Examination of Financial Distress in Indian Sugar Sector

VerifiedAdded on 2023/04/21

|6

|4297

|222

AI Summary

This research paper examines the extent of financial distress in the Indian sugar sector using Ohlson's 'O' Score model. Findings indicate widespread financial distress in the sector.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page221

EXAMINATION OF FINANCIAL DISTRESS IN INDIAN SUGAR SECTOR – APPLICATION OF OHLSON’S ‘O’

SCORE MODEL

Prof. Jyoti Nair

Assistant Professor, N.L.Dalmia Institute of Management Studies and Research, Mumbai.

Abstract

Financial distress is an indicator of probable bankruptcy and insolvency. A company in distress passes through various

stages of decline in financial health before bankruptcy sets in. Bankruptcy or insolvency not only leads to erosion of net

worth of the company but also adversely affects all the corporate stakeholders viz investors, lenders, employees , creditors ,

government and society in general. It becomes very crucial to identify distress signals well in advance so that so that

remedial steps can be taken for company turnaround. Indian sugar sector have been facing distress in recent times. The

profitability of companies in sugar sector is greatly affected by climatic conditions, price trends in international markets, oil

prices, government policies w.r.t cane and sugar pricing. This paper purports to examine the extent of financial distress in

Indian sugar sector. Identification of distress will enable the companies to review the business operations and policies and

develop strategies to combat financial distress. 58 listed companies in sugar sector were studied for the period 2011-12 to

2013-14. Ohlson (1980) model for bankruptcy prediction using logistic regression was applied to the selected companies to

identify distress and probability of bankruptcy. The results of the study indicates widespread financial distress in sugar

sector.

Key Words: Financial Distress, Bankruptcy, Sugar Sector, Ohlson’s ‘O’ Score.

1. INTRODUCTION

Financial distress in companies indicates a situation where the company is not able to meet its contractual obligations due to

dismal financial performance. Such distress is seen through gradual reduction in sales and other income, low margins of

profit, underutilization of assets and a challenging working capital. This leads to delay in payment to banks, suppliers,

employees and government. Sustenance and survival of a distressed company becomes difficult. However a financially

distressed company can turnaround itself through remedial measures taken at appropriate times. This is possible if the distress

signals are identified in advance by the company’s management. When financial distress cannot be mitigated, bankruptcy or

insolvency sets in. (Avenhuis, 2013).

It is generally accepted that financial statements contains relevant information which can help a stakeholder identify signals

of financial decay in a company. Such identification will help all the stake holders to protect their interest with minimum

losses. There are many distress prediction models developed by researchers which can be applied albeit with caution (Grice

and Dugan, 2001). The most commonly used models are:

1. Altman (1968) ‘z’ Score model using Multivariant Discriminant Analysis

2. Ohlson ( 1980) ‘o’ score model using Logit Analysis

3. Zmijewski ( 1984) model using Probit Analysis

4. Shumway (2001) model using Discrete Hazard Analysis.

5. Hillegeist (2004) model using the Black Scholes Probability theory.

FINANCIAL DISTRESS IN INDIA

The important indicators of financial distress leading to bankruptcies are debt default, negative net worth, negative operating

margins. The stressed advances of scheduled banks have shown an increasing trend over the last few years. Of the broad

sectors, 44.8% of the total advances have been made to industry sector. 17.9% of the total advances to industry sector has

been classified as stressed (Financial Stability report of RBI, June 2015). Industrial sickness in India has resulted in loss of

employment to millions of people. (Murty and Misra, 2004). It becomes imperative to adopt mechanisms which can serve as

early warning system for companies to take remedial measures. Applying prediction models using information from financial

statements can indicate distress on companies. Analysing the financial information of a business on a regular basis can

provide valuable insight about the state of affairs of the business. (Bhunia and Sarkar, 2011). This study aims to investigate

the extent of distress in Indian sugar sector.

SUGAR SECTOR IN INDIA

India is the second largest producer of sugar in the world contributing to around 14% of global sugar production. Sugar is a

critical agro based industry in India providing sustenance to around 50 million sugar cane farmers. This industry provides

employment to more than 20 lakh skilled and semi- skilled workers. The industry comprises of public sector units, private

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page221

EXAMINATION OF FINANCIAL DISTRESS IN INDIAN SUGAR SECTOR – APPLICATION OF OHLSON’S ‘O’

SCORE MODEL

Prof. Jyoti Nair

Assistant Professor, N.L.Dalmia Institute of Management Studies and Research, Mumbai.

Abstract

Financial distress is an indicator of probable bankruptcy and insolvency. A company in distress passes through various

stages of decline in financial health before bankruptcy sets in. Bankruptcy or insolvency not only leads to erosion of net

worth of the company but also adversely affects all the corporate stakeholders viz investors, lenders, employees , creditors ,

government and society in general. It becomes very crucial to identify distress signals well in advance so that so that

remedial steps can be taken for company turnaround. Indian sugar sector have been facing distress in recent times. The

profitability of companies in sugar sector is greatly affected by climatic conditions, price trends in international markets, oil

prices, government policies w.r.t cane and sugar pricing. This paper purports to examine the extent of financial distress in

Indian sugar sector. Identification of distress will enable the companies to review the business operations and policies and

develop strategies to combat financial distress. 58 listed companies in sugar sector were studied for the period 2011-12 to

2013-14. Ohlson (1980) model for bankruptcy prediction using logistic regression was applied to the selected companies to

identify distress and probability of bankruptcy. The results of the study indicates widespread financial distress in sugar

sector.

Key Words: Financial Distress, Bankruptcy, Sugar Sector, Ohlson’s ‘O’ Score.

1. INTRODUCTION

Financial distress in companies indicates a situation where the company is not able to meet its contractual obligations due to

dismal financial performance. Such distress is seen through gradual reduction in sales and other income, low margins of

profit, underutilization of assets and a challenging working capital. This leads to delay in payment to banks, suppliers,

employees and government. Sustenance and survival of a distressed company becomes difficult. However a financially

distressed company can turnaround itself through remedial measures taken at appropriate times. This is possible if the distress

signals are identified in advance by the company’s management. When financial distress cannot be mitigated, bankruptcy or

insolvency sets in. (Avenhuis, 2013).

It is generally accepted that financial statements contains relevant information which can help a stakeholder identify signals

of financial decay in a company. Such identification will help all the stake holders to protect their interest with minimum

losses. There are many distress prediction models developed by researchers which can be applied albeit with caution (Grice

and Dugan, 2001). The most commonly used models are:

1. Altman (1968) ‘z’ Score model using Multivariant Discriminant Analysis

2. Ohlson ( 1980) ‘o’ score model using Logit Analysis

3. Zmijewski ( 1984) model using Probit Analysis

4. Shumway (2001) model using Discrete Hazard Analysis.

5. Hillegeist (2004) model using the Black Scholes Probability theory.

FINANCIAL DISTRESS IN INDIA

The important indicators of financial distress leading to bankruptcies are debt default, negative net worth, negative operating

margins. The stressed advances of scheduled banks have shown an increasing trend over the last few years. Of the broad

sectors, 44.8% of the total advances have been made to industry sector. 17.9% of the total advances to industry sector has

been classified as stressed (Financial Stability report of RBI, June 2015). Industrial sickness in India has resulted in loss of

employment to millions of people. (Murty and Misra, 2004). It becomes imperative to adopt mechanisms which can serve as

early warning system for companies to take remedial measures. Applying prediction models using information from financial

statements can indicate distress on companies. Analysing the financial information of a business on a regular basis can

provide valuable insight about the state of affairs of the business. (Bhunia and Sarkar, 2011). This study aims to investigate

the extent of distress in Indian sugar sector.

SUGAR SECTOR IN INDIA

India is the second largest producer of sugar in the world contributing to around 14% of global sugar production. Sugar is a

critical agro based industry in India providing sustenance to around 50 million sugar cane farmers. This industry provides

employment to more than 20 lakh skilled and semi- skilled workers. The industry comprises of public sector units, private

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page222

sector units and cooperative societies. The profitability of this sector is highly cyclical in nature. Climatic conditions, price

trends in international markets, oil prices, government policies w.r.t cane and sugar pricing affects the performance of the

sector.

Over a period of time sugar sector has witnessed crisis due to increase in cane prices proportionately more than sugar prices.

(CRISIL Opinion, 2014). Surplus production and fall in international prices have also contributed to low performance and

consequent decline in the financial health of companies in sugar industry.

Hence there is a need to examine the extent of financial distress in Indian sugar sector so that the stakeholders can take

appropriate measures to mitigate and minimize the adverse effects of financial crisis.

2. LITERATURE REVIEW

Research on corporate distress have always attracted and challenged researchers and practioners alike. Extensive literature is

available on study of corporate distress. The earliest study can be traced back to 1930’s. In 1966 Beaver developed a model

for predicting bankruptcy using univariate analysis. Later Altman in 1968 developed the very popular ‘z’ score bankruptcy

prediction model using Multi variate Discriminant Analysis (Avenhuis, 2013). Some of the recent important studies in this

subject are discussed below:

Kane et al (2006) have examined the usefulness of financial reporting data to predict the probability of a firm recovering

from financial distress. Marc Le Clere (2006) studied the relationship between different sets of financial variables used in

financial distress. Abad et al (2007) identified the unique features of failed companies and the syndromes leading to such

failures. Wang and Li (2007) used a rough set model was used to construct a distress prediction model of Chinese companies.

Smith and Liou (2007) in their study tested the applicability one model across all sectors and whether ratios indicating

financial distress differ sector wise was investigated. Sharpe and Stadnik (2007) tried to identify Australian general insurers

experiencing financial distress: The relationship between indirect financial distress cost borne by a companies under distress

and corporate governance was studied by Hui and Jing-Jing (2008). Coyne et al (2008) analysed financial ratios of 13

bankrupt health care systems and 7 solvent health care systems. Salehi and Bizhan (2009) studied financial distress of

companies listed in Tehran SE. Wang and Campbell (2010) applied Altman’s z-score model to predict financial distress in

publicly listed Chinese companies. Julien le Maux and Morin (2011) tried to analyse whether Lehman’Bros. Downfall could

have been predicted. Hodgkin and Marchesini (2011) studied companies which has defaulted on loan payments. Zaki (2011)

developed distress prediction models for commercial and Islamic banks in UAE. The Malaysian companies were reviewed by

Ong et al (2011). Polemis and Gounopoulos (2012) tried to identify financial characteristics of companies in financial

distress. Dave (2012) in his study tries to establish relationship between financial management and profitability. The

extensive literature accepts the usefulness of financial ratios in predicting financial distress.

There has been some studies conducted in the area of financial distress in Indian companies. Bhunia and Sarkar (2011)

analysed financial ratios of companies in pharma sector. Arun and Kasilingam (2011) applied Altman (1968) ‘z’ score model

to IT companies in India. The financial health of Indian automobile sector was studied by Sarbapriya Ray (2012) by applying

Altman ‘z’ score model. Bardia (2012) examined the long term solvency of Indian steel companies using Altman ‘z’ score

model. Reddy and Reddy (2012) investigated distress in Indian sugar sector by applying the ‘z’ score model.

As seen from the discussion above there has been numerous studies conducted on financial distress using different statistical

techniques. However most of the studies in Indian context has been done using Altman ‘z’ score model.

Wu et al. (2010) in Avenhius, 2014 tested Altman (1968), Ohlson (1980), Zmijewski (1984), Hillegiest (2004) for their

applicability in US firms for the period 1980-2006. The study revealed that Ohlson (1980) model has the highest

discriminating ability. Avenhius (2013) also reviewed Altman (1968), Ohlson (1980) and Zmijewski (1984) models and

observed that accuracy rate of Ohlson’s model is highest and logit regression as the statistical tool gives the best explanat ory

variables for distress prediction. Kumar and Kumar (2011) compared the predictive accuracy of Altman ‘z’ score model and

Ohlson’s ‘o’ score model when applied to Indian companies. Ohlson’s ‘o’ score model was found to be most accurate since it

used logistic regression. This paper applies Ohlson’s ‘o’ score model to companies in sugar sector in India.

3. RESEARCH OBJECTIVE

In view of the critical nature of sugar sector in India, the objective of this paper is to examine financial distress in sugar sector

in India using Ohlson (1980) ‘o’ score model.

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page222

sector units and cooperative societies. The profitability of this sector is highly cyclical in nature. Climatic conditions, price

trends in international markets, oil prices, government policies w.r.t cane and sugar pricing affects the performance of the

sector.

Over a period of time sugar sector has witnessed crisis due to increase in cane prices proportionately more than sugar prices.

(CRISIL Opinion, 2014). Surplus production and fall in international prices have also contributed to low performance and

consequent decline in the financial health of companies in sugar industry.

Hence there is a need to examine the extent of financial distress in Indian sugar sector so that the stakeholders can take

appropriate measures to mitigate and minimize the adverse effects of financial crisis.

2. LITERATURE REVIEW

Research on corporate distress have always attracted and challenged researchers and practioners alike. Extensive literature is

available on study of corporate distress. The earliest study can be traced back to 1930’s. In 1966 Beaver developed a model

for predicting bankruptcy using univariate analysis. Later Altman in 1968 developed the very popular ‘z’ score bankruptcy

prediction model using Multi variate Discriminant Analysis (Avenhuis, 2013). Some of the recent important studies in this

subject are discussed below:

Kane et al (2006) have examined the usefulness of financial reporting data to predict the probability of a firm recovering

from financial distress. Marc Le Clere (2006) studied the relationship between different sets of financial variables used in

financial distress. Abad et al (2007) identified the unique features of failed companies and the syndromes leading to such

failures. Wang and Li (2007) used a rough set model was used to construct a distress prediction model of Chinese companies.

Smith and Liou (2007) in their study tested the applicability one model across all sectors and whether ratios indicating

financial distress differ sector wise was investigated. Sharpe and Stadnik (2007) tried to identify Australian general insurers

experiencing financial distress: The relationship between indirect financial distress cost borne by a companies under distress

and corporate governance was studied by Hui and Jing-Jing (2008). Coyne et al (2008) analysed financial ratios of 13

bankrupt health care systems and 7 solvent health care systems. Salehi and Bizhan (2009) studied financial distress of

companies listed in Tehran SE. Wang and Campbell (2010) applied Altman’s z-score model to predict financial distress in

publicly listed Chinese companies. Julien le Maux and Morin (2011) tried to analyse whether Lehman’Bros. Downfall could

have been predicted. Hodgkin and Marchesini (2011) studied companies which has defaulted on loan payments. Zaki (2011)

developed distress prediction models for commercial and Islamic banks in UAE. The Malaysian companies were reviewed by

Ong et al (2011). Polemis and Gounopoulos (2012) tried to identify financial characteristics of companies in financial

distress. Dave (2012) in his study tries to establish relationship between financial management and profitability. The

extensive literature accepts the usefulness of financial ratios in predicting financial distress.

There has been some studies conducted in the area of financial distress in Indian companies. Bhunia and Sarkar (2011)

analysed financial ratios of companies in pharma sector. Arun and Kasilingam (2011) applied Altman (1968) ‘z’ score model

to IT companies in India. The financial health of Indian automobile sector was studied by Sarbapriya Ray (2012) by applying

Altman ‘z’ score model. Bardia (2012) examined the long term solvency of Indian steel companies using Altman ‘z’ score

model. Reddy and Reddy (2012) investigated distress in Indian sugar sector by applying the ‘z’ score model.

As seen from the discussion above there has been numerous studies conducted on financial distress using different statistical

techniques. However most of the studies in Indian context has been done using Altman ‘z’ score model.

Wu et al. (2010) in Avenhius, 2014 tested Altman (1968), Ohlson (1980), Zmijewski (1984), Hillegiest (2004) for their

applicability in US firms for the period 1980-2006. The study revealed that Ohlson (1980) model has the highest

discriminating ability. Avenhius (2013) also reviewed Altman (1968), Ohlson (1980) and Zmijewski (1984) models and

observed that accuracy rate of Ohlson’s model is highest and logit regression as the statistical tool gives the best explanat ory

variables for distress prediction. Kumar and Kumar (2011) compared the predictive accuracy of Altman ‘z’ score model and

Ohlson’s ‘o’ score model when applied to Indian companies. Ohlson’s ‘o’ score model was found to be most accurate since it

used logistic regression. This paper applies Ohlson’s ‘o’ score model to companies in sugar sector in India.

3. RESEARCH OBJECTIVE

In view of the critical nature of sugar sector in India, the objective of this paper is to examine financial distress in sugar sector

in India using Ohlson (1980) ‘o’ score model.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page223

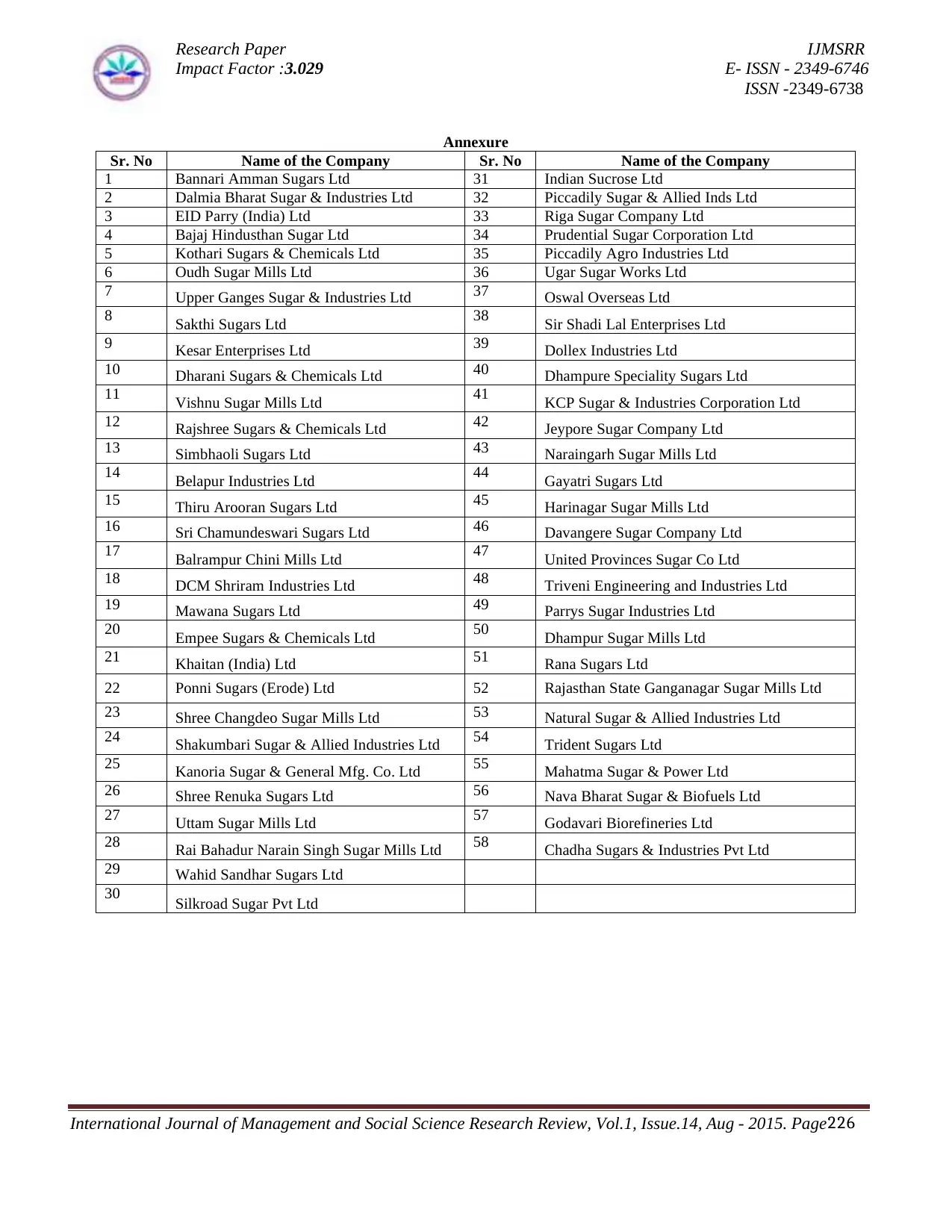

4. RESEARCH METHODOLOGY

1. Data: The data comprises of 58 listed companies in sugar sector. The period of study is 2011-12 to 2013-14 (3

years). Refer Annexure for list of companies.

2. Data Source: The financial data for these companies have been extracted from Capitaline database.

3. Statistical model used: For examining the financial health of selected companies, Ohlson (1980) ‘o’ score model

has been used. Ohlson (1980) used logit regression.to develop bankruptcy prediction model from a sample of 105

bankrupt and 2058 non- bankrupt companies in US.

Model specification

Y = -1.3 – 0.4Y1+ 6.0Y2- 1.4Y3+ 0.1Y4- 2.5Y5- 1.8Y6+ 0.3Y7- 1.7Y8- 0.5Y9

Where Y1 = log (Total Assets/GNP price level index)

Y2 = Total Liabilities/Total Assets

Y3 = Working capital /Total Assets

Y4 = Current Liabilities / Current Assets

Y5 = 1 if Total liabilities > Total Assets else Y5 = 0

Y6 = Net Income/Total Assets

Y7 = Funds from operations/ Total Liabilities

Y8 = 1 if Net Income for 2 preceding years is negative else Y8= 0

Y9 = measure of change in Net Income

5. INTERPRETATION OF VARIABLES

Independent Variables

Y1 – Size of the company. Smaller companies tend to have greater probability of failure. GNP price level index has been

determined using 2011-12 as base year.

Y2 – The ratio of total liabilities to total assets indicates the extent to which the liabilities of the company are covered by

its assets. It also reflects the leverage of the company. A high total liabilities to assets ratio indicates higher risks for the

company.

Y3 – The ratio of working capital to total assets explains working capital adequacy and short term solvency and liquidity of

the company. A high ratio would indicate high levels of liquidity.

Y4 – The ratio of current liabilities to current assets reflects the extent of current asset coverage available to meet the

current liabilities of the company. This ratio is also a measure of short term solvency. A high current liability to current

ratio would indicate a poor solvency condition.

Y5 –Dummy variable for correction of extreme leverage. This value is used for discontinuity correction for the ratio total

liabilities to total assets. A value of 1 would mean a very high probability of bankruptcy (Ohlson, 1980).

Y6- Net Income to Total assets describes the overall profitability of the company. It also measures the return on its total

investment in asset terms.

Y7 – Funds from operations to total liabilities indicates the operating profit coverage for total liabilities. A high ratio

reflects adequacy of operating profits to meet the liabilities. This ratio is a measure of operating performance of the

company.

Y8 – Dummy variable for correction of continuing profits. A value of 1 indicates high probability of bankruptcy.

Y9 – Change in income over the preceding period calculated as N1- N0

|N1|+|N0|

Where N1 is Net income for current year and N0 is Net income for previous year. The change in net income is measured by

this ratio. The denominator acts as a level indicator. (Ohlson, 1980). A positive ratio is an indicator of improved profitability.

A negative ratio signifies distress.

All the above variables are indicators of different aspects of a business. These variables reflect profitability, leverage,

efficiency in asset utilization and liquidity of a company.

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page223

4. RESEARCH METHODOLOGY

1. Data: The data comprises of 58 listed companies in sugar sector. The period of study is 2011-12 to 2013-14 (3

years). Refer Annexure for list of companies.

2. Data Source: The financial data for these companies have been extracted from Capitaline database.

3. Statistical model used: For examining the financial health of selected companies, Ohlson (1980) ‘o’ score model

has been used. Ohlson (1980) used logit regression.to develop bankruptcy prediction model from a sample of 105

bankrupt and 2058 non- bankrupt companies in US.

Model specification

Y = -1.3 – 0.4Y1+ 6.0Y2- 1.4Y3+ 0.1Y4- 2.5Y5- 1.8Y6+ 0.3Y7- 1.7Y8- 0.5Y9

Where Y1 = log (Total Assets/GNP price level index)

Y2 = Total Liabilities/Total Assets

Y3 = Working capital /Total Assets

Y4 = Current Liabilities / Current Assets

Y5 = 1 if Total liabilities > Total Assets else Y5 = 0

Y6 = Net Income/Total Assets

Y7 = Funds from operations/ Total Liabilities

Y8 = 1 if Net Income for 2 preceding years is negative else Y8= 0

Y9 = measure of change in Net Income

5. INTERPRETATION OF VARIABLES

Independent Variables

Y1 – Size of the company. Smaller companies tend to have greater probability of failure. GNP price level index has been

determined using 2011-12 as base year.

Y2 – The ratio of total liabilities to total assets indicates the extent to which the liabilities of the company are covered by

its assets. It also reflects the leverage of the company. A high total liabilities to assets ratio indicates higher risks for the

company.

Y3 – The ratio of working capital to total assets explains working capital adequacy and short term solvency and liquidity of

the company. A high ratio would indicate high levels of liquidity.

Y4 – The ratio of current liabilities to current assets reflects the extent of current asset coverage available to meet the

current liabilities of the company. This ratio is also a measure of short term solvency. A high current liability to current

ratio would indicate a poor solvency condition.

Y5 –Dummy variable for correction of extreme leverage. This value is used for discontinuity correction for the ratio total

liabilities to total assets. A value of 1 would mean a very high probability of bankruptcy (Ohlson, 1980).

Y6- Net Income to Total assets describes the overall profitability of the company. It also measures the return on its total

investment in asset terms.

Y7 – Funds from operations to total liabilities indicates the operating profit coverage for total liabilities. A high ratio

reflects adequacy of operating profits to meet the liabilities. This ratio is a measure of operating performance of the

company.

Y8 – Dummy variable for correction of continuing profits. A value of 1 indicates high probability of bankruptcy.

Y9 – Change in income over the preceding period calculated as N1- N0

|N1|+|N0|

Where N1 is Net income for current year and N0 is Net income for previous year. The change in net income is measured by

this ratio. The denominator acts as a level indicator. (Ohlson, 1980). A positive ratio is an indicator of improved profitability.

A negative ratio signifies distress.

All the above variables are indicators of different aspects of a business. These variables reflect profitability, leverage,

efficiency in asset utilization and liquidity of a company.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page224

Dependent Variable

The value of dependent variable Y is the ‘o’ score. Since Ohlson has used logistic regression to determine the coefficients of

independent variables, ‘o’ score is the log odds of the company being financially distressed.

Hence Y (‘o’ score) = log (p/1-p)

This can be converted to probability as under:

Probability of failure = exp (‘o’score)

1+exp (‘o’score)

Ohlson (1980) gave the cut off at 50%.

P(Y) > 0.50 indicates failed, P(Y) < 0.50 indicates non- failed

6. OBSERVATIONS AND CONCLUSION

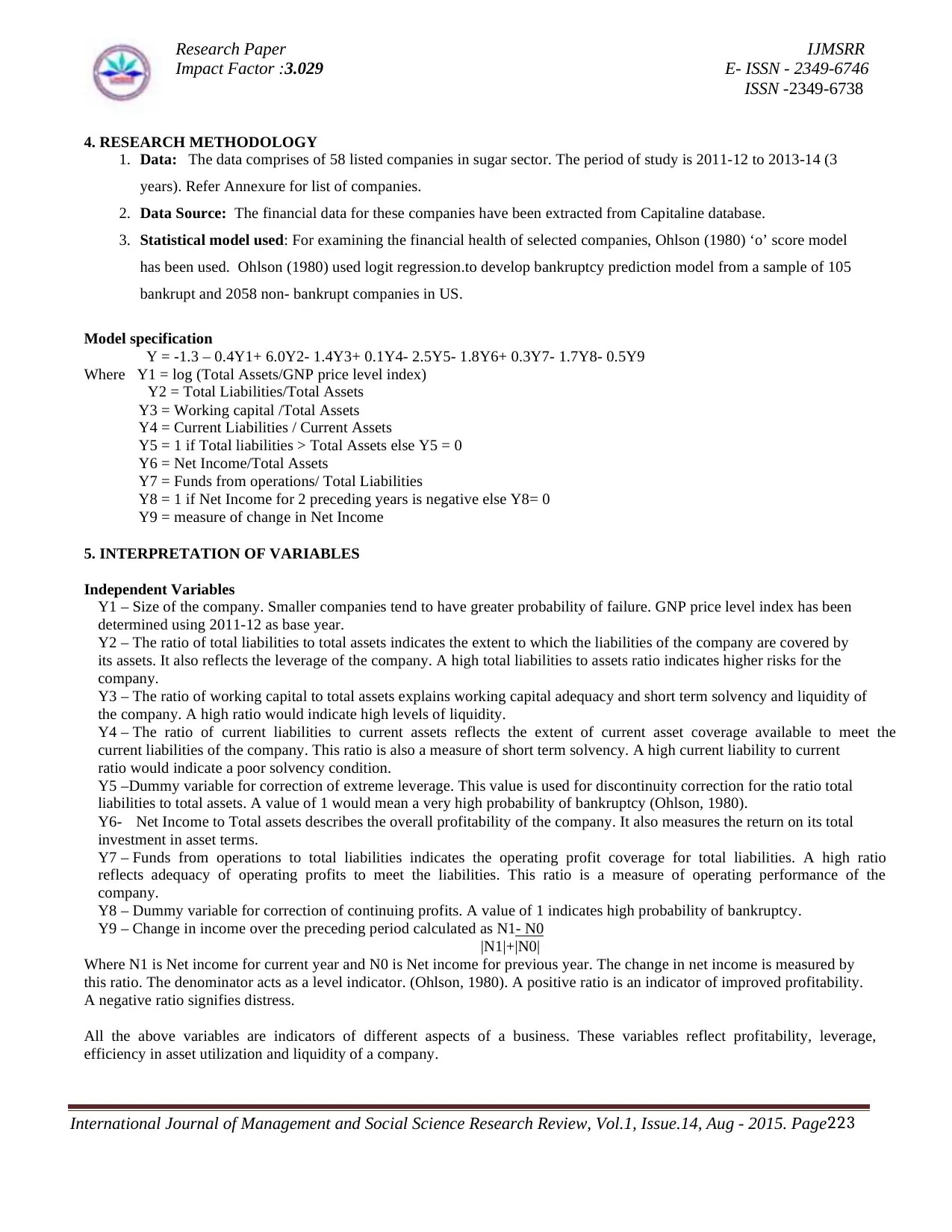

The nine predictor variables as defined by Ohlson (1980) in his model, the ‘o’ score and probability of bankruptcy was

calculated for the 58 companies selected for the study. The values calculated are shown in Table 1.

Table 1,Ohlson (1980) ‘o’ score determinants

Year Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y score P(Y)

2014 0.25 0.88 0.23 0.73 0 -0.04 0.06 0 -0.53 2.77 0.89

2013 0.33 0.83 0.26 0.67 0 0.00 0.11 0 0.14 2.16 0.84

2012 0.32 0.83 0.25 0.63 0 0.00 0.10 0 0.00 2.28 0.87

As seen from Table 1, the companies in sugar sector exhibit very high degrees of financial distress. Table 2 below

summarizes the observations and the indicators.

Table - 2Financial Distress Indicators

Sr. No Observation Indicator

1 Widespread financial distress All companies have a probability score of more than 0.5

2 Adverse Long term solvency Very high total liabilities in relation to total assets.

3 Low operating profitability Very low operating profits in relation to total liabilities

4 Poor efficiency in utilization of assets Very low net income in relation to total assets.

5 Continuous reduction in profitability Decreasing net income from 2011-12 to 2013-14.

From the above observations, it can be concluded that not only the profitability of companies in sugar sector is decreasing

continuously, but the efficiency in operations and long term solvency is also adversely affected.

7. RECOMMENDATIONS

Immediate steps will have to be taken to ensure profitability and survival of the companies. One very important step in this

direction would be to rationalize pricing policy of sugar and cane sugar. The possibility of export of surplus sugar needs to be

explored.

REFERENCES

1. Abad, Cristina, José.L, Arquero, & Sergio, M. Jiménez (2007). Syndromes Leading To Failure: An

Exploratory Research. Investment Management & Financial Innovations, 4(3), 23-32

2. Avenhuis, Jeroen Oude (2013).Testing the generalizability of the bankruptcy prediction models of Altman,

Ohlson and Zmijewski for Dutch listed and large non-listed firms. Thesis submitted to School of Management

and Governance, University of Twente, Netherlands.

3. Bhunia, A., & Sarkar, Bagchi (2011). A study of financial distress based on MDA. Journal of Management

Research, 3(2), 1-11.

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page224

Dependent Variable

The value of dependent variable Y is the ‘o’ score. Since Ohlson has used logistic regression to determine the coefficients of

independent variables, ‘o’ score is the log odds of the company being financially distressed.

Hence Y (‘o’ score) = log (p/1-p)

This can be converted to probability as under:

Probability of failure = exp (‘o’score)

1+exp (‘o’score)

Ohlson (1980) gave the cut off at 50%.

P(Y) > 0.50 indicates failed, P(Y) < 0.50 indicates non- failed

6. OBSERVATIONS AND CONCLUSION

The nine predictor variables as defined by Ohlson (1980) in his model, the ‘o’ score and probability of bankruptcy was

calculated for the 58 companies selected for the study. The values calculated are shown in Table 1.

Table 1,Ohlson (1980) ‘o’ score determinants

Year Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y score P(Y)

2014 0.25 0.88 0.23 0.73 0 -0.04 0.06 0 -0.53 2.77 0.89

2013 0.33 0.83 0.26 0.67 0 0.00 0.11 0 0.14 2.16 0.84

2012 0.32 0.83 0.25 0.63 0 0.00 0.10 0 0.00 2.28 0.87

As seen from Table 1, the companies in sugar sector exhibit very high degrees of financial distress. Table 2 below

summarizes the observations and the indicators.

Table - 2Financial Distress Indicators

Sr. No Observation Indicator

1 Widespread financial distress All companies have a probability score of more than 0.5

2 Adverse Long term solvency Very high total liabilities in relation to total assets.

3 Low operating profitability Very low operating profits in relation to total liabilities

4 Poor efficiency in utilization of assets Very low net income in relation to total assets.

5 Continuous reduction in profitability Decreasing net income from 2011-12 to 2013-14.

From the above observations, it can be concluded that not only the profitability of companies in sugar sector is decreasing

continuously, but the efficiency in operations and long term solvency is also adversely affected.

7. RECOMMENDATIONS

Immediate steps will have to be taken to ensure profitability and survival of the companies. One very important step in this

direction would be to rationalize pricing policy of sugar and cane sugar. The possibility of export of surplus sugar needs to be

explored.

REFERENCES

1. Abad, Cristina, José.L, Arquero, & Sergio, M. Jiménez (2007). Syndromes Leading To Failure: An

Exploratory Research. Investment Management & Financial Innovations, 4(3), 23-32

2. Avenhuis, Jeroen Oude (2013).Testing the generalizability of the bankruptcy prediction models of Altman,

Ohlson and Zmijewski for Dutch listed and large non-listed firms. Thesis submitted to School of Management

and Governance, University of Twente, Netherlands.

3. Bhunia, A., & Sarkar, Bagchi (2011). A study of financial distress based on MDA. Journal of Management

Research, 3(2), 1-11.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page225

4. Coyne, Joseph S., Singh, Sher.G & Smith, Gary J.(2008).The Early Indicators of Financial Failure: A Study of

Bankrupt and Solvent Health Systems. Journal of Healthcare Management, 53(5), 333-346.

5. Dave, A. R. (2012). Financial management as a determinant of profitability: A study of Indian Pharma sector.

South Asian Journal of Management, 19(1), 124-137.

6. Ehab, Zaki (2011). Assessing probabilities of financial distress of banks in UAE. Journal of Managerial

Finance .7(3), 304-320

7. Ganesalingam, S., & Kumar, Kuldeep. (2001).Detection of financial distress via multivariate statistical

analysis. Managerial Finance, 27(4), 45-55

8. Grice, John Stephen., & Dugan, Michael T. (2001).The Limitations of Bankruptcy Prediction Models: Some

Cautions for the Researcher. Review of Quantitative Finance and Accounting. 17(2), 151-166

9. Hodgin, R. F., & Marchesini, R. (2011). Financial distress models: How pertinent are sampling bias

criticisms?. The Journal of Applied Business and Economics, 12(4), 29-35.

10. Hui, Huang.Jing-Jing (2008).Relationship between Corporate Governance and Financial Distress: An

empirical study of distressed companies in China, International Journal of Management; 25(4), 654-664

11. Julien le Maux & Danielle Morin. (2011). Black and white and red all over: Lehman Brothers’ inevitable

bankruptcy splashed across its financial statement. International Journal of Business and Social Science,

2(20), 39-65.

12. Kane, G. D., Richardson, F. M., & Velury, U. (2006). The relevance of stock and flow-based reporting

information in assessing the likelihood of emergence from corporate financial distress. Review of Quantitative

Finance and Accounting, 26(1), 5-22.

13. Mahdi, Salehi., & Bizhan, Abedini (2009).Financial Distress Prediction in Emerging Market: Empirical

Evidences from Iran. Interdisciplinary Journal of Contemporary Research in Business, 1(1), 6-26.

14. Marc J. LeClere (2006). Bankruptcy studies and ad hoc variable selection: a canonical correlation analysis.

Review of Accounting and Finance .5(4), 410-422

15. Murty, A. V .N, & Misra, D. P (2004). Cash Flow Ratios as Indicators of Corporate Failure. Finance India,

18(3), 1315-1325

16. N. Ramana Reddy & K.Hari Prasad Reddy (2010). Financial status of select sugar manufacturing units - z

score model. International Journal of Marketing, Financial Services & Management Research. 1(4), 64-69.

17. Ohlson, James. (1980). Financial ratios and probabilistic prediction of bankruptcy. Journal of Accounting

Research, 18(1), 109-131.

18. Ong, S., Voon, C. Y., & Roy W.L. Khong. (2011).Corporate failure prediction: A study of public listed

companies in Malaysia. Managerial Finance, 37(6), 553-564.

19. Polemis, D., & Gounopoulos, D. (2012). Prediction of distress and identification of potential M&A’s targets in

UK. Managerial Finance, 38(11), 1085-1104.

20. Radha Ganesh Kumar & Kishore Kumar (2012). A comparison of bankruptcy models. International Journal of

Marketing, Financial services & Management Research .1(4), 76-86.

21. R. Arun., & P. Kasilingam (2011). Predicting solvency: Indian IT companies. SCMS Journal of Management,

81-95

22. Sarbapriya Ray (2011). Assessing Corporate Financial Distress in Automobile Industry of India: An

Application of Altman’s Model. Research Journal of Finance and Accounting .2(3), 55-168.

23. S C Bardia (2012). Predicting Financial Distress and Evaluating Long-Term Solvency: An Empirical Study

The IUP Journal of Accounting Research & Audit Practices. 11(1), 47-61

24. Sharpe, Ian. G. & Andrei Stadnik. (2007). Financial distress in Australian General Insurers. Journal of Risk

and Insurance, 7(2), 377-399.

25. Smith, Malcolm, & Dah- Kwei, Liou (2007). Industrial sector and financial distress.Managerial Auditing

Journal, 22(4), 376-391

26. Wang, Ying & Campbell .Michael (2010).Business Failure Prediction for Publicly Listed Companies in China.

Journal of Business and Management. 16(1), 75-88.

27. http://planningcommission.nic.in/data/datatable/index.php

28. https://www.crisil.com/Ratings/Brochureware/News/CRISIL%20Research_Opinion_Sugar-Prices_13Feb

2014 .pdf

29. https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx.

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page225

4. Coyne, Joseph S., Singh, Sher.G & Smith, Gary J.(2008).The Early Indicators of Financial Failure: A Study of

Bankrupt and Solvent Health Systems. Journal of Healthcare Management, 53(5), 333-346.

5. Dave, A. R. (2012). Financial management as a determinant of profitability: A study of Indian Pharma sector.

South Asian Journal of Management, 19(1), 124-137.

6. Ehab, Zaki (2011). Assessing probabilities of financial distress of banks in UAE. Journal of Managerial

Finance .7(3), 304-320

7. Ganesalingam, S., & Kumar, Kuldeep. (2001).Detection of financial distress via multivariate statistical

analysis. Managerial Finance, 27(4), 45-55

8. Grice, John Stephen., & Dugan, Michael T. (2001).The Limitations of Bankruptcy Prediction Models: Some

Cautions for the Researcher. Review of Quantitative Finance and Accounting. 17(2), 151-166

9. Hodgin, R. F., & Marchesini, R. (2011). Financial distress models: How pertinent are sampling bias

criticisms?. The Journal of Applied Business and Economics, 12(4), 29-35.

10. Hui, Huang.Jing-Jing (2008).Relationship between Corporate Governance and Financial Distress: An

empirical study of distressed companies in China, International Journal of Management; 25(4), 654-664

11. Julien le Maux & Danielle Morin. (2011). Black and white and red all over: Lehman Brothers’ inevitable

bankruptcy splashed across its financial statement. International Journal of Business and Social Science,

2(20), 39-65.

12. Kane, G. D., Richardson, F. M., & Velury, U. (2006). The relevance of stock and flow-based reporting

information in assessing the likelihood of emergence from corporate financial distress. Review of Quantitative

Finance and Accounting, 26(1), 5-22.

13. Mahdi, Salehi., & Bizhan, Abedini (2009).Financial Distress Prediction in Emerging Market: Empirical

Evidences from Iran. Interdisciplinary Journal of Contemporary Research in Business, 1(1), 6-26.

14. Marc J. LeClere (2006). Bankruptcy studies and ad hoc variable selection: a canonical correlation analysis.

Review of Accounting and Finance .5(4), 410-422

15. Murty, A. V .N, & Misra, D. P (2004). Cash Flow Ratios as Indicators of Corporate Failure. Finance India,

18(3), 1315-1325

16. N. Ramana Reddy & K.Hari Prasad Reddy (2010). Financial status of select sugar manufacturing units - z

score model. International Journal of Marketing, Financial Services & Management Research. 1(4), 64-69.

17. Ohlson, James. (1980). Financial ratios and probabilistic prediction of bankruptcy. Journal of Accounting

Research, 18(1), 109-131.

18. Ong, S., Voon, C. Y., & Roy W.L. Khong. (2011).Corporate failure prediction: A study of public listed

companies in Malaysia. Managerial Finance, 37(6), 553-564.

19. Polemis, D., & Gounopoulos, D. (2012). Prediction of distress and identification of potential M&A’s targets in

UK. Managerial Finance, 38(11), 1085-1104.

20. Radha Ganesh Kumar & Kishore Kumar (2012). A comparison of bankruptcy models. International Journal of

Marketing, Financial services & Management Research .1(4), 76-86.

21. R. Arun., & P. Kasilingam (2011). Predicting solvency: Indian IT companies. SCMS Journal of Management,

81-95

22. Sarbapriya Ray (2011). Assessing Corporate Financial Distress in Automobile Industry of India: An

Application of Altman’s Model. Research Journal of Finance and Accounting .2(3), 55-168.

23. S C Bardia (2012). Predicting Financial Distress and Evaluating Long-Term Solvency: An Empirical Study

The IUP Journal of Accounting Research & Audit Practices. 11(1), 47-61

24. Sharpe, Ian. G. & Andrei Stadnik. (2007). Financial distress in Australian General Insurers. Journal of Risk

and Insurance, 7(2), 377-399.

25. Smith, Malcolm, & Dah- Kwei, Liou (2007). Industrial sector and financial distress.Managerial Auditing

Journal, 22(4), 376-391

26. Wang, Ying & Campbell .Michael (2010).Business Failure Prediction for Publicly Listed Companies in China.

Journal of Business and Management. 16(1), 75-88.

27. http://planningcommission.nic.in/data/datatable/index.php

28. https://www.crisil.com/Ratings/Brochureware/News/CRISIL%20Research_Opinion_Sugar-Prices_13Feb

2014 .pdf

29. https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx.

Research Paper IJMSRR

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page226

Annexure

Sr. No Name of the Company Sr. No Name of the Company

1 Bannari Amman Sugars Ltd 31 Indian Sucrose Ltd

2 Dalmia Bharat Sugar & Industries Ltd 32 Piccadily Sugar & Allied Inds Ltd

3 EID Parry (India) Ltd 33 Riga Sugar Company Ltd

4 Bajaj Hindusthan Sugar Ltd 34 Prudential Sugar Corporation Ltd

5 Kothari Sugars & Chemicals Ltd 35 Piccadily Agro Industries Ltd

6 Oudh Sugar Mills Ltd 36 Ugar Sugar Works Ltd

7 Upper Ganges Sugar & Industries Ltd 37 Oswal Overseas Ltd

8 Sakthi Sugars Ltd 38 Sir Shadi Lal Enterprises Ltd

9 Kesar Enterprises Ltd 39 Dollex Industries Ltd

10 Dharani Sugars & Chemicals Ltd 40 Dhampure Speciality Sugars Ltd

11 Vishnu Sugar Mills Ltd 41 KCP Sugar & Industries Corporation Ltd

12 Rajshree Sugars & Chemicals Ltd 42 Jeypore Sugar Company Ltd

13 Simbhaoli Sugars Ltd 43 Naraingarh Sugar Mills Ltd

14 Belapur Industries Ltd 44 Gayatri Sugars Ltd

15 Thiru Arooran Sugars Ltd 45 Harinagar Sugar Mills Ltd

16 Sri Chamundeswari Sugars Ltd 46 Davangere Sugar Company Ltd

17 Balrampur Chini Mills Ltd 47 United Provinces Sugar Co Ltd

18 DCM Shriram Industries Ltd 48 Triveni Engineering and Industries Ltd

19 Mawana Sugars Ltd 49 Parrys Sugar Industries Ltd

20 Empee Sugars & Chemicals Ltd 50 Dhampur Sugar Mills Ltd

21 Khaitan (India) Ltd 51 Rana Sugars Ltd

22 Ponni Sugars (Erode) Ltd 52 Rajasthan State Ganganagar Sugar Mills Ltd

23 Shree Changdeo Sugar Mills Ltd 53 Natural Sugar & Allied Industries Ltd

24 Shakumbari Sugar & Allied Industries Ltd 54 Trident Sugars Ltd

25 Kanoria Sugar & General Mfg. Co. Ltd 55 Mahatma Sugar & Power Ltd

26 Shree Renuka Sugars Ltd 56 Nava Bharat Sugar & Biofuels Ltd

27 Uttam Sugar Mills Ltd 57 Godavari Biorefineries Ltd

28 Rai Bahadur Narain Singh Sugar Mills Ltd 58 Chadha Sugars & Industries Pvt Ltd

29 Wahid Sandhar Sugars Ltd

30 Silkroad Sugar Pvt Ltd

Impact Factor :3.029 E- ISSN - 2349-6746

ISSN -2349-6738

International Journal of Management and Social Science Research Review, Vol.1, Issue.14, Aug - 2015. Page226

Annexure

Sr. No Name of the Company Sr. No Name of the Company

1 Bannari Amman Sugars Ltd 31 Indian Sucrose Ltd

2 Dalmia Bharat Sugar & Industries Ltd 32 Piccadily Sugar & Allied Inds Ltd

3 EID Parry (India) Ltd 33 Riga Sugar Company Ltd

4 Bajaj Hindusthan Sugar Ltd 34 Prudential Sugar Corporation Ltd

5 Kothari Sugars & Chemicals Ltd 35 Piccadily Agro Industries Ltd

6 Oudh Sugar Mills Ltd 36 Ugar Sugar Works Ltd

7 Upper Ganges Sugar & Industries Ltd 37 Oswal Overseas Ltd

8 Sakthi Sugars Ltd 38 Sir Shadi Lal Enterprises Ltd

9 Kesar Enterprises Ltd 39 Dollex Industries Ltd

10 Dharani Sugars & Chemicals Ltd 40 Dhampure Speciality Sugars Ltd

11 Vishnu Sugar Mills Ltd 41 KCP Sugar & Industries Corporation Ltd

12 Rajshree Sugars & Chemicals Ltd 42 Jeypore Sugar Company Ltd

13 Simbhaoli Sugars Ltd 43 Naraingarh Sugar Mills Ltd

14 Belapur Industries Ltd 44 Gayatri Sugars Ltd

15 Thiru Arooran Sugars Ltd 45 Harinagar Sugar Mills Ltd

16 Sri Chamundeswari Sugars Ltd 46 Davangere Sugar Company Ltd

17 Balrampur Chini Mills Ltd 47 United Provinces Sugar Co Ltd

18 DCM Shriram Industries Ltd 48 Triveni Engineering and Industries Ltd

19 Mawana Sugars Ltd 49 Parrys Sugar Industries Ltd

20 Empee Sugars & Chemicals Ltd 50 Dhampur Sugar Mills Ltd

21 Khaitan (India) Ltd 51 Rana Sugars Ltd

22 Ponni Sugars (Erode) Ltd 52 Rajasthan State Ganganagar Sugar Mills Ltd

23 Shree Changdeo Sugar Mills Ltd 53 Natural Sugar & Allied Industries Ltd

24 Shakumbari Sugar & Allied Industries Ltd 54 Trident Sugars Ltd

25 Kanoria Sugar & General Mfg. Co. Ltd 55 Mahatma Sugar & Power Ltd

26 Shree Renuka Sugars Ltd 56 Nava Bharat Sugar & Biofuels Ltd

27 Uttam Sugar Mills Ltd 57 Godavari Biorefineries Ltd

28 Rai Bahadur Narain Singh Sugar Mills Ltd 58 Chadha Sugars & Industries Pvt Ltd

29 Wahid Sandhar Sugars Ltd

30 Silkroad Sugar Pvt Ltd

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.