Recording Business Transactions Assignment - University of West London

VerifiedAdded on 2022/12/28

|15

|2751

|34

Homework Assignment

AI Summary

This assignment solution focuses on the practical application of accounting principles through a case study involving the recording of business transactions. It begins with the creation of T-accounts to illustrate debit and credit entries for various transactions. The solution then progresses to the preparation of a trial balance, income statement, and statement of financial position, demonstrating the process of summarizing financial data. The assignment also includes a ratio analysis, comparing key financial metrics like net profit margin, gross profit margin, current ratio, quick ratio, and accounts receivable collection period. The analysis evaluates the company's financial health and performance, with a discussion on the impact of owner drawings. The solution covers topics such as the double-entry bookkeeping system, general ledger, assets, liabilities, equity, revenue, and expenses. Furthermore, the assignment provides an in-depth understanding of how different financial statements work together to give a complete financial picture of a business.

Recording Business

Transaction

Transaction

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

Part a................................................................................................................................................4

T accounts...................................................................................................................................4

Trial balance as on 31 October 2020..........................................................................................8

Income Statement as on 31 October 2020..................................................................................9

Statement of Financial Position ................................................................................................9

Part b..............................................................................................................................................10

Ratio Analysis...........................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................3

Part a................................................................................................................................................4

T accounts...................................................................................................................................4

Trial balance as on 31 October 2020..........................................................................................8

Income Statement as on 31 October 2020..................................................................................9

Statement of Financial Position ................................................................................................9

Part b..............................................................................................................................................10

Ratio Analysis...........................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................13

INTRODUCTION

The case study is about recording of business entries and transactions in various forms like T-

accounts, trial balance, profit and loss statement and Balance sheet. It depicts how the

transactions are recorded following accounting principles of the country. Each form of statement

records entry in a different way but in the end helps a company keep order of its transactions,

the capital involved, its remaining dues to creditors, the debtors and reflects the profit earned by

the company in a financial term. These statements are also evaluated by shareholders to check

the financial status of the company and form decision to invest. The study also does a ratio

analysis and compares with competitors to reflect the standing of the company on various

parameters to the competitors.

Part a

T accounts

It is a method of booking entries double side viz. Debit and Credit. It follows double entry book

keeping where all financial transactions are known to affect at least two of the company's

accounts. One account gets recorded as a debit entry while other one is recorded as a credit

entry. These entries are recorded in a general ledger form where account balances have to

match. The debit side generally represents an increase in the account while the credit side

represents a decrease in the account (Glushchenko, Yarkova and Kucherova, 2017).

The components of the balance sheet like assets, liabilities and shareholder's equity can

be reflected in T-account. It can be used to record changes to the income statement.

The case study is about recording of business entries and transactions in various forms like T-

accounts, trial balance, profit and loss statement and Balance sheet. It depicts how the

transactions are recorded following accounting principles of the country. Each form of statement

records entry in a different way but in the end helps a company keep order of its transactions,

the capital involved, its remaining dues to creditors, the debtors and reflects the profit earned by

the company in a financial term. These statements are also evaluated by shareholders to check

the financial status of the company and form decision to invest. The study also does a ratio

analysis and compares with competitors to reflect the standing of the company on various

parameters to the competitors.

Part a

T accounts

It is a method of booking entries double side viz. Debit and Credit. It follows double entry book

keeping where all financial transactions are known to affect at least two of the company's

accounts. One account gets recorded as a debit entry while other one is recorded as a credit

entry. These entries are recorded in a general ledger form where account balances have to

match. The debit side generally represents an increase in the account while the credit side

represents a decrease in the account (Glushchenko, Yarkova and Kucherova, 2017).

The components of the balance sheet like assets, liabilities and shareholder's equity can

be reflected in T-account. It can be used to record changes to the income statement.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

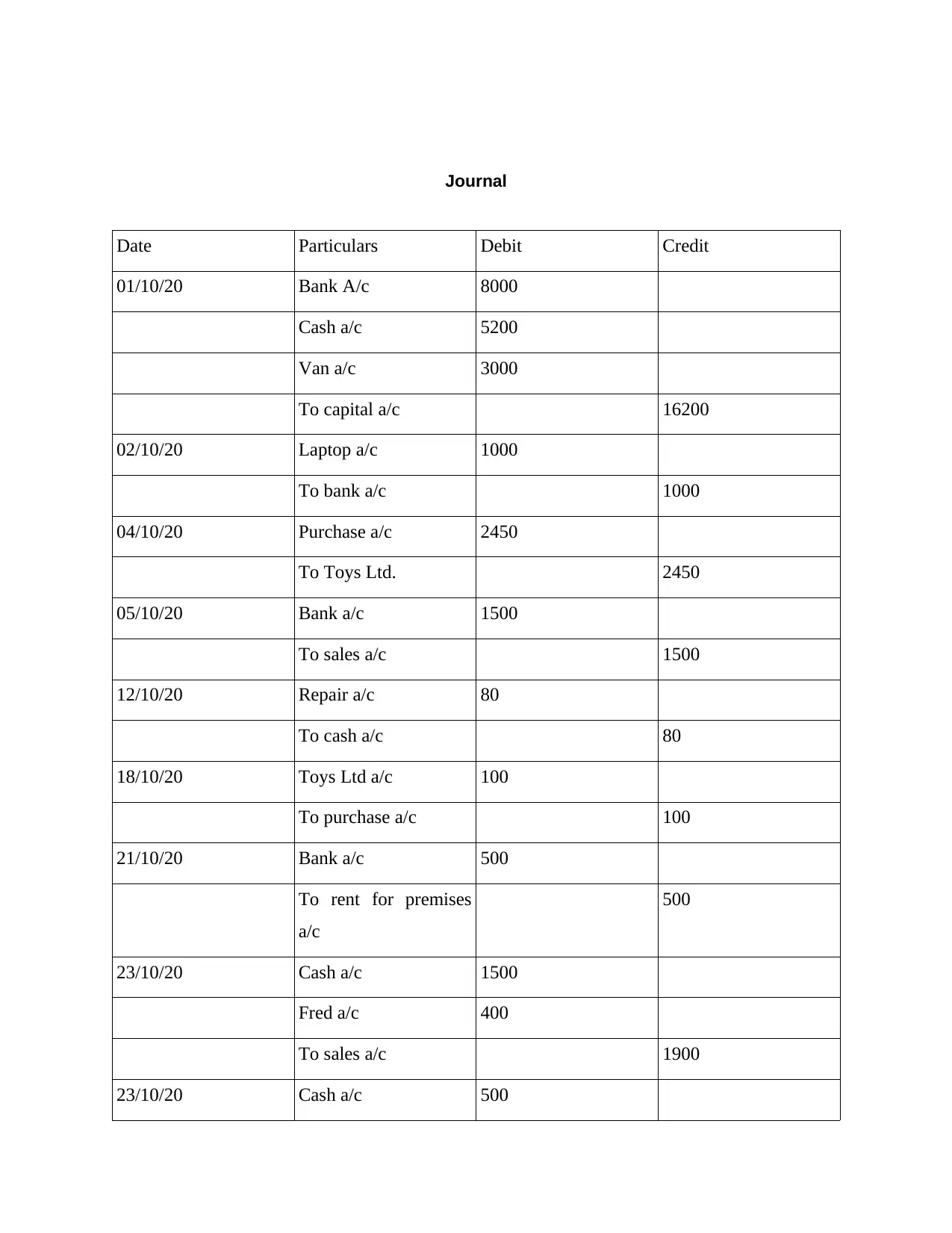

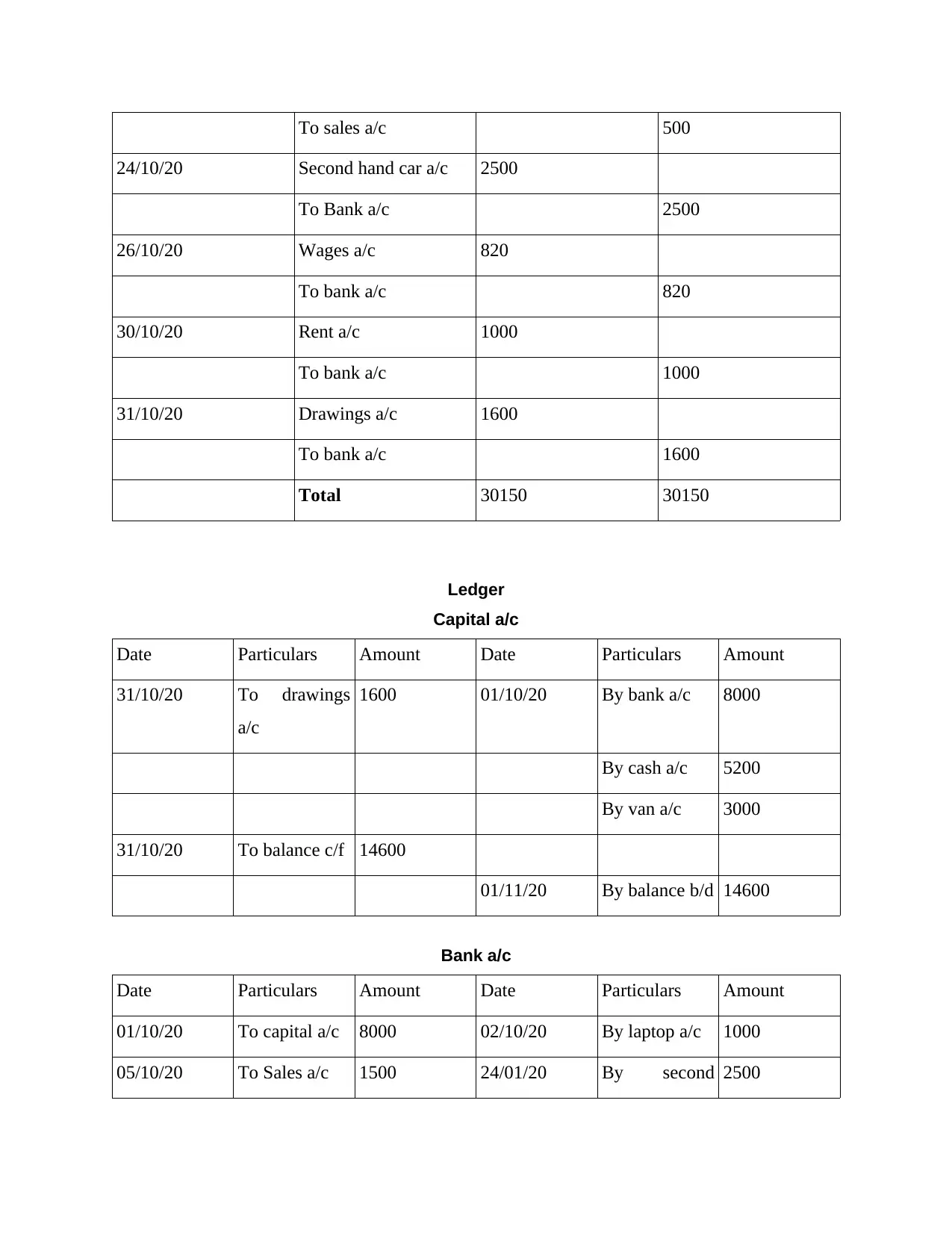

Journal

Date Particulars Debit Credit

01/10/20 Bank A/c 8000

Cash a/c 5200

Van a/c 3000

To capital a/c 16200

02/10/20 Laptop a/c 1000

To bank a/c 1000

04/10/20 Purchase a/c 2450

To Toys Ltd. 2450

05/10/20 Bank a/c 1500

To sales a/c 1500

12/10/20 Repair a/c 80

To cash a/c 80

18/10/20 Toys Ltd a/c 100

To purchase a/c 100

21/10/20 Bank a/c 500

To rent for premises

a/c

500

23/10/20 Cash a/c 1500

Fred a/c 400

To sales a/c 1900

23/10/20 Cash a/c 500

Date Particulars Debit Credit

01/10/20 Bank A/c 8000

Cash a/c 5200

Van a/c 3000

To capital a/c 16200

02/10/20 Laptop a/c 1000

To bank a/c 1000

04/10/20 Purchase a/c 2450

To Toys Ltd. 2450

05/10/20 Bank a/c 1500

To sales a/c 1500

12/10/20 Repair a/c 80

To cash a/c 80

18/10/20 Toys Ltd a/c 100

To purchase a/c 100

21/10/20 Bank a/c 500

To rent for premises

a/c

500

23/10/20 Cash a/c 1500

Fred a/c 400

To sales a/c 1900

23/10/20 Cash a/c 500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To sales a/c 500

24/10/20 Second hand car a/c 2500

To Bank a/c 2500

26/10/20 Wages a/c 820

To bank a/c 820

30/10/20 Rent a/c 1000

To bank a/c 1000

31/10/20 Drawings a/c 1600

To bank a/c 1600

Total 30150 30150

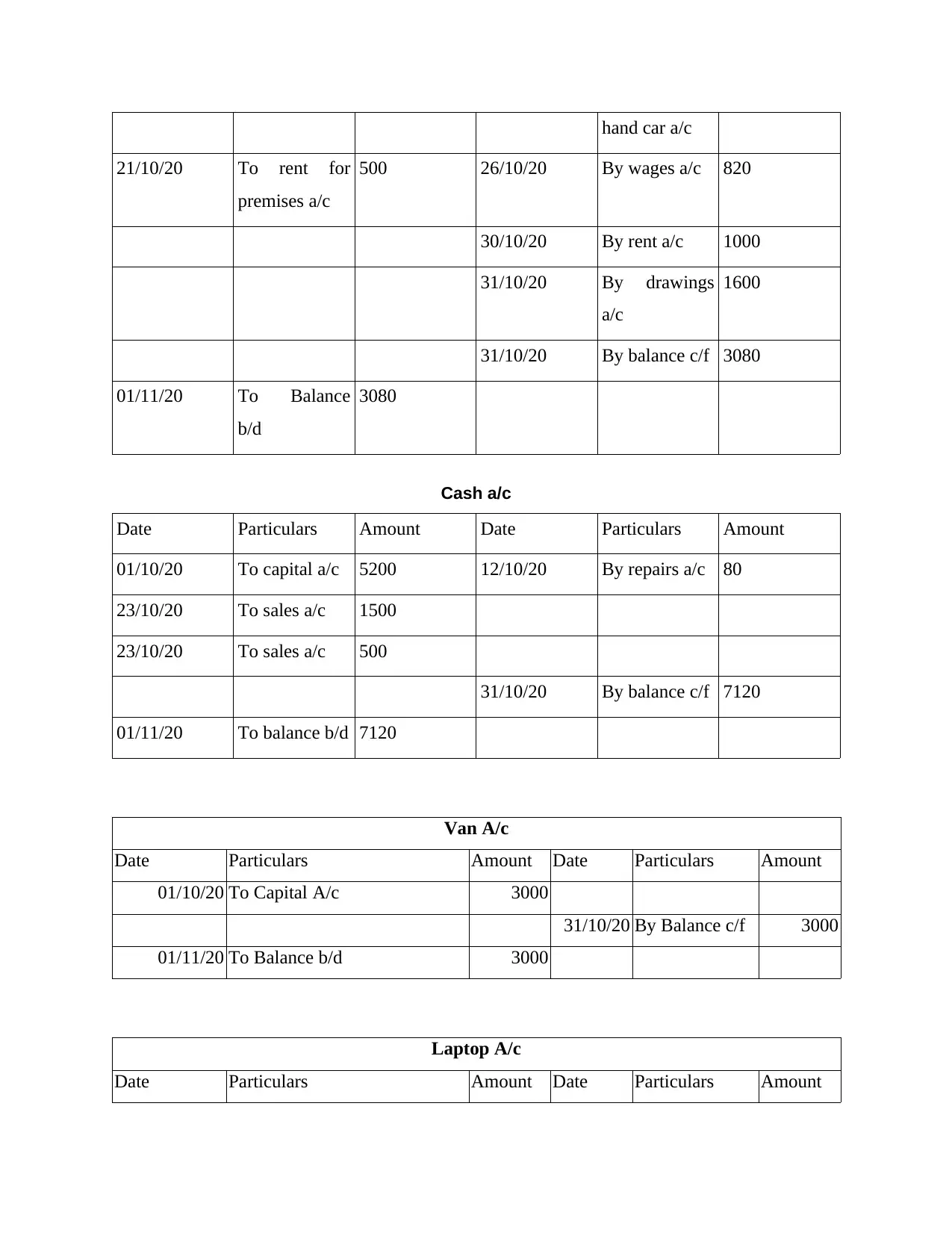

Ledger

Capital a/c

Date Particulars Amount Date Particulars Amount

31/10/20 To drawings

a/c

1600 01/10/20 By bank a/c 8000

By cash a/c 5200

By van a/c 3000

31/10/20 To balance c/f 14600

01/11/20 By balance b/d 14600

Bank a/c

Date Particulars Amount Date Particulars Amount

01/10/20 To capital a/c 8000 02/10/20 By laptop a/c 1000

05/10/20 To Sales a/c 1500 24/01/20 By second 2500

24/10/20 Second hand car a/c 2500

To Bank a/c 2500

26/10/20 Wages a/c 820

To bank a/c 820

30/10/20 Rent a/c 1000

To bank a/c 1000

31/10/20 Drawings a/c 1600

To bank a/c 1600

Total 30150 30150

Ledger

Capital a/c

Date Particulars Amount Date Particulars Amount

31/10/20 To drawings

a/c

1600 01/10/20 By bank a/c 8000

By cash a/c 5200

By van a/c 3000

31/10/20 To balance c/f 14600

01/11/20 By balance b/d 14600

Bank a/c

Date Particulars Amount Date Particulars Amount

01/10/20 To capital a/c 8000 02/10/20 By laptop a/c 1000

05/10/20 To Sales a/c 1500 24/01/20 By second 2500

hand car a/c

21/10/20 To rent for

premises a/c

500 26/10/20 By wages a/c 820

30/10/20 By rent a/c 1000

31/10/20 By drawings

a/c

1600

31/10/20 By balance c/f 3080

01/11/20 To Balance

b/d

3080

Cash a/c

Date Particulars Amount Date Particulars Amount

01/10/20 To capital a/c 5200 12/10/20 By repairs a/c 80

23/10/20 To sales a/c 1500

23/10/20 To sales a/c 500

31/10/20 By balance c/f 7120

01/11/20 To balance b/d 7120

Van A/c

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 3000

31/10/20 By Balance c/f 3000

01/11/20 To Balance b/d 3000

Laptop A/c

Date Particulars Amount Date Particulars Amount

21/10/20 To rent for

premises a/c

500 26/10/20 By wages a/c 820

30/10/20 By rent a/c 1000

31/10/20 By drawings

a/c

1600

31/10/20 By balance c/f 3080

01/11/20 To Balance

b/d

3080

Cash a/c

Date Particulars Amount Date Particulars Amount

01/10/20 To capital a/c 5200 12/10/20 By repairs a/c 80

23/10/20 To sales a/c 1500

23/10/20 To sales a/c 500

31/10/20 By balance c/f 7120

01/11/20 To balance b/d 7120

Van A/c

Date Particulars Amount Date Particulars Amount

01/10/20 To Capital A/c 3000

31/10/20 By Balance c/f 3000

01/11/20 To Balance b/d 3000

Laptop A/c

Date Particulars Amount Date Particulars Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

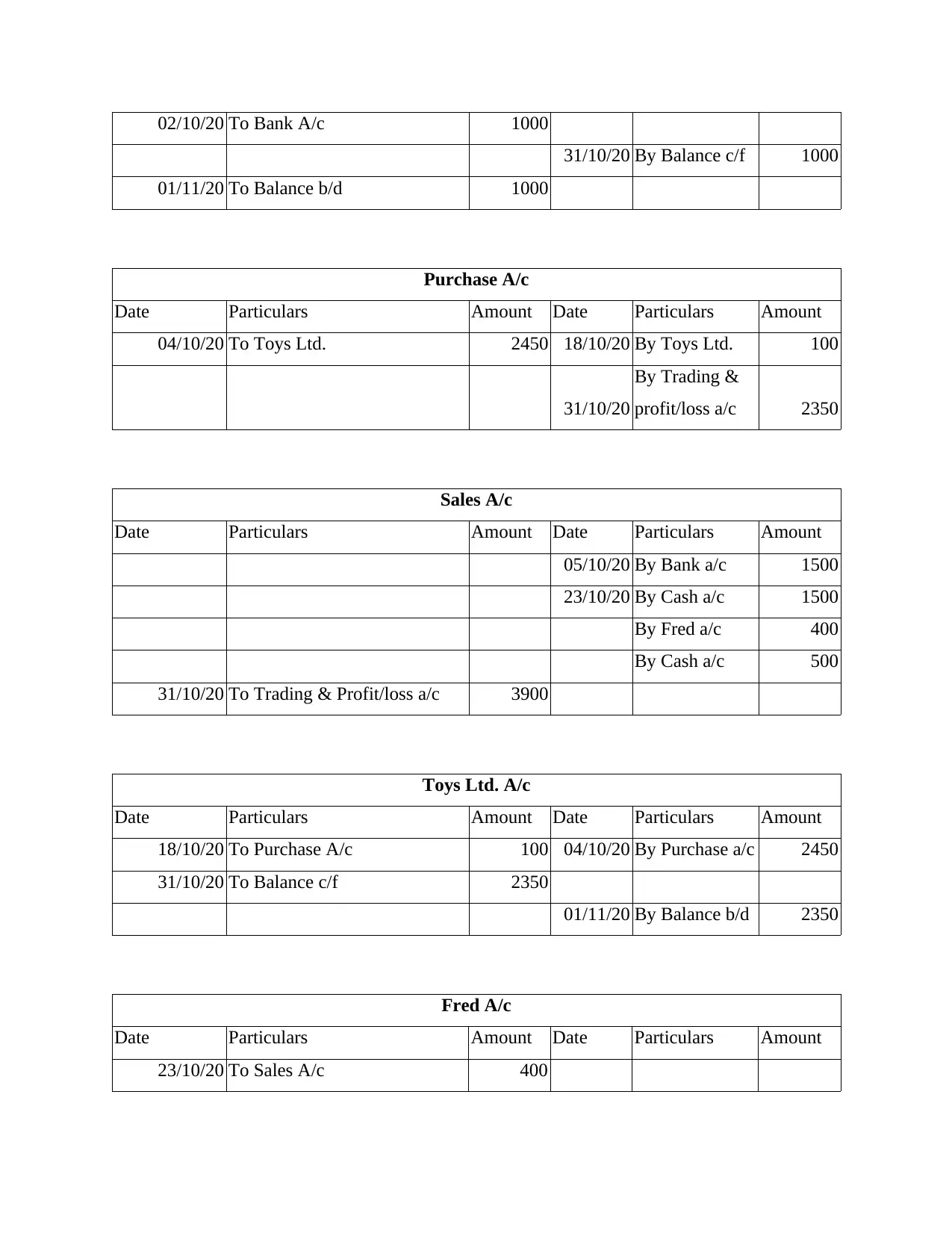

02/10/20 To Bank A/c 1000

31/10/20 By Balance c/f 1000

01/11/20 To Balance b/d 1000

Purchase A/c

Date Particulars Amount Date Particulars Amount

04/10/20 To Toys Ltd. 2450 18/10/20 By Toys Ltd. 100

31/10/20

By Trading &

profit/loss a/c 2350

Sales A/c

Date Particulars Amount Date Particulars Amount

05/10/20 By Bank a/c 1500

23/10/20 By Cash a/c 1500

By Fred a/c 400

By Cash a/c 500

31/10/20 To Trading & Profit/loss a/c 3900

Toys Ltd. A/c

Date Particulars Amount Date Particulars Amount

18/10/20 To Purchase A/c 100 04/10/20 By Purchase a/c 2450

31/10/20 To Balance c/f 2350

01/11/20 By Balance b/d 2350

Fred A/c

Date Particulars Amount Date Particulars Amount

23/10/20 To Sales A/c 400

31/10/20 By Balance c/f 1000

01/11/20 To Balance b/d 1000

Purchase A/c

Date Particulars Amount Date Particulars Amount

04/10/20 To Toys Ltd. 2450 18/10/20 By Toys Ltd. 100

31/10/20

By Trading &

profit/loss a/c 2350

Sales A/c

Date Particulars Amount Date Particulars Amount

05/10/20 By Bank a/c 1500

23/10/20 By Cash a/c 1500

By Fred a/c 400

By Cash a/c 500

31/10/20 To Trading & Profit/loss a/c 3900

Toys Ltd. A/c

Date Particulars Amount Date Particulars Amount

18/10/20 To Purchase A/c 100 04/10/20 By Purchase a/c 2450

31/10/20 To Balance c/f 2350

01/11/20 By Balance b/d 2350

Fred A/c

Date Particulars Amount Date Particulars Amount

23/10/20 To Sales A/c 400

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

31/10/20 By Balance c/f 400

01/11/20 To Balance b/d 400

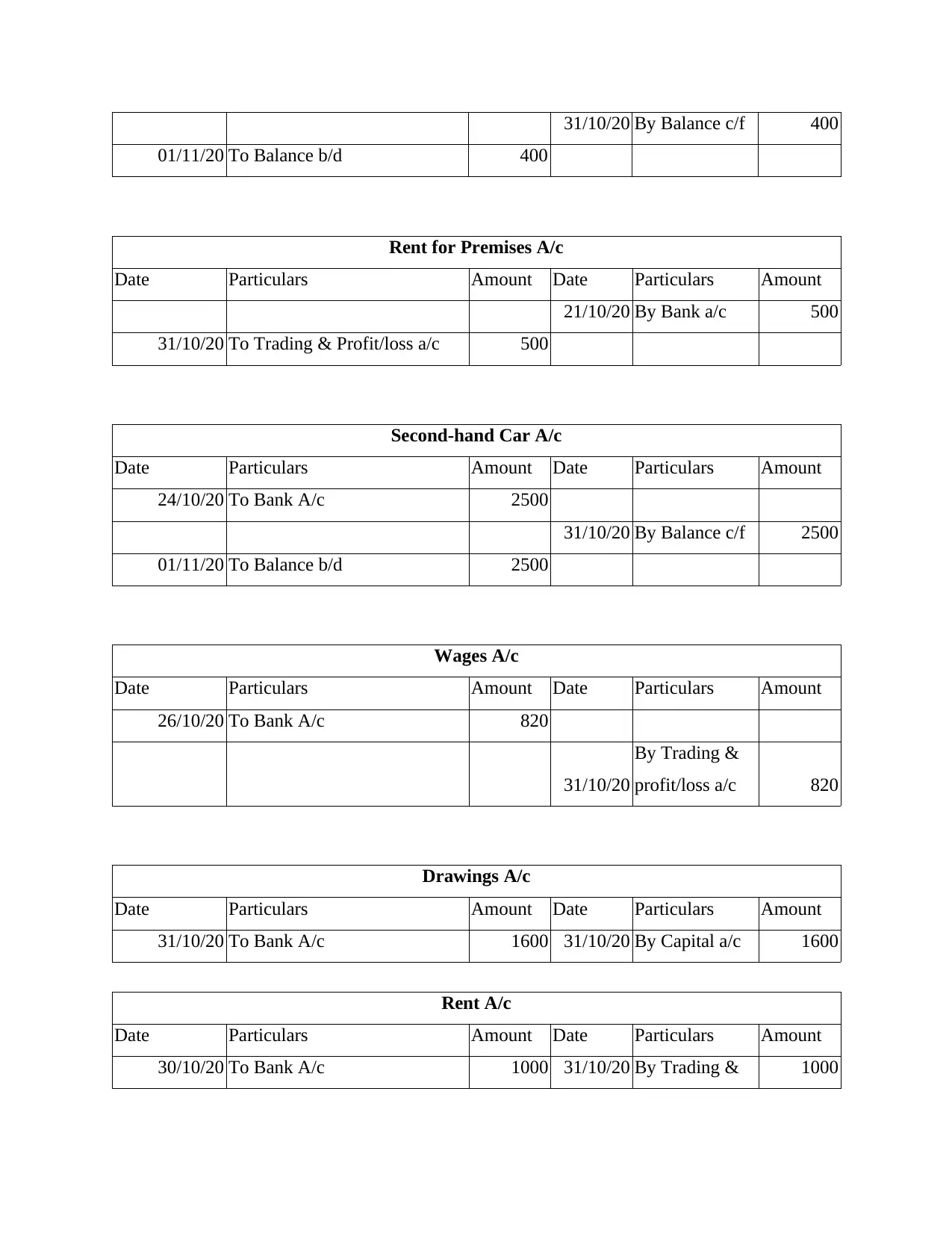

Rent for Premises A/c

Date Particulars Amount Date Particulars Amount

21/10/20 By Bank a/c 500

31/10/20 To Trading & Profit/loss a/c 500

Second-hand Car A/c

Date Particulars Amount Date Particulars Amount

24/10/20 To Bank A/c 2500

31/10/20 By Balance c/f 2500

01/11/20 To Balance b/d 2500

Wages A/c

Date Particulars Amount Date Particulars Amount

26/10/20 To Bank A/c 820

31/10/20

By Trading &

profit/loss a/c 820

Drawings A/c

Date Particulars Amount Date Particulars Amount

31/10/20 To Bank A/c 1600 31/10/20 By Capital a/c 1600

Rent A/c

Date Particulars Amount Date Particulars Amount

30/10/20 To Bank A/c 1000 31/10/20 By Trading & 1000

01/11/20 To Balance b/d 400

Rent for Premises A/c

Date Particulars Amount Date Particulars Amount

21/10/20 By Bank a/c 500

31/10/20 To Trading & Profit/loss a/c 500

Second-hand Car A/c

Date Particulars Amount Date Particulars Amount

24/10/20 To Bank A/c 2500

31/10/20 By Balance c/f 2500

01/11/20 To Balance b/d 2500

Wages A/c

Date Particulars Amount Date Particulars Amount

26/10/20 To Bank A/c 820

31/10/20

By Trading &

profit/loss a/c 820

Drawings A/c

Date Particulars Amount Date Particulars Amount

31/10/20 To Bank A/c 1600 31/10/20 By Capital a/c 1600

Rent A/c

Date Particulars Amount Date Particulars Amount

30/10/20 To Bank A/c 1000 31/10/20 By Trading & 1000

profit/loss a/c

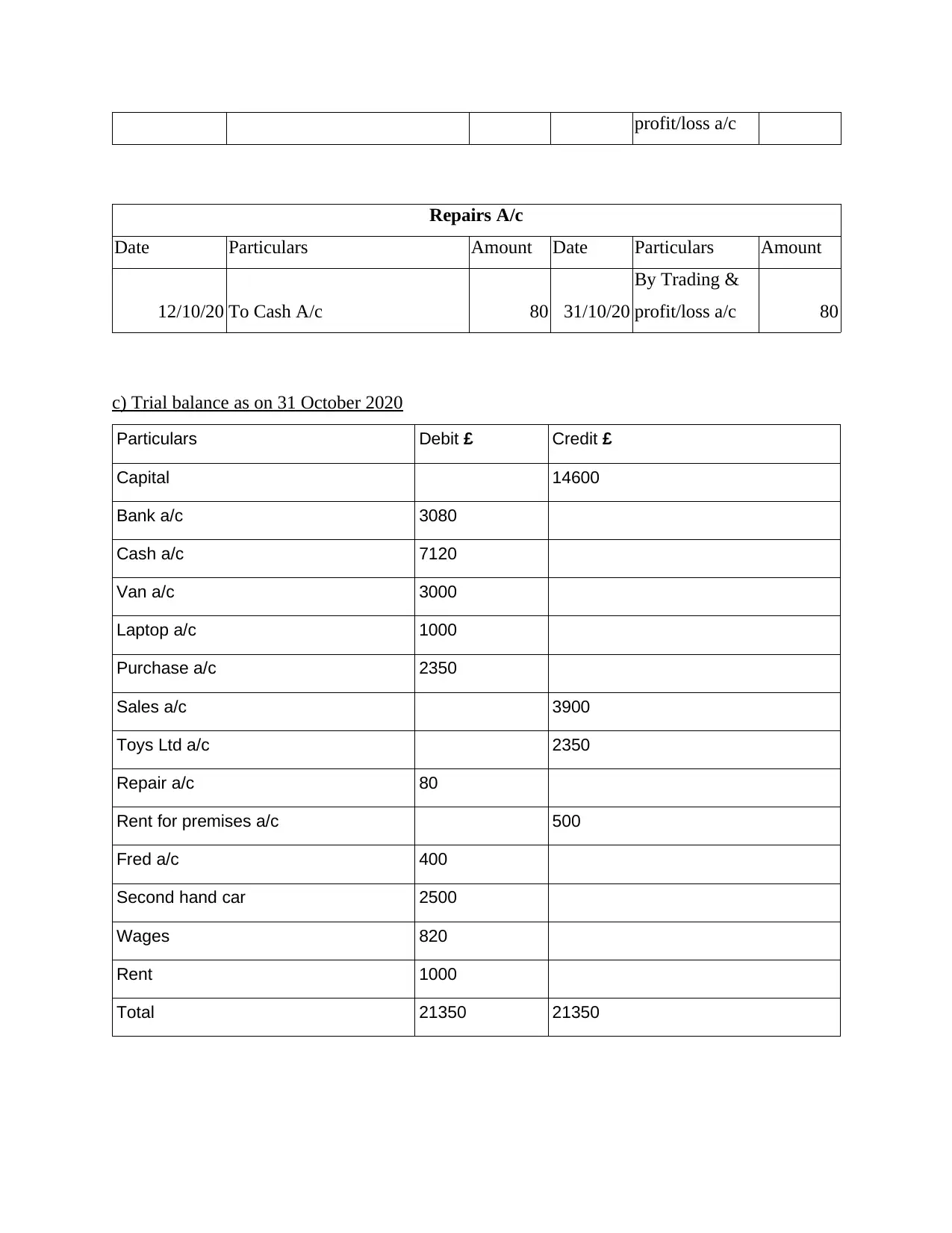

Repairs A/c

Date Particulars Amount Date Particulars Amount

12/10/20 To Cash A/c 80 31/10/20

By Trading &

profit/loss a/c 80

c) Trial balance as on 31 October 2020

Particulars Debit £ Credit £

Capital 14600

Bank a/c 3080

Cash a/c 7120

Van a/c 3000

Laptop a/c 1000

Purchase a/c 2350

Sales a/c 3900

Toys Ltd a/c 2350

Repair a/c 80

Rent for premises a/c 500

Fred a/c 400

Second hand car 2500

Wages 820

Rent 1000

Total 21350 21350

Repairs A/c

Date Particulars Amount Date Particulars Amount

12/10/20 To Cash A/c 80 31/10/20

By Trading &

profit/loss a/c 80

c) Trial balance as on 31 October 2020

Particulars Debit £ Credit £

Capital 14600

Bank a/c 3080

Cash a/c 7120

Van a/c 3000

Laptop a/c 1000

Purchase a/c 2350

Sales a/c 3900

Toys Ltd a/c 2350

Repair a/c 80

Rent for premises a/c 500

Fred a/c 400

Second hand car 2500

Wages 820

Rent 1000

Total 21350 21350

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Trial balance lists the balances of general ledger accounts at a certain point of time. The

accounts on the trial balance relate to different categories which include assets, liability, equity,

revenue and other expenses, gains and losses.

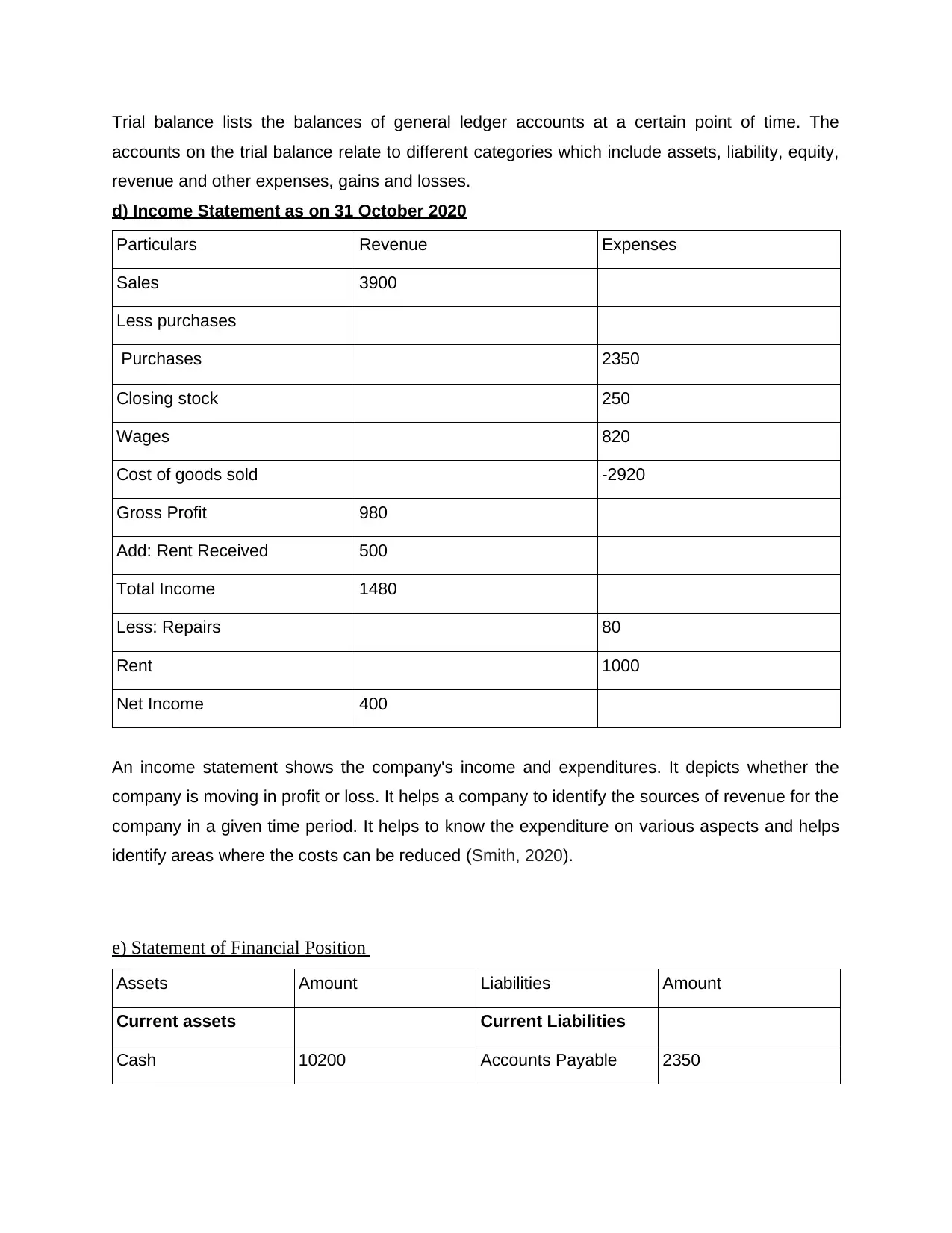

d) Income Statement as on 31 October 2020

Particulars Revenue Expenses

Sales 3900

Less purchases

Purchases 2350

Closing stock 250

Wages 820

Cost of goods sold -2920

Gross Profit 980

Add: Rent Received 500

Total Income 1480

Less: Repairs 80

Rent 1000

Net Income 400

An income statement shows the company's income and expenditures. It depicts whether the

company is moving in profit or loss. It helps a company to identify the sources of revenue for the

company in a given time period. It helps to know the expenditure on various aspects and helps

identify areas where the costs can be reduced (Smith, 2020).

e) Statement of Financial Position

Assets Amount Liabilities Amount

Current assets Current Liabilities

Cash 10200 Accounts Payable 2350

accounts on the trial balance relate to different categories which include assets, liability, equity,

revenue and other expenses, gains and losses.

d) Income Statement as on 31 October 2020

Particulars Revenue Expenses

Sales 3900

Less purchases

Purchases 2350

Closing stock 250

Wages 820

Cost of goods sold -2920

Gross Profit 980

Add: Rent Received 500

Total Income 1480

Less: Repairs 80

Rent 1000

Net Income 400

An income statement shows the company's income and expenditures. It depicts whether the

company is moving in profit or loss. It helps a company to identify the sources of revenue for the

company in a given time period. It helps to know the expenditure on various aspects and helps

identify areas where the costs can be reduced (Smith, 2020).

e) Statement of Financial Position

Assets Amount Liabilities Amount

Current assets Current Liabilities

Cash 10200 Accounts Payable 2350

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

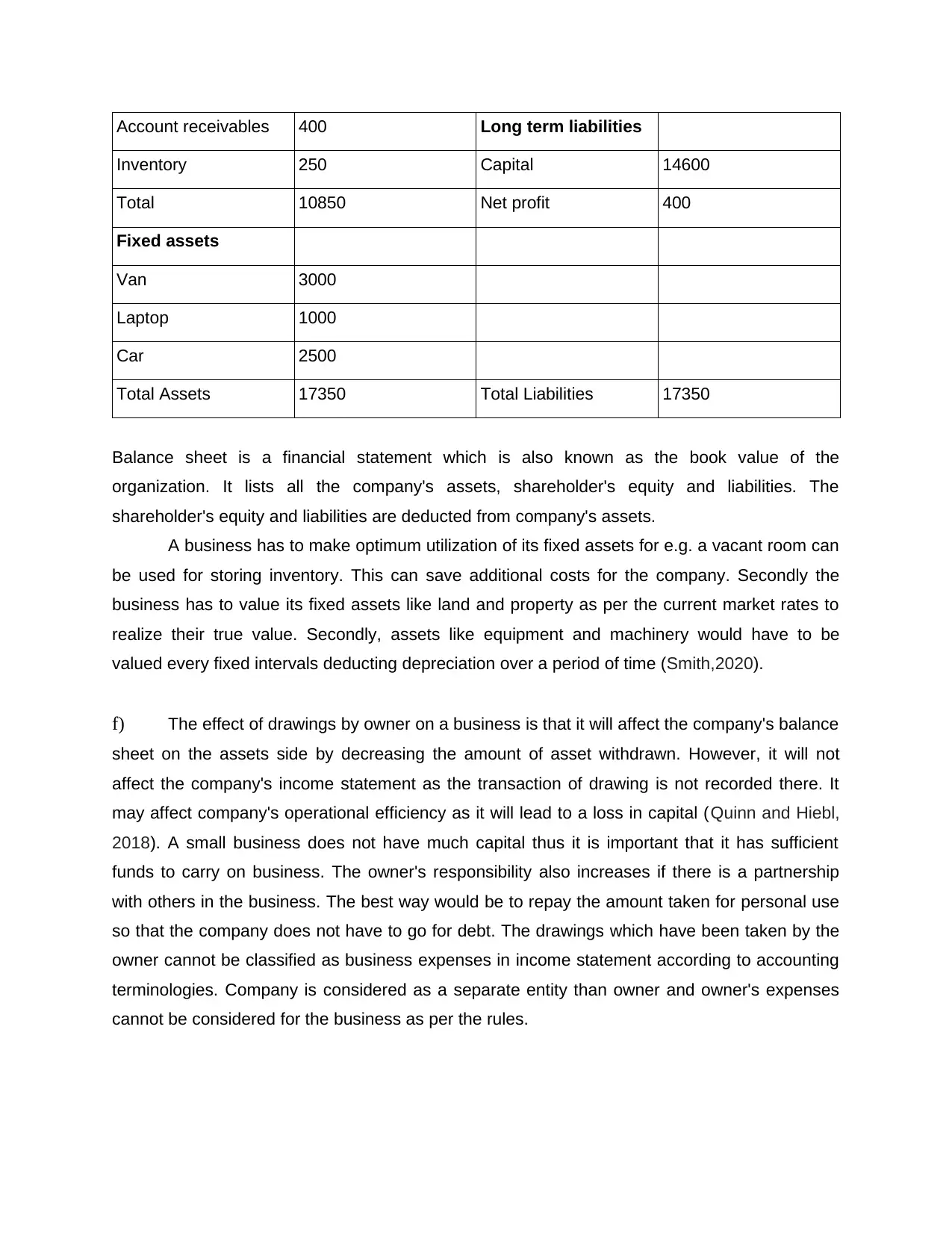

Account receivables 400 Long term liabilities

Inventory 250 Capital 14600

Total 10850 Net profit 400

Fixed assets

Van 3000

Laptop 1000

Car 2500

Total Assets 17350 Total Liabilities 17350

Balance sheet is a financial statement which is also known as the book value of the

organization. It lists all the company's assets, shareholder's equity and liabilities. The

shareholder's equity and liabilities are deducted from company's assets.

A business has to make optimum utilization of its fixed assets for e.g. a vacant room can

be used for storing inventory. This can save additional costs for the company. Secondly the

business has to value its fixed assets like land and property as per the current market rates to

realize their true value. Secondly, assets like equipment and machinery would have to be

valued every fixed intervals deducting depreciation over a period of time (Smith,2020).

f) The effect of drawings by owner on a business is that it will affect the company's balance

sheet on the assets side by decreasing the amount of asset withdrawn. However, it will not

affect the company's income statement as the transaction of drawing is not recorded there. It

may affect company's operational efficiency as it will lead to a loss in capital (Quinn and Hiebl,

2018). A small business does not have much capital thus it is important that it has sufficient

funds to carry on business. The owner's responsibility also increases if there is a partnership

with others in the business. The best way would be to repay the amount taken for personal use

so that the company does not have to go for debt. The drawings which have been taken by the

owner cannot be classified as business expenses in income statement according to accounting

terminologies. Company is considered as a separate entity than owner and owner's expenses

cannot be considered for the business as per the rules.

Inventory 250 Capital 14600

Total 10850 Net profit 400

Fixed assets

Van 3000

Laptop 1000

Car 2500

Total Assets 17350 Total Liabilities 17350

Balance sheet is a financial statement which is also known as the book value of the

organization. It lists all the company's assets, shareholder's equity and liabilities. The

shareholder's equity and liabilities are deducted from company's assets.

A business has to make optimum utilization of its fixed assets for e.g. a vacant room can

be used for storing inventory. This can save additional costs for the company. Secondly the

business has to value its fixed assets like land and property as per the current market rates to

realize their true value. Secondly, assets like equipment and machinery would have to be

valued every fixed intervals deducting depreciation over a period of time (Smith,2020).

f) The effect of drawings by owner on a business is that it will affect the company's balance

sheet on the assets side by decreasing the amount of asset withdrawn. However, it will not

affect the company's income statement as the transaction of drawing is not recorded there. It

may affect company's operational efficiency as it will lead to a loss in capital (Quinn and Hiebl,

2018). A small business does not have much capital thus it is important that it has sufficient

funds to carry on business. The owner's responsibility also increases if there is a partnership

with others in the business. The best way would be to repay the amount taken for personal use

so that the company does not have to go for debt. The drawings which have been taken by the

owner cannot be classified as business expenses in income statement according to accounting

terminologies. Company is considered as a separate entity than owner and owner's expenses

cannot be considered for the business as per the rules.

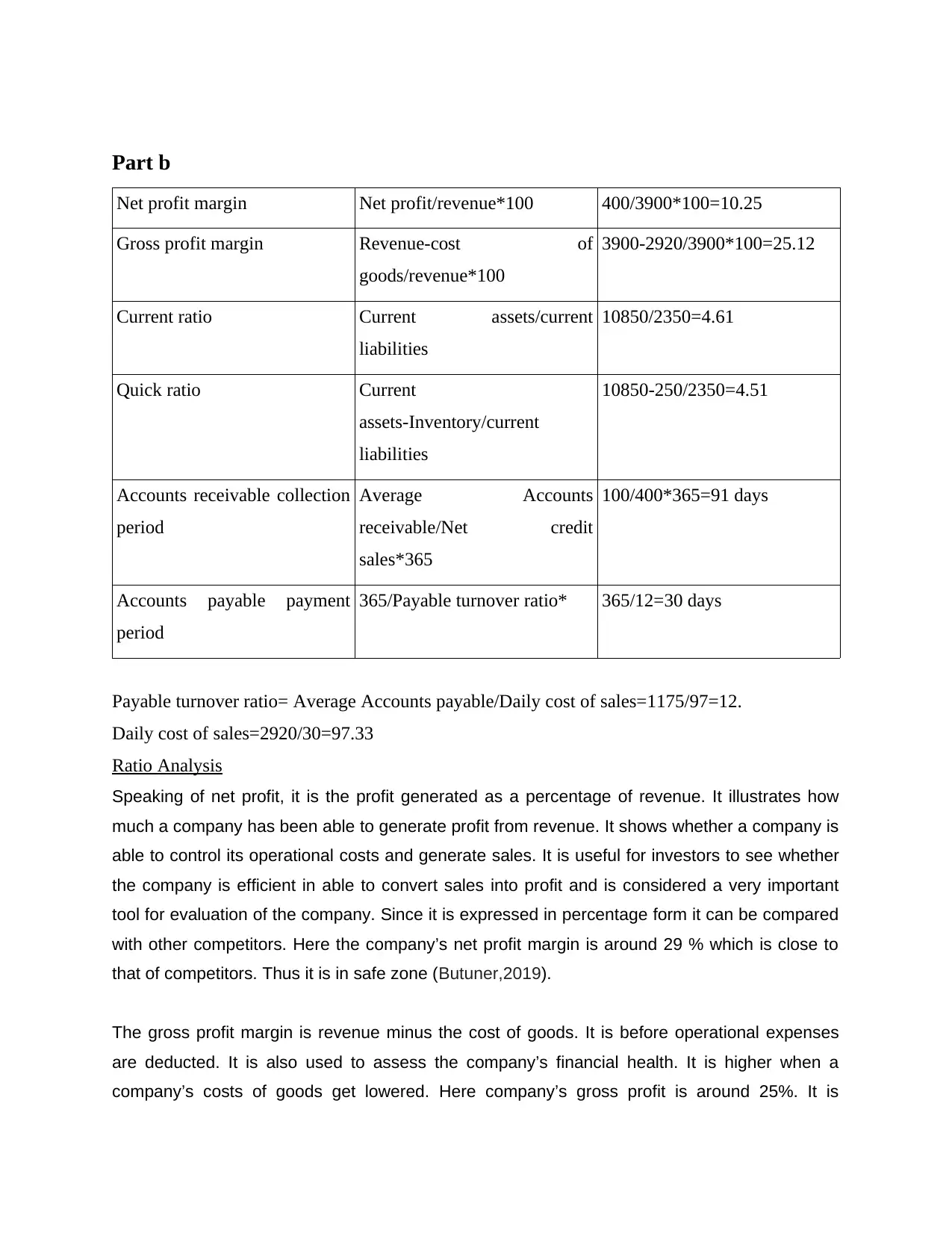

Part b

Net profit margin Net profit/revenue*100 400/3900*100=10.25

Gross profit margin Revenue-cost of

goods/revenue*100

3900-2920/3900*100=25.12

Current ratio Current assets/current

liabilities

10850/2350=4.61

Quick ratio Current

assets-Inventory/current

liabilities

10850-250/2350=4.51

Accounts receivable collection

period

Average Accounts

receivable/Net credit

sales*365

100/400*365=91 days

Accounts payable payment

period

365/Payable turnover ratio* 365/12=30 days

Payable turnover ratio= Average Accounts payable/Daily cost of sales=1175/97=12.

Daily cost of sales=2920/30=97.33

Ratio Analysis

Speaking of net profit, it is the profit generated as a percentage of revenue. It illustrates how

much a company has been able to generate profit from revenue. It shows whether a company is

able to control its operational costs and generate sales. It is useful for investors to see whether

the company is efficient in able to convert sales into profit and is considered a very important

tool for evaluation of the company. Since it is expressed in percentage form it can be compared

with other competitors. Here the company’s net profit margin is around 29 % which is close to

that of competitors. Thus it is in safe zone (Butuner,2019).

The gross profit margin is revenue minus the cost of goods. It is before operational expenses

are deducted. It is also used to assess the company’s financial health. It is higher when a

company’s costs of goods get lowered. Here company’s gross profit is around 25%. It is

Net profit margin Net profit/revenue*100 400/3900*100=10.25

Gross profit margin Revenue-cost of

goods/revenue*100

3900-2920/3900*100=25.12

Current ratio Current assets/current

liabilities

10850/2350=4.61

Quick ratio Current

assets-Inventory/current

liabilities

10850-250/2350=4.51

Accounts receivable collection

period

Average Accounts

receivable/Net credit

sales*365

100/400*365=91 days

Accounts payable payment

period

365/Payable turnover ratio* 365/12=30 days

Payable turnover ratio= Average Accounts payable/Daily cost of sales=1175/97=12.

Daily cost of sales=2920/30=97.33

Ratio Analysis

Speaking of net profit, it is the profit generated as a percentage of revenue. It illustrates how

much a company has been able to generate profit from revenue. It shows whether a company is

able to control its operational costs and generate sales. It is useful for investors to see whether

the company is efficient in able to convert sales into profit and is considered a very important

tool for evaluation of the company. Since it is expressed in percentage form it can be compared

with other competitors. Here the company’s net profit margin is around 29 % which is close to

that of competitors. Thus it is in safe zone (Butuner,2019).

The gross profit margin is revenue minus the cost of goods. It is before operational expenses

are deducted. It is also used to assess the company’s financial health. It is higher when a

company’s costs of goods get lowered. Here company’s gross profit is around 25%. It is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.