Personal Taxation Report: UK Taxation for Froggy Recruitment's Owner

VerifiedAdded on 2020/02/05

|13

|3610

|138

Report

AI Summary

This report analyzes the personal taxation of Isabelle, the owner of Froggy Recruitment, for the tax year 2016-17. It details the calculation of her tax liability, including gross profit, expenses, and various income sources like rental, dividend, and interest. The report covers the application of UK taxation rules, including income tax rates, national insurance contributions (Class 2 and Class 4), and the tax implications of dividend income. Furthermore, it explains the concept of non-domiciled status within the UK tax system, discussing its implications for acquiring a new partner. The report also briefly touches upon the tax position of the Apple corporation in Ireland. The analysis includes detailed calculations and explanations of tax rates, thresholds, and relevant regulations, providing a comprehensive overview of Isabelle's tax obligations and the broader context of UK taxation.

PERSONAL TAXATION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Tax is a sum of money which is taken by the state government on earning and purchasing

as well. In the taxation world, there are mainly two types of taxes such as direct as well as

indirect taxes. Those taxes which are directly taken on income or earnings which are generated

through economic activities, known as direct tax. Further, indirect taxes are taken from goods

and services from customers and users. In different country taxation rules and regulations are

varied and percentage of taxation amount as well. In the present report there is a person Isabelle

who commenced or started a business as a Personnel Recruitment Agency, name is Froggy

Recruitment. Here the owner has not any knowledge regarding tax rates and taxation which are

paid on different types of incomes generated. The report shows statement of tax liability for

Isabelle at the end of tax year 2016-17. Further, it shows various rules of non-domiciled status of

UK taxation. At the last it describes about tax position or rules of Apple corporation in the

country Ireland.

PART 1

Calculation of tax liability of Isabelle for the tax year 2016-17

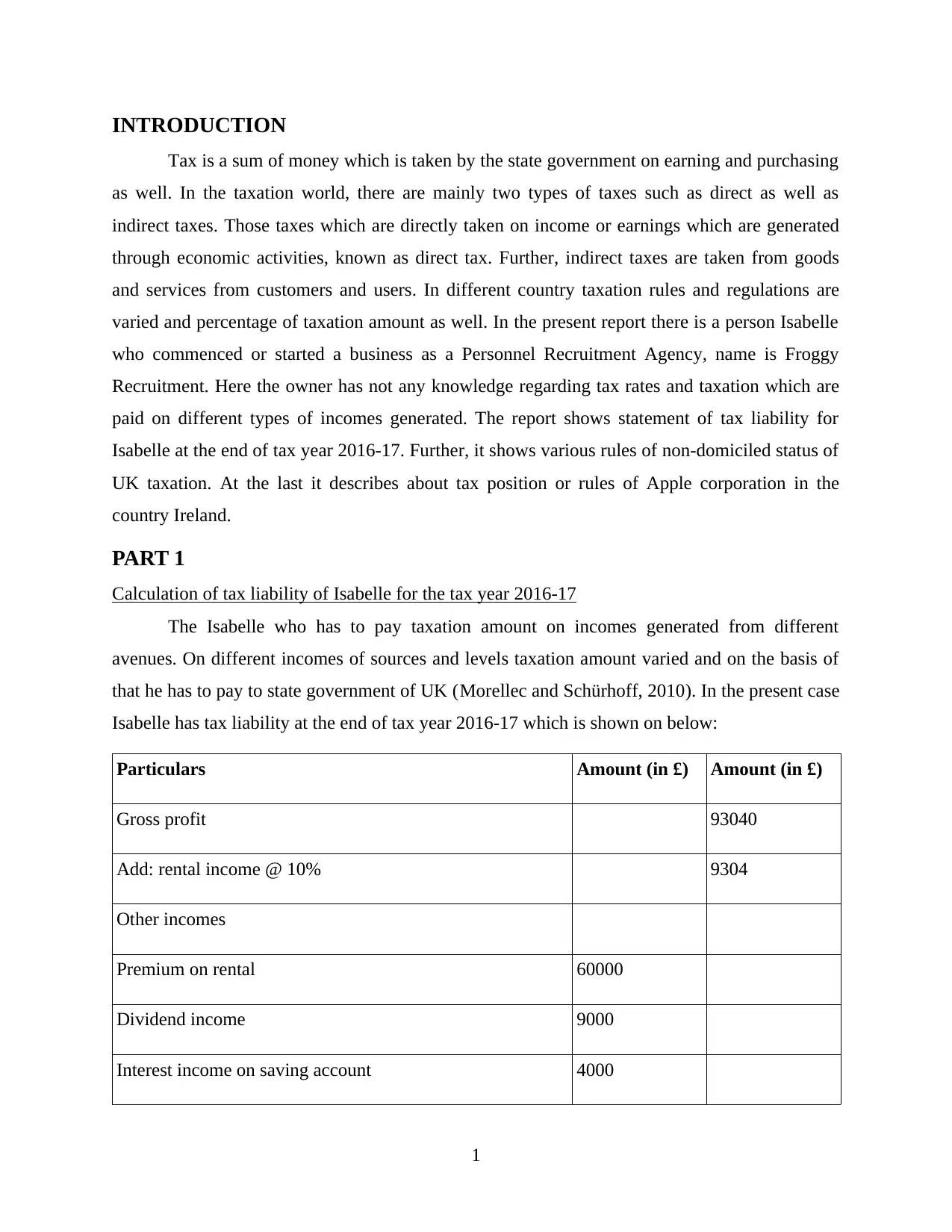

The Isabelle who has to pay taxation amount on incomes generated from different

avenues. On different incomes of sources and levels taxation amount varied and on the basis of

that he has to pay to state government of UK (Morellec and Schürhoff, 2010). In the present case

Isabelle has tax liability at the end of tax year 2016-17 which is shown on below:

Particulars Amount (in £) Amount (in £)

Gross profit 93040

Add: rental income @ 10% 9304

Other incomes

Premium on rental 60000

Dividend income 9000

Interest income on saving account 4000

1

Tax is a sum of money which is taken by the state government on earning and purchasing

as well. In the taxation world, there are mainly two types of taxes such as direct as well as

indirect taxes. Those taxes which are directly taken on income or earnings which are generated

through economic activities, known as direct tax. Further, indirect taxes are taken from goods

and services from customers and users. In different country taxation rules and regulations are

varied and percentage of taxation amount as well. In the present report there is a person Isabelle

who commenced or started a business as a Personnel Recruitment Agency, name is Froggy

Recruitment. Here the owner has not any knowledge regarding tax rates and taxation which are

paid on different types of incomes generated. The report shows statement of tax liability for

Isabelle at the end of tax year 2016-17. Further, it shows various rules of non-domiciled status of

UK taxation. At the last it describes about tax position or rules of Apple corporation in the

country Ireland.

PART 1

Calculation of tax liability of Isabelle for the tax year 2016-17

The Isabelle who has to pay taxation amount on incomes generated from different

avenues. On different incomes of sources and levels taxation amount varied and on the basis of

that he has to pay to state government of UK (Morellec and Schürhoff, 2010). In the present case

Isabelle has tax liability at the end of tax year 2016-17 which is shown on below:

Particulars Amount (in £) Amount (in £)

Gross profit 93040

Add: rental income @ 10% 9304

Other incomes

Premium on rental 60000

Dividend income 9000

Interest income on saving account 4000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Total other incomes 73000

Total gross profit £175344

Less: expenses

Depreciation @ 8% 7443.2

Wages and salaries @ 10% 9304

Rent and other expenses @ 30%

Utility costs @ 12% 11164.8

Printing and stationery costs @ 5% 32.5

Motoring expenses @ 7% 98

Depreciation on car 5333

Cost of PC and accessories 4000

Expense on pension plan 5000

Total expenses £42375.5

Net profit £132968.5

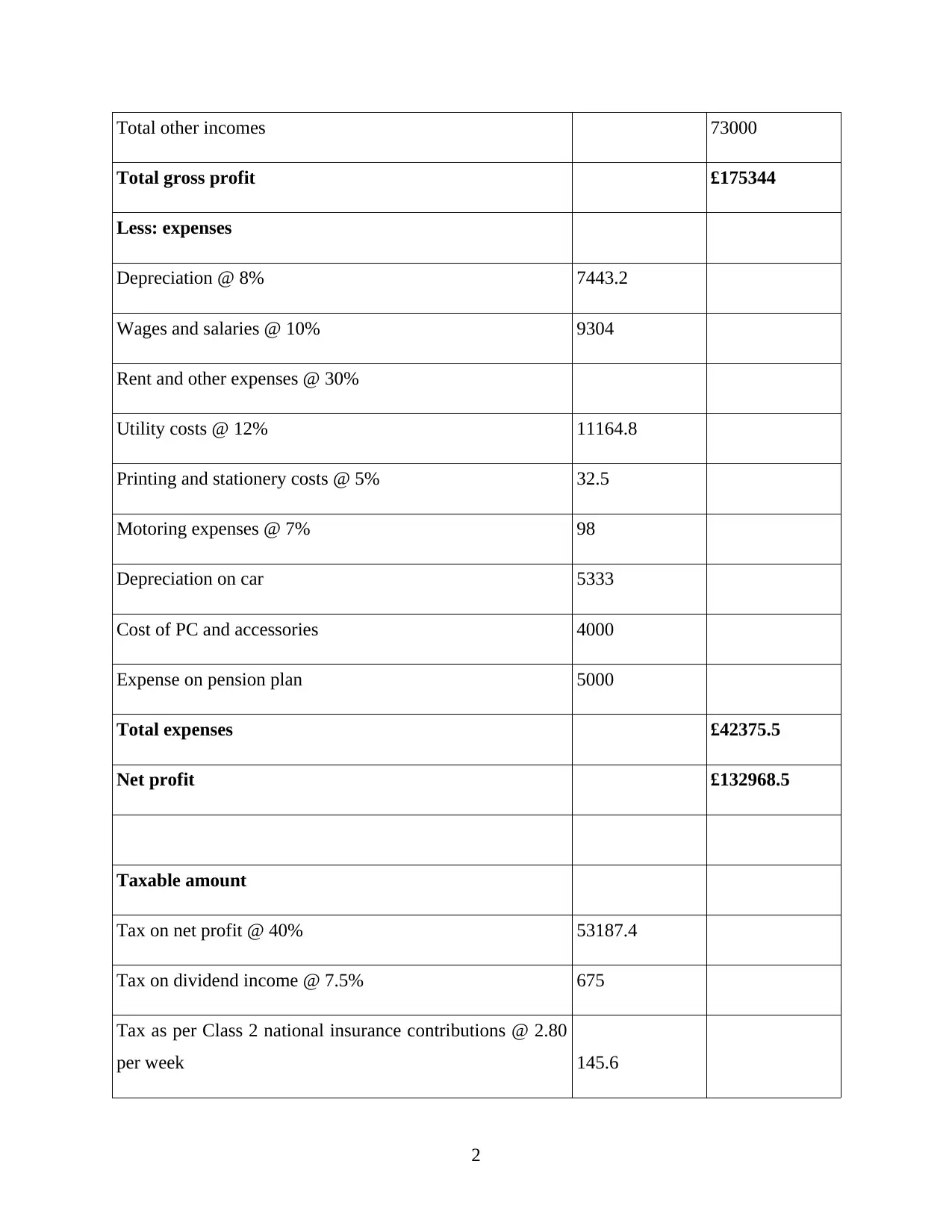

Taxable amount

Tax on net profit @ 40% 53187.4

Tax on dividend income @ 7.5% 675

Tax as per Class 2 national insurance contributions @ 2.80

per week 145.6

2

Total gross profit £175344

Less: expenses

Depreciation @ 8% 7443.2

Wages and salaries @ 10% 9304

Rent and other expenses @ 30%

Utility costs @ 12% 11164.8

Printing and stationery costs @ 5% 32.5

Motoring expenses @ 7% 98

Depreciation on car 5333

Cost of PC and accessories 4000

Expense on pension plan 5000

Total expenses £42375.5

Net profit £132968.5

Taxable amount

Tax on net profit @ 40% 53187.4

Tax on dividend income @ 7.5% 675

Tax as per Class 2 national insurance contributions @ 2.80

per week 145.6

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

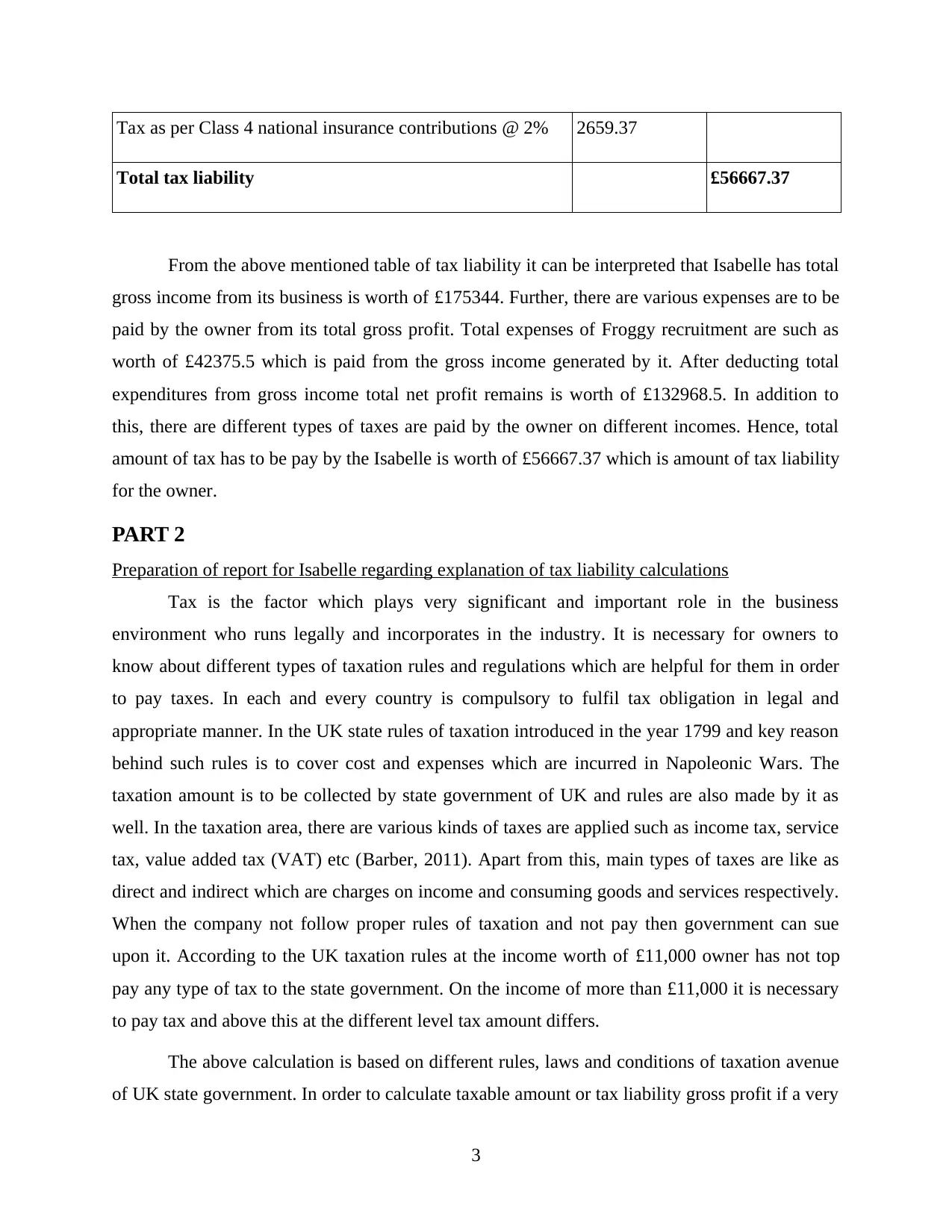

Tax as per Class 4 national insurance contributions @ 2% 2659.37

Total tax liability £56667.37

From the above mentioned table of tax liability it can be interpreted that Isabelle has total

gross income from its business is worth of £175344. Further, there are various expenses are to be

paid by the owner from its total gross profit. Total expenses of Froggy recruitment are such as

worth of £42375.5 which is paid from the gross income generated by it. After deducting total

expenditures from gross income total net profit remains is worth of £132968.5. In addition to

this, there are different types of taxes are paid by the owner on different incomes. Hence, total

amount of tax has to be pay by the Isabelle is worth of £56667.37 which is amount of tax liability

for the owner.

PART 2

Preparation of report for Isabelle regarding explanation of tax liability calculations

Tax is the factor which plays very significant and important role in the business

environment who runs legally and incorporates in the industry. It is necessary for owners to

know about different types of taxation rules and regulations which are helpful for them in order

to pay taxes. In each and every country is compulsory to fulfil tax obligation in legal and

appropriate manner. In the UK state rules of taxation introduced in the year 1799 and key reason

behind such rules is to cover cost and expenses which are incurred in Napoleonic Wars. The

taxation amount is to be collected by state government of UK and rules are also made by it as

well. In the taxation area, there are various kinds of taxes are applied such as income tax, service

tax, value added tax (VAT) etc (Barber, 2011). Apart from this, main types of taxes are like as

direct and indirect which are charges on income and consuming goods and services respectively.

When the company not follow proper rules of taxation and not pay then government can sue

upon it. According to the UK taxation rules at the income worth of £11,000 owner has not top

pay any type of tax to the state government. On the income of more than £11,000 it is necessary

to pay tax and above this at the different level tax amount differs.

The above calculation is based on different rules, laws and conditions of taxation avenue

of UK state government. In order to calculate taxable amount or tax liability gross profit if a very

3

Total tax liability £56667.37

From the above mentioned table of tax liability it can be interpreted that Isabelle has total

gross income from its business is worth of £175344. Further, there are various expenses are to be

paid by the owner from its total gross profit. Total expenses of Froggy recruitment are such as

worth of £42375.5 which is paid from the gross income generated by it. After deducting total

expenditures from gross income total net profit remains is worth of £132968.5. In addition to

this, there are different types of taxes are paid by the owner on different incomes. Hence, total

amount of tax has to be pay by the Isabelle is worth of £56667.37 which is amount of tax liability

for the owner.

PART 2

Preparation of report for Isabelle regarding explanation of tax liability calculations

Tax is the factor which plays very significant and important role in the business

environment who runs legally and incorporates in the industry. It is necessary for owners to

know about different types of taxation rules and regulations which are helpful for them in order

to pay taxes. In each and every country is compulsory to fulfil tax obligation in legal and

appropriate manner. In the UK state rules of taxation introduced in the year 1799 and key reason

behind such rules is to cover cost and expenses which are incurred in Napoleonic Wars. The

taxation amount is to be collected by state government of UK and rules are also made by it as

well. In the taxation area, there are various kinds of taxes are applied such as income tax, service

tax, value added tax (VAT) etc (Barber, 2011). Apart from this, main types of taxes are like as

direct and indirect which are charges on income and consuming goods and services respectively.

When the company not follow proper rules of taxation and not pay then government can sue

upon it. According to the UK taxation rules at the income worth of £11,000 owner has not top

pay any type of tax to the state government. On the income of more than £11,000 it is necessary

to pay tax and above this at the different level tax amount differs.

The above calculation is based on different rules, laws and conditions of taxation avenue

of UK state government. In order to calculate taxable amount or tax liability gross profit if a very

3

basic amount which requires. Without the gross income it is not possible to calculate tax liability

of the company or personal. Apart from gross profit, different kinds of expenses and costs

incurred in operation or production process are also plays an important role which helps to

determine net profit at the end of financial and tax year (Tax and tax credit rates and thresholds

for 2016-17, 2015). Tax amount is to be imposes on net income generate by the firm or owner

such as Isabelle. Here total expenses are calculated on the basis of percentage given which are

added and used for determine net profit at the end of year. Furthermore, apart from gross income

another gains are to be determined from other matters given in question file. Isabelle own a

property which given on lease and from there it generates incomes and gains as well. On the

rental income there is any type of taxation amount has not to give to the state government.

According to the taxation law of UK government, owner already pay tax amount on land and

property due to which such rules are not applied on that.

As per the taxation rule of UK at the different net income level tax rate is varied which is

collected by income tax authority and state government of UK. In the UK at the income level

worth of £11000 there is any kind of income tax has not pay by the person. Further, at the level

of income worth of between £11001 to £43000 and between £43001 to 150000 income tax rate is

20% and 40% respectively (Overesch and Voeller, 2010). Apart from this when a person

generate net income more than 150000 than tax rate will be 45%. In the present scenario net

income generates by Isabelle is worth of £132968.5 where it has to pay 40% amount of the

profit. Hence, amount of income tax for the Isabelle is 53187.4 which has to be given from net

profit which lead to reduce final outcome at the end of financial period.

Moreover, in terms of tax amount on dividend it depends on the profit or return generates

from shares in form of dividend. Higher the amount lead to take high percentage of tax rate by

which level of income affects in negative manner. According to the law of UK taxation at the

level of dividend income worth of £5000 the shareholder no need to pay any tax amount (Rates

and allowances: National Insurance contributions, 2016). As income of dividend increases the

owner Isabelle has to pay higher amount of tax to the UK government. When dividend income

gains by stockholder between £5000 to £10000 then tax rate is 7.5% which is basic rate on

dividend. Further, as dividend incomes gets high then tax rate as well. In this higher rate and

additional rate on dividend amount is 32.5% and 38.1% respectively. In the present case Isabelle

earns dividend income worth of £9000 where basic tax rate is applied and amount is worth of

4

of the company or personal. Apart from gross profit, different kinds of expenses and costs

incurred in operation or production process are also plays an important role which helps to

determine net profit at the end of financial and tax year (Tax and tax credit rates and thresholds

for 2016-17, 2015). Tax amount is to be imposes on net income generate by the firm or owner

such as Isabelle. Here total expenses are calculated on the basis of percentage given which are

added and used for determine net profit at the end of year. Furthermore, apart from gross income

another gains are to be determined from other matters given in question file. Isabelle own a

property which given on lease and from there it generates incomes and gains as well. On the

rental income there is any type of taxation amount has not to give to the state government.

According to the taxation law of UK government, owner already pay tax amount on land and

property due to which such rules are not applied on that.

As per the taxation rule of UK at the different net income level tax rate is varied which is

collected by income tax authority and state government of UK. In the UK at the income level

worth of £11000 there is any kind of income tax has not pay by the person. Further, at the level

of income worth of between £11001 to £43000 and between £43001 to 150000 income tax rate is

20% and 40% respectively (Overesch and Voeller, 2010). Apart from this when a person

generate net income more than 150000 than tax rate will be 45%. In the present scenario net

income generates by Isabelle is worth of £132968.5 where it has to pay 40% amount of the

profit. Hence, amount of income tax for the Isabelle is 53187.4 which has to be given from net

profit which lead to reduce final outcome at the end of financial period.

Moreover, in terms of tax amount on dividend it depends on the profit or return generates

from shares in form of dividend. Higher the amount lead to take high percentage of tax rate by

which level of income affects in negative manner. According to the law of UK taxation at the

level of dividend income worth of £5000 the shareholder no need to pay any tax amount (Rates

and allowances: National Insurance contributions, 2016). As income of dividend increases the

owner Isabelle has to pay higher amount of tax to the UK government. When dividend income

gains by stockholder between £5000 to £10000 then tax rate is 7.5% which is basic rate on

dividend. Further, as dividend incomes gets high then tax rate as well. In this higher rate and

additional rate on dividend amount is 32.5% and 38.1% respectively. In the present case Isabelle

earns dividend income worth of £9000 where basic tax rate is applied and amount is worth of

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

£675. On the interest amount of saving accounts there is not any tax are imposes by state

government of UK.

In addition to this, calculation of Class 2 and Class 4 national insurance contributions

shows that Isabelle has to pay tax amount worth of £145.6 and £2659.37 respectively. In the

national insurance contribution the amount goes in welfare of people or society which affects to

the firm in positive manner indirectly. Under the class 2 and class 4 of national insurance

contributions as level of net income increase, tax rate and amount reduce. There are inverse

relations between net profit and tax rate under national insurance contributions (Self-employed

National Insurance rates, 2017). According to the tax year 2016 to 2017 in UK tax amount has to

pay worth of £2.80 per week under the class two. For this condition is that income level is to

more than £5965, below such income not need to pay taxation amount. Apart from this, as per

the class 4 of national insurance contributions profit level are different which are £8060 and

£43000 which denotes as lower and upper profit limits respectively. According to the tax year

2016 to 2017 at the lower profit limit tax rate is 9% and at higher profit level tax rate is 2%.

In the present scenario net profit level of Isabelle is worth of £132968.5 which is upper

profit limit as per the class 4 where tax rate is 2% and amount is £2659.27. Apart from this,

according to class 2 tax has to pay £2.80 per week and in a year there are 52 weeks. Hence, tax

amount for national insurance contributions is 52*2.80 = £145.6.

On the basis of above calculations it can be derived that total amount of tax or tax

liability for Isabelle is worth of £56667.37 at the end of tax year 2016-17.

PART 3

Report of Non-domiciled status of UK while acquiring new partner

According to the taxation rules and regulations of UK the person who has nationality of

another country and living in the UK on permanent basis is known as a non-domiciled status. In

this the person is tax liable when he has its own property in the UK otherwise if he has bot any

kind of property in the UK then tax charges are not imposes on his by government. Non-

domiciled is criteria where the persons or local community of UK have their own house and

property on permanent basis. On such types of properties there are any types of taxation amount

has not pay to such owners and community which lead to reduce expenses. As an employee of

tax advisor business entity it can be said that to acquire non domicile partner is very helpful as

5

government of UK.

In addition to this, calculation of Class 2 and Class 4 national insurance contributions

shows that Isabelle has to pay tax amount worth of £145.6 and £2659.37 respectively. In the

national insurance contribution the amount goes in welfare of people or society which affects to

the firm in positive manner indirectly. Under the class 2 and class 4 of national insurance

contributions as level of net income increase, tax rate and amount reduce. There are inverse

relations between net profit and tax rate under national insurance contributions (Self-employed

National Insurance rates, 2017). According to the tax year 2016 to 2017 in UK tax amount has to

pay worth of £2.80 per week under the class two. For this condition is that income level is to

more than £5965, below such income not need to pay taxation amount. Apart from this, as per

the class 4 of national insurance contributions profit level are different which are £8060 and

£43000 which denotes as lower and upper profit limits respectively. According to the tax year

2016 to 2017 at the lower profit limit tax rate is 9% and at higher profit level tax rate is 2%.

In the present scenario net profit level of Isabelle is worth of £132968.5 which is upper

profit limit as per the class 4 where tax rate is 2% and amount is £2659.27. Apart from this,

according to class 2 tax has to pay £2.80 per week and in a year there are 52 weeks. Hence, tax

amount for national insurance contributions is 52*2.80 = £145.6.

On the basis of above calculations it can be derived that total amount of tax or tax

liability for Isabelle is worth of £56667.37 at the end of tax year 2016-17.

PART 3

Report of Non-domiciled status of UK while acquiring new partner

According to the taxation rules and regulations of UK the person who has nationality of

another country and living in the UK on permanent basis is known as a non-domiciled status. In

this the person is tax liable when he has its own property in the UK otherwise if he has bot any

kind of property in the UK then tax charges are not imposes on his by government. Non-

domiciled is criteria where the persons or local community of UK have their own house and

property on permanent basis. On such types of properties there are any types of taxation amount

has not pay to such owners and community which lead to reduce expenses. As an employee of

tax advisor business entity it can be said that to acquire non domicile partner is very helpful as

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

well as profitable for the company. The main reason behind acquiring such partner is that when it

uses property of non domicile then it not needs to pay any kind of expenses to state government

of UK in terms of tax amount (Vítek, 2013). In this there are different kinds of rules and

conditions applied by which taxes are not taken on non domiciled property. As per the condition

until and unless the partner make any kind of capital gains or incomes from foreign as well as

sell its shares and property to seller who is from foreign country. As per the taxation law of UK

government when such mentioned conditions are not followed by then tax must paid to the state

government of UK country. It is known as a non-domiciled because the person who has

nationality of another country and live in UK, there are any kind of resident tax are not imposes

on his until and unless he not purchases property.

As per the taxation rules under non-domiciled there are different changes are made by

UK government which will be beneficial for the partners and companies in order to generate

more number of profits. It has been proposed for the April 2017 is that, person who lived in the

UK from last 15 years or 20 previous taxation years that will be understandable as a domiciled in

the UK government. Apart from this another change is related to the owing property in direct or

indirect manner in the country (Proposed Changes to the Non-Dom Regime from April 2017,

2017). When the owner owing property in UK in indirect manner such as with the help of

overseas business enterprise and purchase another country property then he not need to pay taxes

in UK. It is very highly beneficial for the firm by which it able to generate more number of profit

at the end of next financial year. Such mentioned different kinds of rules in order to charge tax

on resident are has to follow those community who have nationality of the UK along with

property. If there is a foreigner living in UK then pit cannot considered as a domiciled because

he already pays charges of resident to owner. Further, the respective owner of property will pay

the taxes on property and considers as a non-domiciled.

According to the proposed changes for April 2017, it has been changes that it the person

who have non-domicile position currently. Further, if he leaves the country and become non-UK

resident up to the six taxation years of UK then he will be deemed as a tax payable or domicile

person. In this he needs to pay tax rate on the basis of taxation rules applied on domicile

property. Moreover, non-domicile individual who paying amount of taxation recently worth of

£30000, £60000 or £90000 to UK government. These all amount will be beneficial for the

individuals in the future of next tax years as per the proposed rules of April 2017 (King and

6

uses property of non domicile then it not needs to pay any kind of expenses to state government

of UK in terms of tax amount (Vítek, 2013). In this there are different kinds of rules and

conditions applied by which taxes are not taken on non domiciled property. As per the condition

until and unless the partner make any kind of capital gains or incomes from foreign as well as

sell its shares and property to seller who is from foreign country. As per the taxation law of UK

government when such mentioned conditions are not followed by then tax must paid to the state

government of UK country. It is known as a non-domiciled because the person who has

nationality of another country and live in UK, there are any kind of resident tax are not imposes

on his until and unless he not purchases property.

As per the taxation rules under non-domiciled there are different changes are made by

UK government which will be beneficial for the partners and companies in order to generate

more number of profits. It has been proposed for the April 2017 is that, person who lived in the

UK from last 15 years or 20 previous taxation years that will be understandable as a domiciled in

the UK government. Apart from this another change is related to the owing property in direct or

indirect manner in the country (Proposed Changes to the Non-Dom Regime from April 2017,

2017). When the owner owing property in UK in indirect manner such as with the help of

overseas business enterprise and purchase another country property then he not need to pay taxes

in UK. It is very highly beneficial for the firm by which it able to generate more number of profit

at the end of next financial year. Such mentioned different kinds of rules in order to charge tax

on resident are has to follow those community who have nationality of the UK along with

property. If there is a foreigner living in UK then pit cannot considered as a domiciled because

he already pays charges of resident to owner. Further, the respective owner of property will pay

the taxes on property and considers as a non-domiciled.

According to the proposed changes for April 2017, it has been changes that it the person

who have non-domicile position currently. Further, if he leaves the country and become non-UK

resident up to the six taxation years of UK then he will be deemed as a tax payable or domicile

person. In this he needs to pay tax rate on the basis of taxation rules applied on domicile

property. Moreover, non-domicile individual who paying amount of taxation recently worth of

£30000, £60000 or £90000 to UK government. These all amount will be beneficial for the

individuals in the future of next tax years as per the proposed rules of April 2017 (King and

6

Fullerton, 2010). Being an employee of tax advisor it can be said that proposed changes will be

beneficial if it acquires non-domiciled partner in firm. Hence, it can be assessed that to acquire

an individual or partner who has non-domiciled status in the UK government will be most

beneficial for the company. Because here firm able to use more services or property at negligible

and very low taxation amount. On the basis of mentioned different kinds of preposed changes in

the forthcoming tax years it can be said that when an organisation acquire non-domiciled status

then it able to utilize more number of property without paying extra and more expenses.

PART 4

Tax position of Apple corporation in the country Ireland

Article in the newspaper on 'The world’s biggest tax bill' reveals that, as Apple is the

biggest giant of information technology in the world. It is having its root in most of the countries.

But obvious, its corporate tax will be so high. As per the facts of article, tax has to be calculated

over and around £11bn. According to the taxation laws of Ireland, the tax which has calculated

for Apple is very high and penalizes as per the rules. This amount of taxation has to be

demanded from the European Commission which is to be called as 'sweetheart deal' between the

biggest giant of technology and the Irish republic stretching back to 1991, according to the

article.

As per the Metro headlines, it has stated that some of the member of Apple are the part of

ruling commission which is showing fury in nature. It has also mentioned under this headline

that in 2014 Apple has paid 0.005p for every £1 of profit which it has made across the European

Union (or £50 in every £1m) (Zucman, 2014). Not paying tax on profit is against the taxation

laws. The company has pay tax to the government can use this for the benefits of the general

public The article has also revealed that Apple is not paying tax on almost all the profits which it

had earned in across the EU from its multibillion-euro sales. This is done by them because the

profits were not booking in the country in which they were earning, instead of that it was

booking in the Irish Republic.

'Spectacular collision', Under this term it has described that the anger has ruling prompted

from anger. This has become alarming situation in front of Apple. It is threat for it which is

related to investment in future and creation of job in Europe. It has expected to appeal from

Dublin as well. Now it has justified on the front page that Apple is facing calls related to

7

beneficial if it acquires non-domiciled partner in firm. Hence, it can be assessed that to acquire

an individual or partner who has non-domiciled status in the UK government will be most

beneficial for the company. Because here firm able to use more services or property at negligible

and very low taxation amount. On the basis of mentioned different kinds of preposed changes in

the forthcoming tax years it can be said that when an organisation acquire non-domiciled status

then it able to utilize more number of property without paying extra and more expenses.

PART 4

Tax position of Apple corporation in the country Ireland

Article in the newspaper on 'The world’s biggest tax bill' reveals that, as Apple is the

biggest giant of information technology in the world. It is having its root in most of the countries.

But obvious, its corporate tax will be so high. As per the facts of article, tax has to be calculated

over and around £11bn. According to the taxation laws of Ireland, the tax which has calculated

for Apple is very high and penalizes as per the rules. This amount of taxation has to be

demanded from the European Commission which is to be called as 'sweetheart deal' between the

biggest giant of technology and the Irish republic stretching back to 1991, according to the

article.

As per the Metro headlines, it has stated that some of the member of Apple are the part of

ruling commission which is showing fury in nature. It has also mentioned under this headline

that in 2014 Apple has paid 0.005p for every £1 of profit which it has made across the European

Union (or £50 in every £1m) (Zucman, 2014). Not paying tax on profit is against the taxation

laws. The company has pay tax to the government can use this for the benefits of the general

public The article has also revealed that Apple is not paying tax on almost all the profits which it

had earned in across the EU from its multibillion-euro sales. This is done by them because the

profits were not booking in the country in which they were earning, instead of that it was

booking in the Irish Republic.

'Spectacular collision', Under this term it has described that the anger has ruling prompted

from anger. This has become alarming situation in front of Apple. It is threat for it which is

related to investment in future and creation of job in Europe. It has expected to appeal from

Dublin as well. Now it has justified on the front page that Apple is facing calls related to

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

government investigation for its tax evasion in UK and its tax adjustments. The European

Commission has taken decision for investigation in the following three years. As Apple has

suspected that till now it is the most spectacular collision in a succession of conflicts on taxation

between the legal authorities and global conglomerates (Ardanaz and Scartascini, 2013).

In the paper report of “Britain open for business”, it has said by the Downing Street that

Apple would be welcomed in the UK economy. The decision could be resultant in a significant

opportunity for Britain, as after leaving the European Union it is seeking to attract more

businesses. It has mentioned by the reporter that UK is the economy where corporate tax rate is

one of the lowest tax rate in the whole European Union and after Brexit this could be proved the

major competitive advantage. Now this has become threat for the EU that they could boycott by

the UK.

Many of the newspapers have mentioned in their editorial columns about the Apple-EU

tax issues. It is the game of time that Apple was beat with a monster tax bill. It has believed by

them that the world should be thankful and grateful as they have generated employment

opportunities for the people. Applying fine of £11bn on tax evader Apple was just a beginning of

fightback against the biggest giant business players who avoids to pay taxes and public dues in

Britain and Europe (Knoester, 2016).

It has stated under the headline 'EU shows its true colours over Apple' that what has

wrong with the EU, both economically and politically with context to the dealing of European

Commission with Apple and Ireland. In sense of economically that punitive approach has to be

followed for the taxation on highly mobile international businesses which is a self harm act.

These kinds of corporations can and will setup itself in those countries where tax can evade

easily. And in political sense, the unelected commission in Brussels should assume that the tax

rate should to levy is to be detected by the Ireland's government (Henrekson and Sanandaji,

2011).

CONCLUSION

It can be concluded from carried out analysis of personal taxation that, tax is one of the

most important part of every business enterprise. Further, tax imposes on each and every person

and firm in direct and indirect manner as well. It can be analysed that Isabelle started a firm

Froggy recruitment where it generates profit and other incomes as well such as rental, dividend,

8

Commission has taken decision for investigation in the following three years. As Apple has

suspected that till now it is the most spectacular collision in a succession of conflicts on taxation

between the legal authorities and global conglomerates (Ardanaz and Scartascini, 2013).

In the paper report of “Britain open for business”, it has said by the Downing Street that

Apple would be welcomed in the UK economy. The decision could be resultant in a significant

opportunity for Britain, as after leaving the European Union it is seeking to attract more

businesses. It has mentioned by the reporter that UK is the economy where corporate tax rate is

one of the lowest tax rate in the whole European Union and after Brexit this could be proved the

major competitive advantage. Now this has become threat for the EU that they could boycott by

the UK.

Many of the newspapers have mentioned in their editorial columns about the Apple-EU

tax issues. It is the game of time that Apple was beat with a monster tax bill. It has believed by

them that the world should be thankful and grateful as they have generated employment

opportunities for the people. Applying fine of £11bn on tax evader Apple was just a beginning of

fightback against the biggest giant business players who avoids to pay taxes and public dues in

Britain and Europe (Knoester, 2016).

It has stated under the headline 'EU shows its true colours over Apple' that what has

wrong with the EU, both economically and politically with context to the dealing of European

Commission with Apple and Ireland. In sense of economically that punitive approach has to be

followed for the taxation on highly mobile international businesses which is a self harm act.

These kinds of corporations can and will setup itself in those countries where tax can evade

easily. And in political sense, the unelected commission in Brussels should assume that the tax

rate should to levy is to be detected by the Ireland's government (Henrekson and Sanandaji,

2011).

CONCLUSION

It can be concluded from carried out analysis of personal taxation that, tax is one of the

most important part of every business enterprise. Further, tax imposes on each and every person

and firm in direct and indirect manner as well. It can be analysed that Isabelle started a firm

Froggy recruitment where it generates profit and other incomes as well such as rental, dividend,

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

interest etc. It can be calculated that total tax liability for Isabelle is worth of £56667.37 at the

end of tax year 2016-2017. Moreover, it can be summarized that non-domiciled status of UK

says that on the inheritance property also taxation charges are taken by state government of UK.

Further, from the year 2016 to April 2017 there are various kinds of changes are proposed by the

UK government in order to impose taxation amount on the local community of London. From

the last part it can be concluded that Apple company is not paying taxation amount in the country

such as Ireland. Further, it has been identified that most of the brands wants to enter in those

country where very less and negligible tax is charges by state government.

9

end of tax year 2016-2017. Moreover, it can be summarized that non-domiciled status of UK

says that on the inheritance property also taxation charges are taken by state government of UK.

Further, from the year 2016 to April 2017 there are various kinds of changes are proposed by the

UK government in order to impose taxation amount on the local community of London. From

the last part it can be concluded that Apple company is not paying taxation amount in the country

such as Ireland. Further, it has been identified that most of the brands wants to enter in those

country where very less and negligible tax is charges by state government.

9

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.