Business Transactions: Formulation of Financial Statements and Accounts

VerifiedAdded on 2022/12/27

|17

|2472

|97

AI Summary

This document discusses the formulation of various financial statements and business accounts in the context of business transactions. It covers topics such as the preparation of journal entries, balancing of accounts, trial balance, income statement, and financial statements. Additionally, it explores the analysis of ratios and compares them with competitors to evaluate the organization's financial position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Recording

Business

Transactions

Business

Transactions

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Preparation of Journal entries of T-accounts .............................................................................3

Balancing of accounts and opening balances..............................................................................5

Preparation of Trial Balance.......................................................................................................8

Income statement of month ending 31st October 2020..............................................................8

Financial Statements of the organisation....................................................................................9

PART B............................................................................................................................................9

Ratio analysis of the given organisation.....................................................................................9

Analysing above ratios in comparison with competitors..........................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

Books and journals....................................................................................................................14

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

Preparation of Journal entries of T-accounts .............................................................................3

Balancing of accounts and opening balances..............................................................................5

Preparation of Trial Balance.......................................................................................................8

Income statement of month ending 31st October 2020..............................................................8

Financial Statements of the organisation....................................................................................9

PART B............................................................................................................................................9

Ratio analysis of the given organisation.....................................................................................9

Analysing above ratios in comparison with competitors..........................................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................14

Books and journals....................................................................................................................14

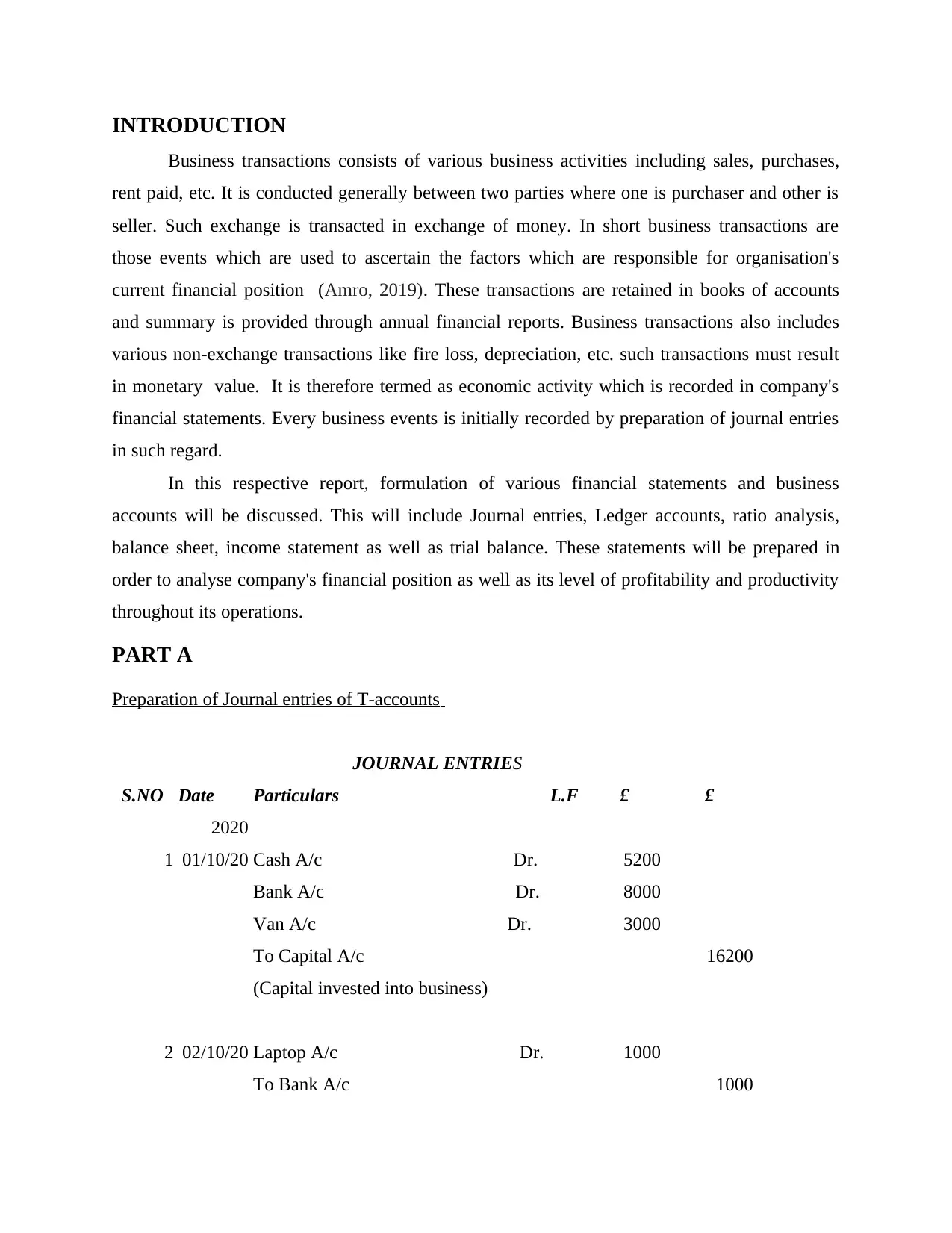

INTRODUCTION

Business transactions consists of various business activities including sales, purchases,

rent paid, etc. It is conducted generally between two parties where one is purchaser and other is

seller. Such exchange is transacted in exchange of money. In short business transactions are

those events which are used to ascertain the factors which are responsible for organisation's

current financial position (Amro, 2019). These transactions are retained in books of accounts

and summary is provided through annual financial reports. Business transactions also includes

various non-exchange transactions like fire loss, depreciation, etc. such transactions must result

in monetary value. It is therefore termed as economic activity which is recorded in company's

financial statements. Every business events is initially recorded by preparation of journal entries

in such regard.

In this respective report, formulation of various financial statements and business

accounts will be discussed. This will include Journal entries, Ledger accounts, ratio analysis,

balance sheet, income statement as well as trial balance. These statements will be prepared in

order to analyse company's financial position as well as its level of profitability and productivity

throughout its operations.

PART A

Preparation of Journal entries of T-accounts

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 01/10/20 Cash A/c Dr. 5200

Bank A/c Dr. 8000

Van A/c Dr. 3000

To Capital A/c 16200

(Capital invested into business)

2 02/10/20 Laptop A/c Dr. 1000

To Bank A/c 1000

Business transactions consists of various business activities including sales, purchases,

rent paid, etc. It is conducted generally between two parties where one is purchaser and other is

seller. Such exchange is transacted in exchange of money. In short business transactions are

those events which are used to ascertain the factors which are responsible for organisation's

current financial position (Amro, 2019). These transactions are retained in books of accounts

and summary is provided through annual financial reports. Business transactions also includes

various non-exchange transactions like fire loss, depreciation, etc. such transactions must result

in monetary value. It is therefore termed as economic activity which is recorded in company's

financial statements. Every business events is initially recorded by preparation of journal entries

in such regard.

In this respective report, formulation of various financial statements and business

accounts will be discussed. This will include Journal entries, Ledger accounts, ratio analysis,

balance sheet, income statement as well as trial balance. These statements will be prepared in

order to analyse company's financial position as well as its level of profitability and productivity

throughout its operations.

PART A

Preparation of Journal entries of T-accounts

JOURNAL ENTRIES

S.NO Date Particulars L.F £ £

2020

1 01/10/20 Cash A/c Dr. 5200

Bank A/c Dr. 8000

Van A/c Dr. 3000

To Capital A/c 16200

(Capital invested into business)

2 02/10/20 Laptop A/c Dr. 1000

To Bank A/c 1000

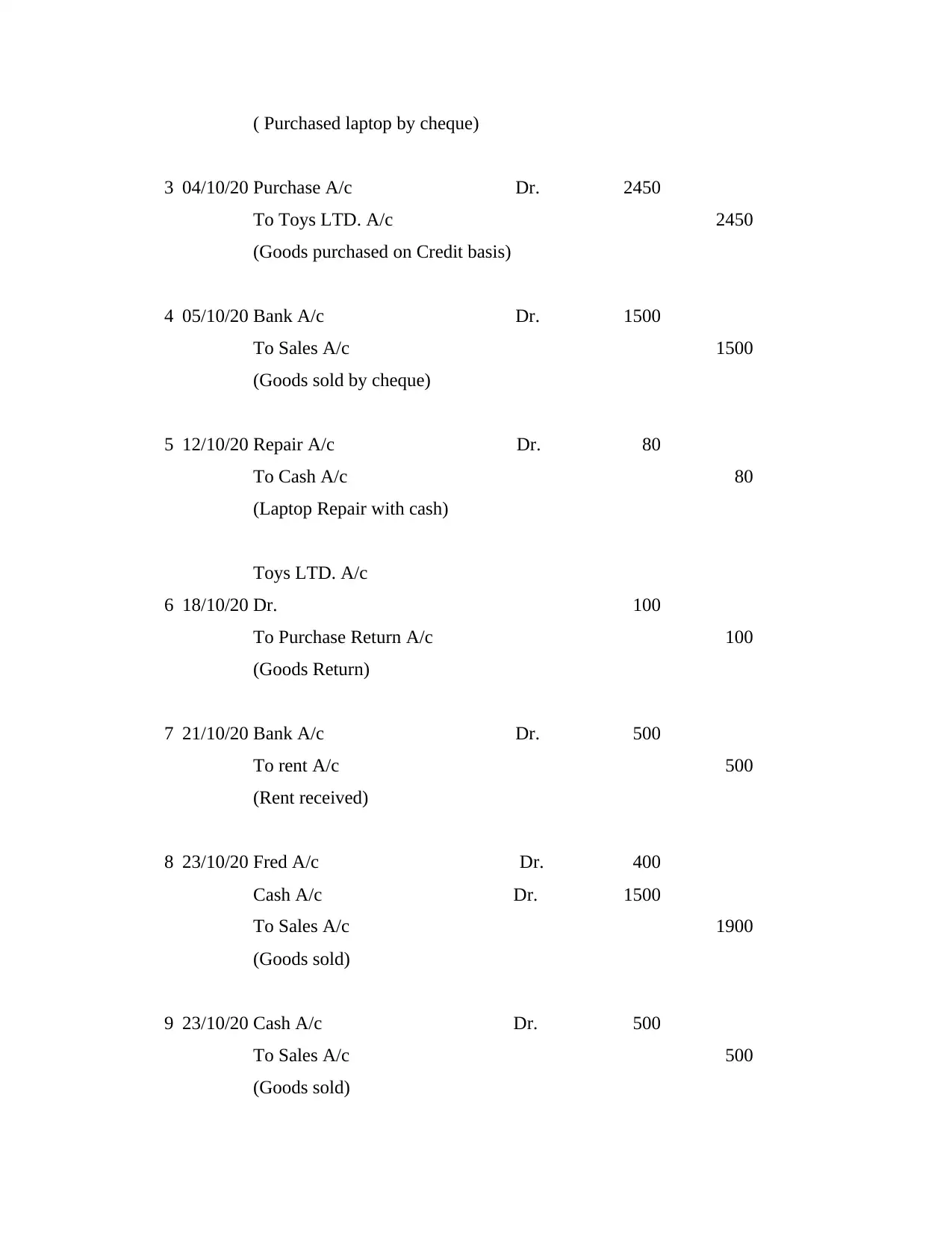

( Purchased laptop by cheque)

3 04/10/20 Purchase A/c Dr. 2450

To Toys LTD. A/c 2450

(Goods purchased on Credit basis)

4 05/10/20 Bank A/c Dr. 1500

To Sales A/c 1500

(Goods sold by cheque)

5 12/10/20 Repair A/c Dr. 80

To Cash A/c 80

(Laptop Repair with cash)

6 18/10/20

Toys LTD. A/c

Dr. 100

To Purchase Return A/c 100

(Goods Return)

7 21/10/20 Bank A/c Dr. 500

To rent A/c 500

(Rent received)

8 23/10/20 Fred A/c Dr. 400

Cash A/c Dr. 1500

To Sales A/c 1900

(Goods sold)

9 23/10/20 Cash A/c Dr. 500

To Sales A/c 500

(Goods sold)

3 04/10/20 Purchase A/c Dr. 2450

To Toys LTD. A/c 2450

(Goods purchased on Credit basis)

4 05/10/20 Bank A/c Dr. 1500

To Sales A/c 1500

(Goods sold by cheque)

5 12/10/20 Repair A/c Dr. 80

To Cash A/c 80

(Laptop Repair with cash)

6 18/10/20

Toys LTD. A/c

Dr. 100

To Purchase Return A/c 100

(Goods Return)

7 21/10/20 Bank A/c Dr. 500

To rent A/c 500

(Rent received)

8 23/10/20 Fred A/c Dr. 400

Cash A/c Dr. 1500

To Sales A/c 1900

(Goods sold)

9 23/10/20 Cash A/c Dr. 500

To Sales A/c 500

(Goods sold)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

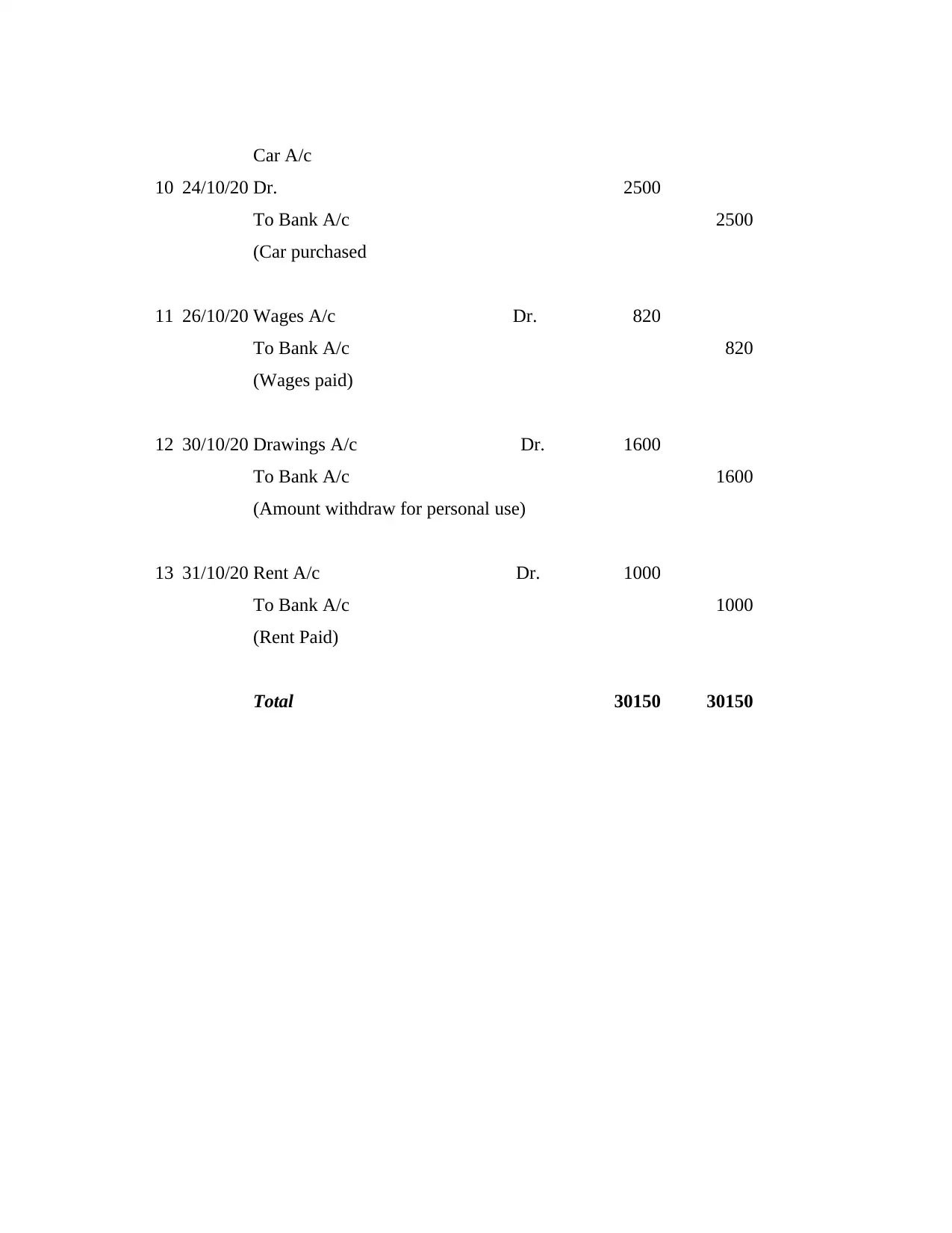

10 24/10/20

Car A/c

Dr. 2500

To Bank A/c 2500

(Car purchased

11 26/10/20 Wages A/c Dr. 820

To Bank A/c 820

(Wages paid)

12 30/10/20 Drawings A/c Dr. 1600

To Bank A/c 1600

(Amount withdraw for personal use)

13 31/10/20 Rent A/c Dr. 1000

To Bank A/c 1000

(Rent Paid)

Total 30150 30150

Car A/c

Dr. 2500

To Bank A/c 2500

(Car purchased

11 26/10/20 Wages A/c Dr. 820

To Bank A/c 820

(Wages paid)

12 30/10/20 Drawings A/c Dr. 1600

To Bank A/c 1600

(Amount withdraw for personal use)

13 31/10/20 Rent A/c Dr. 1000

To Bank A/c 1000

(Rent Paid)

Total 30150 30150

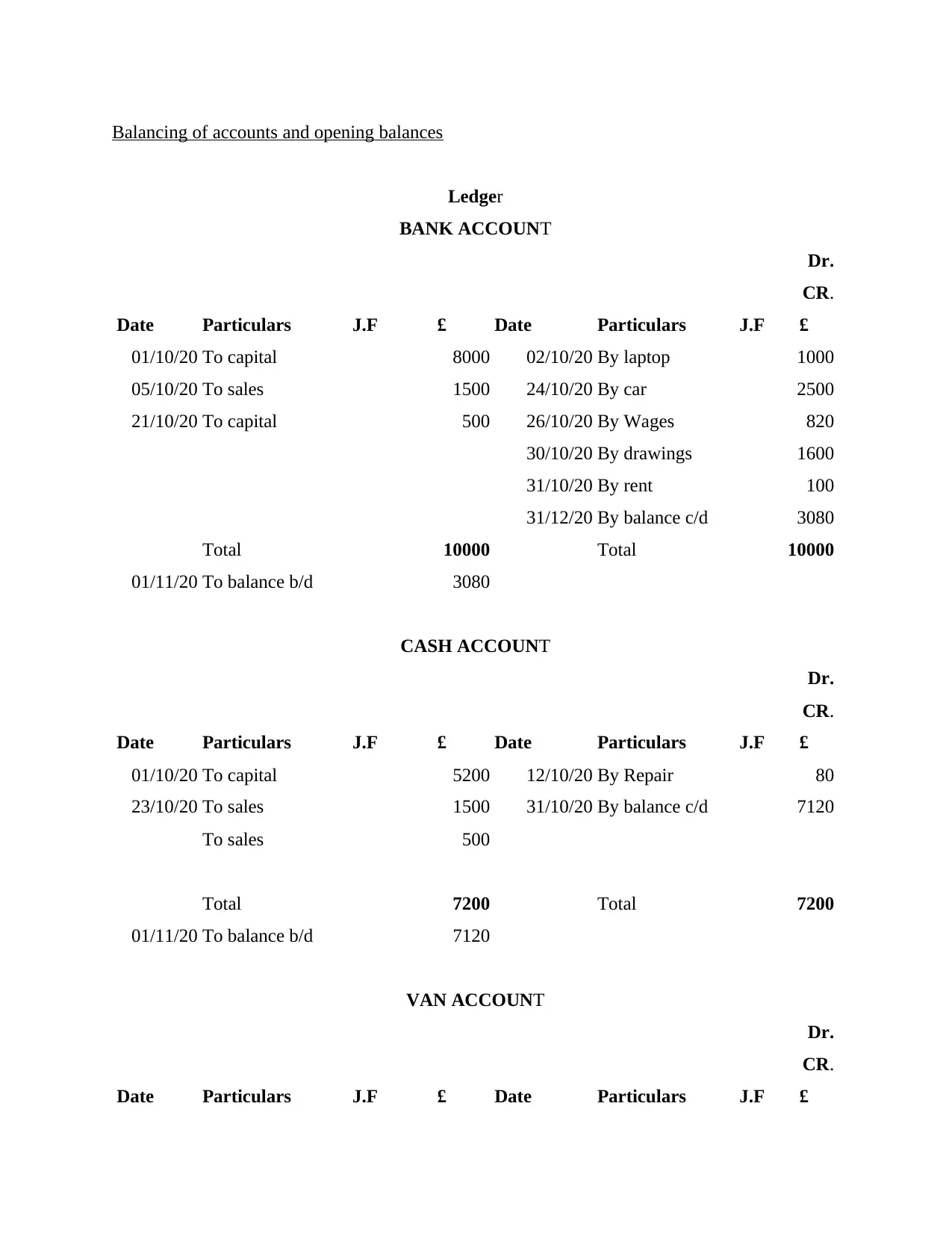

Balancing of accounts and opening balances

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 8000 02/10/20 By laptop 1000

05/10/20 To sales 1500 24/10/20 By car 2500

21/10/20 To capital 500 26/10/20 By Wages 820

30/10/20 By drawings 1600

31/10/20 By rent 100

31/12/20 By balance c/d 3080

Total 10000 Total 10000

01/11/20 To balance b/d 3080

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 5200 12/10/20 By Repair 80

23/10/20 To sales 1500 31/10/20 By balance c/d 7120

To sales 500

Total 7200 Total 7200

01/11/20 To balance b/d 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

Ledger

BANK ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 8000 02/10/20 By laptop 1000

05/10/20 To sales 1500 24/10/20 By car 2500

21/10/20 To capital 500 26/10/20 By Wages 820

30/10/20 By drawings 1600

31/10/20 By rent 100

31/12/20 By balance c/d 3080

Total 10000 Total 10000

01/11/20 To balance b/d 3080

CASH ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

01/10/20 To capital 5200 12/10/20 By Repair 80

23/10/20 To sales 1500 31/10/20 By balance c/d 7120

To sales 500

Total 7200 Total 7200

01/11/20 To balance b/d 7120

VAN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

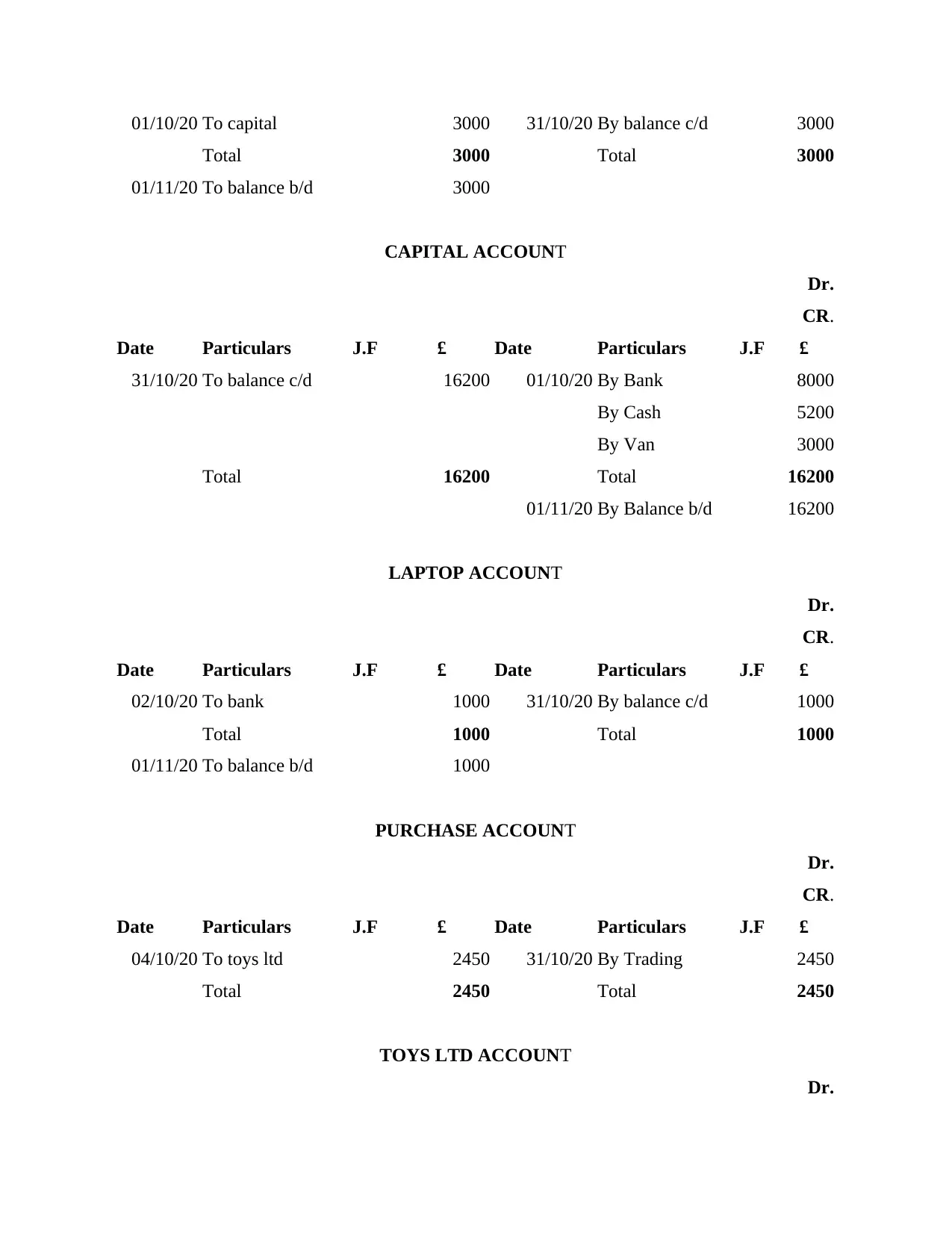

01/10/20 To capital 3000 31/10/20 By balance c/d 3000

Total 3000 Total 3000

01/11/20 To balance b/d 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To balance c/d 16200 01/10/20 By Bank 8000

By Cash 5200

By Van 3000

Total 16200 Total 16200

01/11/20 By Balance b/d 16200

LAPTOP ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

02/10/20 To bank 1000 31/10/20 By balance c/d 1000

Total 1000 Total 1000

01/11/20 To balance b/d 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

04/10/20 To toys ltd 2450 31/10/20 By Trading 2450

Total 2450 Total 2450

TOYS LTD ACCOUNT

Dr.

Total 3000 Total 3000

01/11/20 To balance b/d 3000

CAPITAL ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To balance c/d 16200 01/10/20 By Bank 8000

By Cash 5200

By Van 3000

Total 16200 Total 16200

01/11/20 By Balance b/d 16200

LAPTOP ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

02/10/20 To bank 1000 31/10/20 By balance c/d 1000

Total 1000 Total 1000

01/11/20 To balance b/d 1000

PURCHASE ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

04/10/20 To toys ltd 2450 31/10/20 By Trading 2450

Total 2450 Total 2450

TOYS LTD ACCOUNT

Dr.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

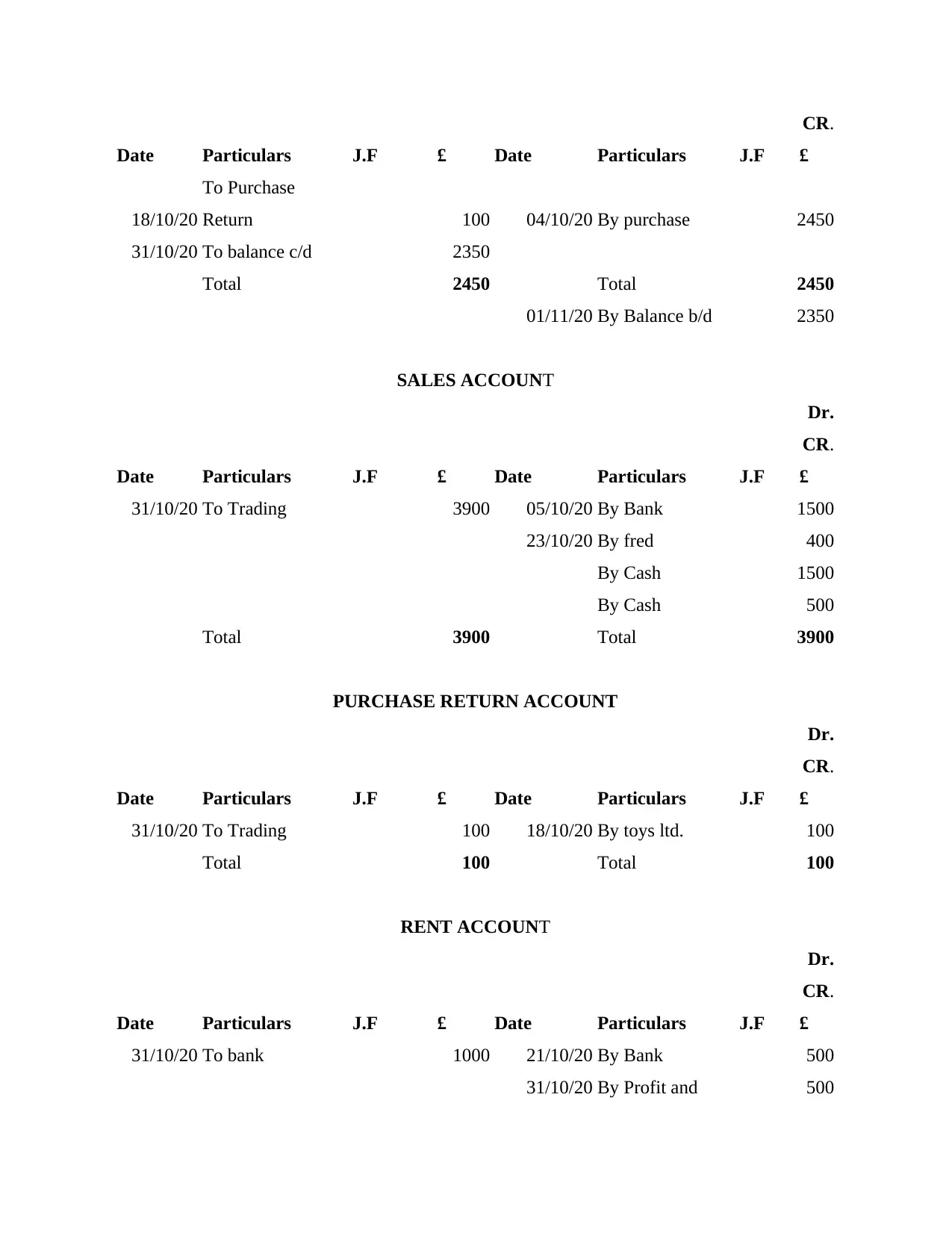

CR.

Date Particulars J.F £ Date Particulars J.F £

18/10/20

To Purchase

Return 100 04/10/20 By purchase 2450

31/10/20 To balance c/d 2350

Total 2450 Total 2450

01/11/20 By Balance b/d 2350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 3900 05/10/20 By Bank 1500

23/10/20 By fred 400

By Cash 1500

By Cash 500

Total 3900 Total 3900

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 100 18/10/20 By toys ltd. 100

Total 100 Total 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To bank 1000 21/10/20 By Bank 500

31/10/20 By Profit and 500

Date Particulars J.F £ Date Particulars J.F £

18/10/20

To Purchase

Return 100 04/10/20 By purchase 2450

31/10/20 To balance c/d 2350

Total 2450 Total 2450

01/11/20 By Balance b/d 2350

SALES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 3900 05/10/20 By Bank 1500

23/10/20 By fred 400

By Cash 1500

By Cash 500

Total 3900 Total 3900

PURCHASE RETURN ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To Trading 100 18/10/20 By toys ltd. 100

Total 100 Total 100

RENT ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

31/10/20 To bank 1000 21/10/20 By Bank 500

31/10/20 By Profit and 500

Loss

Total 1000 Total 1000

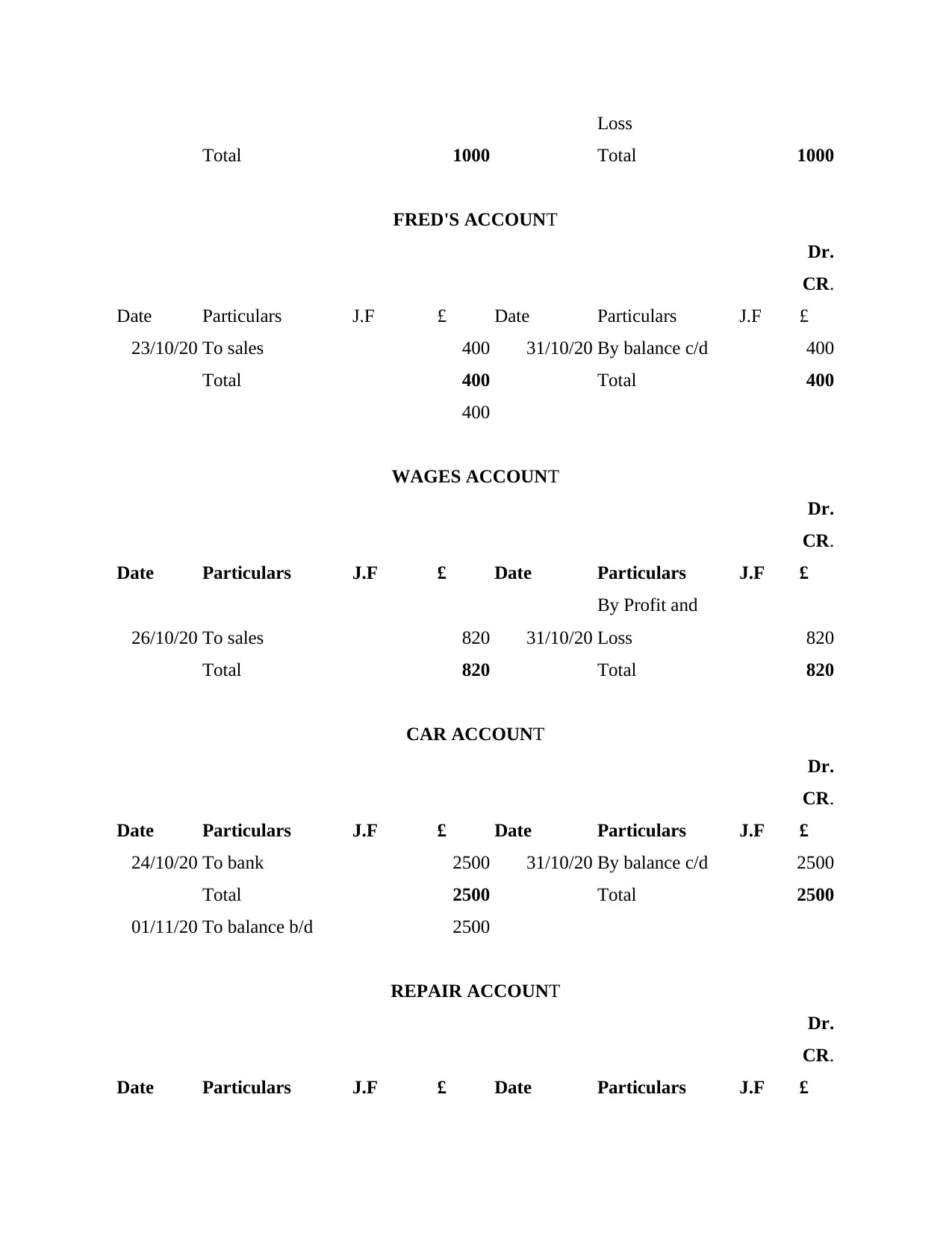

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

23/10/20 To sales 400 31/10/20 By balance c/d 400

Total 400 Total 400

400

WAGES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

26/10/20 To sales 820 31/10/20

By Profit and

Loss 820

Total 820 Total 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

24/10/20 To bank 2500 31/10/20 By balance c/d 2500

Total 2500 Total 2500

01/11/20 To balance b/d 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

Total 1000 Total 1000

FRED'S ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

23/10/20 To sales 400 31/10/20 By balance c/d 400

Total 400 Total 400

400

WAGES ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

26/10/20 To sales 820 31/10/20

By Profit and

Loss 820

Total 820 Total 820

CAR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

24/10/20 To bank 2500 31/10/20 By balance c/d 2500

Total 2500 Total 2500

01/11/20 To balance b/d 2500

REPAIR ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

12/10/20 To cash 80 31/10/20

By Profit and

Loss 80

Total 80 Total 80

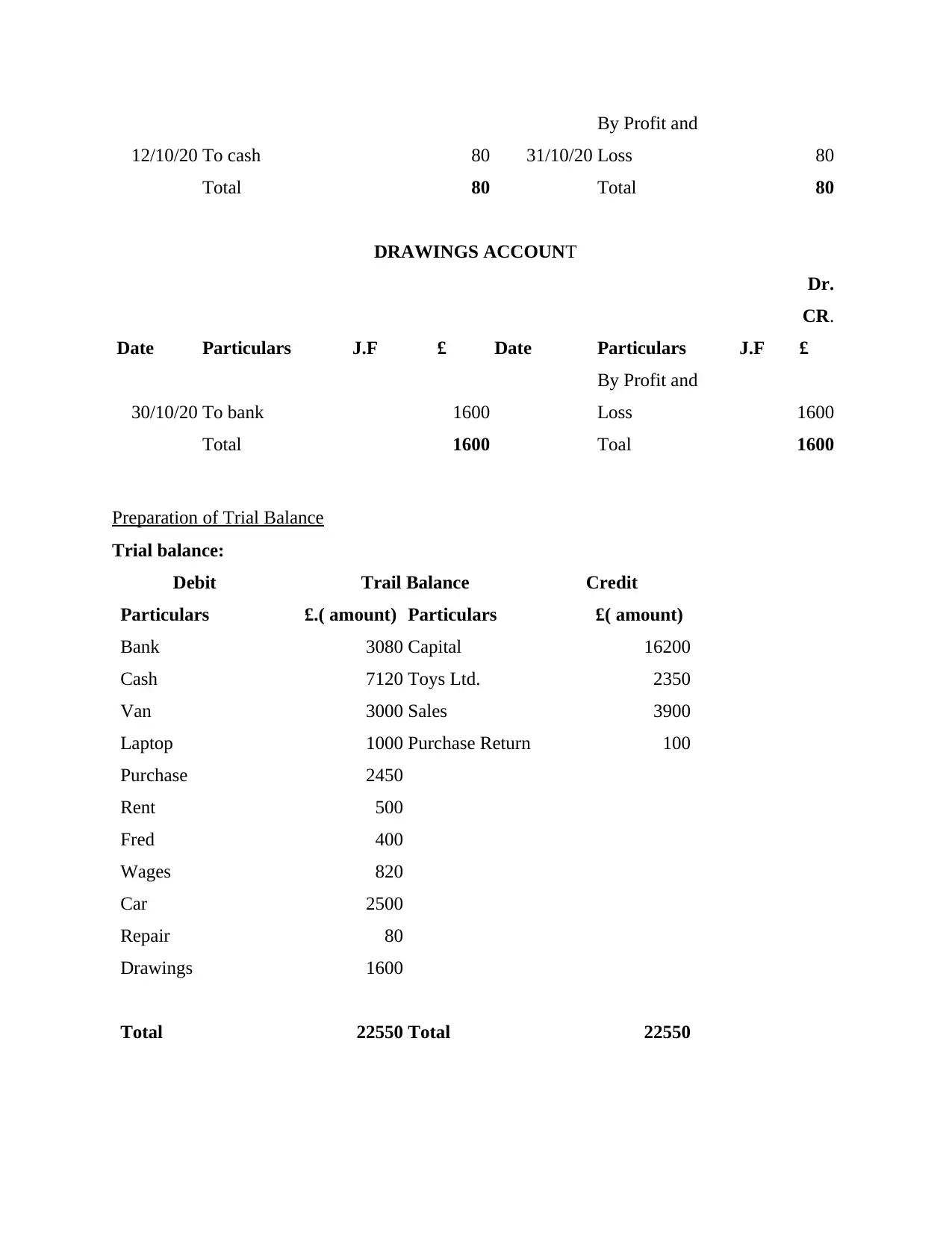

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

30/10/20 To bank 1600

By Profit and

Loss 1600

Total 1600 Toal 1600

Preparation of Trial Balance

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank 3080 Capital 16200

Cash 7120 Toys Ltd. 2350

Van 3000 Sales 3900

Laptop 1000 Purchase Return 100

Purchase 2450

Rent 500

Fred 400

Wages 820

Car 2500

Repair 80

Drawings 1600

Total 22550 Total 22550

By Profit and

Loss 80

Total 80 Total 80

DRAWINGS ACCOUNT

Dr.

CR.

Date Particulars J.F £ Date Particulars J.F £

30/10/20 To bank 1600

By Profit and

Loss 1600

Total 1600 Toal 1600

Preparation of Trial Balance

Trial balance:

Debit Trail Balance Credit

Particulars £.( amount) Particulars £( amount)

Bank 3080 Capital 16200

Cash 7120 Toys Ltd. 2350

Van 3000 Sales 3900

Laptop 1000 Purchase Return 100

Purchase 2450

Rent 500

Fred 400

Wages 820

Car 2500

Repair 80

Drawings 1600

Total 22550 Total 22550

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Income statement of month ending 31st October 2020

Dr Trading Account Cr.

Particulars £. Particulars Cr.

Purchase 2450 Sales 3900

Gross Profit 1800 Closing Stock 250

Purchase Return 100

Total 4250 Total 4250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £

Rent 500 Gross Profit 1800

Wages 820

Repair 80

Net Profit 400

Total 1800 Total 1800

Financial Statements of the organisation

Dr Balance sheet Cr.

Liabilities £. Assets Cr.

Capital 16200 Bank 3080

(-)Drawings 1600 14600 Cash 7120

Creditor (Toys Ltd) 2350 Van 3000

Net Profit 400 Laptop 1000

Car 2500

Debtor (Fred) 400

Closing Stock 250

Dr Trading Account Cr.

Particulars £. Particulars Cr.

Purchase 2450 Sales 3900

Gross Profit 1800 Closing Stock 250

Purchase Return 100

Total 4250 Total 4250

Dr Profit and Loss Account Cr.

Particulars £. Particulars £

Rent 500 Gross Profit 1800

Wages 820

Repair 80

Net Profit 400

Total 1800 Total 1800

Financial Statements of the organisation

Dr Balance sheet Cr.

Liabilities £. Assets Cr.

Capital 16200 Bank 3080

(-)Drawings 1600 14600 Cash 7120

Creditor (Toys Ltd) 2350 Van 3000

Net Profit 400 Laptop 1000

Car 2500

Debtor (Fred) 400

Closing Stock 250

Total 17350 Total 17350

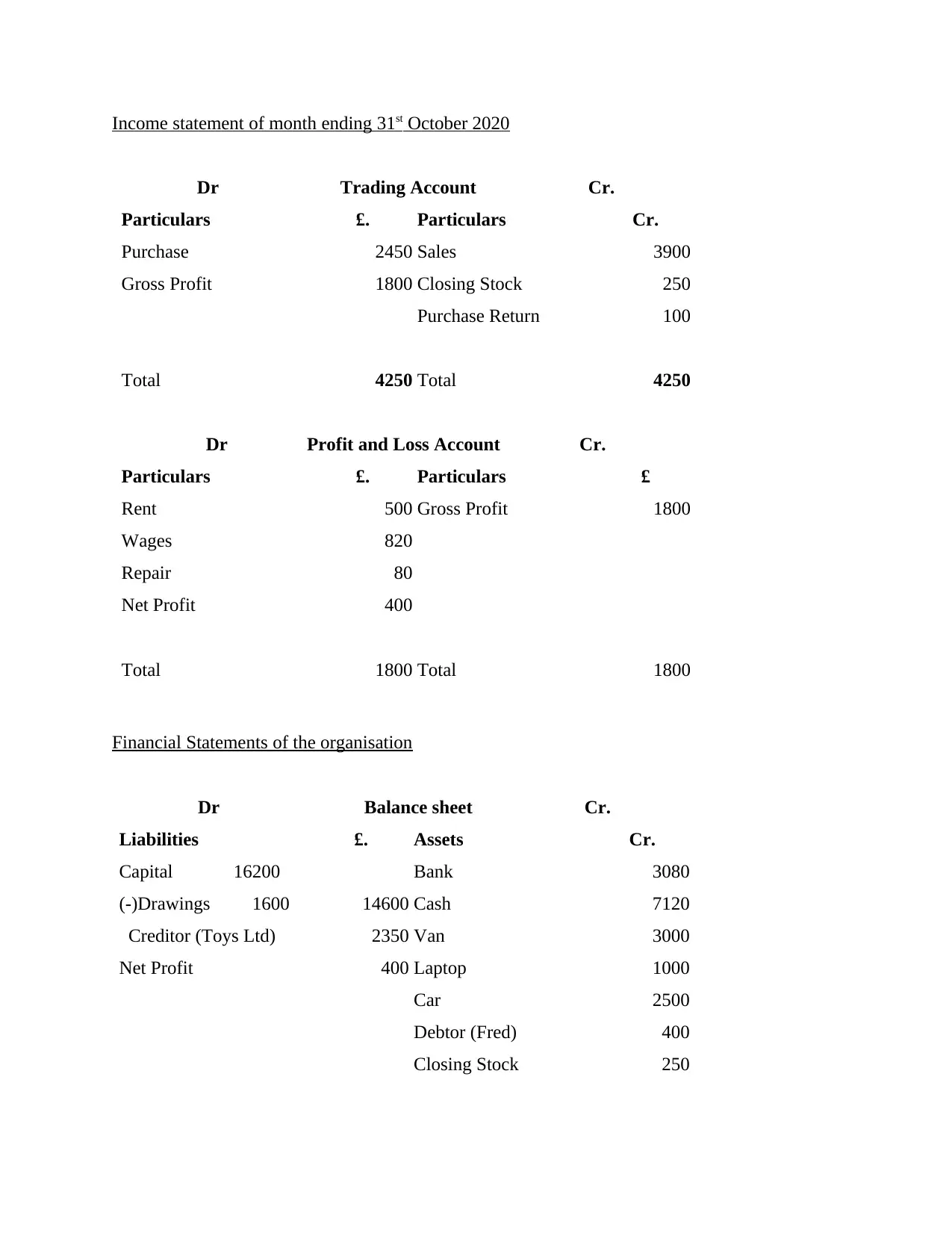

PART B

Ratio analysis of the given organisation

Competitors Average

• Net profit margin 31%

Net profit

margin

31st Oct.2020

Net profit 400

Sales 3900

Ratio 0.1025641026

• Gross profit margin 54%

Gross profit

margin

31st Oct.2020

Gross profit 1800

Sales 3900

Ratio 0.4615384615

• Current ratio 2.87x

Current

Ratio

31st Oct.2020

Current assets 10850

Current Lia. 2350

Ratio 4.6170212766

PART B

Ratio analysis of the given organisation

Competitors Average

• Net profit margin 31%

Net profit

margin

31st Oct.2020

Net profit 400

Sales 3900

Ratio 0.1025641026

• Gross profit margin 54%

Gross profit

margin

31st Oct.2020

Gross profit 1800

Sales 3900

Ratio 0.4615384615

• Current ratio 2.87x

Current

Ratio

31st Oct.2020

Current assets 10850

Current Lia. 2350

Ratio 4.6170212766

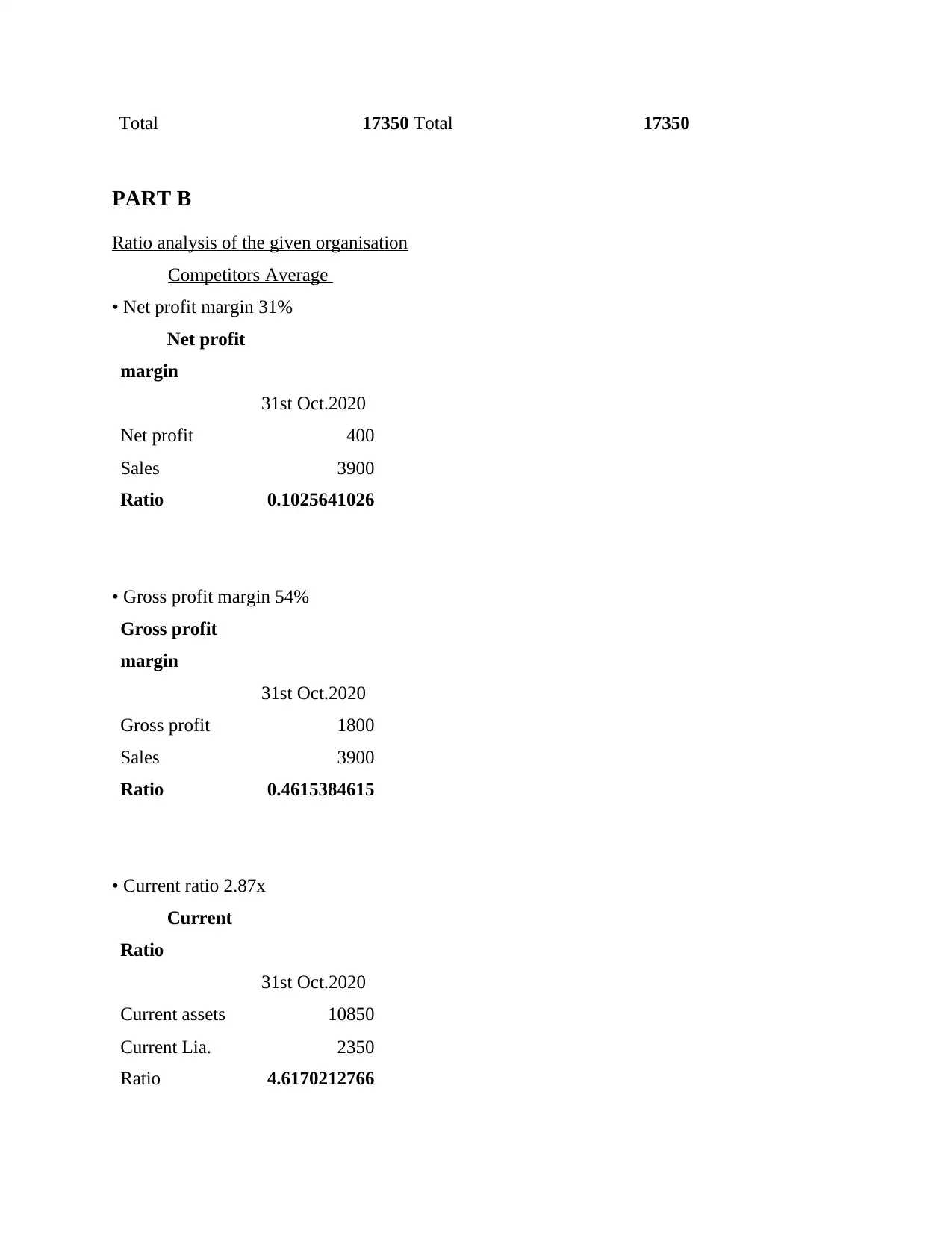

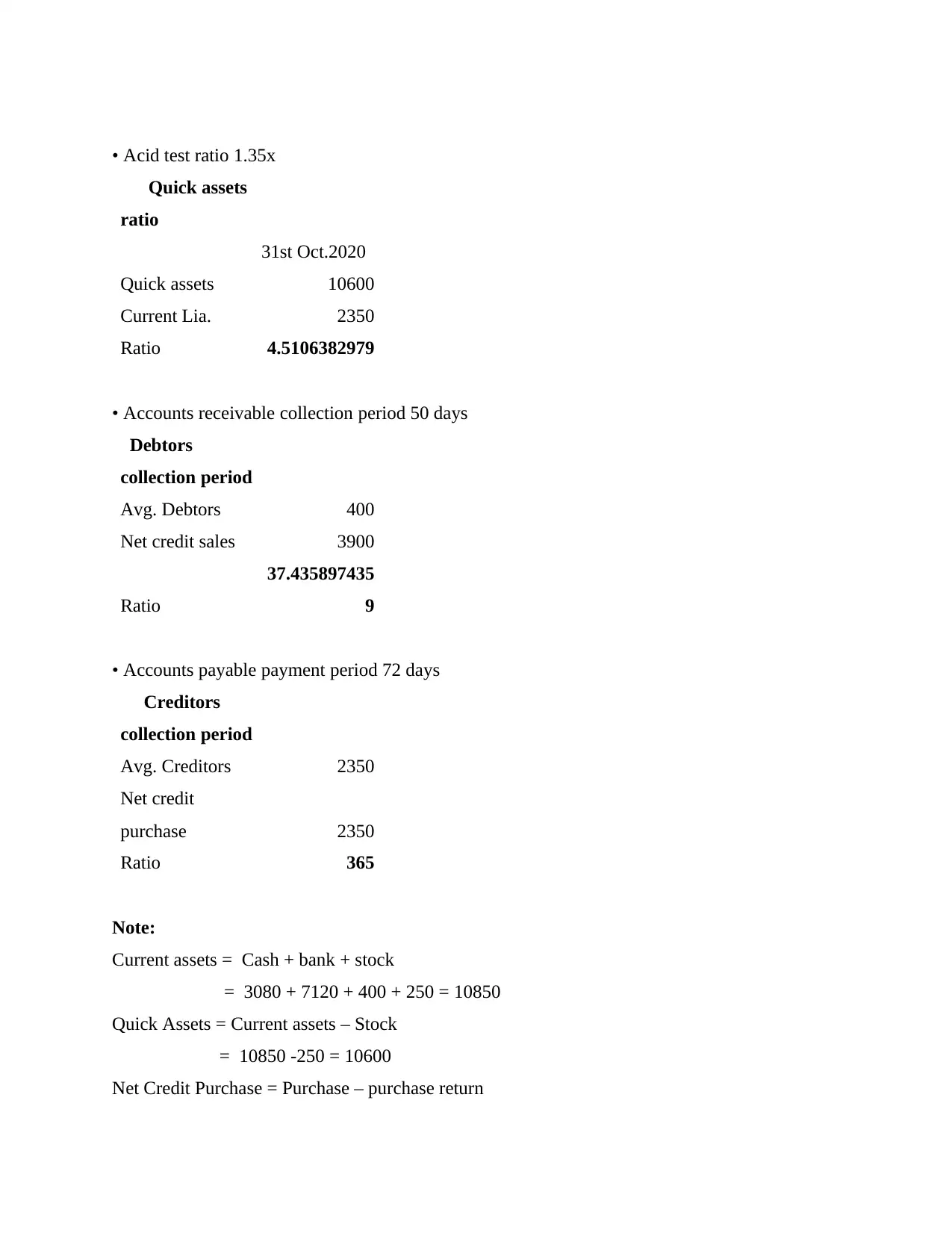

• Acid test ratio 1.35x

Quick assets

ratio

31st Oct.2020

Quick assets 10600

Current Lia. 2350

Ratio 4.5106382979

• Accounts receivable collection period 50 days

Debtors

collection period

Avg. Debtors 400

Net credit sales 3900

Ratio

37.435897435

9

• Accounts payable payment period 72 days

Creditors

collection period

Avg. Creditors 2350

Net credit

purchase 2350

Ratio 365

Note:

Current assets = Cash + bank + stock

= 3080 + 7120 + 400 + 250 = 10850

Quick Assets = Current assets – Stock

= 10850 -250 = 10600

Net Credit Purchase = Purchase – purchase return

Quick assets

ratio

31st Oct.2020

Quick assets 10600

Current Lia. 2350

Ratio 4.5106382979

• Accounts receivable collection period 50 days

Debtors

collection period

Avg. Debtors 400

Net credit sales 3900

Ratio

37.435897435

9

• Accounts payable payment period 72 days

Creditors

collection period

Avg. Creditors 2350

Net credit

purchase 2350

Ratio 365

Note:

Current assets = Cash + bank + stock

= 3080 + 7120 + 400 + 250 = 10850

Quick Assets = Current assets – Stock

= 10850 -250 = 10600

Net Credit Purchase = Purchase – purchase return

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= 2450 – 100 = 2350

Analysing above ratios in comparison with competitors

Ratio Analysis refers to comparison of various items present in financial statements of an

organisation (Papillon, 2018). It is useful in order to measure various issues of the organisation.

Such issues includes deficiency of productivity, liquidity, profitability, etc. Such activity is

mainly conducted by various analysts who operates outside an entity. Their only source of

knowing company's current position is its financial statements. In regard with Linda's

organisation, ratio analysis is covered for understanding its current financial position in market

as compared to its existing competitors. Therefore organisation's position evaluation can be done

through application of varying ratios that will be helpful to know its liquidity, profitability, debt

payment, accounts receivables and so on. With the help of various ratios, analysis of

organisation's current position as compared to its competitors can be done as follows:

Liquidity ratio: This ratio is used to check company's power to convert its existing

assets into cash (Marchini and et. al., 2018). This way its liquidity can be evaluated through

application of given ratio. In the given situation, organisation can make efforts to improvise its

liquidity to increase its sustainability in existing market. This way company can perform in a

better manner as compared to its competitors.

Current ratio: It measures the level of liquidity an organisation has in order to repay its

short term liabilities i.e. payments to be made within a year. Therefore it helps investors to

analyse that a manner in which company can use current assets to repay its existing current

liabilities. The formula used to calculate such liquidity is as follows:

Current Ratio = Current Assets / Current Liabilities

Quick ratio: This ratio measures company's pound amount based liquid assets existing

against pound amount based current debts (Joe and Malhotra, 2021). Quick ratio is also referred

as acid test ratio. Liquid assets are more prone to liquidity in this ratio as compared to current

ratio. As per above situation, Linda's organisation is prone to liquidity that means it has good rate

of liquidity as compared to its competitors. Therefore it has an ability to repay current debts

quickly than its competitors.

Turnover ratio: These ratios are representation of value of assets and liabilities which an

organisation has utilised in connection with sales (Narang, 2017). It is applied that more asset

turnovers are good as it means the collection of receivables are implemented more quickly than

Analysing above ratios in comparison with competitors

Ratio Analysis refers to comparison of various items present in financial statements of an

organisation (Papillon, 2018). It is useful in order to measure various issues of the organisation.

Such issues includes deficiency of productivity, liquidity, profitability, etc. Such activity is

mainly conducted by various analysts who operates outside an entity. Their only source of

knowing company's current position is its financial statements. In regard with Linda's

organisation, ratio analysis is covered for understanding its current financial position in market

as compared to its existing competitors. Therefore organisation's position evaluation can be done

through application of varying ratios that will be helpful to know its liquidity, profitability, debt

payment, accounts receivables and so on. With the help of various ratios, analysis of

organisation's current position as compared to its competitors can be done as follows:

Liquidity ratio: This ratio is used to check company's power to convert its existing

assets into cash (Marchini and et. al., 2018). This way its liquidity can be evaluated through

application of given ratio. In the given situation, organisation can make efforts to improvise its

liquidity to increase its sustainability in existing market. This way company can perform in a

better manner as compared to its competitors.

Current ratio: It measures the level of liquidity an organisation has in order to repay its

short term liabilities i.e. payments to be made within a year. Therefore it helps investors to

analyse that a manner in which company can use current assets to repay its existing current

liabilities. The formula used to calculate such liquidity is as follows:

Current Ratio = Current Assets / Current Liabilities

Quick ratio: This ratio measures company's pound amount based liquid assets existing

against pound amount based current debts (Joe and Malhotra, 2021). Quick ratio is also referred

as acid test ratio. Liquid assets are more prone to liquidity in this ratio as compared to current

ratio. As per above situation, Linda's organisation is prone to liquidity that means it has good rate

of liquidity as compared to its competitors. Therefore it has an ability to repay current debts

quickly than its competitors.

Turnover ratio: These ratios are representation of value of assets and liabilities which an

organisation has utilised in connection with sales (Narang, 2017). It is applied that more asset

turnovers are good as it means the collection of receivables are implemented more quickly than

usual. But liability turnover should be low to be considered as good because it is believed that an

organisation having more possible time to pay its debts is favourable. It means a company

retaining cash for a longer period is better for its performance. The given organisation has

maintained a good level of collection period in regard to both debtors and creditors. Therefore it

will be beneficial for its overall growth and efficiency of outcome. The sustainability of

company increases with more appropriate collection period.

Profitability ratio: This ratio is helpful in evaluating power of an organisation to yield

optimum level of income/profit in reference with its revenue, assets(long term/short term),

shareholder's holdings, etc. It is beneficial if an organisation is earning higher amount of profits

as it will show its overall efficiency. There are various profitability ratios used by organisations

to evaluate its profit earning capacity. For example, Gross profit margin and net profit margin are

two major methods of evaluating company's profit margin. More higher a ratio, it will reflect

advanced efficiency of its operations. These ratios are very significant to measure an

organisation's overall performance, efficiency, profitability and sustainability. In regard to the

given organisation, the profit earning capacity needs to be improvised as compared to its

competitors in the industry. This way the organisation will have better working stability, strong

market position and profitability in the long run.

CONCLUSION

As per above analysis, it can be concluded that the organisation needs to evaluate its business

transactions with the help of various financial statements in order to achieve level of efficiency.

Business transactions are considered as important part of an organisation where it measures them

in monetary value. These transactions has huge impact on company's performance and overall

growth. These statements are kind of measures which are used to identify company's existing

financial position in the market as compared to its competitors. Every enterprise needs to out

grow in its operating industry as it is vital for improvisation in earning power. In the above

report, Linda's organisation has achieved a level of efficiency which will enable its business to

operate on a large platform smoothly. The company is implementing competitive strategies in

order to deal with the existing competition in market. By formulating above mentioned

statements like income statement, trial balance, T-accounts, ledger accounts, balance sheet as

well as various ratios it is determined that organisation has to prepare such statements and

organisation having more possible time to pay its debts is favourable. It means a company

retaining cash for a longer period is better for its performance. The given organisation has

maintained a good level of collection period in regard to both debtors and creditors. Therefore it

will be beneficial for its overall growth and efficiency of outcome. The sustainability of

company increases with more appropriate collection period.

Profitability ratio: This ratio is helpful in evaluating power of an organisation to yield

optimum level of income/profit in reference with its revenue, assets(long term/short term),

shareholder's holdings, etc. It is beneficial if an organisation is earning higher amount of profits

as it will show its overall efficiency. There are various profitability ratios used by organisations

to evaluate its profit earning capacity. For example, Gross profit margin and net profit margin are

two major methods of evaluating company's profit margin. More higher a ratio, it will reflect

advanced efficiency of its operations. These ratios are very significant to measure an

organisation's overall performance, efficiency, profitability and sustainability. In regard to the

given organisation, the profit earning capacity needs to be improvised as compared to its

competitors in the industry. This way the organisation will have better working stability, strong

market position and profitability in the long run.

CONCLUSION

As per above analysis, it can be concluded that the organisation needs to evaluate its business

transactions with the help of various financial statements in order to achieve level of efficiency.

Business transactions are considered as important part of an organisation where it measures them

in monetary value. These transactions has huge impact on company's performance and overall

growth. These statements are kind of measures which are used to identify company's existing

financial position in the market as compared to its competitors. Every enterprise needs to out

grow in its operating industry as it is vital for improvisation in earning power. In the above

report, Linda's organisation has achieved a level of efficiency which will enable its business to

operate on a large platform smoothly. The company is implementing competitive strategies in

order to deal with the existing competition in market. By formulating above mentioned

statements like income statement, trial balance, T-accounts, ledger accounts, balance sheet as

well as various ratios it is determined that organisation has to prepare such statements and

conduct ratio analysis in order to examine its liquidity, solvency, profitability, sustainability and

efficiency of operations in comparison to its existing competitors in the market.

efficiency of operations in comparison to its existing competitors in the market.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

Amro, I., 2019. Online Arbitration in Theory and in Practice: A Comparative Study of Cross-

border Commercial Transactions in Common Law and Civil Law Countries. Cambridge Scholars

Publishing.

Papillon, B.M., 2018. Value Creation, Transactions and the Firm. American Journal of

Management, 18(5), pp.46-62.

Marchini and et. al., 2018. Related party transactions, corporate governance and earnings

management. Corporate Governance: The International Journal of Business in Society.

Narang, M., 2017. Understanding Related Party Transactions: A Neglected Issue in Corporate

Governance. Asian Journal of Research in Business Economics and Management, 7(8), pp.413-

428.

Joe, P. and Malhotra, N., 2021. An exploratory study on increase of transactions with the use of

deferred payment facilities. SMART Journal of Business Management Studies, 17(1), pp.11-19.

Books and journals

Amro, I., 2019. Online Arbitration in Theory and in Practice: A Comparative Study of Cross-

border Commercial Transactions in Common Law and Civil Law Countries. Cambridge Scholars

Publishing.

Papillon, B.M., 2018. Value Creation, Transactions and the Firm. American Journal of

Management, 18(5), pp.46-62.

Marchini and et. al., 2018. Related party transactions, corporate governance and earnings

management. Corporate Governance: The International Journal of Business in Society.

Narang, M., 2017. Understanding Related Party Transactions: A Neglected Issue in Corporate

Governance. Asian Journal of Research in Business Economics and Management, 7(8), pp.413-

428.

Joe, P. and Malhotra, N., 2021. An exploratory study on increase of transactions with the use of

deferred payment facilities. SMART Journal of Business Management Studies, 17(1), pp.11-19.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.