Recording Business Transactions

VerifiedAdded on 2023/06/14

|19

|2247

|219

AI Summary

This report focuses on preparing and maintaining the financial records of Anne’s business. It includes journal books, ledger books, trial balance, income statement, balance sheet, and ratio analysis. The financial position of Anne’s business is good but there is still room for improvement in terms of reducing expenses and increasing profits.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Recording business

transactions

transactions

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

Introduction:..............................................................................................................3

Part A.........................................................................................................................3

Journal books of Anne’s business as on 31 October, 2021...................................3

Ledger books of Anne’s business as on 31 October, 2021....................................4

Introduction:..............................................................................................................3

Part A.........................................................................................................................3

Journal books of Anne’s business as on 31 October, 2021...................................3

Ledger books of Anne’s business as on 31 October, 2021....................................4

Introduction:

This report focuses on preparing and maintaining the financial records of

Anne’s business. In this Anne is sole trader dealing in purchasing and selling of

furniture. Here, all monetary transactions are firstly, recorded in the journal books

then these are posted in ledger accounts and at the last these are summarized in

income statements and balance sheet. In this income statement is prepared to

ascertain revenues and expenses of specific period. Whereas, balance sheet is

prepared to ascertain true and fair position of business enterprises. Besides this,

financial tools are used to evaluate the current performance of business and to

compare it with other companies of same industry. Here, ratios are used to evaluate

liquidity and profitability position of the enterprise.

Part A

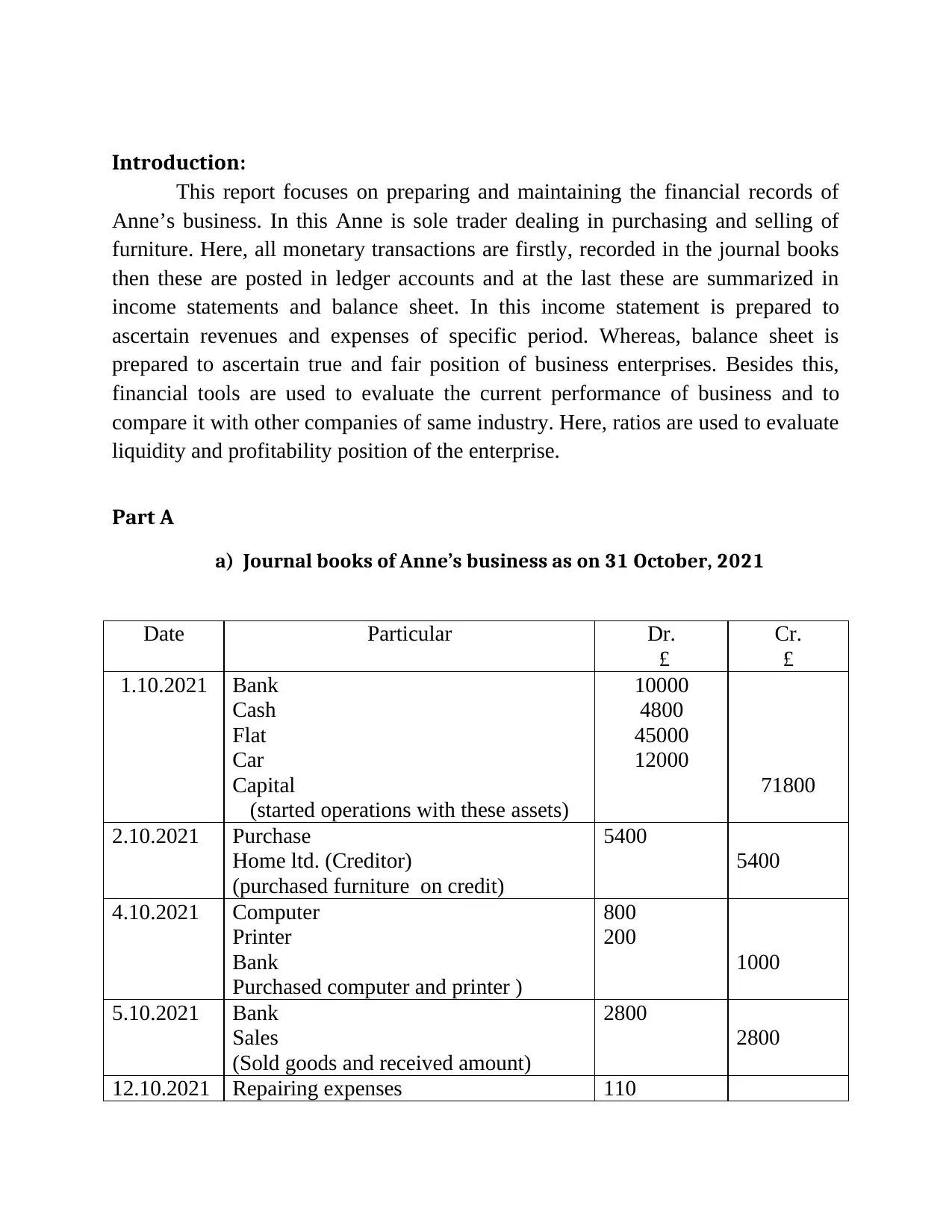

a) Journal books of Anne’s business as on 31 October, 2021

Date Particular Dr.

£

Cr.

£

1.10.2021 Bank

Cash

Flat

Car

Capital

(started operations with these assets)

10000

4800

45000

12000

71800

2.10.2021 Purchase

Home ltd. (Creditor)

(purchased furniture on credit)

5400

5400

4.10.2021 Computer

Printer

Bank

Purchased computer and printer )

800

200

1000

5.10.2021 Bank

Sales

(Sold goods and received amount)

2800

2800

12.10.2021 Repairing expenses 110

This report focuses on preparing and maintaining the financial records of

Anne’s business. In this Anne is sole trader dealing in purchasing and selling of

furniture. Here, all monetary transactions are firstly, recorded in the journal books

then these are posted in ledger accounts and at the last these are summarized in

income statements and balance sheet. In this income statement is prepared to

ascertain revenues and expenses of specific period. Whereas, balance sheet is

prepared to ascertain true and fair position of business enterprises. Besides this,

financial tools are used to evaluate the current performance of business and to

compare it with other companies of same industry. Here, ratios are used to evaluate

liquidity and profitability position of the enterprise.

Part A

a) Journal books of Anne’s business as on 31 October, 2021

Date Particular Dr.

£

Cr.

£

1.10.2021 Bank

Cash

Flat

Car

Capital

(started operations with these assets)

10000

4800

45000

12000

71800

2.10.2021 Purchase

Home ltd. (Creditor)

(purchased furniture on credit)

5400

5400

4.10.2021 Computer

Printer

Bank

Purchased computer and printer )

800

200

1000

5.10.2021 Bank

Sales

(Sold goods and received amount)

2800

2800

12.10.2021 Repairing expenses 110

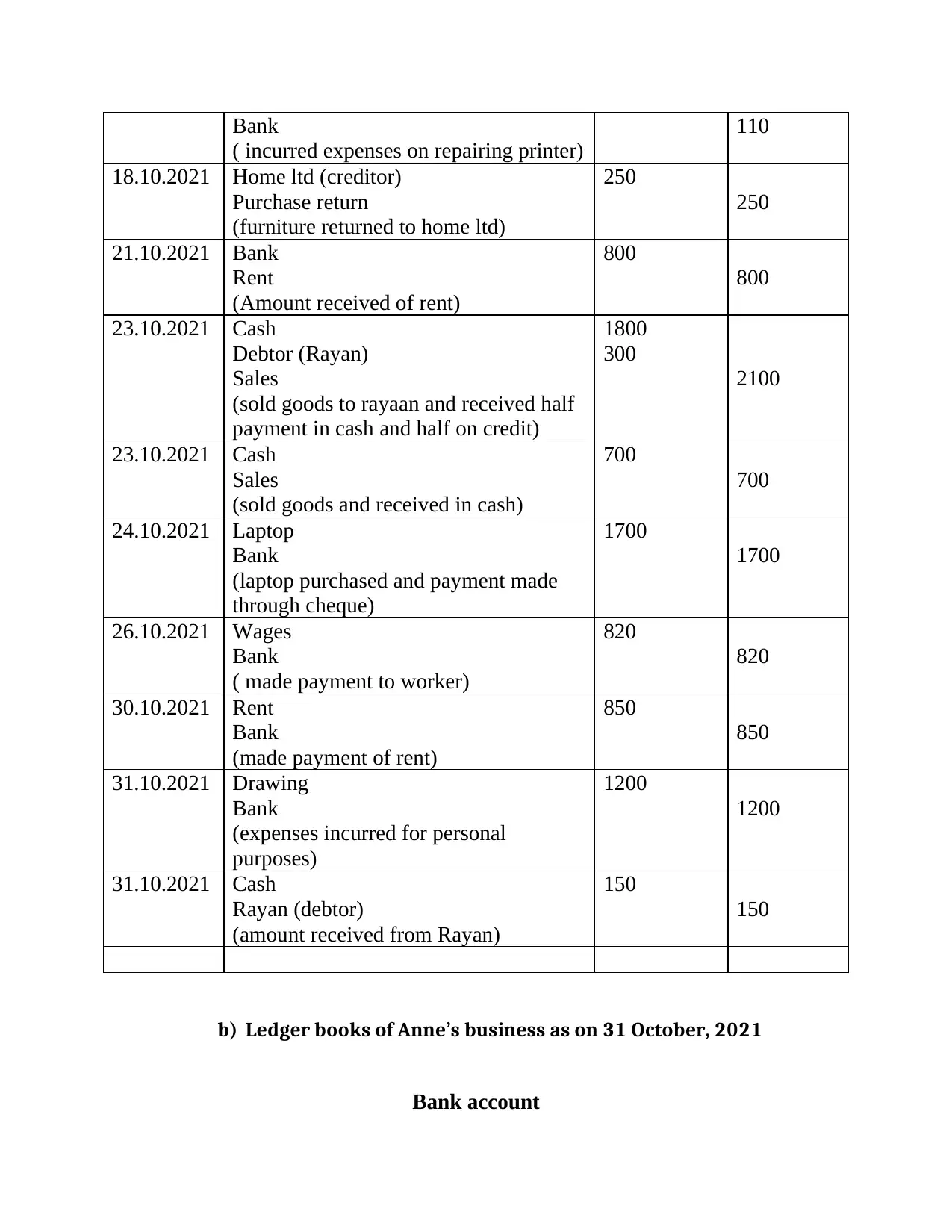

Bank

( incurred expenses on repairing printer)

110

18.10.2021 Home ltd (creditor)

Purchase return

(furniture returned to home ltd)

250

250

21.10.2021 Bank

Rent

(Amount received of rent)

800

800

23.10.2021 Cash

Debtor (Rayan)

Sales

(sold goods to rayaan and received half

payment in cash and half on credit)

1800

300

2100

23.10.2021 Cash

Sales

(sold goods and received in cash)

700

700

24.10.2021 Laptop

Bank

(laptop purchased and payment made

through cheque)

1700

1700

26.10.2021 Wages

Bank

( made payment to worker)

820

820

30.10.2021 Rent

Bank

(made payment of rent)

850

850

31.10.2021 Drawing

Bank

(expenses incurred for personal

purposes)

1200

1200

31.10.2021 Cash

Rayan (debtor)

(amount received from Rayan)

150

150

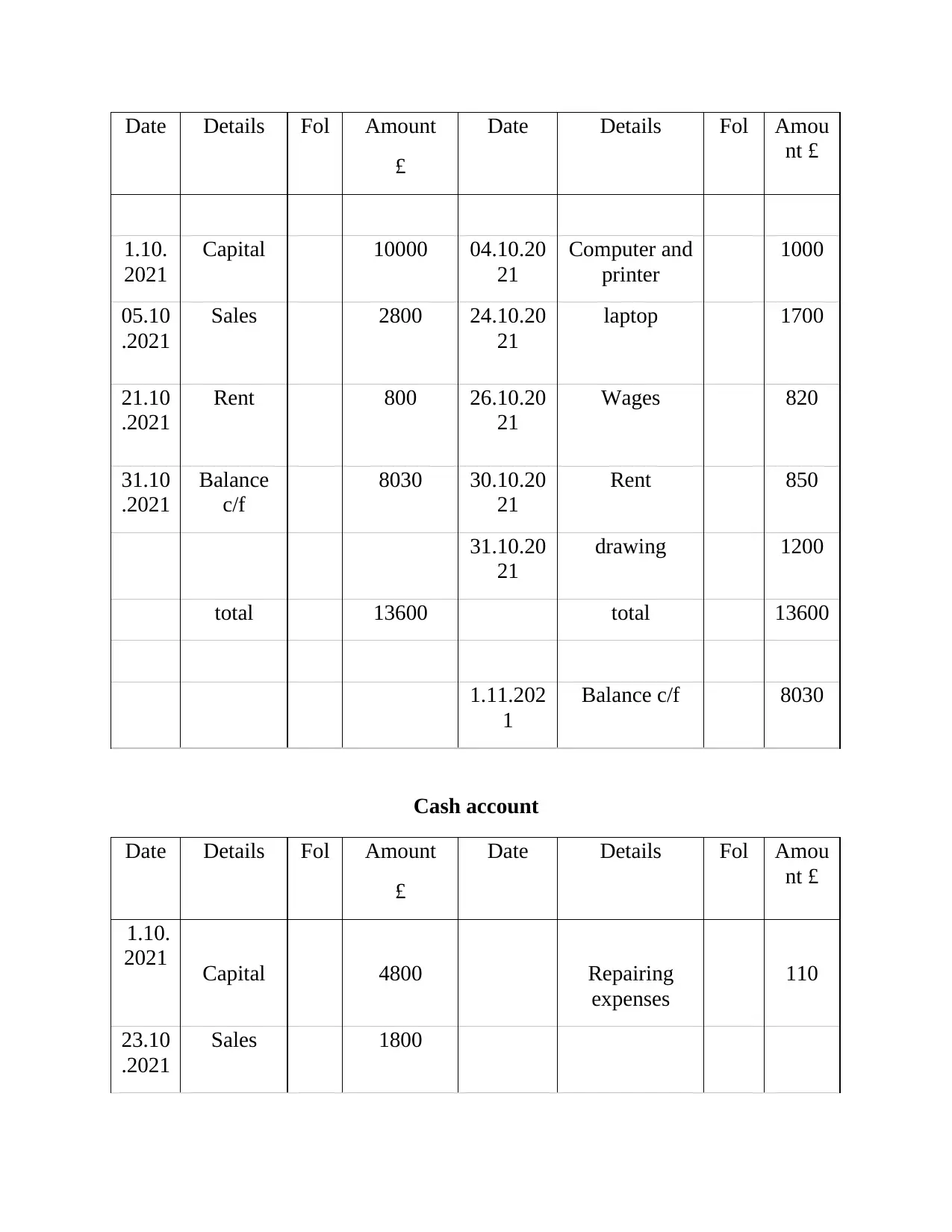

b) Ledger books of Anne’s business as on 31 October, 2021

Bank account

( incurred expenses on repairing printer)

110

18.10.2021 Home ltd (creditor)

Purchase return

(furniture returned to home ltd)

250

250

21.10.2021 Bank

Rent

(Amount received of rent)

800

800

23.10.2021 Cash

Debtor (Rayan)

Sales

(sold goods to rayaan and received half

payment in cash and half on credit)

1800

300

2100

23.10.2021 Cash

Sales

(sold goods and received in cash)

700

700

24.10.2021 Laptop

Bank

(laptop purchased and payment made

through cheque)

1700

1700

26.10.2021 Wages

Bank

( made payment to worker)

820

820

30.10.2021 Rent

Bank

(made payment of rent)

850

850

31.10.2021 Drawing

Bank

(expenses incurred for personal

purposes)

1200

1200

31.10.2021 Cash

Rayan (debtor)

(amount received from Rayan)

150

150

b) Ledger books of Anne’s business as on 31 October, 2021

Bank account

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Date Details Fol Amount

£

Date Details Fol Amou

nt £

1.10.

2021

Capital 10000 04.10.20

21

Computer and

printer

1000

05.10

.2021

Sales 2800 24.10.20

21

laptop 1700

21.10

.2021

Rent 800 26.10.20

21

Wages 820

31.10

.2021

Balance

c/f

8030 30.10.20

21

Rent 850

31.10.20

21

drawing 1200

total 13600 total 13600

1.11.202

1

Balance c/f 8030

Cash account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

1.10.

2021 Capital 4800 Repairing

expenses

110

23.10

.2021

Sales 1800

£

Date Details Fol Amou

nt £

1.10.

2021

Capital 10000 04.10.20

21

Computer and

printer

1000

05.10

.2021

Sales 2800 24.10.20

21

laptop 1700

21.10

.2021

Rent 800 26.10.20

21

Wages 820

31.10

.2021

Balance

c/f

8030 30.10.20

21

Rent 850

31.10.20

21

drawing 1200

total 13600 total 13600

1.11.202

1

Balance c/f 8030

Cash account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

1.10.

2021 Capital 4800 Repairing

expenses

110

23.10

.2021

Sales 1800

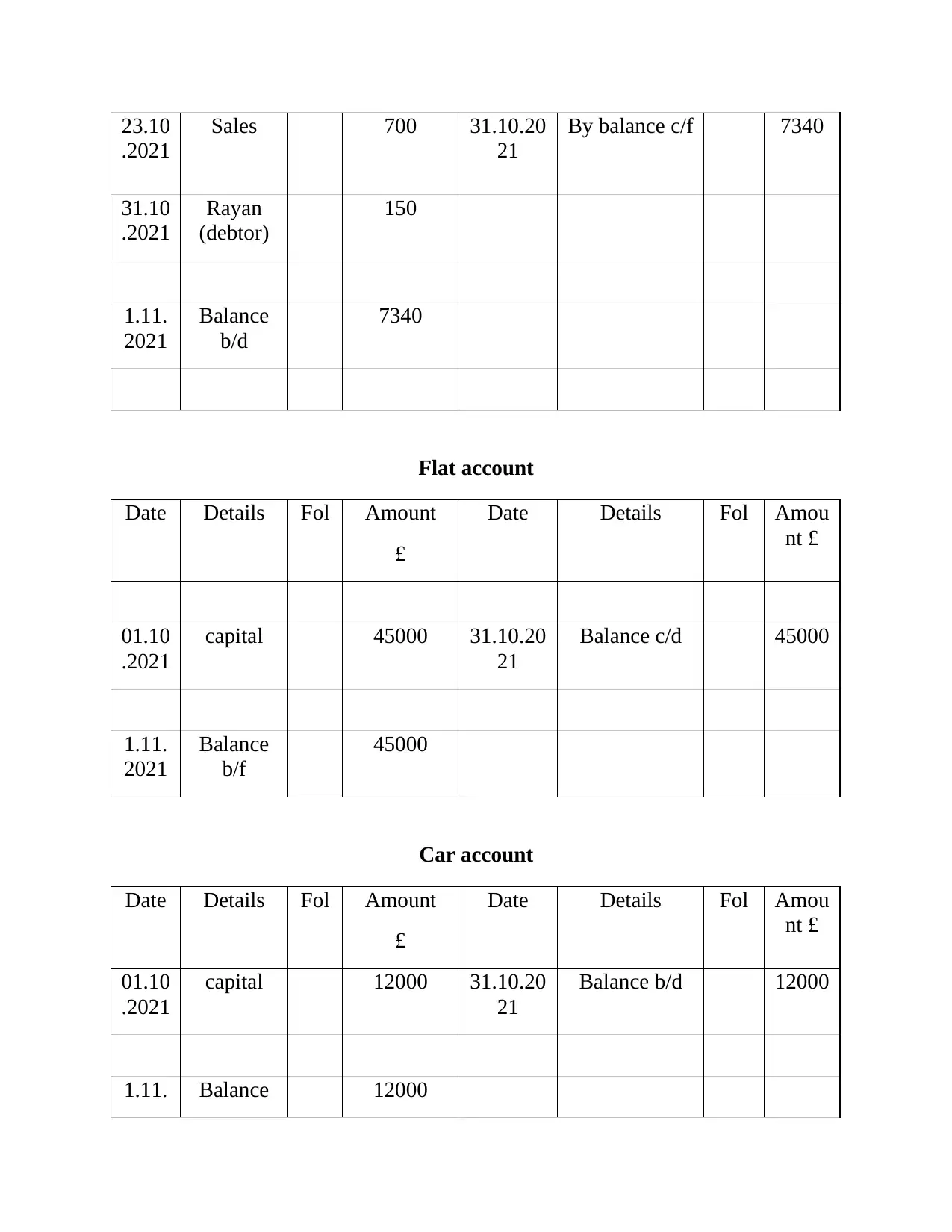

23.10

.2021

Sales 700 31.10.20

21

By balance c/f 7340

31.10

.2021

Rayan

(debtor)

150

1.11.

2021

Balance

b/d

7340

Flat account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

01.10

.2021

capital 45000 31.10.20

21

Balance c/d 45000

1.11.

2021

Balance

b/f

45000

Car account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

01.10

.2021

capital 12000 31.10.20

21

Balance b/d 12000

1.11. Balance 12000

.2021

Sales 700 31.10.20

21

By balance c/f 7340

31.10

.2021

Rayan

(debtor)

150

1.11.

2021

Balance

b/d

7340

Flat account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

01.10

.2021

capital 45000 31.10.20

21

Balance c/d 45000

1.11.

2021

Balance

b/f

45000

Car account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

01.10

.2021

capital 12000 31.10.20

21

Balance b/d 12000

1.11. Balance 12000

2021 c/d

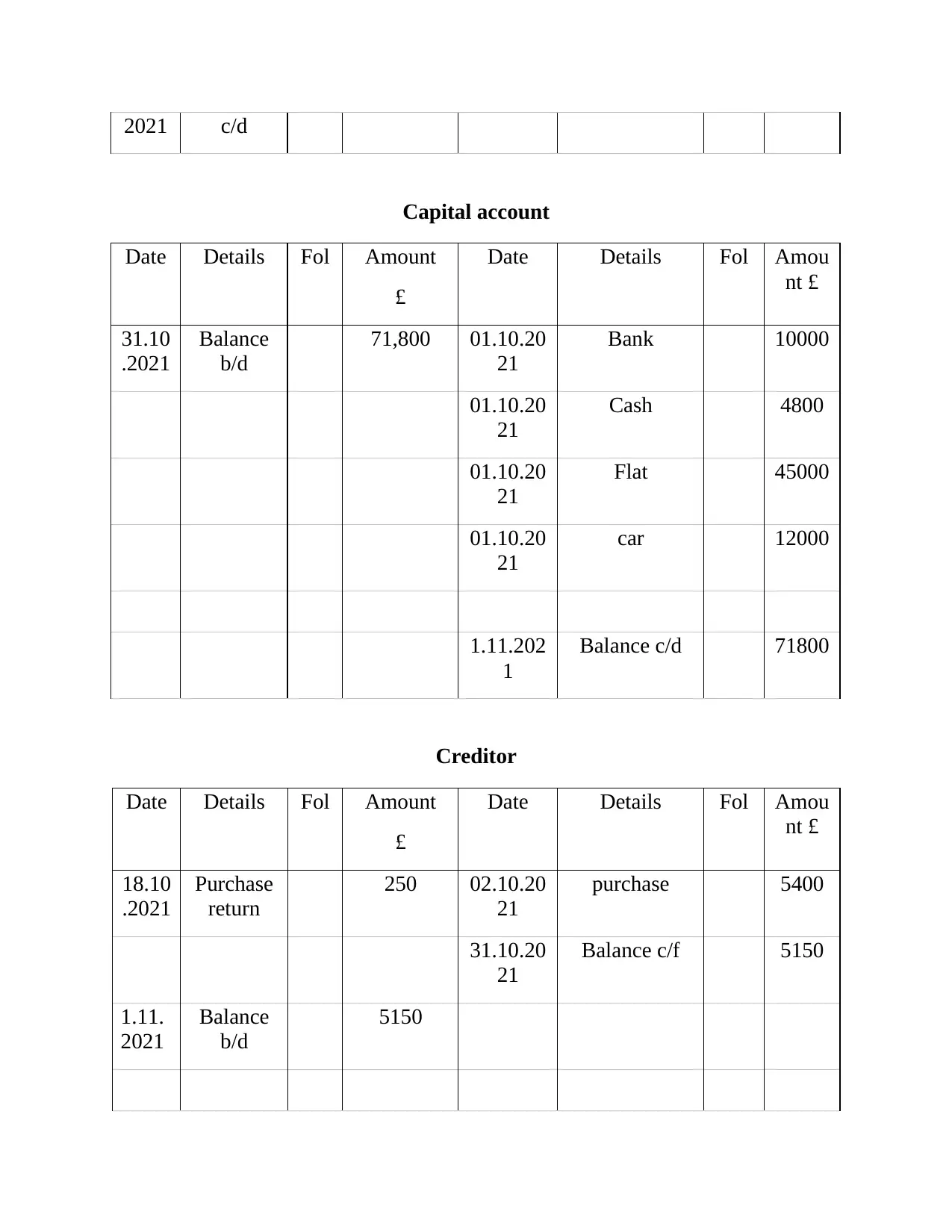

Capital account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

b/d

71,800 01.10.20

21

Bank 10000

01.10.20

21

Cash 4800

01.10.20

21

Flat 45000

01.10.20

21

car 12000

1.11.202

1

Balance c/d 71800

Creditor

Date Details Fol Amount

£

Date Details Fol Amou

nt £

18.10

.2021

Purchase

return

250 02.10.20

21

purchase 5400

31.10.20

21

Balance c/f 5150

1.11.

2021

Balance

b/d

5150

Capital account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

b/d

71,800 01.10.20

21

Bank 10000

01.10.20

21

Cash 4800

01.10.20

21

Flat 45000

01.10.20

21

car 12000

1.11.202

1

Balance c/d 71800

Creditor

Date Details Fol Amount

£

Date Details Fol Amou

nt £

18.10

.2021

Purchase

return

250 02.10.20

21

purchase 5400

31.10.20

21

Balance c/f 5150

1.11.

2021

Balance

b/d

5150

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

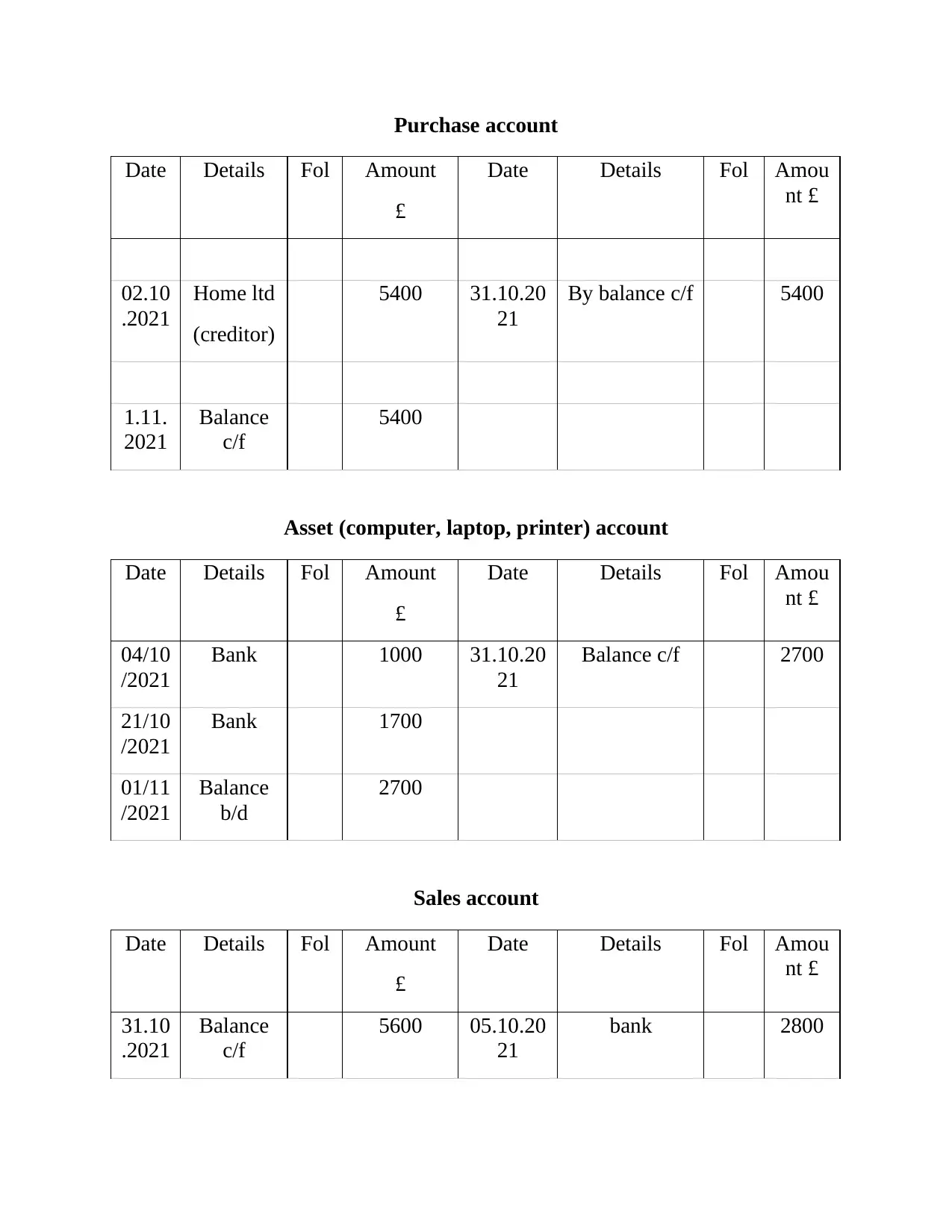

Purchase account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

02.10

.2021

Home ltd

(creditor)

5400 31.10.20

21

By balance c/f 5400

1.11.

2021

Balance

c/f

5400

Asset (computer, laptop, printer) account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

04/10

/2021

Bank 1000 31.10.20

21

Balance c/f 2700

21/10

/2021

Bank 1700

01/11

/2021

Balance

b/d

2700

Sales account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

5600 05.10.20

21

bank 2800

Date Details Fol Amount

£

Date Details Fol Amou

nt £

02.10

.2021

Home ltd

(creditor)

5400 31.10.20

21

By balance c/f 5400

1.11.

2021

Balance

c/f

5400

Asset (computer, laptop, printer) account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

04/10

/2021

Bank 1000 31.10.20

21

Balance c/f 2700

21/10

/2021

Bank 1700

01/11

/2021

Balance

b/d

2700

Sales account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

5600 05.10.20

21

bank 2800

23.10.20

21

Cash 1800

23.10.20

21

Rayan

(debtor)

300

23.10.20

21

Cash 700

1.11.202

1

Balance b/f 5600

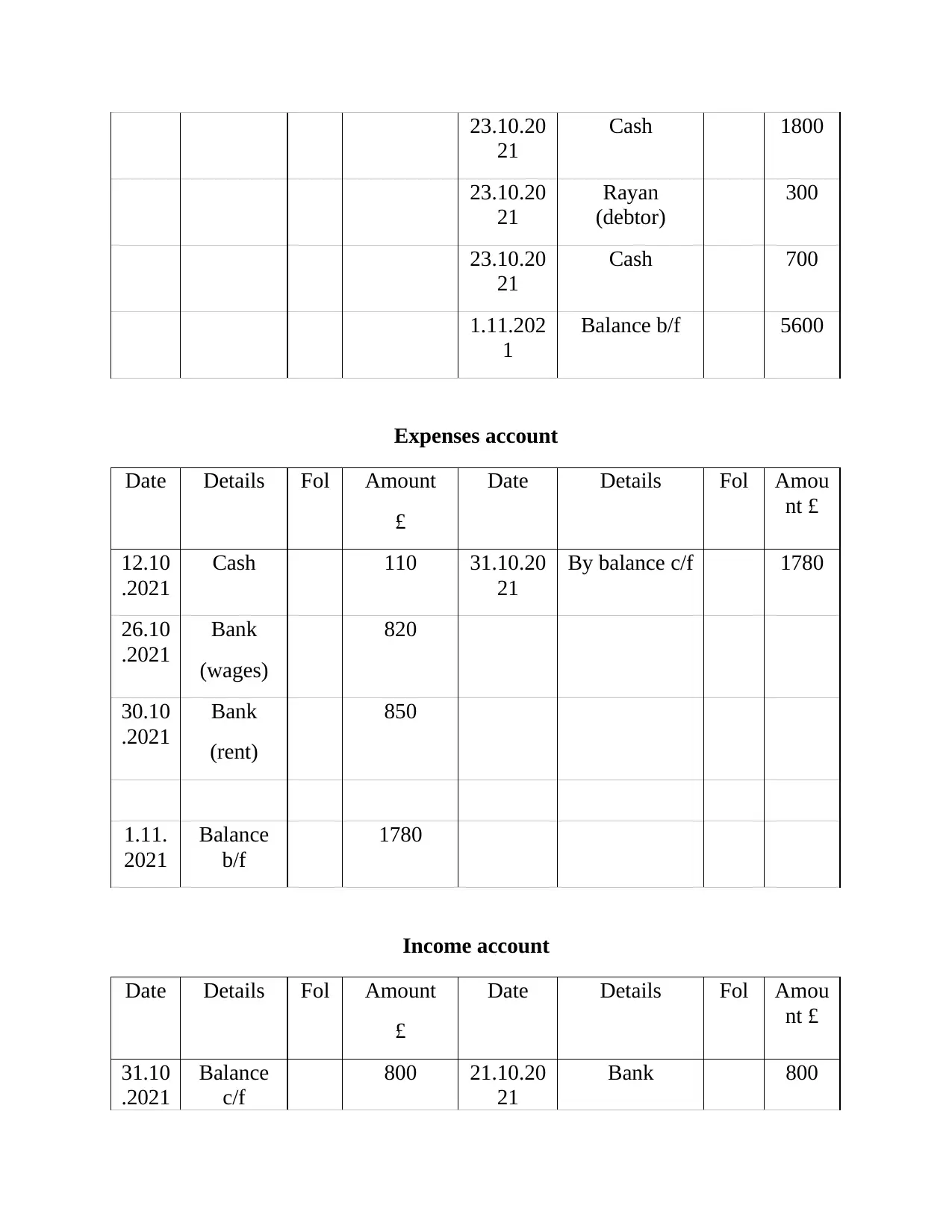

Expenses account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

12.10

.2021

Cash 110 31.10.20

21

By balance c/f 1780

26.10

.2021

Bank

(wages)

820

30.10

.2021

Bank

(rent)

850

1.11.

2021

Balance

b/f

1780

Income account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

800 21.10.20

21

Bank 800

21

Cash 1800

23.10.20

21

Rayan

(debtor)

300

23.10.20

21

Cash 700

1.11.202

1

Balance b/f 5600

Expenses account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

12.10

.2021

Cash 110 31.10.20

21

By balance c/f 1780

26.10

.2021

Bank

(wages)

820

30.10

.2021

Bank

(rent)

850

1.11.

2021

Balance

b/f

1780

Income account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

800 21.10.20

21

Bank 800

(rent)

1.11.202

1

Balance b/f 800

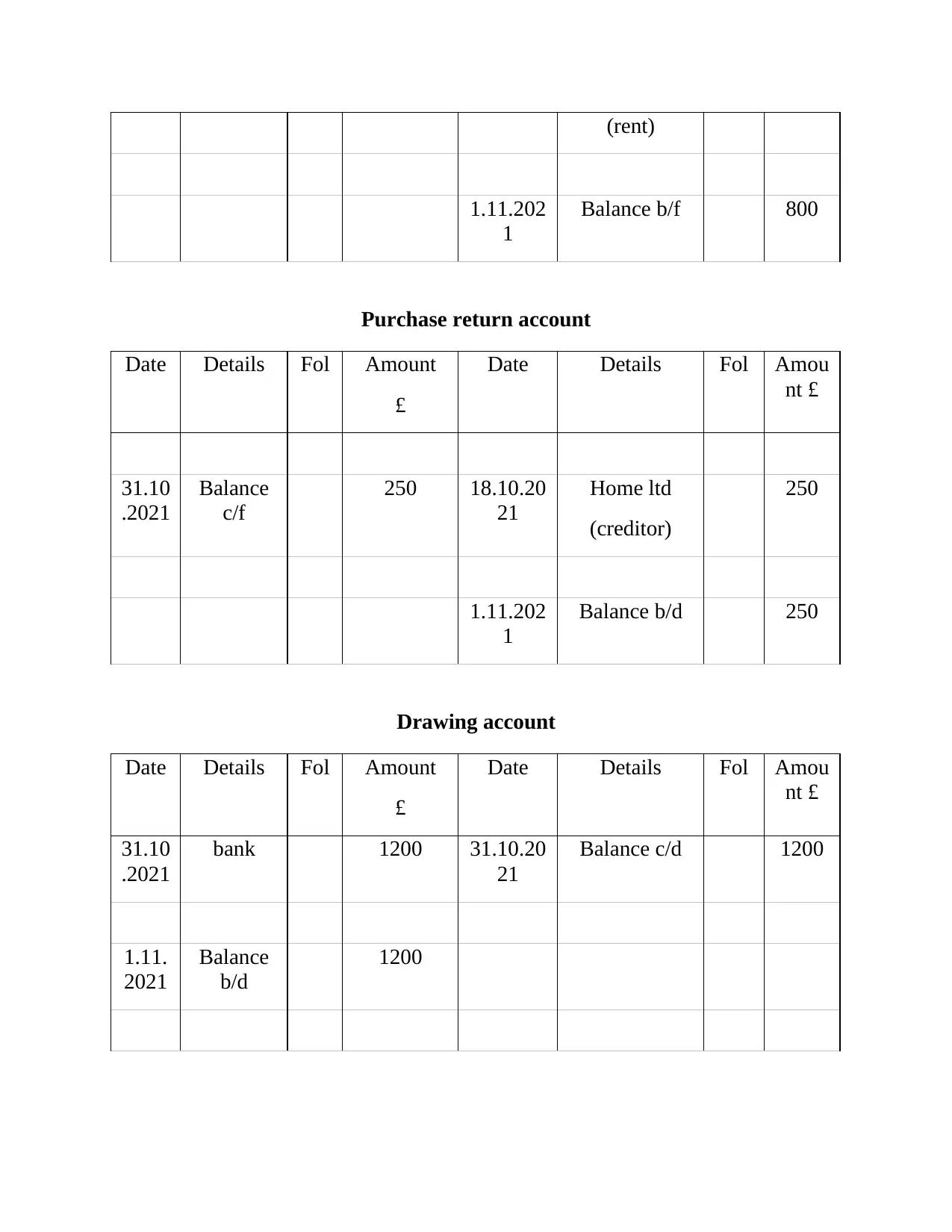

Purchase return account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

250 18.10.20

21

Home ltd

(creditor)

250

1.11.202

1

Balance b/d 250

Drawing account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

bank 1200 31.10.20

21

Balance c/d 1200

1.11.

2021

Balance

b/d

1200

1.11.202

1

Balance b/f 800

Purchase return account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

Balance

c/f

250 18.10.20

21

Home ltd

(creditor)

250

1.11.202

1

Balance b/d 250

Drawing account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

31.10

.2021

bank 1200 31.10.20

21

Balance c/d 1200

1.11.

2021

Balance

b/d

1200

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

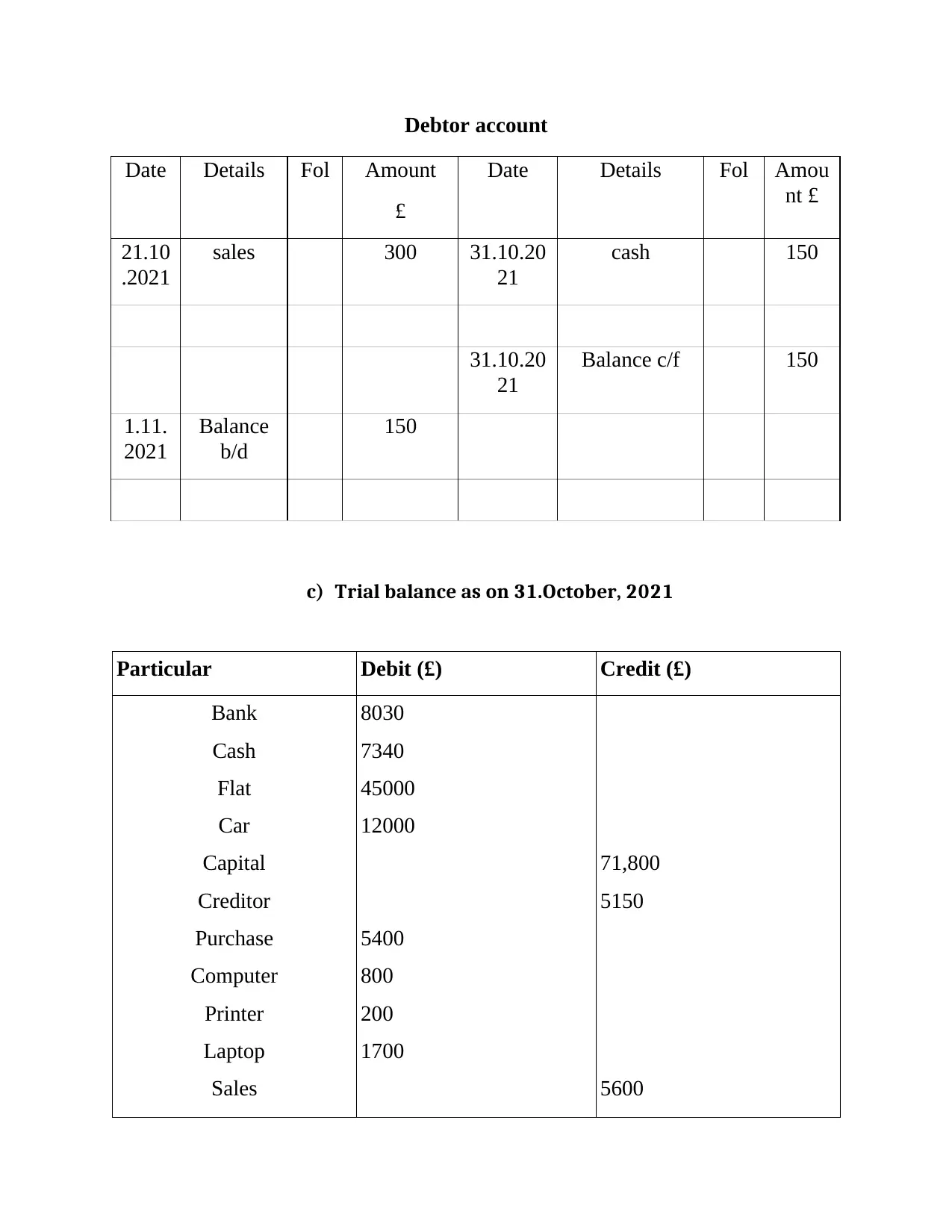

Debtor account

Date Details Fol Amount

£

Date Details Fol Amou

nt £

21.10

.2021

sales 300 31.10.20

21

cash 150

31.10.20

21

Balance c/f 150

1.11.

2021

Balance

b/d

150

c) Trial balance as on 31.October, 2021

Particular Debit (£) Credit (£)

Bank

Cash

Flat

Car

Capital

Creditor

Purchase

Computer

Printer

Laptop

Sales

8030

7340

45000

12000

5400

800

200

1700

71,800

5150

5600

Date Details Fol Amount

£

Date Details Fol Amou

nt £

21.10

.2021

sales 300 31.10.20

21

cash 150

31.10.20

21

Balance c/f 150

1.11.

2021

Balance

b/d

150

c) Trial balance as on 31.October, 2021

Particular Debit (£) Credit (£)

Bank

Cash

Flat

Car

Capital

Creditor

Purchase

Computer

Printer

Laptop

Sales

8030

7340

45000

12000

5400

800

200

1700

71,800

5150

5600

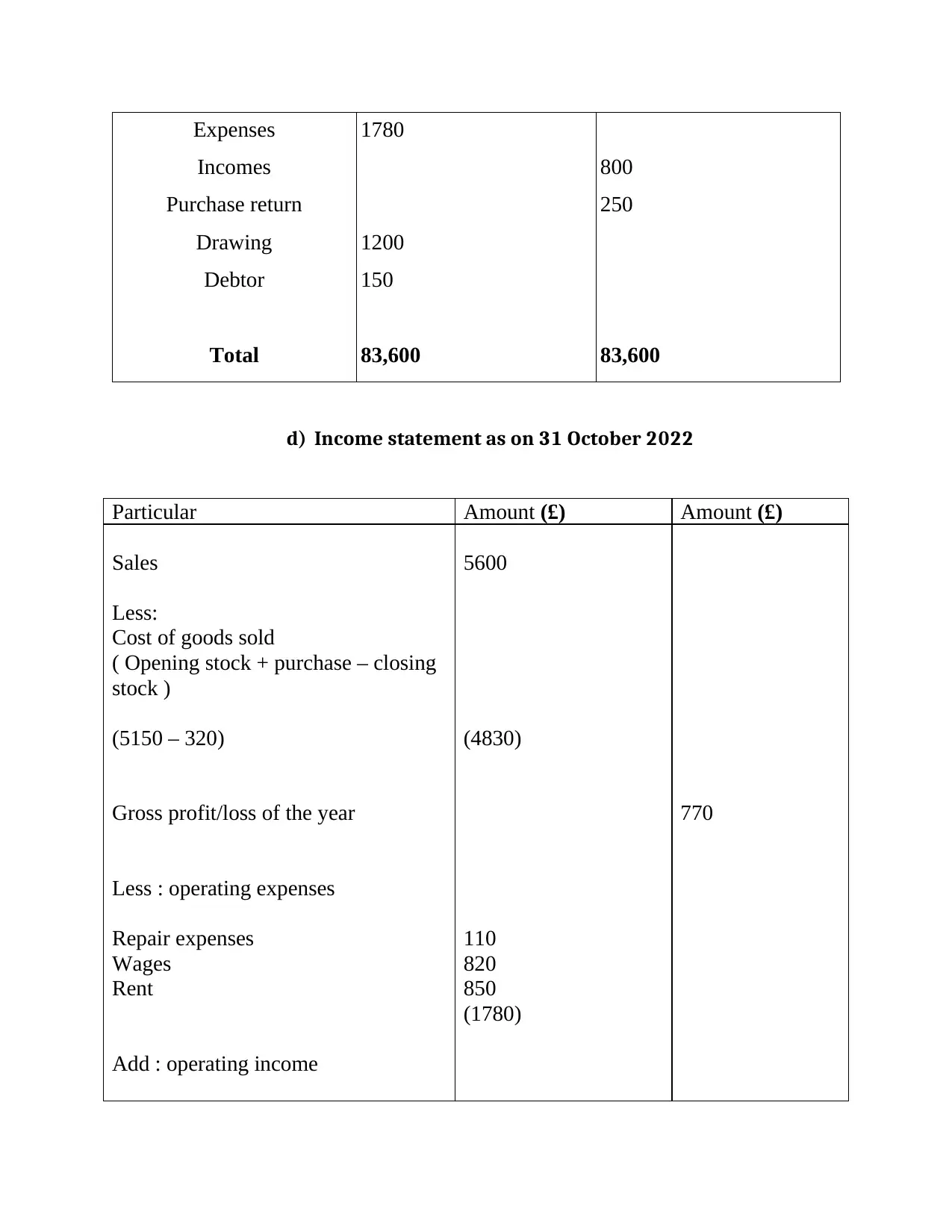

Expenses

Incomes

Purchase return

Drawing

Debtor

Total

1780

1200

150

83,600

800

250

83,600

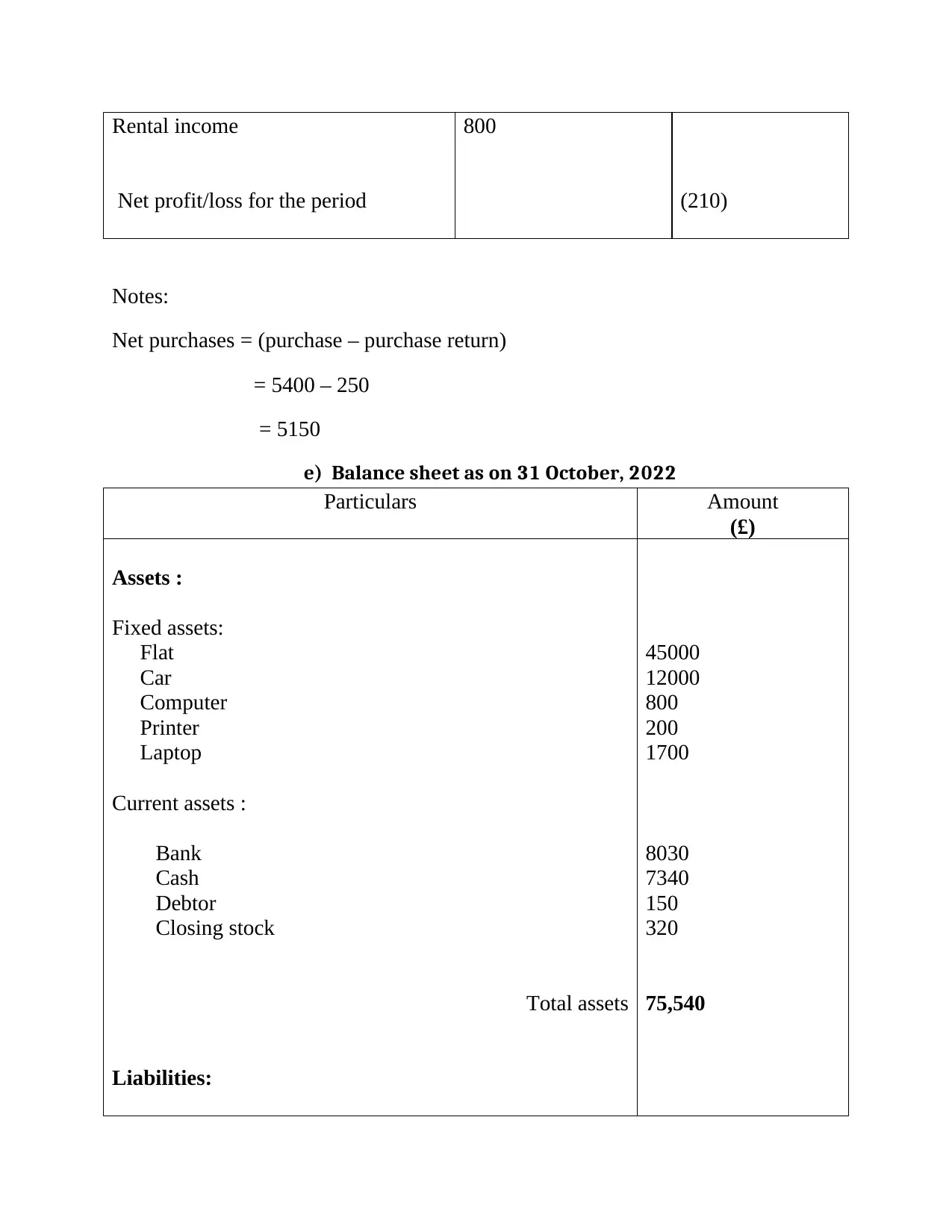

d) Income statement as on 31 October 2022

Particular Amount (£) Amount (£)

Sales

Less:

Cost of goods sold

( Opening stock + purchase – closing

stock )

(5150 – 320)

Gross profit/loss of the year

Less : operating expenses

Repair expenses

Wages

Rent

Add : operating income

5600

(4830)

110

820

850

(1780)

770

Incomes

Purchase return

Drawing

Debtor

Total

1780

1200

150

83,600

800

250

83,600

d) Income statement as on 31 October 2022

Particular Amount (£) Amount (£)

Sales

Less:

Cost of goods sold

( Opening stock + purchase – closing

stock )

(5150 – 320)

Gross profit/loss of the year

Less : operating expenses

Repair expenses

Wages

Rent

Add : operating income

5600

(4830)

110

820

850

(1780)

770

Rental income

Net profit/loss for the period

800

(210)

Notes:

Net purchases = (purchase – purchase return)

= 5400 – 250

= 5150

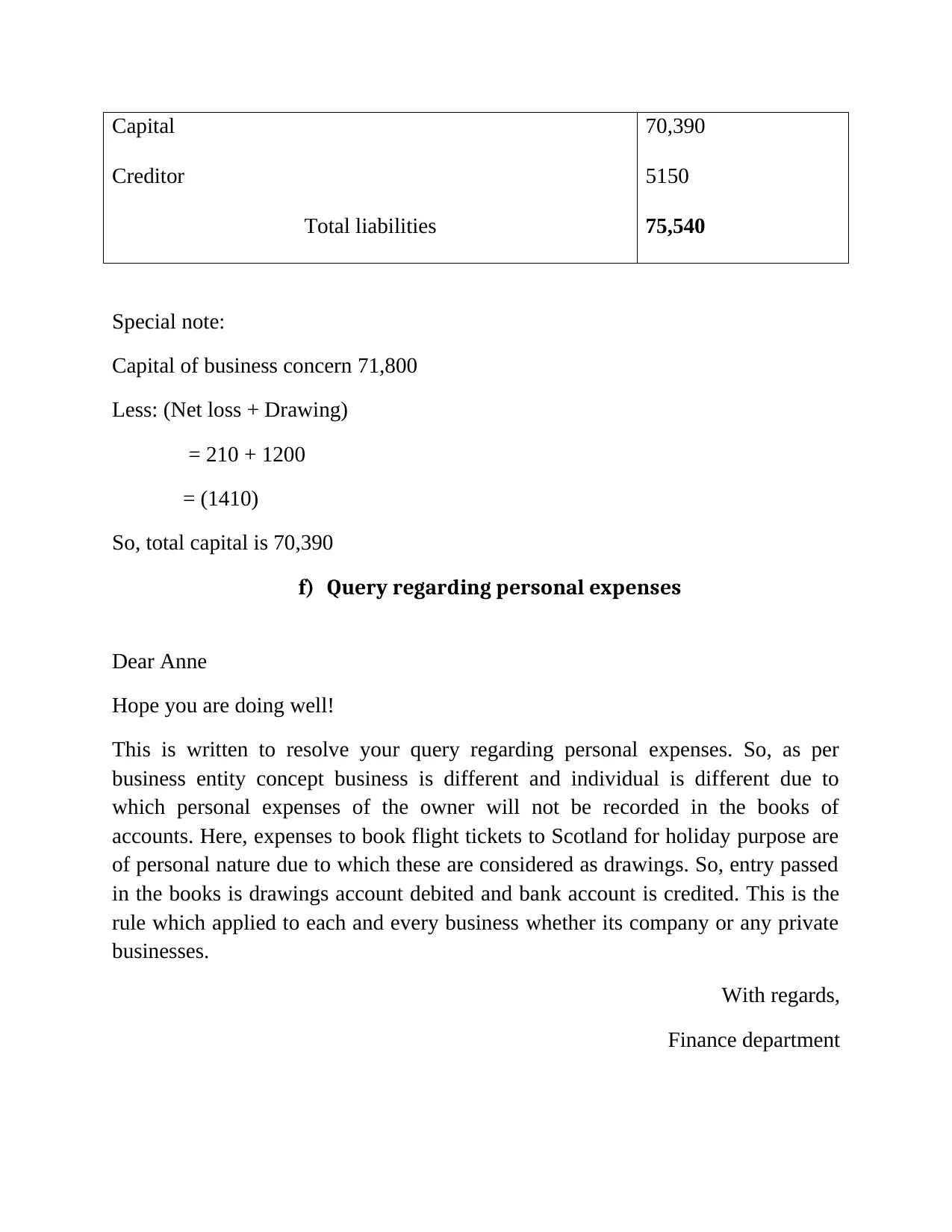

e) Balance sheet as on 31 October, 2022

Particulars Amount

(£)

Assets :

Fixed assets:

Flat

Car

Computer

Printer

Laptop

Current assets :

Bank

Cash

Debtor

Closing stock

Total assets

Liabilities:

45000

12000

800

200

1700

8030

7340

150

320

75,540

Net profit/loss for the period

800

(210)

Notes:

Net purchases = (purchase – purchase return)

= 5400 – 250

= 5150

e) Balance sheet as on 31 October, 2022

Particulars Amount

(£)

Assets :

Fixed assets:

Flat

Car

Computer

Printer

Laptop

Current assets :

Bank

Cash

Debtor

Closing stock

Total assets

Liabilities:

45000

12000

800

200

1700

8030

7340

150

320

75,540

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Capital

Creditor

Total liabilities

70,390

5150

75,540

Special note:

Capital of business concern 71,800

Less: (Net loss + Drawing)

= 210 + 1200

= (1410)

So, total capital is 70,390

f) Query regarding personal expenses

Dear Anne

Hope you are doing well!

This is written to resolve your query regarding personal expenses. So, as per

business entity concept business is different and individual is different due to

which personal expenses of the owner will not be recorded in the books of

accounts. Here, expenses to book flight tickets to Scotland for holiday purpose are

of personal nature due to which these are considered as drawings. So, entry passed

in the books is drawings account debited and bank account is credited. This is the

rule which applied to each and every business whether its company or any private

businesses.

With regards,

Finance department

Creditor

Total liabilities

70,390

5150

75,540

Special note:

Capital of business concern 71,800

Less: (Net loss + Drawing)

= 210 + 1200

= (1410)

So, total capital is 70,390

f) Query regarding personal expenses

Dear Anne

Hope you are doing well!

This is written to resolve your query regarding personal expenses. So, as per

business entity concept business is different and individual is different due to

which personal expenses of the owner will not be recorded in the books of

accounts. Here, expenses to book flight tickets to Scotland for holiday purpose are

of personal nature due to which these are considered as drawings. So, entry passed

in the books is drawings account debited and bank account is credited. This is the

rule which applied to each and every business whether its company or any private

businesses.

With regards,

Finance department

Part B

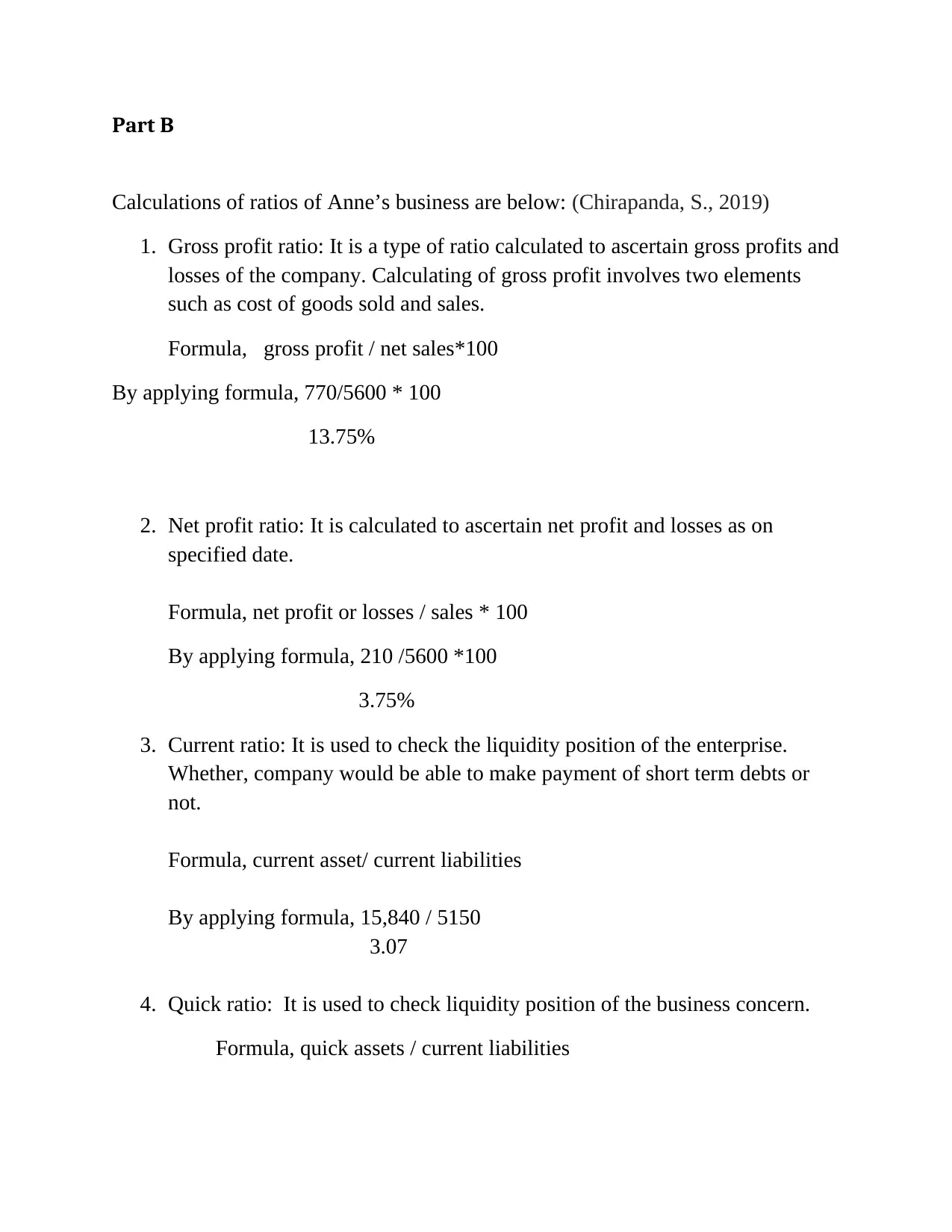

Calculations of ratios of Anne’s business are below: (Chirapanda, S., 2019)

1. Gross profit ratio: It is a type of ratio calculated to ascertain gross profits and

losses of the company. Calculating of gross profit involves two elements

such as cost of goods sold and sales.

Formula, gross profit / net sales*100

By applying formula, 770/5600 * 100

13.75%

2. Net profit ratio: It is calculated to ascertain net profit and losses as on

specified date.

Formula, net profit or losses / sales * 100

By applying formula, 210 /5600 *100

3.75%

3. Current ratio: It is used to check the liquidity position of the enterprise.

Whether, company would be able to make payment of short term debts or

not.

Formula, current asset/ current liabilities

By applying formula, 15,840 / 5150

3.07

4. Quick ratio: It is used to check liquidity position of the business concern.

Formula, quick assets / current liabilities

Calculations of ratios of Anne’s business are below: (Chirapanda, S., 2019)

1. Gross profit ratio: It is a type of ratio calculated to ascertain gross profits and

losses of the company. Calculating of gross profit involves two elements

such as cost of goods sold and sales.

Formula, gross profit / net sales*100

By applying formula, 770/5600 * 100

13.75%

2. Net profit ratio: It is calculated to ascertain net profit and losses as on

specified date.

Formula, net profit or losses / sales * 100

By applying formula, 210 /5600 *100

3.75%

3. Current ratio: It is used to check the liquidity position of the enterprise.

Whether, company would be able to make payment of short term debts or

not.

Formula, current asset/ current liabilities

By applying formula, 15,840 / 5150

3.07

4. Quick ratio: It is used to check liquidity position of the business concern.

Formula, quick assets / current liabilities

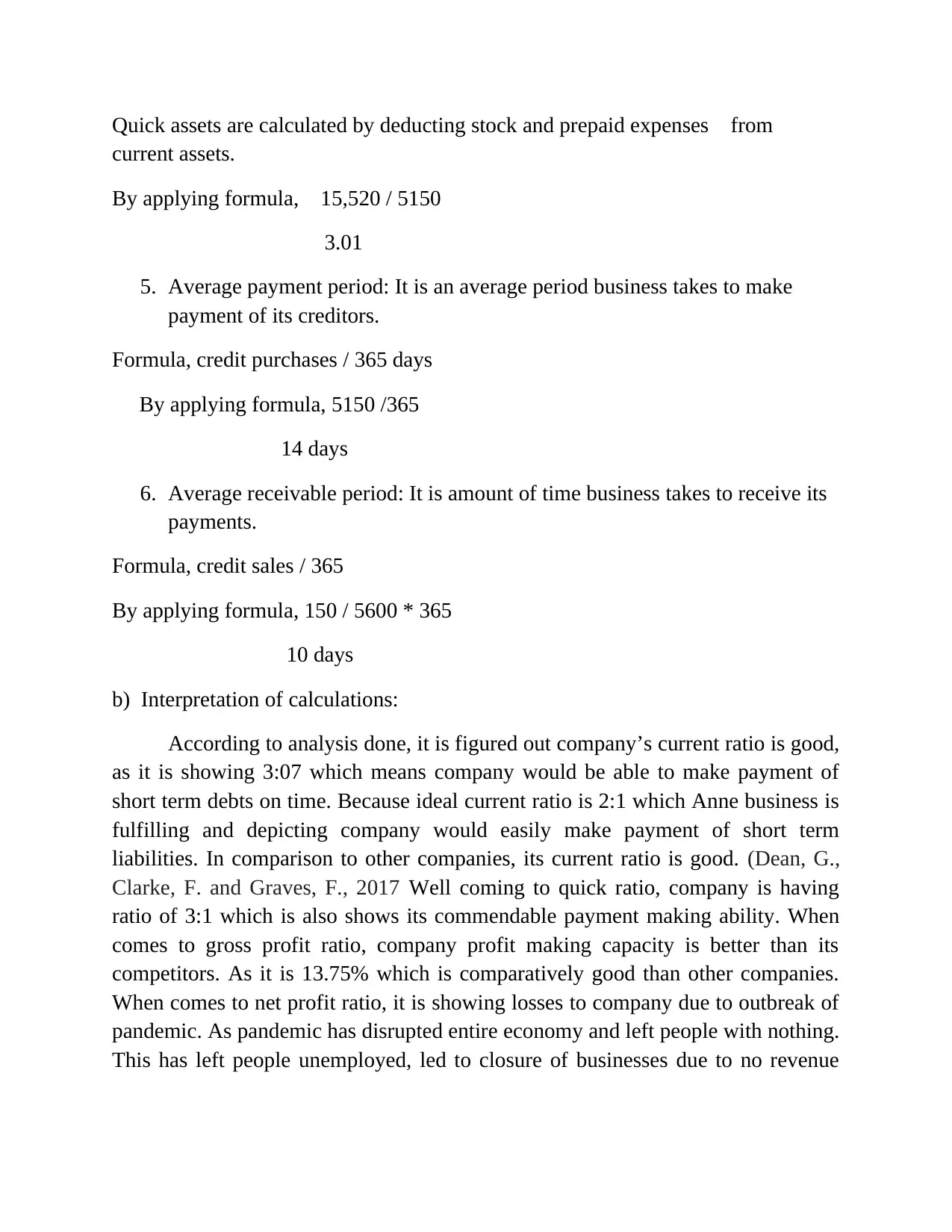

Quick assets are calculated by deducting stock and prepaid expenses from

current assets.

By applying formula, 15,520 / 5150

3.01

5. Average payment period: It is an average period business takes to make

payment of its creditors.

Formula, credit purchases / 365 days

By applying formula, 5150 /365

14 days

6. Average receivable period: It is amount of time business takes to receive its

payments.

Formula, credit sales / 365

By applying formula, 150 / 5600 * 365

10 days

b) Interpretation of calculations:

According to analysis done, it is figured out company’s current ratio is good,

as it is showing 3:07 which means company would be able to make payment of

short term debts on time. Because ideal current ratio is 2:1 which Anne business is

fulfilling and depicting company would easily make payment of short term

liabilities. In comparison to other companies, its current ratio is good. (Dean, G.,

Clarke, F. and Graves, F., 2017 Well coming to quick ratio, company is having

ratio of 3:1 which is also shows its commendable payment making ability. When

comes to gross profit ratio, company profit making capacity is better than its

competitors. As it is 13.75% which is comparatively good than other companies.

When comes to net profit ratio, it is showing losses to company due to outbreak of

pandemic. As pandemic has disrupted entire economy and left people with nothing.

This has left people unemployed, led to closure of businesses due to no revenue

current assets.

By applying formula, 15,520 / 5150

3.01

5. Average payment period: It is an average period business takes to make

payment of its creditors.

Formula, credit purchases / 365 days

By applying formula, 5150 /365

14 days

6. Average receivable period: It is amount of time business takes to receive its

payments.

Formula, credit sales / 365

By applying formula, 150 / 5600 * 365

10 days

b) Interpretation of calculations:

According to analysis done, it is figured out company’s current ratio is good,

as it is showing 3:07 which means company would be able to make payment of

short term debts on time. Because ideal current ratio is 2:1 which Anne business is

fulfilling and depicting company would easily make payment of short term

liabilities. In comparison to other companies, its current ratio is good. (Dean, G.,

Clarke, F. and Graves, F., 2017 Well coming to quick ratio, company is having

ratio of 3:1 which is also shows its commendable payment making ability. When

comes to gross profit ratio, company profit making capacity is better than its

competitors. As it is 13.75% which is comparatively good than other companies.

When comes to net profit ratio, it is showing losses to company due to outbreak of

pandemic. As pandemic has disrupted entire economy and left people with nothing.

This has left people unemployed, led to closure of businesses due to no revenue

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

and various other negative impacts. So, due to these reasons company has losses in

the year, 2020. (Chung, J. and Cho, C. H., 2018. )

Conclusion:

With respect to above report, it is concluded that company has to record all

of its monetary transactions systematically in order to communicate it to the users.

Companies records all the transactions firstly in journal books then took these

balances in ledger account and trial balance. At the last, income statement and

balance sheet is prepared to ascertain true and fair position of concern as on

specified date. In this report, ratios are calculated to evaluate performance of

business and compare with other entities.

the year, 2020. (Chung, J. and Cho, C. H., 2018. )

Conclusion:

With respect to above report, it is concluded that company has to record all

of its monetary transactions systematically in order to communicate it to the users.

Companies records all the transactions firstly in journal books then took these

balances in ledger account and trial balance. At the last, income statement and

balance sheet is prepared to ascertain true and fair position of concern as on

specified date. In this report, ratios are calculated to evaluate performance of

business and compare with other entities.

References:

Books and journals:

Chirapanda, S., 2019. Identification of success factors for sustainability in family

businesses: case study method and exploratory research in Japan. Journal of

Family Business Management.

Chung, J. and Cho, C. H., 2018. Current trends within social and environmental

accounting research: a literature review. Accounting Perspectives, 17(2).

pp.207-239.

Dean, G., Clarke, F. and Graves, F., 2017. Replacement costs and accounting

reform in post-World War I Germany (Vol. 2). Taylor & Francis.

Deegan, C., 2017. Twenty five years of social and environmental accounting

research within Critical Perspectives of Accounting: Hits, misses and ways

forward. Critical Perspectives on Accounting, 43. pp.65-87.

Gullifer, L., 2021. The Financing of Micro-Businesses in the UK: The Current

Position and the Way Forward. The financing of micro-businesses in the

UK: the current position and the way forward (in N. Orkun Akseli & John

Linarelli, The Future of Commercial Law: Ways Forward for Change and

Reform, Hart 2020), University of Cambridge Faculty of Law Research

Paper, (17).

Håkansson, H. and Snehota, I. eds., 2017. No business is an island: Making sense

of the interactive business world. Emerald Group Publishing.

Kapoor, N. and Goel, S., 2017. Board characteristics, firm profitability and

earnings management: evidence from India. Australian Accounting

Review, 27(2). pp.180-194.

Kim, M. J., Lee, K. M. and Earle, J. S., 2021. Does the Community Reinvestment

Act increase lending to small businesses in lower income

neighborhoods?. Economics Letters, 209. p.110146.

Zwick, G. A. and Jurinski, J. J., 2019. VALUATION TECHNIQUES AND

STRATEGIES TO MINIMIZE TAXES ON FAMILY BUSINESSES.

In Tax and Financial Planning for the Closely Held Family Business.

Edward Elgar Publishing.

Books and journals:

Chirapanda, S., 2019. Identification of success factors for sustainability in family

businesses: case study method and exploratory research in Japan. Journal of

Family Business Management.

Chung, J. and Cho, C. H., 2018. Current trends within social and environmental

accounting research: a literature review. Accounting Perspectives, 17(2).

pp.207-239.

Dean, G., Clarke, F. and Graves, F., 2017. Replacement costs and accounting

reform in post-World War I Germany (Vol. 2). Taylor & Francis.

Deegan, C., 2017. Twenty five years of social and environmental accounting

research within Critical Perspectives of Accounting: Hits, misses and ways

forward. Critical Perspectives on Accounting, 43. pp.65-87.

Gullifer, L., 2021. The Financing of Micro-Businesses in the UK: The Current

Position and the Way Forward. The financing of micro-businesses in the

UK: the current position and the way forward (in N. Orkun Akseli & John

Linarelli, The Future of Commercial Law: Ways Forward for Change and

Reform, Hart 2020), University of Cambridge Faculty of Law Research

Paper, (17).

Håkansson, H. and Snehota, I. eds., 2017. No business is an island: Making sense

of the interactive business world. Emerald Group Publishing.

Kapoor, N. and Goel, S., 2017. Board characteristics, firm profitability and

earnings management: evidence from India. Australian Accounting

Review, 27(2). pp.180-194.

Kim, M. J., Lee, K. M. and Earle, J. S., 2021. Does the Community Reinvestment

Act increase lending to small businesses in lower income

neighborhoods?. Economics Letters, 209. p.110146.

Zwick, G. A. and Jurinski, J. J., 2019. VALUATION TECHNIQUES AND

STRATEGIES TO MINIMIZE TAXES ON FAMILY BUSINESSES.

In Tax and Financial Planning for the Closely Held Family Business.

Edward Elgar Publishing.

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.