Analysis of Financial Performance and Cash Flow of Ryanair

VerifiedAdded on 2023/06/13

|14

|3565

|134

AI Summary

This report provides an analysis of the financial performance and cash flow of Ryanair, the largest low fare airline based in Ireland. It includes ratio analysis of profitability, liquidity, solvency, activity and investment ratios. The report also includes analysis of cash flow, operating profit and earnings per share.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ADVANCED REPORTING

Advance reporting

Name of the student

Name of the university

Student ID

Author note

Advance reporting

Name of the student

Name of the university

Student ID

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ADVANCED REPORTING

Table of Contents

Introduction................................................................................................................................2

1. Analysis of financial performance......................................................................................2

1. Analysis of cash flow, operating profit and earnings per share..........................................8

2. Potential investment review................................................................................................9

3. Overall conclusion..............................................................................................................9

Reference..................................................................................................................................11

Appendix..................................................................................................................................12

Table of Contents

Introduction................................................................................................................................2

1. Analysis of financial performance......................................................................................2

1. Analysis of cash flow, operating profit and earnings per share..........................................8

2. Potential investment review................................................................................................9

3. Overall conclusion..............................................................................................................9

Reference..................................................................................................................................11

Appendix..................................................................................................................................12

2ADVANCED REPORTING

Introduction

Ryan air is the largest and low fare airline that is based in Ireland. The company is a

public listed company and trades in New York, London and Dublin. Ryan air is committed

towards low cost airfare and it is introducing competition for the growing airline market in

Europe it has the potential to offer the passengers with the lowest fare in the industry and

high efficiency and low cost in the airport. The company started its operation during 1985

and launched 15 flights per day day between London Gatwik Airport Waterford and Turbine

support. Despite of being successful, Ryanair is committed to lower airfare, maximization of

low fare seats and increasing the service frequency. Direct competitors of the company are

various airlines that includes Scandanavian airline, Lufthansa, Alitalia, Air France and Aer

Lingus. However, the company’s unparalleled low fares, comfortable in-flight service, high

frequency, on time flights have helped it to win continuous increase in customer number and

supports from them (Ryanair.com 2018).

1. Analysis of financial performance

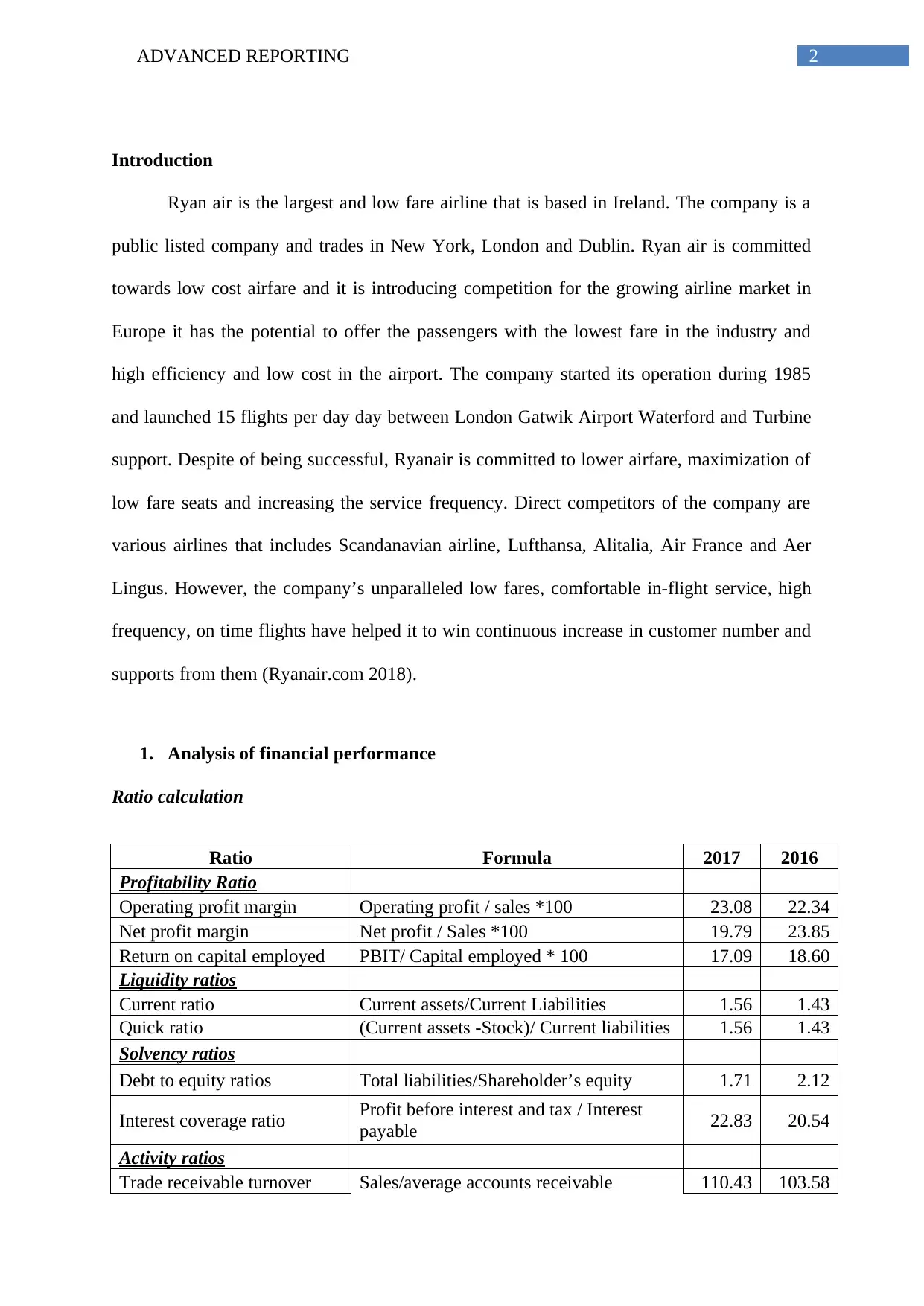

Ratio calculation

Ratio Formula 2017 2016

Profitability Ratio

Operating profit margin Operating profit / sales *100 23.08 22.34

Net profit margin Net profit / Sales *100 19.79 23.85

Return on capital employed PBIT/ Capital employed * 100 17.09 18.60

Liquidity ratios

Current ratio Current assets/Current Liabilities 1.56 1.43

Quick ratio (Current assets -Stock)/ Current liabilities 1.56 1.43

Solvency ratios

Debt to equity ratios Total liabilities/Shareholder’s equity 1.71 2.12

Interest coverage ratio Profit before interest and tax / Interest

payable 22.83 20.54

Activity ratios

Trade receivable turnover Sales/average accounts receivable 110.43 103.58

Introduction

Ryan air is the largest and low fare airline that is based in Ireland. The company is a

public listed company and trades in New York, London and Dublin. Ryan air is committed

towards low cost airfare and it is introducing competition for the growing airline market in

Europe it has the potential to offer the passengers with the lowest fare in the industry and

high efficiency and low cost in the airport. The company started its operation during 1985

and launched 15 flights per day day between London Gatwik Airport Waterford and Turbine

support. Despite of being successful, Ryanair is committed to lower airfare, maximization of

low fare seats and increasing the service frequency. Direct competitors of the company are

various airlines that includes Scandanavian airline, Lufthansa, Alitalia, Air France and Aer

Lingus. However, the company’s unparalleled low fares, comfortable in-flight service, high

frequency, on time flights have helped it to win continuous increase in customer number and

supports from them (Ryanair.com 2018).

1. Analysis of financial performance

Ratio calculation

Ratio Formula 2017 2016

Profitability Ratio

Operating profit margin Operating profit / sales *100 23.08 22.34

Net profit margin Net profit / Sales *100 19.79 23.85

Return on capital employed PBIT/ Capital employed * 100 17.09 18.60

Liquidity ratios

Current ratio Current assets/Current Liabilities 1.56 1.43

Quick ratio (Current assets -Stock)/ Current liabilities 1.56 1.43

Solvency ratios

Debt to equity ratios Total liabilities/Shareholder’s equity 1.71 2.12

Interest coverage ratio Profit before interest and tax / Interest

payable 22.83 20.54

Activity ratios

Trade receivable turnover Sales/average accounts receivable 110.43 103.58

3ADVANCED REPORTING

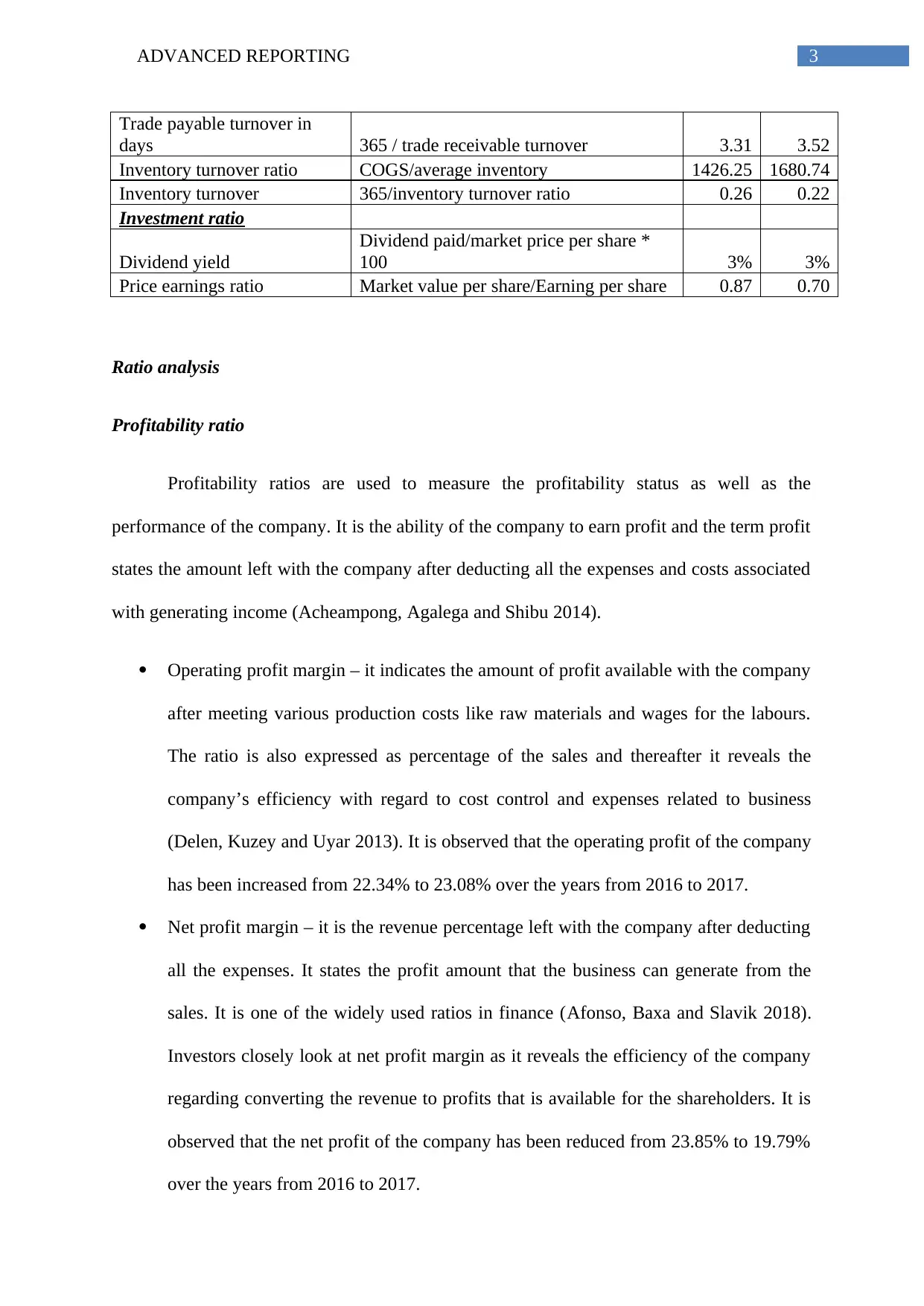

Trade payable turnover in

days 365 / trade receivable turnover 3.31 3.52

Inventory turnover ratio COGS/average inventory 1426.25 1680.74

Inventory turnover 365/inventory turnover ratio 0.26 0.22

Investment ratio

Dividend yield

Dividend paid/market price per share *

100 3% 3%

Price earnings ratio Market value per share/Earning per share 0.87 0.70

Ratio analysis

Profitability ratio

Profitability ratios are used to measure the profitability status as well as the

performance of the company. It is the ability of the company to earn profit and the term profit

states the amount left with the company after deducting all the expenses and costs associated

with generating income (Acheampong, Agalega and Shibu 2014).

Operating profit margin – it indicates the amount of profit available with the company

after meeting various production costs like raw materials and wages for the labours.

The ratio is also expressed as percentage of the sales and thereafter it reveals the

company’s efficiency with regard to cost control and expenses related to business

(Delen, Kuzey and Uyar 2013). It is observed that the operating profit of the company

has been increased from 22.34% to 23.08% over the years from 2016 to 2017.

Net profit margin – it is the revenue percentage left with the company after deducting

all the expenses. It states the profit amount that the business can generate from the

sales. It is one of the widely used ratios in finance (Afonso, Baxa and Slavik 2018).

Investors closely look at net profit margin as it reveals the efficiency of the company

regarding converting the revenue to profits that is available for the shareholders. It is

observed that the net profit of the company has been reduced from 23.85% to 19.79%

over the years from 2016 to 2017.

Trade payable turnover in

days 365 / trade receivable turnover 3.31 3.52

Inventory turnover ratio COGS/average inventory 1426.25 1680.74

Inventory turnover 365/inventory turnover ratio 0.26 0.22

Investment ratio

Dividend yield

Dividend paid/market price per share *

100 3% 3%

Price earnings ratio Market value per share/Earning per share 0.87 0.70

Ratio analysis

Profitability ratio

Profitability ratios are used to measure the profitability status as well as the

performance of the company. It is the ability of the company to earn profit and the term profit

states the amount left with the company after deducting all the expenses and costs associated

with generating income (Acheampong, Agalega and Shibu 2014).

Operating profit margin – it indicates the amount of profit available with the company

after meeting various production costs like raw materials and wages for the labours.

The ratio is also expressed as percentage of the sales and thereafter it reveals the

company’s efficiency with regard to cost control and expenses related to business

(Delen, Kuzey and Uyar 2013). It is observed that the operating profit of the company

has been increased from 22.34% to 23.08% over the years from 2016 to 2017.

Net profit margin – it is the revenue percentage left with the company after deducting

all the expenses. It states the profit amount that the business can generate from the

sales. It is one of the widely used ratios in finance (Afonso, Baxa and Slavik 2018).

Investors closely look at net profit margin as it reveals the efficiency of the company

regarding converting the revenue to profits that is available for the shareholders. It is

observed that the net profit of the company has been reduced from 23.85% to 19.79%

over the years from 2016 to 2017.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ADVANCED REPORTING

Return on capital employed – this is profitability metric and used to measure the

efficiency of the company to generate profits from the employed capital. It reveals the

investors that how many dollars the company can earn as profit from each dollar of

employed capital (Babalola and Abiola 2013). It is observed that the return on capital

employed of the company has been reduced from 18.60% to 17.09% over the years

from 2016 to 2017.

Liquidity ratio

It evaluates the company’s ability make payment of the current liabilities when they

become due and payment of long-term debt when they become current. It reveals the

company’s cash levels and the efficiency in converting the assets into cash for paying off the

liabilities and various other short-term obligations.

Current ratio – it is the liquidity ratio and is used to measure the ability of paying off

the short term obligations. It is important for measuring the liquidity as the short-term

obligations are payable within next 12 months period. Therefore, the company has

limited time for raising the fund to pay off the liabilities and have to be paid with the

available current assets like cash, trade receivables and the marketable securities. It is

identified that the current ratio of the company is in increasing trend and is increased

from 1.43 to 1.56 over the years from 2016 to 2017.

Quick ratio – quick ratio is also used to measure the liquidity of the company. The

only difference between current ratio and quick ratio is that the quick ratio while

computing the current assets the assets that takes long time to get converted into cash

like inventories and prepaid expenses are not taken into consideration. It is identified

that the current ratio of the company is in increasing trend and is increased from 1.43

to 1.56 over the years from 2016 to 2017.

Return on capital employed – this is profitability metric and used to measure the

efficiency of the company to generate profits from the employed capital. It reveals the

investors that how many dollars the company can earn as profit from each dollar of

employed capital (Babalola and Abiola 2013). It is observed that the return on capital

employed of the company has been reduced from 18.60% to 17.09% over the years

from 2016 to 2017.

Liquidity ratio

It evaluates the company’s ability make payment of the current liabilities when they

become due and payment of long-term debt when they become current. It reveals the

company’s cash levels and the efficiency in converting the assets into cash for paying off the

liabilities and various other short-term obligations.

Current ratio – it is the liquidity ratio and is used to measure the ability of paying off

the short term obligations. It is important for measuring the liquidity as the short-term

obligations are payable within next 12 months period. Therefore, the company has

limited time for raising the fund to pay off the liabilities and have to be paid with the

available current assets like cash, trade receivables and the marketable securities. It is

identified that the current ratio of the company is in increasing trend and is increased

from 1.43 to 1.56 over the years from 2016 to 2017.

Quick ratio – quick ratio is also used to measure the liquidity of the company. The

only difference between current ratio and quick ratio is that the quick ratio while

computing the current assets the assets that takes long time to get converted into cash

like inventories and prepaid expenses are not taken into consideration. It is identified

that the current ratio of the company is in increasing trend and is increased from 1.43

to 1.56 over the years from 2016 to 2017.

5ADVANCED REPORTING

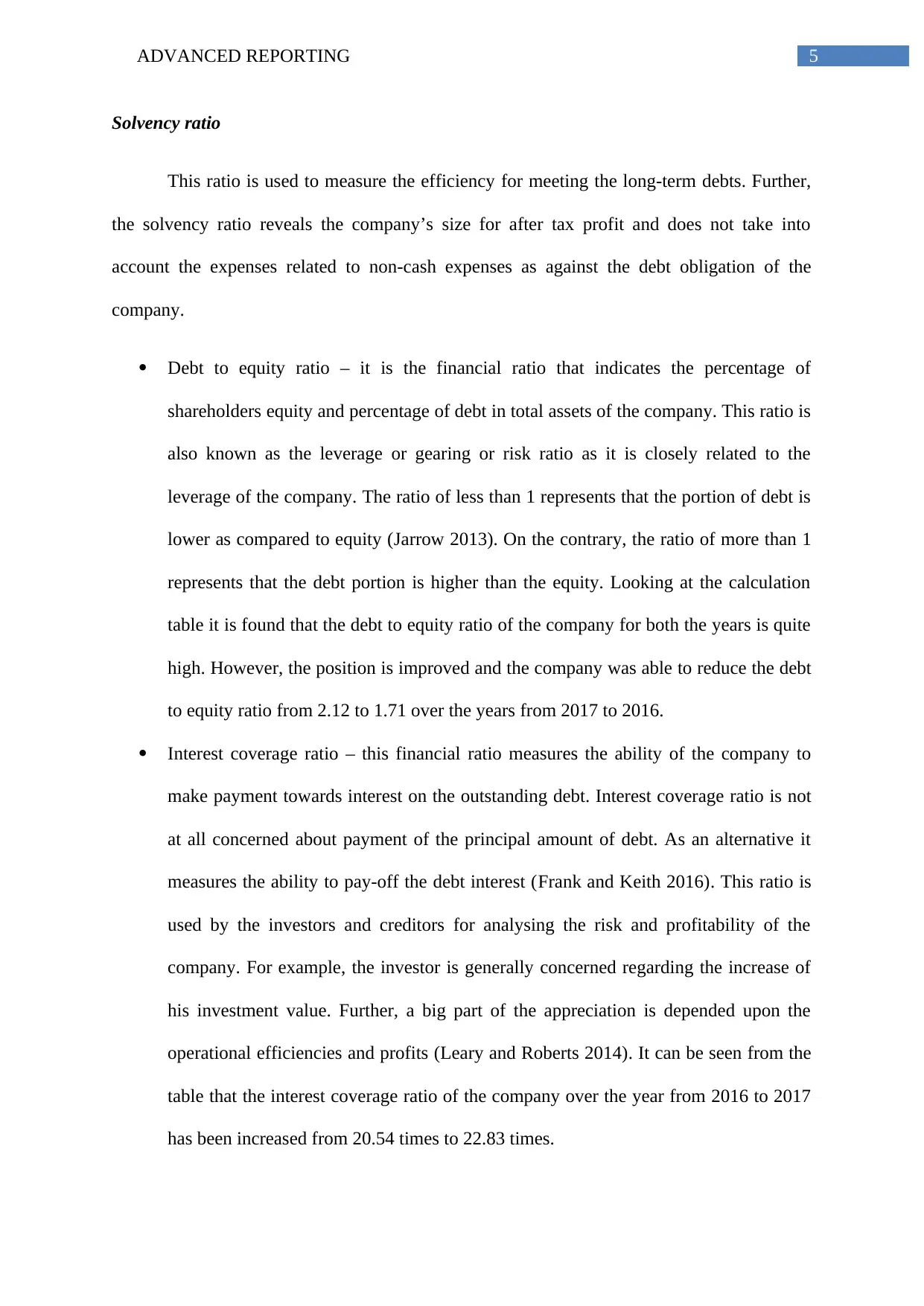

Solvency ratio

This ratio is used to measure the efficiency for meeting the long-term debts. Further,

the solvency ratio reveals the company’s size for after tax profit and does not take into

account the expenses related to non-cash expenses as against the debt obligation of the

company.

Debt to equity ratio – it is the financial ratio that indicates the percentage of

shareholders equity and percentage of debt in total assets of the company. This ratio is

also known as the leverage or gearing or risk ratio as it is closely related to the

leverage of the company. The ratio of less than 1 represents that the portion of debt is

lower as compared to equity (Jarrow 2013). On the contrary, the ratio of more than 1

represents that the debt portion is higher than the equity. Looking at the calculation

table it is found that the debt to equity ratio of the company for both the years is quite

high. However, the position is improved and the company was able to reduce the debt

to equity ratio from 2.12 to 1.71 over the years from 2017 to 2016.

Interest coverage ratio – this financial ratio measures the ability of the company to

make payment towards interest on the outstanding debt. Interest coverage ratio is not

at all concerned about payment of the principal amount of debt. As an alternative it

measures the ability to pay-off the debt interest (Frank and Keith 2016). This ratio is

used by the investors and creditors for analysing the risk and profitability of the

company. For example, the investor is generally concerned regarding the increase of

his investment value. Further, a big part of the appreciation is depended upon the

operational efficiencies and profits (Leary and Roberts 2014). It can be seen from the

table that the interest coverage ratio of the company over the year from 2016 to 2017

has been increased from 20.54 times to 22.83 times.

Solvency ratio

This ratio is used to measure the efficiency for meeting the long-term debts. Further,

the solvency ratio reveals the company’s size for after tax profit and does not take into

account the expenses related to non-cash expenses as against the debt obligation of the

company.

Debt to equity ratio – it is the financial ratio that indicates the percentage of

shareholders equity and percentage of debt in total assets of the company. This ratio is

also known as the leverage or gearing or risk ratio as it is closely related to the

leverage of the company. The ratio of less than 1 represents that the portion of debt is

lower as compared to equity (Jarrow 2013). On the contrary, the ratio of more than 1

represents that the debt portion is higher than the equity. Looking at the calculation

table it is found that the debt to equity ratio of the company for both the years is quite

high. However, the position is improved and the company was able to reduce the debt

to equity ratio from 2.12 to 1.71 over the years from 2017 to 2016.

Interest coverage ratio – this financial ratio measures the ability of the company to

make payment towards interest on the outstanding debt. Interest coverage ratio is not

at all concerned about payment of the principal amount of debt. As an alternative it

measures the ability to pay-off the debt interest (Frank and Keith 2016). This ratio is

used by the investors and creditors for analysing the risk and profitability of the

company. For example, the investor is generally concerned regarding the increase of

his investment value. Further, a big part of the appreciation is depended upon the

operational efficiencies and profits (Leary and Roberts 2014). It can be seen from the

table that the interest coverage ratio of the company over the year from 2016 to 2017

has been increased from 20.54 times to 22.83 times.

6ADVANCED REPORTING

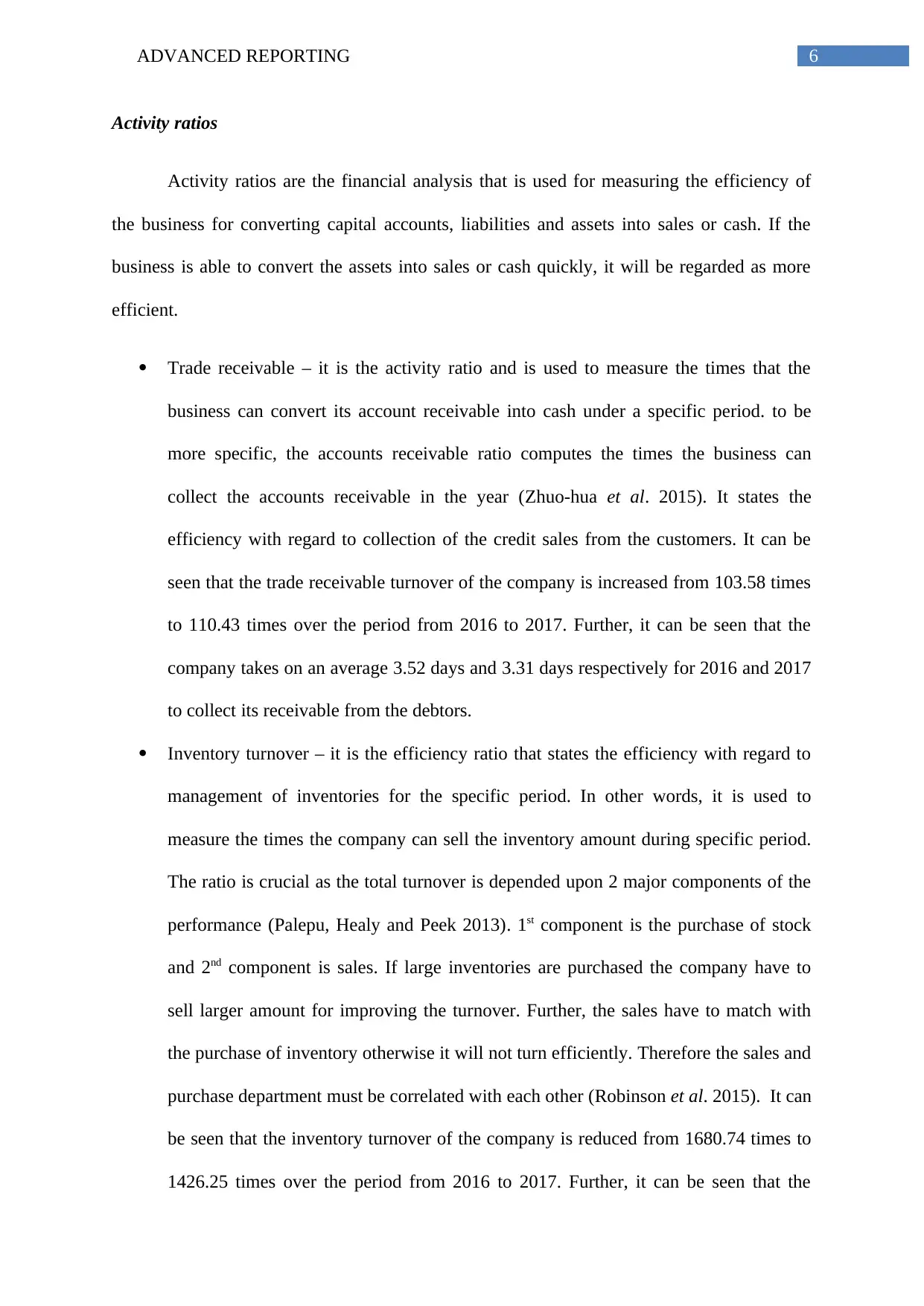

Activity ratios

Activity ratios are the financial analysis that is used for measuring the efficiency of

the business for converting capital accounts, liabilities and assets into sales or cash. If the

business is able to convert the assets into sales or cash quickly, it will be regarded as more

efficient.

Trade receivable – it is the activity ratio and is used to measure the times that the

business can convert its account receivable into cash under a specific period. to be

more specific, the accounts receivable ratio computes the times the business can

collect the accounts receivable in the year (Zhuo-hua et al. 2015). It states the

efficiency with regard to collection of the credit sales from the customers. It can be

seen that the trade receivable turnover of the company is increased from 103.58 times

to 110.43 times over the period from 2016 to 2017. Further, it can be seen that the

company takes on an average 3.52 days and 3.31 days respectively for 2016 and 2017

to collect its receivable from the debtors.

Inventory turnover – it is the efficiency ratio that states the efficiency with regard to

management of inventories for the specific period. In other words, it is used to

measure the times the company can sell the inventory amount during specific period.

The ratio is crucial as the total turnover is depended upon 2 major components of the

performance (Palepu, Healy and Peek 2013). 1st component is the purchase of stock

and 2nd component is sales. If large inventories are purchased the company have to

sell larger amount for improving the turnover. Further, the sales have to match with

the purchase of inventory otherwise it will not turn efficiently. Therefore the sales and

purchase department must be correlated with each other (Robinson et al. 2015). It can

be seen that the inventory turnover of the company is reduced from 1680.74 times to

1426.25 times over the period from 2016 to 2017. Further, it can be seen that the

Activity ratios

Activity ratios are the financial analysis that is used for measuring the efficiency of

the business for converting capital accounts, liabilities and assets into sales or cash. If the

business is able to convert the assets into sales or cash quickly, it will be regarded as more

efficient.

Trade receivable – it is the activity ratio and is used to measure the times that the

business can convert its account receivable into cash under a specific period. to be

more specific, the accounts receivable ratio computes the times the business can

collect the accounts receivable in the year (Zhuo-hua et al. 2015). It states the

efficiency with regard to collection of the credit sales from the customers. It can be

seen that the trade receivable turnover of the company is increased from 103.58 times

to 110.43 times over the period from 2016 to 2017. Further, it can be seen that the

company takes on an average 3.52 days and 3.31 days respectively for 2016 and 2017

to collect its receivable from the debtors.

Inventory turnover – it is the efficiency ratio that states the efficiency with regard to

management of inventories for the specific period. In other words, it is used to

measure the times the company can sell the inventory amount during specific period.

The ratio is crucial as the total turnover is depended upon 2 major components of the

performance (Palepu, Healy and Peek 2013). 1st component is the purchase of stock

and 2nd component is sales. If large inventories are purchased the company have to

sell larger amount for improving the turnover. Further, the sales have to match with

the purchase of inventory otherwise it will not turn efficiently. Therefore the sales and

purchase department must be correlated with each other (Robinson et al. 2015). It can

be seen that the inventory turnover of the company is reduced from 1680.74 times to

1426.25 times over the period from 2016 to 2017. Further, it can be seen that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ADVANCED REPORTING

company takes on an average 0.22 days and 0.26 days respectively for 2016 and 2017

to sell its inventories.

Investment ratio

Investment ratios are used to analyse the performance of the company’s share. Apart

from the shareholders, the investment ratios are important for the potential investors to

analyse its sustainability and completion in the industry.

Dividend yield – it states the percentage of earning that is paid by the company as

dividend as compared to the share price. Normally the companies that make profit

only pays dividend (Zack 2013). Therefore, the investors consider the company that

pay dividend as safe for the purpose of investment. it can be observed from the annual

report of the company that the dividend yield of the company both 2016 as well as

2017 is 3%.

Price earnings ratio – it indicates the amount of dollar an investor can expect to earn

from the earning of the company (Briston 2017). Therefore, the P/E ratio sometimes

called as the price multiple as it states how much the investor prefers to pay for each

dollar of the earnings. The price earnings ratio of the company has been improved and

increased from 0.70 to 0.87 over the year from 2016 to 2017.

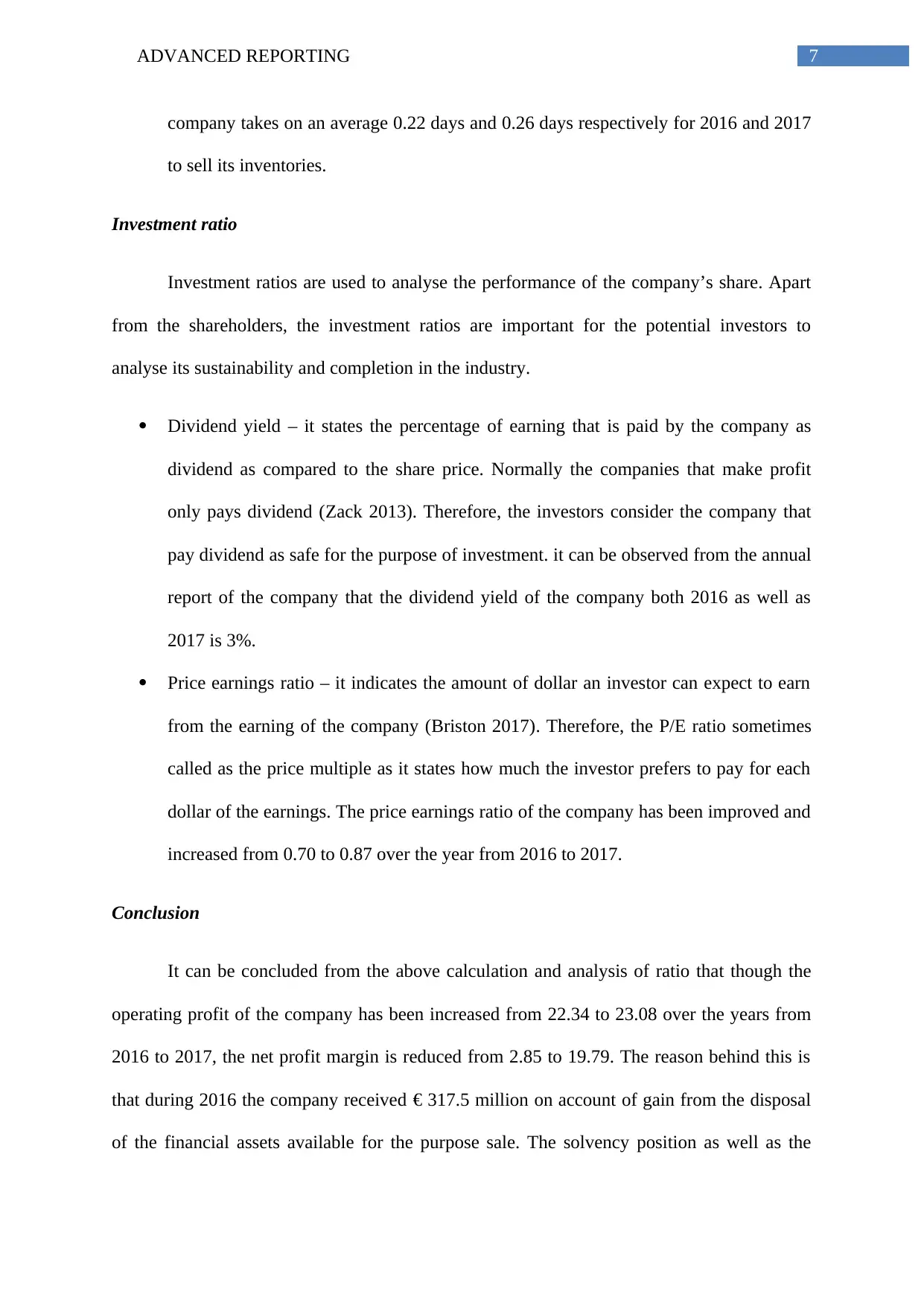

Conclusion

It can be concluded from the above calculation and analysis of ratio that though the

operating profit of the company has been increased from 22.34 to 23.08 over the years from

2016 to 2017, the net profit margin is reduced from 2.85 to 19.79. The reason behind this is

that during 2016 the company received € 317.5 million on account of gain from the disposal

of the financial assets available for the purpose sale. The solvency position as well as the

company takes on an average 0.22 days and 0.26 days respectively for 2016 and 2017

to sell its inventories.

Investment ratio

Investment ratios are used to analyse the performance of the company’s share. Apart

from the shareholders, the investment ratios are important for the potential investors to

analyse its sustainability and completion in the industry.

Dividend yield – it states the percentage of earning that is paid by the company as

dividend as compared to the share price. Normally the companies that make profit

only pays dividend (Zack 2013). Therefore, the investors consider the company that

pay dividend as safe for the purpose of investment. it can be observed from the annual

report of the company that the dividend yield of the company both 2016 as well as

2017 is 3%.

Price earnings ratio – it indicates the amount of dollar an investor can expect to earn

from the earning of the company (Briston 2017). Therefore, the P/E ratio sometimes

called as the price multiple as it states how much the investor prefers to pay for each

dollar of the earnings. The price earnings ratio of the company has been improved and

increased from 0.70 to 0.87 over the year from 2016 to 2017.

Conclusion

It can be concluded from the above calculation and analysis of ratio that though the

operating profit of the company has been increased from 22.34 to 23.08 over the years from

2016 to 2017, the net profit margin is reduced from 2.85 to 19.79. The reason behind this is

that during 2016 the company received € 317.5 million on account of gain from the disposal

of the financial assets available for the purpose sale. The solvency position as well as the

8ADVANCED REPORTING

liquidity position of the company has been improved in the year 2017 as compared to the year

2016. The price earnings ratio of the company is increased from 0.70 to 0.87 and the dividend

yield for both the years is same at 3%. Further, the company is efficient with regard to

collecting the debts from customers and converting the inventories into sales or cash.

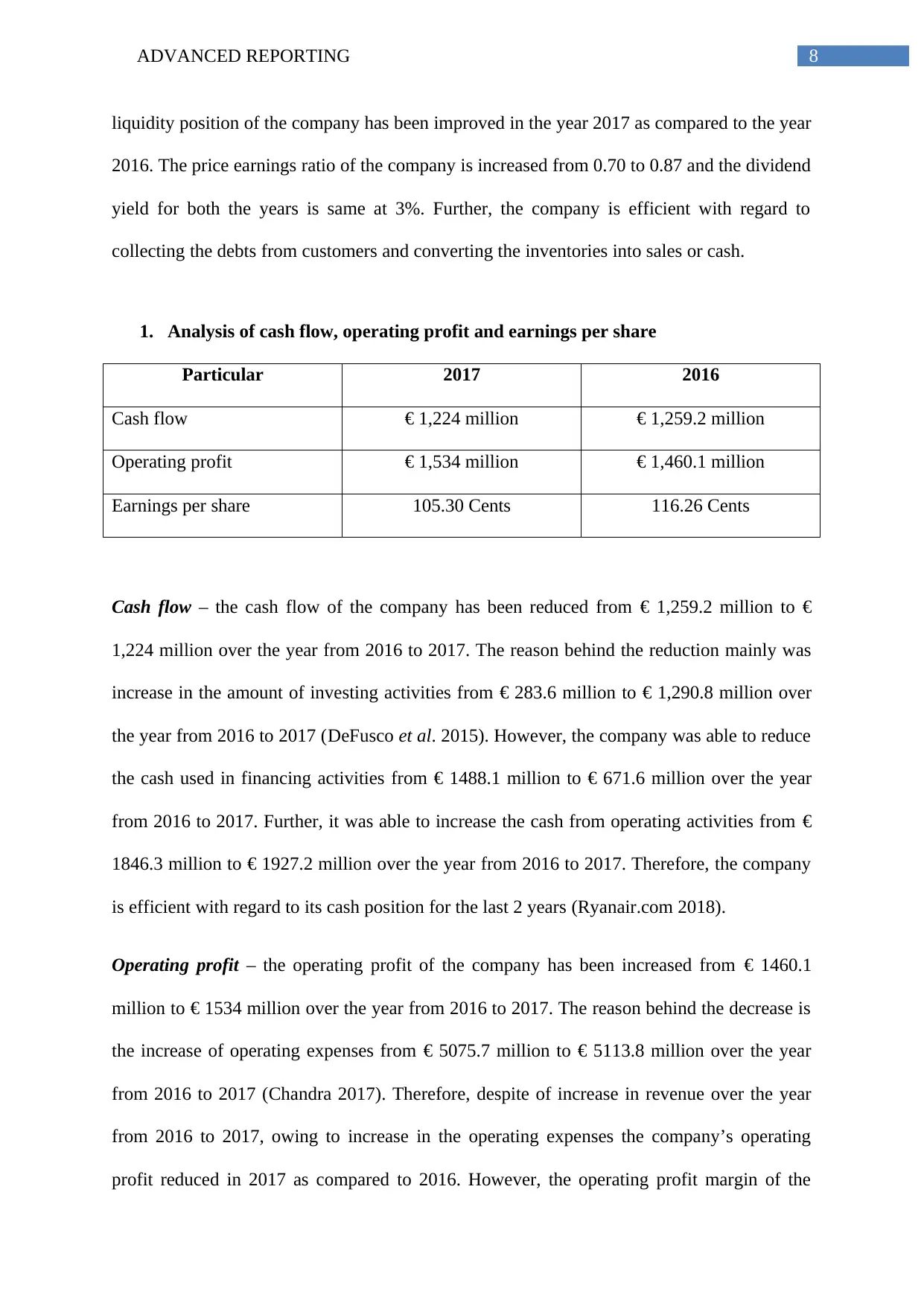

1. Analysis of cash flow, operating profit and earnings per share

Particular 2017 2016

Cash flow € 1,224 million € 1,259.2 million

Operating profit € 1,534 million € 1,460.1 million

Earnings per share 105.30 Cents 116.26 Cents

Cash flow – the cash flow of the company has been reduced from € 1,259.2 million to €

1,224 million over the year from 2016 to 2017. The reason behind the reduction mainly was

increase in the amount of investing activities from € 283.6 million to € 1,290.8 million over

the year from 2016 to 2017 (DeFusco et al. 2015). However, the company was able to reduce

the cash used in financing activities from € 1488.1 million to € 671.6 million over the year

from 2016 to 2017. Further, it was able to increase the cash from operating activities from €

1846.3 million to € 1927.2 million over the year from 2016 to 2017. Therefore, the company

is efficient with regard to its cash position for the last 2 years (Ryanair.com 2018).

Operating profit – the operating profit of the company has been increased from € 1460.1

million to € 1534 million over the year from 2016 to 2017. The reason behind the decrease is

the increase of operating expenses from € 5075.7 million to € 5113.8 million over the year

from 2016 to 2017 (Chandra 2017). Therefore, despite of increase in revenue over the year

from 2016 to 2017, owing to increase in the operating expenses the company’s operating

profit reduced in 2017 as compared to 2016. However, the operating profit margin of the

liquidity position of the company has been improved in the year 2017 as compared to the year

2016. The price earnings ratio of the company is increased from 0.70 to 0.87 and the dividend

yield for both the years is same at 3%. Further, the company is efficient with regard to

collecting the debts from customers and converting the inventories into sales or cash.

1. Analysis of cash flow, operating profit and earnings per share

Particular 2017 2016

Cash flow € 1,224 million € 1,259.2 million

Operating profit € 1,534 million € 1,460.1 million

Earnings per share 105.30 Cents 116.26 Cents

Cash flow – the cash flow of the company has been reduced from € 1,259.2 million to €

1,224 million over the year from 2016 to 2017. The reason behind the reduction mainly was

increase in the amount of investing activities from € 283.6 million to € 1,290.8 million over

the year from 2016 to 2017 (DeFusco et al. 2015). However, the company was able to reduce

the cash used in financing activities from € 1488.1 million to € 671.6 million over the year

from 2016 to 2017. Further, it was able to increase the cash from operating activities from €

1846.3 million to € 1927.2 million over the year from 2016 to 2017. Therefore, the company

is efficient with regard to its cash position for the last 2 years (Ryanair.com 2018).

Operating profit – the operating profit of the company has been increased from € 1460.1

million to € 1534 million over the year from 2016 to 2017. The reason behind the decrease is

the increase of operating expenses from € 5075.7 million to € 5113.8 million over the year

from 2016 to 2017 (Chandra 2017). Therefore, despite of increase in revenue over the year

from 2016 to 2017, owing to increase in the operating expenses the company’s operating

profit reduced in 2017 as compared to 2016. However, the operating profit margin of the

9ADVANCED REPORTING

company increased to 23.08% in 2017 from 22.34% in 2016. Therefore, the percentage of

increase in revenue was more as compared to percentage of increase in operating expenses

(Ryanair.com 2018).

Earnings per share – the earning per share of the company have been reduced from 116.26

euro cent to 105.30 euro cent over the years from 2016 to 2017. The reason was the reduction

of profit from € 1,559.1 million to € 1,315.9 million over the year from 2016 to 2017

(Ryanair.com 2018). Therefore, the company shall try to minimise its operating expenses to

increase the profit which in turn will increase the earning per share (Ogiela 2013).

2. Potential investment review

If the return aspect is considered it can be observed that the company is regular in

paying dividend to the shareholders and the dividend yield for both 2016 as well as 2017 is

3%. The earnings per share of the company for 2017 are 105.30 cents whereas the market

price of the share on closing of the year 2017 was € 91.93 per share. Further, as per the

chairman’s report the company returned more than € 1 billion to the shareholders for the year

ended 2017 through buyback of shares (Ryanair.com 2018). Further, it approved buyback for

€ 600 million. Moreover, the highlights are –

Profit after tax went up by 6% to €1.316 billion

Average fares reduced by 13% to €41;

Unit costs were reduced by 11%

Year 3 of our Always Getting Better (“AGB”) program was smoothly delivered and

Year 4 is already been announced

206 new routes were launched and 10 new bases were opened

Ryanair.com became no. 1 airline website all over the world (Ryanair.com 2018).

company increased to 23.08% in 2017 from 22.34% in 2016. Therefore, the percentage of

increase in revenue was more as compared to percentage of increase in operating expenses

(Ryanair.com 2018).

Earnings per share – the earning per share of the company have been reduced from 116.26

euro cent to 105.30 euro cent over the years from 2016 to 2017. The reason was the reduction

of profit from € 1,559.1 million to € 1,315.9 million over the year from 2016 to 2017

(Ryanair.com 2018). Therefore, the company shall try to minimise its operating expenses to

increase the profit which in turn will increase the earning per share (Ogiela 2013).

2. Potential investment review

If the return aspect is considered it can be observed that the company is regular in

paying dividend to the shareholders and the dividend yield for both 2016 as well as 2017 is

3%. The earnings per share of the company for 2017 are 105.30 cents whereas the market

price of the share on closing of the year 2017 was € 91.93 per share. Further, as per the

chairman’s report the company returned more than € 1 billion to the shareholders for the year

ended 2017 through buyback of shares (Ryanair.com 2018). Further, it approved buyback for

€ 600 million. Moreover, the highlights are –

Profit after tax went up by 6% to €1.316 billion

Average fares reduced by 13% to €41;

Unit costs were reduced by 11%

Year 3 of our Always Getting Better (“AGB”) program was smoothly delivered and

Year 4 is already been announced

206 new routes were launched and 10 new bases were opened

Ryanair.com became no. 1 airline website all over the world (Ryanair.com 2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ADVANCED REPORTING

Taking into consideration all the above mentioned facts it can be said that the

company is a good options for investment.

3. Overall conclusion

It can be concluded from the above discussion that the company have some positive

area as well as some negative areas with regard to investment approach. If the return factor is

considered, then it can be identified that the company is efficient in creating return from sales

as well as creating return for the shareholders. Further, the liquidity position of the company

has been improved in 2017 as compared to the year 2016. On the other hand if the risk factor

is taken into consideration it can be identified that the company is highly leveraged. Though

it has improved its position in 2017 as compared to 2016, the debt portion of the company is

still high as compared to equity. If the efficiency factor is taken into consideration it is found

that the company is efficient in collecting debts and converting the inventories into sales or

cash. Taking into consideration all these factors it can be said that the company is a good

options for investment.

Taking into consideration all the above mentioned facts it can be said that the

company is a good options for investment.

3. Overall conclusion

It can be concluded from the above discussion that the company have some positive

area as well as some negative areas with regard to investment approach. If the return factor is

considered, then it can be identified that the company is efficient in creating return from sales

as well as creating return for the shareholders. Further, the liquidity position of the company

has been improved in 2017 as compared to the year 2016. On the other hand if the risk factor

is taken into consideration it can be identified that the company is highly leveraged. Though

it has improved its position in 2017 as compared to 2016, the debt portion of the company is

still high as compared to equity. If the efficiency factor is taken into consideration it is found

that the company is efficient in collecting debts and converting the inventories into sales or

cash. Taking into consideration all these factors it can be said that the company is a good

options for investment.

11ADVANCED REPORTING

Reference

Acheampong, P., Agalega, E. and Shibu, A.K., 2014. The effect of financial leverage and

market size on stock returns on the Ghana Stock Exchange: evidence from selected stocks in

the manufacturing sector. International Journal of Financial Research, 5(1), p.125.

Afonso, A., Baxa, J. and Slavik, M., 2018. Fiscal developments and financial stress: a

threshold VAR analysis. Empirical Economics, 54(2), pp.395-423.

Babalola, Y.A. and Abiola, F.R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences, 1(4), pp.132-137.

Briston, R.J., 2017. The stock exchange and investment analysis (Vol. 3). Routledge.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial ratios:

A decision tree approach. Expert Systems with Applications, 40(10), pp.3970-3983.

Frank, K.R. and Keith, C.B., 2016. Investment analysis and portfolio management.

Jarrow, R., 2013. A leverage ratio rule for capital adequacy. Journal of Banking &

Finance, 37(3), pp.973-976.

Leary, M.T. and Roberts, M.R., 2014. Do peer firms affect corporate financial policy?. The

Journal of Finance, 69(1), pp.139-178.

Ogiela, L., 2013. Data management in cognitive financial systems. International Journal of

Information Management, 33(2), pp.263-270.

Reference

Acheampong, P., Agalega, E. and Shibu, A.K., 2014. The effect of financial leverage and

market size on stock returns on the Ghana Stock Exchange: evidence from selected stocks in

the manufacturing sector. International Journal of Financial Research, 5(1), p.125.

Afonso, A., Baxa, J. and Slavik, M., 2018. Fiscal developments and financial stress: a

threshold VAR analysis. Empirical Economics, 54(2), pp.395-423.

Babalola, Y.A. and Abiola, F.R., 2013. Financial ratio analysis of firms: A tool for decision

making. International journal of management sciences, 1(4), pp.132-137.

Briston, R.J., 2017. The stock exchange and investment analysis (Vol. 3). Routledge.

Chandra, P., 2017. Investment analysis and portfolio management. McGraw-Hill Education.

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Anson, M.J. and Runkle, D.E.,

2015. Quantitative investment analysis. John Wiley & Sons.

Delen, D., Kuzey, C. and Uyar, A., 2013. Measuring firm performance using financial ratios:

A decision tree approach. Expert Systems with Applications, 40(10), pp.3970-3983.

Frank, K.R. and Keith, C.B., 2016. Investment analysis and portfolio management.

Jarrow, R., 2013. A leverage ratio rule for capital adequacy. Journal of Banking &

Finance, 37(3), pp.973-976.

Leary, M.T. and Roberts, M.R., 2014. Do peer firms affect corporate financial policy?. The

Journal of Finance, 69(1), pp.139-178.

Ogiela, L., 2013. Data management in cognitive financial systems. International Journal of

Information Management, 33(2), pp.263-270.

12ADVANCED REPORTING

Palepu, K.G., Healy, P.M. and Peek, E., 2013. Business analysis and valuation: IFRS edition.

Cengage Learning.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Ryanair.com., 2018. Official Ryanair website | Book direct for the lowest fares |

Ryanair.com. [online] Available at: https://www.ryanair.com/gb/en/ [Accessed 6 Apr. 2018].

Zack, G.M., 2013. Financial Statement Analysis. Financial Statement Fraud: Strategies for

Detection and Investigation, pp.209-213.

Zhuo-hua, Z.H.O.U., Wen-nan, C.H.E.N. and Zong-yi, Z.H.A.N.G., 2015. Application of

cluster analysis in stock investment.

Palepu, K.G., Healy, P.M. and Peek, E., 2013. Business analysis and valuation: IFRS edition.

Cengage Learning.

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Ryanair.com., 2018. Official Ryanair website | Book direct for the lowest fares |

Ryanair.com. [online] Available at: https://www.ryanair.com/gb/en/ [Accessed 6 Apr. 2018].

Zack, G.M., 2013. Financial Statement Analysis. Financial Statement Fraud: Strategies for

Detection and Investigation, pp.209-213.

Zhuo-hua, Z.H.O.U., Wen-nan, C.H.E.N. and Zong-yi, Z.H.A.N.G., 2015. Application of

cluster analysis in stock investment.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ADVANCED REPORTING

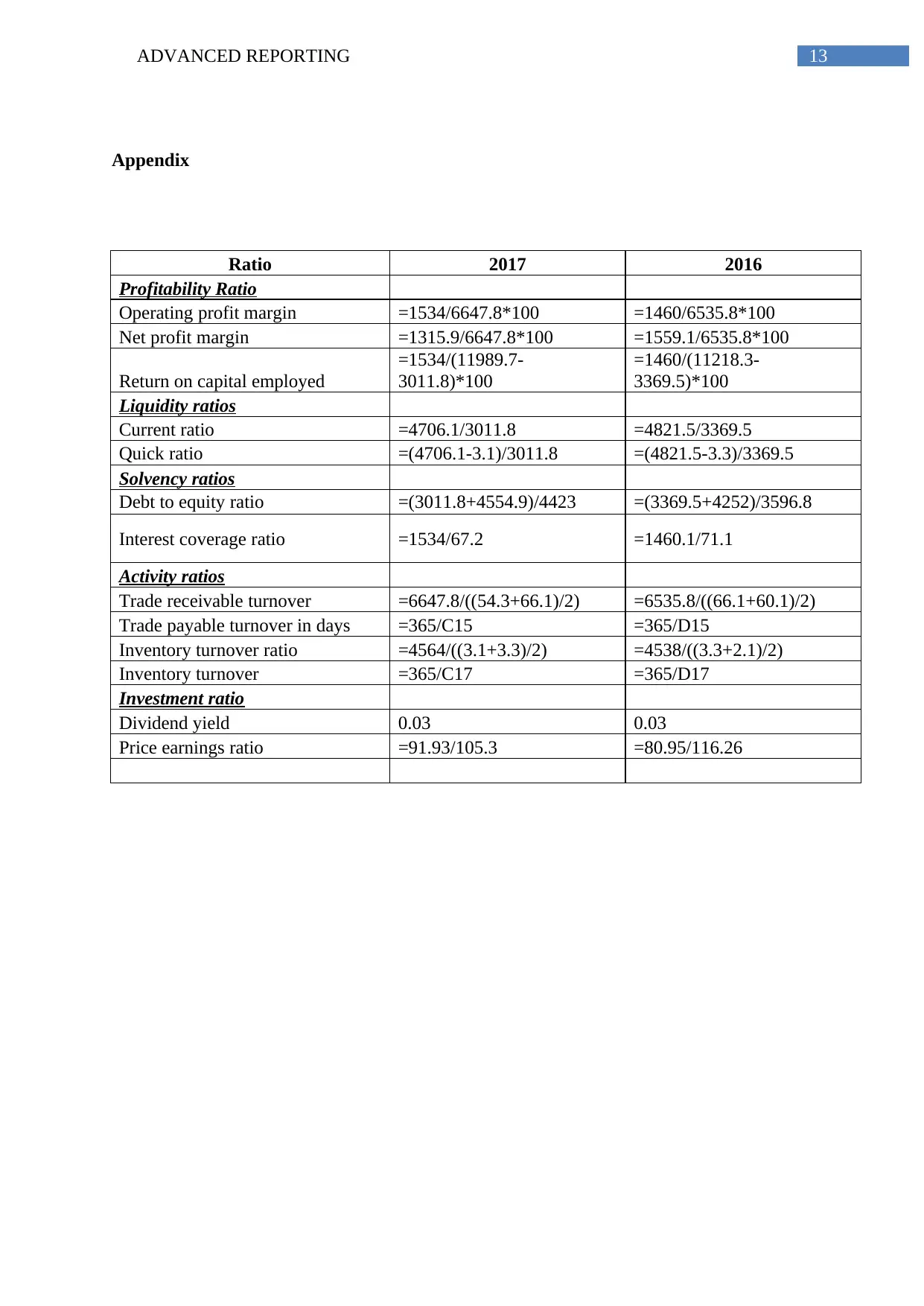

Appendix

Ratio 2017 2016

Profitability Ratio

Operating profit margin =1534/6647.8*100 =1460/6535.8*100

Net profit margin =1315.9/6647.8*100 =1559.1/6535.8*100

Return on capital employed

=1534/(11989.7-

3011.8)*100

=1460/(11218.3-

3369.5)*100

Liquidity ratios

Current ratio =4706.1/3011.8 =4821.5/3369.5

Quick ratio =(4706.1-3.1)/3011.8 =(4821.5-3.3)/3369.5

Solvency ratios

Debt to equity ratio =(3011.8+4554.9)/4423 =(3369.5+4252)/3596.8

Interest coverage ratio =1534/67.2 =1460.1/71.1

Activity ratios

Trade receivable turnover =6647.8/((54.3+66.1)/2) =6535.8/((66.1+60.1)/2)

Trade payable turnover in days =365/C15 =365/D15

Inventory turnover ratio =4564/((3.1+3.3)/2) =4538/((3.3+2.1)/2)

Inventory turnover =365/C17 =365/D17

Investment ratio

Dividend yield 0.03 0.03

Price earnings ratio =91.93/105.3 =80.95/116.26

Appendix

Ratio 2017 2016

Profitability Ratio

Operating profit margin =1534/6647.8*100 =1460/6535.8*100

Net profit margin =1315.9/6647.8*100 =1559.1/6535.8*100

Return on capital employed

=1534/(11989.7-

3011.8)*100

=1460/(11218.3-

3369.5)*100

Liquidity ratios

Current ratio =4706.1/3011.8 =4821.5/3369.5

Quick ratio =(4706.1-3.1)/3011.8 =(4821.5-3.3)/3369.5

Solvency ratios

Debt to equity ratio =(3011.8+4554.9)/4423 =(3369.5+4252)/3596.8

Interest coverage ratio =1534/67.2 =1460.1/71.1

Activity ratios

Trade receivable turnover =6647.8/((54.3+66.1)/2) =6535.8/((66.1+60.1)/2)

Trade payable turnover in days =365/C15 =365/D15

Inventory turnover ratio =4564/((3.1+3.3)/2) =4538/((3.3+2.1)/2)

Inventory turnover =365/C17 =365/D17

Investment ratio

Dividend yield 0.03 0.03

Price earnings ratio =91.93/105.3 =80.95/116.26

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.