China's FDI & International Investment Law

VerifiedAdded on 2020/04/21

|22

|4750

|559

AI Summary

This assignment delves into the complex relationship between China's outward Foreign Direct Investment (FDI) and International Investment Law. It examines China's regulatory framework for FDI, the challenges it presents to existing international legal norms, and policy responses from both China and its investment partners. The analysis draws upon scholarly articles, legal texts, and reports on trade agreements involving China.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CHINESE TRADE AND INVESTMENT LAW

Chinese trade and Investment law

Name of the Student:

Name of the University:

Author’s Note:

Chinese trade and Investment law

Name of the Student:

Name of the University:

Author’s Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

CHINESE TRADE AND INVESTMENT LAW

Table of Contents

Introduction:....................................................................................................................................2

Discussion:.......................................................................................................................................3

China Australia free trade agreement:.............................................................................................3

Five year plan of China:..................................................................................................................5

Laws applicable to Australian business operating in China..........................................................13

Conclusion:....................................................................................................................................17

References and Bibliography:........................................................................................................19

CHINESE TRADE AND INVESTMENT LAW

Table of Contents

Introduction:....................................................................................................................................2

Discussion:.......................................................................................................................................3

China Australia free trade agreement:.............................................................................................3

Five year plan of China:..................................................................................................................5

Laws applicable to Australian business operating in China..........................................................13

Conclusion:....................................................................................................................................17

References and Bibliography:........................................................................................................19

2

CHINESE TRADE AND INVESTMENT LAW

Introduction:

The provincial and central government of China in recent years have created special

zones that have offered several benefits to the countries who are doing business poor operating in

China. Such areas include free trade zone, special economic zones and trade development zones.

One of the factors that can be considered by Australian sector for doing business in China is the

benefits offered by different economic zones and free trade zone. Australian business is required

to check with their state trade office for seeing that it has any relationship with special trade zone

for setting up operations in China. Free economic zone has been opened by the city of China.

Free trade zone of China has created business opportunities for Australian business1. One of the

most important international business hubs that is Shanghai is recent development.

The Shanghai free trade zone was launched on 29th September 2013. Establishment of

China’s national exhibition and trading centre is one of the first initiative of special free trade

zone of china. Opportunities will be created for Australian business due to economic reforms and

significant opportunities created by national exhibition and trading centre. For the private foreign

investments, six service sectors have been opened up under the free trade zone. These sectors

involve shipping services, financial services, business services, cultural services, social services

and professional services 2. It is indicative of the fact that Chinese government has signalled

unprecedented level of economic liberalization. An innovative approach for promoting the

exports of Australian country to China is represented by Australian national exhibition and

1 A One-Speed World: 2017 Value Creators

Report (2017) https://www.bcg.com <https://www.bcg.com/en-in/publications/2017/engineering-construction-

infrastructure-value-creators-report-one-speed-world.aspx>

2 Assets.Kpmg.Com (2017) Assets.kpmg.com <https://assets.kpmg.com/content/dam/kpmg/pdf/2016/06/china-

outlook-2016-v1.pdf>

CHINESE TRADE AND INVESTMENT LAW

Introduction:

The provincial and central government of China in recent years have created special

zones that have offered several benefits to the countries who are doing business poor operating in

China. Such areas include free trade zone, special economic zones and trade development zones.

One of the factors that can be considered by Australian sector for doing business in China is the

benefits offered by different economic zones and free trade zone. Australian business is required

to check with their state trade office for seeing that it has any relationship with special trade zone

for setting up operations in China. Free economic zone has been opened by the city of China.

Free trade zone of China has created business opportunities for Australian business1. One of the

most important international business hubs that is Shanghai is recent development.

The Shanghai free trade zone was launched on 29th September 2013. Establishment of

China’s national exhibition and trading centre is one of the first initiative of special free trade

zone of china. Opportunities will be created for Australian business due to economic reforms and

significant opportunities created by national exhibition and trading centre. For the private foreign

investments, six service sectors have been opened up under the free trade zone. These sectors

involve shipping services, financial services, business services, cultural services, social services

and professional services 2. It is indicative of the fact that Chinese government has signalled

unprecedented level of economic liberalization. An innovative approach for promoting the

exports of Australian country to China is represented by Australian national exhibition and

1 A One-Speed World: 2017 Value Creators

Report (2017) https://www.bcg.com <https://www.bcg.com/en-in/publications/2017/engineering-construction-

infrastructure-value-creators-report-one-speed-world.aspx>

2 Assets.Kpmg.Com (2017) Assets.kpmg.com <https://assets.kpmg.com/content/dam/kpmg/pdf/2016/06/china-

outlook-2016-v1.pdf>

3

CHINESE TRADE AND INVESTMENT LAW

trading centre. The fast growing Chinese market can be accessed by Australian business without

any complex procedures involved in registration of company in China 3.

Discussion:

China Australia free trade agreement:

China has ratified and initiated implementing free trade agreements with Australia in year

2015 as it is the largest trading partner. This free trade agreement will help in encouraging

international investment and trade by relaxing regulator barriers on foreign investments,

eliminating and reducing tariffs by lowering trade barriers. Australia will face increased export

competition in domestic markets by allowing free flow of cheaper goods across trade barriers.

Investment in Australia by private Chinese investors will be stimulated to $ 1094 million due to

increase in threshold in non-sensitive sectors by foreign investment review board.

Investment and trade will be boosted between China and Australia as per the agreement.

As per the agreement, tariff is eliminated on the vast majority of goods between the trading

partners. Authorities of China has remained cautious about Trans pacific partnership and there

will not be immediate negative impact on trade and investment due to implementation of

agreement. Second largest source of foreign investment for Australia in year 2014 is China with

the total value of investment stock amounts to AUD 64.5 billion 4. ChAFTA is expected to

stimulate trade flows between China and Australia will witness increase investment by China.

3 Aggarwal and Urata, Bilateral trade agreements in the Asia-Pacific: Origins, evolution, and

implications (Routledge, 2012)

Agrifutures.Com.Au (2017) Agrifutures.com.au <http://www.agrifutures.com.au/wp-content/uploads/2017/08/

rirdc_ar1516_final-8.pdf>

4 Ayodele and Sotola, China in Africa: An evaluation of Chinese investment. (Initiative for Public Policy Analysis,

pp.1-20. 2014)

CHINESE TRADE AND INVESTMENT LAW

trading centre. The fast growing Chinese market can be accessed by Australian business without

any complex procedures involved in registration of company in China 3.

Discussion:

China Australia free trade agreement:

China has ratified and initiated implementing free trade agreements with Australia in year

2015 as it is the largest trading partner. This free trade agreement will help in encouraging

international investment and trade by relaxing regulator barriers on foreign investments,

eliminating and reducing tariffs by lowering trade barriers. Australia will face increased export

competition in domestic markets by allowing free flow of cheaper goods across trade barriers.

Investment in Australia by private Chinese investors will be stimulated to $ 1094 million due to

increase in threshold in non-sensitive sectors by foreign investment review board.

Investment and trade will be boosted between China and Australia as per the agreement.

As per the agreement, tariff is eliminated on the vast majority of goods between the trading

partners. Authorities of China has remained cautious about Trans pacific partnership and there

will not be immediate negative impact on trade and investment due to implementation of

agreement. Second largest source of foreign investment for Australia in year 2014 is China with

the total value of investment stock amounts to AUD 64.5 billion 4. ChAFTA is expected to

stimulate trade flows between China and Australia will witness increase investment by China.

3 Aggarwal and Urata, Bilateral trade agreements in the Asia-Pacific: Origins, evolution, and

implications (Routledge, 2012)

Agrifutures.Com.Au (2017) Agrifutures.com.au <http://www.agrifutures.com.au/wp-content/uploads/2017/08/

rirdc_ar1516_final-8.pdf>

4 Ayodele and Sotola, China in Africa: An evaluation of Chinese investment. (Initiative for Public Policy Analysis,

pp.1-20. 2014)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

CHINESE TRADE AND INVESTMENT LAW

Chinese companies will further incentivise to make investment in China due to lower cost

of exports brought by tariffs reduction. For securing the supply of high quality of products,

Australia will have investments from china. This will assist Australian companies to tap into

evolving trend of Chinese consumption. Prior to the agreement, Chinese market was accessed by

Australian business for increasing the processing capacity and agricultural production. There has

been increase in investment value that is an encouraging factor for Chinese companies. Real

estate of Australia has been witnessing increasing investment from the Chinese companies in

addition to consumer related sectors. Investment facilitation arrangement made under ChAFTA

under which Chinese workers will be entering Australia in temporary basis for participating in

infrastructure projects of Chinese companies. Furthermore, tariffs on all types of pharmaceutical

products will be removed. Overseas investment has been stepped into by Chinese companies in

healthcare sector of Australia. Australian market access by Chinese companies will help in

accessing technology, high quality trends and expertise5. This would help in satisfying the

growing demand of Chinese market.

The investment targets by Chinese companies in Australia under the free trade agreement

would be mainly in the sector of financial services, computer and electronics, food, agribusiness,

textiles, healthcare and transportation. A range of commitment has been agreed by china under

ChAFTA that would provide assistance to service providers in Australia for establishing their

commercial presence in territories of China. Some of the sectors includes sector of shipping,

health aged care, architecture, mining and legal services, urban planning, fund management

sectors, insurance and banking 6. A clause of most favoured nation is involved in agreement that

5 Berger, Busse, Nunnenkamp, and Roy, Do trade and investment agreements lead to more FDI? Accounting for key

provisions inside the black box. (International Economics and Economic Policy, 10(2), pp.247-275. 2013)

6 Bin, China-Russia relations: into the Syrian storm: between alliance and alignment. (Comparative

Connections, 17(3), p.137. 2016)

CHINESE TRADE AND INVESTMENT LAW

Chinese companies will further incentivise to make investment in China due to lower cost

of exports brought by tariffs reduction. For securing the supply of high quality of products,

Australia will have investments from china. This will assist Australian companies to tap into

evolving trend of Chinese consumption. Prior to the agreement, Chinese market was accessed by

Australian business for increasing the processing capacity and agricultural production. There has

been increase in investment value that is an encouraging factor for Chinese companies. Real

estate of Australia has been witnessing increasing investment from the Chinese companies in

addition to consumer related sectors. Investment facilitation arrangement made under ChAFTA

under which Chinese workers will be entering Australia in temporary basis for participating in

infrastructure projects of Chinese companies. Furthermore, tariffs on all types of pharmaceutical

products will be removed. Overseas investment has been stepped into by Chinese companies in

healthcare sector of Australia. Australian market access by Chinese companies will help in

accessing technology, high quality trends and expertise5. This would help in satisfying the

growing demand of Chinese market.

The investment targets by Chinese companies in Australia under the free trade agreement

would be mainly in the sector of financial services, computer and electronics, food, agribusiness,

textiles, healthcare and transportation. A range of commitment has been agreed by china under

ChAFTA that would provide assistance to service providers in Australia for establishing their

commercial presence in territories of China. Some of the sectors includes sector of shipping,

health aged care, architecture, mining and legal services, urban planning, fund management

sectors, insurance and banking 6. A clause of most favoured nation is involved in agreement that

5 Berger, Busse, Nunnenkamp, and Roy, Do trade and investment agreements lead to more FDI? Accounting for key

provisions inside the black box. (International Economics and Economic Policy, 10(2), pp.247-275. 2013)

6 Bin, China-Russia relations: into the Syrian storm: between alliance and alignment. (Comparative

Connections, 17(3), p.137. 2016)

5

CHINESE TRADE AND INVESTMENT LAW

will help in protecting the competitive position of Australia provided the condition that if

beneficial treatment is extended by China to their trade partners. Under ChAFTA, investors in

Australia are provided with the opportunities of establishing wholly foreign owned entities. 13th

five year plan provides the Australian investors with further liberalization opportunities.

Due to increase in import competition, the merger clearance rates in Australia is likely to

have a favourable impact. Further growth in import competition in areas such as manufacturing,

electronics and household products, is likely to be supported by elimination and reduction of

tariffs under ChAFTA. Australian companies can source cheaper supply from China with this

agreement. Import competition effectiveness can be softened by the applications of anti-dumping

policies and using standards of Australia to impose additional trade barriers on importing of

goods. Increasingly global nature of competition can provide with the remote side effect of

ChAFTA as it seeks that Australian companies intend to merge for creating efficiencies and

competing effectively with counter parts 7. The international competitiveness can be related

under the provisions of formal merger authorization. It will help Australia in becoming more

exposed to export market and import competition and seeking and eliminating trade barriers.

Five year plan of China:

The economic development of China is achieved through a plan of five years in the most

recent year from March 2016 to March 2021. Realising of national and economic development

plan in form of the five year plan has outlined several targets and economic policies for driving

development of industry inn China by year 2020. The main focus of plan is continued efforts in

reforming measures and maintaining social stability and economic growth. Some of the key

7 Bloom, Draca and Van Reenen, Trade induced technical change? The impact of Chinese imports on innovation, IT

and productivity. (The Review of Economic Studies, 83(1), pp.87-117. 2016)

CHINESE TRADE AND INVESTMENT LAW

will help in protecting the competitive position of Australia provided the condition that if

beneficial treatment is extended by China to their trade partners. Under ChAFTA, investors in

Australia are provided with the opportunities of establishing wholly foreign owned entities. 13th

five year plan provides the Australian investors with further liberalization opportunities.

Due to increase in import competition, the merger clearance rates in Australia is likely to

have a favourable impact. Further growth in import competition in areas such as manufacturing,

electronics and household products, is likely to be supported by elimination and reduction of

tariffs under ChAFTA. Australian companies can source cheaper supply from China with this

agreement. Import competition effectiveness can be softened by the applications of anti-dumping

policies and using standards of Australia to impose additional trade barriers on importing of

goods. Increasingly global nature of competition can provide with the remote side effect of

ChAFTA as it seeks that Australian companies intend to merge for creating efficiencies and

competing effectively with counter parts 7. The international competitiveness can be related

under the provisions of formal merger authorization. It will help Australia in becoming more

exposed to export market and import competition and seeking and eliminating trade barriers.

Five year plan of China:

The economic development of China is achieved through a plan of five years in the most

recent year from March 2016 to March 2021. Realising of national and economic development

plan in form of the five year plan has outlined several targets and economic policies for driving

development of industry inn China by year 2020. The main focus of plan is continued efforts in

reforming measures and maintaining social stability and economic growth. Some of the key

7 Bloom, Draca and Van Reenen, Trade induced technical change? The impact of Chinese imports on innovation, IT

and productivity. (The Review of Economic Studies, 83(1), pp.87-117. 2016)

6

CHINESE TRADE AND INVESTMENT LAW

priorities that have been addressed in this particular five year plan involves investment

promotion across sectors, nationwide industrial capacity resolving, supporting development of

private sector, and strengthening protection of properties, innovation in technology, encouraging

population of workforce and re balancing of rural area entrepreneurship. International business

activity and international investments has been further opened in terms of China’s free trade zone

under 13th Five year plan.

International presence of china is on path of increasing continuously that will help in

further expanding of free trade zone for stimulating foreign investments in these zones. The

increasing face value of business opportunities is attributed from increased access to Chinese

markets coupled with western level of free trade. As per the plan, there will be provisions for

substantial change in flow of capital out and into China8. This would facilitate navigation of

foreign invested enterprise by accessing to market of China. Production will also be made

attractive due to proposed incentives of tax under the five year plan. China has taken

considerable step for gaining greater freedom in global market in terms of international financial

liberalization. The plan made in 13th five year plan will be made forward due to likely expansion

and creation of free trade zone and making provision of movement of capital flows.

Gradual liberalization of foreign investment is indicated by five year plan of China. It

involves the implementation of national treatments for foreign and domestic investors eventually

and this is done pre establishment and managing foreign investments with negative list

approaches 9. There will be unified foreign and direct investment system. Formulation of basic

8 Burgoon and Raess, Chinese investment and European labor: should and do workers fear Chinese FDI?. (Asia

Europe Journal, 12(1-2), pp.179-197. 2014)

9 Business.Hsbc.Com.Cn (2017) Business.hsbc.com.cn <http://www.business.hsbc.com.cn/-/media/library/markets-

selective/china/pdfs/trade-report-eng.pdf>

CHINESE TRADE AND INVESTMENT LAW

priorities that have been addressed in this particular five year plan involves investment

promotion across sectors, nationwide industrial capacity resolving, supporting development of

private sector, and strengthening protection of properties, innovation in technology, encouraging

population of workforce and re balancing of rural area entrepreneurship. International business

activity and international investments has been further opened in terms of China’s free trade zone

under 13th Five year plan.

International presence of china is on path of increasing continuously that will help in

further expanding of free trade zone for stimulating foreign investments in these zones. The

increasing face value of business opportunities is attributed from increased access to Chinese

markets coupled with western level of free trade. As per the plan, there will be provisions for

substantial change in flow of capital out and into China8. This would facilitate navigation of

foreign invested enterprise by accessing to market of China. Production will also be made

attractive due to proposed incentives of tax under the five year plan. China has taken

considerable step for gaining greater freedom in global market in terms of international financial

liberalization. The plan made in 13th five year plan will be made forward due to likely expansion

and creation of free trade zone and making provision of movement of capital flows.

Gradual liberalization of foreign investment is indicated by five year plan of China. It

involves the implementation of national treatments for foreign and domestic investors eventually

and this is done pre establishment and managing foreign investments with negative list

approaches 9. There will be unified foreign and direct investment system. Formulation of basic

8 Burgoon and Raess, Chinese investment and European labor: should and do workers fear Chinese FDI?. (Asia

Europe Journal, 12(1-2), pp.179-197. 2014)

9 Business.Hsbc.Com.Cn (2017) Business.hsbc.com.cn <http://www.business.hsbc.com.cn/-/media/library/markets-

selective/china/pdfs/trade-report-eng.pdf>

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CHINESE TRADE AND INVESTMENT LAW

laws have been highlighted in the plan by indicating the growing need to emphasize on

finalization of legislation such as drafting the foreign investment laws. The policymakers of

China has been consistently advocated to do away with the classification of foreign investments

and governing of all the established companies in china under same regulations and laws. Under

this plan, some areas that have been noted for making alterations relating investment includes

reduce barriers to access market, expand openings, encouraging foreign capital and improving

overall quality of foreign investments in China by adopting advanced technology. For achieving

goals related to foreign investments, plan have some targeted goals that re required to achieved

in order to enhance such investment opportunities. For liberalization, the targeted sectors

include construction, education, accounting, designing and auditing 10. Market access for foreign

companies such as insurance, banking, securities and pensions are suggested for expansion under

the plan. Plan would also encourage development of industries involved in high and new

technologies, manufacturing and efficiency in energy sectors.

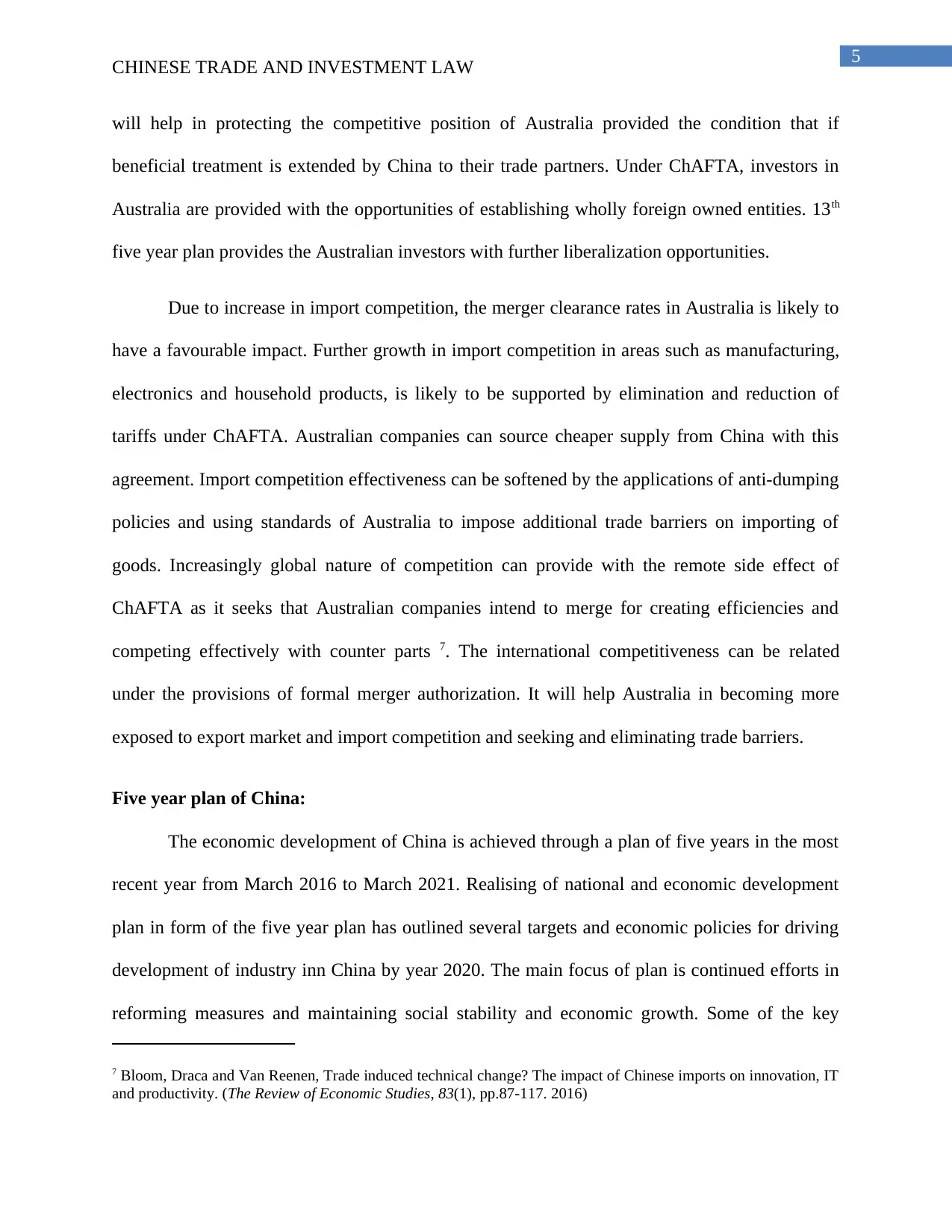

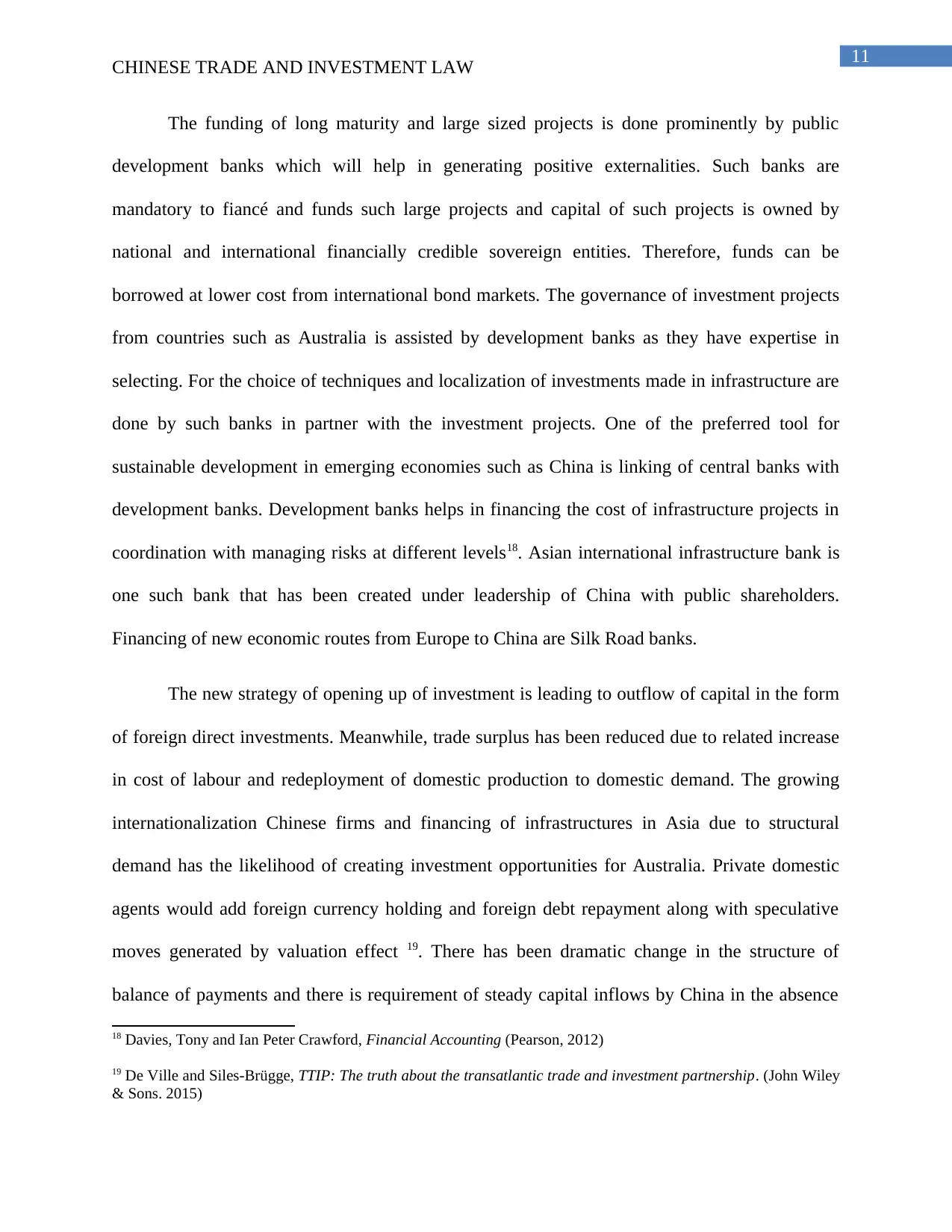

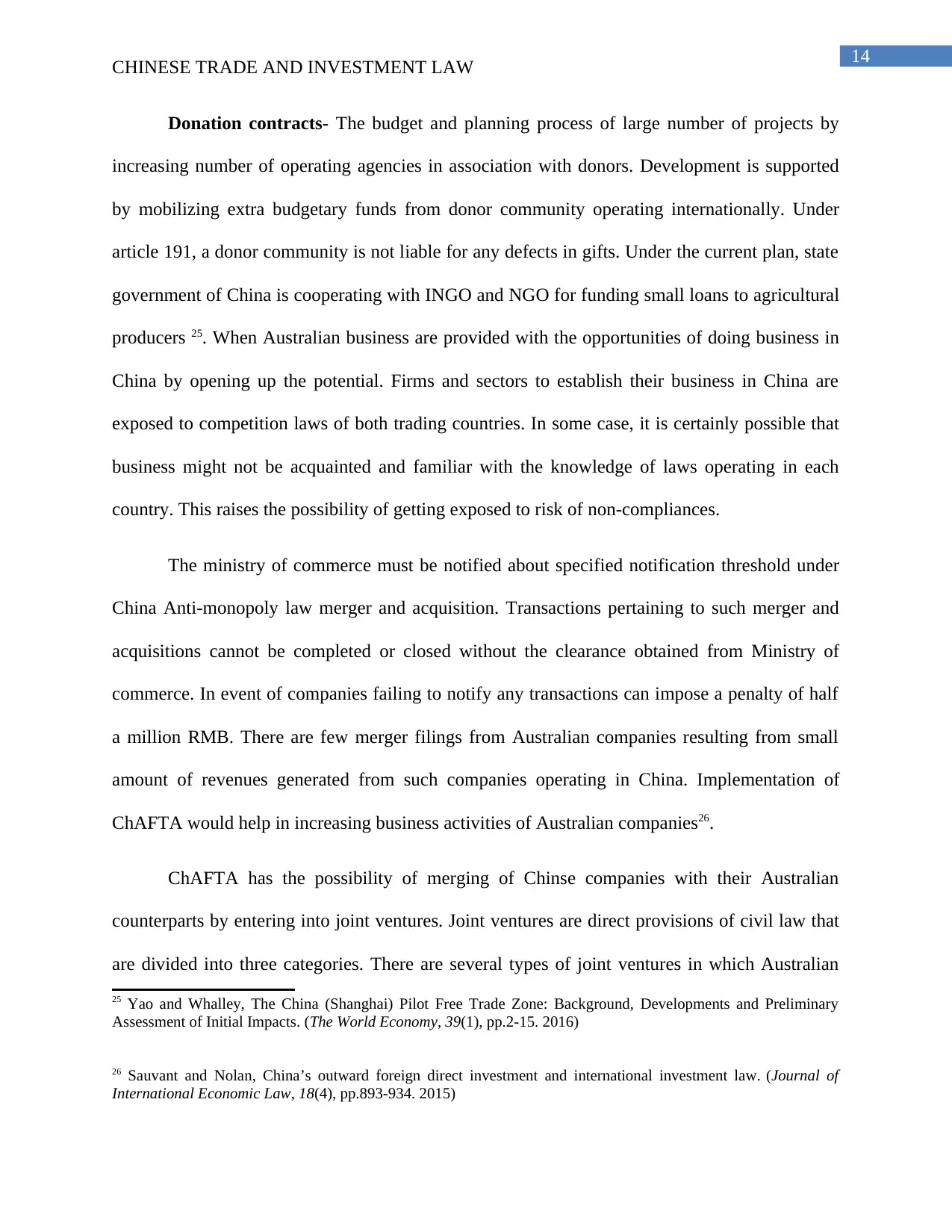

Overall performance targets of Industrial sectors:

10 Büthe and Milner, Foreign direct investment and institutional diversity in trade agreements: Credibility,

commitment, and economic flows in the developing world, 1971–2007. (World Politics, 66(1), pp.88-122. 2014)

CHINESE TRADE AND INVESTMENT LAW

laws have been highlighted in the plan by indicating the growing need to emphasize on

finalization of legislation such as drafting the foreign investment laws. The policymakers of

China has been consistently advocated to do away with the classification of foreign investments

and governing of all the established companies in china under same regulations and laws. Under

this plan, some areas that have been noted for making alterations relating investment includes

reduce barriers to access market, expand openings, encouraging foreign capital and improving

overall quality of foreign investments in China by adopting advanced technology. For achieving

goals related to foreign investments, plan have some targeted goals that re required to achieved

in order to enhance such investment opportunities. For liberalization, the targeted sectors

include construction, education, accounting, designing and auditing 10. Market access for foreign

companies such as insurance, banking, securities and pensions are suggested for expansion under

the plan. Plan would also encourage development of industries involved in high and new

technologies, manufacturing and efficiency in energy sectors.

Overall performance targets of Industrial sectors:

10 Büthe and Milner, Foreign direct investment and institutional diversity in trade agreements: Credibility,

commitment, and economic flows in the developing world, 1971–2007. (World Politics, 66(1), pp.88-122. 2014)

8

CHINESE TRADE AND INVESTMENT LAW

Source:11

It is envisaged in the plan to create strong system and enabling environment for

supporting the variety of manufacturing planned activities. Establishment of export processing

zone and special economic zones is one of the key interventions in the plan. Increasing

investment is being witnessed in service and manufacturing sectors and over the last few years,

there have been change in the patter of inflow and outflow of foreign direct investments. China is

being viewed by international investor as end destination market due to growing investment in

service sector of country 12. Goods produced by manufacturing firms are designed in a specific

way for meeting the needs of Chinese consumers and they are producing high quality goods.

Over the past years, there have been rapid growth of foreign investors in high tech manufacturing

industries. This would provide opportunities to manufacturing companies in Australia to make

investment in China under the new plan. Nonetheless, China has been in the early stage of

transition of service driven economy. It is perceived that foreign direct investment in china

would be concentrated in East due to establishment of free trade zone in Fujian, Tianjin and

Guangdong 13. Such investments would be eventually moving to western area through Belt and

road initiative of country.

11 Cepii.Fr (2017) Cepii.fr <http://www.cepii.fr/PDF_PUB/pb/2016/pb2016-12.pdf>

12 Clegg and Voss, The new two-way street of Chinese direct investment in the European Union. (China-EU Law

Journal, 5(1-2), pp.79-100. 2016)

13 Chow and Schoenbaum, International Trade Law: Problems, Cases, and Materials. (Wolters Kluwer Law &

Business 2017)

CHINESE TRADE AND INVESTMENT LAW

Source:11

It is envisaged in the plan to create strong system and enabling environment for

supporting the variety of manufacturing planned activities. Establishment of export processing

zone and special economic zones is one of the key interventions in the plan. Increasing

investment is being witnessed in service and manufacturing sectors and over the last few years,

there have been change in the patter of inflow and outflow of foreign direct investments. China is

being viewed by international investor as end destination market due to growing investment in

service sector of country 12. Goods produced by manufacturing firms are designed in a specific

way for meeting the needs of Chinese consumers and they are producing high quality goods.

Over the past years, there have been rapid growth of foreign investors in high tech manufacturing

industries. This would provide opportunities to manufacturing companies in Australia to make

investment in China under the new plan. Nonetheless, China has been in the early stage of

transition of service driven economy. It is perceived that foreign direct investment in china

would be concentrated in East due to establishment of free trade zone in Fujian, Tianjin and

Guangdong 13. Such investments would be eventually moving to western area through Belt and

road initiative of country.

11 Cepii.Fr (2017) Cepii.fr <http://www.cepii.fr/PDF_PUB/pb/2016/pb2016-12.pdf>

12 Clegg and Voss, The new two-way street of Chinese direct investment in the European Union. (China-EU Law

Journal, 5(1-2), pp.79-100. 2016)

13 Chow and Schoenbaum, International Trade Law: Problems, Cases, and Materials. (Wolters Kluwer Law &

Business 2017)

9

CHINESE TRADE AND INVESTMENT LAW

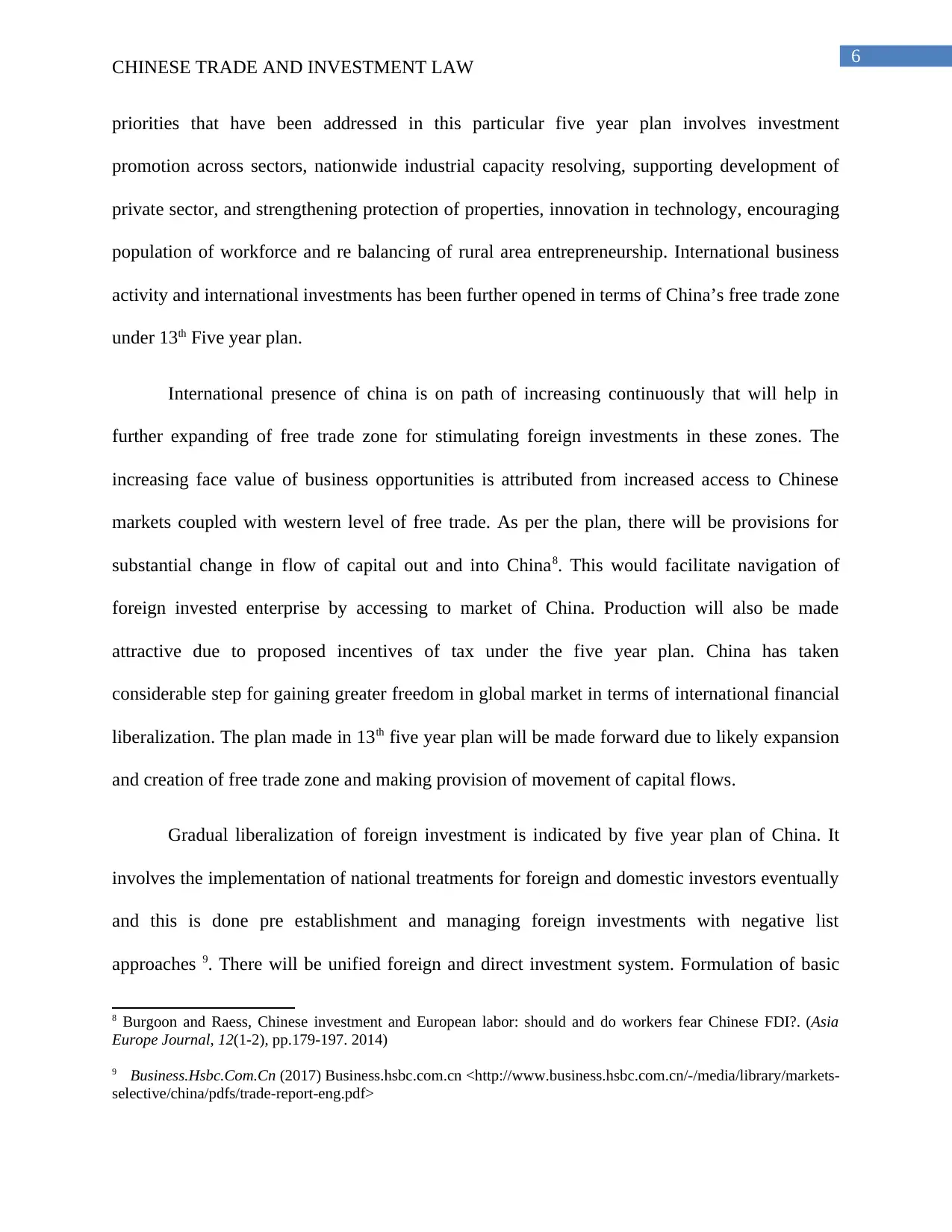

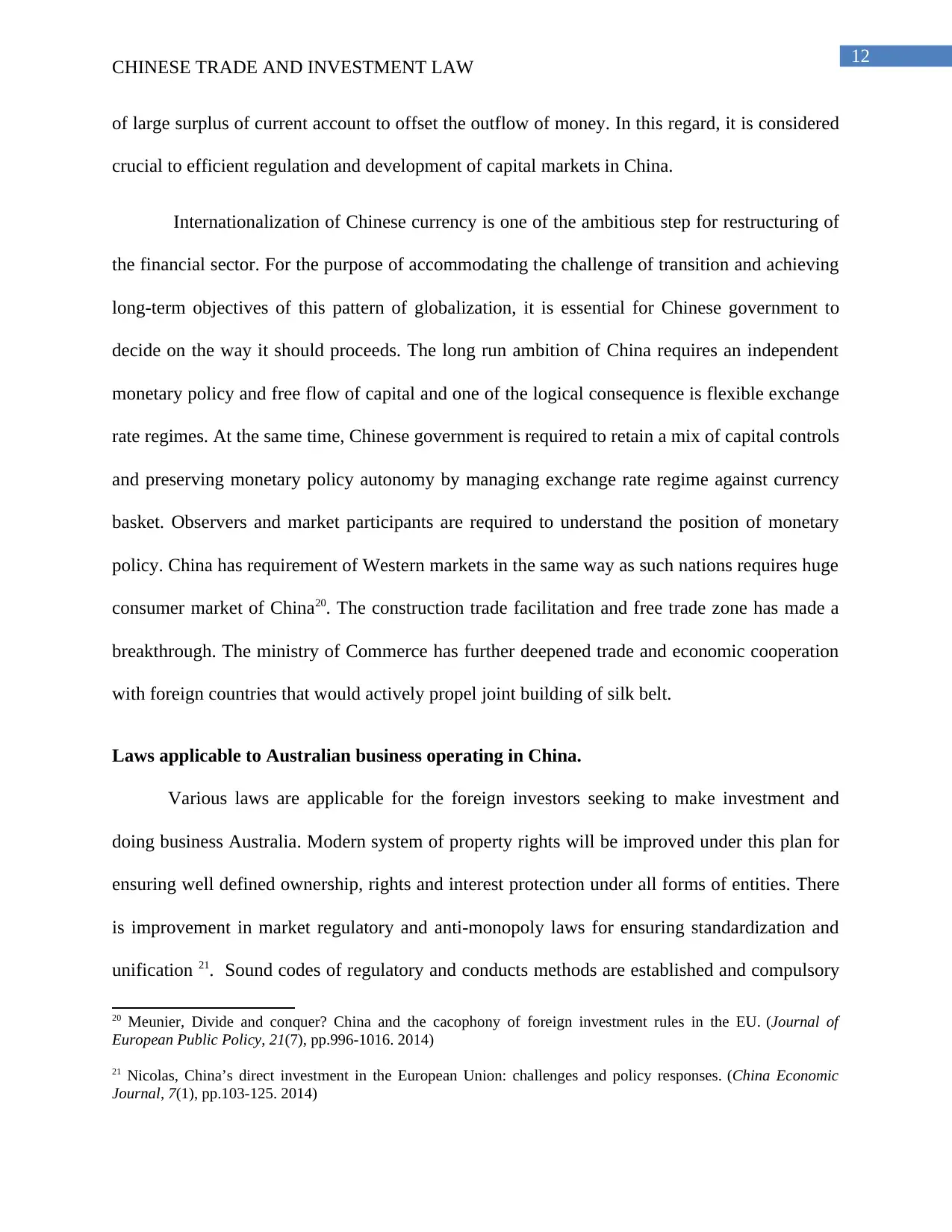

Manufacturing sub sectors target:

Source:14

One of the most important objective of the five year plan is to enhance the total factor

productivity by shifting innovative led growth from capital accumulated led growth. Under the

banner of supply side reform, innovation has increased in last two years. Opening up is another

strategy of this particular plan that incorporates dual strategy formation for encouraging Chinese

business to make investment in other countries such as Australia and compete at global level

accompanied by attracting foreign investments into the country. An alternative concept of

economic integration is promoted by China through building of multilateral development banks

and “Belt and Road initiative” 15. The guiding principle under this plan is one belt and one road.

Distinguishing short term and long-term turmoil is important that is nurtured by exacerbated

financial speculators and international investor’s collective pessimism. It is an initiative that is

14 Drache and Jacobs, Linking Global Trade and Human Rights. (Cambridge University Press. 2014)

Interpretation For The China-Australia Free Trade Agreement

- (2017) English.mofcom.gov.cn <http://english.mofcom.gov.cn/article/policyrelease/Cocoon/

201510/20151001144954.shtml>

15 Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign direct

investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

CHINESE TRADE AND INVESTMENT LAW

Manufacturing sub sectors target:

Source:14

One of the most important objective of the five year plan is to enhance the total factor

productivity by shifting innovative led growth from capital accumulated led growth. Under the

banner of supply side reform, innovation has increased in last two years. Opening up is another

strategy of this particular plan that incorporates dual strategy formation for encouraging Chinese

business to make investment in other countries such as Australia and compete at global level

accompanied by attracting foreign investments into the country. An alternative concept of

economic integration is promoted by China through building of multilateral development banks

and “Belt and Road initiative” 15. The guiding principle under this plan is one belt and one road.

Distinguishing short term and long-term turmoil is important that is nurtured by exacerbated

financial speculators and international investor’s collective pessimism. It is an initiative that is

14 Drache and Jacobs, Linking Global Trade and Human Rights. (Cambridge University Press. 2014)

Interpretation For The China-Australia Free Trade Agreement

- (2017) English.mofcom.gov.cn <http://english.mofcom.gov.cn/article/policyrelease/Cocoon/

201510/20151001144954.shtml>

15 Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign direct

investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

CHINESE TRADE AND INVESTMENT LAW

led by China is one of the critical area of global growth in foreseeable future. Provisions for

encouraged economic growth is provided by 13th Five year plan mainly in Western areas of

China. Industries from foreign countries are provided opportunities to make investment in such

areas as they are underdeveloped. Such industries involve construction, retail sector and other

retail services. New markets will be created that will provide opportunities for urban

developments, financial services, transport, high tech manufacturing industries, infrastructure,

finance and e commerce 16.

It is believed by Chinese government that the basis for financial globalization alternative

model is the multi polar monetary system that would help in supporting multilateral

infrastructure projects. Future transformation of IMS that is international monetary system into

multilateral system is the grand design for achieving the above mentioned objective. The

transformation structure would be based under the auspices reformed International monetary

fund based on institutionalized monetary coordination. Global financial cycle counter cycle

needs would be managed by issuing of special deposit rights and radical reformation of quota

system. Chinese authorities have perceived that monetary basis of transformation of global

finance is the international monetary system evolution. Over capacities in heavy industries of

China would be reduced by making investment in infrastructure throughout Asia. Despite huge

amounts of saving, world economy is suffering from colossal lack of infrastructure and slow

growth17. Therefore, financial system of China should be overhauled and there should be massive

increment in the capacity of public development banks for making investment in infrastructure.

16 Clegg and Voss, The new two-way street of Chinese direct investment in the European Union. (China-EU Law

Journal, 5(1-2), pp.79-100. 2016)

17 Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign direct

investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

CHINESE TRADE AND INVESTMENT LAW

led by China is one of the critical area of global growth in foreseeable future. Provisions for

encouraged economic growth is provided by 13th Five year plan mainly in Western areas of

China. Industries from foreign countries are provided opportunities to make investment in such

areas as they are underdeveloped. Such industries involve construction, retail sector and other

retail services. New markets will be created that will provide opportunities for urban

developments, financial services, transport, high tech manufacturing industries, infrastructure,

finance and e commerce 16.

It is believed by Chinese government that the basis for financial globalization alternative

model is the multi polar monetary system that would help in supporting multilateral

infrastructure projects. Future transformation of IMS that is international monetary system into

multilateral system is the grand design for achieving the above mentioned objective. The

transformation structure would be based under the auspices reformed International monetary

fund based on institutionalized monetary coordination. Global financial cycle counter cycle

needs would be managed by issuing of special deposit rights and radical reformation of quota

system. Chinese authorities have perceived that monetary basis of transformation of global

finance is the international monetary system evolution. Over capacities in heavy industries of

China would be reduced by making investment in infrastructure throughout Asia. Despite huge

amounts of saving, world economy is suffering from colossal lack of infrastructure and slow

growth17. Therefore, financial system of China should be overhauled and there should be massive

increment in the capacity of public development banks for making investment in infrastructure.

16 Clegg and Voss, The new two-way street of Chinese direct investment in the European Union. (China-EU Law

Journal, 5(1-2), pp.79-100. 2016)

17 Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign direct

investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

11

CHINESE TRADE AND INVESTMENT LAW

The funding of long maturity and large sized projects is done prominently by public

development banks which will help in generating positive externalities. Such banks are

mandatory to fiancé and funds such large projects and capital of such projects is owned by

national and international financially credible sovereign entities. Therefore, funds can be

borrowed at lower cost from international bond markets. The governance of investment projects

from countries such as Australia is assisted by development banks as they have expertise in

selecting. For the choice of techniques and localization of investments made in infrastructure are

done by such banks in partner with the investment projects. One of the preferred tool for

sustainable development in emerging economies such as China is linking of central banks with

development banks. Development banks helps in financing the cost of infrastructure projects in

coordination with managing risks at different levels18. Asian international infrastructure bank is

one such bank that has been created under leadership of China with public shareholders.

Financing of new economic routes from Europe to China are Silk Road banks.

The new strategy of opening up of investment is leading to outflow of capital in the form

of foreign direct investments. Meanwhile, trade surplus has been reduced due to related increase

in cost of labour and redeployment of domestic production to domestic demand. The growing

internationalization Chinese firms and financing of infrastructures in Asia due to structural

demand has the likelihood of creating investment opportunities for Australia. Private domestic

agents would add foreign currency holding and foreign debt repayment along with speculative

moves generated by valuation effect 19. There has been dramatic change in the structure of

balance of payments and there is requirement of steady capital inflows by China in the absence

18 Davies, Tony and Ian Peter Crawford, Financial Accounting (Pearson, 2012)

19 De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment partnership. (John Wiley

& Sons. 2015)

CHINESE TRADE AND INVESTMENT LAW

The funding of long maturity and large sized projects is done prominently by public

development banks which will help in generating positive externalities. Such banks are

mandatory to fiancé and funds such large projects and capital of such projects is owned by

national and international financially credible sovereign entities. Therefore, funds can be

borrowed at lower cost from international bond markets. The governance of investment projects

from countries such as Australia is assisted by development banks as they have expertise in

selecting. For the choice of techniques and localization of investments made in infrastructure are

done by such banks in partner with the investment projects. One of the preferred tool for

sustainable development in emerging economies such as China is linking of central banks with

development banks. Development banks helps in financing the cost of infrastructure projects in

coordination with managing risks at different levels18. Asian international infrastructure bank is

one such bank that has been created under leadership of China with public shareholders.

Financing of new economic routes from Europe to China are Silk Road banks.

The new strategy of opening up of investment is leading to outflow of capital in the form

of foreign direct investments. Meanwhile, trade surplus has been reduced due to related increase

in cost of labour and redeployment of domestic production to domestic demand. The growing

internationalization Chinese firms and financing of infrastructures in Asia due to structural

demand has the likelihood of creating investment opportunities for Australia. Private domestic

agents would add foreign currency holding and foreign debt repayment along with speculative

moves generated by valuation effect 19. There has been dramatic change in the structure of

balance of payments and there is requirement of steady capital inflows by China in the absence

18 Davies, Tony and Ian Peter Crawford, Financial Accounting (Pearson, 2012)

19 De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment partnership. (John Wiley

& Sons. 2015)

12

CHINESE TRADE AND INVESTMENT LAW

of large surplus of current account to offset the outflow of money. In this regard, it is considered

crucial to efficient regulation and development of capital markets in China.

Internationalization of Chinese currency is one of the ambitious step for restructuring of

the financial sector. For the purpose of accommodating the challenge of transition and achieving

long-term objectives of this pattern of globalization, it is essential for Chinese government to

decide on the way it should proceeds. The long run ambition of China requires an independent

monetary policy and free flow of capital and one of the logical consequence is flexible exchange

rate regimes. At the same time, Chinese government is required to retain a mix of capital controls

and preserving monetary policy autonomy by managing exchange rate regime against currency

basket. Observers and market participants are required to understand the position of monetary

policy. China has requirement of Western markets in the same way as such nations requires huge

consumer market of China20. The construction trade facilitation and free trade zone has made a

breakthrough. The ministry of Commerce has further deepened trade and economic cooperation

with foreign countries that would actively propel joint building of silk belt.

Laws applicable to Australian business operating in China.

Various laws are applicable for the foreign investors seeking to make investment and

doing business Australia. Modern system of property rights will be improved under this plan for

ensuring well defined ownership, rights and interest protection under all forms of entities. There

is improvement in market regulatory and anti-monopoly laws for ensuring standardization and

unification 21. Sound codes of regulatory and conducts methods are established and compulsory

20 Meunier, Divide and conquer? China and the cacophony of foreign investment rules in the EU. (Journal of

European Public Policy, 21(7), pp.996-1016. 2014)

21 Nicolas, China’s direct investment in the European Union: challenges and policy responses. (China Economic

Journal, 7(1), pp.103-125. 2014)

CHINESE TRADE AND INVESTMENT LAW

of large surplus of current account to offset the outflow of money. In this regard, it is considered

crucial to efficient regulation and development of capital markets in China.

Internationalization of Chinese currency is one of the ambitious step for restructuring of

the financial sector. For the purpose of accommodating the challenge of transition and achieving

long-term objectives of this pattern of globalization, it is essential for Chinese government to

decide on the way it should proceeds. The long run ambition of China requires an independent

monetary policy and free flow of capital and one of the logical consequence is flexible exchange

rate regimes. At the same time, Chinese government is required to retain a mix of capital controls

and preserving monetary policy autonomy by managing exchange rate regime against currency

basket. Observers and market participants are required to understand the position of monetary

policy. China has requirement of Western markets in the same way as such nations requires huge

consumer market of China20. The construction trade facilitation and free trade zone has made a

breakthrough. The ministry of Commerce has further deepened trade and economic cooperation

with foreign countries that would actively propel joint building of silk belt.

Laws applicable to Australian business operating in China.

Various laws are applicable for the foreign investors seeking to make investment and

doing business Australia. Modern system of property rights will be improved under this plan for

ensuring well defined ownership, rights and interest protection under all forms of entities. There

is improvement in market regulatory and anti-monopoly laws for ensuring standardization and

unification 21. Sound codes of regulatory and conducts methods are established and compulsory

20 Meunier, Divide and conquer? China and the cacophony of foreign investment rules in the EU. (Journal of

European Public Policy, 21(7), pp.996-1016. 2014)

21 Nicolas, China’s direct investment in the European Union: challenges and policy responses. (China Economic

Journal, 7(1), pp.103-125. 2014)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

CHINESE TRADE AND INVESTMENT LAW

standards are established for workplace, quality of products, environmental impacts,

consumption and energy. The principle of law based taxation will be fully implemented and

system of taxation will be optimized 22. This plan helps in understanding the economic future of

country from both internal and external view point.

Some of the laws that are required by such busies to comply with are listed below:

Public private partnership- China has experimented with public private partnership for

quite ling time. However, many foreign investors have been deterred from investing or

conducting business on partnership basis. The reasons are attributable to the fact of perceived

risk and due to long contract length. Management measures on franchised operations on public

utilities and infrastructure is implemented by NDRC for protecting the investment of private and

foreign companies. As per the 13th Five year plan, private capital is sought for public

infrastructure and is aimed at reducing restrictions for market access for private investment in

public operations and infrastructure 23.

Loan contracts- Under the 13th five year plan, loans and technical assistance have been

approved by Asian development bank to increase the distribution and energy generation.

Investors can enter into loan contracts under article 196 -211. Under article 202, lender must

provide accounting reports. Under article 204, People bank of China is liable for stipulating the

interest applicable to all loans that are provided by financial institutions24.

22 De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment partnership. (John Wiley

& Sons. 2015)

23 Sauvant and Chen, China’s regulatory framework for outward foreign direct investment. (China Economic

Journal, 7(1), pp.141-163. 2014)

24 Sauvant and Nolan, 10 Reactions to China’s Cross-border Investment and International Investment

Law. (Managing Culture and Interspace in Cross-border Investments: Building a Global Company, 66, p.98. 2017)

CHINESE TRADE AND INVESTMENT LAW

standards are established for workplace, quality of products, environmental impacts,

consumption and energy. The principle of law based taxation will be fully implemented and

system of taxation will be optimized 22. This plan helps in understanding the economic future of

country from both internal and external view point.

Some of the laws that are required by such busies to comply with are listed below:

Public private partnership- China has experimented with public private partnership for

quite ling time. However, many foreign investors have been deterred from investing or

conducting business on partnership basis. The reasons are attributable to the fact of perceived

risk and due to long contract length. Management measures on franchised operations on public

utilities and infrastructure is implemented by NDRC for protecting the investment of private and

foreign companies. As per the 13th Five year plan, private capital is sought for public

infrastructure and is aimed at reducing restrictions for market access for private investment in

public operations and infrastructure 23.

Loan contracts- Under the 13th five year plan, loans and technical assistance have been

approved by Asian development bank to increase the distribution and energy generation.

Investors can enter into loan contracts under article 196 -211. Under article 202, lender must

provide accounting reports. Under article 204, People bank of China is liable for stipulating the

interest applicable to all loans that are provided by financial institutions24.

22 De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment partnership. (John Wiley

& Sons. 2015)

23 Sauvant and Chen, China’s regulatory framework for outward foreign direct investment. (China Economic

Journal, 7(1), pp.141-163. 2014)

24 Sauvant and Nolan, 10 Reactions to China’s Cross-border Investment and International Investment

Law. (Managing Culture and Interspace in Cross-border Investments: Building a Global Company, 66, p.98. 2017)

14

CHINESE TRADE AND INVESTMENT LAW

Donation contracts- The budget and planning process of large number of projects by

increasing number of operating agencies in association with donors. Development is supported

by mobilizing extra budgetary funds from donor community operating internationally. Under

article 191, a donor community is not liable for any defects in gifts. Under the current plan, state

government of China is cooperating with INGO and NGO for funding small loans to agricultural

producers 25. When Australian business are provided with the opportunities of doing business in

China by opening up the potential. Firms and sectors to establish their business in China are

exposed to competition laws of both trading countries. In some case, it is certainly possible that

business might not be acquainted and familiar with the knowledge of laws operating in each

country. This raises the possibility of getting exposed to risk of non-compliances.

The ministry of commerce must be notified about specified notification threshold under

China Anti-monopoly law merger and acquisition. Transactions pertaining to such merger and

acquisitions cannot be completed or closed without the clearance obtained from Ministry of

commerce. In event of companies failing to notify any transactions can impose a penalty of half

a million RMB. There are few merger filings from Australian companies resulting from small

amount of revenues generated from such companies operating in China. Implementation of

ChAFTA would help in increasing business activities of Australian companies26.

ChAFTA has the possibility of merging of Chinse companies with their Australian

counterparts by entering into joint ventures. Joint ventures are direct provisions of civil law that

are divided into three categories. There are several types of joint ventures in which Australian

25 Yao and Whalley, The China (Shanghai) Pilot Free Trade Zone: Background, Developments and Preliminary

Assessment of Initial Impacts. (The World Economy, 39(1), pp.2-15. 2016)

26 Sauvant and Nolan, China’s outward foreign direct investment and international investment law. (Journal of

International Economic Law, 18(4), pp.893-934. 2015)

CHINESE TRADE AND INVESTMENT LAW

Donation contracts- The budget and planning process of large number of projects by

increasing number of operating agencies in association with donors. Development is supported

by mobilizing extra budgetary funds from donor community operating internationally. Under

article 191, a donor community is not liable for any defects in gifts. Under the current plan, state

government of China is cooperating with INGO and NGO for funding small loans to agricultural

producers 25. When Australian business are provided with the opportunities of doing business in

China by opening up the potential. Firms and sectors to establish their business in China are

exposed to competition laws of both trading countries. In some case, it is certainly possible that

business might not be acquainted and familiar with the knowledge of laws operating in each

country. This raises the possibility of getting exposed to risk of non-compliances.

The ministry of commerce must be notified about specified notification threshold under

China Anti-monopoly law merger and acquisition. Transactions pertaining to such merger and

acquisitions cannot be completed or closed without the clearance obtained from Ministry of

commerce. In event of companies failing to notify any transactions can impose a penalty of half

a million RMB. There are few merger filings from Australian companies resulting from small

amount of revenues generated from such companies operating in China. Implementation of

ChAFTA would help in increasing business activities of Australian companies26.

ChAFTA has the possibility of merging of Chinse companies with their Australian

counterparts by entering into joint ventures. Joint ventures are direct provisions of civil law that

are divided into three categories. There are several types of joint ventures in which Australian

25 Yao and Whalley, The China (Shanghai) Pilot Free Trade Zone: Background, Developments and Preliminary

Assessment of Initial Impacts. (The World Economy, 39(1), pp.2-15. 2016)

26 Sauvant and Nolan, China’s outward foreign direct investment and international investment law. (Journal of

International Economic Law, 18(4), pp.893-934. 2015)

15

CHINESE TRADE AND INVESTMENT LAW

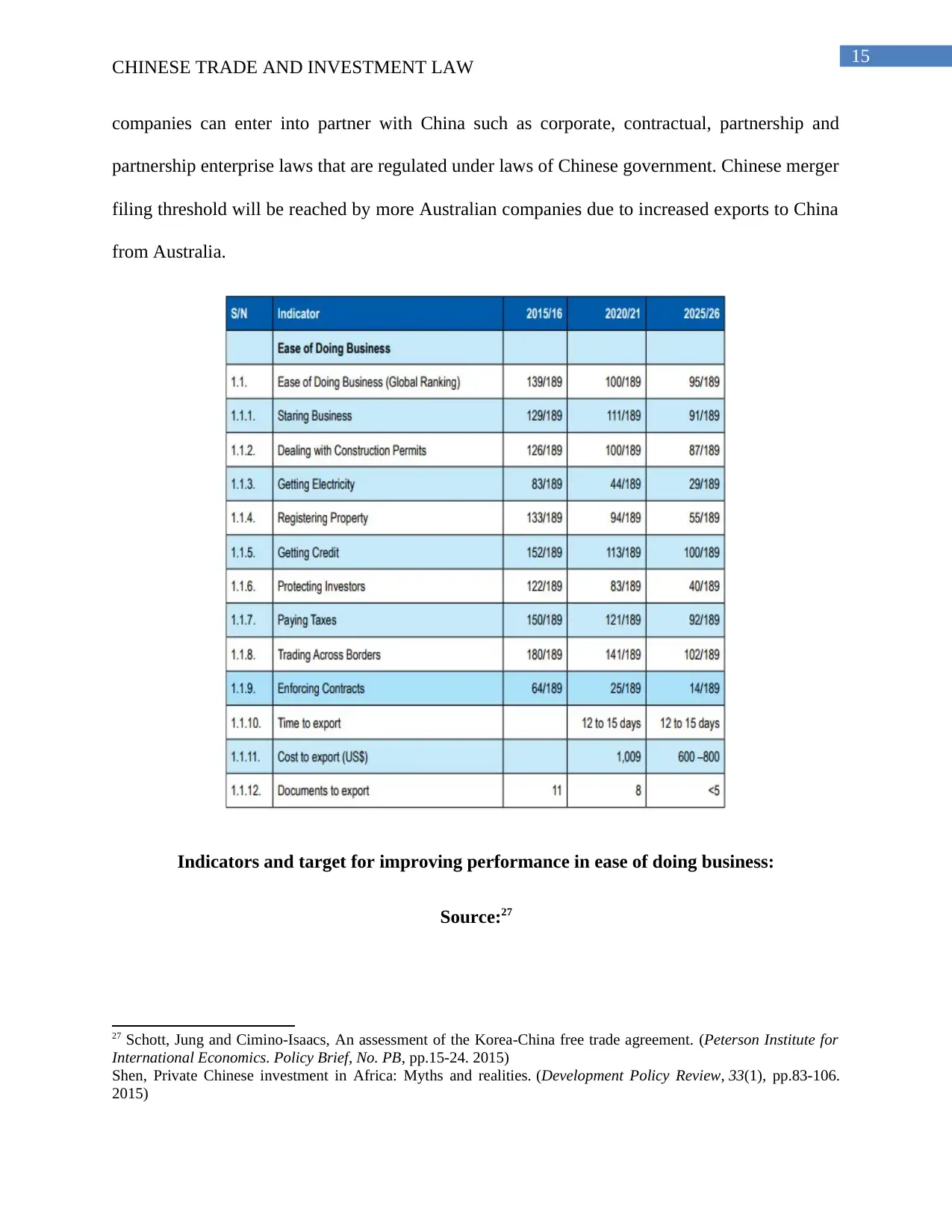

companies can enter into partner with China such as corporate, contractual, partnership and

partnership enterprise laws that are regulated under laws of Chinese government. Chinese merger

filing threshold will be reached by more Australian companies due to increased exports to China

from Australia.

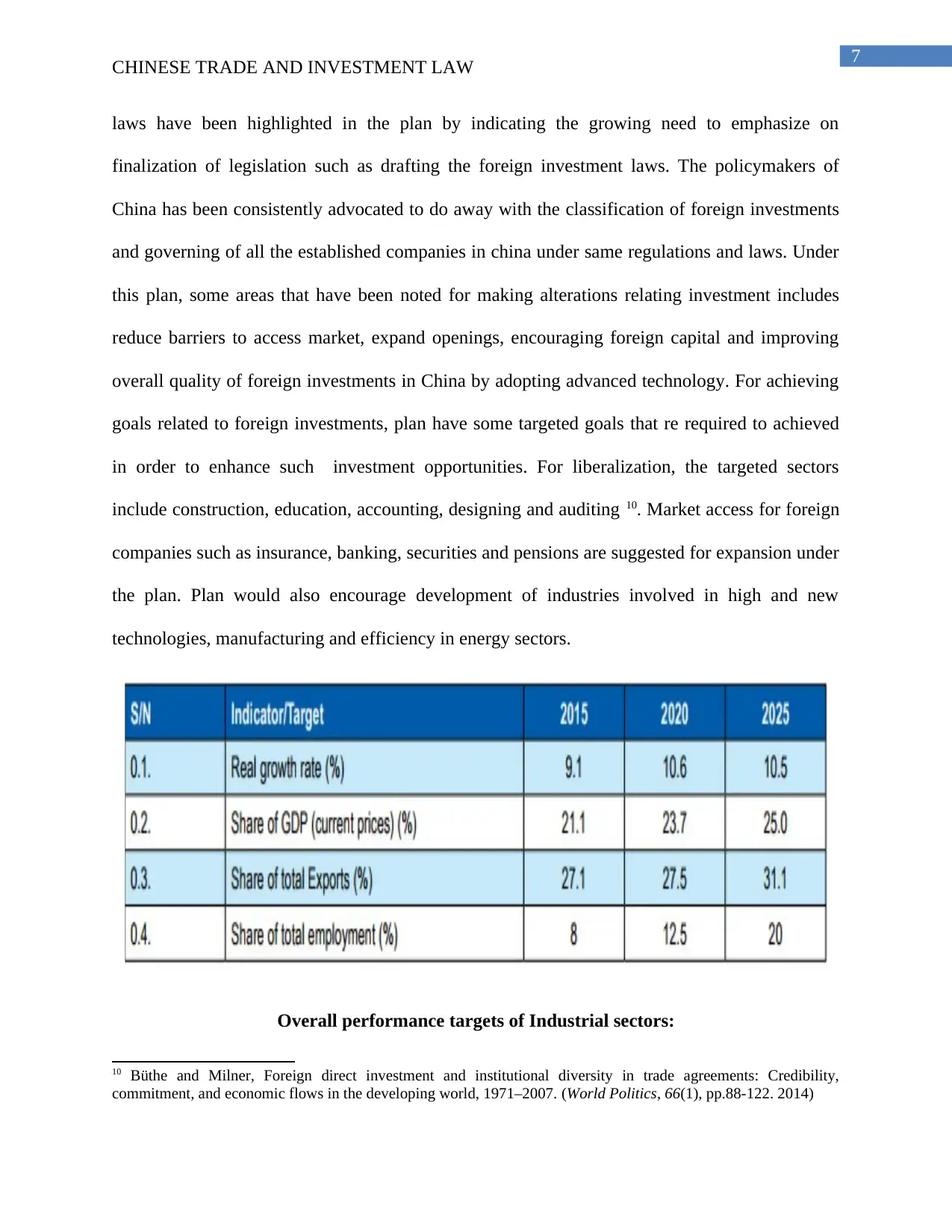

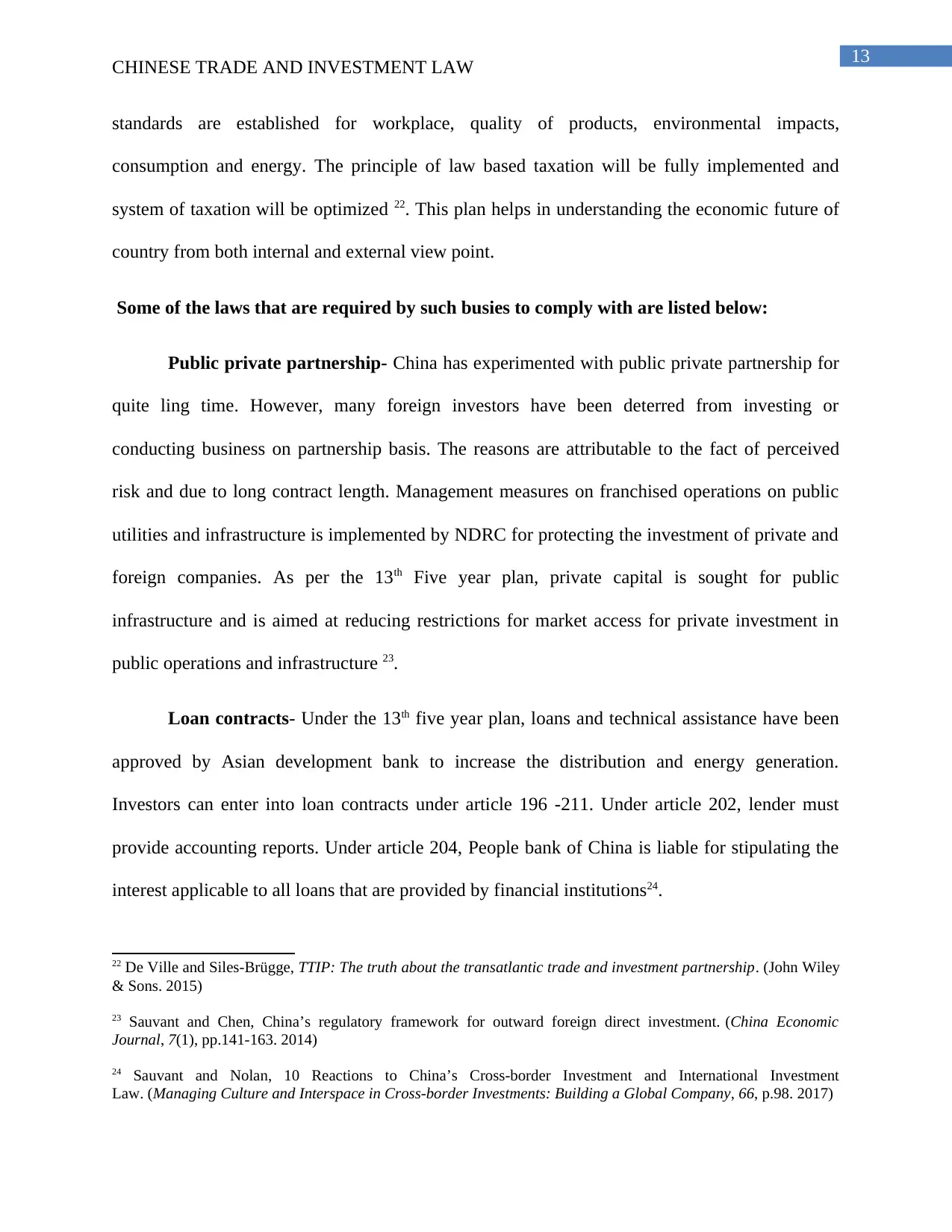

Indicators and target for improving performance in ease of doing business:

Source:27

27 Schott, Jung and Cimino-Isaacs, An assessment of the Korea-China free trade agreement. (Peterson Institute for

International Economics. Policy Brief, No. PB, pp.15-24. 2015)

Shen, Private Chinese investment in Africa: Myths and realities. (Development Policy Review, 33(1), pp.83-106.

2015)

CHINESE TRADE AND INVESTMENT LAW

companies can enter into partner with China such as corporate, contractual, partnership and

partnership enterprise laws that are regulated under laws of Chinese government. Chinese merger

filing threshold will be reached by more Australian companies due to increased exports to China

from Australia.

Indicators and target for improving performance in ease of doing business:

Source:27

27 Schott, Jung and Cimino-Isaacs, An assessment of the Korea-China free trade agreement. (Peterson Institute for

International Economics. Policy Brief, No. PB, pp.15-24. 2015)

Shen, Private Chinese investment in Africa: Myths and realities. (Development Policy Review, 33(1), pp.83-106.

2015)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

CHINESE TRADE AND INVESTMENT LAW

For the first time, China opened its market for overseas private fund managers in year

2016 by joint ventures and allowing wholly foreign owned investors 28. This would help in

raising capital in stock market and private companies. 13 five year plan has the target set for

year 2020 that would enhance measures for enabling and promoting business environment that

would reduce the cost of doing business in terms of easing registration, regulatory reform and

requirement of licence for promoting the foreign as well as domestic investors. This would help

in improving the working of land registries and courts, simplifying regulations and amending

laws29. There would be enforcement of legal instruments and property rights. The effective

implementation of development plan is aimed at eliminating conflicting regulations and laws.

For supporting socio economic transformation and envisaged industrialization needs to review

Village land act for elimination conflicts with other laws30.

Conclusion:

The pattern of globalization is likely to be changed by transformation of economy of

China over the next twenty years. Globalization is entering new stage driven by the

redeployment of growth into domestic and international markets. Supporting infrastructure

investment massively will help in proving momentum of deeper integration. Huge change in

incipient regime leads to assertiveness of China in politics and world markets. China has the

objective of developing political, economic, technological, cultural and financial relationship for

securing global public goods to cooperate politically. The progress of reforms of economic

liberalization has been sceptic due to general global economic uncertainty, stock market

28 Westlaw China (2017) Westlawchina.com <http://www.westlawchina.com/index_en.html>

29 Sornarajah, The international law on foreign investment. (Cambridge university press. 2017)

Subedi, International investment law: reconciling policy and principle. (Bloomsbury Publishing. 2016)

30 Wong, Zhu Rongji and China's Economic Take-Off. (World Scientific. 2016)

CHINESE TRADE AND INVESTMENT LAW

For the first time, China opened its market for overseas private fund managers in year

2016 by joint ventures and allowing wholly foreign owned investors 28. This would help in

raising capital in stock market and private companies. 13 five year plan has the target set for

year 2020 that would enhance measures for enabling and promoting business environment that

would reduce the cost of doing business in terms of easing registration, regulatory reform and

requirement of licence for promoting the foreign as well as domestic investors. This would help

in improving the working of land registries and courts, simplifying regulations and amending

laws29. There would be enforcement of legal instruments and property rights. The effective

implementation of development plan is aimed at eliminating conflicting regulations and laws.

For supporting socio economic transformation and envisaged industrialization needs to review

Village land act for elimination conflicts with other laws30.

Conclusion:

The pattern of globalization is likely to be changed by transformation of economy of

China over the next twenty years. Globalization is entering new stage driven by the

redeployment of growth into domestic and international markets. Supporting infrastructure

investment massively will help in proving momentum of deeper integration. Huge change in

incipient regime leads to assertiveness of China in politics and world markets. China has the

objective of developing political, economic, technological, cultural and financial relationship for

securing global public goods to cooperate politically. The progress of reforms of economic

liberalization has been sceptic due to general global economic uncertainty, stock market

28 Westlaw China (2017) Westlawchina.com <http://www.westlawchina.com/index_en.html>

29 Sornarajah, The international law on foreign investment. (Cambridge university press. 2017)

Subedi, International investment law: reconciling policy and principle. (Bloomsbury Publishing. 2016)

30 Wong, Zhu Rongji and China's Economic Take-Off. (World Scientific. 2016)

17

CHINESE TRADE AND INVESTMENT LAW

volatility and Renminbi depreciation during third and second quarter of year 2015. However, in

spite of this uncertainty, it is strongly believed that there is high chance of occurrence of

liberalization due to significant market potential of China. On the global front, Chinese

government has remained active in securing trade deals in support for the establishment of Asian

infrastructure investment bank and one belt one road project. Free trade zone is the platform for

liberalizing the markets for foreign investor’s interests and a very small proportion of capital

markets is represented in such zone. Concerns of foreign interests would be eased by more

consistent free market. Some of the areas that could be explored for opening up the opportunities

for foreign business activities and financial trading include information, trade, professional

services and logistics. New foreign investors intending to do business in China would face

several challenge in terms of project financing. Challenge would be faced in terms of

infrastructure investment opportunities.

CHINESE TRADE AND INVESTMENT LAW

volatility and Renminbi depreciation during third and second quarter of year 2015. However, in

spite of this uncertainty, it is strongly believed that there is high chance of occurrence of

liberalization due to significant market potential of China. On the global front, Chinese

government has remained active in securing trade deals in support for the establishment of Asian

infrastructure investment bank and one belt one road project. Free trade zone is the platform for

liberalizing the markets for foreign investor’s interests and a very small proportion of capital

markets is represented in such zone. Concerns of foreign interests would be eased by more

consistent free market. Some of the areas that could be explored for opening up the opportunities

for foreign business activities and financial trading include information, trade, professional

services and logistics. New foreign investors intending to do business in China would face

several challenge in terms of project financing. Challenge would be faced in terms of

infrastructure investment opportunities.

18

CHINESE TRADE AND INVESTMENT LAW

References and Bibliography:

A One-Speed World: 2017 Value Creators

Report (2017) https://www.bcg.com <https://www.bcg.com/en-in/publications/2017/

engineering-construction-infrastructure-value-creators-report-one-speed-world.aspx>

Aggarwal and Urata, Bilateral trade agreements in the Asia-Pacific: Origins, evolution, and

implications (Routledge, 2012)

Agrifutures.Com.Au (2017) Agrifutures.com.au <http://www.agrifutures.com.au/wp-content/

uploads/2017/08/rirdc_ar1516_final-8.pdf>

Assets.Kpmg.Com (2017) Assets.kpmg.com <https://assets.kpmg.com/content/dam/kpmg/pdf/

2016/06/china-outlook-2016-v1.pdf>

Ayodele and Sotola, China in Africa: An evaluation of Chinese investment. (Initiative for Public

Policy Analysis, pp.1-20. 2014)

Berger, Busse, Nunnenkamp, and Roy, Do trade and investment agreements lead to more FDI?

Accounting for key provisions inside the black box. (International Economics and Economic

Policy, 10(2), pp.247-275. 2013)

Bin, China-Russia relations: into the Syrian storm: between alliance and

alignment. (Comparative Connections, 17(3), p.137. 2016)

CHINESE TRADE AND INVESTMENT LAW

References and Bibliography:

A One-Speed World: 2017 Value Creators

Report (2017) https://www.bcg.com <https://www.bcg.com/en-in/publications/2017/

engineering-construction-infrastructure-value-creators-report-one-speed-world.aspx>

Aggarwal and Urata, Bilateral trade agreements in the Asia-Pacific: Origins, evolution, and

implications (Routledge, 2012)

Agrifutures.Com.Au (2017) Agrifutures.com.au <http://www.agrifutures.com.au/wp-content/

uploads/2017/08/rirdc_ar1516_final-8.pdf>

Assets.Kpmg.Com (2017) Assets.kpmg.com <https://assets.kpmg.com/content/dam/kpmg/pdf/

2016/06/china-outlook-2016-v1.pdf>

Ayodele and Sotola, China in Africa: An evaluation of Chinese investment. (Initiative for Public

Policy Analysis, pp.1-20. 2014)

Berger, Busse, Nunnenkamp, and Roy, Do trade and investment agreements lead to more FDI?

Accounting for key provisions inside the black box. (International Economics and Economic

Policy, 10(2), pp.247-275. 2013)

Bin, China-Russia relations: into the Syrian storm: between alliance and

alignment. (Comparative Connections, 17(3), p.137. 2016)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

CHINESE TRADE AND INVESTMENT LAW

Bloom, Draca and Van Reenen, Trade induced technical change? The impact of Chinese imports

on innovation, IT and productivity. (The Review of Economic Studies, 83(1), pp.87-117. 2016)

Burgoon and Raess, Chinese investment and European labor: should and do workers fear

Chinese FDI?. (Asia Europe Journal, 12(1-2), pp.179-197. 2014)

Business.Hsbc.Com.Cn (2017) Business.hsbc.com.cn <http://www.business.hsbc.com.cn/-/

media/library/markets-selective/china/pdfs/trade-report-eng.pdf>

Büthe and Milner, Foreign direct investment and institutional diversity in trade agreements:

Credibility, commitment, and economic flows in the developing world, 1971–2007. (World

Politics, 66(1), pp.88-122. 2014)

Cepii.Fr (2017) Cepii.fr <http://www.cepii.fr/PDF_PUB/pb/2016/pb2016-12.pdf>

Chow and Schoenbaum, International Trade Law: Problems, Cases, and Materials. (Wolters

Kluwer Law & Business 2017)

Clegg and Voss, The new two-way street of Chinese direct investment in the European

Union. (China-EU Law Journal, 5(1-2), pp.79-100. 2016)

Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign

direct investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

Davies, Tony and Ian Peter Crawford, Financial Accounting (Pearson, 2012)

De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment

partnership. (John Wiley & Sons. 2015)

Drache and Jacobs, Linking Global Trade and Human Rights. (Cambridge University Press.

2014)

CHINESE TRADE AND INVESTMENT LAW

Bloom, Draca and Van Reenen, Trade induced technical change? The impact of Chinese imports

on innovation, IT and productivity. (The Review of Economic Studies, 83(1), pp.87-117. 2016)

Burgoon and Raess, Chinese investment and European labor: should and do workers fear

Chinese FDI?. (Asia Europe Journal, 12(1-2), pp.179-197. 2014)

Business.Hsbc.Com.Cn (2017) Business.hsbc.com.cn <http://www.business.hsbc.com.cn/-/

media/library/markets-selective/china/pdfs/trade-report-eng.pdf>

Büthe and Milner, Foreign direct investment and institutional diversity in trade agreements:

Credibility, commitment, and economic flows in the developing world, 1971–2007. (World

Politics, 66(1), pp.88-122. 2014)

Cepii.Fr (2017) Cepii.fr <http://www.cepii.fr/PDF_PUB/pb/2016/pb2016-12.pdf>

Chow and Schoenbaum, International Trade Law: Problems, Cases, and Materials. (Wolters

Kluwer Law & Business 2017)

Clegg and Voss, The new two-way street of Chinese direct investment in the European

Union. (China-EU Law Journal, 5(1-2), pp.79-100. 2016)

Czinkota and Skuba, Contextual analysis of legal systems and their impact on trade and foreign

direct investment. (Journal of Business Research, 67(10), pp.2207-2211, 2014)

Davies, Tony and Ian Peter Crawford, Financial Accounting (Pearson, 2012)

De Ville and Siles-Brügge, TTIP: The truth about the transatlantic trade and investment

partnership. (John Wiley & Sons. 2015)

Drache and Jacobs, Linking Global Trade and Human Rights. (Cambridge University Press.

2014)

20

CHINESE TRADE AND INVESTMENT LAW

Interpretation For The China-Australia Free Trade Agreement

- (2017) English.mofcom.gov.cn <http://english.mofcom.gov.cn/article/policyrelease/Cocoon/

201510/20151001144954.shtml>

Meunier, Divide and conquer? China and the cacophony of foreign investment rules in the

EU. (Journal of European Public Policy, 21(7), pp.996-1016. 2014)

Nicolas, China’s direct investment in the European Union: challenges and policy

responses. (China Economic Journal, 7(1), pp.103-125. 2014)

Sauvant and Chen, China’s regulatory framework for outward foreign direct investment. (China

Economic Journal, 7(1), pp.141-163. 2014)

Sauvant and Nolan, 10 Reactions to China’s Cross-border Investment and International

Investment Law. (Managing Culture and Interspace in Cross-border Investments: Building a

Global Company, 66, p.98. 2017)

Sauvant and Nolan, China’s outward foreign direct investment and international investment

law. (Journal of International Economic Law, 18(4), pp.893-934. 2015)

Schott, Jung and Cimino-Isaacs, An assessment of the Korea-China free trade

agreement. (Peterson Institute for International Economics. Policy Brief, No. PB, pp.15-24.

2015)

Shen, Private Chinese investment in Africa: Myths and realities. (Development Policy

Review, 33(1), pp.83-106. 2015)

Sornarajah, The international law on foreign investment. (Cambridge university press. 2017)

Subedi, International investment law: reconciling policy and principle. (Bloomsbury Publishing.

2016)

Westlaw China (2017) Westlawchina.com <http://www.westlawchina.com/index_en.html>

CHINESE TRADE AND INVESTMENT LAW

Interpretation For The China-Australia Free Trade Agreement

- (2017) English.mofcom.gov.cn <http://english.mofcom.gov.cn/article/policyrelease/Cocoon/

201510/20151001144954.shtml>

Meunier, Divide and conquer? China and the cacophony of foreign investment rules in the

EU. (Journal of European Public Policy, 21(7), pp.996-1016. 2014)

Nicolas, China’s direct investment in the European Union: challenges and policy

responses. (China Economic Journal, 7(1), pp.103-125. 2014)

Sauvant and Chen, China’s regulatory framework for outward foreign direct investment. (China

Economic Journal, 7(1), pp.141-163. 2014)

Sauvant and Nolan, 10 Reactions to China’s Cross-border Investment and International

Investment Law. (Managing Culture and Interspace in Cross-border Investments: Building a

Global Company, 66, p.98. 2017)

Sauvant and Nolan, China’s outward foreign direct investment and international investment

law. (Journal of International Economic Law, 18(4), pp.893-934. 2015)

Schott, Jung and Cimino-Isaacs, An assessment of the Korea-China free trade

agreement. (Peterson Institute for International Economics. Policy Brief, No. PB, pp.15-24.

2015)

Shen, Private Chinese investment in Africa: Myths and realities. (Development Policy

Review, 33(1), pp.83-106. 2015)

Sornarajah, The international law on foreign investment. (Cambridge university press. 2017)

Subedi, International investment law: reconciling policy and principle. (Bloomsbury Publishing.

2016)

Westlaw China (2017) Westlawchina.com <http://www.westlawchina.com/index_en.html>

21

CHINESE TRADE AND INVESTMENT LAW

Wong, Zhu Rongji and China's Economic Take-Off. (World Scientific. 2016)

Yao and Whalley, The China (Shanghai) Pilot Free Trade Zone: Background, Developments and

Preliminary Assessment of Initial Impacts. (The World Economy, 39(1), pp.2-15. 2016)

CHINESE TRADE AND INVESTMENT LAW

Wong, Zhu Rongji and China's Economic Take-Off. (World Scientific. 2016)

Yao and Whalley, The China (Shanghai) Pilot Free Trade Zone: Background, Developments and

Preliminary Assessment of Initial Impacts. (The World Economy, 39(1), pp.2-15. 2016)

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.