Evaluating Sainsbury and Morrison's Financial Performance Using Ratios

VerifiedAdded on 2023/06/12

|19

|3569

|190

Report

AI Summary

This report offers a comparative financial analysis of Sainsbury and Morrison, two major supermarket chains in the UK. It evaluates their financial performance using various financial ratios, including net profit ratio, current ratio, debtor collection period, creditor payment period, debt equity ratio, return on equity ratio, quick ratio, gross profit ratio, and EPS ratio for the years 2020 and 2021. The analysis reveals variations in performance across different metrics, influenced by factors like the COVID-19 pandemic. Additionally, the report discusses the sustainability reporting practices of both companies, highlighting their efforts towards environmental and social responsibility. The report concludes that while both companies have faced challenges, their financial performances differ in specific areas, requiring targeted strategies for improvement and sustained growth. Desklib offers a range of solved assignments and resources for students.

COURSEWORK

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

ANALYSIS......................................................................................................................................3

Evaluation of financial performance...........................................................................................3

Sustainability reporting................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................1

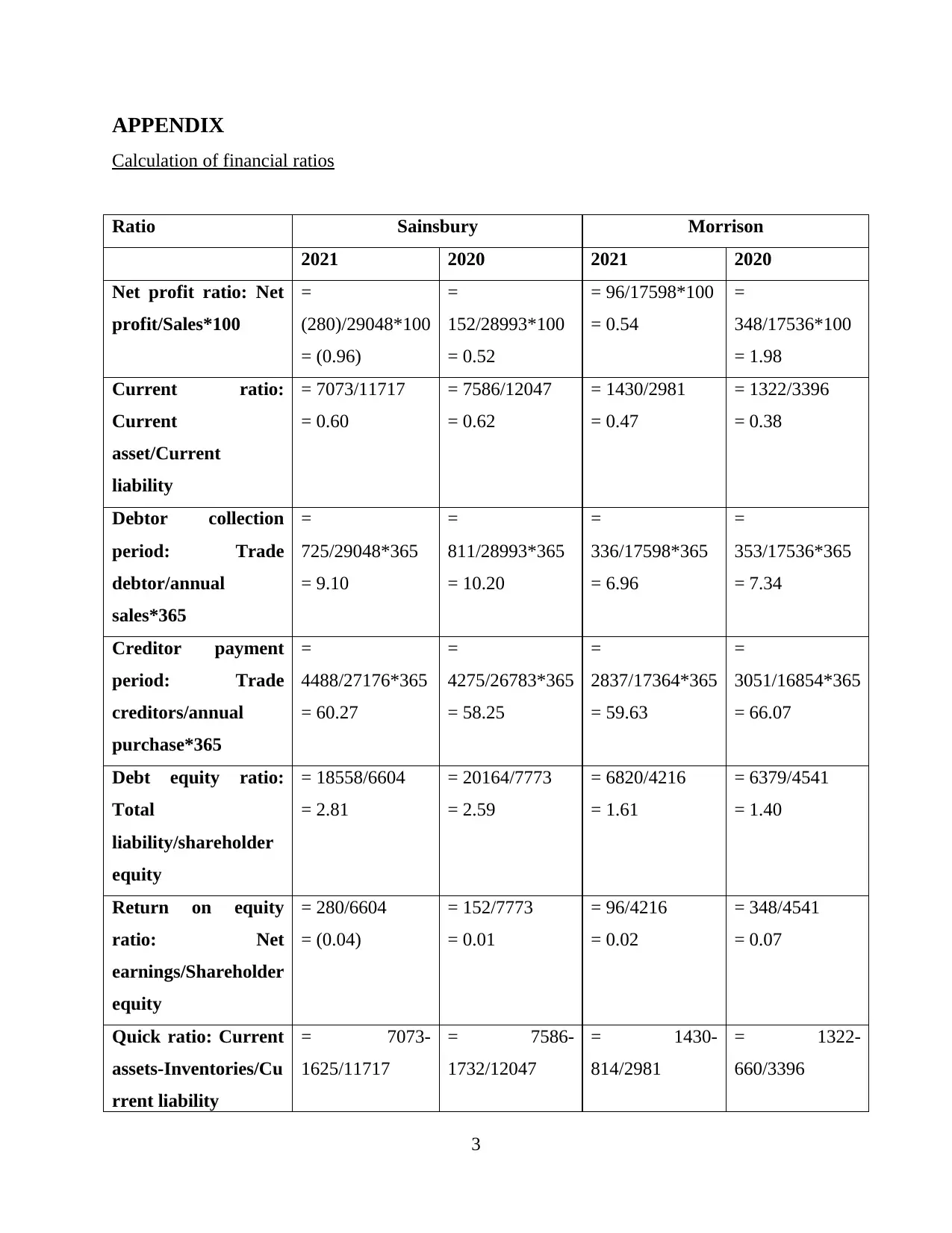

APPENDIX......................................................................................................................................3

Calculation of financial ratios......................................................................................................3

INTRODUCTION...........................................................................................................................3

ANALYSIS......................................................................................................................................3

Evaluation of financial performance...........................................................................................3

Sustainability reporting................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................1

APPENDIX......................................................................................................................................3

Calculation of financial ratios......................................................................................................3

INTRODUCTION

Morrison

It is one of 4th largest chain of supermarket in UK with a headquarter in Bradford (About

us, 2021). As per its history it was founded by William Morrison in 1899 with the starting of

business as selling of egg and butter It sales a large proportion of product that may include the

food and drinks, clothing, homeware, books and various other. The main purpose of the

Morrison is to make the availability of healthy food at affordable price.

Sainsbury

It is the 2nd largest supermarket chain in the UK. it was founded by John James Sainsbury

in 1869 with a shop in Drury lane. Its headquarter is in London, UK. The aim of the Sainsbury is

to provide food at the fair price (About us., 2021). It always works with the perspective of being

fair to suppliers and the environment. It sells its product through supermarket, convenience shop

and various other mode. Its main purpose is to sell the products to its customers at the reasonable

rates. It act as main competitor of the other firm.

Both the company operate in the form of physical stores as well as perform the business

operations in the form of online and digital or online website medium.

ANALYSIS

Evaluation of financial performance

Ratio analysis:

It is an important concept through which the financial performance of the company can

be evaluate and measured. With the aspect of financial ratio analysis, the performance of the

company and its financial aspect can be measured.

Evaluation of financial performance of Sainsbury and Morrison:

Net profit ratio:

The NP ratio measure the net profit earned by the company in the respected year

(Kusmayadi, Rahman and Abdullah, 2018). In case of Sainsbury the NP ratio in 2020 was 0.52

while in 2021 it declines and become (0.96). However, in case of Morrison the NP ratio in 2020

was 1.98 while in 2021 it become 0.54. This it be evaluated that the net profit ratio in case of

Morrison is high while making it compared with the Sainsbury. Thus it can be said that that the

Morrison

It is one of 4th largest chain of supermarket in UK with a headquarter in Bradford (About

us, 2021). As per its history it was founded by William Morrison in 1899 with the starting of

business as selling of egg and butter It sales a large proportion of product that may include the

food and drinks, clothing, homeware, books and various other. The main purpose of the

Morrison is to make the availability of healthy food at affordable price.

Sainsbury

It is the 2nd largest supermarket chain in the UK. it was founded by John James Sainsbury

in 1869 with a shop in Drury lane. Its headquarter is in London, UK. The aim of the Sainsbury is

to provide food at the fair price (About us., 2021). It always works with the perspective of being

fair to suppliers and the environment. It sells its product through supermarket, convenience shop

and various other mode. Its main purpose is to sell the products to its customers at the reasonable

rates. It act as main competitor of the other firm.

Both the company operate in the form of physical stores as well as perform the business

operations in the form of online and digital or online website medium.

ANALYSIS

Evaluation of financial performance

Ratio analysis:

It is an important concept through which the financial performance of the company can

be evaluate and measured. With the aspect of financial ratio analysis, the performance of the

company and its financial aspect can be measured.

Evaluation of financial performance of Sainsbury and Morrison:

Net profit ratio:

The NP ratio measure the net profit earned by the company in the respected year

(Kusmayadi, Rahman and Abdullah, 2018). In case of Sainsbury the NP ratio in 2020 was 0.52

while in 2021 it declines and become (0.96). However, in case of Morrison the NP ratio in 2020

was 1.98 while in 2021 it become 0.54. This it be evaluated that the net profit ratio in case of

Morrison is high while making it compared with the Sainsbury. Thus it can be said that that the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Morrison shows the positive financial performance while making it compared with the

Sainsbury. The declining ratio can be related with them declining proportion of sales with an

increasing amount of expenses. This is also related with the negative impact of the covid which

have a direct impact towards the sales of the company and thus affect the NP ratio and the

profitability of the company.

Current ratio:

This is also called liquidity ratio which measures the liquidity of the company in respect

to payment of short term liability (Nuryani and Sunarsi, 2020). In case of Sainsbury the current

ratio in 2020 was 0.62 while in 2021 it become 0.60. However, in case of Morrison the Current

ratio in 2020 was 0.38 while in 2021 it become 0.47. Thus, it can be evaluating that the current

ratio in Sainsbury is high while making it compared with the Morrison. This need to be improved

because a persistence of high current ratio shows that the holding of liquidity and cash by

Sainsbury is high which restrict the funds in terms of making an investment and raising of

interest income.

Debtor collection period:

It refers to the period that is related with the collection of money from the debtors which

are due (Ibrahim, Usaini and Elijah, 2021). While analysing the financial performance of the

Sainsbury it is analysed that the Debtor collection period in 2020 was 10.20 while in 2021 it

become 9.10. However, in case of Morrison the ratio in 2020 was 7.34 and in 2021 it become

6.96. This also shows that the financial performance of Sainsbury is low in comparison of

Morrison because of the persistence of high collection period in Sainsbury which delay the

payment from the debtor and thus impact towards the availability of funds.

Creditor payment period:

It refers to the period of payment in respect to the company that how many days after the

company make the payment to its creditors (Tran, 2020). In case of Sainsbury the ratio in 2020

was 58.25 while in 2021 it become 60.27. However, in case of Morrison the ratio in 2020 was

66.07 but in 2021 it become 59.63. This shows that the financial performance of the Sainsbury is

better with an increase in the number of payment period. However, with a declining number of

days in case of the Morrison the company’s performance can also be counted as declining and

need to be improved. With the persistence of the high payment period the company can make

Sainsbury. The declining ratio can be related with them declining proportion of sales with an

increasing amount of expenses. This is also related with the negative impact of the covid which

have a direct impact towards the sales of the company and thus affect the NP ratio and the

profitability of the company.

Current ratio:

This is also called liquidity ratio which measures the liquidity of the company in respect

to payment of short term liability (Nuryani and Sunarsi, 2020). In case of Sainsbury the current

ratio in 2020 was 0.62 while in 2021 it become 0.60. However, in case of Morrison the Current

ratio in 2020 was 0.38 while in 2021 it become 0.47. Thus, it can be evaluating that the current

ratio in Sainsbury is high while making it compared with the Morrison. This need to be improved

because a persistence of high current ratio shows that the holding of liquidity and cash by

Sainsbury is high which restrict the funds in terms of making an investment and raising of

interest income.

Debtor collection period:

It refers to the period that is related with the collection of money from the debtors which

are due (Ibrahim, Usaini and Elijah, 2021). While analysing the financial performance of the

Sainsbury it is analysed that the Debtor collection period in 2020 was 10.20 while in 2021 it

become 9.10. However, in case of Morrison the ratio in 2020 was 7.34 and in 2021 it become

6.96. This also shows that the financial performance of Sainsbury is low in comparison of

Morrison because of the persistence of high collection period in Sainsbury which delay the

payment from the debtor and thus impact towards the availability of funds.

Creditor payment period:

It refers to the period of payment in respect to the company that how many days after the

company make the payment to its creditors (Tran, 2020). In case of Sainsbury the ratio in 2020

was 58.25 while in 2021 it become 60.27. However, in case of Morrison the ratio in 2020 was

66.07 but in 2021 it become 59.63. This shows that the financial performance of the Sainsbury is

better with an increase in the number of payment period. However, with a declining number of

days in case of the Morrison the company’s performance can also be counted as declining and

need to be improved. With the persistence of the high payment period the company can make

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

investment and thus earn the interest income which will support the profitability of the company.

But with the persistence of declining period in Sainsbury the financial performance is low.

Debt equity ratio:

This ratio measures the composition of debt and equity in the financial structure of the

company (Kurniawan, 2021). Its ideal ratio is 2.5 or 2 which shows that the debt of the company

must be more than equity. In case of Sainsbury the ratio in 2020 was 2.59 while in 2021 it

become 2.81. However, in case of Morrison the debt equity ratio in 2020 was 1.40 while in 2021

it become 1.61. Thus, from the above analysis it can be right to said that the financial

performance of the Morrison is low while making it compared with the Sainsbury because of the

persistence of low ratio while making it compared with the ideal ratio. Thus, it need to be

improved with the raising proportion of debt in case of equity.

Return on equity ratio:

This ratio measures the profitability of the business in relation with the equity (Hertina

and Saudi, 2019). While analysing the financial performance of Sainsbury it is analysed that the

ratio in 2020 was 0.01 while in 2021 it falls and become (0.04). However, in case of Morrison it

was found that in 2020 the ratio was 0.07 while in 2021 it become 0.02. Thus, it can be

interpreted that the financial performance of the Sainsbury is lower while making it compared

with the Morrison because of the persistence of the loss in 2020 by Sainsbury which has made

declining of the ratio.

Quick ratio:

This ratio measures the liquidity of the company. The ideal ratio is 1:1 (Wijaya and

Sedana, 2020). While making an analysis of the quick ratio it can be analysed that in 2020 the

ratio in Sainsbury was 0.48 which falls in 2021 and become 0.46. However, in case of Morrison

the ratio in 2020 was 0.19 which raise in 2021 and become 0.20. Thus, it can be evaluating that

the Sainsbury may face the issue in relation with the lack of cash and liquidity so that it can

make the repayment of short term liability. However, with a raising ratio in case of Morrison

shows better financial condition while making it compared with the Sainsbury.

Gross profit ratio:

This ratio measures the financial health of the company in respect to the return after the

deduction of cost in relation with sales (Nariswari and Nugraha, 2020). While making an

analysis of the GP ratio of Sainsbury it can be analysed that in 2020 it was 6.95 while in 2021 it

But with the persistence of declining period in Sainsbury the financial performance is low.

Debt equity ratio:

This ratio measures the composition of debt and equity in the financial structure of the

company (Kurniawan, 2021). Its ideal ratio is 2.5 or 2 which shows that the debt of the company

must be more than equity. In case of Sainsbury the ratio in 2020 was 2.59 while in 2021 it

become 2.81. However, in case of Morrison the debt equity ratio in 2020 was 1.40 while in 2021

it become 1.61. Thus, from the above analysis it can be right to said that the financial

performance of the Morrison is low while making it compared with the Sainsbury because of the

persistence of low ratio while making it compared with the ideal ratio. Thus, it need to be

improved with the raising proportion of debt in case of equity.

Return on equity ratio:

This ratio measures the profitability of the business in relation with the equity (Hertina

and Saudi, 2019). While analysing the financial performance of Sainsbury it is analysed that the

ratio in 2020 was 0.01 while in 2021 it falls and become (0.04). However, in case of Morrison it

was found that in 2020 the ratio was 0.07 while in 2021 it become 0.02. Thus, it can be

interpreted that the financial performance of the Sainsbury is lower while making it compared

with the Morrison because of the persistence of the loss in 2020 by Sainsbury which has made

declining of the ratio.

Quick ratio:

This ratio measures the liquidity of the company. The ideal ratio is 1:1 (Wijaya and

Sedana, 2020). While making an analysis of the quick ratio it can be analysed that in 2020 the

ratio in Sainsbury was 0.48 which falls in 2021 and become 0.46. However, in case of Morrison

the ratio in 2020 was 0.19 which raise in 2021 and become 0.20. Thus, it can be evaluating that

the Sainsbury may face the issue in relation with the lack of cash and liquidity so that it can

make the repayment of short term liability. However, with a raising ratio in case of Morrison

shows better financial condition while making it compared with the Sainsbury.

Gross profit ratio:

This ratio measures the financial health of the company in respect to the return after the

deduction of cost in relation with sales (Nariswari and Nugraha, 2020). While making an

analysis of the GP ratio of Sainsbury it can be analysed that in 2020 it was 6.95 while in 2021 it

become 6.07. However, in case of Morrison the concerned ratio in 2020 was 3.58 while in 2021

it become 2.20. This clearly shows that with respect to measurement of the performance of both

the companies the financial health in terms of GP ratio of the Sainsbury is high in comparison of

the Morrison. Thus, Morrison need to lower down the cost of sales so that it can raise the return

and thus the gross profit ratio of the company will be improved.

EPS ratio:

This ratio defines the amount which is made by the company in respect to each share of

the stock. It is widely used matric by which an estimation of corporate value can be made. While

evaluating the financial performance of Sainsbury it was found that the ratio in 2020 was 19.8

which falls in 2021 and it becomes 11.7. However, in case of Morrison the ratio in 2020 was

14.60 which falls in 2021 and become 3.99. Thus it can be evaluated that the financial

performance of the Morrison is declining while making it compared with the Sainsbury.

Likewise, with the declining the EPS ratio the earning in respect to the equity decline.

Return on capital employed ratio:

With the aspect of this ratio the return in respect to the employment of capital can be

measured. In case of Sainsbury the ratio in 2020 was 7.4 while in 2021 it become 5.5. However,

in case of Morrison the financial ratio in 2020 was 7% while in 2021 it become 3.9%. This

shows that the financial performance in terms of declining ROCE can be identified in case of

Morrison which need to be improved in respect to focus towards the performance of

advertisement or the promotion of company that will ultimately raise the return of the company.

Thus, from the above analysis it can be said that the performance of Sainsbury and

Morrison may vary with respect to certain aspects. This is because there is certain financial ratio

like the net profit, current ratio, debt equity ratio, return on equity, GP and various other are

declining in case of Sainsbury which shows that the financial performance of the company is not

well and thus need to be improved. However, when this performance is measured with the

Morrison it can be analysed that the financial performance of Morrison is also good in certain

aspect like the persistence of favourable current ratio, debt equity ratio while at the same time the

declining remaining ratio. Thus, it can be evaluated that with respect to the covid pandemic and

its impact the financial performance of the companies has been affected which truly reflect in the

declining financial performance of the companies in 2021.

it become 2.20. This clearly shows that with respect to measurement of the performance of both

the companies the financial health in terms of GP ratio of the Sainsbury is high in comparison of

the Morrison. Thus, Morrison need to lower down the cost of sales so that it can raise the return

and thus the gross profit ratio of the company will be improved.

EPS ratio:

This ratio defines the amount which is made by the company in respect to each share of

the stock. It is widely used matric by which an estimation of corporate value can be made. While

evaluating the financial performance of Sainsbury it was found that the ratio in 2020 was 19.8

which falls in 2021 and it becomes 11.7. However, in case of Morrison the ratio in 2020 was

14.60 which falls in 2021 and become 3.99. Thus it can be evaluated that the financial

performance of the Morrison is declining while making it compared with the Sainsbury.

Likewise, with the declining the EPS ratio the earning in respect to the equity decline.

Return on capital employed ratio:

With the aspect of this ratio the return in respect to the employment of capital can be

measured. In case of Sainsbury the ratio in 2020 was 7.4 while in 2021 it become 5.5. However,

in case of Morrison the financial ratio in 2020 was 7% while in 2021 it become 3.9%. This

shows that the financial performance in terms of declining ROCE can be identified in case of

Morrison which need to be improved in respect to focus towards the performance of

advertisement or the promotion of company that will ultimately raise the return of the company.

Thus, from the above analysis it can be said that the performance of Sainsbury and

Morrison may vary with respect to certain aspects. This is because there is certain financial ratio

like the net profit, current ratio, debt equity ratio, return on equity, GP and various other are

declining in case of Sainsbury which shows that the financial performance of the company is not

well and thus need to be improved. However, when this performance is measured with the

Morrison it can be analysed that the financial performance of Morrison is also good in certain

aspect like the persistence of favourable current ratio, debt equity ratio while at the same time the

declining remaining ratio. Thus, it can be evaluated that with respect to the covid pandemic and

its impact the financial performance of the companies has been affected which truly reflect in the

declining financial performance of the companies in 2021.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Thus, it is right to conclude that the financial performance of the companies has been

impacted with respect to the impact of the covid which need to be improved with the focus and

working towards the brand promotion and focus towards the sales aspect so that the sales and the

revenue of the company will be improved and thus raise the earning and the profitability aspect

of the company which raise the financial performance of the company along with meeting the

financial loss associated with the covid pandemic.

Sustainability reporting

Sainsbury:

The working practices of the Sainsbury is closely associated with the consideration

towards the focus over society success. The production of the food items and the products are

closely associated with the consideration towards the societal and environmental value. The

company set the baseline by 2018/19 as 14% reduction in absolute greenhouse gas reduction. As

per the goal of the committee it is assumed that by 2040 plan that focus toward the reduction of

the use of carbon, plastic along with focus towards the recycling, biodiversity along with

reducing the use of waste of food, health and various other aspect (Sustainability., 2022). The

working of the company has been made along with a compliance of CSR which shows that along

with working towards the meeting of goal of the company, it also takes consideration towards the

focus in respect to meeting of societal need and safeguarding of environment (Annual Report and

Financial Statements 2021, 2022). Sainsbury also adopt the practice of transparency under which

it makes a clear disclosure of the information and the performance so that the society and other

concerned stakeholders will get the information in relation with the working and operation of the

company.

Morrison:

Morrison also perform various function and operation in relation with the concept of

sustainability. This is justified with respect to the steps it takes in consideration with the focus

towards the 3 pillars that include the Purpose under which it performs right thigs for the

customers, farmers as well as towards those which produce food. In the same way it also makes

focus towards the Planet under which it works towards the reduction of waste, cutting of

greenhouse gases along with utilisation of resources with care. In respect to People which is the

3rd and the most important pillar the Morrison take all those steps that may lead to encourage and

impacted with respect to the impact of the covid which need to be improved with the focus and

working towards the brand promotion and focus towards the sales aspect so that the sales and the

revenue of the company will be improved and thus raise the earning and the profitability aspect

of the company which raise the financial performance of the company along with meeting the

financial loss associated with the covid pandemic.

Sustainability reporting

Sainsbury:

The working practices of the Sainsbury is closely associated with the consideration

towards the focus over society success. The production of the food items and the products are

closely associated with the consideration towards the societal and environmental value. The

company set the baseline by 2018/19 as 14% reduction in absolute greenhouse gas reduction. As

per the goal of the committee it is assumed that by 2040 plan that focus toward the reduction of

the use of carbon, plastic along with focus towards the recycling, biodiversity along with

reducing the use of waste of food, health and various other aspect (Sustainability., 2022). The

working of the company has been made along with a compliance of CSR which shows that along

with working towards the meeting of goal of the company, it also takes consideration towards the

focus in respect to meeting of societal need and safeguarding of environment (Annual Report and

Financial Statements 2021, 2022). Sainsbury also adopt the practice of transparency under which

it makes a clear disclosure of the information and the performance so that the society and other

concerned stakeholders will get the information in relation with the working and operation of the

company.

Morrison:

Morrison also perform various function and operation in relation with the concept of

sustainability. This is justified with respect to the steps it takes in consideration with the focus

towards the 3 pillars that include the Purpose under which it performs right thigs for the

customers, farmers as well as towards those which produce food. In the same way it also makes

focus towards the Planet under which it works towards the reduction of waste, cutting of

greenhouse gases along with utilisation of resources with care. In respect to People which is the

3rd and the most important pillar the Morrison take all those steps that may lead to encourage and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

initiate them to take action and steps which may lead to reduce the impact towards the

environment by taking of suitable steps like work towards the betterment of the society

(Sustainability, 2022). The Morrison also made various policies and the rules in relation with the

CSR so that the company and its employees will be well aware with respect to meeting the

sustainability aspect (Annual Report and Financial Statements 2020/21, 2022). Likewise, the

company has also set the performance target which will allow it to measure its performance in

relation with the sustainability aspect. This means that the Morrison take all those steps which

would allow the company to perform its marketing and the business operation along with taking

care of the environment and the society. Morrison also make focus towards the sustainable use of

natural resources so that the efficient utilisation of the natural resources will take place that will

lead to assist the company in meeting the sustainability compliances. The Governance Board has

also been set up in respect with CSR norms so that the safeguarding of activities of eco-friendly

production will take place along with complying the norms of sustainability. Focus towards the

giving of opportunity to the local traders and the farmers along with minimising the work with

the brand suppliers has work towards the emission of the greenhouse gas emission which is

related with the creation of pollution that is associated with the transportation activities and the

movement of goods and services that may produce ibn case of brand suppliers.

Thus, making a comparison with both the companies it can be right to said that both the

companies take most appropriate steps in relation with the CSR activities and the sustainability

norms by taking suitable steps in relation with the safeguarding of environment along with the

performance of the business operation. Both the companies have taken similar steps in relation

with reduction of the emission of the greenhouse gas emission by the end of 2040. This may also

include the similar steps in relation with the reduction of the plastic use along with the focus

towards the recycling and other procedure that may work towards the safeguarding of the

environment. Consideration towards the eco-friendly steps and production of those products

which are in accordance with the nature and meeting the concept of sustainability.

CONCLUSION

From the above report it can be concluded that while making a comparison between the

Morrison and Sainsbury the financial performance of both the company vary from each other.

However, in respect to sustainability aspect the steps of the both the companies match with each

environment by taking of suitable steps like work towards the betterment of the society

(Sustainability, 2022). The Morrison also made various policies and the rules in relation with the

CSR so that the company and its employees will be well aware with respect to meeting the

sustainability aspect (Annual Report and Financial Statements 2020/21, 2022). Likewise, the

company has also set the performance target which will allow it to measure its performance in

relation with the sustainability aspect. This means that the Morrison take all those steps which

would allow the company to perform its marketing and the business operation along with taking

care of the environment and the society. Morrison also make focus towards the sustainable use of

natural resources so that the efficient utilisation of the natural resources will take place that will

lead to assist the company in meeting the sustainability compliances. The Governance Board has

also been set up in respect with CSR norms so that the safeguarding of activities of eco-friendly

production will take place along with complying the norms of sustainability. Focus towards the

giving of opportunity to the local traders and the farmers along with minimising the work with

the brand suppliers has work towards the emission of the greenhouse gas emission which is

related with the creation of pollution that is associated with the transportation activities and the

movement of goods and services that may produce ibn case of brand suppliers.

Thus, making a comparison with both the companies it can be right to said that both the

companies take most appropriate steps in relation with the CSR activities and the sustainability

norms by taking suitable steps in relation with the safeguarding of environment along with the

performance of the business operation. Both the companies have taken similar steps in relation

with reduction of the emission of the greenhouse gas emission by the end of 2040. This may also

include the similar steps in relation with the reduction of the plastic use along with the focus

towards the recycling and other procedure that may work towards the safeguarding of the

environment. Consideration towards the eco-friendly steps and production of those products

which are in accordance with the nature and meeting the concept of sustainability.

CONCLUSION

From the above report it can be concluded that while making a comparison between the

Morrison and Sainsbury the financial performance of both the company vary from each other.

However, in respect to sustainability aspect the steps of the both the companies match with each

other that work towards the safeguarding of environment along with business operation.

However, in case of financial performance the result of both the company vary with each other in

terms of fluctuation in financial performance.

However, in case of financial performance the result of both the company vary with each other in

terms of fluctuation in financial performance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and journals

Hertina, D. and Saudi, M.H.M., 2019. Stock return: Impact of return on asset, return on equity,

debt to equity ratio and earning per share. International Journal of Innovation, Creativity

and Change. 6(12). pp.93-104.

Ibrahim, K.Y., Usaini, M. and Elijah, S., 2021. Working Capital Management and Business

Performance. Nigerian Journal of Marketing (NJM) Vol. 7(1).

Kurniawan, A., 2021. Analysis of the effect of return on asset, debt to equity ratio, and total asset

turnover on share return. Journal of Industrial Engineering & Management

Research. 2(1). pp.64-72.

Kusmayadi, D., Rahman, R. and Abdullah, Y., 2018. Analysis Of The Effect Of Net Profit

Margin, Price To Book Value, and Debt To Equity Ratio On Stock Return. International

Journal of Recent Scientific Research. 9(7). pp.28091-28095.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth: impact of net profit margin, gross

profit margin and total assests turnover. International Journal of Finance & Banking

Studies (2147-4486). 9(4). pp.87-96.

Nuryani, Y. and Sunarsi, D., 2020. The Effect of Current Ratio and Debt to Equity Ratio on

Deviding Growth. JASa (Jurnal Akuntansi, Audit dan Sistem Informasi Akuntansi). 4(2).

pp.304-312.

Tran, Q.T., 2020. Creditor protection, shareholder protection and investment efficiency: New

evidence. The North American Journal of Economics and Finance. 52. p.101170.

Wijaya, D.P. and Sedana, I.B.P., 2020. Effects of quick ratio, return on assets and exchange rates

on stock returns. Am. J. Humanities Soc. Sci. Res. 4. pp.323-329.

Online references

About us., 2021. [Online]. Available through < https://www.about.sainsburys.co.uk/about-us>

About us., 2021. [Online]. Available through <https://www.morrisons-corporate.com/about-us/>

Annual Report and Financial Statements 2020/21., 2022. [Online]. Available through

<https://www.morrisons-corporate.com/investor-centre/annual-report/>

Annual Report and Financial Statements 2021., 2022. [Online]. Available through <

https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_GB0767628_2021.pdf>

1

Books and journals

Hertina, D. and Saudi, M.H.M., 2019. Stock return: Impact of return on asset, return on equity,

debt to equity ratio and earning per share. International Journal of Innovation, Creativity

and Change. 6(12). pp.93-104.

Ibrahim, K.Y., Usaini, M. and Elijah, S., 2021. Working Capital Management and Business

Performance. Nigerian Journal of Marketing (NJM) Vol. 7(1).

Kurniawan, A., 2021. Analysis of the effect of return on asset, debt to equity ratio, and total asset

turnover on share return. Journal of Industrial Engineering & Management

Research. 2(1). pp.64-72.

Kusmayadi, D., Rahman, R. and Abdullah, Y., 2018. Analysis Of The Effect Of Net Profit

Margin, Price To Book Value, and Debt To Equity Ratio On Stock Return. International

Journal of Recent Scientific Research. 9(7). pp.28091-28095.

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth: impact of net profit margin, gross

profit margin and total assests turnover. International Journal of Finance & Banking

Studies (2147-4486). 9(4). pp.87-96.

Nuryani, Y. and Sunarsi, D., 2020. The Effect of Current Ratio and Debt to Equity Ratio on

Deviding Growth. JASa (Jurnal Akuntansi, Audit dan Sistem Informasi Akuntansi). 4(2).

pp.304-312.

Tran, Q.T., 2020. Creditor protection, shareholder protection and investment efficiency: New

evidence. The North American Journal of Economics and Finance. 52. p.101170.

Wijaya, D.P. and Sedana, I.B.P., 2020. Effects of quick ratio, return on assets and exchange rates

on stock returns. Am. J. Humanities Soc. Sci. Res. 4. pp.323-329.

Online references

About us., 2021. [Online]. Available through < https://www.about.sainsburys.co.uk/about-us>

About us., 2021. [Online]. Available through <https://www.morrisons-corporate.com/about-us/>

Annual Report and Financial Statements 2020/21., 2022. [Online]. Available through

<https://www.morrisons-corporate.com/investor-centre/annual-report/>

Annual Report and Financial Statements 2021., 2022. [Online]. Available through <

https://www.annualreports.com/HostedData/AnnualReports/PDF/LSE_GB0767628_2021.pdf>

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sustainability., 2022. [Online]. Available through <

https://www.about.sainsburys.co.uk/sustainability>

Sustainability., 2022. [Online]. Available through

<https://www.morrisons-corporate.com/morrisons-sustainability/sustainability/>

2

https://www.about.sainsburys.co.uk/sustainability>

Sustainability., 2022. [Online]. Available through

<https://www.morrisons-corporate.com/morrisons-sustainability/sustainability/>

2

APPENDIX

Calculation of financial ratios

Ratio Sainsbury Morrison

2021 2020 2021 2020

Net profit ratio: Net

profit/Sales*100

=

(280)/29048*100

= (0.96)

=

152/28993*100

= 0.52

= 96/17598*100

= 0.54

=

348/17536*100

= 1.98

Current ratio:

Current

asset/Current

liability

= 7073/11717

= 0.60

= 7586/12047

= 0.62

= 1430/2981

= 0.47

= 1322/3396

= 0.38

Debtor collection

period: Trade

debtor/annual

sales*365

=

725/29048*365

= 9.10

=

811/28993*365

= 10.20

=

336/17598*365

= 6.96

=

353/17536*365

= 7.34

Creditor payment

period: Trade

creditors/annual

purchase*365

=

4488/27176*365

= 60.27

=

4275/26783*365

= 58.25

=

2837/17364*365

= 59.63

=

3051/16854*365

= 66.07

Debt equity ratio:

Total

liability/shareholder

equity

= 18558/6604

= 2.81

= 20164/7773

= 2.59

= 6820/4216

= 1.61

= 6379/4541

= 1.40

Return on equity

ratio: Net

earnings/Shareholder

equity

= 280/6604

= (0.04)

= 152/7773

= 0.01

= 96/4216

= 0.02

= 348/4541

= 0.07

Quick ratio: Current

assets-Inventories/Cu

rrent liability

= 7073-

1625/11717

= 7586-

1732/12047

= 1430-

814/2981

= 1322-

660/3396

3

Calculation of financial ratios

Ratio Sainsbury Morrison

2021 2020 2021 2020

Net profit ratio: Net

profit/Sales*100

=

(280)/29048*100

= (0.96)

=

152/28993*100

= 0.52

= 96/17598*100

= 0.54

=

348/17536*100

= 1.98

Current ratio:

Current

asset/Current

liability

= 7073/11717

= 0.60

= 7586/12047

= 0.62

= 1430/2981

= 0.47

= 1322/3396

= 0.38

Debtor collection

period: Trade

debtor/annual

sales*365

=

725/29048*365

= 9.10

=

811/28993*365

= 10.20

=

336/17598*365

= 6.96

=

353/17536*365

= 7.34

Creditor payment

period: Trade

creditors/annual

purchase*365

=

4488/27176*365

= 60.27

=

4275/26783*365

= 58.25

=

2837/17364*365

= 59.63

=

3051/16854*365

= 66.07

Debt equity ratio:

Total

liability/shareholder

equity

= 18558/6604

= 2.81

= 20164/7773

= 2.59

= 6820/4216

= 1.61

= 6379/4541

= 1.40

Return on equity

ratio: Net

earnings/Shareholder

equity

= 280/6604

= (0.04)

= 152/7773

= 0.01

= 96/4216

= 0.02

= 348/4541

= 0.07

Quick ratio: Current

assets-Inventories/Cu

rrent liability

= 7073-

1625/11717

= 7586-

1732/12047

= 1430-

814/2981

= 1322-

660/3396

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.