Recording Business Transaction Assessment A2

VerifiedAdded on 2022/12/28

|16

|2993

|29

AI Summary

This report addresses different aspects related to recording the business activities of the organisation. It includes journal entries, balance accounts, trial balance, income statement, balance sheet, and ratio calculations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

RECORDING BUSINESS

TRANSACTION

ASSESSMENT A2

TRANSACTION

ASSESSMENT A2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

Part A...............................................................................................................................................3

Journal Entry ...............................................................................................................................3

Balance account ..........................................................................................................................4

Trial Balance ...............................................................................................................................8

Income statement for the year ending 31st October 2020...........................................................8

Balance Sheet as at 31st October 2020........................................................................................9

Brief letter ...................................................................................................................................9

Part B.............................................................................................................................................11

Ratio calculation .......................................................................................................................11

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

Part A...............................................................................................................................................3

Journal Entry ...............................................................................................................................3

Balance account ..........................................................................................................................4

Trial Balance ...............................................................................................................................8

Income statement for the year ending 31st October 2020...........................................................8

Balance Sheet as at 31st October 2020........................................................................................9

Brief letter ...................................................................................................................................9

Part B.............................................................................................................................................11

Ratio calculation .......................................................................................................................11

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Recording the business transactions is denoted as maintaining the books of accounts of

company that can reflect about the financial position of the organisation. This report will address

different aspects related to recording the business activities of the organisation. Henceforth,

report will emphasis over projecting the transaction of company based on the double entry book

keeping system maintained by the organisation. Individual ledger account will also project in the

report that can demonstrate precisely the actions taken by entity under te double entry book

keeping system. Trail balance will also reflect in the project. Further the income statement will

project in the project to denote about the profitability situation of the organisation. Letter will

also be summarises to identify the drawing treatment effectiveness of the organisation.

Furthermore, this study will talk about different ratios. Calculation will be shown for different

ratios. Performance of the company will be analysed withy the support of different ratios

calculated in the project.

Part A

Journal Entry

Date Particular Debit Credit

1 October,

2020

Bank a/c

Cash a/c

Van a/c

To Capital a/c

8000

5200

3000

16200

02/10/20 Laptop a/c

To Bank

1000

1000

04/10/20 Purchase a/c

To Toys Ltd.

2450

2450

05/10/20 Bank a/c

To sales

1500

1500

12/10/20 Repairing a/c 80

Recording the business transactions is denoted as maintaining the books of accounts of

company that can reflect about the financial position of the organisation. This report will address

different aspects related to recording the business activities of the organisation. Henceforth,

report will emphasis over projecting the transaction of company based on the double entry book

keeping system maintained by the organisation. Individual ledger account will also project in the

report that can demonstrate precisely the actions taken by entity under te double entry book

keeping system. Trail balance will also reflect in the project. Further the income statement will

project in the project to denote about the profitability situation of the organisation. Letter will

also be summarises to identify the drawing treatment effectiveness of the organisation.

Furthermore, this study will talk about different ratios. Calculation will be shown for different

ratios. Performance of the company will be analysed withy the support of different ratios

calculated in the project.

Part A

Journal Entry

Date Particular Debit Credit

1 October,

2020

Bank a/c

Cash a/c

Van a/c

To Capital a/c

8000

5200

3000

16200

02/10/20 Laptop a/c

To Bank

1000

1000

04/10/20 Purchase a/c

To Toys Ltd.

2450

2450

05/10/20 Bank a/c

To sales

1500

1500

12/10/20 Repairing a/c 80

To cash 80

18/10/20 Toys Ltd. a/c

To Purchase return

100

100

21/10/20 Bank a/c

To rent

500

500

23/10/20 Cash a/c

Fred a/c

To sales

1500

400

1900

23/10/20 Cash a/c

To sales

500

500

24/10/20 Car a/c

To Bank

2500

2500

26/10/20 Wages a/c

To Bank

820

820

30/10/20 Rent /ac

To Bank

1000

1000

31/10/20 Drawing a/c

To Bank

1600

1600

Balance account

Capital Account

Date Particulars Amount Date Particulars Amount

01/10/20 By bank A/c 8000

By Cask A/c 5200

By Van A/c 3000

31/10/20 To Drawings

A/c

1600

To Balance 14600

18/10/20 Toys Ltd. a/c

To Purchase return

100

100

21/10/20 Bank a/c

To rent

500

500

23/10/20 Cash a/c

Fred a/c

To sales

1500

400

1900

23/10/20 Cash a/c

To sales

500

500

24/10/20 Car a/c

To Bank

2500

2500

26/10/20 Wages a/c

To Bank

820

820

30/10/20 Rent /ac

To Bank

1000

1000

31/10/20 Drawing a/c

To Bank

1600

1600

Balance account

Capital Account

Date Particulars Amount Date Particulars Amount

01/10/20 By bank A/c 8000

By Cask A/c 5200

By Van A/c 3000

31/10/20 To Drawings

A/c

1600

To Balance 14600

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

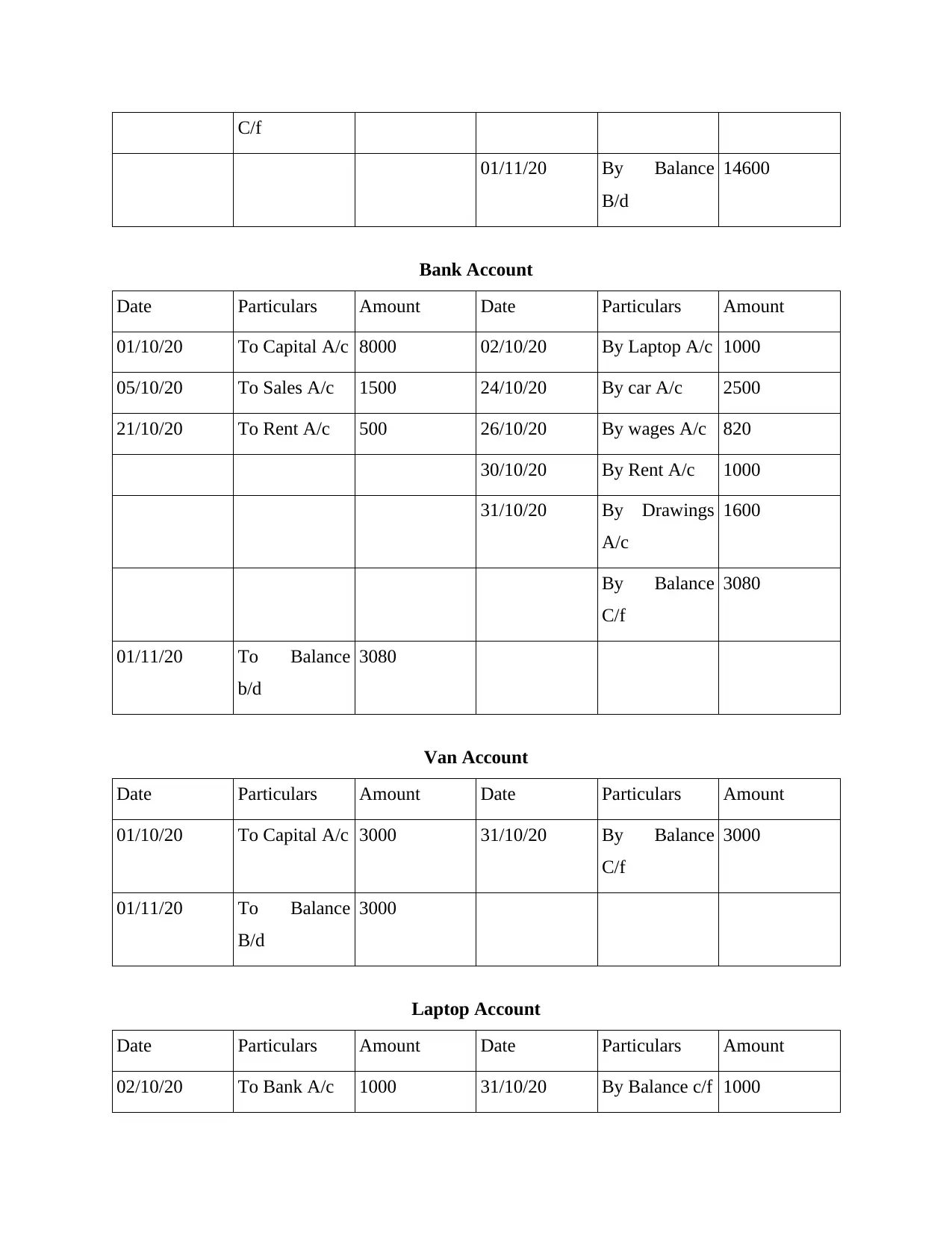

C/f

01/11/20 By Balance

B/d

14600

Bank Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 8000 02/10/20 By Laptop A/c 1000

05/10/20 To Sales A/c 1500 24/10/20 By car A/c 2500

21/10/20 To Rent A/c 500 26/10/20 By wages A/c 820

30/10/20 By Rent A/c 1000

31/10/20 By Drawings

A/c

1600

By Balance

C/f

3080

01/11/20 To Balance

b/d

3080

Van Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 3000 31/10/20 By Balance

C/f

3000

01/11/20 To Balance

B/d

3000

Laptop Account

Date Particulars Amount Date Particulars Amount

02/10/20 To Bank A/c 1000 31/10/20 By Balance c/f 1000

01/11/20 By Balance

B/d

14600

Bank Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 8000 02/10/20 By Laptop A/c 1000

05/10/20 To Sales A/c 1500 24/10/20 By car A/c 2500

21/10/20 To Rent A/c 500 26/10/20 By wages A/c 820

30/10/20 By Rent A/c 1000

31/10/20 By Drawings

A/c

1600

By Balance

C/f

3080

01/11/20 To Balance

b/d

3080

Van Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 3000 31/10/20 By Balance

C/f

3000

01/11/20 To Balance

B/d

3000

Laptop Account

Date Particulars Amount Date Particulars Amount

02/10/20 To Bank A/c 1000 31/10/20 By Balance c/f 1000

01/11/20 To Balance

B/d

1000

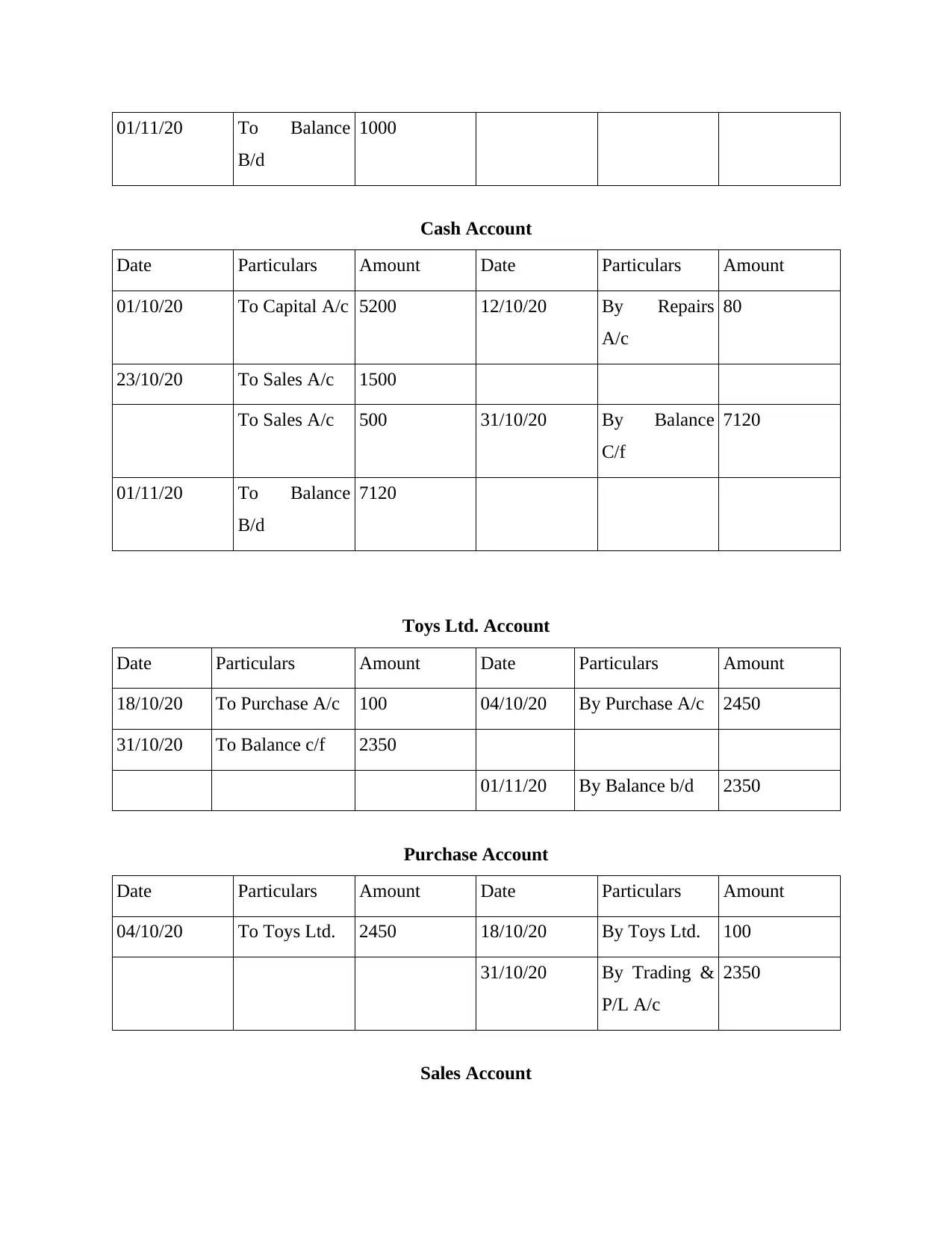

Cash Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 5200 12/10/20 By Repairs

A/c

80

23/10/20 To Sales A/c 1500

To Sales A/c 500 31/10/20 By Balance

C/f

7120

01/11/20 To Balance

B/d

7120

Toys Ltd. Account

Date Particulars Amount Date Particulars Amount

18/10/20 To Purchase A/c 100 04/10/20 By Purchase A/c 2450

31/10/20 To Balance c/f 2350

01/11/20 By Balance b/d 2350

Purchase Account

Date Particulars Amount Date Particulars Amount

04/10/20 To Toys Ltd. 2450 18/10/20 By Toys Ltd. 100

31/10/20 By Trading &

P/L A/c

2350

Sales Account

B/d

1000

Cash Account

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 5200 12/10/20 By Repairs

A/c

80

23/10/20 To Sales A/c 1500

To Sales A/c 500 31/10/20 By Balance

C/f

7120

01/11/20 To Balance

B/d

7120

Toys Ltd. Account

Date Particulars Amount Date Particulars Amount

18/10/20 To Purchase A/c 100 04/10/20 By Purchase A/c 2450

31/10/20 To Balance c/f 2350

01/11/20 By Balance b/d 2350

Purchase Account

Date Particulars Amount Date Particulars Amount

04/10/20 To Toys Ltd. 2450 18/10/20 By Toys Ltd. 100

31/10/20 By Trading &

P/L A/c

2350

Sales Account

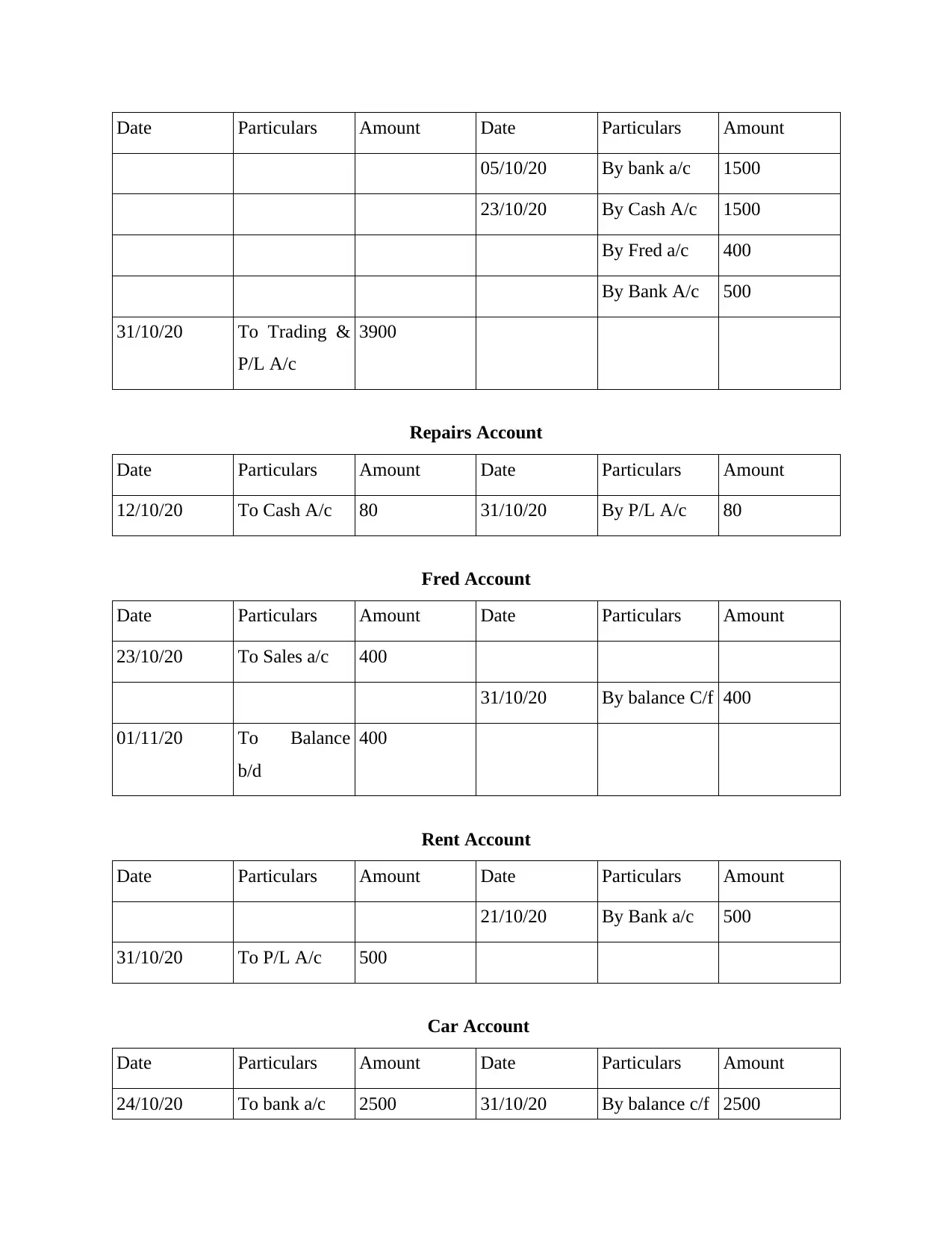

Date Particulars Amount Date Particulars Amount

05/10/20 By bank a/c 1500

23/10/20 By Cash A/c 1500

By Fred a/c 400

By Bank A/c 500

31/10/20 To Trading &

P/L A/c

3900

Repairs Account

Date Particulars Amount Date Particulars Amount

12/10/20 To Cash A/c 80 31/10/20 By P/L A/c 80

Fred Account

Date Particulars Amount Date Particulars Amount

23/10/20 To Sales a/c 400

31/10/20 By balance C/f 400

01/11/20 To Balance

b/d

400

Rent Account

Date Particulars Amount Date Particulars Amount

21/10/20 By Bank a/c 500

31/10/20 To P/L A/c 500

Car Account

Date Particulars Amount Date Particulars Amount

24/10/20 To bank a/c 2500 31/10/20 By balance c/f 2500

05/10/20 By bank a/c 1500

23/10/20 By Cash A/c 1500

By Fred a/c 400

By Bank A/c 500

31/10/20 To Trading &

P/L A/c

3900

Repairs Account

Date Particulars Amount Date Particulars Amount

12/10/20 To Cash A/c 80 31/10/20 By P/L A/c 80

Fred Account

Date Particulars Amount Date Particulars Amount

23/10/20 To Sales a/c 400

31/10/20 By balance C/f 400

01/11/20 To Balance

b/d

400

Rent Account

Date Particulars Amount Date Particulars Amount

21/10/20 By Bank a/c 500

31/10/20 To P/L A/c 500

Car Account

Date Particulars Amount Date Particulars Amount

24/10/20 To bank a/c 2500 31/10/20 By balance c/f 2500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

01/11/20 To balance b/d 2500

Wages Account

Date Particulars Amount Date Particulars Amount

26/10/20 To bank a/c 820 31/10/20 By Trading &

P/L a/c

820

Drawings account

Date Particulars Amount Date Particulars Amount

31/10/20 To bank a/c 1600 31/10/20 By Capital a/c 1600

Trial Balance

Trial balance as at 31 October 2020

Particulars Debit Amount Credit Amount

Capital 14600

Cash 7120

Bank 3080

Purchases 2350

Laptop 1000

Van 3000

Creditor 2350

Sales 3900

Repairs 80

Debtor 400

Rent 500

Wages Account

Date Particulars Amount Date Particulars Amount

26/10/20 To bank a/c 820 31/10/20 By Trading &

P/L a/c

820

Drawings account

Date Particulars Amount Date Particulars Amount

31/10/20 To bank a/c 1600 31/10/20 By Capital a/c 1600

Trial Balance

Trial balance as at 31 October 2020

Particulars Debit Amount Credit Amount

Capital 14600

Cash 7120

Bank 3080

Purchases 2350

Laptop 1000

Van 3000

Creditor 2350

Sales 3900

Repairs 80

Debtor 400

Rent 500

Car 2500

Wages 820

Rent 1000

Total 21350 21350

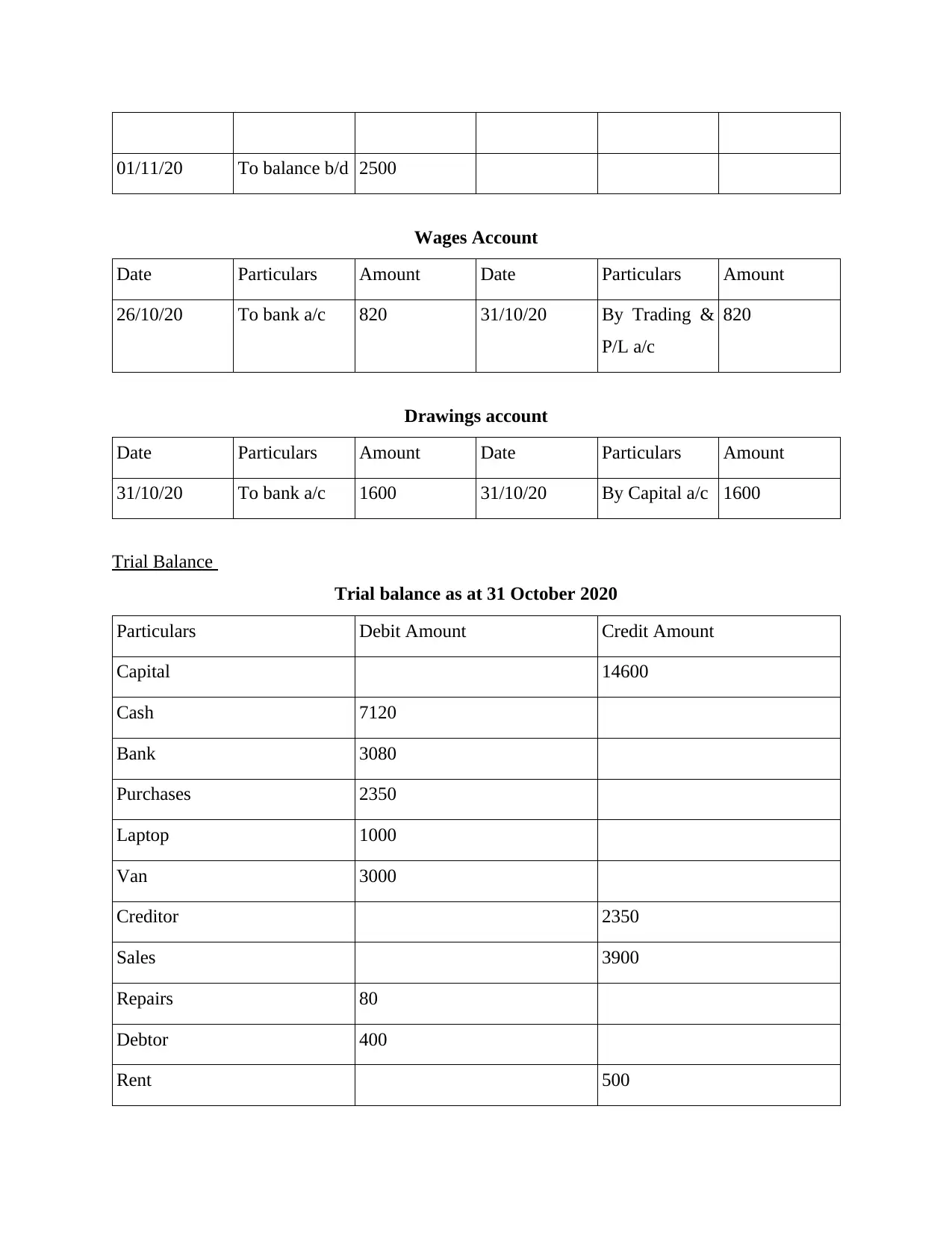

Income statement for the year ending 31st October 2020

Particulars Amount

Sales 3900

Less:

COGS

Purchases

Wages

Closing Stock

2920

2350

820

(250) (5840)

Gross margin 980

Add: Rent received

Less:

Rent 1000

Repairs 80

500

(1080) (580)

Net Profit 400

Balance Sheet as at 31st October 2020

Particulars Amount

Assets

Current Assets

Bank 3080

Cash 7120

Wages 820

Rent 1000

Total 21350 21350

Income statement for the year ending 31st October 2020

Particulars Amount

Sales 3900

Less:

COGS

Purchases

Wages

Closing Stock

2920

2350

820

(250) (5840)

Gross margin 980

Add: Rent received

Less:

Rent 1000

Repairs 80

500

(1080) (580)

Net Profit 400

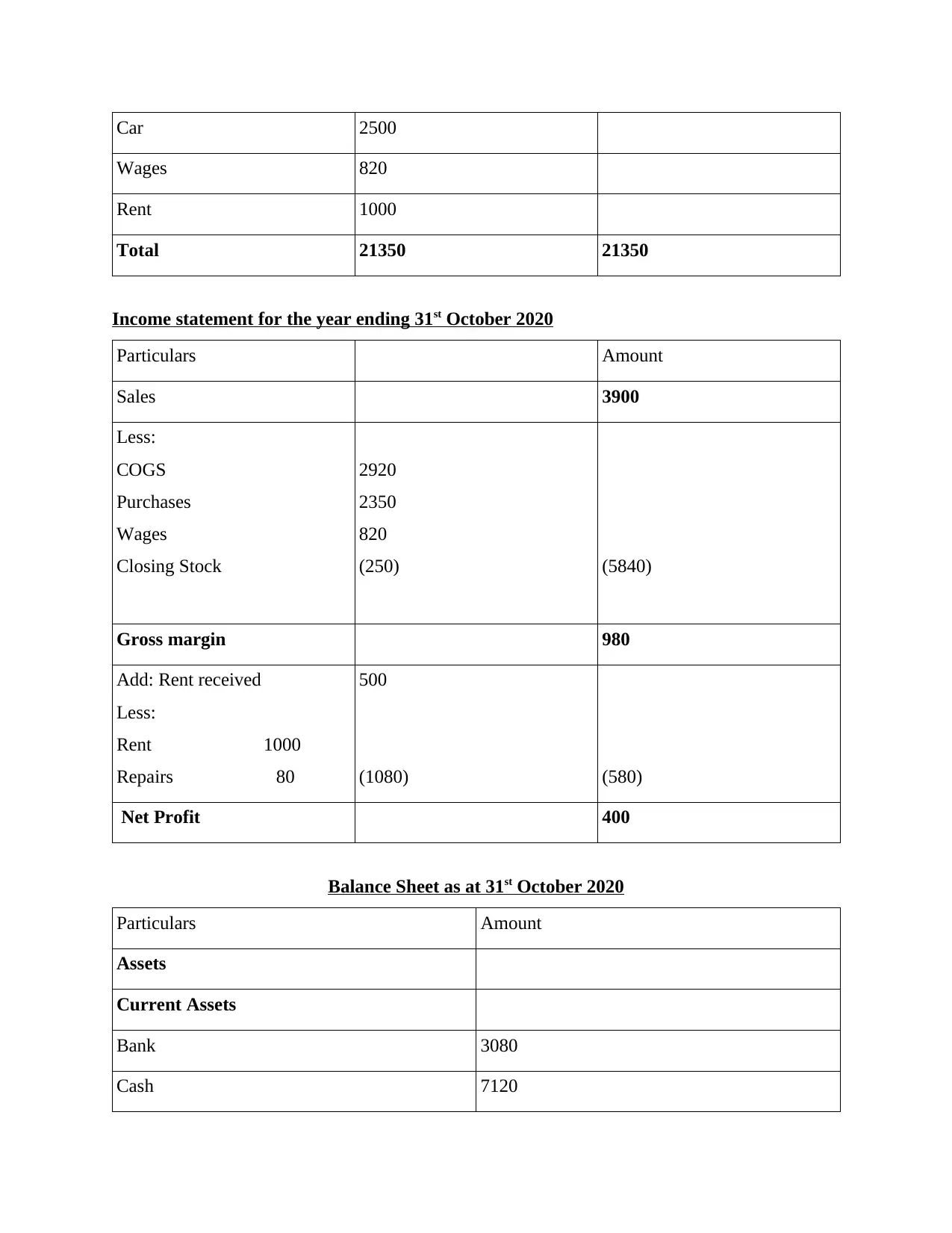

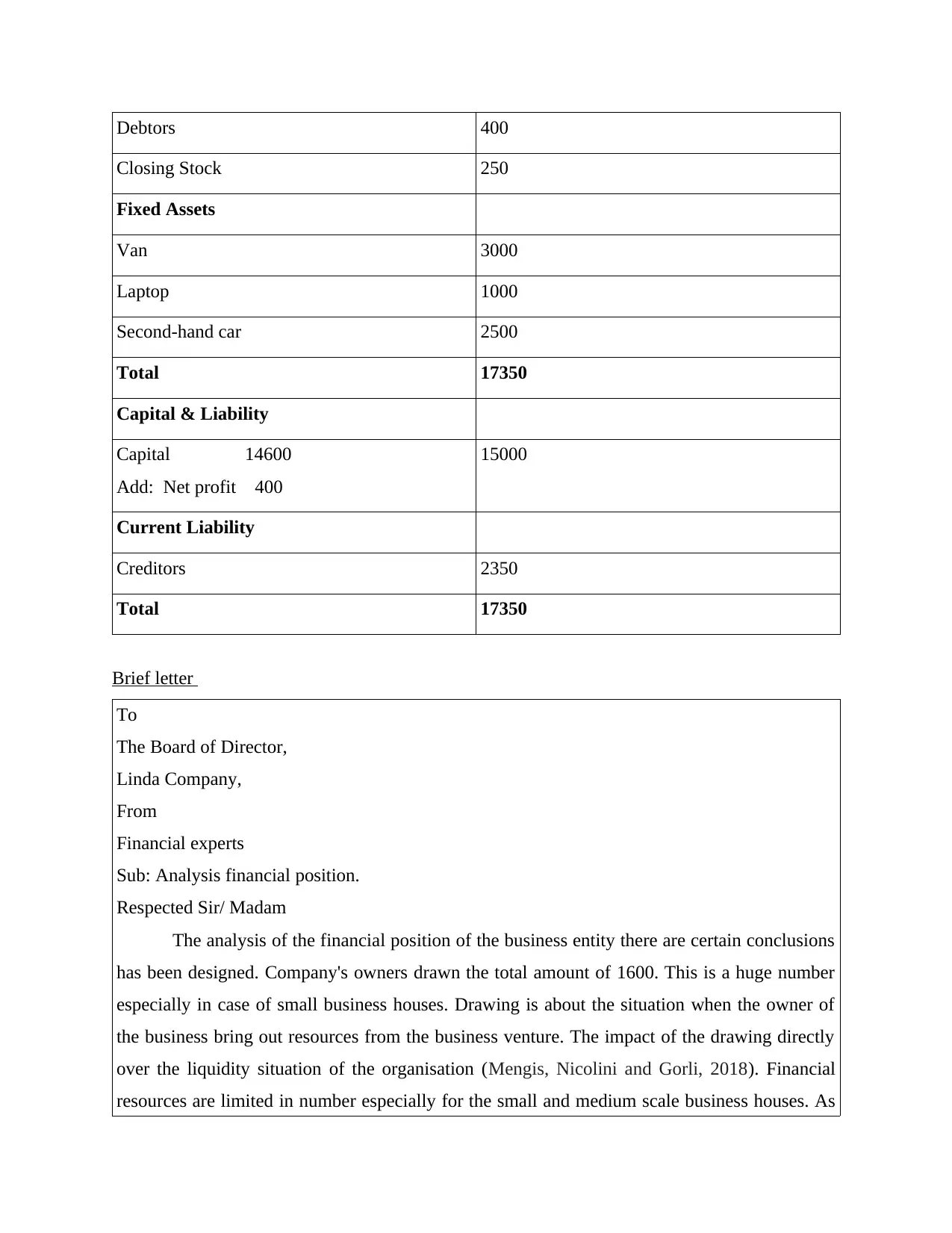

Balance Sheet as at 31st October 2020

Particulars Amount

Assets

Current Assets

Bank 3080

Cash 7120

Debtors 400

Closing Stock 250

Fixed Assets

Van 3000

Laptop 1000

Second-hand car 2500

Total 17350

Capital & Liability

Capital 14600

Add: Net profit 400

15000

Current Liability

Creditors 2350

Total 17350

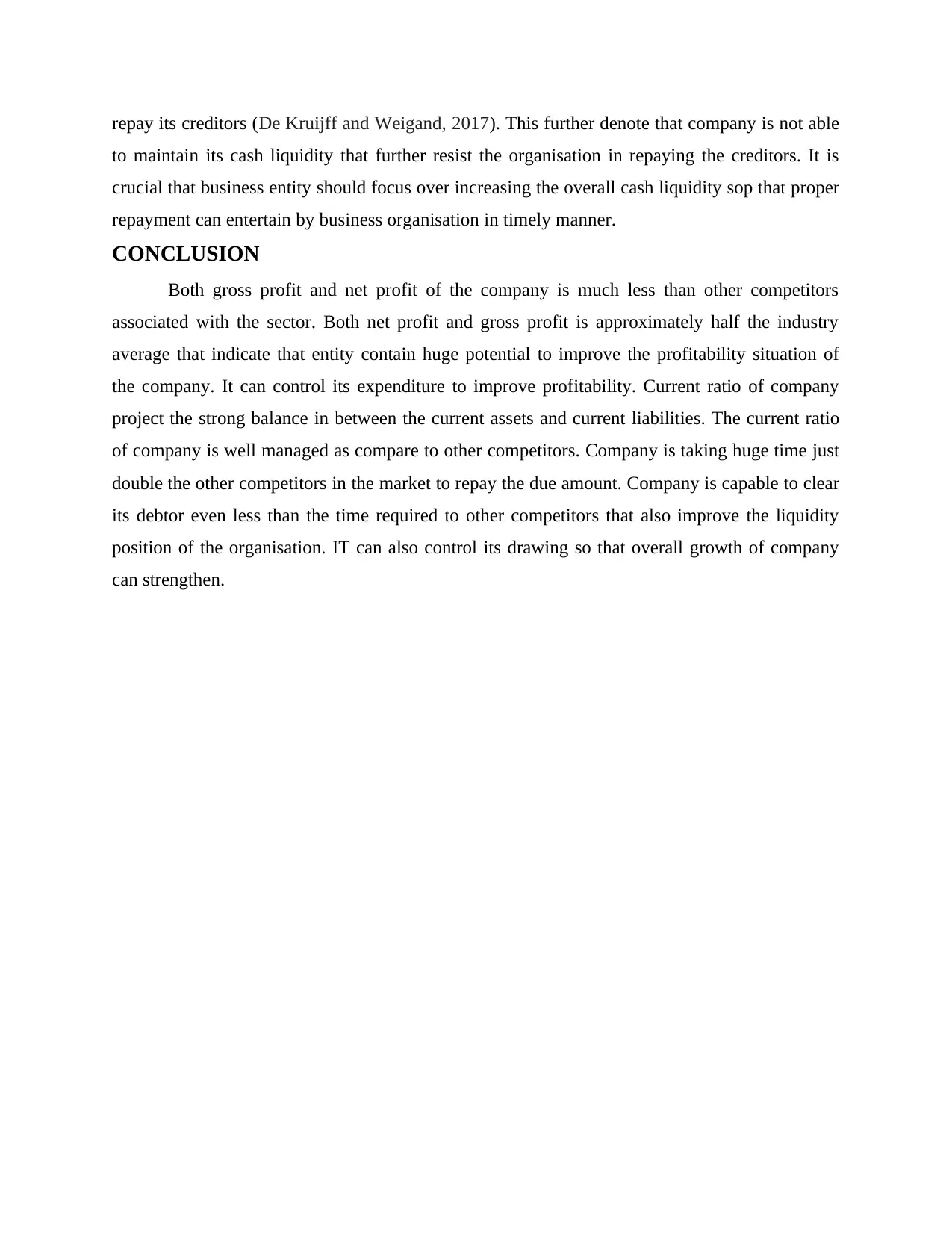

Brief letter

To

The Board of Director,

Linda Company,

From

Financial experts

Sub: Analysis financial position.

Respected Sir/ Madam

The analysis of the financial position of the business entity there are certain conclusions

has been designed. Company's owners drawn the total amount of 1600. This is a huge number

especially in case of small business houses. Drawing is about the situation when the owner of

the business bring out resources from the business venture. The impact of the drawing directly

over the liquidity situation of the organisation (Mengis, Nicolini and Gorli, 2018). Financial

resources are limited in number especially for the small and medium scale business houses. As

Closing Stock 250

Fixed Assets

Van 3000

Laptop 1000

Second-hand car 2500

Total 17350

Capital & Liability

Capital 14600

Add: Net profit 400

15000

Current Liability

Creditors 2350

Total 17350

Brief letter

To

The Board of Director,

Linda Company,

From

Financial experts

Sub: Analysis financial position.

Respected Sir/ Madam

The analysis of the financial position of the business entity there are certain conclusions

has been designed. Company's owners drawn the total amount of 1600. This is a huge number

especially in case of small business houses. Drawing is about the situation when the owner of

the business bring out resources from the business venture. The impact of the drawing directly

over the liquidity situation of the organisation (Mengis, Nicolini and Gorli, 2018). Financial

resources are limited in number especially for the small and medium scale business houses. As

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

the small companies already contain limitation in the financial resources that further drive the

organisation to suffer from its liquidity. Apart from the natural limitation of the overall financial

resources if the management bring out resources in form of drawing this let the organisation

further suffer from the liquidity situation.

The proper strategy bin case of business operations must be that where the company

introduce more resources in the regular business functions. Management should adopt the

strategy where it tend to introduce more number of financial resources in the overall business

activity. The current situation of the company is when it could somehow due to certain situation

bring out the financial resources that could create a certain level of shortage in the bank balance

of company. At any point of time of the businesses follow drawing practice it damage the

overall capabilities and financial stability of such organisations. IN case of small business

houses usually the management are the owners of the company who have invested its capital to

start the business activity (Lemieux, 2017). The board of director in case of small companies

already take salary against the services they deliver to the business houses. Either they charge

some amount of salary or the profit share in against to deliver their services to the business

house. IT is precisely recommended than only if teh owners strictly required the financial

resources, and they are finding themselves unable to meet such need from any other source like

bank, financial institution and any other source they must not approach the bank account to the

company they are involved in as a manager. As the drawing from the business directly demolish

the overall financial capability of the business organisation this is strictly denoted for the

management to billow capital from the organisation.

Whenever the owner seek for any source of finance they must approach the external

sources of finance or the personal resources rather then debiting the bank account of business

organisation. IF they aim to have tge massive success for the business organisation they are

associated with they must focus over improving and enhancing the overall capability and

potential of the business organisation (Limo, 2017). Owner can use other sources like bank

finance, investors and private finances to meet all their funding requirements. Further the

business houses should utilise the personal bank account rather than go towards approaching the

bank account of company as a drawing source to mitigate the financial need they carry.

Company is currently facing the query where it is looking to approach customers and

companies in the South Ealing region. It can approach to other business entity like John

organisation to suffer from its liquidity. Apart from the natural limitation of the overall financial

resources if the management bring out resources in form of drawing this let the organisation

further suffer from the liquidity situation.

The proper strategy bin case of business operations must be that where the company

introduce more resources in the regular business functions. Management should adopt the

strategy where it tend to introduce more number of financial resources in the overall business

activity. The current situation of the company is when it could somehow due to certain situation

bring out the financial resources that could create a certain level of shortage in the bank balance

of company. At any point of time of the businesses follow drawing practice it damage the

overall capabilities and financial stability of such organisations. IN case of small business

houses usually the management are the owners of the company who have invested its capital to

start the business activity (Lemieux, 2017). The board of director in case of small companies

already take salary against the services they deliver to the business houses. Either they charge

some amount of salary or the profit share in against to deliver their services to the business

house. IT is precisely recommended than only if teh owners strictly required the financial

resources, and they are finding themselves unable to meet such need from any other source like

bank, financial institution and any other source they must not approach the bank account to the

company they are involved in as a manager. As the drawing from the business directly demolish

the overall financial capability of the business organisation this is strictly denoted for the

management to billow capital from the organisation.

Whenever the owner seek for any source of finance they must approach the external

sources of finance or the personal resources rather then debiting the bank account of business

organisation. IF they aim to have tge massive success for the business organisation they are

associated with they must focus over improving and enhancing the overall capability and

potential of the business organisation (Limo, 2017). Owner can use other sources like bank

finance, investors and private finances to meet all their funding requirements. Further the

business houses should utilise the personal bank account rather than go towards approaching the

bank account of company as a drawing source to mitigate the financial need they carry.

Company is currently facing the query where it is looking to approach customers and

companies in the South Ealing region. It can approach to other business entity like John

Sanders, St James and such entities. This is also essential for the organisation to approach new

sources that can potentially support the overall growth and development of the business entity.

IN case to achieve the growth and development in business it is essential that the organisation

constantly form strategic alliances with the stakeholders, investors and also it must overlook the

market where it can entertain business houses (Chen and et.al., 2018). Company can further

approach to small business houses associated with the toy industry to expand the reach of its

overall business outcomes. It can further use the holiday packages where it can give extra

discounts to the customers for attracting the new customers over a holiday period. People all

across the globe look for discounts that can suit based on the buying power of such customers.

This will improve the interest of potential customers in the product portfolio of the company.

All the above suggestions has been given based on the knowledge and experience.

Company has the option to also follow other suitable approaches if they find it more fruitful as

per the need and requirement of the business.

Thank You.

Part B

Ratio calculation

Net profit margin

= Net profit / sales * 100

= 400 / 3900 * 100

= 10.26%

Gross Profit Margin

= Gross Profit / Sales * 100

= 980 / 3900 * 100

= 25.12%

Current Ratio

= Current Asset / Current Liability

= 10850 / 2350

sources that can potentially support the overall growth and development of the business entity.

IN case to achieve the growth and development in business it is essential that the organisation

constantly form strategic alliances with the stakeholders, investors and also it must overlook the

market where it can entertain business houses (Chen and et.al., 2018). Company can further

approach to small business houses associated with the toy industry to expand the reach of its

overall business outcomes. It can further use the holiday packages where it can give extra

discounts to the customers for attracting the new customers over a holiday period. People all

across the globe look for discounts that can suit based on the buying power of such customers.

This will improve the interest of potential customers in the product portfolio of the company.

All the above suggestions has been given based on the knowledge and experience.

Company has the option to also follow other suitable approaches if they find it more fruitful as

per the need and requirement of the business.

Thank You.

Part B

Ratio calculation

Net profit margin

= Net profit / sales * 100

= 400 / 3900 * 100

= 10.26%

Gross Profit Margin

= Gross Profit / Sales * 100

= 980 / 3900 * 100

= 25.12%

Current Ratio

= Current Asset / Current Liability

= 10850 / 2350

= 4.62

Acid test ratio

= Current Asset - Inventory / Current Liability

= 10850 - 250 / 2350

= 4.51

Account receivable collection period

= account receivable / Net credit sale * 365

= 400 / 3900 * 365

= 37.43 Days

Average account payable period

= Account payable * 365 / COGS

= 2350 / 5840 * 365

= 146.8 Days

The above mentioned calculations of different ratios indicate that company has generated

the net profit ratio of 10.26%. The other competitors in the industry generated the net profit

margin of 31%. The comparative analysis between the net profitability of business indicate the

huge difference in between the net profit margins of both the organisation. Difference in between

the net profit margin of company and other competitors is so huge. 31% is a huge number in

context to the net profitability percentage of the business entity whereas company is attending

the profitability at the rate of 10.36%. This indicates that sector contains huge potential of

earning net profits whereas the organisation only able to achieve net profit approximately of the

rate of 10.36%. Company should focus over more effective strategic choices that can allow the

business entity to entertain the potential level of profitability out of selling the same products

(Resmi, Pahlevi and Sayekti, 2021). The low net profit margin also indicate that company is

considering more amount of expenditure in order to operate business functions. IF the company

control its expenses than it can boost up the overall profitability margin against the business

operations entertained by the organisation.

Acid test ratio

= Current Asset - Inventory / Current Liability

= 10850 - 250 / 2350

= 4.51

Account receivable collection period

= account receivable / Net credit sale * 365

= 400 / 3900 * 365

= 37.43 Days

Average account payable period

= Account payable * 365 / COGS

= 2350 / 5840 * 365

= 146.8 Days

The above mentioned calculations of different ratios indicate that company has generated

the net profit ratio of 10.26%. The other competitors in the industry generated the net profit

margin of 31%. The comparative analysis between the net profitability of business indicate the

huge difference in between the net profit margins of both the organisation. Difference in between

the net profit margin of company and other competitors is so huge. 31% is a huge number in

context to the net profitability percentage of the business entity whereas company is attending

the profitability at the rate of 10.36%. This indicates that sector contains huge potential of

earning net profits whereas the organisation only able to achieve net profit approximately of the

rate of 10.36%. Company should focus over more effective strategic choices that can allow the

business entity to entertain the potential level of profitability out of selling the same products

(Resmi, Pahlevi and Sayekti, 2021). The low net profit margin also indicate that company is

considering more amount of expenditure in order to operate business functions. IF the company

control its expenses than it can boost up the overall profitability margin against the business

operations entertained by the organisation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Gross profit margin consider by the company is identified as 25.12%. IN the industry

other competitors are attending teh gross profitability at the rate of 54%. The difference between

company and other key competitors is so huge as the 25% and 54% contain a huge difference.

The critical evaluation and analysis between the gross profit margin denote that other

competitors of the company against the trading activities deliver double the gross profitability

whereas it only able to achieve the profit at the rate of 25%. 54% is a huge number that indicate

that company carry the huge opportunity to boost up the overall profitability against the trading

operations entertained by the business entity (Beck and et.al., 2017). The difference between the

average profitability of other competitors and the gross level profits company has entertained is

major. If the entity control over its direct expenditure it will get to boost up the overall gross

level profitability of business entity.

Current ratio calculated of the entity is 4.62. The calculation of current ratio denote that it

has contained a strong balance in between the current assets and current liability of the

organisation. This ratio project that current assets of company keep the current ratio of 4.62 as

compare to the current liability managed by the business entity. This ratio is much stronger even

as compare to the current ratio maintained by other competitors in market. The current ratio

maintained by other competitors is 2.87 whereas company has maintained its current ratio as

4.62. This further denote about the strong liquidity position of the business entity. Liquidity

situation is always a key requirement that business organisation required to sustain in against to

deliver the business activity (Fischer-Pauzenberger and Schwaiger, 2017). IN order to sustain the

effectiveness of the regular business operation organisation needed to manage the strong

liquidity position. AS the organisation has managed the strong management in its current nature

assets as compare to the current liability that is further strengthen the overall liquidity position of

the business entity.

Acid test ratio is identified as 4.51 whereas the industry average is 1.35. This further

denote that company has sustained a strong condition in between the actual figure and the

average of the industry. Account receivable collection period of the entity is 37.43 days whereas

other competitors of the company is sustaining its collection period as 50 days. The ratio indicate

that company is maintaining the strong balance between its collection period. IT is requiring less

number of days to collect amount from the debtors of the organisation. Payment period is 146.8

days whereas other competitors is maintaining 72 days. Company is taking double the days to

other competitors are attending teh gross profitability at the rate of 54%. The difference between

company and other key competitors is so huge as the 25% and 54% contain a huge difference.

The critical evaluation and analysis between the gross profit margin denote that other

competitors of the company against the trading activities deliver double the gross profitability

whereas it only able to achieve the profit at the rate of 25%. 54% is a huge number that indicate

that company carry the huge opportunity to boost up the overall profitability against the trading

operations entertained by the business entity (Beck and et.al., 2017). The difference between the

average profitability of other competitors and the gross level profits company has entertained is

major. If the entity control over its direct expenditure it will get to boost up the overall gross

level profitability of business entity.

Current ratio calculated of the entity is 4.62. The calculation of current ratio denote that it

has contained a strong balance in between the current assets and current liability of the

organisation. This ratio project that current assets of company keep the current ratio of 4.62 as

compare to the current liability managed by the business entity. This ratio is much stronger even

as compare to the current ratio maintained by other competitors in market. The current ratio

maintained by other competitors is 2.87 whereas company has maintained its current ratio as

4.62. This further denote about the strong liquidity position of the business entity. Liquidity

situation is always a key requirement that business organisation required to sustain in against to

deliver the business activity (Fischer-Pauzenberger and Schwaiger, 2017). IN order to sustain the

effectiveness of the regular business operation organisation needed to manage the strong

liquidity position. AS the organisation has managed the strong management in its current nature

assets as compare to the current liability that is further strengthen the overall liquidity position of

the business entity.

Acid test ratio is identified as 4.51 whereas the industry average is 1.35. This further

denote that company has sustained a strong condition in between the actual figure and the

average of the industry. Account receivable collection period of the entity is 37.43 days whereas

other competitors of the company is sustaining its collection period as 50 days. The ratio indicate

that company is maintaining the strong balance between its collection period. IT is requiring less

number of days to collect amount from the debtors of the organisation. Payment period is 146.8

days whereas other competitors is maintaining 72 days. Company is taking double the days to

repay its creditors (De Kruijff and Weigand, 2017). This further denote that company is not able

to maintain its cash liquidity that further resist the organisation in repaying the creditors. It is

crucial that business entity should focus over increasing the overall cash liquidity sop that proper

repayment can entertain by business organisation in timely manner.

CONCLUSION

Both gross profit and net profit of the company is much less than other competitors

associated with the sector. Both net profit and gross profit is approximately half the industry

average that indicate that entity contain huge potential to improve the profitability situation of

the company. It can control its expenditure to improve profitability. Current ratio of company

project the strong balance in between the current assets and current liabilities. The current ratio

of company is well managed as compare to other competitors. Company is taking huge time just

double the other competitors in the market to repay the due amount. Company is capable to clear

its debtor even less than the time required to other competitors that also improve the liquidity

position of the organisation. IT can also control its drawing so that overall growth of company

can strengthen.

to maintain its cash liquidity that further resist the organisation in repaying the creditors. It is

crucial that business entity should focus over increasing the overall cash liquidity sop that proper

repayment can entertain by business organisation in timely manner.

CONCLUSION

Both gross profit and net profit of the company is much less than other competitors

associated with the sector. Both net profit and gross profit is approximately half the industry

average that indicate that entity contain huge potential to improve the profitability situation of

the company. It can control its expenditure to improve profitability. Current ratio of company

project the strong balance in between the current assets and current liabilities. The current ratio

of company is well managed as compare to other competitors. Company is taking huge time just

double the other competitors in the market to repay the due amount. Company is capable to clear

its debtor even less than the time required to other competitors that also improve the liquidity

position of the organisation. IT can also control its drawing so that overall growth of company

can strengthen.

REFERENCES

Books and JOurnals

Beck, R. and et.al., 2017. Blockchain technology in business and information systems research.

Chen, S. and et.al., 2018, July. A comparative testing on performance of blockchain and

relational database: Foundation for applying smart technology into current business

systems. In International Conference on Distributed, Ambient, and Pervasive

Interactions (pp. 21-34). Springer, Cham.

De Kruijff, J. and Weigand, H., 2017, June. Understanding the blockchain using enterprise

ontology. In International Conference on Advanced Information Systems

Engineering(pp. 29-43). Springer, Cham.

Fischer-Pauzenberger, C. and Schwaiger, W. S., 2017. The OntoREA Accounting Model:

Ontology-based Modeling of the Accounting Domain. CSIMQ. 11. pp.20-37.

Lemieux, V. L., 2017, December. A typology of blockchain recordkeeping solutions and some

reflections on their implications for the future of archival preservation. In 2017 IEEE

International Conference on Big Data (Big Data) (pp. 2271-2278). IEEE..

Limo, R. K., 2017. M-Agriculture recording system for milk producers in Kenya: a case of

Uasin Gishu County (Doctoral dissertation, Strathmore University).

Mengis, J., Nicolini, D. and Gorli, M., 2018. The video production of space: How different

recording practices matter. Organizational research methods. 21(2). pp.288-315.

Resmi, S., Pahlevi, R. W. and Sayekti, F., 2021. Implementation of financial report and taxation

training: performance of MSMEs in Special Regions Yogyakarta. Jurnal Siasat Bisnis.

25(1).

Books and JOurnals

Beck, R. and et.al., 2017. Blockchain technology in business and information systems research.

Chen, S. and et.al., 2018, July. A comparative testing on performance of blockchain and

relational database: Foundation for applying smart technology into current business

systems. In International Conference on Distributed, Ambient, and Pervasive

Interactions (pp. 21-34). Springer, Cham.

De Kruijff, J. and Weigand, H., 2017, June. Understanding the blockchain using enterprise

ontology. In International Conference on Advanced Information Systems

Engineering(pp. 29-43). Springer, Cham.

Fischer-Pauzenberger, C. and Schwaiger, W. S., 2017. The OntoREA Accounting Model:

Ontology-based Modeling of the Accounting Domain. CSIMQ. 11. pp.20-37.

Lemieux, V. L., 2017, December. A typology of blockchain recordkeeping solutions and some

reflections on their implications for the future of archival preservation. In 2017 IEEE

International Conference on Big Data (Big Data) (pp. 2271-2278). IEEE..

Limo, R. K., 2017. M-Agriculture recording system for milk producers in Kenya: a case of

Uasin Gishu County (Doctoral dissertation, Strathmore University).

Mengis, J., Nicolini, D. and Gorli, M., 2018. The video production of space: How different

recording practices matter. Organizational research methods. 21(2). pp.288-315.

Resmi, S., Pahlevi, R. W. and Sayekti, F., 2021. Implementation of financial report and taxation

training: performance of MSMEs in Special Regions Yogyakarta. Jurnal Siasat Bisnis.

25(1).

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.