Management Accounting Report: BCM Construction Case Study Analysis

VerifiedAdded on 2020/12/09

|15

|5129

|391

Report

AI Summary

This report provides an in-depth analysis of management accounting practices within BCM Construction. It begins with an introduction to management accounting, defining its meaning and requirements, and differentiating it from other accounting methods. The report then delves into various costing methods, including job costing, and explores different types of accounting reporting methods such as performance reports and inventory management reports. It highlights the benefits of a management accounting system, particularly in decision-making and planning. The report also evaluates the integration of accounting systems and reporting methods, followed by an examination of planning tools used in budgetary control, including their advantages and disadvantages. Furthermore, the report compares BCM Construction's financial issues with those of other organizations and concludes by emphasizing how management accounting contributes to sustainable success. The study encompasses cost accounting, inventory management, price optimization, and job costing within the context of the construction company, BCM.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management Accounting meaning and its requirements......................................................1

P 2. Types of Accounting reporting methods .............................................................................3

M1. Benefits of Management Accounting system .....................................................................5

D1. Evaluation of Accounting system integration and Reporting method ................................5

TASK 2............................................................................................................................................6

Several Costing methods used for calculating the Net profits ...................................................6

M2 Types of accounting tools and techniques used in MA........................................................8

D2 Analysis of Data Collected from income statement..............................................................8

TASK 3............................................................................................................................................8

P4: Advantages and Disadvantages of using planning tools used in budgetary control.............8

M3 Analysis of various Planning tool and its application for forecasting..................................9

D3 Evaluation of planning tools for responding to financial issues.........................................10

TASK4...........................................................................................................................................10

P5 Comparison With Other organisation Financial Issues.......................................................10

M4 Management accounting leads organizations to achieve sustainable success....................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management Accounting meaning and its requirements......................................................1

P 2. Types of Accounting reporting methods .............................................................................3

M1. Benefits of Management Accounting system .....................................................................5

D1. Evaluation of Accounting system integration and Reporting method ................................5

TASK 2............................................................................................................................................6

Several Costing methods used for calculating the Net profits ...................................................6

M2 Types of accounting tools and techniques used in MA........................................................8

D2 Analysis of Data Collected from income statement..............................................................8

TASK 3............................................................................................................................................8

P4: Advantages and Disadvantages of using planning tools used in budgetary control.............8

M3 Analysis of various Planning tool and its application for forecasting..................................9

D3 Evaluation of planning tools for responding to financial issues.........................................10

TASK4...........................................................................................................................................10

P5 Comparison With Other organisation Financial Issues.......................................................10

M4 Management accounting leads organizations to achieve sustainable success....................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Management Accounting means the process of managerial accounting on the basis of

which the management decisions are taken. The management decisions pertains the decisions

like devising planning, performance management systems, providing expertise in financial

accounting and reporting these all tasks consists in management accounting which helps in

assisting control in formulation and implementation of an organisational strategies and plan

(Wickramasinghe and Alawattage, 2012). BCM construction company that is a medium scale

construction providing company.

This study pertains information about management accounting process and as well as

tasks pertains in it. Not only this, several patterns or method of costing, calculation of net profit

and types of planning tools for the budgetary control process and their advantages and

disadvantages are comprises in study. Also an example to describe briefly, a comparison chart of

two organisation is also presented in it.

TASK 1

P1: Management Accounting meaning and its requirements

Management accounting or managerial accounting is the set of activities like the

preparation of devising planning, providing financial information in form of statements and

providing the reporting of financial data to its internal and external users, useful for them to

make business decisions. It provides the crucial information regarding the financial data in form

of final statements in order to to provide them to the management of high level authority of

company, so that on the basis of past and present financial information they can make future

decisions regarding the operations of business. Presentation of financial information pertains the

needful information regarding the revenues or income and expenses incurred during the financial

period and provide information regarding the Net profit of Net loss, information regarding the

cash flows and overall position of the business. this all information helps the management in

ascertainment of profit by making effective and efficient utilisation of financial and other useful

sources. Although in order to make daily decisions regarding the business operations it is

necessary to have the effective management system and management accounting system for

proper or accurate evaluation and analysation of managerial activities. Overall management

1

Management Accounting means the process of managerial accounting on the basis of

which the management decisions are taken. The management decisions pertains the decisions

like devising planning, performance management systems, providing expertise in financial

accounting and reporting these all tasks consists in management accounting which helps in

assisting control in formulation and implementation of an organisational strategies and plan

(Wickramasinghe and Alawattage, 2012). BCM construction company that is a medium scale

construction providing company.

This study pertains information about management accounting process and as well as

tasks pertains in it. Not only this, several patterns or method of costing, calculation of net profit

and types of planning tools for the budgetary control process and their advantages and

disadvantages are comprises in study. Also an example to describe briefly, a comparison chart of

two organisation is also presented in it.

TASK 1

P1: Management Accounting meaning and its requirements

Management accounting or managerial accounting is the set of activities like the

preparation of devising planning, providing financial information in form of statements and

providing the reporting of financial data to its internal and external users, useful for them to

make business decisions. It provides the crucial information regarding the financial data in form

of final statements in order to to provide them to the management of high level authority of

company, so that on the basis of past and present financial information they can make future

decisions regarding the operations of business. Presentation of financial information pertains the

needful information regarding the revenues or income and expenses incurred during the financial

period and provide information regarding the Net profit of Net loss, information regarding the

cash flows and overall position of the business. this all information helps the management in

ascertainment of profit by making effective and efficient utilisation of financial and other useful

sources. Although in order to make daily decisions regarding the business operations it is

necessary to have the effective management system and management accounting system for

proper or accurate evaluation and analysation of managerial activities. Overall management

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accounting is essential part or branch of accounting which required in order to make

ascertainment and growth of the business(Van der Stede, 2011)

Definition: Management Accounting is also known as cost accounting and managerial

accounting. It is the process which comprises with preparation of internal financial report by

analysing business costs and operations in order to make the reporting of financial information

for making useful business decisions for achieving desired future goals.

Importance of Management Accounting in business

Helpful in decision making: under management accounting the proper analysation of

financial information and business operations are made and provided in form of

statements to internal users(Board of directors, managers etc.) of information. so that the

management of BCM constructions can make useful business decision quickly on the

basis of past and present business performance report.

Helpful in planning: One of most important factor important for business growth that is

proper planning and making of proper planning is based on the past and present business

performance data prepared under management accounting.

Helpful in determining future aim: By presenting the past and present year details

regarding the overall business operations, in form of proper format it is needful and

becomes easy to set the targets or goals for future growth.

Types of Management accounting system are :

Cost Accounting system: Cost accounting is the branch of management accounting

which pertains the BCM constructions Ltd. cost of production by assessing the input

costs incurred in each task of production along with the fixed costs. Cost accounting first

evaluate or measure the costs separately after that compares the input results to output or

actual results to aid company management in measuring financial performance.

Inventory Management system: Inventory management system engaged with the

activities regarding the Management of stock or inventory. All transactions regarding the

inventory or stocks of company like BCM constructions and may be of any other kind

and for recording and analysing the inventory transactions, three methods are used for the

inventory valuation. That is LIFO(last in first out), FIFO(first in first out) and Weighted

average cost inventory method. The inventory valuation is related to the production

2

ascertainment and growth of the business(Van der Stede, 2011)

Definition: Management Accounting is also known as cost accounting and managerial

accounting. It is the process which comprises with preparation of internal financial report by

analysing business costs and operations in order to make the reporting of financial information

for making useful business decisions for achieving desired future goals.

Importance of Management Accounting in business

Helpful in decision making: under management accounting the proper analysation of

financial information and business operations are made and provided in form of

statements to internal users(Board of directors, managers etc.) of information. so that the

management of BCM constructions can make useful business decision quickly on the

basis of past and present business performance report.

Helpful in planning: One of most important factor important for business growth that is

proper planning and making of proper planning is based on the past and present business

performance data prepared under management accounting.

Helpful in determining future aim: By presenting the past and present year details

regarding the overall business operations, in form of proper format it is needful and

becomes easy to set the targets or goals for future growth.

Types of Management accounting system are :

Cost Accounting system: Cost accounting is the branch of management accounting

which pertains the BCM constructions Ltd. cost of production by assessing the input

costs incurred in each task of production along with the fixed costs. Cost accounting first

evaluate or measure the costs separately after that compares the input results to output or

actual results to aid company management in measuring financial performance.

Inventory Management system: Inventory management system engaged with the

activities regarding the Management of stock or inventory. All transactions regarding the

inventory or stocks of company like BCM constructions and may be of any other kind

and for recording and analysing the inventory transactions, three methods are used for the

inventory valuation. That is LIFO(last in first out), FIFO(first in first out) and Weighted

average cost inventory method. The inventory valuation is related to the production

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sector in order to create the effective work order, bill of goods and other manufacturing

related invoices(Lavia López, and Hiebl, M.2014)

Price Optimisation system: The price optimisation means the pricing of different types

of products according to their worth and criteria of company may be BCM constructions

Ltd. of U.K. Under the price optimisation task the numeric evaluation done by the

company to know the per product production costs and Tax (on sale of per product) and

the profit margin of the company per product, on the basis of these evaluation the selling

price of per product is decided by the company, it is also known as pricing strategy of

company. Analysis of prices is main purpose of this accounting system. It is beneficial

for company to predict the expected amount of sale units and expected incomes.

Job costing method: It is most important task to determine the costs incurred in a

particular business operation no matter, whether it is related to the production or

promotion or selling. It is required to determine the costs incurred in performing the

business jobs and operation. As this term is widely used in matter of construction

companies like BCM construction Ltd. There are various stages under the job costing

such as, batch costing, standard costing, product or process costing.

P 2. Types of Accounting reporting methods

In present times it is essential to have proper system of accounting and its reporting, to

face the advanced competition prevailing in market. In order to ascertain the business operations

and growth it is essential to ascertain the profit and revenues of the business. The ascertainment

can only be possible when there is appropriate recording and reporting system of managerial as

well as financial information is available. So that the information is analysed in proper format

and the possible factors that influences the business can be find out(Banerjee,2012)

Reporting is one of the crucial function of management in order to make the useful

decisions regarding the business operations. Reporting information may be of financial and non

financial character. Reporting performs the major function of transferring the useful information

about the company's performance to its internal and external users. Internal users includes the

management and high level authority(Board of directors, equity owners etc. CEO's) and the

external users include the potential investors, government authorities and tax authorities etc. the

internal uses needs the information for the business operations and growth and the external users

like potential investors need the information for making the investment decisions and the tax

3

related invoices(Lavia López, and Hiebl, M.2014)

Price Optimisation system: The price optimisation means the pricing of different types

of products according to their worth and criteria of company may be BCM constructions

Ltd. of U.K. Under the price optimisation task the numeric evaluation done by the

company to know the per product production costs and Tax (on sale of per product) and

the profit margin of the company per product, on the basis of these evaluation the selling

price of per product is decided by the company, it is also known as pricing strategy of

company. Analysis of prices is main purpose of this accounting system. It is beneficial

for company to predict the expected amount of sale units and expected incomes.

Job costing method: It is most important task to determine the costs incurred in a

particular business operation no matter, whether it is related to the production or

promotion or selling. It is required to determine the costs incurred in performing the

business jobs and operation. As this term is widely used in matter of construction

companies like BCM construction Ltd. There are various stages under the job costing

such as, batch costing, standard costing, product or process costing.

P 2. Types of Accounting reporting methods

In present times it is essential to have proper system of accounting and its reporting, to

face the advanced competition prevailing in market. In order to ascertain the business operations

and growth it is essential to ascertain the profit and revenues of the business. The ascertainment

can only be possible when there is appropriate recording and reporting system of managerial as

well as financial information is available. So that the information is analysed in proper format

and the possible factors that influences the business can be find out(Banerjee,2012)

Reporting is one of the crucial function of management in order to make the useful

decisions regarding the business operations. Reporting information may be of financial and non

financial character. Reporting performs the major function of transferring the useful information

about the company's performance to its internal and external users. Internal users includes the

management and high level authority(Board of directors, equity owners etc. CEO's) and the

external users include the potential investors, government authorities and tax authorities etc. the

internal uses needs the information for the business operations and growth and the external users

like potential investors need the information for making the investment decisions and the tax

3

authorities need the information to quantify the amount of tax payable by the particular

company. Both the types of users needs the information regarding the company's performance

and profitability, so by reporting system channels it becomes easy to get the information

regarding any company online by websites and google, the effective and efficient reporting

system of present times makes it so simple for its users. Overall, reporting system plays the

eminent role in prevailing business environment.

There are various types of accounting reporting method used to record and report the

necessary information about the company.

Performance report:It is one of the important steps which is related to the company's

overall performance and situation and with project communication management. It

comprises with the collection and dissemination of several techniques or schemes, data ,

effective and efficient utilisation of resources and ascertaining the growth and for

effective planning. Performance report presents the last year one or two year's data along

with the present year's data on the basis of which decision are made by comparison of

data on the basis of past records (Bouten and Hoozée, 2013). Worker's performance

report also maintain by the organisations as in case of BCM constructions the workers

performance report is maintain in order to make the accurate data record and for

performance appraisal. Hence performance report is essential for recording and analysing

the data.

Inventory Management report: Inventory management report is essential in order to

maintain a proper record of the transactions regarding the inventory or stock. An up to

date recording of stock transactions helps in quantifying the produced, sold and

remaining amount of inventory held with the organisation. The inventory system pertains

the appropriate methods of evaluating and analysing the stock transactions, the methods

used for this are LIFO(last in first out), FIFO(first in first out), Weighted average cost

method for the proper analysation.

Account Receivable report: Account receivable report is prepare to quantify the number

of unpaid invoices collect during the specified period or to find out the number of debtors

of the company as in case of BCM constructions(UK) the periodic report is prepared in

order to find out the number of unpaid invoices or debtors of the company. This report

helps in making the correct balance sheet as it shows the debtors amount which is to be

4

company. Both the types of users needs the information regarding the company's performance

and profitability, so by reporting system channels it becomes easy to get the information

regarding any company online by websites and google, the effective and efficient reporting

system of present times makes it so simple for its users. Overall, reporting system plays the

eminent role in prevailing business environment.

There are various types of accounting reporting method used to record and report the

necessary information about the company.

Performance report:It is one of the important steps which is related to the company's

overall performance and situation and with project communication management. It

comprises with the collection and dissemination of several techniques or schemes, data ,

effective and efficient utilisation of resources and ascertaining the growth and for

effective planning. Performance report presents the last year one or two year's data along

with the present year's data on the basis of which decision are made by comparison of

data on the basis of past records (Bouten and Hoozée, 2013). Worker's performance

report also maintain by the organisations as in case of BCM constructions the workers

performance report is maintain in order to make the accurate data record and for

performance appraisal. Hence performance report is essential for recording and analysing

the data.

Inventory Management report: Inventory management report is essential in order to

maintain a proper record of the transactions regarding the inventory or stock. An up to

date recording of stock transactions helps in quantifying the produced, sold and

remaining amount of inventory held with the organisation. The inventory system pertains

the appropriate methods of evaluating and analysing the stock transactions, the methods

used for this are LIFO(last in first out), FIFO(first in first out), Weighted average cost

method for the proper analysation.

Account Receivable report: Account receivable report is prepare to quantify the number

of unpaid invoices collect during the specified period or to find out the number of debtors

of the company as in case of BCM constructions(UK) the periodic report is prepared in

order to find out the number of unpaid invoices or debtors of the company. This report

helps in making the correct balance sheet as it shows the debtors amount which is to be

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

shown in balance sheet as assets, hence, it is helpful in find out the proper BCM

construction Ltd.'s overall performance.

Job cost report: Job cost report is prepared in order to find out the income generate and

cost incurred while completing the business operations and for analysing in to quantify

the profitability in performing the particular job. As in case of BCM constructions(UK)

job cost report is prepare in a manner like, basically it is based on the format of income

statement that it comprises two side one is of income generated and second is of expenses

and after deducting the expense from income the result is profit generated from a

particular job (Maas, Schaltegger, and Crutzen, 2016).

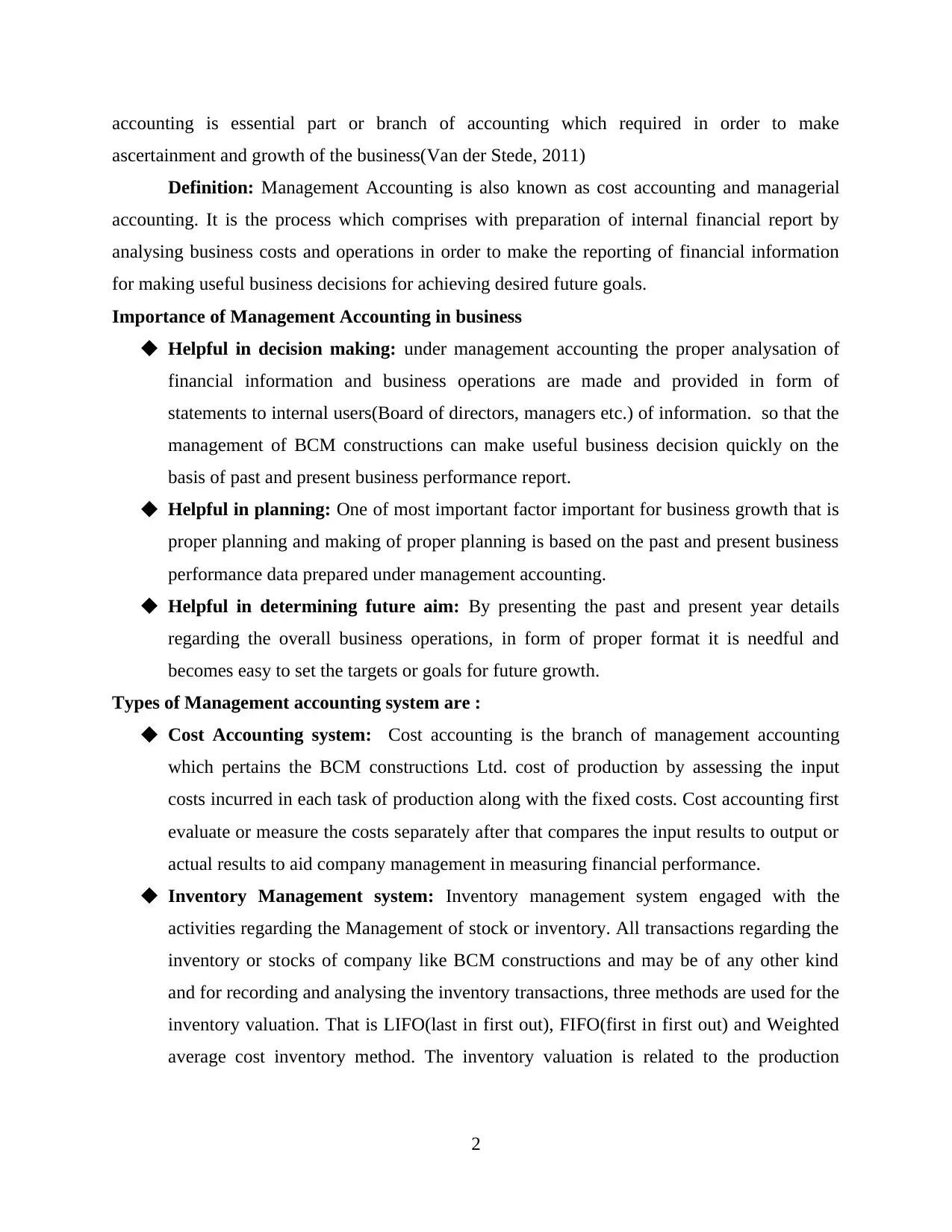

M1. Benefits of Management Accounting system

There are several merits and demerits of using the management accounting system, as it

is important for sooth functioning, proper recording and analysation of data and overall crucial

for business growth. The BCM construction Ltd. (UK) also follow the management accounting

system and its technique in order to present systematic business report and ascertain it properly.

There are the benefits of Accounting system and its types.

Types of Accounting

system

Benefits of Accounting system

Cost accounting system This system helps in proper maintaining record of cost incurred

and helpful in quantifying and ascertaining the profit of the

business.

Inventory management

system

It maintain the accurate record of inventory or stock so, helpful in

determining opening and closing stock.

Price optimisation It helps in determining the price of the product and used to analyse

the perception of customers.

Job costing system It helps in determining the the cost incurred and income generated

by the particular job, and determines the profit from that job or

operation.

5

construction Ltd.'s overall performance.

Job cost report: Job cost report is prepared in order to find out the income generate and

cost incurred while completing the business operations and for analysing in to quantify

the profitability in performing the particular job. As in case of BCM constructions(UK)

job cost report is prepare in a manner like, basically it is based on the format of income

statement that it comprises two side one is of income generated and second is of expenses

and after deducting the expense from income the result is profit generated from a

particular job (Maas, Schaltegger, and Crutzen, 2016).

M1. Benefits of Management Accounting system

There are several merits and demerits of using the management accounting system, as it

is important for sooth functioning, proper recording and analysation of data and overall crucial

for business growth. The BCM construction Ltd. (UK) also follow the management accounting

system and its technique in order to present systematic business report and ascertain it properly.

There are the benefits of Accounting system and its types.

Types of Accounting

system

Benefits of Accounting system

Cost accounting system This system helps in proper maintaining record of cost incurred

and helpful in quantifying and ascertaining the profit of the

business.

Inventory management

system

It maintain the accurate record of inventory or stock so, helpful in

determining opening and closing stock.

Price optimisation It helps in determining the price of the product and used to analyse

the perception of customers.

Job costing system It helps in determining the the cost incurred and income generated

by the particular job, and determines the profit from that job or

operation.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1. Evaluation of Accounting system integration and Reporting method

It is true that the accounting system and reporting both are useful for recording and

transferring the business operational information. The company like BCM constructions Ltd.

Used these two tasks of management accounting combined in order to reduce the gap between

the preparation, integration and transferring of business performance information. The task of

management accounting pertains both the functions and is used to provide standard process for

recording and reporting the information about business activities. There are several types of

reporting methods used to report the business operational information according to their nature.

One of the type of reporting system is performance report which is helpful in presenting the

performance of business operations as well as performance of employees working in

organisation in a direction of desired goals. Moreover the, account receivable report is helpful in

reporting the information regarding the unpaid invoices or debtors which is useful to prepare the

balance sheet as major financial statement which shows the overall performance of BCM

constructions Ltd. Or of any other company (Cuganesan, Dunford, and Palmer, 2012).

TASK 2

Several Costing methods used for calculating the Net profits

Cost is the value which is to be paid or incurred in performing the business transactions

and the costing methods are used to identify the profit generated from these business tasks after

paying all costs incurred, the remaining is the profit.

Marginal costing:

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales revenue = ( No. of goods sold * selling price = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = ( Marginal cost per unit * Produced units= 16*800) 12800

closing stock = ( Marginal cost per unit * Closing Stock Units = 16

* 200) 3200

Contribution 23400

Fixed cost ( 1200+3200+1500 ) 5900

Net profit 17500

Absorption costing

Computation of net income by using absorption costing method:

6

It is true that the accounting system and reporting both are useful for recording and

transferring the business operational information. The company like BCM constructions Ltd.

Used these two tasks of management accounting combined in order to reduce the gap between

the preparation, integration and transferring of business performance information. The task of

management accounting pertains both the functions and is used to provide standard process for

recording and reporting the information about business activities. There are several types of

reporting methods used to report the business operational information according to their nature.

One of the type of reporting system is performance report which is helpful in presenting the

performance of business operations as well as performance of employees working in

organisation in a direction of desired goals. Moreover the, account receivable report is helpful in

reporting the information regarding the unpaid invoices or debtors which is useful to prepare the

balance sheet as major financial statement which shows the overall performance of BCM

constructions Ltd. Or of any other company (Cuganesan, Dunford, and Palmer, 2012).

TASK 2

Several Costing methods used for calculating the Net profits

Cost is the value which is to be paid or incurred in performing the business transactions

and the costing methods are used to identify the profit generated from these business tasks after

paying all costs incurred, the remaining is the profit.

Marginal costing:

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales revenue = ( No. of goods sold * selling price = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = ( Marginal cost per unit * Produced units= 16*800) 12800

closing stock = ( Marginal cost per unit * Closing Stock Units = 16

* 200) 3200

Contribution 23400

Fixed cost ( 1200+3200+1500 ) 5900

Net profit 17500

Absorption costing

Computation of net income by using absorption costing method:

6

Particulars Amount

Sales = (Price of selling * no. of units sold = 600 * 55) 33000

Cost of goods sold = (total expenses per unit * actual sales = 600*23.375) 14025

Gross profit 18975

Selling & Administrative expenses = ( Selling and administrative cost +

variable sales overhead * actual sales = 600 + 2700*1) 3300

Net profit/ operating income 15675

Break even analysis:

A. Total number of product sold

Sales per unit 40

Variable costs VC = Direct Labor + Direct Material 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Sales per unit 40

Variable costs VC = Direct Labor + Direct Material 28

Contribution 12

Fixed costs 6000

Profit volume ratio = Contribution / sales * 100 30.00%

BEP in sales 20000

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety:

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

7

Sales = (Price of selling * no. of units sold = 600 * 55) 33000

Cost of goods sold = (total expenses per unit * actual sales = 600*23.375) 14025

Gross profit 18975

Selling & Administrative expenses = ( Selling and administrative cost +

variable sales overhead * actual sales = 600 + 2700*1) 3300

Net profit/ operating income 15675

Break even analysis:

A. Total number of product sold

Sales per unit 40

Variable costs VC = Direct Labor + Direct Material 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Sales per unit 40

Variable costs VC = Direct Labor + Direct Material 28

Contribution 12

Fixed costs 6000

Profit volume ratio = Contribution / sales * 100 30.00%

BEP in sales 20000

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety:

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

M2 Types of accounting tools and techniques used in MA

Marginal costing tools: This can be implement in manufacturing organisation.

Historical cost: it can be implemented in historical accounting operating organisations.

D2 Analysis of Data Collected from income statement

In respect to deal with several issues that are arises in BCM construction limited in

coming time they need to make use of various costing method. It would be make reliable aspects

to the company which will be necessary for effectual decision making. In respect to use of

marginal costing the company used to make adequate amount of profit with 17500. While in case

they are using absorption costing they are getting a net profit of 15675. All the variation is being

analyse by using total fixed cost consideration.

TASK 3

P4: Advantages and Disadvantages of using planning tools used in budgetary control

A budget is a formal statement of forecasting revenue and expenses supported on future

objectives and plans. In different words, a budget is a document that management makes to

estimate the incomes and expenditure for an upcoming period based on their goals for the

business.

Budgetary control is the procedure of determinant different actual results with budgeted

amounts for the organisation for the future period and standard set then examination the

budgeted figures with the actual performance for conniving variances (Lachmann, Trapp, and

Trapp, 2017).

Scenario tool:

In this planning tool of budgetary control, various situations in distinct set of futures are

examined in BCM construction limited. Intention of this system is to assemble a number of

probable future results that differ from most commonly acknowledged scenario. Thereafter,

BCM construction limited can develop eventuality plans to deal with various sets of future

scenario.

Advantage - In respect to face various uncertainty that are occur in the department as

prime techniques to make effective decision making in coming period of time.

8

Marginal costing tools: This can be implement in manufacturing organisation.

Historical cost: it can be implemented in historical accounting operating organisations.

D2 Analysis of Data Collected from income statement

In respect to deal with several issues that are arises in BCM construction limited in

coming time they need to make use of various costing method. It would be make reliable aspects

to the company which will be necessary for effectual decision making. In respect to use of

marginal costing the company used to make adequate amount of profit with 17500. While in case

they are using absorption costing they are getting a net profit of 15675. All the variation is being

analyse by using total fixed cost consideration.

TASK 3

P4: Advantages and Disadvantages of using planning tools used in budgetary control

A budget is a formal statement of forecasting revenue and expenses supported on future

objectives and plans. In different words, a budget is a document that management makes to

estimate the incomes and expenditure for an upcoming period based on their goals for the

business.

Budgetary control is the procedure of determinant different actual results with budgeted

amounts for the organisation for the future period and standard set then examination the

budgeted figures with the actual performance for conniving variances (Lachmann, Trapp, and

Trapp, 2017).

Scenario tool:

In this planning tool of budgetary control, various situations in distinct set of futures are

examined in BCM construction limited. Intention of this system is to assemble a number of

probable future results that differ from most commonly acknowledged scenario. Thereafter,

BCM construction limited can develop eventuality plans to deal with various sets of future

scenario.

Advantage - In respect to face various uncertainty that are occur in the department as

prime techniques to make effective decision making in coming period of time.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Disadvantage – It is difficult to create sensible occasion that are found to examine several

impressive decision in respect to future growth of the organisation.

Forecasting tool

It is known as technical tool used for estimation of future trends, outcomes of BCM

construction limited by analysis of existent data. In context of budgetary control, companies

apply this planning tool in deciding allocation of budgets for expected expenses of future. At the

last stage of forecasting, after data analysis and determination of assumptions, confirmation is

done. Verification between actual outcomes and forecasted results is done for more accuracy.

Advantage – This tool provide estimated financial information to company which can be

used for taking decision regarding future and provides flexibility.

Disadvantage – It is mostly depended on qualitative estimation which could be not relies

on subjective inputs and accounts not taken reliable (Baird, Jia Hu and Reeve, 2011).

Contingency tool

This tool describes those various factors which help in providing accurately and timely

effective areas of humanistic that aids to most critical time those are arising in BMC construction

limited. It is a type of course of action that is planned to help a company to react at different

types of business risks those are moving performance of an organisation. It is advised as Plan B

because it is mostly used in critical situation those are become in the section.

Advantage - Contingency planning tool an effective designed tool for facing all types

issues to assesses in advance about unpredicted changes in market or business. Thus with

the help of this tool one can formulate strategies to overcome from difficulties that might

happen in future. Along with it BCM construction limited can integrate globalization and

change management into analysis of strategies.

Disadvantage – Approach of contingency in suggestion is well good but in practical it is

very complex to apply and also in some kind of situations. It is reactive in nature rather

than proactive.

M3 Analysis of various Planning tool and its application for forecasting

According to different methods of controlling budget for BCM construction limited,

manager need to make use of several planning tools. There are specific type of tool like as

contingency tools are taken into account for controlling business risks those are grow in the

division. Forecasting that is used to examine total expenses and costs obtain by the company

9

impressive decision in respect to future growth of the organisation.

Forecasting tool

It is known as technical tool used for estimation of future trends, outcomes of BCM

construction limited by analysis of existent data. In context of budgetary control, companies

apply this planning tool in deciding allocation of budgets for expected expenses of future. At the

last stage of forecasting, after data analysis and determination of assumptions, confirmation is

done. Verification between actual outcomes and forecasted results is done for more accuracy.

Advantage – This tool provide estimated financial information to company which can be

used for taking decision regarding future and provides flexibility.

Disadvantage – It is mostly depended on qualitative estimation which could be not relies

on subjective inputs and accounts not taken reliable (Baird, Jia Hu and Reeve, 2011).

Contingency tool

This tool describes those various factors which help in providing accurately and timely

effective areas of humanistic that aids to most critical time those are arising in BMC construction

limited. It is a type of course of action that is planned to help a company to react at different

types of business risks those are moving performance of an organisation. It is advised as Plan B

because it is mostly used in critical situation those are become in the section.

Advantage - Contingency planning tool an effective designed tool for facing all types

issues to assesses in advance about unpredicted changes in market or business. Thus with

the help of this tool one can formulate strategies to overcome from difficulties that might

happen in future. Along with it BCM construction limited can integrate globalization and

change management into analysis of strategies.

Disadvantage – Approach of contingency in suggestion is well good but in practical it is

very complex to apply and also in some kind of situations. It is reactive in nature rather

than proactive.

M3 Analysis of various Planning tool and its application for forecasting

According to different methods of controlling budget for BCM construction limited,

manager need to make use of several planning tools. There are specific type of tool like as

contingency tools are taken into account for controlling business risks those are grow in the

division. Forecasting that is used to examine total expenses and costs obtain by the company

9

(Busco and Scapens, 2011). There are particular type of equipment that are examined in the

above according to the help of effective budget process. Planning and generated revenue is said

to be important principal for evaluating alteration of income related to difficulty in more certain

manner.

D3 Evaluation of planning tools for responding to financial issues

It has been found that company need to face various inner problem those are develop in

BCM construction limited. In order to control various implications that are connected with

budgets of a company. contingency tool is taken into account as one of the reliable tool which

will be taken into account to control business risks those are moving the overall performance of

the organisation (Wanderley and Cullen, 2013). While Forecasting tools is used to estimate

future issues those are affecting performance of the company can be resolve by using Key

performance indicators. It can be resolve by using financial governance rules those are made for

the intention of moving business in more impressive way.

TASK4

P5 Comparison With Other organisation Financial Issues

In BCM construction limited can be simply found that the managers are having many

problems regarding to management accounting system. It carrier critical situations to manage

financial resources of business. In this system including various kind of financial issues such as

customer satisfaction, increase in coast and decrease in revenue. These issues can resolved by

using following tool are as:

KPI (key Performance Indicator)

It is a measurable amount that present how effectively an organization is reach key

business objectives. Companies use key performance indicators for arrival targets to evaluate

multiple levels of success. KPIs divided in two parts are low level and high level. High level KPI

using for focus on the entire performance of a company. And low level KPI using for direction

on processes or employees in various departments. Financial issues faces relating current ratio,

working capital, operating cash flow and working capital (KPIs-financial and non-finanacial,

2018). BCM construction limited are use this financial tool for high level and low level

performance and measuring or following development of essential field. It also using for

achieving organizations goals and indicates that how to manage team.

10

above according to the help of effective budget process. Planning and generated revenue is said

to be important principal for evaluating alteration of income related to difficulty in more certain

manner.

D3 Evaluation of planning tools for responding to financial issues

It has been found that company need to face various inner problem those are develop in

BCM construction limited. In order to control various implications that are connected with

budgets of a company. contingency tool is taken into account as one of the reliable tool which

will be taken into account to control business risks those are moving the overall performance of

the organisation (Wanderley and Cullen, 2013). While Forecasting tools is used to estimate

future issues those are affecting performance of the company can be resolve by using Key

performance indicators. It can be resolve by using financial governance rules those are made for

the intention of moving business in more impressive way.

TASK4

P5 Comparison With Other organisation Financial Issues

In BCM construction limited can be simply found that the managers are having many

problems regarding to management accounting system. It carrier critical situations to manage

financial resources of business. In this system including various kind of financial issues such as

customer satisfaction, increase in coast and decrease in revenue. These issues can resolved by

using following tool are as:

KPI (key Performance Indicator)

It is a measurable amount that present how effectively an organization is reach key

business objectives. Companies use key performance indicators for arrival targets to evaluate

multiple levels of success. KPIs divided in two parts are low level and high level. High level KPI

using for focus on the entire performance of a company. And low level KPI using for direction

on processes or employees in various departments. Financial issues faces relating current ratio,

working capital, operating cash flow and working capital (KPIs-financial and non-finanacial,

2018). BCM construction limited are use this financial tool for high level and low level

performance and measuring or following development of essential field. It also using for

achieving organizations goals and indicates that how to manage team.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.