ACC702 Managerial Accounting: Remuneration and Performance Analysis

VerifiedAdded on 2023/06/08

|7

|1137

|485

Report

AI Summary

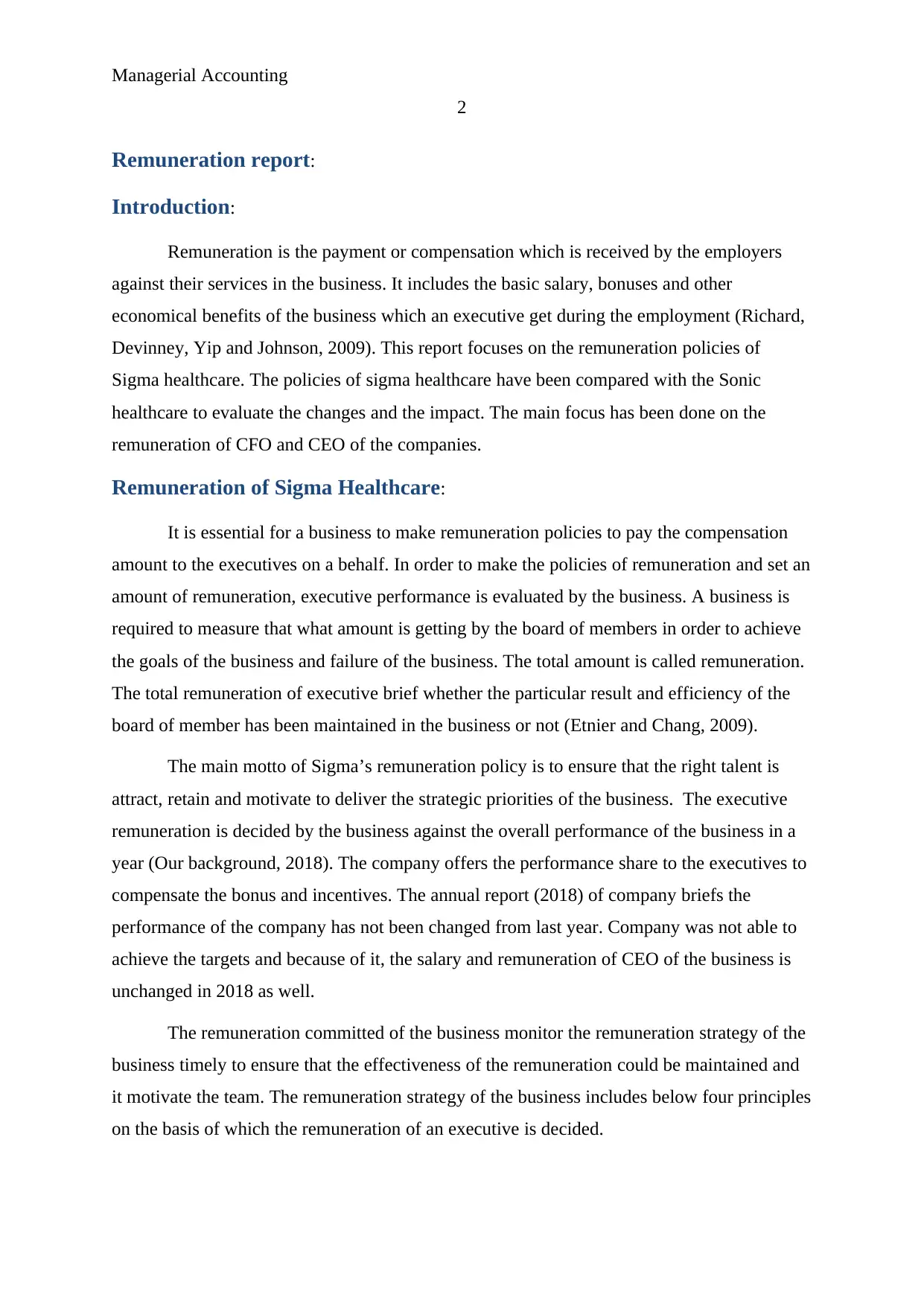

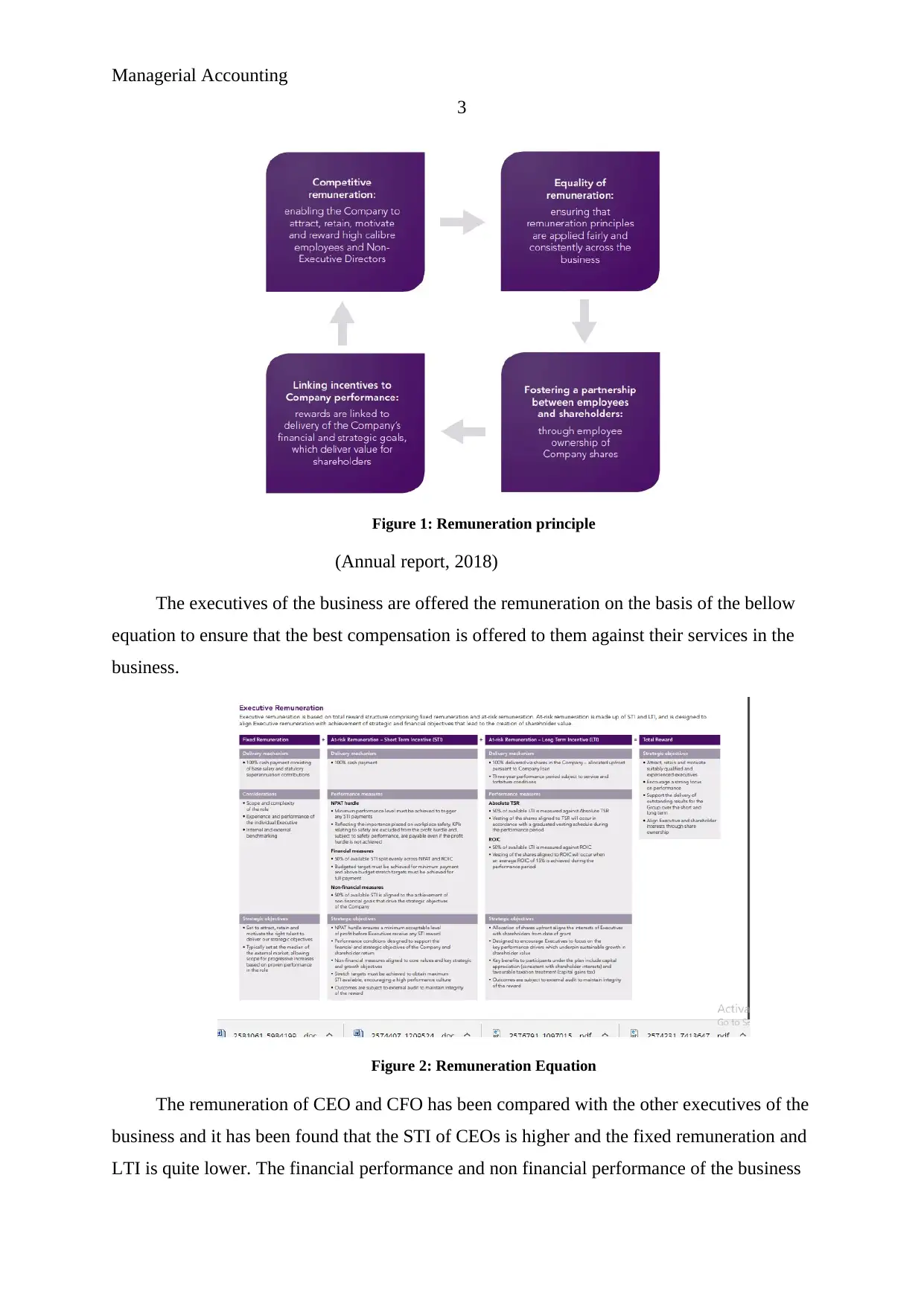

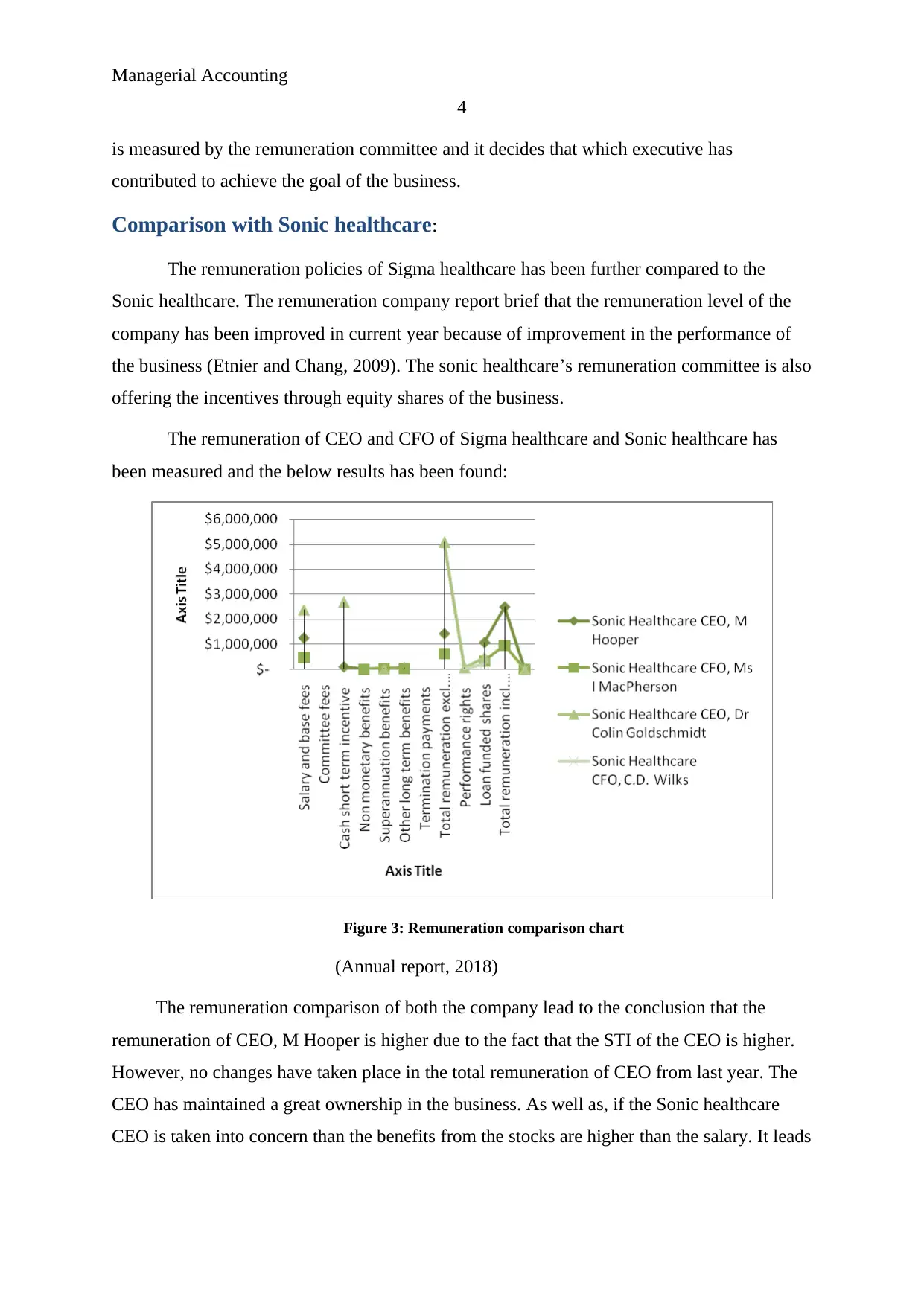

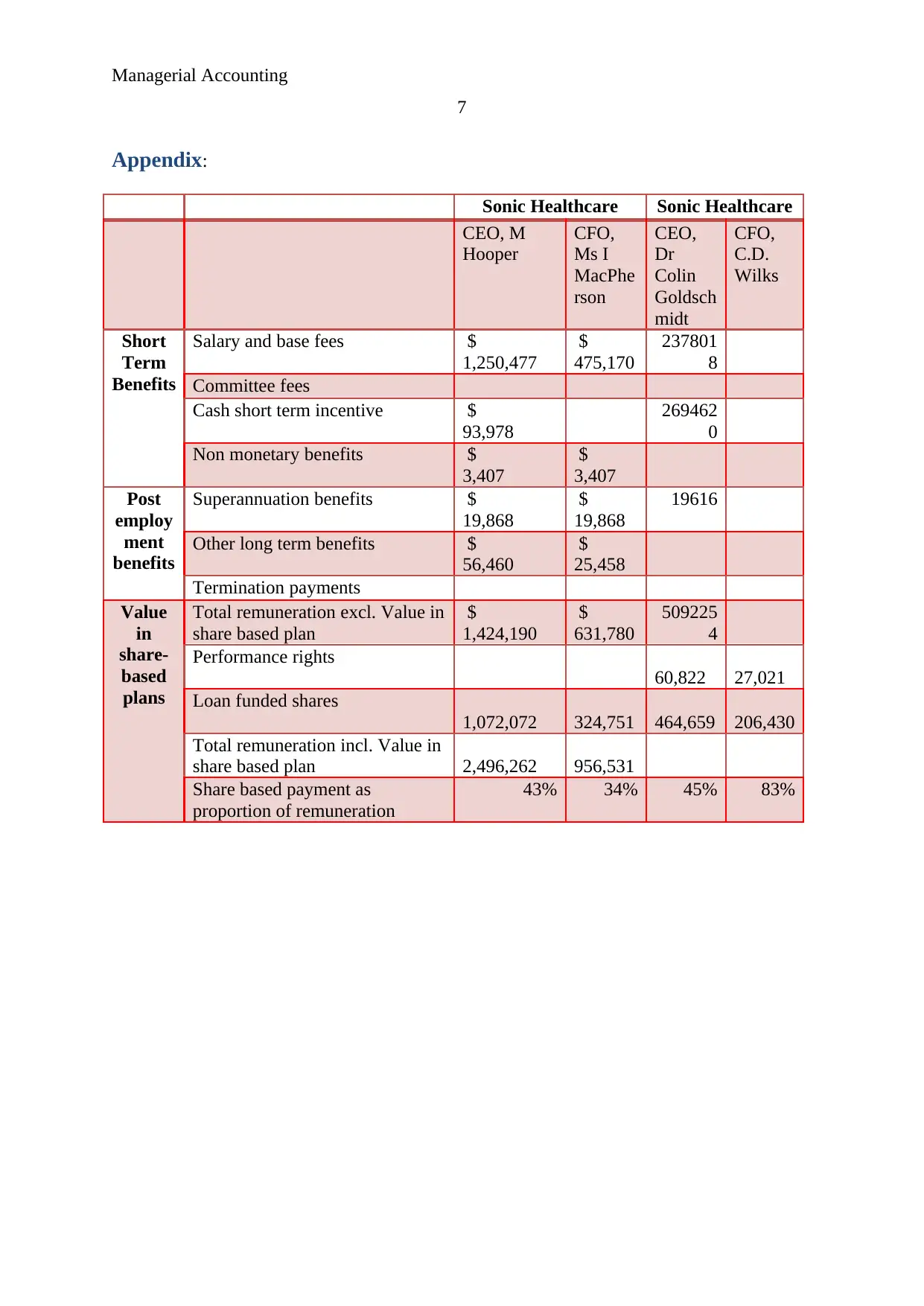

This report provides an analysis of executive remuneration policies, focusing on Sigma Healthcare and comparing them with Sonic Healthcare. It examines the remuneration of CEOs and CFOs, highlighting the importance of aligning remuneration with strategic priorities. The report details Sigma Healthcare's remuneration principles and equation, noting the emphasis on attracting, retaining, and motivating talent. A comparison with Sonic Healthcare reveals differences in remuneration levels and the use of equity shares as incentives. The analysis concludes that both companies aim to reward executives in ways that drive business goals. The document also includes an appendix with detailed financial information. Find more solved assignments and past papers on Desklib.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)