RBS Stress Test Failure: Implications for Risk Management and Capital

VerifiedAdded on 2023/01/05

|14

|2687

|84

Report

AI Summary

This report provides a comprehensive analysis of the Royal Bank of Scotland's (RBS) financial risk management, focusing on the implications of its failure to pass the advanced stress test, specifically the Systemic Reference Point. It begins with an introduction to Tier 1 and CET 1 capital ratios, highlighting their importance in measuring a bank's financial strength, and notes RBS's compliance with these minimum requirements. The report then critically evaluates the implications of RBS's stress test failure, detailing its impact on the bank's stock and bond values, and discusses the bank's recent financial performance using income statements and graphical representations. It further examines the impact of the stress test failure on RBS's ability to raise capital and recommends steps the management should take to improve the situation, including improving the capital adequacy ratio and increasing the core capital. The report concludes by emphasizing the importance of proactive risk management strategies for financial institutions.

Running head: RISK MANAGEMENT

Risk Management

Name of the Student:

Name of the University:

Authors Note:

Risk Management

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

RISK MANAGEMENT

Contents

Introduction:....................................................................................................................................2

Tier 1 capital ratio and CET 1 capital ratio:....................................................................................2

Critical evaluation of implications on RBS of the failure of the bank to pass the advanced stress

test to prove its financial strength:...................................................................................................4

Impact of stress test failure of RBS on its ability to raise capital and steps to be taken by the

management to improve the situation:.............................................................................................9

Recommendations of steps to be taken by the management:........................................................10

Conclusion:....................................................................................................................................11

References:....................................................................................................................................12

RISK MANAGEMENT

Contents

Introduction:....................................................................................................................................2

Tier 1 capital ratio and CET 1 capital ratio:....................................................................................2

Critical evaluation of implications on RBS of the failure of the bank to pass the advanced stress

test to prove its financial strength:...................................................................................................4

Impact of stress test failure of RBS on its ability to raise capital and steps to be taken by the

management to improve the situation:.............................................................................................9

Recommendations of steps to be taken by the management:........................................................10

Conclusion:....................................................................................................................................11

References:....................................................................................................................................12

2

RISK MANAGEMENT

Introduction:

Equity capital and disclosed reserves are the core capital of a bank and is referred to as tier 1

capital for banks. Tier 1 capital ratio thus, measures, bank’s core capital to its total risk weighted

assets. Basel III Accord specifies use of Tier 1 capital ratio for measurement of financial

strengths of banks. Thus, the importance of core tier 1 capital for banks to measure its financial

strengths is clear from the fact that it has been specifically mentioned by the Basel III Accord on

core baking regulations.

Tier 1 capital ratio and CET 1 capital ratio:

Core equity capital of a bank against all the assets held by the bank is systematically measured

using Tier 1 capital ratio. Thus, the financial strengths of banks can be effectively measured

using the Tier 1 capital ratio. Weightage are assigned to different assets held by a bank to

calculate Tier 1 capital ratio; for example cash in hand and government securities will be

assigned 0% weightage whereas the mortgage loans provided by the banks will be assigned 50%

weightage. In short the financial strengths of a bank will be effectively measured by using Tier 1

capital ratio (Alajmi and Alqasem, 2015).

As per the information provided in the document Royal Bank of Scotland (RBS) has passed the

Tier 1 capital ratio requirements as well as the minimum requirement of CET 1 capital ratio.

Thus, the bank has minimum financial strength to continue its banking operations however, a

bank which is listed in a recognized stock exchange and is subjected to the market fluctuations

must also satisfy number of other criterions to have positive effects on the shareholders and other

stakeholders of the bank (Balasubramanyan, 2014). However, RBS has not passed the more

advance systematic reference point to prove its financial strengths in case there is any systematic

RISK MANAGEMENT

Introduction:

Equity capital and disclosed reserves are the core capital of a bank and is referred to as tier 1

capital for banks. Tier 1 capital ratio thus, measures, bank’s core capital to its total risk weighted

assets. Basel III Accord specifies use of Tier 1 capital ratio for measurement of financial

strengths of banks. Thus, the importance of core tier 1 capital for banks to measure its financial

strengths is clear from the fact that it has been specifically mentioned by the Basel III Accord on

core baking regulations.

Tier 1 capital ratio and CET 1 capital ratio:

Core equity capital of a bank against all the assets held by the bank is systematically measured

using Tier 1 capital ratio. Thus, the financial strengths of banks can be effectively measured

using the Tier 1 capital ratio. Weightage are assigned to different assets held by a bank to

calculate Tier 1 capital ratio; for example cash in hand and government securities will be

assigned 0% weightage whereas the mortgage loans provided by the banks will be assigned 50%

weightage. In short the financial strengths of a bank will be effectively measured by using Tier 1

capital ratio (Alajmi and Alqasem, 2015).

As per the information provided in the document Royal Bank of Scotland (RBS) has passed the

Tier 1 capital ratio requirements as well as the minimum requirement of CET 1 capital ratio.

Thus, the bank has minimum financial strength to continue its banking operations however, a

bank which is listed in a recognized stock exchange and is subjected to the market fluctuations

must also satisfy number of other criterions to have positive effects on the shareholders and other

stakeholders of the bank (Balasubramanyan, 2014). However, RBS has not passed the more

advance systematic reference point to prove its financial strengths in case there is any systematic

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

RISK MANAGEMENT

risk in the market such as collapse of the economy, recession and other such risks which have

adverse effects on the ability of a bank to continue its operations. System reference point is an

advanced benchmark used to measure the ability of a bank to continue its operations without any

difficulty even at the time when systemic risks such as severe recession is experienced by an

economy.

Advanced systematic reference point:

Financial Services Act 2012 provides that the banks in England should use advanced benchmark

system to prove their financial strengths to show their ability to continue banking operations

when the economic conditions extremely negative. Testing the financial strengths of banks under

extreme economic conditions such as severe recession, economic slowdown and other such

situations will give the stakeholders of the banks including the shareholders huge amount of

confidence. Thus, a bank that passes the systemic reference point test will have much more

positive perspective towards the market as compared to the banks that have not passed systemic

reference point.

Hence, it is clear from the above that a bank in addition to the Tier 1 capital and CET 1 capital

ratios which are minimum requirements for banks to comply with to have minimum financial

strengths to continue functioning in the monetary market must also look to fulfil the

requirements of more advanced benchmark testing of financial strength by using systematic

reference point. A bank which is operating in the market and is exposed to the market risk will

be adversely affected if the bank fails to pass the advanced bench mark testing to prove that it

has necessary buffer in case any untoward situation emerge in the future (Balasubramanyan,

2014).

RISK MANAGEMENT

risk in the market such as collapse of the economy, recession and other such risks which have

adverse effects on the ability of a bank to continue its operations. System reference point is an

advanced benchmark used to measure the ability of a bank to continue its operations without any

difficulty even at the time when systemic risks such as severe recession is experienced by an

economy.

Advanced systematic reference point:

Financial Services Act 2012 provides that the banks in England should use advanced benchmark

system to prove their financial strengths to show their ability to continue banking operations

when the economic conditions extremely negative. Testing the financial strengths of banks under

extreme economic conditions such as severe recession, economic slowdown and other such

situations will give the stakeholders of the banks including the shareholders huge amount of

confidence. Thus, a bank that passes the systemic reference point test will have much more

positive perspective towards the market as compared to the banks that have not passed systemic

reference point.

Hence, it is clear from the above that a bank in addition to the Tier 1 capital and CET 1 capital

ratios which are minimum requirements for banks to comply with to have minimum financial

strengths to continue functioning in the monetary market must also look to fulfil the

requirements of more advanced benchmark testing of financial strength by using systematic

reference point. A bank which is operating in the market and is exposed to the market risk will

be adversely affected if the bank fails to pass the advanced bench mark testing to prove that it

has necessary buffer in case any untoward situation emerge in the future (Balasubramanyan,

2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

RISK MANAGEMENT

Critical evaluation of implications on RBS of the failure of the bank to pass the advanced

stress test to prove its financial strength:

As already mentioned that banks and financial institutions in the United Kingdom are subjected

to strict rules and regulations which they must follow in order to continue their financial services

in the monetary market in the country. The Financial Policy Committee established under the

Bank of England Act 1998 has the supreme authority to frame rules and regulations governing

the banking sector in the country provide these are not in contravention with provisions of Bank

of England Act 1998 and Financial Services Act 2012. The committee, i.e. the Financial Policy

Committee (FPC) has provided that banks must satisfy the minimum capital and liquidity

requirements to show that they have necessary capital and liquidity to continue in the market.

Thus, banks have to pass the Tier 1 capital ratio and CET 1 capital ratio in order to pass the

minimum requirements to continue their banking operations in the future. The above ratio

measures the core capital of the bank against the assets held by the bank using weightage

assignment method. The core financial strengths is the minimum requirements for banks and

financial institutions to comply with. Without complying with these requirements a bank or a

financial institution will not be allowed to continue their operations in the monetary market.

Considering that RBS has passed the minimum requirements by complying with the CET 1

capital and Tier 1 capital ratio there is no risk of bank not being allowed to operate in the

monetary market by the Financial Services Committee (Borzykh, 2017).

However, the bank has failed to comply with the more advanced stress test by failing to comply

with the stress test of systematic reference point. Considering that it measures the extra leverage

or buffer a bank has to deal with adverse economic conditions such as severe recession,

economic slowdown and other such negative economic conditions, the failure of the bank to pass

RISK MANAGEMENT

Critical evaluation of implications on RBS of the failure of the bank to pass the advanced

stress test to prove its financial strength:

As already mentioned that banks and financial institutions in the United Kingdom are subjected

to strict rules and regulations which they must follow in order to continue their financial services

in the monetary market in the country. The Financial Policy Committee established under the

Bank of England Act 1998 has the supreme authority to frame rules and regulations governing

the banking sector in the country provide these are not in contravention with provisions of Bank

of England Act 1998 and Financial Services Act 2012. The committee, i.e. the Financial Policy

Committee (FPC) has provided that banks must satisfy the minimum capital and liquidity

requirements to show that they have necessary capital and liquidity to continue in the market.

Thus, banks have to pass the Tier 1 capital ratio and CET 1 capital ratio in order to pass the

minimum requirements to continue their banking operations in the future. The above ratio

measures the core capital of the bank against the assets held by the bank using weightage

assignment method. The core financial strengths is the minimum requirements for banks and

financial institutions to comply with. Without complying with these requirements a bank or a

financial institution will not be allowed to continue their operations in the monetary market.

Considering that RBS has passed the minimum requirements by complying with the CET 1

capital and Tier 1 capital ratio there is no risk of bank not being allowed to operate in the

monetary market by the Financial Services Committee (Borzykh, 2017).

However, the bank has failed to comply with the more advanced stress test by failing to comply

with the stress test of systematic reference point. Considering that it measures the extra leverage

or buffer a bank has to deal with adverse economic conditions such as severe recession,

economic slowdown and other such negative economic conditions, the failure of the bank to pass

5

RISK MANAGEMENT

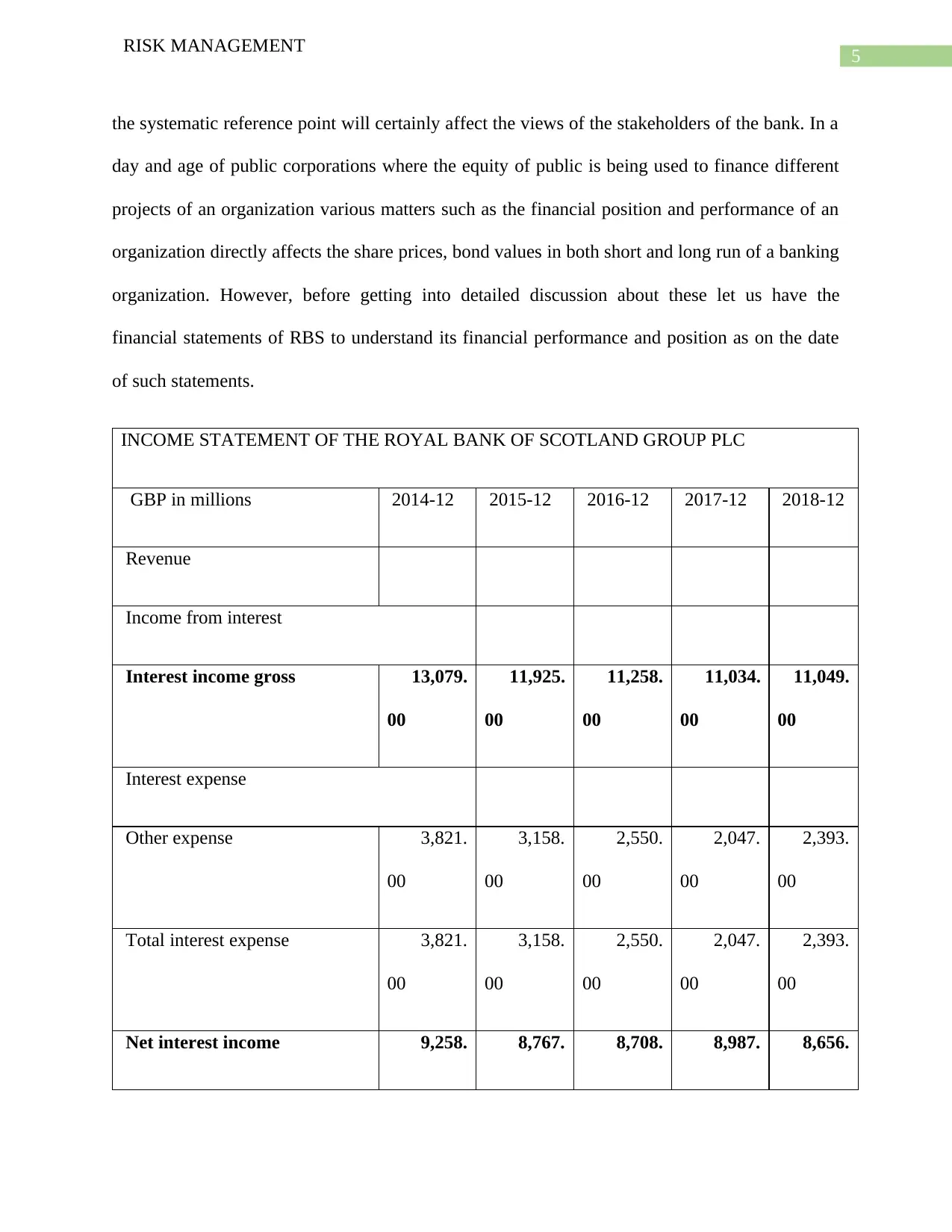

the systematic reference point will certainly affect the views of the stakeholders of the bank. In a

day and age of public corporations where the equity of public is being used to finance different

projects of an organization various matters such as the financial position and performance of an

organization directly affects the share prices, bond values in both short and long run of a banking

organization. However, before getting into detailed discussion about these let us have the

financial statements of RBS to understand its financial performance and position as on the date

of such statements.

INCOME STATEMENT OF THE ROYAL BANK OF SCOTLAND GROUP PLC

GBP in millions 2014-12 2015-12 2016-12 2017-12 2018-12

Revenue

Income from interest

Interest income gross 13,079.

00

11,925.

00

11,258.

00

11,034.

00

11,049.

00

Interest expense

Other expense 3,821.

00

3,158.

00

2,550.

00

2,047.

00

2,393.

00

Total interest expense 3,821.

00

3,158.

00

2,550.

00

2,047.

00

2,393.

00

Net interest income 9,258. 8,767. 8,708. 8,987. 8,656.

RISK MANAGEMENT

the systematic reference point will certainly affect the views of the stakeholders of the bank. In a

day and age of public corporations where the equity of public is being used to finance different

projects of an organization various matters such as the financial position and performance of an

organization directly affects the share prices, bond values in both short and long run of a banking

organization. However, before getting into detailed discussion about these let us have the

financial statements of RBS to understand its financial performance and position as on the date

of such statements.

INCOME STATEMENT OF THE ROYAL BANK OF SCOTLAND GROUP PLC

GBP in millions 2014-12 2015-12 2016-12 2017-12 2018-12

Revenue

Income from interest

Interest income gross 13,079.

00

11,925.

00

11,258.

00

11,034.

00

11,049.

00

Interest expense

Other expense 3,821.

00

3,158.

00

2,550.

00

2,047.

00

2,393.

00

Total interest expense 3,821.

00

3,158.

00

2,550.

00

2,047.

00

2,393.

00

Net interest income 9,258. 8,767. 8,708. 8,987. 8,656.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

RISK MANAGEMENT

00 00 00 00 00

Noninterest revenue

Commissions and fees 3,539.

00

2,933.

00

2,535.

00

2,455.

00

2,357.

00

Securities gains (losses) 179.

00

428.

00

311.

00

26

.00

Insurance premium 357

.00

Other income 1,699.

00

929.

00

1,473.

00

963.

00

1,945.

00

Noninterest revenue in total 5,417.

00

4,290.

00

4,008.

00

3,729.

00

4,685.

00

Total net revenue 14,675.

00

13,057.

00

12,716.

00

12,716.

00

13,341.

00

Noninterest expenses

Tech, communication and

equipment

4,568.

00

6,288.

00

8,745.

00

3,323.

00

3,372.

00

Amortization of intangibles 259.

00

204.

00

222.

00

RISK MANAGEMENT

00 00 00 00 00

Noninterest revenue

Commissions and fees 3,539.

00

2,933.

00

2,535.

00

2,455.

00

2,357.

00

Securities gains (losses) 179.

00

428.

00

311.

00

26

.00

Insurance premium 357

.00

Other income 1,699.

00

929.

00

1,473.

00

963.

00

1,945.

00

Noninterest revenue in total 5,417.

00

4,290.

00

4,008.

00

3,729.

00

4,685.

00

Total net revenue 14,675.

00

13,057.

00

12,716.

00

12,716.

00

13,341.

00

Noninterest expenses

Tech, communication and

equipment

4,568.

00

6,288.

00

8,745.

00

3,323.

00

3,372.

00

Amortization of intangibles 259.

00

204.

00

222.

00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

RISK MANAGEMENT

Other special charges 174.

00

1,606.

00

285.

00

(284.

00)

59

.00

Other expenses (5,001.

00)

(7,894.

00)

(9,234.0

0)

(3,261.

00)

(3,431.

00)

Total noninterest expenses

Earnings / (loss) from cont ops

before taxes

14,675.

00

13,057.

00

12,716.

00

12,716.

00

13,341.

00

Provision (benefit) for taxes 1,909.

00

23

.00

1,166.

00

824.

00

1,275.

00

Other income (expense) (12,092.

00)

(16,169.

00)

(16,808.0

0)

(10,512.

00)

(9,974.

00)

Earnings from discontinued ops (3,445.

00)

1,541.

00

Net earnings (2,771.

00)

(1,594.

00)

(5,258.0

0)

1,380.

00

2,092.

00

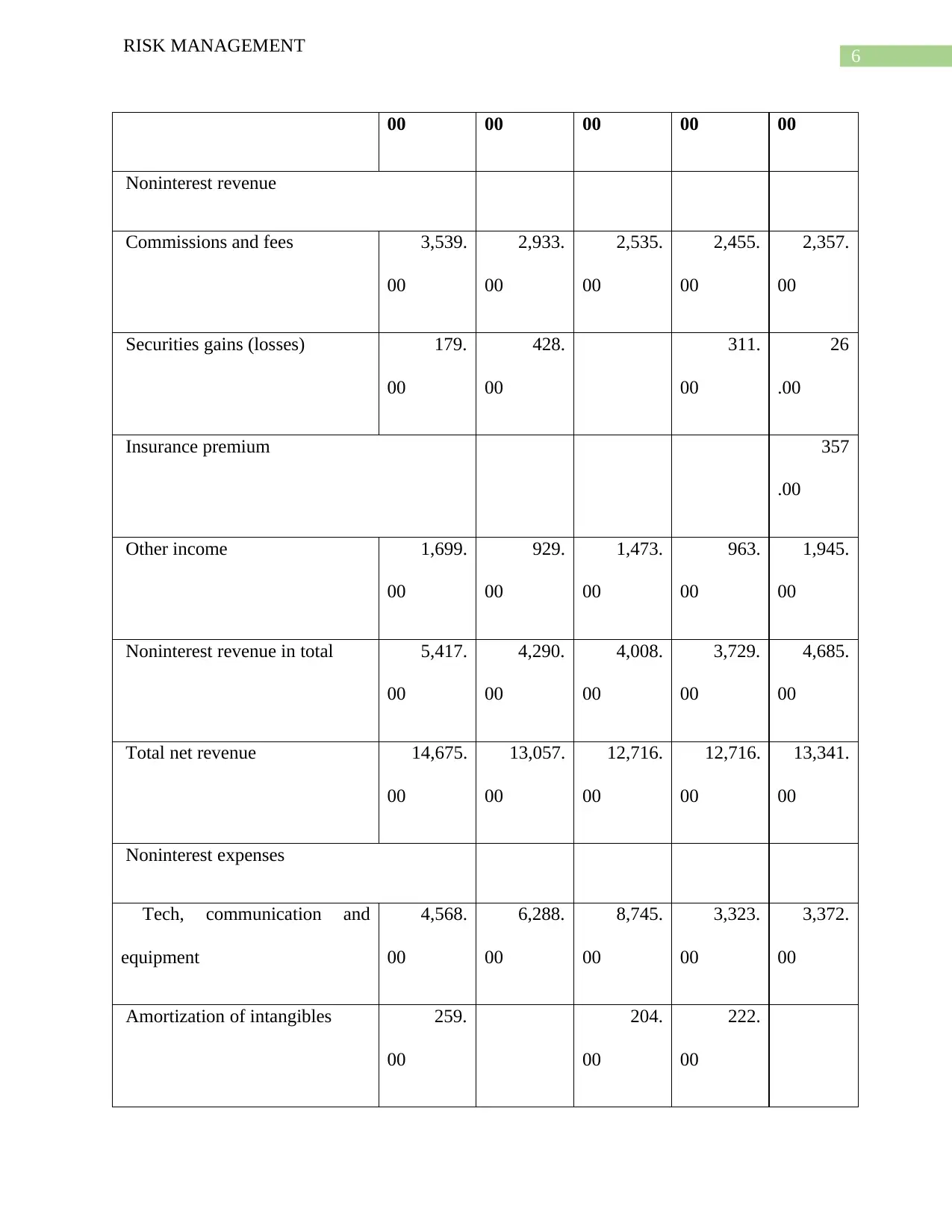

It is clear from the financial performance of the company that in recent years the performance of

the company has declined significantly. Especially the amount gross interest income of the bank

has declined at a constant pace since 2014. This is certainly a matter of concern for the bank

considering that the gross revenue from interest is the primary source of income for the bank.

RISK MANAGEMENT

Other special charges 174.

00

1,606.

00

285.

00

(284.

00)

59

.00

Other expenses (5,001.

00)

(7,894.

00)

(9,234.0

0)

(3,261.

00)

(3,431.

00)

Total noninterest expenses

Earnings / (loss) from cont ops

before taxes

14,675.

00

13,057.

00

12,716.

00

12,716.

00

13,341.

00

Provision (benefit) for taxes 1,909.

00

23

.00

1,166.

00

824.

00

1,275.

00

Other income (expense) (12,092.

00)

(16,169.

00)

(16,808.0

0)

(10,512.

00)

(9,974.

00)

Earnings from discontinued ops (3,445.

00)

1,541.

00

Net earnings (2,771.

00)

(1,594.

00)

(5,258.0

0)

1,380.

00

2,092.

00

It is clear from the financial performance of the company that in recent years the performance of

the company has declined significantly. Especially the amount gross interest income of the bank

has declined at a constant pace since 2014. This is certainly a matter of concern for the bank

considering that the gross revenue from interest is the primary source of income for the bank.

8

RISK MANAGEMENT

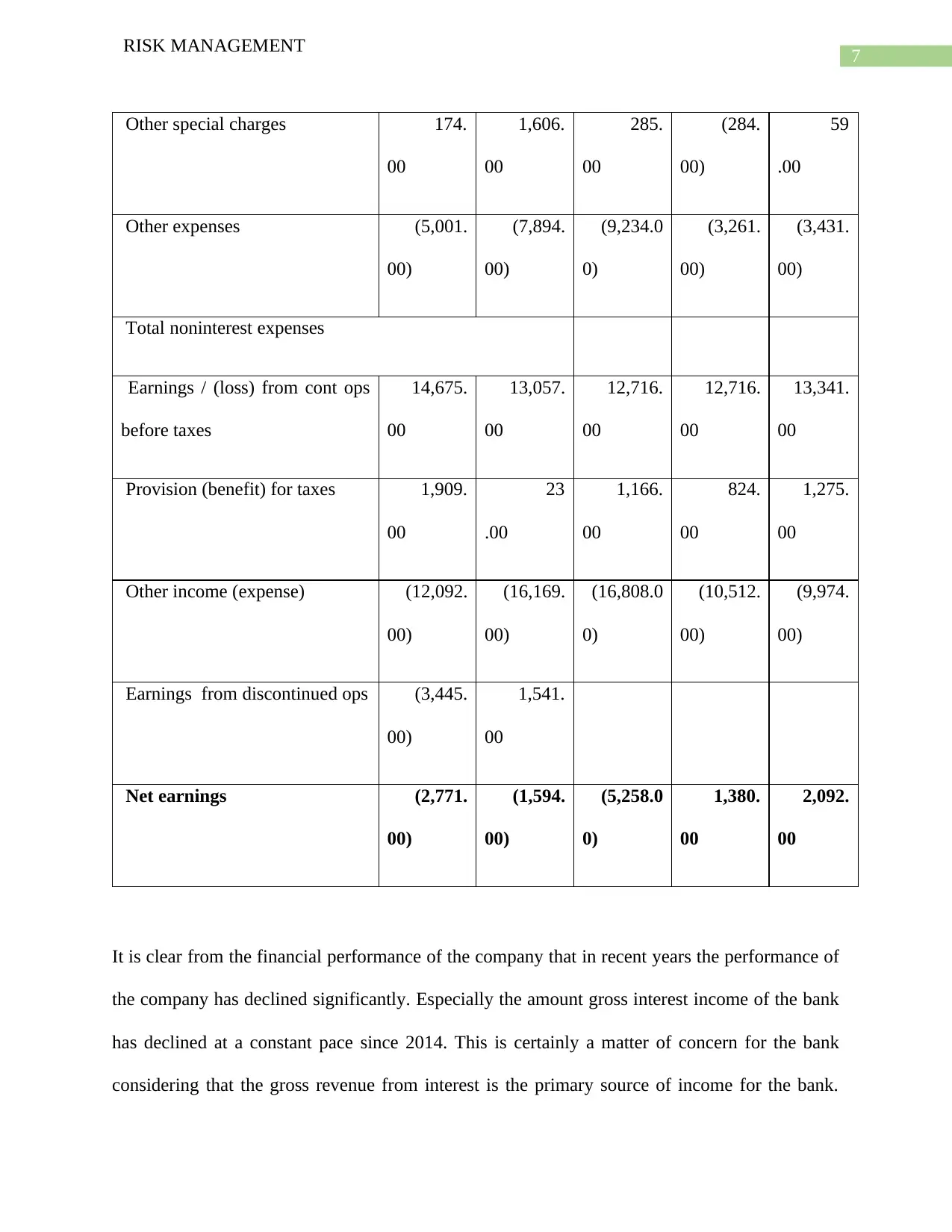

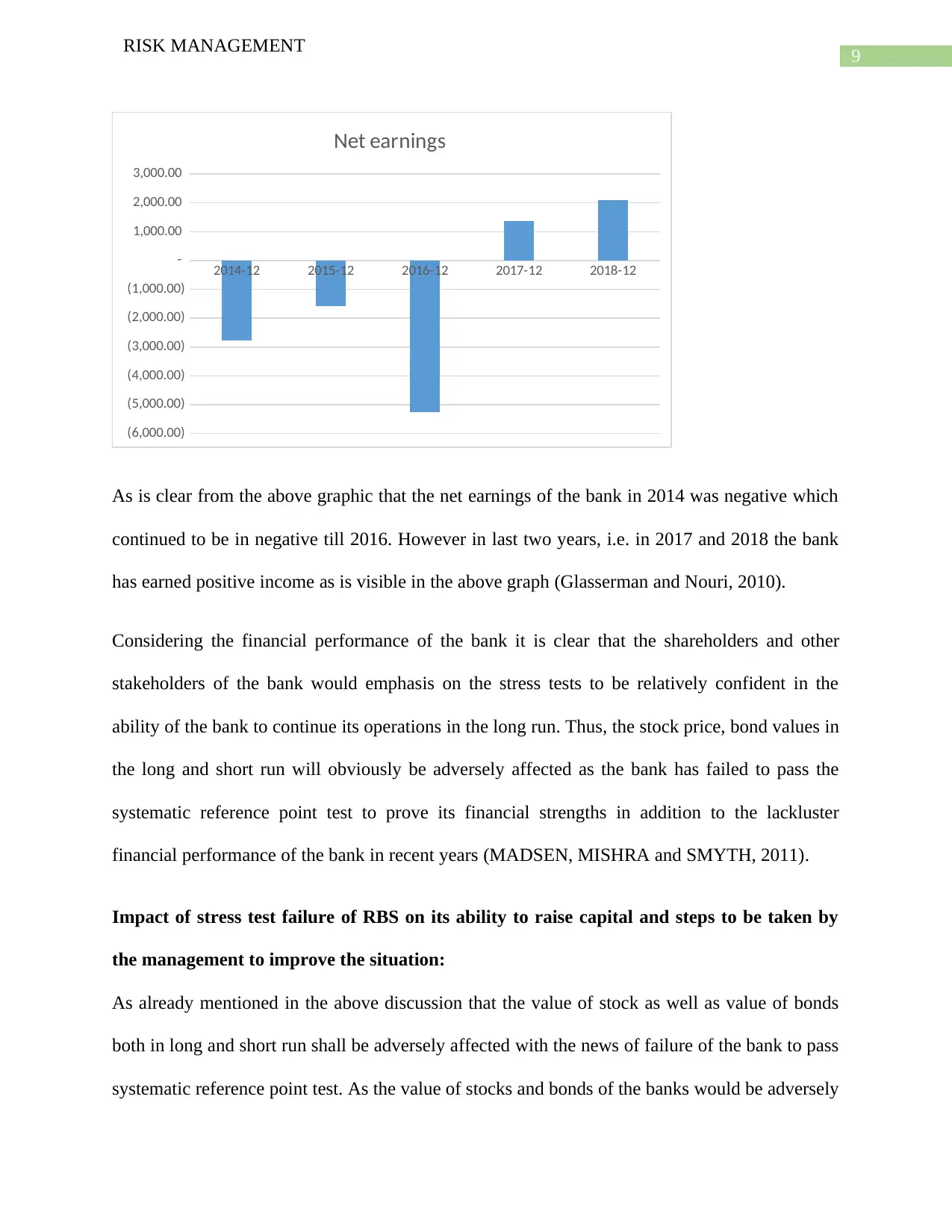

The char below shows how the revenue from interest has declined each year since 2014

(Giuliana, 2017).

2014-12 2015-12 2016-12 2017-12 2018-12

10,000.00

10,500.00

11,000.00

11,500.00

12,000.00

12,500.00

13,000.00

13,500.00

Interest income gross

It is very clear from the above chart that the financial performance of the bank especially the

ability of the bank to earn interest income has deteriorated significantly over the years. The net

earnings of the bank has also under gone huge fluctuations over the years as can be seen from the

above income statement. The net earnings of the bank over the last five years are showed in the

form of graphical representation below to understand the fluctuations better.

RISK MANAGEMENT

The char below shows how the revenue from interest has declined each year since 2014

(Giuliana, 2017).

2014-12 2015-12 2016-12 2017-12 2018-12

10,000.00

10,500.00

11,000.00

11,500.00

12,000.00

12,500.00

13,000.00

13,500.00

Interest income gross

It is very clear from the above chart that the financial performance of the bank especially the

ability of the bank to earn interest income has deteriorated significantly over the years. The net

earnings of the bank has also under gone huge fluctuations over the years as can be seen from the

above income statement. The net earnings of the bank over the last five years are showed in the

form of graphical representation below to understand the fluctuations better.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

RISK MANAGEMENT

2014-12 2015-12 2016-12 2017-12 2018-12

(6,000.00)

(5,000.00)

(4,000.00)

(3,000.00)

(2,000.00)

(1,000.00)

-

1,000.00

2,000.00

3,000.00

Net earnings

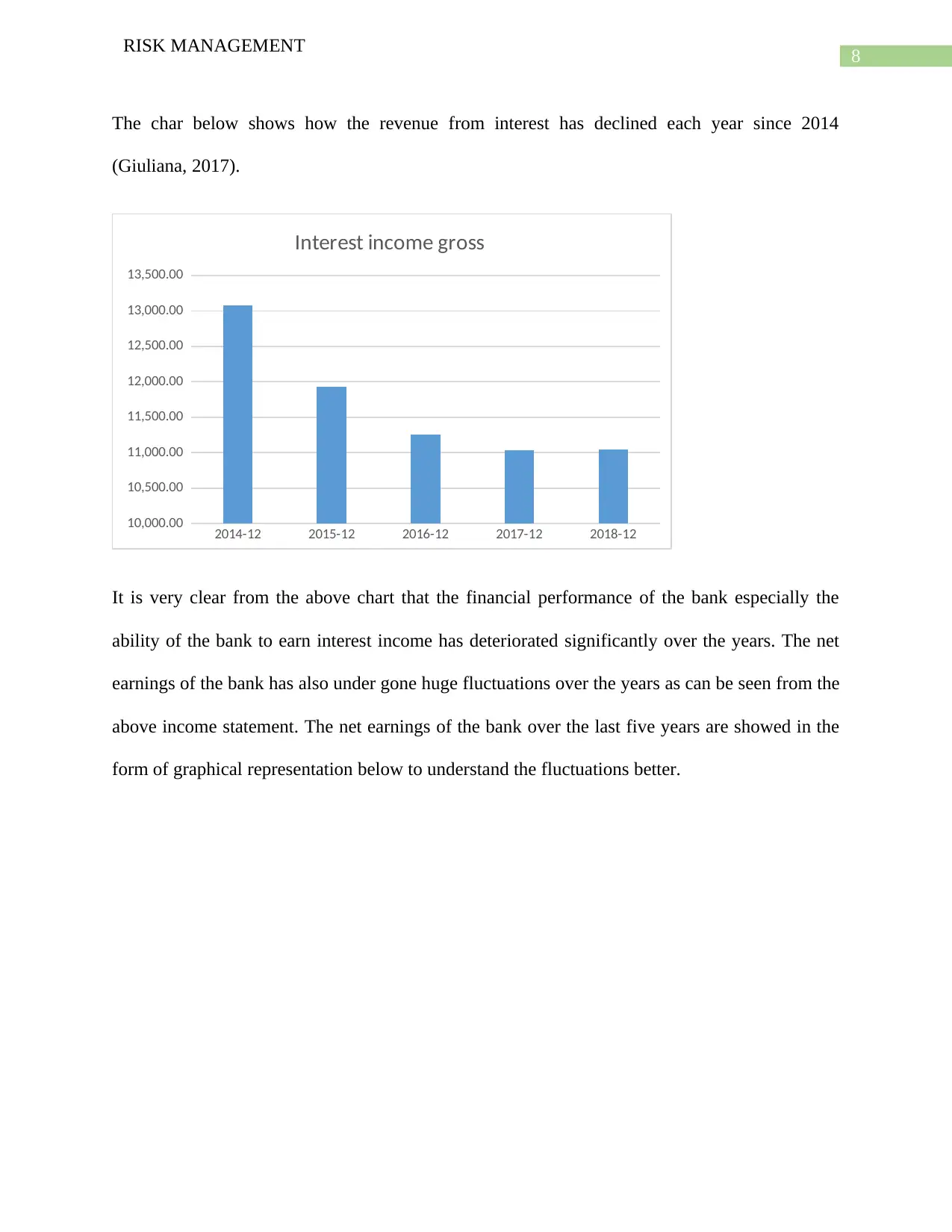

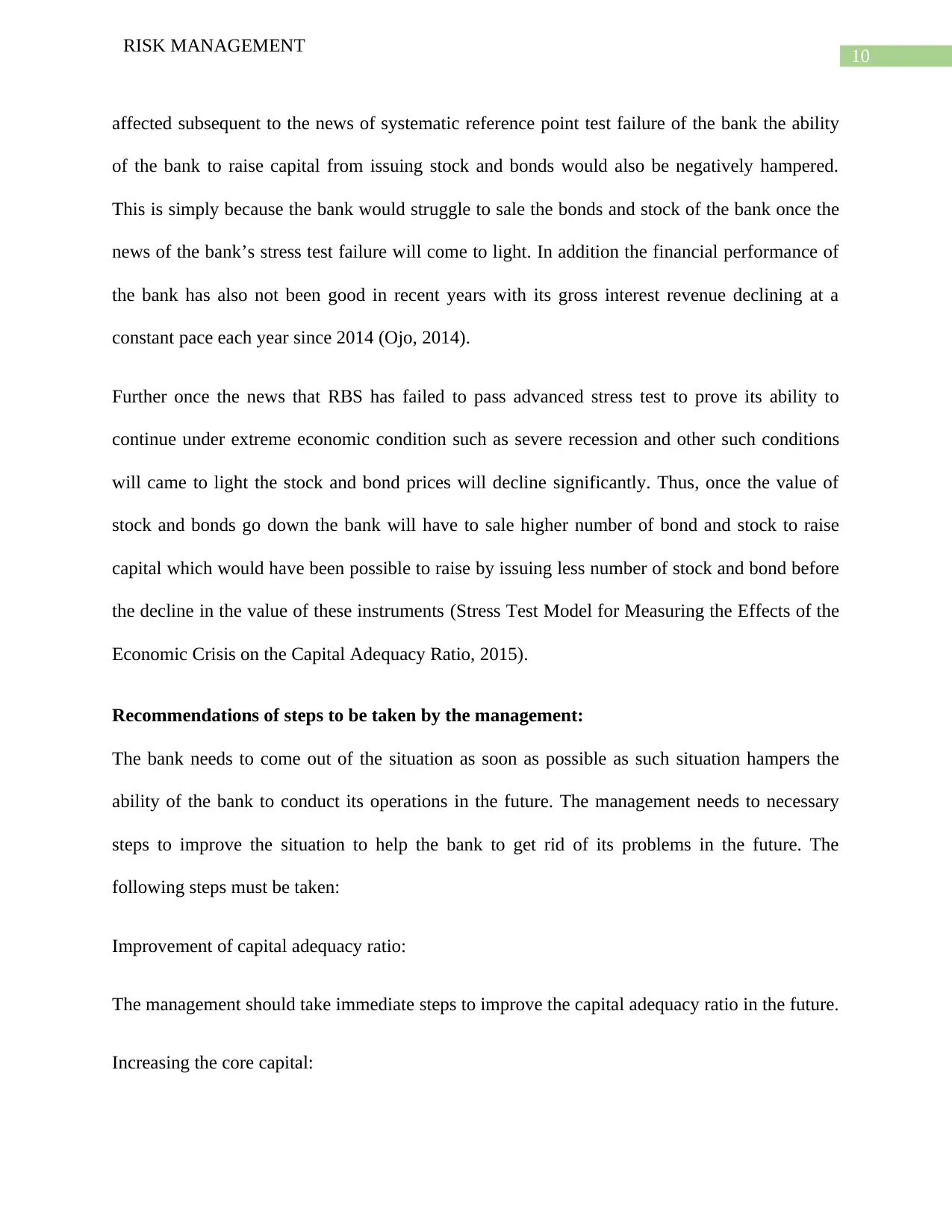

As is clear from the above graphic that the net earnings of the bank in 2014 was negative which

continued to be in negative till 2016. However in last two years, i.e. in 2017 and 2018 the bank

has earned positive income as is visible in the above graph (Glasserman and Nouri, 2010).

Considering the financial performance of the bank it is clear that the shareholders and other

stakeholders of the bank would emphasis on the stress tests to be relatively confident in the

ability of the bank to continue its operations in the long run. Thus, the stock price, bond values in

the long and short run will obviously be adversely affected as the bank has failed to pass the

systematic reference point test to prove its financial strengths in addition to the lackluster

financial performance of the bank in recent years (MADSEN, MISHRA and SMYTH, 2011).

Impact of stress test failure of RBS on its ability to raise capital and steps to be taken by

the management to improve the situation:

As already mentioned in the above discussion that the value of stock as well as value of bonds

both in long and short run shall be adversely affected with the news of failure of the bank to pass

systematic reference point test. As the value of stocks and bonds of the banks would be adversely

RISK MANAGEMENT

2014-12 2015-12 2016-12 2017-12 2018-12

(6,000.00)

(5,000.00)

(4,000.00)

(3,000.00)

(2,000.00)

(1,000.00)

-

1,000.00

2,000.00

3,000.00

Net earnings

As is clear from the above graphic that the net earnings of the bank in 2014 was negative which

continued to be in negative till 2016. However in last two years, i.e. in 2017 and 2018 the bank

has earned positive income as is visible in the above graph (Glasserman and Nouri, 2010).

Considering the financial performance of the bank it is clear that the shareholders and other

stakeholders of the bank would emphasis on the stress tests to be relatively confident in the

ability of the bank to continue its operations in the long run. Thus, the stock price, bond values in

the long and short run will obviously be adversely affected as the bank has failed to pass the

systematic reference point test to prove its financial strengths in addition to the lackluster

financial performance of the bank in recent years (MADSEN, MISHRA and SMYTH, 2011).

Impact of stress test failure of RBS on its ability to raise capital and steps to be taken by

the management to improve the situation:

As already mentioned in the above discussion that the value of stock as well as value of bonds

both in long and short run shall be adversely affected with the news of failure of the bank to pass

systematic reference point test. As the value of stocks and bonds of the banks would be adversely

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

RISK MANAGEMENT

affected subsequent to the news of systematic reference point test failure of the bank the ability

of the bank to raise capital from issuing stock and bonds would also be negatively hampered.

This is simply because the bank would struggle to sale the bonds and stock of the bank once the

news of the bank’s stress test failure will come to light. In addition the financial performance of

the bank has also not been good in recent years with its gross interest revenue declining at a

constant pace each year since 2014 (Ojo, 2014).

Further once the news that RBS has failed to pass advanced stress test to prove its ability to

continue under extreme economic condition such as severe recession and other such conditions

will came to light the stock and bond prices will decline significantly. Thus, once the value of

stock and bonds go down the bank will have to sale higher number of bond and stock to raise

capital which would have been possible to raise by issuing less number of stock and bond before

the decline in the value of these instruments (Stress Test Model for Measuring the Effects of the

Economic Crisis on the Capital Adequacy Ratio, 2015).

Recommendations of steps to be taken by the management:

The bank needs to come out of the situation as soon as possible as such situation hampers the

ability of the bank to conduct its operations in the future. The management needs to necessary

steps to improve the situation to help the bank to get rid of its problems in the future. The

following steps must be taken:

Improvement of capital adequacy ratio:

The management should take immediate steps to improve the capital adequacy ratio in the future.

Increasing the core capital:

RISK MANAGEMENT

affected subsequent to the news of systematic reference point test failure of the bank the ability

of the bank to raise capital from issuing stock and bonds would also be negatively hampered.

This is simply because the bank would struggle to sale the bonds and stock of the bank once the

news of the bank’s stress test failure will come to light. In addition the financial performance of

the bank has also not been good in recent years with its gross interest revenue declining at a

constant pace each year since 2014 (Ojo, 2014).

Further once the news that RBS has failed to pass advanced stress test to prove its ability to

continue under extreme economic condition such as severe recession and other such conditions

will came to light the stock and bond prices will decline significantly. Thus, once the value of

stock and bonds go down the bank will have to sale higher number of bond and stock to raise

capital which would have been possible to raise by issuing less number of stock and bond before

the decline in the value of these instruments (Stress Test Model for Measuring the Effects of the

Economic Crisis on the Capital Adequacy Ratio, 2015).

Recommendations of steps to be taken by the management:

The bank needs to come out of the situation as soon as possible as such situation hampers the

ability of the bank to conduct its operations in the future. The management needs to necessary

steps to improve the situation to help the bank to get rid of its problems in the future. The

following steps must be taken:

Improvement of capital adequacy ratio:

The management should take immediate steps to improve the capital adequacy ratio in the future.

Increasing the core capital:

11

RISK MANAGEMENT

The management should take necessary steps to increase the core capital of the bank such as

equity by issuing additional equity shares.

Liquidity position:

The bank should improve its liquidity position by ensuring that it has necessary current assets to

meet its current liabilities and time demand.

Financial performance:

Improving the financial performance will help the bank to improve its financial position

including improvement in capital ratios (Ahmet Büyükşalvarci, 2011).

Conclusion:

Taking into consideration above discussion it is clear that a bank in addition to passing the

minimum requirements of CET1 capital ratio and Tier 1 capital ratio must passing the advanced

bench mark to show its ability to continue under adverse economic situation will increase the

trust of the stakeholders. This will positively influence the value of stock and bonds of the bank1

and its ability to raise capital from the market. Exactly opposite would be the case if the bank

fails to pass the stress tests as is the case with RBS. Thus, necessary steps shall be taken

immediately to improve the financial strength of the bank.

RISK MANAGEMENT

The management should take necessary steps to increase the core capital of the bank such as

equity by issuing additional equity shares.

Liquidity position:

The bank should improve its liquidity position by ensuring that it has necessary current assets to

meet its current liabilities and time demand.

Financial performance:

Improving the financial performance will help the bank to improve its financial position

including improvement in capital ratios (Ahmet Büyükşalvarci, 2011).

Conclusion:

Taking into consideration above discussion it is clear that a bank in addition to passing the

minimum requirements of CET1 capital ratio and Tier 1 capital ratio must passing the advanced

bench mark to show its ability to continue under adverse economic situation will increase the

trust of the stakeholders. This will positively influence the value of stock and bonds of the bank1

and its ability to raise capital from the market. Exactly opposite would be the case if the bank

fails to pass the stress tests as is the case with RBS. Thus, necessary steps shall be taken

immediately to improve the financial strength of the bank.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.