Assessment Item 2: Role of Cost Control in Managing Production

VerifiedAdded on 2020/02/18

|18

|2405

|33

Report

AI Summary

This report, designed for a Management Accounting course, meticulously examines the critical role of cost control in production management. It begins by exploring job costing, providing detailed calculations and analysis, and then progresses to process costing, including comprehensive process cost summaries and unit cost calculations. The report then delves into joint costing, offering decision-making scenarios and calculations to determine optimal selling strategies. A significant portion is dedicated to variance analysis, with in-depth explanations and calculations of direct material and labor variances, alongside a business report summarizing the findings. The report concludes with a thorough examination of budgeting, presenting sales, purchase, and inventory budgets, as well as a budgeted income statement and statement of retained earnings, demonstrating the financial impact of effective cost control. The assignment provides a practical application of cost accounting principles.

Role of cost control in managing the production - Assessment item 2

Management accounting Cost & control

1 | P a g e

Management accounting Cost & control

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Role of cost control in managing the production - Assessment item 2

Table of Contents

Solution 1 Job costing.................................................................................................................................3

Solution 2 Process costing...........................................................................................................................6

Solution 3 - Joint costing - decision making..............................................................................................10

Solution 4 Variance analysis.....................................................................................................................12

Solution 5 Budgeting.................................................................................................................................16

Bibliography..............................................................................................................................................19

2 | P a g e

Table of Contents

Solution 1 Job costing.................................................................................................................................3

Solution 2 Process costing...........................................................................................................................6

Solution 3 - Joint costing - decision making..............................................................................................10

Solution 4 Variance analysis.....................................................................................................................12

Solution 5 Budgeting.................................................................................................................................16

Bibliography..............................................................................................................................................19

2 | P a g e

Role of cost control in managing the production - Assessment item 2

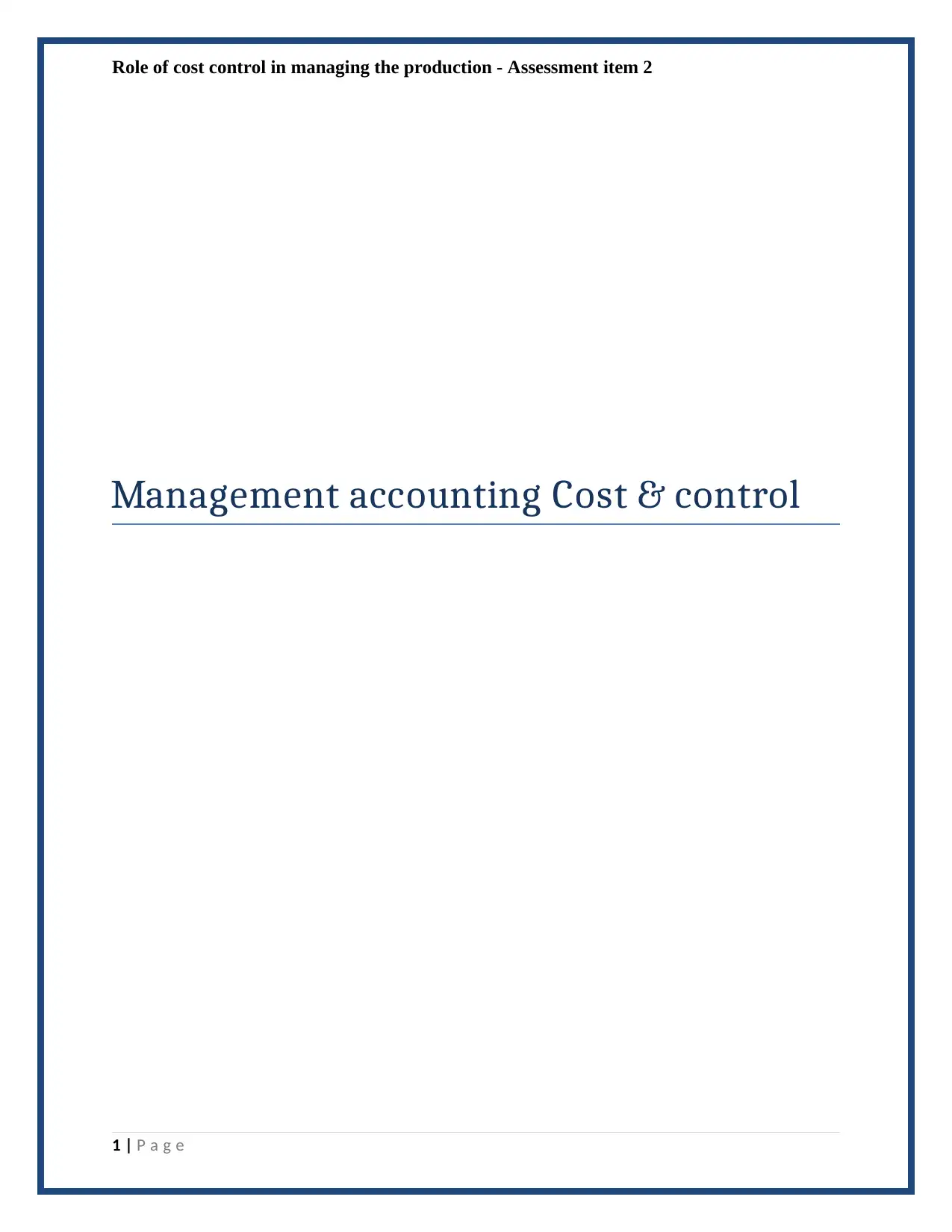

Solution 1 Job costing

Predetermined Overhead Rate = 12,000

3,000

4.00 per Direct Labour hour

Direct Material

Control

15055 3210

6155

7000

25000

28210 28210

Work In Process

6700 30110

3210

14800 1200

14800 7000

1200

39510 39510

Finished Goods

8790 30000

30110

8900

38900 38900

Accounts Payable

3 | P a g e

Solution 1 Job costing

Predetermined Overhead Rate = 12,000

3,000

4.00 per Direct Labour hour

Direct Material

Control

15055 3210

6155

7000

25000

28210 28210

Work In Process

6700 30110

3210

14800 1200

14800 7000

1200

39510 39510

Finished Goods

8790 30000

30110

8900

38900 38900

Accounts Payable

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Role of cost control in managing the production - Assessment item 2

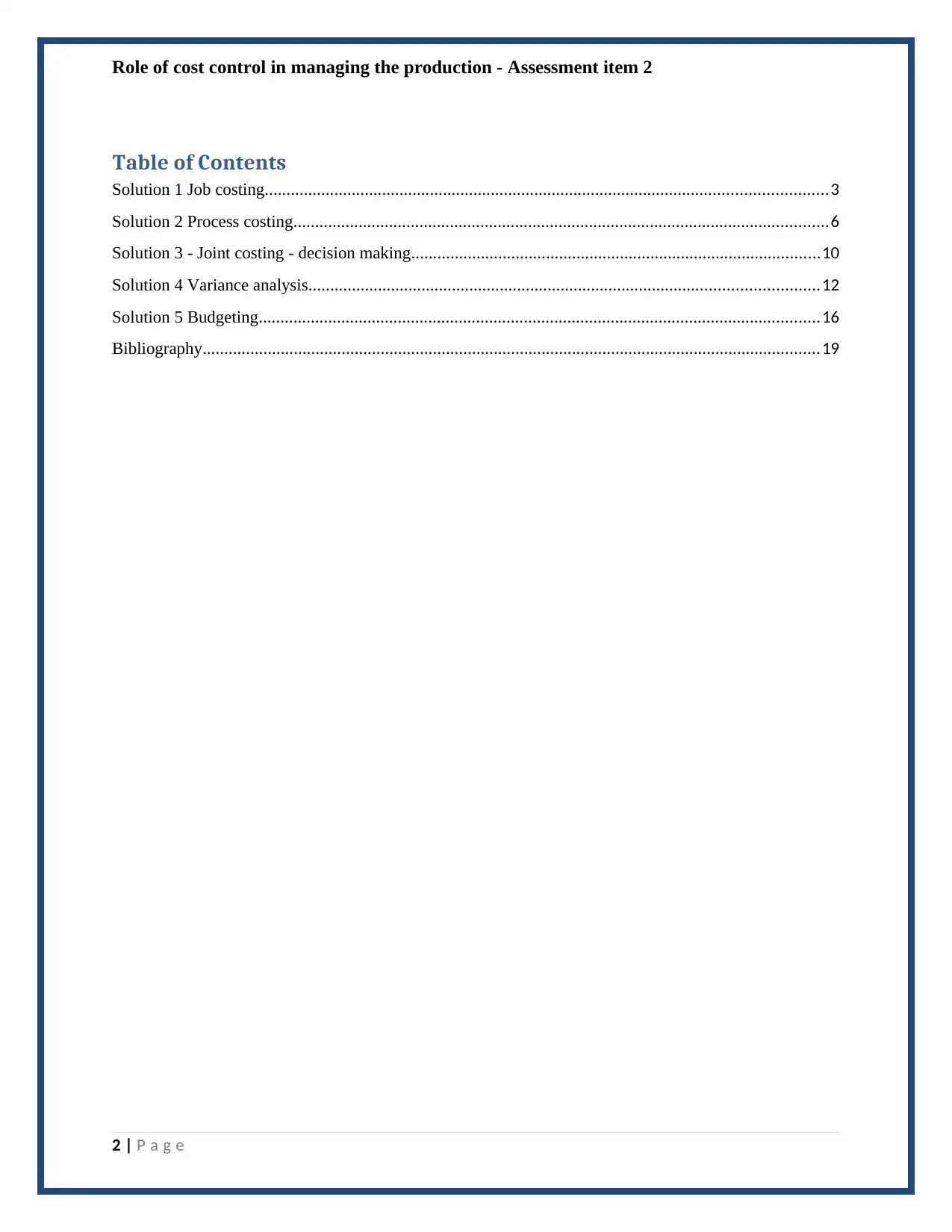

6700 2345

1800 6155

(Purchase of Direct

Material)

8500 8500

Cost of Goods Sold

30000

The great Pyramid of Giza if would have constructed now it would have tough to reconstruct the

pyramid even after presence of modern technologies and machinery. It took around 20 years in

the past around 4500 years back to complete the structure. According to the experts and civil

engineers it would take around $5 billion in the present terms to complete the structure.

According to the accurate data of the structure the pyramid is around 756 feet in length and 481

feet in height. The pyramid was originally built with the help of around 4000 workers in a time

span of 20 years but now with the advanced technology and availability of cranes and helicopters

it would be completed in 5 years time and would take around 1500 to 2000 workers help.

However economist do not find economical to build such a structure in present time due to cost

benefit analysis. The same cost if would have incurred in constructing a building then it would

have resulted in better outcome and facilities for the public. While making comparison the One

World Trade Centre was constructed within the lesser cost if it would have incurred to develop

Giza Pyramid (Wolchover, 2012).

Cost benefit analysis

Cost incurred in building

Pyramid of Giza - $5 billion

One World Trade Centre - $4 billion

4 | P a g e

6700 2345

1800 6155

(Purchase of Direct

Material)

8500 8500

Cost of Goods Sold

30000

The great Pyramid of Giza if would have constructed now it would have tough to reconstruct the

pyramid even after presence of modern technologies and machinery. It took around 20 years in

the past around 4500 years back to complete the structure. According to the experts and civil

engineers it would take around $5 billion in the present terms to complete the structure.

According to the accurate data of the structure the pyramid is around 756 feet in length and 481

feet in height. The pyramid was originally built with the help of around 4000 workers in a time

span of 20 years but now with the advanced technology and availability of cranes and helicopters

it would be completed in 5 years time and would take around 1500 to 2000 workers help.

However economist do not find economical to build such a structure in present time due to cost

benefit analysis. The same cost if would have incurred in constructing a building then it would

have resulted in better outcome and facilities for the public. While making comparison the One

World Trade Centre was constructed within the lesser cost if it would have incurred to develop

Giza Pyramid (Wolchover, 2012).

Cost benefit analysis

Cost incurred in building

Pyramid of Giza - $5 billion

One World Trade Centre - $4 billion

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Role of cost control in managing the production - Assessment item 2

Pyramid of Giza One World Trade Centre

5 | P a g e

Pyramid of Giza One World Trade Centre

5 | P a g e

Role of cost control in managing the production - Assessment item 2

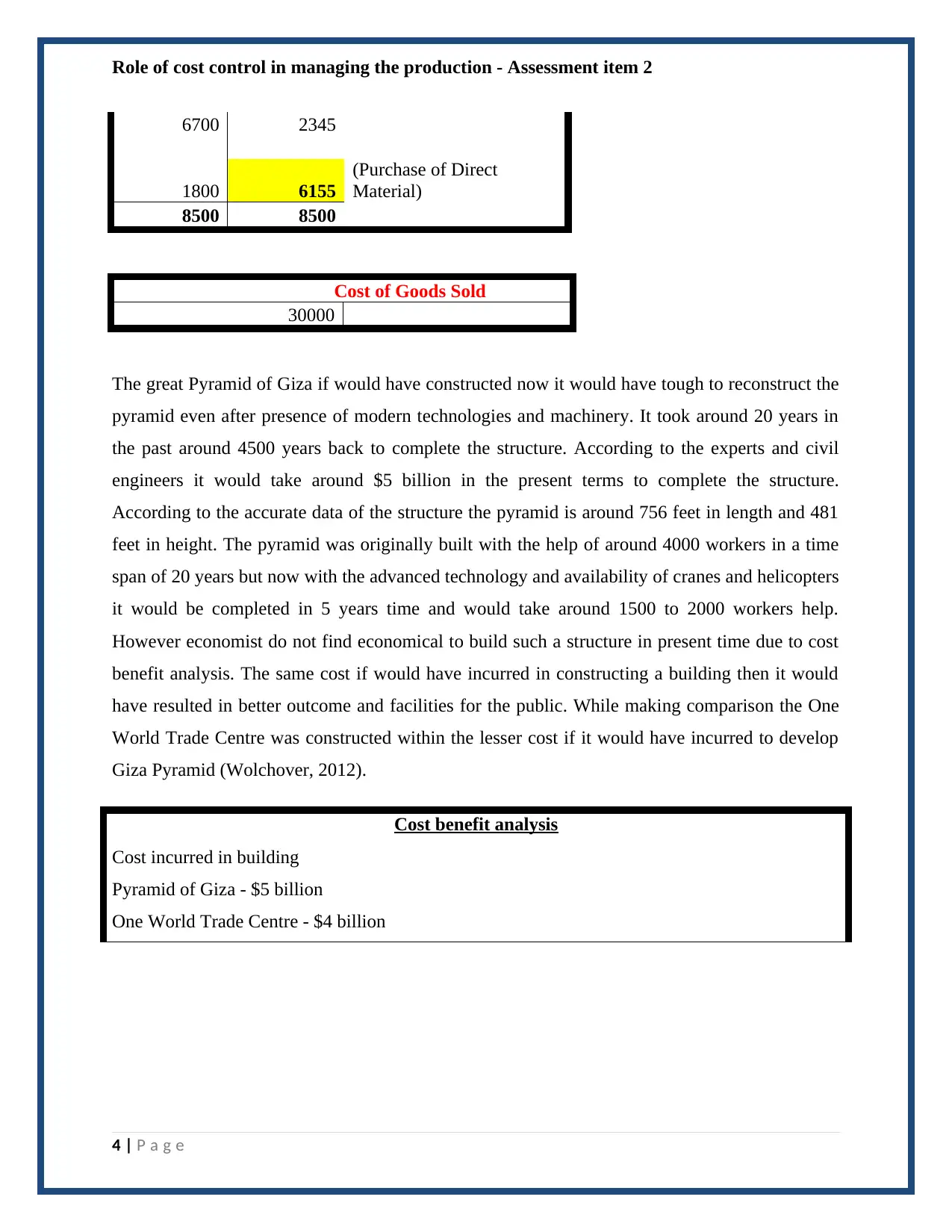

Solution 2 Process costing

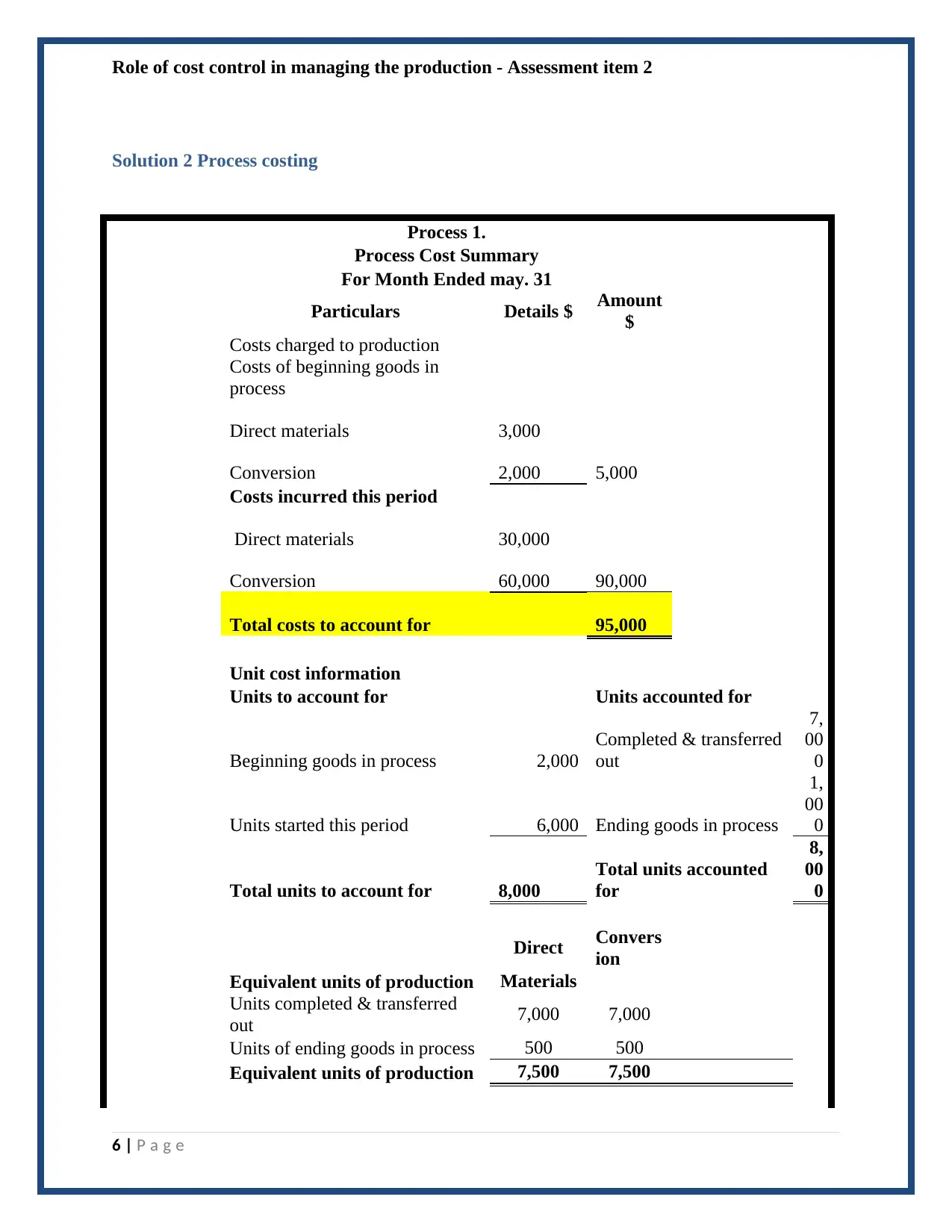

Process 1.

Process Cost Summary

For Month Ended may. 31

Particulars Details $ Amount

$

Costs charged to production

Costs of beginning goods in

process

Direct materials 3,000

Conversion 2,000 5,000

Costs incurred this period

Direct materials 30,000

Conversion 60,000 90,000

Total costs to account for 95,000

Unit cost information

Units to account for Units accounted for

Beginning goods in process 2,000

Completed & transferred

out

7,

00

0

Units started this period 6,000 Ending goods in process

1,

00

0

Total units to account for 8,000

Total units accounted

for

8,

00

0

Direct Convers

ion

Equivalent units of production Materials

Units completed & transferred

out 7,000 7,000

Units of ending goods in process 500 500

Equivalent units of production 7,500 7,500

6 | P a g e

Solution 2 Process costing

Process 1.

Process Cost Summary

For Month Ended may. 31

Particulars Details $ Amount

$

Costs charged to production

Costs of beginning goods in

process

Direct materials 3,000

Conversion 2,000 5,000

Costs incurred this period

Direct materials 30,000

Conversion 60,000 90,000

Total costs to account for 95,000

Unit cost information

Units to account for Units accounted for

Beginning goods in process 2,000

Completed & transferred

out

7,

00

0

Units started this period 6,000 Ending goods in process

1,

00

0

Total units to account for 8,000

Total units accounted

for

8,

00

0

Direct Convers

ion

Equivalent units of production Materials

Units completed & transferred

out 7,000 7,000

Units of ending goods in process 500 500

Equivalent units of production 7,500 7,500

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Role of cost control in managing the production - Assessment item 2

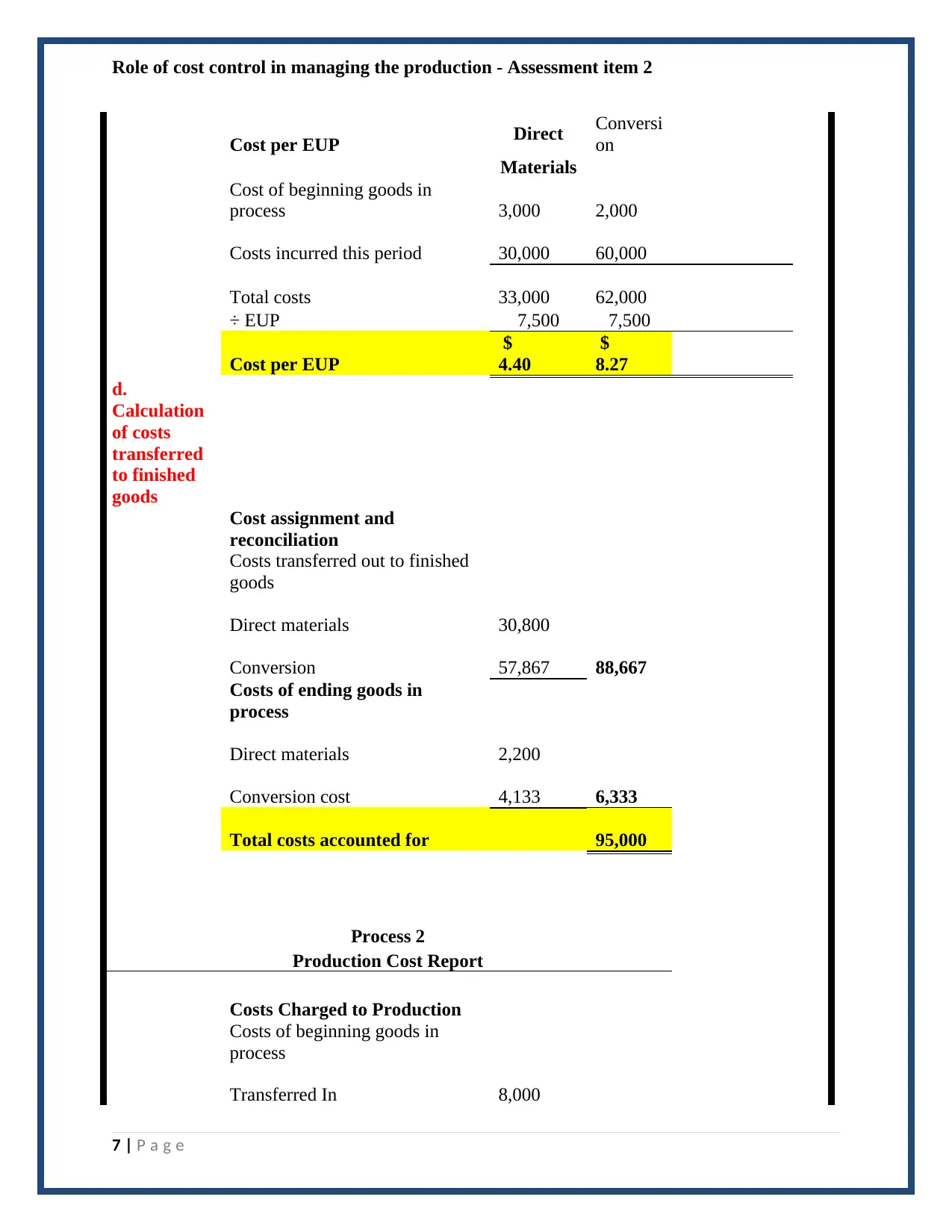

Cost per EUP Direct Conversi

on

Materials

Cost of beginning goods in

process 3,000 2,000

Costs incurred this period 30,000 60,000

Total costs 33,000 62,000

÷ EUP 7,500 7,500

Cost per EUP

$

4.40

$

8.27

d.

Calculation

of costs

transferred

to finished

goods

Cost assignment and

reconciliation

Costs transferred out to finished

goods

Direct materials 30,800

Conversion 57,867 88,667

Costs of ending goods in

process

Direct materials 2,200

Conversion cost 4,133 6,333

Total costs accounted for 95,000

Process 2

Production Cost Report

Costs Charged to Production

Costs of beginning goods in

process

Transferred In 8,000

7 | P a g e

Cost per EUP Direct Conversi

on

Materials

Cost of beginning goods in

process 3,000 2,000

Costs incurred this period 30,000 60,000

Total costs 33,000 62,000

÷ EUP 7,500 7,500

Cost per EUP

$

4.40

$

8.27

d.

Calculation

of costs

transferred

to finished

goods

Cost assignment and

reconciliation

Costs transferred out to finished

goods

Direct materials 30,800

Conversion 57,867 88,667

Costs of ending goods in

process

Direct materials 2,200

Conversion cost 4,133 6,333

Total costs accounted for 95,000

Process 2

Production Cost Report

Costs Charged to Production

Costs of beginning goods in

process

Transferred In 8,000

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Role of cost control in managing the production - Assessment item 2

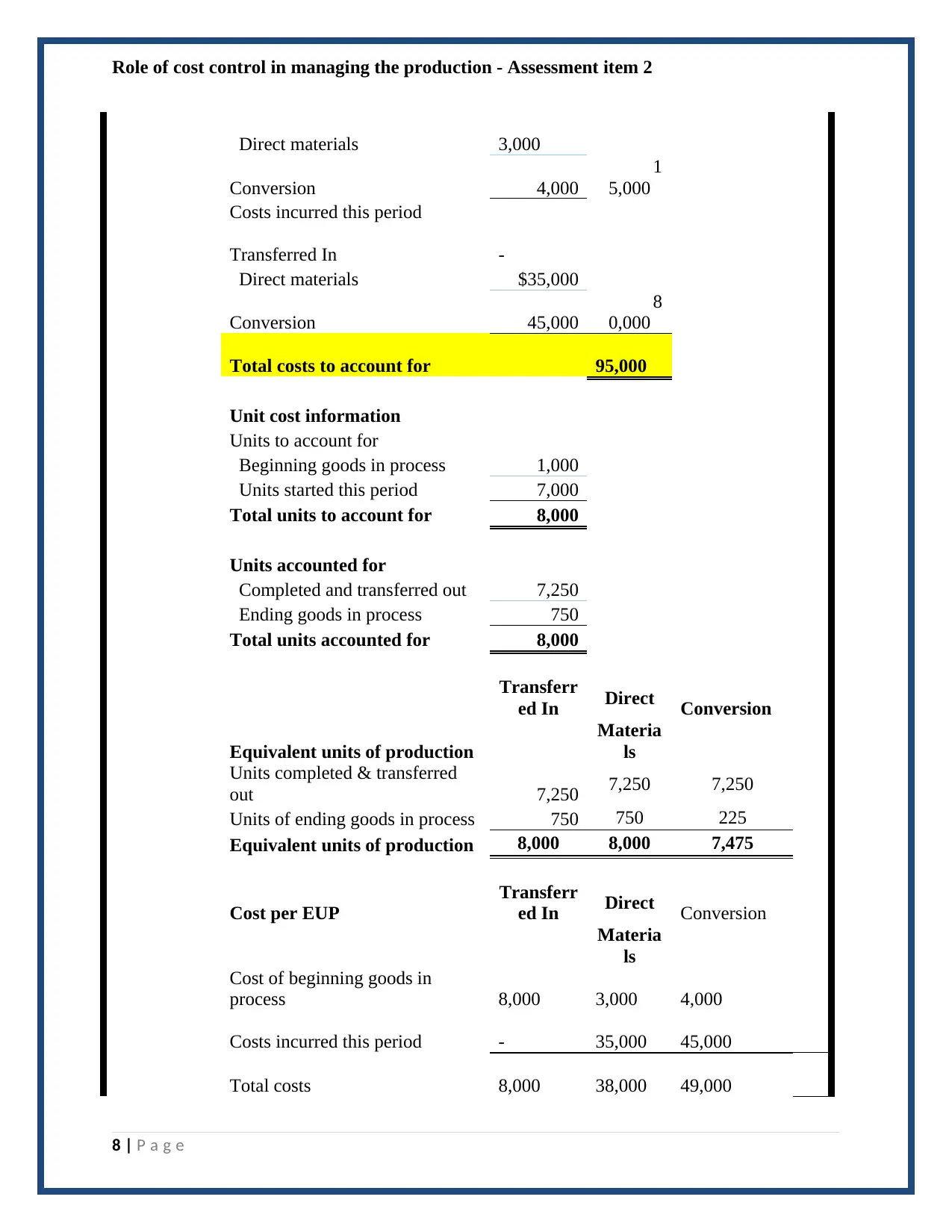

Direct materials 3,000

Conversion 4,000

1

5,000

Costs incurred this period

Transferred In -

Direct materials $35,000

Conversion 45,000

8

0,000

Total costs to account for 95,000

Unit cost information

Units to account for

Beginning goods in process 1,000

Units started this period 7,000

Total units to account for 8,000

Units accounted for

Completed and transferred out 7,250

Ending goods in process 750

Total units accounted for 8,000

Transferr

ed In Direct Conversion

Equivalent units of production

Materia

ls

Units completed & transferred

out 7,250 7,250 7,250

Units of ending goods in process 750 750 225

Equivalent units of production 8,000 8,000 7,475

Cost per EUP

Transferr

ed In Direct Conversion

Materia

ls

Cost of beginning goods in

process 8,000 3,000 4,000

Costs incurred this period - 35,000 45,000

Total costs 8,000 38,000 49,000

8 | P a g e

Direct materials 3,000

Conversion 4,000

1

5,000

Costs incurred this period

Transferred In -

Direct materials $35,000

Conversion 45,000

8

0,000

Total costs to account for 95,000

Unit cost information

Units to account for

Beginning goods in process 1,000

Units started this period 7,000

Total units to account for 8,000

Units accounted for

Completed and transferred out 7,250

Ending goods in process 750

Total units accounted for 8,000

Transferr

ed In Direct Conversion

Equivalent units of production

Materia

ls

Units completed & transferred

out 7,250 7,250 7,250

Units of ending goods in process 750 750 225

Equivalent units of production 8,000 8,000 7,475

Cost per EUP

Transferr

ed In Direct Conversion

Materia

ls

Cost of beginning goods in

process 8,000 3,000 4,000

Costs incurred this period - 35,000 45,000

Total costs 8,000 38,000 49,000

8 | P a g e

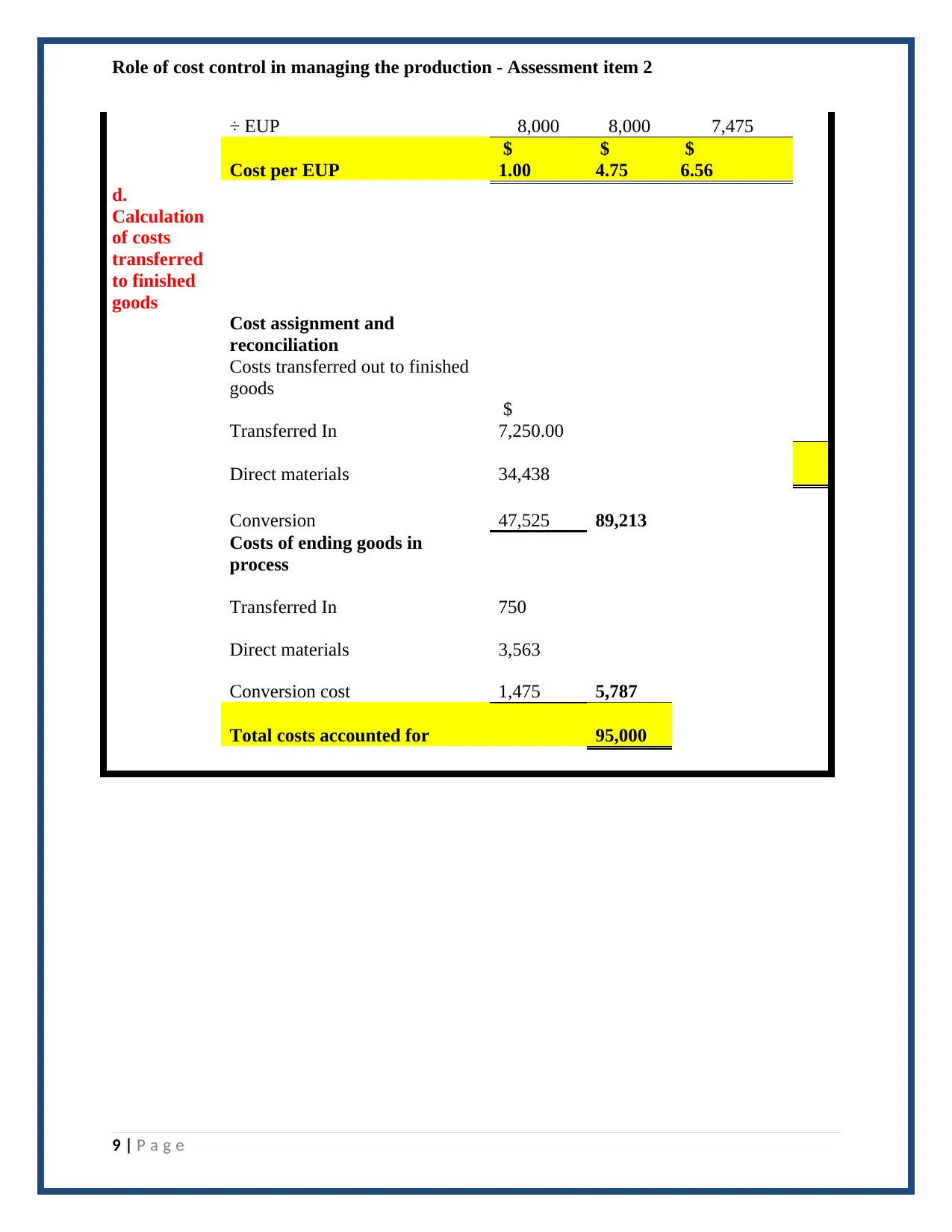

Role of cost control in managing the production - Assessment item 2

÷ EUP 8,000 8,000 7,475

Cost per EUP

$

1.00

$

4.75

$

6.56

d.

Calculation

of costs

transferred

to finished

goods

Cost assignment and

reconciliation

Costs transferred out to finished

goods

Transferred In

$

7,250.00

Direct materials 34,438

Conversion 47,525 89,213

Costs of ending goods in

process

Transferred In 750

Direct materials 3,563

Conversion cost 1,475 5,787

Total costs accounted for 95,000

9 | P a g e

÷ EUP 8,000 8,000 7,475

Cost per EUP

$

1.00

$

4.75

$

6.56

d.

Calculation

of costs

transferred

to finished

goods

Cost assignment and

reconciliation

Costs transferred out to finished

goods

Transferred In

$

7,250.00

Direct materials 34,438

Conversion 47,525 89,213

Costs of ending goods in

process

Transferred In 750

Direct materials 3,563

Conversion cost 1,475 5,787

Total costs accounted for 95,000

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Role of cost control in managing the production - Assessment item 2

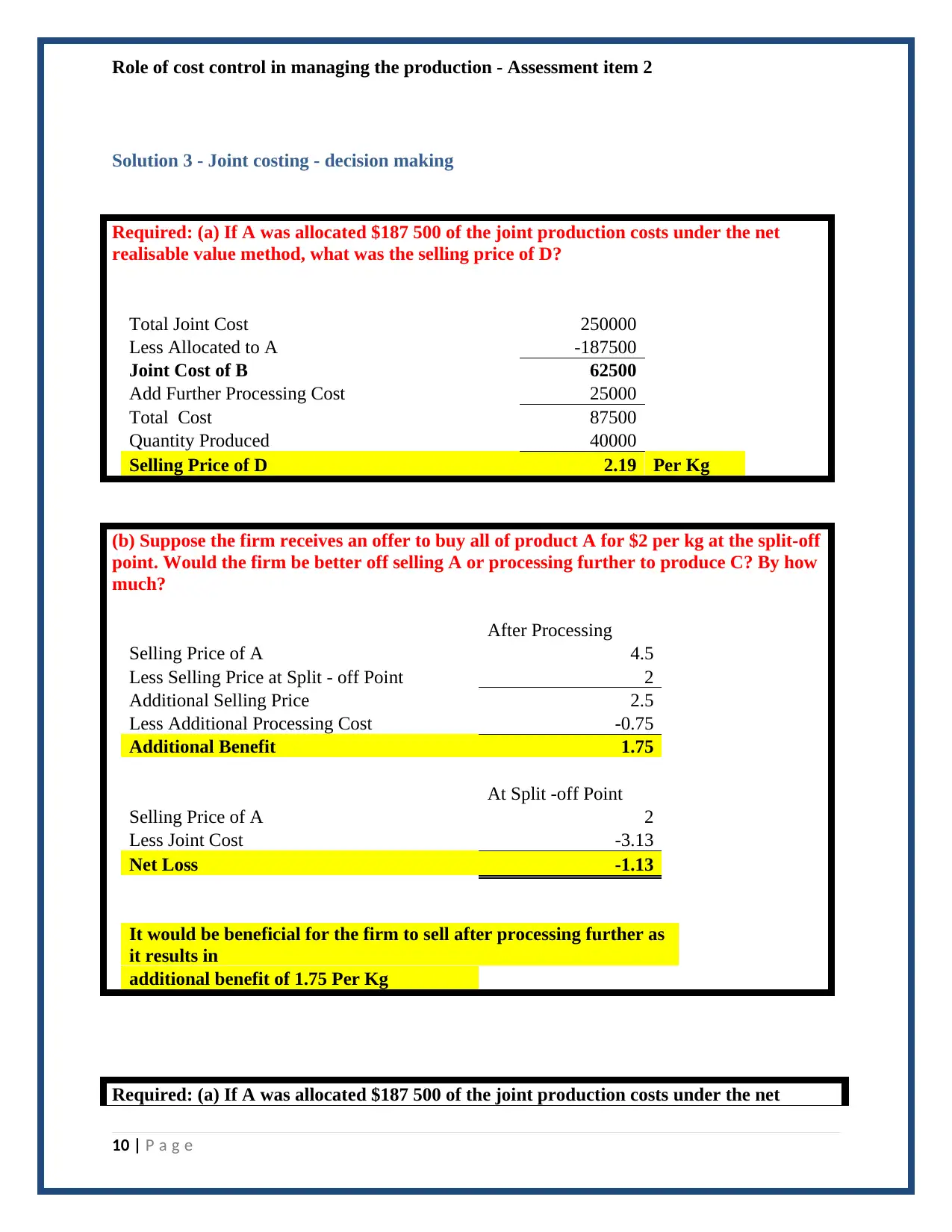

Solution 3 - Joint costing - decision making

Required: (a) If A was allocated $187 500 of the joint production costs under the net

realisable value method, what was the selling price of D?

Total Joint Cost 250000

Less Allocated to A -187500

Joint Cost of B 62500

Add Further Processing Cost 25000

Total Cost 87500

Quantity Produced 40000

Selling Price of D 2.19 Per Kg

(b) Suppose the firm receives an offer to buy all of product A for $2 per kg at the split-off

point. Would the firm be better off selling A or processing further to produce C? By how

much?

After Processing

Selling Price of A 4.5

Less Selling Price at Split - off Point 2

Additional Selling Price 2.5

Less Additional Processing Cost -0.75

Additional Benefit 1.75

At Split -off Point

Selling Price of A 2

Less Joint Cost -3.13

Net Loss -1.13

It would be beneficial for the firm to sell after processing further as

it results in

additional benefit of 1.75 Per Kg

Required: (a) If A was allocated $187 500 of the joint production costs under the net

10 | P a g e

Solution 3 - Joint costing - decision making

Required: (a) If A was allocated $187 500 of the joint production costs under the net

realisable value method, what was the selling price of D?

Total Joint Cost 250000

Less Allocated to A -187500

Joint Cost of B 62500

Add Further Processing Cost 25000

Total Cost 87500

Quantity Produced 40000

Selling Price of D 2.19 Per Kg

(b) Suppose the firm receives an offer to buy all of product A for $2 per kg at the split-off

point. Would the firm be better off selling A or processing further to produce C? By how

much?

After Processing

Selling Price of A 4.5

Less Selling Price at Split - off Point 2

Additional Selling Price 2.5

Less Additional Processing Cost -0.75

Additional Benefit 1.75

At Split -off Point

Selling Price of A 2

Less Joint Cost -3.13

Net Loss -1.13

It would be beneficial for the firm to sell after processing further as

it results in

additional benefit of 1.75 Per Kg

Required: (a) If A was allocated $187 500 of the joint production costs under the net

10 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

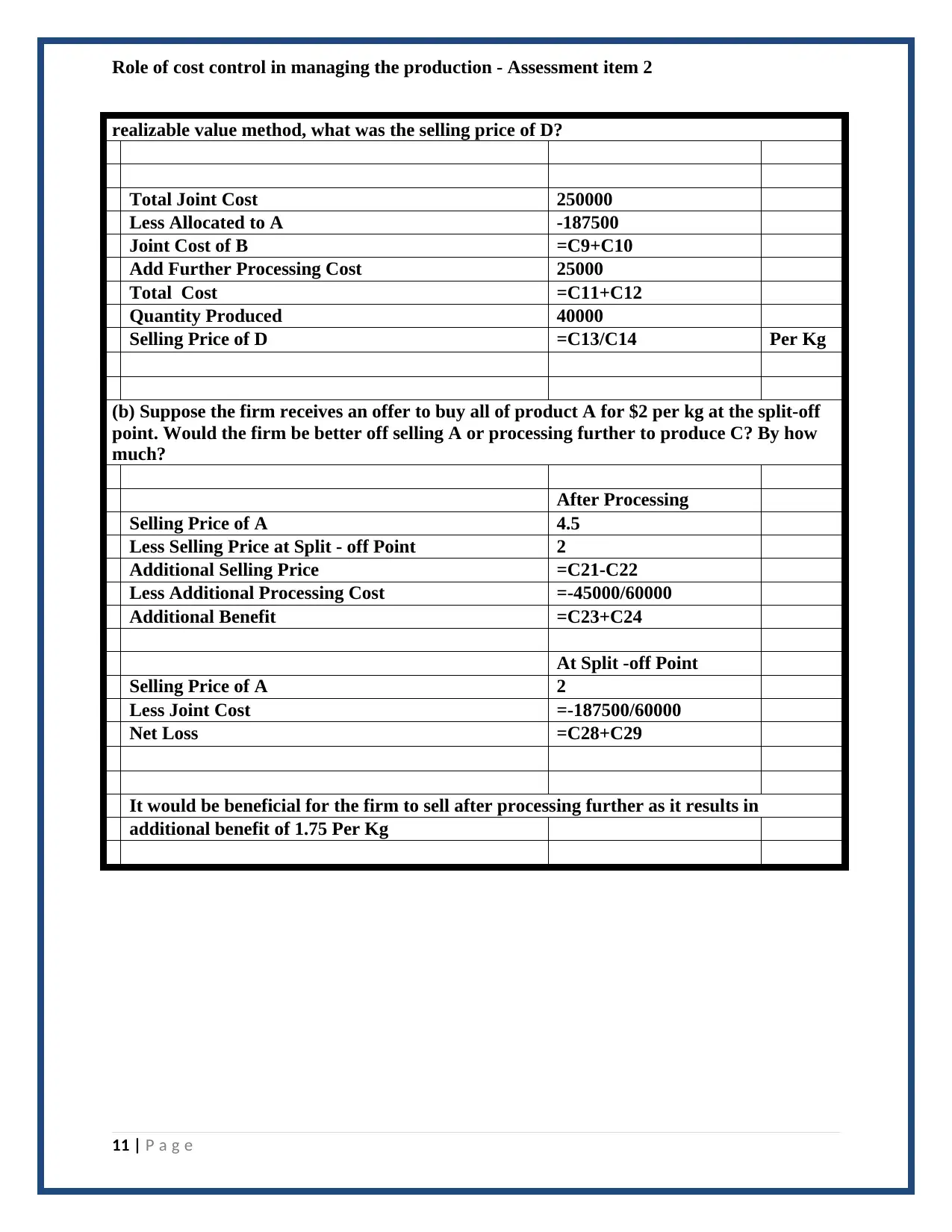

Role of cost control in managing the production - Assessment item 2

realizable value method, what was the selling price of D?

Total Joint Cost 250000

Less Allocated to A -187500

Joint Cost of B =C9+C10

Add Further Processing Cost 25000

Total Cost =C11+C12

Quantity Produced 40000

Selling Price of D =C13/C14 Per Kg

(b) Suppose the firm receives an offer to buy all of product A for $2 per kg at the split-off

point. Would the firm be better off selling A or processing further to produce C? By how

much?

After Processing

Selling Price of A 4.5

Less Selling Price at Split - off Point 2

Additional Selling Price =C21-C22

Less Additional Processing Cost =-45000/60000

Additional Benefit =C23+C24

At Split -off Point

Selling Price of A 2

Less Joint Cost =-187500/60000

Net Loss =C28+C29

It would be beneficial for the firm to sell after processing further as it results in

additional benefit of 1.75 Per Kg

11 | P a g e

realizable value method, what was the selling price of D?

Total Joint Cost 250000

Less Allocated to A -187500

Joint Cost of B =C9+C10

Add Further Processing Cost 25000

Total Cost =C11+C12

Quantity Produced 40000

Selling Price of D =C13/C14 Per Kg

(b) Suppose the firm receives an offer to buy all of product A for $2 per kg at the split-off

point. Would the firm be better off selling A or processing further to produce C? By how

much?

After Processing

Selling Price of A 4.5

Less Selling Price at Split - off Point 2

Additional Selling Price =C21-C22

Less Additional Processing Cost =-45000/60000

Additional Benefit =C23+C24

At Split -off Point

Selling Price of A 2

Less Joint Cost =-187500/60000

Net Loss =C28+C29

It would be beneficial for the firm to sell after processing further as it results in

additional benefit of 1.75 Per Kg

11 | P a g e

Role of cost control in managing the production - Assessment item 2

Solution 4 Variance analysis

12 | P a g e

Solution 4 Variance analysis

12 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.