Comprehensive Financial Report: Goodman Group, ASX Listed Company

VerifiedAdded on 2022/11/13

|17

|3705

|353

Report

AI Summary

This report provides a comprehensive financial analysis of the Goodman Group, an Australian-based integrated industrial and commercial property group. The report begins with an industry introduction, highlighting the growth and investor interest in the commercial property market. It then describes the Goodman Group's operations, including its global presence and diverse property portfolio. The core of the report focuses on financial instrument analysis, examining instruments like letters of credit and hire purchase agreements. Part A delves into financial ratio analysis, calculating and interpreting profitability, efficiency, and liquidity ratios over a three-year period. Part B shifts to competitor analysis, identifying and comparing Goodman Group with key competitors like Realterm and Segro. The report also includes a financial market analysis, exploring the influence of competitors and the need for government intervention. The report also identifies strengths and weaknesses of the company. Finally, the report concludes with recommendations and a list of references.

REPORT ON GOODMAN GROUP

GOODMAN GROUP

GOODMAN GROUP

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1. INDUSTRY INTRODUCTION....................................................................................................2

2. Description of Company................................................................................................................2

3. FINANCIAL INSTRUMENT ANALYSIS...................................................................................3

4. Part-A............................................................................................................................................4

FIANANCIAL RATIO ANALYSIS.....................................................................................................4

3 key financial ratios that apply to your chosen company.................................................................4

Computation of the financial ratios based on the financial statements............................................4

STRENGTHS AND WEAKNESS....................................................................................................6

Part-B COMPETITOR ANALYSIS..........................................................................................................7

5. FINANCIAL MARKET ANALYSIS............................................................................................7

6. Finding CONCLUSIONS AND RECOMMENDATIONS............................................................8

REFERENCES....................................................................................................................................10

Appendix.............................................................................................................................................12

1. INDUSTRY INTRODUCTION....................................................................................................2

2. Description of Company................................................................................................................2

3. FINANCIAL INSTRUMENT ANALYSIS...................................................................................3

4. Part-A............................................................................................................................................4

FIANANCIAL RATIO ANALYSIS.....................................................................................................4

3 key financial ratios that apply to your chosen company.................................................................4

Computation of the financial ratios based on the financial statements............................................4

STRENGTHS AND WEAKNESS....................................................................................................6

Part-B COMPETITOR ANALYSIS..........................................................................................................7

5. FINANCIAL MARKET ANALYSIS............................................................................................7

6. Finding CONCLUSIONS AND RECOMMENDATIONS............................................................8

REFERENCES....................................................................................................................................10

Appendix.............................................................................................................................................12

1. INDUSTRY INTRODUCTION

In the world of 21st centaury, the investors are always on the lookout for the better

opportunities for the investments. Now as the world is opening globally, more and more

options are getting available for the investors (Bond, 2010). Commercial property is one such

option. Due to considerable and significant cash flow advantage, growth and stability in

rental prices, decline in vacancy rates, commercial property is fast becoming a smart and top

most choice for the investors in Australia. In last few years downsizing of real estate market,

decreased retail trade profits and boom in online marketing has benefited the commercial

property market and made it investor’s hot favourite (Goodman Company, 2019).

Commercial Property segment is very diversified and includes office buildings, medical

centres, retail stores, hotels, land for commercial farming, malls, warehouses and

redevelopment land. From 2012-2017, commercial real estate market has recorded growth of

10.6 % and revenue of $1.3 billion (Ball, Lizeiri, Macgregor, 2012). The economy in

Australia is now shifting more towards the service based industries and thus so need for the

rented office has increased in last decade which has resulted in high number of revenue and

increased growth (Brigham, and Ehrhardt, 2013).

In this report we are undertaking Goodman group for further study and will do the detailed

analysis of the company financials. We will in detail analyse the various financial ratios,

financial instruments and analysis of strengths and weaknesses of internal factors (Robinson,

and Burnett, 2016).

2. Description of Company

Goodman Limited is an Australian company founded in 1989 by Gregory Goodman.

Company is an integrated industrial and commercial property group and deals in owing,

developing and managing real estate in Australia. The headquarters of the company is

situated in Sydney, New South Wales, Australia. Company profile includes business and

office parks, logistics facilities on large scales and warehouses worldwide. The Goodman

group was listed in ASX in 1995 with eight properties and valuation of A$75 million as

Goodman Hardie Industrial Property Trust. In 2000 it merged with Macquarie Industrial

Trust and became Macquarie Goodman Industrial Trust. Following many acquisitions and

mergers in 2005, it was renamed Macquarie Goodman Group and became largest industrial

property group in Australia. In 2007, Macquarie Bank sold 7.7% interest and company again

In the world of 21st centaury, the investors are always on the lookout for the better

opportunities for the investments. Now as the world is opening globally, more and more

options are getting available for the investors (Bond, 2010). Commercial property is one such

option. Due to considerable and significant cash flow advantage, growth and stability in

rental prices, decline in vacancy rates, commercial property is fast becoming a smart and top

most choice for the investors in Australia. In last few years downsizing of real estate market,

decreased retail trade profits and boom in online marketing has benefited the commercial

property market and made it investor’s hot favourite (Goodman Company, 2019).

Commercial Property segment is very diversified and includes office buildings, medical

centres, retail stores, hotels, land for commercial farming, malls, warehouses and

redevelopment land. From 2012-2017, commercial real estate market has recorded growth of

10.6 % and revenue of $1.3 billion (Ball, Lizeiri, Macgregor, 2012). The economy in

Australia is now shifting more towards the service based industries and thus so need for the

rented office has increased in last decade which has resulted in high number of revenue and

increased growth (Brigham, and Ehrhardt, 2013).

In this report we are undertaking Goodman group for further study and will do the detailed

analysis of the company financials. We will in detail analyse the various financial ratios,

financial instruments and analysis of strengths and weaknesses of internal factors (Robinson,

and Burnett, 2016).

2. Description of Company

Goodman Limited is an Australian company founded in 1989 by Gregory Goodman.

Company is an integrated industrial and commercial property group and deals in owing,

developing and managing real estate in Australia. The headquarters of the company is

situated in Sydney, New South Wales, Australia. Company profile includes business and

office parks, logistics facilities on large scales and warehouses worldwide. The Goodman

group was listed in ASX in 1995 with eight properties and valuation of A$75 million as

Goodman Hardie Industrial Property Trust. In 2000 it merged with Macquarie Industrial

Trust and became Macquarie Goodman Industrial Trust. Following many acquisitions and

mergers in 2005, it was renamed Macquarie Goodman Group and became largest industrial

property group in Australia. In 2007, Macquarie Bank sold 7.7% interest and company again

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

got renamed to Goodman Limited. In the last decade company has shown incomprehensible

organic growth, done many acquisitions and mergers, and expanded among European,

American and Asian market (Savytska, 2018).

According to reports, the Group is operating in 16 countries, had 432 properties with69 active

developments going on, as of September 2014. The market capitalization of company stood

at AUD $8.7 billion. Goodman had reported its earning before interest and tax to be $138 m

between 2007 to 2014. The total revenue reported in 2013-2014 was A$ 1,182,800,000, and

net income reported in 2013-2014 was A$ 601,100,100. Goodman Group has 3 divisions:

Development Management, Fund Management and Property Portfolio (Serôdio, McKee, and

Stuckler. (2018)

3. FINANCIAL INSTRUMENT ANALYSIS

There are several financial instrument analysis which could be used by company to raise the

funds for its business. In case of the Goodman Limited, it has been dealing in the financial

instruments such as letter of the credits, bill of exchanges and forward contract. These

financial instruments are helpful for the company to strengthen its return on capital employed

by keeping the low financial cost of capital. The bill of exchange is used by the company to

allow its debtors to pay their debts later on when they do not have capital to make the

business. This allow organization to strengthen the overall turnover. The letter of the credit is

used by the Goodman Limited to take the loan or finance the particular project by the bank.

Goodman Limited has financed AUD $ 123 million in its business by using the letter of the

credit. Most of the assets such as plants and machinery recorded in the balance sheet of the

company is purchased by using the hire purchase agreement. It is also considered as financial

instrument which is used by company to finance its plants and machinery (Tahir, and Azhar,

2013).

Off balance sheet are the imperative items for the investors to assess the financial health of

the company. In case of the Goodman Limited, company has collateral debt securities in its

balance sheet which is regarded as offshore balance sheet in its books of account. These are

the toxic assets in the books of account of Goodman Limited. These offshore assets are not

inherently intended to the balance sheet and owned by other companies. Goodman Limited

has recorded offshore assets of AUD $ 156 in its balance sheet which is owned and supported

by the other companies with a view to share the risk and return associated with the particular

organic growth, done many acquisitions and mergers, and expanded among European,

American and Asian market (Savytska, 2018).

According to reports, the Group is operating in 16 countries, had 432 properties with69 active

developments going on, as of September 2014. The market capitalization of company stood

at AUD $8.7 billion. Goodman had reported its earning before interest and tax to be $138 m

between 2007 to 2014. The total revenue reported in 2013-2014 was A$ 1,182,800,000, and

net income reported in 2013-2014 was A$ 601,100,100. Goodman Group has 3 divisions:

Development Management, Fund Management and Property Portfolio (Serôdio, McKee, and

Stuckler. (2018)

3. FINANCIAL INSTRUMENT ANALYSIS

There are several financial instrument analysis which could be used by company to raise the

funds for its business. In case of the Goodman Limited, it has been dealing in the financial

instruments such as letter of the credits, bill of exchanges and forward contract. These

financial instruments are helpful for the company to strengthen its return on capital employed

by keeping the low financial cost of capital. The bill of exchange is used by the company to

allow its debtors to pay their debts later on when they do not have capital to make the

business. This allow organization to strengthen the overall turnover. The letter of the credit is

used by the Goodman Limited to take the loan or finance the particular project by the bank.

Goodman Limited has financed AUD $ 123 million in its business by using the letter of the

credit. Most of the assets such as plants and machinery recorded in the balance sheet of the

company is purchased by using the hire purchase agreement. It is also considered as financial

instrument which is used by company to finance its plants and machinery (Tahir, and Azhar,

2013).

Off balance sheet are the imperative items for the investors to assess the financial health of

the company. In case of the Goodman Limited, company has collateral debt securities in its

balance sheet which is regarded as offshore balance sheet in its books of account. These are

the toxic assets in the books of account of Goodman Limited. These offshore assets are not

inherently intended to the balance sheet and owned by other companies. Goodman Limited

has recorded offshore assets of AUD $ 156 in its balance sheet which is owned and supported

by the other companies with a view to share the risk and return associated with the particular

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

project in organization. This type of funding is mostly supported when company is facing

high risk in tis business process and wants to delegate its risk to other organization.

4. Part-A

FIANANCIAL RATIO ANALYSIS

There are several ratio of the company which helps investors to measure the financial

performance of the company and its future business trends (Tappura, Sievänen, Heikkilä, and

Jussila, 2015).

3 key financial ratios that apply to your chosen company.

Profitability ratio

Efficiency ratio

Liquidity ratio

Computation of the financial ratios based on the financial statements

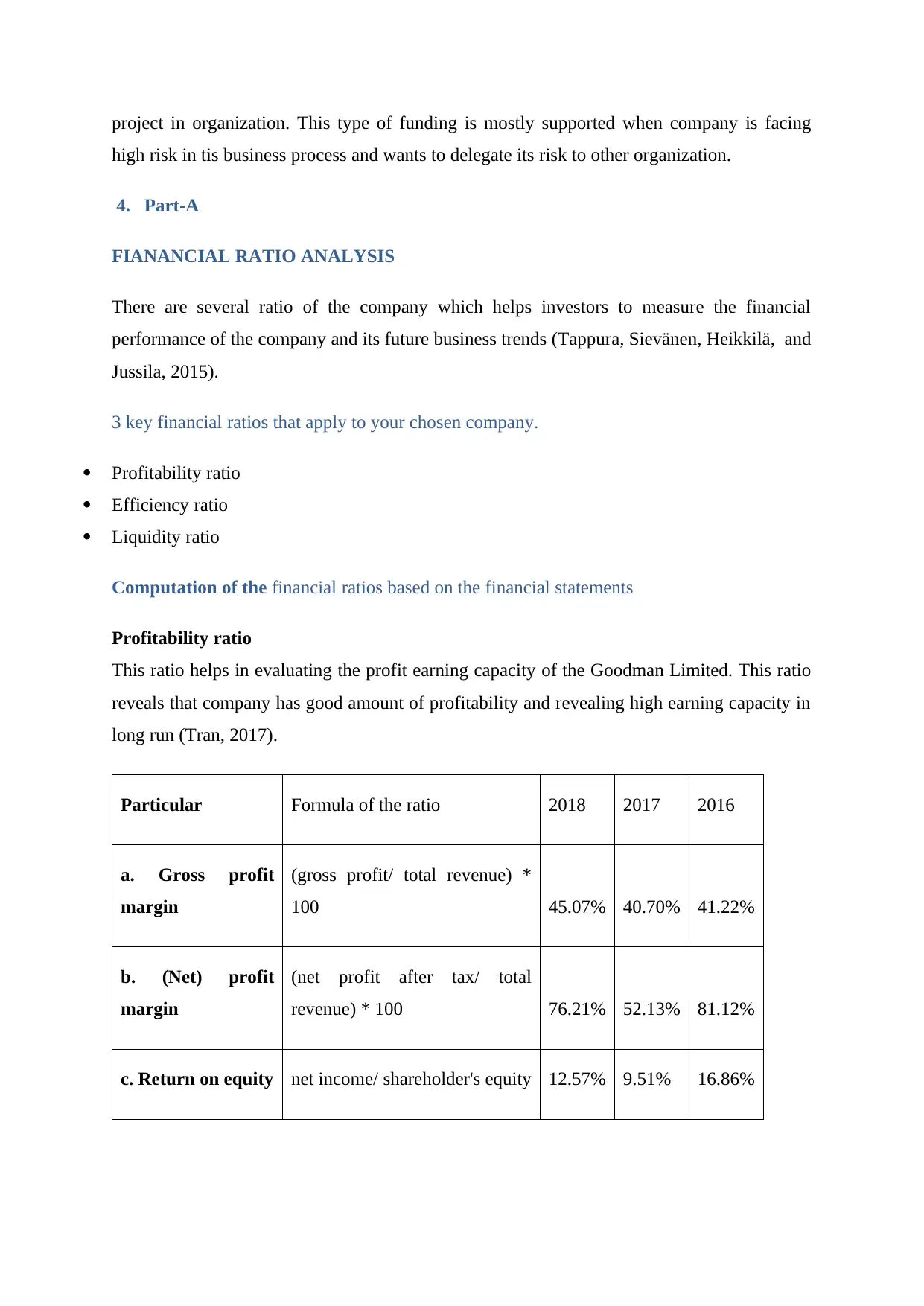

Profitability ratio

This ratio helps in evaluating the profit earning capacity of the Goodman Limited. This ratio

reveals that company has good amount of profitability and revealing high earning capacity in

long run (Tran, 2017).

Particular Formula of the ratio 2018 2017 2016

a. Gross profit

margin

(gross profit/ total revenue) *

100 45.07% 40.70% 41.22%

b. (Net) profit

margin

(net profit after tax/ total

revenue) * 100 76.21% 52.13% 81.12%

c. Return on equity net income/ shareholder's equity 12.57% 9.51% 16.86%

high risk in tis business process and wants to delegate its risk to other organization.

4. Part-A

FIANANCIAL RATIO ANALYSIS

There are several ratio of the company which helps investors to measure the financial

performance of the company and its future business trends (Tappura, Sievänen, Heikkilä, and

Jussila, 2015).

3 key financial ratios that apply to your chosen company.

Profitability ratio

Efficiency ratio

Liquidity ratio

Computation of the financial ratios based on the financial statements

Profitability ratio

This ratio helps in evaluating the profit earning capacity of the Goodman Limited. This ratio

reveals that company has good amount of profitability and revealing high earning capacity in

long run (Tran, 2017).

Particular Formula of the ratio 2018 2017 2016

a. Gross profit

margin

(gross profit/ total revenue) *

100 45.07% 40.70% 41.22%

b. (Net) profit

margin

(net profit after tax/ total

revenue) * 100 76.21% 52.13% 81.12%

c. Return on equity net income/ shareholder's equity 12.57% 9.51% 16.86%

d. Return on assets

ratio net income/ total assets 8.39% 6.2% 10.78%

Interpretation

It is analysed that the gross profit margin of the Goodman Limited has been increasing. The

net profit of the company is showing the 76% earning which is 5% lower since last three year

but showing the high amount of profitability as compared to other rivals. The return on equity

been low as company is offering very less return to its shareholders and plugging most of its

earnings in its business.

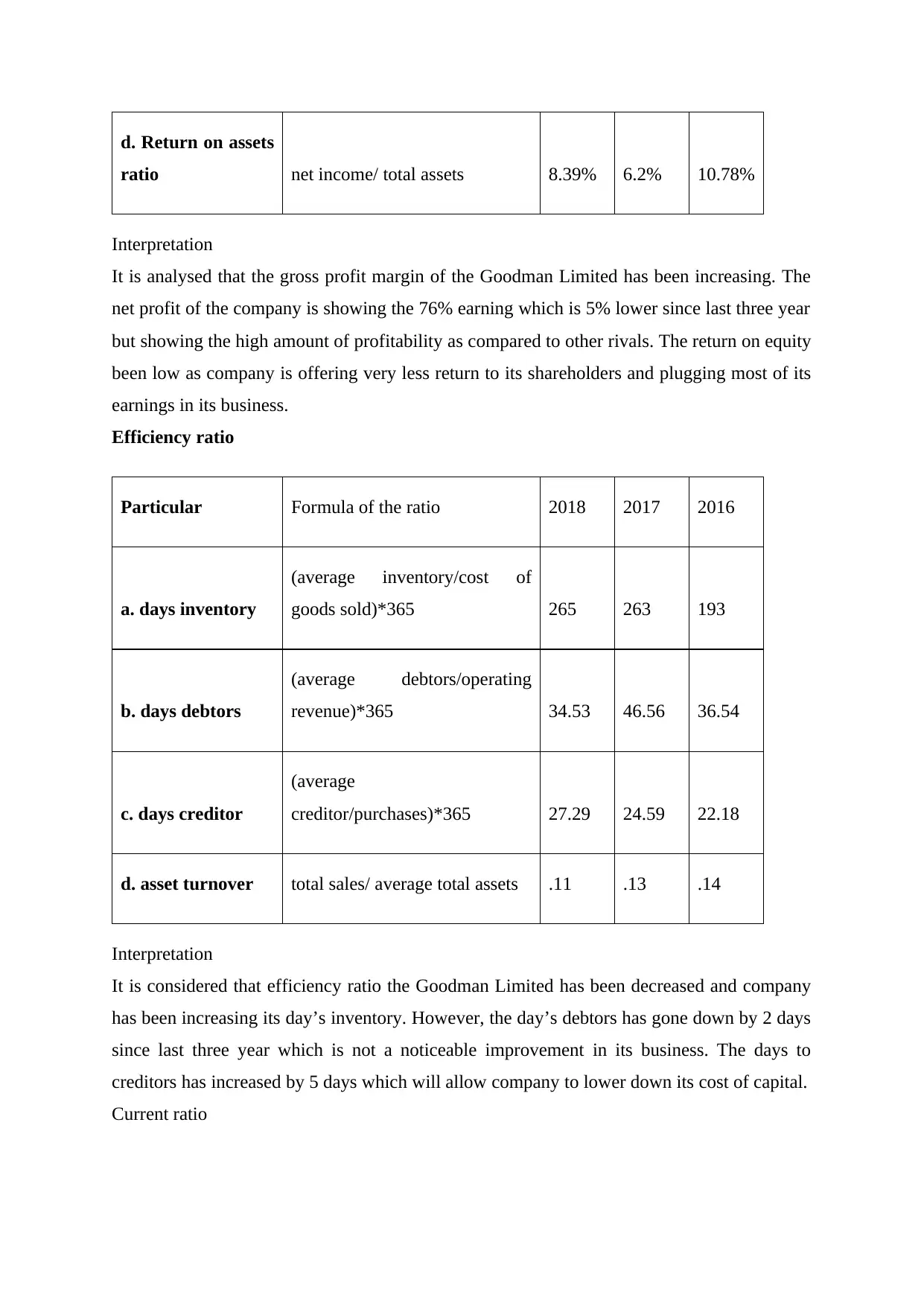

Efficiency ratio

Particular Formula of the ratio 2018 2017 2016

a. days inventory

(average inventory/cost of

goods sold)*365 265 263 193

b. days debtors

(average debtors/operating

revenue)*365 34.53 46.56 36.54

c. days creditor

(average

creditor/purchases)*365 27.29 24.59 22.18

d. asset turnover total sales/ average total assets .11 .13 .14

Interpretation

It is considered that efficiency ratio the Goodman Limited has been decreased and company

has been increasing its day’s inventory. However, the day’s debtors has gone down by 2 days

since last three year which is not a noticeable improvement in its business. The days to

creditors has increased by 5 days which will allow company to lower down its cost of capital.

Current ratio

ratio net income/ total assets 8.39% 6.2% 10.78%

Interpretation

It is analysed that the gross profit margin of the Goodman Limited has been increasing. The

net profit of the company is showing the 76% earning which is 5% lower since last three year

but showing the high amount of profitability as compared to other rivals. The return on equity

been low as company is offering very less return to its shareholders and plugging most of its

earnings in its business.

Efficiency ratio

Particular Formula of the ratio 2018 2017 2016

a. days inventory

(average inventory/cost of

goods sold)*365 265 263 193

b. days debtors

(average debtors/operating

revenue)*365 34.53 46.56 36.54

c. days creditor

(average

creditor/purchases)*365 27.29 24.59 22.18

d. asset turnover total sales/ average total assets .11 .13 .14

Interpretation

It is considered that efficiency ratio the Goodman Limited has been decreased and company

has been increasing its day’s inventory. However, the day’s debtors has gone down by 2 days

since last three year which is not a noticeable improvement in its business. The days to

creditors has increased by 5 days which will allow company to lower down its cost of capital.

Current ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

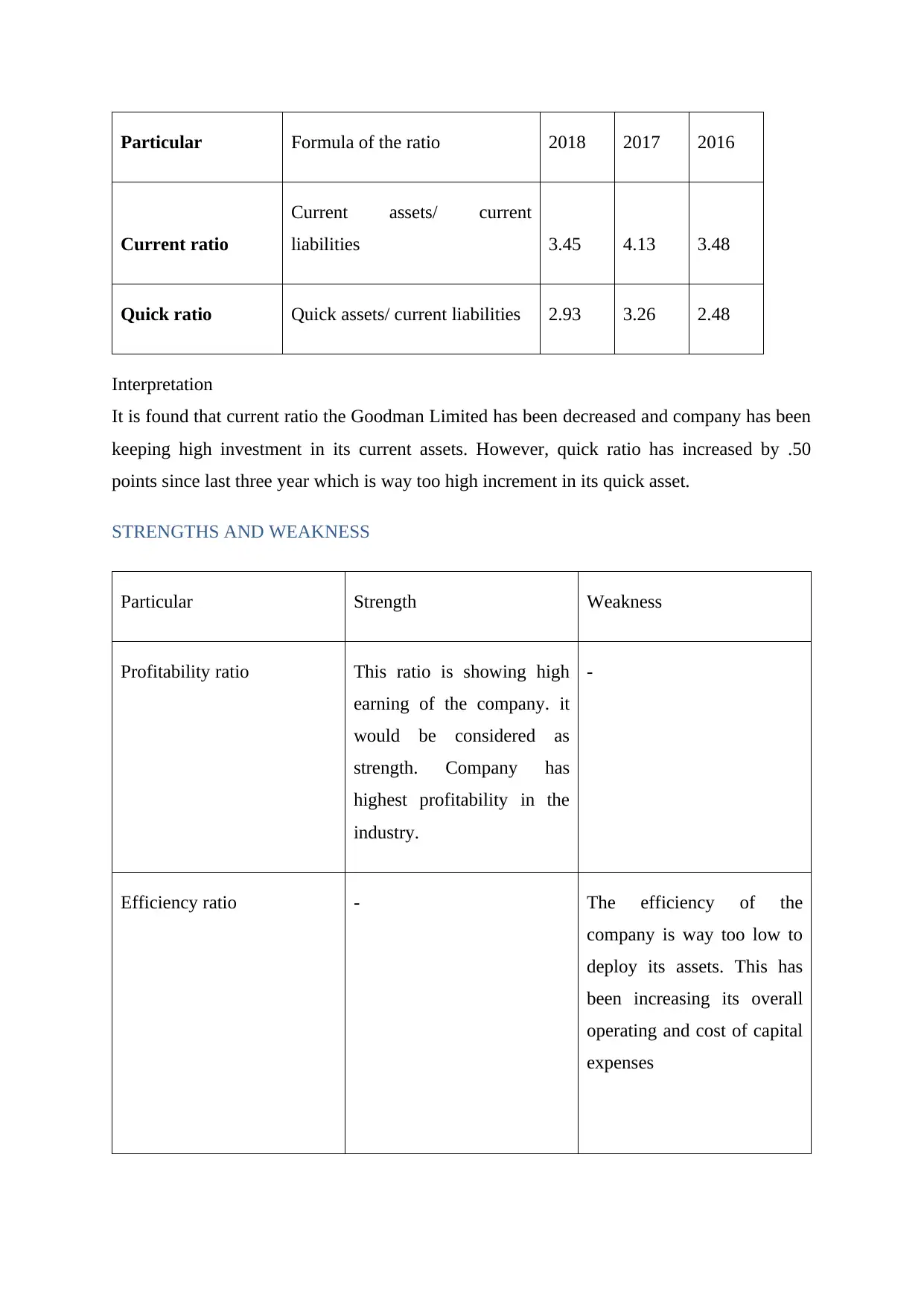

Particular Formula of the ratio 2018 2017 2016

Current ratio

Current assets/ current

liabilities 3.45 4.13 3.48

Quick ratio Quick assets/ current liabilities 2.93 3.26 2.48

Interpretation

It is found that current ratio the Goodman Limited has been decreased and company has been

keeping high investment in its current assets. However, quick ratio has increased by .50

points since last three year which is way too high increment in its quick asset.

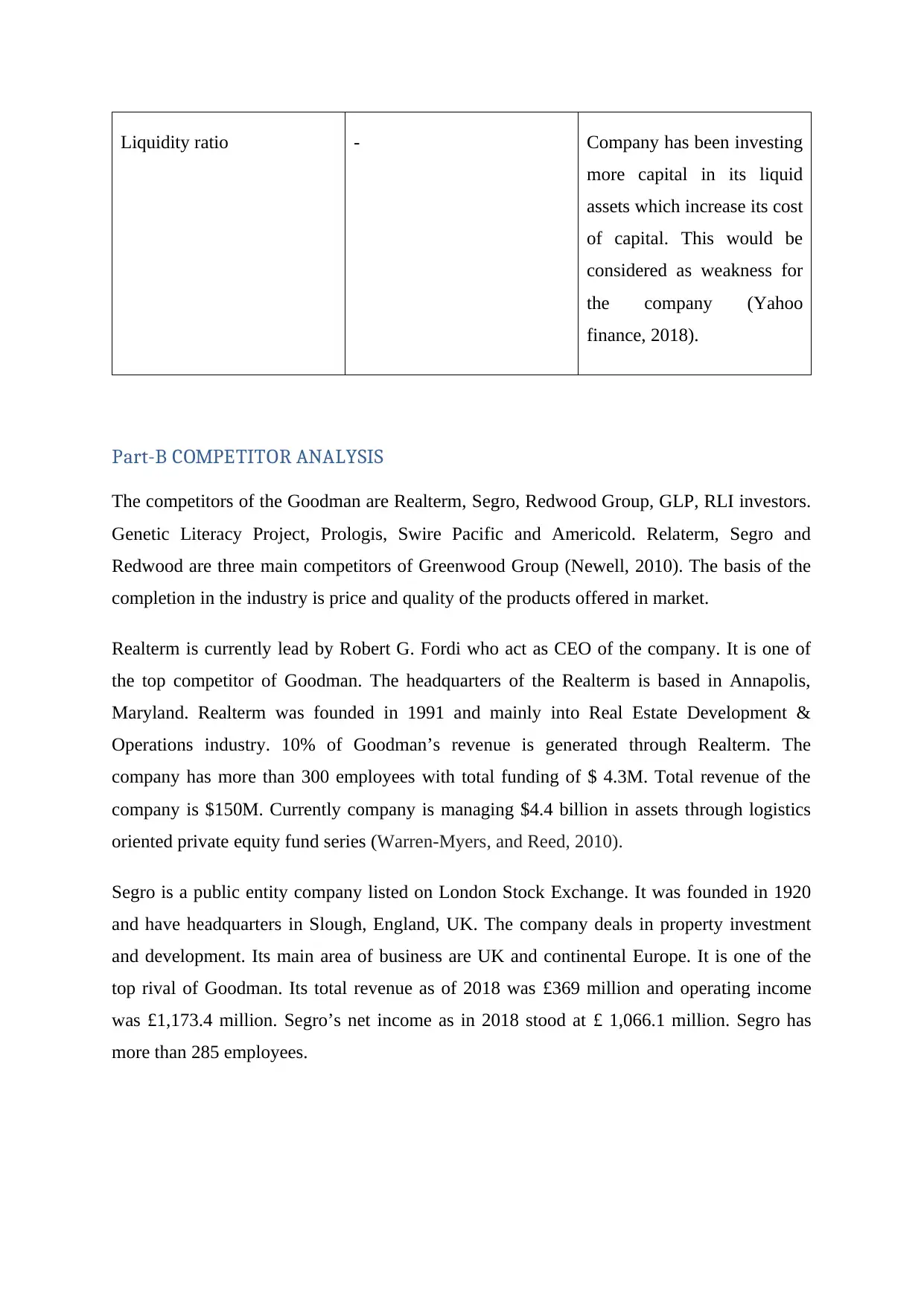

STRENGTHS AND WEAKNESS

Particular Strength Weakness

Profitability ratio This ratio is showing high

earning of the company. it

would be considered as

strength. Company has

highest profitability in the

industry.

-

Efficiency ratio - The efficiency of the

company is way too low to

deploy its assets. This has

been increasing its overall

operating and cost of capital

expenses

Current ratio

Current assets/ current

liabilities 3.45 4.13 3.48

Quick ratio Quick assets/ current liabilities 2.93 3.26 2.48

Interpretation

It is found that current ratio the Goodman Limited has been decreased and company has been

keeping high investment in its current assets. However, quick ratio has increased by .50

points since last three year which is way too high increment in its quick asset.

STRENGTHS AND WEAKNESS

Particular Strength Weakness

Profitability ratio This ratio is showing high

earning of the company. it

would be considered as

strength. Company has

highest profitability in the

industry.

-

Efficiency ratio - The efficiency of the

company is way too low to

deploy its assets. This has

been increasing its overall

operating and cost of capital

expenses

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Liquidity ratio - Company has been investing

more capital in its liquid

assets which increase its cost

of capital. This would be

considered as weakness for

the company (Yahoo

finance, 2018).

Part-B COMPETITOR ANALYSIS

The competitors of the Goodman are Realterm, Segro, Redwood Group, GLP, RLI investors.

Genetic Literacy Project, Prologis, Swire Pacific and Americold. Relaterm, Segro and

Redwood are three main competitors of Greenwood Group (Newell, 2010). The basis of the

completion in the industry is price and quality of the products offered in market.

Realterm is currently lead by Robert G. Fordi who act as CEO of the company. It is one of

the top competitor of Goodman. The headquarters of the Realterm is based in Annapolis,

Maryland. Realterm was founded in 1991 and mainly into Real Estate Development &

Operations industry. 10% of Goodman’s revenue is generated through Realterm. The

company has more than 300 employees with total funding of $ 4.3M. Total revenue of the

company is $150M. Currently company is managing $4.4 billion in assets through logistics

oriented private equity fund series (Warren-Myers, and Reed, 2010).

Segro is a public entity company listed on London Stock Exchange. It was founded in 1920

and have headquarters in Slough, England, UK. The company deals in property investment

and development. Its main area of business are UK and continental Europe. It is one of the

top rival of Goodman. Its total revenue as of 2018 was £369 million and operating income

was £1,173.4 million. Segro’s net income as in 2018 stood at £ 1,066.1 million. Segro has

more than 285 employees.

more capital in its liquid

assets which increase its cost

of capital. This would be

considered as weakness for

the company (Yahoo

finance, 2018).

Part-B COMPETITOR ANALYSIS

The competitors of the Goodman are Realterm, Segro, Redwood Group, GLP, RLI investors.

Genetic Literacy Project, Prologis, Swire Pacific and Americold. Relaterm, Segro and

Redwood are three main competitors of Greenwood Group (Newell, 2010). The basis of the

completion in the industry is price and quality of the products offered in market.

Realterm is currently lead by Robert G. Fordi who act as CEO of the company. It is one of

the top competitor of Goodman. The headquarters of the Realterm is based in Annapolis,

Maryland. Realterm was founded in 1991 and mainly into Real Estate Development &

Operations industry. 10% of Goodman’s revenue is generated through Realterm. The

company has more than 300 employees with total funding of $ 4.3M. Total revenue of the

company is $150M. Currently company is managing $4.4 billion in assets through logistics

oriented private equity fund series (Warren-Myers, and Reed, 2010).

Segro is a public entity company listed on London Stock Exchange. It was founded in 1920

and have headquarters in Slough, England, UK. The company deals in property investment

and development. Its main area of business are UK and continental Europe. It is one of the

top rival of Goodman. Its total revenue as of 2018 was £369 million and operating income

was £1,173.4 million. Segro’s net income as in 2018 stood at £ 1,066.1 million. Segro has

more than 285 employees.

5. FINANCIAL MARKET ANALYSIS

The Realterm, Segro and Redwood Group both are strong competitor in market and

influencing the market with their core competency and cost leadership. It is analysed that the

backward integration of these two companies are way too strong and they are having their

own factory to get the raw material prepared and customized for their business. In addition to

this, most of the business player in this industry, connect with each other through their annual

report and notices in market. All these players keep their business more transparent in market

with a view to strengthen its business outcomes and wining the trust of the stakeholders. It is

analysed that all these companies are having strong influence on each other either through the

core competency, market share and other competitive advantage developed in the market

(Vohs, Vohs, and Baumeister, 2016).

Yes, in order to strengthen the industry output, there is requirement of the government

intervention. This will be related to liberalise the some of the regulations and legal

compliance related to business operation in market. The annual quarter filing, legal

compliance related to the products supply and strategic alliance results to several trouble to

organization. This not only takes lot of business costing to comply with these terms and

conditions but also consume lot of time. It has been analysed that if government by its

intervention lower down these legal compliance then it will save company from the several

business costing and also helps companies to sustain their business in market. In addition to

this, government has also mandate all the CSR activities and sustainable business practice for

the companies to align their interest with the society and environment at large. This align the

interest of the general public with the organizational growth and development (Sayce,

Sundberg, and Clements, 2010).

Goodman Company has faced the related party transaction issue in its business in its last two

year. However, company has kept all the business transactions transparent in its books of

account. In the non-qualified audit report, auditors of the company has also published that

company has complied with all the terms and condition in its books of account. Company

needs to work upon the legal compliance issues of the related party transactions in its

business accounts (Newell, 2010).

The Realterm, Segro and Redwood Group both are strong competitor in market and

influencing the market with their core competency and cost leadership. It is analysed that the

backward integration of these two companies are way too strong and they are having their

own factory to get the raw material prepared and customized for their business. In addition to

this, most of the business player in this industry, connect with each other through their annual

report and notices in market. All these players keep their business more transparent in market

with a view to strengthen its business outcomes and wining the trust of the stakeholders. It is

analysed that all these companies are having strong influence on each other either through the

core competency, market share and other competitive advantage developed in the market

(Vohs, Vohs, and Baumeister, 2016).

Yes, in order to strengthen the industry output, there is requirement of the government

intervention. This will be related to liberalise the some of the regulations and legal

compliance related to business operation in market. The annual quarter filing, legal

compliance related to the products supply and strategic alliance results to several trouble to

organization. This not only takes lot of business costing to comply with these terms and

conditions but also consume lot of time. It has been analysed that if government by its

intervention lower down these legal compliance then it will save company from the several

business costing and also helps companies to sustain their business in market. In addition to

this, government has also mandate all the CSR activities and sustainable business practice for

the companies to align their interest with the society and environment at large. This align the

interest of the general public with the organizational growth and development (Sayce,

Sundberg, and Clements, 2010).

Goodman Company has faced the related party transaction issue in its business in its last two

year. However, company has kept all the business transactions transparent in its books of

account. In the non-qualified audit report, auditors of the company has also published that

company has complied with all the terms and condition in its books of account. Company

needs to work upon the legal compliance issues of the related party transactions in its

business accounts (Newell, 2010).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Goodman Company should set up sustainability legal compliance department in its business

process which will help it to comply with the compliance of the legal business and set ethical

business program in its undertaken business activities (Bond, 2010).

6. FINDING CONCLUSIONS AND RECOMMENDATIONS

The Realterm, Segro and Redwood Group both are strong competitor in market and

influencing the market and in order to compete them company needs to lower down its

business costing to develop core competency.

Goodman Company also needs to lower down its business investment in its current assets so

that available capital could be used to strengthen the business outcomes.

The profitability of the company is way too high therefore, Company should raise most of its

funds by issue of the debts funding.

Due to the strengthen brand image in market, company should focus on setting up alliance

with other organization which will boost its market share in long run.

The ethical business practice of Goodman Company should be supported by triple bottom

line approach (Ball, Lizieri, & MacGregor, 2012).

The gross profit of company is also way too high which should be used to diversify its

business. The return on assets of company has been kept low due to its low efficiency of the

deployed assets.

Currently Goodman is one of the largest business space in Australia along with largest

provider of industrial property which could be used by company to create core competency to

attract more clients in market.

These are the toxic assets in the books of account of Goodman Limited which should be used

by company to strengthen the return on capital employed.

It is concluded that company has maintained strong profitability and will have long term

sustainability in long run.

process which will help it to comply with the compliance of the legal business and set ethical

business program in its undertaken business activities (Bond, 2010).

6. FINDING CONCLUSIONS AND RECOMMENDATIONS

The Realterm, Segro and Redwood Group both are strong competitor in market and

influencing the market and in order to compete them company needs to lower down its

business costing to develop core competency.

Goodman Company also needs to lower down its business investment in its current assets so

that available capital could be used to strengthen the business outcomes.

The profitability of the company is way too high therefore, Company should raise most of its

funds by issue of the debts funding.

Due to the strengthen brand image in market, company should focus on setting up alliance

with other organization which will boost its market share in long run.

The ethical business practice of Goodman Company should be supported by triple bottom

line approach (Ball, Lizieri, & MacGregor, 2012).

The gross profit of company is also way too high which should be used to diversify its

business. The return on assets of company has been kept low due to its low efficiency of the

deployed assets.

Currently Goodman is one of the largest business space in Australia along with largest

provider of industrial property which could be used by company to create core competency to

attract more clients in market.

These are the toxic assets in the books of account of Goodman Limited which should be used

by company to strengthen the return on capital employed.

It is concluded that company has maintained strong profitability and will have long term

sustainability in long run.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Ball, M., Lizieri, C., & MacGregor, B. (2012). The economics of commercial property

markets. Routledge.

Bond, S. (2010). Lessons from the leaders of green designed commercial buildings in

Australia. Pacific Rim Property Research Journal, 16(3), 314-338.

Brigham, E.F. and Ehrhardt, M.C., (2013). Financial management: Theory and practice.

Cengage Learning.

Goodman Company, (2019), annual report, available at https://www.goodman.com/investor-

centre/goodman-group-australia/annual-reports accessed on 22nd May, 2017 from

Newell, G. (2010). Listed property trusts in Australia. Global Trends in Real Estate Finance,

46-63.

Robinson, C. J., and Burnett,, J. (2016). Financial Management Practices: An Exploratory

Study of Capital Budgeting Techniques in the Caribbean Region. Captial Budgeting, 12-55.

Savytska, N. L. (2018). MARKETING STUDY IN THE COMPETITIVE POSITIONS OF

DAIRY INDUSTRY ENTERPRISES. Молодий вчений,, 59(7), 281.

Sayce, S., Sundberg, A., and Clements, B. (2010). Is sustainability reflected in commercial

property prices: an analysis of the evidence base.

Serôdio, P. M., McKee, M., and Stuckler, D. (2018). Coca-Cola–a model of transparency in

research partnerships? A network analysis of Coca-Cola’s research funding (2008–2016).

Public health nutrition, 21(9), pp.1594-1607.

Tahir, R., and Azhar, N. (2013). The adjustment process of female repatriate managers in

Australian and New Zealand (ANZ) companies. Global Business Review, pp.155-167.

Tappura, S., Sievänen, M., Heikkilä, J., and Jussila, . (2015). Accounting. A management

accounting perspective on safety. Safety science,, 71, 151-159.

Tran, T. T. (2017). Corporate social responsibility (CSR) situation in Vietnam. Vietnam:

Rotoulge.

Ball, M., Lizieri, C., & MacGregor, B. (2012). The economics of commercial property

markets. Routledge.

Bond, S. (2010). Lessons from the leaders of green designed commercial buildings in

Australia. Pacific Rim Property Research Journal, 16(3), 314-338.

Brigham, E.F. and Ehrhardt, M.C., (2013). Financial management: Theory and practice.

Cengage Learning.

Goodman Company, (2019), annual report, available at https://www.goodman.com/investor-

centre/goodman-group-australia/annual-reports accessed on 22nd May, 2017 from

Newell, G. (2010). Listed property trusts in Australia. Global Trends in Real Estate Finance,

46-63.

Robinson, C. J., and Burnett,, J. (2016). Financial Management Practices: An Exploratory

Study of Capital Budgeting Techniques in the Caribbean Region. Captial Budgeting, 12-55.

Savytska, N. L. (2018). MARKETING STUDY IN THE COMPETITIVE POSITIONS OF

DAIRY INDUSTRY ENTERPRISES. Молодий вчений,, 59(7), 281.

Sayce, S., Sundberg, A., and Clements, B. (2010). Is sustainability reflected in commercial

property prices: an analysis of the evidence base.

Serôdio, P. M., McKee, M., and Stuckler, D. (2018). Coca-Cola–a model of transparency in

research partnerships? A network analysis of Coca-Cola’s research funding (2008–2016).

Public health nutrition, 21(9), pp.1594-1607.

Tahir, R., and Azhar, N. (2013). The adjustment process of female repatriate managers in

Australian and New Zealand (ANZ) companies. Global Business Review, pp.155-167.

Tappura, S., Sievänen, M., Heikkilä, J., and Jussila, . (2015). Accounting. A management

accounting perspective on safety. Safety science,, 71, 151-159.

Tran, T. T. (2017). Corporate social responsibility (CSR) situation in Vietnam. Vietnam:

Rotoulge.

Vohs, Vohs, K., and Baumeister, R. (2016). Handbook of self-regulation, theory, research,

and applications. Guiltford publications

Warren-Myers, G., and Reed, R. (2010). The challenges of identifying and examining links

between sustainability and value: evidence from Australia and New Zealand. Journal of

Sustainable Real Estate, 2(1), 201-220.

Yahoo finance, (2018), Goodman Company financials Retrieved on Available at

https://in.finance.yahoo.com/ accessed on 22nd May, 2017

and applications. Guiltford publications

Warren-Myers, G., and Reed, R. (2010). The challenges of identifying and examining links

between sustainability and value: evidence from Australia and New Zealand. Journal of

Sustainable Real Estate, 2(1), 201-220.

Yahoo finance, (2018), Goodman Company financials Retrieved on Available at

https://in.finance.yahoo.com/ accessed on 22nd May, 2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.