RMIT Macroeconomics: Australia Economic Progress Report Analysis

VerifiedAdded on 2023/04/20

|6

|907

|420

Report

AI Summary

This report analyzes the current state of the Australian economy, focusing on key macroeconomic indicators and recent events. It begins by examining the minutes of the latest Monetary Policy Committee, highlighting the RBA's concerns about the slowdown in China and its potential impact on interest rates, aggregate demand, inflation, and GDP growth. The report then presents GDP per capita data, labor market highlights, and inflation rate trends. A significant portion of the report is dedicated to the risks associated with China's economic slowdown, given Australia's substantial trade and economic ties with China. The report details how a slowdown in China could negatively impact Australia's exports, services, tourism, real estate market, and budget deficit. The analysis draws on data from 1981 to 2019, and references key economic concepts and relevant sources to provide a comprehensive overview of the Australian economy.

RMIT University

MACROECONOMICS

STUDENT ID:

[Pick the date]

MACROECONOMICS

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Australia Economic Progress Report

Current Events

A significant event from the perspective of domestic Australian economy is the minutes of

the latest Monetary Policy Committee released on March 2019. About an year ago, the RBA

was looking to increase the cash rate but the persistent economic conditions (both domestic

and global) have not allowed for the same as status quo has been maintained. In the recent

minutes, the slowdown in China has been addressed coupled with deterioration in the leading

indicators related to unemployment (RBA, 2019). This is leading to a strong expectation of a

rate cut of 25 bps in the current year by RBA.

The cash rate is significant since it would impact the interest rate which would in turn impact

various macroeconomic variables indicated below (Mankiw, 2016).

Aggregate demand would increase owing to lowering of interest rates by banks.

This would potentially lead to higher inflation coupled with higher GDP growth in the

medium term.

Additionally, on account of higher consuming spending, it is expected that private

investment cycle would be kicked off.

Also, there would be a depreciation in the currency as money might move from the debt

funds owing to better interest rates being offered elsewhere.

The credit growth may improve along with providing much needed support to the real

estate market which is the verge of collapsing especially as China enters a slowdown.

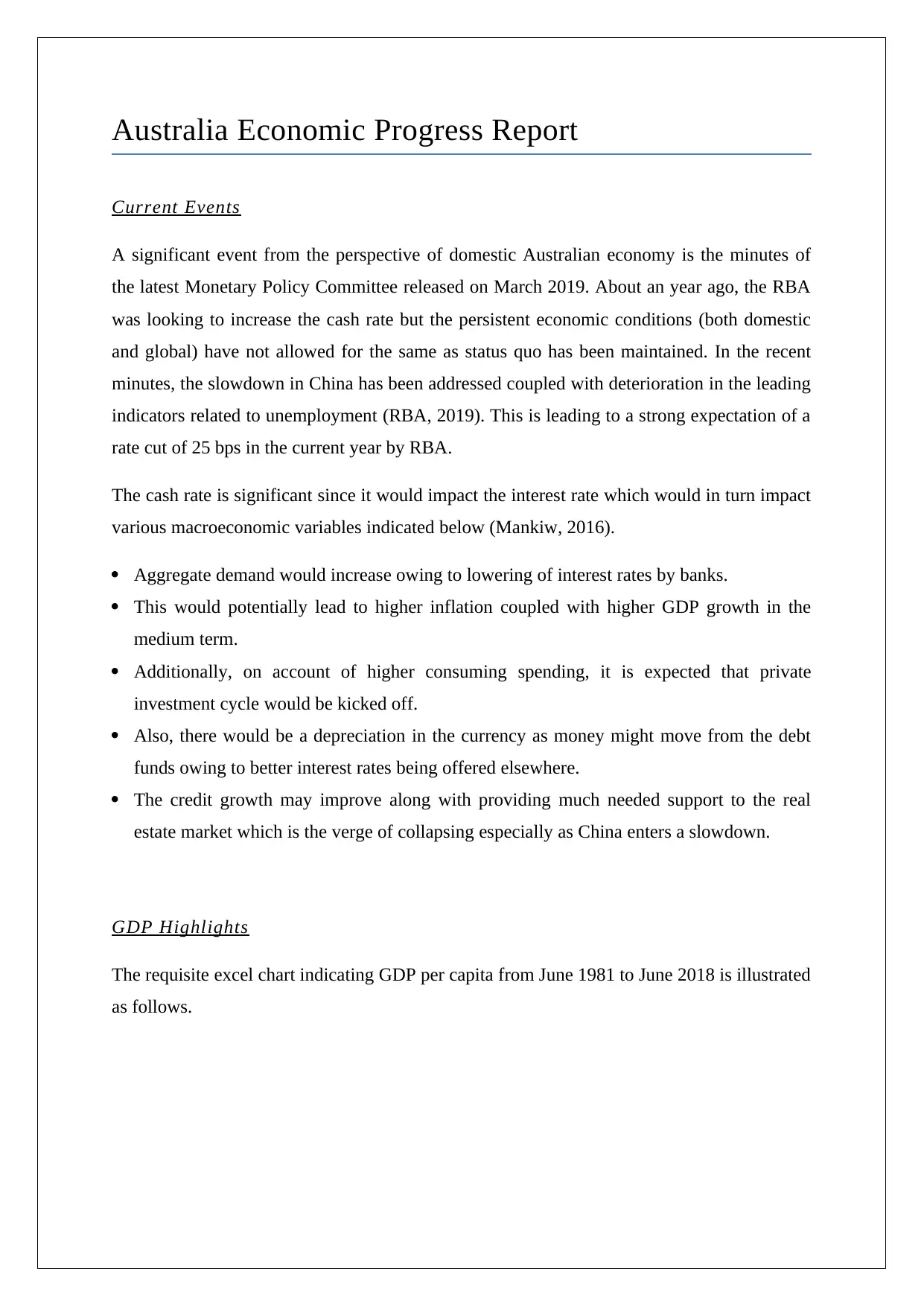

GDP Highlights

The requisite excel chart indicating GDP per capita from June 1981 to June 2018 is illustrated

as follows.

Current Events

A significant event from the perspective of domestic Australian economy is the minutes of

the latest Monetary Policy Committee released on March 2019. About an year ago, the RBA

was looking to increase the cash rate but the persistent economic conditions (both domestic

and global) have not allowed for the same as status quo has been maintained. In the recent

minutes, the slowdown in China has been addressed coupled with deterioration in the leading

indicators related to unemployment (RBA, 2019). This is leading to a strong expectation of a

rate cut of 25 bps in the current year by RBA.

The cash rate is significant since it would impact the interest rate which would in turn impact

various macroeconomic variables indicated below (Mankiw, 2016).

Aggregate demand would increase owing to lowering of interest rates by banks.

This would potentially lead to higher inflation coupled with higher GDP growth in the

medium term.

Additionally, on account of higher consuming spending, it is expected that private

investment cycle would be kicked off.

Also, there would be a depreciation in the currency as money might move from the debt

funds owing to better interest rates being offered elsewhere.

The credit growth may improve along with providing much needed support to the real

estate market which is the verge of collapsing especially as China enters a slowdown.

GDP Highlights

The requisite excel chart indicating GDP per capita from June 1981 to June 2018 is illustrated

as follows.

The two consumption categories which witnessed the largest growth rate over the most recent

quarter are transport services and insurance & other financial services.

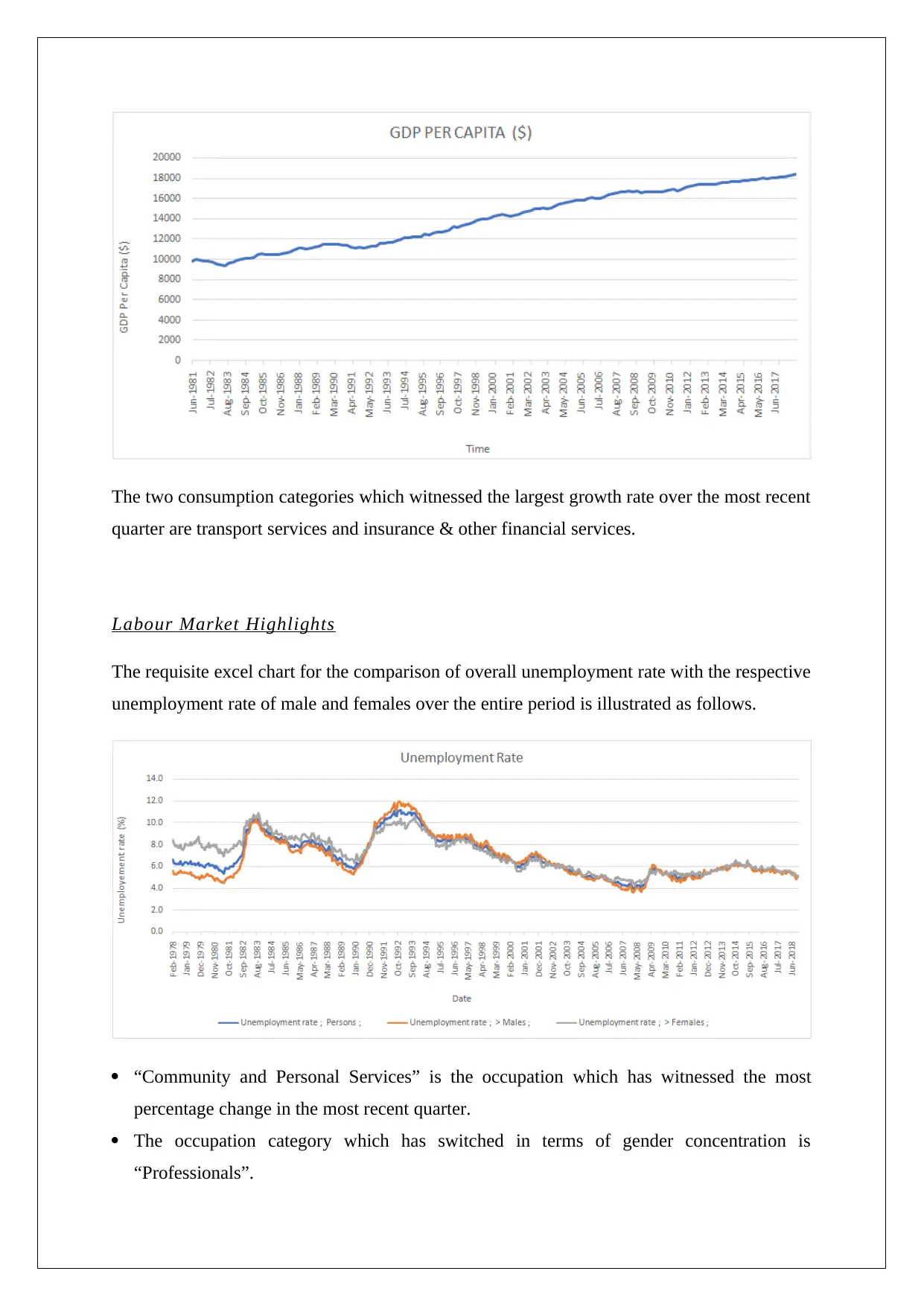

Labour Market Highlights

The requisite excel chart for the comparison of overall unemployment rate with the respective

unemployment rate of male and females over the entire period is illustrated as follows.

“Community and Personal Services” is the occupation which has witnessed the most

percentage change in the most recent quarter.

The occupation category which has switched in terms of gender concentration is

“Professionals”.

quarter are transport services and insurance & other financial services.

Labour Market Highlights

The requisite excel chart for the comparison of overall unemployment rate with the respective

unemployment rate of male and females over the entire period is illustrated as follows.

“Community and Personal Services” is the occupation which has witnessed the most

percentage change in the most recent quarter.

The occupation category which has switched in terms of gender concentration is

“Professionals”.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The occupation category which has shown smallest difference between male and female

employment over the entire period is “Professionals”.

The requisite occupation category which has a higher proportion of female employment

over the entire period is “Clerical and Administrative Workers”.

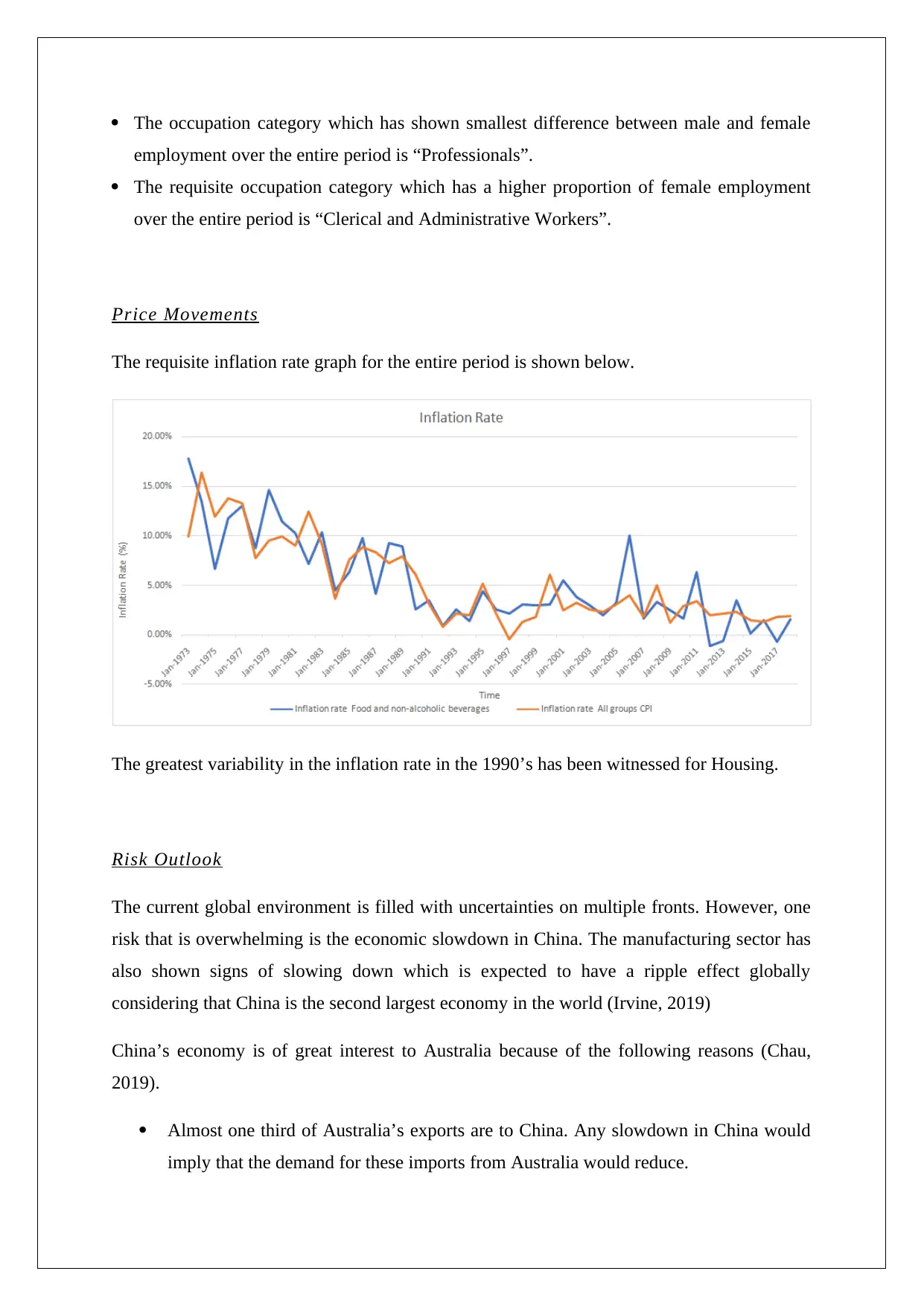

Price Movements

The requisite inflation rate graph for the entire period is shown below.

The greatest variability in the inflation rate in the 1990’s has been witnessed for Housing.

Risk Outlook

The current global environment is filled with uncertainties on multiple fronts. However, one

risk that is overwhelming is the economic slowdown in China. The manufacturing sector has

also shown signs of slowing down which is expected to have a ripple effect globally

considering that China is the second largest economy in the world (Irvine, 2019)

China’s economy is of great interest to Australia because of the following reasons (Chau,

2019).

Almost one third of Australia’s exports are to China. Any slowdown in China would

imply that the demand for these imports from Australia would reduce.

employment over the entire period is “Professionals”.

The requisite occupation category which has a higher proportion of female employment

over the entire period is “Clerical and Administrative Workers”.

Price Movements

The requisite inflation rate graph for the entire period is shown below.

The greatest variability in the inflation rate in the 1990’s has been witnessed for Housing.

Risk Outlook

The current global environment is filled with uncertainties on multiple fronts. However, one

risk that is overwhelming is the economic slowdown in China. The manufacturing sector has

also shown signs of slowing down which is expected to have a ripple effect globally

considering that China is the second largest economy in the world (Irvine, 2019)

China’s economy is of great interest to Australia because of the following reasons (Chau,

2019).

Almost one third of Australia’s exports are to China. Any slowdown in China would

imply that the demand for these imports from Australia would reduce.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

With regards to composition of exports from Australia, 30 % is attributed to coal and

iron ore which amount to $ 120 billion annually. Considering that China is the largest

consumer of coal and iron ore in the world, hence slowdown in China would impact

the commodity prices driving the exports lower.

The exports of services could also be adversely impacted considering that $32.4

billion worth of earnings from international students. A sizable chunk of these are

from China.

Also, the tourism industry would be adversely impacted considering that last year,

Chinese tourists spent $ 11.3 billion in Australia.

The real estate market may also face adverse price movements owing to the

significant investments by Chinese nationals in Australia housing and commercial

estate market especially in Sydney and Australia.

Owing to falling trade, there would a increase in the budget deficit which would cause

depreciation of AUD besides requiring cut on government expenditure. This would

lead to lowering of GDP growth at a time when the Australian economy is in a

difficult phase (Irvine, 2019).

iron ore which amount to $ 120 billion annually. Considering that China is the largest

consumer of coal and iron ore in the world, hence slowdown in China would impact

the commodity prices driving the exports lower.

The exports of services could also be adversely impacted considering that $32.4

billion worth of earnings from international students. A sizable chunk of these are

from China.

Also, the tourism industry would be adversely impacted considering that last year,

Chinese tourists spent $ 11.3 billion in Australia.

The real estate market may also face adverse price movements owing to the

significant investments by Chinese nationals in Australia housing and commercial

estate market especially in Sydney and Australia.

Owing to falling trade, there would a increase in the budget deficit which would cause

depreciation of AUD besides requiring cut on government expenditure. This would

lead to lowering of GDP growth at a time when the Australian economy is in a

difficult phase (Irvine, 2019).

References

Chau, D. (2019) Australia's fortunes are linked to China's economy — for better or worse,

[online] Available at https://www.abc.net.au/news/2019-01-15/china-economy-slowdown-

will-affect-australia/10716240 [Accessed on March 26, 2019]

Irvine, J. (2019) What will a China slowdown mean for the Australian economy?, [online]

Available at https://www.smh.com.au/business/the-economy/what-will-a-china-slowdown-

mean-for-the-australian-economy-20190125-p50tlx.html [Accessed on March 26, 2019]

Mankiw, G. (2016). Principles of Macroeconomics (6th ed.). London: Cengage Learning, pp.

65-67

RBA (2019) Minutes of the Monetary Policy Meeting of the Reserve Bank Board, [online]

Available at https://www.rba.gov.au/monetary-policy/rba-board-minutes/2019/2019-03-

05.html [Accessed on March 26, 2019]

Chau, D. (2019) Australia's fortunes are linked to China's economy — for better or worse,

[online] Available at https://www.abc.net.au/news/2019-01-15/china-economy-slowdown-

will-affect-australia/10716240 [Accessed on March 26, 2019]

Irvine, J. (2019) What will a China slowdown mean for the Australian economy?, [online]

Available at https://www.smh.com.au/business/the-economy/what-will-a-china-slowdown-

mean-for-the-australian-economy-20190125-p50tlx.html [Accessed on March 26, 2019]

Mankiw, G. (2016). Principles of Macroeconomics (6th ed.). London: Cengage Learning, pp.

65-67

RBA (2019) Minutes of the Monetary Policy Meeting of the Reserve Bank Board, [online]

Available at https://www.rba.gov.au/monetary-policy/rba-board-minutes/2019/2019-03-

05.html [Accessed on March 26, 2019]

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.