Security Market Line and Capital Market Line

VerifiedAdded on 2023/06/07

|10

|2473

|404

AI Summary

This article explains the relationship between Security Market Line and Capital Market Line, and how they help in deriving the expected rate of return from the beta which is already given and also reflects in the risk or the riskiness which is connected or is associated with the given rate of return in terms of the security.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE FINANCIAL MANAGEMENT

1

SECURITY MARKET LINE AND

CAPITAL MARKET LINE

1

SECURITY MARKET LINE AND

CAPITAL MARKET LINE

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CORPORATE FINANCIAL MANAGEMENT

2

Security market line:

The security market line or SML represents the CAPM model graphically. This is something

which shows in the relationship that exists between the 2 techniques, namely security market

line and the capital market line. This shows the relationship between the return that an

investor derives from a security and the risk which is associated with it and is ultimately

measured by the beta coefficient. Another way of saying the same is the fact that the

securities market line help in deriving the expected rate of return from the beta which is

already given and also reflects in the risk or the riskiness which is connected or is associated

with the given rate of return in terms of the security (Bawa, 2018).

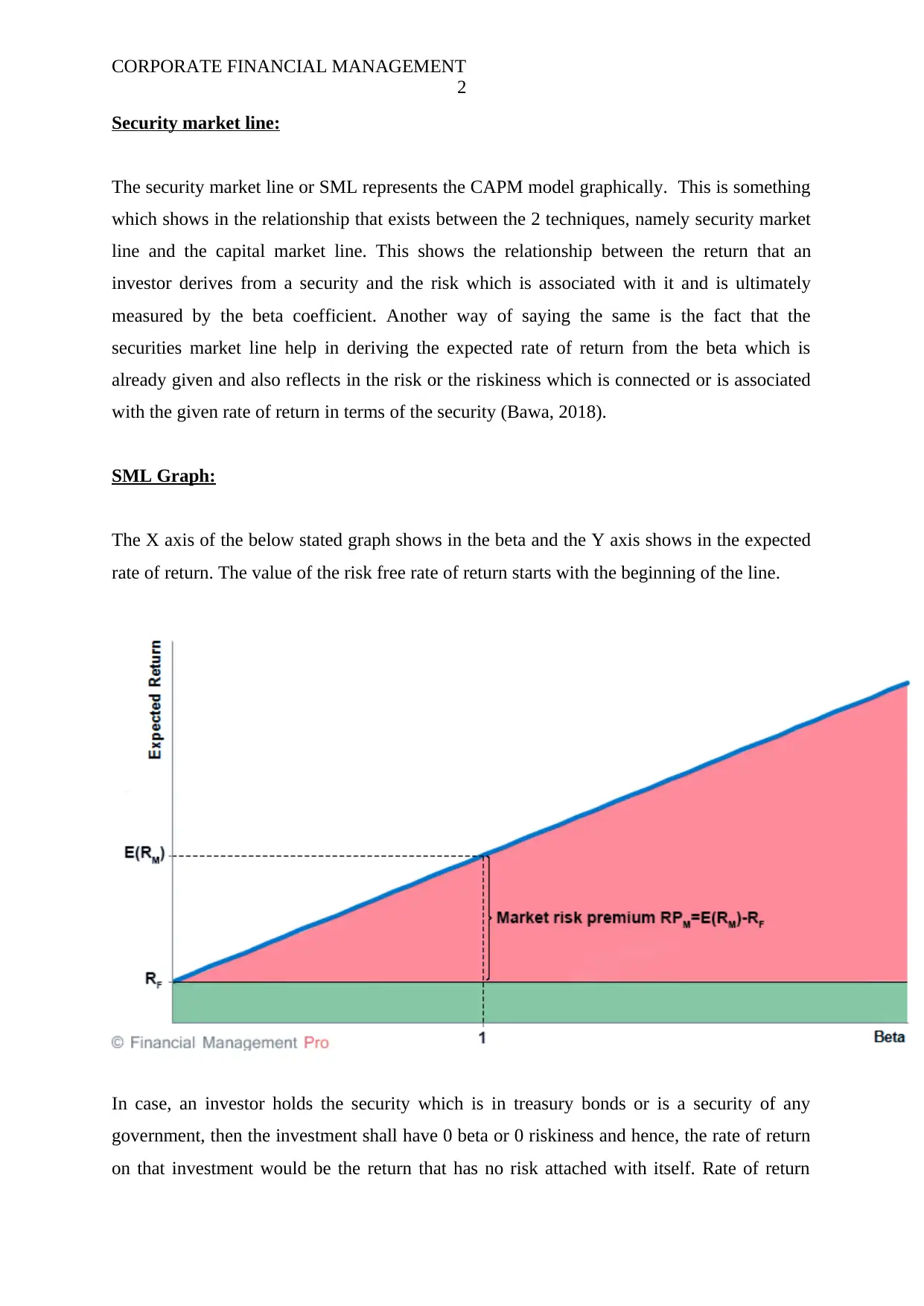

SML Graph:

The X axis of the below stated graph shows in the beta and the Y axis shows in the expected

rate of return. The value of the risk free rate of return starts with the beginning of the line.

In case, an investor holds the security which is in treasury bonds or is a security of any

government, then the investment shall have 0 beta or 0 riskiness and hence, the rate of return

on that investment would be the return that has no risk attached with itself. Rate of return

2

Security market line:

The security market line or SML represents the CAPM model graphically. This is something

which shows in the relationship that exists between the 2 techniques, namely security market

line and the capital market line. This shows the relationship between the return that an

investor derives from a security and the risk which is associated with it and is ultimately

measured by the beta coefficient. Another way of saying the same is the fact that the

securities market line help in deriving the expected rate of return from the beta which is

already given and also reflects in the risk or the riskiness which is connected or is associated

with the given rate of return in terms of the security (Bawa, 2018).

SML Graph:

The X axis of the below stated graph shows in the beta and the Y axis shows in the expected

rate of return. The value of the risk free rate of return starts with the beginning of the line.

In case, an investor holds the security which is in treasury bonds or is a security of any

government, then the investment shall have 0 beta or 0 riskiness and hence, the rate of return

on that investment would be the return that has no risk attached with itself. Rate of return

CORPORATE FINANCIAL MANAGEMENT

3

expected on that investment shall be 0 beta portfolio which would be equal to the risk free

rate of return.

The slope of this security market line is the result of the risk premium in the market which

exists in respect of the security which indicates the difference between the risk free rate of

return and the expected rate of return on the market. The relationships exists as is the more

the market risk premium, the steeper would be the slope and vice versa.

This security market line I never fixed and it all depends upon the changes in the rates of

interest in the market and the relationship which exists between the risk and return and the

risk and return trade off (Ross, 1985). Hence, the position of the security in the market would

change if the coefficient changes of that security in the market over the period of time.

There would be a change in the SML if there is a change in the expected rate of inflation or

the GDP or the rate of unemployment.

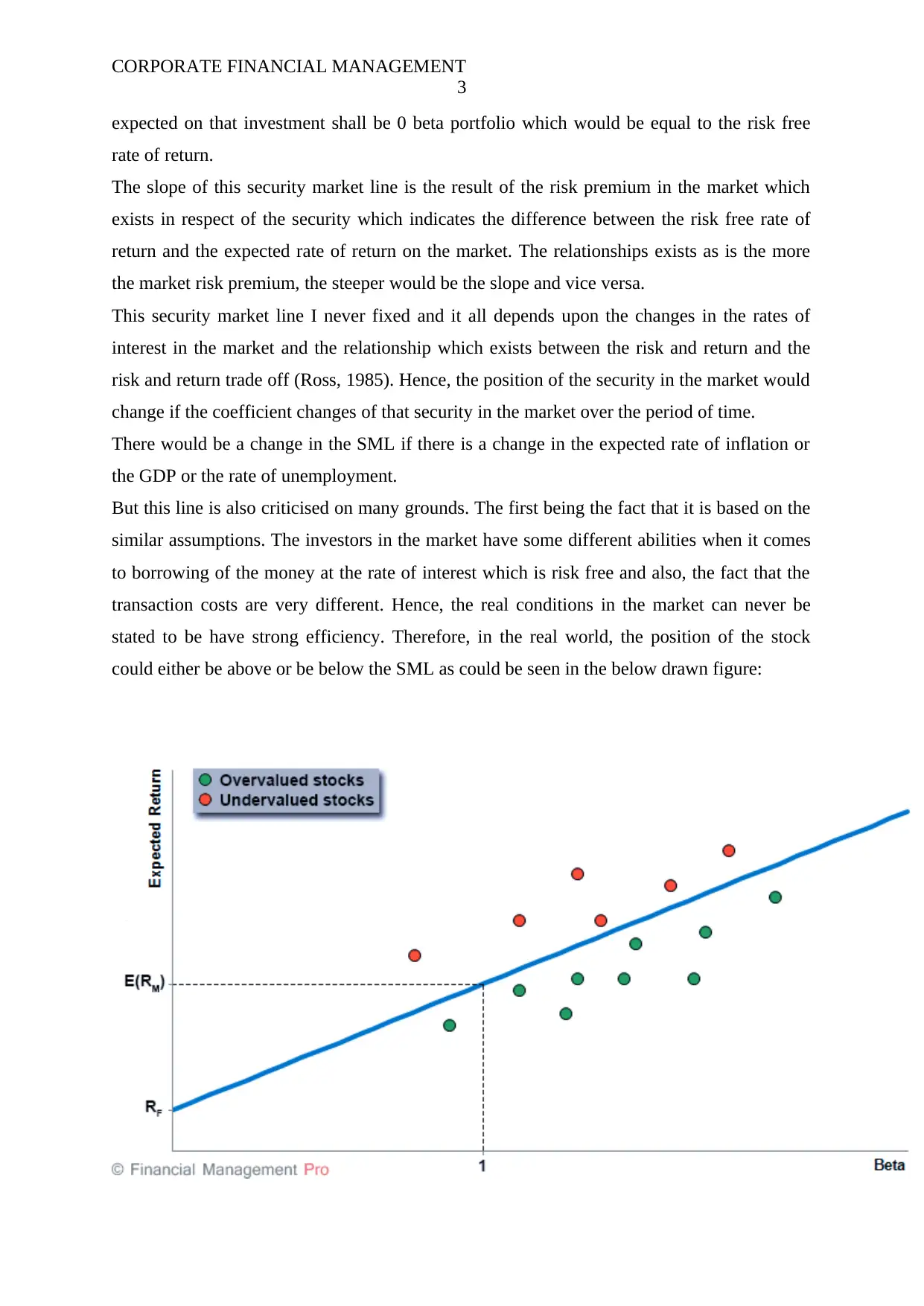

But this line is also criticised on many grounds. The first being the fact that it is based on the

similar assumptions. The investors in the market have some different abilities when it comes

to borrowing of the money at the rate of interest which is risk free and also, the fact that the

transaction costs are very different. Hence, the real conditions in the market can never be

stated to be have strong efficiency. Therefore, in the real world, the position of the stock

could either be above or be below the SML as could be seen in the below drawn figure:

3

expected on that investment shall be 0 beta portfolio which would be equal to the risk free

rate of return.

The slope of this security market line is the result of the risk premium in the market which

exists in respect of the security which indicates the difference between the risk free rate of

return and the expected rate of return on the market. The relationships exists as is the more

the market risk premium, the steeper would be the slope and vice versa.

This security market line I never fixed and it all depends upon the changes in the rates of

interest in the market and the relationship which exists between the risk and return and the

risk and return trade off (Ross, 1985). Hence, the position of the security in the market would

change if the coefficient changes of that security in the market over the period of time.

There would be a change in the SML if there is a change in the expected rate of inflation or

the GDP or the rate of unemployment.

But this line is also criticised on many grounds. The first being the fact that it is based on the

similar assumptions. The investors in the market have some different abilities when it comes

to borrowing of the money at the rate of interest which is risk free and also, the fact that the

transaction costs are very different. Hence, the real conditions in the market can never be

stated to be have strong efficiency. Therefore, in the real world, the position of the stock

could either be above or be below the SML as could be seen in the below drawn figure:

CORPORATE FINANCIAL MANAGEMENT

4

Hence, the above graph shows in the actual values of the betas along with the expected rate of

returns on these stocks that would just look like the points instead of a single line. The stocks

that are there above this drawn line are the stocks that are undervalued. The main reason

behind the same is the fact that there is a higher rate of return for any given risk rather than

the CAPM assessment. And in case, these stocks are shown below the security market line,

then it can be stated that these stocks are overvalued. This is merely since these require in the

lower rate of return for the given risk which could be assessed by the CAPM model

(Financial management pro, 2018).

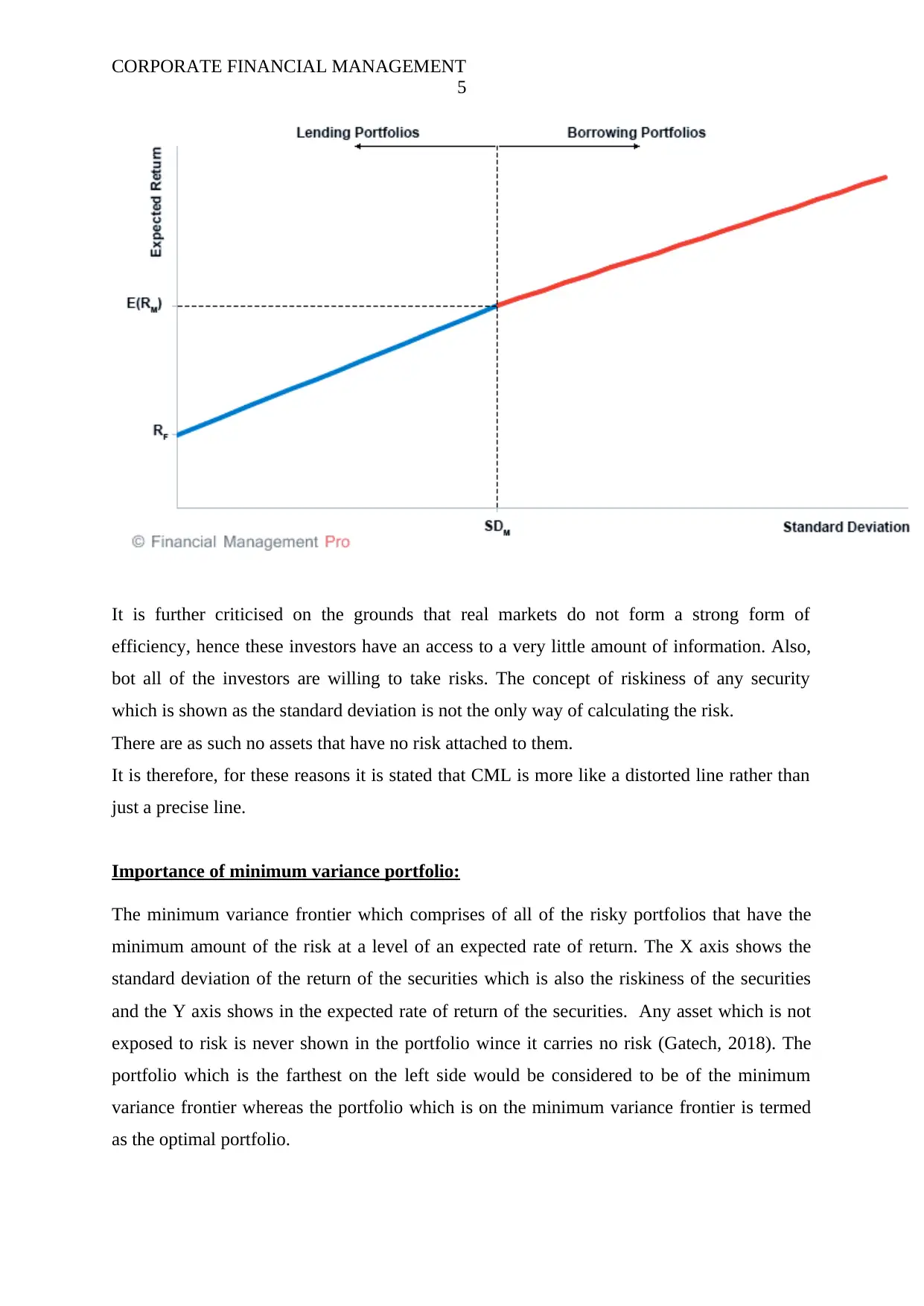

Capital Market Line:

This is the market line which shows in the expected return of the portfolio. The portfolio

comprises of all of the possible securities between the market portfolio and the asset which

has no risk involved with it. The portfolio in the market is completely diversified. It also

carries in the systematic risk along with the expected rate of return along with the expected

market return in its entirety (Hogan, 1974). This return on these portfolio could be less than

or could be equal to the market rate of return, in case, the portfolio is equal to 1 or 100%. But

it is also true that the return on these leveraged portfolios would be more than the market ate

of return.

Again, this is criticised on many grounds. There are many of the taxes and the transaction

costs involved, which could significantly vary amongst the different investors. It is also true

that an investor could lend or borrow money at an uncertain rate of risk which could be

termed as the risk free rate of return. In the real world, it is often seen that the investors can

borrow at the rate which is higher rate than at what they lend the money. This is the concept

which brings in the CML in picture.

4

Hence, the above graph shows in the actual values of the betas along with the expected rate of

returns on these stocks that would just look like the points instead of a single line. The stocks

that are there above this drawn line are the stocks that are undervalued. The main reason

behind the same is the fact that there is a higher rate of return for any given risk rather than

the CAPM assessment. And in case, these stocks are shown below the security market line,

then it can be stated that these stocks are overvalued. This is merely since these require in the

lower rate of return for the given risk which could be assessed by the CAPM model

(Financial management pro, 2018).

Capital Market Line:

This is the market line which shows in the expected return of the portfolio. The portfolio

comprises of all of the possible securities between the market portfolio and the asset which

has no risk involved with it. The portfolio in the market is completely diversified. It also

carries in the systematic risk along with the expected rate of return along with the expected

market return in its entirety (Hogan, 1974). This return on these portfolio could be less than

or could be equal to the market rate of return, in case, the portfolio is equal to 1 or 100%. But

it is also true that the return on these leveraged portfolios would be more than the market ate

of return.

Again, this is criticised on many grounds. There are many of the taxes and the transaction

costs involved, which could significantly vary amongst the different investors. It is also true

that an investor could lend or borrow money at an uncertain rate of risk which could be

termed as the risk free rate of return. In the real world, it is often seen that the investors can

borrow at the rate which is higher rate than at what they lend the money. This is the concept

which brings in the CML in picture.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CORPORATE FINANCIAL MANAGEMENT

5

It is further criticised on the grounds that real markets do not form a strong form of

efficiency, hence these investors have an access to a very little amount of information. Also,

bot all of the investors are willing to take risks. The concept of riskiness of any security

which is shown as the standard deviation is not the only way of calculating the risk.

There are as such no assets that have no risk attached to them.

It is therefore, for these reasons it is stated that CML is more like a distorted line rather than

just a precise line.

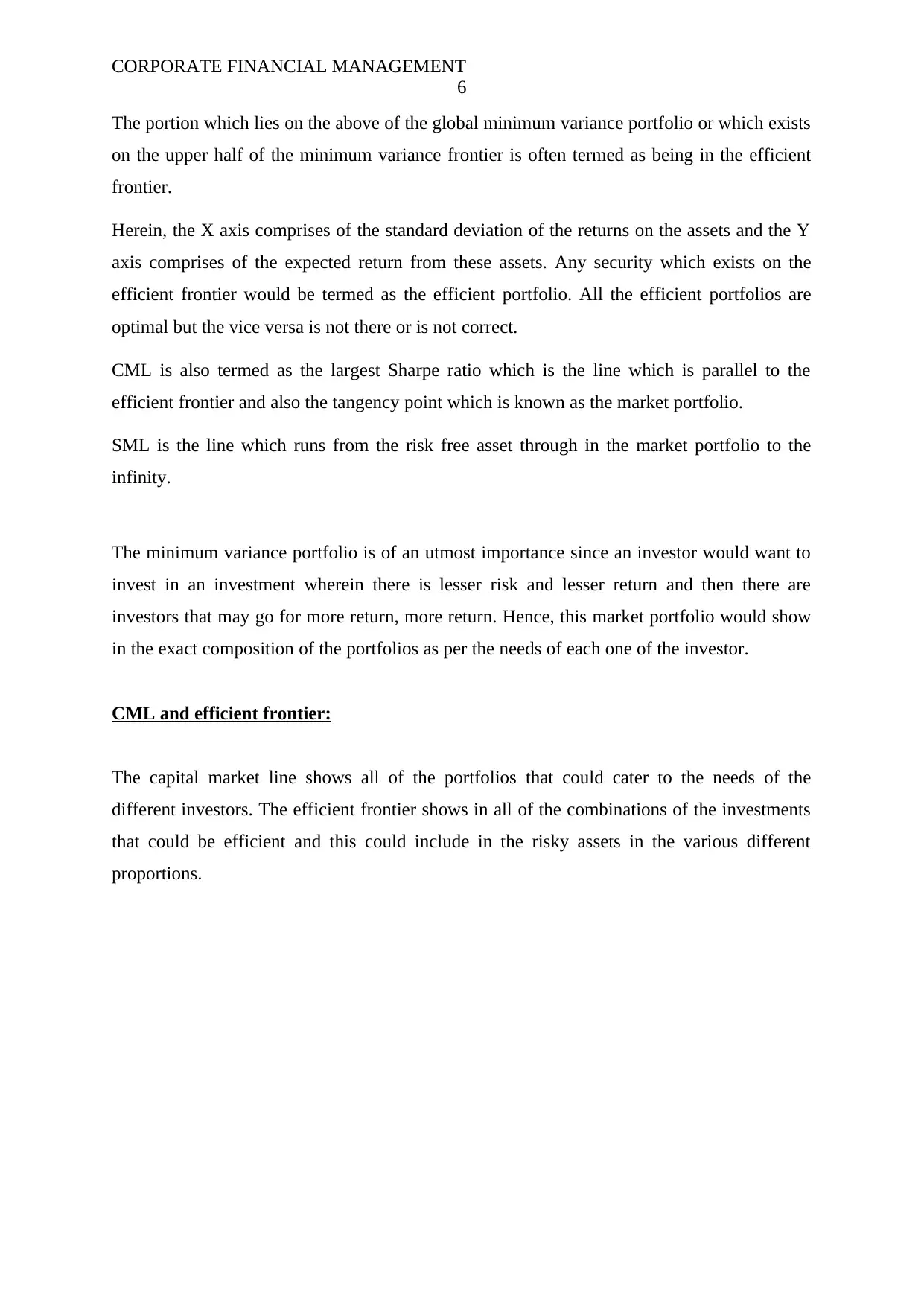

Importance of minimum variance portfolio:

The minimum variance frontier which comprises of all of the risky portfolios that have the

minimum amount of the risk at a level of an expected rate of return. The X axis shows the

standard deviation of the return of the securities which is also the riskiness of the securities

and the Y axis shows in the expected rate of return of the securities. Any asset which is not

exposed to risk is never shown in the portfolio wince it carries no risk (Gatech, 2018). The

portfolio which is the farthest on the left side would be considered to be of the minimum

variance frontier whereas the portfolio which is on the minimum variance frontier is termed

as the optimal portfolio.

5

It is further criticised on the grounds that real markets do not form a strong form of

efficiency, hence these investors have an access to a very little amount of information. Also,

bot all of the investors are willing to take risks. The concept of riskiness of any security

which is shown as the standard deviation is not the only way of calculating the risk.

There are as such no assets that have no risk attached to them.

It is therefore, for these reasons it is stated that CML is more like a distorted line rather than

just a precise line.

Importance of minimum variance portfolio:

The minimum variance frontier which comprises of all of the risky portfolios that have the

minimum amount of the risk at a level of an expected rate of return. The X axis shows the

standard deviation of the return of the securities which is also the riskiness of the securities

and the Y axis shows in the expected rate of return of the securities. Any asset which is not

exposed to risk is never shown in the portfolio wince it carries no risk (Gatech, 2018). The

portfolio which is the farthest on the left side would be considered to be of the minimum

variance frontier whereas the portfolio which is on the minimum variance frontier is termed

as the optimal portfolio.

CORPORATE FINANCIAL MANAGEMENT

6

The portion which lies on the above of the global minimum variance portfolio or which exists

on the upper half of the minimum variance frontier is often termed as being in the efficient

frontier.

Herein, the X axis comprises of the standard deviation of the returns on the assets and the Y

axis comprises of the expected return from these assets. Any security which exists on the

efficient frontier would be termed as the efficient portfolio. All the efficient portfolios are

optimal but the vice versa is not there or is not correct.

CML is also termed as the largest Sharpe ratio which is the line which is parallel to the

efficient frontier and also the tangency point which is known as the market portfolio.

SML is the line which runs from the risk free asset through in the market portfolio to the

infinity.

The minimum variance portfolio is of an utmost importance since an investor would want to

invest in an investment wherein there is lesser risk and lesser return and then there are

investors that may go for more return, more return. Hence, this market portfolio would show

in the exact composition of the portfolios as per the needs of each one of the investor.

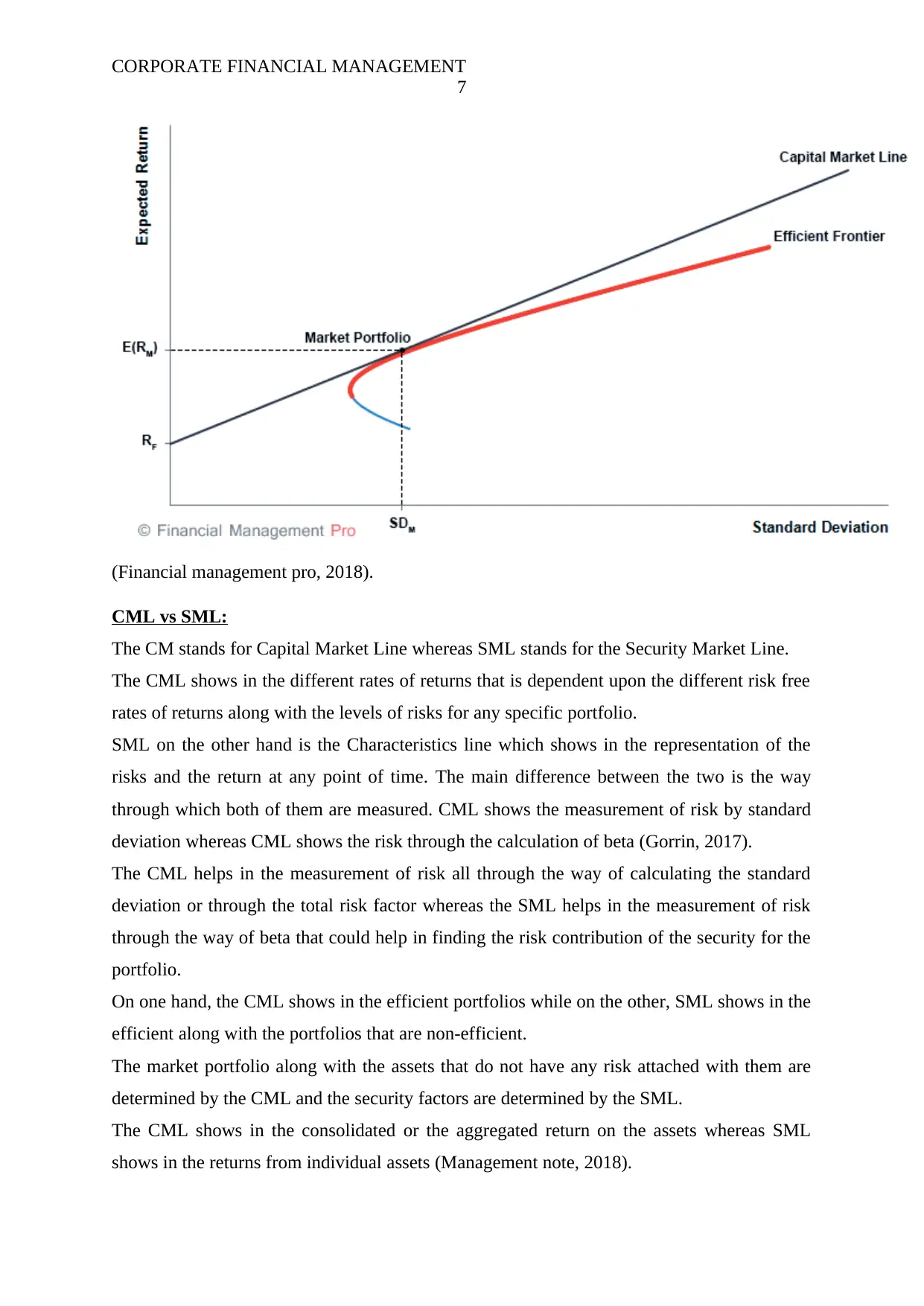

CML and efficient frontier:

The capital market line shows all of the portfolios that could cater to the needs of the

different investors. The efficient frontier shows in all of the combinations of the investments

that could be efficient and this could include in the risky assets in the various different

proportions.

6

The portion which lies on the above of the global minimum variance portfolio or which exists

on the upper half of the minimum variance frontier is often termed as being in the efficient

frontier.

Herein, the X axis comprises of the standard deviation of the returns on the assets and the Y

axis comprises of the expected return from these assets. Any security which exists on the

efficient frontier would be termed as the efficient portfolio. All the efficient portfolios are

optimal but the vice versa is not there or is not correct.

CML is also termed as the largest Sharpe ratio which is the line which is parallel to the

efficient frontier and also the tangency point which is known as the market portfolio.

SML is the line which runs from the risk free asset through in the market portfolio to the

infinity.

The minimum variance portfolio is of an utmost importance since an investor would want to

invest in an investment wherein there is lesser risk and lesser return and then there are

investors that may go for more return, more return. Hence, this market portfolio would show

in the exact composition of the portfolios as per the needs of each one of the investor.

CML and efficient frontier:

The capital market line shows all of the portfolios that could cater to the needs of the

different investors. The efficient frontier shows in all of the combinations of the investments

that could be efficient and this could include in the risky assets in the various different

proportions.

CORPORATE FINANCIAL MANAGEMENT

7

(Financial management pro, 2018).

CML vs SML:

The CM stands for Capital Market Line whereas SML stands for the Security Market Line.

The CML shows in the different rates of returns that is dependent upon the different risk free

rates of returns along with the levels of risks for any specific portfolio.

SML on the other hand is the Characteristics line which shows in the representation of the

risks and the return at any point of time. The main difference between the two is the way

through which both of them are measured. CML shows the measurement of risk by standard

deviation whereas CML shows the risk through the calculation of beta (Gorrin, 2017).

The CML helps in the measurement of risk all through the way of calculating the standard

deviation or through the total risk factor whereas the SML helps in the measurement of risk

through the way of beta that could help in finding the risk contribution of the security for the

portfolio.

On one hand, the CML shows in the efficient portfolios while on the other, SML shows in the

efficient along with the portfolios that are non-efficient.

The market portfolio along with the assets that do not have any risk attached with them are

determined by the CML and the security factors are determined by the SML.

The CML shows in the consolidated or the aggregated return on the assets whereas SML

shows in the returns from individual assets (Management note, 2018).

7

(Financial management pro, 2018).

CML vs SML:

The CM stands for Capital Market Line whereas SML stands for the Security Market Line.

The CML shows in the different rates of returns that is dependent upon the different risk free

rates of returns along with the levels of risks for any specific portfolio.

SML on the other hand is the Characteristics line which shows in the representation of the

risks and the return at any point of time. The main difference between the two is the way

through which both of them are measured. CML shows the measurement of risk by standard

deviation whereas CML shows the risk through the calculation of beta (Gorrin, 2017).

The CML helps in the measurement of risk all through the way of calculating the standard

deviation or through the total risk factor whereas the SML helps in the measurement of risk

through the way of beta that could help in finding the risk contribution of the security for the

portfolio.

On one hand, the CML shows in the efficient portfolios while on the other, SML shows in the

efficient along with the portfolios that are non-efficient.

The market portfolio along with the assets that do not have any risk attached with them are

determined by the CML and the security factors are determined by the SML.

The CML shows in the consolidated or the aggregated return on the assets whereas SML

shows in the returns from individual assets (Management note, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE FINANCIAL MANAGEMENT

8

The CML indicates the risk or the return which is associated with the efficient portfolios

whereas the SML indicates the risk or the return which is associated with the individual

stocks (Boundless, 2018).

It is because of these reasons, CAPM is considered to be superior than the SML.

In the nutshell, the CAPM identifies in two important forms of compensation, on being time

value for money and the other being risk. The arte of risk free investment is the formula

which shows in the time value of money and also is in line with the investors for the purposes

of placing in the money in any investment over the period of time. This is the risk free return

on the US Treasurer or the bonds that are issued by the government.

The CAPM model also helps in the calculation of the compensation and the risk that would

help the investor in taking on some additional risk.

This model shows in the expected rate of return on the security of the portfolio which is

somewhat equal to the rate on the risk free security along with the risk premium.

It states that in case, this rate of return beats in the required rate of return, then the investment

must never be undertaken. Whereas the SML plots in these results derived from CAPM for

all of the different risks or betas (Corporate finance institute, 2018).

CAPM considered the systematic risk along with the unsystematic risk that could

easily be diversified which is not the cash with SML. CAPM also creates in a

theoretical relationship which exists between the risk and the rate of return from any

portfolio which is again not the case with SML (educba, 2018).

8

The CML indicates the risk or the return which is associated with the efficient portfolios

whereas the SML indicates the risk or the return which is associated with the individual

stocks (Boundless, 2018).

It is because of these reasons, CAPM is considered to be superior than the SML.

In the nutshell, the CAPM identifies in two important forms of compensation, on being time

value for money and the other being risk. The arte of risk free investment is the formula

which shows in the time value of money and also is in line with the investors for the purposes

of placing in the money in any investment over the period of time. This is the risk free return

on the US Treasurer or the bonds that are issued by the government.

The CAPM model also helps in the calculation of the compensation and the risk that would

help the investor in taking on some additional risk.

This model shows in the expected rate of return on the security of the portfolio which is

somewhat equal to the rate on the risk free security along with the risk premium.

It states that in case, this rate of return beats in the required rate of return, then the investment

must never be undertaken. Whereas the SML plots in these results derived from CAPM for

all of the different risks or betas (Corporate finance institute, 2018).

CAPM considered the systematic risk along with the unsystematic risk that could

easily be diversified which is not the cash with SML. CAPM also creates in a

theoretical relationship which exists between the risk and the rate of return from any

portfolio which is again not the case with SML (educba, 2018).

CORPORATE FINANCIAL MANAGEMENT

9

References:

Corporate Finance Institute. (2018). What is CAPM - Capital Asset Pricing Model - Formula,

Example. [online] Available at:

https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-the-capm-

formula/ [Accessed 6 Sep. 2018].

Courses.lumenlearning.com. (2018). Understanding the Security Market Line | Boundless

Finance. [online] Available at:

https://courses.lumenlearning.com/boundless-finance/chapter/understanding-the-security-

market-line/ [Accessed 6 Sep. 2018].

EDUCBA. (2018). How Important Is CAPM (Capital Asset Pricing Model) and Its

Calculations?. [online] Available at: https://www.educba.com/capm-capital-asset-pricing-

model/ [Accessed 6 Sep. 2018].

Financialmanagementpro.com. (2018). Capital Market Line – CML | Definition | CML

Equation | Graph | Examples | Efficient Frontier. [online] Available at:

http://financialmanagementpro.com/capital-market-line-cml/ [Accessed 6 Sep. 2018].

Financialmanagementpro.com. (2018). Security Market Line, SML | Definition | CAPM

model | Equation | Example | Graph. [online] Available at:

http://financialmanagementpro.com/security-market-line-sml/ [Accessed 6 Sep. 2018].

LSE Finance Job Market Candidate | London | Jesus Gorrin. (2018). Capital Market Line

(CML) vs Security Market Line (SML) | LSE Finance Job Market Candidate | London | Jesus

Gorrin. [online] Available at: https://www.jesusgorrin.com/single-post/2017/10/11/Capital-

Market-Line-CML-vs-Security-Market-Line-SML [Accessed 6 Sep. 2018].

Management Notes. (2018). Difference between Capital Market Line(CML) and Security

Market Line(SML) | Finance - Management Notes. [online] Available at:

http://www.managementnote.com/difference-between-cml-and-sml/ [Accessed 6 Sep. 2018].

Www2.isye.gatech.edu. (2018). Mean-Variance Portfolio Analysis and the Capital Asset

Pricing Model. [online] Available at:

https://www2.isye.gatech.edu/~shackman/isye6225_Fall_2011/MVA_CAPM.pdf [Accessed

6 Sep. 2018].

9

References:

Corporate Finance Institute. (2018). What is CAPM - Capital Asset Pricing Model - Formula,

Example. [online] Available at:

https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-the-capm-

formula/ [Accessed 6 Sep. 2018].

Courses.lumenlearning.com. (2018). Understanding the Security Market Line | Boundless

Finance. [online] Available at:

https://courses.lumenlearning.com/boundless-finance/chapter/understanding-the-security-

market-line/ [Accessed 6 Sep. 2018].

EDUCBA. (2018). How Important Is CAPM (Capital Asset Pricing Model) and Its

Calculations?. [online] Available at: https://www.educba.com/capm-capital-asset-pricing-

model/ [Accessed 6 Sep. 2018].

Financialmanagementpro.com. (2018). Capital Market Line – CML | Definition | CML

Equation | Graph | Examples | Efficient Frontier. [online] Available at:

http://financialmanagementpro.com/capital-market-line-cml/ [Accessed 6 Sep. 2018].

Financialmanagementpro.com. (2018). Security Market Line, SML | Definition | CAPM

model | Equation | Example | Graph. [online] Available at:

http://financialmanagementpro.com/security-market-line-sml/ [Accessed 6 Sep. 2018].

LSE Finance Job Market Candidate | London | Jesus Gorrin. (2018). Capital Market Line

(CML) vs Security Market Line (SML) | LSE Finance Job Market Candidate | London | Jesus

Gorrin. [online] Available at: https://www.jesusgorrin.com/single-post/2017/10/11/Capital-

Market-Line-CML-vs-Security-Market-Line-SML [Accessed 6 Sep. 2018].

Management Notes. (2018). Difference between Capital Market Line(CML) and Security

Market Line(SML) | Finance - Management Notes. [online] Available at:

http://www.managementnote.com/difference-between-cml-and-sml/ [Accessed 6 Sep. 2018].

Www2.isye.gatech.edu. (2018). Mean-Variance Portfolio Analysis and the Capital Asset

Pricing Model. [online] Available at:

https://www2.isye.gatech.edu/~shackman/isye6225_Fall_2011/MVA_CAPM.pdf [Accessed

6 Sep. 2018].

CORPORATE FINANCIAL MANAGEMENT

10

Bawa, V. (1977). Capital market equilibrium in a mean-lower partial moment framework.

[online] Available at: https://www.sciencedirect.com/science/article/pii/0304405X77900174

[Accessed 12 Sep. 2018].

Hogan, W. (1974). Toward the Development of an Equilibrium Capital-Market Model Based

on Semivariance. [online] www.cambridge.org. Available at:

https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/

article/toward-the-development-of-an-equilibrium-capitalmarket-model-based-on-

semivariance/795CEF1CD80A2F8C3A5A3C8276EA6654 [Accessed 12 Sep. 2018].

Ross, S. (1985). Differential Information and Performance Measurement Using a Security

Market Line. [online] onlinelibrary.wiley.com. Available at:

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1985.tb04963.x [Accessed 12

Sep. 2018].

10

Bawa, V. (1977). Capital market equilibrium in a mean-lower partial moment framework.

[online] Available at: https://www.sciencedirect.com/science/article/pii/0304405X77900174

[Accessed 12 Sep. 2018].

Hogan, W. (1974). Toward the Development of an Equilibrium Capital-Market Model Based

on Semivariance. [online] www.cambridge.org. Available at:

https://www.cambridge.org/core/journals/journal-of-financial-and-quantitative-analysis/

article/toward-the-development-of-an-equilibrium-capitalmarket-model-based-on-

semivariance/795CEF1CD80A2F8C3A5A3C8276EA6654 [Accessed 12 Sep. 2018].

Ross, S. (1985). Differential Information and Performance Measurement Using a Security

Market Line. [online] onlinelibrary.wiley.com. Available at:

https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1985.tb04963.x [Accessed 12

Sep. 2018].

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.