Regulation; Natural Monopoly: Pricing and Market Efficiency Analysis

VerifiedAdded on 2020/02/24

|12

|2771

|130

Essay

AI Summary

This essay provides an in-depth analysis of natural monopolies and their regulation. It begins by contrasting monopoly and perfect competition, highlighting the inefficiencies of monopolies. The essay then defines natural monopolies, emphasizing their unique cost structures and the rationale for government intervention. It explores different pricing strategies, including unregulated pricing, marginal cost pricing, average cost pricing, and price cap regulation, evaluating their advantages and disadvantages. The discussion covers the challenges of implementing cost-plus regulation and the efficiency gains associated with price cap regulation. The analysis considers the impact of these strategies on market outcomes, including consumer surplus, producer surplus, and overall market efficiency. The essay uses figures to illustrate market conditions. Overall, the essay offers a comprehensive understanding of the economic principles underlying natural monopoly regulation and provides insights into the design of effective regulatory policies.

Running head: REGUALTION; NATURAL MONOPOLY

Regulation; Natural Monopoly

Name of the Student

Name of the University

Author note

Regulation; Natural Monopoly

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1REGULATION; NATURAL MONOPOLY

Introduction

In economic terms, market represents exchange relation between buyers and sellers.

Depending on several aspects of market such as how many buyers and sellers presence in the

market, what type of product the specific market sold, size of the market determines specific

category of market. Most commonly used market classification is based on the buyers and sellers

in the market. Efficient allocation of resources depends on specific structure of the market. The

less is market power the more efficient is allocation. In this regard, market power is highest for a

seller operating in a monopoly market, a market characterized by a single seller and numerous

buyers. A monopoly market in its general form is less efficient than a competitive market.

A related form of pure monopoly is natural monopoly. The difference between pure

monopoly and natural monopoly is that in the presence of a pure monopolist, competition is

more preferred to a single seller. However, in a natural monopoly market the presence of single

seller entails maximum efficiency. This is because the natural monopolist operates at a point in

average cost curve, such that scale benefit can be enjoyed. In the natural monopoly market, need

for government regulation is realized to ensure an efficient pricing.

Analysis

Monopoly and perfect competition

In a standard monopoly market, equilibrium combination of price and quantity is derived

from the profit maximization condition. In the monopoly market, control of price is in the hand

of monopolist. The point where revenue from selling marginal quantity matches with the cost of

producing marginal quantity is considered as profit maximizing point (Currie, Peel, & Peters,

2016). Price in the monopoly market exceeds marginal cost generating profit for the monopolist.

Introduction

In economic terms, market represents exchange relation between buyers and sellers.

Depending on several aspects of market such as how many buyers and sellers presence in the

market, what type of product the specific market sold, size of the market determines specific

category of market. Most commonly used market classification is based on the buyers and sellers

in the market. Efficient allocation of resources depends on specific structure of the market. The

less is market power the more efficient is allocation. In this regard, market power is highest for a

seller operating in a monopoly market, a market characterized by a single seller and numerous

buyers. A monopoly market in its general form is less efficient than a competitive market.

A related form of pure monopoly is natural monopoly. The difference between pure

monopoly and natural monopoly is that in the presence of a pure monopolist, competition is

more preferred to a single seller. However, in a natural monopoly market the presence of single

seller entails maximum efficiency. This is because the natural monopolist operates at a point in

average cost curve, such that scale benefit can be enjoyed. In the natural monopoly market, need

for government regulation is realized to ensure an efficient pricing.

Analysis

Monopoly and perfect competition

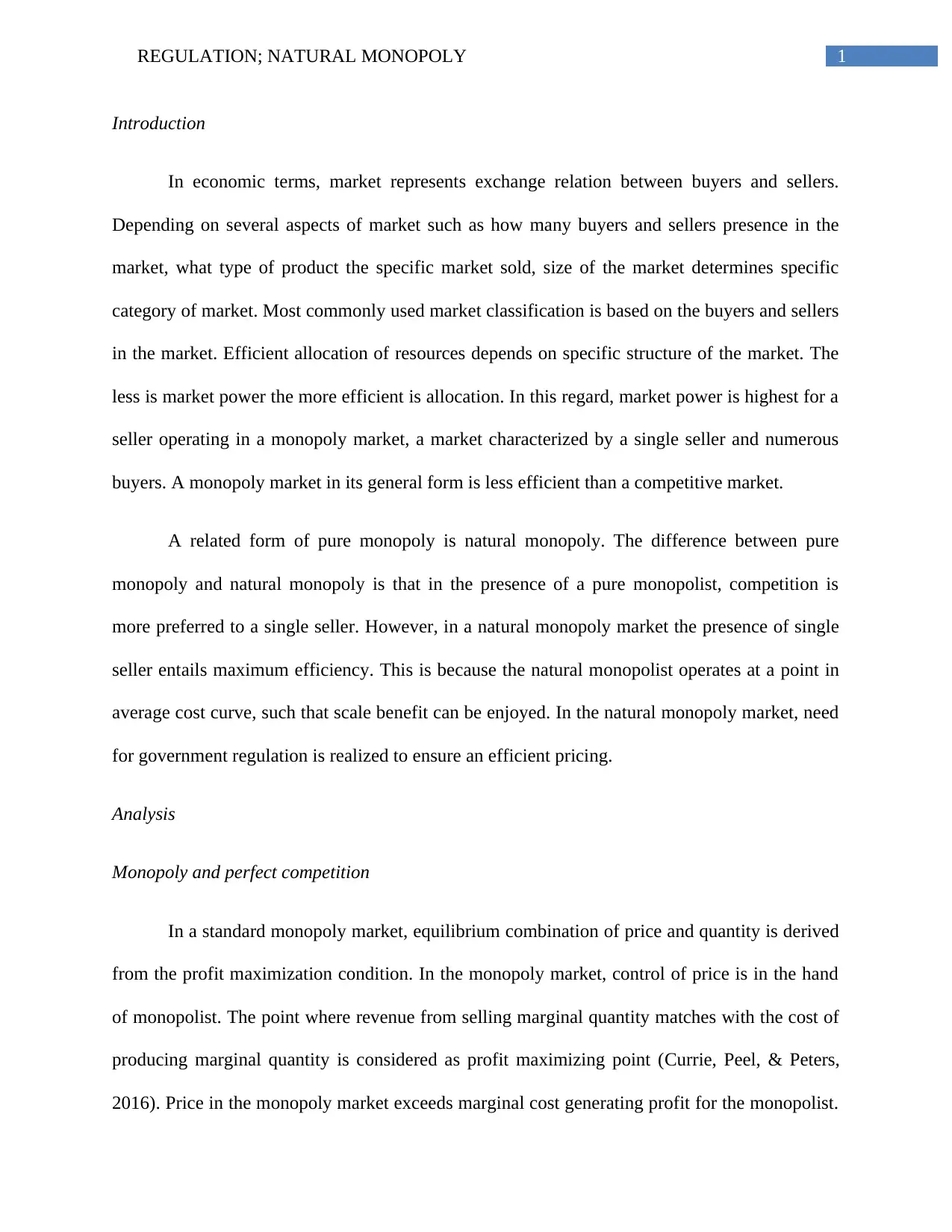

In a standard monopoly market, equilibrium combination of price and quantity is derived

from the profit maximization condition. In the monopoly market, control of price is in the hand

of monopolist. The point where revenue from selling marginal quantity matches with the cost of

producing marginal quantity is considered as profit maximizing point (Currie, Peel, & Peters,

2016). Price in the monopoly market exceeds marginal cost generating profit for the monopolist.

2REGULATION; NATURAL MONOPOLY

Figure 1 shows condition in the monopoly market. Profit of the monopolist is shown by the

shaded region.

Figure 1: Monopoly market Condition

(Source: As created by the Author)

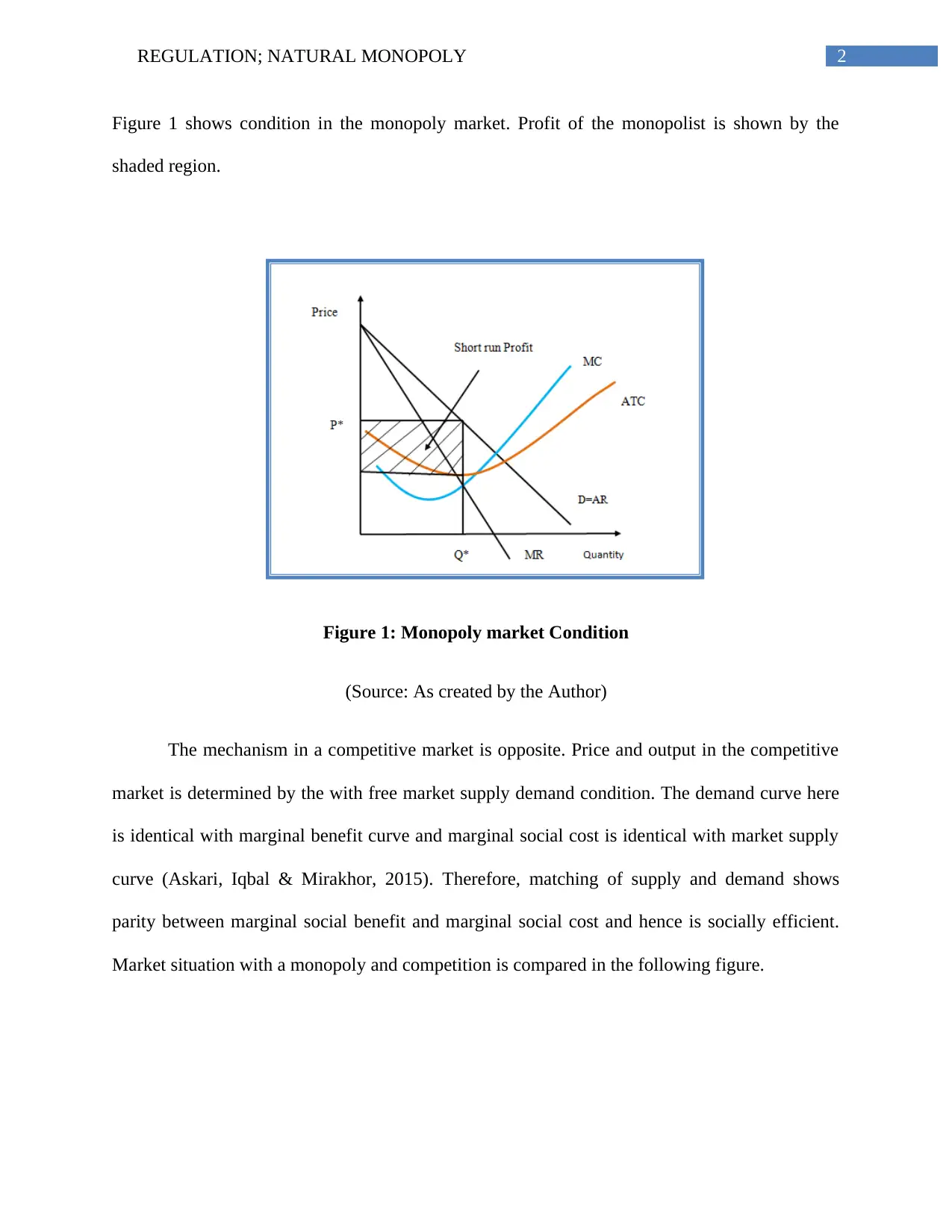

The mechanism in a competitive market is opposite. Price and output in the competitive

market is determined by the with free market supply demand condition. The demand curve here

is identical with marginal benefit curve and marginal social cost is identical with market supply

curve (Askari, Iqbal & Mirakhor, 2015). Therefore, matching of supply and demand shows

parity between marginal social benefit and marginal social cost and hence is socially efficient.

Market situation with a monopoly and competition is compared in the following figure.

Figure 1 shows condition in the monopoly market. Profit of the monopolist is shown by the

shaded region.

Figure 1: Monopoly market Condition

(Source: As created by the Author)

The mechanism in a competitive market is opposite. Price and output in the competitive

market is determined by the with free market supply demand condition. The demand curve here

is identical with marginal benefit curve and marginal social cost is identical with market supply

curve (Askari, Iqbal & Mirakhor, 2015). Therefore, matching of supply and demand shows

parity between marginal social benefit and marginal social cost and hence is socially efficient.

Market situation with a monopoly and competition is compared in the following figure.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3REGULATION; NATURAL MONOPOLY

Figure 2: Comparing monopoly and competitive market

(Source: as created by the Author)

The supply curve or marginal social cost curve is the marginal cost curve the monopolist.

Price and quantity in the monopoly market is Pm and Qm and that of a competitive market is Pc

and Qc respectively. It is clearly seen from the diagram that Pm>Pc and Qm<Qc. The loss to the

society in operation of monopolist and resulted low output and high price is indicated as the

deadweight loss to the society (Wang, 2016).

Natural monopoly

From the earlier discussion, it is clear that the position of a single seller in the monopoly

market is not socially desirable. The status of a single supplier is retained by creating entry

barrier in the market. Natural monopoly is a market where natural barrier restricts entry of new

seller in the market (Yang & Ng, 2015). The natural barriers refer to conditions where other

Figure 2: Comparing monopoly and competitive market

(Source: as created by the Author)

The supply curve or marginal social cost curve is the marginal cost curve the monopolist.

Price and quantity in the monopoly market is Pm and Qm and that of a competitive market is Pc

and Qc respectively. It is clearly seen from the diagram that Pm>Pc and Qm<Qc. The loss to the

society in operation of monopolist and resulted low output and high price is indicated as the

deadweight loss to the society (Wang, 2016).

Natural monopoly

From the earlier discussion, it is clear that the position of a single seller in the monopoly

market is not socially desirable. The status of a single supplier is retained by creating entry

barrier in the market. Natural monopoly is a market where natural barrier restricts entry of new

seller in the market (Yang & Ng, 2015). The natural barriers refer to conditions where other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4REGULATION; NATURAL MONOPOLY

firms itself do not take interest to enter in the market because of a very high fixed cost.

Government often crates regulatory barriers to entry in order to retain the efficiency of the

market with a single supplier.

Average fixed cost and average variable cost together constitute average total cost. If

fixed cost is high then with increase in output level it falls at a faster rate because fixed cost does

not increase with an increase in output. As a result, average total cost falls with an increase in the

range of output (Barreto, 2013). This is exactly the situation in a natural monopoly market. The

natural barrier exists in terms of high fixed cost. With a high fixed cost, total average fixed cost

is rapidly falling. This generates benefits of economics scale for the monopolist. In the presence

of economics of scale the monopolist can operate anywhere in the falling part of average cost

curve.

The single seller in the natural monopoly market has scope for maximizing profit as like

a pure monopolist. The profit can be much greater for natural monopolist because of scale

efficiency. The natural monopolist here charges same price output combination as is obtained for

a general monopoly market. This gives rise to the need for regulatory price in a natural

monopoly market. Socially efficient price is that price obtained from the pricing condition

similar as that in a competitive market (Cowing & McFadden, 2015). However, it is not possible

always to go with a competitive price as this imposes an additional burden of loss. Henceforth,

the regulators chose next best alternative strategy.

Natural Monopoly Pricing and regulation

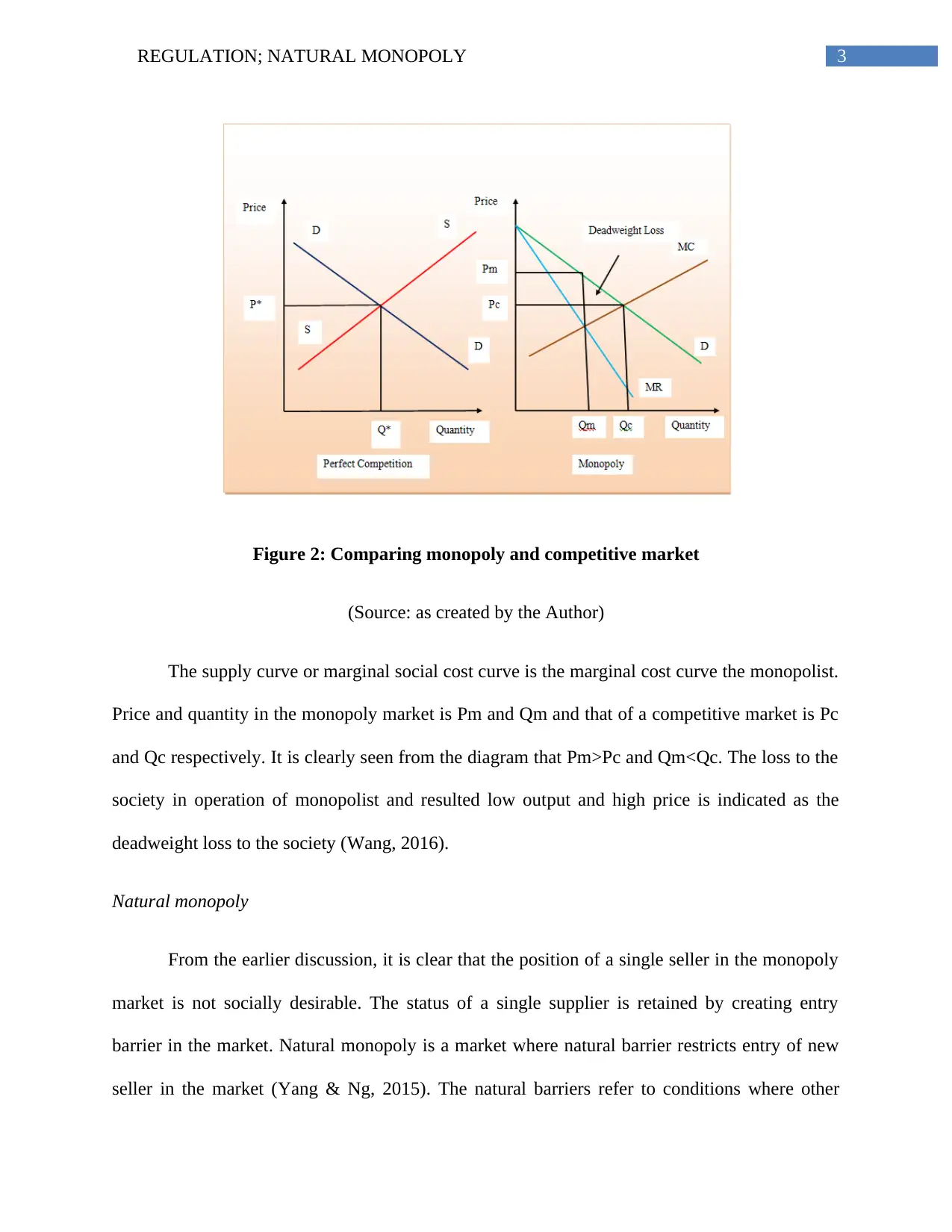

There are three types of pricing option in a natural monopoly market. First, the natural

monopoly market without any regulation is considered. When there is no administrative control

firms itself do not take interest to enter in the market because of a very high fixed cost.

Government often crates regulatory barriers to entry in order to retain the efficiency of the

market with a single supplier.

Average fixed cost and average variable cost together constitute average total cost. If

fixed cost is high then with increase in output level it falls at a faster rate because fixed cost does

not increase with an increase in output. As a result, average total cost falls with an increase in the

range of output (Barreto, 2013). This is exactly the situation in a natural monopoly market. The

natural barrier exists in terms of high fixed cost. With a high fixed cost, total average fixed cost

is rapidly falling. This generates benefits of economics scale for the monopolist. In the presence

of economics of scale the monopolist can operate anywhere in the falling part of average cost

curve.

The single seller in the natural monopoly market has scope for maximizing profit as like

a pure monopolist. The profit can be much greater for natural monopolist because of scale

efficiency. The natural monopolist here charges same price output combination as is obtained for

a general monopoly market. This gives rise to the need for regulatory price in a natural

monopoly market. Socially efficient price is that price obtained from the pricing condition

similar as that in a competitive market (Cowing & McFadden, 2015). However, it is not possible

always to go with a competitive price as this imposes an additional burden of loss. Henceforth,

the regulators chose next best alternative strategy.

Natural Monopoly Pricing and regulation

There are three types of pricing option in a natural monopoly market. First, the natural

monopoly market without any regulation is considered. When there is no administrative control

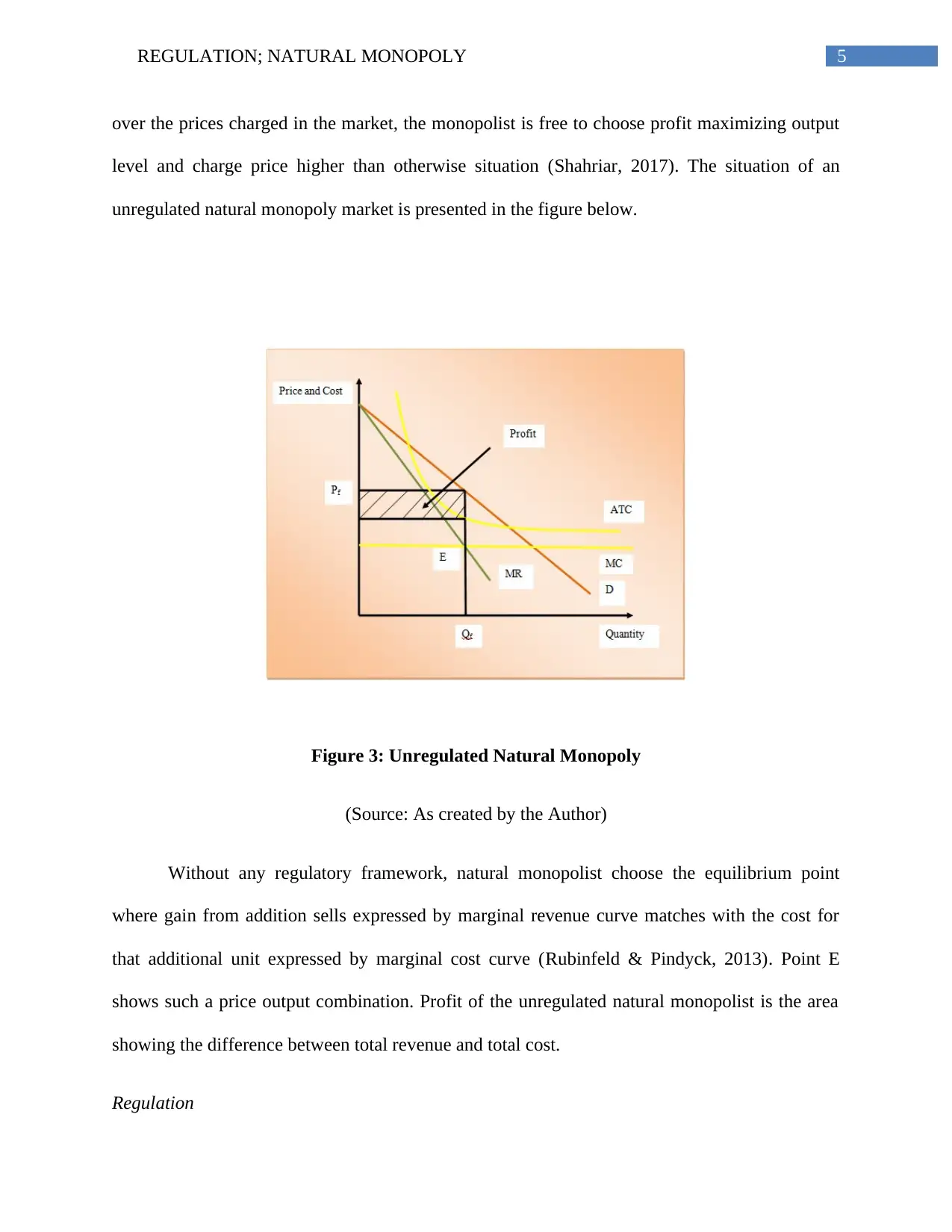

5REGULATION; NATURAL MONOPOLY

over the prices charged in the market, the monopolist is free to choose profit maximizing output

level and charge price higher than otherwise situation (Shahriar, 2017). The situation of an

unregulated natural monopoly market is presented in the figure below.

Figure 3: Unregulated Natural Monopoly

(Source: As created by the Author)

Without any regulatory framework, natural monopolist choose the equilibrium point

where gain from addition sells expressed by marginal revenue curve matches with the cost for

that additional unit expressed by marginal cost curve (Rubinfeld & Pindyck, 2013). Point E

shows such a price output combination. Profit of the unregulated natural monopolist is the area

showing the difference between total revenue and total cost.

Regulation

over the prices charged in the market, the monopolist is free to choose profit maximizing output

level and charge price higher than otherwise situation (Shahriar, 2017). The situation of an

unregulated natural monopoly market is presented in the figure below.

Figure 3: Unregulated Natural Monopoly

(Source: As created by the Author)

Without any regulatory framework, natural monopolist choose the equilibrium point

where gain from addition sells expressed by marginal revenue curve matches with the cost for

that additional unit expressed by marginal cost curve (Rubinfeld & Pindyck, 2013). Point E

shows such a price output combination. Profit of the unregulated natural monopolist is the area

showing the difference between total revenue and total cost.

Regulation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6REGULATION; NATURAL MONOPOLY

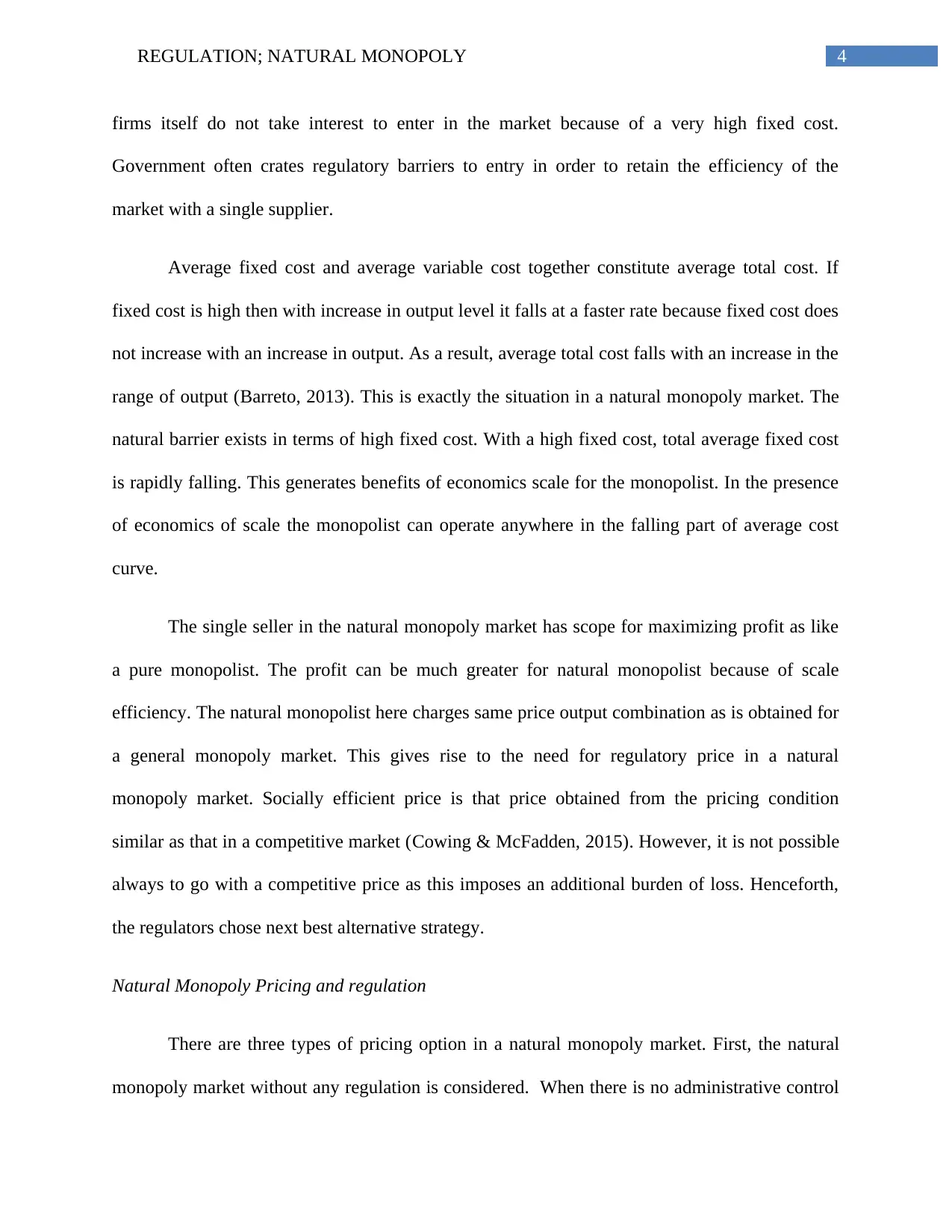

In an unregulated situation, the natural monopolist may deceive buyers who are solely

dependent o the monopoly supplier by serving them a low output at a very high price. It is the

responsibility of regulators to ensure that an optimum quantity is sold at an affordable price in

the market. First best choice for the society is to choose price by rule of marginal pricing. In a

competitive market, price is determined by the level of marginal cost (Basso, Figueroa &

Vásquez, 2017). As marginal cost curve is the social benefit curve, price is actually equals to the

social benefit received and hence is socially optimal. In competitive market, price thus derived is

only sufficient to recover total cost of production and generates only normal profit. The situation

is however different for natural monopoly market.

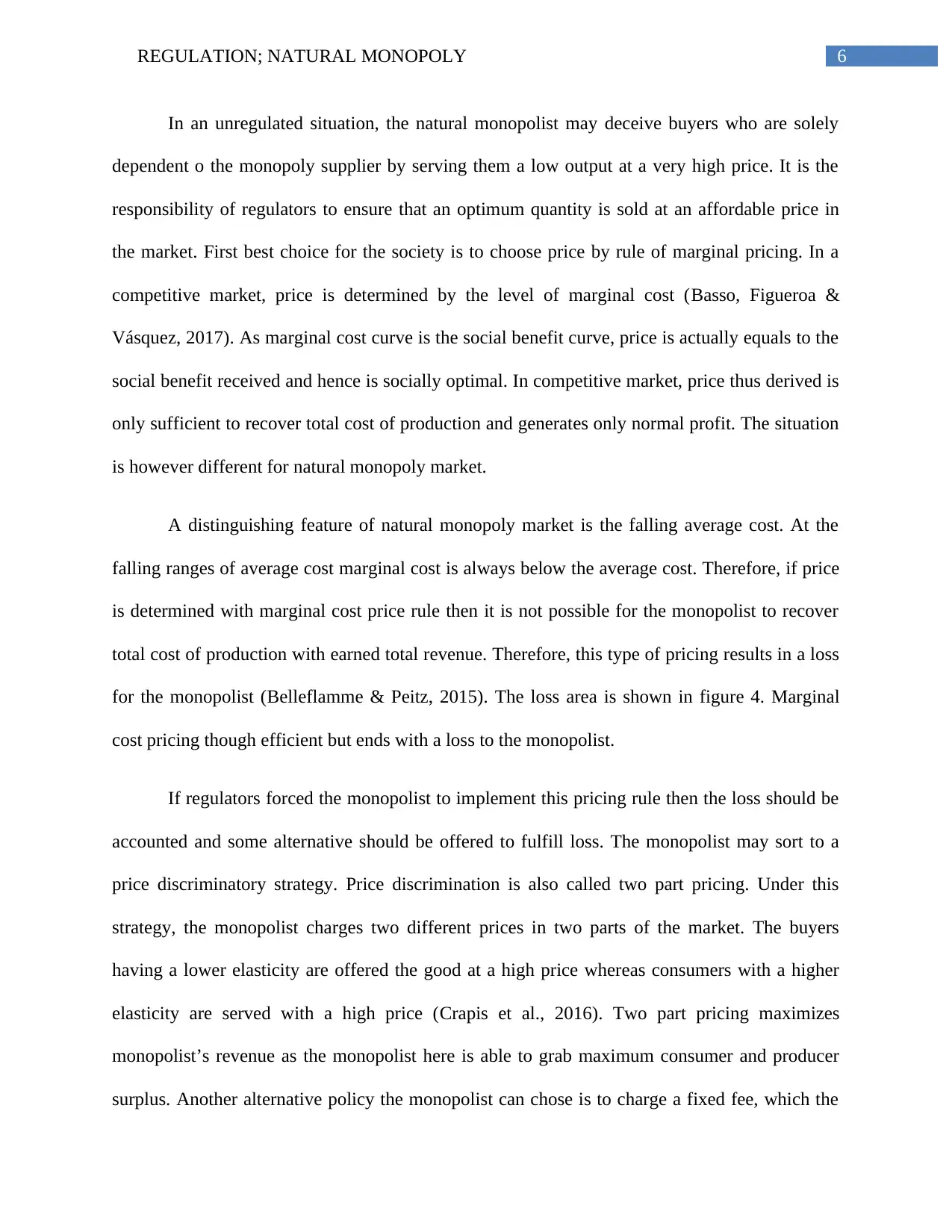

A distinguishing feature of natural monopoly market is the falling average cost. At the

falling ranges of average cost marginal cost is always below the average cost. Therefore, if price

is determined with marginal cost price rule then it is not possible for the monopolist to recover

total cost of production with earned total revenue. Therefore, this type of pricing results in a loss

for the monopolist (Belleflamme & Peitz, 2015). The loss area is shown in figure 4. Marginal

cost pricing though efficient but ends with a loss to the monopolist.

If regulators forced the monopolist to implement this pricing rule then the loss should be

accounted and some alternative should be offered to fulfill loss. The monopolist may sort to a

price discriminatory strategy. Price discrimination is also called two part pricing. Under this

strategy, the monopolist charges two different prices in two parts of the market. The buyers

having a lower elasticity are offered the good at a high price whereas consumers with a higher

elasticity are served with a high price (Crapis et al., 2016). Two part pricing maximizes

monopolist’s revenue as the monopolist here is able to grab maximum consumer and producer

surplus. Another alternative policy the monopolist can chose is to charge a fixed fee, which the

In an unregulated situation, the natural monopolist may deceive buyers who are solely

dependent o the monopoly supplier by serving them a low output at a very high price. It is the

responsibility of regulators to ensure that an optimum quantity is sold at an affordable price in

the market. First best choice for the society is to choose price by rule of marginal pricing. In a

competitive market, price is determined by the level of marginal cost (Basso, Figueroa &

Vásquez, 2017). As marginal cost curve is the social benefit curve, price is actually equals to the

social benefit received and hence is socially optimal. In competitive market, price thus derived is

only sufficient to recover total cost of production and generates only normal profit. The situation

is however different for natural monopoly market.

A distinguishing feature of natural monopoly market is the falling average cost. At the

falling ranges of average cost marginal cost is always below the average cost. Therefore, if price

is determined with marginal cost price rule then it is not possible for the monopolist to recover

total cost of production with earned total revenue. Therefore, this type of pricing results in a loss

for the monopolist (Belleflamme & Peitz, 2015). The loss area is shown in figure 4. Marginal

cost pricing though efficient but ends with a loss to the monopolist.

If regulators forced the monopolist to implement this pricing rule then the loss should be

accounted and some alternative should be offered to fulfill loss. The monopolist may sort to a

price discriminatory strategy. Price discrimination is also called two part pricing. Under this

strategy, the monopolist charges two different prices in two parts of the market. The buyers

having a lower elasticity are offered the good at a high price whereas consumers with a higher

elasticity are served with a high price (Crapis et al., 2016). Two part pricing maximizes

monopolist’s revenue as the monopolist here is able to grab maximum consumer and producer

surplus. Another alternative policy the monopolist can chose is to charge a fixed fee, which the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7REGULATION; NATURAL MONOPOLY

buyers have to pay once. After paying the fixed fee, price is charged equal to the marginal cost

(Dahl, 2015).

However, leaving the monopolist to recover loss itself is again subject to inefficiency.

Hence, for charging marginal cost pricing proper support from government is needed to cover

loss. The government or regulator has to make direct payment to the monopolist an amount

equivalent to loss called subsidy. Payment for subsidy is made out of government revenue.

Therefore, to make subsidy payment government has to increase the tax rate. Increasing tax rate

crates distortion in the society (Ifrach, Maglaras & Scarsini, 2011). In figure 4 socially efficient

price and quantity is denoted as PE and QE.

Figure 4: Different pricing strategy under natural monopoly

(Source: As created by the Author)

buyers have to pay once. After paying the fixed fee, price is charged equal to the marginal cost

(Dahl, 2015).

However, leaving the monopolist to recover loss itself is again subject to inefficiency.

Hence, for charging marginal cost pricing proper support from government is needed to cover

loss. The government or regulator has to make direct payment to the monopolist an amount

equivalent to loss called subsidy. Payment for subsidy is made out of government revenue.

Therefore, to make subsidy payment government has to increase the tax rate. Increasing tax rate

crates distortion in the society (Ifrach, Maglaras & Scarsini, 2011). In figure 4 socially efficient

price and quantity is denoted as PE and QE.

Figure 4: Different pricing strategy under natural monopoly

(Source: As created by the Author)

8REGULATION; NATURAL MONOPOLY

Sometimes it may happen that the distortion crates from increase taxation are greater than

the deadweight loss resulted in an unregulated monopoly market. In this situation, regulation is

proved highly inefficient. The next best alternative is to charge price following average pricing

rule. Here, price is determined by equating it with average cost of production. Since, natural

monopolist makes production to the left of average cost curve, marginal cost never equals

average cost. When price is set equals to the average cost then revenue earned from total sales

exactly matches with the total cost of producing these units. The monopolist here can only earn

normal profit as like competitive firm (Holzhacker, Krishnan & Mahlendorf, 2015). Therefore,

this can be also considered as an efficient operation point. Corresponding price and quantity

under such a scenario is indicated as Pr and Qr respectively. As shown from the figure, the area

of total revenue and total cost are same and there is only normal profit for the monopolist.

Regulating price by using average cost seems to have efficiency over marginal cost

pricing, as there is no additional burden on government budget generated from the loss because

of operating at a point lower than the average cost. The regulation based on costs of the

monopolist is known as the cost plus regulation. The general method here is to have a record on

the cost of the market. The regulators face challenges in implementing cost plus regulation

because the monopolist never reveals true production cost. The general tendency of the

monopolist is to reveal an overestimated figure of cost. In addition, when pricing is dependent on

the estimated cost, then the monopolist bothered least about high cost. The burden of high cost

can easily transfer to customers in terms of a high price (Revesz, 2017). In recent days,

application of cost plus regulation has reduced. Regulators now rely on an alternative price

setting mechanism know as price cap regulation. As the name suggests, it is a mechanism where

a cap or ceiling is set on market price. The price is set for a certain period. In order to increase

Sometimes it may happen that the distortion crates from increase taxation are greater than

the deadweight loss resulted in an unregulated monopoly market. In this situation, regulation is

proved highly inefficient. The next best alternative is to charge price following average pricing

rule. Here, price is determined by equating it with average cost of production. Since, natural

monopolist makes production to the left of average cost curve, marginal cost never equals

average cost. When price is set equals to the average cost then revenue earned from total sales

exactly matches with the total cost of producing these units. The monopolist here can only earn

normal profit as like competitive firm (Holzhacker, Krishnan & Mahlendorf, 2015). Therefore,

this can be also considered as an efficient operation point. Corresponding price and quantity

under such a scenario is indicated as Pr and Qr respectively. As shown from the figure, the area

of total revenue and total cost are same and there is only normal profit for the monopolist.

Regulating price by using average cost seems to have efficiency over marginal cost

pricing, as there is no additional burden on government budget generated from the loss because

of operating at a point lower than the average cost. The regulation based on costs of the

monopolist is known as the cost plus regulation. The general method here is to have a record on

the cost of the market. The regulators face challenges in implementing cost plus regulation

because the monopolist never reveals true production cost. The general tendency of the

monopolist is to reveal an overestimated figure of cost. In addition, when pricing is dependent on

the estimated cost, then the monopolist bothered least about high cost. The burden of high cost

can easily transfer to customers in terms of a high price (Revesz, 2017). In recent days,

application of cost plus regulation has reduced. Regulators now rely on an alternative price

setting mechanism know as price cap regulation. As the name suggests, it is a mechanism where

a cap or ceiling is set on market price. The price is set for a certain period. In order to increase

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9REGULATION; NATURAL MONOPOLY

profit share within the caped price, the monopolist has to reduce cost. To increase profit the cost

saving advanced technologies are employed in the production by the monopolist, which

enhances production efficiency (Sappington & Weisman, 2016). Additionally, more investment

is made for innovation and installing advanced technology. Here lies the efficiency of price cap

regulation. However, in cost plus regulation price is determined based on the estimated cost and

hence, only cost information is required here. For price cap regulation, setting an appropriate

price becomes a difficult task. The ceiling price should neither be too high nor be too low. The

price should be a realistic one so that no parties face loss from the transaction and an efficient

exchange is made in the marketplace.

Conclusion

The essay discusses different pricing strategy that can be undertaken in a natural market.

Some inherent characteristics of natural monopoly market distinguish it from a pure monopoly

market. The natural monopoly market is known for exhibiting scale of production in the market

operation. However, when left regulated the natural monopolist can take advantage of its

monopoly power and charges a high price. Then regulation becomes necessary to ensure

efficiency in the market. The regulators have two pricing strategies. One is marginal or socially

efficient pricing and other is average pricing rule. Regulation under cost plus mechanism is

dependent on monopolist cost and often fails to ensure efficient pricing. An alternative means of

regulation is regulating price by setting a ceiling on it known as price cap regulation.

profit share within the caped price, the monopolist has to reduce cost. To increase profit the cost

saving advanced technologies are employed in the production by the monopolist, which

enhances production efficiency (Sappington & Weisman, 2016). Additionally, more investment

is made for innovation and installing advanced technology. Here lies the efficiency of price cap

regulation. However, in cost plus regulation price is determined based on the estimated cost and

hence, only cost information is required here. For price cap regulation, setting an appropriate

price becomes a difficult task. The ceiling price should neither be too high nor be too low. The

price should be a realistic one so that no parties face loss from the transaction and an efficient

exchange is made in the marketplace.

Conclusion

The essay discusses different pricing strategy that can be undertaken in a natural market.

Some inherent characteristics of natural monopoly market distinguish it from a pure monopoly

market. The natural monopoly market is known for exhibiting scale of production in the market

operation. However, when left regulated the natural monopolist can take advantage of its

monopoly power and charges a high price. Then regulation becomes necessary to ensure

efficiency in the market. The regulators have two pricing strategies. One is marginal or socially

efficient pricing and other is average pricing rule. Regulation under cost plus mechanism is

dependent on monopolist cost and often fails to ensure efficient pricing. An alternative means of

regulation is regulating price by setting a ceiling on it known as price cap regulation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10REGULATION; NATURAL MONOPOLY

References

Askari, H., Iqbal, Z., & Mirakhor, A. (2015). Key Microeconomic Concepts. Introduction to

Islamic Economics: Theory and Application, 95-124.

Barreto, H. (2013). The Entrepreneur in Microeconomic Theory: Disappearance and

Explanaition. Routledge.

Basso, L. J., Figueroa, N., & Vásquez, J. (2017). Monopoly regulation under asymmetric

information: prices versus quantities. The RAND Journal of Economics, 48(3), 557-578.

Belleflamme, P., & Peitz, M. (2015). Industrial organization: markets and strategies. Cambridge

University Press.

Cowing, T. G., & McFadden, D. L. (2015). Microeconomic modeling and policy analysis:

Studies in residential energy demand. Elsevier.

Crapis, D., Ifrach, B., Maglaras, C., & Scarsini, M. (2016). Monopoly pricing in the presence of

social learning. Management Science.

Currie, D., Peel, D., & Peters, W. (Eds.). (2016). Microeconomic Analysis (Routledge Revivals):

Essays in Microeconomics and Economic Development. Routledge.

Dahl, C. (2015). International Energy Markets: Understanding Pricing, Policies, & Profits.

PennWell Books.

Holzhacker, M., Krishnan, R., & Mahlendorf, M. D. (2015). The impact of changes in regulation

on cost behavior. Contemporary Accounting Research, 32(2), 534-566.

References

Askari, H., Iqbal, Z., & Mirakhor, A. (2015). Key Microeconomic Concepts. Introduction to

Islamic Economics: Theory and Application, 95-124.

Barreto, H. (2013). The Entrepreneur in Microeconomic Theory: Disappearance and

Explanaition. Routledge.

Basso, L. J., Figueroa, N., & Vásquez, J. (2017). Monopoly regulation under asymmetric

information: prices versus quantities. The RAND Journal of Economics, 48(3), 557-578.

Belleflamme, P., & Peitz, M. (2015). Industrial organization: markets and strategies. Cambridge

University Press.

Cowing, T. G., & McFadden, D. L. (2015). Microeconomic modeling and policy analysis:

Studies in residential energy demand. Elsevier.

Crapis, D., Ifrach, B., Maglaras, C., & Scarsini, M. (2016). Monopoly pricing in the presence of

social learning. Management Science.

Currie, D., Peel, D., & Peters, W. (Eds.). (2016). Microeconomic Analysis (Routledge Revivals):

Essays in Microeconomics and Economic Development. Routledge.

Dahl, C. (2015). International Energy Markets: Understanding Pricing, Policies, & Profits.

PennWell Books.

Holzhacker, M., Krishnan, R., & Mahlendorf, M. D. (2015). The impact of changes in regulation

on cost behavior. Contemporary Accounting Research, 32(2), 534-566.

11REGULATION; NATURAL MONOPOLY

Ifrach, B., Maglaras, C., & Scarsini, M. (2011). Monopoly pricing in the presence of social

learning.

Revesz, R. L. (2017). Cost-Benefit Analysis and the Structure of the Administrative State: The

Case of Financial Services Regulation. Yale J. on Reg., 34, 545.

Rubinfeld, D., & Pindyck, R. (2013). Microeconomics. Pearson Education.

Sappington, D. E., & Weisman, D. L. (2016). The price cap regulation paradox in the electricity

sector. The Electricity Journal, 29(3), 1-5.

Shahriar, Q. (2017). ECON 321 Section 01 Intermediate Microeconomic Theory.

Wang, S. (2016). Microeconomic Theory (Book). Browser Download This Paper.

Yang, X., & Ng, Y. K. (2015). Specialization and economic organization: A new classical

microeconomic framework (Vol. 215). Elsevier.

Ifrach, B., Maglaras, C., & Scarsini, M. (2011). Monopoly pricing in the presence of social

learning.

Revesz, R. L. (2017). Cost-Benefit Analysis and the Structure of the Administrative State: The

Case of Financial Services Regulation. Yale J. on Reg., 34, 545.

Rubinfeld, D., & Pindyck, R. (2013). Microeconomics. Pearson Education.

Sappington, D. E., & Weisman, D. L. (2016). The price cap regulation paradox in the electricity

sector. The Electricity Journal, 29(3), 1-5.

Shahriar, Q. (2017). ECON 321 Section 01 Intermediate Microeconomic Theory.

Wang, S. (2016). Microeconomic Theory (Book). Browser Download This Paper.

Yang, X., & Ng, Y. K. (2015). Specialization and economic organization: A new classical

microeconomic framework (Vol. 215). Elsevier.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.