Analysis of Macroeconomic Performance: Australia vs USA (1985-2015)

VerifiedAdded on 2020/04/01

|16

|2914

|68

Report

AI Summary

This report provides a comparative analysis of the macroeconomic performance of Australia and the USA from 1985 to 2015, focusing on key indicators such as real GDP growth, yearly exchange rate movements, net exports growth rate, and real interest rates. The study aims to determine the extent to which the Australian economy is influenced by changes in the USA's real GDP, considering that both countries are significant trading partners. The report examines these factors over a thirty-year period, using data from the World Bank, and divides the period into three distinct segments to observe the trends. The findings suggest that while both economies are affected by global events, the Australian economy demonstrates a degree of independence from the fluctuations in the USA's GDP, particularly during periods of recession and negative export rates in the USA. The report concludes by highlighting the discrete GDP trends, exchange rate impacts, export patterns, and interest rate dynamics of both countries. The report offers a detailed overview of the economic relationship between the two nations.

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

EVALUATION OF MACROECONOMIC PERFORMANCE OF AUSTRALIA AND USA

Name of student:

Name of University:

Author note:

EVALUATION OF MACROECONOMIC PERFORMANCE OF AUSTRALIA AND USA

Name of student:

Name of University:

Author note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

Executive summary

This report on Australian economy and USA economy shows that Australia is not

affected by changes occurred in USA. For assessing the result this report considered period

from 1985 to 2015 and focused on domains that are GDP, interest rate, net export and

exchange rate. Result from these domains shows that Australia is not being affected by USA

economy. Although both countries performance are being affected by global events which in

turn affected the performance of the both economies.

Executive summary

This report on Australian economy and USA economy shows that Australia is not

affected by changes occurred in USA. For assessing the result this report considered period

from 1985 to 2015 and focused on domains that are GDP, interest rate, net export and

exchange rate. Result from these domains shows that Australia is not being affected by USA

economy. Although both countries performance are being affected by global events which in

turn affected the performance of the both economies.

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

Table of Contents

Introduction.............................................................................................................5

Discussion................................................................................................................ 6

Real GDP growth of Australia and USA.................................................................7

Yearly Exchange rate movement in Australia and USA.........................................9

Net Exports growth rate of Australia and USA....................................................11

Real Interest rate of Australia and USA..............................................................13

Conclusion..............................................................................................................15

References.............................................................................................................16

Table of Contents

Introduction.............................................................................................................5

Discussion................................................................................................................ 6

Real GDP growth of Australia and USA.................................................................7

Yearly Exchange rate movement in Australia and USA.........................................9

Net Exports growth rate of Australia and USA....................................................11

Real Interest rate of Australia and USA..............................................................13

Conclusion..............................................................................................................15

References.............................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

Introduction

Australian economy is a developed economy and it stands as one of the largest

economy in the world. Australia also considered as one of the wealthiest nation in the world.

The economy considered as 14th largest in terms of national GDP, 20th largest with respect to

purchasing power parity and 25th largest as exporter of goods and finally 20th largest with

respect to importer of goods. Australian economy previously was dominated by mining sector

and the reason was due to large level of availability of natural resources and this availability due

to location of the economy, but over the years the scenario changed the economy which was

run by the mining sector, now dominated by the service sector and this was due to decline in

mining sector (Downes, Hanslow and Tulip, 2014).

USA economy is considered as world’s largest economy. In terms of purchasing power

parity economy stands in the second position .In terms of GDP economy is 7th highest with

compared to other nations. Economy of USA is a mixed one and has maintained GDP with

stability over the past decades. With respect to availability of natural resources the economy

stands in highest position. Production level of the economy is also high for which economy has

been able to achieve its desired goal over the years (Summers, 2014).

Now if the economy of Australia is compared to USA then a rigid result can be obtained

regarding in their terms of growth. The aim of this report is to explore whether Australian

economy changes due to changes in USA’s real GDP. The reason behind investigating this kind

of study because Australia and USA are trading economies and trade with each other, however

Introduction

Australian economy is a developed economy and it stands as one of the largest

economy in the world. Australia also considered as one of the wealthiest nation in the world.

The economy considered as 14th largest in terms of national GDP, 20th largest with respect to

purchasing power parity and 25th largest as exporter of goods and finally 20th largest with

respect to importer of goods. Australian economy previously was dominated by mining sector

and the reason was due to large level of availability of natural resources and this availability due

to location of the economy, but over the years the scenario changed the economy which was

run by the mining sector, now dominated by the service sector and this was due to decline in

mining sector (Downes, Hanslow and Tulip, 2014).

USA economy is considered as world’s largest economy. In terms of purchasing power

parity economy stands in the second position .In terms of GDP economy is 7th highest with

compared to other nations. Economy of USA is a mixed one and has maintained GDP with

stability over the past decades. With respect to availability of natural resources the economy

stands in highest position. Production level of the economy is also high for which economy has

been able to achieve its desired goal over the years (Summers, 2014).

Now if the economy of Australia is compared to USA then a rigid result can be obtained

regarding in their terms of growth. The aim of this report is to explore whether Australian

economy changes due to changes in USA’s real GDP. The reason behind investigating this kind

of study because Australia and USA are trading economies and trade with each other, however

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

Australian economy is much smaller than USA. Yet the study is a relevant one because both

economies are very important to be researched.

The study mainly aims to compare and contrast and evaluate the results obtained. For

comparing the two economies, some of the significant factors are considered in this study they

are related to real GDP growth rates, yearly exchange rate movements, net exports growth rate

and interest rate. After comparing these factors of both economies they are evaluated to reach

the result.

Discussion

Over the years Australian economy and USA economy has changed a lot. With respect

to development, both economies have shown development in terms of various indicators and

these indicators in turn have shown its impact on countries development process. With

development, both economies have participated in trade with each country which has

contributed towards the growth of each economy. Both economies are diversified one as they

comprises of both negative and positive side. Back in 1945 U.S proposed a free trade

agreement to Australia. Later, in 1980 both the countries initiated free trade agreement. Free

trade agreement lays conditions regarding types of goods to be traded that are subject to non

discretionary treatment.

The purpose of this report is to provide an understanding of Australian economy if

affected due to changes in real GDP of USA. Time period chosen for this report is 1985 to 2015.

To reach the result four aspects are considered and detailed study is provided below.

Australian economy is much smaller than USA. Yet the study is a relevant one because both

economies are very important to be researched.

The study mainly aims to compare and contrast and evaluate the results obtained. For

comparing the two economies, some of the significant factors are considered in this study they

are related to real GDP growth rates, yearly exchange rate movements, net exports growth rate

and interest rate. After comparing these factors of both economies they are evaluated to reach

the result.

Discussion

Over the years Australian economy and USA economy has changed a lot. With respect

to development, both economies have shown development in terms of various indicators and

these indicators in turn have shown its impact on countries development process. With

development, both economies have participated in trade with each country which has

contributed towards the growth of each economy. Both economies are diversified one as they

comprises of both negative and positive side. Back in 1945 U.S proposed a free trade

agreement to Australia. Later, in 1980 both the countries initiated free trade agreement. Free

trade agreement lays conditions regarding types of goods to be traded that are subject to non

discretionary treatment.

The purpose of this report is to provide an understanding of Australian economy if

affected due to changes in real GDP of USA. Time period chosen for this report is 1985 to 2015.

To reach the result four aspects are considered and detailed study is provided below.

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

Real GDP growth of Australia and USA

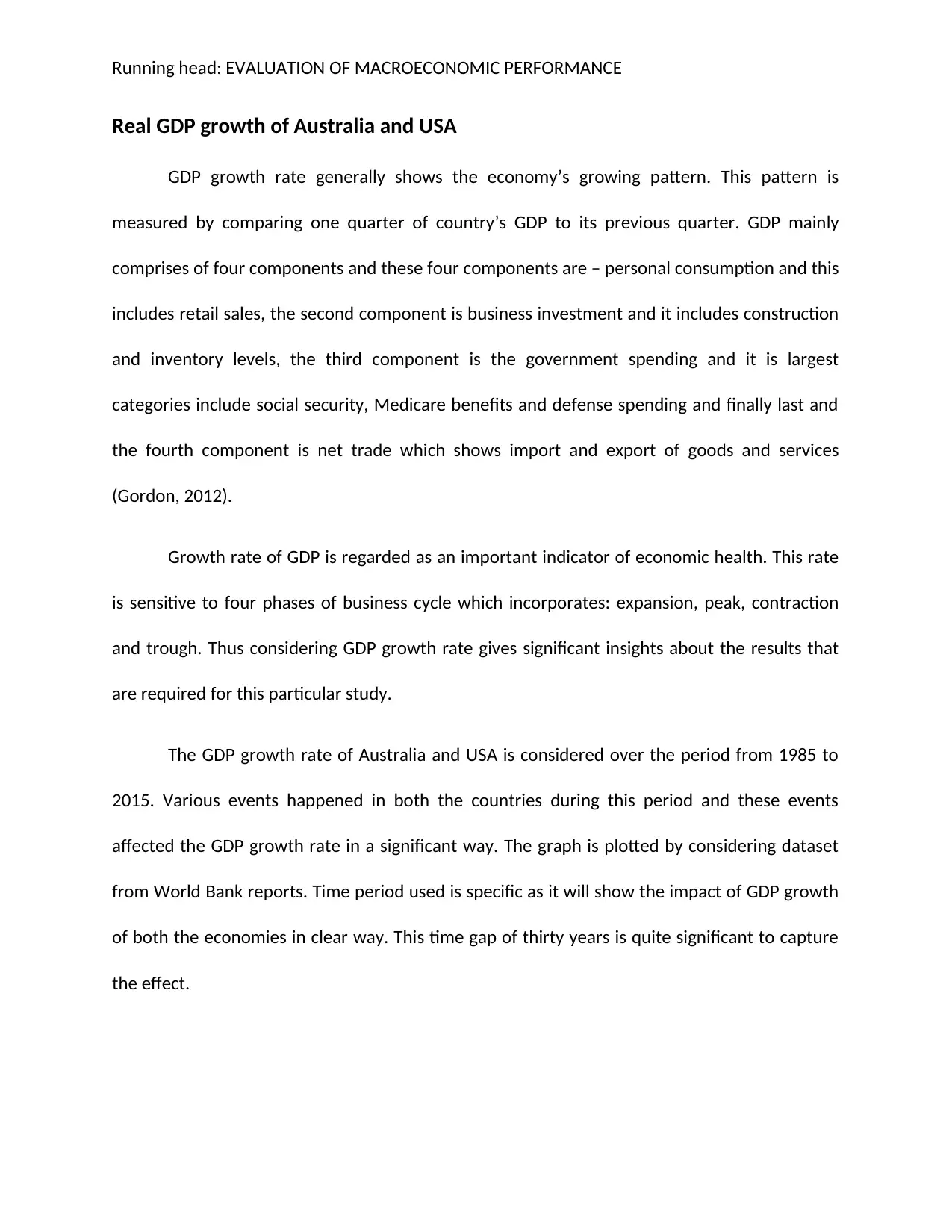

GDP growth rate generally shows the economy’s growing pattern. This pattern is

measured by comparing one quarter of country’s GDP to its previous quarter. GDP mainly

comprises of four components and these four components are – personal consumption and this

includes retail sales, the second component is business investment and it includes construction

and inventory levels, the third component is the government spending and it is largest

categories include social security, Medicare benefits and defense spending and finally last and

the fourth component is net trade which shows import and export of goods and services

(Gordon, 2012).

Growth rate of GDP is regarded as an important indicator of economic health. This rate

is sensitive to four phases of business cycle which incorporates: expansion, peak, contraction

and trough. Thus considering GDP growth rate gives significant insights about the results that

are required for this particular study.

The GDP growth rate of Australia and USA is considered over the period from 1985 to

2015. Various events happened in both the countries during this period and these events

affected the GDP growth rate in a significant way. The graph is plotted by considering dataset

from World Bank reports. Time period used is specific as it will show the impact of GDP growth

of both the economies in clear way. This time gap of thirty years is quite significant to capture

the effect.

Real GDP growth of Australia and USA

GDP growth rate generally shows the economy’s growing pattern. This pattern is

measured by comparing one quarter of country’s GDP to its previous quarter. GDP mainly

comprises of four components and these four components are – personal consumption and this

includes retail sales, the second component is business investment and it includes construction

and inventory levels, the third component is the government spending and it is largest

categories include social security, Medicare benefits and defense spending and finally last and

the fourth component is net trade which shows import and export of goods and services

(Gordon, 2012).

Growth rate of GDP is regarded as an important indicator of economic health. This rate

is sensitive to four phases of business cycle which incorporates: expansion, peak, contraction

and trough. Thus considering GDP growth rate gives significant insights about the results that

are required for this particular study.

The GDP growth rate of Australia and USA is considered over the period from 1985 to

2015. Various events happened in both the countries during this period and these events

affected the GDP growth rate in a significant way. The graph is plotted by considering dataset

from World Bank reports. Time period used is specific as it will show the impact of GDP growth

of both the economies in clear way. This time gap of thirty years is quite significant to capture

the effect.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

1985

1988

1991

1994

1997

2000

2003

2006

2009

2012

2015

-4

-2

0

2

4

6

8

Australia(GDP growth %)

USA(GDP growth %)

Graph 1: Gross domestic product over the years

Source: (Data.worldbank.org, 2017)

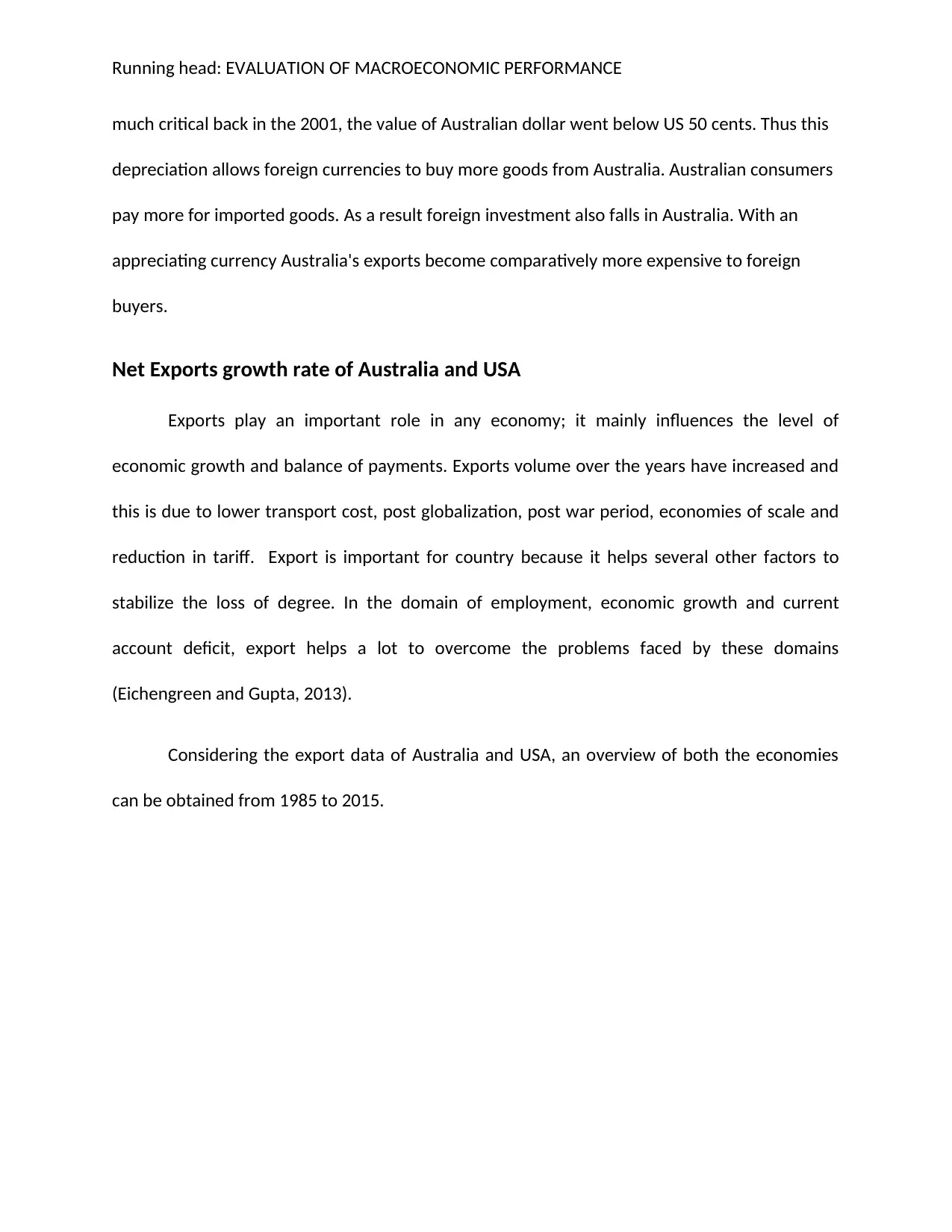

The above graph shows GDP growth rate of Australia and USA. Graph shows that GDP

trends of both countries are discrete one, and this trend is applicable to all countries, but if

these two countries under consideration are particularly considered then it can be observed

that trend of GDP for USA is far more discontinuous as compared to Australia. If the study of

period is divided into three distinct periods then each consist of ten years then it will be easier

to get overview of GDP in both countries. Time period can be divided as- 1985 to 1995, 1995 to

2005 and finally 2005 to 2015.

From 1985 to 1995 it can be observed that during this period GDP growth of Australia

and USA is not much different from each year. Result even shows that in some years both the

countries have recorded same GDP growth rate. The period of 1991 shows that both countries

recorded negative GDP rate but the degree of negativity is much higher in Australia than that of

1985

1988

1991

1994

1997

2000

2003

2006

2009

2012

2015

-4

-2

0

2

4

6

8

Australia(GDP growth %)

USA(GDP growth %)

Graph 1: Gross domestic product over the years

Source: (Data.worldbank.org, 2017)

The above graph shows GDP growth rate of Australia and USA. Graph shows that GDP

trends of both countries are discrete one, and this trend is applicable to all countries, but if

these two countries under consideration are particularly considered then it can be observed

that trend of GDP for USA is far more discontinuous as compared to Australia. If the study of

period is divided into three distinct periods then each consist of ten years then it will be easier

to get overview of GDP in both countries. Time period can be divided as- 1985 to 1995, 1995 to

2005 and finally 2005 to 2015.

From 1985 to 1995 it can be observed that during this period GDP growth of Australia

and USA is not much different from each year. Result even shows that in some years both the

countries have recorded same GDP growth rate. The period of 1991 shows that both countries

recorded negative GDP rate but the degree of negativity is much higher in Australia than that of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

USA. This negative result was mainly due to recession that occurred globally during that period.

Now if the period from 1995 to 2005 is considered it can be observed that there are some

periods where Australian GDP recorded higher than that of USA, more or less two countries

recorded same GDP growth rate. Finally if the period from 2005 to 2015 is considered then it

can be observed that Australian GDP remained consistent over the years not much growth

achieved in terms of GDP but the USA’s GDP for the year’s 2008 to 2009 shows negative result

and this result was the outcome of recession in USA. This result shows that negative GDP

growth rate does not affected growth rate of GDP in Australia. Thus it can be observed that in

terms of GDP, if there is negative GDP in USA it will not affect the Australian economy

(Data.worldbank.org, 2017).

Yearly Exchange rate movement in Australia and USA

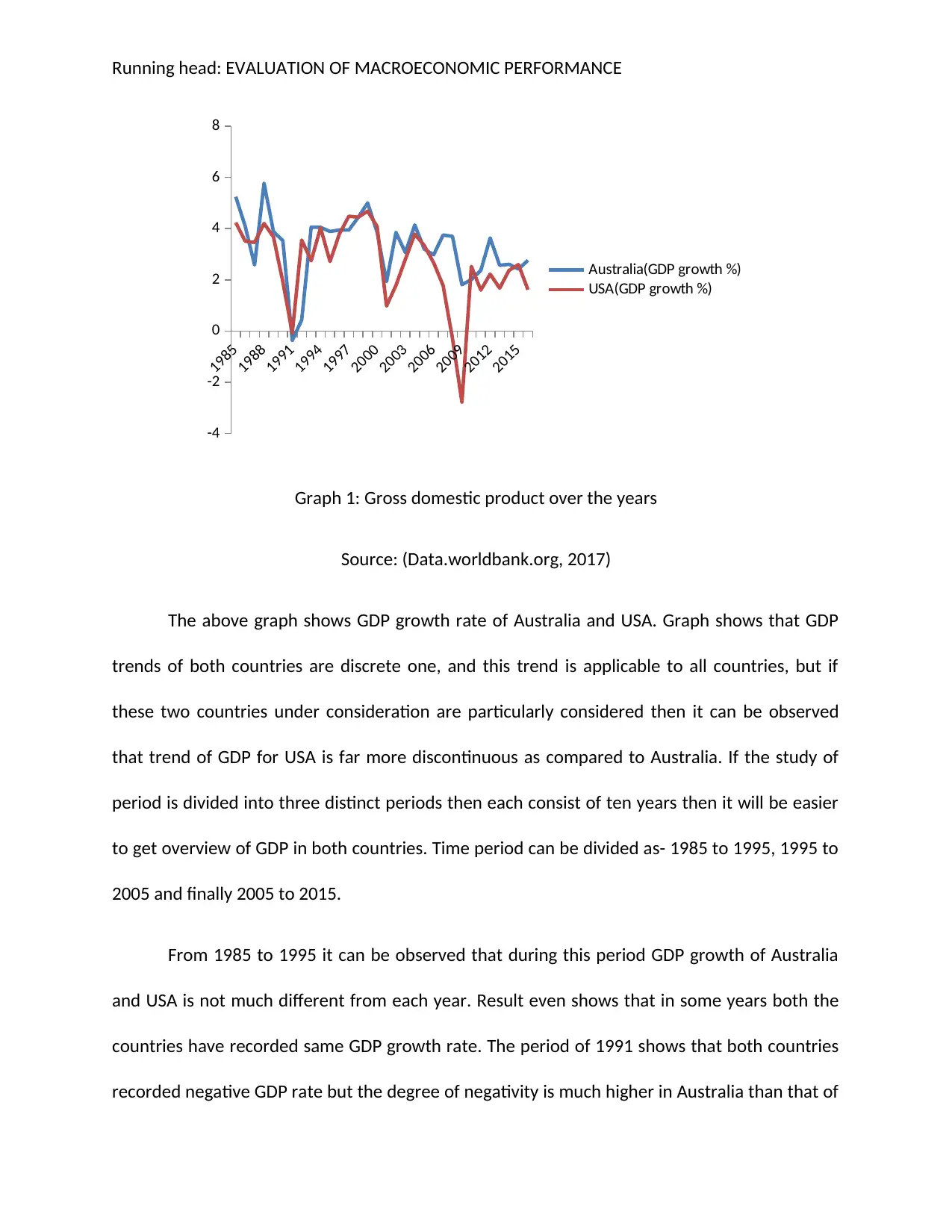

Buying and selling of foreign currencies on world currency market shows the actual

exchange rate. Forces of demand and supply in this domain of exchange rate, works as invisible

force and this force mainly determine the price of currency. Exchange rate mainly manipulates

interest rates, inflation rate and others. Exchange rate is often considered as the most

significant determinant of a country’s level of economic health (Berganza and Broto, 2012).

Country’s level of trade is also influenced by exchange rates. Thus it is an economic measure

that is manipulated by government. Exchange rate is related to trading relationship between

two countries. There are various factors that influence exchange rate and these are-fluctuating

inflation rate, interest rates, current account deficits, public debt, terms of trade and political

situation.

USA. This negative result was mainly due to recession that occurred globally during that period.

Now if the period from 1995 to 2005 is considered it can be observed that there are some

periods where Australian GDP recorded higher than that of USA, more or less two countries

recorded same GDP growth rate. Finally if the period from 2005 to 2015 is considered then it

can be observed that Australian GDP remained consistent over the years not much growth

achieved in terms of GDP but the USA’s GDP for the year’s 2008 to 2009 shows negative result

and this result was the outcome of recession in USA. This result shows that negative GDP

growth rate does not affected growth rate of GDP in Australia. Thus it can be observed that in

terms of GDP, if there is negative GDP in USA it will not affect the Australian economy

(Data.worldbank.org, 2017).

Yearly Exchange rate movement in Australia and USA

Buying and selling of foreign currencies on world currency market shows the actual

exchange rate. Forces of demand and supply in this domain of exchange rate, works as invisible

force and this force mainly determine the price of currency. Exchange rate mainly manipulates

interest rates, inflation rate and others. Exchange rate is often considered as the most

significant determinant of a country’s level of economic health (Berganza and Broto, 2012).

Country’s level of trade is also influenced by exchange rates. Thus it is an economic measure

that is manipulated by government. Exchange rate is related to trading relationship between

two countries. There are various factors that influence exchange rate and these are-fluctuating

inflation rate, interest rates, current account deficits, public debt, terms of trade and political

situation.

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

The exchange rate of two countries Australia and USA is considered , here exchange rate

of Australia shown with respect to USA, this is due to exchange rates are pegged to dollar which

is the currency of USA.

1980 1985 1990 1995 2000 2005 2010 2015 2020

0

0.5

1

1.5

2

2.5

Australia (EXCH)

USA(EXCH)

Graph 2: Yearly Exchange rate of Australia with respect to USA

Source: (theOECD, 2017)

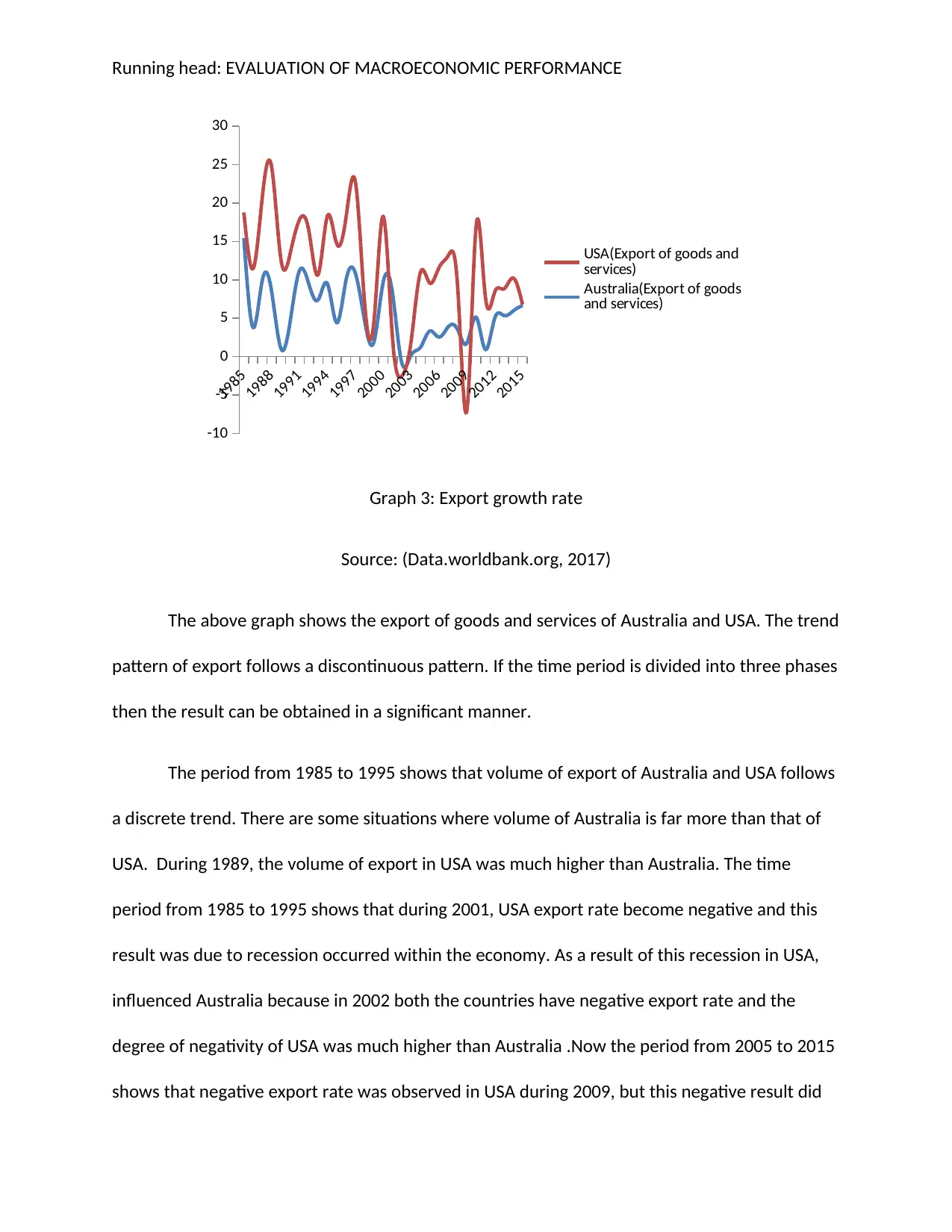

The above graph shows the movement of exchange rate in Australia over the years 1985

to 2015. The result shows that currency fluctuation is mainly outcome of floating exchange rate

system. If USA currency depreciates then it affects the Australian economy, and this is mainly

due to US exporter has remained competitive in international market. However, if currency is

stronger then it will reduce the export competitiveness and makes import cheaper for which

trade deficit can occur. This is the reason Australian investors invest in USA with a view to get

greater return from the investment. Recently it is observed from the above graph that

depreciation in US currency affects Australia in a much lower level. But the result was somehow

The exchange rate of two countries Australia and USA is considered , here exchange rate

of Australia shown with respect to USA, this is due to exchange rates are pegged to dollar which

is the currency of USA.

1980 1985 1990 1995 2000 2005 2010 2015 2020

0

0.5

1

1.5

2

2.5

Australia (EXCH)

USA(EXCH)

Graph 2: Yearly Exchange rate of Australia with respect to USA

Source: (theOECD, 2017)

The above graph shows the movement of exchange rate in Australia over the years 1985

to 2015. The result shows that currency fluctuation is mainly outcome of floating exchange rate

system. If USA currency depreciates then it affects the Australian economy, and this is mainly

due to US exporter has remained competitive in international market. However, if currency is

stronger then it will reduce the export competitiveness and makes import cheaper for which

trade deficit can occur. This is the reason Australian investors invest in USA with a view to get

greater return from the investment. Recently it is observed from the above graph that

depreciation in US currency affects Australia in a much lower level. But the result was somehow

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

much critical back in the 2001, the value of Australian dollar went below US 50 cents. Thus this

depreciation allows foreign currencies to buy more goods from Australia. Australian consumers

pay more for imported goods. As a result foreign investment also falls in Australia. With an

appreciating currency Australia's exports become comparatively more expensive to foreign

buyers.

Net Exports growth rate of Australia and USA

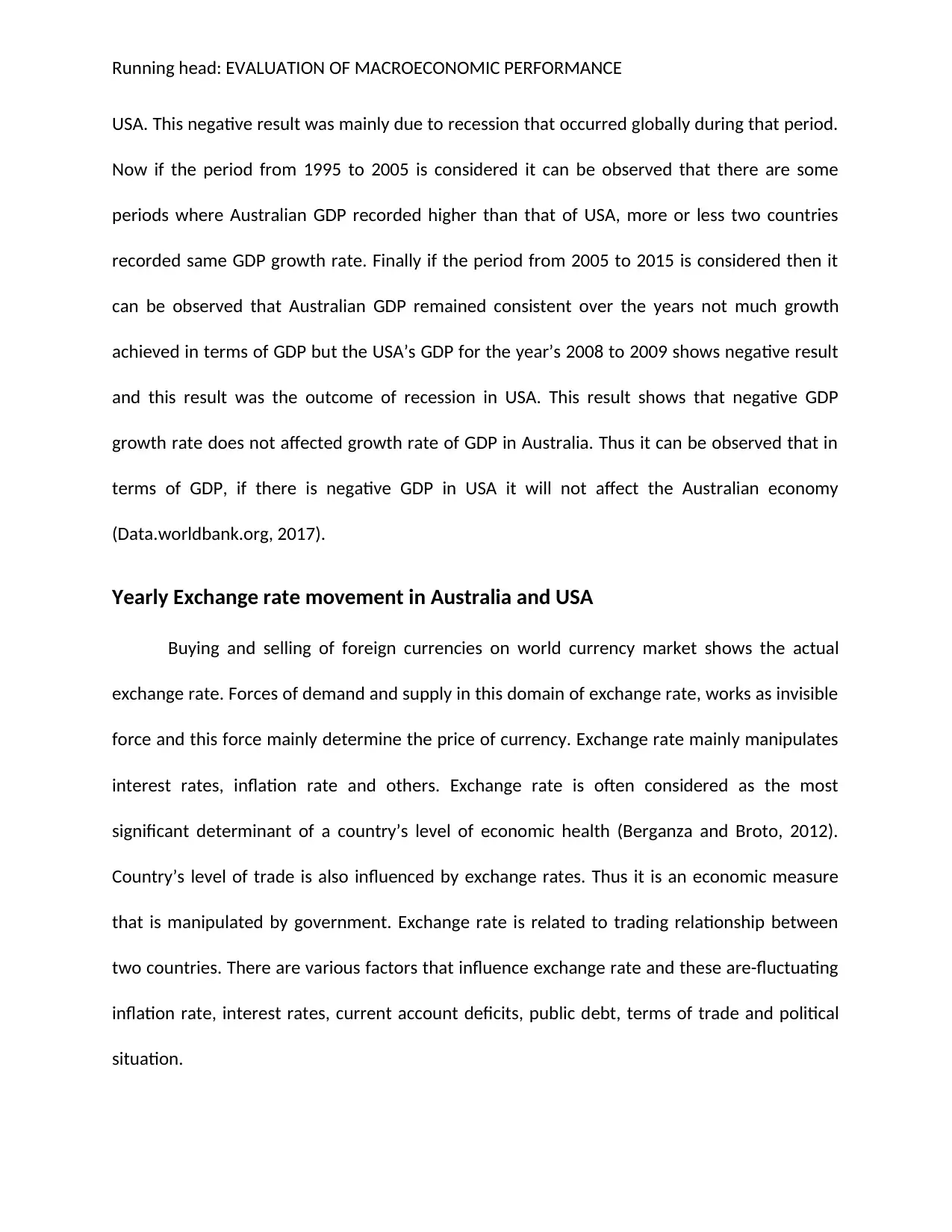

Exports play an important role in any economy; it mainly influences the level of

economic growth and balance of payments. Exports volume over the years have increased and

this is due to lower transport cost, post globalization, post war period, economies of scale and

reduction in tariff. Export is important for country because it helps several other factors to

stabilize the loss of degree. In the domain of employment, economic growth and current

account deficit, export helps a lot to overcome the problems faced by these domains

(Eichengreen and Gupta, 2013).

Considering the export data of Australia and USA, an overview of both the economies

can be obtained from 1985 to 2015.

much critical back in the 2001, the value of Australian dollar went below US 50 cents. Thus this

depreciation allows foreign currencies to buy more goods from Australia. Australian consumers

pay more for imported goods. As a result foreign investment also falls in Australia. With an

appreciating currency Australia's exports become comparatively more expensive to foreign

buyers.

Net Exports growth rate of Australia and USA

Exports play an important role in any economy; it mainly influences the level of

economic growth and balance of payments. Exports volume over the years have increased and

this is due to lower transport cost, post globalization, post war period, economies of scale and

reduction in tariff. Export is important for country because it helps several other factors to

stabilize the loss of degree. In the domain of employment, economic growth and current

account deficit, export helps a lot to overcome the problems faced by these domains

(Eichengreen and Gupta, 2013).

Considering the export data of Australia and USA, an overview of both the economies

can be obtained from 1985 to 2015.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

1985

1988

1991

1994

1997

2000

2003

2006

2009

2012

2015

-10

-5

0

5

10

15

20

25

30

USA(Export of goods and

services)

Australia(Export of goods

and services)

Graph 3: Export growth rate

Source: (Data.worldbank.org, 2017)

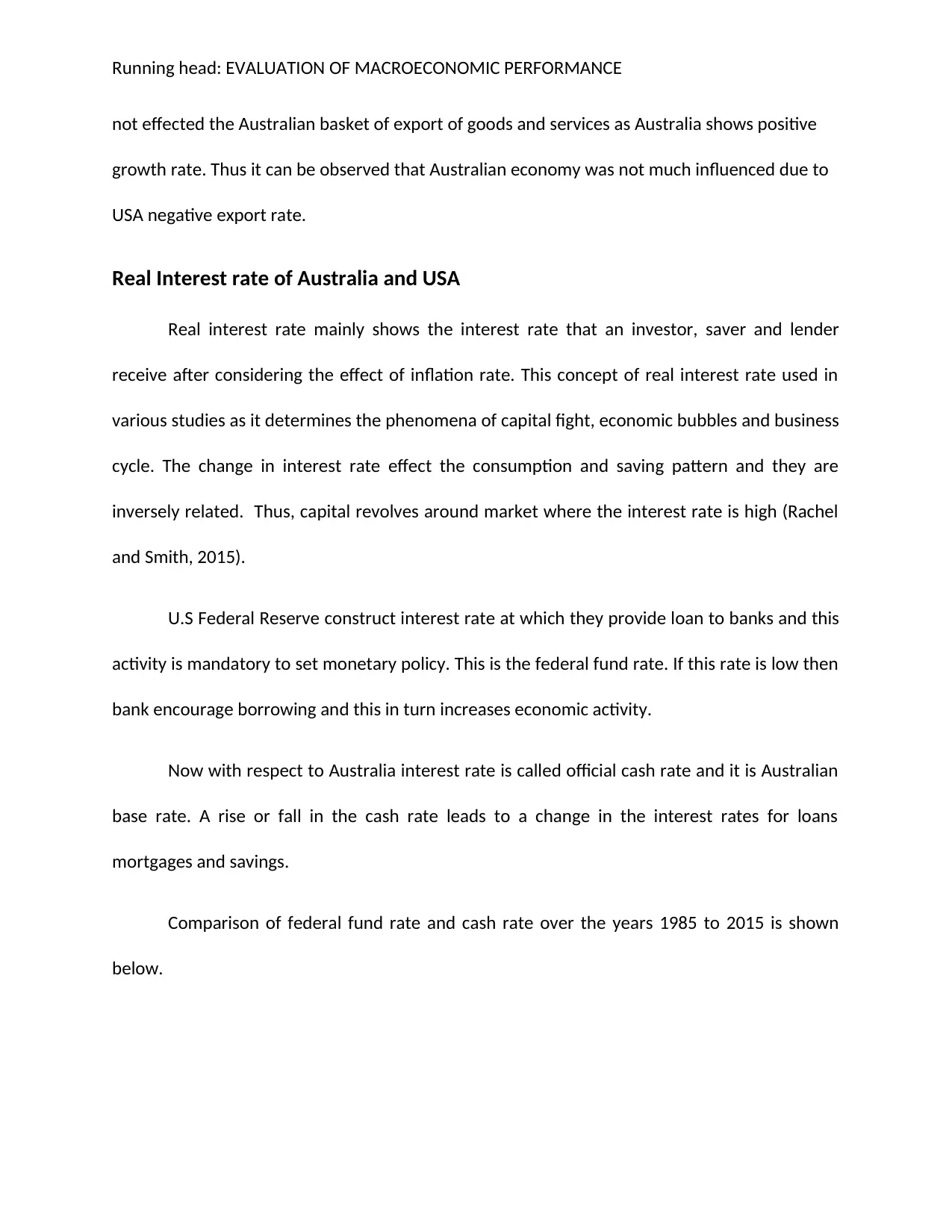

The above graph shows the export of goods and services of Australia and USA. The trend

pattern of export follows a discontinuous pattern. If the time period is divided into three phases

then the result can be obtained in a significant manner.

The period from 1985 to 1995 shows that volume of export of Australia and USA follows

a discrete trend. There are some situations where volume of Australia is far more than that of

USA. During 1989, the volume of export in USA was much higher than Australia. The time

period from 1985 to 1995 shows that during 2001, USA export rate become negative and this

result was due to recession occurred within the economy. As a result of this recession in USA,

influenced Australia because in 2002 both the countries have negative export rate and the

degree of negativity of USA was much higher than Australia .Now the period from 2005 to 2015

shows that negative export rate was observed in USA during 2009, but this negative result did

1985

1988

1991

1994

1997

2000

2003

2006

2009

2012

2015

-10

-5

0

5

10

15

20

25

30

USA(Export of goods and

services)

Australia(Export of goods

and services)

Graph 3: Export growth rate

Source: (Data.worldbank.org, 2017)

The above graph shows the export of goods and services of Australia and USA. The trend

pattern of export follows a discontinuous pattern. If the time period is divided into three phases

then the result can be obtained in a significant manner.

The period from 1985 to 1995 shows that volume of export of Australia and USA follows

a discrete trend. There are some situations where volume of Australia is far more than that of

USA. During 1989, the volume of export in USA was much higher than Australia. The time

period from 1985 to 1995 shows that during 2001, USA export rate become negative and this

result was due to recession occurred within the economy. As a result of this recession in USA,

influenced Australia because in 2002 both the countries have negative export rate and the

degree of negativity of USA was much higher than Australia .Now the period from 2005 to 2015

shows that negative export rate was observed in USA during 2009, but this negative result did

Running head: EVALUATION OF MACROECONOMIC PERFORMANCE

not effected the Australian basket of export of goods and services as Australia shows positive

growth rate. Thus it can be observed that Australian economy was not much influenced due to

USA negative export rate.

Real Interest rate of Australia and USA

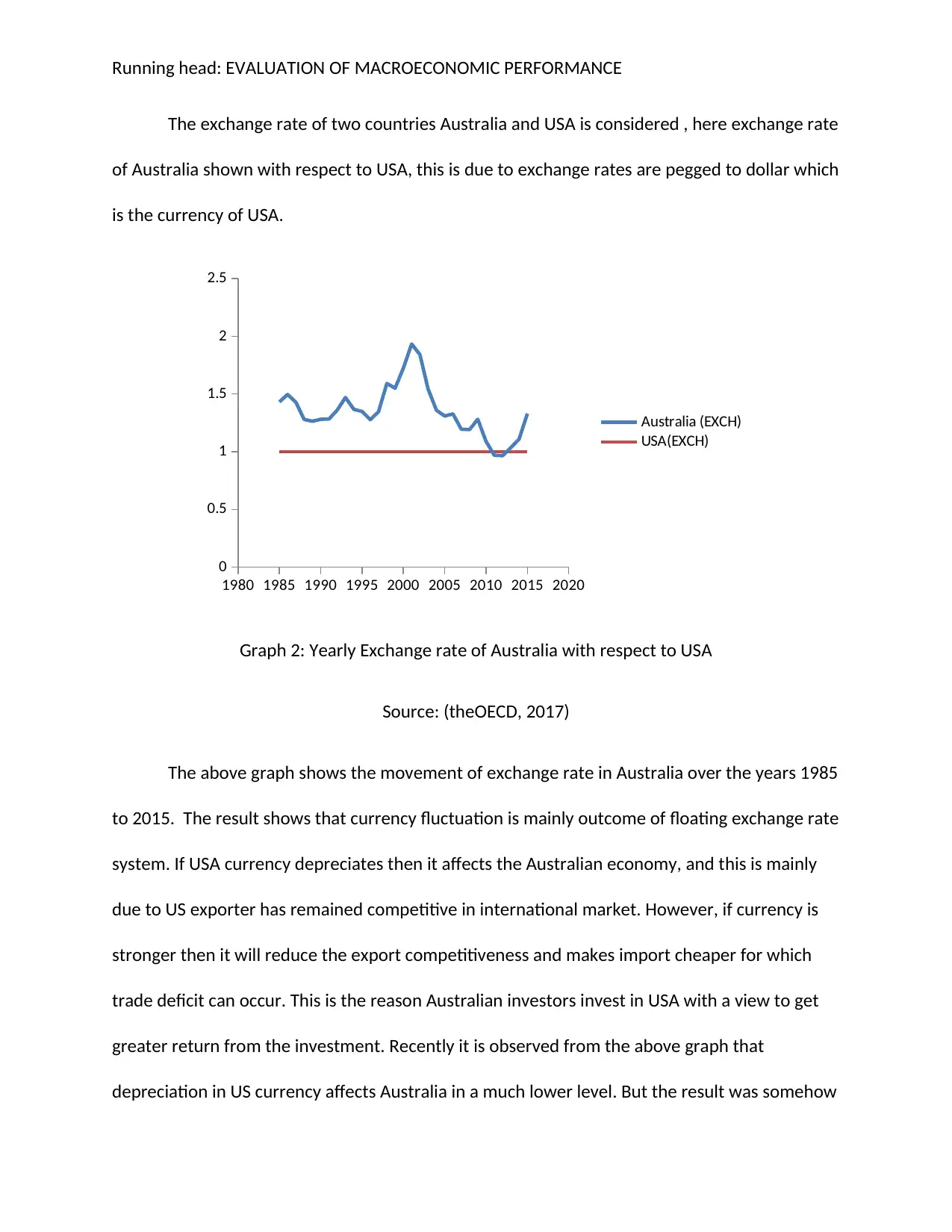

Real interest rate mainly shows the interest rate that an investor, saver and lender

receive after considering the effect of inflation rate. This concept of real interest rate used in

various studies as it determines the phenomena of capital fight, economic bubbles and business

cycle. The change in interest rate effect the consumption and saving pattern and they are

inversely related. Thus, capital revolves around market where the interest rate is high (Rachel

and Smith, 2015).

U.S Federal Reserve construct interest rate at which they provide loan to banks and this

activity is mandatory to set monetary policy. This is the federal fund rate. If this rate is low then

bank encourage borrowing and this in turn increases economic activity.

Now with respect to Australia interest rate is called official cash rate and it is Australian

base rate. A rise or fall in the cash rate leads to a change in the interest rates for loans

mortgages and savings.

Comparison of federal fund rate and cash rate over the years 1985 to 2015 is shown

below.

not effected the Australian basket of export of goods and services as Australia shows positive

growth rate. Thus it can be observed that Australian economy was not much influenced due to

USA negative export rate.

Real Interest rate of Australia and USA

Real interest rate mainly shows the interest rate that an investor, saver and lender

receive after considering the effect of inflation rate. This concept of real interest rate used in

various studies as it determines the phenomena of capital fight, economic bubbles and business

cycle. The change in interest rate effect the consumption and saving pattern and they are

inversely related. Thus, capital revolves around market where the interest rate is high (Rachel

and Smith, 2015).

U.S Federal Reserve construct interest rate at which they provide loan to banks and this

activity is mandatory to set monetary policy. This is the federal fund rate. If this rate is low then

bank encourage borrowing and this in turn increases economic activity.

Now with respect to Australia interest rate is called official cash rate and it is Australian

base rate. A rise or fall in the cash rate leads to a change in the interest rates for loans

mortgages and savings.

Comparison of federal fund rate and cash rate over the years 1985 to 2015 is shown

below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.