Report on Ratio Analysis: Serco PLC, Capita PLC, and Carillion PLC

VerifiedAdded on 2023/01/16

|25

|5820

|33

Report

AI Summary

This report undertakes a comprehensive financial analysis of Serco PLC, Capita PLC, and Carillion PLC, focusing on ratio analysis to assess their financial stability and performance. The analysis includes a detailed examination of liquidity, profitability, and debt management ratios for each company, with a particular focus on Capita PLC and Serco PLC in the context of securing a contract from the NHS. The report also addresses the financial collapse of Carillion PLC, exploring the factors that led to its insolvency and the implications for stakeholders, including the role of financial risk and ethical considerations. The study emphasizes the importance of evidence-based decision-making in procurement and the appreciation of counterparty risk, providing a valuable perspective on financial management within the public sector and the significance of robust financial assessments in awarding contracts.

Running head: Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Executive Summary:

This project is done to understand the concerns related to financial stability of all the 3

companies like Serco PLC, Capita PLC and Carillion PLC these are one of the biggest

company and the accountability of these companies impact the process in UK. The effect of

the insolvency filing of the Carillion PLC was a major disaster for the 40000 employees and

suppliers. They were affected by the liquidation. It is considered as the biggest financial

disaster in the history of UK. The amount of loss that this company impacted on all the

stakeholders was around 2 billion dollar. Thus an analysis of the debt and equity that the

company was having in the course of the action is analysis through this project.

The other two company is Serco Plc and Capita Plc that are used to analysis the financial

soundness for the a contract form NHS. The financial soundness shall be calculated by the

ratio analysis. The ratio analysis looks into factors that may make the decision making

process for the company easy.

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Executive Summary:

This project is done to understand the concerns related to financial stability of all the 3

companies like Serco PLC, Capita PLC and Carillion PLC these are one of the biggest

company and the accountability of these companies impact the process in UK. The effect of

the insolvency filing of the Carillion PLC was a major disaster for the 40000 employees and

suppliers. They were affected by the liquidation. It is considered as the biggest financial

disaster in the history of UK. The amount of loss that this company impacted on all the

stakeholders was around 2 billion dollar. Thus an analysis of the debt and equity that the

company was having in the course of the action is analysis through this project.

The other two company is Serco Plc and Capita Plc that are used to analysis the financial

soundness for the a contract form NHS. The financial soundness shall be calculated by the

ratio analysis. The ratio analysis looks into factors that may make the decision making

process for the company easy.

2

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................4

Section A....................................................................................................................................4

Evidence based decision to ensure value for money:.............................................................4

Appreciation of counterparty risk in the procurement function:............................................5

Ratio analysis of Capita Plc:..................................................................................................6

Ratio analysis of Serco Plc...................................................................................................10

Decision to award the Contract............................................................................................13

Section B..................................................................................................................................13

About Carillion PLC:...........................................................................................................13

Funding Sources for the Carillion:.......................................................................................14

Financial Risk:.....................................................................................................................14

Ratio analysis of Carillion....................................................................................................16

Conclusion:..............................................................................................................................20

Referencing:.............................................................................................................................22

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Table of Contents

Introduction................................................................................................................................3

Discussion..................................................................................................................................4

Section A....................................................................................................................................4

Evidence based decision to ensure value for money:.............................................................4

Appreciation of counterparty risk in the procurement function:............................................5

Ratio analysis of Capita Plc:..................................................................................................6

Ratio analysis of Serco Plc...................................................................................................10

Decision to award the Contract............................................................................................13

Section B..................................................................................................................................13

About Carillion PLC:...........................................................................................................13

Funding Sources for the Carillion:.......................................................................................14

Financial Risk:.....................................................................................................................14

Ratio analysis of Carillion....................................................................................................16

Conclusion:..............................................................................................................................20

Referencing:.............................................................................................................................22

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Introduction

The report is about the analysis of the ratios to understand the financial stability of the

company. The contract of NHS is to be awarded to the company with the best ratio

performance. There are two company betting for the contract Serco Plc and Capita Plc. The

contract will be given to the company that can manage the contract with least disturbance of

the finance.

The report also consists of the analysis of a giant company whose loss created a huge

impact on the whole country and specially the stakeholder. Carillion has recently filled for

liquidation (Altman 2000). The company is a construction and service based organization that

is specialized into field of Health, Transport, Justice, Immigration, Defense, and Citizens

Services. The company was not able to manage the cash inflow and outflow which led to

state of liquidation. The debt was almost around 2 billion which was the highest amount of

debt any company must have had in the history of UK. The report focuses on how the

situation led to liquefy the company and filled for insolvency (Ahmed Et al. 2016)

The report has been prepared to understand the lacks in the financial assessment and

the loss that the management done to the company due mis-management. The two company

capita and Serco is trying to get a contract that of NHS. So here the financial stability will be

analyzed.

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Introduction

The report is about the analysis of the ratios to understand the financial stability of the

company. The contract of NHS is to be awarded to the company with the best ratio

performance. There are two company betting for the contract Serco Plc and Capita Plc. The

contract will be given to the company that can manage the contract with least disturbance of

the finance.

The report also consists of the analysis of a giant company whose loss created a huge

impact on the whole country and specially the stakeholder. Carillion has recently filled for

liquidation (Altman 2000). The company is a construction and service based organization that

is specialized into field of Health, Transport, Justice, Immigration, Defense, and Citizens

Services. The company was not able to manage the cash inflow and outflow which led to

state of liquidation. The debt was almost around 2 billion which was the highest amount of

debt any company must have had in the history of UK. The report focuses on how the

situation led to liquefy the company and filled for insolvency (Ahmed Et al. 2016)

The report has been prepared to understand the lacks in the financial assessment and

the loss that the management done to the company due mis-management. The two company

capita and Serco is trying to get a contract that of NHS. So here the financial stability will be

analyzed.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Discussion

Section A

Evidence based decision to ensure value for money:

Value for money is a term that describes how nicely the return in investment is done.

The goods bought are for some value and the return that they might get will be equal or less

or more. Same goes for any governmental projects. The contract is an opportunity for private

and public companies to bid for this may give them a chance to expand and earn profit. It

involves major decision making for the public procurement of the contract. The research is all

about the formulation of the questions based on the project decision making. The forecasted

cost, return over the period of year and the duration to complete the project is also an

important factor for the estimation of the task.

The evidence based decision makings nothing but the procedure of back checking the

performance and credibility of the company. The ratio analysis is a method where the

companies ratios value over a period of years are compared and check. The comparison can

be done across the peer companies also. The ratio analysis is one method to do the evidence

based decision making. The other methodology that is by checking the past contract

completion reports and remarks. The evaluation of the contractor, supplier’s performance and

also the relationship between contractor and the supplier are evaluated (Jewell 2005).

NHS is a medical service system that has a procedure to mitigate the risk in the

contractual system. It is England based service provider that is affiliated to HSC that was

established in 1948. Each UK service system is operated independently and is politically

accountable to the relevant government. Thus it becomes the responsibility of the

government to check the contracts given to the companies. The contracts may be for

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Discussion

Section A

Evidence based decision to ensure value for money:

Value for money is a term that describes how nicely the return in investment is done.

The goods bought are for some value and the return that they might get will be equal or less

or more. Same goes for any governmental projects. The contract is an opportunity for private

and public companies to bid for this may give them a chance to expand and earn profit. It

involves major decision making for the public procurement of the contract. The research is all

about the formulation of the questions based on the project decision making. The forecasted

cost, return over the period of year and the duration to complete the project is also an

important factor for the estimation of the task.

The evidence based decision makings nothing but the procedure of back checking the

performance and credibility of the company. The ratio analysis is a method where the

companies ratios value over a period of years are compared and check. The comparison can

be done across the peer companies also. The ratio analysis is one method to do the evidence

based decision making. The other methodology that is by checking the past contract

completion reports and remarks. The evaluation of the contractor, supplier’s performance and

also the relationship between contractor and the supplier are evaluated (Jewell 2005).

NHS is a medical service system that has a procedure to mitigate the risk in the

contractual system. It is England based service provider that is affiliated to HSC that was

established in 1948. Each UK service system is operated independently and is politically

accountable to the relevant government. Thus it becomes the responsibility of the

government to check the contracts given to the companies. The contracts may be for

5

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

different purpose and it is of huge amount. Thus, the evidence based decision making is very

important.

Appreciation of counterparty risk in the procurement function:

Procurement risk is potential where the failure of a task process which is designed to

purchase services, product or resources may not be completed properly in the time frame

mentioned. The risk is of the loss of the confidence of the giver. Common types of risk are

fraud, cost, quality compromised, and time frame or delivery risk. So some times the risk of

procurement is considered as the compliance risk. The contract has a process of procurement

and thus the contracts are prone to risk. There is a risk of counter party appreciation are the

possibility of clients and sub-contractor not fulfilling their commitments. The subsidiaries

have the assess to the credit standing of the clients by accessing the financial position, past

experience and other factors that are relevant. The accountability of their advance payment,

credit letter and third party guarantees are a kind to mitigate the credit risk. The maximum

credit risk that can be allowed depends on the value of the trade and other receivables

(Edmister 2002).

To mitigate the risk of the supply chain management there is a best way:

Diversify the suppliers

Switching the suppliers

Pile up

Pre-payment.

All the method is used to cover the risk and mitigate the chances of faulty performance. This

is methodology to ensure a robust supply chain resilience for an accurate business process.

Sometimes the counterparty risk may arise from the financial transactions that takes place

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

different purpose and it is of huge amount. Thus, the evidence based decision making is very

important.

Appreciation of counterparty risk in the procurement function:

Procurement risk is potential where the failure of a task process which is designed to

purchase services, product or resources may not be completed properly in the time frame

mentioned. The risk is of the loss of the confidence of the giver. Common types of risk are

fraud, cost, quality compromised, and time frame or delivery risk. So some times the risk of

procurement is considered as the compliance risk. The contract has a process of procurement

and thus the contracts are prone to risk. There is a risk of counter party appreciation are the

possibility of clients and sub-contractor not fulfilling their commitments. The subsidiaries

have the assess to the credit standing of the clients by accessing the financial position, past

experience and other factors that are relevant. The accountability of their advance payment,

credit letter and third party guarantees are a kind to mitigate the credit risk. The maximum

credit risk that can be allowed depends on the value of the trade and other receivables

(Edmister 2002).

To mitigate the risk of the supply chain management there is a best way:

Diversify the suppliers

Switching the suppliers

Pile up

Pre-payment.

All the method is used to cover the risk and mitigate the chances of faulty performance. This

is methodology to ensure a robust supply chain resilience for an accurate business process.

Sometimes the counterparty risk may arise from the financial transactions that takes place

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

from the bank and other financial institution. The risk is managed carefully by selecting the

right institution for the financial support (Otani 1990).

Ratio analysis of Capita Plc:

Capita Plc is a business process that works on outsourcing. It deals in governmental

and private contract procurement. The head quarter is in London. It is considered as the

biggest outsourcing process company. The company earns revenue from the business process

of governmental and private sector. It was established in 1987 and today the company has

overcame all hurdles and became so successful with 70000 employees. Here the company is

trying to take a contract from NHS and there shall be ratio analysis to understand the stability

and capacity of Capita Plc (Capita PLC 2019).

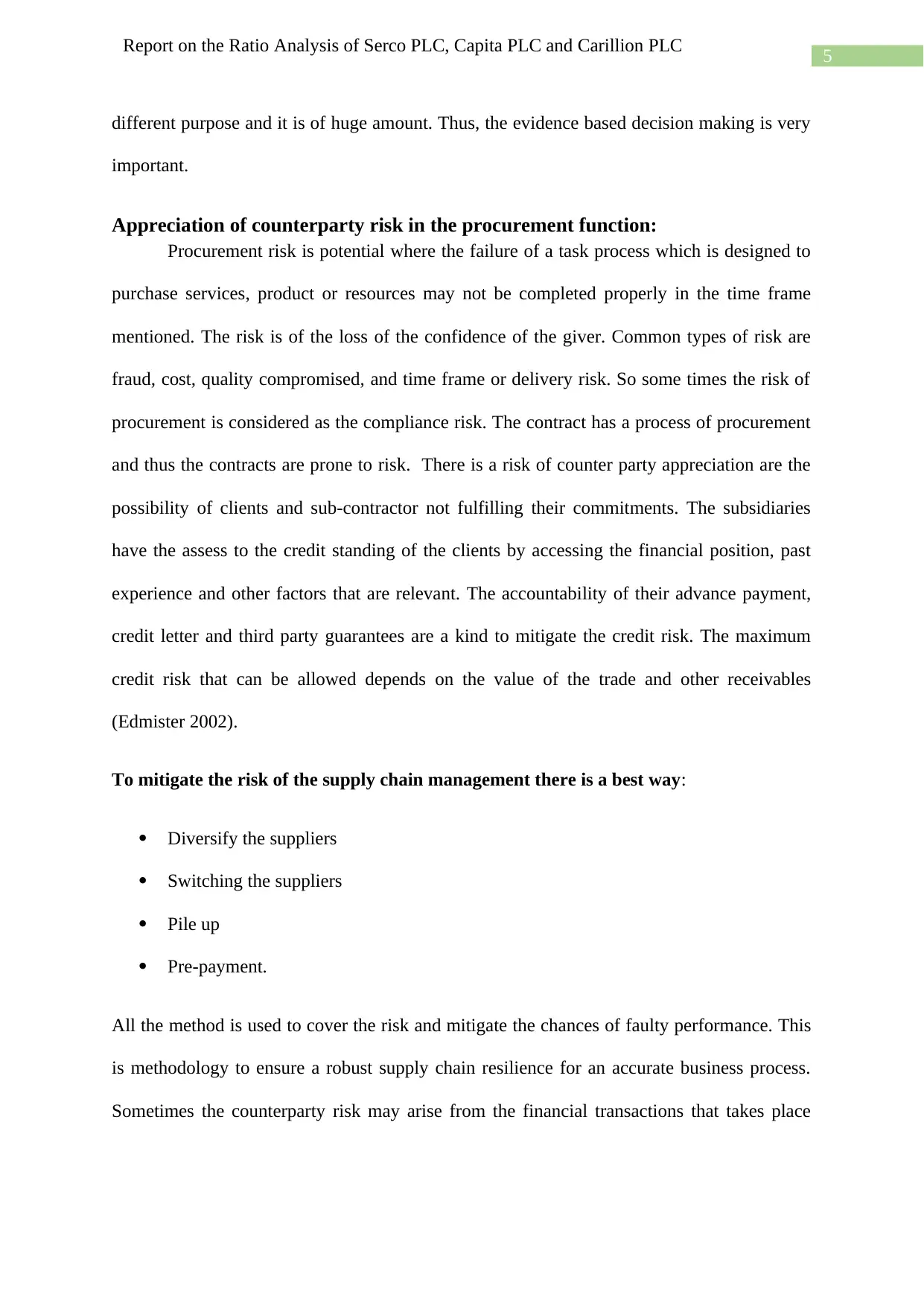

Liquidity ratio: It analysis the company’s ability to pay back the debt which are closely due

like the payment to the creditors. The ratio measure how fast the company will be converting

the current asset to cash. The ratio of 1 is considered as safe.

2015 2016 2017

current ratio current asset 1,836.00 1,592.30 1,817.70

current liability 2,449.00 2,660.00 2,520.20

0.750 0.599 0.721

Quick ratio Liquid asset 1791.7 1548 1729

current liability 2,449.00 2,660.00 2,520.20

0.732 0.582 0.686

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

from the bank and other financial institution. The risk is managed carefully by selecting the

right institution for the financial support (Otani 1990).

Ratio analysis of Capita Plc:

Capita Plc is a business process that works on outsourcing. It deals in governmental

and private contract procurement. The head quarter is in London. It is considered as the

biggest outsourcing process company. The company earns revenue from the business process

of governmental and private sector. It was established in 1987 and today the company has

overcame all hurdles and became so successful with 70000 employees. Here the company is

trying to take a contract from NHS and there shall be ratio analysis to understand the stability

and capacity of Capita Plc (Capita PLC 2019).

Liquidity ratio: It analysis the company’s ability to pay back the debt which are closely due

like the payment to the creditors. The ratio measure how fast the company will be converting

the current asset to cash. The ratio of 1 is considered as safe.

2015 2016 2017

current ratio current asset 1,836.00 1,592.30 1,817.70

current liability 2,449.00 2,660.00 2,520.20

0.750 0.599 0.721

Quick ratio Liquid asset 1791.7 1548 1729

current liability 2,449.00 2,660.00 2,520.20

0.732 0.582 0.686

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

The graph is about the current ratio and quick ratio for company Capita PLC. The

company maintains a good ratio trend by keeping the ratio above the minimum level. The

ratio is comparative same and mentioned at the same level by paying the short term debt. The

liquidity is maintained constantly mitigating any financial risk.

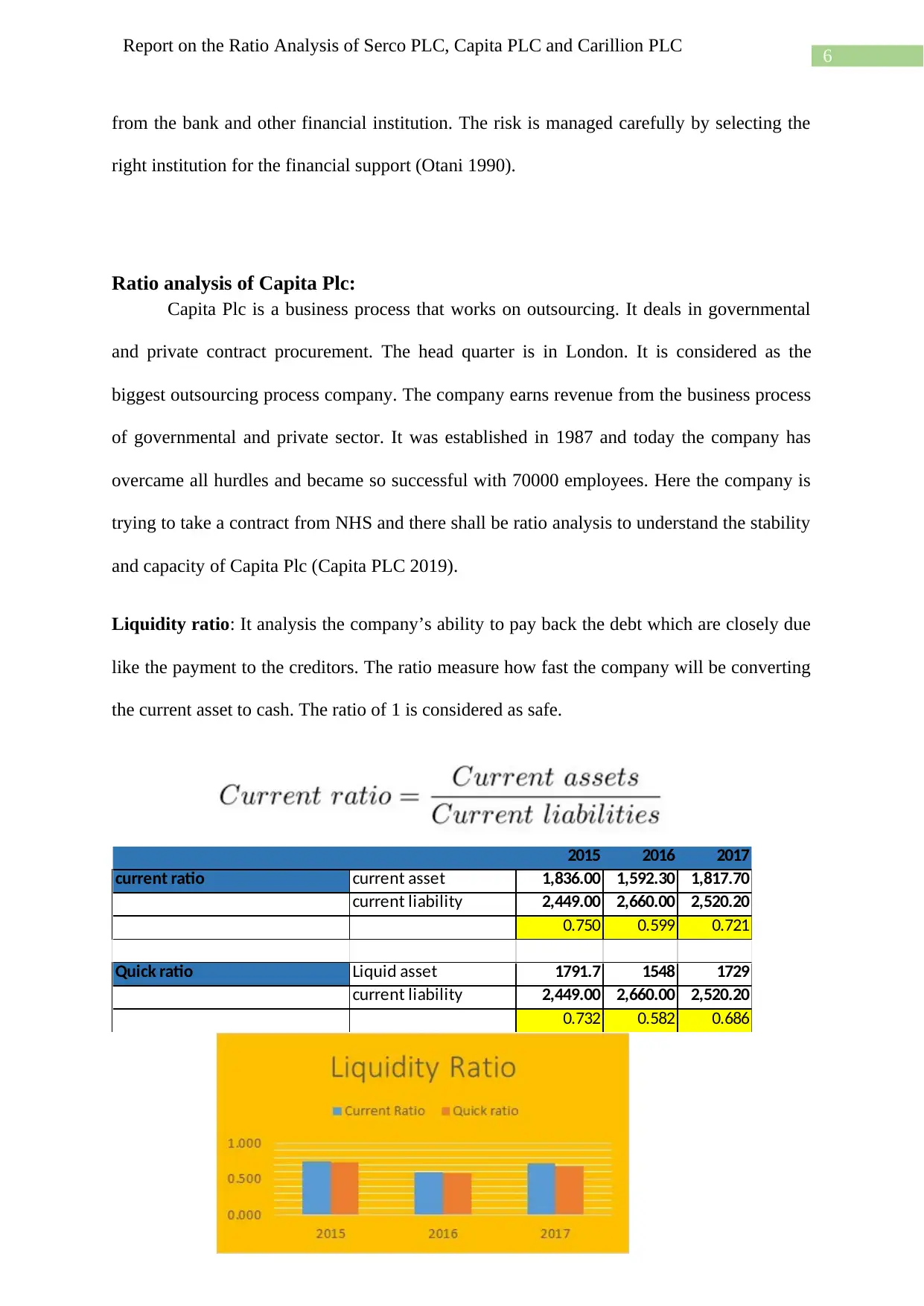

Profitability ratio: this ratio is to see how well is the company is making income from the

asset and equity. The company’s profitability is measure through this ratio.

The ratio is not performing well that can be inferred from the ratio analysis done. The graph

shows that in the year 2017 the ROA went negative due to the decreased income from the

Profitability ratio

2015 2016 2017

Net profit margin Net Profit 55.6 -51.7 -110.7

Sales 4,836.90 4,368.60 4,234.60

0.011 -0.012 -0.026

1% -1% -3%

2015 2016 2017

ROA Operating profit 206.6 -16.1 -420.1

(Return on Asset) Total asset 5,343.50 5,498.50 4,421.20

0.04 0.00 -0.10

4% 0% -10%

Return On equity Profit/loss after tax 55.6 -51.7 -110.7

Equity capital 679.3 -255.4 -999

0.082 0.202 0.111

8% 20% 11%

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

The graph is about the current ratio and quick ratio for company Capita PLC. The

company maintains a good ratio trend by keeping the ratio above the minimum level. The

ratio is comparative same and mentioned at the same level by paying the short term debt. The

liquidity is maintained constantly mitigating any financial risk.

Profitability ratio: this ratio is to see how well is the company is making income from the

asset and equity. The company’s profitability is measure through this ratio.

The ratio is not performing well that can be inferred from the ratio analysis done. The graph

shows that in the year 2017 the ROA went negative due to the decreased income from the

Profitability ratio

2015 2016 2017

Net profit margin Net Profit 55.6 -51.7 -110.7

Sales 4,836.90 4,368.60 4,234.60

0.011 -0.012 -0.026

1% -1% -3%

2015 2016 2017

ROA Operating profit 206.6 -16.1 -420.1

(Return on Asset) Total asset 5,343.50 5,498.50 4,421.20

0.04 0.00 -0.10

4% 0% -10%

Return On equity Profit/loss after tax 55.6 -51.7 -110.7

Equity capital 679.3 -255.4 -999

0.082 0.202 0.111

8% 20% 11%

8

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

operations. The ROA represents the Return on asset. This indicates that the company is

having huge amount of unused asset. The return on equity is not attractive this is due to the

low profit the company is making. The company has plan to become a B2G company in the

year 2014. The company made some changes that faced some loss due to the diversification

(Leiper Et al 2003.

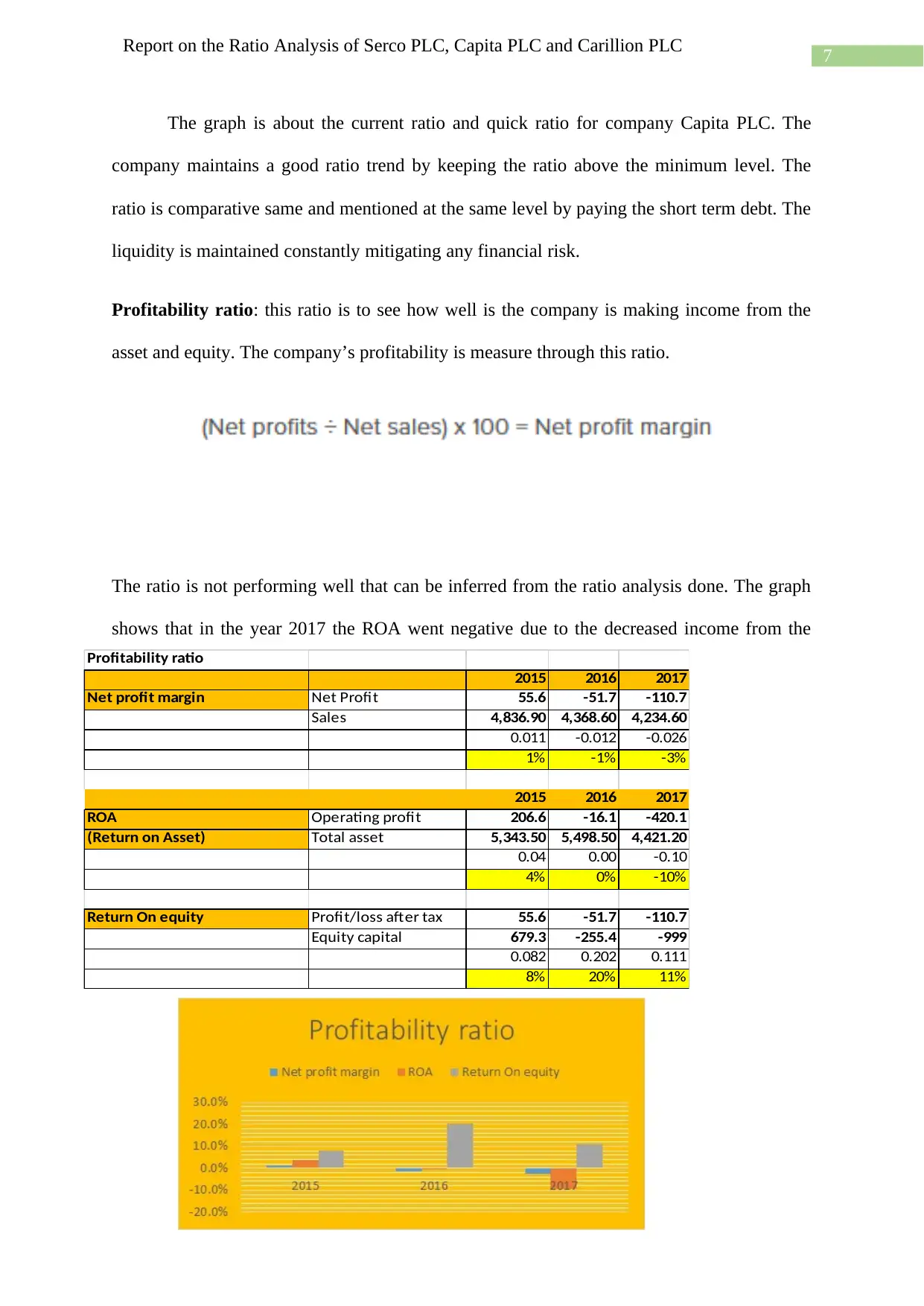

Working capital ratios: This ratio is more important to the organization as it measures the

liquidity of the organization. The accounts receivable day measures the average days it takes

to collect the receivables from the debtors.

The ratio shows how much days does it gives to its debtor to repay the amount. As it

can be noted that the repayment days are not more than 6 months thus the company is very

2015 2016 2017

Accounts receivable days

Accounts receivable X

Number of years in a

year. 1,144.00 873 755.2

Annual revenue 4,836.90 4,368.60 4,234.60

86.33 72.94 65.09

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

operations. The ROA represents the Return on asset. This indicates that the company is

having huge amount of unused asset. The return on equity is not attractive this is due to the

low profit the company is making. The company has plan to become a B2G company in the

year 2014. The company made some changes that faced some loss due to the diversification

(Leiper Et al 2003.

Working capital ratios: This ratio is more important to the organization as it measures the

liquidity of the organization. The accounts receivable day measures the average days it takes

to collect the receivables from the debtors.

The ratio shows how much days does it gives to its debtor to repay the amount. As it

can be noted that the repayment days are not more than 6 months thus the company is very

2015 2016 2017

Accounts receivable days

Accounts receivable X

Number of years in a

year. 1,144.00 873 755.2

Annual revenue 4,836.90 4,368.60 4,234.60

86.33 72.94 65.09

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

much safe the amount is getting back to the account is very early. The company seems very

stable.

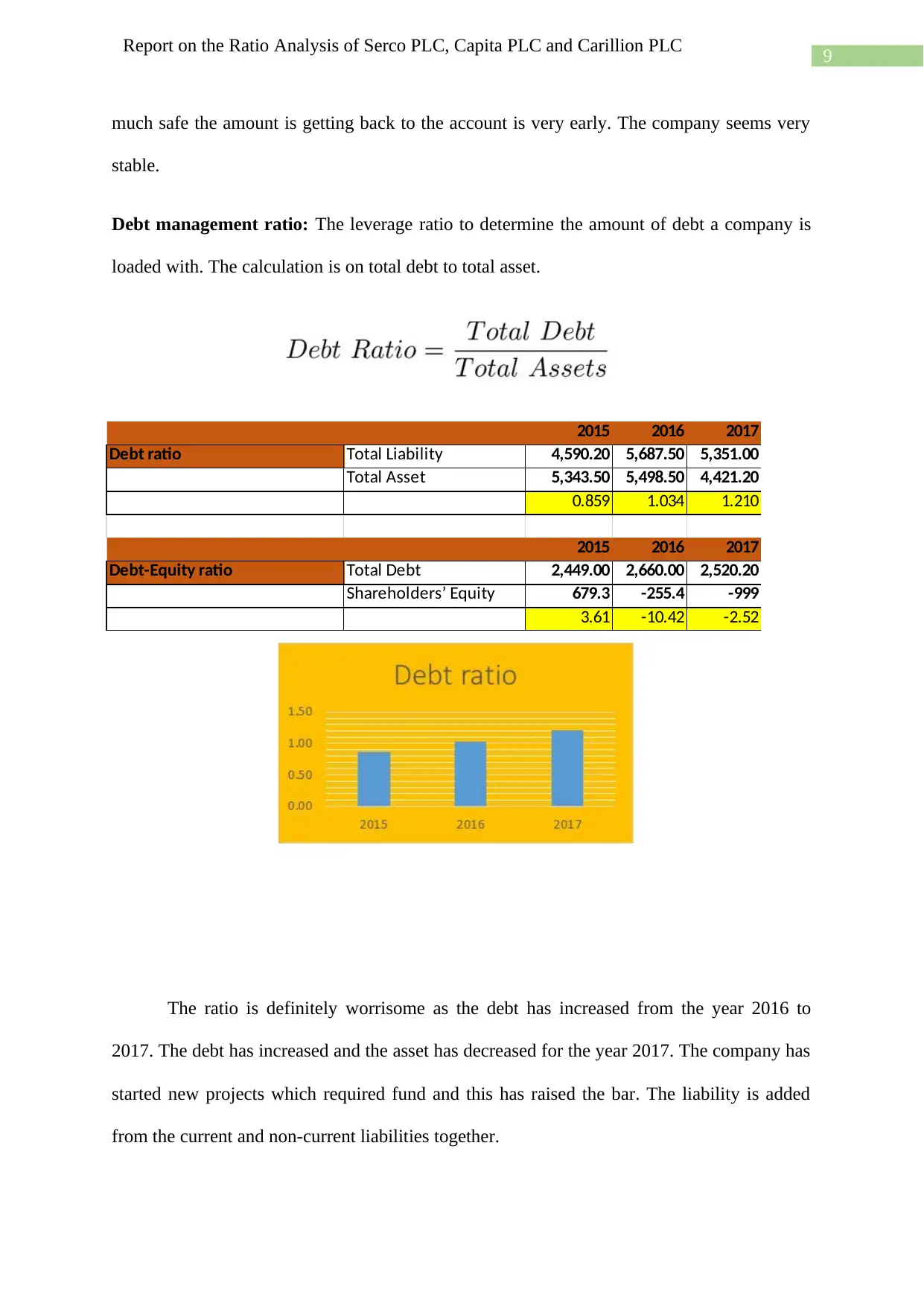

Debt management ratio: The leverage ratio to determine the amount of debt a company is

loaded with. The calculation is on total debt to total asset.

The ratio is definitely worrisome as the debt has increased from the year 2016 to

2017. The debt has increased and the asset has decreased for the year 2017. The company has

started new projects which required fund and this has raised the bar. The liability is added

from the current and non-current liabilities together.

2015 2016 2017

Debt ratio Total Liability 4,590.20 5,687.50 5,351.00

Total Asset 5,343.50 5,498.50 4,421.20

0.859 1.034 1.210

2015 2016 2017

Debt-Equity ratio Total Debt 2,449.00 2,660.00 2,520.20

Shareholders’ Equity 679.3 -255.4 -999

3.61 -10.42 -2.52

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

much safe the amount is getting back to the account is very early. The company seems very

stable.

Debt management ratio: The leverage ratio to determine the amount of debt a company is

loaded with. The calculation is on total debt to total asset.

The ratio is definitely worrisome as the debt has increased from the year 2016 to

2017. The debt has increased and the asset has decreased for the year 2017. The company has

started new projects which required fund and this has raised the bar. The liability is added

from the current and non-current liabilities together.

2015 2016 2017

Debt ratio Total Liability 4,590.20 5,687.50 5,351.00

Total Asset 5,343.50 5,498.50 4,421.20

0.859 1.034 1.210

2015 2016 2017

Debt-Equity ratio Total Debt 2,449.00 2,660.00 2,520.20

Shareholders’ Equity 679.3 -255.4 -999

3.61 -10.42 -2.52

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Looking at the ratios we can conclude that in all case company Capita Plc is in safe

and stable conditions. The debt is manageable as the amount of asset is also in same ratio.

The liquidity is also very good state the company is operating safely.

Ratio analysis of Serco Plc.

The Public service giant is one of the biggest companies sin UK. The company has

clients from the private and public sector. The diversification that it has in Defense, justice &

immigration, health and citizen services. The service is delivered in countries in UK, Europe

North America and the middle east. The history if the company is very interesting it started in

1929 and in year 1988 it got listed on stock exchange of London (Serco Group plc 2019).

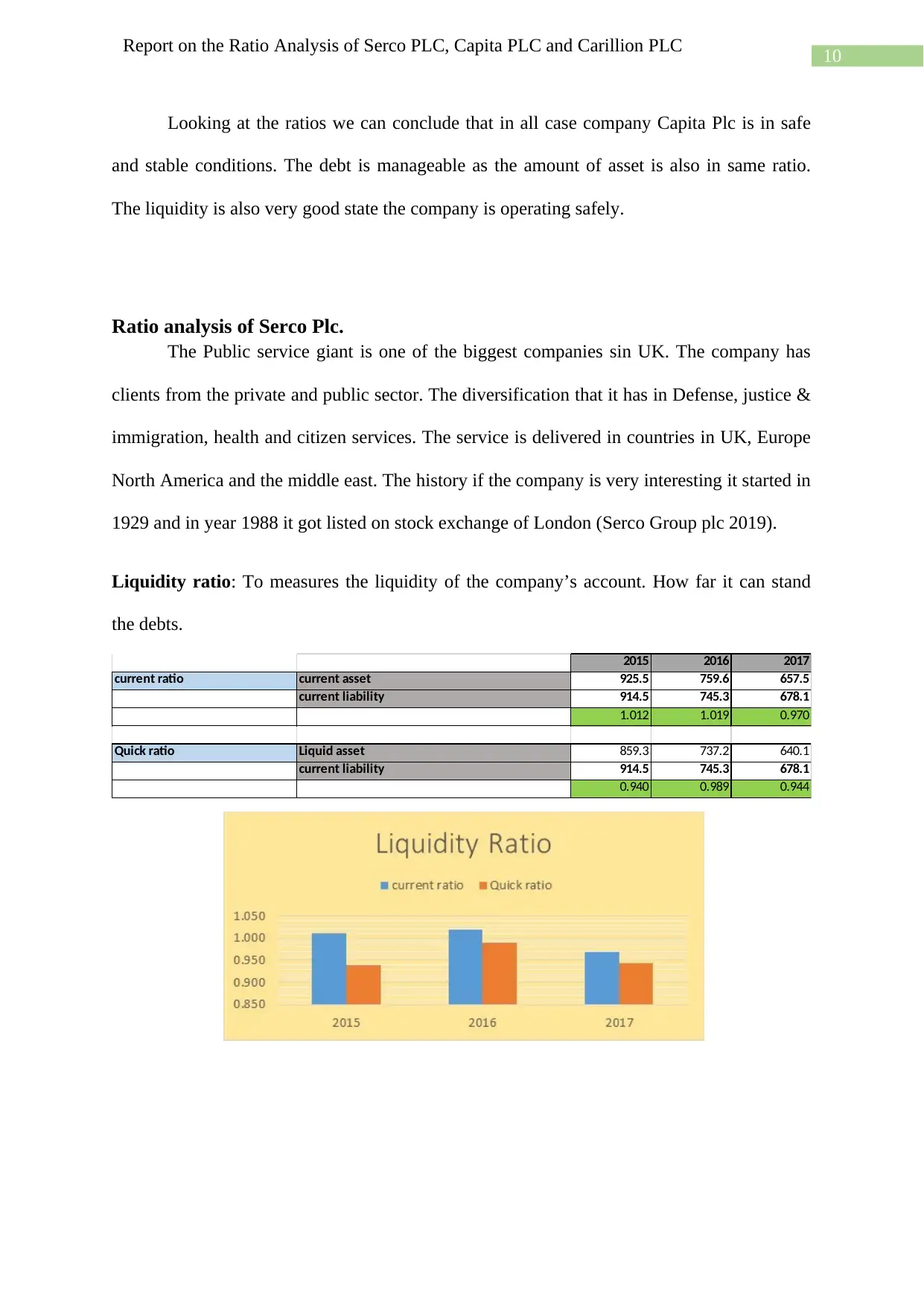

Liquidity ratio: To measures the liquidity of the company’s account. How far it can stand

the debts.

2015 2016 2017

current ratio current asset 925.5 759.6 657.5

current liability 914.5 745.3 678.1

1.012 1.019 0.970

Quick ratio Liquid asset 859.3 737.2 640.1

current liability 914.5 745.3 678.1

0.940 0.989 0.944

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

Looking at the ratios we can conclude that in all case company Capita Plc is in safe

and stable conditions. The debt is manageable as the amount of asset is also in same ratio.

The liquidity is also very good state the company is operating safely.

Ratio analysis of Serco Plc.

The Public service giant is one of the biggest companies sin UK. The company has

clients from the private and public sector. The diversification that it has in Defense, justice &

immigration, health and citizen services. The service is delivered in countries in UK, Europe

North America and the middle east. The history if the company is very interesting it started in

1929 and in year 1988 it got listed on stock exchange of London (Serco Group plc 2019).

Liquidity ratio: To measures the liquidity of the company’s account. How far it can stand

the debts.

2015 2016 2017

current ratio current asset 925.5 759.6 657.5

current liability 914.5 745.3 678.1

1.012 1.019 0.970

Quick ratio Liquid asset 859.3 737.2 640.1

current liability 914.5 745.3 678.1

0.940 0.989 0.944

11

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

The liquidity ratio is in the best position. The current asset has decreased from the

year 2016 to 2017 this is due to the sale of the asset and conversion the ratio is still at the best

condition as the management is very concerned about the maintenance of the ratio. The quick

ratio is close to the 1 which is counting the stability of the company’s account.

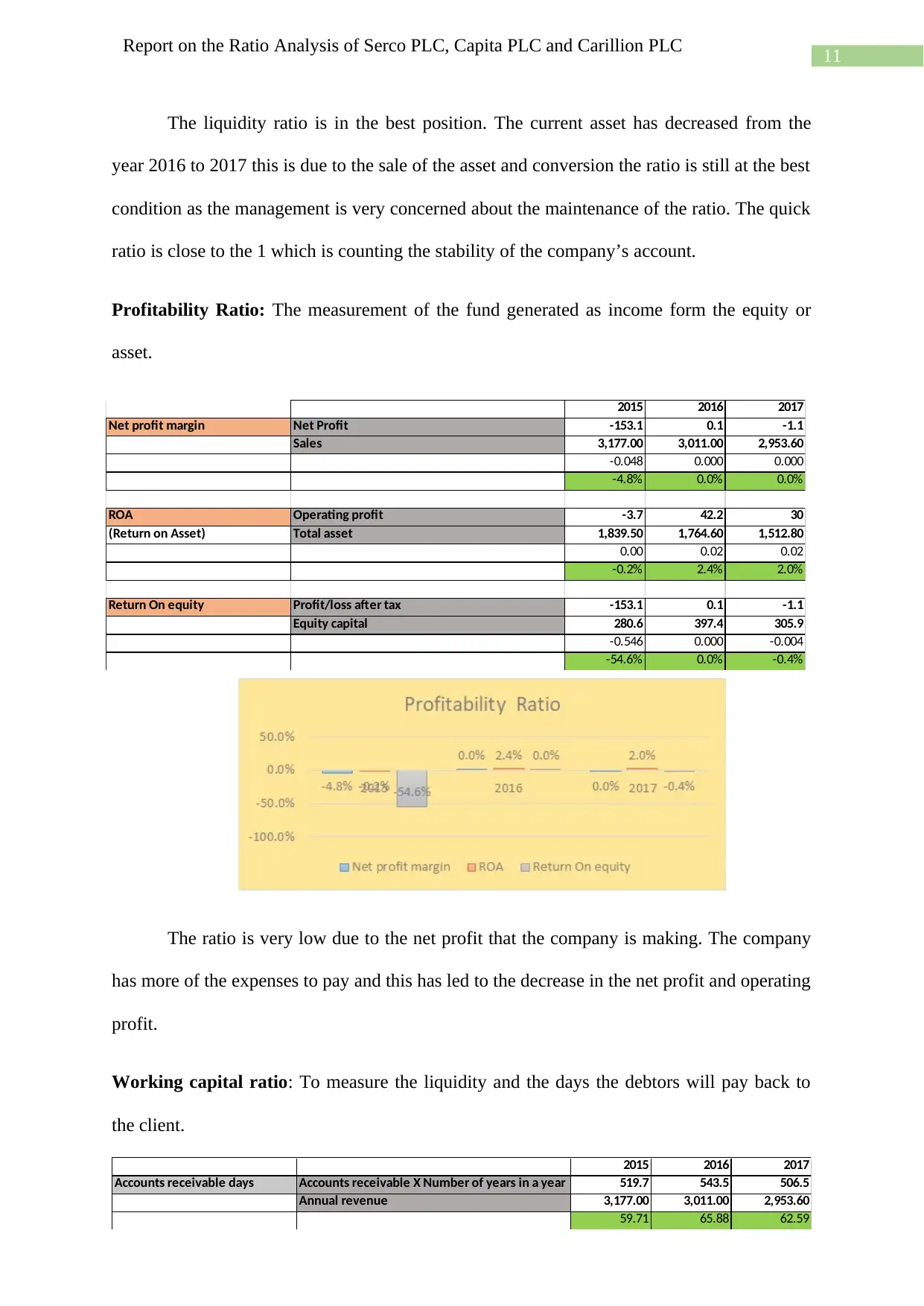

Profitability Ratio: The measurement of the fund generated as income form the equity or

asset.

The ratio is very low due to the net profit that the company is making. The company

has more of the expenses to pay and this has led to the decrease in the net profit and operating

profit.

Working capital ratio: To measure the liquidity and the days the debtors will pay back to

the client.

2015 2016 2017

Net profit margin Net Profit -153.1 0.1 -1.1

Sales 3,177.00 3,011.00 2,953.60

-0.048 0.000 0.000

-4.8% 0.0% 0.0%

ROA Operating profit -3.7 42.2 30

(Return on Asset) Total asset 1,839.50 1,764.60 1,512.80

0.00 0.02 0.02

-0.2% 2.4% 2.0%

Return On equity Profit/loss after tax -153.1 0.1 -1.1

Equity capital 280.6 397.4 305.9

-0.546 0.000 -0.004

-54.6% 0.0% -0.4%

2015 2016 2017

Accounts receivable days Accounts receivable X Number of years in a year 519.7 543.5 506.5

Annual revenue 3,177.00 3,011.00 2,953.60

59.71 65.88 62.59

Report on the Ratio Analysis of Serco PLC, Capita PLC and Carillion PLC

The liquidity ratio is in the best position. The current asset has decreased from the

year 2016 to 2017 this is due to the sale of the asset and conversion the ratio is still at the best

condition as the management is very concerned about the maintenance of the ratio. The quick

ratio is close to the 1 which is counting the stability of the company’s account.

Profitability Ratio: The measurement of the fund generated as income form the equity or

asset.

The ratio is very low due to the net profit that the company is making. The company

has more of the expenses to pay and this has led to the decrease in the net profit and operating

profit.

Working capital ratio: To measure the liquidity and the days the debtors will pay back to

the client.

2015 2016 2017

Net profit margin Net Profit -153.1 0.1 -1.1

Sales 3,177.00 3,011.00 2,953.60

-0.048 0.000 0.000

-4.8% 0.0% 0.0%

ROA Operating profit -3.7 42.2 30

(Return on Asset) Total asset 1,839.50 1,764.60 1,512.80

0.00 0.02 0.02

-0.2% 2.4% 2.0%

Return On equity Profit/loss after tax -153.1 0.1 -1.1

Equity capital 280.6 397.4 305.9

-0.546 0.000 -0.004

-54.6% 0.0% -0.4%

2015 2016 2017

Accounts receivable days Accounts receivable X Number of years in a year 519.7 543.5 506.5

Annual revenue 3,177.00 3,011.00 2,953.60

59.71 65.88 62.59

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.