Analysis of Financial Performance and Investment Appraisal

VerifiedAdded on 2020/02/05

|16

|3811

|33

Report

AI Summary

This report provides a comprehensive analysis of financial performance and investment appraisal techniques. It begins with an examination of the financial and non-financial performance of Next Plc and H&M, utilizing various financial ratios and non-financial performance indicators to assess their strengths and weaknesses. The report includes charts illustrating the financial performance of both companies and offers recommendations to the Certified Financial Manager of Asol Ltd regarding investment decisions. Furthermore, the report delves into investment appraisal techniques, including net cash flow, payback period, and accounting rate of return, and applies these tools to a case study involving Hilltop Ltd. The analysis culminates in recommendations for senior management at Hilltop Ltd, along with justifications for the chosen investment strategies, and also discusses the limitations of ratio analysis and investment appraisal techniques.

ACCOUNTING AND

FINANCE

1 | P a g e

FINANCE

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

Analysis of financial and non-financial performance.......................................................1

Non-financial performance indicators (NFPI)..................................................................3

Analysis of financial performance of Next Plc and H&M through charts.......................3

Recommendations to Certified Financial Manager of Asol Ltd.......................................6

Recommendation to H&M management..........................................................................6

Limitation of ratio analysis...............................................................................................7

TASK 2......................................................................................................................................7

Q.1. Investment appraisal techniques or capital budgeting tools......................................8

Net cash flow....................................................................................................................8

Payback period..................................................................................................................9

Project NPV......................................................................................................................9

Accounting rate of return................................................................................................10

Recommendation to senior management of Hilltop Ltd with justification.....................10

Q. 2. Limitations of investment appraisal techniques.....................................................10

CONCLUSION........................................................................................................................11

REFERENCES.........................................................................................................................12

2 | P a g e

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

Analysis of financial and non-financial performance.......................................................1

Non-financial performance indicators (NFPI)..................................................................3

Analysis of financial performance of Next Plc and H&M through charts.......................3

Recommendations to Certified Financial Manager of Asol Ltd.......................................6

Recommendation to H&M management..........................................................................6

Limitation of ratio analysis...............................................................................................7

TASK 2......................................................................................................................................7

Q.1. Investment appraisal techniques or capital budgeting tools......................................8

Net cash flow....................................................................................................................8

Payback period..................................................................................................................9

Project NPV......................................................................................................................9

Accounting rate of return................................................................................................10

Recommendation to senior management of Hilltop Ltd with justification.....................10

Q. 2. Limitations of investment appraisal techniques.....................................................10

CONCLUSION........................................................................................................................11

REFERENCES.........................................................................................................................12

2 | P a g e

Index of Tables

Table 1: Calculation of Net cash flow of project A (In £000's).................................................8

Table 2: Calculation of Net cash flow of project B (In £000's).................................................8

Table 3: Computation of payback period of project A and B (In £000's)..................................9

Table 4: Project Net present value (In £000's)...........................................................................9

3 | P a g e

Table 1: Calculation of Net cash flow of project A (In £000's).................................................8

Table 2: Calculation of Net cash flow of project B (In £000's).................................................8

Table 3: Computation of payback period of project A and B (In £000's)..................................9

Table 4: Project Net present value (In £000's)...........................................................................9

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting and finance plays a crucial role in every business organization as it helps

to operate business without any difficulty and determine performance. Asol Ltd, is a large

retail organization who is providing fashionable cloths to large number of buyers. It was

founded in Swedish in 1947. In now-a-days, Certified Financial Manager (CFO) of the firm

desires to buy shares of one of the well established firms that are Next Plc, as well as Hennes

and Mauritz (H&M). The report will make detailed examination of both the firms’

performance so that appropriate investment decisions can be taken. Another part of the report

will apply the use of various capital budgeting tools so that Hilltop Ltd., can identify the most

viable project in which funds can be invested.

TASK 1

Analysis of financial and non-financial performance

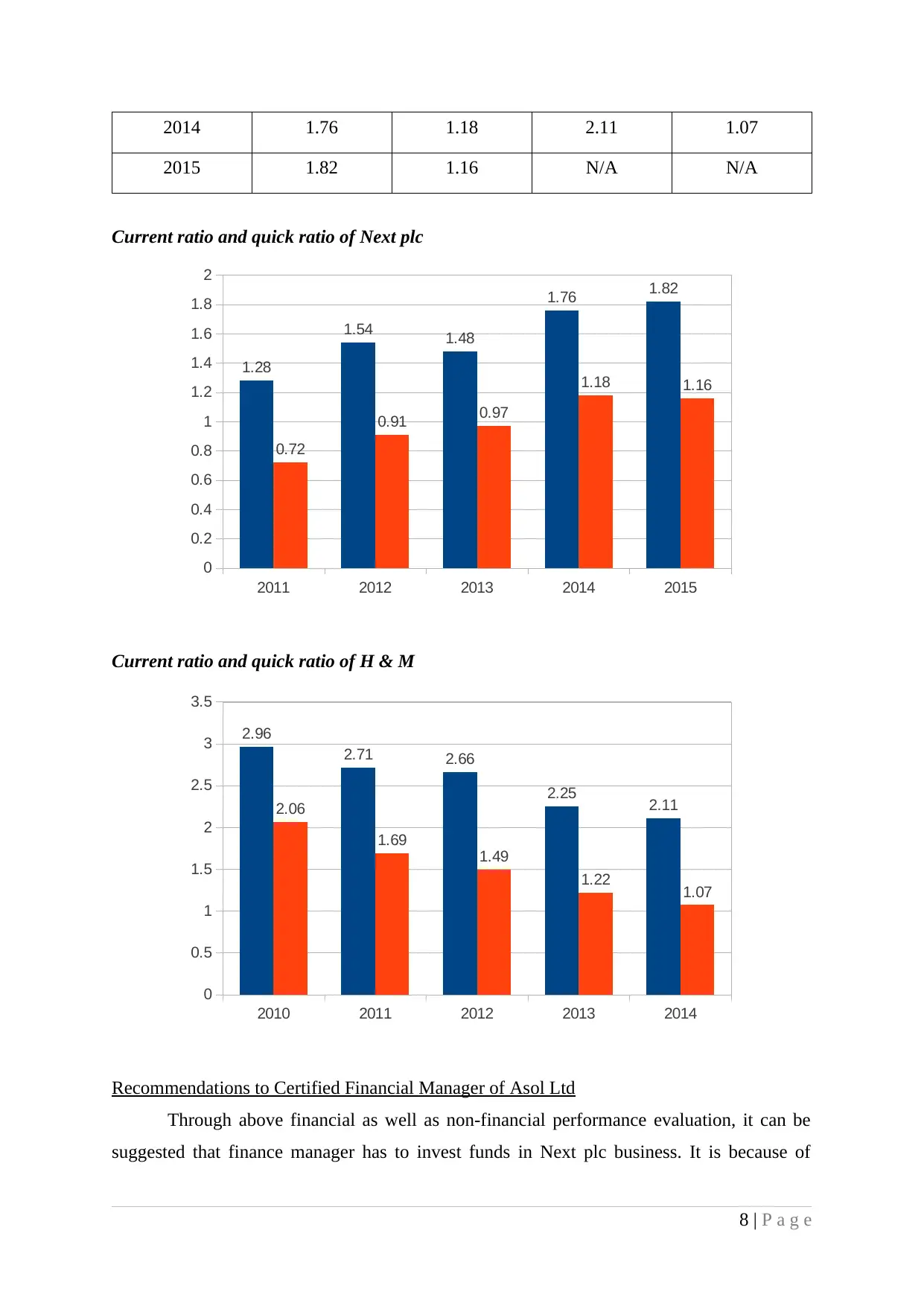

Financial strength Current ratio (CR) and quick ratio (QR): Balance sheet gives information regarding

company's financial strength. Proportion of current assets and current liabilities can be

determined through CR whilst quick ratio indicates proportion of quick assets and

current liabilities (Saleem and Rehman, 2011). In Next plc, CR and QR show a rising

trend and gone increased to 1.82 and 1.16. On contrary, H&M possesses decreased

trend to 2.11 and 1.07 respectively. High CR of Next Plc. demonstrates greater

Working capital available amounted to 729400 however, in H&M, it has been

reduced. Thus, it can be interpreted that Next Plc is comparatively more able to satisfy

their short-term obligations within one year (Malik, Awais and Khursheed, 2016).

Proper and sufficient availability of funds help to run operations without any hazards.

Hence, it is clear that Next Plc has sound liquidity position.

Efficiency ratios Inventory turnover ratio and days: Time lag between both the firms will convert their

goods into actual sales can be measured through inventory days (Koumanakos, 2008).

High stock turnover ratio will lower this length of time and vice versa. In Next plc

and H&M, the ratio has been reduced from 6.70 to 6.62 and 3.70 to 3.46 respectively.

This in turn, inventory conversion days are 55.13 and 105.63. It demonstrates that

Next plc is comparatively more able and selling its goods quickly in the market (Gaur

and Kesavan, 2008). It is because turnover ratio is 2 time higher and conversion days

4 | P a g e

Accounting and finance plays a crucial role in every business organization as it helps

to operate business without any difficulty and determine performance. Asol Ltd, is a large

retail organization who is providing fashionable cloths to large number of buyers. It was

founded in Swedish in 1947. In now-a-days, Certified Financial Manager (CFO) of the firm

desires to buy shares of one of the well established firms that are Next Plc, as well as Hennes

and Mauritz (H&M). The report will make detailed examination of both the firms’

performance so that appropriate investment decisions can be taken. Another part of the report

will apply the use of various capital budgeting tools so that Hilltop Ltd., can identify the most

viable project in which funds can be invested.

TASK 1

Analysis of financial and non-financial performance

Financial strength Current ratio (CR) and quick ratio (QR): Balance sheet gives information regarding

company's financial strength. Proportion of current assets and current liabilities can be

determined through CR whilst quick ratio indicates proportion of quick assets and

current liabilities (Saleem and Rehman, 2011). In Next plc, CR and QR show a rising

trend and gone increased to 1.82 and 1.16. On contrary, H&M possesses decreased

trend to 2.11 and 1.07 respectively. High CR of Next Plc. demonstrates greater

Working capital available amounted to 729400 however, in H&M, it has been

reduced. Thus, it can be interpreted that Next Plc is comparatively more able to satisfy

their short-term obligations within one year (Malik, Awais and Khursheed, 2016).

Proper and sufficient availability of funds help to run operations without any hazards.

Hence, it is clear that Next Plc has sound liquidity position.

Efficiency ratios Inventory turnover ratio and days: Time lag between both the firms will convert their

goods into actual sales can be measured through inventory days (Koumanakos, 2008).

High stock turnover ratio will lower this length of time and vice versa. In Next plc

and H&M, the ratio has been reduced from 6.70 to 6.62 and 3.70 to 3.46 respectively.

This in turn, inventory conversion days are 55.13 and 105.63. It demonstrates that

Next plc is comparatively more able and selling its goods quickly in the market (Gaur

and Kesavan, 2008). It is because turnover ratio is 2 time higher and conversion days

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

are approximately half of H&M. Hence, it can be aid that Next plc is using stock in

more efficient manner. Debt/equity ratio: Next plc ratio gone improved from 2.57 to 2.61 while in H&M it is

not existed. High ratio in Next Plc will presents greater risk in invested funds but still,

it is using both the debt and equity in its total capital employed (Fullerton and

Wempe, 2009). However, zero D/E ratio posses that H&M do not use debts in its total

capital. Hence, it can not take benefits of trading on equity and can not maximize

shareholder return through taking tax benefits. Thus, it can be said that Asol Ltd,

should invest in Next plc.

Profitability ratios Gross profit (GP) and net profit (NP): Balance of total revenues over the cost of sales

is termed as GP whereas NP is the balance of revenues after covering all the

operational expenditures (Knight, 2012). Both the ratios show a downward trend in

H&M as it decreased from 62.96% to 58.81% and 17.22% to 13.19% respectively. On

the Contrary, in Next Plc, it shows an upward moving trend as it increased from

29.27% to 33.59% and 11.93% to 15.87% respectively. Hence, reducing trend

indicates decreased revenues, high expenses and lower profits which is a sign of poor

performance.

Management effectiveness ROA and ROA: ROA and ROE measure profit percentage on total assets and total

equity employed (Lesakova, 2007). Upward movement of ROA from 22.55% to

28.68% tells that Next plc is increasing its profitability relative to TA. On the other

hand, in H&M it gone reduced to 28.28% in 2014. Another, ROE was reduced by

6.23% and reached at 208.75% but still it is more than 5 times greater than H&M's

ROE of 41.27%. Hence, it implies that Asol Ltd's CFO should invest in Next Plc

because there will be a greater chance that Next Plc will provide high return to their

equity contributors.

Valuation ratio

FCF to share has been increased to 4.14 whereas in H&M, it turned out from 0.93 to

0.76. Thus, it interpreted that Next Plc is earning good cash flow on invested shares

so, Asol Ltd, should invest in this organization (Hoskin, Fizzell and Cherry, 2014).

5 | P a g e

more efficient manner. Debt/equity ratio: Next plc ratio gone improved from 2.57 to 2.61 while in H&M it is

not existed. High ratio in Next Plc will presents greater risk in invested funds but still,

it is using both the debt and equity in its total capital employed (Fullerton and

Wempe, 2009). However, zero D/E ratio posses that H&M do not use debts in its total

capital. Hence, it can not take benefits of trading on equity and can not maximize

shareholder return through taking tax benefits. Thus, it can be said that Asol Ltd,

should invest in Next plc.

Profitability ratios Gross profit (GP) and net profit (NP): Balance of total revenues over the cost of sales

is termed as GP whereas NP is the balance of revenues after covering all the

operational expenditures (Knight, 2012). Both the ratios show a downward trend in

H&M as it decreased from 62.96% to 58.81% and 17.22% to 13.19% respectively. On

the Contrary, in Next Plc, it shows an upward moving trend as it increased from

29.27% to 33.59% and 11.93% to 15.87% respectively. Hence, reducing trend

indicates decreased revenues, high expenses and lower profits which is a sign of poor

performance.

Management effectiveness ROA and ROA: ROA and ROE measure profit percentage on total assets and total

equity employed (Lesakova, 2007). Upward movement of ROA from 22.55% to

28.68% tells that Next plc is increasing its profitability relative to TA. On the other

hand, in H&M it gone reduced to 28.28% in 2014. Another, ROE was reduced by

6.23% and reached at 208.75% but still it is more than 5 times greater than H&M's

ROE of 41.27%. Hence, it implies that Asol Ltd's CFO should invest in Next Plc

because there will be a greater chance that Next Plc will provide high return to their

equity contributors.

Valuation ratio

FCF to share has been increased to 4.14 whereas in H&M, it turned out from 0.93 to

0.76. Thus, it interpreted that Next Plc is earning good cash flow on invested shares

so, Asol Ltd, should invest in this organization (Hoskin, Fizzell and Cherry, 2014).

5 | P a g e

Non-financial performance indicators (NFPI)

As per the swot reports of Next plc, its key strengths are quality customer service,

growing demand, online services, on-time delivery and high customer satisfaction. It helps to

create loyalty and trust in the mind of consumers and they always prefer goods offered by

Next plc (Stahl and et.al., 2012). Another, fulfilment of social, environmental and corporate

responsibility demonstrates that Next plc perform better in upcoming period. Thus, it has

been clear that Next plc's can ensure long-run survival through taking advantageous of

available market opportunities and meet customer demand on timely basis (Rodrigo, 2012).

On contrary, weak competitive position, newly business unit in Europe are its threats.

Moreover, large quantity of purchase imposed high stocking cost and lower profits (H and M

Swot Analysis, USP and Competitors, n.d). In addition to it, revenues available for employees

has been reduced to 138467 in 2014 while in H&M, it has been inclined to 135759. Thus, it

has been clear that Asol Ltd, management should invest in Next Plc business because it is

operating well as per the financial as well as non-financial aspects.

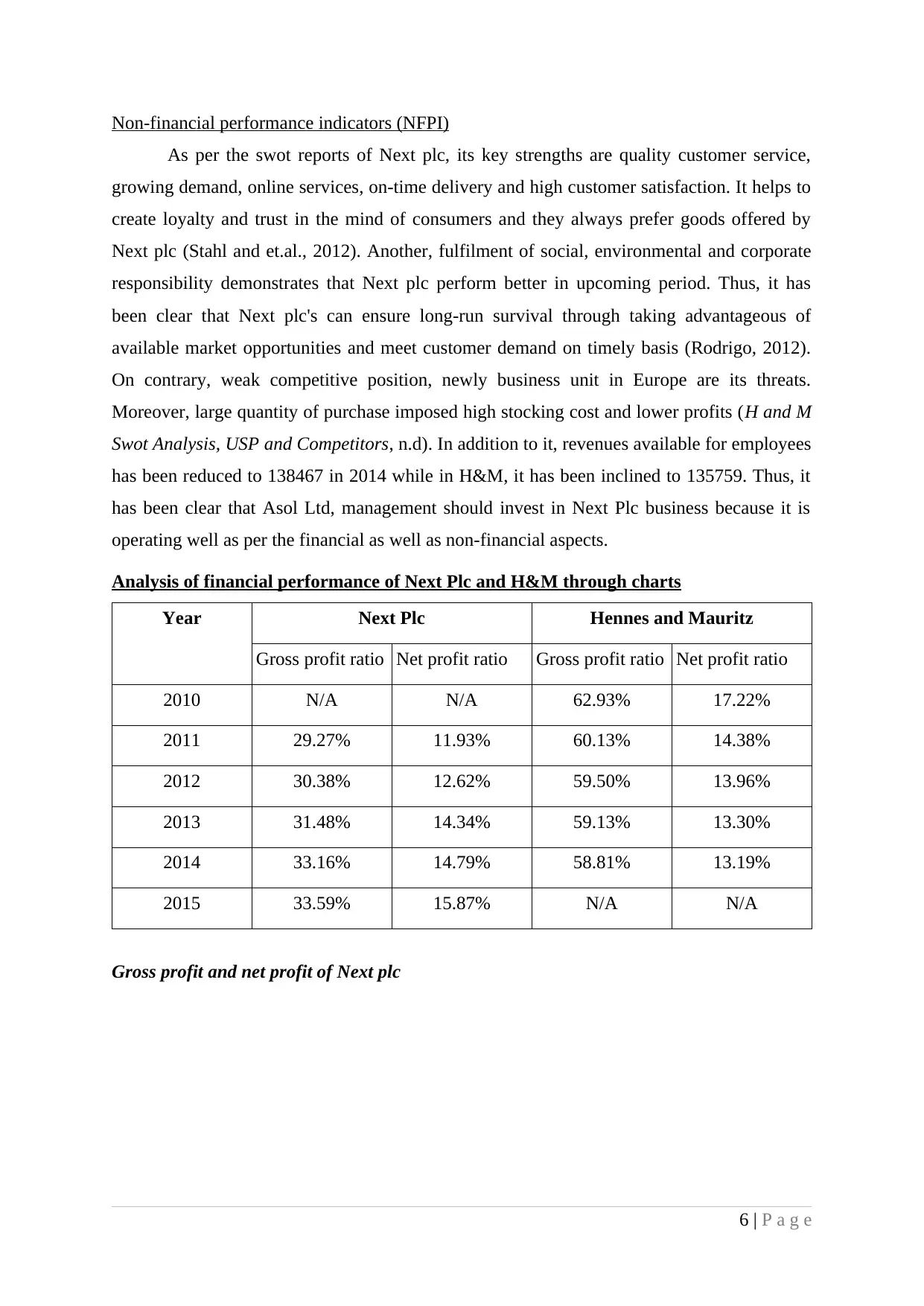

Analysis of financial performance of Next Plc and H&M through charts

Year Next Plc Hennes and Mauritz

Gross profit ratio Net profit ratio Gross profit ratio Net profit ratio

2010 N/A N/A 62.93% 17.22%

2011 29.27% 11.93% 60.13% 14.38%

2012 30.38% 12.62% 59.50% 13.96%

2013 31.48% 14.34% 59.13% 13.30%

2014 33.16% 14.79% 58.81% 13.19%

2015 33.59% 15.87% N/A N/A

Gross profit and net profit of Next plc

6 | P a g e

As per the swot reports of Next plc, its key strengths are quality customer service,

growing demand, online services, on-time delivery and high customer satisfaction. It helps to

create loyalty and trust in the mind of consumers and they always prefer goods offered by

Next plc (Stahl and et.al., 2012). Another, fulfilment of social, environmental and corporate

responsibility demonstrates that Next plc perform better in upcoming period. Thus, it has

been clear that Next plc's can ensure long-run survival through taking advantageous of

available market opportunities and meet customer demand on timely basis (Rodrigo, 2012).

On contrary, weak competitive position, newly business unit in Europe are its threats.

Moreover, large quantity of purchase imposed high stocking cost and lower profits (H and M

Swot Analysis, USP and Competitors, n.d). In addition to it, revenues available for employees

has been reduced to 138467 in 2014 while in H&M, it has been inclined to 135759. Thus, it

has been clear that Asol Ltd, management should invest in Next Plc business because it is

operating well as per the financial as well as non-financial aspects.

Analysis of financial performance of Next Plc and H&M through charts

Year Next Plc Hennes and Mauritz

Gross profit ratio Net profit ratio Gross profit ratio Net profit ratio

2010 N/A N/A 62.93% 17.22%

2011 29.27% 11.93% 60.13% 14.38%

2012 30.38% 12.62% 59.50% 13.96%

2013 31.48% 14.34% 59.13% 13.30%

2014 33.16% 14.79% 58.81% 13.19%

2015 33.59% 15.87% N/A N/A

Gross profit and net profit of Next plc

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

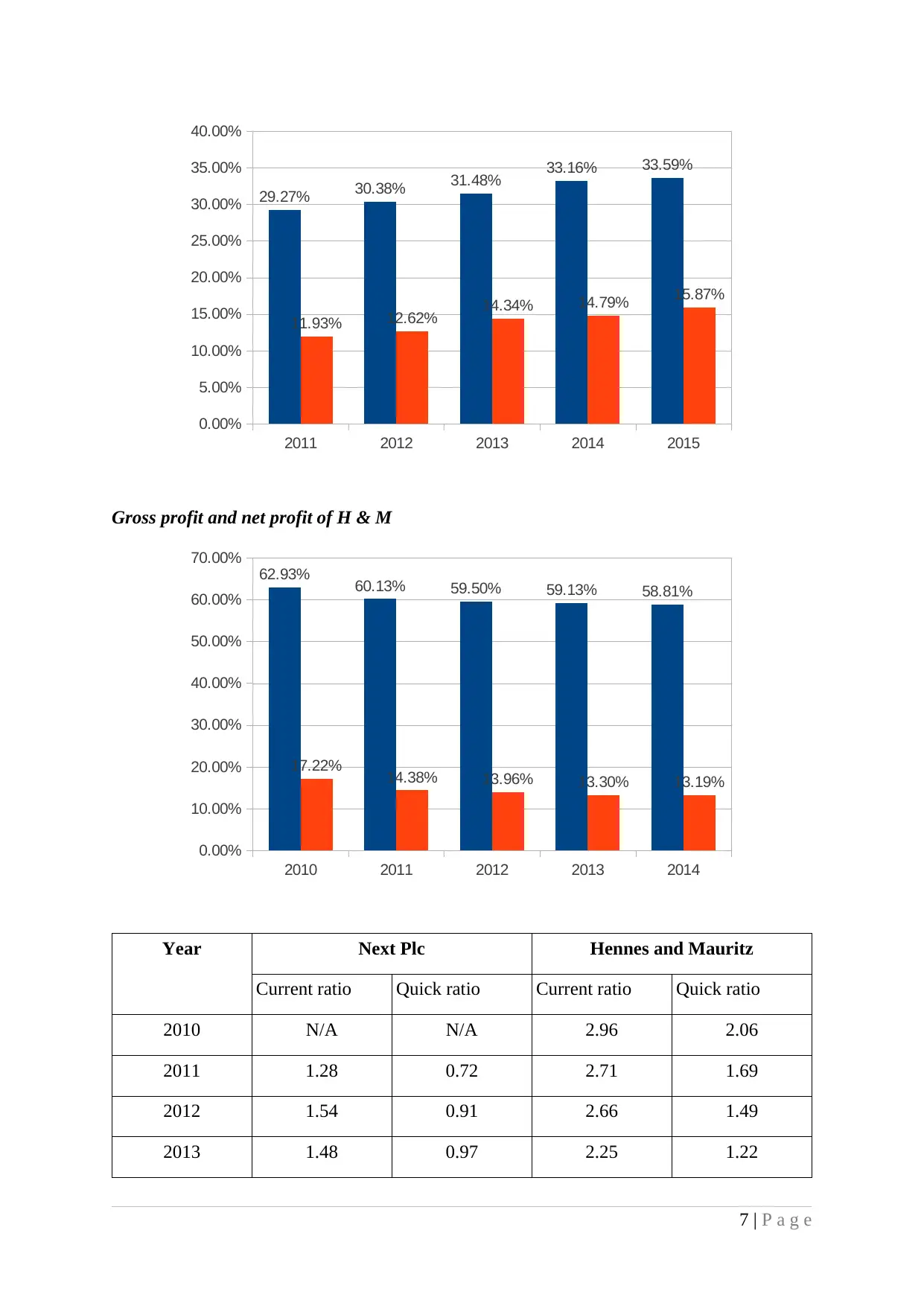

Gross profit and net profit of H & M

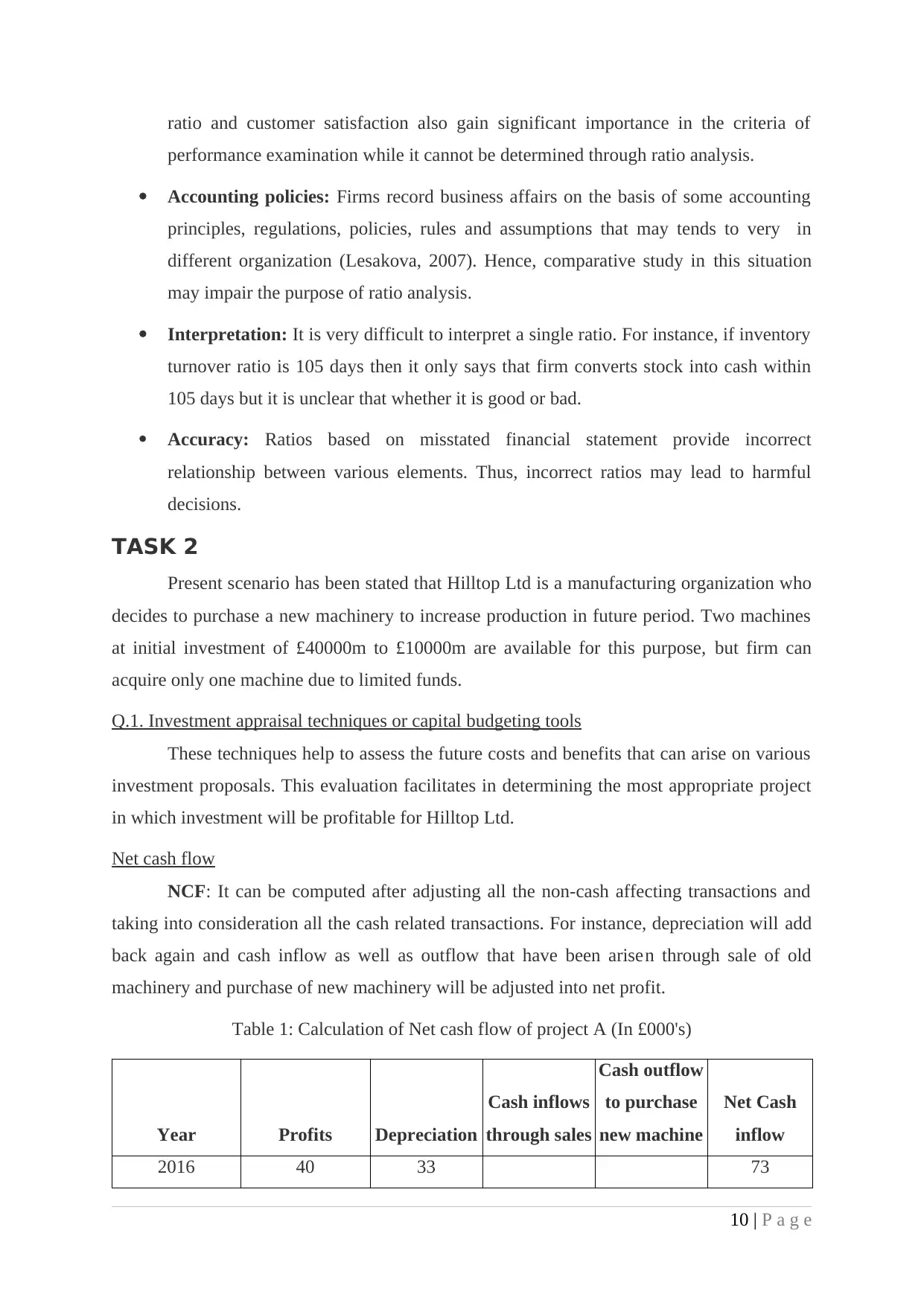

Year Next Plc Hennes and Mauritz

Current ratio Quick ratio Current ratio Quick ratio

2010 N/A N/A 2.96 2.06

2011 1.28 0.72 2.71 1.69

2012 1.54 0.91 2.66 1.49

2013 1.48 0.97 2.25 1.22

7 | P a g e

2011 2012 2013 2014 2015

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

29.27% 30.38% 31.48% 33.16% 33.59%

11.93% 12.62% 14.34% 14.79% 15.87%

2010 2011 2012 2013 2014

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

62.93% 60.13% 59.50% 59.13% 58.81%

17.22% 14.38% 13.96% 13.30% 13.19%

Year Next Plc Hennes and Mauritz

Current ratio Quick ratio Current ratio Quick ratio

2010 N/A N/A 2.96 2.06

2011 1.28 0.72 2.71 1.69

2012 1.54 0.91 2.66 1.49

2013 1.48 0.97 2.25 1.22

7 | P a g e

2011 2012 2013 2014 2015

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

35.00%

40.00%

29.27% 30.38% 31.48% 33.16% 33.59%

11.93% 12.62% 14.34% 14.79% 15.87%

2010 2011 2012 2013 2014

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

62.93% 60.13% 59.50% 59.13% 58.81%

17.22% 14.38% 13.96% 13.30% 13.19%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2014 1.76 1.18 2.11 1.07

2015 1.82 1.16 N/A N/A

Current ratio and quick ratio of Next plc

Current ratio and quick ratio of H & M

Recommendations to Certified Financial Manager of Asol Ltd

Through above financial as well as non-financial performance evaluation, it can be

suggested that finance manager has to invest funds in Next plc business. It is because of

8 | P a g e

2011 2012 2013 2014 2015

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

1.28

1.54 1.48

1.76 1.82

0.72

0.91 0.97

1.18 1.16

2010 2011 2012 2013 2014

0

0.5

1

1.5

2

2.5

3

3.5

2.96

2.71 2.66

2.25 2.112.06

1.69

1.49

1.22 1.07

2015 1.82 1.16 N/A N/A

Current ratio and quick ratio of Next plc

Current ratio and quick ratio of H & M

Recommendations to Certified Financial Manager of Asol Ltd

Through above financial as well as non-financial performance evaluation, it can be

suggested that finance manager has to invest funds in Next plc business. It is because of

8 | P a g e

2011 2012 2013 2014 2015

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

1.28

1.54 1.48

1.76 1.82

0.72

0.91 0.97

1.18 1.16

2010 2011 2012 2013 2014

0

0.5

1

1.5

2

2.5

3

3.5

2.96

2.71 2.66

2.25 2.112.06

1.69

1.49

1.22 1.07

sound financial strength in the way of liquidity, maximum profit margin, good assets utilizing

efficiency, higher cash flow and uses of both the equity and debt in the capital employed

(Delen, Kuzey and Uyar, 2013). Moreover, as per NFPI, high demand, customer satisfaction,

less waiting time, affordable products and good corporate governance report indicates that

Next plc will survive better in future years. Thus, it has been clear that through investing in

Next plc, Asol ltd, can earn larger return on their invested funds and maximize profitability.

Recommendation to H&M management

To

The director, H&M

Date: 9th March, 2016

Above analysis interpreted that H&M's financial performance got reduced over the

past few years. Hence, management need to be work out to enhance future performance.

They can maximize their profits through increasing sales and controlling cost. Moreover,

high profitability provide benefits of increasing ROE and ROA. Another, better liquidity

position will assist firm to remove operational hazard. It can be done through quicker

conversion of inventory, negotiating supplier period and decreasing debtors credit offering

period. Through this, H&M can increase business liquidity and meet out short-term

liabilities effectively (Šarlija and Harc, 2012). In addition, cash flow management

techniques will assist managers to remove financial difficulties that can be arise due to lack

of funds and ensure smooth functioning. Another, most important suggestion is it make use

of debt along with the equity capital. It facilitates H&M firm to take tax benefits and

increase investors return. So that, it will achieve high growth and success in forthcoming

period.

Limitation of ratio analysis

Although, ratios provide great assistance to evaluate and analysis the overall business

performance, but still there are several limitations in this, which are described below:

Historical: Ratios only exhibit past business results instead of potential performance

(Urgast and Feldmann, 2013). Hence, it is its drawback that limits its applications and

does not accomplish performance evaluation targets in an appropriate manner.

Quantitative: All the transactions reported in the financial statements are of

quantitative characteristics. However, qualitative factors such as employee turnover

9 | P a g e

efficiency, higher cash flow and uses of both the equity and debt in the capital employed

(Delen, Kuzey and Uyar, 2013). Moreover, as per NFPI, high demand, customer satisfaction,

less waiting time, affordable products and good corporate governance report indicates that

Next plc will survive better in future years. Thus, it has been clear that through investing in

Next plc, Asol ltd, can earn larger return on their invested funds and maximize profitability.

Recommendation to H&M management

To

The director, H&M

Date: 9th March, 2016

Above analysis interpreted that H&M's financial performance got reduced over the

past few years. Hence, management need to be work out to enhance future performance.

They can maximize their profits through increasing sales and controlling cost. Moreover,

high profitability provide benefits of increasing ROE and ROA. Another, better liquidity

position will assist firm to remove operational hazard. It can be done through quicker

conversion of inventory, negotiating supplier period and decreasing debtors credit offering

period. Through this, H&M can increase business liquidity and meet out short-term

liabilities effectively (Šarlija and Harc, 2012). In addition, cash flow management

techniques will assist managers to remove financial difficulties that can be arise due to lack

of funds and ensure smooth functioning. Another, most important suggestion is it make use

of debt along with the equity capital. It facilitates H&M firm to take tax benefits and

increase investors return. So that, it will achieve high growth and success in forthcoming

period.

Limitation of ratio analysis

Although, ratios provide great assistance to evaluate and analysis the overall business

performance, but still there are several limitations in this, which are described below:

Historical: Ratios only exhibit past business results instead of potential performance

(Urgast and Feldmann, 2013). Hence, it is its drawback that limits its applications and

does not accomplish performance evaluation targets in an appropriate manner.

Quantitative: All the transactions reported in the financial statements are of

quantitative characteristics. However, qualitative factors such as employee turnover

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ratio and customer satisfaction also gain significant importance in the criteria of

performance examination while it cannot be determined through ratio analysis.

Accounting policies: Firms record business affairs on the basis of some accounting

principles, regulations, policies, rules and assumptions that may tends to very in

different organization (Lesakova, 2007). Hence, comparative study in this situation

may impair the purpose of ratio analysis.

Interpretation: It is very difficult to interpret a single ratio. For instance, if inventory

turnover ratio is 105 days then it only says that firm converts stock into cash within

105 days but it is unclear that whether it is good or bad.

Accuracy: Ratios based on misstated financial statement provide incorrect

relationship between various elements. Thus, incorrect ratios may lead to harmful

decisions.

TASK 2

Present scenario has been stated that Hilltop Ltd is a manufacturing organization who

decides to purchase a new machinery to increase production in future period. Two machines

at initial investment of £40000m to £10000m are available for this purpose, but firm can

acquire only one machine due to limited funds.

Q.1. Investment appraisal techniques or capital budgeting tools

These techniques help to assess the future costs and benefits that can arise on various

investment proposals. This evaluation facilitates in determining the most appropriate project

in which investment will be profitable for Hilltop Ltd.

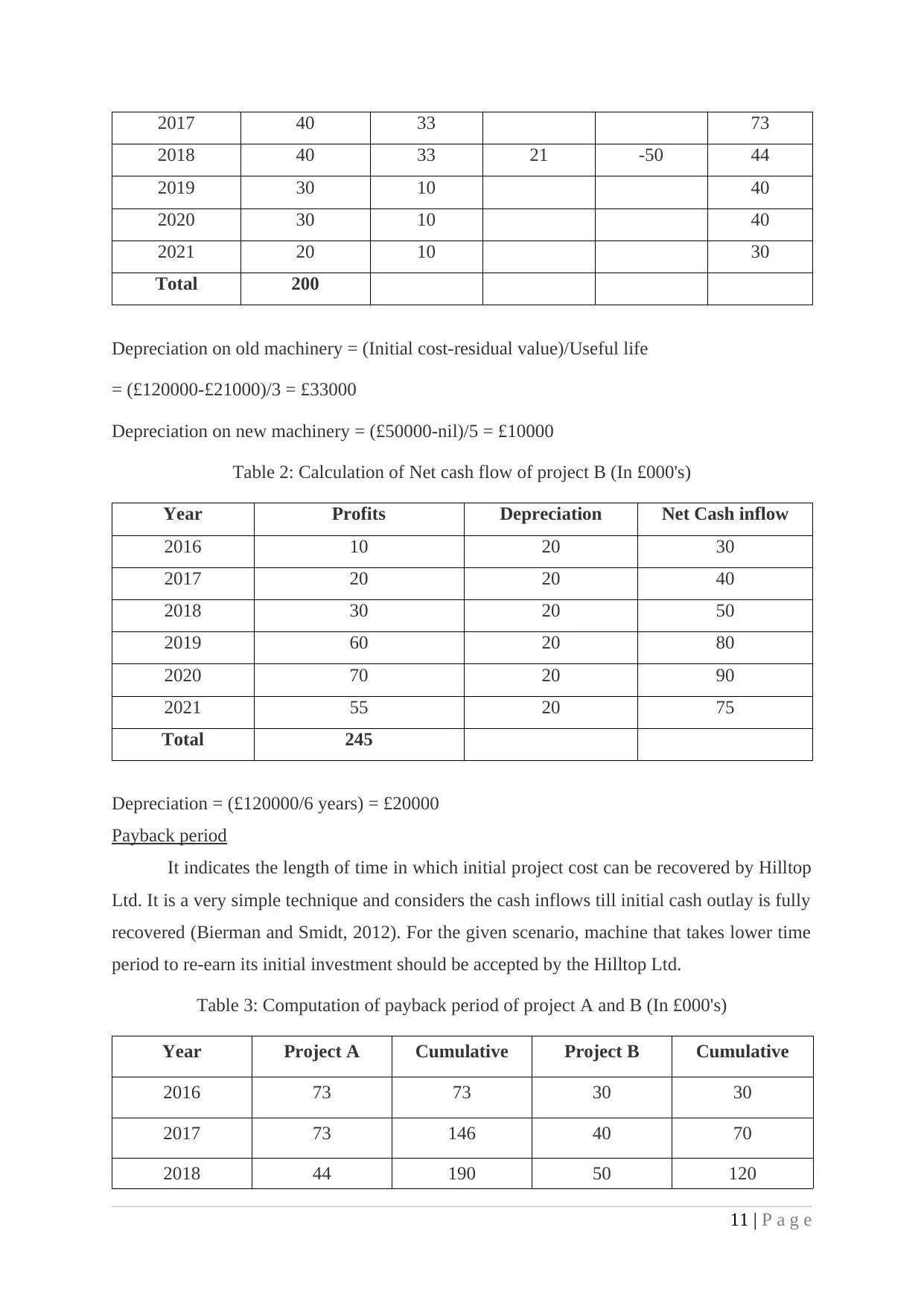

Net cash flow

NCF: It can be computed after adjusting all the non-cash affecting transactions and

taking into consideration all the cash related transactions. For instance, depreciation will add

back again and cash inflow as well as outflow that have been arisen through sale of old

machinery and purchase of new machinery will be adjusted into net profit.

Table 1: Calculation of Net cash flow of project A (In £000's)

Year Profits Depreciation

Cash inflows

through sales

Cash outflow

to purchase

new machine

Net Cash

inflow

2016 40 33 73

10 | P a g e

performance examination while it cannot be determined through ratio analysis.

Accounting policies: Firms record business affairs on the basis of some accounting

principles, regulations, policies, rules and assumptions that may tends to very in

different organization (Lesakova, 2007). Hence, comparative study in this situation

may impair the purpose of ratio analysis.

Interpretation: It is very difficult to interpret a single ratio. For instance, if inventory

turnover ratio is 105 days then it only says that firm converts stock into cash within

105 days but it is unclear that whether it is good or bad.

Accuracy: Ratios based on misstated financial statement provide incorrect

relationship between various elements. Thus, incorrect ratios may lead to harmful

decisions.

TASK 2

Present scenario has been stated that Hilltop Ltd is a manufacturing organization who

decides to purchase a new machinery to increase production in future period. Two machines

at initial investment of £40000m to £10000m are available for this purpose, but firm can

acquire only one machine due to limited funds.

Q.1. Investment appraisal techniques or capital budgeting tools

These techniques help to assess the future costs and benefits that can arise on various

investment proposals. This evaluation facilitates in determining the most appropriate project

in which investment will be profitable for Hilltop Ltd.

Net cash flow

NCF: It can be computed after adjusting all the non-cash affecting transactions and

taking into consideration all the cash related transactions. For instance, depreciation will add

back again and cash inflow as well as outflow that have been arisen through sale of old

machinery and purchase of new machinery will be adjusted into net profit.

Table 1: Calculation of Net cash flow of project A (In £000's)

Year Profits Depreciation

Cash inflows

through sales

Cash outflow

to purchase

new machine

Net Cash

inflow

2016 40 33 73

10 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2017 40 33 73

2018 40 33 21 -50 44

2019 30 10 40

2020 30 10 40

2021 20 10 30

Total 200

Depreciation on old machinery = (Initial cost-residual value)/Useful life

= (£120000-£21000)/3 = £33000

Depreciation on new machinery = (£50000-nil)/5 = £10000

Table 2: Calculation of Net cash flow of project B (In £000's)

Year Profits Depreciation Net Cash inflow

2016 10 20 30

2017 20 20 40

2018 30 20 50

2019 60 20 80

2020 70 20 90

2021 55 20 75

Total 245

Depreciation = (£120000/6 years) = £20000

Payback period

It indicates the length of time in which initial project cost can be recovered by Hilltop

Ltd. It is a very simple technique and considers the cash inflows till initial cash outlay is fully

recovered (Bierman and Smidt, 2012). For the given scenario, machine that takes lower time

period to re-earn its initial investment should be accepted by the Hilltop Ltd.

Table 3: Computation of payback period of project A and B (In £000's)

Year Project A Cumulative Project B Cumulative

2016 73 73 30 30

2017 73 146 40 70

2018 44 190 50 120

11 | P a g e

2018 40 33 21 -50 44

2019 30 10 40

2020 30 10 40

2021 20 10 30

Total 200

Depreciation on old machinery = (Initial cost-residual value)/Useful life

= (£120000-£21000)/3 = £33000

Depreciation on new machinery = (£50000-nil)/5 = £10000

Table 2: Calculation of Net cash flow of project B (In £000's)

Year Profits Depreciation Net Cash inflow

2016 10 20 30

2017 20 20 40

2018 30 20 50

2019 60 20 80

2020 70 20 90

2021 55 20 75

Total 245

Depreciation = (£120000/6 years) = £20000

Payback period

It indicates the length of time in which initial project cost can be recovered by Hilltop

Ltd. It is a very simple technique and considers the cash inflows till initial cash outlay is fully

recovered (Bierman and Smidt, 2012). For the given scenario, machine that takes lower time

period to re-earn its initial investment should be accepted by the Hilltop Ltd.

Table 3: Computation of payback period of project A and B (In £000's)

Year Project A Cumulative Project B Cumulative

2016 73 73 30 30

2017 73 146 40 70

2018 44 190 50 120

11 | P a g e

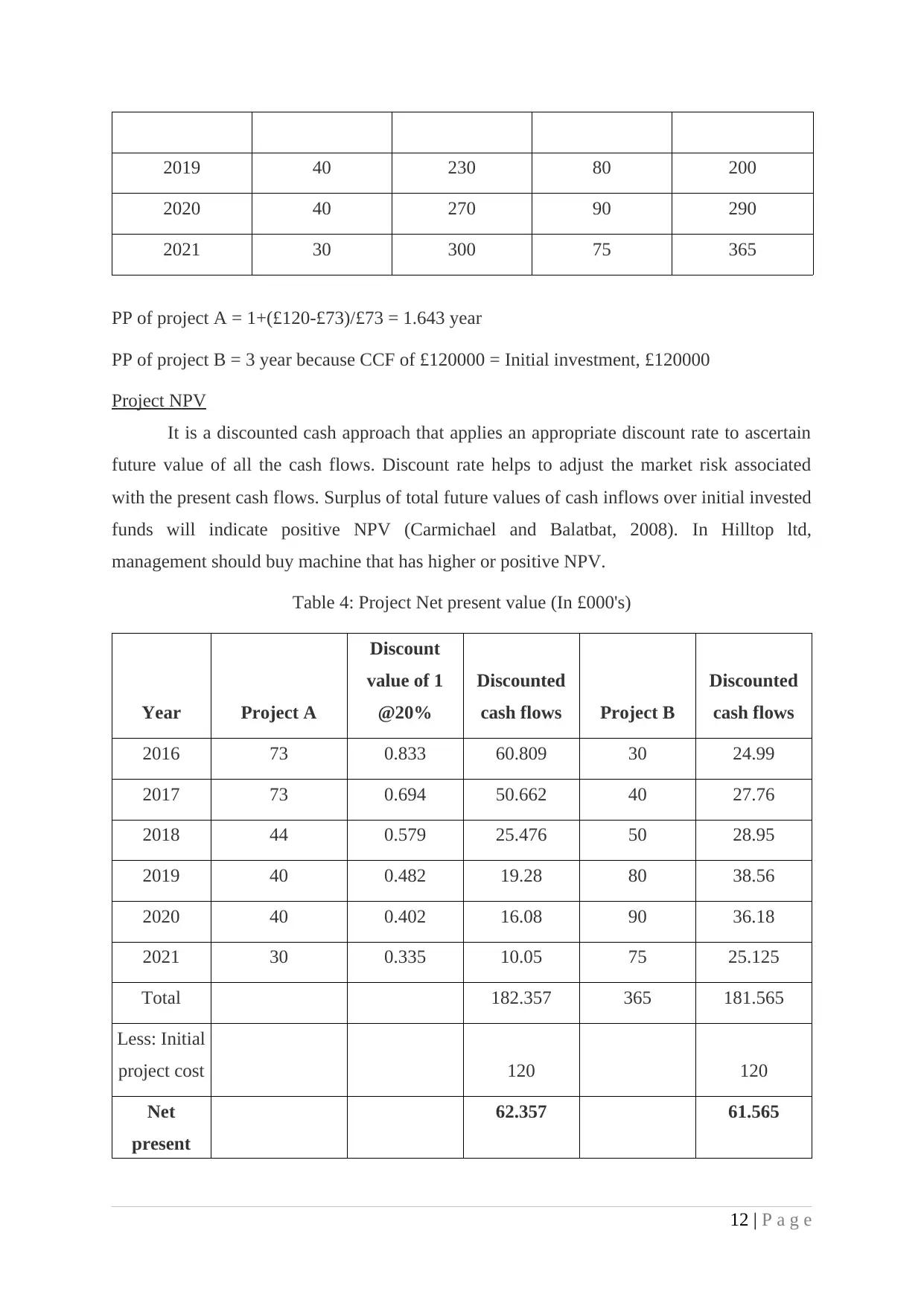

2019 40 230 80 200

2020 40 270 90 290

2021 30 300 75 365

PP of project A = 1+(£120-£73)/£73 = 1.643 year

PP of project B = 3 year because CCF of £120000 = Initial investment, £120000

Project NPV

It is a discounted cash approach that applies an appropriate discount rate to ascertain

future value of all the cash flows. Discount rate helps to adjust the market risk associated

with the present cash flows. Surplus of total future values of cash inflows over initial invested

funds will indicate positive NPV (Carmichael and Balatbat, 2008). In Hilltop ltd,

management should buy machine that has higher or positive NPV.

Table 4: Project Net present value (In £000's)

Year Project A

Discount

value of 1

@20%

Discounted

cash flows Project B

Discounted

cash flows

2016 73 0.833 60.809 30 24.99

2017 73 0.694 50.662 40 27.76

2018 44 0.579 25.476 50 28.95

2019 40 0.482 19.28 80 38.56

2020 40 0.402 16.08 90 36.18

2021 30 0.335 10.05 75 25.125

Total 182.357 365 181.565

Less: Initial

project cost 120 120

Net

present

62.357 61.565

12 | P a g e

2020 40 270 90 290

2021 30 300 75 365

PP of project A = 1+(£120-£73)/£73 = 1.643 year

PP of project B = 3 year because CCF of £120000 = Initial investment, £120000

Project NPV

It is a discounted cash approach that applies an appropriate discount rate to ascertain

future value of all the cash flows. Discount rate helps to adjust the market risk associated

with the present cash flows. Surplus of total future values of cash inflows over initial invested

funds will indicate positive NPV (Carmichael and Balatbat, 2008). In Hilltop ltd,

management should buy machine that has higher or positive NPV.

Table 4: Project Net present value (In £000's)

Year Project A

Discount

value of 1

@20%

Discounted

cash flows Project B

Discounted

cash flows

2016 73 0.833 60.809 30 24.99

2017 73 0.694 50.662 40 27.76

2018 44 0.579 25.476 50 28.95

2019 40 0.482 19.28 80 38.56

2020 40 0.402 16.08 90 36.18

2021 30 0.335 10.05 75 25.125

Total 182.357 365 181.565

Less: Initial

project cost 120 120

Net

present

62.357 61.565

12 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.