Assessing IFRS Adoption Implications in India: Dissertation Proposal

VerifiedAdded on 2020/02/03

|9

|1958

|93

Project

AI Summary

This dissertation proposal examines the implications of adopting International Financial Reporting Standards (IFRS) in India, a developing country. The project aims to investigate the factors encouraging businesses to adopt IFRS, the benefits Indian companies can gain, and the challenges they may face during implementation. The proposal includes a literature review discussing the evolution and adoption of IFRS in India, benefits, and challenges. The research methodology outlines a qualitative case study approach, using secondary data sources for analysis. The study employs a thematic perception test to identify patterns, challenges, and opportunities related to IFRS implementation in the Indian corporate sector. The proposal also provides a detailed timeline for the research process and lists relevant references.

Dissertation proposal

(To assess the implications of adopting international

financial reporting standards in developing countries, A

case study on India)

1

(To assess the implications of adopting international

financial reporting standards in developing countries, A

case study on India)

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................3

Project title.......................................................................................................................................3

Background & overview..................................................................................................................3

Statement of the problem.................................................................................................................3

Research aims and objectives..........................................................................................................3

Research question............................................................................................................................4

LITERATURE REVIEW.....................................................................................................................4

Evolution & adoption of IFRS in India...........................................................................................4

Benefits and challenges of IFRS adoption in India.........................................................................5

RESEARCH METHODOLOGY.........................................................................................................5

Quantitative & qualitative................................................................................................................5

Research approach...........................................................................................................................6

Data collection.................................................................................................................................6

Data analysis....................................................................................................................................6

Time-scale........................................................................................................................................6

REFERENCES.....................................................................................................................................8

2

INTRODUCTION................................................................................................................................3

Project title.......................................................................................................................................3

Background & overview..................................................................................................................3

Statement of the problem.................................................................................................................3

Research aims and objectives..........................................................................................................3

Research question............................................................................................................................4

LITERATURE REVIEW.....................................................................................................................4

Evolution & adoption of IFRS in India...........................................................................................4

Benefits and challenges of IFRS adoption in India.........................................................................5

RESEARCH METHODOLOGY.........................................................................................................5

Quantitative & qualitative................................................................................................................5

Research approach...........................................................................................................................6

Data collection.................................................................................................................................6

Data analysis....................................................................................................................................6

Time-scale........................................................................................................................................6

REFERENCES.....................................................................................................................................8

2

INTRODUCTION

Project title

To assess the implications of international financial reporting standards (IFRS) in developing

countries

Background & overview

Over the period, globalization integrated the corporate financial market which arise the need

of common financial reporting standards in order to harmonize the reporting practices of

multinational companies. International Accounting Standard Board (IASB) issued the International

Financial Reporting Standards (IFRS) to develop a set of global accounting standards & common

financial language for the business affairs so as to produce the comparable and understandable

annual accounts across international boundaries (Akdogan and Ozturk, 2015). The development of

uniform financial language at an international level in the form of IFRS has mitigated the

discrepancies in the financial reporting due to differences in local and national accounting

standards. The main target of the IFRS is to improve comparability, understand ability, relevance

and reliability of the financial reporting of companies operating worldwide (Bhat, Callen and

Segal,2016). The current research study will focus on investigating the implications of IFRS for the

developing nation, India.

Statement of the problem

In the past few years, global corporate world has witnesses a significant level of change as

now-a-days, establishments are expanding their operations overseas and also raising money from

the outside countries for fuelling growth. However, the accounting and reporting rules and

regulations of the foreign country is different from the local or national standards. Thus, it raises the

requirement for the domestic corporations to implement IFRS to report their annual accounts

(Choudhary, Gupta and Chauhan, 2012). By applying the single set of financial reporting standards,

firms will be able to ensure uniformity which assists foreign investors to make better and

rationalized investment decisions and build confidence. Thus, the current research will investigate

the importance as well as challenges for the Indian companies in implementation of IFRS.

http://www.researchambition.com/uploads/201682162922ra.pdf

Research aims and objectives

Research aim: To investigate the implications of IFRS in developing country; A case study on India

Research objectives:

1. What are the main factors that encourage businesses to prepare their accounts by applying

3

Project title

To assess the implications of international financial reporting standards (IFRS) in developing

countries

Background & overview

Over the period, globalization integrated the corporate financial market which arise the need

of common financial reporting standards in order to harmonize the reporting practices of

multinational companies. International Accounting Standard Board (IASB) issued the International

Financial Reporting Standards (IFRS) to develop a set of global accounting standards & common

financial language for the business affairs so as to produce the comparable and understandable

annual accounts across international boundaries (Akdogan and Ozturk, 2015). The development of

uniform financial language at an international level in the form of IFRS has mitigated the

discrepancies in the financial reporting due to differences in local and national accounting

standards. The main target of the IFRS is to improve comparability, understand ability, relevance

and reliability of the financial reporting of companies operating worldwide (Bhat, Callen and

Segal,2016). The current research study will focus on investigating the implications of IFRS for the

developing nation, India.

Statement of the problem

In the past few years, global corporate world has witnesses a significant level of change as

now-a-days, establishments are expanding their operations overseas and also raising money from

the outside countries for fuelling growth. However, the accounting and reporting rules and

regulations of the foreign country is different from the local or national standards. Thus, it raises the

requirement for the domestic corporations to implement IFRS to report their annual accounts

(Choudhary, Gupta and Chauhan, 2012). By applying the single set of financial reporting standards,

firms will be able to ensure uniformity which assists foreign investors to make better and

rationalized investment decisions and build confidence. Thus, the current research will investigate

the importance as well as challenges for the Indian companies in implementation of IFRS.

http://www.researchambition.com/uploads/201682162922ra.pdf

Research aims and objectives

Research aim: To investigate the implications of IFRS in developing country; A case study on India

Research objectives:

1. What are the main factors that encourage businesses to prepare their accounts by applying

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

global standards, IFRS?

2. How Indian companies can get benefits by adopting IFRS in their financial reporting?

3. What are the challenges Indian organizations can face in IFRS adoption & implementation?

Research question

What is the concept of IFRS and what are the possible benefits and challenges Indian

establishments can face in IFRS adopting practices?

LITERATURE REVIEW

Evolution & adoption of IFRS in India

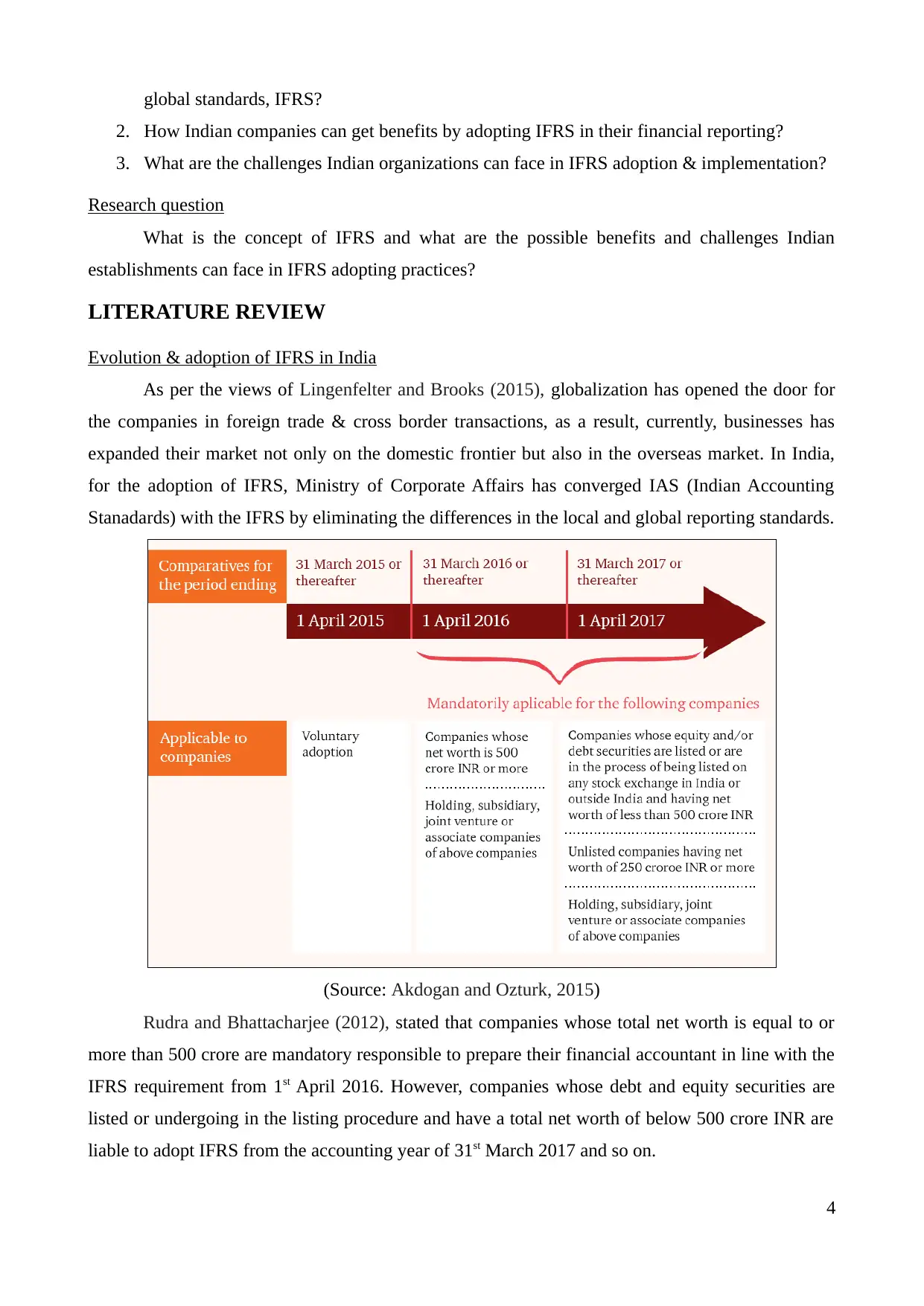

As per the views of Lingenfelter and Brooks (2015), globalization has opened the door for

the companies in foreign trade & cross border transactions, as a result, currently, businesses has

expanded their market not only on the domestic frontier but also in the overseas market. In India,

for the adoption of IFRS, Ministry of Corporate Affairs has converged IAS (Indian Accounting

Stanadards) with the IFRS by eliminating the differences in the local and global reporting standards.

(Source: Akdogan and Ozturk, 2015)

Rudra and Bhattacharjee (2012), stated that companies whose total net worth is equal to or

more than 500 crore are mandatory responsible to prepare their financial accountant in line with the

IFRS requirement from 1st April 2016. However, companies whose debt and equity securities are

listed or undergoing in the listing procedure and have a total net worth of below 500 crore INR are

liable to adopt IFRS from the accounting year of 31st March 2017 and so on.

4

2. How Indian companies can get benefits by adopting IFRS in their financial reporting?

3. What are the challenges Indian organizations can face in IFRS adoption & implementation?

Research question

What is the concept of IFRS and what are the possible benefits and challenges Indian

establishments can face in IFRS adopting practices?

LITERATURE REVIEW

Evolution & adoption of IFRS in India

As per the views of Lingenfelter and Brooks (2015), globalization has opened the door for

the companies in foreign trade & cross border transactions, as a result, currently, businesses has

expanded their market not only on the domestic frontier but also in the overseas market. In India,

for the adoption of IFRS, Ministry of Corporate Affairs has converged IAS (Indian Accounting

Stanadards) with the IFRS by eliminating the differences in the local and global reporting standards.

(Source: Akdogan and Ozturk, 2015)

Rudra and Bhattacharjee (2012), stated that companies whose total net worth is equal to or

more than 500 crore are mandatory responsible to prepare their financial accountant in line with the

IFRS requirement from 1st April 2016. However, companies whose debt and equity securities are

listed or undergoing in the listing procedure and have a total net worth of below 500 crore INR are

liable to adopt IFRS from the accounting year of 31st March 2017 and so on.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Benefits and challenges of IFRS adoption in India

According to Srivastava and Bhutani (2012), IFRS is not just a common financial language

or global accounting standards but it offers opportunities to the businesses to bring improvement in

their business growth in various ways. By compliance with the IFRS, establishments can reshape

their reporting systems and make better planning & decisions for the effective and efficient

management. The most important possible benefit that the business can receive by IFRS

implementation is that they can improve their disclosure requirement and build confidence among

stakeholders, more importantly, investors who undertake excessive risk by investing their money in

the business. With the integration of IFRS, investors became able to make a comparative analysis of

various domestic and foreign company’s performance and make effective quality of investment

decisions. However, on the contrary side, Venkatesh (2016), argued that lack of excellent

accounting professional is the main challenge which Indian establishments can face in IFRS

adoption practices, as a result, Indian corporate have to depend on the external auditors which leads

to incur a high cost. In contrast, Lingenfelter and Brooks (2015), commented that convergence of

IAS in line with the global reporting standards brought only a fundamental change in the currently

applied legislations and accounting rules which just require in-depth knowledge of the standards for

implementing the conversion process.

Despite this, Sambaru and Kavitha (2014), stated that adoption of IFRS in India will not

only affect the reporting requirement but also bring significant change in the taxation liabilities,

thus, it will bring the major challenge to the firms. Furthermore, companies also have to re-

negotiate various contracts because of the differences in the accounting and reporting requirement

under national Indian accounting standards and global standard, IFRS, thus, it can be said that IFRS

implementation will be a costlier approach for the Indian firms.

RESEARCH METHODOLOGY

Quantitative & qualitative

Quantitative involves numerical, financial & statistical dataset whereas qualitative observe

pattern, behaviour, opinion, attitude, thoughts and other qualitative aspects (Kothari, 2004). Here,

the planned research will apply qualitative study, wherein, the possible impact of IFRS adoption on

the Indian organizations will be studied. In this regards, both the opportunities and major challenges

will be founded which Indian corporate can face while integrating IFRS in their accounting &

reporting framework.

Research design

5

According to Srivastava and Bhutani (2012), IFRS is not just a common financial language

or global accounting standards but it offers opportunities to the businesses to bring improvement in

their business growth in various ways. By compliance with the IFRS, establishments can reshape

their reporting systems and make better planning & decisions for the effective and efficient

management. The most important possible benefit that the business can receive by IFRS

implementation is that they can improve their disclosure requirement and build confidence among

stakeholders, more importantly, investors who undertake excessive risk by investing their money in

the business. With the integration of IFRS, investors became able to make a comparative analysis of

various domestic and foreign company’s performance and make effective quality of investment

decisions. However, on the contrary side, Venkatesh (2016), argued that lack of excellent

accounting professional is the main challenge which Indian establishments can face in IFRS

adoption practices, as a result, Indian corporate have to depend on the external auditors which leads

to incur a high cost. In contrast, Lingenfelter and Brooks (2015), commented that convergence of

IAS in line with the global reporting standards brought only a fundamental change in the currently

applied legislations and accounting rules which just require in-depth knowledge of the standards for

implementing the conversion process.

Despite this, Sambaru and Kavitha (2014), stated that adoption of IFRS in India will not

only affect the reporting requirement but also bring significant change in the taxation liabilities,

thus, it will bring the major challenge to the firms. Furthermore, companies also have to re-

negotiate various contracts because of the differences in the accounting and reporting requirement

under national Indian accounting standards and global standard, IFRS, thus, it can be said that IFRS

implementation will be a costlier approach for the Indian firms.

RESEARCH METHODOLOGY

Quantitative & qualitative

Quantitative involves numerical, financial & statistical dataset whereas qualitative observe

pattern, behaviour, opinion, attitude, thoughts and other qualitative aspects (Kothari, 2004). Here,

the planned research will apply qualitative study, wherein, the possible impact of IFRS adoption on

the Indian organizations will be studied. In this regards, both the opportunities and major challenges

will be founded which Indian corporate can face while integrating IFRS in their accounting &

reporting framework.

Research design

5

Case-study, experimental, exploratory, descriptive, analytical and others are the most

commonly preferred designs in various studies. Here, the researcher will apply case-study design in

which he/she will assess the implication of IFRS implementation in developing country, India.

Thus, he will only focus the major attention on the Indian companies that how they can receive the

benefits of various opportunities and what challenges they might face while adopting global

accounting standards, IFRS.

Research approach

Being a qualitative nature of study, inductive approach is founded effective wherein the

scholar will initially observe the pattern & explain theories for identifying the possible impact on

the Indian companies in terms of both the opportunities and challenges (Kumar and Phrommathed,

2005). Thus, it moves from the observation to developing a new concept or theory and thereby find

out the correct solution of the issue.

Data collection

Primary sources are used to obtain the firsthand data which is not collected before by any

other scholar and thereby tailor the specific material information need of the researcher by the help

of making a real survey, observation, field research, interview and other. In contrast, secondary

sources generates data that is already obtained in the historic period by other scholar like library

research, online resources, research papers, articles, books, newspapers and statistical reports

(Kothari, 2004). Herein, materialistic & useable data will be gather by employing secondary sources

such as previous articles, governmental reports published on IFRS implementation and other web

resources.

Data analysis

Thematic perception test will be applied for finding out the pattern, challenges & the

opportunities that will be driven by the IFRS implementation in Indian corporate sector.

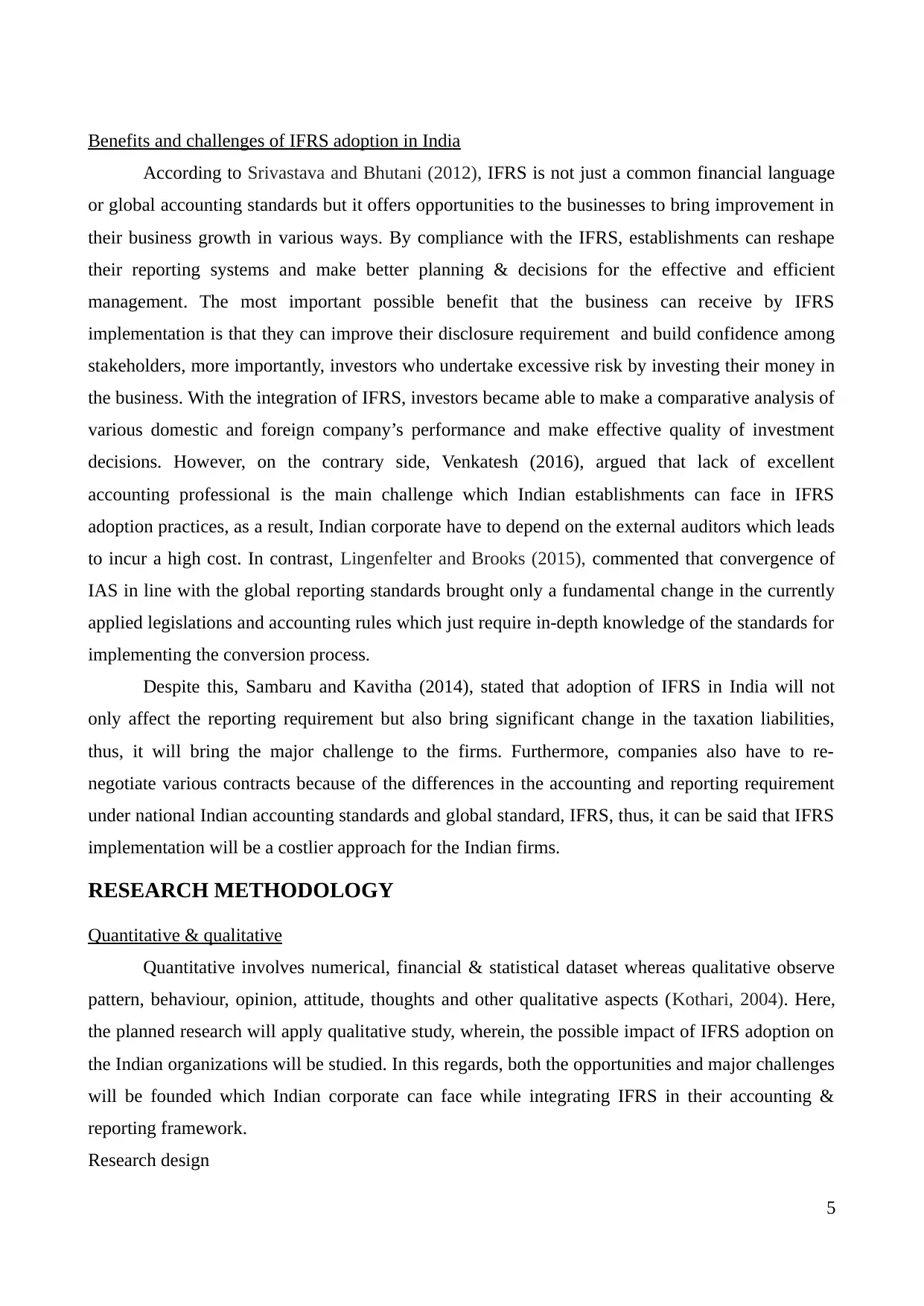

Time-scale

Activities/(weeks) 1 2 3 4 5 6 7 8 9

Topic selection

Clearly stating the objectives

Peer-review to develop conceptual

knowledge

Research methodology

Data collection

6

commonly preferred designs in various studies. Here, the researcher will apply case-study design in

which he/she will assess the implication of IFRS implementation in developing country, India.

Thus, he will only focus the major attention on the Indian companies that how they can receive the

benefits of various opportunities and what challenges they might face while adopting global

accounting standards, IFRS.

Research approach

Being a qualitative nature of study, inductive approach is founded effective wherein the

scholar will initially observe the pattern & explain theories for identifying the possible impact on

the Indian companies in terms of both the opportunities and challenges (Kumar and Phrommathed,

2005). Thus, it moves from the observation to developing a new concept or theory and thereby find

out the correct solution of the issue.

Data collection

Primary sources are used to obtain the firsthand data which is not collected before by any

other scholar and thereby tailor the specific material information need of the researcher by the help

of making a real survey, observation, field research, interview and other. In contrast, secondary

sources generates data that is already obtained in the historic period by other scholar like library

research, online resources, research papers, articles, books, newspapers and statistical reports

(Kothari, 2004). Herein, materialistic & useable data will be gather by employing secondary sources

such as previous articles, governmental reports published on IFRS implementation and other web

resources.

Data analysis

Thematic perception test will be applied for finding out the pattern, challenges & the

opportunities that will be driven by the IFRS implementation in Indian corporate sector.

Time-scale

Activities/(weeks) 1 2 3 4 5 6 7 8 9

Topic selection

Clearly stating the objectives

Peer-review to develop conceptual

knowledge

Research methodology

Data collection

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

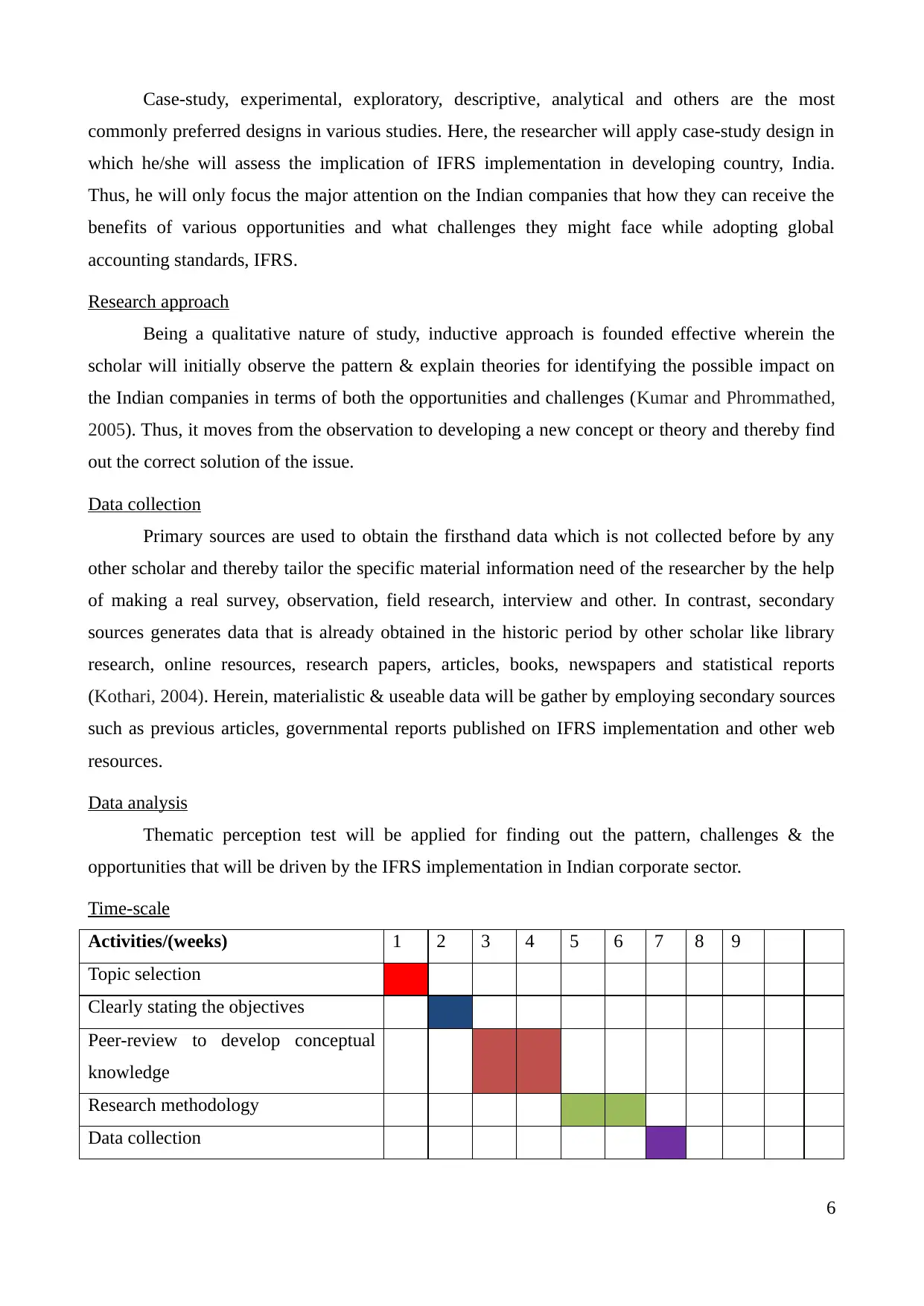

Analysis of the data

submission

Required changes

Re-submission

7

submission

Required changes

Re-submission

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Akdogan, N. and Ozturk, C., 2015. A Country Specific Approach To IFRS Accounting Policy

Choice In The European, Australian And Turkish Context.Emerging Markets Journal. 5(1).

pp. 60-82.

Bhat, G., Callen, J. L. and Segal, D., 2016. Testing the transparency implications of mandatory

IFRS adoption: The spread/maturity relation of credit default swaps. Management Science.

Choudhary, B., Gupta, R. and Chauhan, H., 2012. Convergence of IFRS in India–Strategy, Benefits

and Challenges for Infrastructure Industry. Zenith International Journal of Business

Economics and Management Research. 2(1). pp.140-147.

Kothari, C.R., 2004. Research methodology: Methods and techniques. New Age International.

Kumar, S. and Phrommathed, P., 2005. Research methodology. Springer US.

Lingenfelter, G. and Brooks, A., 2015. Profit and Inventory under IFRS and GAAP. Journal of

Critical Incidents. 8(1). pp. 81-93.

Rudra, T. and Bhattacharjee, C.D., 2012. Does IFRs influence earnings management? Evidence

from India. Journal of Management Research. 4(1). p.1.

Srivastava, A. and Bhutani, P., 2012. IFRS in India: Challenges and opportunities. IUP Journal of

Accounting Research & Audit Practices. 11(2). p.6.

Online

Sambaru, M. and Kavitha, V. N., 2014. A study on IFRS in India. [Online]. Available through: <

http://www.ijird.com/index.php/ijird/article/viewFile/58565/45788>. [Accessed on 1st May

2017].

Venkatesh, D. V., 2016. Opportunities and challenges in adopting IFRS in India. [PDF]. Available

through: <

http://vfgc.in/seminar2016proceeding/papers/4_1_D_Venkatesh_and_Prof_M_Venkateswarl

u.pdf> [Accessed on 1st May 2017].

8

Books and Journals

Akdogan, N. and Ozturk, C., 2015. A Country Specific Approach To IFRS Accounting Policy

Choice In The European, Australian And Turkish Context.Emerging Markets Journal. 5(1).

pp. 60-82.

Bhat, G., Callen, J. L. and Segal, D., 2016. Testing the transparency implications of mandatory

IFRS adoption: The spread/maturity relation of credit default swaps. Management Science.

Choudhary, B., Gupta, R. and Chauhan, H., 2012. Convergence of IFRS in India–Strategy, Benefits

and Challenges for Infrastructure Industry. Zenith International Journal of Business

Economics and Management Research. 2(1). pp.140-147.

Kothari, C.R., 2004. Research methodology: Methods and techniques. New Age International.

Kumar, S. and Phrommathed, P., 2005. Research methodology. Springer US.

Lingenfelter, G. and Brooks, A., 2015. Profit and Inventory under IFRS and GAAP. Journal of

Critical Incidents. 8(1). pp. 81-93.

Rudra, T. and Bhattacharjee, C.D., 2012. Does IFRs influence earnings management? Evidence

from India. Journal of Management Research. 4(1). p.1.

Srivastava, A. and Bhutani, P., 2012. IFRS in India: Challenges and opportunities. IUP Journal of

Accounting Research & Audit Practices. 11(2). p.6.

Online

Sambaru, M. and Kavitha, V. N., 2014. A study on IFRS in India. [Online]. Available through: <

http://www.ijird.com/index.php/ijird/article/viewFile/58565/45788>. [Accessed on 1st May

2017].

Venkatesh, D. V., 2016. Opportunities and challenges in adopting IFRS in India. [PDF]. Available

through: <

http://vfgc.in/seminar2016proceeding/papers/4_1_D_Venkatesh_and_Prof_M_Venkateswarl

u.pdf> [Accessed on 1st May 2017].

8

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.