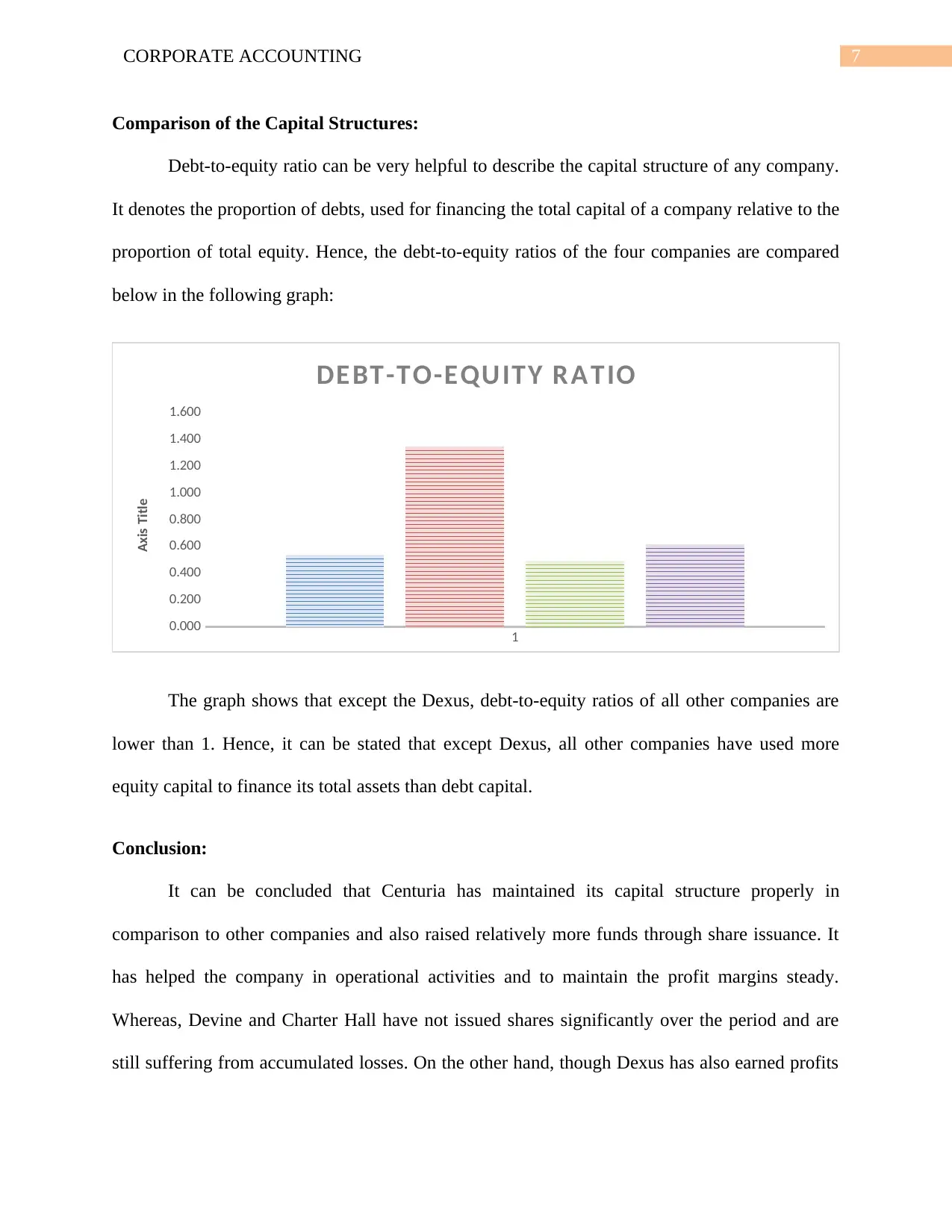

Comparison of the Capital Structures:

Debt-to-equity ratio can be very helpful to describe the capital structure of any company.

It denotes the proportion of debts, used for financing the total capital of a company relative to the

proportion of total equity. Hence, the debt-to-equity ratios of the four companies are compared

below in the following graph:

1

0.000

0.200

0.400

0.600

0.800

1.000

1.200

1.400

1.600

DEBT-TO-EQUITY R ATIO

Axis Title

The graph shows that except the Dexus, debt-to-equity ratios of all other companies are

lower than 1. Hence, it can be stated that except Dexus, all other companies have used more

equity capital to finance its total assets than debt capital.

Conclusion:

It can be concluded that Centuria has maintained its capital structure properly in

comparison to other companies and also raised relatively more funds through share issuance. It

has helped the company in operational activities and to maintain the profit margins steady.

Whereas, Devine and Charter Hall have not issued shares significantly over the period and are

still suffering from accumulated losses. On the other hand, though Dexus has also earned profits

Comparison of the Capital Structures:

Debt-to-equity ratio can be very helpful to describe the capital structure of any company.

It denotes the proportion of debts, used for financing the total capital of a company relative to the

proportion of total equity. Hence, the debt-to-equity ratios of the four companies are compared

below in the following graph:

1

0.000

0.200

0.400

0.600

0.800

1.000

1.200

1.400

1.600

DEBT-TO-EQUITY R ATIO

Axis Title

The graph shows that except the Dexus, debt-to-equity ratios of all other companies are

lower than 1. Hence, it can be stated that except Dexus, all other companies have used more

equity capital to finance its total assets than debt capital.

Conclusion:

It can be concluded that Centuria has maintained its capital structure properly in

comparison to other companies and also raised relatively more funds through share issuance. It

has helped the company in operational activities and to maintain the profit margins steady.

Whereas, Devine and Charter Hall have not issued shares significantly over the period and are

still suffering from accumulated losses. On the other hand, though Dexus has also earned profits

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8CORPORATE ACCOUNTING

over the period, it has higher debts, which should be lower down at earliest. Otherwise, in future

it may create several issues, such as, increase in interest expense, decrease in profit margins etc.

over the period, it has higher debts, which should be lower down at earliest. Otherwise, in future

it may create several issues, such as, increase in interest expense, decrease in profit margins etc.

9CORPORATE ACCOUNTING

Reference:

Ampenberger, M., Schmid, T., Achleitner, A. K., & Kaserer, C. (2013). Capital structure

decisions in family firms: empirical evidence from a bank-based economy. Review of

Managerial Science, 7(3), 247-275.

Chen, H., Wang, H., & Zhou, H. (2014). Stock return volatility and capital structure decisions.

Jain, P. K., Singh, S., & Yadav, S. S. (2013). Capital Structure Decisions. In Financial

Management Practices (pp. 77-158). Springer, India.

Jõeveer, K. (2013). What do we know about the capital structure of small firms?. Small Business

Economics, 41(2), 479-501.

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. The

Review of Financial Studies, 27(1), 153-179.

Serfling, M. (2016). Firing costs and capital structure decisions. The Journal of Finance, 71(5),

2239-2286.

Reference:

Ampenberger, M., Schmid, T., Achleitner, A. K., & Kaserer, C. (2013). Capital structure

decisions in family firms: empirical evidence from a bank-based economy. Review of

Managerial Science, 7(3), 247-275.

Chen, H., Wang, H., & Zhou, H. (2014). Stock return volatility and capital structure decisions.

Jain, P. K., Singh, S., & Yadav, S. S. (2013). Capital Structure Decisions. In Financial

Management Practices (pp. 77-158). Springer, India.

Jõeveer, K. (2013). What do we know about the capital structure of small firms?. Small Business

Economics, 41(2), 479-501.

Robb, A. M., & Robinson, D. T. (2014). The capital structure decisions of new firms. The

Review of Financial Studies, 27(1), 153-179.

Serfling, M. (2016). Firing costs and capital structure decisions. The Journal of Finance, 71(5),

2239-2286.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.