Financial Accounting: Recording Business Transactions Analysis

VerifiedAdded on 2023/01/17

|12

|1006

|66

Homework Assignment

AI Summary

This assignment solution presents a comprehensive analysis of recording and interpreting business transactions. Part A meticulously details the double-entry bookkeeping process, showcasing the recording of transactions in T-accounts, balancing accounts, and creating a trial balance. It then proceeds to construct an income statement and a statement of financial position, providing a complete overview of the company's financial performance and position as of September 30, 2019. Part B focuses on ratio analysis, comparing James plc's financial ratios to industry competitors. The analysis includes calculating and interpreting key ratios such as net profit margin, gross profit margin, current ratio, acid test ratio, and accounts receivable and payable periods. The solution identifies significant performance variations and provides insights into areas where James plc could improve its financial management. Appendices provide supporting documentation, including detailed T-accounts, account balances, the trial balance, the income statement, and the statement of financial position.

RECORDING BUSINESS

TRANSACTION

TRANSACTION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

PART A...........................................................................................................................................1

a) Double entry recorded in T accounts (Appendix 1)...........................................................1

b) Balance the accounts and bring down on opening balance (Appendix 2).........................1

c) Trial balance as at 30th September 2019 (Appendix 3)......................................................1

d) Prepare an income statement for the period ended 30th September (Appendix 4).............1

e) Statement of financial position as at 30th September 2019 (Appendix 5)..........................1

PART B............................................................................................................................................1

i) Ratios for James..................................................................................................................1

ii) Analysis of performance....................................................................................................1

APPENDIX......................................................................................................................................3

Appendix 1.............................................................................................................................3

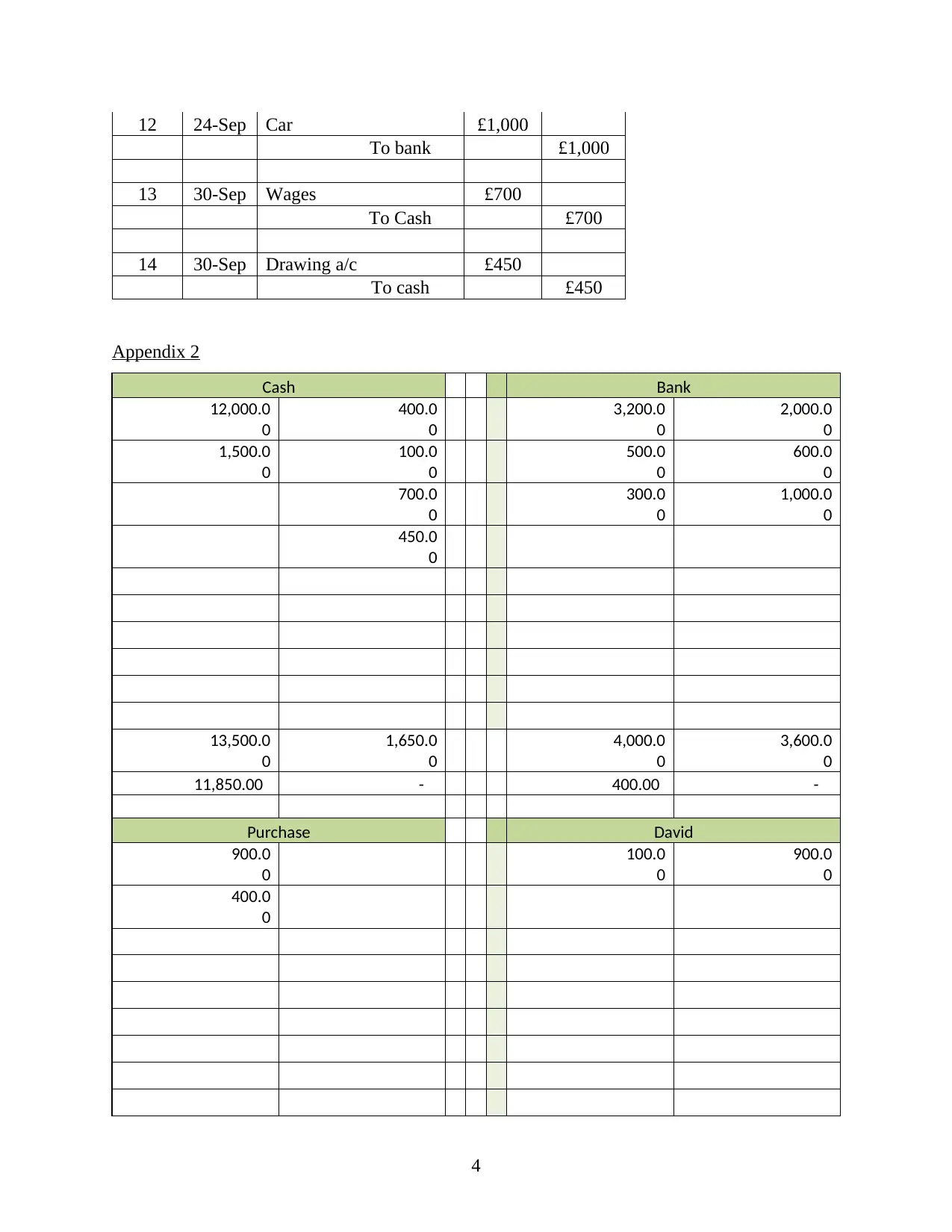

Appendix 2.............................................................................................................................4

Appendix 3.............................................................................................................................8

Appendix 4.............................................................................................................................9

Appendix 5.............................................................................................................................9

PART A...........................................................................................................................................1

a) Double entry recorded in T accounts (Appendix 1)...........................................................1

b) Balance the accounts and bring down on opening balance (Appendix 2).........................1

c) Trial balance as at 30th September 2019 (Appendix 3)......................................................1

d) Prepare an income statement for the period ended 30th September (Appendix 4).............1

e) Statement of financial position as at 30th September 2019 (Appendix 5)..........................1

PART B............................................................................................................................................1

i) Ratios for James..................................................................................................................1

ii) Analysis of performance....................................................................................................1

APPENDIX......................................................................................................................................3

Appendix 1.............................................................................................................................3

Appendix 2.............................................................................................................................4

Appendix 3.............................................................................................................................8

Appendix 4.............................................................................................................................9

Appendix 5.............................................................................................................................9

PART A

a) Double entry recorded in T accounts (Appendix 1)

b) Balance the accounts and bring down on opening balance (Appendix 2)

c) Trial balance as at 30th September 2019 (Appendix 3)

d) Prepare an income statement for the period ended 30th September (Appendix 4)

e) Statement of financial position as at 30th September 2019 (Appendix 5)

PART B

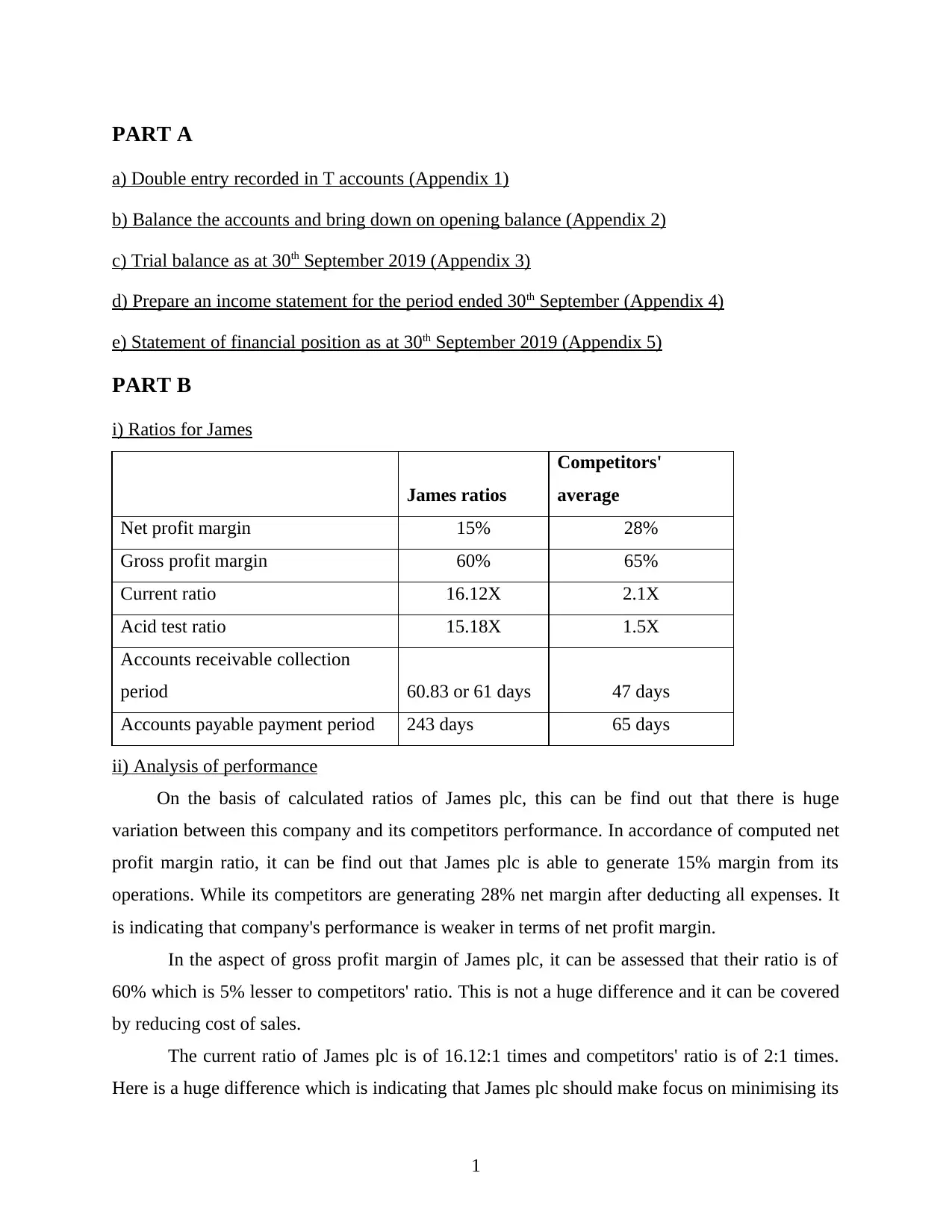

i) Ratios for James

James ratios

Competitors'

average

Net profit margin 15% 28%

Gross profit margin 60% 65%

Current ratio 16.12X 2.1X

Acid test ratio 15.18X 1.5X

Accounts receivable collection

period 60.83 or 61 days 47 days

Accounts payable payment period 243 days 65 days

ii) Analysis of performance

On the basis of calculated ratios of James plc, this can be find out that there is huge

variation between this company and its competitors performance. In accordance of computed net

profit margin ratio, it can be find out that James plc is able to generate 15% margin from its

operations. While its competitors are generating 28% net margin after deducting all expenses. It

is indicating that company's performance is weaker in terms of net profit margin.

In the aspect of gross profit margin of James plc, it can be assessed that their ratio is of

60% which is 5% lesser to competitors' ratio. This is not a huge difference and it can be covered

by reducing cost of sales.

The current ratio of James plc is of 16.12:1 times and competitors' ratio is of 2:1 times.

Here is a huge difference which is indicating that James plc should make focus on minimising its

1

a) Double entry recorded in T accounts (Appendix 1)

b) Balance the accounts and bring down on opening balance (Appendix 2)

c) Trial balance as at 30th September 2019 (Appendix 3)

d) Prepare an income statement for the period ended 30th September (Appendix 4)

e) Statement of financial position as at 30th September 2019 (Appendix 5)

PART B

i) Ratios for James

James ratios

Competitors'

average

Net profit margin 15% 28%

Gross profit margin 60% 65%

Current ratio 16.12X 2.1X

Acid test ratio 15.18X 1.5X

Accounts receivable collection

period 60.83 or 61 days 47 days

Accounts payable payment period 243 days 65 days

ii) Analysis of performance

On the basis of calculated ratios of James plc, this can be find out that there is huge

variation between this company and its competitors performance. In accordance of computed net

profit margin ratio, it can be find out that James plc is able to generate 15% margin from its

operations. While its competitors are generating 28% net margin after deducting all expenses. It

is indicating that company's performance is weaker in terms of net profit margin.

In the aspect of gross profit margin of James plc, it can be assessed that their ratio is of

60% which is 5% lesser to competitors' ratio. This is not a huge difference and it can be covered

by reducing cost of sales.

The current ratio of James plc is of 16.12:1 times and competitors' ratio is of 2:1 times.

Here is a huge difference which is indicating that James plc should make focus on minimising its

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

current liabilities so that their current ratio may reach its ideal form which is of 2:1. The

company is needed to reduce their ratio by 14.02 times so that their liquidity position may

increase.

In accordance of acid test ratio of James plc, it can be find out that it is of 15.18 times and

competitors' ratio is of 1.5:1. Similar as the above current ratio, this ratio is too higher in

compare to competitor. The receivable period is higher of James as 61 days and payable days is

counted as 243 days that states that comparative to competitors it gets payment form debtors

within 61 days and pay its creditors in 243 days.

2

company is needed to reduce their ratio by 14.02 times so that their liquidity position may

increase.

In accordance of acid test ratio of James plc, it can be find out that it is of 15.18 times and

competitors' ratio is of 1.5:1. Similar as the above current ratio, this ratio is too higher in

compare to competitor. The receivable period is higher of James as 61 days and payable days is

counted as 243 days that states that comparative to competitors it gets payment form debtors

within 61 days and pay its creditors in 243 days.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDIX

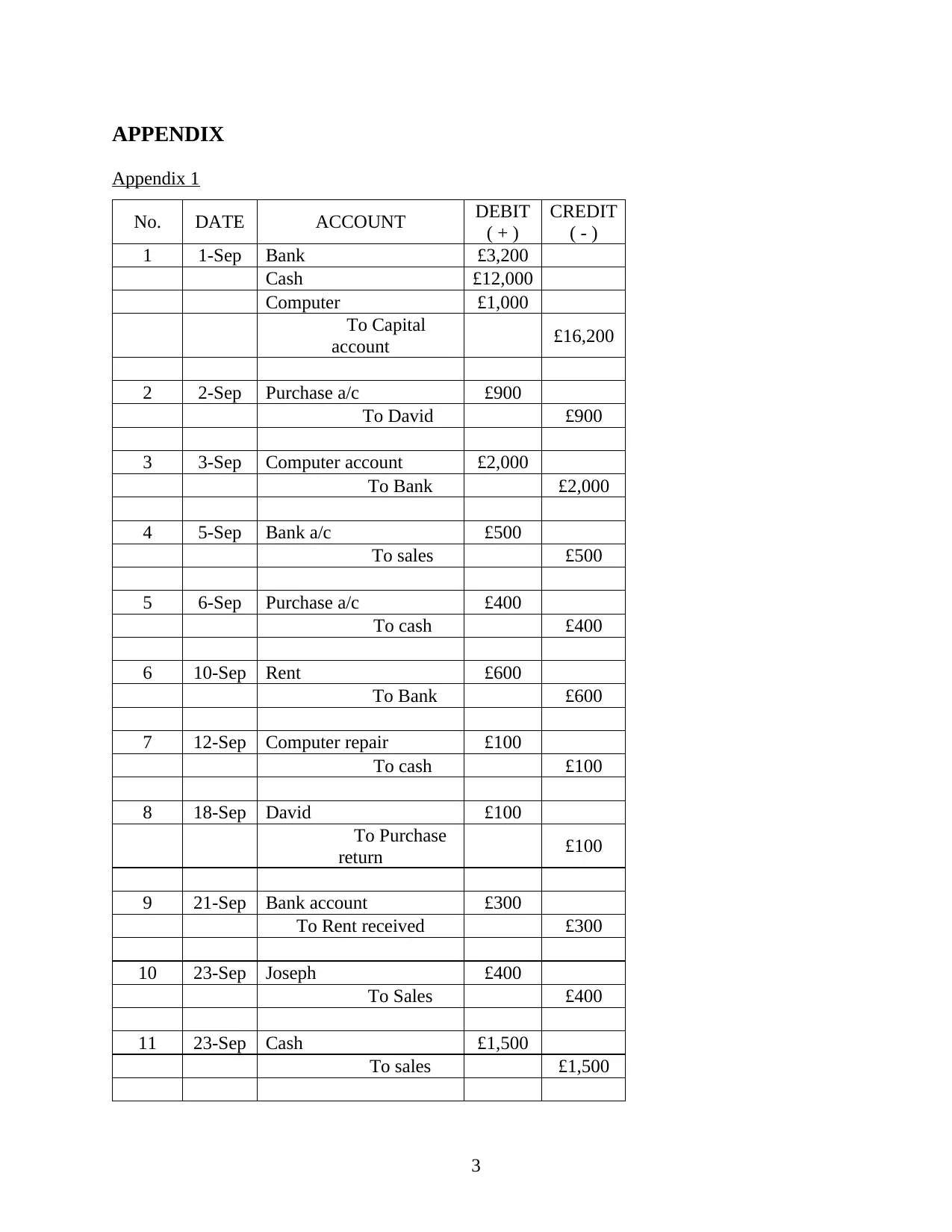

Appendix 1

No. DATE ACCOUNT DEBIT

( + )

CREDIT

( - )

1 1-Sep Bank £3,200

Cash £12,000

Computer £1,000

To Capital

account £16,200

2 2-Sep Purchase a/c £900

To David £900

3 3-Sep Computer account £2,000

To Bank £2,000

4 5-Sep Bank a/c £500

To sales £500

5 6-Sep Purchase a/c £400

To cash £400

6 10-Sep Rent £600

To Bank £600

7 12-Sep Computer repair £100

To cash £100

8 18-Sep David £100

To Purchase

return £100

9 21-Sep Bank account £300

To Rent received £300

10 23-Sep Joseph £400

To Sales £400

11 23-Sep Cash £1,500

To sales £1,500

3

Appendix 1

No. DATE ACCOUNT DEBIT

( + )

CREDIT

( - )

1 1-Sep Bank £3,200

Cash £12,000

Computer £1,000

To Capital

account £16,200

2 2-Sep Purchase a/c £900

To David £900

3 3-Sep Computer account £2,000

To Bank £2,000

4 5-Sep Bank a/c £500

To sales £500

5 6-Sep Purchase a/c £400

To cash £400

6 10-Sep Rent £600

To Bank £600

7 12-Sep Computer repair £100

To cash £100

8 18-Sep David £100

To Purchase

return £100

9 21-Sep Bank account £300

To Rent received £300

10 23-Sep Joseph £400

To Sales £400

11 23-Sep Cash £1,500

To sales £1,500

3

12 24-Sep Car £1,000

To bank £1,000

13 30-Sep Wages £700

To Cash £700

14 30-Sep Drawing a/c £450

To cash £450

Appendix 2

Cash Bank

12,000.0

0

400.0

0

3,200.0

0

2,000.0

0

1,500.0

0

100.0

0

500.0

0

600.0

0

700.0

0

300.0

0

1,000.0

0

450.0

0

13,500.0

0

1,650.0

0

4,000.0

0

3,600.0

0

11,850.00 - 400.00 -

Purchase David

900.0

0

100.0

0

900.0

0

400.0

0

4

To bank £1,000

13 30-Sep Wages £700

To Cash £700

14 30-Sep Drawing a/c £450

To cash £450

Appendix 2

Cash Bank

12,000.0

0

400.0

0

3,200.0

0

2,000.0

0

1,500.0

0

100.0

0

500.0

0

600.0

0

700.0

0

300.0

0

1,000.0

0

450.0

0

13,500.0

0

1,650.0

0

4,000.0

0

3,600.0

0

11,850.00 - 400.00 -

Purchase David

900.0

0

100.0

0

900.0

0

400.0

0

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

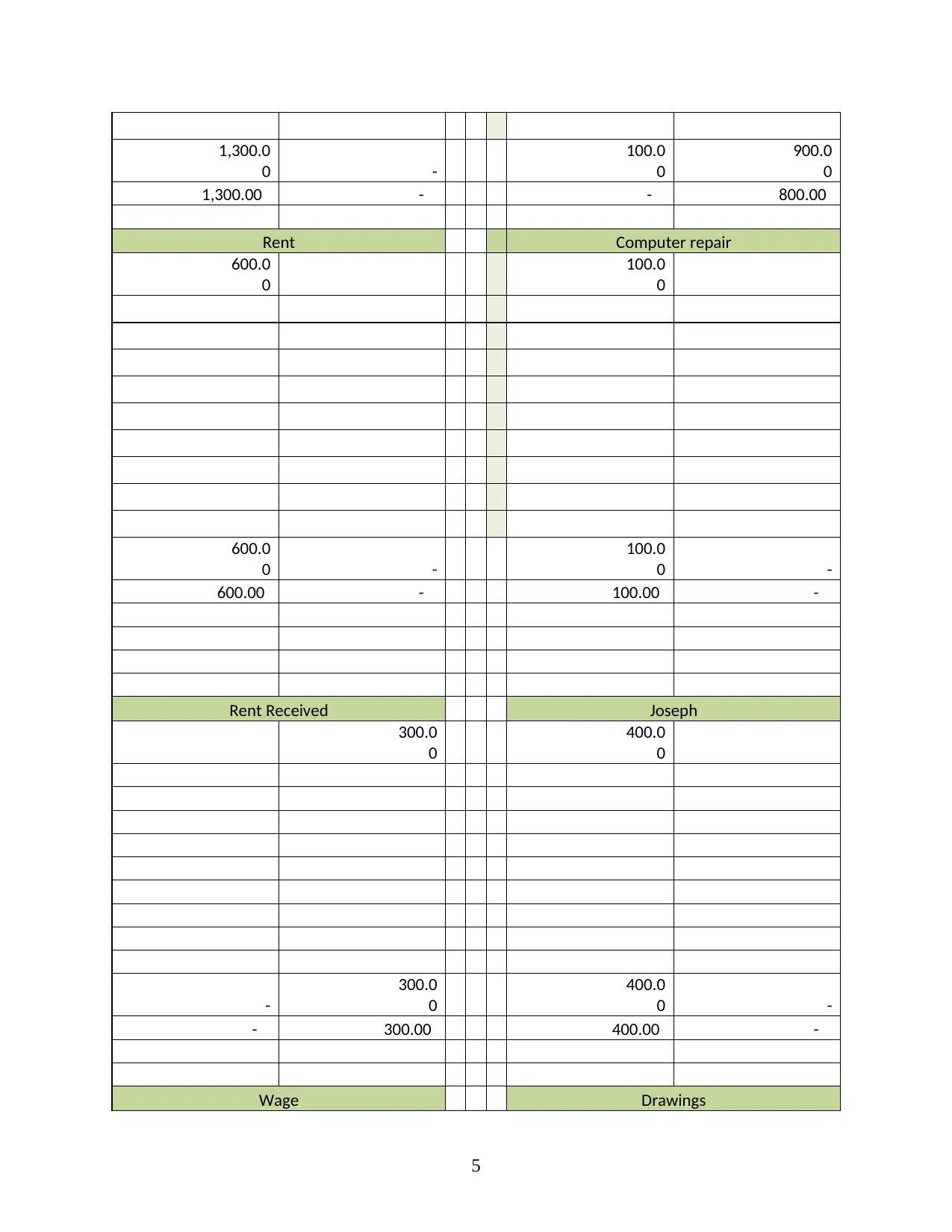

1,300.0

0 -

100.0

0

900.0

0

1,300.00 - - 800.00

Rent Computer repair

600.0

0

100.0

0

600.0

0 -

100.0

0 -

600.00 - 100.00 -

Rent Received Joseph

300.0

0

400.0

0

-

300.0

0

400.0

0 -

- 300.00 400.00 -

Wage Drawings

5

0 -

100.0

0

900.0

0

1,300.00 - - 800.00

Rent Computer repair

600.0

0

100.0

0

600.0

0 -

100.0

0 -

600.00 - 100.00 -

Rent Received Joseph

300.0

0

400.0

0

-

300.0

0

400.0

0 -

- 300.00 400.00 -

Wage Drawings

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

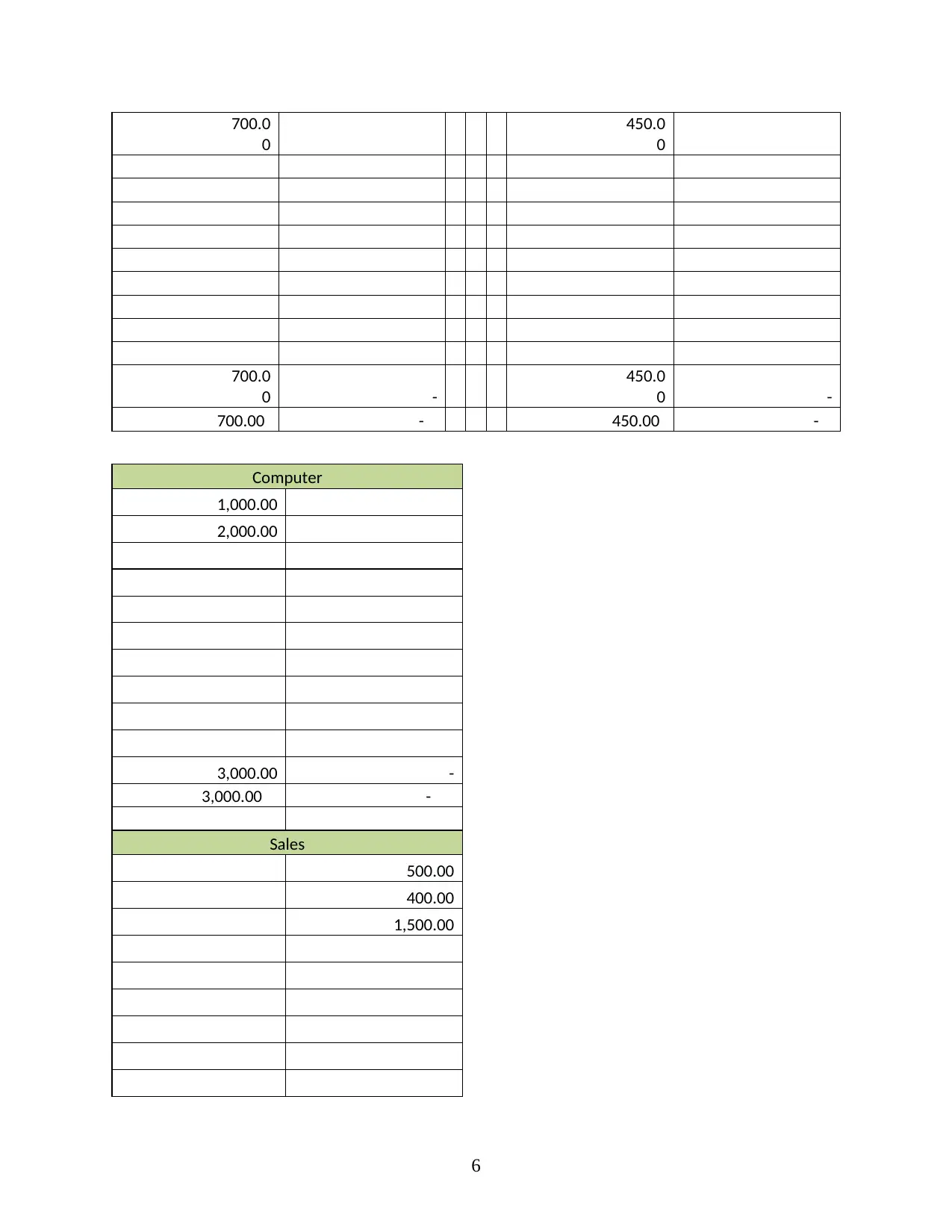

700.0

0

450.0

0

700.0

0 -

450.0

0 -

700.00 - 450.00 -

Computer

1,000.00

2,000.00

3,000.00 -

3,000.00 -

Sales

500.00

400.00

1,500.00

6

0

450.0

0

700.0

0 -

450.0

0 -

700.00 - 450.00 -

Computer

1,000.00

2,000.00

3,000.00 -

3,000.00 -

Sales

500.00

400.00

1,500.00

6

- 2,400.00

- 2,400.00

Capital

16,200.00

- 16,200.00

- 16,200.00

Car

1,000.00

1,000.00 -

1,000.00 -

Purchase return

100.00

7

- 2,400.00

Capital

16,200.00

- 16,200.00

- 16,200.00

Car

1,000.00

1,000.00 -

1,000.00 -

Purchase return

100.00

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

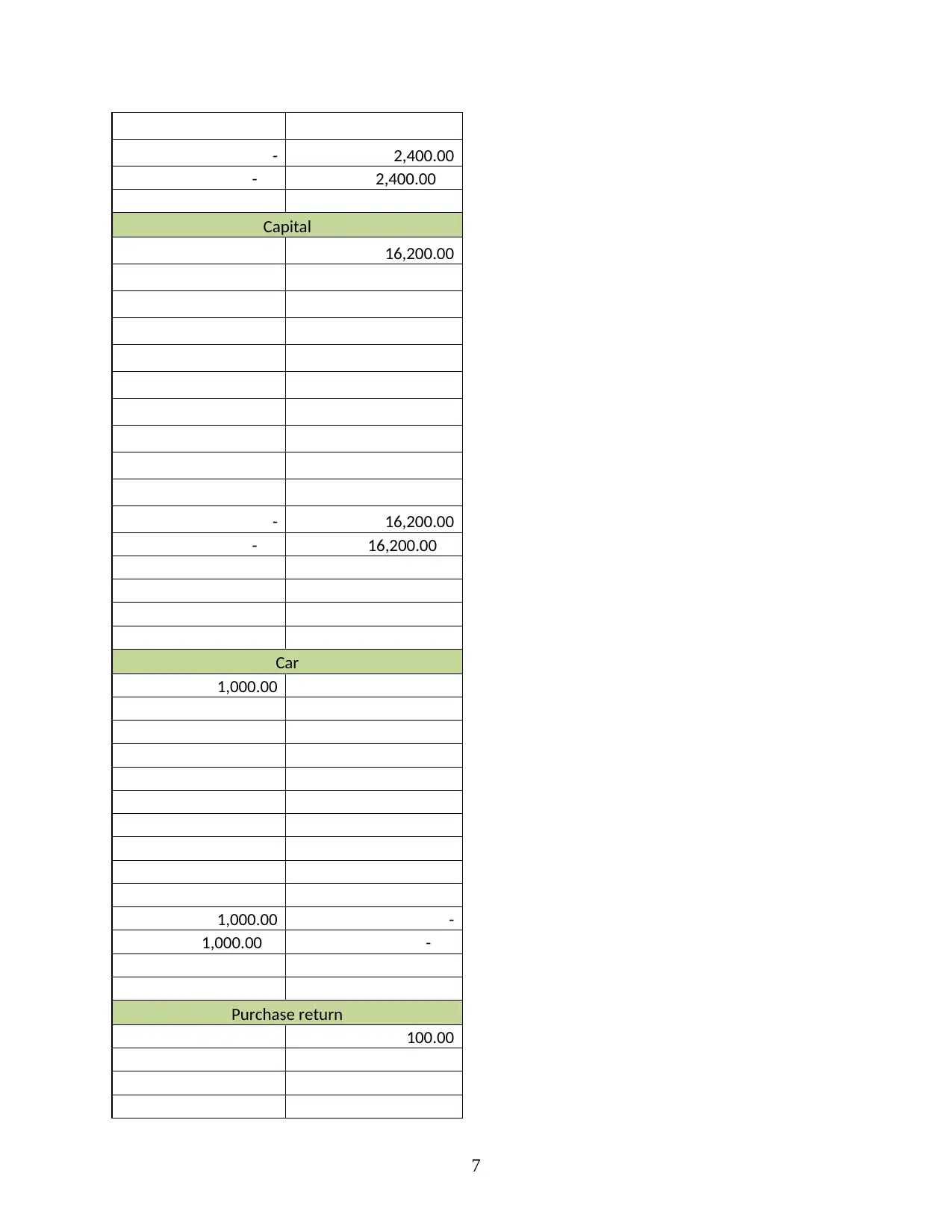

- 100.00

- 100.00

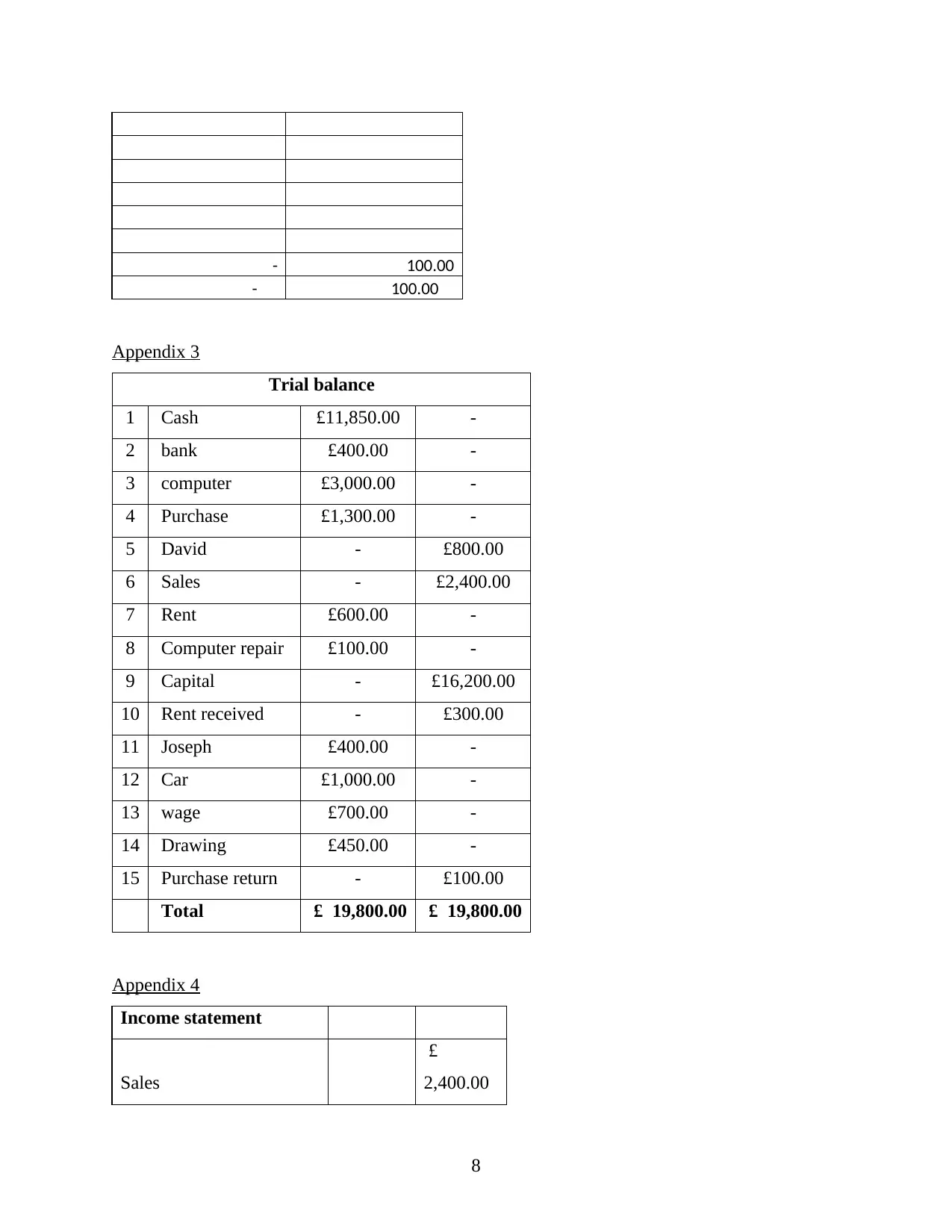

Appendix 3

Trial balance

1 Cash £11,850.00 -

2 bank £400.00 -

3 computer £3,000.00 -

4 Purchase £1,300.00 -

5 David - £800.00

6 Sales - £2,400.00

7 Rent £600.00 -

8 Computer repair £100.00 -

9 Capital - £16,200.00

10 Rent received - £300.00

11 Joseph £400.00 -

12 Car £1,000.00 -

13 wage £700.00 -

14 Drawing £450.00 -

15 Purchase return - £100.00

Total £ 19,800.00 £ 19,800.00

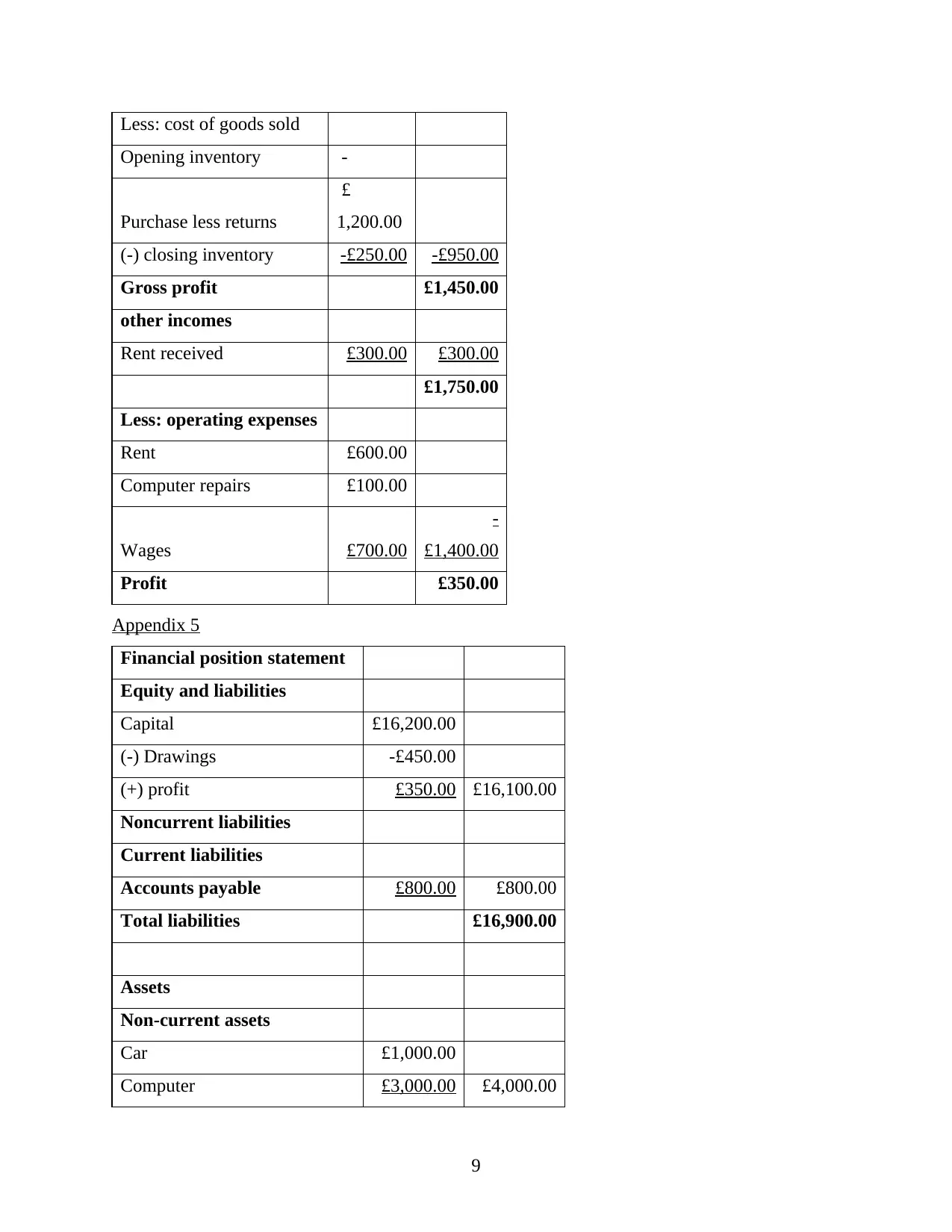

Appendix 4

Income statement

Sales

£

2,400.00

8

- 100.00

Appendix 3

Trial balance

1 Cash £11,850.00 -

2 bank £400.00 -

3 computer £3,000.00 -

4 Purchase £1,300.00 -

5 David - £800.00

6 Sales - £2,400.00

7 Rent £600.00 -

8 Computer repair £100.00 -

9 Capital - £16,200.00

10 Rent received - £300.00

11 Joseph £400.00 -

12 Car £1,000.00 -

13 wage £700.00 -

14 Drawing £450.00 -

15 Purchase return - £100.00

Total £ 19,800.00 £ 19,800.00

Appendix 4

Income statement

Sales

£

2,400.00

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: cost of goods sold

Opening inventory -

Purchase less returns

£

1,200.00

(-) closing inventory -£250.00 -£950.00

Gross profit £1,450.00

other incomes

Rent received £300.00 £300.00

£1,750.00

Less: operating expenses

Rent £600.00

Computer repairs £100.00

Wages £700.00

-

£1,400.00

Profit £350.00

Appendix 5

Financial position statement

Equity and liabilities

Capital £16,200.00

(-) Drawings -£450.00

(+) profit £350.00 £16,100.00

Noncurrent liabilities

Current liabilities

Accounts payable £800.00 £800.00

Total liabilities £16,900.00

Assets

Non-current assets

Car £1,000.00

Computer £3,000.00 £4,000.00

9

Opening inventory -

Purchase less returns

£

1,200.00

(-) closing inventory -£250.00 -£950.00

Gross profit £1,450.00

other incomes

Rent received £300.00 £300.00

£1,750.00

Less: operating expenses

Rent £600.00

Computer repairs £100.00

Wages £700.00

-

£1,400.00

Profit £350.00

Appendix 5

Financial position statement

Equity and liabilities

Capital £16,200.00

(-) Drawings -£450.00

(+) profit £350.00 £16,100.00

Noncurrent liabilities

Current liabilities

Accounts payable £800.00 £800.00

Total liabilities £16,900.00

Assets

Non-current assets

Car £1,000.00

Computer £3,000.00 £4,000.00

9

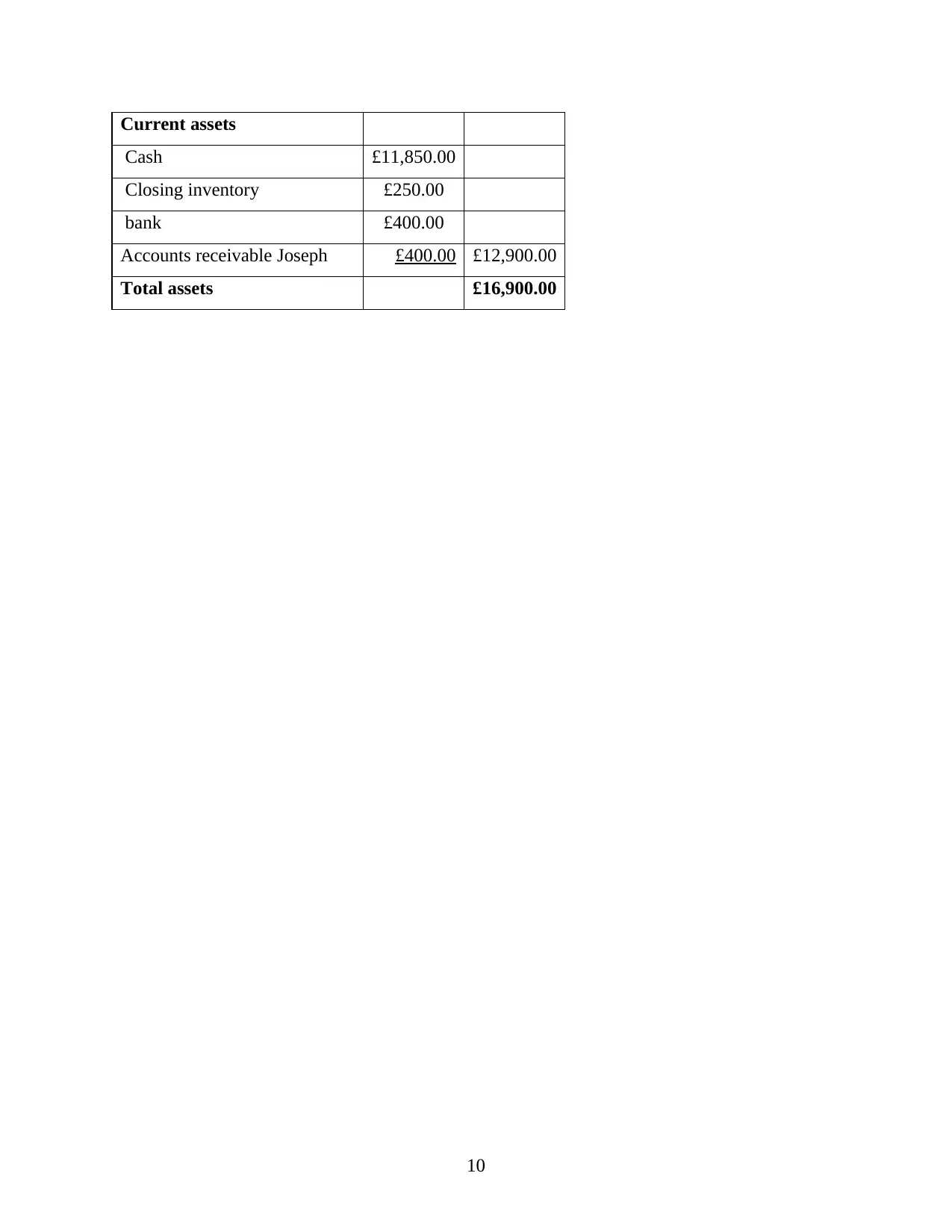

Current assets

Cash £11,850.00

Closing inventory £250.00

bank £400.00

Accounts receivable Joseph £400.00 £12,900.00

Total assets £16,900.00

10

Cash £11,850.00

Closing inventory £250.00

bank £400.00

Accounts receivable Joseph £400.00 £12,900.00

Total assets £16,900.00

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.