Accounting Concepts and Conceptual Framework: A Study

VerifiedAdded on 2023/03/30

|15

|2819

|122

AI Summary

This study explores the accounting concepts and conceptual framework, focusing on the relevance and faithful representation of financial statements. It discusses the accounting basics, the purpose of financial reporting, and the fundamental qualitative characteristics. The study also analyzes the accounting concepts adopted by Qantas Airways Limited and its adherence to the conceptual framework. Subject: Advanced Accounting

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: REPORT 1

Advanced Accounting

Student details:

6/2/2019

Advanced Accounting

Student details:

6/2/2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REPORT 2

Contents

Introduction......................................................................................................................................3

Background of company..................................................................................................................3

The accounting concepts..................................................................................................................3

Conceptual framework and issues related to measurement.............................................................3

Fundamental qualitative characteristics: Relevance and faithful representation.............................3

Conclusion.......................................................................................................................................3

References........................................................................................................................................4

Contents

Introduction......................................................................................................................................3

Background of company..................................................................................................................3

The accounting concepts..................................................................................................................3

Conceptual framework and issues related to measurement.............................................................3

Fundamental qualitative characteristics: Relevance and faithful representation.............................3

Conclusion.......................................................................................................................................3

References........................................................................................................................................4

REPORT 3

Introduction

The accounting concepts are very significant in proper accounting and for understanding of the

financial statements of the company. The accounting basics state some fundamental concepts

related to the accounting, accounting principles, and the techniques of accounting. The main

purpose of financial reporting is to provide useful information for accounting that is relevant as

well as useful (Schulze, et. al, 2016). The accounting concept makes dealing with the laws, rules,

and regulations needed for completing the needs of the workers, investors, as well as

stakeholders of the corporation. The accounting concepts state that the business may recognise

the revenue, loss and profit in the amounts that vary from what would be recognised as per the

cash received from the customers or when cash is paid to suppliers as well as employees.

The conceptual framework of corporation can define as the system of concept as well as

purposes that lead to the production of consistent and perpetual set of the regulations and laws.

The conceptual framework is helpful for setting the standards of accounting. The conceptual

framework of company is also useful in solving the accounting disputes (Gummer and

Mandinach, 2015). The conceptual framework provides the fundamental principles for better

accounting. The main aim to develop the agreed conceptual framework is that it provides the

base for resolving the accosting disputes in proper way, and structure to describe the relevant

standards. In these parts, the accounting concepts adopted by Qantas Airways Limited is

explained and assessed. These parts also explain the conceptual framework of company, the

measurement issues, and fundamental qualitative characteristics such as relevance and faithful

representation.

Introduction

The accounting concepts are very significant in proper accounting and for understanding of the

financial statements of the company. The accounting basics state some fundamental concepts

related to the accounting, accounting principles, and the techniques of accounting. The main

purpose of financial reporting is to provide useful information for accounting that is relevant as

well as useful (Schulze, et. al, 2016). The accounting concept makes dealing with the laws, rules,

and regulations needed for completing the needs of the workers, investors, as well as

stakeholders of the corporation. The accounting concepts state that the business may recognise

the revenue, loss and profit in the amounts that vary from what would be recognised as per the

cash received from the customers or when cash is paid to suppliers as well as employees.

The conceptual framework of corporation can define as the system of concept as well as

purposes that lead to the production of consistent and perpetual set of the regulations and laws.

The conceptual framework is helpful for setting the standards of accounting. The conceptual

framework of company is also useful in solving the accounting disputes (Gummer and

Mandinach, 2015). The conceptual framework provides the fundamental principles for better

accounting. The main aim to develop the agreed conceptual framework is that it provides the

base for resolving the accosting disputes in proper way, and structure to describe the relevant

standards. In these parts, the accounting concepts adopted by Qantas Airways Limited is

explained and assessed. These parts also explain the conceptual framework of company, the

measurement issues, and fundamental qualitative characteristics such as relevance and faithful

representation.

REPORT 4

Background of company

In Australia, Qantas Airways Limited is well-known corporation. This company runs the national

airline as well as international airline. This company renders the passenger and services of

freight air transportation in Australia as well as in other nations worldwide. It also renders the

express freight service and air cargo. Qantas Airways also runs the program related to customer

loyalty. As of June 30, 2018, this managed the fleet of 313 aircrafts. This corporation was

founded in year 1920. The headquarter of this company is in Mascot, Australia. This

organization is involved in the operation of international and domestic air transportation services,

the provision of freight services and the operation of a frequent flyer loyalty program. The

segments of this company involve the Qantas International, Qantas Domestic, Qantas Freight,

Qantas reliability and Corporate, and Jetstar Group. The segment such as Qantas Domestic,

Jetstar Group, and Qantas International cover business related tio passenger flying. A segment

‘Qantas Freight’ is involved in express freight business as well as air cargo. In the addition of

this, a segment ‘Qantas Loyalty’ is involved in a program to recognize the customer’s integrity.

The main function is transportation of customer utilizing 2 airline brands. These two brands are

Jetstar and Qantas. This also runs the subsidiary business, involving other airlines or business in

professional marketplaces, for an example Q Catering. The airline brands run provincial, local as

well as foreign services.

The accounting concepts

In present world, the company faces the issues related to accounting. This is very essential to

understand that one must know the accounting concept to develop the foundations of company

that how accounting does effort (Kelley and Knowles, 2016). There are various fundamental

Background of company

In Australia, Qantas Airways Limited is well-known corporation. This company runs the national

airline as well as international airline. This company renders the passenger and services of

freight air transportation in Australia as well as in other nations worldwide. It also renders the

express freight service and air cargo. Qantas Airways also runs the program related to customer

loyalty. As of June 30, 2018, this managed the fleet of 313 aircrafts. This corporation was

founded in year 1920. The headquarter of this company is in Mascot, Australia. This

organization is involved in the operation of international and domestic air transportation services,

the provision of freight services and the operation of a frequent flyer loyalty program. The

segments of this company involve the Qantas International, Qantas Domestic, Qantas Freight,

Qantas reliability and Corporate, and Jetstar Group. The segment such as Qantas Domestic,

Jetstar Group, and Qantas International cover business related tio passenger flying. A segment

‘Qantas Freight’ is involved in express freight business as well as air cargo. In the addition of

this, a segment ‘Qantas Loyalty’ is involved in a program to recognize the customer’s integrity.

The main function is transportation of customer utilizing 2 airline brands. These two brands are

Jetstar and Qantas. This also runs the subsidiary business, involving other airlines or business in

professional marketplaces, for an example Q Catering. The airline brands run provincial, local as

well as foreign services.

The accounting concepts

In present world, the company faces the issues related to accounting. This is very essential to

understand that one must know the accounting concept to develop the foundations of company

that how accounting does effort (Kelley and Knowles, 2016). There are various fundamental

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REPORT 5

accounting concepts to be followed by company at the time of making financial statements.

These accounting concepts are mentioned below:

1. The conservatism concept- This concept is the common concept to recognize the expense

and liability on the instant basis when there are impossibilities regarding the accounting

results, though, to just recognize the asset as well as revenue while they is guarantee for

sure that it can be adopted. The conservatism concept predisposes results in the

traditional financial statements of the company. in this way, it is a principle in accounting

in GAAP, which notes and recognizes the undefined or defined expenses or liabilities, as

soon as possible however identifies revenues as well as assets, when they are assured of

being adopted. It gives the simple guidance to record the cases related to the estimate and

uncertainty (Kršeková and Pakšiová, 2015).

2. Matching concept - the expenses in relation to revenues, are required to be recognised in

the same period, in which the revenue was recorded. According to this concept, there is

no any deferral related to expenditure recognition in succeeding reporting period, with a

view of someone monitoring, the financial statements of company can be assured that

every characteristic of related to transaction has recorded in the same period.

3. The materiality concept- the materiality concept says that the accounting standard can be

neglected, in the matter in which the net effects of making it so has the small effect on the

company’s financial statement, which readers of financial statements would not be

misled. This concept also considered as materiality constraint. In this way, the materiality

concept states that the financial information is very significant to the financial statements

of corporation if it would alter standpoints and ideas of fair-minded people. In other

accounting concepts to be followed by company at the time of making financial statements.

These accounting concepts are mentioned below:

1. The conservatism concept- This concept is the common concept to recognize the expense

and liability on the instant basis when there are impossibilities regarding the accounting

results, though, to just recognize the asset as well as revenue while they is guarantee for

sure that it can be adopted. The conservatism concept predisposes results in the

traditional financial statements of the company. in this way, it is a principle in accounting

in GAAP, which notes and recognizes the undefined or defined expenses or liabilities, as

soon as possible however identifies revenues as well as assets, when they are assured of

being adopted. It gives the simple guidance to record the cases related to the estimate and

uncertainty (Kršeková and Pakšiová, 2015).

2. Matching concept - the expenses in relation to revenues, are required to be recognised in

the same period, in which the revenue was recorded. According to this concept, there is

no any deferral related to expenditure recognition in succeeding reporting period, with a

view of someone monitoring, the financial statements of company can be assured that

every characteristic of related to transaction has recorded in the same period.

3. The materiality concept- the materiality concept says that the accounting standard can be

neglected, in the matter in which the net effects of making it so has the small effect on the

company’s financial statement, which readers of financial statements would not be

misled. This concept also considered as materiality constraint. In this way, the materiality

concept states that the financial information is very significant to the financial statements

of corporation if it would alter standpoints and ideas of fair-minded people. In other

REPORT 6

words, the corporation’s financial statements should cover the relevant financial

information for better understanding.

4. Consistency concept- while the businesses chose to use specific accounting methods,

then it is required to continuously use this upon the go-forwarding basis. By doing so, the

corporation’s financial statements made in different periods, can be constantly compared.

5. Economic entity concept – the transactions related to business are to be kept separated

from the transactions of owners. According to this, there is no mixing of business

transactions and personal transactions in the financial statements of corporation

(Christensen, Nikolaev and Wittenberg‐Moerman, 2016).

6. Going concern concept- The Corporation’s financial statements are conducted as per the

assumptions that business will continue in the operation in future. By adopting the going

concern principle, the expenditures recognition and the recognition of revenue may be

deferred to a future period, when an entity is still working. Otherwise, identification of

the expenses would be accelerated in a current period.

7. Accruals concept- as per an accruals concept, the revenue is identified at a period when

produces. Additionally, the accruals concept states that the expense is identified at a

while asset is consumed. In this way, this principle states that the businesses can record

the revenues on the basis of cash taken from clients or when the payment is made to the

workers and dealers. In the addition of this, the auditor would only allow the financial

statement of organisation, which have made as per the accruals concept. Hence, it is

addressed by this concept that the business can recognise the revenue on the basis of cash

accepted from (Geisker, and Tallis, 2018).

words, the corporation’s financial statements should cover the relevant financial

information for better understanding.

4. Consistency concept- while the businesses chose to use specific accounting methods,

then it is required to continuously use this upon the go-forwarding basis. By doing so, the

corporation’s financial statements made in different periods, can be constantly compared.

5. Economic entity concept – the transactions related to business are to be kept separated

from the transactions of owners. According to this, there is no mixing of business

transactions and personal transactions in the financial statements of corporation

(Christensen, Nikolaev and Wittenberg‐Moerman, 2016).

6. Going concern concept- The Corporation’s financial statements are conducted as per the

assumptions that business will continue in the operation in future. By adopting the going

concern principle, the expenditures recognition and the recognition of revenue may be

deferred to a future period, when an entity is still working. Otherwise, identification of

the expenses would be accelerated in a current period.

7. Accruals concept- as per an accruals concept, the revenue is identified at a period when

produces. Additionally, the accruals concept states that the expense is identified at a

while asset is consumed. In this way, this principle states that the businesses can record

the revenues on the basis of cash taken from clients or when the payment is made to the

workers and dealers. In the addition of this, the auditor would only allow the financial

statement of organisation, which have made as per the accruals concept. Hence, it is

addressed by this concept that the business can recognise the revenue on the basis of cash

accepted from (Geisker, and Tallis, 2018).

REPORT 7

It is analysed by annual report of Qantas Airways Limited that the financial report has

represented and made by following the going concern principle. The company also follows the

consistency concept in preparing the financial statements of the company. It is assumed by the

directors of company that it will continue to keep the operating cash flows to complete the duty

of making payment in the normal course of business. Furthermore, Qantas Airways Limited

reduces the possible effects of changing the financial position by looking for keeping traditional

and solid balance sheet and company’s financial position. Hence, these relevant assumptions are

based on the current restraints when the company made consolidated financial statements (Díaz,

et. al, 2015).

In the addition of this, the company, in preparing the financial reports, incorporates the GRI

Reporting Principles. According to the GRI Principle ‘Materiality’, the financial impacts,

environmental impacts as well as social impacts were evaluated and ranked in relation to risks to

the stakeholders and company itself. The company also follows the GRI Principle ‘Stakeholder

Inclusiveness’. As per this, a review of shareholders and connected engagement through the

reporting year was made, but not particularly for composing of the report. Further, the

sustainability framework, cultural influences, surrounding effects and economic effects of the

functions of company, was identified and assessed at the time of making financial statements.

Additionally, the concept of completeness mentions the GRI and other matters included in report

are those that have identified as material to the stakeholders of company and company itself in

FY 2018.

It is analysed by annual report of Qantas Airways Limited that the financial report has

represented and made by following the going concern principle. The company also follows the

consistency concept in preparing the financial statements of the company. It is assumed by the

directors of company that it will continue to keep the operating cash flows to complete the duty

of making payment in the normal course of business. Furthermore, Qantas Airways Limited

reduces the possible effects of changing the financial position by looking for keeping traditional

and solid balance sheet and company’s financial position. Hence, these relevant assumptions are

based on the current restraints when the company made consolidated financial statements (Díaz,

et. al, 2015).

In the addition of this, the company, in preparing the financial reports, incorporates the GRI

Reporting Principles. According to the GRI Principle ‘Materiality’, the financial impacts,

environmental impacts as well as social impacts were evaluated and ranked in relation to risks to

the stakeholders and company itself. The company also follows the GRI Principle ‘Stakeholder

Inclusiveness’. As per this, a review of shareholders and connected engagement through the

reporting year was made, but not particularly for composing of the report. Further, the

sustainability framework, cultural influences, surrounding effects and economic effects of the

functions of company, was identified and assessed at the time of making financial statements.

Additionally, the concept of completeness mentions the GRI and other matters included in report

are those that have identified as material to the stakeholders of company and company itself in

FY 2018.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 8

Conceptual framework and issues related to measurement

An adequate conceptual framework acts as a foundation for the setting up standards and

advancing them with the changing time as well. The conceptual framework of accounting helps

the organization in resolving the practical issues present in the business. These conceptual

frameworks assist the International Accounting Standard Board in implementing and effectively

creating new IFRS and analysing the current ones. Along with this, the conceptual framework

also provides help in forming the financial statements and developing accounting policies for the

event or transaction that is not formed using current standards. So, in this way, these frameworks

help in handling the situation that is related to financial reporting of accounts of the company.

The company gets the advantage to make the data relevant by using such frameworks in the

business environment (Maas, Schaltegger, and Crutzen 2016).

These frameworks provide essential and materialistic information to the stakeholders about the

activities of the company. Such fundamental components include asset, equity, revenue, liability

and expenses. This framework helps the organization in identifying the components that are

crucial in the financial statements of the business. Thus, it should be noted that in this way, the

fundamental elements of the conceptual framework includes qualitative aspects of accounting of

data, the general objective behind financial reporting, purpose of creating financial reports,

identification and measuring the financial accounts of the business, and lastly, other fundamental

objects of the company’s financial accounts (Macve 2015).

According to the annual reports of the company Qantas Airlines, it can be said that the financial

reports have showed a clear as well as prescribed view of the accounts on the basis of

Corporation Act CTH 2001, along with authoritative declaration of the AASB Australian

Accounting Standards present in business environment. The company Qantas Airlines makes the

Conceptual framework and issues related to measurement

An adequate conceptual framework acts as a foundation for the setting up standards and

advancing them with the changing time as well. The conceptual framework of accounting helps

the organization in resolving the practical issues present in the business. These conceptual

frameworks assist the International Accounting Standard Board in implementing and effectively

creating new IFRS and analysing the current ones. Along with this, the conceptual framework

also provides help in forming the financial statements and developing accounting policies for the

event or transaction that is not formed using current standards. So, in this way, these frameworks

help in handling the situation that is related to financial reporting of accounts of the company.

The company gets the advantage to make the data relevant by using such frameworks in the

business environment (Maas, Schaltegger, and Crutzen 2016).

These frameworks provide essential and materialistic information to the stakeholders about the

activities of the company. Such fundamental components include asset, equity, revenue, liability

and expenses. This framework helps the organization in identifying the components that are

crucial in the financial statements of the business. Thus, it should be noted that in this way, the

fundamental elements of the conceptual framework includes qualitative aspects of accounting of

data, the general objective behind financial reporting, purpose of creating financial reports,

identification and measuring the financial accounts of the business, and lastly, other fundamental

objects of the company’s financial accounts (Macve 2015).

According to the annual reports of the company Qantas Airlines, it can be said that the financial

reports have showed a clear as well as prescribed view of the accounts on the basis of

Corporation Act CTH 2001, along with authoritative declaration of the AASB Australian

Accounting Standards present in business environment. The company Qantas Airlines makes the

REPORT 9

financial statements according to the Australian IFRS issues by the IASB and the Accounting

Standards of Australian Standards. The company presents its financial reports to the stakeholders

in a true and fair manner so as to clearly describe the actual financial position of the

organization. The financial statements of Qantas Airlines follow the guidelines of Corporations

Regulations 2001 along with the accounting standards. Qantas follows the guidelines given the

environment about accounting policies so as to make the base from the value of income, asset,

liability, equity and expenses. Also, the company is an independent group according to the

provisions related to the auditor’s independent report based on the Corporations Act 2001

(Schaltegger, and Burritt 2017). Thus, the company Qantas Airlines effectively complies with

the moral obligations according to the code of conduct.

Fundamental qualitative characteristics: Relevance and faithful representation

The main aim to establish the conceptual framework is to provide the framework in relation of

setting of the accounting standards, and the foundations to solve the accounting issues. The

corporation’s conceptual framework also describes the basic principles that do not need to repeat

again in relation of the accounting standards. The framework to make and represent the financial

statements of company as amended involves the conceptual framework for financial report as

provided by international accounting standard board. Conceptual framework’s measurement

requirements include fundamental qualitative characteristics in respect of accounting

information, the general purpose financial reporting, financial reporting’s objectives,

measurements of the financial statements of company, and basic features of the organisation’s

financial statement.

financial statements according to the Australian IFRS issues by the IASB and the Accounting

Standards of Australian Standards. The company presents its financial reports to the stakeholders

in a true and fair manner so as to clearly describe the actual financial position of the

organization. The financial statements of Qantas Airlines follow the guidelines of Corporations

Regulations 2001 along with the accounting standards. Qantas follows the guidelines given the

environment about accounting policies so as to make the base from the value of income, asset,

liability, equity and expenses. Also, the company is an independent group according to the

provisions related to the auditor’s independent report based on the Corporations Act 2001

(Schaltegger, and Burritt 2017). Thus, the company Qantas Airlines effectively complies with

the moral obligations according to the code of conduct.

Fundamental qualitative characteristics: Relevance and faithful representation

The main aim to establish the conceptual framework is to provide the framework in relation of

setting of the accounting standards, and the foundations to solve the accounting issues. The

corporation’s conceptual framework also describes the basic principles that do not need to repeat

again in relation of the accounting standards. The framework to make and represent the financial

statements of company as amended involves the conceptual framework for financial report as

provided by international accounting standard board. Conceptual framework’s measurement

requirements include fundamental qualitative characteristics in respect of accounting

information, the general purpose financial reporting, financial reporting’s objectives,

measurements of the financial statements of company, and basic features of the organisation’s

financial statement.

REPORT 10

First, it is essential to use fundamental qualitative characteristic ‘The faithful representation’.

The reason is that the fundamental qualitative characteristic is very important characteristic. The

faithful representation refers to the concept addressing that the financial statements of

corporation should be made in a way to precisely explain the condition of the business of an

organisation. According to the annual report of the company, it is clear that the financial

statement of the entity renders the faithful representation as well as relevant representation.

Qantas Airways Limited faithfully states numerous events and the transactions, states the basic

matters related to transactions, and prudently states estimate. It also shows the indecisions

through relevant disclosures (Henderson, et. al, 2015).

According to the international Accounting standard board (IASB), relevance is a capacity of

making the differences regarding the decisions made by the users or readers according to the

capital providers. The fundamental qualitative characteristic ‘relevance’ is usually worked in

relation to methodical value and the positive value. The logical value usually refers to the

information over the ability of entity to make future cash flow. International Accounting standard

board (IASB) assessed regarding financial phenomenon has logical value in the matter while this

has values as input to logical process used by capital providers to make own expectations

regarding the future time. The logical value is considered as the important indicator of the

relevance in relation to the decision’s importance. There are some fundamental measures in

relation to analytical value (Schnipper, et. al, 2015). These are mention as below-

a. whether the annual report of entity states information related to business matters and risk

related to business, and

b. a degree to that annual report provides the forward-looking statements

First, it is essential to use fundamental qualitative characteristic ‘The faithful representation’.

The reason is that the fundamental qualitative characteristic is very important characteristic. The

faithful representation refers to the concept addressing that the financial statements of

corporation should be made in a way to precisely explain the condition of the business of an

organisation. According to the annual report of the company, it is clear that the financial

statement of the entity renders the faithful representation as well as relevant representation.

Qantas Airways Limited faithfully states numerous events and the transactions, states the basic

matters related to transactions, and prudently states estimate. It also shows the indecisions

through relevant disclosures (Henderson, et. al, 2015).

According to the international Accounting standard board (IASB), relevance is a capacity of

making the differences regarding the decisions made by the users or readers according to the

capital providers. The fundamental qualitative characteristic ‘relevance’ is usually worked in

relation to methodical value and the positive value. The logical value usually refers to the

information over the ability of entity to make future cash flow. International Accounting standard

board (IASB) assessed regarding financial phenomenon has logical value in the matter while this

has values as input to logical process used by capital providers to make own expectations

regarding the future time. The logical value is considered as the important indicator of the

relevance in relation to the decision’s importance. There are some fundamental measures in

relation to analytical value (Schnipper, et. al, 2015). These are mention as below-

a. whether the annual report of entity states information related to business matters and risk

related to business, and

b. a degree to that annual report provides the forward-looking statements

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REPORT 11

c. Whether the fair value is used by company

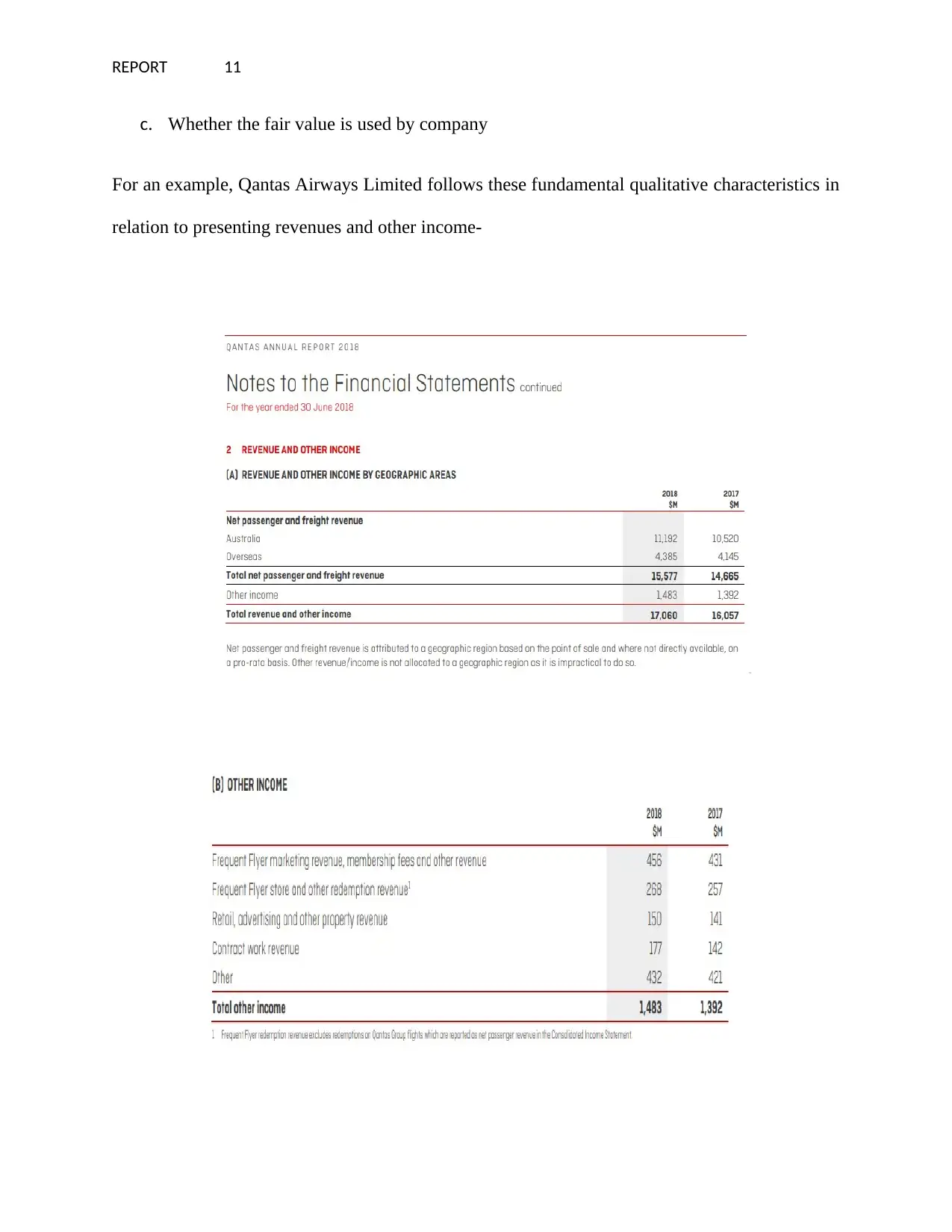

For an example, Qantas Airways Limited follows these fundamental qualitative characteristics in

relation to presenting revenues and other income-

c. Whether the fair value is used by company

For an example, Qantas Airways Limited follows these fundamental qualitative characteristics in

relation to presenting revenues and other income-

REPORT 12

(Annual report, 2018)

Conclusion

Thus, by analysing the above mentioned events, it should be concluded that the conceptual

framework explain the state of nature of the financial reporting along with the functions,

accounting and drawbacks. The Financial Accounting Standards Board also showed role in

enhancing the quality and utility of the financial reports. The conceptual framework in the

business environment improves the accounting standards and renders the fundamental principles

in the business environment. Thus, it should be noted that conceptual framework gives an

integrated structure and rationale strategy to the accounting standards and increases the beliefs of

the stakeholders on the financial reporting of the company like Qantas.

(Annual report, 2018)

Conclusion

Thus, by analysing the above mentioned events, it should be concluded that the conceptual

framework explain the state of nature of the financial reporting along with the functions,

accounting and drawbacks. The Financial Accounting Standards Board also showed role in

enhancing the quality and utility of the financial reports. The conceptual framework in the

business environment improves the accounting standards and renders the fundamental principles

in the business environment. Thus, it should be noted that conceptual framework gives an

integrated structure and rationale strategy to the accounting standards and increases the beliefs of

the stakeholders on the financial reporting of the company like Qantas.

REPORT 13

References

Annual Report (2018) Qantas Airways Limited. Available at:

https://investor.qantas.com/FormBuilder/_Resource/_module/doLLG5ufYkCyEPjF1tpgyw/file/

annual-reports/2018-Annual-Report-ASX.pdf. Access on 02/06/2019

Bridgett, D.J., Burt, N.M., Edwards, E.S. and Deater-Deckard, K. (2015) Intergenerational

transmission of self-regulation: A multidisciplinary review and integrative conceptual

framework. Psychological bulletin, 141(3), p.602.

Christensen, H.B., Nikolaev, V.V. and Wittenberg‐Moerman, R. (2016) Accounting information

in financial contracting: The incomplete contract theory perspective. Journal of accounting

research, 54(2), pp.397-435.

Díaz, S., Demissew, S., Carabias, J., Joly, C., Lonsdale, M., Ash, N., Larigauderie, A., Adhikari,

J.R., Arico, S., Báldi, A. and Bartuska, A. (2015) The IPBES Conceptual Framework—

connecting nature and people. Current Opinion in Environmental Sustainability, 14, pp.1-16.

Geisker, J. and Tallis, J. (2018) Litigation funding in Australia: A year of review and

change?. LSJ: Law Society of NSW Journal, (46), p.81.

Gummer, E. and Mandinach, E. (2015) Building a Conceptual Framework for Data

Literacy. Teachers College Record, 117(4), p.n4.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B. (2015) Issues in financial accounting.

Pearson Higher Education AU.

References

Annual Report (2018) Qantas Airways Limited. Available at:

https://investor.qantas.com/FormBuilder/_Resource/_module/doLLG5ufYkCyEPjF1tpgyw/file/

annual-reports/2018-Annual-Report-ASX.pdf. Access on 02/06/2019

Bridgett, D.J., Burt, N.M., Edwards, E.S. and Deater-Deckard, K. (2015) Intergenerational

transmission of self-regulation: A multidisciplinary review and integrative conceptual

framework. Psychological bulletin, 141(3), p.602.

Christensen, H.B., Nikolaev, V.V. and Wittenberg‐Moerman, R. (2016) Accounting information

in financial contracting: The incomplete contract theory perspective. Journal of accounting

research, 54(2), pp.397-435.

Díaz, S., Demissew, S., Carabias, J., Joly, C., Lonsdale, M., Ash, N., Larigauderie, A., Adhikari,

J.R., Arico, S., Báldi, A. and Bartuska, A. (2015) The IPBES Conceptual Framework—

connecting nature and people. Current Opinion in Environmental Sustainability, 14, pp.1-16.

Geisker, J. and Tallis, J. (2018) Litigation funding in Australia: A year of review and

change?. LSJ: Law Society of NSW Journal, (46), p.81.

Gummer, E. and Mandinach, E. (2015) Building a Conceptual Framework for Data

Literacy. Teachers College Record, 117(4), p.n4.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B. (2015) Issues in financial accounting.

Pearson Higher Education AU.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 14

Kelley, T.R. and Knowles, J.G. (2016) A conceptual framework for integrated STEM

education. International Journal of STEM Education, 3(1), p.11.

Kršeková, M. and Pakšiová, R. (2015) Financial reporting on information about the financial

position and financial performance in the financial statements of the public sector. Finance and

risk 2015, 14(1), pp.136-145.

Lewandowski, M. (2016) Designing the business models for circular economy—Towards the

conceptual framework. Sustainability, 8(1), p.43.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136, pp.237-

248.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

Panteli, M. and Mancarella, P. (2015) The grid: Stronger bigger smarter?: Presenting a

conceptual framework of power system resilience. IEEE Power Energy Mag, 13(3), pp.58-66.

Reuters (2018) Qantas Airways Limited. Available at:

https://www.reuters.com/finance/stocks/companyProfile/QAN.AX. Access on 02/06/2019

Sampaio, P.G.V. and González, M.O.A. (2017) Photovoltaic solar energy: Conceptual

framework. Renewable and Sustainable Energy Reviews, 74, pp.590-601.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues, concepts

and practice. Routledge.

Kelley, T.R. and Knowles, J.G. (2016) A conceptual framework for integrated STEM

education. International Journal of STEM Education, 3(1), p.11.

Kršeková, M. and Pakšiová, R. (2015) Financial reporting on information about the financial

position and financial performance in the financial statements of the public sector. Finance and

risk 2015, 14(1), pp.136-145.

Lewandowski, M. (2016) Designing the business models for circular economy—Towards the

conceptual framework. Sustainability, 8(1), p.43.

Maas, K., Schaltegger, S. and Crutzen, N., 2016. Integrating corporate sustainability assessment,

management accounting, control, and reporting. Journal of Cleaner Production, 136, pp.237-

248.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

Panteli, M. and Mancarella, P. (2015) The grid: Stronger bigger smarter?: Presenting a

conceptual framework of power system resilience. IEEE Power Energy Mag, 13(3), pp.58-66.

Reuters (2018) Qantas Airways Limited. Available at:

https://www.reuters.com/finance/stocks/companyProfile/QAN.AX. Access on 02/06/2019

Sampaio, P.G.V. and González, M.O.A. (2017) Photovoltaic solar energy: Conceptual

framework. Renewable and Sustainable Energy Reviews, 74, pp.590-601.

Schaltegger, S. and Burritt, R., 2017. Contemporary environmental accounting: issues, concepts

and practice. Routledge.

REPORT 15

Schnipper, L.E., Davidson, N.E., Wollins, D.S., Tyne, C., Blayney, D.W., Blum, D., Dicker,

A.P., Ganz, P.A., Hoverman, J.R., Langdon, R. and Lyman, G.H. (2015) American Society of

Clinical Oncology statement: a conceptual framework to assess the value of cancer treatment

options. Journal of Clinical Oncology, 33(23), p.2563.

Schulze, M., Nehler, H., Ottosson, M. and Thollander, P. (2016) Energy management in

industry–a systematic review of previous findings and an integrative conceptual

framework. Journal of Cleaner Production, 112, pp.3692-3708.

Schnipper, L.E., Davidson, N.E., Wollins, D.S., Tyne, C., Blayney, D.W., Blum, D., Dicker,

A.P., Ganz, P.A., Hoverman, J.R., Langdon, R. and Lyman, G.H. (2015) American Society of

Clinical Oncology statement: a conceptual framework to assess the value of cancer treatment

options. Journal of Clinical Oncology, 33(23), p.2563.

Schulze, M., Nehler, H., Ottosson, M. and Thollander, P. (2016) Energy management in

industry–a systematic review of previous findings and an integrative conceptual

framework. Journal of Cleaner Production, 112, pp.3692-3708.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.