Managerial Accounting Analysis of SAS Company Financial Statements

VerifiedAdded on 2023/06/11

|45

|6379

|358

AI Summary

This assignment analyzes the different aspects of financial statements of SAS Company using the PwC Value Framework. The analysis covers different aspects of financial statements and is graded on the basis of good, bad and ugly policy. The report also evaluates whether the financial reports are consistent with the framework and if the various elements reported in the annual reports are appropriately reported or not.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGERIAL ACCOUNTING

Managerial Accounting

Name of the Student:

Name of the University:

Author’s Note

Managerial Accounting

Name of the Student:

Name of the University:

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

MANAGERIAL ACCOUNTING

Executive Summary

The main purpose of the assignment is to analyze the different aspects of financial statements of

SAS company which is engaged in business of d. The different analysis will be graded on the

basis of good, bad and ugly policy. The reporting framework of PwC will be followed for the

purpose of establishing whether the financial reports which are prepared by SAS ltd is consistent

with the framework. In addition to this, the various elements which are reported in the annual

reports will be considered if the same are appropriately reported or not.

Table of Contents

MANAGERIAL ACCOUNTING

Executive Summary

The main purpose of the assignment is to analyze the different aspects of financial statements of

SAS company which is engaged in business of d. The different analysis will be graded on the

basis of good, bad and ugly policy. The reporting framework of PwC will be followed for the

purpose of establishing whether the financial reports which are prepared by SAS ltd is consistent

with the framework. In addition to this, the various elements which are reported in the annual

reports will be considered if the same are appropriately reported or not.

Table of Contents

2

MANAGERIAL ACCOUNTING

PwC Value Framework Elements....................................................................................................8

1. Value Framework Element: Strategies and Objectives............................................................8

Report Extracts:...........................................................................................................................8

Reporting Critique.......................................................................................................................8

Extensiveness and Accessibility..................................................................................................9

Comprehensiveness.....................................................................................................................9

Conclusion and Strength..............................................................................................................9

2. Value Framework Element: Business Model.........................................................................10

Report Extracts:.........................................................................................................................10

Reporting Critique.....................................................................................................................10

Extensiveness and Accessibility................................................................................................11

Comprehensiveness...................................................................................................................11

Conclusion and Strength............................................................................................................11

3. Value Framework Element: Governance...............................................................................11

Report Extracts:.........................................................................................................................11

Reporting Critique.....................................................................................................................12

Extensiveness and Accessibility................................................................................................13

Comprehensiveness...................................................................................................................13

Conclusion and Strength............................................................................................................13

4. Value Framework Element: Risk Management.....................................................................14

MANAGERIAL ACCOUNTING

PwC Value Framework Elements....................................................................................................8

1. Value Framework Element: Strategies and Objectives............................................................8

Report Extracts:...........................................................................................................................8

Reporting Critique.......................................................................................................................8

Extensiveness and Accessibility..................................................................................................9

Comprehensiveness.....................................................................................................................9

Conclusion and Strength..............................................................................................................9

2. Value Framework Element: Business Model.........................................................................10

Report Extracts:.........................................................................................................................10

Reporting Critique.....................................................................................................................10

Extensiveness and Accessibility................................................................................................11

Comprehensiveness...................................................................................................................11

Conclusion and Strength............................................................................................................11

3. Value Framework Element: Governance...............................................................................11

Report Extracts:.........................................................................................................................11

Reporting Critique.....................................................................................................................12

Extensiveness and Accessibility................................................................................................13

Comprehensiveness...................................................................................................................13

Conclusion and Strength............................................................................................................13

4. Value Framework Element: Risk Management.....................................................................14

3

MANAGERIAL ACCOUNTING

Report Extracts:.........................................................................................................................14

Reporting Critique.....................................................................................................................15

Extensiveness and Accessibility................................................................................................15

Comprehensiveness...................................................................................................................15

Conclusion and Strength............................................................................................................16

5. Value Framework Element: Remuneration............................................................................16

Report Extracts:.........................................................................................................................16

Reporting Critique.....................................................................................................................17

Extensiveness and Accessibility................................................................................................18

Comprehensiveness...................................................................................................................18

Conclusion and Strength............................................................................................................19

6. Value Framework Element: Financial Assets........................................................................19

Report Extracts:.........................................................................................................................19

Reporting Critique.....................................................................................................................20

Extensiveness and Accessibility................................................................................................20

Comprehensiveness...................................................................................................................20

Conclusion and Strength............................................................................................................20

7. Value Framework Element: Physical Assets..........................................................................21

Report Extracts:.........................................................................................................................21

Reporting Critique.....................................................................................................................22

MANAGERIAL ACCOUNTING

Report Extracts:.........................................................................................................................14

Reporting Critique.....................................................................................................................15

Extensiveness and Accessibility................................................................................................15

Comprehensiveness...................................................................................................................15

Conclusion and Strength............................................................................................................16

5. Value Framework Element: Remuneration............................................................................16

Report Extracts:.........................................................................................................................16

Reporting Critique.....................................................................................................................17

Extensiveness and Accessibility................................................................................................18

Comprehensiveness...................................................................................................................18

Conclusion and Strength............................................................................................................19

6. Value Framework Element: Financial Assets........................................................................19

Report Extracts:.........................................................................................................................19

Reporting Critique.....................................................................................................................20

Extensiveness and Accessibility................................................................................................20

Comprehensiveness...................................................................................................................20

Conclusion and Strength............................................................................................................20

7. Value Framework Element: Physical Assets..........................................................................21

Report Extracts:.........................................................................................................................21

Reporting Critique.....................................................................................................................22

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility................................................................................................23

Comprehensiveness...................................................................................................................23

Conclusion and Strength............................................................................................................23

8. Value Framework Element: Customers.................................................................................24

Report Extracts:.........................................................................................................................24

Reporting Critique.....................................................................................................................25

Extensiveness and Accessibility................................................................................................25

Comprehensiveness...................................................................................................................25

Conclusion and Strength............................................................................................................25

9. Value Framework Element: People & Culture.......................................................................26

Report Extracts:.........................................................................................................................26

Reporting Critique.....................................................................................................................26

Extensiveness and Accessibility................................................................................................26

Comprehensiveness...................................................................................................................27

Conclusion and Strength............................................................................................................27

10. Value Framework Element: Innovation G&S....................................................................28

Report Extracts:.........................................................................................................................28

Reporting Critique.....................................................................................................................28

Extensiveness and Accessibility................................................................................................28

Comprehensiveness...................................................................................................................28

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility................................................................................................23

Comprehensiveness...................................................................................................................23

Conclusion and Strength............................................................................................................23

8. Value Framework Element: Customers.................................................................................24

Report Extracts:.........................................................................................................................24

Reporting Critique.....................................................................................................................25

Extensiveness and Accessibility................................................................................................25

Comprehensiveness...................................................................................................................25

Conclusion and Strength............................................................................................................25

9. Value Framework Element: People & Culture.......................................................................26

Report Extracts:.........................................................................................................................26

Reporting Critique.....................................................................................................................26

Extensiveness and Accessibility................................................................................................26

Comprehensiveness...................................................................................................................27

Conclusion and Strength............................................................................................................27

10. Value Framework Element: Innovation G&S....................................................................28

Report Extracts:.........................................................................................................................28

Reporting Critique.....................................................................................................................28

Extensiveness and Accessibility................................................................................................28

Comprehensiveness...................................................................................................................28

5

MANAGERIAL ACCOUNTING

Conclusion and Strength............................................................................................................29

11. Value Framework Element: Brands and Intellectual Assets..............................................29

Report Extracts:.........................................................................................................................29

Reporting Critique.....................................................................................................................29

Extensiveness and Accessibility................................................................................................29

Comprehensiveness...................................................................................................................30

Conclusion and Strength............................................................................................................30

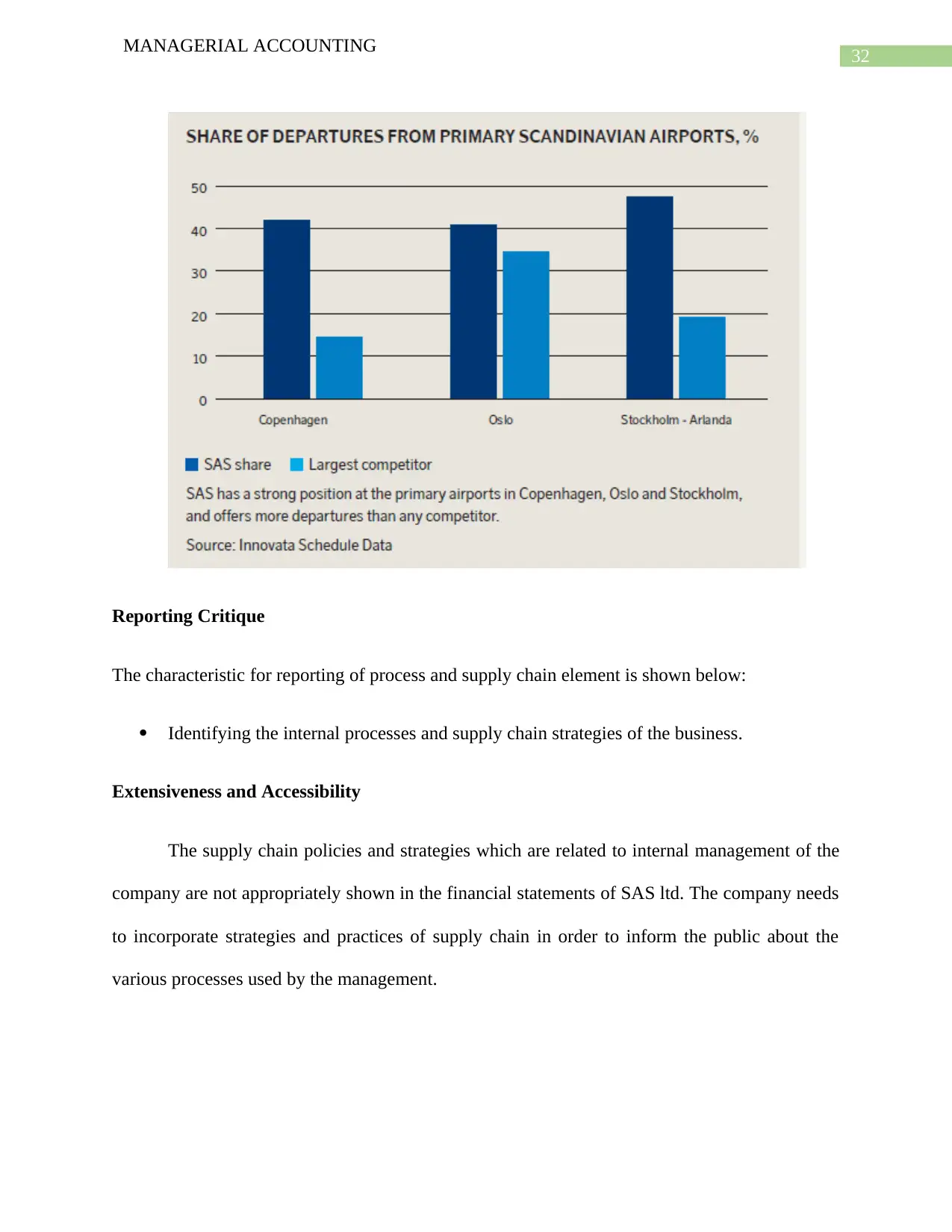

12. Value Framework Element: Processes and Supply Chain..................................................30

Report Extracts:.........................................................................................................................30

Reporting Critique.....................................................................................................................31

Extensiveness and Accessibility................................................................................................31

Comprehensiveness...................................................................................................................32

Conclusion and Strength............................................................................................................32

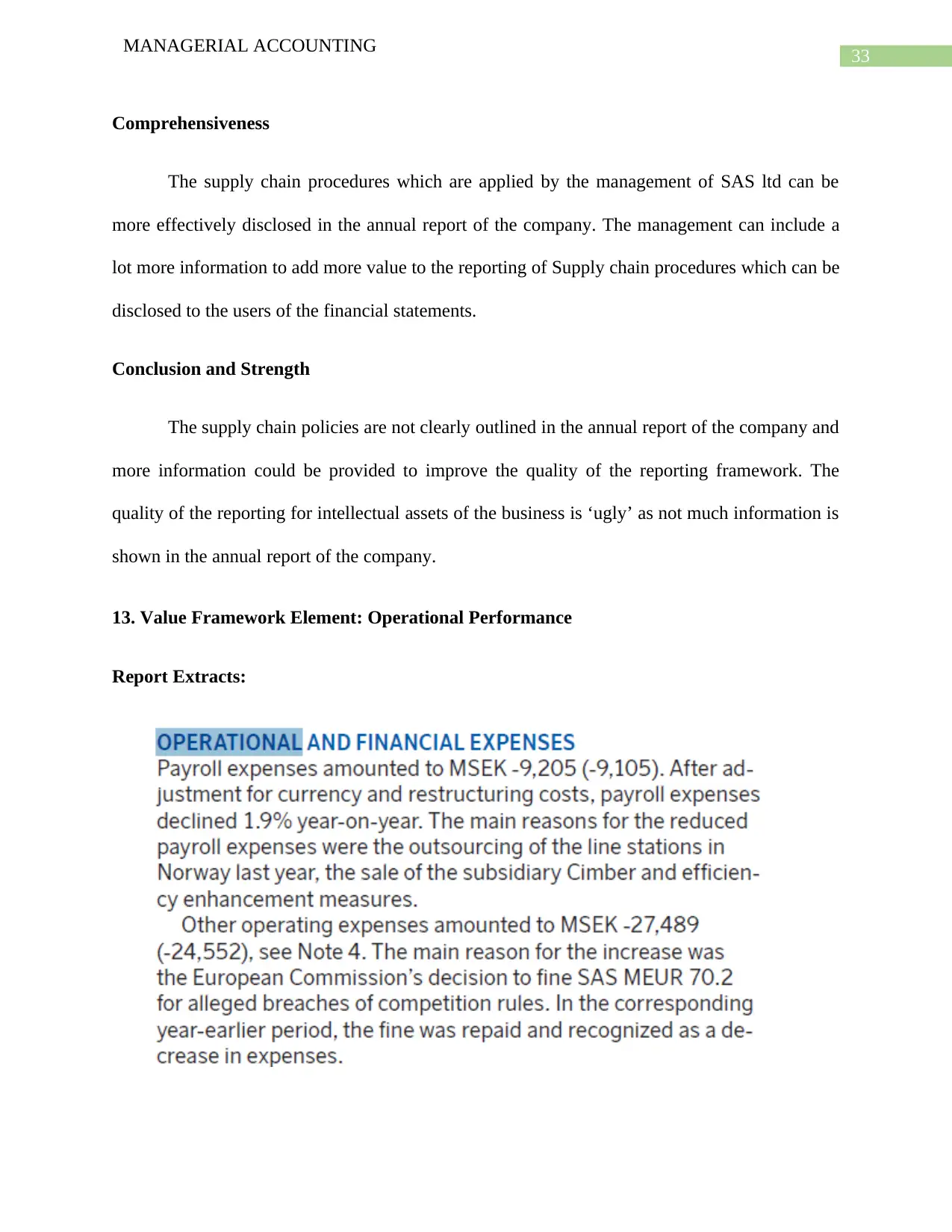

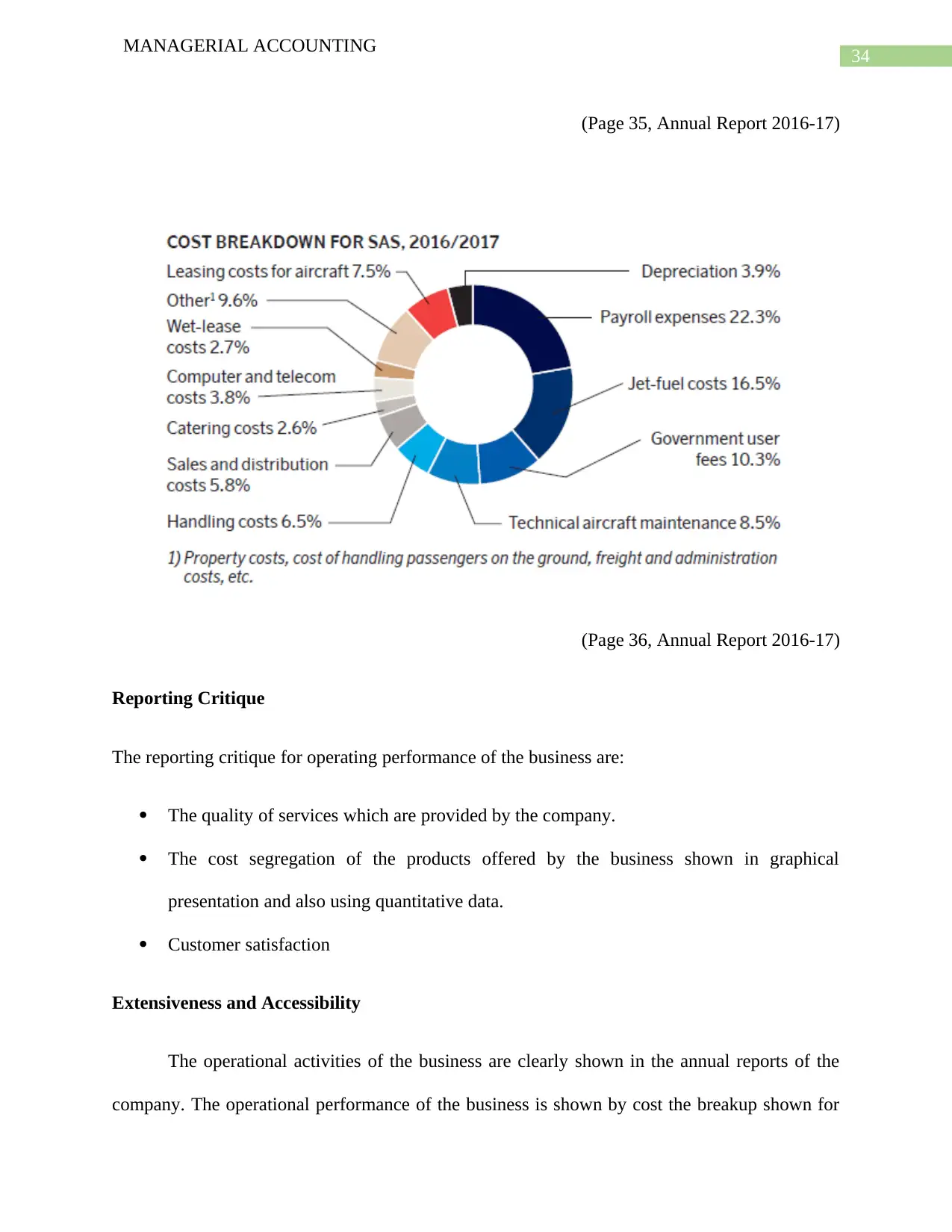

13. Value Framework Element: Operational Performance.......................................................32

Report Extracts:.........................................................................................................................32

Reporting Critique.....................................................................................................................33

Extensiveness and Accessibility................................................................................................33

Comprehensiveness...................................................................................................................34

Conclusion and Strength............................................................................................................34

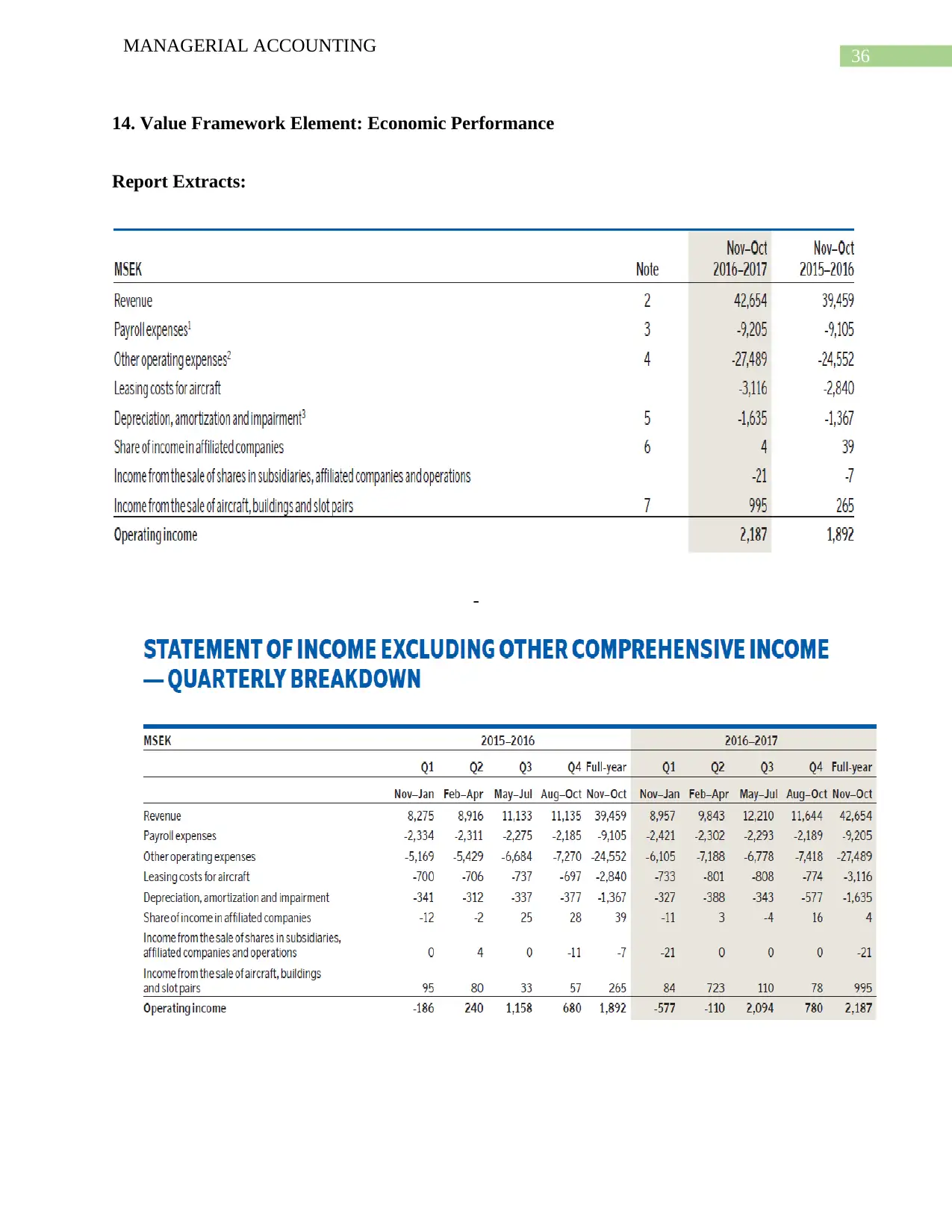

14. Value Framework Element: Economic Performance.........................................................34

MANAGERIAL ACCOUNTING

Conclusion and Strength............................................................................................................29

11. Value Framework Element: Brands and Intellectual Assets..............................................29

Report Extracts:.........................................................................................................................29

Reporting Critique.....................................................................................................................29

Extensiveness and Accessibility................................................................................................29

Comprehensiveness...................................................................................................................30

Conclusion and Strength............................................................................................................30

12. Value Framework Element: Processes and Supply Chain..................................................30

Report Extracts:.........................................................................................................................30

Reporting Critique.....................................................................................................................31

Extensiveness and Accessibility................................................................................................31

Comprehensiveness...................................................................................................................32

Conclusion and Strength............................................................................................................32

13. Value Framework Element: Operational Performance.......................................................32

Report Extracts:.........................................................................................................................32

Reporting Critique.....................................................................................................................33

Extensiveness and Accessibility................................................................................................33

Comprehensiveness...................................................................................................................34

Conclusion and Strength............................................................................................................34

14. Value Framework Element: Economic Performance.........................................................34

6

MANAGERIAL ACCOUNTING

Report Extracts:.........................................................................................................................34

Reporting Critique.....................................................................................................................35

Extensiveness and Accessibility................................................................................................35

Comprehensiveness...................................................................................................................36

Conclusion and Strength............................................................................................................36

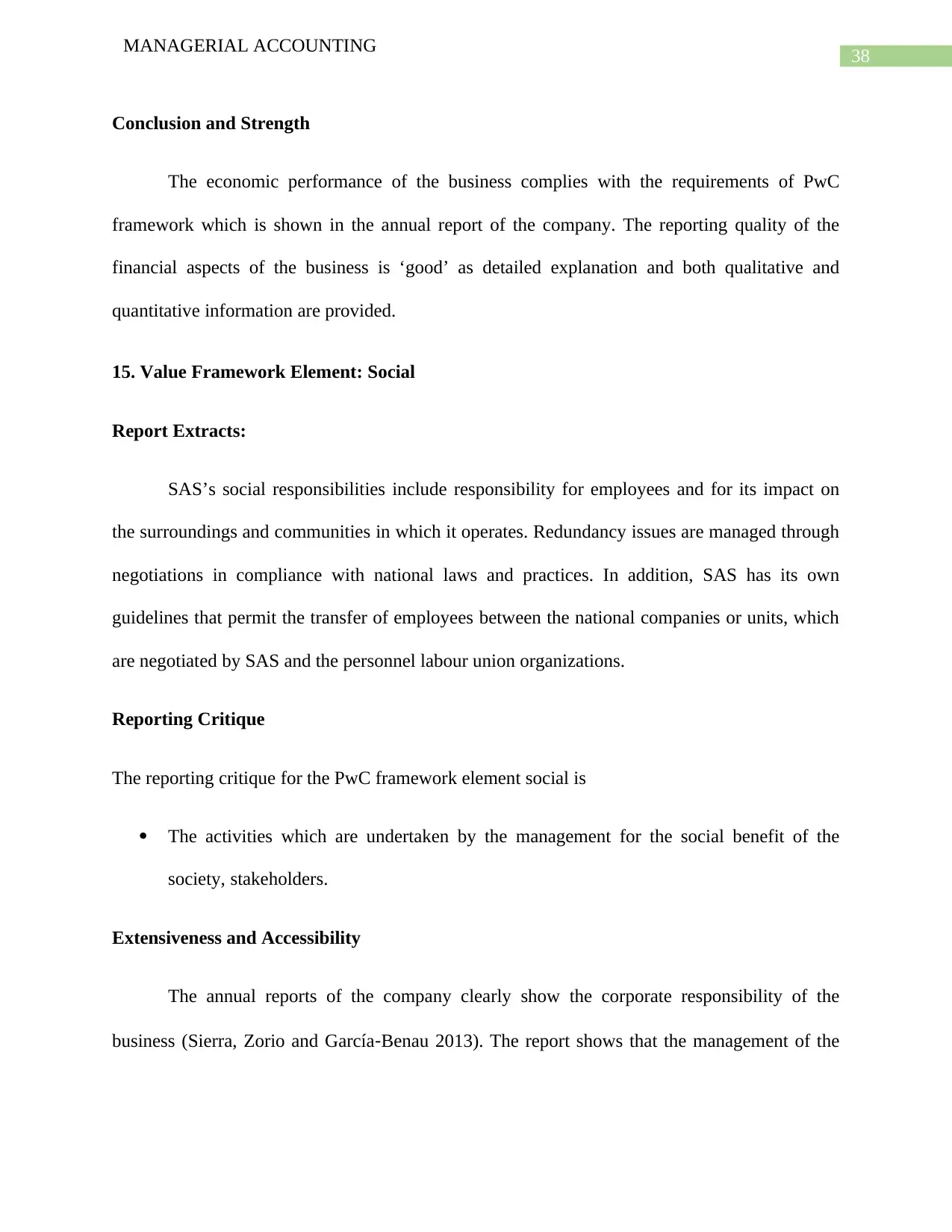

15. Value Framework Element: Social.....................................................................................36

Report Extracts:.........................................................................................................................36

Reporting Critique.....................................................................................................................37

Extensiveness and Accessibility................................................................................................37

Comprehensiveness...................................................................................................................37

Conclusion and Strength............................................................................................................37

16. Value Framework Element: Environmental.......................................................................38

Report Extracts:.........................................................................................................................38

Reporting Critique.....................................................................................................................38

Extensiveness and Accessibility................................................................................................38

Comprehensiveness...................................................................................................................38

Conclusion and Strength............................................................................................................39

17. Value Framework Element: Segmental..............................................................................39

Report Extracts:.........................................................................................................................39

Reporting Critique.....................................................................................................................40

MANAGERIAL ACCOUNTING

Report Extracts:.........................................................................................................................34

Reporting Critique.....................................................................................................................35

Extensiveness and Accessibility................................................................................................35

Comprehensiveness...................................................................................................................36

Conclusion and Strength............................................................................................................36

15. Value Framework Element: Social.....................................................................................36

Report Extracts:.........................................................................................................................36

Reporting Critique.....................................................................................................................37

Extensiveness and Accessibility................................................................................................37

Comprehensiveness...................................................................................................................37

Conclusion and Strength............................................................................................................37

16. Value Framework Element: Environmental.......................................................................38

Report Extracts:.........................................................................................................................38

Reporting Critique.....................................................................................................................38

Extensiveness and Accessibility................................................................................................38

Comprehensiveness...................................................................................................................38

Conclusion and Strength............................................................................................................39

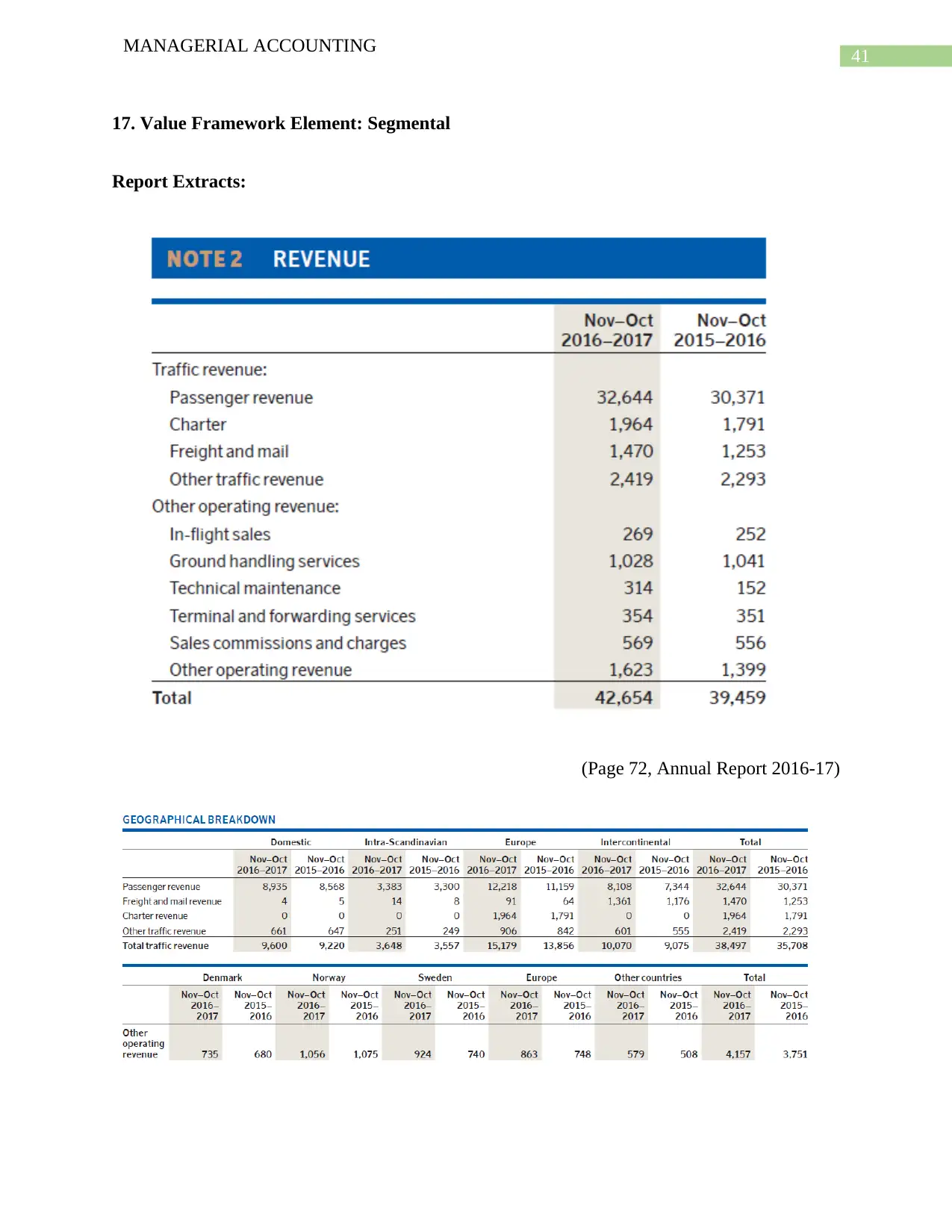

17. Value Framework Element: Segmental..............................................................................39

Report Extracts:.........................................................................................................................39

Reporting Critique.....................................................................................................................40

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility................................................................................................40

Comprehensiveness...................................................................................................................40

Conclusion and Strength............................................................................................................41

Reference.......................................................................................................................................42

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility................................................................................................40

Comprehensiveness...................................................................................................................40

Conclusion and Strength............................................................................................................41

Reference.......................................................................................................................................42

8

MANAGERIAL ACCOUNTING

PwC Value Framework Elements

1. Value Framework Element: Strategies and Objectives

Report Extracts:

(Page 6, Annual Report 2016-17)

The report which is shown above shows the strategy of the business for the future and the

strategy is formulated for the purpose of achieving the long-term goals of the business (Owen

2013). The performance of the company during the year has been promising and due to the new

tax regime which is introduced in Sweden, the company has targeted to achieve SEK 3 billion in

the core activities of the business, establish bases in London and Malaga and capitalize on the

brand value of the company in order to ensure even better performance in future.

Reporting Critique

The reporting critique for Strategies and Objectives as portrayed in the financial statements of

the company are:

The future goals and set of objectives which the business will be following are clearly

shown in the section

MANAGERIAL ACCOUNTING

PwC Value Framework Elements

1. Value Framework Element: Strategies and Objectives

Report Extracts:

(Page 6, Annual Report 2016-17)

The report which is shown above shows the strategy of the business for the future and the

strategy is formulated for the purpose of achieving the long-term goals of the business (Owen

2013). The performance of the company during the year has been promising and due to the new

tax regime which is introduced in Sweden, the company has targeted to achieve SEK 3 billion in

the core activities of the business, establish bases in London and Malaga and capitalize on the

brand value of the company in order to ensure even better performance in future.

Reporting Critique

The reporting critique for Strategies and Objectives as portrayed in the financial statements of

the company are:

The future goals and set of objectives which the business will be following are clearly

shown in the section

9

MANAGERIAL ACCOUNTING

In addition to this, the goals are also segregated on the basis of how much it is anticipated

that the business will be achieving such goals that is by 2019 or 2020.

Extensiveness and Accessibility

The strategy which is followed by SAS Ltd are easily made available from the financial

reports as the same is provided ion the initial pages of the report that is om page 6. The strategies

are extensively explained in the President’s letter informing the stakeholders about the

performance of the business. Further on Page 12 of the annual report strategies which makes the

business successful are provided. The strategies also include the future expectations of the

business which is provided in page 6.

Comprehensiveness

The president’s letter which is shown in page 6, the over all performance of the business

and also the future perspective of the business are set out effectively on the basis of Improved

Customers Offerings by the company, Enhancing the Efficiency program, Sustainable Aviation

and building up a strong financial position for the business in the market.

Conclusion and Strength

As per the strategies set by SAS ltd and the effective pursuance of the same resulted in

enhanced efficiency of the business. In addition to this, the strategies focus mainly on medium

term and long terms plans as shown the target time period is 2020 in most cases. Therefore, it

can be said that the quality of strategies and objective of the business is ‘good’

.

MANAGERIAL ACCOUNTING

In addition to this, the goals are also segregated on the basis of how much it is anticipated

that the business will be achieving such goals that is by 2019 or 2020.

Extensiveness and Accessibility

The strategy which is followed by SAS Ltd are easily made available from the financial

reports as the same is provided ion the initial pages of the report that is om page 6. The strategies

are extensively explained in the President’s letter informing the stakeholders about the

performance of the business. Further on Page 12 of the annual report strategies which makes the

business successful are provided. The strategies also include the future expectations of the

business which is provided in page 6.

Comprehensiveness

The president’s letter which is shown in page 6, the over all performance of the business

and also the future perspective of the business are set out effectively on the basis of Improved

Customers Offerings by the company, Enhancing the Efficiency program, Sustainable Aviation

and building up a strong financial position for the business in the market.

Conclusion and Strength

As per the strategies set by SAS ltd and the effective pursuance of the same resulted in

enhanced efficiency of the business. In addition to this, the strategies focus mainly on medium

term and long terms plans as shown the target time period is 2020 in most cases. Therefore, it

can be said that the quality of strategies and objective of the business is ‘good’

.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

MANAGERIAL ACCOUNTING

2. Value Framework Element: Business Model

Report Extracts:

(Page 8, Annual Report 2016-17)

Reporting Critique

The report critique of the business model of business model of the company are:

The extract provides a clear view as to how SAS creates value and what are the activities

which the business engages in for the purpose of creating value.

MANAGERIAL ACCOUNTING

2. Value Framework Element: Business Model

Report Extracts:

(Page 8, Annual Report 2016-17)

Reporting Critique

The report critique of the business model of business model of the company are:

The extract provides a clear view as to how SAS creates value and what are the activities

which the business engages in for the purpose of creating value.

11

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The presentation of the business model of the company is effectively shown in Table

form which is quite easy to understand and the accessibility is also effective as the it is presented

in the initial pages of the annual report specifically page 8 which deals with the value creation

model of the business. In addition to this, the annual report also looks promising to provide

further information of the value creation activities of the business in later pages of the report.

Comprehensiveness

The business model of SAS ltd is based on a broad network for effective departure to,

from and within the country in which the business operates. The company offers a variety of

choices in terms of products which are related to business travels, leisure travel. The business

rewards the customers of the business through the EuroBonus programs. The performance

elements of the business are effectively depicted in the business model and the page also shows

different types of capital which is utilized by the business.

Conclusion and Strength

As per the analysis of the Business model of SAS ltd, it is clearly seen that the

management of the company is crystal clear on the activities which the business needs to engage

in for the purpose of attaining the business goals. The quality of the reporting of business model

is ‘good’.

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The presentation of the business model of the company is effectively shown in Table

form which is quite easy to understand and the accessibility is also effective as the it is presented

in the initial pages of the annual report specifically page 8 which deals with the value creation

model of the business. In addition to this, the annual report also looks promising to provide

further information of the value creation activities of the business in later pages of the report.

Comprehensiveness

The business model of SAS ltd is based on a broad network for effective departure to,

from and within the country in which the business operates. The company offers a variety of

choices in terms of products which are related to business travels, leisure travel. The business

rewards the customers of the business through the EuroBonus programs. The performance

elements of the business are effectively depicted in the business model and the page also shows

different types of capital which is utilized by the business.

Conclusion and Strength

As per the analysis of the Business model of SAS ltd, it is clearly seen that the

management of the company is crystal clear on the activities which the business needs to engage

in for the purpose of attaining the business goals. The quality of the reporting of business model

is ‘good’.

12

MANAGERIAL ACCOUNTING

3. Value Framework Element: Governance

Report Extracts:

The board is responsible for the overall management of risks and operations of the

business and also ensures that the overall governance of the business is effectively done. The

actions of the board are governed by the Swedish Companies Act, Article of association and

other establish. In order to further enhance the performance and overall governance by the board,

two committee are established which are remuneration committee and audit committee. An

overall structure of the corporate governance of SAS ltd is shown below:

(Page 51, Annual Report 2016-17)

Reporting Critique

The reporting critique for the reporting which is done for the governance of the business are:

The structure of corporate governance which is followed by the business are effectively

represented in the annual reports of the business in a graph presentation.

MANAGERIAL ACCOUNTING

3. Value Framework Element: Governance

Report Extracts:

The board is responsible for the overall management of risks and operations of the

business and also ensures that the overall governance of the business is effectively done. The

actions of the board are governed by the Swedish Companies Act, Article of association and

other establish. In order to further enhance the performance and overall governance by the board,

two committee are established which are remuneration committee and audit committee. An

overall structure of the corporate governance of SAS ltd is shown below:

(Page 51, Annual Report 2016-17)

Reporting Critique

The reporting critique for the reporting which is done for the governance of the business are:

The structure of corporate governance which is followed by the business are effectively

represented in the annual reports of the business in a graph presentation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

MANAGERIAL ACCOUNTING

The responsibilities of the board and various committee in the overall corporate

governance system of the business are shown

Various details of the rules and regulations which are followed by the business such as

Swedish Companies Act and other codes of conduct are identified appropriately.

Extensiveness and Accessibility

The corporate governance policy of the business is extensively stated in the annual

reports of the company as shown. The corporate governance report clearly shows that the

business follows the code established in the country and also the rules and regulations which are

stated in the article of association of the business. The role of nomination, remuneration and

audit committee is clearly stated and the same is disclosed effectively.

Comprehensiveness

The corporate governance principles which are followed by the business are as per the

requirement of the PwC Framework and covers all appropriate areas. The corporate governance

reports show that the business follows all the necessary code of conduct as prescribed by law.

The reports of different committee which are responsible for the corporate governance of the

business also considered in the decision-making process and such enhances the board’s corporate

governance.

Conclusion and Strength

The corporate governance of SAS ltd is effectively reported in the annual reports of the company

and the integration of the reports and responsibilities of nomination committee, remuneration

MANAGERIAL ACCOUNTING

The responsibilities of the board and various committee in the overall corporate

governance system of the business are shown

Various details of the rules and regulations which are followed by the business such as

Swedish Companies Act and other codes of conduct are identified appropriately.

Extensiveness and Accessibility

The corporate governance policy of the business is extensively stated in the annual

reports of the company as shown. The corporate governance report clearly shows that the

business follows the code established in the country and also the rules and regulations which are

stated in the article of association of the business. The role of nomination, remuneration and

audit committee is clearly stated and the same is disclosed effectively.

Comprehensiveness

The corporate governance principles which are followed by the business are as per the

requirement of the PwC Framework and covers all appropriate areas. The corporate governance

reports show that the business follows all the necessary code of conduct as prescribed by law.

The reports of different committee which are responsible for the corporate governance of the

business also considered in the decision-making process and such enhances the board’s corporate

governance.

Conclusion and Strength

The corporate governance of SAS ltd is effectively reported in the annual reports of the company

and the integration of the reports and responsibilities of nomination committee, remuneration

14

MANAGERIAL ACCOUNTING

committee and audit committee in the financial statement shows the commitment of the board

towards the effective and ethical management of the company.

The quality of the reporting for the corporate governance of SAS ltd is ‘good’.

MANAGERIAL ACCOUNTING

committee and audit committee in the financial statement shows the commitment of the board

towards the effective and ethical management of the company.

The quality of the reporting for the corporate governance of SAS ltd is ‘good’.

15

MANAGERIAL ACCOUNTING

4. Value Framework Element: Risk Management

Report Extracts:

MANAGERIAL ACCOUNTING

4. Value Framework Element: Risk Management

Report Extracts:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

MANAGERIAL ACCOUNTING

(Page 42, Annual Report 2016-17)

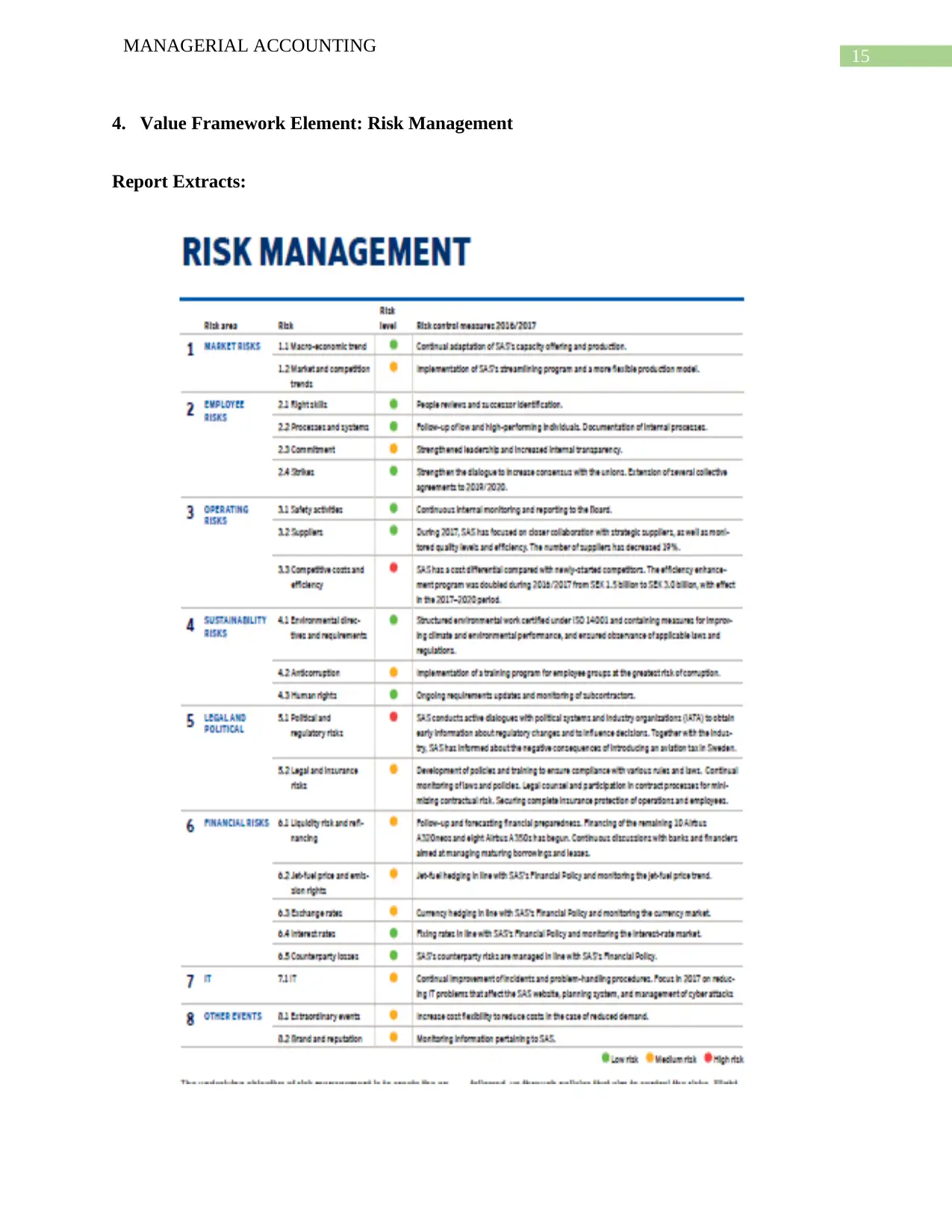

The risk management policy of SAS is about positioning the company in such a manner

that the business is able to minimize the negative impacts which can be caused by occurrence of

an uncertain event. The risks which are associated with the business are monitored and then

policies with the purpose of minimizing such risks are implemented.

Reporting Critique

The characteristics of reporting for the risk management which drives the PwC framework are:

The risks which are associated with the business are clearly identified on the basis of

specific areas such as financial, sustainability, legal and political

The risks are also effectively shown in a chart format on the basis of priority as shown

above in the report extract part.

Extensiveness and Accessibility

The risks which are faced by the management of SAS are effectively shown in with

proper explanation of the same in page 42 of the annual reports of the company. The risk

management policy of the company effectively deals with every risks effectively in different

segment and the same has been appropriately disclosed by the management.

Comprehensiveness

The risk management policy as reported in the annual reports of the business covers all

significant risks which are faced by the business which are market risks, employee risks,

operating risks, sustainability risks, legal risks and financial risks. The first step towards risk

MANAGERIAL ACCOUNTING

(Page 42, Annual Report 2016-17)

The risk management policy of SAS is about positioning the company in such a manner

that the business is able to minimize the negative impacts which can be caused by occurrence of

an uncertain event. The risks which are associated with the business are monitored and then

policies with the purpose of minimizing such risks are implemented.

Reporting Critique

The characteristics of reporting for the risk management which drives the PwC framework are:

The risks which are associated with the business are clearly identified on the basis of

specific areas such as financial, sustainability, legal and political

The risks are also effectively shown in a chart format on the basis of priority as shown

above in the report extract part.

Extensiveness and Accessibility

The risks which are faced by the management of SAS are effectively shown in with

proper explanation of the same in page 42 of the annual reports of the company. The risk

management policy of the company effectively deals with every risks effectively in different

segment and the same has been appropriately disclosed by the management.

Comprehensiveness

The risk management policy as reported in the annual reports of the business covers all

significant risks which are faced by the business which are market risks, employee risks,

operating risks, sustainability risks, legal risks and financial risks. The first step towards risk

17

MANAGERIAL ACCOUNTING

management is effective recognition of different risks which the business faces. The annual

reports also shows graphical representation and trends which are shown in the annual reports.

Conclusion and Strength

The principle risks which the business faces are effectively outlined in the annual report

along with the different trends which shows growth in prices, jet fuel costs of the business. The

analysis contains both quantitative and qualitative data analysis along with graphical presentation

which is properly reported.

Thus, the quality of reporting on risk management policies of the business is ‘good’.

5. Value Framework Element: Remuneration

Report Extracts:

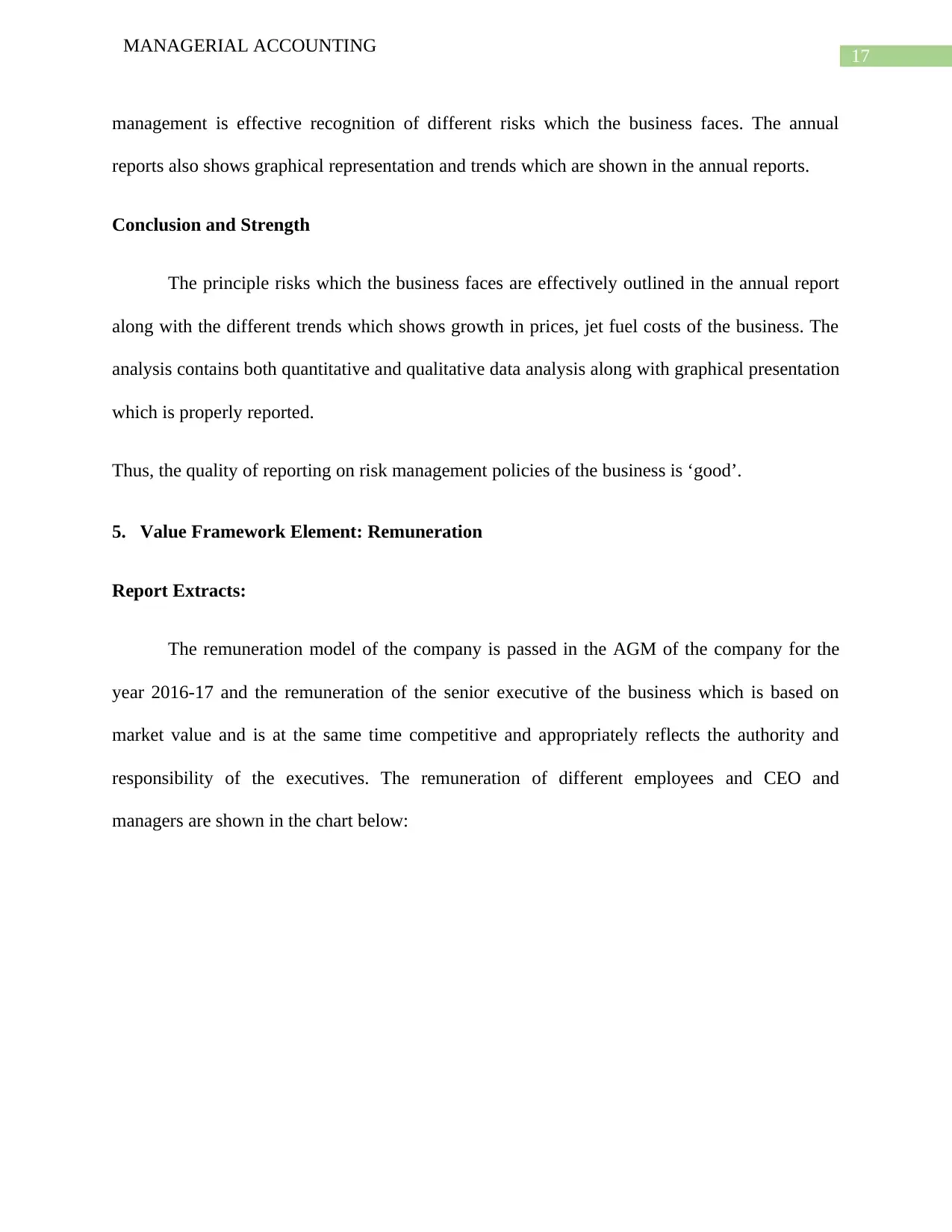

The remuneration model of the company is passed in the AGM of the company for the

year 2016-17 and the remuneration of the senior executive of the business which is based on

market value and is at the same time competitive and appropriately reflects the authority and

responsibility of the executives. The remuneration of different employees and CEO and

managers are shown in the chart below:

MANAGERIAL ACCOUNTING

management is effective recognition of different risks which the business faces. The annual

reports also shows graphical representation and trends which are shown in the annual reports.

Conclusion and Strength

The principle risks which the business faces are effectively outlined in the annual report

along with the different trends which shows growth in prices, jet fuel costs of the business. The

analysis contains both quantitative and qualitative data analysis along with graphical presentation

which is properly reported.

Thus, the quality of reporting on risk management policies of the business is ‘good’.

5. Value Framework Element: Remuneration

Report Extracts:

The remuneration model of the company is passed in the AGM of the company for the

year 2016-17 and the remuneration of the senior executive of the business which is based on

market value and is at the same time competitive and appropriately reflects the authority and

responsibility of the executives. The remuneration of different employees and CEO and

managers are shown in the chart below:

18

MANAGERIAL ACCOUNTING

(Page 73, Annual Report 2016-17)

Reporting Critique

The characteristic of the reporting for remuneration policy of the business is:

The effective reporting of remuneration communicates the consideration which is

received by the senior management.

The disclosures show the value of the consideration and impact of the same on the

company as a whole.

MANAGERIAL ACCOUNTING

(Page 73, Annual Report 2016-17)

Reporting Critique

The characteristic of the reporting for remuneration policy of the business is:

The effective reporting of remuneration communicates the consideration which is

received by the senior management.

The disclosures show the value of the consideration and impact of the same on the

company as a whole.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The remuneration policy of the company is communicated in details in the annual reports

of the company and the same is covered from page 72 covered under salaries, remuneration and

other social security expenses. The remuneration reporting covers a wide part of the report where

the rationale and the breakup of the remuneration is provided effectively. The reporting covers

the remuneration which is provided to

President and CEO

Deputy President

Other Senior Executives

Others (Employees)

Comprehensiveness

The reporting framework which is adopted by SAS ltd is consistent with the PwC

framework as the reporting discloses quality information. The remuneration section of the annual

report provides information about the break up of the salaries in fixed and variable parts. In

addition to this, for the senior management, the rate of pension is also shown in a chart form. The

section provides table which shows remuneration paid to CEO and senior management and also

to other employees. In addition to this, the table also provides information on remuneration

which the company had paid in the previous year which is very useful for the purpose of

comparison. The employee gets pension and termination benefits as shown in the annual reports

of the business.

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The remuneration policy of the company is communicated in details in the annual reports

of the company and the same is covered from page 72 covered under salaries, remuneration and

other social security expenses. The remuneration reporting covers a wide part of the report where

the rationale and the breakup of the remuneration is provided effectively. The reporting covers

the remuneration which is provided to

President and CEO

Deputy President

Other Senior Executives

Others (Employees)

Comprehensiveness

The reporting framework which is adopted by SAS ltd is consistent with the PwC

framework as the reporting discloses quality information. The remuneration section of the annual

report provides information about the break up of the salaries in fixed and variable parts. In

addition to this, for the senior management, the rate of pension is also shown in a chart form. The

section provides table which shows remuneration paid to CEO and senior management and also

to other employees. In addition to this, the table also provides information on remuneration

which the company had paid in the previous year which is very useful for the purpose of

comparison. The employee gets pension and termination benefits as shown in the annual reports

of the business.

20

MANAGERIAL ACCOUNTING

Conclusion and Strength

The remuneration strategy of the company is clearly reported in the annual reports of the

business under note 3 which is covered in page 72 onwards. In addition to this, the breakup of

the amount which is to be paid to different senior management executive are shown. Moreover,

the values are summarized properly in a table and chart form.

The quality of the reporting for remuneration as shown is annual report is ‘good’.

6. Value Framework Element: Financial Assets

Report Extracts:

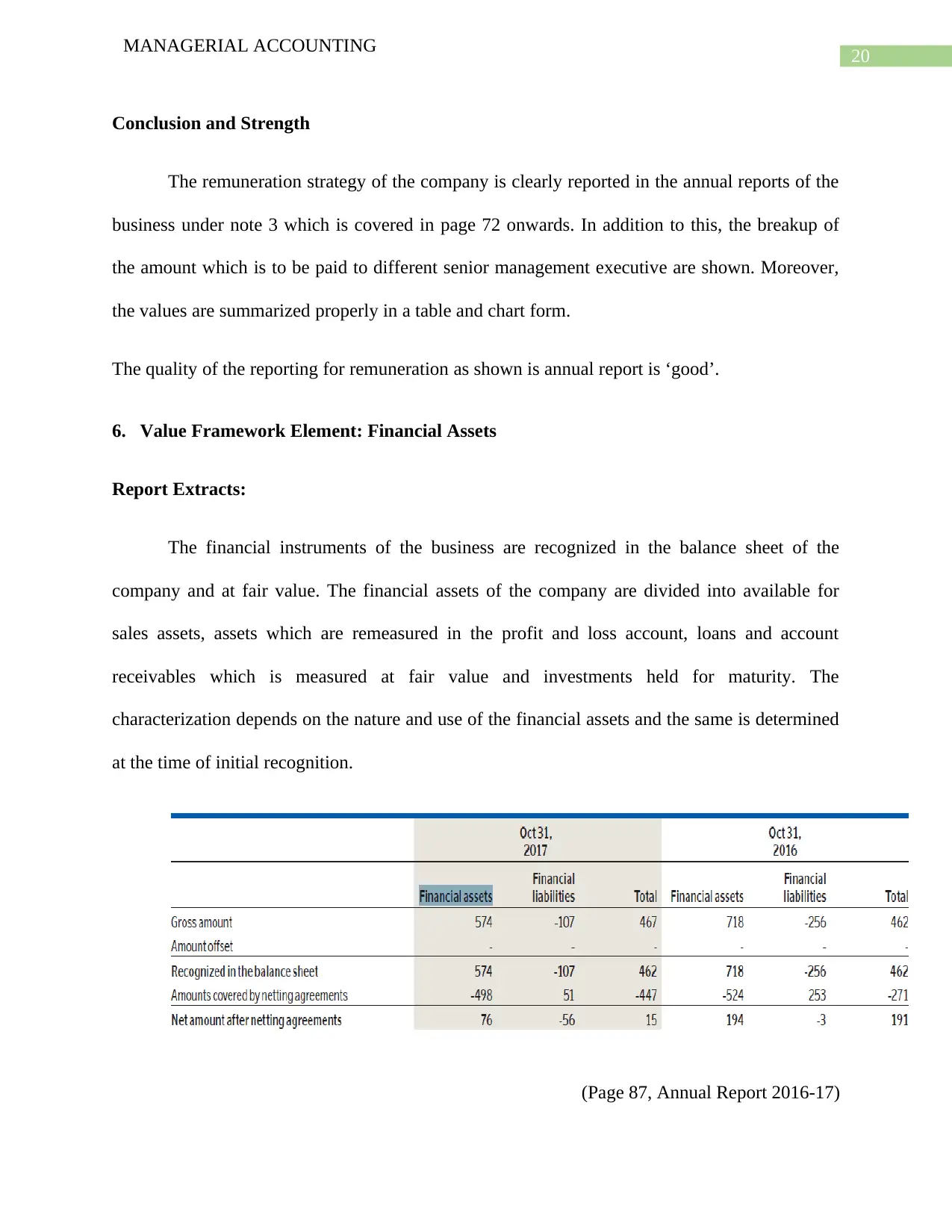

The financial instruments of the business are recognized in the balance sheet of the

company and at fair value. The financial assets of the company are divided into available for

sales assets, assets which are remeasured in the profit and loss account, loans and account

receivables which is measured at fair value and investments held for maturity. The

characterization depends on the nature and use of the financial assets and the same is determined

at the time of initial recognition.

(Page 87, Annual Report 2016-17)

MANAGERIAL ACCOUNTING

Conclusion and Strength

The remuneration strategy of the company is clearly reported in the annual reports of the

business under note 3 which is covered in page 72 onwards. In addition to this, the breakup of

the amount which is to be paid to different senior management executive are shown. Moreover,

the values are summarized properly in a table and chart form.

The quality of the reporting for remuneration as shown is annual report is ‘good’.

6. Value Framework Element: Financial Assets

Report Extracts:

The financial instruments of the business are recognized in the balance sheet of the

company and at fair value. The financial assets of the company are divided into available for

sales assets, assets which are remeasured in the profit and loss account, loans and account

receivables which is measured at fair value and investments held for maturity. The

characterization depends on the nature and use of the financial assets and the same is determined

at the time of initial recognition.

(Page 87, Annual Report 2016-17)

21

MANAGERIAL ACCOUNTING

Reporting Critique

The characteristic which drive the PwC framework financial assets are

Identification of the financial assets of SAS ltd

Determining the value of such Financial assets and judging the financial health of the

business.

Extensiveness and Accessibility

The financial assets which is covered in the notes to account part of the annual report do

have much information and only identifies the financial assets of the business which are cash and

cash equivalents and loan receivables and account receivables. The financial assets of the

business are just recognized in tabular format in note 27 in the annual reports of the company.

Comprehensiveness

The company is engaged in airline business and has numerous operations, therefore it is

essential that the management needs to maintain proper reporting records of the financial asset of

the business which is not shown in details in the annual reports of the company. However, the

financial assets and financial liabilities of previous year is given in the notes to account section

which shows that effective comparison between the two years is possible.

Conclusion and Strength

The reporting about the financial assets of the company is not complying with the requirements

of PwC framework as the detail reporting for the same is not done by SAS ltd. However, the

amount for financial assets for 2016 and 2017 are given without proper classification of the

same.

MANAGERIAL ACCOUNTING

Reporting Critique

The characteristic which drive the PwC framework financial assets are

Identification of the financial assets of SAS ltd

Determining the value of such Financial assets and judging the financial health of the

business.

Extensiveness and Accessibility

The financial assets which is covered in the notes to account part of the annual report do

have much information and only identifies the financial assets of the business which are cash and

cash equivalents and loan receivables and account receivables. The financial assets of the

business are just recognized in tabular format in note 27 in the annual reports of the company.

Comprehensiveness

The company is engaged in airline business and has numerous operations, therefore it is

essential that the management needs to maintain proper reporting records of the financial asset of

the business which is not shown in details in the annual reports of the company. However, the

financial assets and financial liabilities of previous year is given in the notes to account section

which shows that effective comparison between the two years is possible.

Conclusion and Strength

The reporting about the financial assets of the company is not complying with the requirements

of PwC framework as the detail reporting for the same is not done by SAS ltd. However, the

amount for financial assets for 2016 and 2017 are given without proper classification of the

same.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22

MANAGERIAL ACCOUNTING

The quality of reporting for Financial assets is ‘ugly’.

7. Value Framework Element: Physical Assets

Report Extracts:

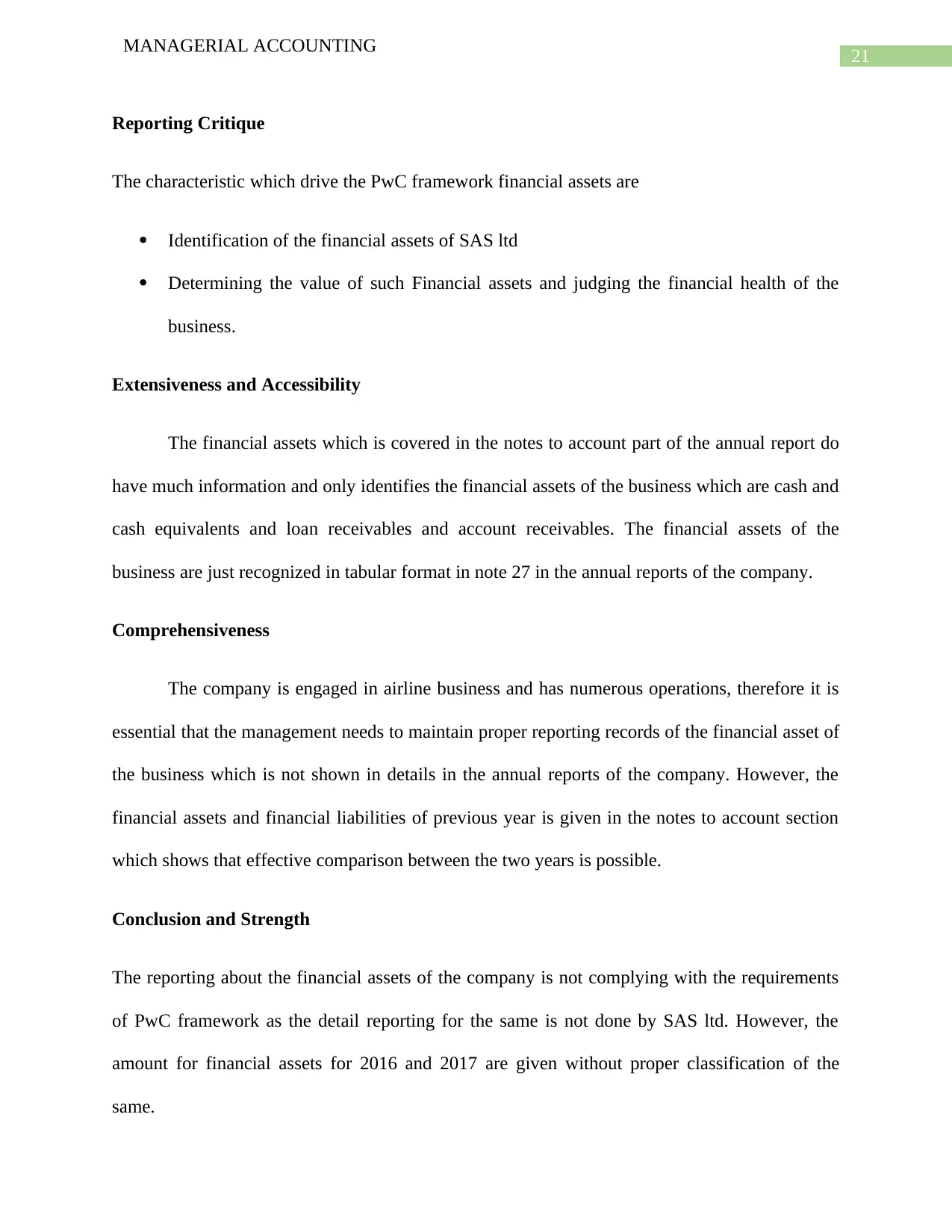

The physical assets of the business represent the tangible assets of the business such as

fixed assets of the airlines and also inventories which is used by SAS ltd. Tangible fixed assets

are recognized at cost less accumulated depreciation and any impairment. These assets are

depreciated to their estimated residual values on a straight-line basis over their estimated useful

lives. A table summarising the depreciation period is shown below:

(Page 69, Annual Report 2016-17)

The depreciation is charged following the straight line basis of depreciation.

MANAGERIAL ACCOUNTING

The quality of reporting for Financial assets is ‘ugly’.

7. Value Framework Element: Physical Assets

Report Extracts:

The physical assets of the business represent the tangible assets of the business such as

fixed assets of the airlines and also inventories which is used by SAS ltd. Tangible fixed assets

are recognized at cost less accumulated depreciation and any impairment. These assets are

depreciated to their estimated residual values on a straight-line basis over their estimated useful

lives. A table summarising the depreciation period is shown below:

(Page 69, Annual Report 2016-17)

The depreciation is charged following the straight line basis of depreciation.

23

MANAGERIAL ACCOUNTING

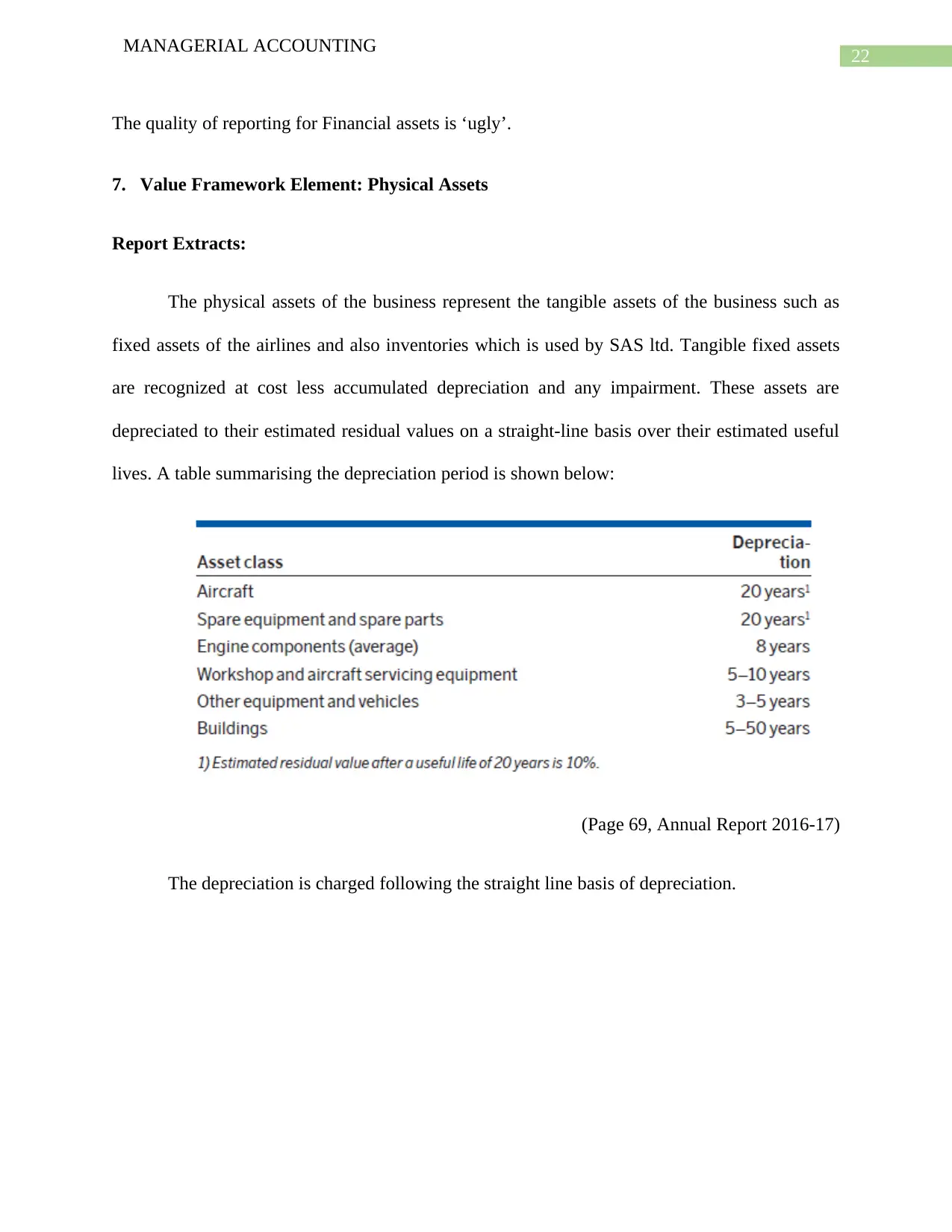

The inventories which are attributable to the airline company is shown above.

Expendable spare parts and inventories are carried at the lower of cost or net realizable value.

Cost is calculated using the weighted average cost.

Reporting Critique

The reporting characteristics which drives the PwC element framework for physical assets of the

business are:

Effective representation of the physical assets of the business which includes, fixed assets

of the business as well as the current assets of the company.

Book value and depreciation schedule of the assets shown in the financial accounts and

notes to account of the business.

The application of the asset and its effectiveness is shown in the report.

MANAGERIAL ACCOUNTING

The inventories which are attributable to the airline company is shown above.

Expendable spare parts and inventories are carried at the lower of cost or net realizable value.

Cost is calculated using the weighted average cost.

Reporting Critique

The reporting characteristics which drives the PwC element framework for physical assets of the

business are:

Effective representation of the physical assets of the business which includes, fixed assets

of the business as well as the current assets of the company.

Book value and depreciation schedule of the assets shown in the financial accounts and

notes to account of the business.

The application of the asset and its effectiveness is shown in the report.

24

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The techniques which are used for the purpose of measuring the physical assets of the

company are explained clearly in the significant accounting policies section of Notes to accounts

of the business (de Villiers, Rinaldi and Unerman 2014). The significant accounting policies start

from page 67 and the same is note 1 of the notes to account section of the annual report.

Comprehensiveness

The reporting about the intangible fixed assets of the business have been extensive as

shown in the annual reports of the business. The reporting on the fixed assets of the business is

done effective and the notes to accounting sections shows detailed classification and

summarization of the fixed assets of the business which effectively shows the accumulated cost

which has already adjusted any addition or sales made on the assets. The depreciation is also

clearly shown and the final figure which is obtained after deducting depreciation is compared

with carrying amount of the asset so as to determine any impairment loss to the business.

Conclusion and Strength

The reporting for the physical assets especially the tangible assets of the business re

shown appropriately which shows an in-depth data presentation and analysis of the same. Thus,

it can be said that the reporting quality of Physical assets is ‘good’ and will meet the expectation

of the stakeholders.

MANAGERIAL ACCOUNTING

Extensiveness and Accessibility

The techniques which are used for the purpose of measuring the physical assets of the

company are explained clearly in the significant accounting policies section of Notes to accounts

of the business (de Villiers, Rinaldi and Unerman 2014). The significant accounting policies start

from page 67 and the same is note 1 of the notes to account section of the annual report.

Comprehensiveness

The reporting about the intangible fixed assets of the business have been extensive as

shown in the annual reports of the business. The reporting on the fixed assets of the business is

done effective and the notes to accounting sections shows detailed classification and

summarization of the fixed assets of the business which effectively shows the accumulated cost

which has already adjusted any addition or sales made on the assets. The depreciation is also

clearly shown and the final figure which is obtained after deducting depreciation is compared

with carrying amount of the asset so as to determine any impairment loss to the business.

Conclusion and Strength

The reporting for the physical assets especially the tangible assets of the business re

shown appropriately which shows an in-depth data presentation and analysis of the same. Thus,

it can be said that the reporting quality of Physical assets is ‘good’ and will meet the expectation

of the stakeholders.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

25

MANAGERIAL ACCOUNTING

8. Value Framework Element: Customers

Report Extracts:

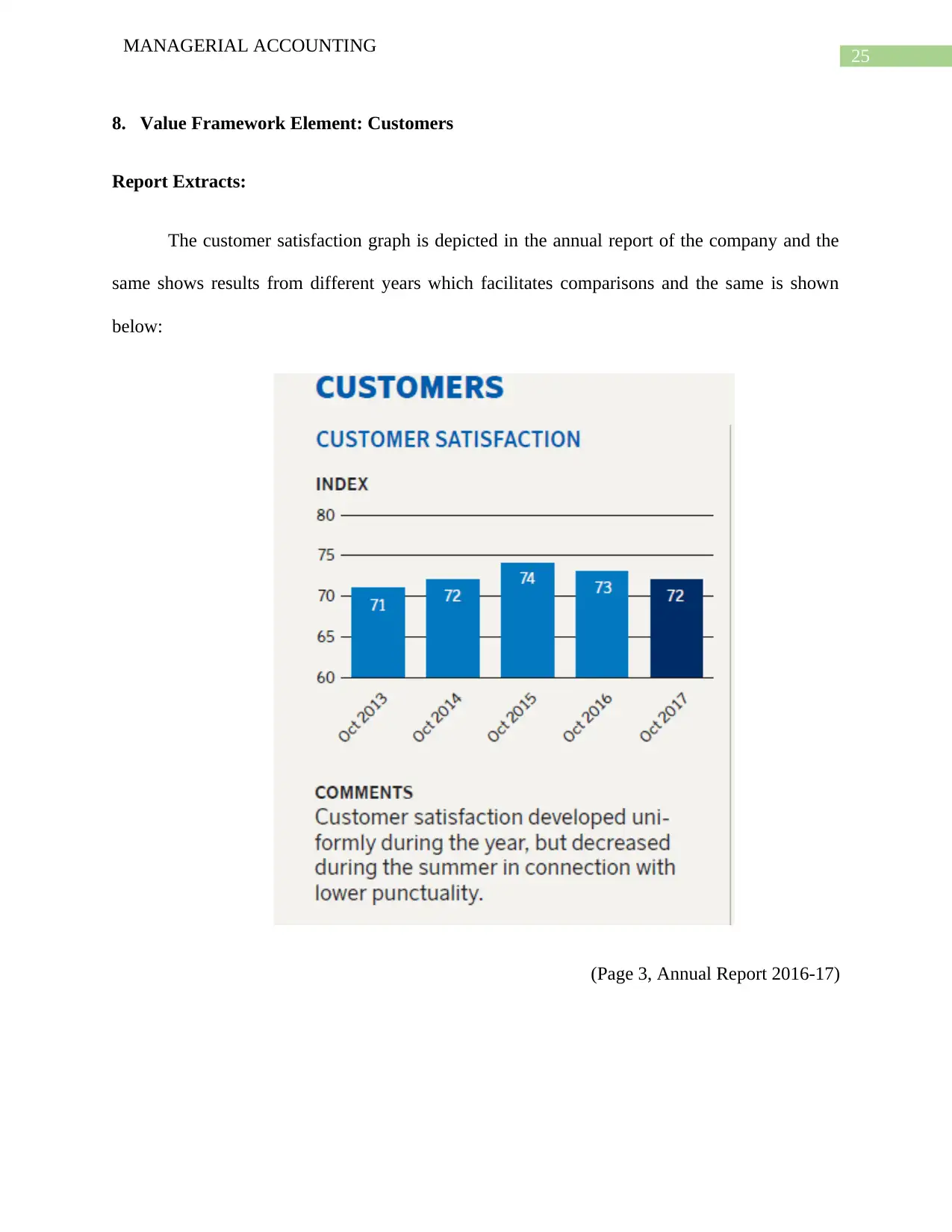

The customer satisfaction graph is depicted in the annual report of the company and the

same shows results from different years which facilitates comparisons and the same is shown

below:

(Page 3, Annual Report 2016-17)

MANAGERIAL ACCOUNTING

8. Value Framework Element: Customers

Report Extracts:

The customer satisfaction graph is depicted in the annual report of the company and the

same shows results from different years which facilitates comparisons and the same is shown

below:

(Page 3, Annual Report 2016-17)

26

MANAGERIAL ACCOUNTING

Reporting Critique

The characteristic of the PwC framework element of Customers are:

Effective presentation of the customer satisfaction index which facilitates comparisons.

Brand preference and customer loyalty

Extensiveness and Accessibility

The reporting area of the customers and the major countries to which the airlines provide

services are not distinctly shown in the annual reports of the company. As the airline is well

known business firm in the country therefore appropriate customer segment and a list of

important clients should be mentioned in the annual report of the company. The reports only

shows the customers satisfaction chart and the annual growth which the business is able to

achieve in leisure and business flights.

Comprehensiveness

The annual report does not provide a clear idea as to who are important customers of the

business and the reporting is only about the strategies which are applied by the business in

increasing the services of the airlines. The report shows the customer satisfaction level which is

not enough for proper reporting of the same.

Conclusion and Strength

The reporting for customer segments are not appropriately shown in the annual reports of

the company and SAS ltd which is also engaged in foreign travel need to report the customer

segment more appropriately.

MANAGERIAL ACCOUNTING

Reporting Critique

The characteristic of the PwC framework element of Customers are:

Effective presentation of the customer satisfaction index which facilitates comparisons.

Brand preference and customer loyalty

Extensiveness and Accessibility

The reporting area of the customers and the major countries to which the airlines provide

services are not distinctly shown in the annual reports of the company. As the airline is well

known business firm in the country therefore appropriate customer segment and a list of

important clients should be mentioned in the annual report of the company. The reports only

shows the customers satisfaction chart and the annual growth which the business is able to

achieve in leisure and business flights.

Comprehensiveness

The annual report does not provide a clear idea as to who are important customers of the

business and the reporting is only about the strategies which are applied by the business in

increasing the services of the airlines. The report shows the customer satisfaction level which is

not enough for proper reporting of the same.

Conclusion and Strength

The reporting for customer segments are not appropriately shown in the annual reports of

the company and SAS ltd which is also engaged in foreign travel need to report the customer

segment more appropriately.

27

MANAGERIAL ACCOUNTING

The quality of the reporting for the customers can be regarded as ‘ugly’.

9. Value Framework Element: People & Culture

Report Extracts:

The company recruits employee from different origins for the purpose of different

designation which are cabin crew, pilots and attendants. The management of the company is

committed towards establishing a shared culture environment for the purpose of effective

performance of the business. The management recognizes that a positive culture is essential for

the motivation and right guidance of the employee of the business.

Reporting Critique

The characteristic for reporting as per PwC Framework are shown below:

The competency of the employees and their commitment towards overall development of

the business.

The skills of employee are also a determining

Extensiveness and Accessibility

The report does not provide a clear outline of the culture and employee level of the

business. The employee diversity is shown in page 26 of the annual report of the company. The

report shows that the gender diversity of the business that is the number of male and female

employee working in the business (Mock, Rao and Srivastava 2013).

MANAGERIAL ACCOUNTING

The quality of the reporting for the customers can be regarded as ‘ugly’.

9. Value Framework Element: People & Culture

Report Extracts:

The company recruits employee from different origins for the purpose of different

designation which are cabin crew, pilots and attendants. The management of the company is

committed towards establishing a shared culture environment for the purpose of effective

performance of the business. The management recognizes that a positive culture is essential for

the motivation and right guidance of the employee of the business.

Reporting Critique

The characteristic for reporting as per PwC Framework are shown below:

The competency of the employees and their commitment towards overall development of

the business.

The skills of employee are also a determining

Extensiveness and Accessibility

The report does not provide a clear outline of the culture and employee level of the

business. The employee diversity is shown in page 26 of the annual report of the company. The

report shows that the gender diversity of the business that is the number of male and female

employee working in the business (Mock, Rao and Srivastava 2013).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

28

MANAGERIAL ACCOUNTING

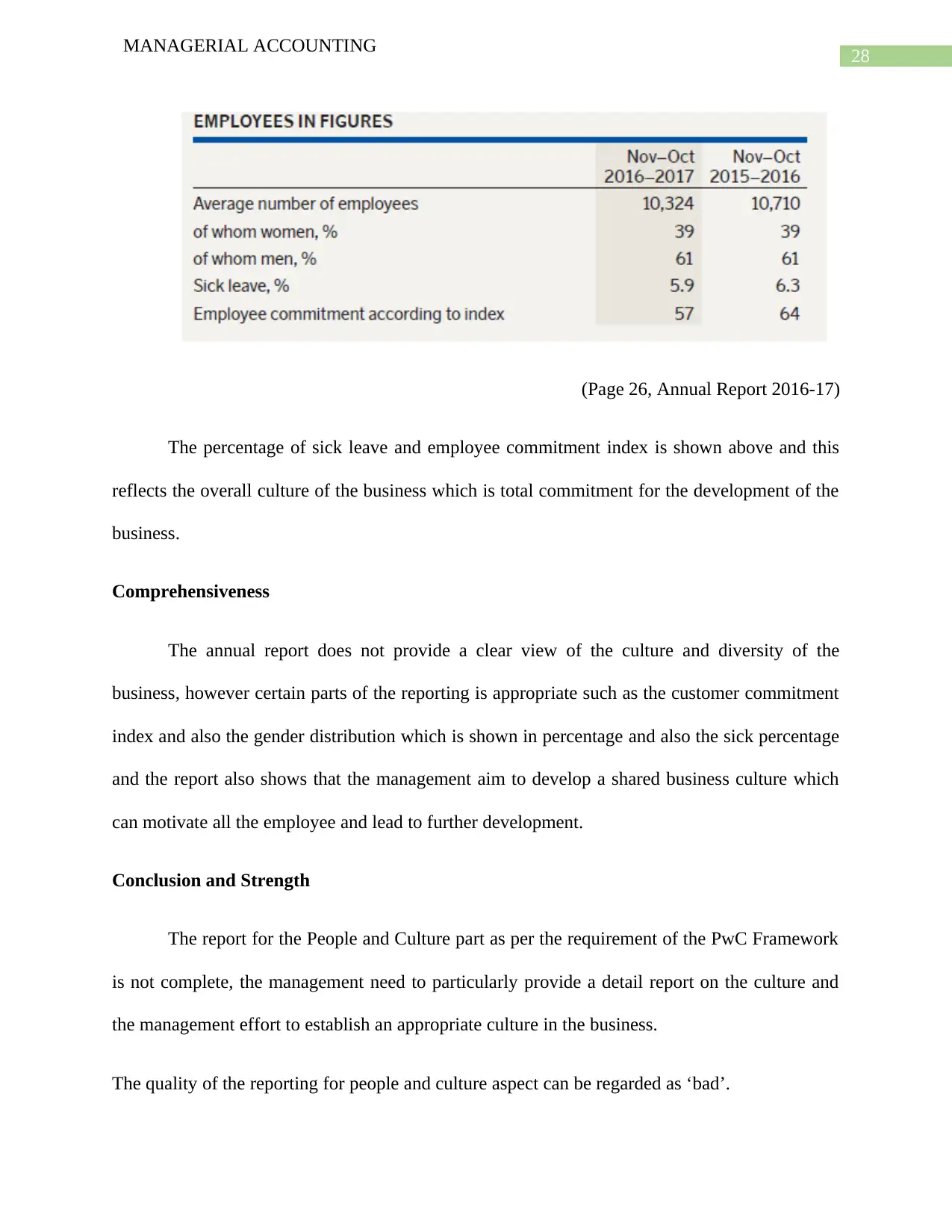

(Page 26, Annual Report 2016-17)

The percentage of sick leave and employee commitment index is shown above and this

reflects the overall culture of the business which is total commitment for the development of the

business.

Comprehensiveness

The annual report does not provide a clear view of the culture and diversity of the

business, however certain parts of the reporting is appropriate such as the customer commitment

index and also the gender distribution which is shown in percentage and also the sick percentage

and the report also shows that the management aim to develop a shared business culture which

can motivate all the employee and lead to further development.

Conclusion and Strength

The report for the People and Culture part as per the requirement of the PwC Framework

is not complete, the management need to particularly provide a detail report on the culture and

the management effort to establish an appropriate culture in the business.

The quality of the reporting for people and culture aspect can be regarded as ‘bad’.

MANAGERIAL ACCOUNTING

(Page 26, Annual Report 2016-17)

The percentage of sick leave and employee commitment index is shown above and this

reflects the overall culture of the business which is total commitment for the development of the

business.

Comprehensiveness

The annual report does not provide a clear view of the culture and diversity of the

business, however certain parts of the reporting is appropriate such as the customer commitment

index and also the gender distribution which is shown in percentage and also the sick percentage

and the report also shows that the management aim to develop a shared business culture which

can motivate all the employee and lead to further development.

Conclusion and Strength

The report for the People and Culture part as per the requirement of the PwC Framework

is not complete, the management need to particularly provide a detail report on the culture and

the management effort to establish an appropriate culture in the business.

The quality of the reporting for people and culture aspect can be regarded as ‘bad’.

29

MANAGERIAL ACCOUNTING

10. Value Framework Element: Innovation G&S

Report Extracts:

SAS ltd has in the month of May 2017 has introduced a new and innovative food and

drinking concept which focuses on functionality and locally produced using ingredients. The

business has also introduced lounge in Oslo recently which provides amenities such as gym and

other innovative activities.

Reporting Critique

The characteristic for reporting as per PwC framework for innovative practices are:

Identification of the innovative approaches applied by the management

Various changes and positive impacts which are brought about by such an innovation.

Extensiveness and Accessibility

The annual report of the company does not provide any information regarding significant

innovative practices which are undertaken by the business. The innovative activities of the

business are in varieties of food and also other amenities.

Comprehensiveness

The report does not provide any significant information whether the management of SAS

ltd is engaged in any sort of innovation or not and therefore the reporting of the innovation

segment does not meet the criteria of the framework of PwC.

MANAGERIAL ACCOUNTING

10. Value Framework Element: Innovation G&S

Report Extracts:

SAS ltd has in the month of May 2017 has introduced a new and innovative food and

drinking concept which focuses on functionality and locally produced using ingredients. The

business has also introduced lounge in Oslo recently which provides amenities such as gym and

other innovative activities.

Reporting Critique

The characteristic for reporting as per PwC framework for innovative practices are:

Identification of the innovative approaches applied by the management

Various changes and positive impacts which are brought about by such an innovation.

Extensiveness and Accessibility

The annual report of the company does not provide any information regarding significant

innovative practices which are undertaken by the business. The innovative activities of the

business are in varieties of food and also other amenities.

Comprehensiveness

The report does not provide any significant information whether the management of SAS

ltd is engaged in any sort of innovation or not and therefore the reporting of the innovation

segment does not meet the criteria of the framework of PwC.

30

MANAGERIAL ACCOUNTING

Conclusion and Strength