Recording Business Transaction: Journal Entries, Trial Balance, Financial Position, and Ratios

VerifiedAdded on 2023/06/15

|30

|2792

|67

AI Summary

This study provides information on recording business transactions, including journal entries, trial balance, income statement, balance sheet, and financial position. It also calculates ratios and evaluates the organizational performance and impact of COVID-19.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

RECORDING BUSINESS

TRANSACTION

TRANSACTION

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................2

PART A...........................................................................................................................................2

a) Recording journal entries in T account.................................................................................2

b) Balancing the account in ledger format...................................................................................5

c) Formulating trial balance.......................................................................................................16

d) Preparing income statement..................................................................................................18

e) Formulating financial position...............................................................................................20

f) Writing letter..........................................................................................................................22

PART B.........................................................................................................................................23

a) Determining ratios.................................................................................................................23

b) Evaluating organizational performance and impact of covid 19...........................................26

CONCLUSION..............................................................................................................................27

REFERENCES..............................................................................................................................28

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................2

PART A...........................................................................................................................................2

a) Recording journal entries in T account.................................................................................2

b) Balancing the account in ledger format...................................................................................5

c) Formulating trial balance.......................................................................................................16

d) Preparing income statement..................................................................................................18

e) Formulating financial position...............................................................................................20

f) Writing letter..........................................................................................................................22

PART B.........................................................................................................................................23

a) Determining ratios.................................................................................................................23

b) Evaluating organizational performance and impact of covid 19...........................................26

CONCLUSION..............................................................................................................................27

REFERENCES..............................................................................................................................28

INTRODUCTION

Recording business transaction refers to keeping information about the all the transaction

that are executed for particular span of period. In the current era, competition has inclined which

require firm to pay attention on having significant information regarding the prevailing

circumstances so that higher level of ability to make strategic decision can become possible.

There is major need to pay attention on having relevant understanding about the basic tactics

which can allow to incline efficiency of conducting operational activities to get success. There

are several aspects which are required to be taken into consideration so that higher profitability

& stability providing decision can be formulated. The current study will pay attention on having

significant information regarding journal entries, balancing the account to get an opening

balance, trial balance, income statements, financial position and writing letter. This current study

will give emphasis on calculating ratios and having information related with evaluating

performance of company along with assessing impact of covid 19.

1

Recording business transaction refers to keeping information about the all the transaction

that are executed for particular span of period. In the current era, competition has inclined which

require firm to pay attention on having significant information regarding the prevailing

circumstances so that higher level of ability to make strategic decision can become possible.

There is major need to pay attention on having relevant understanding about the basic tactics

which can allow to incline efficiency of conducting operational activities to get success. There

are several aspects which are required to be taken into consideration so that higher profitability

& stability providing decision can be formulated. The current study will pay attention on having

significant information regarding journal entries, balancing the account to get an opening

balance, trial balance, income statements, financial position and writing letter. This current study

will give emphasis on calculating ratios and having information related with evaluating

performance of company along with assessing impact of covid 19.

1

MAIN BODY

PART A

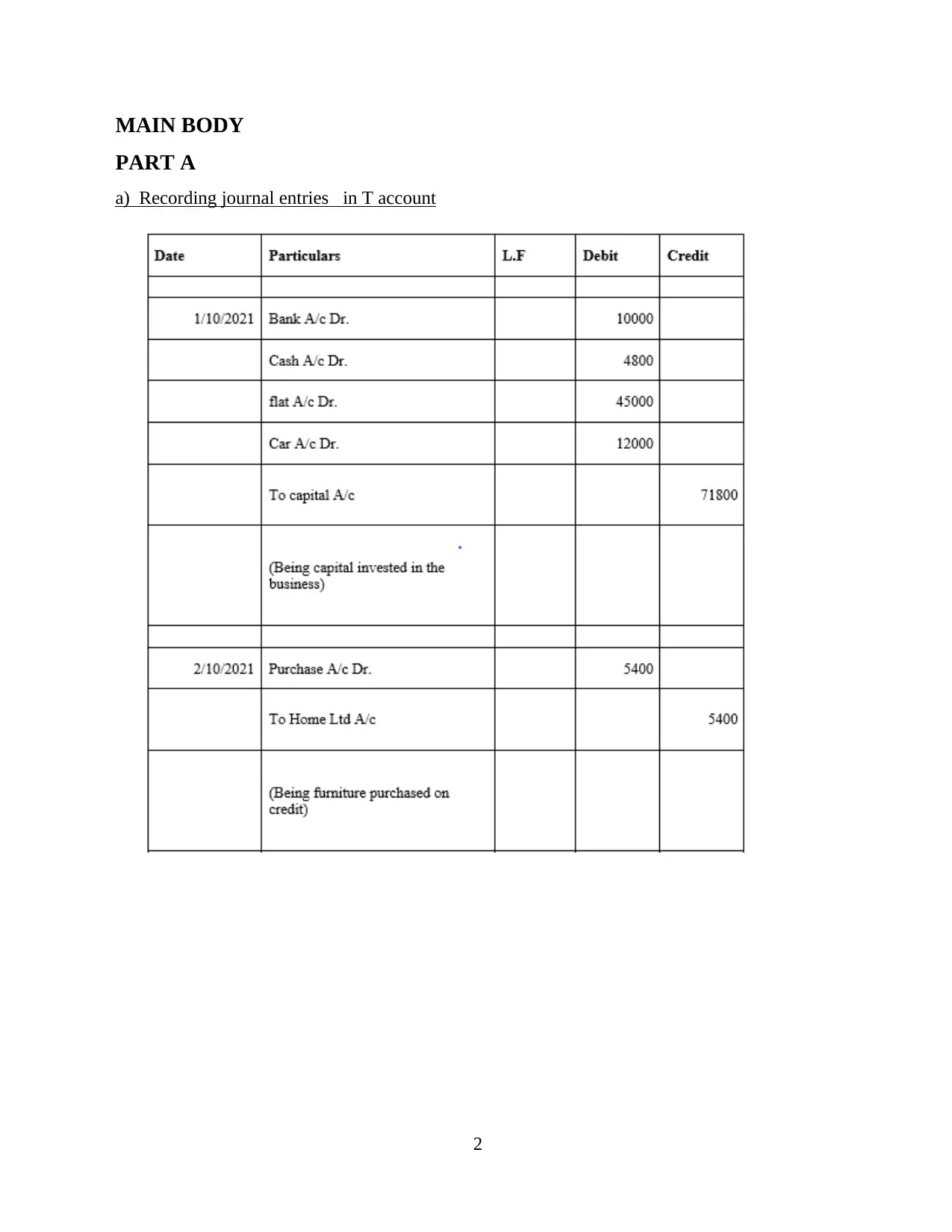

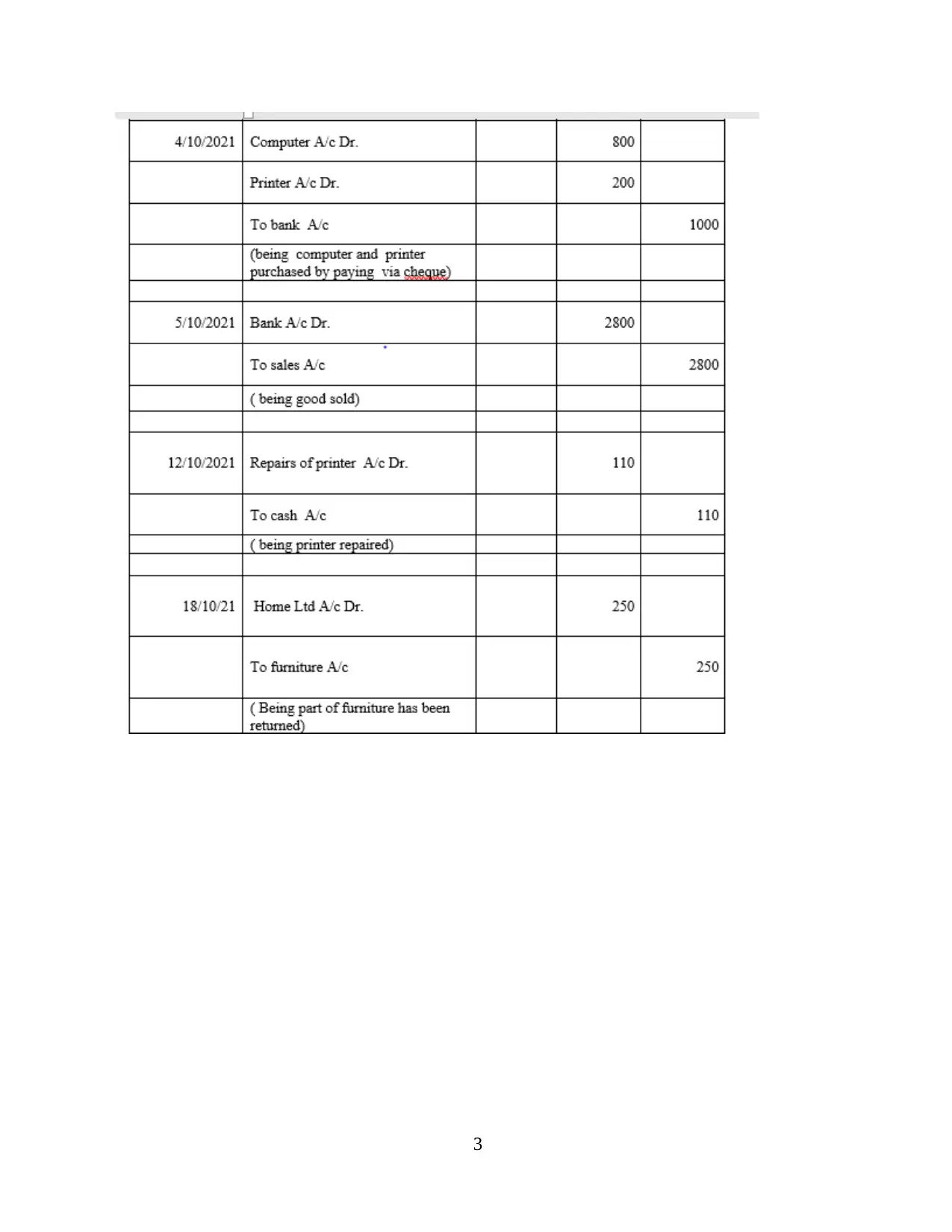

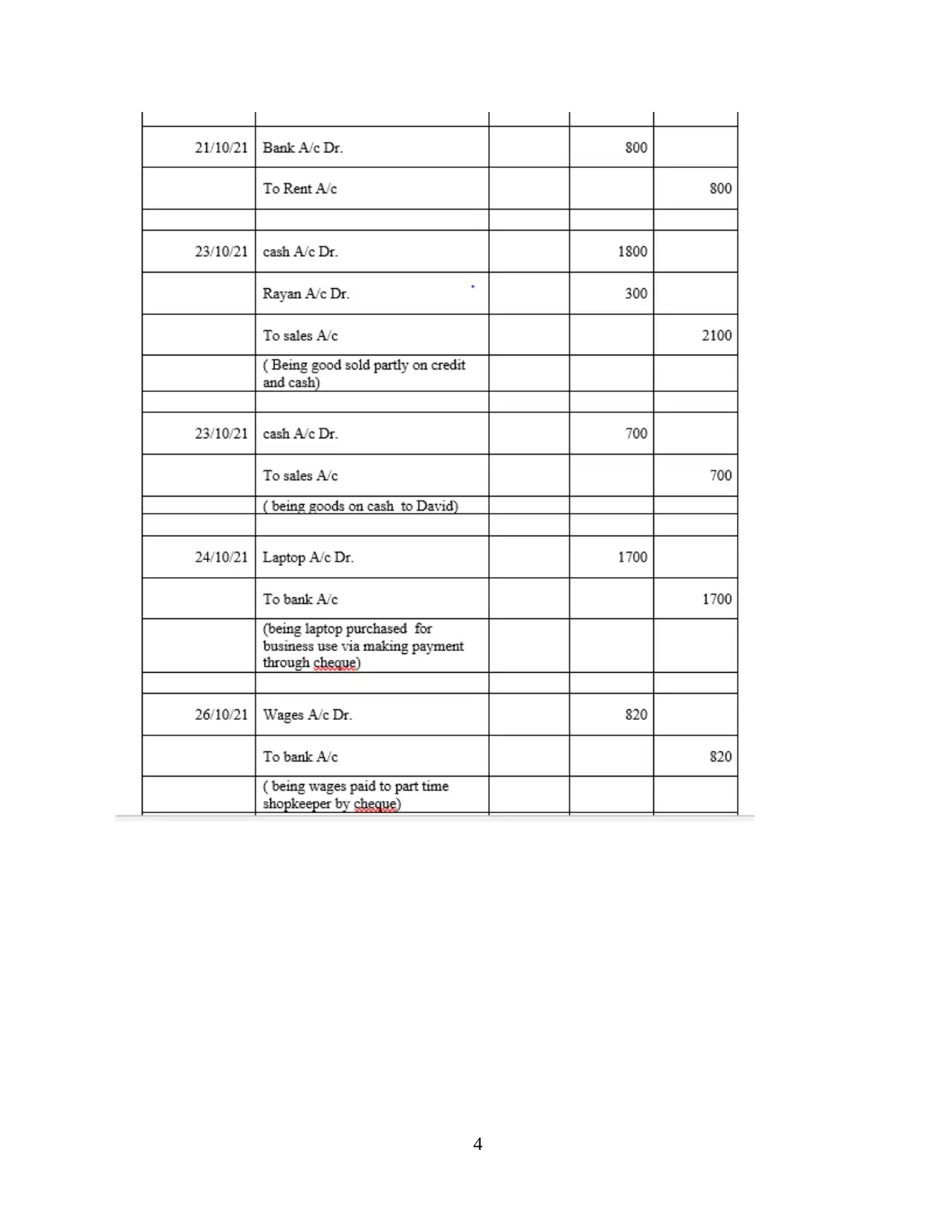

a) Recording journal entries in T account

2

PART A

a) Recording journal entries in T account

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

3

4

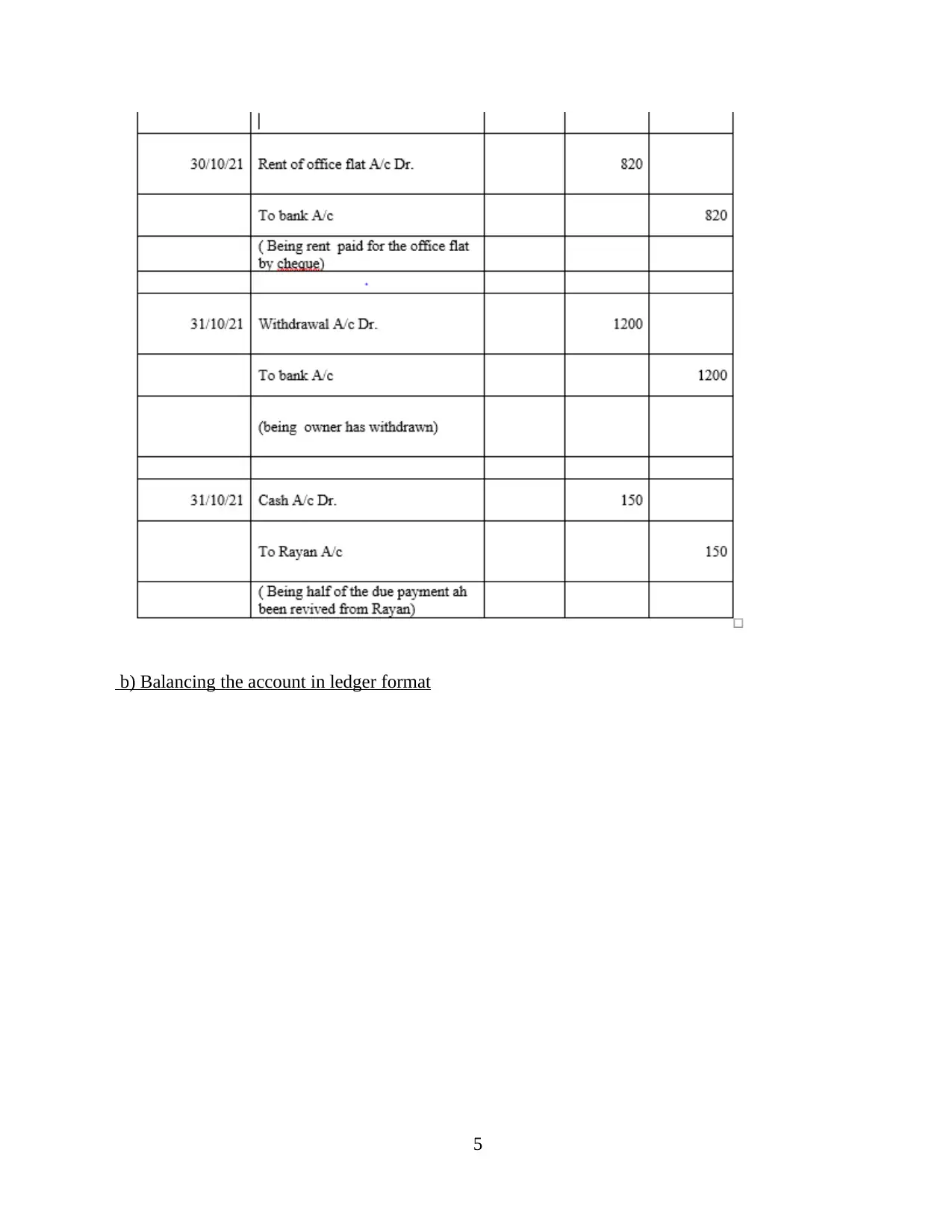

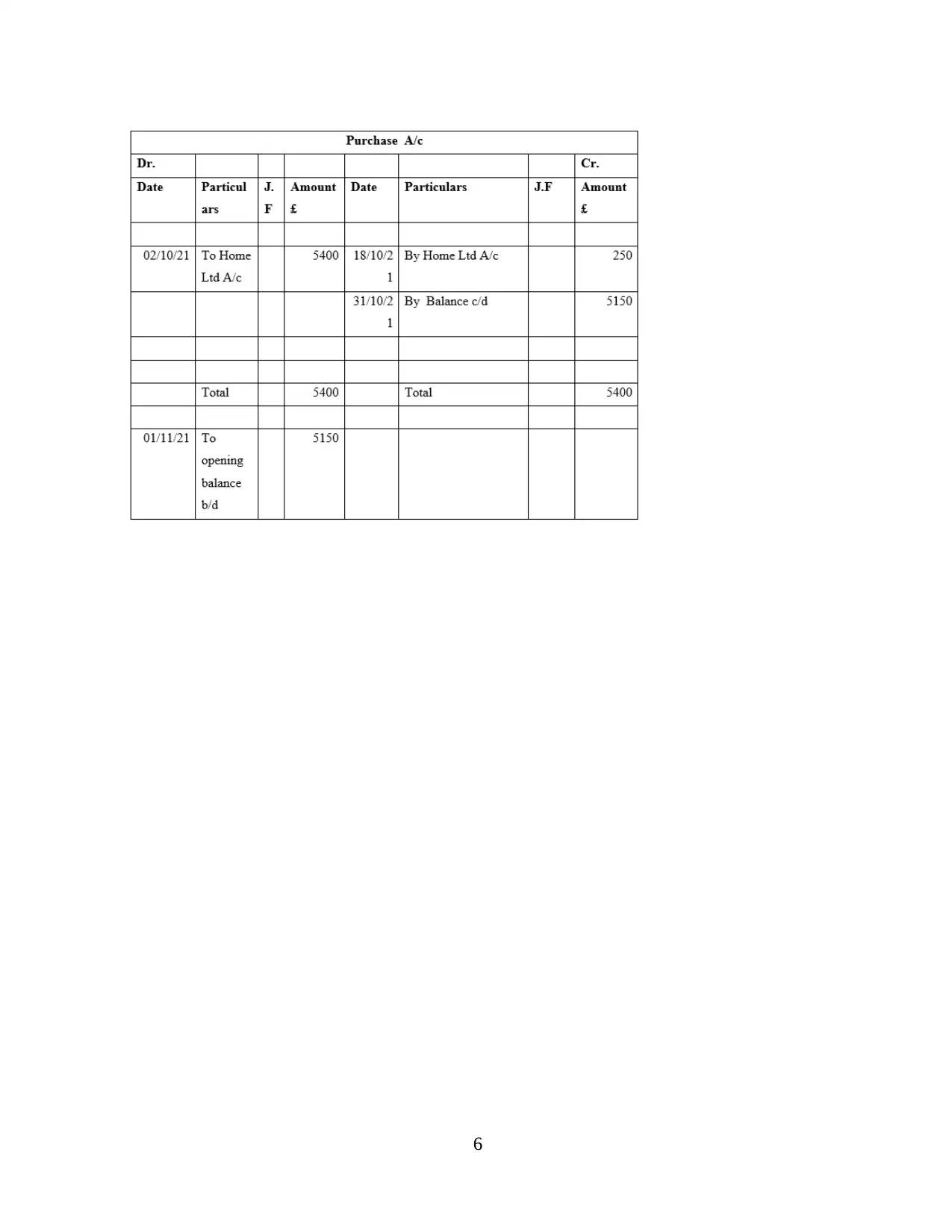

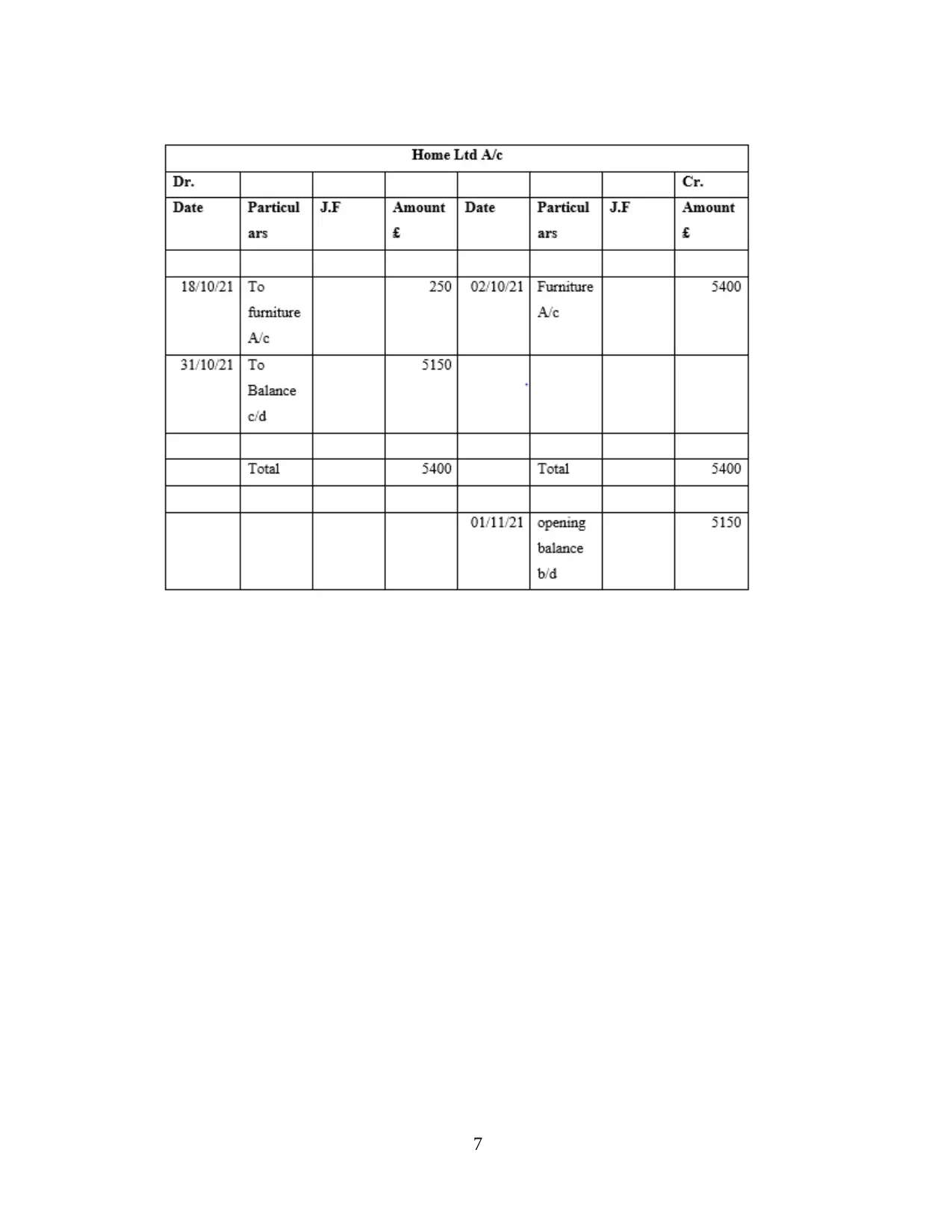

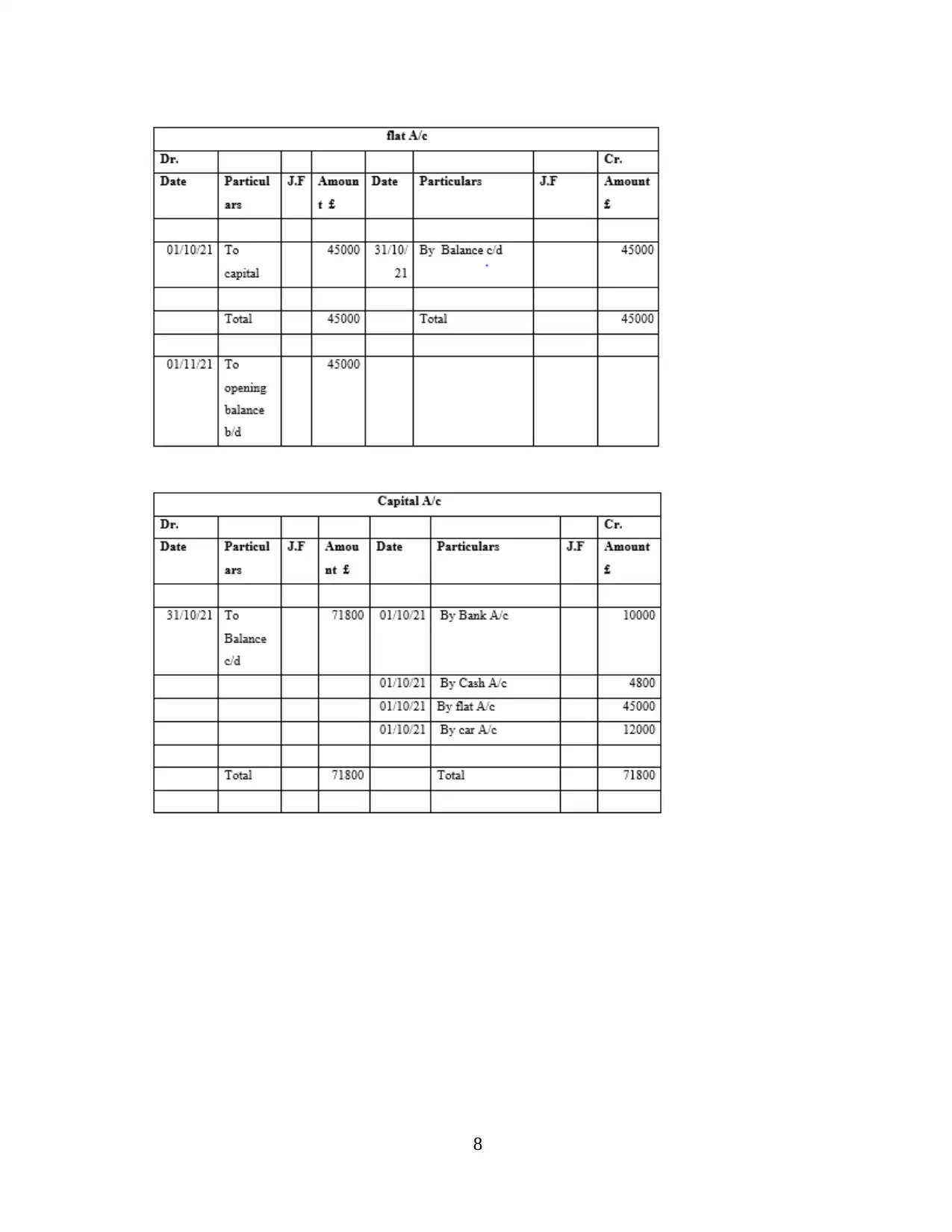

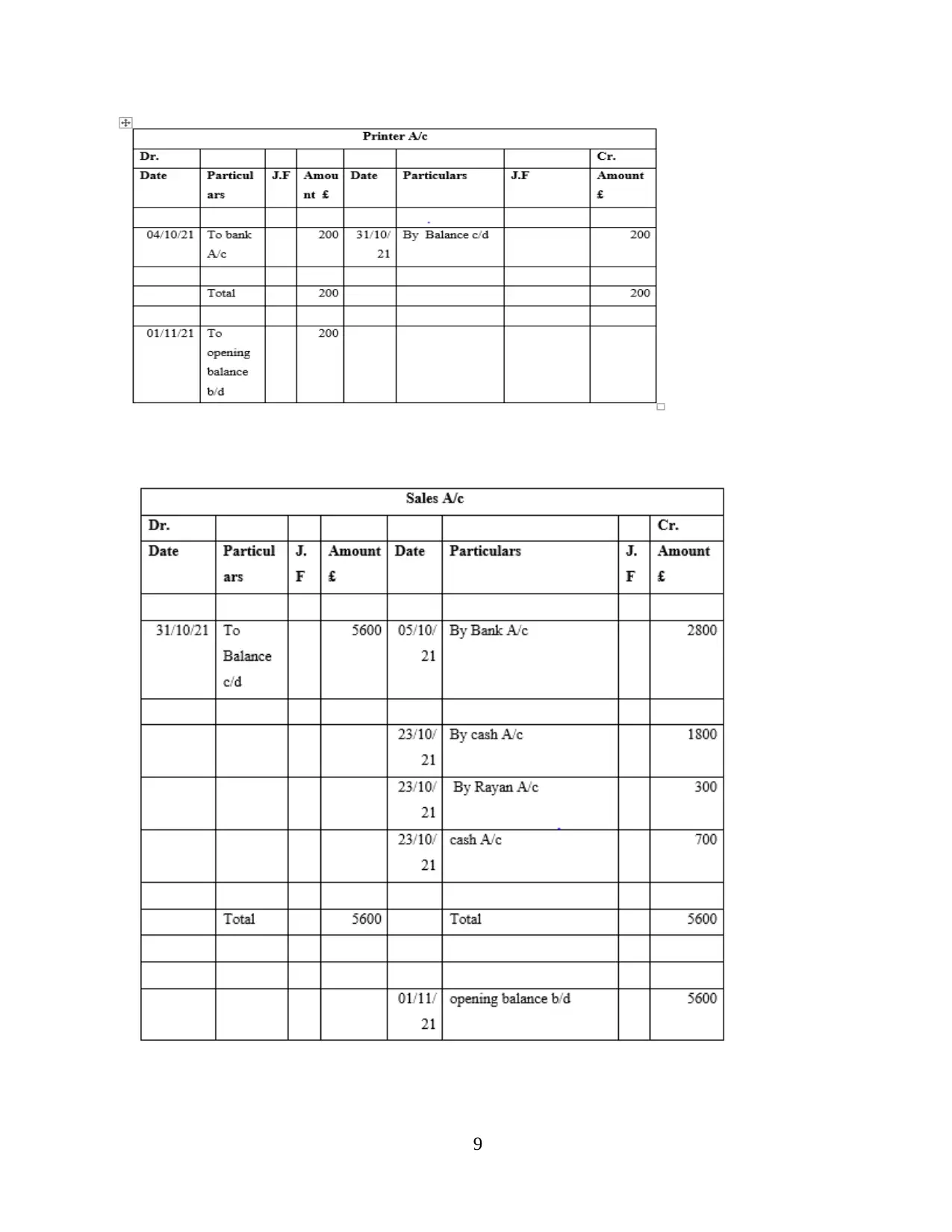

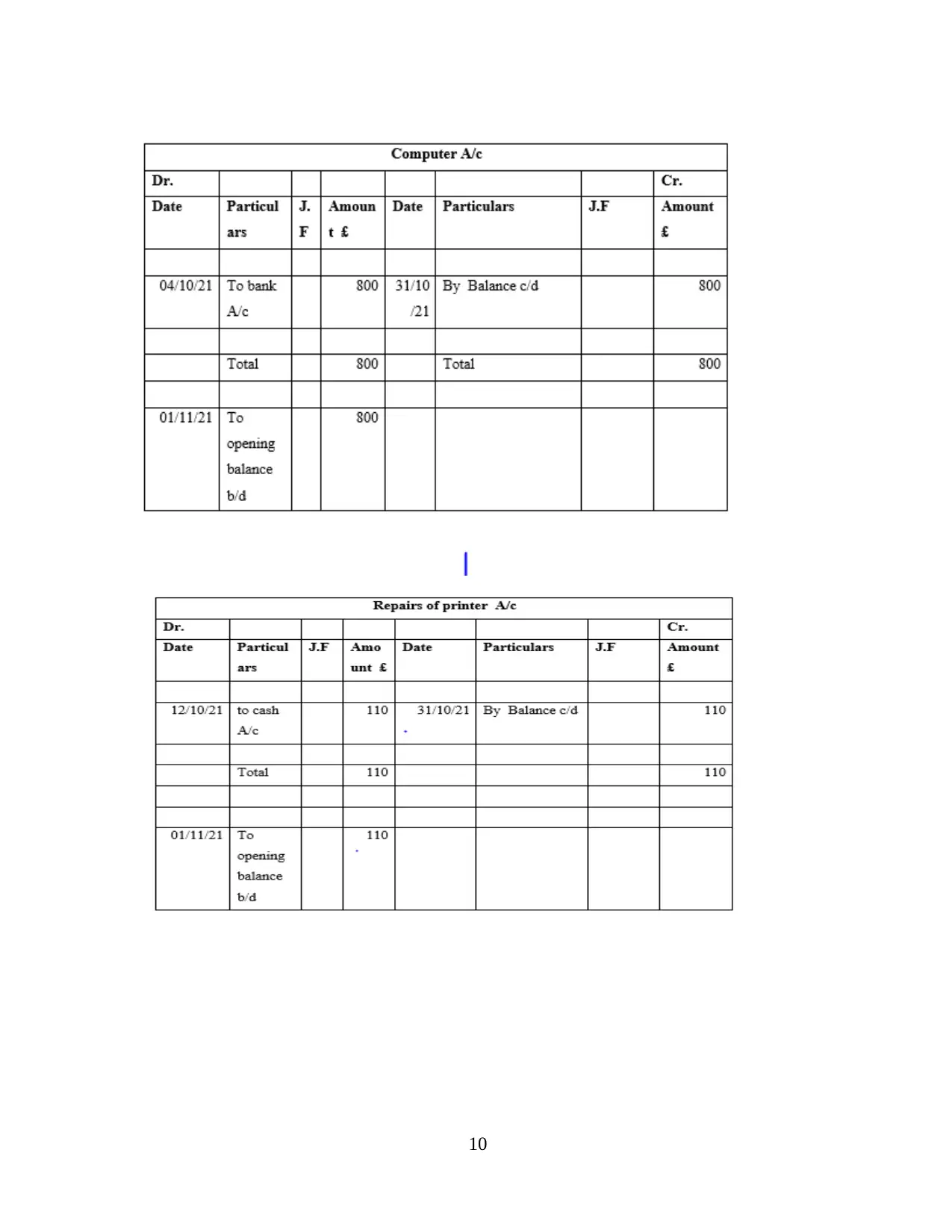

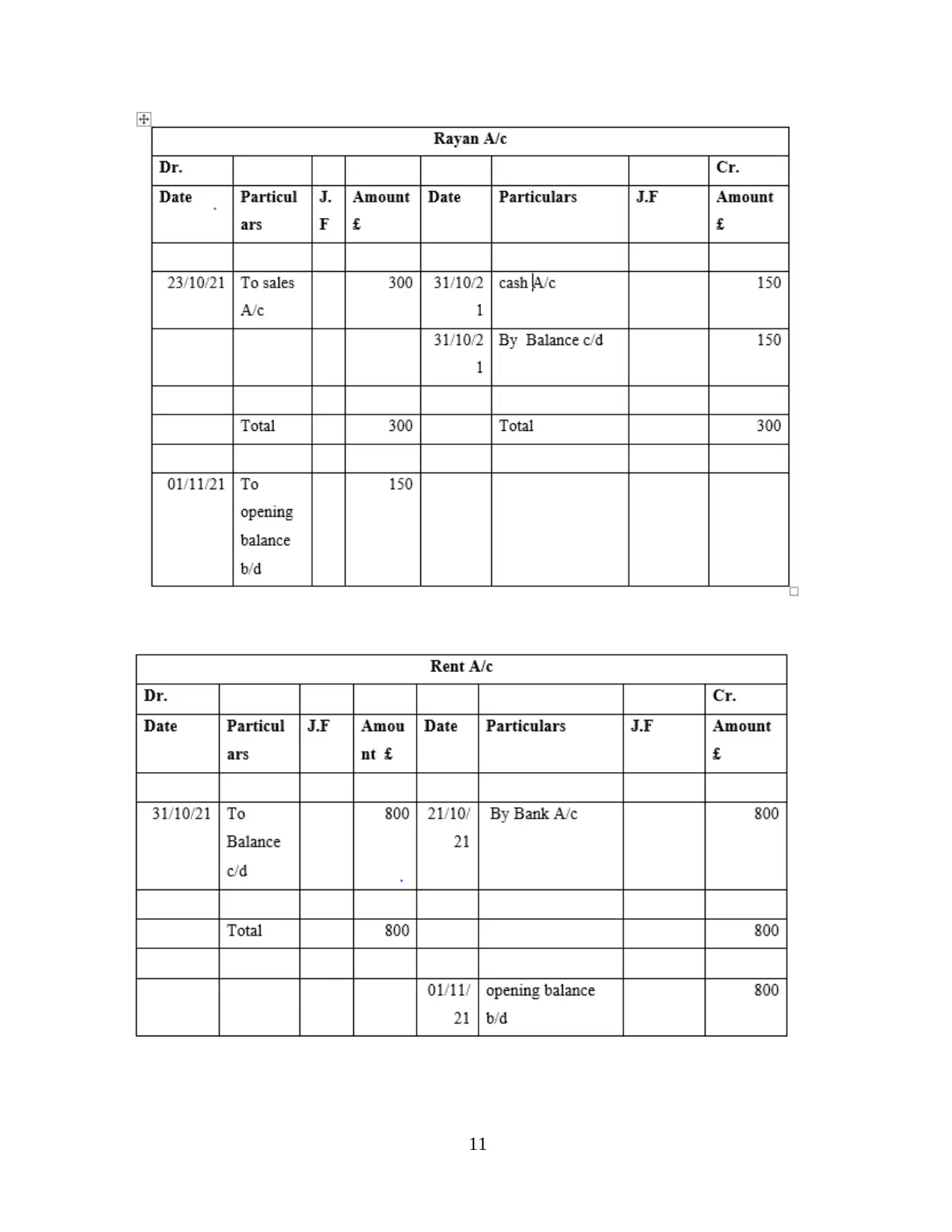

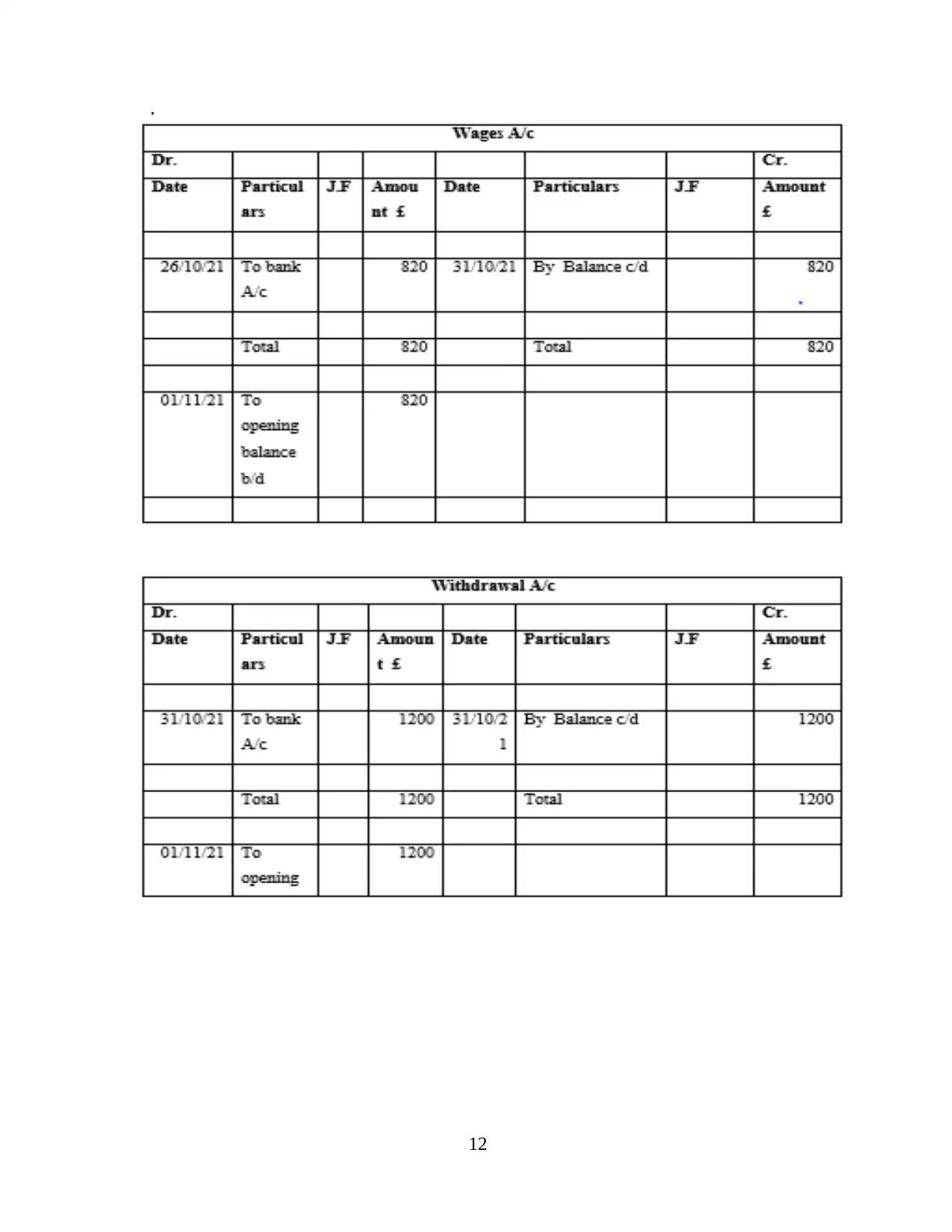

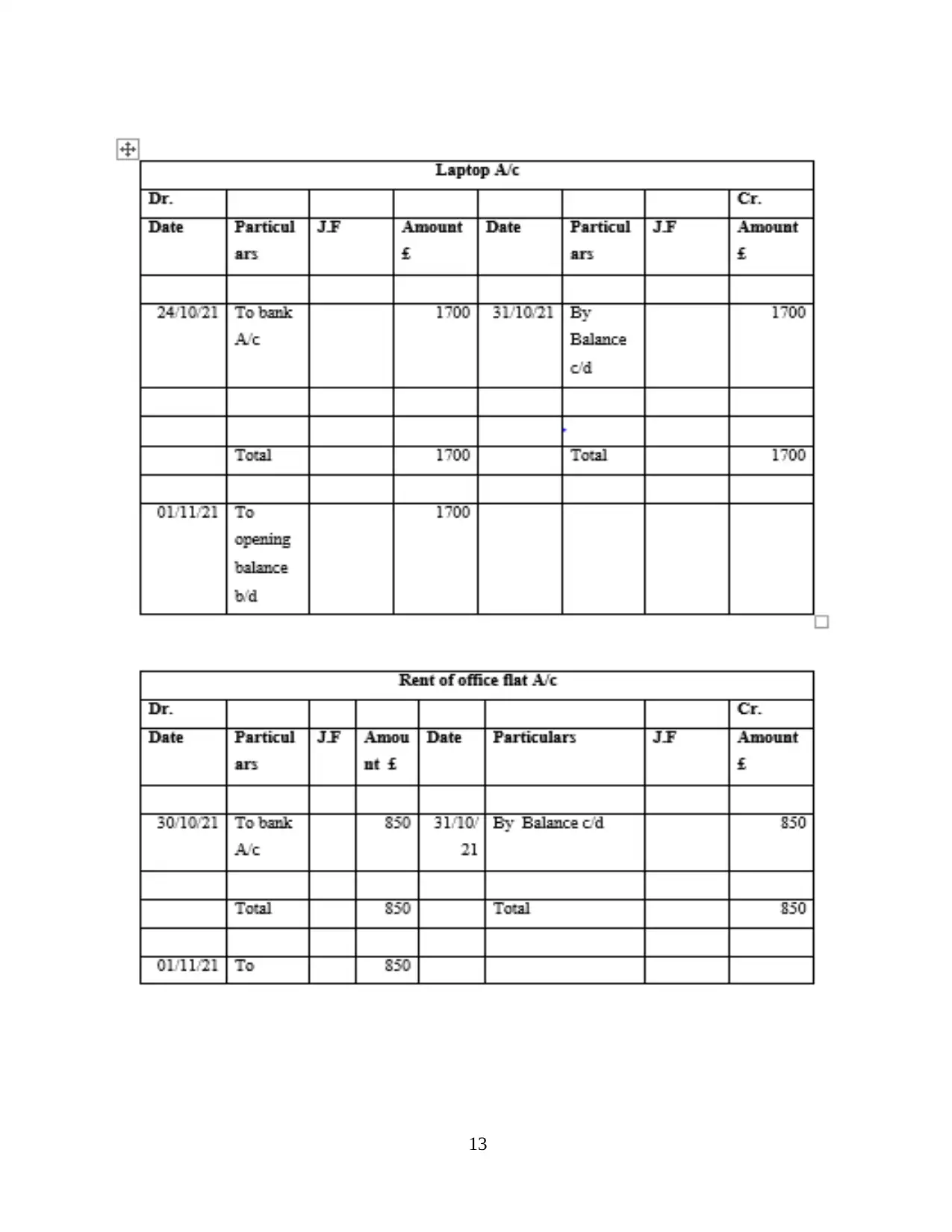

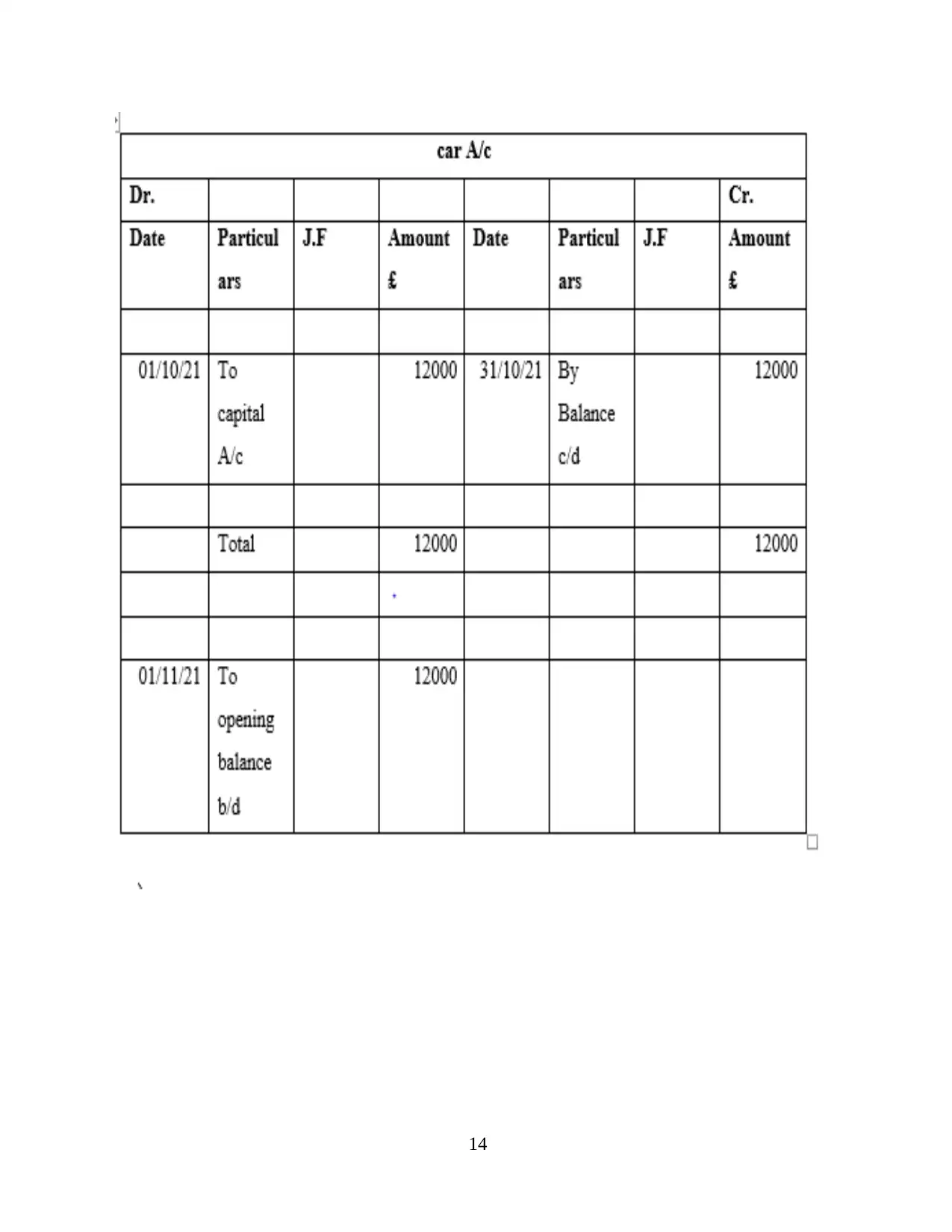

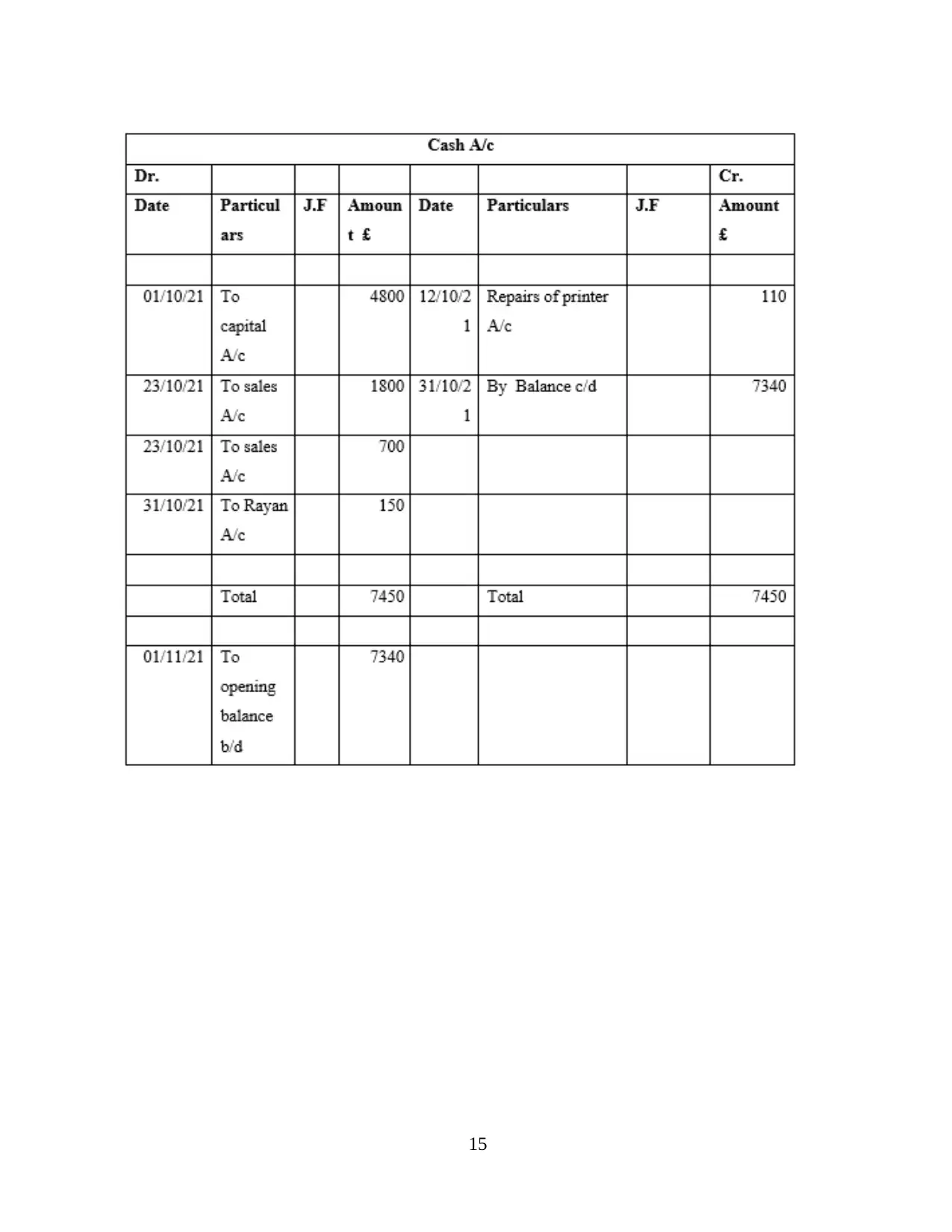

b) Balancing the account in ledger format

5

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

6

7

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

9

10

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

12

13

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

15

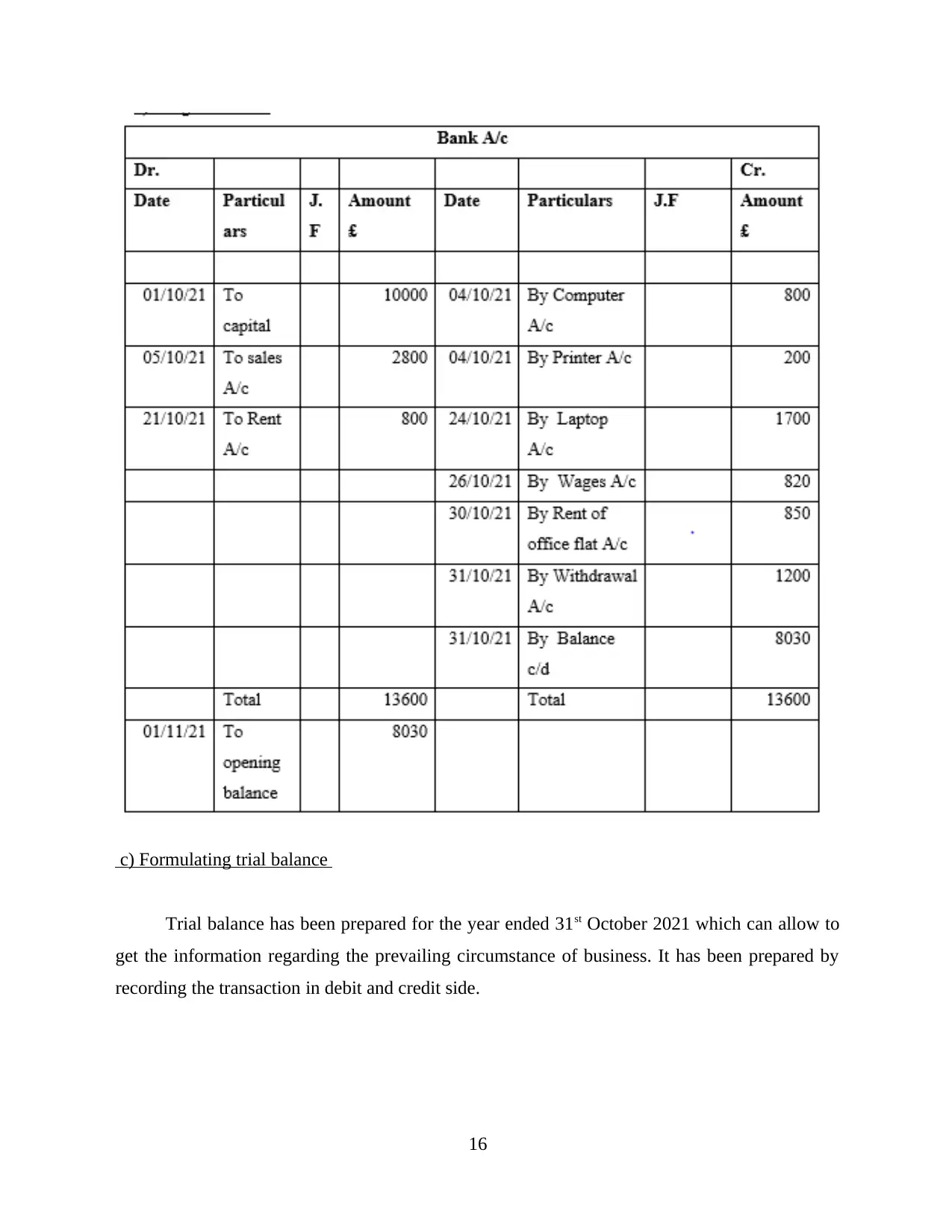

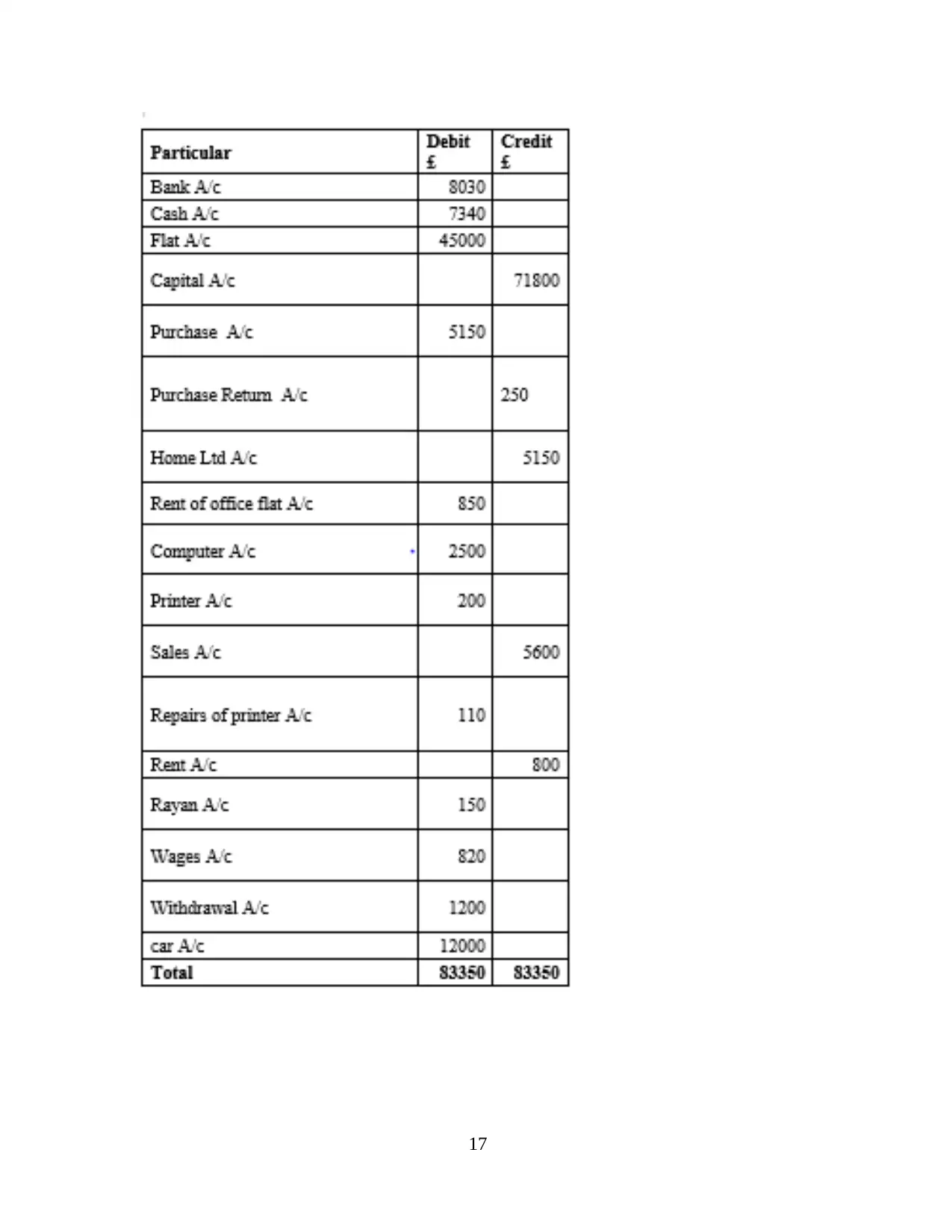

c) Formulating trial balance

Trial balance has been prepared for the year ended 31st October 2021 which can allow to

get the information regarding the prevailing circumstance of business. It has been prepared by

recording the transaction in debit and credit side.

16

Trial balance has been prepared for the year ended 31st October 2021 which can allow to

get the information regarding the prevailing circumstance of business. It has been prepared by

recording the transaction in debit and credit side.

16

17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

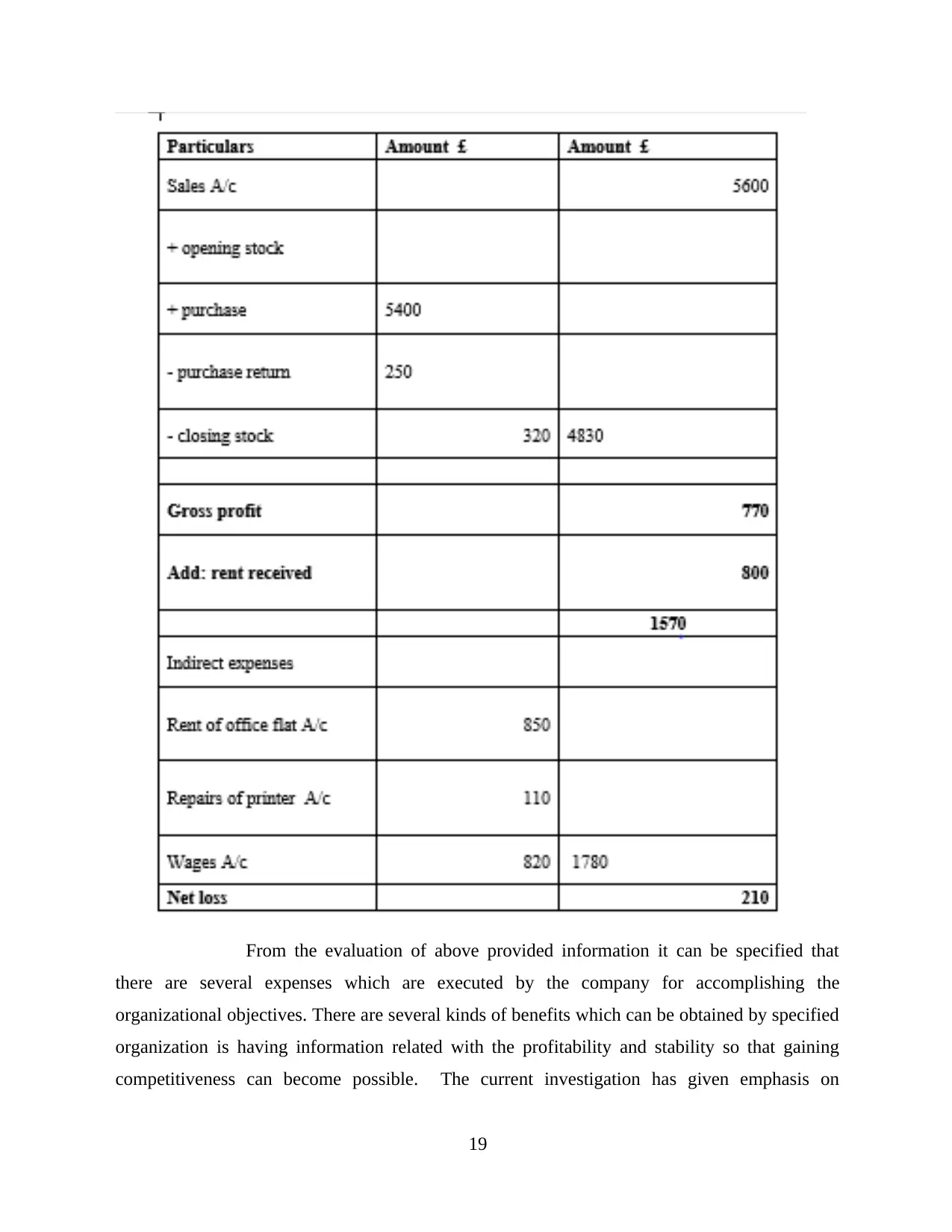

d) Preparing income statement

Income statement is one of the crucial financial statement that pay attention on

having the significant information regarding the earnings and expenditure of particular period

(Arslan, 2021). The particular statement comprises the expenditure of both direct and indirect

nature that are basically executed for gaining information regarding the prevailing activities. It

as well pay attention on providing details about earning obtained from sources such as sales

revenue, rent received, etc. It allows to ascertain data regarding cost of goods sold and higher

profitability generating capacity.

18

Income statement is one of the crucial financial statement that pay attention on

having the significant information regarding the earnings and expenditure of particular period

(Arslan, 2021). The particular statement comprises the expenditure of both direct and indirect

nature that are basically executed for gaining information regarding the prevailing activities. It

as well pay attention on providing details about earning obtained from sources such as sales

revenue, rent received, etc. It allows to ascertain data regarding cost of goods sold and higher

profitability generating capacity.

18

From the evaluation of above provided information it can be specified that

there are several expenses which are executed by the company for accomplishing the

organizational objectives. There are several kinds of benefits which can be obtained by specified

organization is having information related with the profitability and stability so that gaining

competitiveness can become possible. The current investigation has given emphasis on

19

there are several expenses which are executed by the company for accomplishing the

organizational objectives. There are several kinds of benefits which can be obtained by specified

organization is having information related with the profitability and stability so that gaining

competitiveness can become possible. The current investigation has given emphasis on

19

evaluating the result which has derived after spending cost on repair of printer, wages, etc. has

lead the frim towards loss the earning that has been received by firm in indirect form is

obtaining income from the rennet activity. On the basis of provided information related to loss it

can be analysed that there are several lacking areas which are not properly managed by

organization. There is need to make improvement strategy application for gaining the significant

profitability in turn stability for longer duration can be attained. To become successful in the

current competitive scenario there is requirement to identify the lacking areas which is hindering

growth & development of organization so that eliminating such expenses which are not allow to

have productive outcome. On the basis of this, it can be recognized that there are these

limitations which are needed to be focused for gaining competitive position.

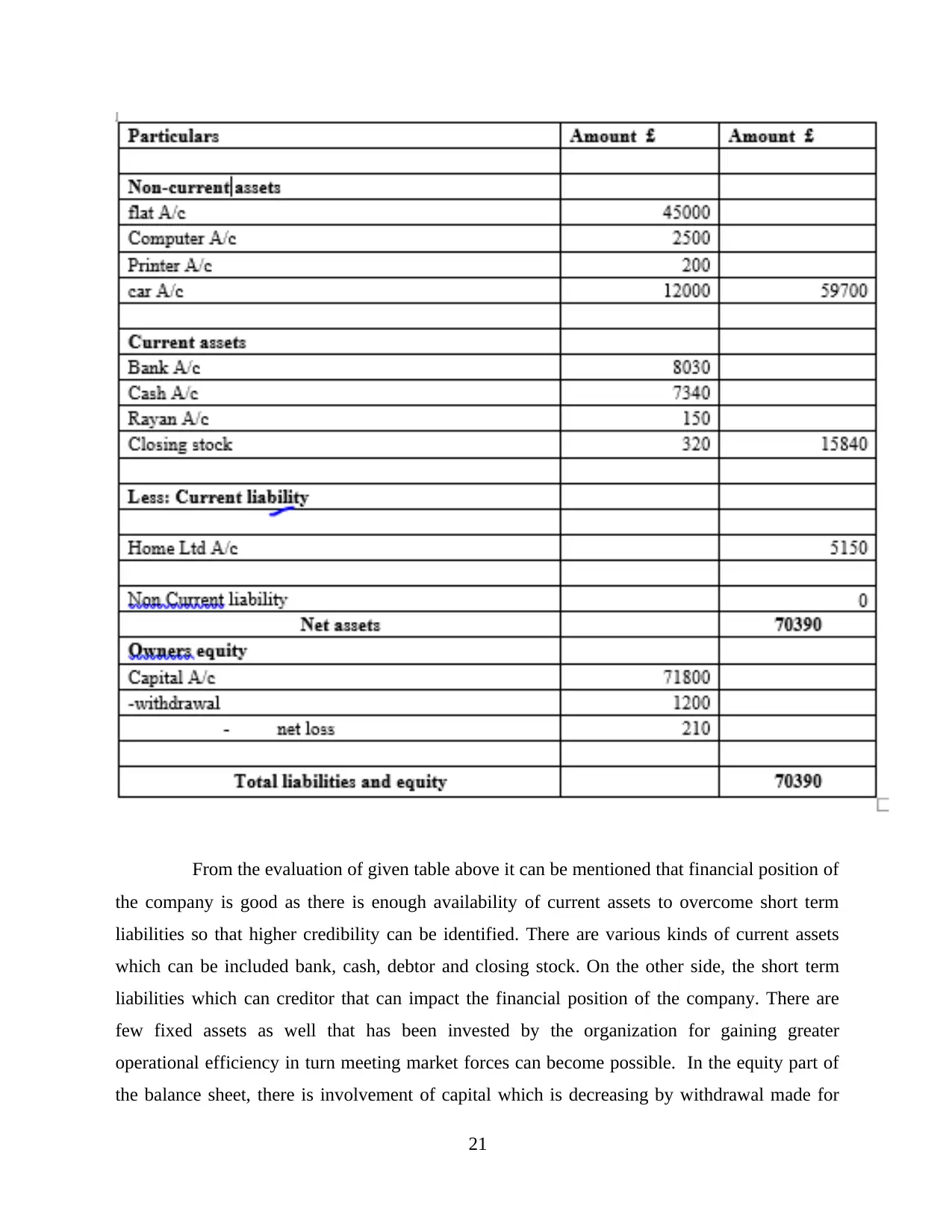

e) Formulating financial position

Balance sheet is prepared to have summarized details about the performance of

company at the end of the year. This provides assistance in gaining the information about the

several aspects such as current ability to pay off liabilities. The current financial position of the

organization has been estimated by applying accounting equation which includes assets equals

to liabilities plus equity. This allows to get the entry recorder via using double entry

system so that overall picture of company can be covered so that interpreting the financial

position can be identified.

20

lead the frim towards loss the earning that has been received by firm in indirect form is

obtaining income from the rennet activity. On the basis of provided information related to loss it

can be analysed that there are several lacking areas which are not properly managed by

organization. There is need to make improvement strategy application for gaining the significant

profitability in turn stability for longer duration can be attained. To become successful in the

current competitive scenario there is requirement to identify the lacking areas which is hindering

growth & development of organization so that eliminating such expenses which are not allow to

have productive outcome. On the basis of this, it can be recognized that there are these

limitations which are needed to be focused for gaining competitive position.

e) Formulating financial position

Balance sheet is prepared to have summarized details about the performance of

company at the end of the year. This provides assistance in gaining the information about the

several aspects such as current ability to pay off liabilities. The current financial position of the

organization has been estimated by applying accounting equation which includes assets equals

to liabilities plus equity. This allows to get the entry recorder via using double entry

system so that overall picture of company can be covered so that interpreting the financial

position can be identified.

20

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

From the evaluation of given table above it can be mentioned that financial position of

the company is good as there is enough availability of current assets to overcome short term

liabilities so that higher credibility can be identified. There are various kinds of current assets

which can be included bank, cash, debtor and closing stock. On the other side, the short term

liabilities which can creditor that can impact the financial position of the company. There are

few fixed assets as well that has been invested by the organization for gaining greater

operational efficiency in turn meeting market forces can become possible. In the equity part of

the balance sheet, there is involvement of capital which is decreasing by withdrawal made for

21

the company is good as there is enough availability of current assets to overcome short term

liabilities so that higher credibility can be identified. There are various kinds of current assets

which can be included bank, cash, debtor and closing stock. On the other side, the short term

liabilities which can creditor that can impact the financial position of the company. There are

few fixed assets as well that has been invested by the organization for gaining greater

operational efficiency in turn meeting market forces can become possible. In the equity part of

the balance sheet, there is involvement of capital which is decreasing by withdrawal made for

21

personal use. In addition to this, net loss occurred by the organization is impacting the position

of company and reducing the capital possessed by organization. on the basis of this, it can be

specified that there is requirement of making certain changes in turn gaining depth

understanding about the organizational performance can be derived. There are several benefits

of using the balance sheet into decision making procedures it allows to get the relevant insights

about the decision making procedure so that higher profitability and stability in overall

functioning of company can be obtained. This can permit the enterprise to get the capability to

function effectively in turn meeting organizational objective by maintaining competitive position

can become possible.

f) Writing letter

To Owner

Subject: Concern for withdrawal

In the recent business environment, competition has inclined which has increased

complexities to function in the industry. As being sole trader it is important for the organization

to pay attention on getting the effective strategy which can contribute in achieving success.

There are several internal and external components that impact the smooth processing of

company. It becomes essential for the management of the company to focus on recognizing the

lacking areas that can increase the productiveness. this limitations of business can be assessed

by referring the income and financial position prepared so that higher profitability to add value

to strengthening company’s position.

From the analysis of the prepared income statement it can be mentioned that there are

several expenses which are executed by organization for gaining capability to coordinate with

prevailing circumstances (Wang and Kogan, 2018). On the basis of conducted evaluation, it can

be specified that there is various component which are not properly focused that is leading firm

towards non-significant growth and development. There is lack of proper management and

identification of appropriate allocation and utilization of resources which has hampered the

growth & development of business. In order to become successful, the firm need to pay

attention on eliminating of such non relevant expenses so that higher profit margin can be

formulated. In respect to get the higher profitability and stability the firm is need to focus on

implementing such course of action that has capability to boost performance via optimizing

resources. Sole trader does not have such ability to manage the operational activities in relevant

22

of company and reducing the capital possessed by organization. on the basis of this, it can be

specified that there is requirement of making certain changes in turn gaining depth

understanding about the organizational performance can be derived. There are several benefits

of using the balance sheet into decision making procedures it allows to get the relevant insights

about the decision making procedure so that higher profitability and stability in overall

functioning of company can be obtained. This can permit the enterprise to get the capability to

function effectively in turn meeting organizational objective by maintaining competitive position

can become possible.

f) Writing letter

To Owner

Subject: Concern for withdrawal

In the recent business environment, competition has inclined which has increased

complexities to function in the industry. As being sole trader it is important for the organization

to pay attention on getting the effective strategy which can contribute in achieving success.

There are several internal and external components that impact the smooth processing of

company. It becomes essential for the management of the company to focus on recognizing the

lacking areas that can increase the productiveness. this limitations of business can be assessed

by referring the income and financial position prepared so that higher profitability to add value

to strengthening company’s position.

From the analysis of the prepared income statement it can be mentioned that there are

several expenses which are executed by organization for gaining capability to coordinate with

prevailing circumstances (Wang and Kogan, 2018). On the basis of conducted evaluation, it can

be specified that there is various component which are not properly focused that is leading firm

towards non-significant growth and development. There is lack of proper management and

identification of appropriate allocation and utilization of resources which has hampered the

growth & development of business. In order to become successful, the firm need to pay

attention on eliminating of such non relevant expenses so that higher profit margin can be

formulated. In respect to get the higher profitability and stability the firm is need to focus on

implementing such course of action that has capability to boost performance via optimizing

resources. Sole trader does not have such ability to manage the operational activities in relevant

22

manner which can hamper the growth & development of business. The specified owner should

concentrate on optimum utilization of resources via ensuring achieving of competitive position.

The formulated financial position of the business is reflecting that there is less availability of

short term debt which might influence the functioning of organization. there is availability of

current assets that includes cash, debtor, etc. which is helpful in assessing that firm is obtaining

roper efficiency to coordinate with prevailing circumstances. From the analysis it can be

mentioned that frim is possessing capital which is negatively impacted by the loss incurred in

the particular period. There are irrelevant expenses which has been made by the owner for own

travel which is adversely affecting the performance of the company that is required to be

managed by the organization by the company. Withdrawing fund can largely impact the

organizational ability to meet requirements so that higher profit earning get affected. On the

basis of this, it become important for the owner to pay attention on eliminating such personal

expenses in order to have higher profitability. This can allow the organization to ensure that

proper utilization of resources along with strategic management can permit the business to have

the ability to get the leading position in sector (Cai, 2021). For this purpose, it is suggested to the

owner to emphasize on getting the effective position by developing optimum utilization,

eliminating irrelevant expense, diversification of fund, etc. through focusing on accurate use of

available capital. In addition to this, as being sole trader specified proprietor can pay attention on

avoiding making withdrawal as it can impact in negative manner.

PART B

a) Determining ratios

Ratio technique is one the significant approach that is taken into consideration for

evaluating the organizational performance by referring different aspects so that higher profitable

decision can be made (What is Ratio Analysis? 2020). In the current era, complexity regarding

the operational practice has increased which require firm to pay attention on getting the relevant

information about firm so that strategy can be formulated. The current study has given emphasis

on gaining the proper data about the specified business performance so that various benefit

providing decision can be made. There are number of benefits of using the ratio analysis which

involves forecasting, budgeting, measuring operational efficiency, communication of significant

23

concentrate on optimum utilization of resources via ensuring achieving of competitive position.

The formulated financial position of the business is reflecting that there is less availability of

short term debt which might influence the functioning of organization. there is availability of

current assets that includes cash, debtor, etc. which is helpful in assessing that firm is obtaining

roper efficiency to coordinate with prevailing circumstances. From the analysis it can be

mentioned that frim is possessing capital which is negatively impacted by the loss incurred in

the particular period. There are irrelevant expenses which has been made by the owner for own

travel which is adversely affecting the performance of the company that is required to be

managed by the organization by the company. Withdrawing fund can largely impact the

organizational ability to meet requirements so that higher profit earning get affected. On the

basis of this, it become important for the owner to pay attention on eliminating such personal

expenses in order to have higher profitability. This can allow the organization to ensure that

proper utilization of resources along with strategic management can permit the business to have

the ability to get the leading position in sector (Cai, 2021). For this purpose, it is suggested to the

owner to emphasize on getting the effective position by developing optimum utilization,

eliminating irrelevant expense, diversification of fund, etc. through focusing on accurate use of

available capital. In addition to this, as being sole trader specified proprietor can pay attention on

avoiding making withdrawal as it can impact in negative manner.

PART B

a) Determining ratios

Ratio technique is one the significant approach that is taken into consideration for

evaluating the organizational performance by referring different aspects so that higher profitable

decision can be made (What is Ratio Analysis? 2020). In the current era, complexity regarding

the operational practice has increased which require firm to pay attention on getting the relevant

information about firm so that strategy can be formulated. The current study has given emphasis

on gaining the proper data about the specified business performance so that various benefit

providing decision can be made. There are number of benefits of using the ratio analysis which

involves forecasting, budgeting, measuring operational efficiency, communication of significant

23

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

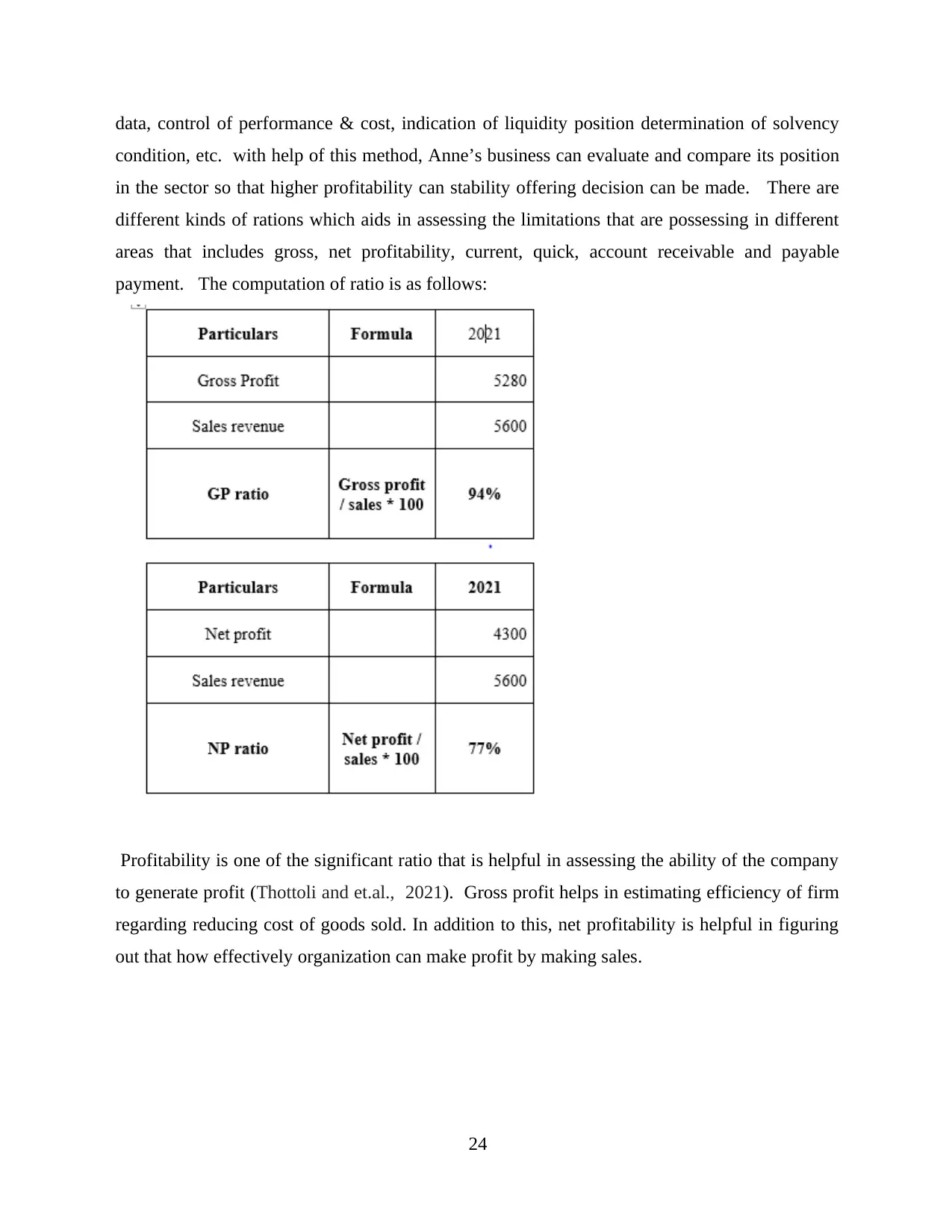

data, control of performance & cost, indication of liquidity position determination of solvency

condition, etc. with help of this method, Anne’s business can evaluate and compare its position

in the sector so that higher profitability can stability offering decision can be made. There are

different kinds of rations which aids in assessing the limitations that are possessing in different

areas that includes gross, net profitability, current, quick, account receivable and payable

payment. The computation of ratio is as follows:

Profitability is one of the significant ratio that is helpful in assessing the ability of the company

to generate profit (Thottoli and et.al., 2021). Gross profit helps in estimating efficiency of firm

regarding reducing cost of goods sold. In addition to this, net profitability is helpful in figuring

out that how effectively organization can make profit by making sales.

24

condition, etc. with help of this method, Anne’s business can evaluate and compare its position

in the sector so that higher profitability can stability offering decision can be made. There are

different kinds of rations which aids in assessing the limitations that are possessing in different

areas that includes gross, net profitability, current, quick, account receivable and payable

payment. The computation of ratio is as follows:

Profitability is one of the significant ratio that is helpful in assessing the ability of the company

to generate profit (Thottoli and et.al., 2021). Gross profit helps in estimating efficiency of firm

regarding reducing cost of goods sold. In addition to this, net profitability is helpful in figuring

out that how effectively organization can make profit by making sales.

24

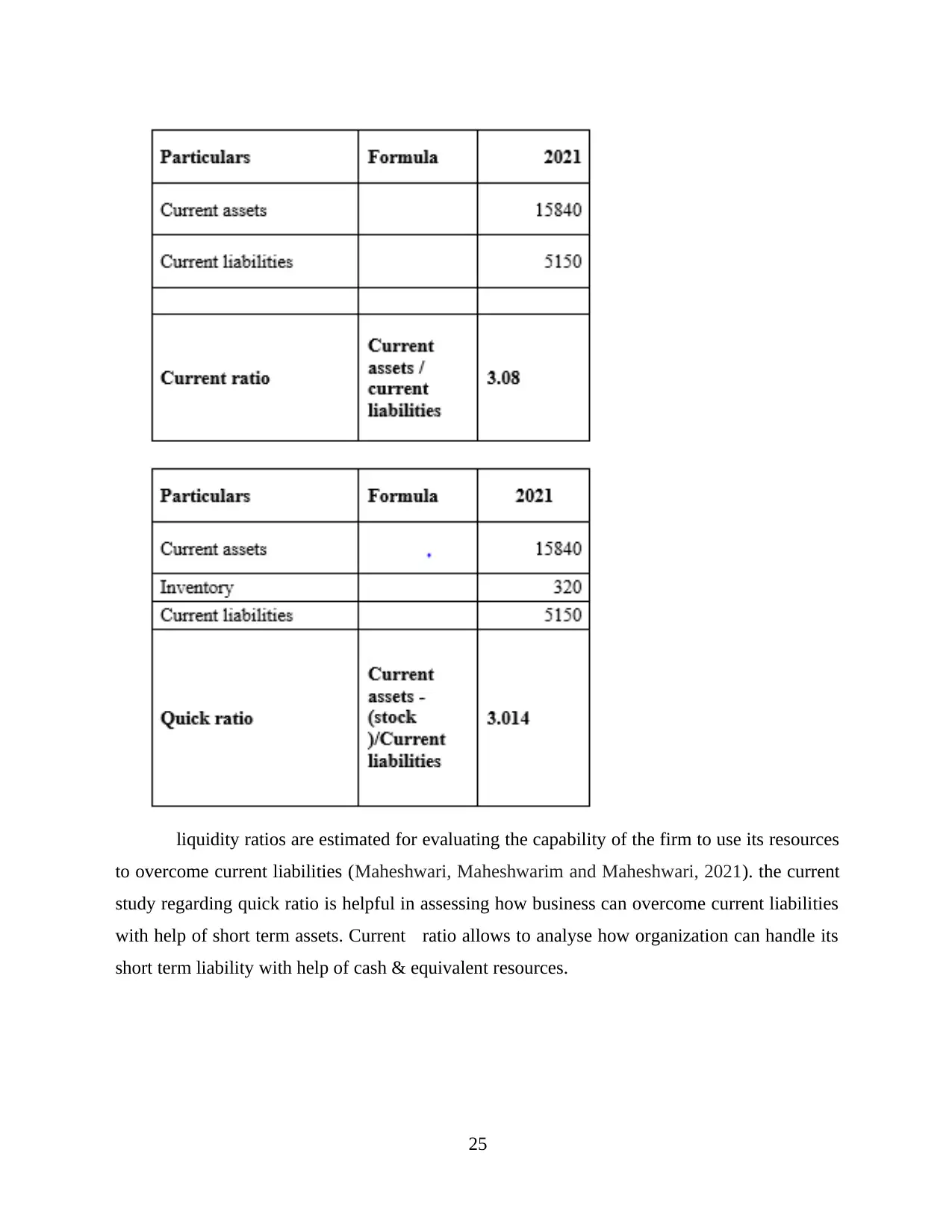

liquidity ratios are estimated for evaluating the capability of the firm to use its resources

to overcome current liabilities (Maheshwari, Maheshwarim and Maheshwari, 2021). the current

study regarding quick ratio is helpful in assessing how business can overcome current liabilities

with help of short term assets. Current ratio allows to analyse how organization can handle its

short term liability with help of cash & equivalent resources.

25

to overcome current liabilities (Maheshwari, Maheshwarim and Maheshwari, 2021). the current

study regarding quick ratio is helpful in assessing how business can overcome current liabilities

with help of short term assets. Current ratio allows to analyse how organization can handle its

short term liability with help of cash & equivalent resources.

25

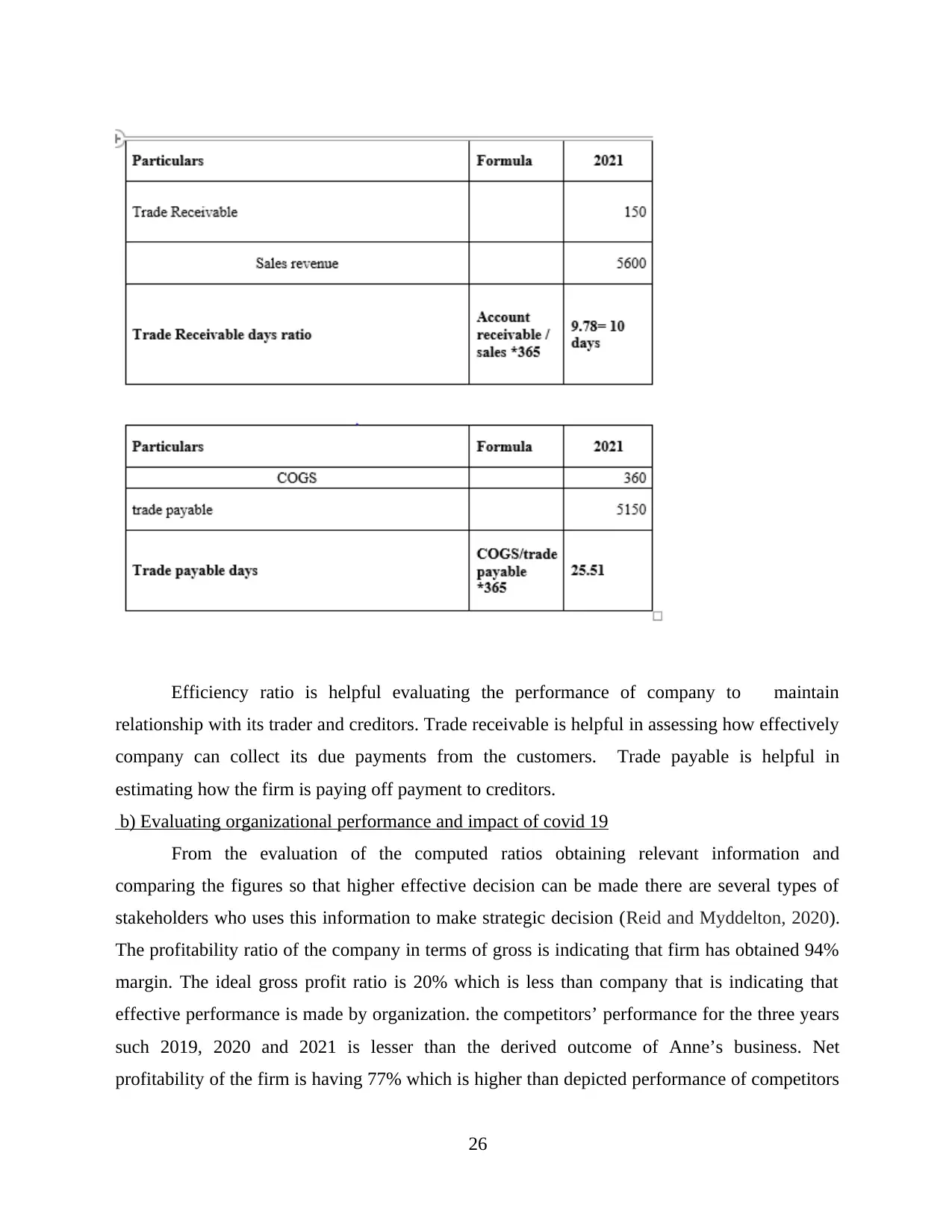

Efficiency ratio is helpful evaluating the performance of company to maintain

relationship with its trader and creditors. Trade receivable is helpful in assessing how effectively

company can collect its due payments from the customers. Trade payable is helpful in

estimating how the firm is paying off payment to creditors.

b) Evaluating organizational performance and impact of covid 19

From the evaluation of the computed ratios obtaining relevant information and

comparing the figures so that higher effective decision can be made there are several types of

stakeholders who uses this information to make strategic decision (Reid and Myddelton, 2020).

The profitability ratio of the company in terms of gross is indicating that firm has obtained 94%

margin. The ideal gross profit ratio is 20% which is less than company that is indicating that

effective performance is made by organization. the competitors’ performance for the three years

such 2019, 2020 and 2021 is lesser than the derived outcome of Anne’s business. Net

profitability of the firm is having 77% which is higher than depicted performance of competitors

26

relationship with its trader and creditors. Trade receivable is helpful in assessing how effectively

company can collect its due payments from the customers. Trade payable is helpful in

estimating how the firm is paying off payment to creditors.

b) Evaluating organizational performance and impact of covid 19

From the evaluation of the computed ratios obtaining relevant information and

comparing the figures so that higher effective decision can be made there are several types of

stakeholders who uses this information to make strategic decision (Reid and Myddelton, 2020).

The profitability ratio of the company in terms of gross is indicating that firm has obtained 94%

margin. The ideal gross profit ratio is 20% which is less than company that is indicating that

effective performance is made by organization. the competitors’ performance for the three years

such 2019, 2020 and 2021 is lesser than the derived outcome of Anne’s business. Net

profitability of the firm is having 77% which is higher than depicted performance of competitors

26

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

which is indicating that firm is possessing that greater profitability than the competitor results.

On the basis of this, it can be articulated that organizational performance in terms of profitability

is good.

From the analysis of the given data, it can be mentioned that liquidity of Anne’s

business is good. The current study regarding ratio computed that quick ratio of the firm is 3.014

times which is greater than 1 times standard benchmarking established for the specified ratio.

This is helpful in assessing that business is gaining proper ability to overcome the short term

liabilities. In addition to this, current ratio of the firm is having 3.08 times that is higher than

stand performance established. On the basis of this, it can be identified that liquidity position of

the business is highly effective which is reflecting good financial condition of enterprise. There

are number of stakeholders who pay attention on gaining information about liquidity which is

positive sign for them to make decision regarding organizational performance which includes

investors, creditors, etc.

Efficiency play major role in affecting the stakeholders’ decision which involves how

business is maintaining enough resources to meet the requirements of organization. Trade

receivable is indicating how organization is receivable the payments from the customer on

goods are sold on credit. This ratio of Anne’s business is having 10 days which is less as

compared to organizational performance shown by similar firms operating in sector. From the

evaluation of trade payable period of the business is 25.51 days which is basically more than

current performance of the competitors which is negative sign needs organization to make

improvements so that higher trustworthiness & credibility in sector can be received.

Covid 19 as being pandemic circumstances has highly affected the performance of

enterprises as impacted access to resources, availability of employees, customer, etc. factor in

negative manner. Anne’s business is having good financial condition which is indicating that

business is having good financial health.

CONCLUSION

From the above report it can be concluded that recording business transaction allows to

have effective ability to make decision. The current study has given emphasis on having

information regarding journal, ledger account, trail balance, income statement and balance sheet.

It has involved calculation of ratios and interpretation that Anne’s business is performing good

without being impacted from covid 19

27

On the basis of this, it can be articulated that organizational performance in terms of profitability

is good.

From the analysis of the given data, it can be mentioned that liquidity of Anne’s

business is good. The current study regarding ratio computed that quick ratio of the firm is 3.014

times which is greater than 1 times standard benchmarking established for the specified ratio.

This is helpful in assessing that business is gaining proper ability to overcome the short term

liabilities. In addition to this, current ratio of the firm is having 3.08 times that is higher than

stand performance established. On the basis of this, it can be identified that liquidity position of

the business is highly effective which is reflecting good financial condition of enterprise. There

are number of stakeholders who pay attention on gaining information about liquidity which is

positive sign for them to make decision regarding organizational performance which includes

investors, creditors, etc.

Efficiency play major role in affecting the stakeholders’ decision which involves how

business is maintaining enough resources to meet the requirements of organization. Trade

receivable is indicating how organization is receivable the payments from the customer on

goods are sold on credit. This ratio of Anne’s business is having 10 days which is less as

compared to organizational performance shown by similar firms operating in sector. From the

evaluation of trade payable period of the business is 25.51 days which is basically more than

current performance of the competitors which is negative sign needs organization to make

improvements so that higher trustworthiness & credibility in sector can be received.

Covid 19 as being pandemic circumstances has highly affected the performance of

enterprises as impacted access to resources, availability of employees, customer, etc. factor in

negative manner. Anne’s business is having good financial condition which is indicating that

business is having good financial health.

CONCLUSION

From the above report it can be concluded that recording business transaction allows to

have effective ability to make decision. The current study has given emphasis on having

information regarding journal, ledger account, trail balance, income statement and balance sheet.

It has involved calculation of ratios and interpretation that Anne’s business is performing good

without being impacted from covid 19

27

REFERENCES

Books and Journals

Arslan, Ö., 2021. Modern Approaches, Recording Methods, and International Regulations on

Public Accounting. In Contemporary Issues in Public Sector Accounting and Auditing.

Emerald Publishing Limited.

Cai, C.W., 2021. Triple‐entry accounting with blockchain: How far have we come?. Accounting

& Finances. 61(1). pp.71-93.

Maheshwari, S. N., Maheshwari, S. K. and Maheshwari, M. S. K., 2021. Principles of

Management Accounting. Sultan Chand & Sons.

Reid, W. and Myddelton, D.R., 2020. The meaning of company accounts. Routledge.

Thottoli, M.M and et.al., 2021. Does Creditors Terms and Accounting Process Affect MSMEs

Debtor’s Management? The Need for Novel IT Tools. REVISTA GEINTEC-GESTAO

INOVACAO E TECNOLOGIAS. 11(4). pp.4545-4560.

Wang, Y. and Kogan, A., 2018. Designing confidentiality-preserving Blockchain-based

transaction processing systems. International Journal of Accounting Information

Systems. 30. pp.1-18.

Online

What is Ratio Analysis?. 2020. [Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/ratio-analysis/ >.

28

Books and Journals

Arslan, Ö., 2021. Modern Approaches, Recording Methods, and International Regulations on

Public Accounting. In Contemporary Issues in Public Sector Accounting and Auditing.

Emerald Publishing Limited.

Cai, C.W., 2021. Triple‐entry accounting with blockchain: How far have we come?. Accounting

& Finances. 61(1). pp.71-93.

Maheshwari, S. N., Maheshwari, S. K. and Maheshwari, M. S. K., 2021. Principles of

Management Accounting. Sultan Chand & Sons.

Reid, W. and Myddelton, D.R., 2020. The meaning of company accounts. Routledge.

Thottoli, M.M and et.al., 2021. Does Creditors Terms and Accounting Process Affect MSMEs

Debtor’s Management? The Need for Novel IT Tools. REVISTA GEINTEC-GESTAO

INOVACAO E TECNOLOGIAS. 11(4). pp.4545-4560.

Wang, Y. and Kogan, A., 2018. Designing confidentiality-preserving Blockchain-based

transaction processing systems. International Journal of Accounting Information

Systems. 30. pp.1-18.

Online

What is Ratio Analysis?. 2020. [Online]. Available through:

<https://corporatefinanceinstitute.com/resources/knowledge/finance/ratio-analysis/ >.

28

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.