Recording Business Transactions: Assessment 2

VerifiedAdded on 2023/06/15

|14

|1816

|333

AI Summary

This report discusses the recording of business transactions, preparation of financial statements, and interpretation of accounting ratios. It also explores the impact of Covid-19 on the profits of the business. The report includes journal entries, general ledgers, trial balance, income statement, and balance sheet.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business Transactions

ASSESSMENT 2

ASSESSMENT 2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

Record the enterprise proceedings in the journal........................................................................3

Prepare general ledgers...............................................................................................................5

Formulate the Trial Balance........................................................................................................8

Construct the Income Statement.................................................................................................8

Provide details of the Balance Sheet...........................................................................................9

Explain the drawings in the case of Anne to Linda .................................................................10

TASK 2 .........................................................................................................................................10

Determine the Accounting Ratios of the Business....................................................................10

What can be seen as an impact of Covid-19 on the profits of the business..............................11

CONCLUSION .............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION ..........................................................................................................................3

TASK 1............................................................................................................................................3

Record the enterprise proceedings in the journal........................................................................3

Prepare general ledgers...............................................................................................................5

Formulate the Trial Balance........................................................................................................8

Construct the Income Statement.................................................................................................8

Provide details of the Balance Sheet...........................................................................................9

Explain the drawings in the case of Anne to Linda .................................................................10

TASK 2 .........................................................................................................................................10

Determine the Accounting Ratios of the Business....................................................................10

What can be seen as an impact of Covid-19 on the profits of the business..............................11

CONCLUSION .............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

The business transactions means all the monetary and non-monetary events that take

place in the business which relates to the operations of the business done for the motive of

earning profits (de Souza Junior, and et.al.,2019). The above discussed transactions are recorded

in the books of accounts of the business for the motive of determining the profits earned by the

business. The further report highlights how different transactions are recorded in the books of

accounts of the business and further transferred to the financial statements to derive profits or

losses from these transactions. Ratio analysis is also performed of the different financial values

and an interpretation is provided for the same.

TASK 1

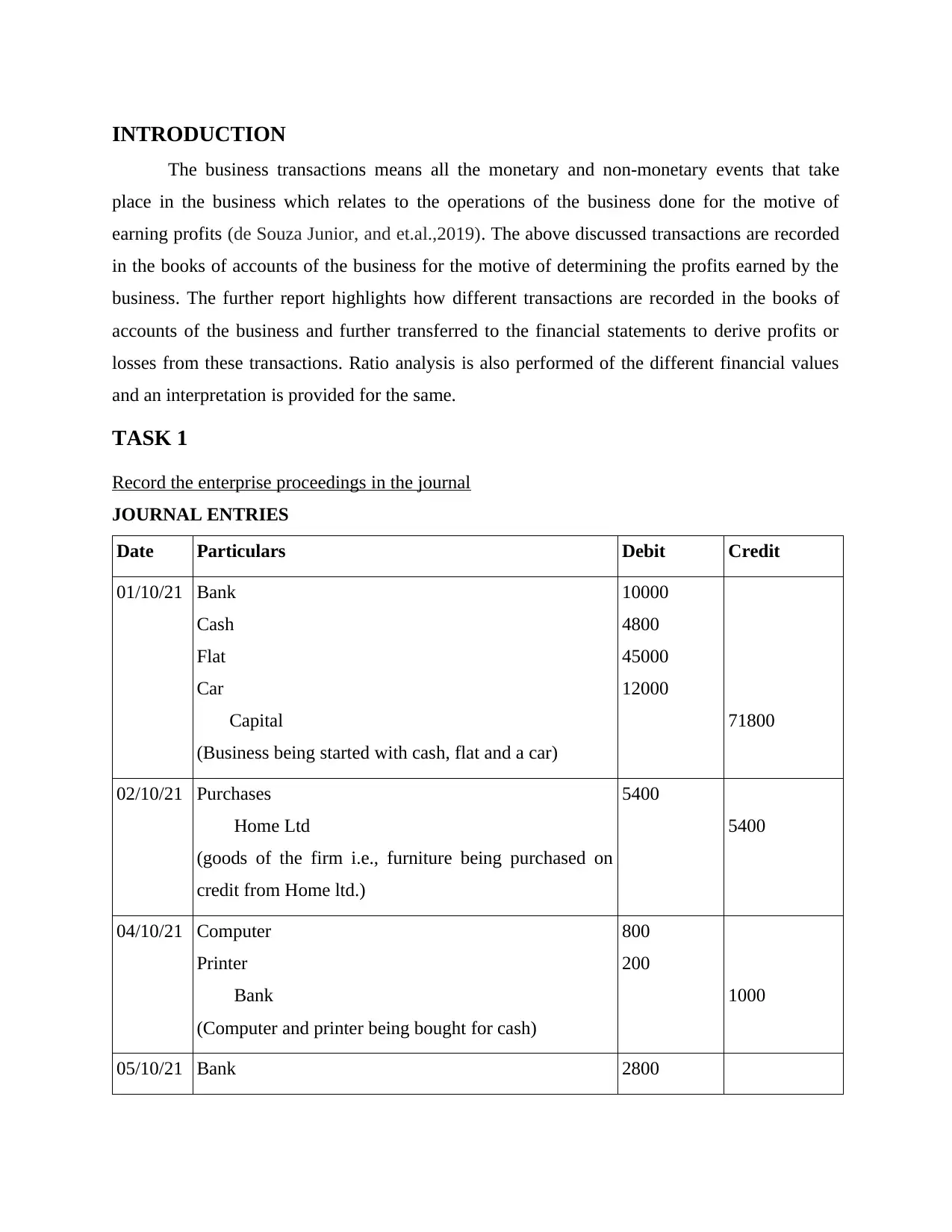

Record the enterprise proceedings in the journal

JOURNAL ENTRIES

Date Particulars Debit Credit

01/10/21 Bank

Cash

Flat

Car

Capital

(Business being started with cash, flat and a car)

10000

4800

45000

12000

71800

02/10/21 Purchases

Home Ltd

(goods of the firm i.e., furniture being purchased on

credit from Home ltd.)

5400

5400

04/10/21 Computer

Printer

Bank

(Computer and printer being bought for cash)

800

200

1000

05/10/21 Bank 2800

The business transactions means all the monetary and non-monetary events that take

place in the business which relates to the operations of the business done for the motive of

earning profits (de Souza Junior, and et.al.,2019). The above discussed transactions are recorded

in the books of accounts of the business for the motive of determining the profits earned by the

business. The further report highlights how different transactions are recorded in the books of

accounts of the business and further transferred to the financial statements to derive profits or

losses from these transactions. Ratio analysis is also performed of the different financial values

and an interpretation is provided for the same.

TASK 1

Record the enterprise proceedings in the journal

JOURNAL ENTRIES

Date Particulars Debit Credit

01/10/21 Bank

Cash

Flat

Car

Capital

(Business being started with cash, flat and a car)

10000

4800

45000

12000

71800

02/10/21 Purchases

Home Ltd

(goods of the firm i.e., furniture being purchased on

credit from Home ltd.)

5400

5400

04/10/21 Computer

Printer

Bank

(Computer and printer being bought for cash)

800

200

1000

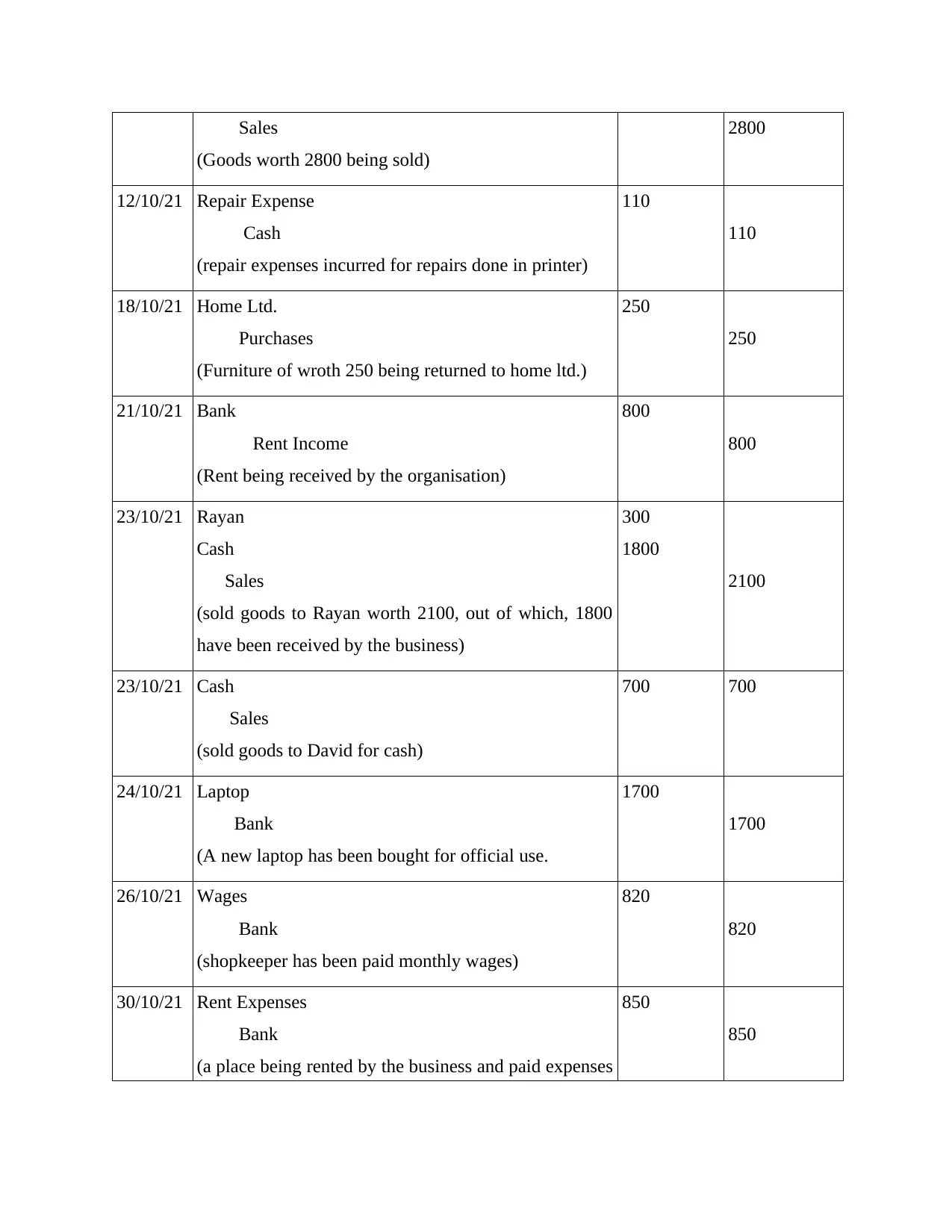

05/10/21 Bank 2800

Sales

(Goods worth 2800 being sold)

2800

12/10/21 Repair Expense

Cash

(repair expenses incurred for repairs done in printer)

110

110

18/10/21 Home Ltd.

Purchases

(Furniture of wroth 250 being returned to home ltd.)

250

250

21/10/21 Bank

Rent Income

(Rent being received by the organisation)

800

800

23/10/21 Rayan

Cash

Sales

(sold goods to Rayan worth 2100, out of which, 1800

have been received by the business)

300

1800

2100

23/10/21 Cash

Sales

(sold goods to David for cash)

700 700

24/10/21 Laptop

Bank

(A new laptop has been bought for official use.

1700

1700

26/10/21 Wages

Bank

(shopkeeper has been paid monthly wages)

820

820

30/10/21 Rent Expenses

Bank

(a place being rented by the business and paid expenses

850

850

(Goods worth 2800 being sold)

2800

12/10/21 Repair Expense

Cash

(repair expenses incurred for repairs done in printer)

110

110

18/10/21 Home Ltd.

Purchases

(Furniture of wroth 250 being returned to home ltd.)

250

250

21/10/21 Bank

Rent Income

(Rent being received by the organisation)

800

800

23/10/21 Rayan

Cash

Sales

(sold goods to Rayan worth 2100, out of which, 1800

have been received by the business)

300

1800

2100

23/10/21 Cash

Sales

(sold goods to David for cash)

700 700

24/10/21 Laptop

Bank

(A new laptop has been bought for official use.

1700

1700

26/10/21 Wages

Bank

(shopkeeper has been paid monthly wages)

820

820

30/10/21 Rent Expenses

Bank

(a place being rented by the business and paid expenses

850

850

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

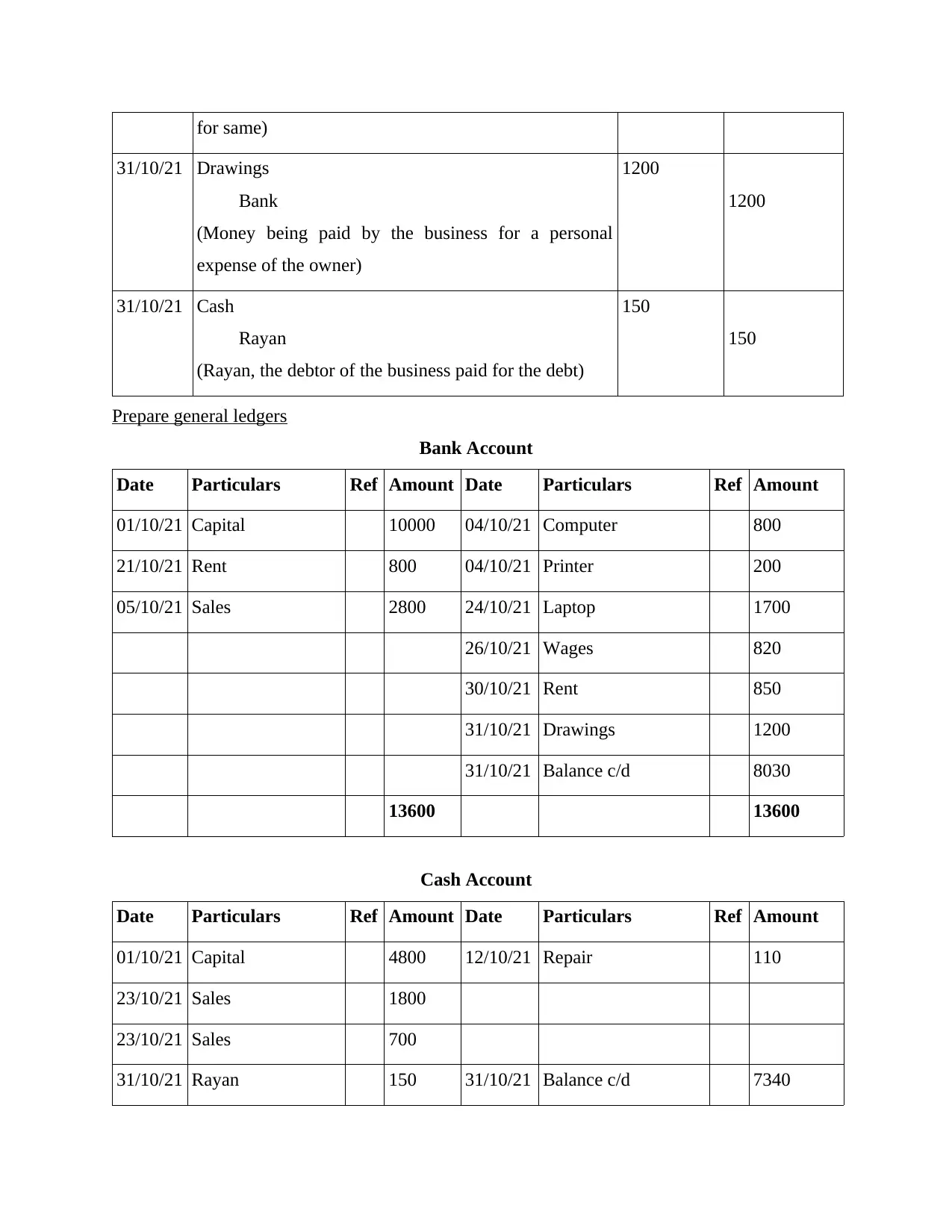

for same)

31/10/21 Drawings

Bank

(Money being paid by the business for a personal

expense of the owner)

1200

1200

31/10/21 Cash

Rayan

(Rayan, the debtor of the business paid for the debt)

150

150

Prepare general ledgers

Bank Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 10000 04/10/21 Computer 800

21/10/21 Rent 800 04/10/21 Printer 200

05/10/21 Sales 2800 24/10/21 Laptop 1700

26/10/21 Wages 820

30/10/21 Rent 850

31/10/21 Drawings 1200

31/10/21 Balance c/d 8030

13600 13600

Cash Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 4800 12/10/21 Repair 110

23/10/21 Sales 1800

23/10/21 Sales 700

31/10/21 Rayan 150 31/10/21 Balance c/d 7340

31/10/21 Drawings

Bank

(Money being paid by the business for a personal

expense of the owner)

1200

1200

31/10/21 Cash

Rayan

(Rayan, the debtor of the business paid for the debt)

150

150

Prepare general ledgers

Bank Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 10000 04/10/21 Computer 800

21/10/21 Rent 800 04/10/21 Printer 200

05/10/21 Sales 2800 24/10/21 Laptop 1700

26/10/21 Wages 820

30/10/21 Rent 850

31/10/21 Drawings 1200

31/10/21 Balance c/d 8030

13600 13600

Cash Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 4800 12/10/21 Repair 110

23/10/21 Sales 1800

23/10/21 Sales 700

31/10/21 Rayan 150 31/10/21 Balance c/d 7340

7450 7450

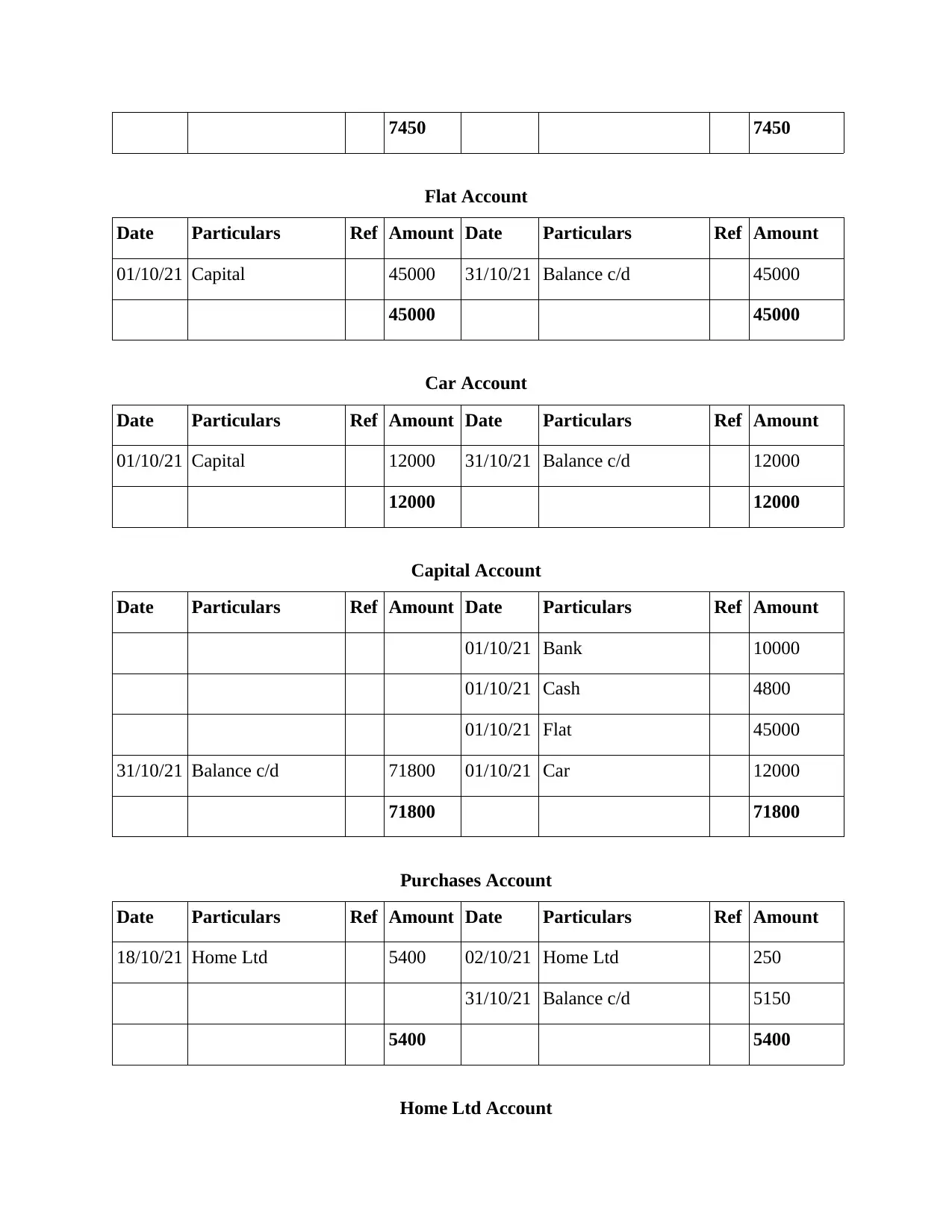

Flat Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 45000 31/10/21 Balance c/d 45000

45000 45000

Car Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 12000 31/10/21 Balance c/d 12000

12000 12000

Capital Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Bank 10000

01/10/21 Cash 4800

01/10/21 Flat 45000

31/10/21 Balance c/d 71800 01/10/21 Car 12000

71800 71800

Purchases Account

Date Particulars Ref Amount Date Particulars Ref Amount

18/10/21 Home Ltd 5400 02/10/21 Home Ltd 250

31/10/21 Balance c/d 5150

5400 5400

Home Ltd Account

Flat Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 45000 31/10/21 Balance c/d 45000

45000 45000

Car Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Capital 12000 31/10/21 Balance c/d 12000

12000 12000

Capital Account

Date Particulars Ref Amount Date Particulars Ref Amount

01/10/21 Bank 10000

01/10/21 Cash 4800

01/10/21 Flat 45000

31/10/21 Balance c/d 71800 01/10/21 Car 12000

71800 71800

Purchases Account

Date Particulars Ref Amount Date Particulars Ref Amount

18/10/21 Home Ltd 5400 02/10/21 Home Ltd 250

31/10/21 Balance c/d 5150

5400 5400

Home Ltd Account

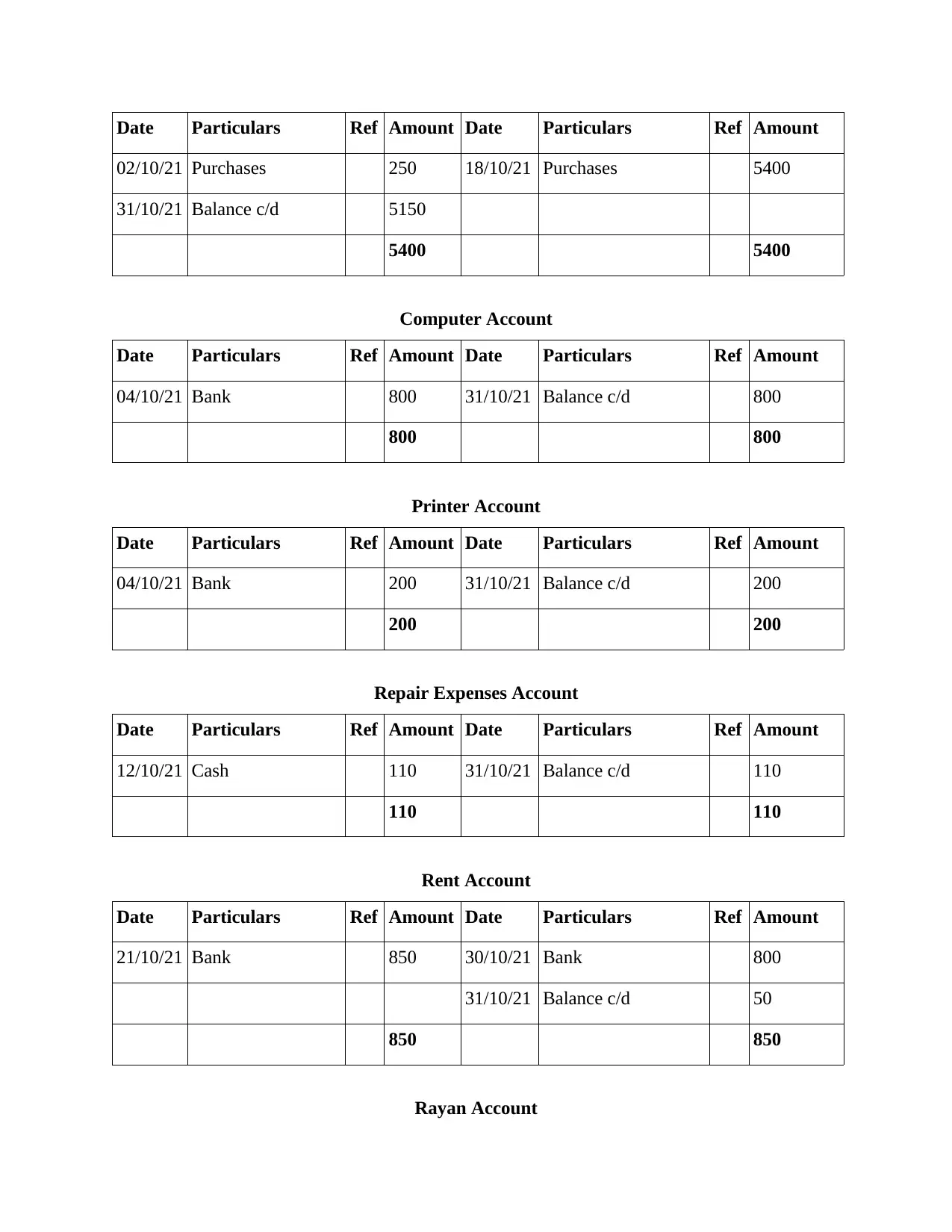

Date Particulars Ref Amount Date Particulars Ref Amount

02/10/21 Purchases 250 18/10/21 Purchases 5400

31/10/21 Balance c/d 5150

5400 5400

Computer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 800 31/10/21 Balance c/d 800

800 800

Printer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 200 31/10/21 Balance c/d 200

200 200

Repair Expenses Account

Date Particulars Ref Amount Date Particulars Ref Amount

12/10/21 Cash 110 31/10/21 Balance c/d 110

110 110

Rent Account

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 850 30/10/21 Bank 800

31/10/21 Balance c/d 50

850 850

Rayan Account

02/10/21 Purchases 250 18/10/21 Purchases 5400

31/10/21 Balance c/d 5150

5400 5400

Computer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 800 31/10/21 Balance c/d 800

800 800

Printer Account

Date Particulars Ref Amount Date Particulars Ref Amount

04/10/21 Bank 200 31/10/21 Balance c/d 200

200 200

Repair Expenses Account

Date Particulars Ref Amount Date Particulars Ref Amount

12/10/21 Cash 110 31/10/21 Balance c/d 110

110 110

Rent Account

Date Particulars Ref Amount Date Particulars Ref Amount

21/10/21 Bank 850 30/10/21 Bank 800

31/10/21 Balance c/d 50

850 850

Rayan Account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Date Particulars Ref Amount Date Particulars Ref Amount

23/10/21 Sales 300 31/10/21 Cash 150

31/10/21 Balance c/d 150

300 300

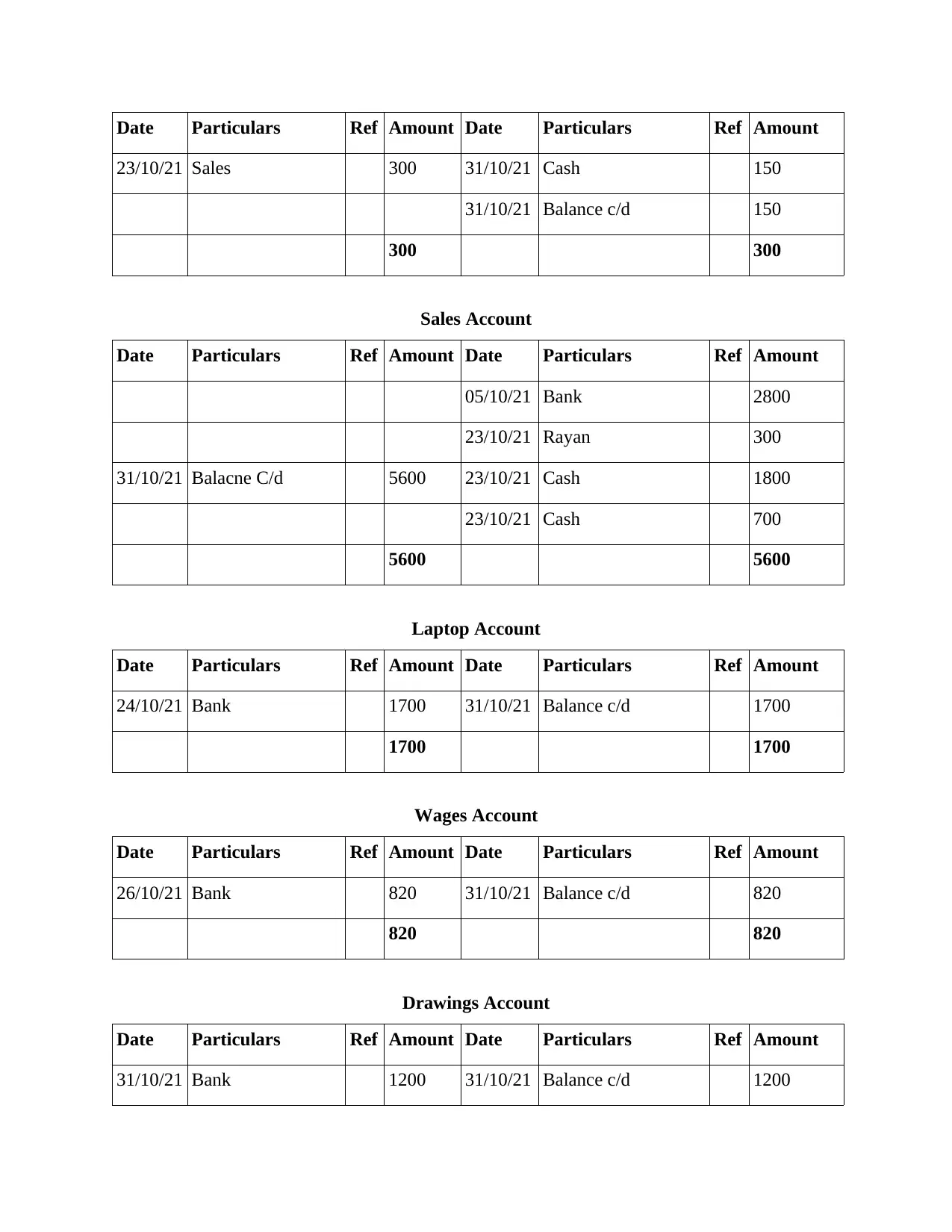

Sales Account

Date Particulars Ref Amount Date Particulars Ref Amount

05/10/21 Bank 2800

23/10/21 Rayan 300

31/10/21 Balacne C/d 5600 23/10/21 Cash 1800

23/10/21 Cash 700

5600 5600

Laptop Account

Date Particulars Ref Amount Date Particulars Ref Amount

24/10/21 Bank 1700 31/10/21 Balance c/d 1700

1700 1700

Wages Account

Date Particulars Ref Amount Date Particulars Ref Amount

26/10/21 Bank 820 31/10/21 Balance c/d 820

820 820

Drawings Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 1200 31/10/21 Balance c/d 1200

23/10/21 Sales 300 31/10/21 Cash 150

31/10/21 Balance c/d 150

300 300

Sales Account

Date Particulars Ref Amount Date Particulars Ref Amount

05/10/21 Bank 2800

23/10/21 Rayan 300

31/10/21 Balacne C/d 5600 23/10/21 Cash 1800

23/10/21 Cash 700

5600 5600

Laptop Account

Date Particulars Ref Amount Date Particulars Ref Amount

24/10/21 Bank 1700 31/10/21 Balance c/d 1700

1700 1700

Wages Account

Date Particulars Ref Amount Date Particulars Ref Amount

26/10/21 Bank 820 31/10/21 Balance c/d 820

820 820

Drawings Account

Date Particulars Ref Amount Date Particulars Ref Amount

31/10/21 Bank 1200 31/10/21 Balance c/d 1200

1200 1200

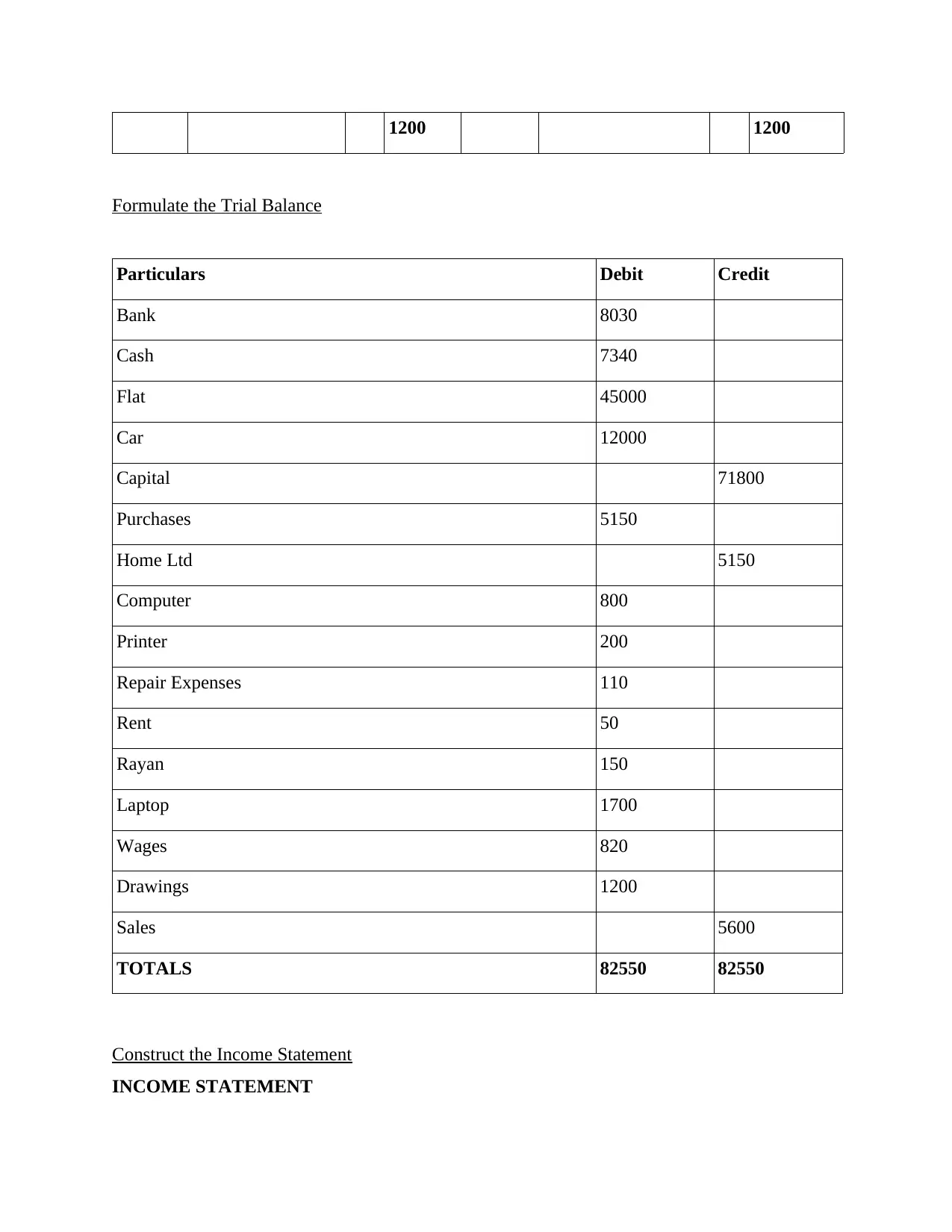

Formulate the Trial Balance

Particulars Debit Credit

Bank 8030

Cash 7340

Flat 45000

Car 12000

Capital 71800

Purchases 5150

Home Ltd 5150

Computer 800

Printer 200

Repair Expenses 110

Rent 50

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Sales 5600

TOTALS 82550 82550

Construct the Income Statement

INCOME STATEMENT

Formulate the Trial Balance

Particulars Debit Credit

Bank 8030

Cash 7340

Flat 45000

Car 12000

Capital 71800

Purchases 5150

Home Ltd 5150

Computer 800

Printer 200

Repair Expenses 110

Rent 50

Rayan 150

Laptop 1700

Wages 820

Drawings 1200

Sales 5600

TOTALS 82550 82550

Construct the Income Statement

INCOME STATEMENT

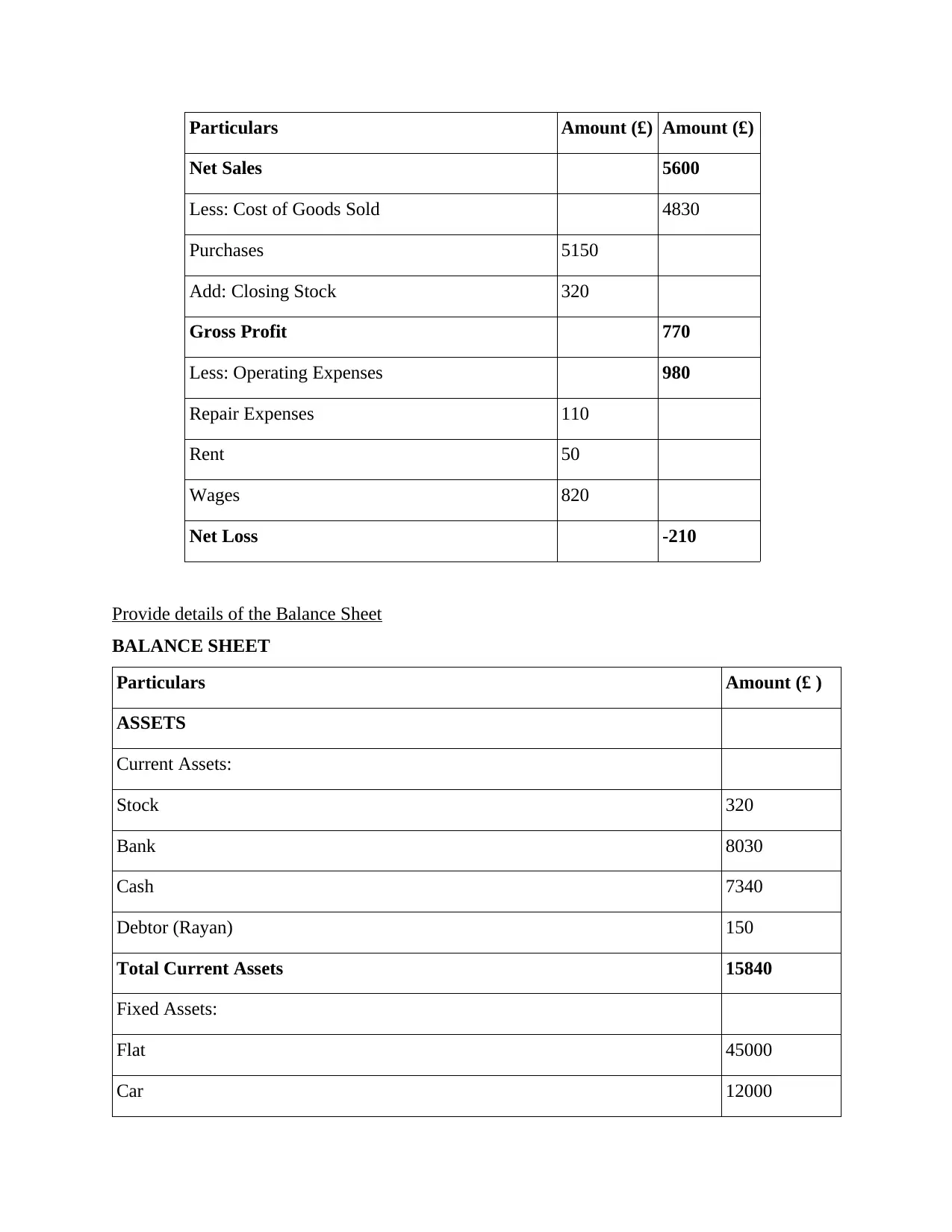

Particulars Amount (£) Amount (£)

Net Sales 5600

Less: Cost of Goods Sold 4830

Purchases 5150

Add: Closing Stock 320

Gross Profit 770

Less: Operating Expenses 980

Repair Expenses 110

Rent 50

Wages 820

Net Loss -210

Provide details of the Balance Sheet

BALANCE SHEET

Particulars Amount (£ )

ASSETS

Current Assets:

Stock 320

Bank 8030

Cash 7340

Debtor (Rayan) 150

Total Current Assets 15840

Fixed Assets:

Flat 45000

Car 12000

Net Sales 5600

Less: Cost of Goods Sold 4830

Purchases 5150

Add: Closing Stock 320

Gross Profit 770

Less: Operating Expenses 980

Repair Expenses 110

Rent 50

Wages 820

Net Loss -210

Provide details of the Balance Sheet

BALANCE SHEET

Particulars Amount (£ )

ASSETS

Current Assets:

Stock 320

Bank 8030

Cash 7340

Debtor (Rayan) 150

Total Current Assets 15840

Fixed Assets:

Flat 45000

Car 12000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

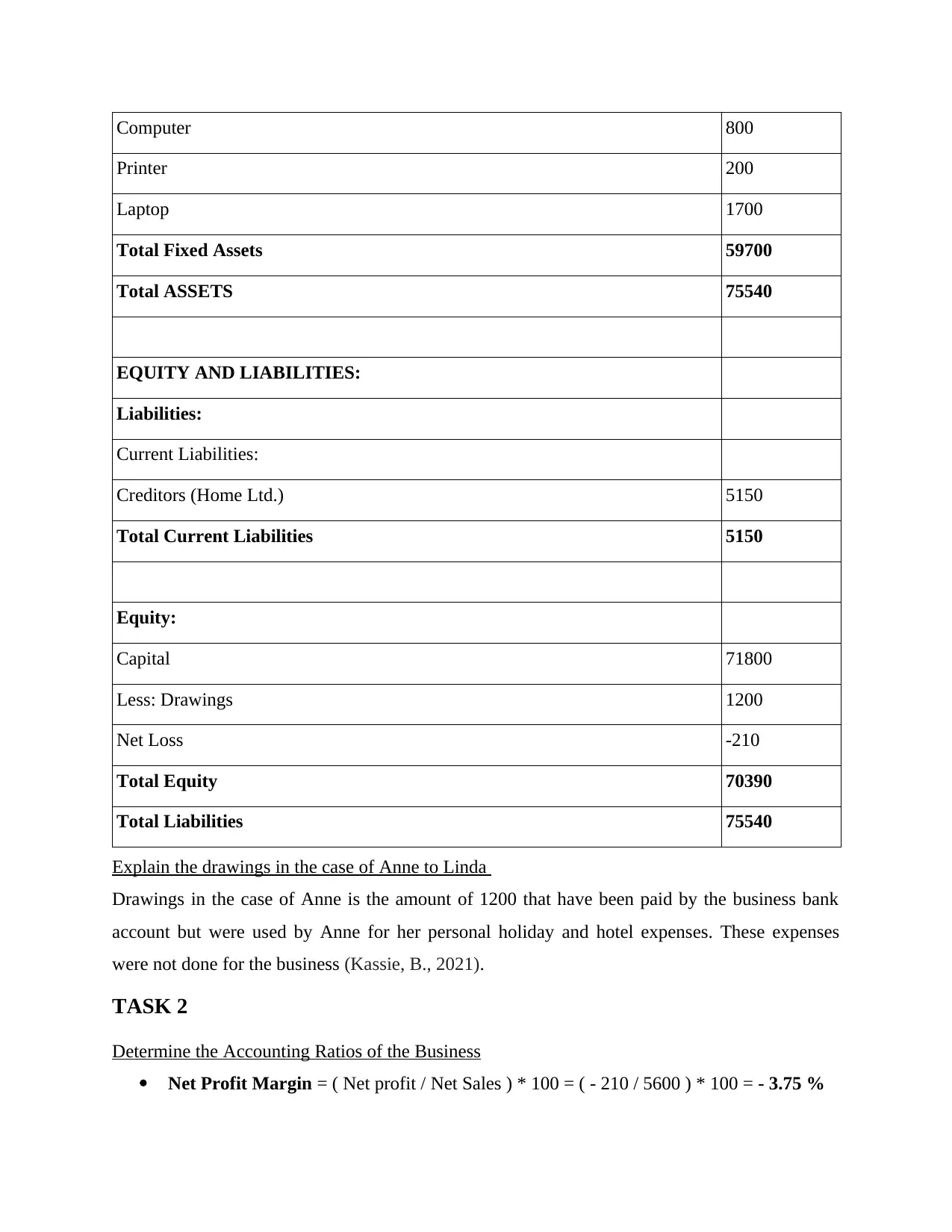

Computer 800

Printer 200

Laptop 1700

Total Fixed Assets 59700

Total ASSETS 75540

EQUITY AND LIABILITIES:

Liabilities:

Current Liabilities:

Creditors (Home Ltd.) 5150

Total Current Liabilities 5150

Equity:

Capital 71800

Less: Drawings 1200

Net Loss -210

Total Equity 70390

Total Liabilities 75540

Explain the drawings in the case of Anne to Linda

Drawings in the case of Anne is the amount of 1200 that have been paid by the business bank

account but were used by Anne for her personal holiday and hotel expenses. These expenses

were not done for the business (Kassie, B., 2021).

TASK 2

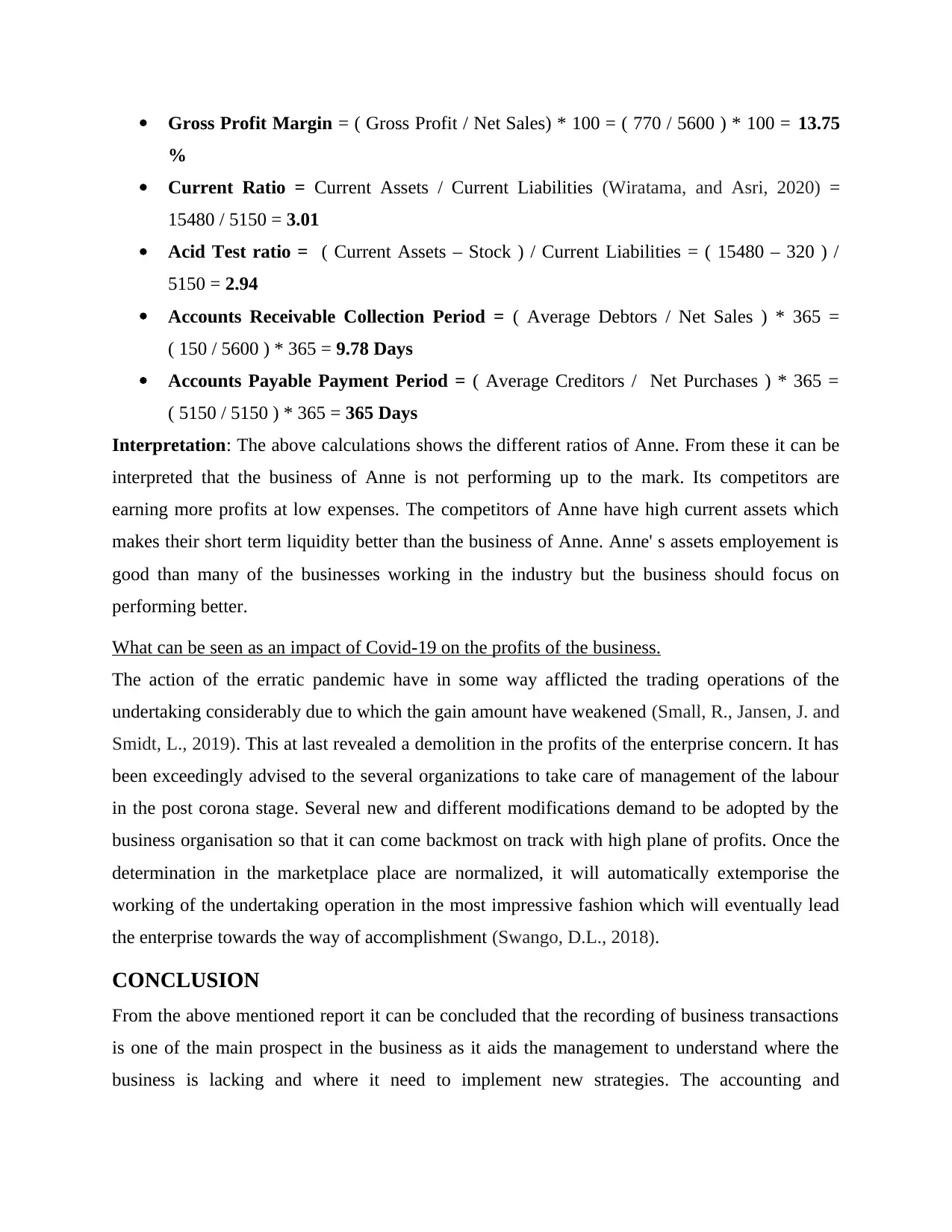

Determine the Accounting Ratios of the Business

Net Profit Margin = ( Net profit / Net Sales ) * 100 = ( - 210 / 5600 ) * 100 = - 3.75 %

Printer 200

Laptop 1700

Total Fixed Assets 59700

Total ASSETS 75540

EQUITY AND LIABILITIES:

Liabilities:

Current Liabilities:

Creditors (Home Ltd.) 5150

Total Current Liabilities 5150

Equity:

Capital 71800

Less: Drawings 1200

Net Loss -210

Total Equity 70390

Total Liabilities 75540

Explain the drawings in the case of Anne to Linda

Drawings in the case of Anne is the amount of 1200 that have been paid by the business bank

account but were used by Anne for her personal holiday and hotel expenses. These expenses

were not done for the business (Kassie, B., 2021).

TASK 2

Determine the Accounting Ratios of the Business

Net Profit Margin = ( Net profit / Net Sales ) * 100 = ( - 210 / 5600 ) * 100 = - 3.75 %

Gross Profit Margin = ( Gross Profit / Net Sales) * 100 = ( 770 / 5600 ) * 100 = 13.75

%

Current Ratio = Current Assets / Current Liabilities (Wiratama, and Asri, 2020) =

15480 / 5150 = 3.01

Acid Test ratio = ( Current Assets – Stock ) / Current Liabilities = ( 15480 – 320 ) /

5150 = 2.94

Accounts Receivable Collection Period = ( Average Debtors / Net Sales ) * 365 =

( 150 / 5600 ) * 365 = 9.78 Days

Accounts Payable Payment Period = ( Average Creditors / Net Purchases ) * 365 =

( 5150 / 5150 ) * 365 = 365 Days

Interpretation: The above calculations shows the different ratios of Anne. From these it can be

interpreted that the business of Anne is not performing up to the mark. Its competitors are

earning more profits at low expenses. The competitors of Anne have high current assets which

makes their short term liquidity better than the business of Anne. Anne' s assets employement is

good than many of the businesses working in the industry but the business should focus on

performing better.

What can be seen as an impact of Covid-19 on the profits of the business.

The action of the erratic pandemic have in some way afflicted the trading operations of the

undertaking considerably due to which the gain amount have weakened (Small, R., Jansen, J. and

Smidt, L., 2019). This at last revealed a demolition in the profits of the enterprise concern. It has

been exceedingly advised to the several organizations to take care of management of the labour

in the post corona stage. Several new and different modifications demand to be adopted by the

business organisation so that it can come backmost on track with high plane of profits. Once the

determination in the marketplace place are normalized, it will automatically extemporise the

working of the undertaking operation in the most impressive fashion which will eventually lead

the enterprise towards the way of accomplishment (Swango, D.L., 2018).

CONCLUSION

From the above mentioned report it can be concluded that the recording of business transactions

is one of the main prospect in the business as it aids the management to understand where the

business is lacking and where it need to implement new strategies. The accounting and

%

Current Ratio = Current Assets / Current Liabilities (Wiratama, and Asri, 2020) =

15480 / 5150 = 3.01

Acid Test ratio = ( Current Assets – Stock ) / Current Liabilities = ( 15480 – 320 ) /

5150 = 2.94

Accounts Receivable Collection Period = ( Average Debtors / Net Sales ) * 365 =

( 150 / 5600 ) * 365 = 9.78 Days

Accounts Payable Payment Period = ( Average Creditors / Net Purchases ) * 365 =

( 5150 / 5150 ) * 365 = 365 Days

Interpretation: The above calculations shows the different ratios of Anne. From these it can be

interpreted that the business of Anne is not performing up to the mark. Its competitors are

earning more profits at low expenses. The competitors of Anne have high current assets which

makes their short term liquidity better than the business of Anne. Anne' s assets employement is

good than many of the businesses working in the industry but the business should focus on

performing better.

What can be seen as an impact of Covid-19 on the profits of the business.

The action of the erratic pandemic have in some way afflicted the trading operations of the

undertaking considerably due to which the gain amount have weakened (Small, R., Jansen, J. and

Smidt, L., 2019). This at last revealed a demolition in the profits of the enterprise concern. It has

been exceedingly advised to the several organizations to take care of management of the labour

in the post corona stage. Several new and different modifications demand to be adopted by the

business organisation so that it can come backmost on track with high plane of profits. Once the

determination in the marketplace place are normalized, it will automatically extemporise the

working of the undertaking operation in the most impressive fashion which will eventually lead

the enterprise towards the way of accomplishment (Swango, D.L., 2018).

CONCLUSION

From the above mentioned report it can be concluded that the recording of business transactions

is one of the main prospect in the business as it aids the management to understand where the

business is lacking and where it need to implement new strategies. The accounting and

preparation of financial statements also gives insights to its different users about the performance

of the business and the profits earned by the business. The above report shows recording of such

business transactions and interpretation of the financial ratios calculated from the information

provided.

of the business and the profits earned by the business. The above report shows recording of such

business transactions and interpretation of the financial ratios calculated from the information

provided.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

de Souza Junior, and et.al.,2019. Accountancy teaching in Brazil: epistemology, pedagogy and

professional knowledge. Revista de Educação e Pesquisa em Contabilidade. 13(3).

Kassie, B., 2021. The effect of demographic factors on ethical dilemma: empirical evidence from

certified public accountancy firms in Ethiopia. African Journal of Accounting, Auditing

and Finance. 7(3). pp.205-224.

Small, R., Jansen, J. and Smidt, L., 2019. Developing professional judgement competence in the

accountancy profession. Professional Accountant, 2019(36), pp.10-12.

Swango, D.L., 2018. Borrowing from Accountancy. Appraisal Journal. 86(4).

Venter, E.R., Gordon, E.A. and Street, D.L., 2018. The role of accounting and the accountancy

profession in economic development: A research agenda. Journal of International

Financial Management & Accounting. 29(2). pp.195-218.

Wildberg, J. and Möhring, B., 2019. Empirical analysis of the economic effect of tree species

diversity based on the results of a forest accountancy data network. Forest Policy and

Economics. 109. p.101982.

Books and Journals

de Souza Junior, and et.al.,2019. Accountancy teaching in Brazil: epistemology, pedagogy and

professional knowledge. Revista de Educação e Pesquisa em Contabilidade. 13(3).

Kassie, B., 2021. The effect of demographic factors on ethical dilemma: empirical evidence from

certified public accountancy firms in Ethiopia. African Journal of Accounting, Auditing

and Finance. 7(3). pp.205-224.

Small, R., Jansen, J. and Smidt, L., 2019. Developing professional judgement competence in the

accountancy profession. Professional Accountant, 2019(36), pp.10-12.

Swango, D.L., 2018. Borrowing from Accountancy. Appraisal Journal. 86(4).

Venter, E.R., Gordon, E.A. and Street, D.L., 2018. The role of accounting and the accountancy

profession in economic development: A research agenda. Journal of International

Financial Management & Accounting. 29(2). pp.195-218.

Wildberg, J. and Möhring, B., 2019. Empirical analysis of the economic effect of tree species

diversity based on the results of a forest accountancy data network. Forest Policy and

Economics. 109. p.101982.

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.