BUS286 Corporate Finance: Risk, Return, and Portfolio Diversification

VerifiedAdded on 2023/06/04

|6

|784

|128

Report

AI Summary

This report provides a comprehensive analysis of risk and return concepts in corporate finance, particularly within the context of investment portfolios. It addresses how standard deviation is used to assess the risk of shares and how correlation coefficients help in understanding the risk associated with combining multiple shares in a portfolio. The report includes calculations of expected return and standard deviation for various portfolios, demonstrating the impact of different asset allocations on overall portfolio risk and return. Key concepts such as the normal distribution curve and dispersion statistics are discussed to provide a deeper understanding of risk assessment in investment decisions. The document is available on Desklib, a platform offering a wide range of study resources for students.

Running head: BUS286

BUS286

Name of the Student:

Name of the University:

Authors Note:

BUS286

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUS286

1

Table of Contents

Part 1:.........................................................................................................................................2

Question 1:.................................................................................................................................2

Question 2:.................................................................................................................................2

Part 2:.........................................................................................................................................3

1. Calculating the expected return and standard deviation of portfolio 3:.................................3

2. Calculating the expected return and standard deviation of portfolio 4:.................................3

3. Calculating the expected return and standard deviation of portfolio 5:.................................4

Reference and Bibliography:......................................................................................................5

1

Table of Contents

Part 1:.........................................................................................................................................2

Question 1:.................................................................................................................................2

Question 2:.................................................................................................................................2

Part 2:.........................................................................................................................................3

1. Calculating the expected return and standard deviation of portfolio 3:.................................3

2. Calculating the expected return and standard deviation of portfolio 4:.................................3

3. Calculating the expected return and standard deviation of portfolio 5:.................................4

Reference and Bibliography:......................................................................................................5

BUS286

2

Part 1:

Question 1:

The risk of the shares is detected adequately with the help of standard deviation, as it

evaluates the level of volatility, which can be detected for an investment. The standard

deviation measures the variation in the mean returns of the stock, which can help in detecting

the volatility present within the share price movement. The generate assumption for the

shares is normal distribution curve, which plots the historical data in accordance with the

returns. In addition, the use of dispersion statistics directly helps in detecting the magnitude

of risk present within a stock. The dispersion statistics allows the comparison of the standard

deviation for multiple shares, which can help invests to gauge into the current risk attributes

of the stocks1. As depicted in the case study standard deviation is a statistical tool for

calculating the most likely range of returns of a stock.

Question 2:

The use of more than one share in a portfolio will directly affect the level of risk,

which can be affected from an investment. However, the use of correlation coefficient can

help investors to assess the risk of both shares. The correlation conditions of a stock

relevantly help in detecting the level of similarity between the returns of a stock. The

detection allows the investor to determine the level of risk that the portfolio holds with the

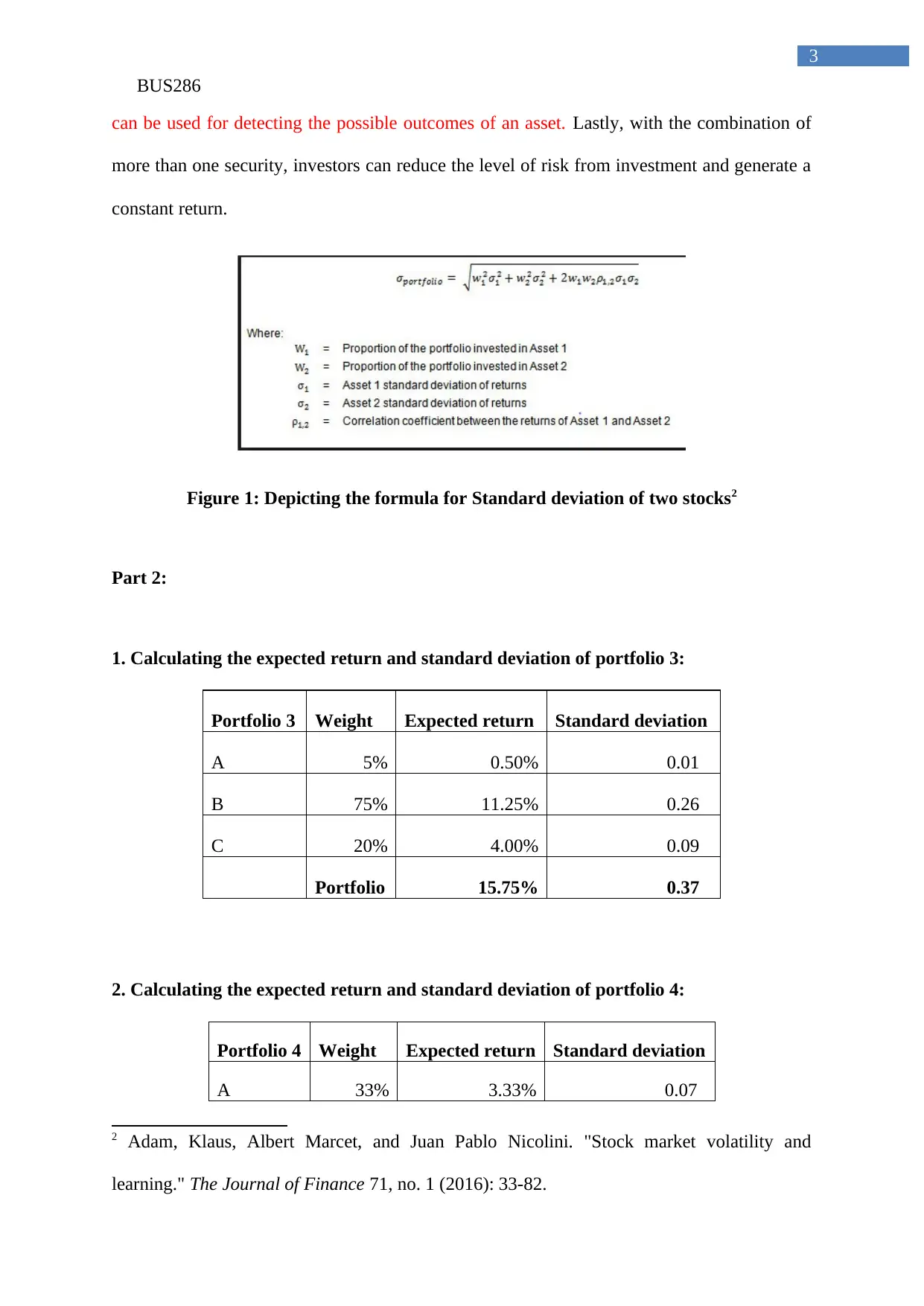

combination of two stocks. the formula for the standards deviation is depicted in the below

figure, which indicates that without the calculation of correlation the actual risk attributes of

the stock is not detected. The case study also indicates the significance of added risk, which

1 Gorodnichenko, Yuriy, and Michael Weber. "Are sticky prices costly? Evidence from the

stock market." American Economic Review 106, no. 1 (2016): 165-99.

2

Part 1:

Question 1:

The risk of the shares is detected adequately with the help of standard deviation, as it

evaluates the level of volatility, which can be detected for an investment. The standard

deviation measures the variation in the mean returns of the stock, which can help in detecting

the volatility present within the share price movement. The generate assumption for the

shares is normal distribution curve, which plots the historical data in accordance with the

returns. In addition, the use of dispersion statistics directly helps in detecting the magnitude

of risk present within a stock. The dispersion statistics allows the comparison of the standard

deviation for multiple shares, which can help invests to gauge into the current risk attributes

of the stocks1. As depicted in the case study standard deviation is a statistical tool for

calculating the most likely range of returns of a stock.

Question 2:

The use of more than one share in a portfolio will directly affect the level of risk,

which can be affected from an investment. However, the use of correlation coefficient can

help investors to assess the risk of both shares. The correlation conditions of a stock

relevantly help in detecting the level of similarity between the returns of a stock. The

detection allows the investor to determine the level of risk that the portfolio holds with the

combination of two stocks. the formula for the standards deviation is depicted in the below

figure, which indicates that without the calculation of correlation the actual risk attributes of

the stock is not detected. The case study also indicates the significance of added risk, which

1 Gorodnichenko, Yuriy, and Michael Weber. "Are sticky prices costly? Evidence from the

stock market." American Economic Review 106, no. 1 (2016): 165-99.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

BUS286

3

can be used for detecting the possible outcomes of an asset. Lastly, with the combination of

more than one security, investors can reduce the level of risk from investment and generate a

constant return.

Figure 1: Depicting the formula for Standard deviation of two stocks2

Part 2:

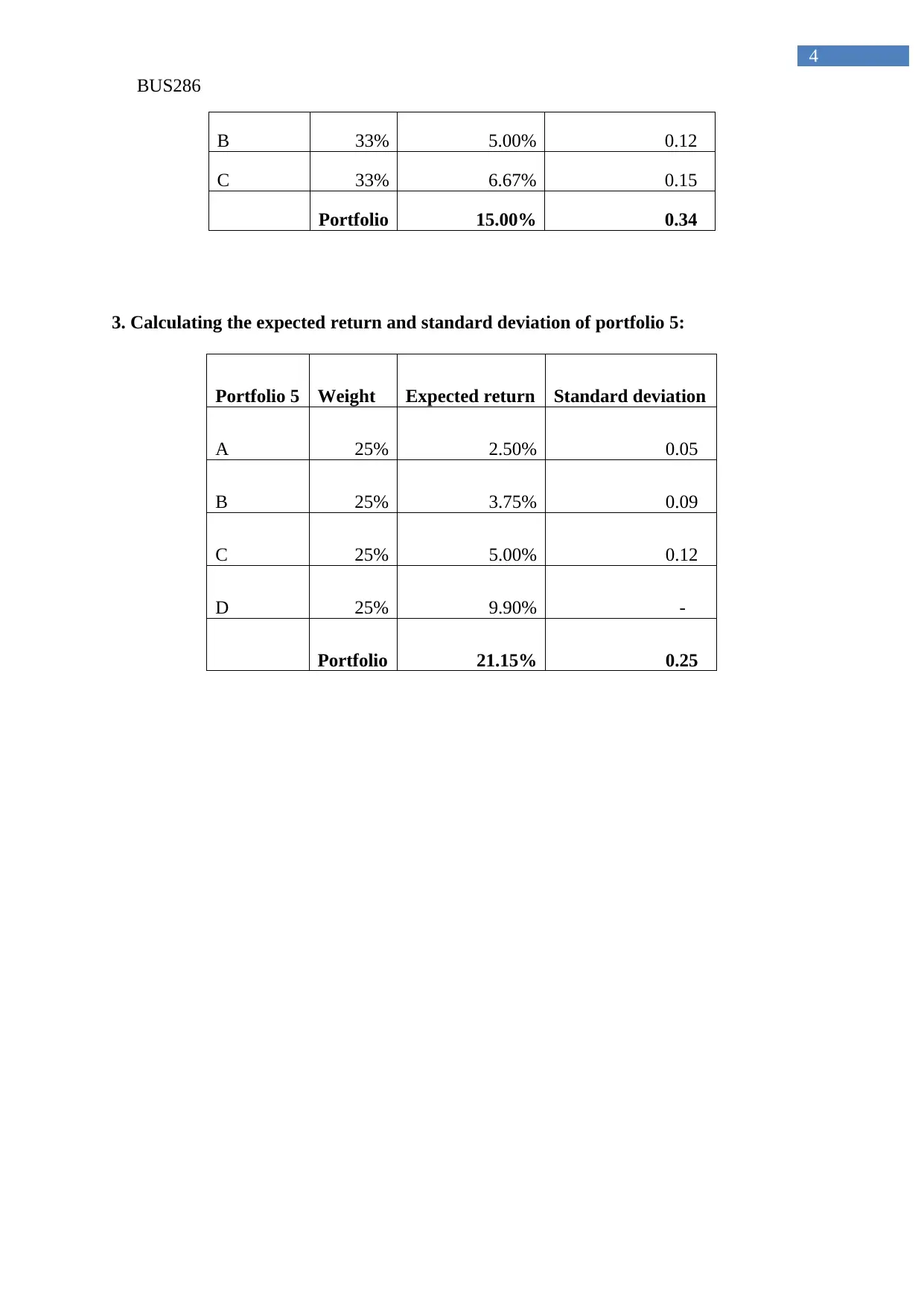

1. Calculating the expected return and standard deviation of portfolio 3:

Portfolio 3 Weight Expected return Standard deviation

A 5% 0.50% 0.01

B 75% 11.25% 0.26

C 20% 4.00% 0.09

Portfolio 15.75% 0.37

2. Calculating the expected return and standard deviation of portfolio 4:

Portfolio 4 Weight Expected return Standard deviation

A 33% 3.33% 0.07

2 Adam, Klaus, Albert Marcet, and Juan Pablo Nicolini. "Stock market volatility and

learning." The Journal of Finance 71, no. 1 (2016): 33-82.

3

can be used for detecting the possible outcomes of an asset. Lastly, with the combination of

more than one security, investors can reduce the level of risk from investment and generate a

constant return.

Figure 1: Depicting the formula for Standard deviation of two stocks2

Part 2:

1. Calculating the expected return and standard deviation of portfolio 3:

Portfolio 3 Weight Expected return Standard deviation

A 5% 0.50% 0.01

B 75% 11.25% 0.26

C 20% 4.00% 0.09

Portfolio 15.75% 0.37

2. Calculating the expected return and standard deviation of portfolio 4:

Portfolio 4 Weight Expected return Standard deviation

A 33% 3.33% 0.07

2 Adam, Klaus, Albert Marcet, and Juan Pablo Nicolini. "Stock market volatility and

learning." The Journal of Finance 71, no. 1 (2016): 33-82.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BUS286

4

B 33% 5.00% 0.12

C 33% 6.67% 0.15

Portfolio 15.00% 0.34

3. Calculating the expected return and standard deviation of portfolio 5:

Portfolio 5 Weight Expected return Standard deviation

A 25% 2.50% 0.05

B 25% 3.75% 0.09

C 25% 5.00% 0.12

D 25% 9.90% -

Portfolio 21.15% 0.25

4

B 33% 5.00% 0.12

C 33% 6.67% 0.15

Portfolio 15.00% 0.34

3. Calculating the expected return and standard deviation of portfolio 5:

Portfolio 5 Weight Expected return Standard deviation

A 25% 2.50% 0.05

B 25% 3.75% 0.09

C 25% 5.00% 0.12

D 25% 9.90% -

Portfolio 21.15% 0.25

BUS286

5

Reference and Bibliography:

Adam, Klaus, Albert Marcet, and Juan Pablo Nicolini. "Stock market volatility and

learning." The Journal of Finance 71, no. 1 (2016): 33-82.

Giannetti, Mariassunta, and Tracy Yue Wang. "Corporate scandals and household stock

market participation." The Journal of Finance 71, no. 6 (2016): 2591-2636.

Gorodnichenko, Yuriy, and Michael Weber. "Are sticky prices costly? Evidence from the

stock market." American Economic Review 106, no. 1 (2016): 165-99.

Sornette, Didier. Why stock markets crash: critical events in complex financial systems.

Princeton University Press, 2017.

5

Reference and Bibliography:

Adam, Klaus, Albert Marcet, and Juan Pablo Nicolini. "Stock market volatility and

learning." The Journal of Finance 71, no. 1 (2016): 33-82.

Giannetti, Mariassunta, and Tracy Yue Wang. "Corporate scandals and household stock

market participation." The Journal of Finance 71, no. 6 (2016): 2591-2636.

Gorodnichenko, Yuriy, and Michael Weber. "Are sticky prices costly? Evidence from the

stock market." American Economic Review 106, no. 1 (2016): 165-99.

Sornette, Didier. Why stock markets crash: critical events in complex financial systems.

Princeton University Press, 2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.