Contemporary Property Investment Planning Case Study Analysis

VerifiedAdded on 2021/04/17

|13

|3089

|19

Case Study

AI Summary

This case study delves into the complexities of real estate investment, using the example of Grace Monka's land banking scheme. It examines the risks associated with such investments, highlighting the importance of financial planning and seeking professional advice. The study analyzes the role of financial planners in guiding investors on asset allocation, superannuation fund selection, and various investment strategies, including strategic and constant-weighting asset allocation. It also discusses the challenges of land banking for private investors, such as development approval issues and potential investment scams. The case study concludes by offering financial planning advice for investors, emphasizing the importance of diversifying assets, understanding risk tolerance, and considering illiquid issues. It provides a comprehensive overview of property investment planning, emphasizing the need for informed decision-making and professional guidance.

Real Estate Contemporary Property Investment Planning 1

REAL ESTATE CONTEMPORARY PROPERTY INVESTMENT PLANNING

By (Student’s Name)

Professor’s Name

Course Details

University Program

College

Course

Lecturer

Date

REAL ESTATE CONTEMPORARY PROPERTY INVESTMENT PLANNING

By (Student’s Name)

Professor’s Name

Course Details

University Program

College

Course

Lecturer

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Real Estate Contemporary Property Investment Planning 2

REAL ESTATE CONTEMPORARY PROPERTY INVESTMENT PLANNING

2. Introduction

The case study revolves around the awful truth surrounding the land-banking fantasy. It

follows the investment case that Grace Monka made of eighty percent of her super in a high-risk

land banking scheme. Monka is pictured below:

Source: http://www.afr.com/personal-finance/the-awful-truth-about-the-landbanking-fantasy-20160106-

gm0i8l

Monka, pictured above, was a single woman in her early fifty when she first got the

information about land banking. She became concerned about her financial security. Because she

only had few assets and her mother was sickling whom she had to care for. She was thus keen at

putting her super to work in a way that might would deliver returns over a long-run. She got the

concept of land banking explained to her by Jamie McIintyre in a 4-day seminar. It was

REAL ESTATE CONTEMPORARY PROPERTY INVESTMENT PLANNING

2. Introduction

The case study revolves around the awful truth surrounding the land-banking fantasy. It

follows the investment case that Grace Monka made of eighty percent of her super in a high-risk

land banking scheme. Monka is pictured below:

Source: http://www.afr.com/personal-finance/the-awful-truth-about-the-landbanking-fantasy-20160106-

gm0i8l

Monka, pictured above, was a single woman in her early fifty when she first got the

information about land banking. She became concerned about her financial security. Because she

only had few assets and her mother was sickling whom she had to care for. She was thus keen at

putting her super to work in a way that might would deliver returns over a long-run. She got the

concept of land banking explained to her by Jamie McIintyre in a 4-day seminar. It was

Real Estate Contemporary Property Investment Planning 3

explained that the concept encompassed purchasing “wholesale options” over undeveloped land

and then waiting for the rolling of windfall gains.

Source: http://www.afr.com/personal-finance/the-awful-truth-about-the-landbanking-fantasy-20160106-gm0i8l

Monka was urged by the salesman and got persuaded to withdraw $60,000 which was about

eighty percent of her super. She then established a self-managed super fund and subsequently

invested her lot in a land-banking scheme outside Shepparton after convinced in the seminar that

the place would be a lovely estate, with parks as well as everything. However, Monka seemed to

have lost her lot as seven years later, the land remained undeveloped (Frost 2016).

To make it worse, the developer is even in liquidation with assets purchased by another

McIntyre firm that shows no signs of success. Indeed, Monka’s dream of supplementing her

retirement income was dealt a blow and set out to share her story as a means to save others from

explained that the concept encompassed purchasing “wholesale options” over undeveloped land

and then waiting for the rolling of windfall gains.

Source: http://www.afr.com/personal-finance/the-awful-truth-about-the-landbanking-fantasy-20160106-gm0i8l

Monka was urged by the salesman and got persuaded to withdraw $60,000 which was about

eighty percent of her super. She then established a self-managed super fund and subsequently

invested her lot in a land-banking scheme outside Shepparton after convinced in the seminar that

the place would be a lovely estate, with parks as well as everything. However, Monka seemed to

have lost her lot as seven years later, the land remained undeveloped (Frost 2016).

To make it worse, the developer is even in liquidation with assets purchased by another

McIntyre firm that shows no signs of success. Indeed, Monka’s dream of supplementing her

retirement income was dealt a blow and set out to share her story as a means to save others from

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Real Estate Contemporary Property Investment Planning 4

falling into such a trap. It was an investment without an exit and hence much riskier which is

only suitable for wealthier individuals. This is because it offers nearly zero liquidity, and based

on underlying land quality, it is further, highly speculative. Thus, land banking is never an

appropriate for the ordinary investor. This is because none of the land banking scheme has gone

to maturity in Australia.

3. Land Banking Challenge for Private Investors

A. Development approval

There is a higher probability that the developers may mislead the private investors about

the prospects of land development. Some developers provide land as a form of investment with

no information on how they will acquire council authority for its development. Developers

sometimes fail to inform the private investors the required restrictions on the method of land

development. Where development approval is not permitted, the investors will remain with the

investment which sale less in the market than the original amount paid for the investment.

Scheme Collapse

The planning approval require huge amount of money and it may also take several years.

During the process, on-going planning and legal costs eat the money set aside for the

development funding and may cause the development industry to become insolvent. If the

company become insolvent, option holders like the private investors will lose the amount which

they have invested in the business.

Investment scams

The developers may scam the private investors if they offer them with option in land

which is not for the company.

falling into such a trap. It was an investment without an exit and hence much riskier which is

only suitable for wealthier individuals. This is because it offers nearly zero liquidity, and based

on underlying land quality, it is further, highly speculative. Thus, land banking is never an

appropriate for the ordinary investor. This is because none of the land banking scheme has gone

to maturity in Australia.

3. Land Banking Challenge for Private Investors

A. Development approval

There is a higher probability that the developers may mislead the private investors about

the prospects of land development. Some developers provide land as a form of investment with

no information on how they will acquire council authority for its development. Developers

sometimes fail to inform the private investors the required restrictions on the method of land

development. Where development approval is not permitted, the investors will remain with the

investment which sale less in the market than the original amount paid for the investment.

Scheme Collapse

The planning approval require huge amount of money and it may also take several years.

During the process, on-going planning and legal costs eat the money set aside for the

development funding and may cause the development industry to become insolvent. If the

company become insolvent, option holders like the private investors will lose the amount which

they have invested in the business.

Investment scams

The developers may scam the private investors if they offer them with option in land

which is not for the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Real Estate Contemporary Property Investment Planning 5

B Financial planner role

Individuals should try to seek for the advice and guidance of a financial planner because

they provide additional strategies that offer assistance to individual’s lives in respects to their

financial positions. Some of the more significant strategies that the financial planners may

provide to an individual include:

Manage and organize finance- many individual experience complex financial difficulties,

yet luck enough expertise, discipline, time and objectivity of putting their financial household in

order. Financial planner can therefore examine individual overall financial situation and net

worth, help individuals to identify their objectives and goals, and advice on the best strategies to

assist people toward achieving their goals.

Receiving a financial windfall- getting a considerable amount of money or a win in

lottery often includes other non-financial and financial factors. Therefore, it may be advisable if

the money is put toward debts, or individuals may decide to distribute some through donations to

charity. Independent outside Financial planner may be required because inheritance is often

accompanied with family conflicts and deep emotional issues.

Planning for retirement- Decisions related to investments are naturally a vital elements of

retirement planning. Individuals often experience challenges on how to withdraw and spend their

money once they retire, and on the type of retirement they intended to live. The assist of a

financial planner can help individuals to set their vision, and then come up with strategic plan

that can help them achieving their vision (Frost 2016).

Facing a financial problems- serious illness, loss of jobs, a natural disaster and a legal

problem might force individuals to seek the help of a financial advisor.

Running a business- A financial planner can assist in setting up benefits and a retirement

B Financial planner role

Individuals should try to seek for the advice and guidance of a financial planner because

they provide additional strategies that offer assistance to individual’s lives in respects to their

financial positions. Some of the more significant strategies that the financial planners may

provide to an individual include:

Manage and organize finance- many individual experience complex financial difficulties,

yet luck enough expertise, discipline, time and objectivity of putting their financial household in

order. Financial planner can therefore examine individual overall financial situation and net

worth, help individuals to identify their objectives and goals, and advice on the best strategies to

assist people toward achieving their goals.

Receiving a financial windfall- getting a considerable amount of money or a win in

lottery often includes other non-financial and financial factors. Therefore, it may be advisable if

the money is put toward debts, or individuals may decide to distribute some through donations to

charity. Independent outside Financial planner may be required because inheritance is often

accompanied with family conflicts and deep emotional issues.

Planning for retirement- Decisions related to investments are naturally a vital elements of

retirement planning. Individuals often experience challenges on how to withdraw and spend their

money once they retire, and on the type of retirement they intended to live. The assist of a

financial planner can help individuals to set their vision, and then come up with strategic plan

that can help them achieving their vision (Frost 2016).

Facing a financial problems- serious illness, loss of jobs, a natural disaster and a legal

problem might force individuals to seek the help of a financial advisor.

Running a business- A financial planner can assist in setting up benefits and a retirement

Real Estate Contemporary Property Investment Planning 6

plan for the employees and owner. This may make help in creating achievable succession plan

when the owner of the business retire or die.

Estate planning- A financial planner can assist individual put the draft documents that are

related to their financial circumstances and also help them in setting their vision on how to run

the estate dispersed. Financial planner can help in the discussion of strategies for trust, life

insurance, power of attorney, living wills and other issues in relation of estate planning like the

distribution of properties.

Insurance review- A financial planner can help individuals to analyse their insurance

desires and look at options such as long term care and disability income in relation to their goal

and overall financial situations.

Career advice- Financial planner can assist in the provision of advice that are related to

financial problems for the change of career, separation packages or compensation, retirement

plans and employee stock options.

Financial planner can also help their clients in the approximation of their living expenses

especially when they retire and discuss amicable strategies for the assets distribution following

the retirement.

Financial planner also checks their clients and discuss with them present and future

economic conditions.

4. Financial Planning Advice for the Investor

Financial planner will advise the investors on how to select the right superannuation fund.

Choosing the correct superannuation fund especially on their retirements will require the

investors to seek the help of a financial planner. In most cases, it is advisable to select the super

fund that the investors want the compulsory contribution to be paid into.

plan for the employees and owner. This may make help in creating achievable succession plan

when the owner of the business retire or die.

Estate planning- A financial planner can assist individual put the draft documents that are

related to their financial circumstances and also help them in setting their vision on how to run

the estate dispersed. Financial planner can help in the discussion of strategies for trust, life

insurance, power of attorney, living wills and other issues in relation of estate planning like the

distribution of properties.

Insurance review- A financial planner can help individuals to analyse their insurance

desires and look at options such as long term care and disability income in relation to their goal

and overall financial situations.

Career advice- Financial planner can assist in the provision of advice that are related to

financial problems for the change of career, separation packages or compensation, retirement

plans and employee stock options.

Financial planner can also help their clients in the approximation of their living expenses

especially when they retire and discuss amicable strategies for the assets distribution following

the retirement.

Financial planner also checks their clients and discuss with them present and future

economic conditions.

4. Financial Planning Advice for the Investor

Financial planner will advise the investors on how to select the right superannuation fund.

Choosing the correct superannuation fund especially on their retirements will require the

investors to seek the help of a financial planner. In most cases, it is advisable to select the super

fund that the investors want the compulsory contribution to be paid into.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Real Estate Contemporary Property Investment Planning 7

The major types of super funds that the investors will have to enquire about can be group

into three:

Industry super funds – this type are run specifically on profit member.

Corporate funds- this type of the super fund are only managed by the company or the

employer.

Retail super funds or Commercial- they are mostly being provided and run by insurance

Companies and banks.

Financial planner helps the investors in choosing the superannuation fund that satisfy

their needs. The factors that the financial planner will consider include:

Whether the fund possess a good track record

Amount of fees to be charged

Whether the fund provides a variety of investment options

If it provides disability cover and life insurance and the costs of each

Once the investors have made the selection of the right super fund, the financial planner

will then help them on the process of joining the account.

Asset allocation will require the investors to seek the advice of the financial planner. The

investors will have to separate their money according to different classes of assets, such as

bonds, stocks, and cash alternatives, for example money market account. The assets classes have

variety of potential returns and risk profiles.

The financial planner advice to Investors will help them offset any losses and replace it

with gain. This enables the investors to reduce the risk that are associated with the portfolio.

Determining the most appropriate mix- the most suitable asset allocation depends on the

investor’s situation. It is mostly being determined by two major elements.

The major types of super funds that the investors will have to enquire about can be group

into three:

Industry super funds – this type are run specifically on profit member.

Corporate funds- this type of the super fund are only managed by the company or the

employer.

Retail super funds or Commercial- they are mostly being provided and run by insurance

Companies and banks.

Financial planner helps the investors in choosing the superannuation fund that satisfy

their needs. The factors that the financial planner will consider include:

Whether the fund possess a good track record

Amount of fees to be charged

Whether the fund provides a variety of investment options

If it provides disability cover and life insurance and the costs of each

Once the investors have made the selection of the right super fund, the financial planner

will then help them on the process of joining the account.

Asset allocation will require the investors to seek the advice of the financial planner. The

investors will have to separate their money according to different classes of assets, such as

bonds, stocks, and cash alternatives, for example money market account. The assets classes have

variety of potential returns and risk profiles.

The financial planner advice to Investors will help them offset any losses and replace it

with gain. This enables the investors to reduce the risk that are associated with the portfolio.

Determining the most appropriate mix- the most suitable asset allocation depends on the

investor’s situation. It is mostly being determined by two major elements.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Real Estate Contemporary Property Investment Planning 8

i) Time. Those investors that have longer time are mostly comfortable with investments

that provide higher returns and also possess higher risk. Longer time duration enables individuals

to study the markets. An Investor that has short time duration will have to take into consideration

market volatility in the process of evaluating various choices of investments.

ii) Risk tolerances- An investor who possess higher risk tolerance are willing to take

higher market volatility with intention of getting higher return. Whereas an investor who has low

risk tolerance is willing to ignore some potential return to investment that try to limit price

swings.

Asset allocation is an important building block in portfolio creation. The strong

knowledge of asset allocation is being provided by the Financial planners to the investors thereby

enable them to consider the appropriate investments for their long term-strategy.

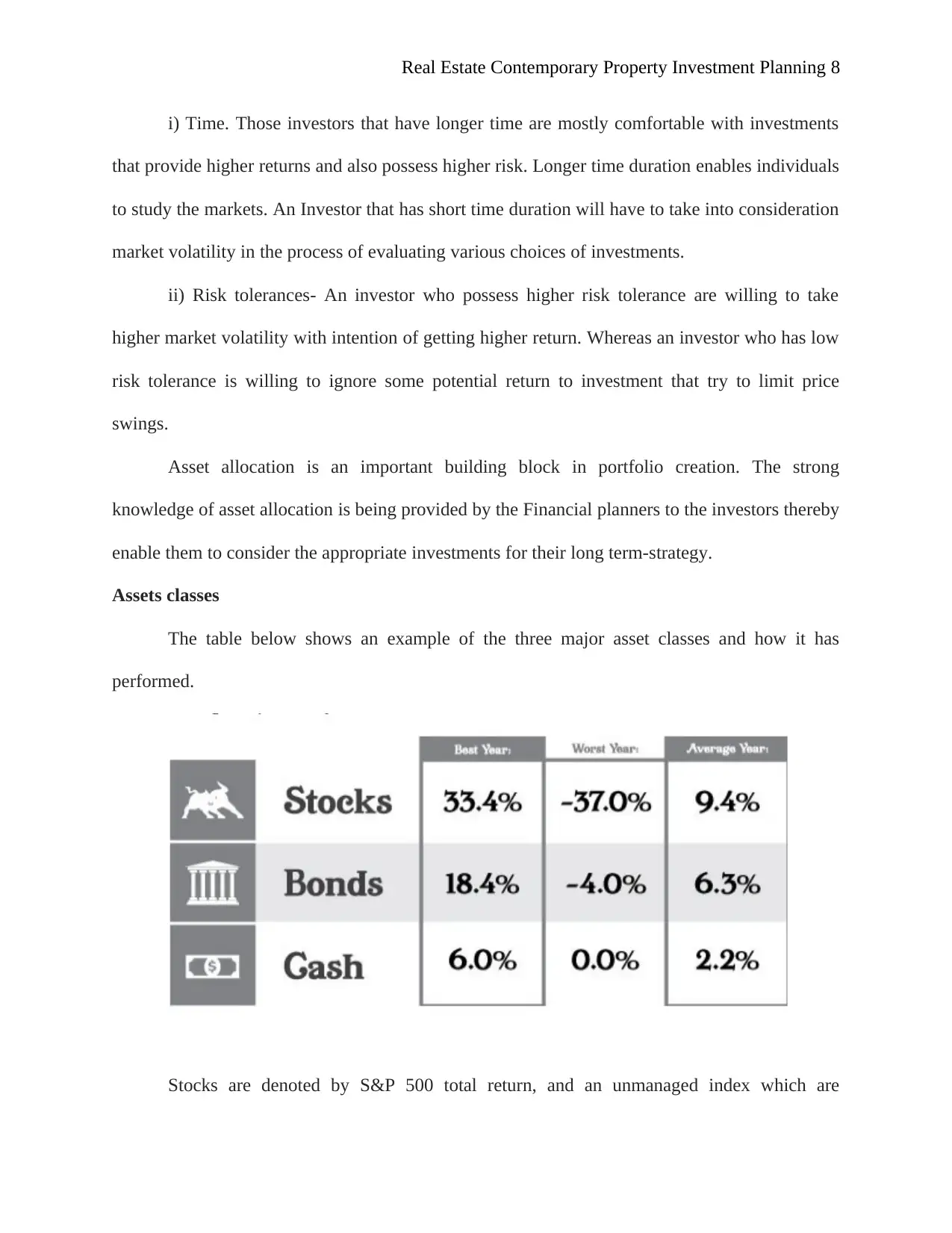

Assets classes

The table below shows an example of the three major asset classes and how it has

performed.

Stocks are denoted by S&P 500 total return, and an unmanaged index which are

i) Time. Those investors that have longer time are mostly comfortable with investments

that provide higher returns and also possess higher risk. Longer time duration enables individuals

to study the markets. An Investor that has short time duration will have to take into consideration

market volatility in the process of evaluating various choices of investments.

ii) Risk tolerances- An investor who possess higher risk tolerance are willing to take

higher market volatility with intention of getting higher return. Whereas an investor who has low

risk tolerance is willing to ignore some potential return to investment that try to limit price

swings.

Asset allocation is an important building block in portfolio creation. The strong

knowledge of asset allocation is being provided by the Financial planners to the investors thereby

enable them to consider the appropriate investments for their long term-strategy.

Assets classes

The table below shows an example of the three major asset classes and how it has

performed.

Stocks are denoted by S&P 500 total return, and an unmanaged index which are

Real Estate Contemporary Property Investment Planning 9

considered to be a representative of United State Stock market. Bonds are denoted Citi group

corporate Bond composite index. Cash are denoted by Citi group Treasury bill.

The best asset allocation for the investor’s age- the old thumb rule requires individual to

subtract their age from 100 and the result will represent the portfolio percentage that the

investors will have to sustain in stock. For example, if an investor is 40, they should keep 60% of

their portfolio in stocks. If an investor is 60, they should keep 40% of their portfolio in stocks.

However, with United State different financial planners recommend that the rule should

be made closer to 110 or 120 being subtracted from individual age. This is because individuals

need to make their money to last longer, and therefore, require the extra growth being provided

by the stock.

Illiquid issues- this refers to the situation whereby the security or other different assets

cannot be exchanged in term of cash easily without making loss. The investors have to seek the

help of the financial planner in order to advice the on the correct illiquid assets to be purchased.

5. Asset/Property Allocation Strategy Proposals

a. Establishing an effective asset mix of stock, cash, bonds, and real estate in one’s

portfolio remains a dynamic course. The allocation process plays a central role in the

determination of the overall risk and return of a particular portfolio. Thus, the asset mix has to be

a reflection of one’s goal at all time. The subsequent discussion present various strategies for

creating asset allocations based on their respective management approaches. Various proposal

are thus presented here to help Monika Grace manage her asset allocation straight on all her

savings. The various options are presented below, including the strategy, alongside the property

investment with examples.

Strategic Asset Allocation: This option creates and then follows the “best policy mix”.

considered to be a representative of United State Stock market. Bonds are denoted Citi group

corporate Bond composite index. Cash are denoted by Citi group Treasury bill.

The best asset allocation for the investor’s age- the old thumb rule requires individual to

subtract their age from 100 and the result will represent the portfolio percentage that the

investors will have to sustain in stock. For example, if an investor is 40, they should keep 60% of

their portfolio in stocks. If an investor is 60, they should keep 40% of their portfolio in stocks.

However, with United State different financial planners recommend that the rule should

be made closer to 110 or 120 being subtracted from individual age. This is because individuals

need to make their money to last longer, and therefore, require the extra growth being provided

by the stock.

Illiquid issues- this refers to the situation whereby the security or other different assets

cannot be exchanged in term of cash easily without making loss. The investors have to seek the

help of the financial planner in order to advice the on the correct illiquid assets to be purchased.

5. Asset/Property Allocation Strategy Proposals

a. Establishing an effective asset mix of stock, cash, bonds, and real estate in one’s

portfolio remains a dynamic course. The allocation process plays a central role in the

determination of the overall risk and return of a particular portfolio. Thus, the asset mix has to be

a reflection of one’s goal at all time. The subsequent discussion present various strategies for

creating asset allocations based on their respective management approaches. Various proposal

are thus presented here to help Monika Grace manage her asset allocation straight on all her

savings. The various options are presented below, including the strategy, alongside the property

investment with examples.

Strategic Asset Allocation: This option creates and then follows the “best policy mix”.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Real Estate Contemporary Property Investment Planning 10

This is a proportionate merger of assets depending on the anticipated rates of return for every

class of assets. For instance, where stocks have returned 10% yearly in the past while bonds have

historically returned 5% per annum, the investor will have a 50 percent stock and fifty percent

bonds anticipated to return 7.50 percent yearly.

Constant-Weighing Asset Allocation: Strategic asset allocation means a purchase-and-

hold mechanism, as the value of asset shifts triggers a drift from the originally created policy

mix. Thus, one could prefer to embrace a constant-weighing option to asset allocation. With this

option, one continually rebalance her portfolio. For instance, where a single asset is diminishing

in value, one would buy more of such an asset. And in case that asset value is surging, then the

investor will set it thus making profits (Shin 2015). No hard-and-fast rules for timing rebalancing

of a portfolio in constant-weighing or strategic asset allocation. Nevertheless, a shared rule of

thumb is that an investor must ensure that a portfolio is rebalanced to its initial mix where any

particular asset class moves beyond five percent from its initial value.

Tactical Asset Allocation: A strategic asset allocation approach, over the long run,

might appear comparatively rigid. Hence, one could find it essential to from time to time involve

in short-run, tactical deviances from asset mix hence capitalizing on the exceptional or unusual

opportunities for investment. Such a flexibility include the element of market-timing to portfolio,

permitting the investor to partake in economic situations more favourable for a single class of

asset than for other classes. This method is designated as the abstemiously active option, because

the overall general asset mix will be returned to where the anticipated short-run profits are

accomplished. This approach requires certain levels of discipline, as the investor has to initially

acknowledge where short-run opportunities have stopped and subsequently rebalance their

portfolio to long-run asset stance.

This is a proportionate merger of assets depending on the anticipated rates of return for every

class of assets. For instance, where stocks have returned 10% yearly in the past while bonds have

historically returned 5% per annum, the investor will have a 50 percent stock and fifty percent

bonds anticipated to return 7.50 percent yearly.

Constant-Weighing Asset Allocation: Strategic asset allocation means a purchase-and-

hold mechanism, as the value of asset shifts triggers a drift from the originally created policy

mix. Thus, one could prefer to embrace a constant-weighing option to asset allocation. With this

option, one continually rebalance her portfolio. For instance, where a single asset is diminishing

in value, one would buy more of such an asset. And in case that asset value is surging, then the

investor will set it thus making profits (Shin 2015). No hard-and-fast rules for timing rebalancing

of a portfolio in constant-weighing or strategic asset allocation. Nevertheless, a shared rule of

thumb is that an investor must ensure that a portfolio is rebalanced to its initial mix where any

particular asset class moves beyond five percent from its initial value.

Tactical Asset Allocation: A strategic asset allocation approach, over the long run,

might appear comparatively rigid. Hence, one could find it essential to from time to time involve

in short-run, tactical deviances from asset mix hence capitalizing on the exceptional or unusual

opportunities for investment. Such a flexibility include the element of market-timing to portfolio,

permitting the investor to partake in economic situations more favourable for a single class of

asset than for other classes. This method is designated as the abstemiously active option, because

the overall general asset mix will be returned to where the anticipated short-run profits are

accomplished. This approach requires certain levels of discipline, as the investor has to initially

acknowledge where short-run opportunities have stopped and subsequently rebalance their

portfolio to long-run asset stance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Real Estate Contemporary Property Investment Planning 11

Dynamic Asset Allocation: This is also an active allocation option. Here, the investor

can continually adjust the asset mix as markets fall and rise, and as economy weakens and

strengthens. Here, the investor can sells his assets that are diminishing and buy asset that are

rising. This option is the polar opposite of the constant-weighing alternative. For instance, if the

stock market is indicating signs of weakening, the investor will sell stock in expectation of

continued plunges; and where a market shows indication of strength, the investor buys stocks in

expectation of sustained market surges.

Insured Asset Allocation: With this option, the investor will create a portfolio value

base upon which portfolio has to be permitted to decline. So long as portfolio hits a return

beyond the established base, an investor will start exercising active management. This

management will rely on analytical research, judgment and forecast as well as experience to

make a decision on what securities she can purchase, hold and even sell, with the intention of

surging the value of the portfolio as far as feasible. When, nevertheless, the portfolio should ever

decline to base value, the investor will invest in assets that are risk-free, like Treasury

(particularly T-bills) to have a fixed base value.

At such a point, the investor will consult with her advisor on the reallocation of assets,

maybe even overhauling her investment strategy. The insured asset allocation could be

appropriate for risk-averse individual with a desire of some degrees of active portfolio

management, however, still appreciate the security of creating a guaranteed floor under which

the portfolio is never permitted to plunge. For instance, an investor that wishes to create a

minimum standard of living when she retires could find an insured asset allocation option the

best strategy to manage her goals.

Integrated Asset Allocation: With this option, the investor will consider both her

Dynamic Asset Allocation: This is also an active allocation option. Here, the investor

can continually adjust the asset mix as markets fall and rise, and as economy weakens and

strengthens. Here, the investor can sells his assets that are diminishing and buy asset that are

rising. This option is the polar opposite of the constant-weighing alternative. For instance, if the

stock market is indicating signs of weakening, the investor will sell stock in expectation of

continued plunges; and where a market shows indication of strength, the investor buys stocks in

expectation of sustained market surges.

Insured Asset Allocation: With this option, the investor will create a portfolio value

base upon which portfolio has to be permitted to decline. So long as portfolio hits a return

beyond the established base, an investor will start exercising active management. This

management will rely on analytical research, judgment and forecast as well as experience to

make a decision on what securities she can purchase, hold and even sell, with the intention of

surging the value of the portfolio as far as feasible. When, nevertheless, the portfolio should ever

decline to base value, the investor will invest in assets that are risk-free, like Treasury

(particularly T-bills) to have a fixed base value.

At such a point, the investor will consult with her advisor on the reallocation of assets,

maybe even overhauling her investment strategy. The insured asset allocation could be

appropriate for risk-averse individual with a desire of some degrees of active portfolio

management, however, still appreciate the security of creating a guaranteed floor under which

the portfolio is never permitted to plunge. For instance, an investor that wishes to create a

minimum standard of living when she retires could find an insured asset allocation option the

best strategy to manage her goals.

Integrated Asset Allocation: With this option, the investor will consider both her

Real Estate Contemporary Property Investment Planning 12

economic anticipations and her risk in creating an asset mix. Whereas all of the above-discussed

options consider expectations for the coming market returns, not each of them consider the risk

tolerance of the investor. The integrated asset allocation, conversely, encompass elements of all

strategies, considering both expectations and real alterations in capital markets and the investor’s

risk tolerance. It is the wider asset allocation method. However, it must be noted that this

strategy is unable to include dynamic and constant-weighing allocation because apparently, an

investor might never wish to implement 2 strategies which are antagonists.

B. Proposed Asset Allocation Strategy for a Master Degree Graduate

The best asset allocation strategy chosen for the master degree graduate is the integrated

asset allocation. The reason this strategy has been proposed is that it will help the graduate

consider both economic expectations and his risk as he establishes his asset mix. Moreover, this

strategy takes into account both expectations for future returns and graduate’s risk tolerance

which is lacking in other strategies. Moreover, it encompasses aspects of all strategies and

consider both expectations and actual alterations in the capital markets together with risk

tolerance.

Conclusion

In conclusion, it is true that no land-banking scheme has gone to maturity in Australia.

Whereas this scheme might seem lucrative in seminars, as witnessed by Monka, it is a higher risk

which is strictly a preserve for wealthier people who can wait for years without returns.

Therefore, the ordinary investors should learn from Monka’s case not to invest in this kind a no

exit investment.

economic anticipations and her risk in creating an asset mix. Whereas all of the above-discussed

options consider expectations for the coming market returns, not each of them consider the risk

tolerance of the investor. The integrated asset allocation, conversely, encompass elements of all

strategies, considering both expectations and real alterations in capital markets and the investor’s

risk tolerance. It is the wider asset allocation method. However, it must be noted that this

strategy is unable to include dynamic and constant-weighing allocation because apparently, an

investor might never wish to implement 2 strategies which are antagonists.

B. Proposed Asset Allocation Strategy for a Master Degree Graduate

The best asset allocation strategy chosen for the master degree graduate is the integrated

asset allocation. The reason this strategy has been proposed is that it will help the graduate

consider both economic expectations and his risk as he establishes his asset mix. Moreover, this

strategy takes into account both expectations for future returns and graduate’s risk tolerance

which is lacking in other strategies. Moreover, it encompasses aspects of all strategies and

consider both expectations and actual alterations in the capital markets together with risk

tolerance.

Conclusion

In conclusion, it is true that no land-banking scheme has gone to maturity in Australia.

Whereas this scheme might seem lucrative in seminars, as witnessed by Monka, it is a higher risk

which is strictly a preserve for wealthier people who can wait for years without returns.

Therefore, the ordinary investors should learn from Monka’s case not to invest in this kind a no

exit investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.