Impact of Financial Performance on CDS Score: A Detailed Analysis

VerifiedAdded on 2020/05/08

|14

|3073

|133

Report

AI Summary

This report presents an analysis of the relationship between Credit Default Swap (CDS) scores and the financial performance of 25 companies listed on the US stock market. The study employs inferential statistical techniques, including independent sample t-tests, correlation analysis, and regression analysis, to examine the impact of financial indicators such as EBITDA, market capitalization, Beta, and Earnings Per Share (EPS) on CDS scores. The results indicate a positive correlation between CDS scores and EBITDA, market capitalization, though these relationships are not statistically significant. The analysis also explores the influence of different sectors on CDS scores using ANOVA. Furthermore, the regression analysis reveals that the model explains only a small portion of the variance in CDS scores, possibly due to a small sample size and the influence of other unmeasured factors. The hypothesis testing confirms the positive, but not statistically significant, relationships between CDS and EBITDA and market capitalization. The report concludes with a discussion of limitations and suggestions for further research.

Chapter: 1 Results

Contents

Chapter: 1 Results.................................................................................................................................1

1.1 Data analysis (Inferential analysis)..............................................................................................1

1.2 Independent sample t test.............................................................................................................1

1.2.1 Correlation analysis.............................................................................................................5

1.2.2 Regression analysis..............................................................................................................7

1.3 Hypothesis testing......................................................................................................................10

1.4 Discussion..................................................................................................................................11

1.5 Limitations.................................................................................................................................12

1.6 Further Research........................................................................................................................12

Contents

Chapter: 1 Results.................................................................................................................................1

1.1 Data analysis (Inferential analysis)..............................................................................................1

1.2 Independent sample t test.............................................................................................................1

1.2.1 Correlation analysis.............................................................................................................5

1.2.2 Regression analysis..............................................................................................................7

1.3 Hypothesis testing......................................................................................................................10

1.4 Discussion..................................................................................................................................11

1.5 Limitations.................................................................................................................................12

1.6 Further Research........................................................................................................................12

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1.1 Data analysis (Inferential analysis)

In this section the results from the inferential analysis has been shown. For the analysis purpose

secondary data has been collected for 25 different companies listed in US stock market. Since

this research is aimed to examine the relationship between the CDS score and the performance of

the firm as the legitimacy theory states that the companies who are performing well in terms of

finance have better CDS score as compared to the companies who are not performing well. In

this case the financial health of the companies has been measured in terms of different

parameters. This includes the EBITDA, market capitalization, beta and earnings per share (EPS).

Among all the indicators of the financial performance of the company, EBITDA has been taken

as the main variable of interest.

To find the relationship between the CDS and the EBITDA different inferential analysis has been

performed. In the first section the difference between the CDS score of the companies on the

basis of their financial performance has been analyzed using the independent sample t test. In the

second section the correlation analysis has been performed to examine the relationship financial

performance and the CDS score. Finally the regression analysis has been conducted to find the

impact of financial performance on CDS score for the selected companies.

1.2 Independent sample t test

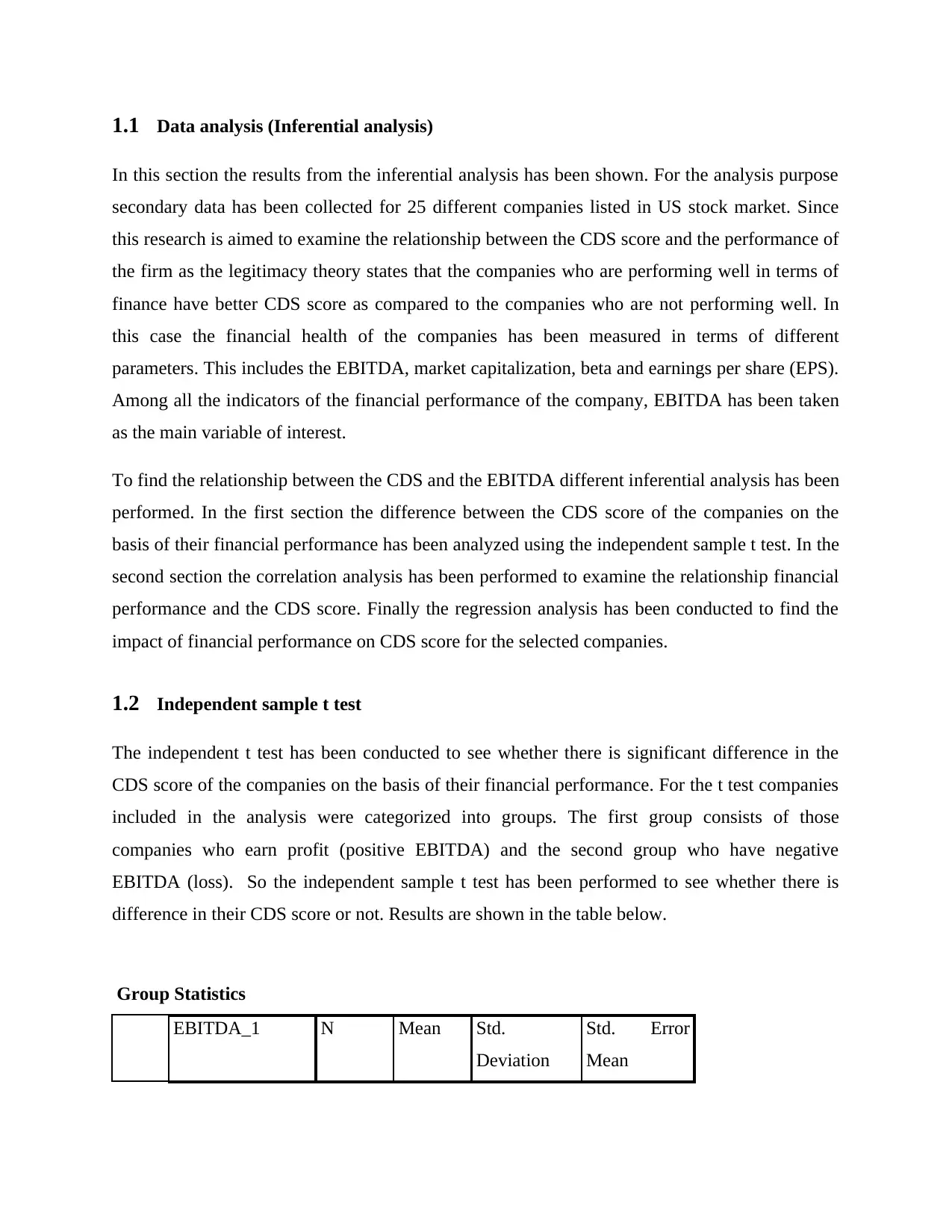

The independent t test has been conducted to see whether there is significant difference in the

CDS score of the companies on the basis of their financial performance. For the t test companies

included in the analysis were categorized into groups. The first group consists of those

companies who earn profit (positive EBITDA) and the second group who have negative

EBITDA (loss). So the independent sample t test has been performed to see whether there is

difference in their CDS score or not. Results are shown in the table below.

Group Statistics

EBITDA_1 N Mean Std.

Deviation

Std. Error

Mean

In this section the results from the inferential analysis has been shown. For the analysis purpose

secondary data has been collected for 25 different companies listed in US stock market. Since

this research is aimed to examine the relationship between the CDS score and the performance of

the firm as the legitimacy theory states that the companies who are performing well in terms of

finance have better CDS score as compared to the companies who are not performing well. In

this case the financial health of the companies has been measured in terms of different

parameters. This includes the EBITDA, market capitalization, beta and earnings per share (EPS).

Among all the indicators of the financial performance of the company, EBITDA has been taken

as the main variable of interest.

To find the relationship between the CDS and the EBITDA different inferential analysis has been

performed. In the first section the difference between the CDS score of the companies on the

basis of their financial performance has been analyzed using the independent sample t test. In the

second section the correlation analysis has been performed to examine the relationship financial

performance and the CDS score. Finally the regression analysis has been conducted to find the

impact of financial performance on CDS score for the selected companies.

1.2 Independent sample t test

The independent t test has been conducted to see whether there is significant difference in the

CDS score of the companies on the basis of their financial performance. For the t test companies

included in the analysis were categorized into groups. The first group consists of those

companies who earn profit (positive EBITDA) and the second group who have negative

EBITDA (loss). So the independent sample t test has been performed to see whether there is

difference in their CDS score or not. Results are shown in the table below.

Group Statistics

EBITDA_1 N Mean Std.

Deviation

Std. Error

Mean

CDS

Good_performanc

e

7 82.86 5.521 2.087

bad_performance 18 81.78 5.331 1.257

Table 1 Comparing mean of the good performing and bad performing firms

As shown in the table above the group statistics shows that the mean CDS score of the

companies who perform well in terms of EBITDA is 82.86 whereas the mean score of the other

group is 81.78. This shows that the mean score of the companies with high EBITDA is more;

however the difference in mean score is not so high.

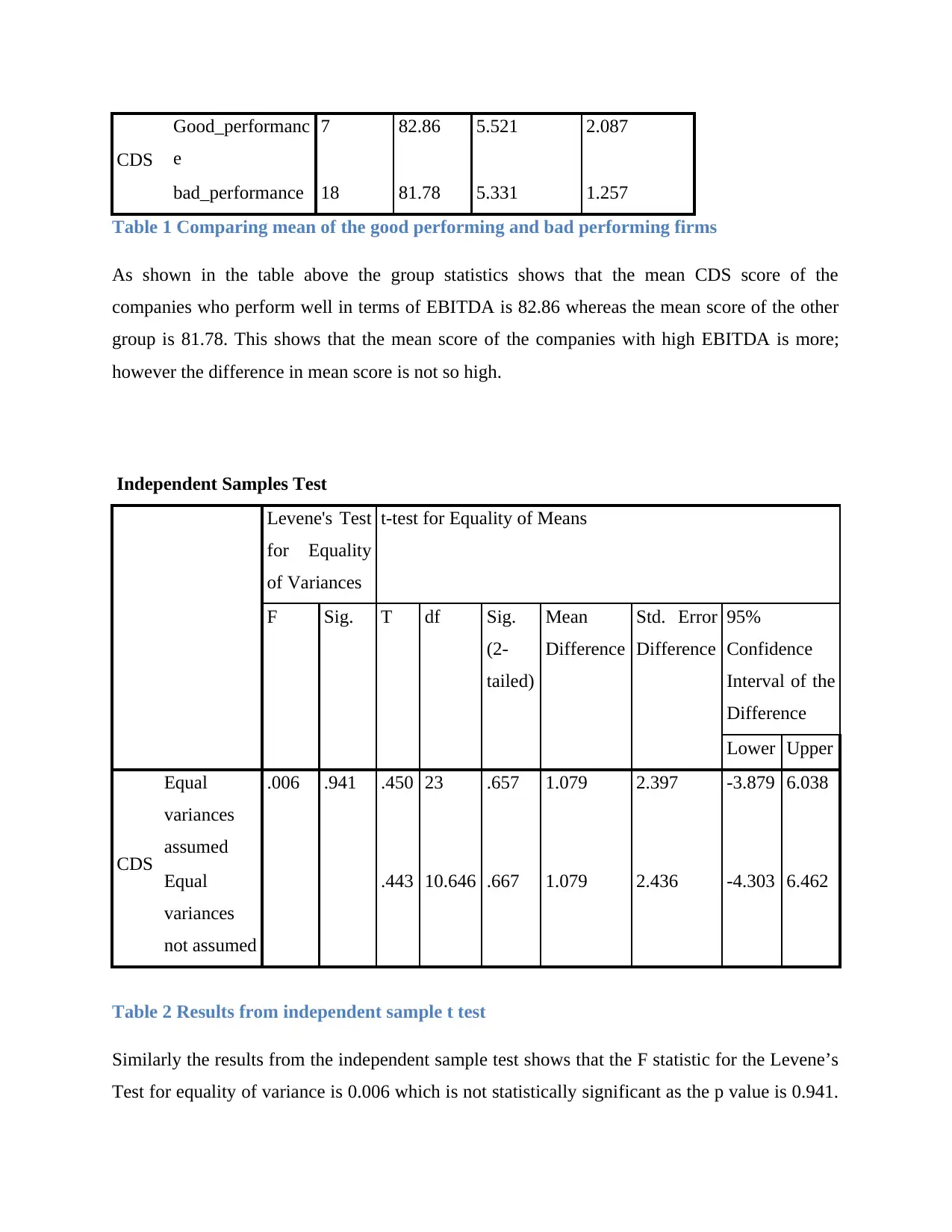

Independent Samples Test

Levene's Test

for Equality

of Variances

t-test for Equality of Means

F Sig. T df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95%

Confidence

Interval of the

Difference

Lower Upper

CDS

Equal

variances

assumed

.006 .941 .450 23 .657 1.079 2.397 -3.879 6.038

Equal

variances

not assumed

.443 10.646 .667 1.079 2.436 -4.303 6.462

Table 2 Results from independent sample t test

Similarly the results from the independent sample test shows that the F statistic for the Levene’s

Test for equality of variance is 0.006 which is not statistically significant as the p value is 0.941.

Good_performanc

e

7 82.86 5.521 2.087

bad_performance 18 81.78 5.331 1.257

Table 1 Comparing mean of the good performing and bad performing firms

As shown in the table above the group statistics shows that the mean CDS score of the

companies who perform well in terms of EBITDA is 82.86 whereas the mean score of the other

group is 81.78. This shows that the mean score of the companies with high EBITDA is more;

however the difference in mean score is not so high.

Independent Samples Test

Levene's Test

for Equality

of Variances

t-test for Equality of Means

F Sig. T df Sig.

(2-

tailed)

Mean

Difference

Std. Error

Difference

95%

Confidence

Interval of the

Difference

Lower Upper

CDS

Equal

variances

assumed

.006 .941 .450 23 .657 1.079 2.397 -3.879 6.038

Equal

variances

not assumed

.443 10.646 .667 1.079 2.436 -4.303 6.462

Table 2 Results from independent sample t test

Similarly the results from the independent sample test shows that the F statistic for the Levene’s

Test for equality of variance is 0.006 which is not statistically significant as the p value is 0.941.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

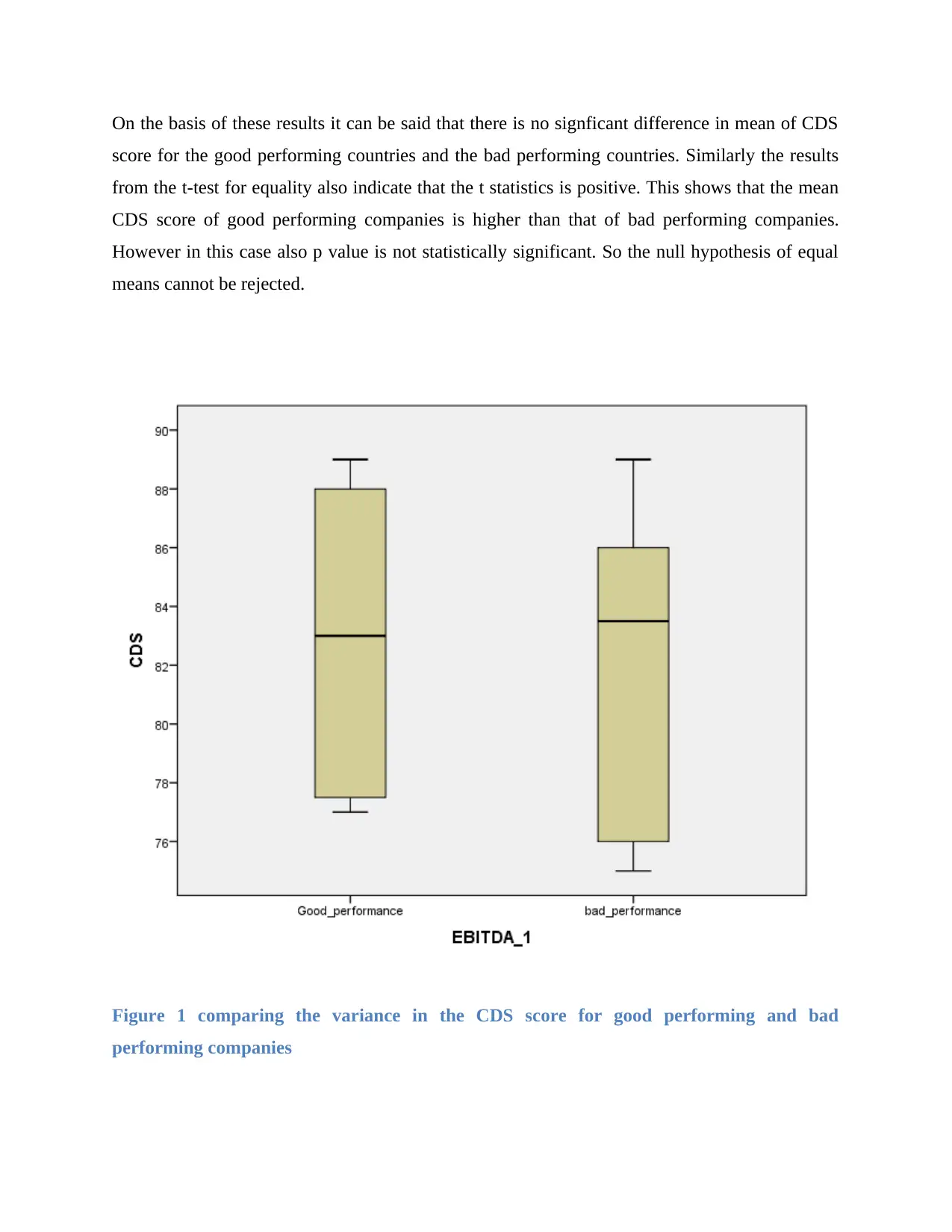

On the basis of these results it can be said that there is no signficant difference in mean of CDS

score for the good performing countries and the bad performing countries. Similarly the results

from the t-test for equality also indicate that the t statistics is positive. This shows that the mean

CDS score of good performing companies is higher than that of bad performing companies.

However in this case also p value is not statistically significant. So the null hypothesis of equal

means cannot be rejected.

Figure 1 comparing the variance in the CDS score for good performing and bad

performing companies

score for the good performing countries and the bad performing countries. Similarly the results

from the t-test for equality also indicate that the t statistics is positive. This shows that the mean

CDS score of good performing companies is higher than that of bad performing companies.

However in this case also p value is not statistically significant. So the null hypothesis of equal

means cannot be rejected.

Figure 1 comparing the variance in the CDS score for good performing and bad

performing companies

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As shown in the box plot above the spread in the bad performing companies is higher as

compared to those who are performing financially well. However the difference is not so high so

it can be said that the variance is not so high.

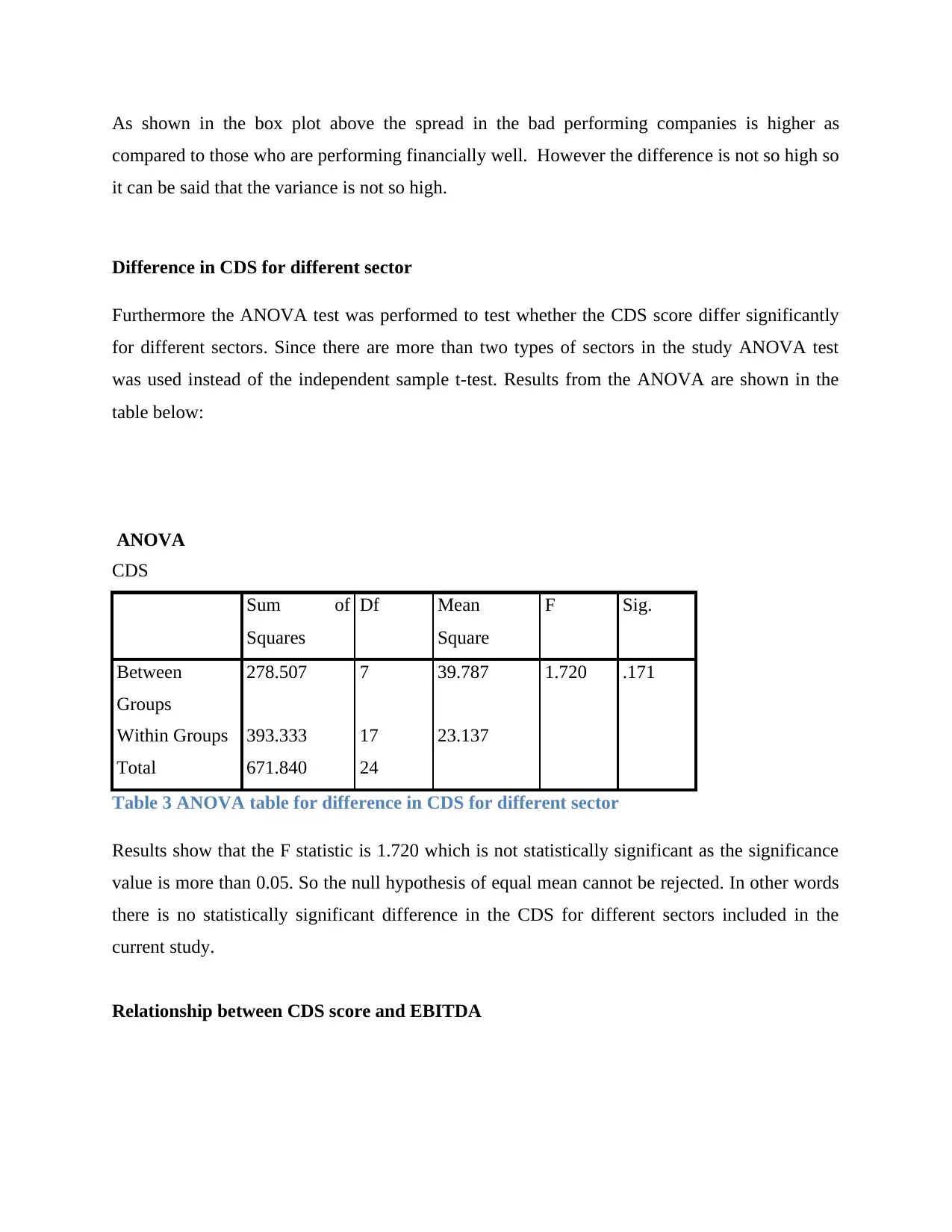

Difference in CDS for different sector

Furthermore the ANOVA test was performed to test whether the CDS score differ significantly

for different sectors. Since there are more than two types of sectors in the study ANOVA test

was used instead of the independent sample t-test. Results from the ANOVA are shown in the

table below:

ANOVA

CDS

Sum of

Squares

Df Mean

Square

F Sig.

Between

Groups

278.507 7 39.787 1.720 .171

Within Groups 393.333 17 23.137

Total 671.840 24

Table 3 ANOVA table for difference in CDS for different sector

Results show that the F statistic is 1.720 which is not statistically significant as the significance

value is more than 0.05. So the null hypothesis of equal mean cannot be rejected. In other words

there is no statistically significant difference in the CDS for different sectors included in the

current study.

Relationship between CDS score and EBITDA

compared to those who are performing financially well. However the difference is not so high so

it can be said that the variance is not so high.

Difference in CDS for different sector

Furthermore the ANOVA test was performed to test whether the CDS score differ significantly

for different sectors. Since there are more than two types of sectors in the study ANOVA test

was used instead of the independent sample t-test. Results from the ANOVA are shown in the

table below:

ANOVA

CDS

Sum of

Squares

Df Mean

Square

F Sig.

Between

Groups

278.507 7 39.787 1.720 .171

Within Groups 393.333 17 23.137

Total 671.840 24

Table 3 ANOVA table for difference in CDS for different sector

Results show that the F statistic is 1.720 which is not statistically significant as the significance

value is more than 0.05. So the null hypothesis of equal mean cannot be rejected. In other words

there is no statistically significant difference in the CDS for different sectors included in the

current study.

Relationship between CDS score and EBITDA

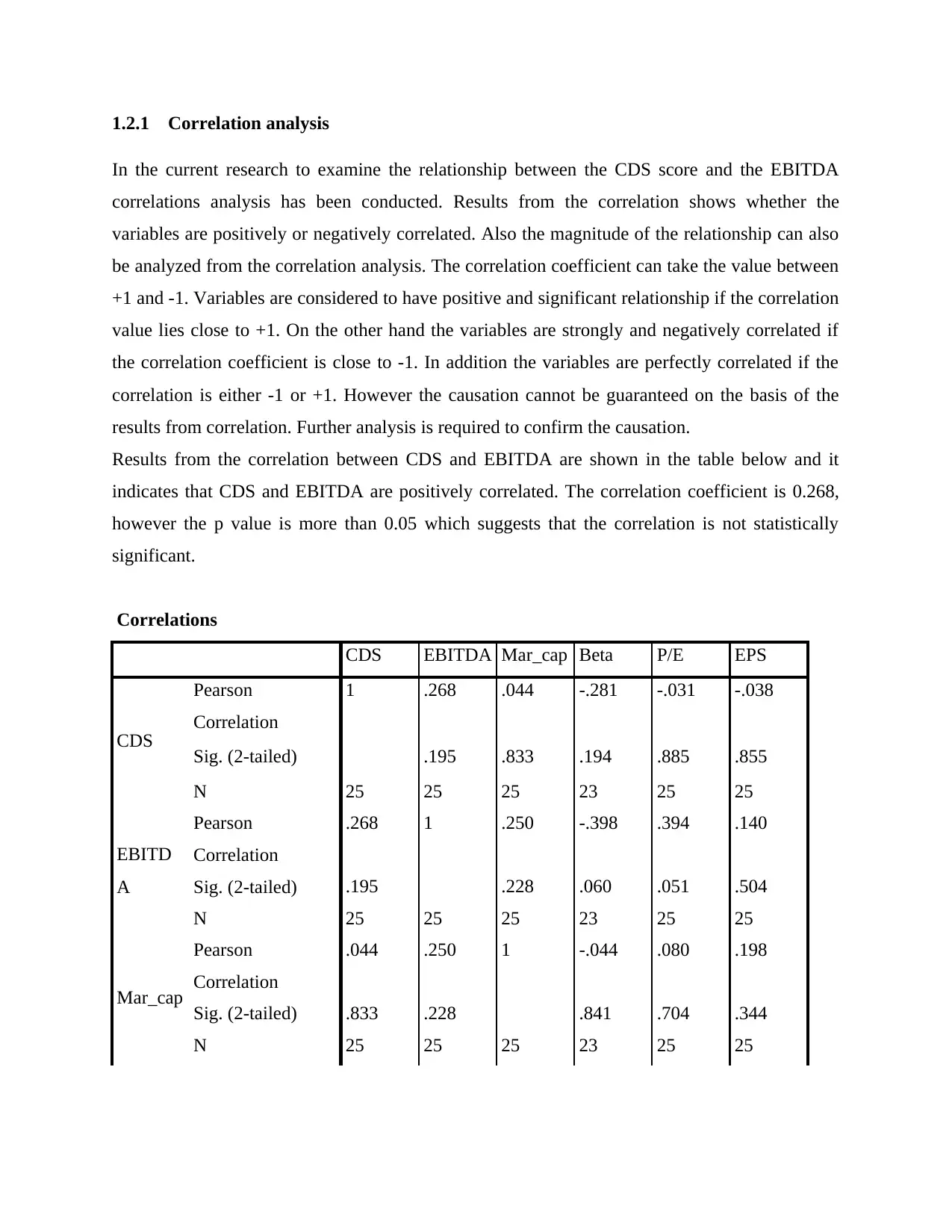

1.2.1 Correlation analysis

In the current research to examine the relationship between the CDS score and the EBITDA

correlations analysis has been conducted. Results from the correlation shows whether the

variables are positively or negatively correlated. Also the magnitude of the relationship can also

be analyzed from the correlation analysis. The correlation coefficient can take the value between

+1 and -1. Variables are considered to have positive and significant relationship if the correlation

value lies close to +1. On the other hand the variables are strongly and negatively correlated if

the correlation coefficient is close to -1. In addition the variables are perfectly correlated if the

correlation is either -1 or +1. However the causation cannot be guaranteed on the basis of the

results from correlation. Further analysis is required to confirm the causation.

Results from the correlation between CDS and EBITDA are shown in the table below and it

indicates that CDS and EBITDA are positively correlated. The correlation coefficient is 0.268,

however the p value is more than 0.05 which suggests that the correlation is not statistically

significant.

Correlations

CDS EBITDA Mar_cap Beta P/E EPS

CDS

Pearson

Correlation

1 .268 .044 -.281 -.031 -.038

Sig. (2-tailed) .195 .833 .194 .885 .855

N 25 25 25 23 25 25

EBITD

A

Pearson

Correlation

.268 1 .250 -.398 .394 .140

Sig. (2-tailed) .195 .228 .060 .051 .504

N 25 25 25 23 25 25

Mar_cap

Pearson

Correlation

.044 .250 1 -.044 .080 .198

Sig. (2-tailed) .833 .228 .841 .704 .344

N 25 25 25 23 25 25

In the current research to examine the relationship between the CDS score and the EBITDA

correlations analysis has been conducted. Results from the correlation shows whether the

variables are positively or negatively correlated. Also the magnitude of the relationship can also

be analyzed from the correlation analysis. The correlation coefficient can take the value between

+1 and -1. Variables are considered to have positive and significant relationship if the correlation

value lies close to +1. On the other hand the variables are strongly and negatively correlated if

the correlation coefficient is close to -1. In addition the variables are perfectly correlated if the

correlation is either -1 or +1. However the causation cannot be guaranteed on the basis of the

results from correlation. Further analysis is required to confirm the causation.

Results from the correlation between CDS and EBITDA are shown in the table below and it

indicates that CDS and EBITDA are positively correlated. The correlation coefficient is 0.268,

however the p value is more than 0.05 which suggests that the correlation is not statistically

significant.

Correlations

CDS EBITDA Mar_cap Beta P/E EPS

CDS

Pearson

Correlation

1 .268 .044 -.281 -.031 -.038

Sig. (2-tailed) .195 .833 .194 .885 .855

N 25 25 25 23 25 25

EBITD

A

Pearson

Correlation

.268 1 .250 -.398 .394 .140

Sig. (2-tailed) .195 .228 .060 .051 .504

N 25 25 25 23 25 25

Mar_cap

Pearson

Correlation

.044 .250 1 -.044 .080 .198

Sig. (2-tailed) .833 .228 .841 .704 .344

N 25 25 25 23 25 25

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Beta

Pearson

Correlation

-.281 -.398 -.044 1 -.318 -.099

Sig. (2-tailed) .194 .060 .841 .139 .654

N 23 23 23 23 23 23

P/E

Pearson

Correlation

-.031 .394 .080 -.318 1 .070

Sig. (2-tailed) .885 .051 .704 .139 .740

N 25 25 25 23 25 25

EPS

Pearson

Correlation

-.038 .140 .198 -.099 .070 1

Sig. (2-tailed) .855 .504 .344 .654 .740

N 25 25 25 23 25 25

Table 4 Correlation between CDS and the performance of the firms

Similarly the relationship between CDS and other financial parameters is also shown. As per the

results CDS is positively correlated with market capitalization, beta and P/E ratio, whereas EPS

and Beta value are negatively correlated with CDS score. However none of the correlation

coefficients are statistically significant.

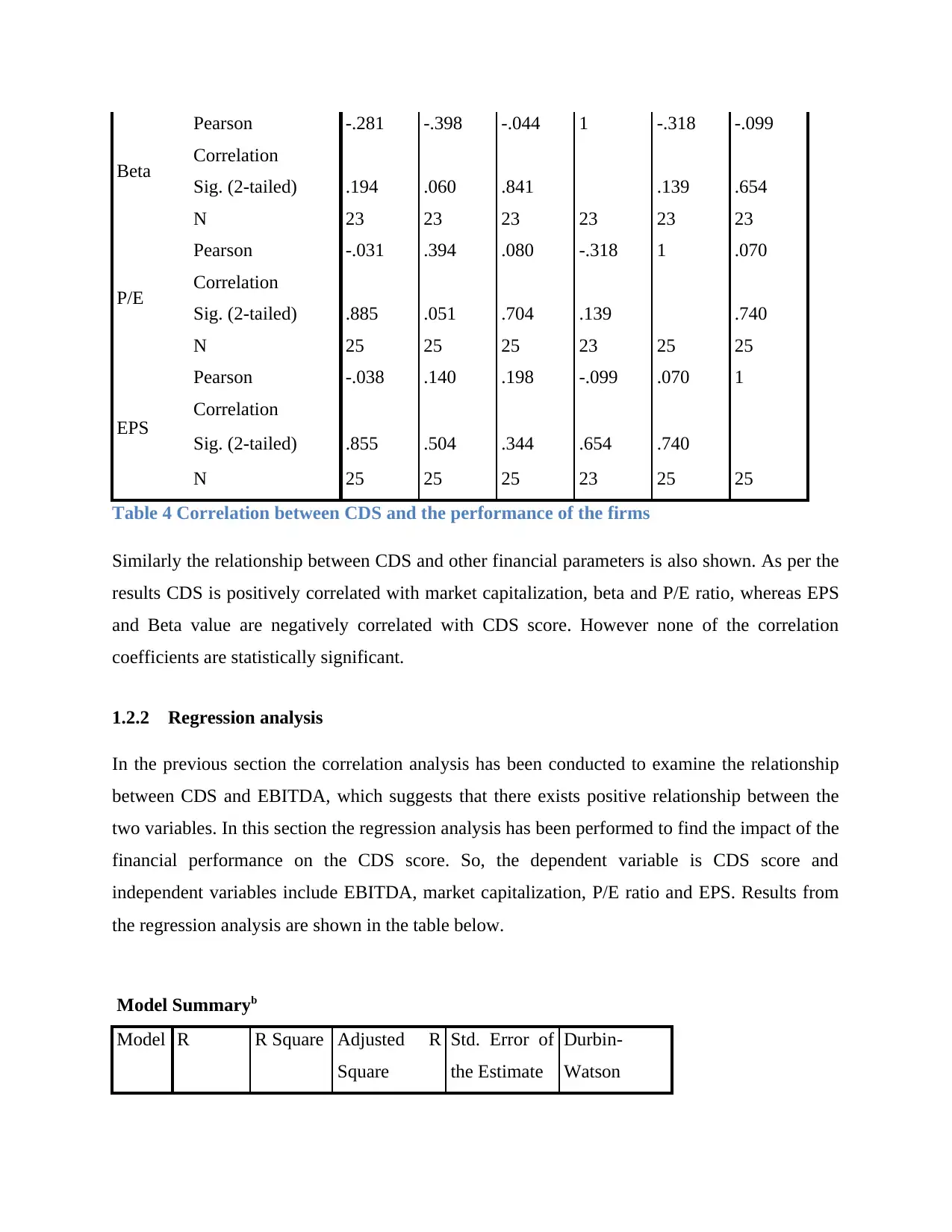

1.2.2 Regression analysis

In the previous section the correlation analysis has been conducted to examine the relationship

between CDS and EBITDA, which suggests that there exists positive relationship between the

two variables. In this section the regression analysis has been performed to find the impact of the

financial performance on the CDS score. So, the dependent variable is CDS score and

independent variables include EBITDA, market capitalization, P/E ratio and EPS. Results from

the regression analysis are shown in the table below.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

Durbin-

Watson

Pearson

Correlation

-.281 -.398 -.044 1 -.318 -.099

Sig. (2-tailed) .194 .060 .841 .139 .654

N 23 23 23 23 23 23

P/E

Pearson

Correlation

-.031 .394 .080 -.318 1 .070

Sig. (2-tailed) .885 .051 .704 .139 .740

N 25 25 25 23 25 25

EPS

Pearson

Correlation

-.038 .140 .198 -.099 .070 1

Sig. (2-tailed) .855 .504 .344 .654 .740

N 25 25 25 23 25 25

Table 4 Correlation between CDS and the performance of the firms

Similarly the relationship between CDS and other financial parameters is also shown. As per the

results CDS is positively correlated with market capitalization, beta and P/E ratio, whereas EPS

and Beta value are negatively correlated with CDS score. However none of the correlation

coefficients are statistically significant.

1.2.2 Regression analysis

In the previous section the correlation analysis has been conducted to examine the relationship

between CDS and EBITDA, which suggests that there exists positive relationship between the

two variables. In this section the regression analysis has been performed to find the impact of the

financial performance on the CDS score. So, the dependent variable is CDS score and

independent variables include EBITDA, market capitalization, P/E ratio and EPS. Results from

the regression analysis are shown in the table below.

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

Durbin-

Watson

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 .381a .145 -.106 5.519 2.124

a. Predictors: (Constant), EPS, P/E, Mar_cap, Beta, EBITDA

b. Dependent Variable: CDS

Table 5 Model summary for the regression results

Results from the model summary show that R squared is only 0.145 which suggests that only

around 15 % variation in CDS is explained by the independent variables included in the data set.

The rest of the variation in the data set is due to some other factors. The low value of R squared

is because CDS score is affected by many other factors which are not included in the current

regression model as the independent variables. Also the sample size in the current research is less

than 30 which can be the possible reason behind such results. In addition the Durbin Watson

shows that there is no strong problem of autocorrelation in the variables as the DW test is close

to 2.

ANOVAa

Model Sum of

Squares

Df Mean

Square

F Sig.

1

Regression 88.013 5 17.603 .578 .716b

Residual 517.900 17 30.465

Total 605.913 22

a. Dependent Variable: CDS

b. Predictors: (Constant), EPS, P/E, Mar_cap, Beta, EBITDA

Table 6 ANOVA results for the regression results

Similarly the cumulative impact of the independent variables on the dependent variable is shown

by the F statistics in the ANOVA table. In this case the F statistics of 0.578 is not statistically

significant as the p value is more than 0.05.

Coefficientsa

a. Predictors: (Constant), EPS, P/E, Mar_cap, Beta, EBITDA

b. Dependent Variable: CDS

Table 5 Model summary for the regression results

Results from the model summary show that R squared is only 0.145 which suggests that only

around 15 % variation in CDS is explained by the independent variables included in the data set.

The rest of the variation in the data set is due to some other factors. The low value of R squared

is because CDS score is affected by many other factors which are not included in the current

regression model as the independent variables. Also the sample size in the current research is less

than 30 which can be the possible reason behind such results. In addition the Durbin Watson

shows that there is no strong problem of autocorrelation in the variables as the DW test is close

to 2.

ANOVAa

Model Sum of

Squares

Df Mean

Square

F Sig.

1

Regression 88.013 5 17.603 .578 .716b

Residual 517.900 17 30.465

Total 605.913 22

a. Dependent Variable: CDS

b. Predictors: (Constant), EPS, P/E, Mar_cap, Beta, EBITDA

Table 6 ANOVA results for the regression results

Similarly the cumulative impact of the independent variables on the dependent variable is shown

by the F statistics in the ANOVA table. In this case the F statistics of 0.578 is not statistically

significant as the p value is more than 0.05.

Coefficientsa

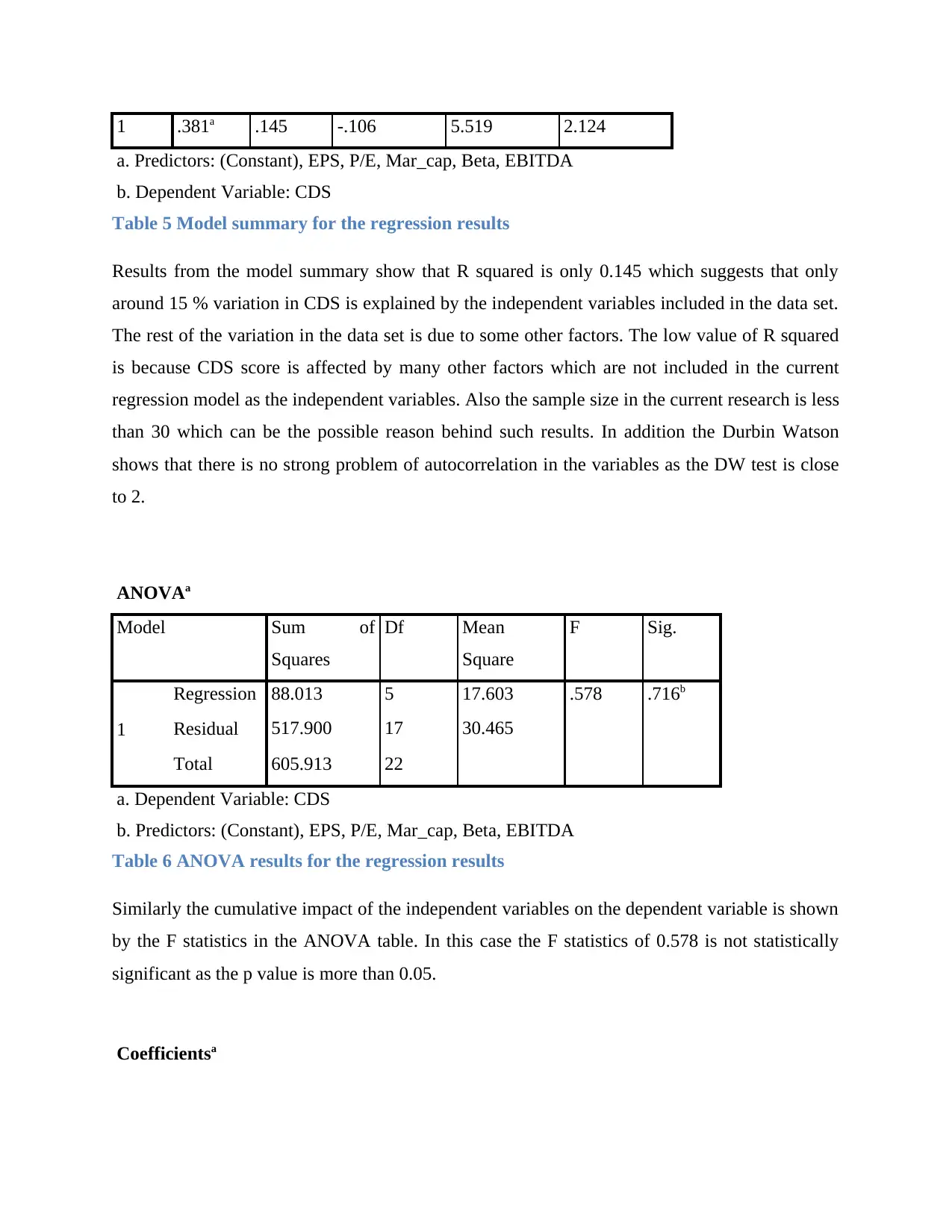

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig. Collinearity

Statistics

B Std. Error Beta Tolerance VIF

1

(Constant) 85.651 3.389 25.271 .000

EBITDA 1.084E-008 .000 .269 1.007 .328 .704 1.420

Mar_cap .001 .011 .017 .073 .943 .902 1.108

Beta -2.255 2.410 -.234 -.936 .363 .806 1.240

P/E -.054 .084 -.161 -.647 .526 .809 1.236

EPS -.056 .144 -.090 -.392 .700 .951 1.051

a. Dependent Variable: CDS

Table 7 Regression results to find the impact of financial performance on the CDS

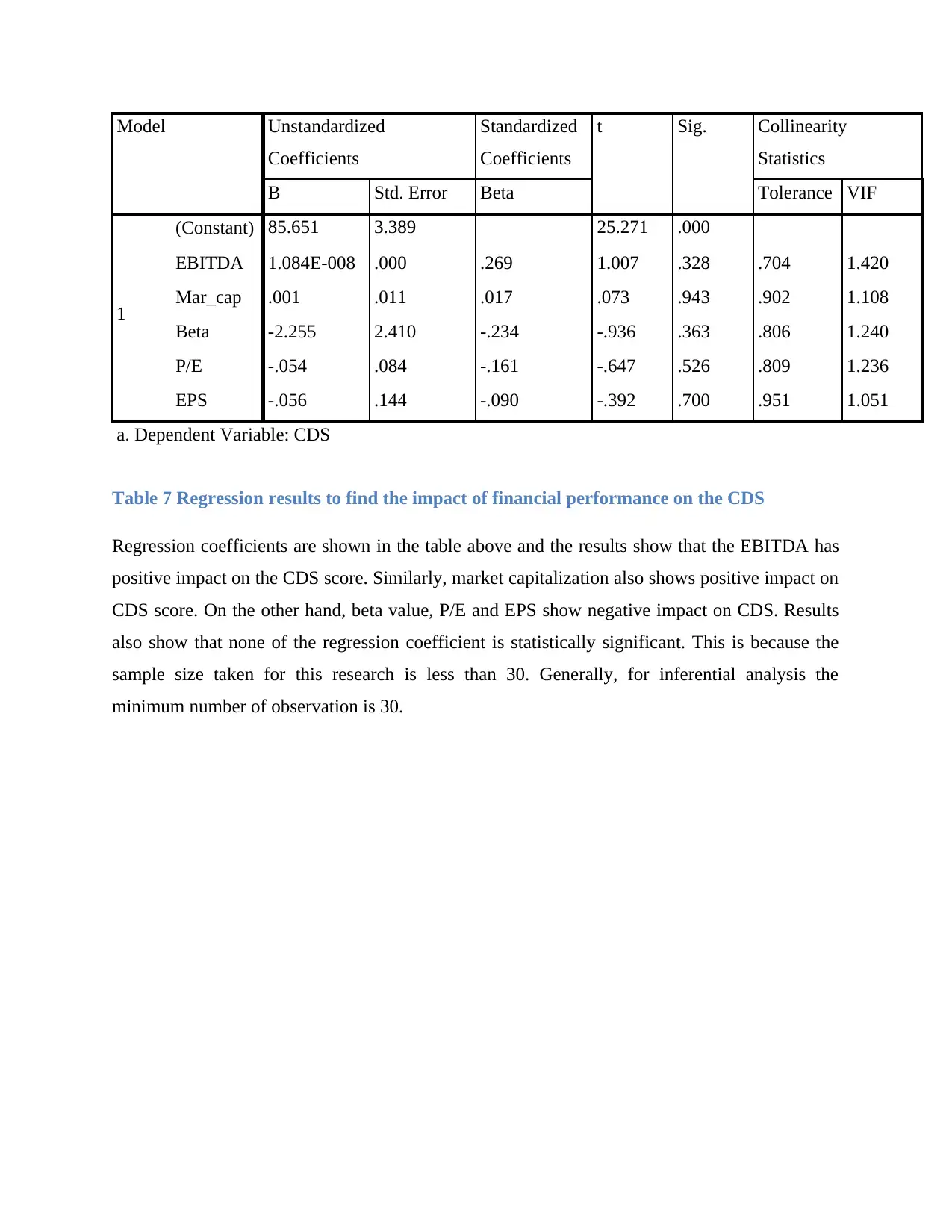

Regression coefficients are shown in the table above and the results show that the EBITDA has

positive impact on the CDS score. Similarly, market capitalization also shows positive impact on

CDS score. On the other hand, beta value, P/E and EPS show negative impact on CDS. Results

also show that none of the regression coefficient is statistically significant. This is because the

sample size taken for this research is less than 30. Generally, for inferential analysis the

minimum number of observation is 30.

Coefficients

Standardized

Coefficients

t Sig. Collinearity

Statistics

B Std. Error Beta Tolerance VIF

1

(Constant) 85.651 3.389 25.271 .000

EBITDA 1.084E-008 .000 .269 1.007 .328 .704 1.420

Mar_cap .001 .011 .017 .073 .943 .902 1.108

Beta -2.255 2.410 -.234 -.936 .363 .806 1.240

P/E -.054 .084 -.161 -.647 .526 .809 1.236

EPS -.056 .144 -.090 -.392 .700 .951 1.051

a. Dependent Variable: CDS

Table 7 Regression results to find the impact of financial performance on the CDS

Regression coefficients are shown in the table above and the results show that the EBITDA has

positive impact on the CDS score. Similarly, market capitalization also shows positive impact on

CDS score. On the other hand, beta value, P/E and EPS show negative impact on CDS. Results

also show that none of the regression coefficient is statistically significant. This is because the

sample size taken for this research is less than 30. Generally, for inferential analysis the

minimum number of observation is 30.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

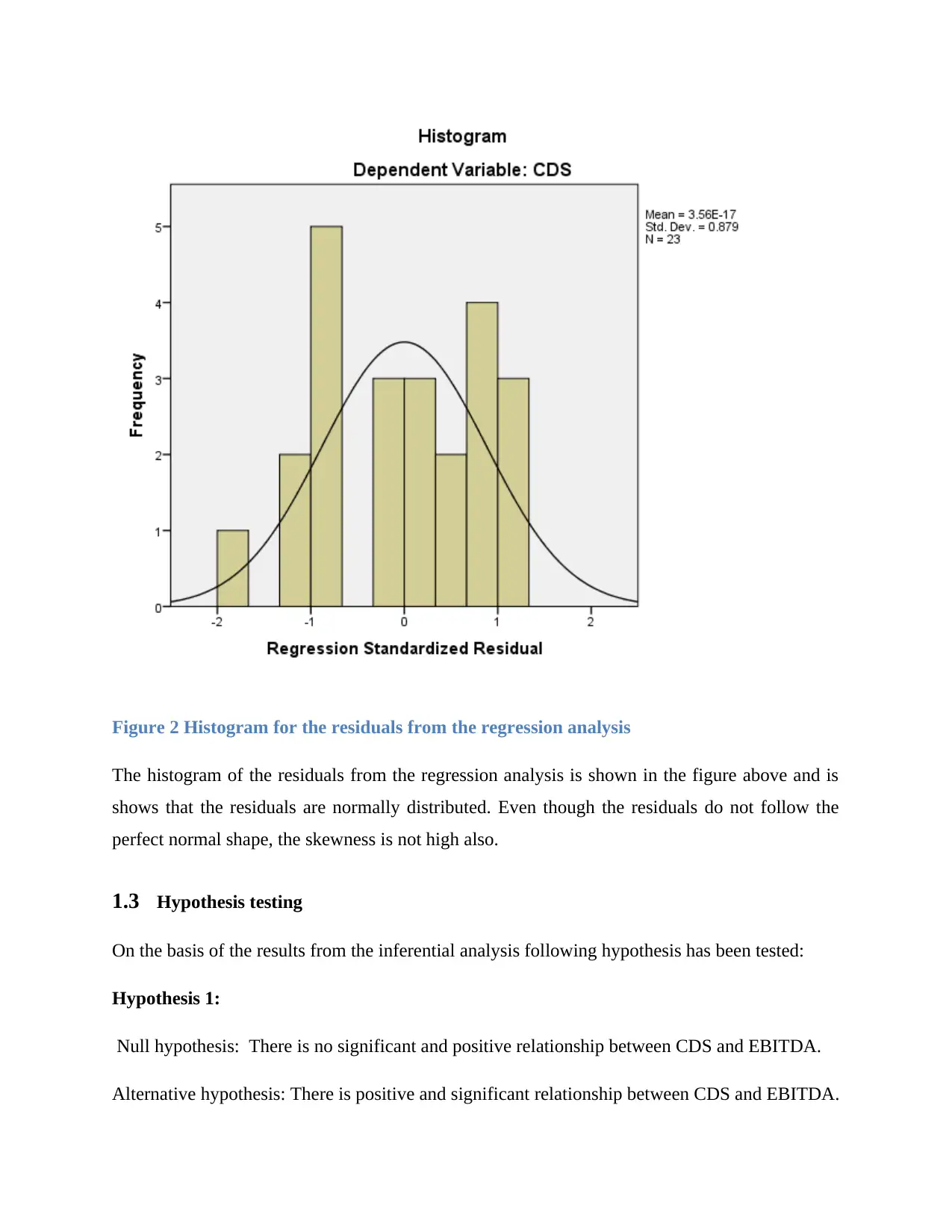

Figure 2 Histogram for the residuals from the regression analysis

The histogram of the residuals from the regression analysis is shown in the figure above and is

shows that the residuals are normally distributed. Even though the residuals do not follow the

perfect normal shape, the skewness is not high also.

1.3 Hypothesis testing

On the basis of the results from the inferential analysis following hypothesis has been tested:

Hypothesis 1:

Null hypothesis: There is no significant and positive relationship between CDS and EBITDA.

Alternative hypothesis: There is positive and significant relationship between CDS and EBITDA.

The histogram of the residuals from the regression analysis is shown in the figure above and is

shows that the residuals are normally distributed. Even though the residuals do not follow the

perfect normal shape, the skewness is not high also.

1.3 Hypothesis testing

On the basis of the results from the inferential analysis following hypothesis has been tested:

Hypothesis 1:

Null hypothesis: There is no significant and positive relationship between CDS and EBITDA.

Alternative hypothesis: There is positive and significant relationship between CDS and EBITDA.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

As the results from the correlation and regression analysis shows positive relationship between

CDS and EBITDA. However the coefficients are not statistically significant. So the alternative

hypothesis can be accepted only partially.

Hypothesis 2:

Null hypothesis: There is no significant and positive relationship between CDS and market

capitalization.

Alternative hypothesis: There is significant and positive relationship between CDS and market

capitalization.

The regression coefficient for market capitalization is positive but not statistically significant, so

the alternative hypothesis cannot be accepted fully.

Hypothesis 3:

There is no significant and positive relationship between CDS and P/E.

Alternative hypothesis: There is significant and positive relationship between CDS and market

P/E.

The regression coefficient of P/E is negative and insignificant so the null hypothesis cannot be

rejected.

Hypothesis 4:

There is no significant and positive relationship between CDS and Beta.

Alternative hypothesis: There is significant and positive relationship between CDS and Beta.

The regression coefficient of Beta is negative and statistically insignificant so the null hypothesis

cannot be rejected.

Hypothesis 5:

There is no significant and positive relationship between CDS and EPS.

Alternative hypothesis: There is significant and positive relationship between CDS and EPS.

CDS and EBITDA. However the coefficients are not statistically significant. So the alternative

hypothesis can be accepted only partially.

Hypothesis 2:

Null hypothesis: There is no significant and positive relationship between CDS and market

capitalization.

Alternative hypothesis: There is significant and positive relationship between CDS and market

capitalization.

The regression coefficient for market capitalization is positive but not statistically significant, so

the alternative hypothesis cannot be accepted fully.

Hypothesis 3:

There is no significant and positive relationship between CDS and P/E.

Alternative hypothesis: There is significant and positive relationship between CDS and market

P/E.

The regression coefficient of P/E is negative and insignificant so the null hypothesis cannot be

rejected.

Hypothesis 4:

There is no significant and positive relationship between CDS and Beta.

Alternative hypothesis: There is significant and positive relationship between CDS and Beta.

The regression coefficient of Beta is negative and statistically insignificant so the null hypothesis

cannot be rejected.

Hypothesis 5:

There is no significant and positive relationship between CDS and EPS.

Alternative hypothesis: There is significant and positive relationship between CDS and EPS.

The regression coefficient of EPS is negative and insignificant so the null hypothesis cannot be

rejected.

1.4 Discussion

Results from the ANOVA test shows that there is no statistical difference in CDS score for good

performing companies and the bad performing companies. This shows that the results do not

follow the legitimacy theory at least for the companies included in the current research. Similarly

the results from the correlation analysis show that the CDS and the EBITDA is positively

correlated, whereas correlation between EBITDA and beta is negative. However previous

researches on similar topic show positive relationship between the financial performance and the

CDS score(Mousa & Hassan 2015; Najah & Cotter 2010; Sharfman & Fernando 2008; Reid &

Toffel 2009; Smith et al. 2008). Results from the regression analysis also show that the CDS is

positively affected by the EBITDA. In other words with increase in profit before tax the CDS

score also increases. Companies performing financially well are expected to fulfill their

corporate social responsibility as compared to those who do not perform well. Also in some

countries companies are obliged to spend some proportion of profits for corporate responsibility

which also includes the environmental sustainability. Previous studies on the similar issues also

show similar results(Singh 2014; Omran & Ramdhony 2015; Clarkson et al. 2008; Clarkson et

al. 2011; Beatty & Shimshack 2010; Plumlee et al. 2008). However the results in the current

research are not statistically significant as the sample size is low.

1.5 Limitations

There are some limitations associated with the current research. One of the major problems is

small sample size. Since the minimum sample size required for t test is 30, which is not the case

in the current research. Apart from that only the quantitative research is conducted to find the

relationship between the CDS score and the EBITDA. However to get further information

qualitative analysis is considered to be more appropriate. Among the statistical techniques only

correlation and regression analysis is conducted, however there other statistical tools such as the

co-integration and causality test which could have been performed. Lastly there were limitations

related to the cost and time invested in the current research.

rejected.

1.4 Discussion

Results from the ANOVA test shows that there is no statistical difference in CDS score for good

performing companies and the bad performing companies. This shows that the results do not

follow the legitimacy theory at least for the companies included in the current research. Similarly

the results from the correlation analysis show that the CDS and the EBITDA is positively

correlated, whereas correlation between EBITDA and beta is negative. However previous

researches on similar topic show positive relationship between the financial performance and the

CDS score(Mousa & Hassan 2015; Najah & Cotter 2010; Sharfman & Fernando 2008; Reid &

Toffel 2009; Smith et al. 2008). Results from the regression analysis also show that the CDS is

positively affected by the EBITDA. In other words with increase in profit before tax the CDS

score also increases. Companies performing financially well are expected to fulfill their

corporate social responsibility as compared to those who do not perform well. Also in some

countries companies are obliged to spend some proportion of profits for corporate responsibility

which also includes the environmental sustainability. Previous studies on the similar issues also

show similar results(Singh 2014; Omran & Ramdhony 2015; Clarkson et al. 2008; Clarkson et

al. 2011; Beatty & Shimshack 2010; Plumlee et al. 2008). However the results in the current

research are not statistically significant as the sample size is low.

1.5 Limitations

There are some limitations associated with the current research. One of the major problems is

small sample size. Since the minimum sample size required for t test is 30, which is not the case

in the current research. Apart from that only the quantitative research is conducted to find the

relationship between the CDS score and the EBITDA. However to get further information

qualitative analysis is considered to be more appropriate. Among the statistical techniques only

correlation and regression analysis is conducted, however there other statistical tools such as the

co-integration and causality test which could have been performed. Lastly there were limitations

related to the cost and time invested in the current research.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.