Managing Financial Resources and Decisions for Clarion Antiques Ltd.

VerifiedAdded on 2020/01/28

|20

|5803

|38

Report

AI Summary

This report provides a comprehensive analysis of financial resource management and decision-making for Clarion Antiques Ltd., a London-based antique items provider seeking expansion. It explores various financial sources, including internal (personal savings, retained earnings, sale of assets) and external (loans, borrowing from other businesses), evaluating their implications and suitability for the company's expansion plans. The report delves into the cost of financial sources (dividends, interest, taxes), financial planning techniques (budgeting, implications of inadequate finance, over-trading), and the roles of partners, venture capitalists, and finance brokers in decision-making. It further examines the impact of financial decisions on financial statements and utilizes ratio analysis to interpret the company's current financial performance. Additionally, the report includes a cash budget analysis, capital budgeting methods, and an overview of financial statement elements, offering valuable insights into Clarion Antiques' financial strategies.

Managing Financial

Resources and

Decisions

1

Resources and

Decisions

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Financial sources available to different businesses...............................................................3

1.2 Implications for utilizing internal and external sources of finance........................................5

1.3 Most suitable sources of finance for Clarion-antiques-limited..............................................6

Task 2...............................................................................................................................................6

2.1 Cost of financial sources........................................................................................................6

2.2 Significance of financial planning for Clarion-antiques-limited regarding fund allocation..7

2.3 Information that is required for decision making on financing.............................................7

2.4 Impact on financial statements of Clarion-antiques-limited..................................................8

TASK 3............................................................................................................................................9

3.1 Cash budget for Clariton Antiques Limited, its analysis and suggestions in order to

overcome shortfalls......................................................................................................................9

3.2 Ways for assessing cost of each unit and prices as well......................................................10

3.3 Different methods of capital budgeting for taking investment decisions............................12

task 4..............................................................................................................................................14

4.1 Key elements of financial statements..................................................................................14

4.2 Format used by Clarion-antiques-limited to present financial statements with sole trader or

partnership or both.....................................................................................................................15

4.3 Interpretation of current financial statement of Clarion-antiques-limited through ratio

analysis.......................................................................................................................................16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

1.1 Financial sources available to different businesses...............................................................3

1.2 Implications for utilizing internal and external sources of finance........................................5

1.3 Most suitable sources of finance for Clarion-antiques-limited..............................................6

Task 2...............................................................................................................................................6

2.1 Cost of financial sources........................................................................................................6

2.2 Significance of financial planning for Clarion-antiques-limited regarding fund allocation..7

2.3 Information that is required for decision making on financing.............................................7

2.4 Impact on financial statements of Clarion-antiques-limited..................................................8

TASK 3............................................................................................................................................9

3.1 Cash budget for Clariton Antiques Limited, its analysis and suggestions in order to

overcome shortfalls......................................................................................................................9

3.2 Ways for assessing cost of each unit and prices as well......................................................10

3.3 Different methods of capital budgeting for taking investment decisions............................12

task 4..............................................................................................................................................14

4.1 Key elements of financial statements..................................................................................14

4.2 Format used by Clarion-antiques-limited to present financial statements with sole trader or

partnership or both.....................................................................................................................15

4.3 Interpretation of current financial statement of Clarion-antiques-limited through ratio

analysis.......................................................................................................................................16

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

2

INTRODUCTION

Financial management organization is important for the entire business organization's

development. It includes different sources and monetary tools for proper fund allocation. The

present report is based on understanding financial resource management and making decisions

for Clariton Antiques Ltd. It is one of the largest antique items provider enterprises of London

which is looking for its expansion by operating new branches. In this regard, various internal and

external financial sources for allocating fund are also determined. However, financial planning

and decision making for the systematic financial management is to be recognized. In addition to

this, cash budget is prepared and pricing decision is made by performing relevant calculation.

Along with this, elements of financial statements are discussed and comparison of business

performance is carried out by using ratio analysis method.

TASK 1

1.1 Financial sources available to different businesses

Unincorporated business: - These organizations are not registered in company house. In

accordance to this, decisions regarding business operations are taken by the company's owner

and manager. Under these entities, partnership, sole trader and private limited companies

prepare strategies set by an individual. For instance; Clariton Antiues Ltd is one of the great

examples of unincorporated business which is handled and operated by its four partners.

However, unincorporated organizations are under monitor of private individual which are not

registered in the company’s house of UK (Morley and et.al., 2016). In this regard, decisions

including financial and non-monetary are made by the company's owner to operate the

organization effectively. Thus, unincorporated business entities are operated by the private

individuals to maintain good reputation and enhancing profitability of the firm.

Incorporated business: - These are those organizations that are registered in company's

house. Therefore, these companies have to follow rules and regulations provided by the

Company house of UK. Under these businesses, there are some criteria and after passing the

same any firm can be registered as company. Under incorporated business, various entities of

UKlike Tesco, Sainsbury etc. In addition to this, there are government intervention presents for

supplementing goods and producing qualitative services of the firm. However, incorporated

3

Financial management organization is important for the entire business organization's

development. It includes different sources and monetary tools for proper fund allocation. The

present report is based on understanding financial resource management and making decisions

for Clariton Antiques Ltd. It is one of the largest antique items provider enterprises of London

which is looking for its expansion by operating new branches. In this regard, various internal and

external financial sources for allocating fund are also determined. However, financial planning

and decision making for the systematic financial management is to be recognized. In addition to

this, cash budget is prepared and pricing decision is made by performing relevant calculation.

Along with this, elements of financial statements are discussed and comparison of business

performance is carried out by using ratio analysis method.

TASK 1

1.1 Financial sources available to different businesses

Unincorporated business: - These organizations are not registered in company house. In

accordance to this, decisions regarding business operations are taken by the company's owner

and manager. Under these entities, partnership, sole trader and private limited companies

prepare strategies set by an individual. For instance; Clariton Antiues Ltd is one of the great

examples of unincorporated business which is handled and operated by its four partners.

However, unincorporated organizations are under monitor of private individual which are not

registered in the company’s house of UK (Morley and et.al., 2016). In this regard, decisions

including financial and non-monetary are made by the company's owner to operate the

organization effectively. Thus, unincorporated business entities are operated by the private

individuals to maintain good reputation and enhancing profitability of the firm.

Incorporated business: - These are those organizations that are registered in company's

house. Therefore, these companies have to follow rules and regulations provided by the

Company house of UK. Under these businesses, there are some criteria and after passing the

same any firm can be registered as company. Under incorporated business, various entities of

UKlike Tesco, Sainsbury etc. In addition to this, there are government intervention presents for

supplementing goods and producing qualitative services of the firm. However, incorporated

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Massingham, P., 2014.business entities set target in increasing profitability in business. Social

welfare is another target of the firms which is fulfilled by performing the CSR activities. Thus, it

can be said that companies have multiple targets in their business (Massingham, 2014).

Internal financial sources

These include reserve fund and earned profit for allocating fund regarding expansion of

Clariton Antiques Ltd. However, various tools and components can understand as below:-

Personal saving: - Partners of Clariton Ltd can use their personal savings for expanding

the entity. In this regard, saved money in bank and other financial institutions can be utilized on

enlargement of organization by establishing new branches (Staddon, 2016). It is considered as an

effective source but it impacts financial position of individual.

Retained Earnings: - It is determined as net income company earned. Therefore,

reserved fund and gained profit can be used for allocating the fund regarding operating new

branches in Birmingham. Including this, it is also considered as risky for further business

operations due to decreasing in the liquidity assets of organization.

Sale of assets: - It is a source from where some times firm arrange finance to fund their

operations. In this regard, old and wastage machinery equipment are sold out and in this way

fund is obtained from this source of finance (Hart and et.al., 2014).

External sources for allocating fund

These are those sources that can be allocated from different financial institutions Ican

express as:-

Long term loan: - Taking loan from financial institutions such as bank and other

institutions that provide loan facilities. In this regard, high level of finance can be obtained

through this source that is usable for enlargement of Clariton Antiques Ltd by establishing new

branches (Monteiro, 2016). However, it impacts the financial position of organization. In this

accordance to this, interest rates over loan services affect economic structure of the firm.

Borrow money from other business entities: - According to set targets, for gaining fund

can be obtained through taking help from other organizations. It remains usable to allocate large

scale fund for operating new branches. However, there is implication determined for presenting

monetary profile of Clarion-antiques-limited. Thus, company must focus on this tool for taking

advantage of loan from other businesses (Laot, 2016).

4

welfare is another target of the firms which is fulfilled by performing the CSR activities. Thus, it

can be said that companies have multiple targets in their business (Massingham, 2014).

Internal financial sources

These include reserve fund and earned profit for allocating fund regarding expansion of

Clariton Antiques Ltd. However, various tools and components can understand as below:-

Personal saving: - Partners of Clariton Ltd can use their personal savings for expanding

the entity. In this regard, saved money in bank and other financial institutions can be utilized on

enlargement of organization by establishing new branches (Staddon, 2016). It is considered as an

effective source but it impacts financial position of individual.

Retained Earnings: - It is determined as net income company earned. Therefore,

reserved fund and gained profit can be used for allocating the fund regarding operating new

branches in Birmingham. Including this, it is also considered as risky for further business

operations due to decreasing in the liquidity assets of organization.

Sale of assets: - It is a source from where some times firm arrange finance to fund their

operations. In this regard, old and wastage machinery equipment are sold out and in this way

fund is obtained from this source of finance (Hart and et.al., 2014).

External sources for allocating fund

These are those sources that can be allocated from different financial institutions Ican

express as:-

Long term loan: - Taking loan from financial institutions such as bank and other

institutions that provide loan facilities. In this regard, high level of finance can be obtained

through this source that is usable for enlargement of Clariton Antiques Ltd by establishing new

branches (Monteiro, 2016). However, it impacts the financial position of organization. In this

accordance to this, interest rates over loan services affect economic structure of the firm.

Borrow money from other business entities: - According to set targets, for gaining fund

can be obtained through taking help from other organizations. It remains usable to allocate large

scale fund for operating new branches. However, there is implication determined for presenting

monetary profile of Clarion-antiques-limited. Thus, company must focus on this tool for taking

advantage of loan from other businesses (Laot, 2016).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

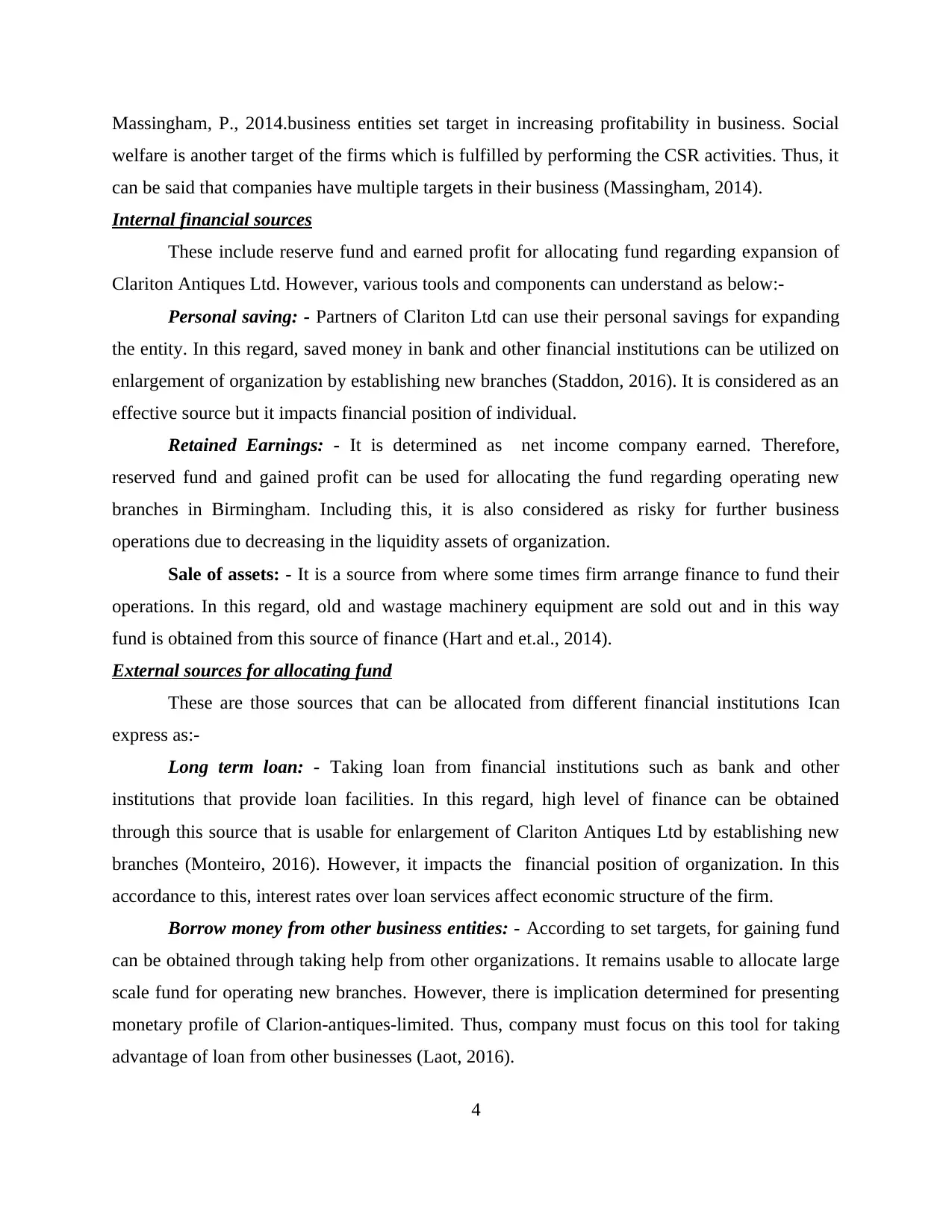

1.2 Implications for utilizing internal and external sources of finance

As per the given case scenario, Clarion-antiques-limited is looking for expanding the

organization by operating new branch in Birmingham. Therefore, it needs to allocate £0.5

million. Implications of sources of finance are given below.

Sources Financial

implications

Legal implication Dilution of control

Personal savings Lack of personal

saving is obtained

No legal formalities It is risky to utilize

personal money for

further business

operations.

Retained earning There are no financial

implications because

retained earnings are a

part of profits and

there is no cost of

capital of same.

Less formalities Control of existing

shareholders will

remain unchanged.

Sale of assets Selling of wastage and

old machinery

equipment affects the

monetary structure of

organization.

Less legal implications Same of retained

earnings.

Long term loan Affects finance of

company due to

fluctuations in interest

rates.

Required lots of legal

formalities

Same of retained

earnings.

Borrow money from

other business

Less financial

implications for taking

No legal formalities. Same of retained

earnings.

5

As per the given case scenario, Clarion-antiques-limited is looking for expanding the

organization by operating new branch in Birmingham. Therefore, it needs to allocate £0.5

million. Implications of sources of finance are given below.

Sources Financial

implications

Legal implication Dilution of control

Personal savings Lack of personal

saving is obtained

No legal formalities It is risky to utilize

personal money for

further business

operations.

Retained earning There are no financial

implications because

retained earnings are a

part of profits and

there is no cost of

capital of same.

Less formalities Control of existing

shareholders will

remain unchanged.

Sale of assets Selling of wastage and

old machinery

equipment affects the

monetary structure of

organization.

Less legal implications Same of retained

earnings.

Long term loan Affects finance of

company due to

fluctuations in interest

rates.

Required lots of legal

formalities

Same of retained

earnings.

Borrow money from

other business

Less financial

implications for taking

No legal formalities. Same of retained

earnings.

5

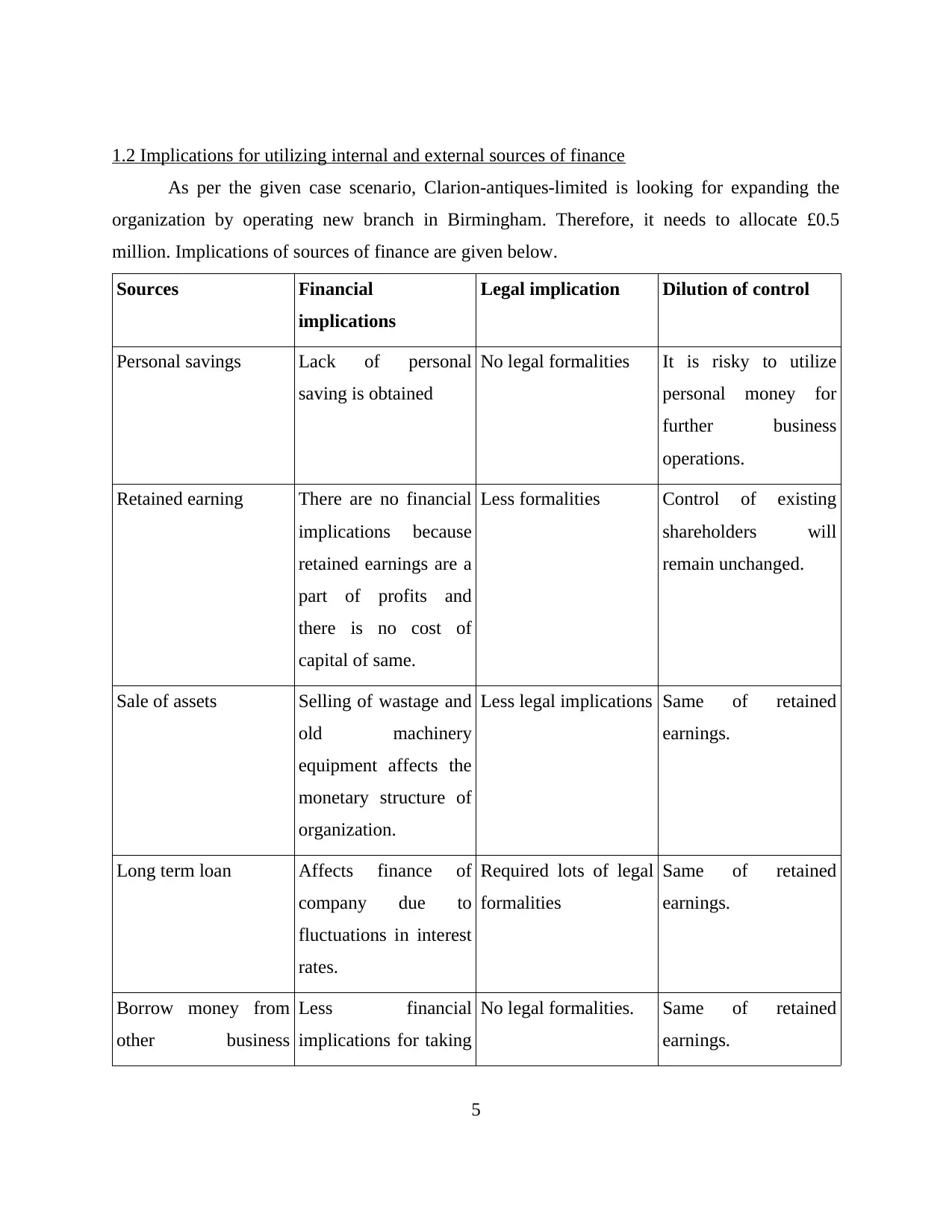

organizations advantage of

borrowing money due

to less percentage of

interest charged on

debt by the business

friends.

1.3 Most suitable sources of finance for Clarion-antiques-limited

As per the given case scenario, partners of Clarion-antiques-limited are looking for

allocating £0.5 million which is huge amount. Therefore, determining appropriate source is

essential for expansion of firm. In accordance to this, sources can be critically recognized for

effective fund allocation can obtain as below:-

Above mentioned sources are valuable for fund allocation to expand Clarion-antiques-

limited effectively. For obtaining adequate fund, partners of the company critically analyze all

internal and external sources of the monetary resources. Further, they choose appropriate sources

such as; taking loan from bank and financial institutions which is useful for allocating £0.5

million (Koropp and et.al., 2014). Including this, retained earnings and borrowing money from

other businesses are considered as valuable for fund allocation which is helpful in expanding

Clariton Ltd through operating new branches. Retained earnings is assumed appropriate source

of finance because there is no cost of capital of same. There is less cost of bank loan and due to

this reason it is also considered as an appropriate alternative for the business firm. Thus,

organization can utilize high level of fund from these sources which is useful in expanding the

entity by operating other new branches.

TASK 2

2.1 Cost of financial sources

a) Dividends:- According to case scenario, We Finance Ltd approaches to help for fund

allocation regarding enlargement of Clarion-antiques-limited. Therefore, venture capital is high

that impacts on dividend to paid. Through this analysis, it is determined that dividend rate is

higher than interest that affects cost of financial sources (Fahy, O'Brien and Poti, 2016).

6

borrowing money due

to less percentage of

interest charged on

debt by the business

friends.

1.3 Most suitable sources of finance for Clarion-antiques-limited

As per the given case scenario, partners of Clarion-antiques-limited are looking for

allocating £0.5 million which is huge amount. Therefore, determining appropriate source is

essential for expansion of firm. In accordance to this, sources can be critically recognized for

effective fund allocation can obtain as below:-

Above mentioned sources are valuable for fund allocation to expand Clarion-antiques-

limited effectively. For obtaining adequate fund, partners of the company critically analyze all

internal and external sources of the monetary resources. Further, they choose appropriate sources

such as; taking loan from bank and financial institutions which is useful for allocating £0.5

million (Koropp and et.al., 2014). Including this, retained earnings and borrowing money from

other businesses are considered as valuable for fund allocation which is helpful in expanding

Clariton Ltd through operating new branches. Retained earnings is assumed appropriate source

of finance because there is no cost of capital of same. There is less cost of bank loan and due to

this reason it is also considered as an appropriate alternative for the business firm. Thus,

organization can utilize high level of fund from these sources which is useful in expanding the

entity by operating other new branches.

TASK 2

2.1 Cost of financial sources

a) Dividends:- According to case scenario, We Finance Ltd approaches to help for fund

allocation regarding enlargement of Clarion-antiques-limited. Therefore, venture capital is high

that impacts on dividend to paid. Through this analysis, it is determined that dividend rate is

higher than interest that affects cost of financial sources (Fahy, O'Brien and Poti, 2016).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

b) Interest:- As Clarion-antiques-limited is looking for taking advantage of bank loan. In

this regard, it is essential for organization to focus on interest rate. It is considered that

fluctuations in interest rate affects economic performance of firm. Thus, for obtaining fund, firm

needed to checking out interest rate for taking loan services provided by bank.

c) Tax:- It is related to government policy and income tax rate that impacts on financial

position of Clariton Ltd. According to given table, it is analyzed that in 2015, company paid 13

million while in 2016, expense on tax is 14 million. Therfeore, financial position of firm is

reduced. It is considered as basis for requirement of fund due to paying money for government

policy plans (Chhatwal and et.al., 2015).

2.2 Significance of financial planning for Clarion-antiques-limited regarding fund allocation

For establishing new branches of Clariton, financial planning is required that includes

following tools such as:-

a) Budgeting:- It is technique for forecasting and decision making related to further

business activities. In accordance to this, partners of Clariton prepare budget for fund allocation

to start up new branches of company (Garnier and et. al., 2015). Therefore, budget is useful for

implementing business activities and enhancing qualitative services of firm.

b) Implications of failure to finance adequately:- There are several barriers occur for

proper financing. Thus, for recovering obstacles financial planning is made by partners of

Clariton Ltd. In accordance to this, several planning and decision making is implemented to

reduce issue of inadequate fund. However, financial planning is useful for getting sufficient fund

that is crucial for enlargement of business organization.

c) Over-trading:- The term is related to creating balance of trading for adequate fund

allocation. Hence, financial planning is essential for reducing over trading of antique items of

Clariton Ltd (Berman, 2015). However, it is beneficial for getting economic growth of firm. It is

determined that effective financial planning is helpful for proper trading.

2.3 Information that is required for decision making on financing

a) Partners:- Financing for proper fund can be obtained by partners' important role. In

this regard, partners of Clariton Antiques Ltd make decision regarding fund allocation. Including

this, they share profit earned by company as per terms and conditions. However, planning and

decision making regarding production and distribution as well qualitative services provided by

7

this regard, it is essential for organization to focus on interest rate. It is considered that

fluctuations in interest rate affects economic performance of firm. Thus, for obtaining fund, firm

needed to checking out interest rate for taking loan services provided by bank.

c) Tax:- It is related to government policy and income tax rate that impacts on financial

position of Clariton Ltd. According to given table, it is analyzed that in 2015, company paid 13

million while in 2016, expense on tax is 14 million. Therfeore, financial position of firm is

reduced. It is considered as basis for requirement of fund due to paying money for government

policy plans (Chhatwal and et.al., 2015).

2.2 Significance of financial planning for Clarion-antiques-limited regarding fund allocation

For establishing new branches of Clariton, financial planning is required that includes

following tools such as:-

a) Budgeting:- It is technique for forecasting and decision making related to further

business activities. In accordance to this, partners of Clariton prepare budget for fund allocation

to start up new branches of company (Garnier and et. al., 2015). Therefore, budget is useful for

implementing business activities and enhancing qualitative services of firm.

b) Implications of failure to finance adequately:- There are several barriers occur for

proper financing. Thus, for recovering obstacles financial planning is made by partners of

Clariton Ltd. In accordance to this, several planning and decision making is implemented to

reduce issue of inadequate fund. However, financial planning is useful for getting sufficient fund

that is crucial for enlargement of business organization.

c) Over-trading:- The term is related to creating balance of trading for adequate fund

allocation. Hence, financial planning is essential for reducing over trading of antique items of

Clariton Ltd (Berman, 2015). However, it is beneficial for getting economic growth of firm. It is

determined that effective financial planning is helpful for proper trading.

2.3 Information that is required for decision making on financing

a) Partners:- Financing for proper fund can be obtained by partners' important role. In

this regard, partners of Clariton Antiques Ltd make decision regarding fund allocation. Including

this, they share profit earned by company as per terms and conditions. However, planning and

decision making regarding production and distribution as well qualitative services provided by

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company are handled by these stakeholders (Sullivan and et.al., 2014). Thus, partners of

company plan and evaluate business performance as well share profit and loss achieved by

organization.

b) Venture Capitalist:- According to given scenario, We Finance Ltd approaches

Clariton Antique Ltd for adequate fund allocation. Thus, venture capitalist is considered as an

approach for getting fund and expand entity. However, taking help form other business

organization remains as great technique for Clarion-antiques-limited regarding funding and

establishing new branches of firm (Megginson, Ullah and Wei, 2014).

c) Finance broker:- These are those individuals who remains helpful for financial

support. As per the given table, there is broker charged 1% interest over taking loan for

allocating fund. Therefore, it is required for partners of Clariton to focus on interest rates that

impacts on economic position of organization. Thus, financial broker plays important role in

economic support and stability of organization.

2.4 Impact on financial statements of Clarion-antiques-limited

Partners and manager of Clariton Ltd identify and forecast financial statement if it take

help from venture capitalist and finance broker can explain as below:-

a) Venture capitalist:- For fund allocation of regarding expansion of business

organization We Finance Ltd proposed help as venture capitalist. Under which, it is essential to

concentrate on capitalist business profile and its activities (Hou and et.al., 2013). As per given

scenario, it is determined that venture capital organization offers 20% stake for helping needed

entity. However, it remains as large amount for expansion and enhancing qualitative services of

firm. Thus, partners can take decision for fund allocation regarding venture capitalist effectively.

It affects economic structure of firm that is useful for expansion of entity.

b) Finance broker:- For taking advantage of loan service from bank, it is determined

that broker charges 1% interests. In addition to this, bank charges 2% interest for loan over 10

years. Thus, overall interest obtained is 3% for taking loan more effectively. However,

organization requires to focus on finance broker to enlarge Clariton Ltd. In this regard, it is

essential to concentrate on broker's role for fund allocation. It impacts on financial statement of

organization for loaning and other services (Petruzzo and et.al., 2015).

8

company plan and evaluate business performance as well share profit and loss achieved by

organization.

b) Venture Capitalist:- According to given scenario, We Finance Ltd approaches

Clariton Antique Ltd for adequate fund allocation. Thus, venture capitalist is considered as an

approach for getting fund and expand entity. However, taking help form other business

organization remains as great technique for Clarion-antiques-limited regarding funding and

establishing new branches of firm (Megginson, Ullah and Wei, 2014).

c) Finance broker:- These are those individuals who remains helpful for financial

support. As per the given table, there is broker charged 1% interest over taking loan for

allocating fund. Therefore, it is required for partners of Clariton to focus on interest rates that

impacts on economic position of organization. Thus, financial broker plays important role in

economic support and stability of organization.

2.4 Impact on financial statements of Clarion-antiques-limited

Partners and manager of Clariton Ltd identify and forecast financial statement if it take

help from venture capitalist and finance broker can explain as below:-

a) Venture capitalist:- For fund allocation of regarding expansion of business

organization We Finance Ltd proposed help as venture capitalist. Under which, it is essential to

concentrate on capitalist business profile and its activities (Hou and et.al., 2013). As per given

scenario, it is determined that venture capital organization offers 20% stake for helping needed

entity. However, it remains as large amount for expansion and enhancing qualitative services of

firm. Thus, partners can take decision for fund allocation regarding venture capitalist effectively.

It affects economic structure of firm that is useful for expansion of entity.

b) Finance broker:- For taking advantage of loan service from bank, it is determined

that broker charges 1% interests. In addition to this, bank charges 2% interest for loan over 10

years. Thus, overall interest obtained is 3% for taking loan more effectively. However,

organization requires to focus on finance broker to enlarge Clariton Ltd. In this regard, it is

essential to concentrate on broker's role for fund allocation. It impacts on financial statement of

organization for loaning and other services (Petruzzo and et.al., 2015).

8

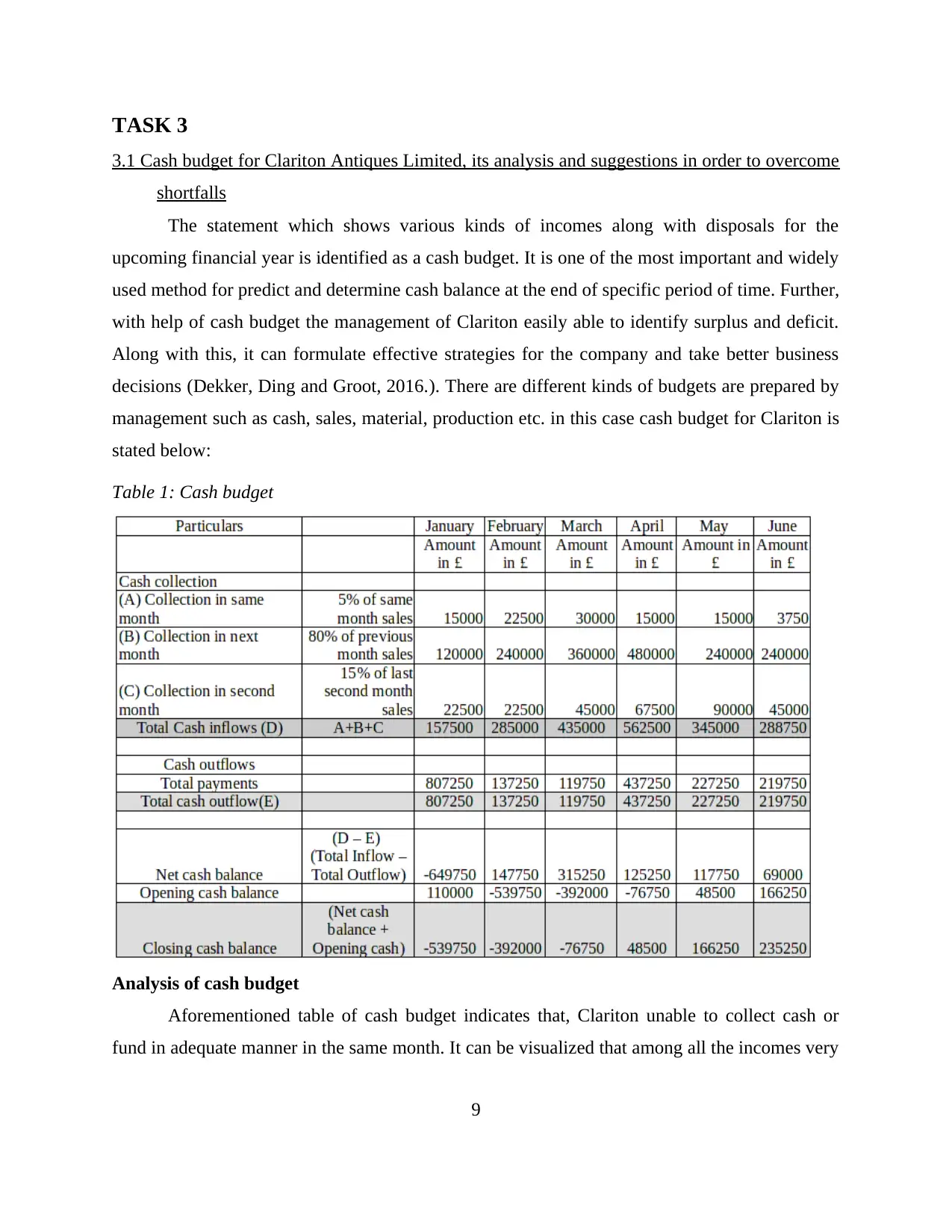

TASK 3

3.1 Cash budget for Clariton Antiques Limited, its analysis and suggestions in order to overcome

shortfalls

The statement which shows various kinds of incomes along with disposals for the

upcoming financial year is identified as a cash budget. It is one of the most important and widely

used method for predict and determine cash balance at the end of specific period of time. Further,

with help of cash budget the management of Clariton easily able to identify surplus and deficit.

Along with this, it can formulate effective strategies for the company and take better business

decisions (Dekker, Ding and Groot, 2016.). There are different kinds of budgets are prepared by

management such as cash, sales, material, production etc. in this case cash budget for Clariton is

stated below:

Table 1: Cash budget

Analysis of cash budget

Aforementioned table of cash budget indicates that, Clariton unable to collect cash or

fund in adequate manner in the same month. It can be visualized that among all the incomes very

9

3.1 Cash budget for Clariton Antiques Limited, its analysis and suggestions in order to overcome

shortfalls

The statement which shows various kinds of incomes along with disposals for the

upcoming financial year is identified as a cash budget. It is one of the most important and widely

used method for predict and determine cash balance at the end of specific period of time. Further,

with help of cash budget the management of Clariton easily able to identify surplus and deficit.

Along with this, it can formulate effective strategies for the company and take better business

decisions (Dekker, Ding and Groot, 2016.). There are different kinds of budgets are prepared by

management such as cash, sales, material, production etc. in this case cash budget for Clariton is

stated below:

Table 1: Cash budget

Analysis of cash budget

Aforementioned table of cash budget indicates that, Clariton unable to collect cash or

fund in adequate manner in the same month. It can be visualized that among all the incomes very

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

low cash is generated in same month due to increasing bank overdrafts. Apart from this, net cash

balance at the end of January is very low in all the months which is worth of -649750 GBP. In

this month incomes and disposals are worth of 157500 and 807250 GBP respectively which lead

to generate negative income in month ending. Afterwards, management of Clariton uses better

strategies which helps to generate positive balance in every months. From the month of January

to June the highest cash balance generated by firm is in March which is worth of £315250. Due

to having control on cost and expenses as well as enhance revenue cash flow is higher in

respective month. Apart from this at the end of June incomes generate by Clariton are £288750

and outflows are worth of £219750, due to this cash balance is positive i.e. £69000. From the

overall analysis it can be said that performance of the company is not poor but little good.

Further, it needs to improve cash balance to enhance its financial performance in the industry of

Antique items.

Suggestions for overcome shortfalls

In order to reduce negative cash balance the management of Clariton should check and

review about the cost and expenses which are incurred in operation process. It helps to

identify activities where expenses are higher and company able to take corrective actions

against it (Options to cover cash shortfalls, 2016).

Further, policymakers of Clariton requires to offer various kinds of discounts as well as

schemes which helps to increase interest of customers towards purchasing its antique

items. With this sales production will increase by which total expenditures are as well.

Along with this, it needs to formulate and applied highly effective promotional and

marketing activities to increase awareness and purchasing power of consumers towards

consuming antique items offered by Clariton Antiques Limited.

3.2 Ways for assessing cost of each unit and prices as well

In the corporate world, all the companies determine cost and price of every products and

services which are produced in the firm. With help of this management able to derive prices of

selling to sell in the market. Generally, for determine cost all kinds of expenses which are

incurred in the firm such as production and non-production are used. In the present a scenario,

Clariton Antiques Limited is operating in services industry where production expenditures are

10

balance at the end of January is very low in all the months which is worth of -649750 GBP. In

this month incomes and disposals are worth of 157500 and 807250 GBP respectively which lead

to generate negative income in month ending. Afterwards, management of Clariton uses better

strategies which helps to generate positive balance in every months. From the month of January

to June the highest cash balance generated by firm is in March which is worth of £315250. Due

to having control on cost and expenses as well as enhance revenue cash flow is higher in

respective month. Apart from this at the end of June incomes generate by Clariton are £288750

and outflows are worth of £219750, due to this cash balance is positive i.e. £69000. From the

overall analysis it can be said that performance of the company is not poor but little good.

Further, it needs to improve cash balance to enhance its financial performance in the industry of

Antique items.

Suggestions for overcome shortfalls

In order to reduce negative cash balance the management of Clariton should check and

review about the cost and expenses which are incurred in operation process. It helps to

identify activities where expenses are higher and company able to take corrective actions

against it (Options to cover cash shortfalls, 2016).

Further, policymakers of Clariton requires to offer various kinds of discounts as well as

schemes which helps to increase interest of customers towards purchasing its antique

items. With this sales production will increase by which total expenditures are as well.

Along with this, it needs to formulate and applied highly effective promotional and

marketing activities to increase awareness and purchasing power of consumers towards

consuming antique items offered by Clariton Antiques Limited.

3.2 Ways for assessing cost of each unit and prices as well

In the corporate world, all the companies determine cost and price of every products and

services which are produced in the firm. With help of this management able to derive prices of

selling to sell in the market. Generally, for determine cost all kinds of expenses which are

incurred in the firm such as production and non-production are used. In the present a scenario,

Clariton Antiques Limited is operating in services industry where production expenditures are

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

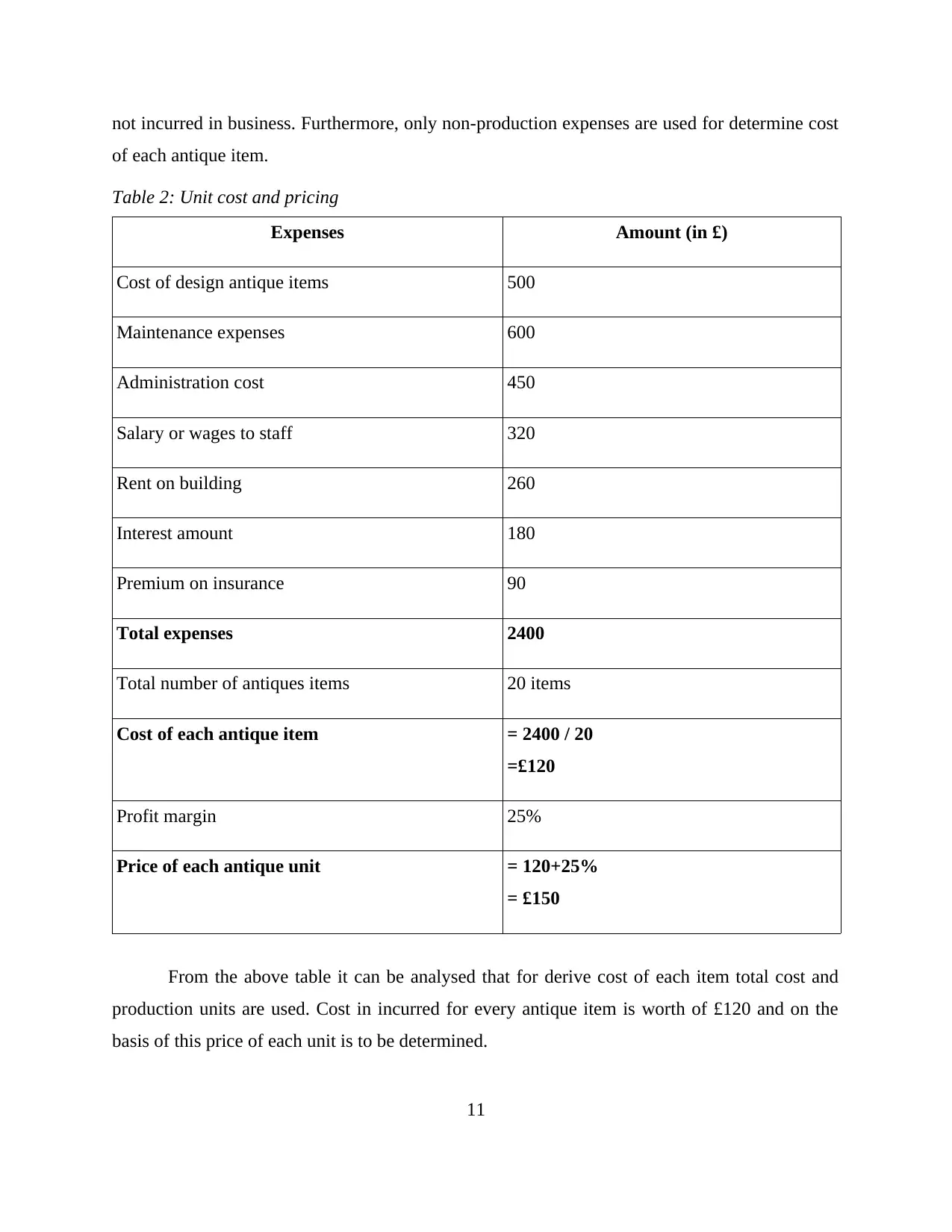

not incurred in business. Furthermore, only non-production expenses are used for determine cost

of each antique item.

Table 2: Unit cost and pricing

Expenses Amount (in £)

Cost of design antique items 500

Maintenance expenses 600

Administration cost 450

Salary or wages to staff 320

Rent on building 260

Interest amount 180

Premium on insurance 90

Total expenses 2400

Total number of antiques items 20 items

Cost of each antique item = 2400 / 20

=£120

Profit margin 25%

Price of each antique unit = 120+25%

= £150

From the above table it can be analysed that for derive cost of each item total cost and

production units are used. Cost in incurred for every antique item is worth of £120 and on the

basis of this price of each unit is to be determined.

11

of each antique item.

Table 2: Unit cost and pricing

Expenses Amount (in £)

Cost of design antique items 500

Maintenance expenses 600

Administration cost 450

Salary or wages to staff 320

Rent on building 260

Interest amount 180

Premium on insurance 90

Total expenses 2400

Total number of antiques items 20 items

Cost of each antique item = 2400 / 20

=£120

Profit margin 25%

Price of each antique unit = 120+25%

= £150

From the above table it can be analysed that for derive cost of each item total cost and

production units are used. Cost in incurred for every antique item is worth of £120 and on the

basis of this price of each unit is to be determined.

11

There are various types of pricing methods are used by different companies which are

such as cost plus, value added, skimmed, market based etc. In the present case cost plus pricing

method is used where percentage of profit which the management wants to take is supposed to

add in cost of each item (Stacchezzini, Melloni and Lai, 2016). Here Clariton charges 25% profit

margin from customers which is added in cost of each antique items. Furthermore, price of each

item is worth of £150 (120+25%). Hence, the management wills sell every item at the price of

£150 in the market.

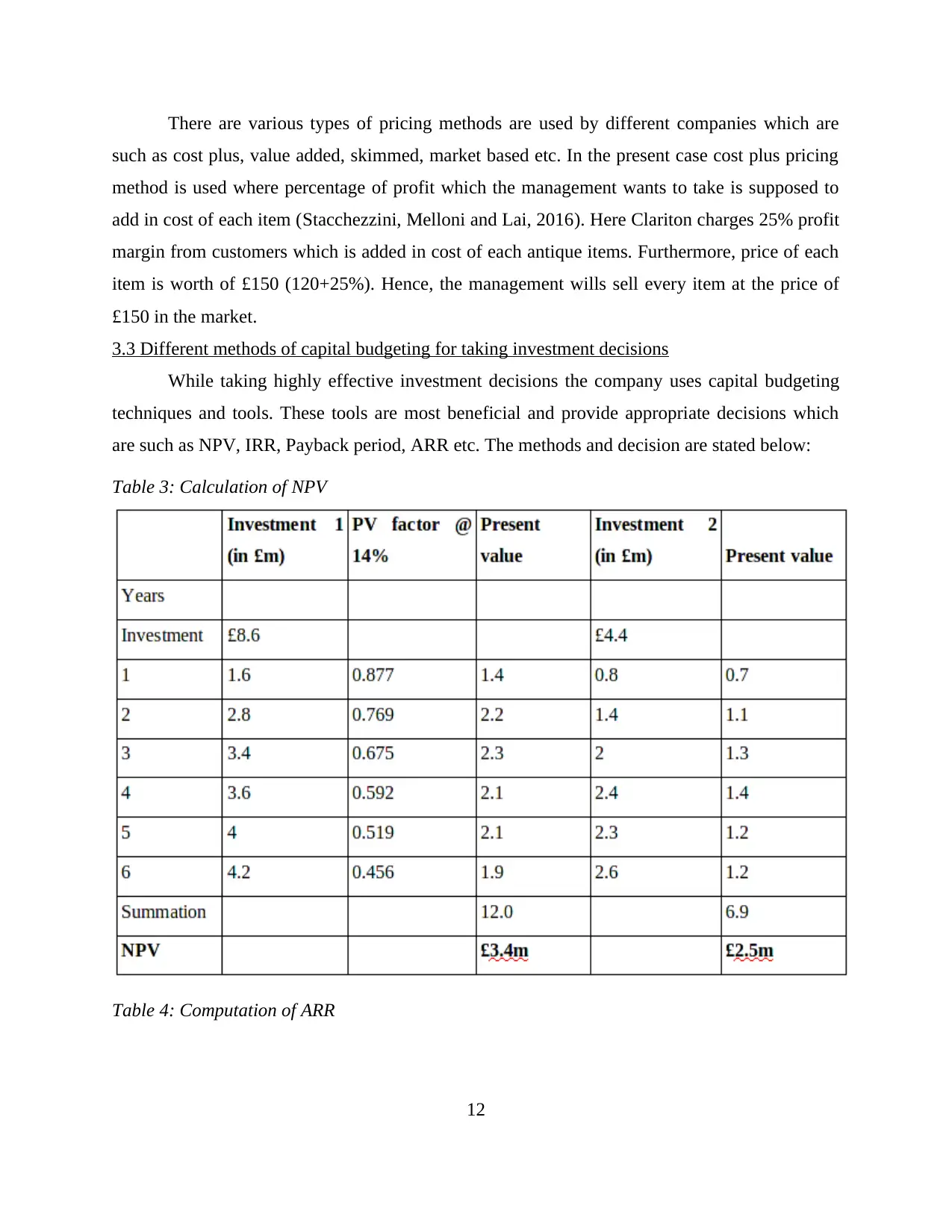

3.3 Different methods of capital budgeting for taking investment decisions

While taking highly effective investment decisions the company uses capital budgeting

techniques and tools. These tools are most beneficial and provide appropriate decisions which

are such as NPV, IRR, Payback period, ARR etc. The methods and decision are stated below:

Table 3: Calculation of NPV

Table 4: Computation of ARR

12

such as cost plus, value added, skimmed, market based etc. In the present case cost plus pricing

method is used where percentage of profit which the management wants to take is supposed to

add in cost of each item (Stacchezzini, Melloni and Lai, 2016). Here Clariton charges 25% profit

margin from customers which is added in cost of each antique items. Furthermore, price of each

item is worth of £150 (120+25%). Hence, the management wills sell every item at the price of

£150 in the market.

3.3 Different methods of capital budgeting for taking investment decisions

While taking highly effective investment decisions the company uses capital budgeting

techniques and tools. These tools are most beneficial and provide appropriate decisions which

are such as NPV, IRR, Payback period, ARR etc. The methods and decision are stated below:

Table 3: Calculation of NPV

Table 4: Computation of ARR

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.