Sensitivity Analysis - Assignment

VerifiedAdded on 2021/05/31

|5

|1125

|38

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

ANSWERS

1 Radiant should purchase the specialized equipment and packaging facilities from Donnalley

Limited because it would be $2.6 million cheaper than

Danforth from a cost basis.

2a No, the market testing cost is a sunk cost, hence it is not relevant to include into the future cash

flows.

2

b

No, the annual interest expense should be ignored because cost of financing is accounted for in

the discount rate.

2c Yes, the change in working capital is relevant and hence these cash flows should be recognized.

2

d

Yes, the erosion of sales from current detergents should be included as these will affect the

future revenues, and hence are a cost Radiant will bear should it produce FAB.

2e Yes, the cost of using current excess production facilities and annual rental cost to an outside

firms, should be included as these are opportunity costs arising from utilizing current resources

elsewhere.

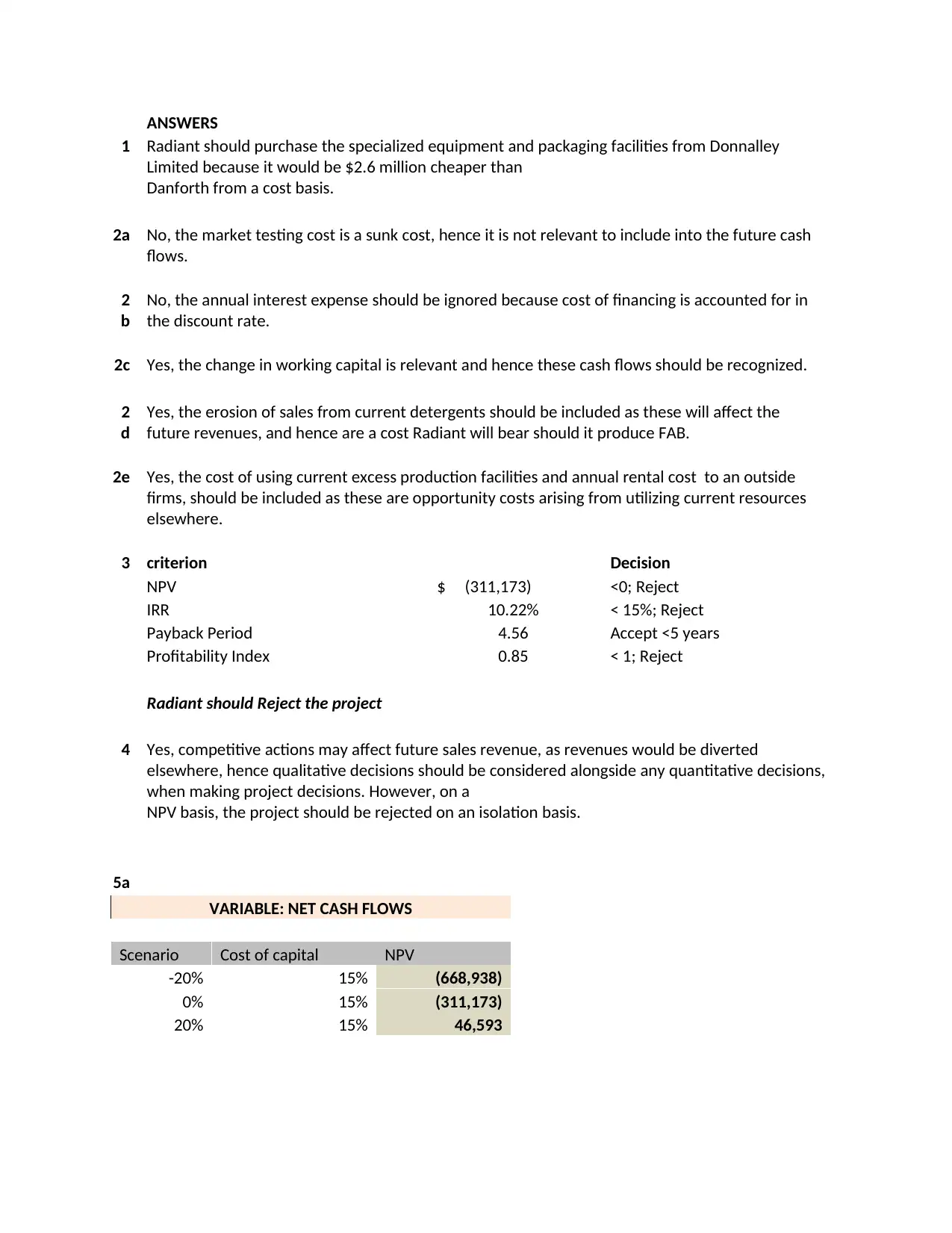

3 criterion Decision

NPV $ (311,173) <0; Reject

IRR 10.22% < 15%; Reject

Payback Period 4.56 Accept <5 years

Profitability Index 0.85 < 1; Reject

Radiant should Reject the project

4 Yes, competitive actions may affect future sales revenue, as revenues would be diverted

elsewhere, hence qualitative decisions should be considered alongside any quantitative decisions,

when making project decisions. However, on a

NPV basis, the project should be rejected on an isolation basis.

5a

VARIABLE: NET CASH FLOWS

Scenario Cost of capital NPV

-20% 15% (668,938)

0% 15% (311,173)

20% 15% 46,593

1 Radiant should purchase the specialized equipment and packaging facilities from Donnalley

Limited because it would be $2.6 million cheaper than

Danforth from a cost basis.

2a No, the market testing cost is a sunk cost, hence it is not relevant to include into the future cash

flows.

2

b

No, the annual interest expense should be ignored because cost of financing is accounted for in

the discount rate.

2c Yes, the change in working capital is relevant and hence these cash flows should be recognized.

2

d

Yes, the erosion of sales from current detergents should be included as these will affect the

future revenues, and hence are a cost Radiant will bear should it produce FAB.

2e Yes, the cost of using current excess production facilities and annual rental cost to an outside

firms, should be included as these are opportunity costs arising from utilizing current resources

elsewhere.

3 criterion Decision

NPV $ (311,173) <0; Reject

IRR 10.22% < 15%; Reject

Payback Period 4.56 Accept <5 years

Profitability Index 0.85 < 1; Reject

Radiant should Reject the project

4 Yes, competitive actions may affect future sales revenue, as revenues would be diverted

elsewhere, hence qualitative decisions should be considered alongside any quantitative decisions,

when making project decisions. However, on a

NPV basis, the project should be rejected on an isolation basis.

5a

VARIABLE: NET CASH FLOWS

Scenario Cost of capital NPV

-20% 15% (668,938)

0% 15% (311,173)

20% 15% 46,593

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

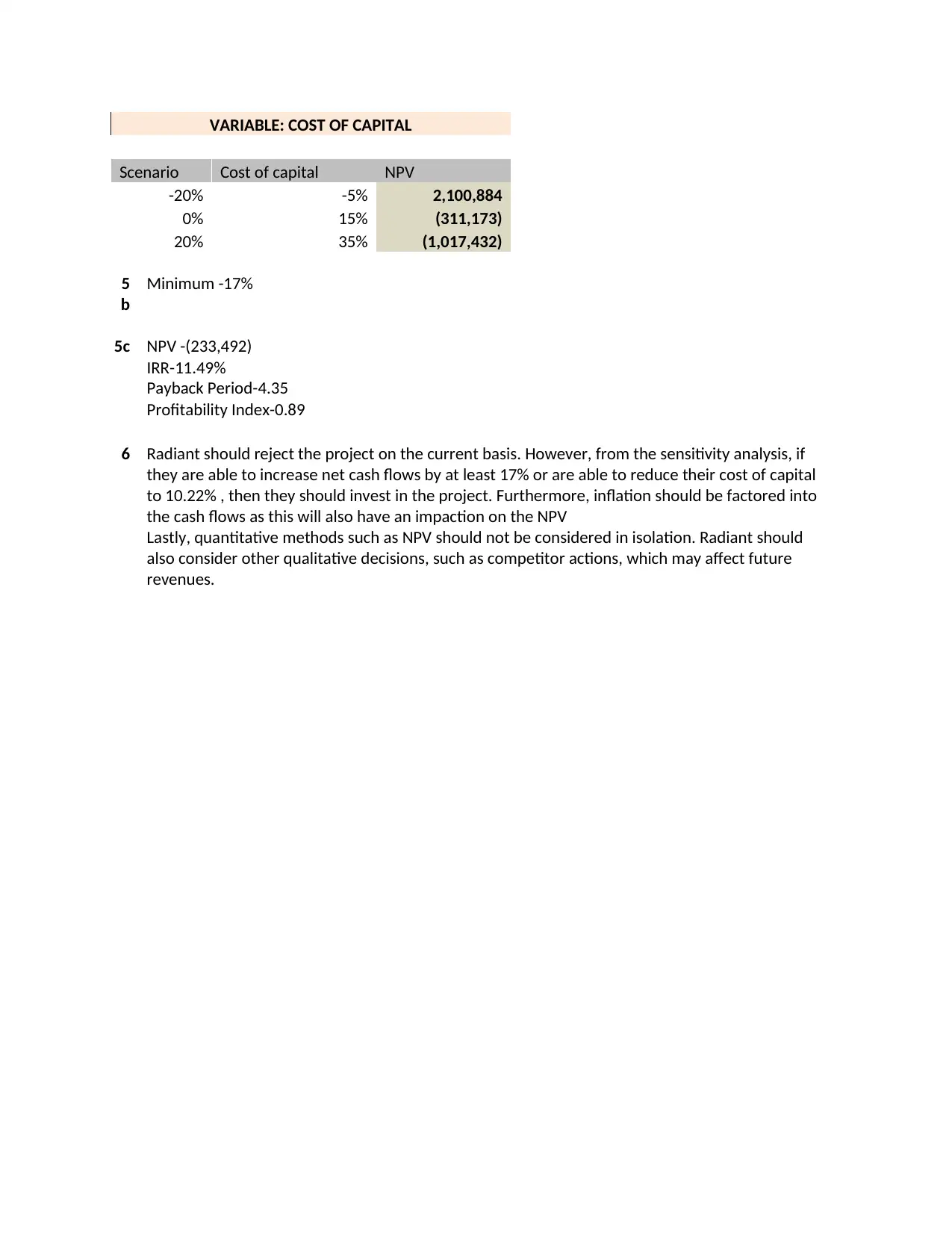

VARIABLE: COST OF CAPITAL

Scenario Cost of capital NPV

-20% -5% 2,100,884

0% 15% (311,173)

20% 35% (1,017,432)

5

b

Minimum -17%

5c NPV -(233,492)

IRR-11.49%

Payback Period-4.35

Profitability Index-0.89

6 Radiant should reject the project on the current basis. However, from the sensitivity analysis, if

they are able to increase net cash flows by at least 17% or are able to reduce their cost of capital

to 10.22% , then they should invest in the project. Furthermore, inflation should be factored into

the cash flows as this will also have an impaction on the NPV

Lastly, quantitative methods such as NPV should not be considered in isolation. Radiant should

also consider other qualitative decisions, such as competitor actions, which may affect future

revenues.

Scenario Cost of capital NPV

-20% -5% 2,100,884

0% 15% (311,173)

20% 35% (1,017,432)

5

b

Minimum -17%

5c NPV -(233,492)

IRR-11.49%

Payback Period-4.35

Profitability Index-0.89

6 Radiant should reject the project on the current basis. However, from the sensitivity analysis, if

they are able to increase net cash flows by at least 17% or are able to reduce their cost of capital

to 10.22% , then they should invest in the project. Furthermore, inflation should be factored into

the cash flows as this will also have an impaction on the NPV

Lastly, quantitative methods such as NPV should not be considered in isolation. Radiant should

also consider other qualitative decisions, such as competitor actions, which may affect future

revenues.

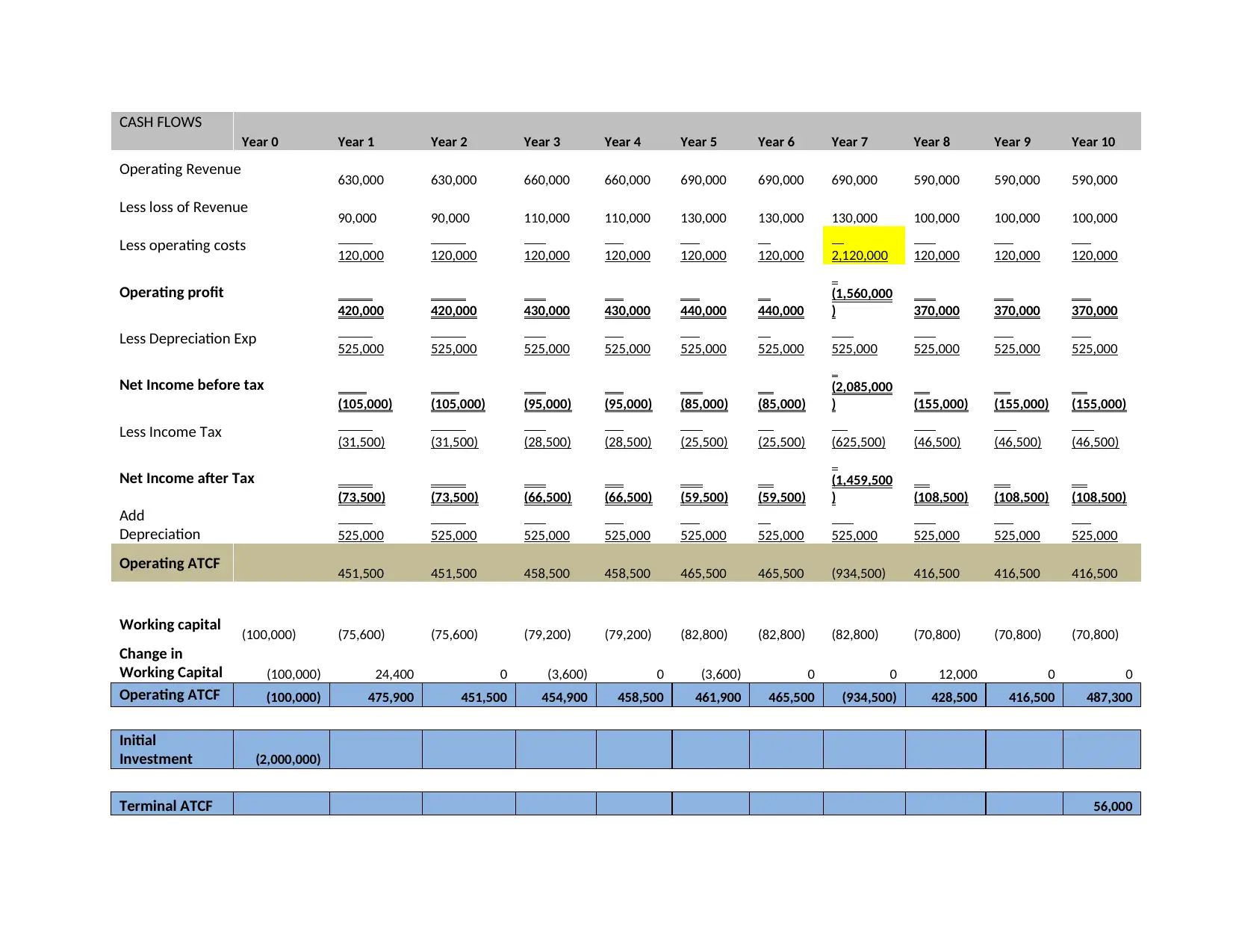

CASH FLOWS

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 630,000 630,000 660,000 660,000 690,000 690,000 690,000 590,000 590,000 590,000

Less loss of Revenue 90,000 90,000 110,000 110,000 130,000 130,000 130,000 100,000 100,000 100,000

Less operating costs 120,000 120,000 120,000 120,000 120,000 120,000 2,120,000 120,000 120,000 120,000

Operating profit

420,000 420,000 430,000 430,000 440,000 440,000

(1,560,000

) 370,000 370,000 370,000

Less Depreciation Exp 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Net Income before tax

(105,000) (105,000) (95,000) (95,000) (85,000) (85,000)

(2,085,000

) (155,000) (155,000) (155,000)

Less Income Tax (31,500) (31,500) (28,500) (28,500) (25,500) (25,500) (625,500) (46,500) (46,500) (46,500)

Net Income after Tax

(73,500) (73,500) (66,500) (66,500) (59,500) (59,500)

(1,459,500

) (108,500) (108,500) (108,500)

Add

Depreciation 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Operating ATCF 451,500 451,500 458,500 458,500 465,500 465,500 (934,500) 416,500 416,500 416,500

Working capital (100,000) (75,600) (75,600) (79,200) (79,200) (82,800) (82,800) (82,800) (70,800) (70,800) (70,800)

Change in

Working Capital (100,000) 24,400 0 (3,600) 0 (3,600) 0 0 12,000 0 0

Operating ATCF (100,000) 475,900 451,500 454,900 458,500 461,900 465,500 (934,500) 428,500 416,500 487,300

Initial

Investment (2,000,000)

Terminal ATCF 56,000

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 630,000 630,000 660,000 660,000 690,000 690,000 690,000 590,000 590,000 590,000

Less loss of Revenue 90,000 90,000 110,000 110,000 130,000 130,000 130,000 100,000 100,000 100,000

Less operating costs 120,000 120,000 120,000 120,000 120,000 120,000 2,120,000 120,000 120,000 120,000

Operating profit

420,000 420,000 430,000 430,000 440,000 440,000

(1,560,000

) 370,000 370,000 370,000

Less Depreciation Exp 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Net Income before tax

(105,000) (105,000) (95,000) (95,000) (85,000) (85,000)

(2,085,000

) (155,000) (155,000) (155,000)

Less Income Tax (31,500) (31,500) (28,500) (28,500) (25,500) (25,500) (625,500) (46,500) (46,500) (46,500)

Net Income after Tax

(73,500) (73,500) (66,500) (66,500) (59,500) (59,500)

(1,459,500

) (108,500) (108,500) (108,500)

Add

Depreciation 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Operating ATCF 451,500 451,500 458,500 458,500 465,500 465,500 (934,500) 416,500 416,500 416,500

Working capital (100,000) (75,600) (75,600) (79,200) (79,200) (82,800) (82,800) (82,800) (70,800) (70,800) (70,800)

Change in

Working Capital (100,000) 24,400 0 (3,600) 0 (3,600) 0 0 12,000 0 0

Operating ATCF (100,000) 475,900 451,500 454,900 458,500 461,900 465,500 (934,500) 428,500 416,500 487,300

Initial

Investment (2,000,000)

Terminal ATCF 56,000

ATCF (2,100,000) 475,900 451,500 454,900 458,500 461,900 465,500 (934,500) 428,500 416,500 543,300

Cum ATCF (2,100,000) 475,900 927,400 1,382,300 1,840,800 2,302,700

2,768,20

0 1,833,700 2,262,200 2,678,700 3,222,000

NPV (311,173)

IRR 10.22%

Payback Period 4.56

Profitability

Index 0.85

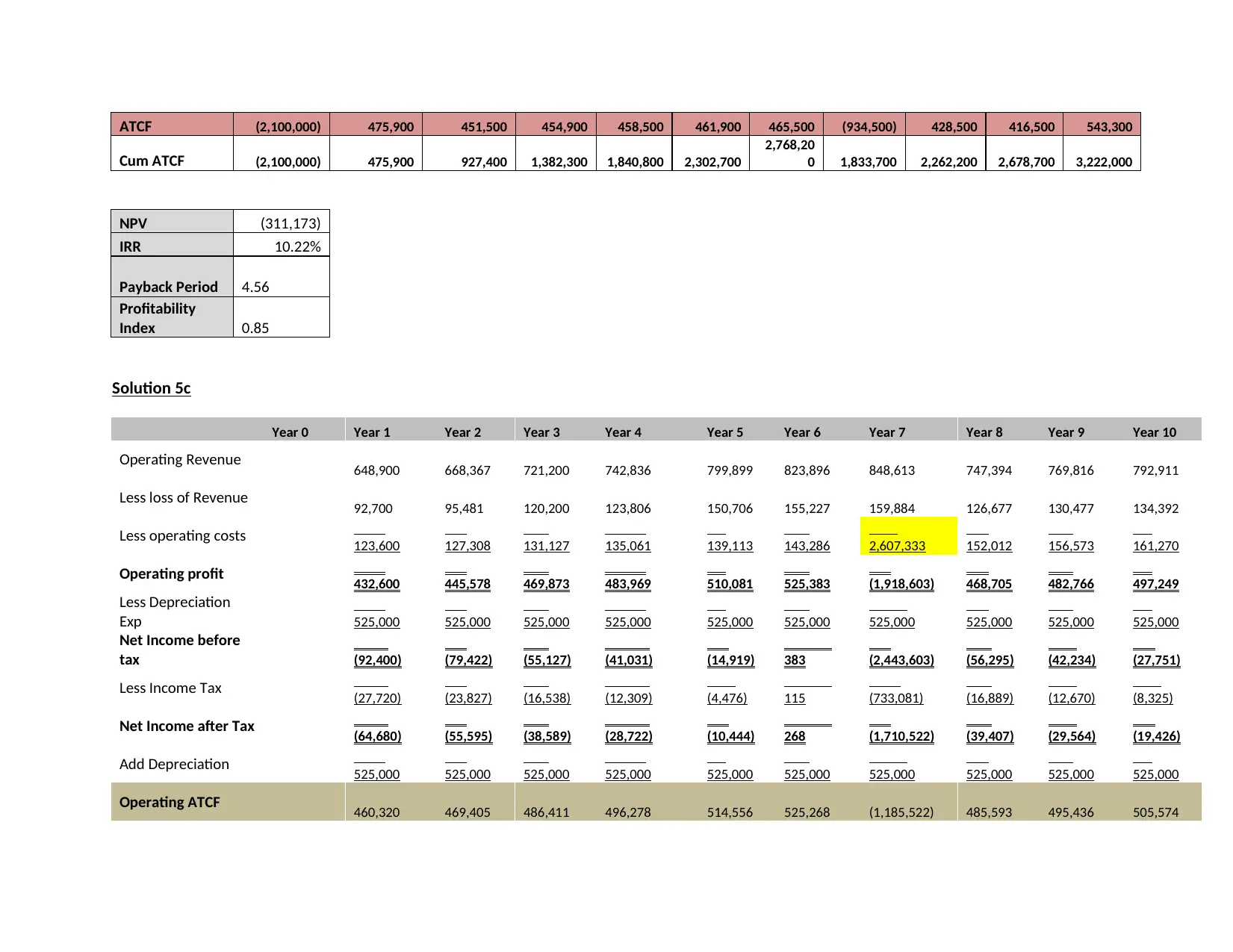

Solution 5c

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 648,900 668,367 721,200 742,836 799,899 823,896 848,613 747,394 769,816 792,911

Less loss of Revenue 92,700 95,481 120,200 123,806 150,706 155,227 159,884 126,677 130,477 134,392

Less operating costs 123,600 127,308 131,127 135,061 139,113 143,286 2,607,333 152,012 156,573 161,270

Operating profit 432,600 445,578 469,873 483,969 510,081 525,383 (1,918,603) 468,705 482,766 497,249

Less Depreciation

Exp 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Net Income before

tax (92,400) (79,422) (55,127) (41,031) (14,919) 383 (2,443,603) (56,295) (42,234) (27,751)

Less Income Tax (27,720) (23,827) (16,538) (12,309) (4,476) 115 (733,081) (16,889) (12,670) (8,325)

Net Income after Tax (64,680) (55,595) (38,589) (28,722) (10,444) 268 (1,710,522) (39,407) (29,564) (19,426)

Add Depreciation 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Operating ATCF 460,320 469,405 486,411 496,278 514,556 525,268 (1,185,522) 485,593 495,436 505,574

Cum ATCF (2,100,000) 475,900 927,400 1,382,300 1,840,800 2,302,700

2,768,20

0 1,833,700 2,262,200 2,678,700 3,222,000

NPV (311,173)

IRR 10.22%

Payback Period 4.56

Profitability

Index 0.85

Solution 5c

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10

Operating Revenue 648,900 668,367 721,200 742,836 799,899 823,896 848,613 747,394 769,816 792,911

Less loss of Revenue 92,700 95,481 120,200 123,806 150,706 155,227 159,884 126,677 130,477 134,392

Less operating costs 123,600 127,308 131,127 135,061 139,113 143,286 2,607,333 152,012 156,573 161,270

Operating profit 432,600 445,578 469,873 483,969 510,081 525,383 (1,918,603) 468,705 482,766 497,249

Less Depreciation

Exp 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Net Income before

tax (92,400) (79,422) (55,127) (41,031) (14,919) 383 (2,443,603) (56,295) (42,234) (27,751)

Less Income Tax (27,720) (23,827) (16,538) (12,309) (4,476) 115 (733,081) (16,889) (12,670) (8,325)

Net Income after Tax (64,680) (55,595) (38,589) (28,722) (10,444) 268 (1,710,522) (39,407) (29,564) (19,426)

Add Depreciation 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000 525,000

Operating ATCF 460,320 469,405 486,411 496,278 514,556 525,268 (1,185,522) 485,593 495,436 505,574

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

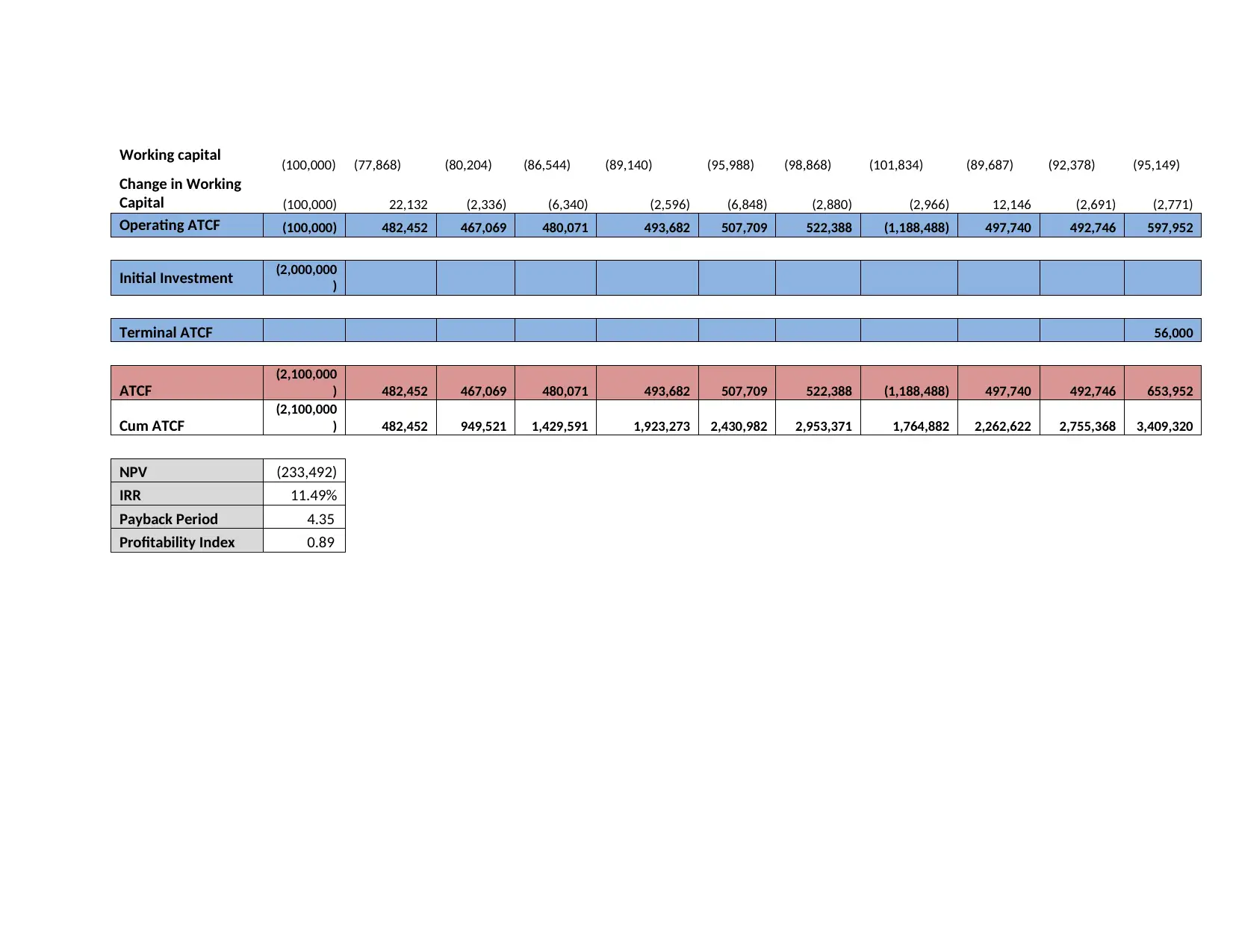

Working capital (100,000) (77,868) (80,204) (86,544) (89,140) (95,988) (98,868) (101,834) (89,687) (92,378) (95,149)

Change in Working

Capital (100,000) 22,132 (2,336) (6,340) (2,596) (6,848) (2,880) (2,966) 12,146 (2,691) (2,771)

Operating ATCF (100,000) 482,452 467,069 480,071 493,682 507,709 522,388 (1,188,488) 497,740 492,746 597,952

Initial Investment (2,000,000

)

Terminal ATCF 56,000

ATCF

(2,100,000

) 482,452 467,069 480,071 493,682 507,709 522,388 (1,188,488) 497,740 492,746 653,952

Cum ATCF

(2,100,000

) 482,452 949,521 1,429,591 1,923,273 2,430,982 2,953,371 1,764,882 2,262,622 2,755,368 3,409,320

NPV (233,492)

IRR 11.49%

Payback Period 4.35

Profitability Index 0.89

Change in Working

Capital (100,000) 22,132 (2,336) (6,340) (2,596) (6,848) (2,880) (2,966) 12,146 (2,691) (2,771)

Operating ATCF (100,000) 482,452 467,069 480,071 493,682 507,709 522,388 (1,188,488) 497,740 492,746 597,952

Initial Investment (2,000,000

)

Terminal ATCF 56,000

ATCF

(2,100,000

) 482,452 467,069 480,071 493,682 507,709 522,388 (1,188,488) 497,740 492,746 653,952

Cum ATCF

(2,100,000

) 482,452 949,521 1,429,591 1,923,273 2,430,982 2,953,371 1,764,882 2,262,622 2,755,368 3,409,320

NPV (233,492)

IRR 11.49%

Payback Period 4.35

Profitability Index 0.89

1 out of 5

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.