Management Accounting

VerifiedAdded on 2023/01/19

|13

|1568

|59

AI Summary

This report explains the accounting equation and its significance in the double-entry system. It discusses how the equation ensures that the balance sheet remains balanced and how it is used to calculate the total assets, liabilities, and equity of a company. The report also includes journal entries, general ledger accounts, and financial statements. References are provided for further reading.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: REPORT 1

MANAGEMENT ACCOUNTING

STUDENT DETAILS:

4/17/2019

MANAGEMENT ACCOUNTING

STUDENT DETAILS:

4/17/2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REPORT 2

The accounting equation is the foundation of system related to the double-entry. The accounting

equation states he balance sheet of company where the total of all the assets of a company is

similar to the sum of liabilities of corporation and equity of shareholder (Koopman, Wang and

Wei, 2014). On the basis of the double-entry system, the accounting equation makes sure that the

balance sheet remains “balanced,” and all entries conducted on the side of debit must have the

corresponding entry on a side of credit (Warren and Jones, 2018). Following is the formula of

accounting equation-

Assets= Liabilities + Owner's Equity

Assets= (Liabilities + Owner’s Equity)

The balance sheet of a company keeps the foundation of an accounting equation:

Place the total assets of corporation on a balance sheet for a period.

All the liabilities that must be the separate listing on a balance sheet of company.

Place whole equity of the shareholders and add the numbers to all liabilities as total.

Total assets would be the sum total equity and liabilities.

In this way, the accounting equation makes the basis for the double-entry accounting and is a

brief illustration of the perception that expand in a difficult, expanded, and multi-item state of

the balance sheet. As per the double-entry accounting system, the balance sheet of company

is made where the total asset of a corporation are same to the complete liabilities and

stakeholder equity (Schwaiger, 2015).

The accounting equation is the foundation of system related to the double-entry. The accounting

equation states he balance sheet of company where the total of all the assets of a company is

similar to the sum of liabilities of corporation and equity of shareholder (Koopman, Wang and

Wei, 2014). On the basis of the double-entry system, the accounting equation makes sure that the

balance sheet remains “balanced,” and all entries conducted on the side of debit must have the

corresponding entry on a side of credit (Warren and Jones, 2018). Following is the formula of

accounting equation-

Assets= Liabilities + Owner's Equity

Assets= (Liabilities + Owner’s Equity)

The balance sheet of a company keeps the foundation of an accounting equation:

Place the total assets of corporation on a balance sheet for a period.

All the liabilities that must be the separate listing on a balance sheet of company.

Place whole equity of the shareholders and add the numbers to all liabilities as total.

Total assets would be the sum total equity and liabilities.

In this way, the accounting equation makes the basis for the double-entry accounting and is a

brief illustration of the perception that expand in a difficult, expanded, and multi-item state of

the balance sheet. As per the double-entry accounting system, the balance sheet of company

is made where the total asset of a corporation are same to the complete liabilities and

stakeholder equity (Schwaiger, 2015).

REPORT 3

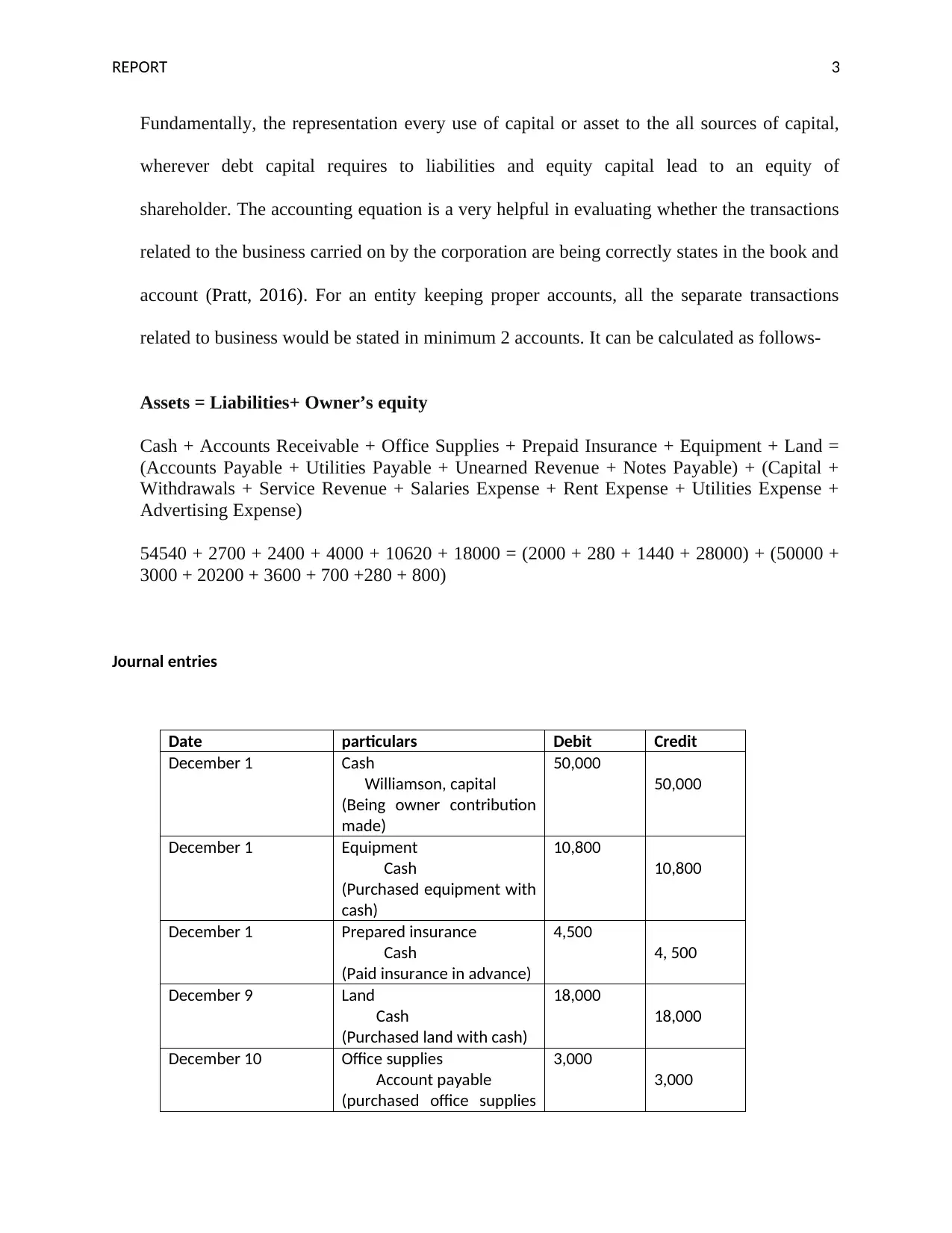

Fundamentally, the representation every use of capital or asset to the all sources of capital,

wherever debt capital requires to liabilities and equity capital lead to an equity of

shareholder. The accounting equation is a very helpful in evaluating whether the transactions

related to the business carried on by the corporation are being correctly states in the book and

account (Pratt, 2016). For an entity keeping proper accounts, all the separate transactions

related to business would be stated in minimum 2 accounts. It can be calculated as follows-

Assets = Liabilities+ Owner’s equity

Cash + Accounts Receivable + Office Supplies + Prepaid Insurance + Equipment + Land =

(Accounts Payable + Utilities Payable + Unearned Revenue + Notes Payable) + (Capital +

Withdrawals + Service Revenue + Salaries Expense + Rent Expense + Utilities Expense +

Advertising Expense)

54540 + 2700 + 2400 + 4000 + 10620 + 18000 = (2000 + 280 + 1440 + 28000) + (50000 +

3000 + 20200 + 3600 + 700 +280 + 800)

Journal entries

Date particulars Debit Credit

December 1 Cash

Williamson, capital

(Being owner contribution

made)

50,000

50,000

December 1 Equipment

Cash

(Purchased equipment with

cash)

10,800

10,800

December 1 Prepared insurance

Cash

(Paid insurance in advance)

4,500

4, 500

December 9 Land

Cash

(Purchased land with cash)

18,000

18,000

December 10 Office supplies

Account payable

(purchased office supplies

3,000

3,000

Fundamentally, the representation every use of capital or asset to the all sources of capital,

wherever debt capital requires to liabilities and equity capital lead to an equity of

shareholder. The accounting equation is a very helpful in evaluating whether the transactions

related to the business carried on by the corporation are being correctly states in the book and

account (Pratt, 2016). For an entity keeping proper accounts, all the separate transactions

related to business would be stated in minimum 2 accounts. It can be calculated as follows-

Assets = Liabilities+ Owner’s equity

Cash + Accounts Receivable + Office Supplies + Prepaid Insurance + Equipment + Land =

(Accounts Payable + Utilities Payable + Unearned Revenue + Notes Payable) + (Capital +

Withdrawals + Service Revenue + Salaries Expense + Rent Expense + Utilities Expense +

Advertising Expense)

54540 + 2700 + 2400 + 4000 + 10620 + 18000 = (2000 + 280 + 1440 + 28000) + (50000 +

3000 + 20200 + 3600 + 700 +280 + 800)

Journal entries

Date particulars Debit Credit

December 1 Cash

Williamson, capital

(Being owner contribution

made)

50,000

50,000

December 1 Equipment

Cash

(Purchased equipment with

cash)

10,800

10,800

December 1 Prepared insurance

Cash

(Paid insurance in advance)

4,500

4, 500

December 9 Land

Cash

(Purchased land with cash)

18,000

18,000

December 10 Office supplies

Account payable

(purchased office supplies

3,000

3,000

REPORT 4

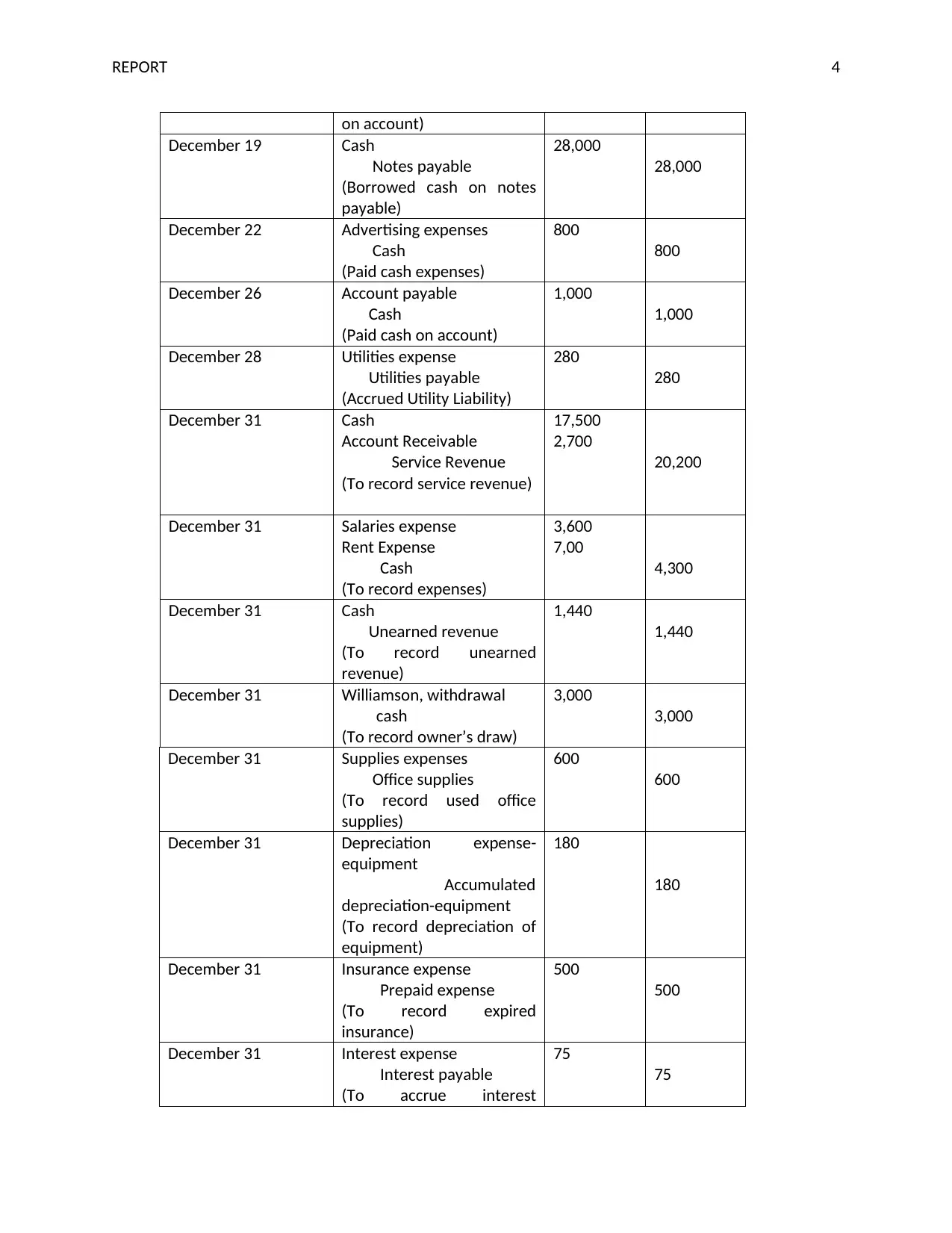

on account)

December 19 Cash

Notes payable

(Borrowed cash on notes

payable)

28,000

28,000

December 22 Advertising expenses

Cash

(Paid cash expenses)

800

800

December 26 Account payable

Cash

(Paid cash on account)

1,000

1,000

December 28 Utilities expense

Utilities payable

(Accrued Utility Liability)

280

280

December 31 Cash

Account Receivable

Service Revenue

(To record service revenue)

17,500

2,700

20,200

December 31 Salaries expense

Rent Expense

Cash

(To record expenses)

3,600

7,00

4,300

December 31 Cash

Unearned revenue

(To record unearned

revenue)

1,440

1,440

December 31 Williamson, withdrawal

cash

(To record owner’s draw)

3,000

3,000

December 31 Supplies expenses

Office supplies

(To record used office

supplies)

600

600

December 31 Depreciation expense-

equipment

Accumulated

depreciation-equipment

(To record depreciation of

equipment)

180

180

December 31 Insurance expense

Prepaid expense

(To record expired

insurance)

500

500

December 31 Interest expense

Interest payable

(To accrue interest

75

75

on account)

December 19 Cash

Notes payable

(Borrowed cash on notes

payable)

28,000

28,000

December 22 Advertising expenses

Cash

(Paid cash expenses)

800

800

December 26 Account payable

Cash

(Paid cash on account)

1,000

1,000

December 28 Utilities expense

Utilities payable

(Accrued Utility Liability)

280

280

December 31 Cash

Account Receivable

Service Revenue

(To record service revenue)

17,500

2,700

20,200

December 31 Salaries expense

Rent Expense

Cash

(To record expenses)

3,600

7,00

4,300

December 31 Cash

Unearned revenue

(To record unearned

revenue)

1,440

1,440

December 31 Williamson, withdrawal

cash

(To record owner’s draw)

3,000

3,000

December 31 Supplies expenses

Office supplies

(To record used office

supplies)

600

600

December 31 Depreciation expense-

equipment

Accumulated

depreciation-equipment

(To record depreciation of

equipment)

180

180

December 31 Insurance expense

Prepaid expense

(To record expired

insurance)

500

500

December 31 Interest expense

Interest payable

(To accrue interest

75

75

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REPORT 5

expense)

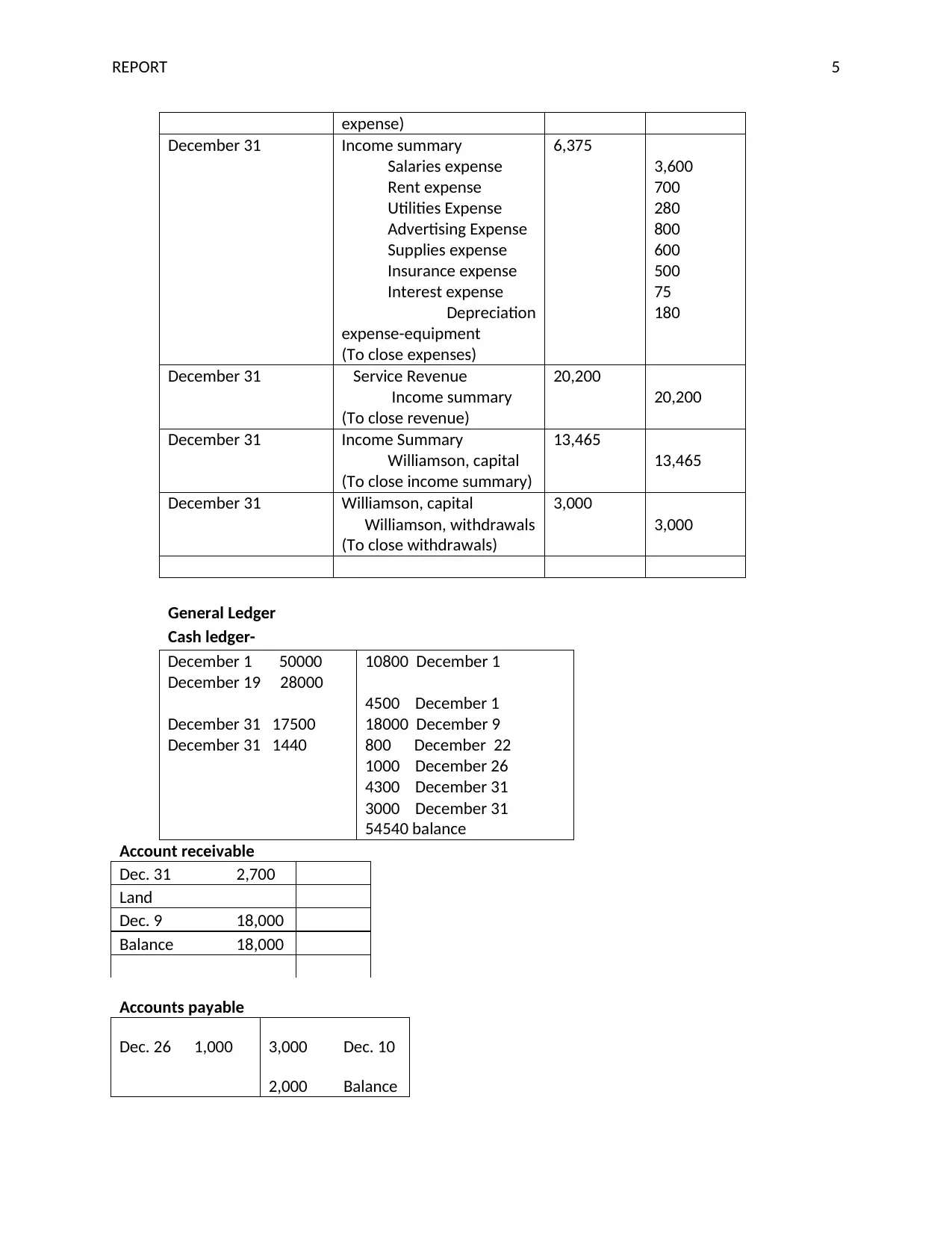

December 31 Income summary

Salaries expense

Rent expense

Utilities Expense

Advertising Expense

Supplies expense

Insurance expense

Interest expense

Depreciation

expense-equipment

(To close expenses)

6,375

3,600

700

280

800

600

500

75

180

December 31 Service Revenue

Income summary

(To close revenue)

20,200

20,200

December 31 Income Summary

Williamson, capital

(To close income summary)

13,465

13,465

December 31 Williamson, capital

Williamson, withdrawals

(To close withdrawals)

3,000

3,000

General Ledger

Cash ledger-

Account receivable

Dec. 31 2,700

Land

Dec. 9 18,000

Balance 18,000

Accounts payable

Dec. 26 1,000 3,000 Dec. 10

2,000 Balance

December 1 50000

December 19 28000

December 31 17500

December 31 1440

10800 December 1

4500 December 1

18000 December 9

800 December 22

1000 December 26

4300 December 31

3000 December 31

54540 balance

expense)

December 31 Income summary

Salaries expense

Rent expense

Utilities Expense

Advertising Expense

Supplies expense

Insurance expense

Interest expense

Depreciation

expense-equipment

(To close expenses)

6,375

3,600

700

280

800

600

500

75

180

December 31 Service Revenue

Income summary

(To close revenue)

20,200

20,200

December 31 Income Summary

Williamson, capital

(To close income summary)

13,465

13,465

December 31 Williamson, capital

Williamson, withdrawals

(To close withdrawals)

3,000

3,000

General Ledger

Cash ledger-

Account receivable

Dec. 31 2,700

Land

Dec. 9 18,000

Balance 18,000

Accounts payable

Dec. 26 1,000 3,000 Dec. 10

2,000 Balance

December 1 50000

December 19 28000

December 31 17500

December 31 1440

10800 December 1

4500 December 1

18000 December 9

800 December 22

1000 December 26

4300 December 31

3000 December 31

54540 balance

REPORT 6

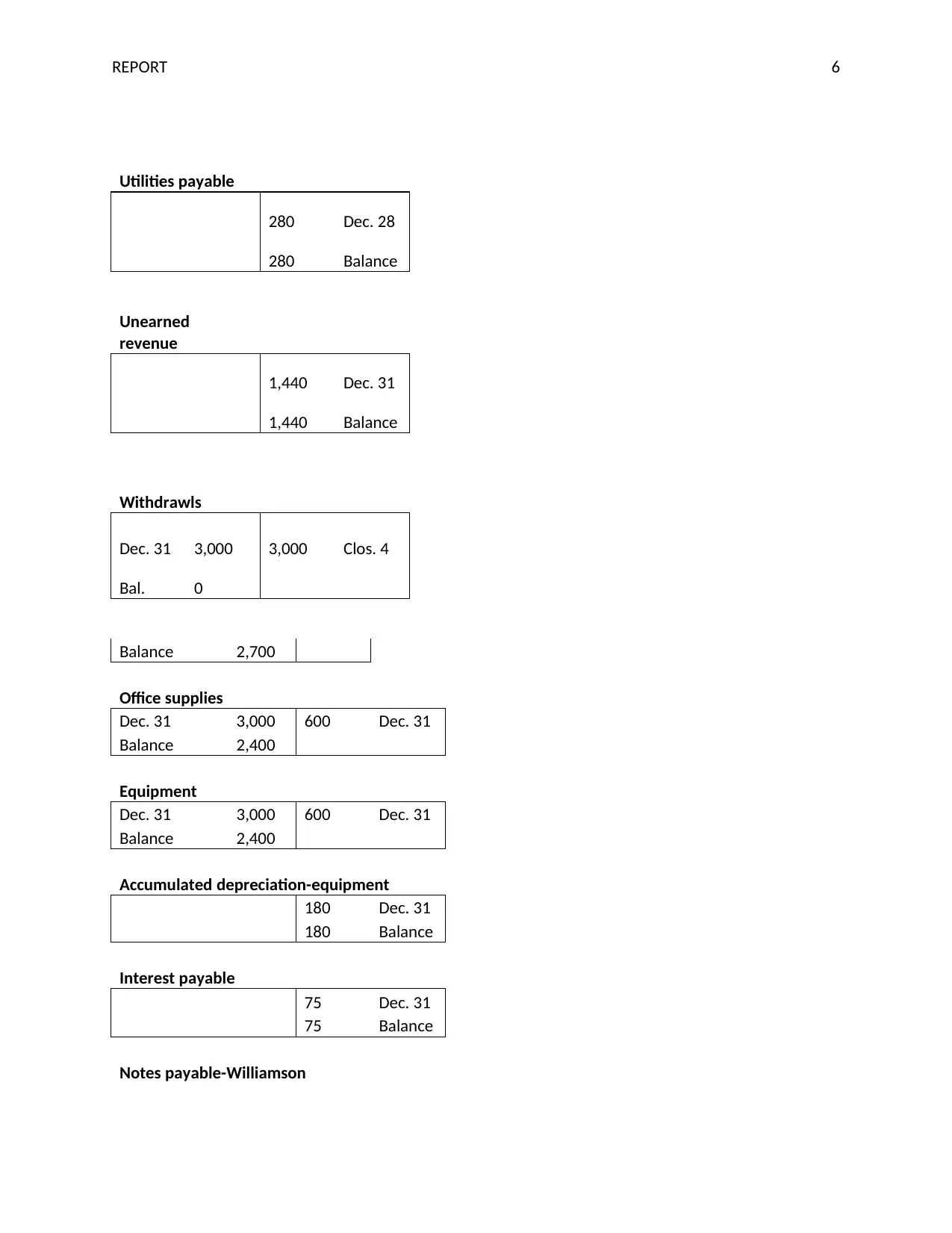

Utilities payable

280 Dec. 28

280 Balance

Unearned

revenue

1,440 Dec. 31

1,440 Balance

Withdrawls

Dec. 31 3,000 3,000 Clos. 4

Bal. 0

Balance 2,700

Office supplies

Dec. 31 3,000 600 Dec. 31

Balance 2,400

Equipment

Dec. 31 3,000 600 Dec. 31

Balance 2,400

Accumulated depreciation-equipment

180 Dec. 31

180 Balance

Interest payable

75 Dec. 31

75 Balance

Notes payable-Williamson

Utilities payable

280 Dec. 28

280 Balance

Unearned

revenue

1,440 Dec. 31

1,440 Balance

Withdrawls

Dec. 31 3,000 3,000 Clos. 4

Bal. 0

Balance 2,700

Office supplies

Dec. 31 3,000 600 Dec. 31

Balance 2,400

Equipment

Dec. 31 3,000 600 Dec. 31

Balance 2,400

Accumulated depreciation-equipment

180 Dec. 31

180 Balance

Interest payable

75 Dec. 31

75 Balance

Notes payable-Williamson

REPORT 7

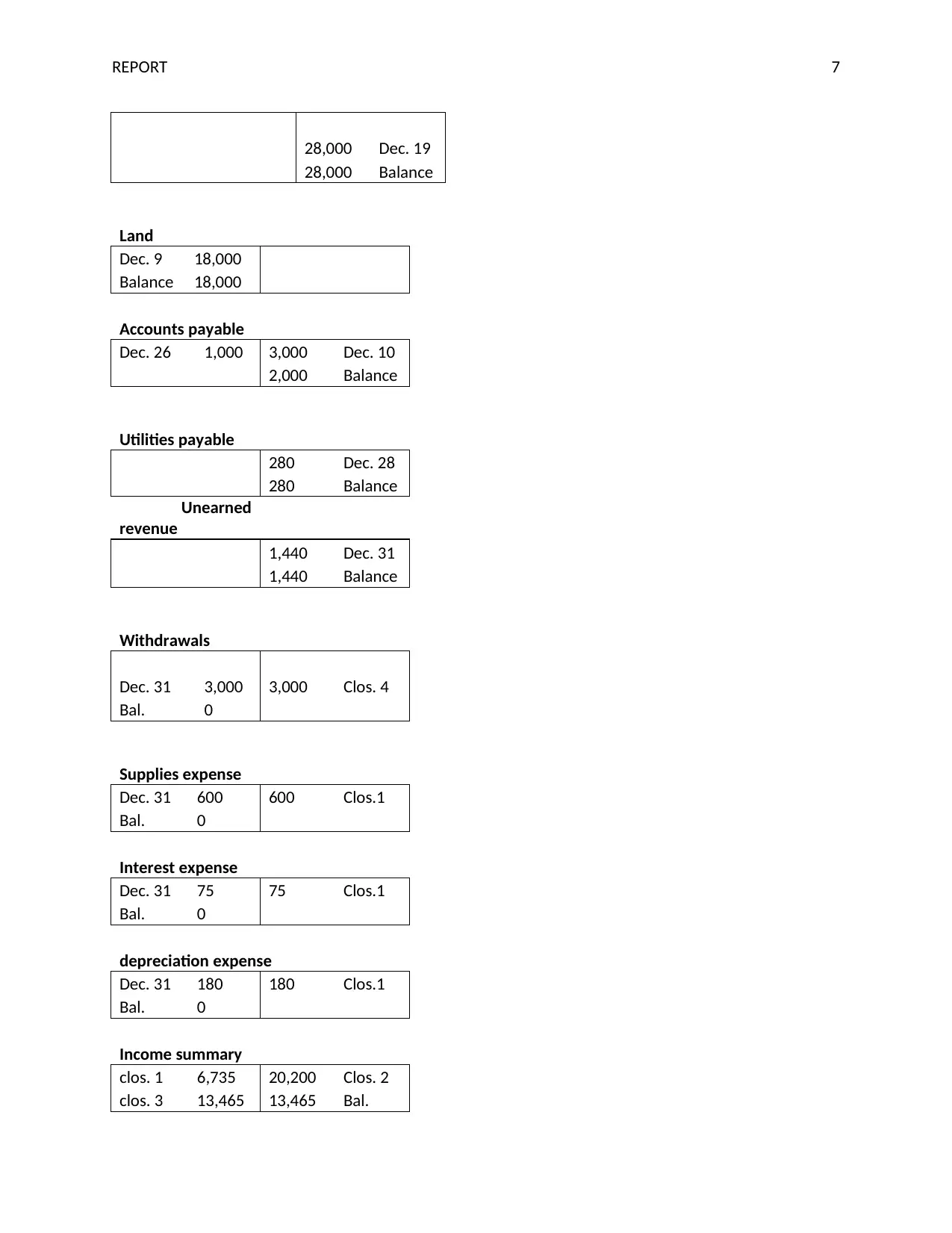

28,000 Dec. 19

28,000 Balance

Land

Dec. 9 18,000

Balance 18,000

Accounts payable

Dec. 26 1,000 3,000 Dec. 10

2,000 Balance

Utilities payable

280 Dec. 28

280 Balance

Unearned

revenue

1,440 Dec. 31

1,440 Balance

Withdrawals

Dec. 31 3,000 3,000 Clos. 4

Bal. 0

Supplies expense

Dec. 31 600 600 Clos.1

Bal. 0

Interest expense

Dec. 31 75 75 Clos.1

Bal. 0

depreciation expense

Dec. 31 180 180 Clos.1

Bal. 0

Income summary

clos. 1 6,735 20,200 Clos. 2

clos. 3 13,465 13,465 Bal.

28,000 Dec. 19

28,000 Balance

Land

Dec. 9 18,000

Balance 18,000

Accounts payable

Dec. 26 1,000 3,000 Dec. 10

2,000 Balance

Utilities payable

280 Dec. 28

280 Balance

Unearned

revenue

1,440 Dec. 31

1,440 Balance

Withdrawals

Dec. 31 3,000 3,000 Clos. 4

Bal. 0

Supplies expense

Dec. 31 600 600 Clos.1

Bal. 0

Interest expense

Dec. 31 75 75 Clos.1

Bal. 0

depreciation expense

Dec. 31 180 180 Clos.1

Bal. 0

Income summary

clos. 1 6,735 20,200 Clos. 2

clos. 3 13,465 13,465 Bal.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT 8

0 Bal.

Salaries Expense

Dec. 31 3,600 3,600 Clos. 1

Bal. 0

Capital Williamson

Clos. 4 3,000 50,000 Dec. 31

13465 clos.3

60,465 Bal.

Service Revenue

Clos. 2 20,200 20,200 Dec. 31

0 Balance

Rent expenses

Dec. 31 700 700 Clos.1

Bal. 0

Advertising expenses

Dec. 28 800 800 Clos.1

Bal. 0

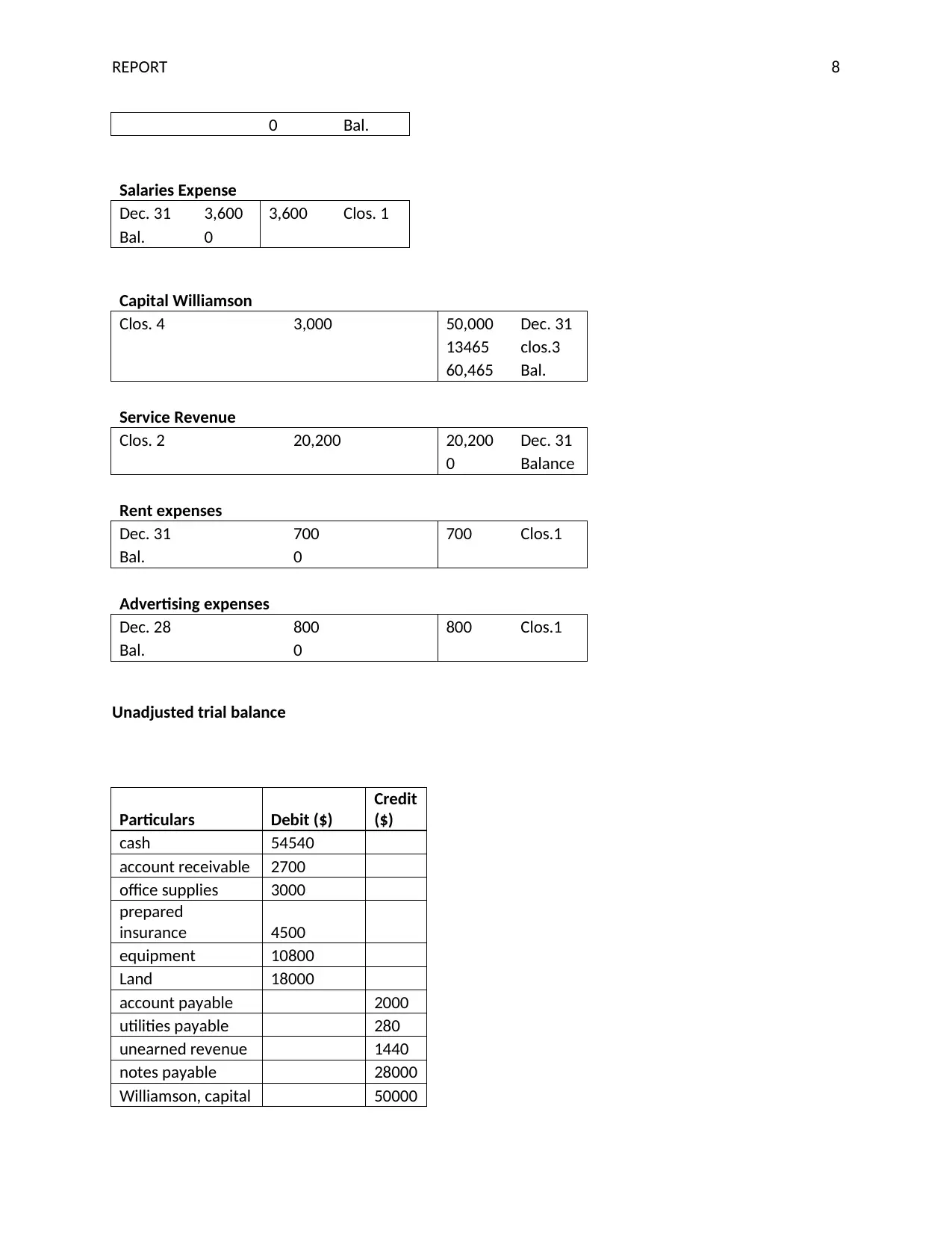

Unadjusted trial balance

Particulars Debit ($)

Credit

($)

cash 54540

account receivable 2700

office supplies 3000

prepared

insurance 4500

equipment 10800

Land 18000

account payable 2000

utilities payable 280

unearned revenue 1440

notes payable 28000

Williamson, capital 50000

0 Bal.

Salaries Expense

Dec. 31 3,600 3,600 Clos. 1

Bal. 0

Capital Williamson

Clos. 4 3,000 50,000 Dec. 31

13465 clos.3

60,465 Bal.

Service Revenue

Clos. 2 20,200 20,200 Dec. 31

0 Balance

Rent expenses

Dec. 31 700 700 Clos.1

Bal. 0

Advertising expenses

Dec. 28 800 800 Clos.1

Bal. 0

Unadjusted trial balance

Particulars Debit ($)

Credit

($)

cash 54540

account receivable 2700

office supplies 3000

prepared

insurance 4500

equipment 10800

Land 18000

account payable 2000

utilities payable 280

unearned revenue 1440

notes payable 28000

Williamson, capital 50000

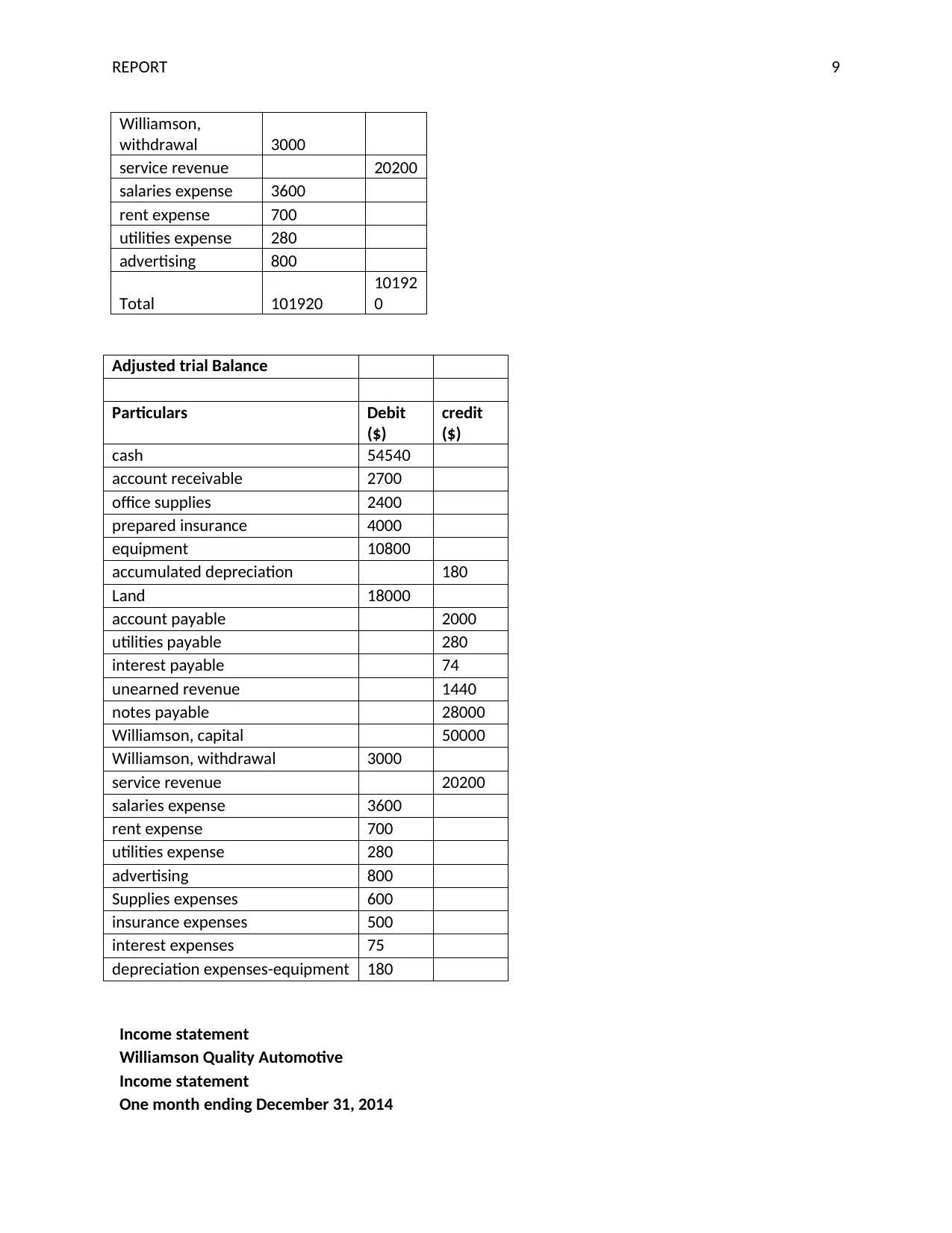

REPORT 9

Williamson,

withdrawal 3000

service revenue 20200

salaries expense 3600

rent expense 700

utilities expense 280

advertising 800

Total 101920

10192

0

Adjusted trial Balance

Particulars Debit

($)

credit

($)

cash 54540

account receivable 2700

office supplies 2400

prepared insurance 4000

equipment 10800

accumulated depreciation 180

Land 18000

account payable 2000

utilities payable 280

interest payable 74

unearned revenue 1440

notes payable 28000

Williamson, capital 50000

Williamson, withdrawal 3000

service revenue 20200

salaries expense 3600

rent expense 700

utilities expense 280

advertising 800

Supplies expenses 600

insurance expenses 500

interest expenses 75

depreciation expenses-equipment 180

Income statement

Williamson Quality Automotive

Income statement

One month ending December 31, 2014

Williamson,

withdrawal 3000

service revenue 20200

salaries expense 3600

rent expense 700

utilities expense 280

advertising 800

Total 101920

10192

0

Adjusted trial Balance

Particulars Debit

($)

credit

($)

cash 54540

account receivable 2700

office supplies 2400

prepared insurance 4000

equipment 10800

accumulated depreciation 180

Land 18000

account payable 2000

utilities payable 280

interest payable 74

unearned revenue 1440

notes payable 28000

Williamson, capital 50000

Williamson, withdrawal 3000

service revenue 20200

salaries expense 3600

rent expense 700

utilities expense 280

advertising 800

Supplies expenses 600

insurance expenses 500

interest expenses 75

depreciation expenses-equipment 180

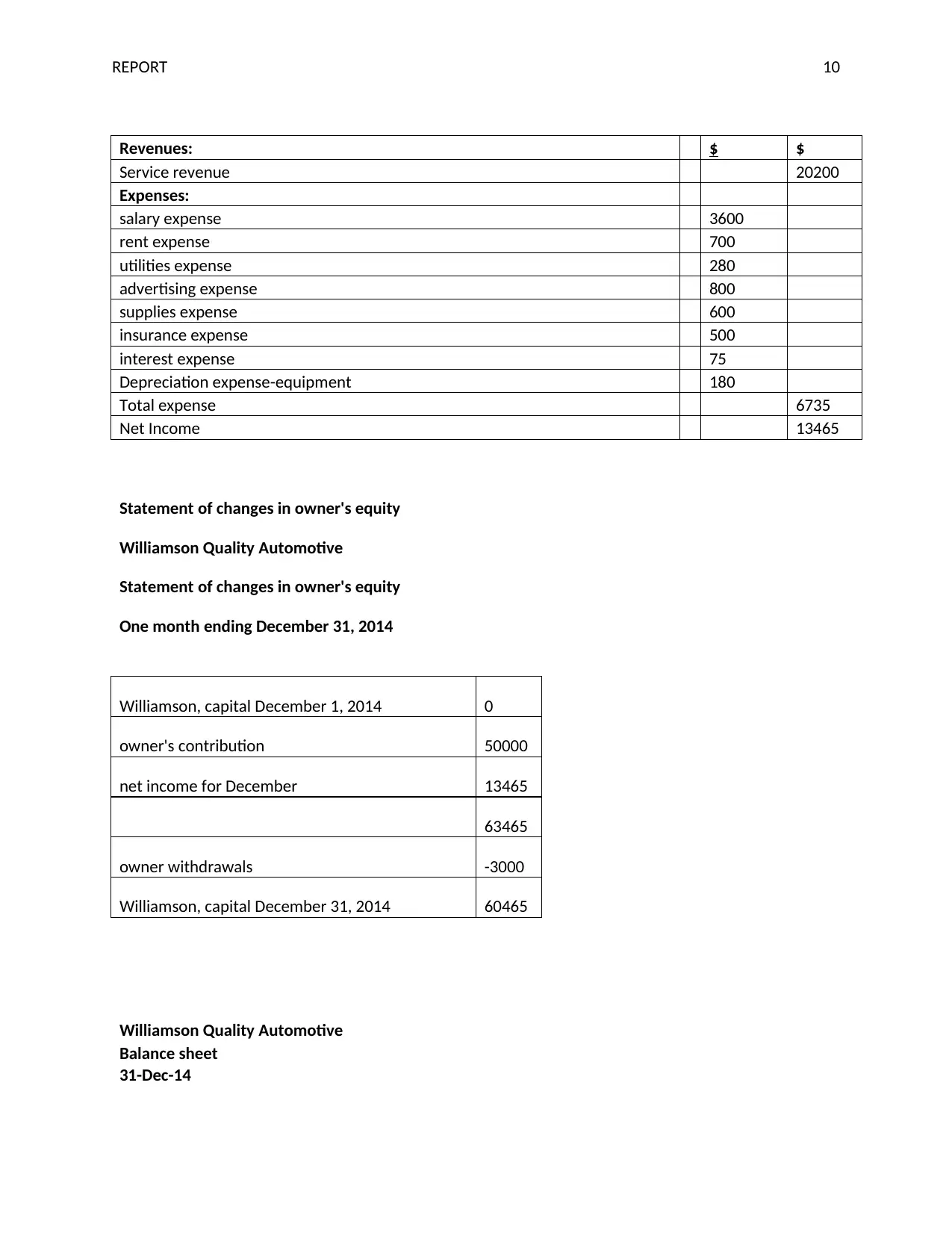

Income statement

Williamson Quality Automotive

Income statement

One month ending December 31, 2014

REPORT 10

Revenues: $ $

Service revenue 20200

Expenses:

salary expense 3600

rent expense 700

utilities expense 280

advertising expense 800

supplies expense 600

insurance expense 500

interest expense 75

Depreciation expense-equipment 180

Total expense 6735

Net Income 13465

Statement of changes in owner's equity

Williamson Quality Automotive

Statement of changes in owner's equity

One month ending December 31, 2014

Williamson, capital December 1, 2014 0

owner's contribution 50000

net income for December 13465

63465

owner withdrawals -3000

Williamson, capital December 31, 2014 60465

Williamson Quality Automotive

Balance sheet

31-Dec-14

Revenues: $ $

Service revenue 20200

Expenses:

salary expense 3600

rent expense 700

utilities expense 280

advertising expense 800

supplies expense 600

insurance expense 500

interest expense 75

Depreciation expense-equipment 180

Total expense 6735

Net Income 13465

Statement of changes in owner's equity

Williamson Quality Automotive

Statement of changes in owner's equity

One month ending December 31, 2014

Williamson, capital December 1, 2014 0

owner's contribution 50000

net income for December 13465

63465

owner withdrawals -3000

Williamson, capital December 31, 2014 60465

Williamson Quality Automotive

Balance sheet

31-Dec-14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

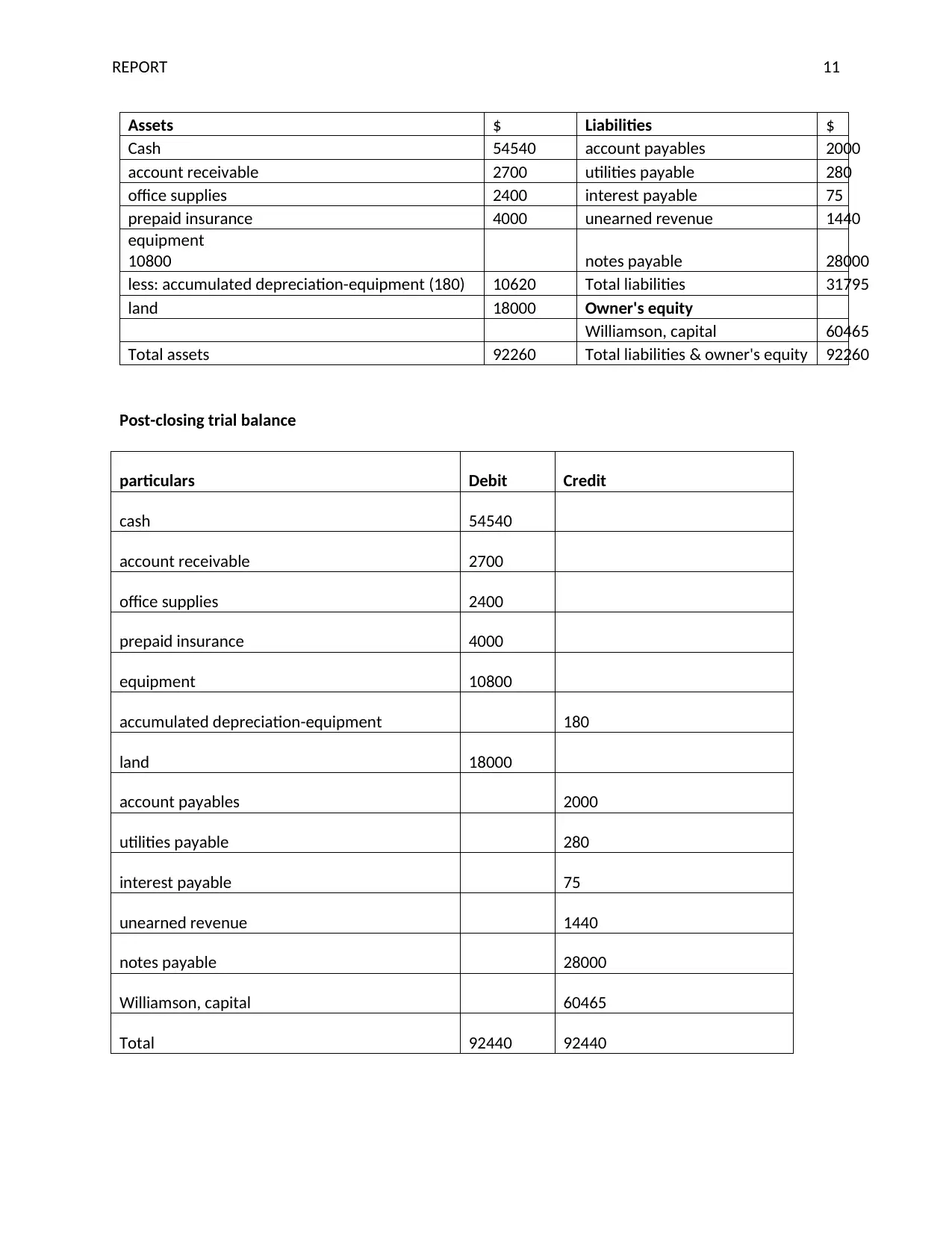

REPORT 11

Assets $ Liabilities $

Cash 54540 account payables 2000

account receivable 2700 utilities payable 280

office supplies 2400 interest payable 75

prepaid insurance 4000 unearned revenue 1440

equipment

10800 notes payable 28000

less: accumulated depreciation-equipment (180) 10620 Total liabilities 31795

land 18000 Owner's equity

Williamson, capital 60465

Total assets 92260 Total liabilities & owner's equity 92260

Post-closing trial balance

particulars Debit Credit

cash 54540

account receivable 2700

office supplies 2400

prepaid insurance 4000

equipment 10800

accumulated depreciation-equipment 180

land 18000

account payables 2000

utilities payable 280

interest payable 75

unearned revenue 1440

notes payable 28000

Williamson, capital 60465

Total 92440 92440

Assets $ Liabilities $

Cash 54540 account payables 2000

account receivable 2700 utilities payable 280

office supplies 2400 interest payable 75

prepaid insurance 4000 unearned revenue 1440

equipment

10800 notes payable 28000

less: accumulated depreciation-equipment (180) 10620 Total liabilities 31795

land 18000 Owner's equity

Williamson, capital 60465

Total assets 92260 Total liabilities & owner's equity 92260

Post-closing trial balance

particulars Debit Credit

cash 54540

account receivable 2700

office supplies 2400

prepaid insurance 4000

equipment 10800

accumulated depreciation-equipment 180

land 18000

account payables 2000

utilities payable 280

interest payable 75

unearned revenue 1440

notes payable 28000

Williamson, capital 60465

Total 92440 92440

REPORT 12

REPORT 13

References

Koopman, R., Wang, Z. and Wei, S.J. (2014) Tracing value-added and double counting in gross

exports. American Economic Review, 104(2), pp.459-94.

Pratt, J. (2016) Financial accounting in an economic context. Springer: John Wiley & Sons.

Schwaiger, W.S. (2015) October. The REA accounting model: Enhancing understandability and

applicability. In International Conference on Conceptual Modeling (pp. 566-573). Springer,

Cham.

Warren, C. and Jones, J. (2018) Corporate financial accounting. Australia: Cengage Learning.

References

Koopman, R., Wang, Z. and Wei, S.J. (2014) Tracing value-added and double counting in gross

exports. American Economic Review, 104(2), pp.459-94.

Pratt, J. (2016) Financial accounting in an economic context. Springer: John Wiley & Sons.

Schwaiger, W.S. (2015) October. The REA accounting model: Enhancing understandability and

applicability. In International Conference on Conceptual Modeling (pp. 566-573). Springer,

Cham.

Warren, C. and Jones, J. (2018) Corporate financial accounting. Australia: Cengage Learning.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.

![[SOLVED] Financial Analysis of PA Engineering Inc](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fvk%2Fd03ded40310446f68e5077f05f214541.jpg&w=256&q=75)