Tax Implications on Property Transactions and Fringe Benefits for BMA

VerifiedAdded on 2020/04/01

|13

|2435

|146

AI Summary

This assignment delves into the intricacies of fringe benefit tax (FBT) as outlined by the Fringe Benefit Tax Assessment Act 1986, highlighting how employers are mandated to pay certain taxes for employee benefits. Specifically, it examines the calculation methods such as the statutory formula method applied in determining taxable amounts, illustrated through an example where BMA incurs a FBT of $29,400 due to car fringe benefits. Additionally, the analysis extends to deductible expenses with reference to key legal cases and academic discussions, including landmark decisions like Commissioner of Taxation v. Robb (1999) 201 CLR 1 that influence how retirement contributions are treated under tax law. The assignment also assesses legislative changes affecting tax compliance and simplification, drawing on sources such as the works by Braverman et al., Du Plessis, Edmonds, and others to provide a comprehensive understanding of current practices and reforms in Australian taxation.

Running head: TAX

Tax

Name of the Student:

Name of the University:

Authors note:

Tax

Name of the Student:

Name of the University:

Authors note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2TAX

Table of Contents

Part A...............................................................................................................................................3

Part B...............................................................................................................................................6

Part C...............................................................................................................................................9

Reference.......................................................................................................................................12

Table of Contents

Part A...............................................................................................................................................3

Part B...............................................................................................................................................6

Part C...............................................................................................................................................9

Reference.......................................................................................................................................12

3TAX

Part A

The Income Tax Assessment Act 1997 under section 4-1 provides that an individual,

company or any other entity is required to pay tax on the taxable income. The section 4-15 of the

Income Tax Assessment Act 1997 states that taxable income can be calculated by deducting

allowable deduction from the assessable income. The Income tax law classifies the assessable

income as the ordinary income and the statutory income. The section 6-5 of the ITAA 97

provides that income according to the ordinary concept is known as the ordinary income. The

section 6-10 provides that income that are not ordinary income according to the ordinary concept

is known as the statutory income1. These are included in the assessable income by way of

specific provisions. The expenses that are allowed as deduction from the assessable income are

included in the Division 8 of the ITAA 97. The division allows two types of deductions general

deduction that are included in the section 8-1 of the ITAA 97 and the specific deduction

provided under section 8-5 of the ITAA 97.

In this case the taxable income of Janet Brown is prepared and for that all the receipts and

deductions are analyzed to determine the taxable income. The discussion are provided below:

Interest on Loan

In this case it can be seen that Janet Brown has taken loan of $400000 from BMA on July

2017. The interest rate of 3% was charged on the loan amount. It can be seen that the loan was

used for purchasing an investment property and for renovating the personal house. The income

from investment property is included in the assessable income. The section 8-1 of the ITAA 97

provides that an expenses is allowed as deduction if it is useful in generating assessable income.

In this case the interest paid for the part of $300000 amount that is used for purchasing the

1 Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance. Pearson Higher

Education AU, 2015.

Part A

The Income Tax Assessment Act 1997 under section 4-1 provides that an individual,

company or any other entity is required to pay tax on the taxable income. The section 4-15 of the

Income Tax Assessment Act 1997 states that taxable income can be calculated by deducting

allowable deduction from the assessable income. The Income tax law classifies the assessable

income as the ordinary income and the statutory income. The section 6-5 of the ITAA 97

provides that income according to the ordinary concept is known as the ordinary income. The

section 6-10 provides that income that are not ordinary income according to the ordinary concept

is known as the statutory income1. These are included in the assessable income by way of

specific provisions. The expenses that are allowed as deduction from the assessable income are

included in the Division 8 of the ITAA 97. The division allows two types of deductions general

deduction that are included in the section 8-1 of the ITAA 97 and the specific deduction

provided under section 8-5 of the ITAA 97.

In this case the taxable income of Janet Brown is prepared and for that all the receipts and

deductions are analyzed to determine the taxable income. The discussion are provided below:

Interest on Loan

In this case it can be seen that Janet Brown has taken loan of $400000 from BMA on July

2017. The interest rate of 3% was charged on the loan amount. It can be seen that the loan was

used for purchasing an investment property and for renovating the personal house. The income

from investment property is included in the assessable income. The section 8-1 of the ITAA 97

provides that an expenses is allowed as deduction if it is useful in generating assessable income.

In this case the interest paid for the part of $300000 amount that is used for purchasing the

1 Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance. Pearson Higher

Education AU, 2015.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4TAX

investment property will be allowed as deduction. The interest paid for the $100000 part of the

loan will not be allowed as deduction as it is an expenditure of personal nature2.

Car Provided by BMA

The section 15-2 of the Income Tax Assessment Act 1997 provides that any benefit or

allowances provided by the employer to the employee that is directly or indirectly related to the

employment are included in the assessable income3. The section 7 of the Fringe Benefit Tax

Assessment Act 1986 provides that car benefit should be treated as fringe benefit if the employee

is allowed to use the car for personal use or it is available to the employee for the personal use.

In this case it can be seen that a car was provided to Janet for commuting to the office and it is

also avail be for her personal use so it is a reportable fringe benefit. The reportable fringe benefit

are not included in the calculation of the assessable income. In this situation it is important to

understand the relationship between the income tax act and the fringe benefit tax. It should be

noted that if a benefit is considered as fringe benefit then it is taxed under fringe benefit tax and

is not included in the assessable income as per the Income Tax Assessment Act. In the current

case the benefit is a fringe benefit and hence it is not included in the assessable income4.

Rent from Investment property

The rent received from investment property is an assessable income. As discussed earlier

it can be seen that expenses incurred for producing assessable income is allowed as deduction.

However, the section 8-1(2) of the ITAA 97 clearly states that expenses or loss that is of capital

2 Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to Legislative Changes: A

Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n 17 (2015): 1.

3 Stewart, M., 2015. Looking forward at 100 Years: Where Next for the Income Tax. Austl. Tax F., 30, p.667.

4 Hodgson, Helen, and Prafula Pearce. "TravelSmart or travel tax breaks: is the fringe benefits tax a barrier to active

commuting in Australia? 1." eJournal of Tax Research 13, no. 3 (2015): 819.

investment property will be allowed as deduction. The interest paid for the $100000 part of the

loan will not be allowed as deduction as it is an expenditure of personal nature2.

Car Provided by BMA

The section 15-2 of the Income Tax Assessment Act 1997 provides that any benefit or

allowances provided by the employer to the employee that is directly or indirectly related to the

employment are included in the assessable income3. The section 7 of the Fringe Benefit Tax

Assessment Act 1986 provides that car benefit should be treated as fringe benefit if the employee

is allowed to use the car for personal use or it is available to the employee for the personal use.

In this case it can be seen that a car was provided to Janet for commuting to the office and it is

also avail be for her personal use so it is a reportable fringe benefit. The reportable fringe benefit

are not included in the calculation of the assessable income. In this situation it is important to

understand the relationship between the income tax act and the fringe benefit tax. It should be

noted that if a benefit is considered as fringe benefit then it is taxed under fringe benefit tax and

is not included in the assessable income as per the Income Tax Assessment Act. In the current

case the benefit is a fringe benefit and hence it is not included in the assessable income4.

Rent from Investment property

The rent received from investment property is an assessable income. As discussed earlier

it can be seen that expenses incurred for producing assessable income is allowed as deduction.

However, the section 8-1(2) of the ITAA 97 clearly states that expenses or loss that is of capital

2 Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to Legislative Changes: A

Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n 17 (2015): 1.

3 Stewart, M., 2015. Looking forward at 100 Years: Where Next for the Income Tax. Austl. Tax F., 30, p.667.

4 Hodgson, Helen, and Prafula Pearce. "TravelSmart or travel tax breaks: is the fringe benefits tax a barrier to active

commuting in Australia? 1." eJournal of Tax Research 13, no. 3 (2015): 819.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5TAX

or private nature is not allowed as deduction. In this case cost that has been incurred for

replacement of roof is a capital expenditure hence not allowed as deduction. The AC system is a

capital assets so the expenses incurred for that is not allowed as deduction.

Sale of Shares and doll

The capital gain is a statutory income and it should be included in the assessable income

as per section 102-5 of the ITAA 97. The profit or loss made from sale of shares should be

included in the assessable income. The section 118-10(1) states that capital gain or loss made

from the personal use assets and collectable should be disregarded provided the cost or market

value of the assets is less than $500. In this case, Janet purchased doll for $1000 so the cost is

more than $500 hence the exemption does not apply5.

Legal expenses and damages

The legal expense are allowed as deduction but the damages paid are not allowed as

deduction. The detailed discussion is provided later.

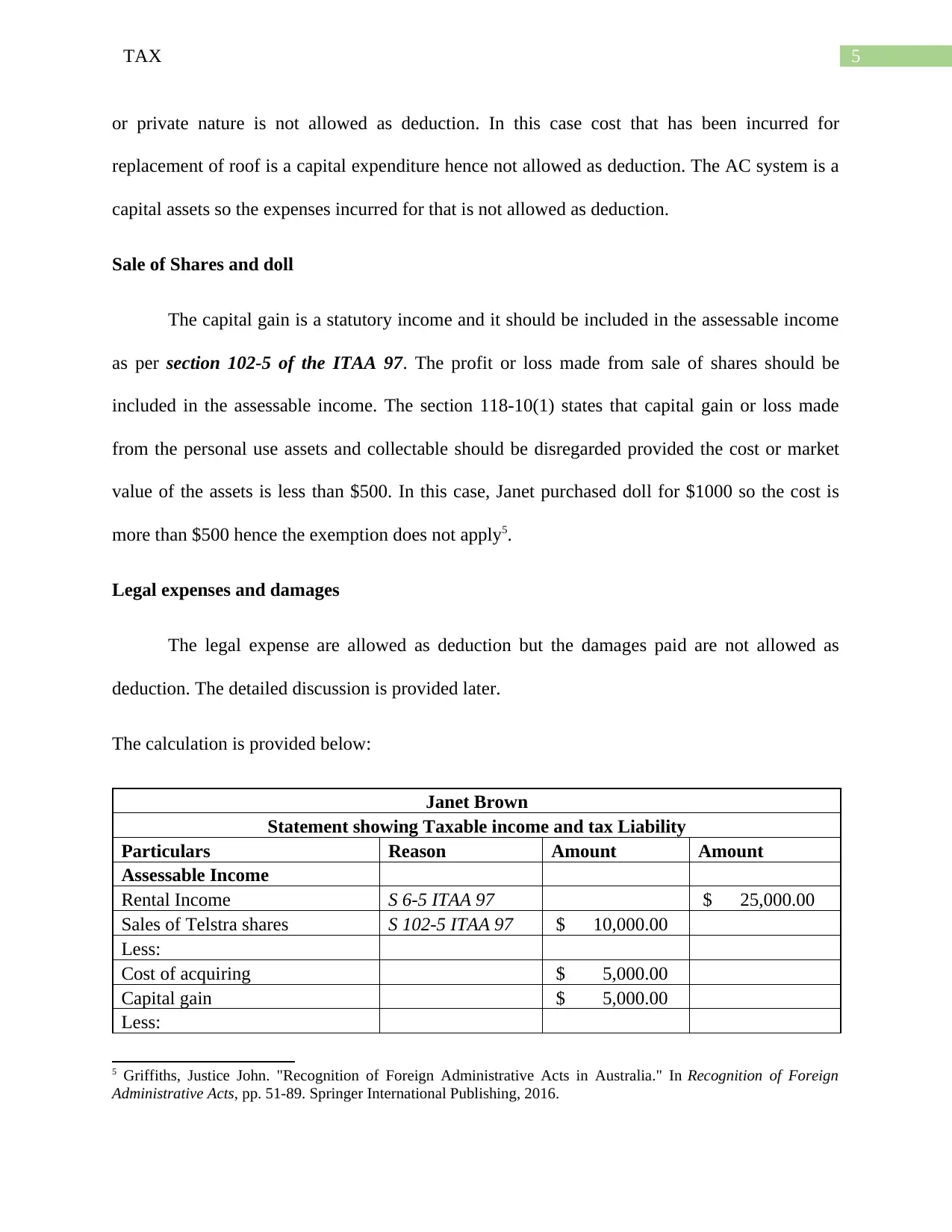

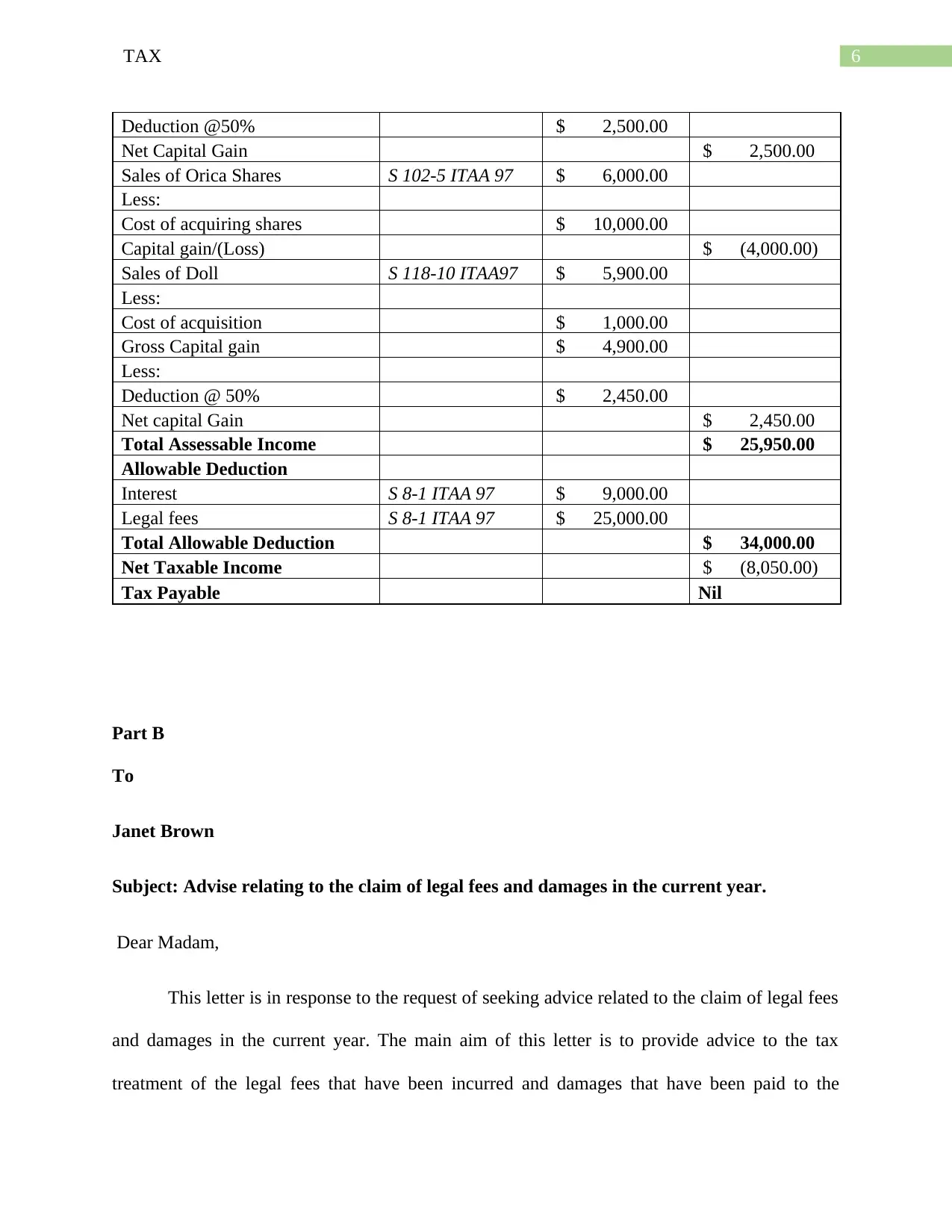

The calculation is provided below:

Janet Brown

Statement showing Taxable income and tax Liability

Particulars Reason Amount Amount

Assessable Income

Rental Income S 6-5 ITAA 97 $ 25,000.00

Sales of Telstra shares S 102-5 ITAA 97 $ 10,000.00

Less:

Cost of acquiring $ 5,000.00

Capital gain $ 5,000.00

Less:

5 Griffiths, Justice John. "Recognition of Foreign Administrative Acts in Australia." In Recognition of Foreign

Administrative Acts, pp. 51-89. Springer International Publishing, 2016.

or private nature is not allowed as deduction. In this case cost that has been incurred for

replacement of roof is a capital expenditure hence not allowed as deduction. The AC system is a

capital assets so the expenses incurred for that is not allowed as deduction.

Sale of Shares and doll

The capital gain is a statutory income and it should be included in the assessable income

as per section 102-5 of the ITAA 97. The profit or loss made from sale of shares should be

included in the assessable income. The section 118-10(1) states that capital gain or loss made

from the personal use assets and collectable should be disregarded provided the cost or market

value of the assets is less than $500. In this case, Janet purchased doll for $1000 so the cost is

more than $500 hence the exemption does not apply5.

Legal expenses and damages

The legal expense are allowed as deduction but the damages paid are not allowed as

deduction. The detailed discussion is provided later.

The calculation is provided below:

Janet Brown

Statement showing Taxable income and tax Liability

Particulars Reason Amount Amount

Assessable Income

Rental Income S 6-5 ITAA 97 $ 25,000.00

Sales of Telstra shares S 102-5 ITAA 97 $ 10,000.00

Less:

Cost of acquiring $ 5,000.00

Capital gain $ 5,000.00

Less:

5 Griffiths, Justice John. "Recognition of Foreign Administrative Acts in Australia." In Recognition of Foreign

Administrative Acts, pp. 51-89. Springer International Publishing, 2016.

6TAX

Deduction @50% $ 2,500.00

Net Capital Gain $ 2,500.00

Sales of Orica Shares S 102-5 ITAA 97 $ 6,000.00

Less:

Cost of acquiring shares $ 10,000.00

Capital gain/(Loss) $ (4,000.00)

Sales of Doll S 118-10 ITAA97 $ 5,900.00

Less:

Cost of acquisition $ 1,000.00

Gross Capital gain $ 4,900.00

Less:

Deduction @ 50% $ 2,450.00

Net capital Gain $ 2,450.00

Total Assessable Income $ 25,950.00

Allowable Deduction

Interest S 8-1 ITAA 97 $ 9,000.00

Legal fees S 8-1 ITAA 97 $ 25,000.00

Total Allowable Deduction $ 34,000.00

Net Taxable Income $ (8,050.00)

Tax Payable Nil

Part B

To

Janet Brown

Subject: Advise relating to the claim of legal fees and damages in the current year.

Dear Madam,

This letter is in response to the request of seeking advice related to the claim of legal fees

and damages in the current year. The main aim of this letter is to provide advice to the tax

treatment of the legal fees that have been incurred and damages that have been paid to the

Deduction @50% $ 2,500.00

Net Capital Gain $ 2,500.00

Sales of Orica Shares S 102-5 ITAA 97 $ 6,000.00

Less:

Cost of acquiring shares $ 10,000.00

Capital gain/(Loss) $ (4,000.00)

Sales of Doll S 118-10 ITAA97 $ 5,900.00

Less:

Cost of acquisition $ 1,000.00

Gross Capital gain $ 4,900.00

Less:

Deduction @ 50% $ 2,450.00

Net capital Gain $ 2,450.00

Total Assessable Income $ 25,950.00

Allowable Deduction

Interest S 8-1 ITAA 97 $ 9,000.00

Legal fees S 8-1 ITAA 97 $ 25,000.00

Total Allowable Deduction $ 34,000.00

Net Taxable Income $ (8,050.00)

Tax Payable Nil

Part B

To

Janet Brown

Subject: Advise relating to the claim of legal fees and damages in the current year.

Dear Madam,

This letter is in response to the request of seeking advice related to the claim of legal fees

and damages in the current year. The main aim of this letter is to provide advice to the tax

treatment of the legal fees that have been incurred and damages that have been paid to the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7TAX

neighbors of the Newport townhouse. In order to provide the advice relevant legislations and

ruling have been discussed. The entire advice have been classified into two parts the

deductibility of legal expenses and the deductibility of damages.

Legal Expenses

The taxpayer is allowed to claim deduction from the assessable income for the purpose of

computing the taxable income. The deduction that are allowed under the Income Tax Assessment

Act 1997 are provided under the Division 8 Deductions. The deduction can be classified into

general deduction that are provided under section 8-1 of the ITAA 97 and the specific deduction

that are provided under the section 8- 5 of the ITAA 976. The specific deduction are further

classified into statutory entitling provision and the statutory disallowing provision. The legal

expenses can be specific deduction, general deduction or both and is entirely dependent on the

character of the legal work performed.

The section 8-1 of the Income Tax Assessment Act 1997 is the key provision that deals

with the deductibility of expenses. The section 8-1 of the ITAA 97 states that the taxpayer is

allowed to claim deduction from the assessable income any loss or outgoings that is incurred for

the purpose of producing assessable income7. The section also provides that the taxpayer is

allowed to claim deduction for the expenses that have been incurred for carrying on the business

or for producing assessable income. The section further provides that the taxpayer is not allowed

to claim loss or outgoing under this section that is of capital nature and private or domestic

nature. In order to decide whether an expenses is allowed as general business expenses there are

6 Martin, Fiona. "To Be, Or Not to Be, a Charity: That Is the Question for Prescribed Bodies Corporate under the

Native Title Act." Deakin L. Rev. 21 (2016): 25.

7 Hurley, T., 2014. Case notes: The latest from the high and federal courts. LSJ: Law Society of NSW Journal, 1(3),

p.84.

neighbors of the Newport townhouse. In order to provide the advice relevant legislations and

ruling have been discussed. The entire advice have been classified into two parts the

deductibility of legal expenses and the deductibility of damages.

Legal Expenses

The taxpayer is allowed to claim deduction from the assessable income for the purpose of

computing the taxable income. The deduction that are allowed under the Income Tax Assessment

Act 1997 are provided under the Division 8 Deductions. The deduction can be classified into

general deduction that are provided under section 8-1 of the ITAA 97 and the specific deduction

that are provided under the section 8- 5 of the ITAA 976. The specific deduction are further

classified into statutory entitling provision and the statutory disallowing provision. The legal

expenses can be specific deduction, general deduction or both and is entirely dependent on the

character of the legal work performed.

The section 8-1 of the Income Tax Assessment Act 1997 is the key provision that deals

with the deductibility of expenses. The section 8-1 of the ITAA 97 states that the taxpayer is

allowed to claim deduction from the assessable income any loss or outgoings that is incurred for

the purpose of producing assessable income7. The section also provides that the taxpayer is

allowed to claim deduction for the expenses that have been incurred for carrying on the business

or for producing assessable income. The section further provides that the taxpayer is not allowed

to claim loss or outgoing under this section that is of capital nature and private or domestic

nature. In order to decide whether an expenses is allowed as general business expenses there are

6 Martin, Fiona. "To Be, Or Not to Be, a Charity: That Is the Question for Prescribed Bodies Corporate under the

Native Title Act." Deakin L. Rev. 21 (2016): 25.

7 Hurley, T., 2014. Case notes: The latest from the high and federal courts. LSJ: Law Society of NSW Journal, 1(3),

p.84.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8TAX

number of hurdles that should be considered before claiming legal expenses as deduction. In the

case of Magna Alloys & Research Pty Ltd v. Federal Commissioner of Taxation 80 ATC 4542

the court have determined that the legal expenses incurred by a business is allowed as deduction

if it arise out of the day to day business activity of the tax payer8. It should be noted that the legal

expenses incurred should have peripheral connection to the activity of the business in order to be

deductible. The legal expenses character is the advantage that have been sought for incurring the

expenditure. That means if the advantage is of the capital nature then the expenses that have been

incurred for the legal expenses will also be considered as that of the capital nature. It is therefore

necessary for a business to determine whether the legal expenditure should be necessary for

incurring the business. Therefore based on the above discussion it can be said that the taxpayer is

allowed to claim deduction for the expenses that have been incurred for producing the assessable

income9.

In the current scenario Janet has purchased a Newport Town house and has rented it on

$2500 per month. The rent is an assessable income under section 6-5 of the Income Tax

Assessment Act 1997. Therefore it can be said that as per discussion the legal fees that have

been incurred for defending in the court will be allowed as deduction.

Damages

The ATO Interpretative Decision ATO ID 2002/63 deals with the issue whether the

taxpayer is allowed to claim deduction under section 8-1 of the Income Tax Assessment Act

1997 for the damages payment that have been made by the taxpayer. It provides that the taxpayer

8 Edmonds, Richard. "Structural tax reform: What should be brought to the table." Austl. Tax F. 30 (2015): 393.

9 Mihaylov, George, John Tretola, Alfred Yawson, and Ralf Zurbruegg. "Tax compliance behaviour in Australian

self-managed superannuation funds." (2015).

number of hurdles that should be considered before claiming legal expenses as deduction. In the

case of Magna Alloys & Research Pty Ltd v. Federal Commissioner of Taxation 80 ATC 4542

the court have determined that the legal expenses incurred by a business is allowed as deduction

if it arise out of the day to day business activity of the tax payer8. It should be noted that the legal

expenses incurred should have peripheral connection to the activity of the business in order to be

deductible. The legal expenses character is the advantage that have been sought for incurring the

expenditure. That means if the advantage is of the capital nature then the expenses that have been

incurred for the legal expenses will also be considered as that of the capital nature. It is therefore

necessary for a business to determine whether the legal expenditure should be necessary for

incurring the business. Therefore based on the above discussion it can be said that the taxpayer is

allowed to claim deduction for the expenses that have been incurred for producing the assessable

income9.

In the current scenario Janet has purchased a Newport Town house and has rented it on

$2500 per month. The rent is an assessable income under section 6-5 of the Income Tax

Assessment Act 1997. Therefore it can be said that as per discussion the legal fees that have

been incurred for defending in the court will be allowed as deduction.

Damages

The ATO Interpretative Decision ATO ID 2002/63 deals with the issue whether the

taxpayer is allowed to claim deduction under section 8-1 of the Income Tax Assessment Act

1997 for the damages payment that have been made by the taxpayer. It provides that the taxpayer

8 Edmonds, Richard. "Structural tax reform: What should be brought to the table." Austl. Tax F. 30 (2015): 393.

9 Mihaylov, George, John Tretola, Alfred Yawson, and Ralf Zurbruegg. "Tax compliance behaviour in Australian

self-managed superannuation funds." (2015).

9TAX

is not allowed to claim deduction for the damage payment under section 8-1 of the Income Tax

Assessment Act 1997 as these expenses are not incurred in connection with the producing of the

assessable income. In this case Janet had to pay for the damages as the court awarded the damage

as it held that the fence is really on the property of the neighbor. This damage did not arise as a

result of earning assessable income and hence it is not allowed as deduction under section 8-1 of

the Income tax Assessment Act 199710.

Based on the above discussion it can be said that the legal expenses is allowed as

deduction. However the expenses for the payment of damage will not be allowed as deduction

under section 8-1 of the Income Tax Assessment Act 1997. It is expected that the above letter

clears all the doubt relating tax treatment of the expenses. If there are any further clarification

required please feel free to ask and response will be provided in a timely manner.

Thanking You

Part C

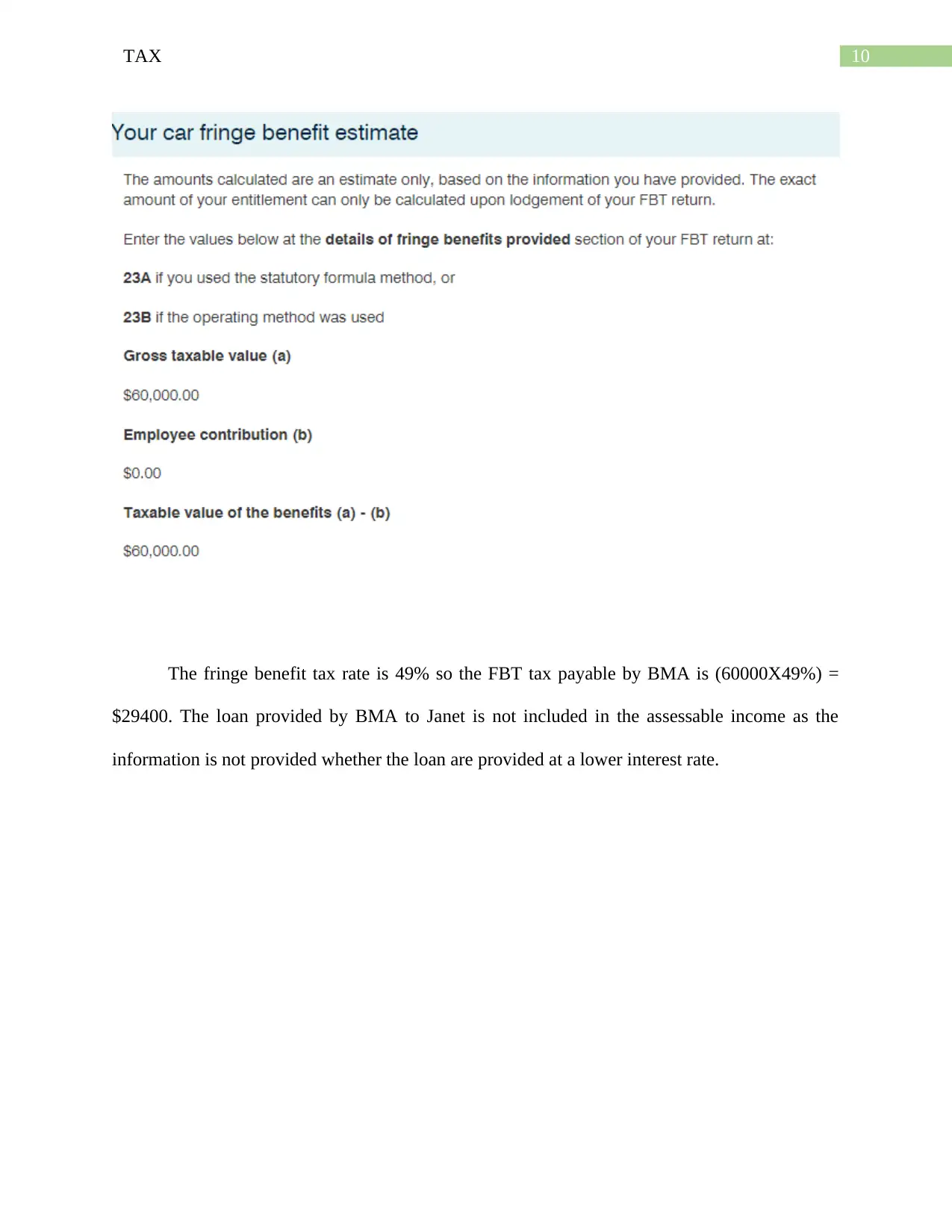

The Fringe Benefit Tax Assessment Act 1986 deals with the administration of the fringe

benefit tax. It states that an employer is required to pay certain fringe benefit tax for the benefit

provided to the employees11. There benefit for which BMA will be required to pay tax is the Car

fringe benefit. The method that is applied for determining the taxable amount of the car fringe

benefit is the statutory formula. The calculation shows:

10 Farrell, Jan. "Tax and Time Travel: Looking Back and Looking Forward-A Tax Administrator's Perspective." J.

Australasian Tax Tchrs. Ass'n 11 (2016): 27.

11 Du Plessis, C.J., 2015. The capping of the deductibility of retirement contributions for tax: a comparison between

South Africa and developed countries (Doctoral dissertation, North-West University (South Africa), Potchefstroom

Campus).

is not allowed to claim deduction for the damage payment under section 8-1 of the Income Tax

Assessment Act 1997 as these expenses are not incurred in connection with the producing of the

assessable income. In this case Janet had to pay for the damages as the court awarded the damage

as it held that the fence is really on the property of the neighbor. This damage did not arise as a

result of earning assessable income and hence it is not allowed as deduction under section 8-1 of

the Income tax Assessment Act 199710.

Based on the above discussion it can be said that the legal expenses is allowed as

deduction. However the expenses for the payment of damage will not be allowed as deduction

under section 8-1 of the Income Tax Assessment Act 1997. It is expected that the above letter

clears all the doubt relating tax treatment of the expenses. If there are any further clarification

required please feel free to ask and response will be provided in a timely manner.

Thanking You

Part C

The Fringe Benefit Tax Assessment Act 1986 deals with the administration of the fringe

benefit tax. It states that an employer is required to pay certain fringe benefit tax for the benefit

provided to the employees11. There benefit for which BMA will be required to pay tax is the Car

fringe benefit. The method that is applied for determining the taxable amount of the car fringe

benefit is the statutory formula. The calculation shows:

10 Farrell, Jan. "Tax and Time Travel: Looking Back and Looking Forward-A Tax Administrator's Perspective." J.

Australasian Tax Tchrs. Ass'n 11 (2016): 27.

11 Du Plessis, C.J., 2015. The capping of the deductibility of retirement contributions for tax: a comparison between

South Africa and developed countries (Doctoral dissertation, North-West University (South Africa), Potchefstroom

Campus).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10TAX

The fringe benefit tax rate is 49% so the FBT tax payable by BMA is (60000X49%) =

$29400. The loan provided by BMA to Janet is not included in the assessable income as the

information is not provided whether the loan are provided at a lower interest rate.

The fringe benefit tax rate is 49% so the FBT tax payable by BMA is (60000X49%) =

$29400. The loan provided by BMA to Janet is not included in the assessable income as the

information is not provided whether the loan are provided at a lower interest rate.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11TAX

Reference

Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n 17

(2015): 1.

Du Plessis, C.J., 2015. The capping of the deductibility of retirement contributions for tax: a

comparison between South Africa and developed countries (Doctoral dissertation, North-West

University (South Africa), Potchefstroom Campus).

Edmonds, Richard. "Structural tax reform: What should be brought to the table." Austl. Tax F. 30

(2015): 393.

Farrell, Jan. "Tax and Time Travel: Looking Back and Looking Forward-A Tax Administrator's

Perspective." J. Australasian Tax Tchrs. Ass'n 11 (2016): 27.

Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance.

Pearson Higher Education AU, 2015.

Griffiths, Justice John. "Recognition of Foreign Administrative Acts in Australia."

In Recognition of Foreign Administrative Acts, pp. 51-89. Springer International Publishing,

2016.

Hodgson, Helen, and Prafula Pearce. "TravelSmart or travel tax breaks: is the fringe benefits tax

a barrier to active commuting in Australia? 1." eJournal of Tax Research 13, no. 3 (2015): 819.

Hurley, T., 2014. Case notes: The latest from the high and federal courts. LSJ: Law Society of

NSW Journal, 1(3), p.84.

Reference

Braverman, Daniel, Stephen Marsden, and Kerrie Sadiq. "Assessing Taxpayer Response to

Legislative Changes: A Case Study of In-House Fringe Benefits Rules." J. Austl. Tax'n 17

(2015): 1.

Du Plessis, C.J., 2015. The capping of the deductibility of retirement contributions for tax: a

comparison between South Africa and developed countries (Doctoral dissertation, North-West

University (South Africa), Potchefstroom Campus).

Edmonds, Richard. "Structural tax reform: What should be brought to the table." Austl. Tax F. 30

(2015): 393.

Farrell, Jan. "Tax and Time Travel: Looking Back and Looking Forward-A Tax Administrator's

Perspective." J. Australasian Tax Tchrs. Ass'n 11 (2016): 27.

Gitman, Lawrence J., Roger Juchau, and Jack Flanagan. Principles of managerial finance.

Pearson Higher Education AU, 2015.

Griffiths, Justice John. "Recognition of Foreign Administrative Acts in Australia."

In Recognition of Foreign Administrative Acts, pp. 51-89. Springer International Publishing,

2016.

Hodgson, Helen, and Prafula Pearce. "TravelSmart or travel tax breaks: is the fringe benefits tax

a barrier to active commuting in Australia? 1." eJournal of Tax Research 13, no. 3 (2015): 819.

Hurley, T., 2014. Case notes: The latest from the high and federal courts. LSJ: Law Society of

NSW Journal, 1(3), p.84.

12TAX

Martin, Fiona. "To Be, Or Not to Be, a Charity: That Is the Question for Prescribed Bodies

Corporate under the Native Title Act." Deakin L. Rev. 21 (2016): 25.

Mihaylov, George, John Tretola, Alfred Yawson, and Ralf Zurbruegg. "Tax compliance

behaviour in Australian self-managed superannuation funds." (2015).

Stewart, M., 2015. Looking forward at 100 Years: Where Next for the Income Tax. Austl. Tax

F., 30, p.667.

Tran-Nam, Binh. "Tax Reform and Tax Simplification: Conceptual and Measurement Issues and

Australian Experiences." In The Complexity of Tax Simplification, pp. 11-44. Palgrave

Macmillan UK, 2016.

Martin, Fiona. "To Be, Or Not to Be, a Charity: That Is the Question for Prescribed Bodies

Corporate under the Native Title Act." Deakin L. Rev. 21 (2016): 25.

Mihaylov, George, John Tretola, Alfred Yawson, and Ralf Zurbruegg. "Tax compliance

behaviour in Australian self-managed superannuation funds." (2015).

Stewart, M., 2015. Looking forward at 100 Years: Where Next for the Income Tax. Austl. Tax

F., 30, p.667.

Tran-Nam, Binh. "Tax Reform and Tax Simplification: Conceptual and Measurement Issues and

Australian Experiences." In The Complexity of Tax Simplification, pp. 11-44. Palgrave

Macmillan UK, 2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13