Financial Management Report: Facebook, WhatsApp Merger & Dividends

VerifiedAdded on 2020/06/04

|12

|3849

|74

Report

AI Summary

This report delves into key aspects of financial management, exploring the concepts of dividend relevance and irrelevance, and their impact on shareholder wealth. It presents an overview of dividend relevance theories, including Walter's and Gordon's models, and their underlying assumptions. The report also examines the role of mergers and acquisitions in maximizing shareholder value, with a real-world case study of the Facebook-WhatsApp merger. Furthermore, it discusses the motives behind mergers and acquisitions, such as cost synergies and rapid growth, and how they contribute to enhanced profitability and market gains. The report also provides an analysis of how dividend policies affect share prices and discusses conflicting viewpoints from various authors. Overall, the report aims to provide a comprehensive understanding of financial management principles and their practical application in the business environment.

Financial Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

PART C............................................................................................................................................4

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

PART C............................................................................................................................................4

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Financial management refers to planning, organizing, directing and controlling various

financial activities of the enterprise. It can be related to procurement and utilization of funds

available to it. It plays an important role in accomplishing core objectives of the business in such

a manner that amount of available resources can be optimally used (Lunev and et.al., 2016). The

report makes comprehensive discussion regarding the core concept related to mergers and

acquisitions and its direct or indirect association to maximization of shareholders wealth. The

report also makes discussion regarding merger that took place between Facebook and What’s

App with the help of a numerical example. The report will then discuss regarding relevance and

irrelevance of dividend. Moreover, report will also help in analysing the relevance of dividend

payments in order to determine overall share prices of the company and understanding

conflicting viewpoints that has been given various authors in relation with this aspect.

PART A

By considering the operations of the business there will be use of various sources which

in turn will be effective and helpful as to have appropriate development of funds and operations.

Thus, it is a prime requirement of a business in order to make payments to their shareholders, on

the basis of level of securities acquired by them (Relevance and irrelevance theories of dividend,

2018). However, these are the benefits which will be made to shareholders as to have the

adequate analysis over the business operations. They are the liabilities to entity so making

payment to the is the prime requirements of the entity. However, there are various theories which

in turn will be effective and helpful to the business as to have proper dividend assessment such

as:

Dividend relevance theory:

The policies determined by the business professional which will have impacts over the

revenue and capital structure. Therefore, a suitable dividend policy will be beneficial in terms of

meeting the desired needs of shareholders as well as managing the capital structure of industry. It

will have huge impacts over changing the market value of the firm. The dividend policies will be

attractive to investors as well as suitable to the professionals of organisation (Truong, Huong and

Van Anh, 2017). Thus, if the dividend is relevant than there will be optimum payout ratios which

1

Financial management refers to planning, organizing, directing and controlling various

financial activities of the enterprise. It can be related to procurement and utilization of funds

available to it. It plays an important role in accomplishing core objectives of the business in such

a manner that amount of available resources can be optimally used (Lunev and et.al., 2016). The

report makes comprehensive discussion regarding the core concept related to mergers and

acquisitions and its direct or indirect association to maximization of shareholders wealth. The

report also makes discussion regarding merger that took place between Facebook and What’s

App with the help of a numerical example. The report will then discuss regarding relevance and

irrelevance of dividend. Moreover, report will also help in analysing the relevance of dividend

payments in order to determine overall share prices of the company and understanding

conflicting viewpoints that has been given various authors in relation with this aspect.

PART A

By considering the operations of the business there will be use of various sources which

in turn will be effective and helpful as to have appropriate development of funds and operations.

Thus, it is a prime requirement of a business in order to make payments to their shareholders, on

the basis of level of securities acquired by them (Relevance and irrelevance theories of dividend,

2018). However, these are the benefits which will be made to shareholders as to have the

adequate analysis over the business operations. They are the liabilities to entity so making

payment to the is the prime requirements of the entity. However, there are various theories which

in turn will be effective and helpful to the business as to have proper dividend assessment such

as:

Dividend relevance theory:

The policies determined by the business professional which will have impacts over the

revenue and capital structure. Therefore, a suitable dividend policy will be beneficial in terms of

meeting the desired needs of shareholders as well as managing the capital structure of industry. It

will have huge impacts over changing the market value of the firm. The dividend policies will be

attractive to investors as well as suitable to the professionals of organisation (Truong, Huong and

Van Anh, 2017). Thus, if the dividend is relevant than there will be optimum payout ratios which

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

in turn present the highest market value per share. Similarly, there are two approaches which will

be beneficial to have appropriate knowledge relevant with dividend policies such as:

Walter's Model:

In relation with this theory it can be said that the changes in firm's value is based on the

dividend payout ratio. Therefore, the elements which affects the dividend pay out ratios are

mainly relationship among the cost of capital, internal rate of return etc. which in turn gives the

proper information related with the operational practices of an organisation (Baker and Jabbouri,

2017). Therefore, this theory and approach will be based on various assumptions such as:

The financial stability of the firm is always with managing the entire investments on the basis of

retained earning. However, these are the revue which were left after making payments to all

the shareholders and trade payables and expenses etc.

There must be consistency in the rates of cost of capital and internal rate of return.

There must be distribution of the revenue retained by the firm in reinvestment and dividends

made internally (Wanjohi, 2017).

There will not be any changes in the earning and dividend payable by the company.

The business is ongoing concern and has the long term life.

Gordon's Model:

In relation with the theoretical concept of this approach is that here the dividend are to be

considered as the relevant object in the financial statement of the business (Kanwal and Hameed,

2017). Therefore, here the theory comprises with the fact that the divided are relevant in terms of

setting the firm's value in the market. Therefore, there are various assumptions which are needed

to be considered over several assumptions such as:

The industry must be comprises with all the equity in the chaptalisation. Therefore, there

will not be any debts or liabilities left in the organisation (Baker and Jabbouri, 2017).

There is no consideration of the outside financing and all the relevant investments were

being financed by the professionals as to have the adequate retained earning. These will

be helpful in securing the long term debts of the organisation as well as building the

ability to meet the cost of firm.

2

be beneficial to have appropriate knowledge relevant with dividend policies such as:

Walter's Model:

In relation with this theory it can be said that the changes in firm's value is based on the

dividend payout ratio. Therefore, the elements which affects the dividend pay out ratios are

mainly relationship among the cost of capital, internal rate of return etc. which in turn gives the

proper information related with the operational practices of an organisation (Baker and Jabbouri,

2017). Therefore, this theory and approach will be based on various assumptions such as:

The financial stability of the firm is always with managing the entire investments on the basis of

retained earning. However, these are the revue which were left after making payments to all

the shareholders and trade payables and expenses etc.

There must be consistency in the rates of cost of capital and internal rate of return.

There must be distribution of the revenue retained by the firm in reinvestment and dividends

made internally (Wanjohi, 2017).

There will not be any changes in the earning and dividend payable by the company.

The business is ongoing concern and has the long term life.

Gordon's Model:

In relation with the theoretical concept of this approach is that here the dividend are to be

considered as the relevant object in the financial statement of the business (Kanwal and Hameed,

2017). Therefore, here the theory comprises with the fact that the divided are relevant in terms of

setting the firm's value in the market. Therefore, there are various assumptions which are needed

to be considered over several assumptions such as:

The industry must be comprises with all the equity in the chaptalisation. Therefore, there

will not be any debts or liabilities left in the organisation (Baker and Jabbouri, 2017).

There is no consideration of the outside financing and all the relevant investments were

being financed by the professionals as to have the adequate retained earning. These will

be helpful in securing the long term debts of the organisation as well as building the

ability to meet the cost of firm.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It also comprises with the fact that there will be consistency in the internal rate of return

thus, it will be remain unchanged or constant for the longer terms (Anjali and Raju,

2017).

The costs of capital of entity will be consistent only if there are any changes in the risk

complexion in entity.

The earnings of firm will drive the perpetuity.

There will also be consistency in the retention ratio as well as growth of firm. Thus, it can

be said that the growth rate of firm will have the comparatively fixed ratio of

development in the period.

There will not be any existence of the corporate taxes. Therefore, this will remain

consistent and adequate as to have appropriate growth and development of the firm's

value.

The theory consists of the fact that there will be increase in the share prices which will

eventually decrease the dividend payout ratio (Oloyede, Olaoye and Oluwaleye, 2018).

The capital markets are perfect as the investors in the organisation will have rational

information regrading the operational activities as well as transactional costs in such

functions. Thus, there will be no influences to the market price of shares.

Dividend irrelevance theory

According to the views of Wanjohi, (2017), dividend irrelevance theory presents that

investors do not require concerning themselves with the policies undertaken by the company in

relation to same. Moreover, investors have option in relation to selling the portion of their

portfolio of equities whenever they need cash. Such a theoretical framework presents that

company’s declaration and dividend payment has little or no impact on stock price. In other

words, it can be depicted that dividends do not add value in the company’s price. Anjali and

Raju, (2017) assessed in their study, by considering MM model that in a perfect market where no

tax and bankruptcy cost exists dividend policy is regarded as irrelevant. On the basis of MM

model dividend policy has no impact on stock’s price and capital structure of the company. MM

model assumes that when an investor gets more than the expectation level a then excess amount

can be re-invested in company’s stock with surplus cash flow. On the other side, when level of

3

thus, it will be remain unchanged or constant for the longer terms (Anjali and Raju,

2017).

The costs of capital of entity will be consistent only if there are any changes in the risk

complexion in entity.

The earnings of firm will drive the perpetuity.

There will also be consistency in the retention ratio as well as growth of firm. Thus, it can

be said that the growth rate of firm will have the comparatively fixed ratio of

development in the period.

There will not be any existence of the corporate taxes. Therefore, this will remain

consistent and adequate as to have appropriate growth and development of the firm's

value.

The theory consists of the fact that there will be increase in the share prices which will

eventually decrease the dividend payout ratio (Oloyede, Olaoye and Oluwaleye, 2018).

The capital markets are perfect as the investors in the organisation will have rational

information regrading the operational activities as well as transactional costs in such

functions. Thus, there will be no influences to the market price of shares.

Dividend irrelevance theory

According to the views of Wanjohi, (2017), dividend irrelevance theory presents that

investors do not require concerning themselves with the policies undertaken by the company in

relation to same. Moreover, investors have option in relation to selling the portion of their

portfolio of equities whenever they need cash. Such a theoretical framework presents that

company’s declaration and dividend payment has little or no impact on stock price. In other

words, it can be depicted that dividends do not add value in the company’s price. Anjali and

Raju, (2017) assessed in their study, by considering MM model that in a perfect market where no

tax and bankruptcy cost exists dividend policy is regarded as irrelevant. On the basis of MM

model dividend policy has no impact on stock’s price and capital structure of the company. MM

model assumes that when an investor gets more than the expectation level a then excess amount

can be re-invested in company’s stock with surplus cash flow. On the other side, when level of

3

expected dividend is small then there is possibility that investor will sell some part of the shares.

Hence, dividend policy of the business unit is not relevant because investors have ability to

create their own cash flows. However, on the critical note, Truong, Huong and Van Anh, (2017)

depicted in their study that assumptions related to the existence of perfect capital market is

unrealistic in nature. On the other side, in the real worlds, perfect capital market does not exist.

The rationale behind this, taxes are usually present in the capital market. Further, it is based on

an unrealistic assumption that no difference takes place between internal and external financing.

However, when floatation costs of new issues are taken into consideration then it considered as

false (Baker and Jabbouri, 2017). It is also criticized on the basis of aspect that shareholders'

wealth are not influenced from dividend.

PART C

The Mergers and Acquisitions are important one for organisation so that it may be able to

inject higher growth and prospectus in the best possible manner. This is done by organisation as

internal growth opportunities are not available and as such, company can take external

opportunities with the help of mergers and acquisitions. This will provide ample of growth and

as such, operations can be maximised with much ease. Moreover, organisation will be expand its

reach to more markets which are not tapped by it. This will inject revenue and organisation will

be able to gain more market share as well. The common reason behind mergers and acquisitions

is that organisation is able to initiate control over markets in the best possible manner.

Furthermore, economies of scale is obtained by such process and this leads to cost savings for

the firm and as a result, more efficiency can be gained with much ease (Brueller, Carmeli and

Markman, 2018).

Financial risk can be managed in effectual way as risk prevailing in the market is shared

between two organisations leading to double efficiency. One company can be benefited by taking

over another company as technological advancements can be acquired helping organisation to

effectively attain competitive edge in the market in the best possible manner. On the other hand,

shareholders' of the acquiring company are also benefited by acquisitions as well. Initially stock

price of the acquiring is not increased instantly but as company acquires another company, share

price goes up leading to several benefits to shareholders in effective way. Profitability position of

company increases leading to enhance market gains and sales also gets hiked in the best possible

4

Hence, dividend policy of the business unit is not relevant because investors have ability to

create their own cash flows. However, on the critical note, Truong, Huong and Van Anh, (2017)

depicted in their study that assumptions related to the existence of perfect capital market is

unrealistic in nature. On the other side, in the real worlds, perfect capital market does not exist.

The rationale behind this, taxes are usually present in the capital market. Further, it is based on

an unrealistic assumption that no difference takes place between internal and external financing.

However, when floatation costs of new issues are taken into consideration then it considered as

false (Baker and Jabbouri, 2017). It is also criticized on the basis of aspect that shareholders'

wealth are not influenced from dividend.

PART C

The Mergers and Acquisitions are important one for organisation so that it may be able to

inject higher growth and prospectus in the best possible manner. This is done by organisation as

internal growth opportunities are not available and as such, company can take external

opportunities with the help of mergers and acquisitions. This will provide ample of growth and

as such, operations can be maximised with much ease. Moreover, organisation will be expand its

reach to more markets which are not tapped by it. This will inject revenue and organisation will

be able to gain more market share as well. The common reason behind mergers and acquisitions

is that organisation is able to initiate control over markets in the best possible manner.

Furthermore, economies of scale is obtained by such process and this leads to cost savings for

the firm and as a result, more efficiency can be gained with much ease (Brueller, Carmeli and

Markman, 2018).

Financial risk can be managed in effectual way as risk prevailing in the market is shared

between two organisations leading to double efficiency. One company can be benefited by taking

over another company as technological advancements can be acquired helping organisation to

effectively attain competitive edge in the market in the best possible manner. On the other hand,

shareholders' of the acquiring company are also benefited by acquisitions as well. Initially stock

price of the acquiring is not increased instantly but as company acquires another company, share

price goes up leading to several benefits to shareholders in effective way. Profitability position of

company increases leading to enhance market gains and sales also gets hiked in the best possible

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

manner (Holburn and Bergh, 2014). This leads to more profits and ultimate benefit is provided to

shareholders as desired dividends are being paid to them which eventually aligns core financial

objective of wealth maximisation of shareholder with much ease. Furthermore, it enhances trust

of the investors and as such, more investment can be easily garnered by the acquiring company

in effective way. Thus, investors' become loyal as wealth maximisation objective is fulfilled by

company through acquiring another organisation.

The motives of mergers are numerous such as it leads to cost synergies (Motives of

merger. 2018). This means that bigger form of company can be attained with successful

acquisitions and mergers. It directly leads to maximum revenue as costs can be decreased up to a

high extent. Moreover, another motive of mergers is that rapid growth can be accomplished in

the best possible manner. Thus, risk can be minimised as well because of such mergers. Unique

capabilities can be achieved by the company. This is required as at certain point of time company

lacks that extraordinary factor which is essential as more growth can be achieved in effectual

manner. Another motive is that EPS (Earnings Per Share) of the organisation boosts up which

leads to enhance profits and is the ultimate goal of firm so that stock price may be injected and

income can be earned with much ease. Furthermore, this help to attain shareholder wealth

maximisation objective as well (Zhang and et.al, 2015).

Mergers and takeovers helps in strengthening the organizations and helps them in enhancing

their profitability aspect to the maximum. The working conditions of the organization improves

in a manner that both the organizations that are coming up for mergers are able to fulfil the core

objectives of the businesses. The current and real life example of mergers and Takeover can be

that of mergers and takeovers where Facebook opted for purchasing messaging application Wats

App with the total deal of $19bn (£11.4bn), both in the form of cash and shares in 2014 (Barnes,

2016).

What’s App has more that 450 million users at that time with the people who avoid to send

text messages to their peers due to charges implemented on it by the telecom companies where,

wats app allow its user to send messages over internet, which is free of any cost. The deal

included $ 4 billion in cash and $ 12 billion worth of Facebook shares plus with an additional

stock of $ 3 billion. The owner of What’s App have now been ale to become one of the board of

directors of Facebook and also share adequate amount of authority to take decisions for

5

shareholders as desired dividends are being paid to them which eventually aligns core financial

objective of wealth maximisation of shareholder with much ease. Furthermore, it enhances trust

of the investors and as such, more investment can be easily garnered by the acquiring company

in effective way. Thus, investors' become loyal as wealth maximisation objective is fulfilled by

company through acquiring another organisation.

The motives of mergers are numerous such as it leads to cost synergies (Motives of

merger. 2018). This means that bigger form of company can be attained with successful

acquisitions and mergers. It directly leads to maximum revenue as costs can be decreased up to a

high extent. Moreover, another motive of mergers is that rapid growth can be accomplished in

the best possible manner. Thus, risk can be minimised as well because of such mergers. Unique

capabilities can be achieved by the company. This is required as at certain point of time company

lacks that extraordinary factor which is essential as more growth can be achieved in effectual

manner. Another motive is that EPS (Earnings Per Share) of the organisation boosts up which

leads to enhance profits and is the ultimate goal of firm so that stock price may be injected and

income can be earned with much ease. Furthermore, this help to attain shareholder wealth

maximisation objective as well (Zhang and et.al, 2015).

Mergers and takeovers helps in strengthening the organizations and helps them in enhancing

their profitability aspect to the maximum. The working conditions of the organization improves

in a manner that both the organizations that are coming up for mergers are able to fulfil the core

objectives of the businesses. The current and real life example of mergers and Takeover can be

that of mergers and takeovers where Facebook opted for purchasing messaging application Wats

App with the total deal of $19bn (£11.4bn), both in the form of cash and shares in 2014 (Barnes,

2016).

What’s App has more that 450 million users at that time with the people who avoid to send

text messages to their peers due to charges implemented on it by the telecom companies where,

wats app allow its user to send messages over internet, which is free of any cost. The deal

included $ 4 billion in cash and $ 12 billion worth of Facebook shares plus with an additional

stock of $ 3 billion. The owner of What’s App have now been ale to become one of the board of

directors of Facebook and also share adequate amount of authority to take decisions for

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Facebook and what’s App with other appointed board of directors. What’s App has now been

able to gather a bigger platform where various addition in the application has been introduced so

as to make it user friendly and enhance the overall customer base of the application as well

(Banga and Gupta, 2012).

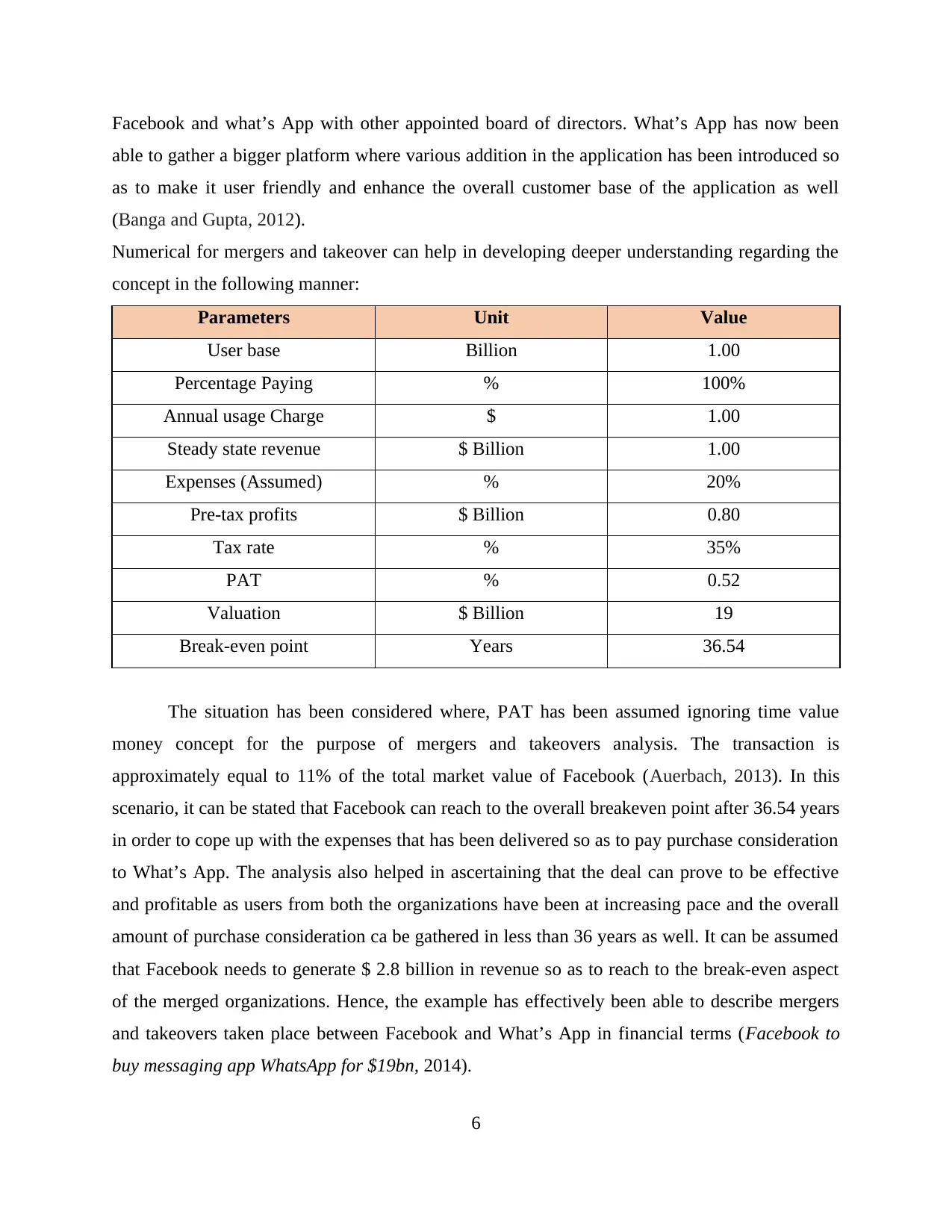

Numerical for mergers and takeover can help in developing deeper understanding regarding the

concept in the following manner:

Parameters Unit Value

User base Billion 1.00

Percentage Paying % 100%

Annual usage Charge $ 1.00

Steady state revenue $ Billion 1.00

Expenses (Assumed) % 20%

Pre-tax profits $ Billion 0.80

Tax rate % 35%

PAT % 0.52

Valuation $ Billion 19

Break-even point Years 36.54

The situation has been considered where, PAT has been assumed ignoring time value

money concept for the purpose of mergers and takeovers analysis. The transaction is

approximately equal to 11% of the total market value of Facebook (Auerbach, 2013). In this

scenario, it can be stated that Facebook can reach to the overall breakeven point after 36.54 years

in order to cope up with the expenses that has been delivered so as to pay purchase consideration

to What’s App. The analysis also helped in ascertaining that the deal can prove to be effective

and profitable as users from both the organizations have been at increasing pace and the overall

amount of purchase consideration ca be gathered in less than 36 years as well. It can be assumed

that Facebook needs to generate $ 2.8 billion in revenue so as to reach to the break-even aspect

of the merged organizations. Hence, the example has effectively been able to describe mergers

and takeovers taken place between Facebook and What’s App in financial terms (Facebook to

buy messaging app WhatsApp for $19bn, 2014).

6

able to gather a bigger platform where various addition in the application has been introduced so

as to make it user friendly and enhance the overall customer base of the application as well

(Banga and Gupta, 2012).

Numerical for mergers and takeover can help in developing deeper understanding regarding the

concept in the following manner:

Parameters Unit Value

User base Billion 1.00

Percentage Paying % 100%

Annual usage Charge $ 1.00

Steady state revenue $ Billion 1.00

Expenses (Assumed) % 20%

Pre-tax profits $ Billion 0.80

Tax rate % 35%

PAT % 0.52

Valuation $ Billion 19

Break-even point Years 36.54

The situation has been considered where, PAT has been assumed ignoring time value

money concept for the purpose of mergers and takeovers analysis. The transaction is

approximately equal to 11% of the total market value of Facebook (Auerbach, 2013). In this

scenario, it can be stated that Facebook can reach to the overall breakeven point after 36.54 years

in order to cope up with the expenses that has been delivered so as to pay purchase consideration

to What’s App. The analysis also helped in ascertaining that the deal can prove to be effective

and profitable as users from both the organizations have been at increasing pace and the overall

amount of purchase consideration ca be gathered in less than 36 years as well. It can be assumed

that Facebook needs to generate $ 2.8 billion in revenue so as to reach to the break-even aspect

of the merged organizations. Hence, the example has effectively been able to describe mergers

and takeovers taken place between Facebook and What’s App in financial terms (Facebook to

buy messaging app WhatsApp for $19bn, 2014).

6

The mergers and acquisitions also has certain disadvantages as well. One of the major

demerit is that employees of firm may require more training and additional skills will be requied

so that goals can be achieved quite effectually. Merging two same organisations which are

carrying similar business leads to duplication and overlapping of work leading to wastage of time

and resources in effective manner. On the other hand, process of merger can be explained below-

Valuation of businesses

The valuation of business is required so that present and future value can be assessed in a

better way. Complete study of company should be evaluated such as background, market share,

organisational culture, strengths and weakness and many other factors play crucial role while

evaluating company.

Proposal phase

This is the further process in which company sends proposal to other firm to successful

merger or acquisition with much ease. The details sent are amount which is purchase

consideration, strategies and commitments as well.

Exit planning

This is the stage where company takes decision to sell its firm and as such, exit planning

should take place so that it may be organised in a better way. All financial issues are taken into

account and sale takes place (Kansal and Chandani, 2014).

Structuring deal

The deal is finalised and as such, acquiring organisation has to make marketing and

implement strategies so that business may be enhanced in the best possible manner. Thus,

leading emphasis on structured deal.

Integration

This is the formal integration stage where two organisations involved in the merger

process come together for signing the document which contains agreement and as such,

negotiating process takes place with much ease. Moreover, relationships of two companies are

also discussed in this stage.

Venture operations

7

demerit is that employees of firm may require more training and additional skills will be requied

so that goals can be achieved quite effectually. Merging two same organisations which are

carrying similar business leads to duplication and overlapping of work leading to wastage of time

and resources in effective manner. On the other hand, process of merger can be explained below-

Valuation of businesses

The valuation of business is required so that present and future value can be assessed in a

better way. Complete study of company should be evaluated such as background, market share,

organisational culture, strengths and weakness and many other factors play crucial role while

evaluating company.

Proposal phase

This is the further process in which company sends proposal to other firm to successful

merger or acquisition with much ease. The details sent are amount which is purchase

consideration, strategies and commitments as well.

Exit planning

This is the stage where company takes decision to sell its firm and as such, exit planning

should take place so that it may be organised in a better way. All financial issues are taken into

account and sale takes place (Kansal and Chandani, 2014).

Structuring deal

The deal is finalised and as such, acquiring organisation has to make marketing and

implement strategies so that business may be enhanced in the best possible manner. Thus,

leading emphasis on structured deal.

Integration

This is the formal integration stage where two organisations involved in the merger

process come together for signing the document which contains agreement and as such,

negotiating process takes place with much ease. Moreover, relationships of two companies are

also discussed in this stage.

Venture operations

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This is the last stage of merger and acquisition process in which companies have signed

the deal and now venture operations should take place. Thus, desires and expectations of

companies involved in the process is done in effective way (Tanriverdi and Uysal, 2015).

The mergers are financed through various methods. Among them is stock exchanging

which means that company buys stock of another company by scrutinising balance sheets in the

best possible manner. Cash payment is another method through which mergers can be financed.

This is an alternative to exchanging stock. Issuing bonds are another way as lenders and owners

can meet to make agreement for arranging payment in effective way. The parties involved in the

merger process are Purchaser, sellers, Board of Directors, lawyers involved in the process.

Moreover, attorneys, investment bankers are also involved in the merger and acquisition process

and as such, shareholders' wealth maximisation objective is aligned to acquisition and expansion

of the firm.

CONCLUSION

Based on the above report, it can be concluded that, dividend plays an important role in

determining the overall prices of shares of the company. Authors have been able to state that

based on the prices of dividend being paid in earlier period, it is decided by the shareholders that

whether they want to make investment in the organization or not. Moreover, the percentage

dividend paid by them also stimulates new shareholders to invest in the organization. Another

aspect that has been discussed in the report is related to merger and takeovers. It plays an

important role in strengthening core aspects of business operations so that two organizations can

together generate maximum amount of profits. A comprehensive discussion of What’s App and

Facebook merger case has been discussed in the report so as to analyse the key aspects related to

subject matter. It helps in assessing that What’s App has been able to get enhanced customer

base where they can target maximum number of customers towards it.

8

the deal and now venture operations should take place. Thus, desires and expectations of

companies involved in the process is done in effective way (Tanriverdi and Uysal, 2015).

The mergers are financed through various methods. Among them is stock exchanging

which means that company buys stock of another company by scrutinising balance sheets in the

best possible manner. Cash payment is another method through which mergers can be financed.

This is an alternative to exchanging stock. Issuing bonds are another way as lenders and owners

can meet to make agreement for arranging payment in effective way. The parties involved in the

merger process are Purchaser, sellers, Board of Directors, lawyers involved in the process.

Moreover, attorneys, investment bankers are also involved in the merger and acquisition process

and as such, shareholders' wealth maximisation objective is aligned to acquisition and expansion

of the firm.

CONCLUSION

Based on the above report, it can be concluded that, dividend plays an important role in

determining the overall prices of shares of the company. Authors have been able to state that

based on the prices of dividend being paid in earlier period, it is decided by the shareholders that

whether they want to make investment in the organization or not. Moreover, the percentage

dividend paid by them also stimulates new shareholders to invest in the organization. Another

aspect that has been discussed in the report is related to merger and takeovers. It plays an

important role in strengthening core aspects of business operations so that two organizations can

together generate maximum amount of profits. A comprehensive discussion of What’s App and

Facebook merger case has been discussed in the report so as to analyse the key aspects related to

subject matter. It helps in assessing that What’s App has been able to get enhanced customer

base where they can target maximum number of customers towards it.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Anjali, R. and Raju, G. A., 2017. Dividend Announcement and Market Efficiency-An Empirical

Study on Service Sector Companies Listed in BSE. SDMIMD Journal of

Management. 8(1). pp.1-10.

Auerbach, A. J. ed., 2013. Corporate takeovers: Causes and consequences. University of

Chicago Press.

Baker, H. K. and Jabbouri, I., 2017. How Moroccan institutional investors view dividend

policy. Managerial Finance. 43(12). pp.1332-1347.

Banga, C. and Gupta, A., 2012. Motives for mergers and takeovers in the Indian mutual fund

industry. Vikalpa. 37(2). pp.33-42.

Barnes, P., 2016. Stock market efficiency, insider dealing and market abuse. Gower.

Brueller, N. N., Carmeli, A. and Markman, G. D., 2018. Linking merger and acquisition

strategies to postmerger integration: a configurational perspective of human resource

management.Journal of Management. 44(5). pp.1793-1818.

Holburn, G. L. and Vanden Bergh, R. G., 2014. Integrated market and nonmarket strategies:

Political campaign contributions around merger and acquisition events in the energy

sector. Strategic Management Journal. 35(3). pp.450-460.

Kansal, S. and Chandani, A., 2014. Effective management of change during merger and

acquisition. Procedia Economics and Finance. 11. pp.208-217.

Kanwal, M. and Hameed, S., 2017. The Relationship between Dividend Payout And Firm

Financial Performance. Research in Business and Management. 4(1). pp.5-13.

9

Books and Journals

Anjali, R. and Raju, G. A., 2017. Dividend Announcement and Market Efficiency-An Empirical

Study on Service Sector Companies Listed in BSE. SDMIMD Journal of

Management. 8(1). pp.1-10.

Auerbach, A. J. ed., 2013. Corporate takeovers: Causes and consequences. University of

Chicago Press.

Baker, H. K. and Jabbouri, I., 2017. How Moroccan institutional investors view dividend

policy. Managerial Finance. 43(12). pp.1332-1347.

Banga, C. and Gupta, A., 2012. Motives for mergers and takeovers in the Indian mutual fund

industry. Vikalpa. 37(2). pp.33-42.

Barnes, P., 2016. Stock market efficiency, insider dealing and market abuse. Gower.

Brueller, N. N., Carmeli, A. and Markman, G. D., 2018. Linking merger and acquisition

strategies to postmerger integration: a configurational perspective of human resource

management.Journal of Management. 44(5). pp.1793-1818.

Holburn, G. L. and Vanden Bergh, R. G., 2014. Integrated market and nonmarket strategies:

Political campaign contributions around merger and acquisition events in the energy

sector. Strategic Management Journal. 35(3). pp.450-460.

Kansal, S. and Chandani, A., 2014. Effective management of change during merger and

acquisition. Procedia Economics and Finance. 11. pp.208-217.

Kanwal, M. and Hameed, S., 2017. The Relationship between Dividend Payout And Firm

Financial Performance. Research in Business and Management. 4(1). pp.5-13.

9

Lunev, A. N. and et.al., 2016. The mechanism of industrial educational clusters creation as

managerial entities of vocational education. International Review of Management and

Marketing. 6(2S).

Oloyede, J. A., Olaoye, C. O. and Oluwaleye, T. O., 2018. Impact Of Corporate Taxation On

Dividend Policy Of Quoted Firms In Nigeria. Advances in Social Sciences Research

Journal. 5(3).

Tanriverdi, H. and Uysal, V. B., 2015. When IT capabilities are not scale-free in merger and

acquisition integrations: how do capital markets react to IT capability asymmetries

between acquirer and target?. European Journal of Information Systems. 24(2). pp.145-

158.

Truong, N. X., Huong, D. M. and Van Anh, N. T., 2017. Stock price reaction to cash dividend

announcements in Vietnam. Journal of Economic Development. (JED, Vol. 24 (2)). pp.74-

89.

Wanjohi, M. M., 2017. Effects of dividend policy on shareholders wealth: Evidence from

insurance firms in the Kenya. International Academic Journal of Economics and

Finance. 2(3). pp.183-205.

Zhang, J. and et.al, 2015. The effect of leadership style on talent retention during merger and

acquisition integration: Evidence from China. The International Journal of Human

Resource Management. 26(7). pp.1021-1050.

Online

Facebook to buy messaging app WhatsApp for $19bn. 2014. [Online]. Available through

<http://www.bbc.com/news/business-26266689>

Relevance and irrelevance theories of dividend. 2018. [Online]. Available through

:<http://makemynote.weebly.com/relevance-and-irrelevance-theories-of-dividend.html>

Motives of merger. 2018 [Online] Available Through:

<https://efinancemanagement.com/mergers-and-acquisitions/motives-of-mergers>

10

managerial entities of vocational education. International Review of Management and

Marketing. 6(2S).

Oloyede, J. A., Olaoye, C. O. and Oluwaleye, T. O., 2018. Impact Of Corporate Taxation On

Dividend Policy Of Quoted Firms In Nigeria. Advances in Social Sciences Research

Journal. 5(3).

Tanriverdi, H. and Uysal, V. B., 2015. When IT capabilities are not scale-free in merger and

acquisition integrations: how do capital markets react to IT capability asymmetries

between acquirer and target?. European Journal of Information Systems. 24(2). pp.145-

158.

Truong, N. X., Huong, D. M. and Van Anh, N. T., 2017. Stock price reaction to cash dividend

announcements in Vietnam. Journal of Economic Development. (JED, Vol. 24 (2)). pp.74-

89.

Wanjohi, M. M., 2017. Effects of dividend policy on shareholders wealth: Evidence from

insurance firms in the Kenya. International Academic Journal of Economics and

Finance. 2(3). pp.183-205.

Zhang, J. and et.al, 2015. The effect of leadership style on talent retention during merger and

acquisition integration: Evidence from China. The International Journal of Human

Resource Management. 26(7). pp.1021-1050.

Online

Facebook to buy messaging app WhatsApp for $19bn. 2014. [Online]. Available through

<http://www.bbc.com/news/business-26266689>

Relevance and irrelevance theories of dividend. 2018. [Online]. Available through

:<http://makemynote.weebly.com/relevance-and-irrelevance-theories-of-dividend.html>

Motives of merger. 2018 [Online] Available Through:

<https://efinancemanagement.com/mergers-and-acquisitions/motives-of-mergers>

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.