Comprehensive Financial Accounting Report: Brooks City Case Study

VerifiedAdded on 2021/02/20

|30

|6425

|19

Report

AI Summary

This report delves into financial accounting principles, examining their significance and purpose within the context of Brooks City, a small business accountancy firm. It covers the definition of financial accounting, its major purposes, and the preparation of financial statements. The report identifies and describes both internal (managers and owners) and external stakeholders (lenders, investors, auditors, and government), highlighting their respective interests in financial reporting. It includes detailed journal entries for January 2019, illustrating transaction recording. Furthermore, the report provides insights into accounting concepts like depreciation, suspense, and control accounts, as well as Bank Reconciliation Statements (BRS) and the causes of deviations in comparison to cash flow statements, offering a comprehensive overview of financial accounting practices.

Financial accounting principle.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Financial accounting principles are referred as the rules or the regulations that has be

comply by the organization at time of reporting the financial data within the statements. The

organization has to formulate its financial reports in accordance and compliance with accounting

principles or rules. Present study is based on Brooks City which is an small business accountancy

firm, it provides tax and accounting services to its customers. This study is based on various

aspects relating to financial accounting. Furthermore, the report present deep insights towards the

meaning and the purpose of the FA. Moreover, it includes the information regarding all the

stakeholders with appropriate preparation of the primary books and the final accounts of the

company. It also highlights the accounting principle that includes consistency and prudence

concept. Report will also provide deeper insight about accounting concepts or rules pertaining to

depreciation, suspense and control account etc. In addition to this, it also develops understanding

about BRS and causes due to which deviations occurred in the same in comparison to cash flow

statement.

MAIN BODY

a. Defining financial accounting and its major purposes

FA refers to the practice of recording, reporting and interpreting the transactions are

resulting from the operations of the business. In this, business transactions are been summarized

within the formulation of the financial reports that includes profit and loss statement, b/s and the

cash flow statements (Barth, 2015). These statements record for the operating performance of an

entity over the particular time period. Financial accounting makes utilisation of the established

principles for the accounting. It is mandatory for all the organization to report their financials in

compliance with the IFRS and GAAP. The development of these principles of an accounting is

to facilitate information on the constant basis to the stakeholders namely creditors, investors, tax

authorities, regulators etc (Libby, 2017). Financial accounting could be performed by utilising

the two main methods that includes accrual and cash method. However, cash method reflects the

recording of the business transactions only on the exchange of the cash. Financial and

management accounting are the main branch of the accounting but differs with each other in the

following manner-

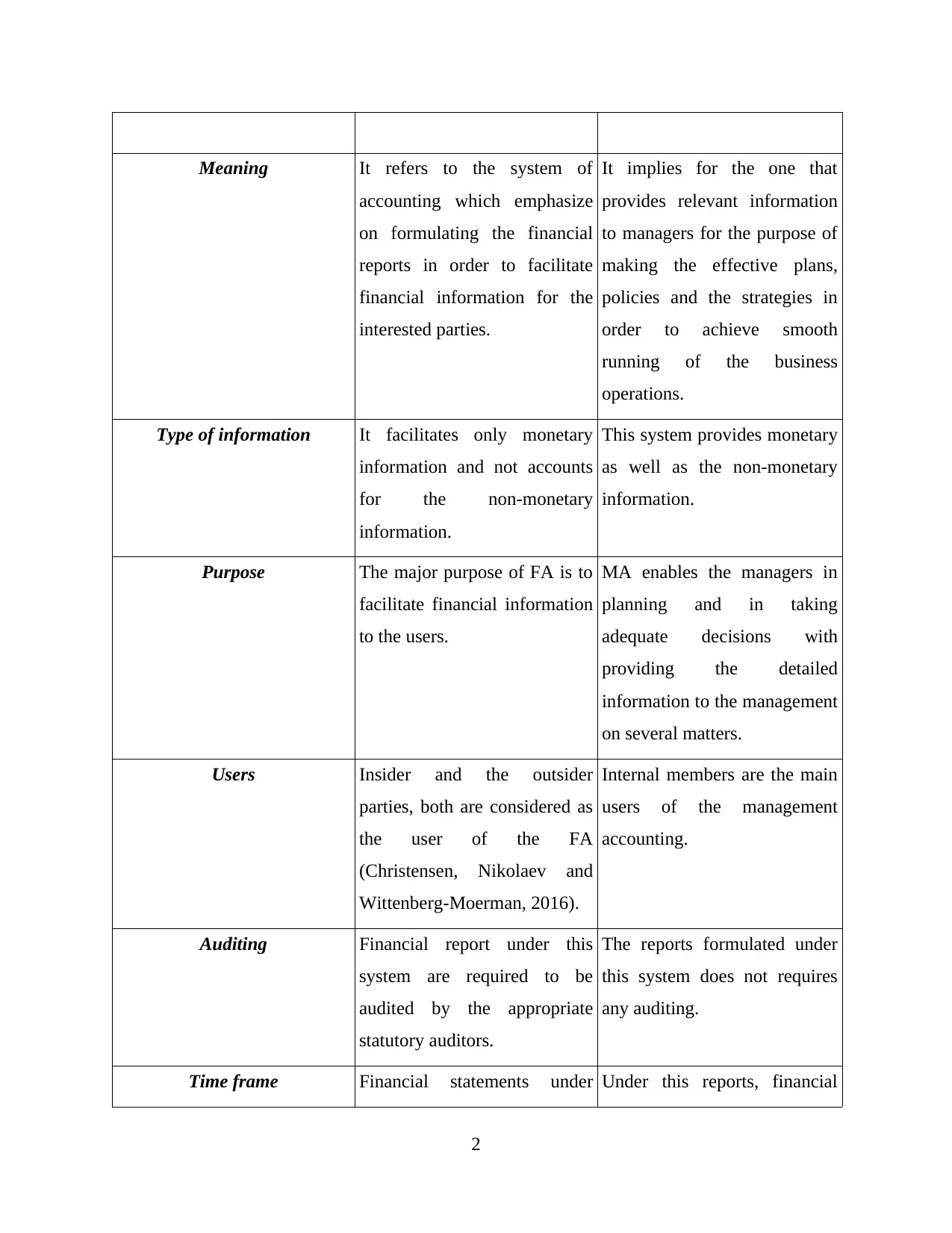

Basis Financial accounting Management accounting

1

Financial accounting principles are referred as the rules or the regulations that has be

comply by the organization at time of reporting the financial data within the statements. The

organization has to formulate its financial reports in accordance and compliance with accounting

principles or rules. Present study is based on Brooks City which is an small business accountancy

firm, it provides tax and accounting services to its customers. This study is based on various

aspects relating to financial accounting. Furthermore, the report present deep insights towards the

meaning and the purpose of the FA. Moreover, it includes the information regarding all the

stakeholders with appropriate preparation of the primary books and the final accounts of the

company. It also highlights the accounting principle that includes consistency and prudence

concept. Report will also provide deeper insight about accounting concepts or rules pertaining to

depreciation, suspense and control account etc. In addition to this, it also develops understanding

about BRS and causes due to which deviations occurred in the same in comparison to cash flow

statement.

MAIN BODY

a. Defining financial accounting and its major purposes

FA refers to the practice of recording, reporting and interpreting the transactions are

resulting from the operations of the business. In this, business transactions are been summarized

within the formulation of the financial reports that includes profit and loss statement, b/s and the

cash flow statements (Barth, 2015). These statements record for the operating performance of an

entity over the particular time period. Financial accounting makes utilisation of the established

principles for the accounting. It is mandatory for all the organization to report their financials in

compliance with the IFRS and GAAP. The development of these principles of an accounting is

to facilitate information on the constant basis to the stakeholders namely creditors, investors, tax

authorities, regulators etc (Libby, 2017). Financial accounting could be performed by utilising

the two main methods that includes accrual and cash method. However, cash method reflects the

recording of the business transactions only on the exchange of the cash. Financial and

management accounting are the main branch of the accounting but differs with each other in the

following manner-

Basis Financial accounting Management accounting

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Meaning It refers to the system of

accounting which emphasize

on formulating the financial

reports in order to facilitate

financial information for the

interested parties.

It implies for the one that

provides relevant information

to managers for the purpose of

making the effective plans,

policies and the strategies in

order to achieve smooth

running of the business

operations.

Type of information It facilitates only monetary

information and not accounts

for the non-monetary

information.

This system provides monetary

as well as the non-monetary

information.

Purpose The major purpose of FA is to

facilitate financial information

to the users.

MA enables the managers in

planning and in taking

adequate decisions with

providing the detailed

information to the management

on several matters.

Users Insider and the outsider

parties, both are considered as

the user of the FA

(Christensen, Nikolaev and

Wittenberg‐Moerman, 2016).

Internal members are the main

users of the management

accounting.

Auditing Financial report under this

system are required to be

audited by the appropriate

statutory auditors.

The reports formulated under

this system does not requires

any auditing.

Time frame Financial statements under Under this reports, financial

2

accounting which emphasize

on formulating the financial

reports in order to facilitate

financial information for the

interested parties.

It implies for the one that

provides relevant information

to managers for the purpose of

making the effective plans,

policies and the strategies in

order to achieve smooth

running of the business

operations.

Type of information It facilitates only monetary

information and not accounts

for the non-monetary

information.

This system provides monetary

as well as the non-monetary

information.

Purpose The major purpose of FA is to

facilitate financial information

to the users.

MA enables the managers in

planning and in taking

adequate decisions with

providing the detailed

information to the management

on several matters.

Users Insider and the outsider

parties, both are considered as

the user of the FA

(Christensen, Nikolaev and

Wittenberg‐Moerman, 2016).

Internal members are the main

users of the management

accounting.

Auditing Financial report under this

system are required to be

audited by the appropriate

statutory auditors.

The reports formulated under

this system does not requires

any auditing.

Time frame Financial statements under Under this reports, financial

2

financial accounting is been

framed at year end which is

specifically one year.

statements are been formulated

as per the requirements of an

entity.

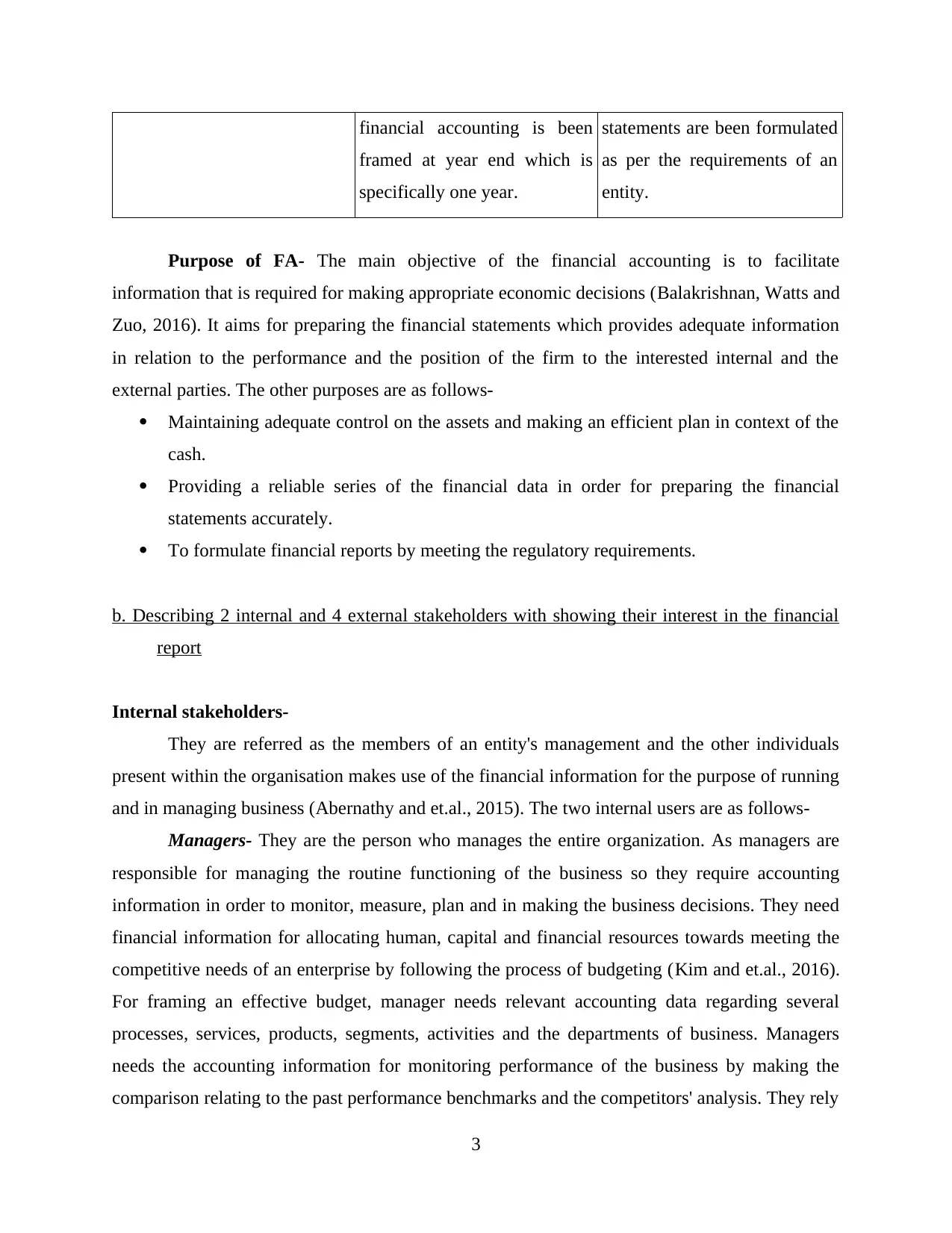

Purpose of FA- The main objective of the financial accounting is to facilitate

information that is required for making appropriate economic decisions (Balakrishnan, Watts and

Zuo, 2016). It aims for preparing the financial statements which provides adequate information

in relation to the performance and the position of the firm to the interested internal and the

external parties. The other purposes are as follows-

Maintaining adequate control on the assets and making an efficient plan in context of the

cash.

Providing a reliable series of the financial data in order for preparing the financial

statements accurately.

To formulate financial reports by meeting the regulatory requirements.

b. Describing 2 internal and 4 external stakeholders with showing their interest in the financial

report

Internal stakeholders-

They are referred as the members of an entity's management and the other individuals

present within the organisation makes use of the financial information for the purpose of running

and in managing business (Abernathy and et.al., 2015). The two internal users are as follows-

Managers- They are the person who manages the entire organization. As managers are

responsible for managing the routine functioning of the business so they require accounting

information in order to monitor, measure, plan and in making the business decisions. They need

financial information for allocating human, capital and financial resources towards meeting the

competitive needs of an enterprise by following the process of budgeting (Kim and et.al., 2016).

For framing an effective budget, manager needs relevant accounting data regarding several

processes, services, products, segments, activities and the departments of business. Managers

needs the accounting information for monitoring performance of the business by making the

comparison relating to the past performance benchmarks and the competitors' analysis. They rely

3

framed at year end which is

specifically one year.

statements are been formulated

as per the requirements of an

entity.

Purpose of FA- The main objective of the financial accounting is to facilitate

information that is required for making appropriate economic decisions (Balakrishnan, Watts and

Zuo, 2016). It aims for preparing the financial statements which provides adequate information

in relation to the performance and the position of the firm to the interested internal and the

external parties. The other purposes are as follows-

Maintaining adequate control on the assets and making an efficient plan in context of the

cash.

Providing a reliable series of the financial data in order for preparing the financial

statements accurately.

To formulate financial reports by meeting the regulatory requirements.

b. Describing 2 internal and 4 external stakeholders with showing their interest in the financial

report

Internal stakeholders-

They are referred as the members of an entity's management and the other individuals

present within the organisation makes use of the financial information for the purpose of running

and in managing business (Abernathy and et.al., 2015). The two internal users are as follows-

Managers- They are the person who manages the entire organization. As managers are

responsible for managing the routine functioning of the business so they require accounting

information in order to monitor, measure, plan and in making the business decisions. They need

financial information for allocating human, capital and financial resources towards meeting the

competitive needs of an enterprise by following the process of budgeting (Kim and et.al., 2016).

For framing an effective budget, manager needs relevant accounting data regarding several

processes, services, products, segments, activities and the departments of business. Managers

needs the accounting information for monitoring performance of the business by making the

comparison relating to the past performance benchmarks and the competitors' analysis. They rely

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

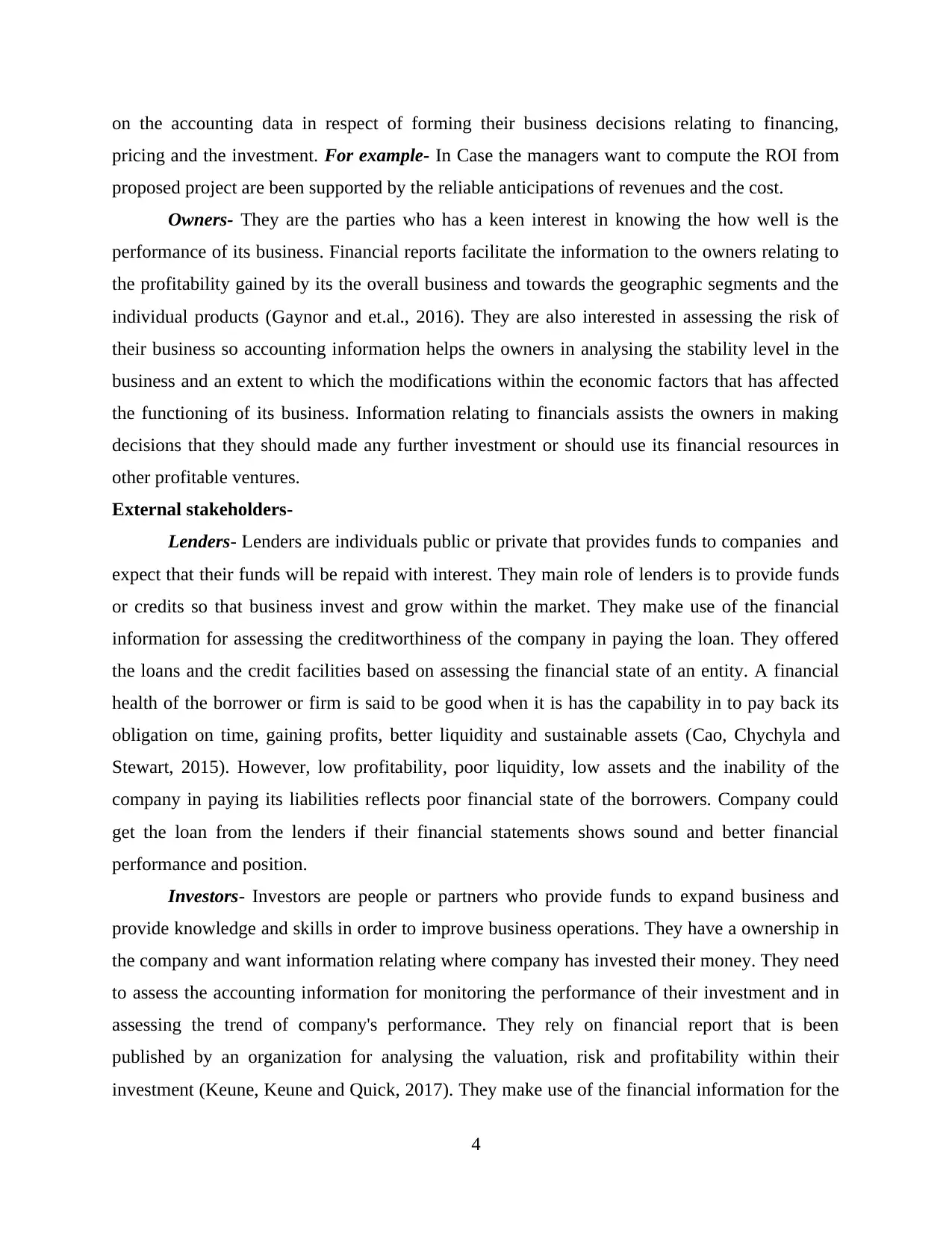

on the accounting data in respect of forming their business decisions relating to financing,

pricing and the investment. For example- In Case the managers want to compute the ROI from

proposed project are been supported by the reliable anticipations of revenues and the cost.

Owners- They are the parties who has a keen interest in knowing the how well is the

performance of its business. Financial reports facilitate the information to the owners relating to

the profitability gained by its the overall business and towards the geographic segments and the

individual products (Gaynor and et.al., 2016). They are also interested in assessing the risk of

their business so accounting information helps the owners in analysing the stability level in the

business and an extent to which the modifications within the economic factors that has affected

the functioning of its business. Information relating to financials assists the owners in making

decisions that they should made any further investment or should use its financial resources in

other profitable ventures.

External stakeholders-

Lenders- Lenders are individuals public or private that provides funds to companies and

expect that their funds will be repaid with interest. They main role of lenders is to provide funds

or credits so that business invest and grow within the market. They make use of the financial

information for assessing the creditworthiness of the company in paying the loan. They offered

the loans and the credit facilities based on assessing the financial state of an entity. A financial

health of the borrower or firm is said to be good when it is has the capability in to pay back its

obligation on time, gaining profits, better liquidity and sustainable assets (Cao, Chychyla and

Stewart, 2015). However, low profitability, poor liquidity, low assets and the inability of the

company in paying its liabilities reflects poor financial state of the borrowers. Company could

get the loan from the lenders if their financial statements shows sound and better financial

performance and position.

Investors- Investors are people or partners who provide funds to expand business and

provide knowledge and skills in order to improve business operations. They have a ownership in

the company and want information relating where company has invested their money. They need

to assess the accounting information for monitoring the performance of their investment and in

assessing the trend of company's performance. They rely on financial report that is been

published by an organization for analysing the valuation, risk and profitability within their

investment (Keune, Keune and Quick, 2017). They make use of the financial information for the

4

pricing and the investment. For example- In Case the managers want to compute the ROI from

proposed project are been supported by the reliable anticipations of revenues and the cost.

Owners- They are the parties who has a keen interest in knowing the how well is the

performance of its business. Financial reports facilitate the information to the owners relating to

the profitability gained by its the overall business and towards the geographic segments and the

individual products (Gaynor and et.al., 2016). They are also interested in assessing the risk of

their business so accounting information helps the owners in analysing the stability level in the

business and an extent to which the modifications within the economic factors that has affected

the functioning of its business. Information relating to financials assists the owners in making

decisions that they should made any further investment or should use its financial resources in

other profitable ventures.

External stakeholders-

Lenders- Lenders are individuals public or private that provides funds to companies and

expect that their funds will be repaid with interest. They main role of lenders is to provide funds

or credits so that business invest and grow within the market. They make use of the financial

information for assessing the creditworthiness of the company in paying the loan. They offered

the loans and the credit facilities based on assessing the financial state of an entity. A financial

health of the borrower or firm is said to be good when it is has the capability in to pay back its

obligation on time, gaining profits, better liquidity and sustainable assets (Cao, Chychyla and

Stewart, 2015). However, low profitability, poor liquidity, low assets and the inability of the

company in paying its liabilities reflects poor financial state of the borrowers. Company could

get the loan from the lenders if their financial statements shows sound and better financial

performance and position.

Investors- Investors are people or partners who provide funds to expand business and

provide knowledge and skills in order to improve business operations. They have a ownership in

the company and want information relating where company has invested their money. They need

to assess the accounting information for monitoring the performance of their investment and in

assessing the trend of company's performance. They rely on financial report that is been

published by an organization for analysing the valuation, risk and profitability within their

investment (Keune, Keune and Quick, 2017). They make use of the financial information for the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

purpose of determining that they should hold, withdraw or increase the proportion of their

investment.

Auditors- They are authorized person who review financials of the company and records

every transaction to ensure that business follows tax laws. It provides financial statements to

lenders and investors in order to tell them financial position of the company. External auditors

makes analysis of the financial report and an accounting record in relation to forming a true and

fair audit opinion. Stakeholders highly relies on independent opinion of an auditor regarding the

accuracy and relevancy of the financial reports.

Government- This party makes use of the accounting information in order to ensure that

that an enterprise discloses all the information that are material and are reporting as per the

appropriate standards. They aim at protecting interest of the several stakeholders who relies on

the accounting information in order to form suitable decisions (Bailey and Sawers, 2018). They

monitor and clearly defines the thresholds limit within the accounting like towards the sales

revenue, business size and the net profit. Government reviews the accounting information for

ensuring that they are making all the compliance in relation with the safety, employee and the

consumer related regulations

CLIENT 1

I. Journal entries

Journal entries in the books of Alexandra for January 2019 are as follows

Date Particulars Debit Credit

1st Jan 2019 Storage exp. A/c Dr 450

To bank A/c

2nd Jan 2019 Purchase A/c Dr 6080

To S. hood A/c 1450

To D main A/c 2060

To W Tone A/c 960

To R foot A/c 1610

3rd Jan 2019 J Wilson A/c Dr 1200

T . Cole A/c dr 1650

F. Syme A/c Dr 2100

5

investment.

Auditors- They are authorized person who review financials of the company and records

every transaction to ensure that business follows tax laws. It provides financial statements to

lenders and investors in order to tell them financial position of the company. External auditors

makes analysis of the financial report and an accounting record in relation to forming a true and

fair audit opinion. Stakeholders highly relies on independent opinion of an auditor regarding the

accuracy and relevancy of the financial reports.

Government- This party makes use of the accounting information in order to ensure that

that an enterprise discloses all the information that are material and are reporting as per the

appropriate standards. They aim at protecting interest of the several stakeholders who relies on

the accounting information in order to form suitable decisions (Bailey and Sawers, 2018). They

monitor and clearly defines the thresholds limit within the accounting like towards the sales

revenue, business size and the net profit. Government reviews the accounting information for

ensuring that they are making all the compliance in relation with the safety, employee and the

consumer related regulations

CLIENT 1

I. Journal entries

Journal entries in the books of Alexandra for January 2019 are as follows

Date Particulars Debit Credit

1st Jan 2019 Storage exp. A/c Dr 450

To bank A/c

2nd Jan 2019 Purchase A/c Dr 6080

To S. hood A/c 1450

To D main A/c 2060

To W Tone A/c 960

To R foot A/c 1610

3rd Jan 2019 J Wilson A/c Dr 1200

T . Cole A/c dr 1650

F. Syme A/c Dr 2100

5

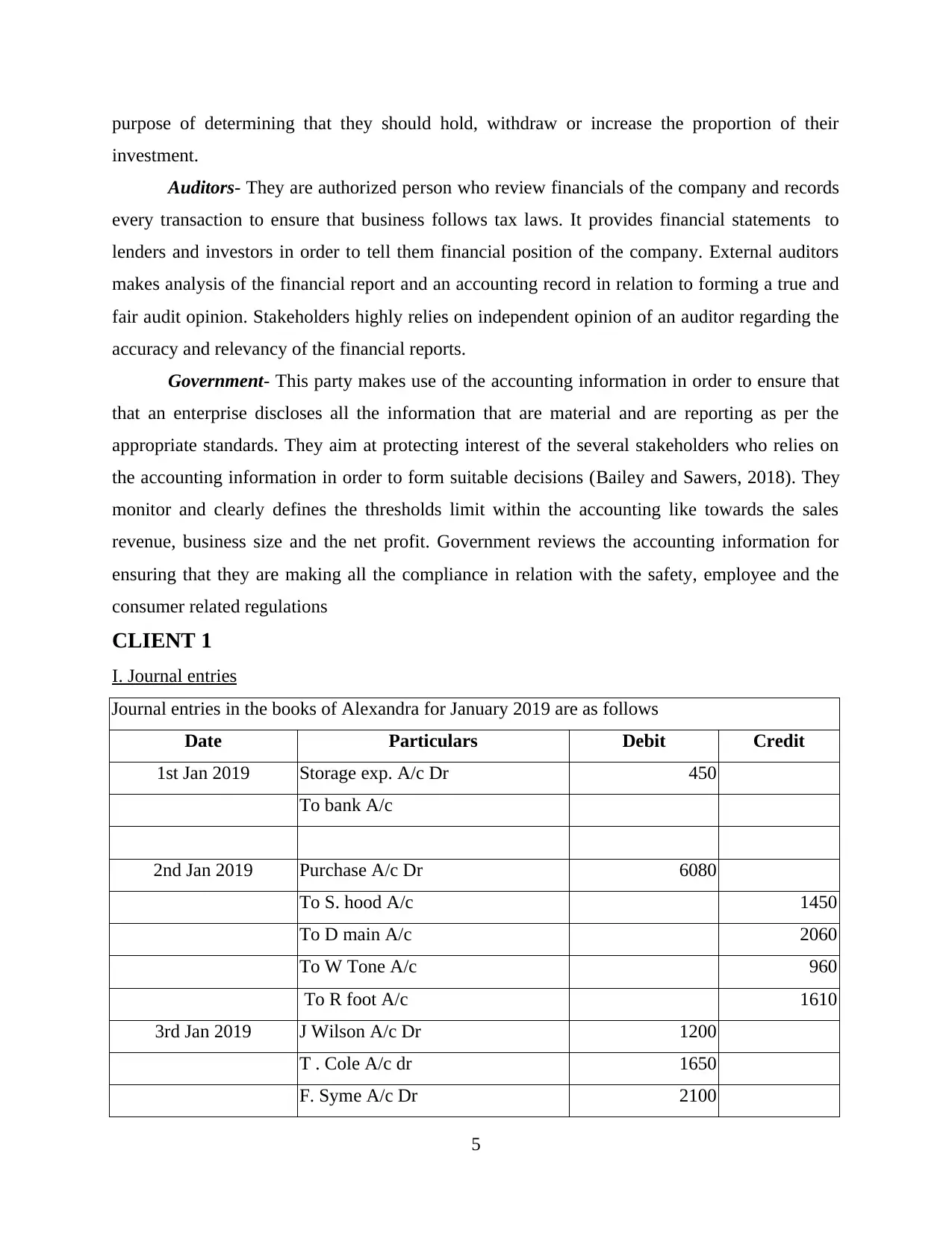

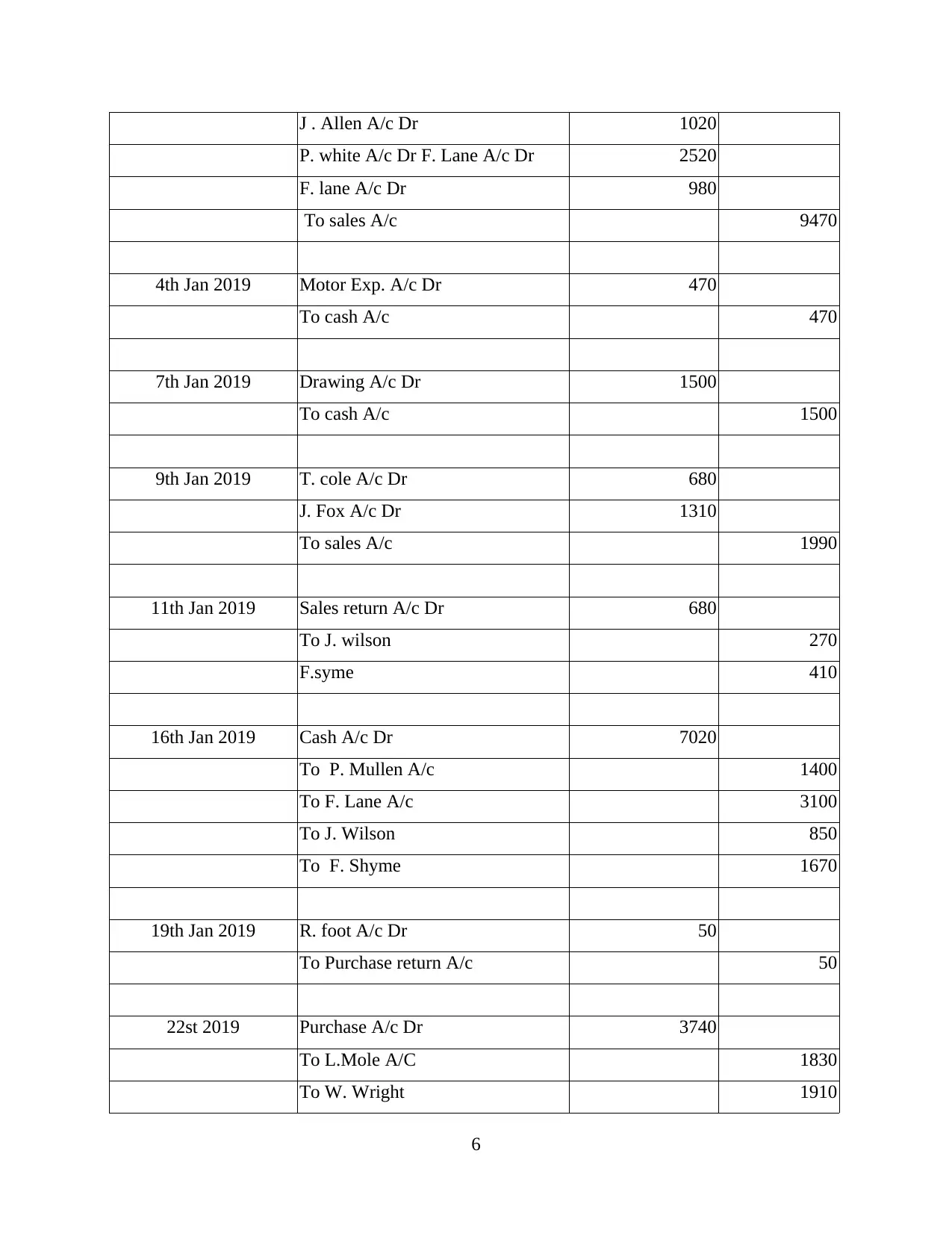

J . Allen A/c Dr 1020

P. white A/c Dr F. Lane A/c Dr 2520

F. lane A/c Dr 980

To sales A/c 9470

4th Jan 2019 Motor Exp. A/c Dr 470

To cash A/c 470

7th Jan 2019 Drawing A/c Dr 1500

To cash A/c 1500

9th Jan 2019 T. cole A/c Dr 680

J. Fox A/c Dr 1310

To sales A/c 1990

11th Jan 2019 Sales return A/c Dr 680

To J. wilson 270

F.syme 410

16th Jan 2019 Cash A/c Dr 7020

To P. Mullen A/c 1400

To F. Lane A/c 3100

To J. Wilson 850

To F. Shyme 1670

19th Jan 2019 R. foot A/c Dr 50

To Purchase return A/c 50

22st 2019 Purchase A/c Dr 3740

To L.Mole A/C 1830

To W. Wright 1910

6

P. white A/c Dr F. Lane A/c Dr 2520

F. lane A/c Dr 980

To sales A/c 9470

4th Jan 2019 Motor Exp. A/c Dr 470

To cash A/c 470

7th Jan 2019 Drawing A/c Dr 1500

To cash A/c 1500

9th Jan 2019 T. cole A/c Dr 680

J. Fox A/c Dr 1310

To sales A/c 1990

11th Jan 2019 Sales return A/c Dr 680

To J. wilson 270

F.syme 410

16th Jan 2019 Cash A/c Dr 7020

To P. Mullen A/c 1400

To F. Lane A/c 3100

To J. Wilson 850

To F. Shyme 1670

19th Jan 2019 R. foot A/c Dr 50

To Purchase return A/c 50

22st 2019 Purchase A/c Dr 3740

To L.Mole A/C 1830

To W. Wright 1910

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

24th Jan 2019 S. Hood A/c DR 3600

J. Brown A/c Dr 4600

R. Foot A/c Dr 1400

To Bank A/c 9600

27th Jan 2019 Salary A/c Dr 4800

To bank A/c 4800

30th Jan 2019 Business rates A/c Dr 1320

To bank A/c 1320

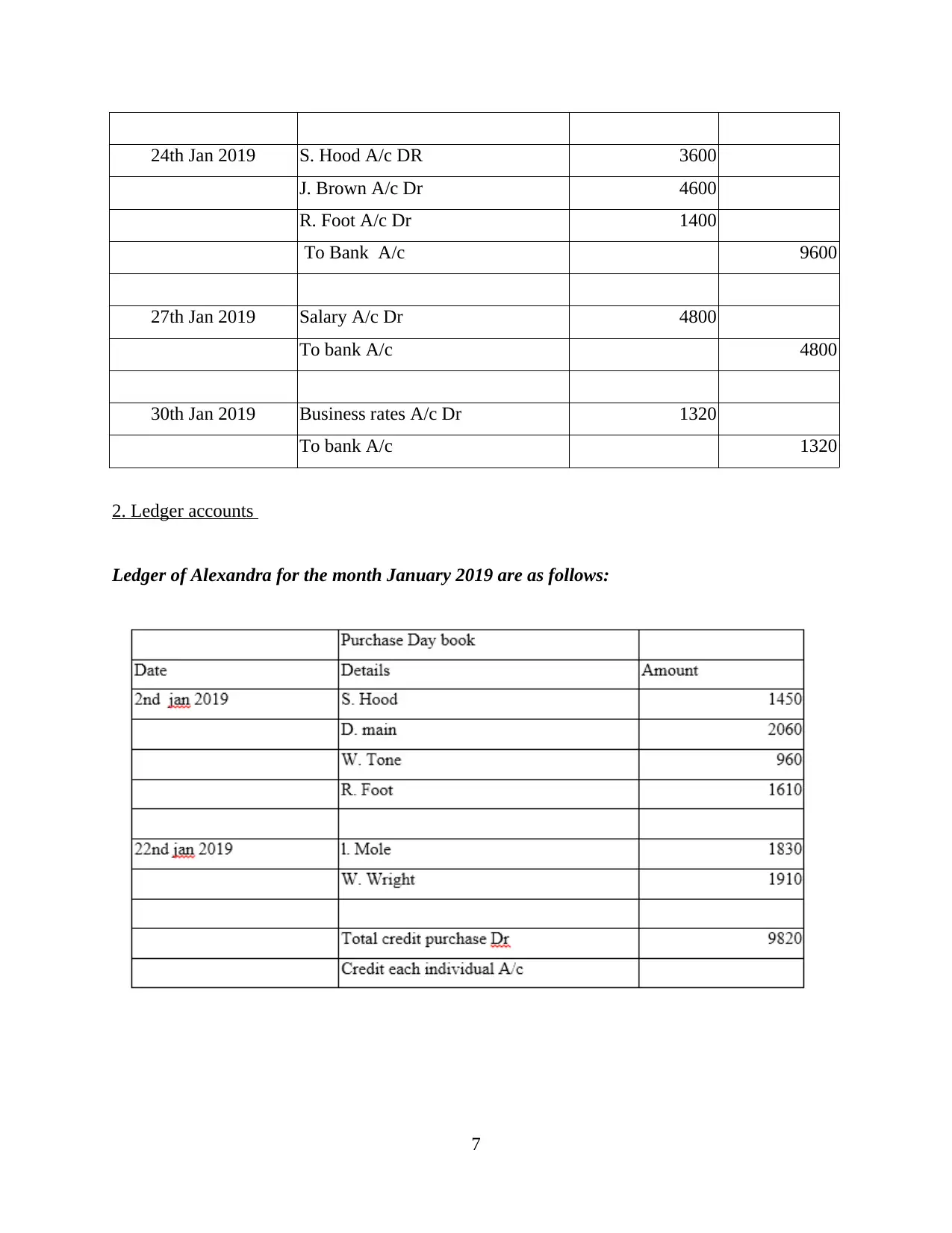

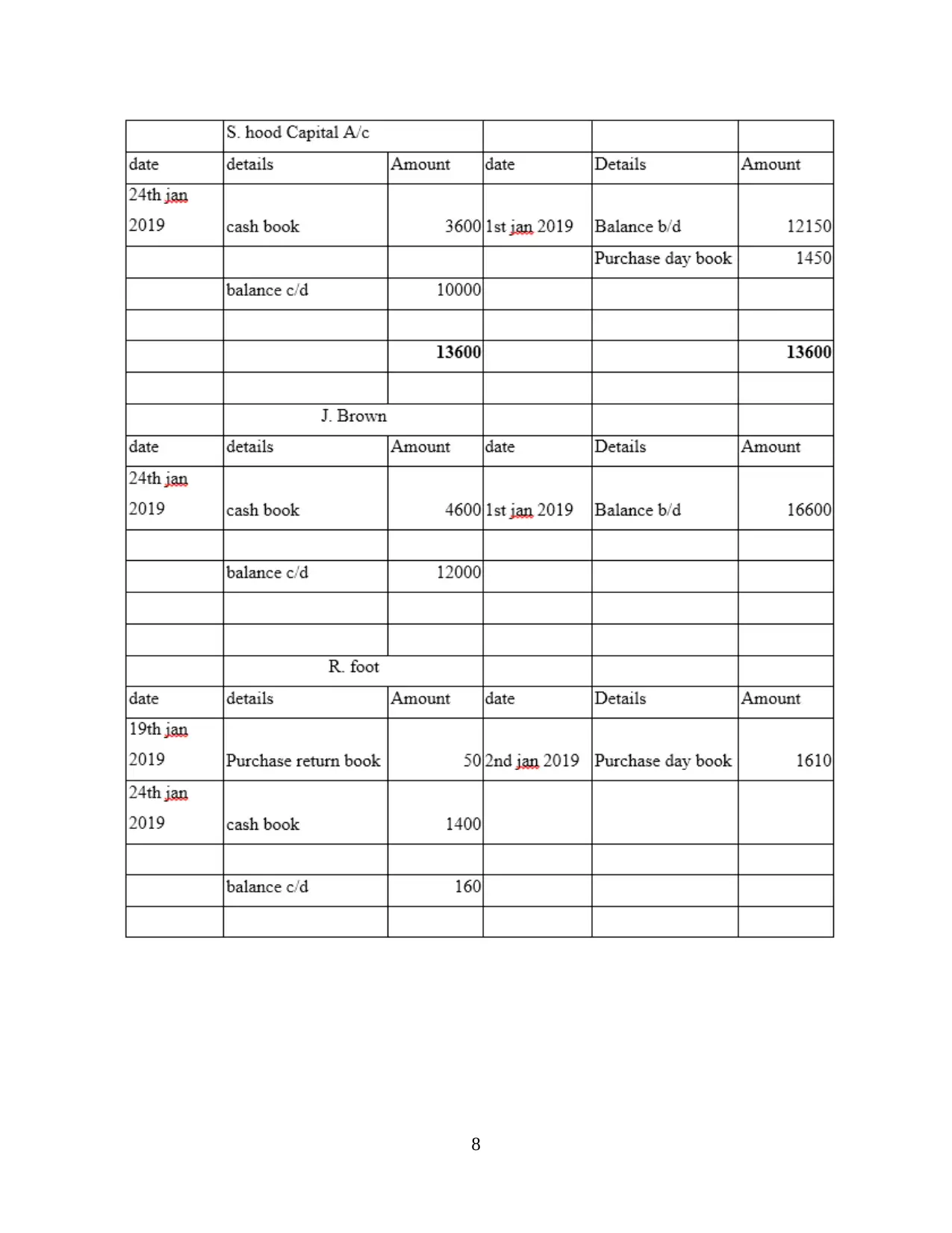

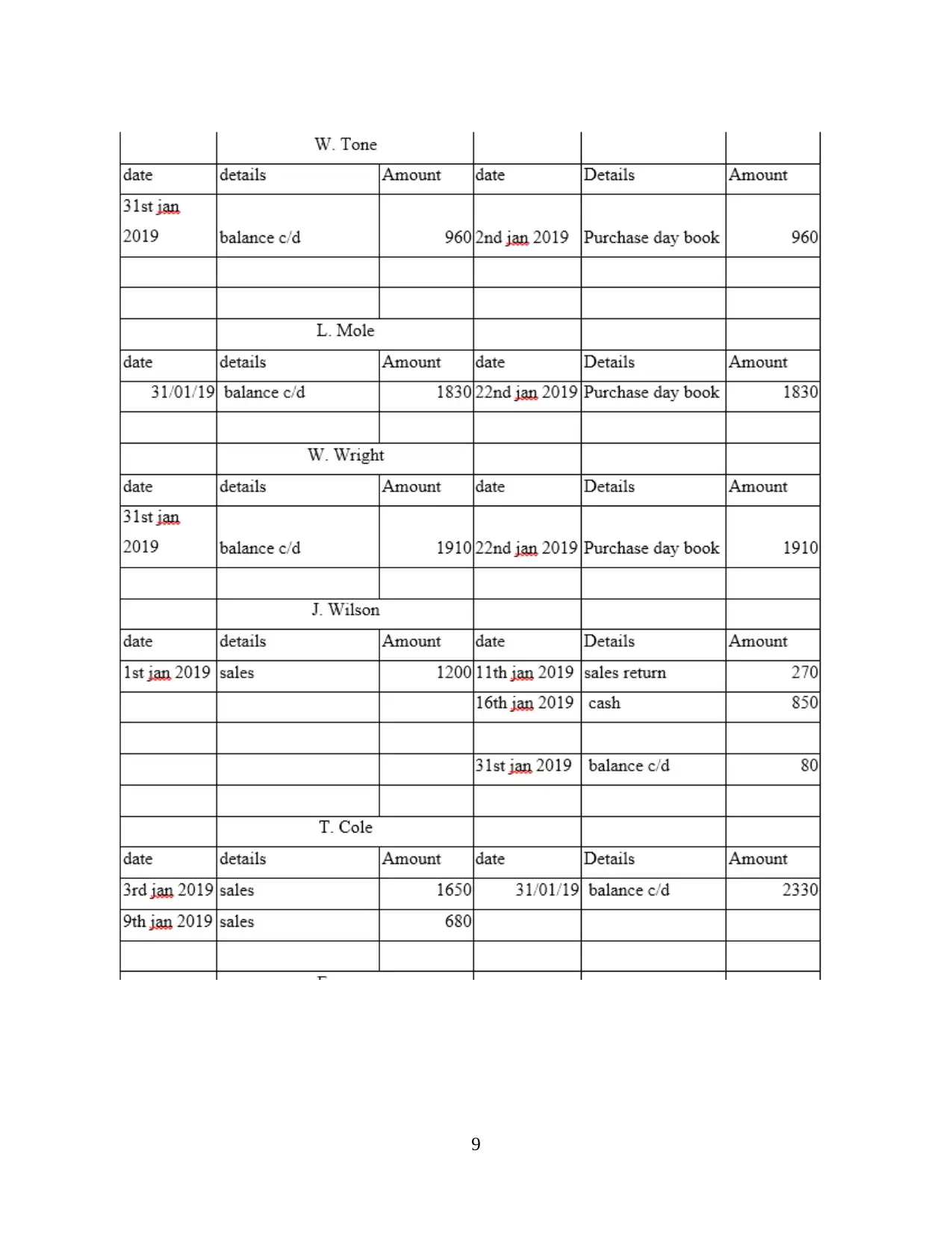

2. Ledger accounts

Ledger of Alexandra for the month January 2019 are as follows:

7

J. Brown A/c Dr 4600

R. Foot A/c Dr 1400

To Bank A/c 9600

27th Jan 2019 Salary A/c Dr 4800

To bank A/c 4800

30th Jan 2019 Business rates A/c Dr 1320

To bank A/c 1320

2. Ledger accounts

Ledger of Alexandra for the month January 2019 are as follows:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.