RBA's Role and Deflation: An Economics Essay on Monetary Policy

VerifiedAdded on 2023/06/07

|14

|2756

|176

Essay

AI Summary

This essay delves into the multifaceted role of the Reserve Bank of Australia (RBA) in the Australian economy, focusing on its monetary policy tools and functions, including setting interest rates and managing inflation. It explores the interconnectedness of inflation, deflation, and recession, highlighting the potential for deflation to trigger or exacerbate economic downturns. The essay further examines the concept of leverage and its significance within the Australian financial system, analyzing how monetary policy impacts asset values and yields. Drawing on the provided article and additional readings, the essay provides a comprehensive analysis of the RBA's strategies in addressing the threat of deflation and maintaining economic stability. The essay explains the role of RBA, the current economic environment of Australia, the connection between recession and inflation, and the dynamics of leverage in the economy. The essay also explores the importance of leverage to the economy and concludes with a summary of the key points. The essay provides a detailed overview of the RBA's operations and its impact on the Australian economy.

Economics Assignment

Students Name

Course

Professor

University

Date

Students Name

Course

Professor

University

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reserve Bank of Australia 1

EXECUTIVE SUMMARY

Basically, this report explains the role, tools and functions of the Reserve Bank of

Australia. Primarily, the mandate of the bank is to formulate, regulate and implement monetary

policy, issue currency and maintain a strong financial system in the Australian economy. Also,

the report explores the meaning of inflation, deflation, recession and how the three aspects of the

Australian economy are interconnected. Majorly, deflation and recession are related due to the

fact that deflation might be a cause or consequence of recessive periods of an

economy .Moreover, the reports looks into leverage and its importance to the Australian

economy .In addition, I explore the effects of monetary policy on the value of assets and yields

in the Australian economy.

EXECUTIVE SUMMARY

Basically, this report explains the role, tools and functions of the Reserve Bank of

Australia. Primarily, the mandate of the bank is to formulate, regulate and implement monetary

policy, issue currency and maintain a strong financial system in the Australian economy. Also,

the report explores the meaning of inflation, deflation, recession and how the three aspects of the

Australian economy are interconnected. Majorly, deflation and recession are related due to the

fact that deflation might be a cause or consequence of recessive periods of an

economy .Moreover, the reports looks into leverage and its importance to the Australian

economy .In addition, I explore the effects of monetary policy on the value of assets and yields

in the Australian economy.

Reserve Bank of Australia 2

TABLE OF CONTENTS

1.0 INTRODUCTION………………………………………………………………………….3

1.0.1 .ROLE AND TOOLS OF THE RBA……………………………………………………..3

2. CURRENT ECONOMIC ENVIRONMENT OF AUSTRALIA……………………………4

2.0. INFLATION……………………………………………………………………………….4

2.0.1. INTEREST RATES………………………………………………………………………5

2.0.2. EFFECT OF RBA POLICY ON FINANCIAL MARKETS ASSET VALUES AND

YIELDS………………………………………………………………………………………..5

3. CONNECTION BETWEEN RECESSION AND INFLATION…………………………..6

3.0. WHY IS DEFLATION DREADED …………………………………….........................7

4 LEVERAGES DYNAMICS ……………………………………………………………....8

4.0 IMPORTANCE TO THE ECONOMY…………………………………………………...9

5.0. CONCLUSION……………………………………………………………………….…10

6.0 REFERENCES……………………………………………………………………………11

TABLE OF CONTENTS

1.0 INTRODUCTION………………………………………………………………………….3

1.0.1 .ROLE AND TOOLS OF THE RBA……………………………………………………..3

2. CURRENT ECONOMIC ENVIRONMENT OF AUSTRALIA……………………………4

2.0. INFLATION……………………………………………………………………………….4

2.0.1. INTEREST RATES………………………………………………………………………5

2.0.2. EFFECT OF RBA POLICY ON FINANCIAL MARKETS ASSET VALUES AND

YIELDS………………………………………………………………………………………..5

3. CONNECTION BETWEEN RECESSION AND INFLATION…………………………..6

3.0. WHY IS DEFLATION DREADED …………………………………….........................7

4 LEVERAGES DYNAMICS ……………………………………………………………....8

4.0 IMPORTANCE TO THE ECONOMY…………………………………………………...9

5.0. CONCLUSION……………………………………………………………………….…10

6.0 REFERENCES……………………………………………………………………………11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Reserve Bank of Australia 3

Introduction

Noteworthy, the Australian financial economy policy is formulated, regulated and

implemented by the Reserve Bank of Australia (RBA) which gets its power an functions from

the Reserve Bank Act(1959).The Act establishes two Boards ,the payments systems board and

the Reserve Bank Board to perform some of its major functions. The bank through the

implementation of monetary policy has affected the interest rates and inflation rates in the

Australian economy since its inception. Deflation is negative inflationary pressures in an

economy. Unfortunately, Japan and Greece have been on the receiving end of deflation. For

some economists, deflation might be a precipitate for recession and vice versa.

Undoubtedly, there is a connection between deflation and recessive periods in any economy.

The monetary policy directly affects the assets and yields of the Australian enterprises due to the

effects of the policies on the money supply. Monetary policies can be contractionary or

expansionary which affect the asset values and yields of the Australian businesses. From an

economic perspective, leverage is both desirable and undesirable in the economy. Leverage

desirability stems to the fact that it might increase a firms earnings. However, leverage might

instigate losses for the respective firms. Overall, leverage is a gamble that should be kept at a

balance.

Role and tools of RBA in Australia

Primarily, the Reserve Bank of Australia (RBA) is the central bank for the Australian

economy. Fundamentally, it is mandated to formulate the country’s monetary policy which

affects the all financial sectors in the country(Reserve bank of Australia, 2018).Additionally, the

Introduction

Noteworthy, the Australian financial economy policy is formulated, regulated and

implemented by the Reserve Bank of Australia (RBA) which gets its power an functions from

the Reserve Bank Act(1959).The Act establishes two Boards ,the payments systems board and

the Reserve Bank Board to perform some of its major functions. The bank through the

implementation of monetary policy has affected the interest rates and inflation rates in the

Australian economy since its inception. Deflation is negative inflationary pressures in an

economy. Unfortunately, Japan and Greece have been on the receiving end of deflation. For

some economists, deflation might be a precipitate for recession and vice versa.

Undoubtedly, there is a connection between deflation and recessive periods in any economy.

The monetary policy directly affects the assets and yields of the Australian enterprises due to the

effects of the policies on the money supply. Monetary policies can be contractionary or

expansionary which affect the asset values and yields of the Australian businesses. From an

economic perspective, leverage is both desirable and undesirable in the economy. Leverage

desirability stems to the fact that it might increase a firms earnings. However, leverage might

instigate losses for the respective firms. Overall, leverage is a gamble that should be kept at a

balance.

Role and tools of RBA in Australia

Primarily, the Reserve Bank of Australia (RBA) is the central bank for the Australian

economy. Fundamentally, it is mandated to formulate the country’s monetary policy which

affects the all financial sectors in the country(Reserve bank of Australia, 2018).Additionally, the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reserve Bank of Australia 4

RBA is tasked with the duty of issuing Australian currency which is the Australian dollar. Also,

the bank is responsible for the management of foreign exchange reserves and also responsible for

maintaining a strong system of finance in the country. Fundamentally, the reserve Bank derives

its powers and functions from the Reserve Bank Act of 1959.

Undoubtedly, the Act equips the bank with the powers, resources and departments which help

it with the implementation of its functions. The bank through the Bank board and the payments

systems board help implement it various functions

Current economic environment of Australia

2.0. Inflation

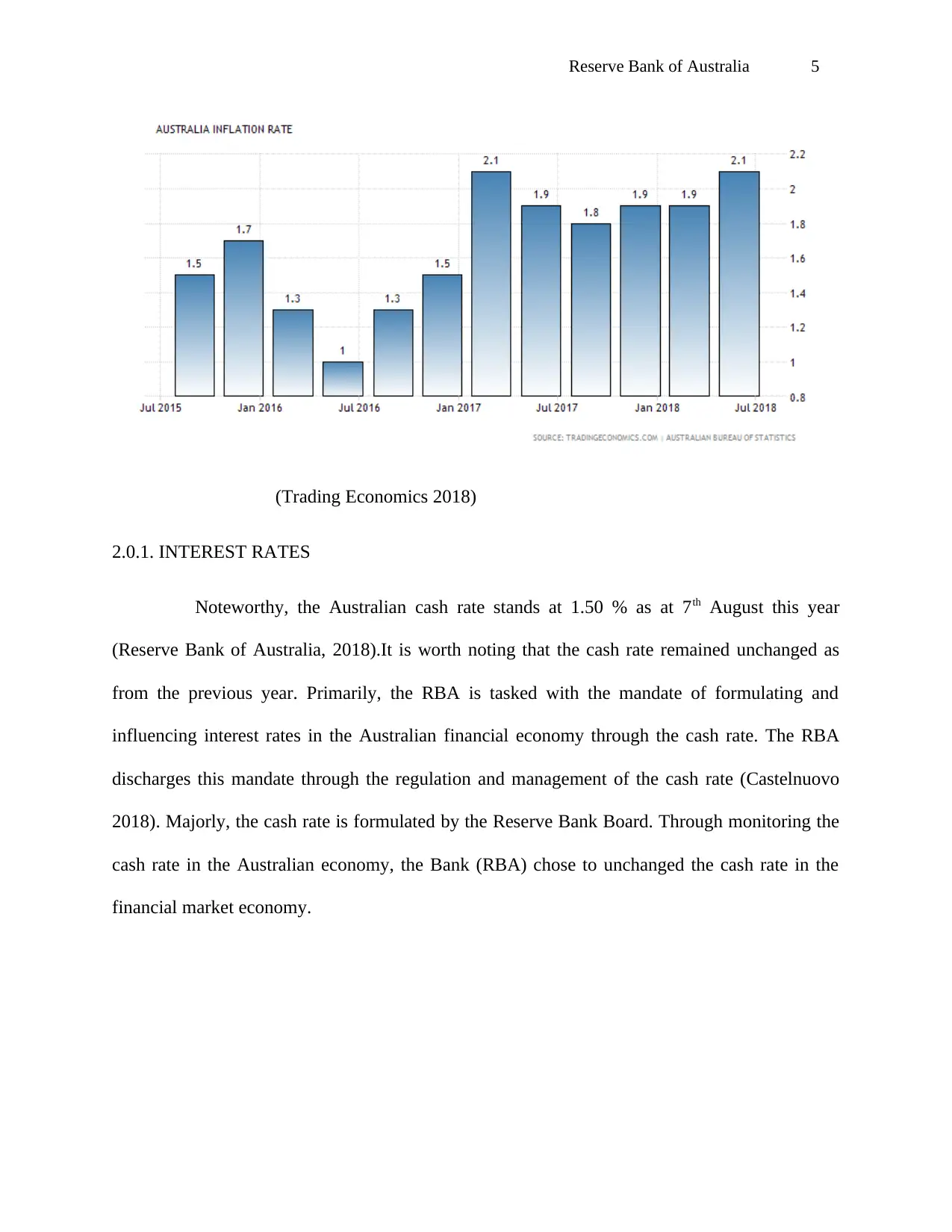

Majorly, the inflation rate in Australia has increased between the month of January and July

2018(Trading economics 2018).Predominantly, inflation refers to the instability in prices of

goods and services .Specifically, the rate of consumer prices rose from 1.9 % to 2.1% during the

stipulated period of time .Majorly, the rise in transportation cost is responsible for the

inflationary pressures being experienced currently in the Australian economy. Currently, the

Australian inflationary pressures are manageable hence the unchanged monetary policy to

maintain the current inflationary conditions of in the economy. Primarily, the Bank (RBA) uses

an target to control the inflationary rates in the economy.

RBA is tasked with the duty of issuing Australian currency which is the Australian dollar. Also,

the bank is responsible for the management of foreign exchange reserves and also responsible for

maintaining a strong system of finance in the country. Fundamentally, the reserve Bank derives

its powers and functions from the Reserve Bank Act of 1959.

Undoubtedly, the Act equips the bank with the powers, resources and departments which help

it with the implementation of its functions. The bank through the Bank board and the payments

systems board help implement it various functions

Current economic environment of Australia

2.0. Inflation

Majorly, the inflation rate in Australia has increased between the month of January and July

2018(Trading economics 2018).Predominantly, inflation refers to the instability in prices of

goods and services .Specifically, the rate of consumer prices rose from 1.9 % to 2.1% during the

stipulated period of time .Majorly, the rise in transportation cost is responsible for the

inflationary pressures being experienced currently in the Australian economy. Currently, the

Australian inflationary pressures are manageable hence the unchanged monetary policy to

maintain the current inflationary conditions of in the economy. Primarily, the Bank (RBA) uses

an target to control the inflationary rates in the economy.

Reserve Bank of Australia 5

(Trading Economics 2018)

2.0.1. INTEREST RATES

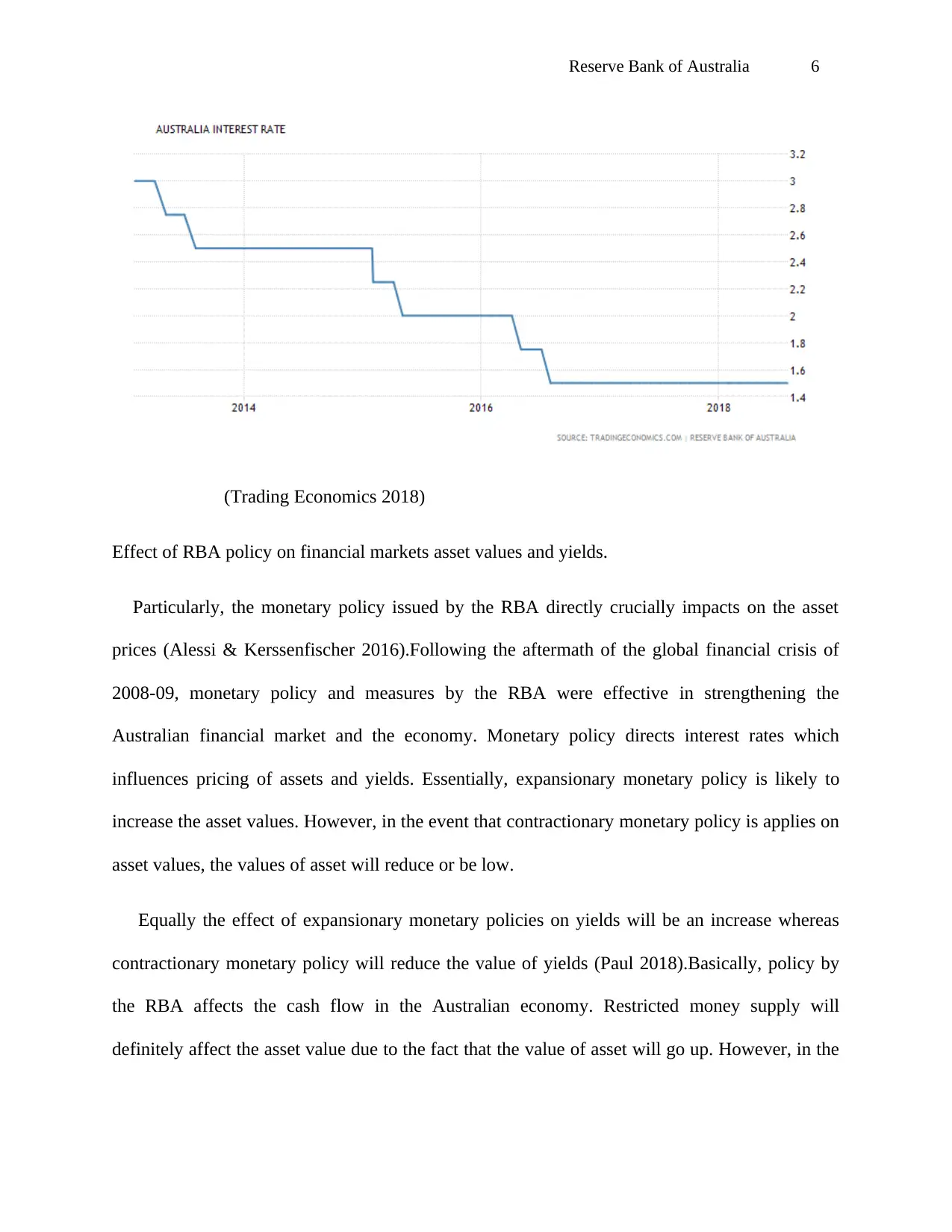

Noteworthy, the Australian cash rate stands at 1.50 % as at 7th August this year

(Reserve Bank of Australia, 2018).It is worth noting that the cash rate remained unchanged as

from the previous year. Primarily, the RBA is tasked with the mandate of formulating and

influencing interest rates in the Australian financial economy through the cash rate. The RBA

discharges this mandate through the regulation and management of the cash rate (Castelnuovo

2018). Majorly, the cash rate is formulated by the Reserve Bank Board. Through monitoring the

cash rate in the Australian economy, the Bank (RBA) chose to unchanged the cash rate in the

financial market economy.

(Trading Economics 2018)

2.0.1. INTEREST RATES

Noteworthy, the Australian cash rate stands at 1.50 % as at 7th August this year

(Reserve Bank of Australia, 2018).It is worth noting that the cash rate remained unchanged as

from the previous year. Primarily, the RBA is tasked with the mandate of formulating and

influencing interest rates in the Australian financial economy through the cash rate. The RBA

discharges this mandate through the regulation and management of the cash rate (Castelnuovo

2018). Majorly, the cash rate is formulated by the Reserve Bank Board. Through monitoring the

cash rate in the Australian economy, the Bank (RBA) chose to unchanged the cash rate in the

financial market economy.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Reserve Bank of Australia 6

(Trading Economics 2018)

Effect of RBA policy on financial markets asset values and yields.

Particularly, the monetary policy issued by the RBA directly crucially impacts on the asset

prices (Alessi & Kerssenfischer 2016).Following the aftermath of the global financial crisis of

2008-09, monetary policy and measures by the RBA were effective in strengthening the

Australian financial market and the economy. Monetary policy directs interest rates which

influences pricing of assets and yields. Essentially, expansionary monetary policy is likely to

increase the asset values. However, in the event that contractionary monetary policy is applies on

asset values, the values of asset will reduce or be low.

Equally the effect of expansionary monetary policies on yields will be an increase whereas

contractionary monetary policy will reduce the value of yields (Paul 2018).Basically, policy by

the RBA affects the cash flow in the Australian economy. Restricted money supply will

definitely affect the asset value due to the fact that the value of asset will go up. However, in the

(Trading Economics 2018)

Effect of RBA policy on financial markets asset values and yields.

Particularly, the monetary policy issued by the RBA directly crucially impacts on the asset

prices (Alessi & Kerssenfischer 2016).Following the aftermath of the global financial crisis of

2008-09, monetary policy and measures by the RBA were effective in strengthening the

Australian financial market and the economy. Monetary policy directs interest rates which

influences pricing of assets and yields. Essentially, expansionary monetary policy is likely to

increase the asset values. However, in the event that contractionary monetary policy is applies on

asset values, the values of asset will reduce or be low.

Equally the effect of expansionary monetary policies on yields will be an increase whereas

contractionary monetary policy will reduce the value of yields (Paul 2018).Basically, policy by

the RBA affects the cash flow in the Australian economy. Restricted money supply will

definitely affect the asset value due to the fact that the value of asset will go up. However, in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reserve Bank of Australia 7

case that the monetary policy allows more cash supply in the economy, the value of asset will go

down in turn affecting the investment yields for the Australian economy.

3. Connection between recession and inflation

Inevitably, deflation might lead to recessive periods for any economy (Guerrore & Parker

N.d).Majorly, recession implies stagnated economic growth rate whereas deflation is the fall in

pricing for goods and services. Essentially, low pricing for goods might affect the aggregate

demand and supply of goods which in turns affects the economy. Typically, fall in prices of

goods and services limits the circulation and supply of money which is critical to investment and

consumption of goods and services. In some instances, deflation has been the cause of recessive

periods in the economy such as Japan.

Primarily recession is characterized by reduced aggregate demand for goods and services

which might be due to deflation (Bordo & Filardo, 2005).Also, recession is characterized by high

unemployment rates due to reduced price of labor, workers chose to stay away from employment

or employer wages are low thus leaving work by some workers.

3.0 Why is deflation is feared?

Predominantly, deflation denotes the fall in pricing for goods and services. However, the impact

of deflation on economic growth are majorly negative hence the fear for deflationary trends in

any economy. From an economical perspective, fall in prices implies purchase delays thereby

prompting further price falls thus less consumption and purchase power of goods and services.

Incidentally, deflation weakens the demand for goods and services thus less revenue and less

money in circulation which grows an economy. In addition, deflation negatively impacts on the

case that the monetary policy allows more cash supply in the economy, the value of asset will go

down in turn affecting the investment yields for the Australian economy.

3. Connection between recession and inflation

Inevitably, deflation might lead to recessive periods for any economy (Guerrore & Parker

N.d).Majorly, recession implies stagnated economic growth rate whereas deflation is the fall in

pricing for goods and services. Essentially, low pricing for goods might affect the aggregate

demand and supply of goods which in turns affects the economy. Typically, fall in prices of

goods and services limits the circulation and supply of money which is critical to investment and

consumption of goods and services. In some instances, deflation has been the cause of recessive

periods in the economy such as Japan.

Primarily recession is characterized by reduced aggregate demand for goods and services

which might be due to deflation (Bordo & Filardo, 2005).Also, recession is characterized by high

unemployment rates due to reduced price of labor, workers chose to stay away from employment

or employer wages are low thus leaving work by some workers.

3.0 Why is deflation is feared?

Predominantly, deflation denotes the fall in pricing for goods and services. However, the impact

of deflation on economic growth are majorly negative hence the fear for deflationary trends in

any economy. From an economical perspective, fall in prices implies purchase delays thereby

prompting further price falls thus less consumption and purchase power of goods and services.

Incidentally, deflation weakens the demand for goods and services thus less revenue and less

money in circulation which grows an economy. In addition, deflation negatively impacts on the

Reserve Bank of Australia 8

interest rates (The Economist, 2015).Typically, higher interest rates encourages savings rather

than investment.

Additionally, deflation encourages labor market rigidity. Usually low wages for labor

will discourage workers due to wage cuts. Specifically, the Japanese economy has been marred

by the effects of deflation. Particularly, the Japanese economy was characterized by negative

inflationary rates in the year 1998,average economic growth rate of 1 % between the year 1993-

03 and a consumer inflation rate below 3 percent as at the end of the year 2003(Ito & Mishkin,

2004).The Japanese finance market experienced massive losses due to the fall in asset pricing.

Also, some Japanese banks capital declined due to the deflationary pressures in the country in

1998.

Also, the Greece economy has experienced negative

inflation(Eurobank ,2014).Particularly, the Greek economy experienced fall in prices for goods

and services in the year 2013 .The deflation was estimated to be -2.1 % of the Greek gross

domestic product. Majorly, deflation leads to high value for debts, distortion of resource

allocation, reduction of financial deposits, reduced output, possible bankruptcies, and reduced

income among other detrimental consequences to economic growth.

4 .Leverages dynamics

Essentially, leverage implies the ability of businesses are able to fund their assets through

borrowing(Ingves 2015).Typically high leverage would be characterized by high debt levels as

opposed to equity. Arguably, leverage can be beneficial to a business entity to a certain extent.

However certain levels of leverage in the financial market can be harmful to a financial entity.

According to the NAB predictions of possible increases in interest rates this year, there

interest rates (The Economist, 2015).Typically, higher interest rates encourages savings rather

than investment.

Additionally, deflation encourages labor market rigidity. Usually low wages for labor

will discourage workers due to wage cuts. Specifically, the Japanese economy has been marred

by the effects of deflation. Particularly, the Japanese economy was characterized by negative

inflationary rates in the year 1998,average economic growth rate of 1 % between the year 1993-

03 and a consumer inflation rate below 3 percent as at the end of the year 2003(Ito & Mishkin,

2004).The Japanese finance market experienced massive losses due to the fall in asset pricing.

Also, some Japanese banks capital declined due to the deflationary pressures in the country in

1998.

Also, the Greece economy has experienced negative

inflation(Eurobank ,2014).Particularly, the Greek economy experienced fall in prices for goods

and services in the year 2013 .The deflation was estimated to be -2.1 % of the Greek gross

domestic product. Majorly, deflation leads to high value for debts, distortion of resource

allocation, reduction of financial deposits, reduced output, possible bankruptcies, and reduced

income among other detrimental consequences to economic growth.

4 .Leverages dynamics

Essentially, leverage implies the ability of businesses are able to fund their assets through

borrowing(Ingves 2015).Typically high leverage would be characterized by high debt levels as

opposed to equity. Arguably, leverage can be beneficial to a business entity to a certain extent.

However certain levels of leverage in the financial market can be harmful to a financial entity.

According to the NAB predictions of possible increases in interest rates this year, there

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Reserve Bank of Australia 9

likelihood of slow economic growth rate might necessitate leverage for struggling firms (Fensom

,2017).With low economic growth rate due to increased interest rates, the money in circulation

will be limited which could restrict the operations of businesses and affect the aggregate demand

for goods and services which is key to economic growth. Due to low economic growth rate and

reduced money circulation, firms might need to leverage so as to keep their operations afloat.

4.0. Importance to the economy.

According to some economic perspectives, leverage is an essential part of the business cycle

due to the various benefits it affords businesses, financial or otherwise .For some businesses,

leverage might be a cheaper funding option for the business as contrasted with equity (Ingves,

2013).Specifically leverage has been hailed for raising funding costs for most businesses.

Basically, through obtained leverage, businesses are able to make earning on their own assets

which could lead to expansion of the business, increased profits and be able to maintain the

operation of the respective business (Fandom 2017).

In addition, for the financial market, the returns on leveraged products might yield higher

returns which is positive to the operation of the financial entity. Basically, leverage increases the

investment returns if thought about and implemented properly thus leading to more revenue,

expansion and investment which are crucial to the growth of the economy. Moreover, through

leverage, a business might be able to retain its employees and increase production in the event

that the business entity was facing hard times. Through borrowed capital, the business operations

might save the business from bankruptcy (Accounting Tools 2017).

likelihood of slow economic growth rate might necessitate leverage for struggling firms (Fensom

,2017).With low economic growth rate due to increased interest rates, the money in circulation

will be limited which could restrict the operations of businesses and affect the aggregate demand

for goods and services which is key to economic growth. Due to low economic growth rate and

reduced money circulation, firms might need to leverage so as to keep their operations afloat.

4.0. Importance to the economy.

According to some economic perspectives, leverage is an essential part of the business cycle

due to the various benefits it affords businesses, financial or otherwise .For some businesses,

leverage might be a cheaper funding option for the business as contrasted with equity (Ingves,

2013).Specifically leverage has been hailed for raising funding costs for most businesses.

Basically, through obtained leverage, businesses are able to make earning on their own assets

which could lead to expansion of the business, increased profits and be able to maintain the

operation of the respective business (Fandom 2017).

In addition, for the financial market, the returns on leveraged products might yield higher

returns which is positive to the operation of the financial entity. Basically, leverage increases the

investment returns if thought about and implemented properly thus leading to more revenue,

expansion and investment which are crucial to the growth of the economy. Moreover, through

leverage, a business might be able to retain its employees and increase production in the event

that the business entity was facing hard times. Through borrowed capital, the business operations

might save the business from bankruptcy (Accounting Tools 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Reserve Bank of Australia 10

However, due to the inability to service the debt through the business assets, leverage

isn’t considered a healthy option to funding .Also, leverage might lead to losses as opposed to

profits as hoped thus making it a dangerous gamble for the business entity.

Conclusion

Undoubtedly, the RBA is the Australian central bank tasked with the mandate of formulating

monetary measures and policies, strengthening the financial market of the Australian economy

and issuance of the Australian dollar. The Role of the bank can be manifested though the

implemented monetary policies which affect interest rates and inflation rates as a bid to

strengthen and regulate the Australian financial market. The enabling statute grants the bank

massive powers, functions and bodies to implement this mandate. The effects of monetary policy

by the bank can be felt through contractionary and expansionary policies which affect the interest

rates and inflation rates in the economy which directly and indirectly affect the value of assets

and returns on investments.

Essentially, Deflation which is negative inflation has led to detrimental consequences on the

Japanese and Greek economy. Negative inflation leads to stagnated economic growth rates,

reduced outcomes, increased value of public debts, reduced income which implies less

investment, more savings and reduced investment which is critical to economy growth rate.

Basically, deflation and recessive periods in an economy are related .Arguably, deflation is a

cause and a consequence of recession in any economy thus the assertion that they are

interconnected.

However, due to the inability to service the debt through the business assets, leverage

isn’t considered a healthy option to funding .Also, leverage might lead to losses as opposed to

profits as hoped thus making it a dangerous gamble for the business entity.

Conclusion

Undoubtedly, the RBA is the Australian central bank tasked with the mandate of formulating

monetary measures and policies, strengthening the financial market of the Australian economy

and issuance of the Australian dollar. The Role of the bank can be manifested though the

implemented monetary policies which affect interest rates and inflation rates as a bid to

strengthen and regulate the Australian financial market. The enabling statute grants the bank

massive powers, functions and bodies to implement this mandate. The effects of monetary policy

by the bank can be felt through contractionary and expansionary policies which affect the interest

rates and inflation rates in the economy which directly and indirectly affect the value of assets

and returns on investments.

Essentially, Deflation which is negative inflation has led to detrimental consequences on the

Japanese and Greek economy. Negative inflation leads to stagnated economic growth rates,

reduced outcomes, increased value of public debts, reduced income which implies less

investment, more savings and reduced investment which is critical to economy growth rate.

Basically, deflation and recessive periods in an economy are related .Arguably, deflation is a

cause and a consequence of recession in any economy thus the assertion that they are

interconnected.

Reserve Bank of Australia 11

References

Accounting Tools.(2017).Financial leverage .Accounting tools.com.[Online].Available at

https://www.accountingtools.com/articles/2017/5/14/financial-leverage[Accessed 2

Sep 2018]

Alessi, L & Kerssenfischer, M. (2016). Working Paper Series The response of asset prices to

monetary policy shocks: stronger than thought. European Central Bank.

[Online].Available at

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1967.en.pdf?

23d2ec9ce1c93d4315e88bb90d8531ff[Accessed 2 Sep 2018]

Bordo, M & Filardo, A. (2005).Deflation in a historical perspective. Bis working papers.

[Online].Available at https://www.bis.org/publ/work186.pdf[Accessed 2 Sep 2018]

Eurobank.2014.Economy and Markets. Eurobank Research. [Online].Available at

https://www.eurobank.gr/Uploads/Reports/ECONOMYMARKETS_APRIL2014%

20MAY%20UPDATE.pdf[Accessed 2 Sep 2018]

Fensom, A. (2017).Is the deflation bugbear heading down under? Morning star.

[Online].Available at https://www.morningstar.com.au/stocks/article/Is-the-

deflation-bugbear-heading-Down-Under/8994[Accessed 2 Sep 2018]

References

Accounting Tools.(2017).Financial leverage .Accounting tools.com.[Online].Available at

https://www.accountingtools.com/articles/2017/5/14/financial-leverage[Accessed 2

Sep 2018]

Alessi, L & Kerssenfischer, M. (2016). Working Paper Series The response of asset prices to

monetary policy shocks: stronger than thought. European Central Bank.

[Online].Available at

https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1967.en.pdf?

23d2ec9ce1c93d4315e88bb90d8531ff[Accessed 2 Sep 2018]

Bordo, M & Filardo, A. (2005).Deflation in a historical perspective. Bis working papers.

[Online].Available at https://www.bis.org/publ/work186.pdf[Accessed 2 Sep 2018]

Eurobank.2014.Economy and Markets. Eurobank Research. [Online].Available at

https://www.eurobank.gr/Uploads/Reports/ECONOMYMARKETS_APRIL2014%

20MAY%20UPDATE.pdf[Accessed 2 Sep 2018]

Fensom, A. (2017).Is the deflation bugbear heading down under? Morning star.

[Online].Available at https://www.morningstar.com.au/stocks/article/Is-the-

deflation-bugbear-heading-Down-Under/8994[Accessed 2 Sep 2018]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.