Comparative Analysis of Costing Methods: Sewing Easy Ltd. Report

VerifiedAdded on 2023/06/10

|11

|2665

|369

Report

AI Summary

This report provides a detailed analysis of traditional and activity-based costing (ABC) methods. It begins with an introduction to traditional costing, which allocates overhead based on volume, and then delves into a case study of Sewing Easy Ltd. The report includes calculations using both costing methods, comparing per-unit costs for basic and advanced models. It presents profit and loss statements under each method, highlighting how ABC can lead to more accurate product costing and potentially influence pricing strategies. The report also addresses the over- or under-application of manufacturing overhead, explaining the causes and treatments. Finally, it outlines the advantages and disadvantages of ABC, such as improved product cost accuracy and information about cost behavior, while acknowledging its complexity and potential for higher implementation costs. The report concludes with a discussion on the implications of these costing methods for business decisions.

Introduction to accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction................................................................................................................................4

Question 1..................................................................................................................................5

Calculation as per traditional costing method........................................................................5

Question 2..................................................................................................................................5

Calculation as per activity base costing model......................................................................5

Question 3..................................................................................................................................6

Statement of profit and loss as per Traditional method as well as ABC method...................6

Question 4..................................................................................................................................7

Question 5..................................................................................................................................9

Advantages of Activity Based Costing..................................................................................9

Disadvantages of Activity Based Costing............................................................................10

Conclusion................................................................................................................................10

References................................................................................................................................12

Introduction................................................................................................................................4

Question 1..................................................................................................................................5

Calculation as per traditional costing method........................................................................5

Question 2..................................................................................................................................5

Calculation as per activity base costing model......................................................................5

Question 3..................................................................................................................................6

Statement of profit and loss as per Traditional method as well as ABC method...................6

Question 4..................................................................................................................................7

Question 5..................................................................................................................................9

Advantages of Activity Based Costing..................................................................................9

Disadvantages of Activity Based Costing............................................................................10

Conclusion................................................................................................................................10

References................................................................................................................................12

List of tables

Table 1: Statement presenting per unit cost of basic model and advance model.......................4

Table 2 Statement presenting per unit cost of basic model and advance model........................4

Table 3 Profit and loss statement of advance model..................................................................5

Table 1: Statement presenting per unit cost of basic model and advance model.......................4

Table 2 Statement presenting per unit cost of basic model and advance model........................4

Table 3 Profit and loss statement of advance model..................................................................5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Traditional costing method assigns factory overheads on the basis of the volume of the

resources consumed. In this method, the overheads are generally applied on the basis of either

the amount of the direct working hours consumed or on the hours the machine was used. This

costing method is less complex than any other method such as activity-based costing which

measures the cost of every product or service which is based on the particular expenses

indulge in it (Weygandt, Kimmel, and Kieso, 2015). Present report revolves around the

assessment of traditional costing method and activity-based costing method with regard to

Sewing Easy Ltd. The assessment of both the methods is being done in order to assess the

reason behind the interest of overseas purchaser in buying the advance model manufactured

by the company.

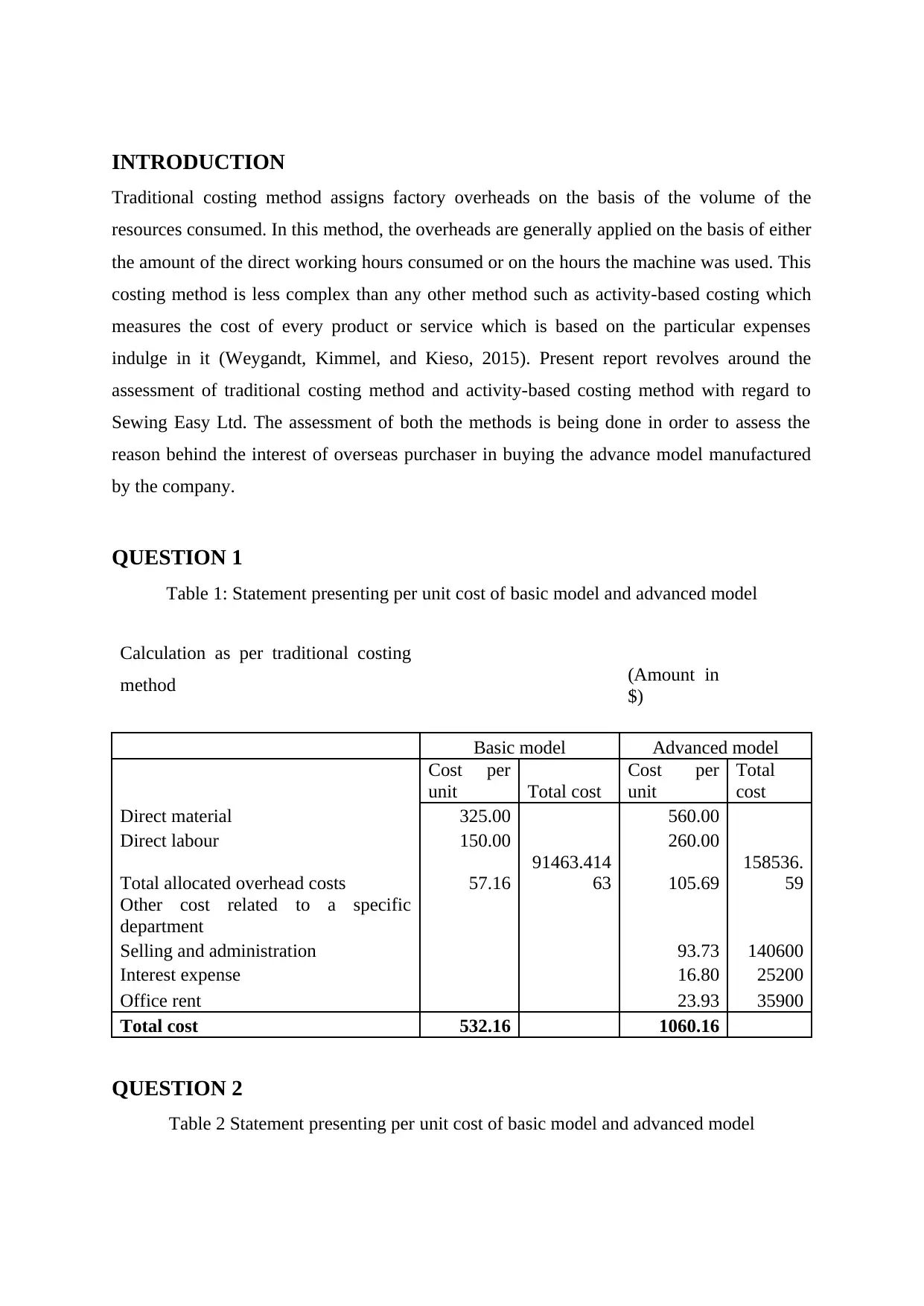

QUESTION 1

Table 1: Statement presenting per unit cost of basic model and advanced model

Calculation as per traditional costing

method (Amount in

$)

Basic model Advanced model

Cost per

unit Total cost

Cost per

unit

Total

cost

Direct material 325.00 560.00

Direct labour 150.00 260.00

Total allocated overhead costs 57.16

91463.414

63 105.69

158536.

59

Other cost related to a specific

department

Selling and administration 93.73 140600

Interest expense 16.80 25200

Office rent 23.93 35900

Total cost 532.16 1060.16

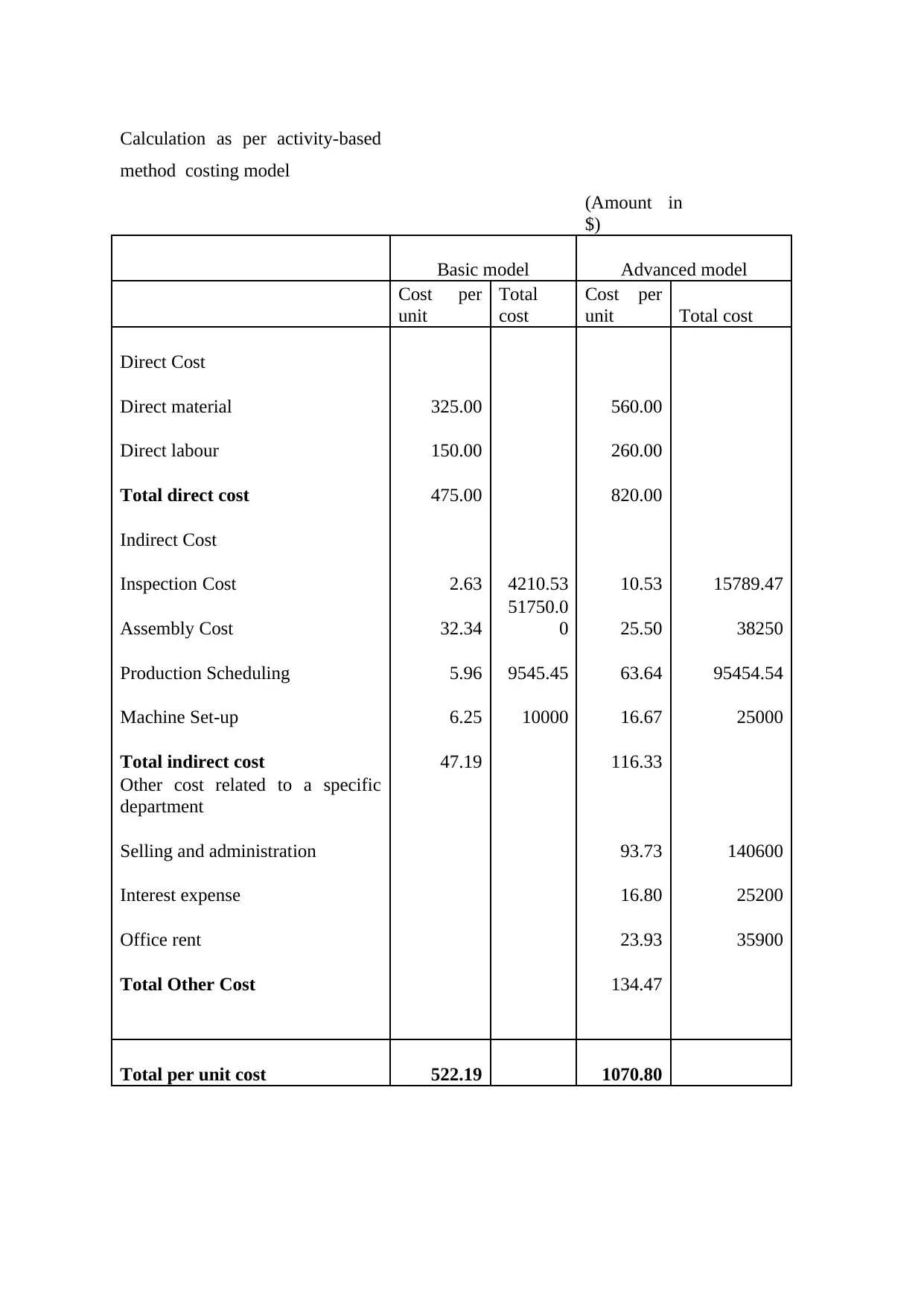

QUESTION 2

Table 2 Statement presenting per unit cost of basic model and advanced model

Traditional costing method assigns factory overheads on the basis of the volume of the

resources consumed. In this method, the overheads are generally applied on the basis of either

the amount of the direct working hours consumed or on the hours the machine was used. This

costing method is less complex than any other method such as activity-based costing which

measures the cost of every product or service which is based on the particular expenses

indulge in it (Weygandt, Kimmel, and Kieso, 2015). Present report revolves around the

assessment of traditional costing method and activity-based costing method with regard to

Sewing Easy Ltd. The assessment of both the methods is being done in order to assess the

reason behind the interest of overseas purchaser in buying the advance model manufactured

by the company.

QUESTION 1

Table 1: Statement presenting per unit cost of basic model and advanced model

Calculation as per traditional costing

method (Amount in

$)

Basic model Advanced model

Cost per

unit Total cost

Cost per

unit

Total

cost

Direct material 325.00 560.00

Direct labour 150.00 260.00

Total allocated overhead costs 57.16

91463.414

63 105.69

158536.

59

Other cost related to a specific

department

Selling and administration 93.73 140600

Interest expense 16.80 25200

Office rent 23.93 35900

Total cost 532.16 1060.16

QUESTION 2

Table 2 Statement presenting per unit cost of basic model and advanced model

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Calculation as per activity-based

method costing model

(Amount in

$)

Basic model Advanced model

Cost per

unit

Total

cost

Cost per

unit Total cost

Direct Cost

Direct material 325.00 560.00

Direct labour 150.00 260.00

Total direct cost 475.00 820.00

Indirect Cost

Inspection Cost 2.63 4210.53 10.53 15789.47

Assembly Cost 32.34

51750.0

0 25.50 38250

Production Scheduling 5.96 9545.45 63.64 95454.54

Machine Set-up 6.25 10000 16.67 25000

Total indirect cost 47.19 116.33

Other cost related to a specific

department

Selling and administration 93.73 140600

Interest expense 16.80 25200

Office rent 23.93 35900

Total Other Cost 134.47

Total per unit cost 522.19 1070.80

method costing model

(Amount in

$)

Basic model Advanced model

Cost per

unit

Total

cost

Cost per

unit Total cost

Direct Cost

Direct material 325.00 560.00

Direct labour 150.00 260.00

Total direct cost 475.00 820.00

Indirect Cost

Inspection Cost 2.63 4210.53 10.53 15789.47

Assembly Cost 32.34

51750.0

0 25.50 38250

Production Scheduling 5.96 9545.45 63.64 95454.54

Machine Set-up 6.25 10000 16.67 25000

Total indirect cost 47.19 116.33

Other cost related to a specific

department

Selling and administration 93.73 140600

Interest expense 16.80 25200

Office rent 23.93 35900

Total Other Cost 134.47

Total per unit cost 522.19 1070.80

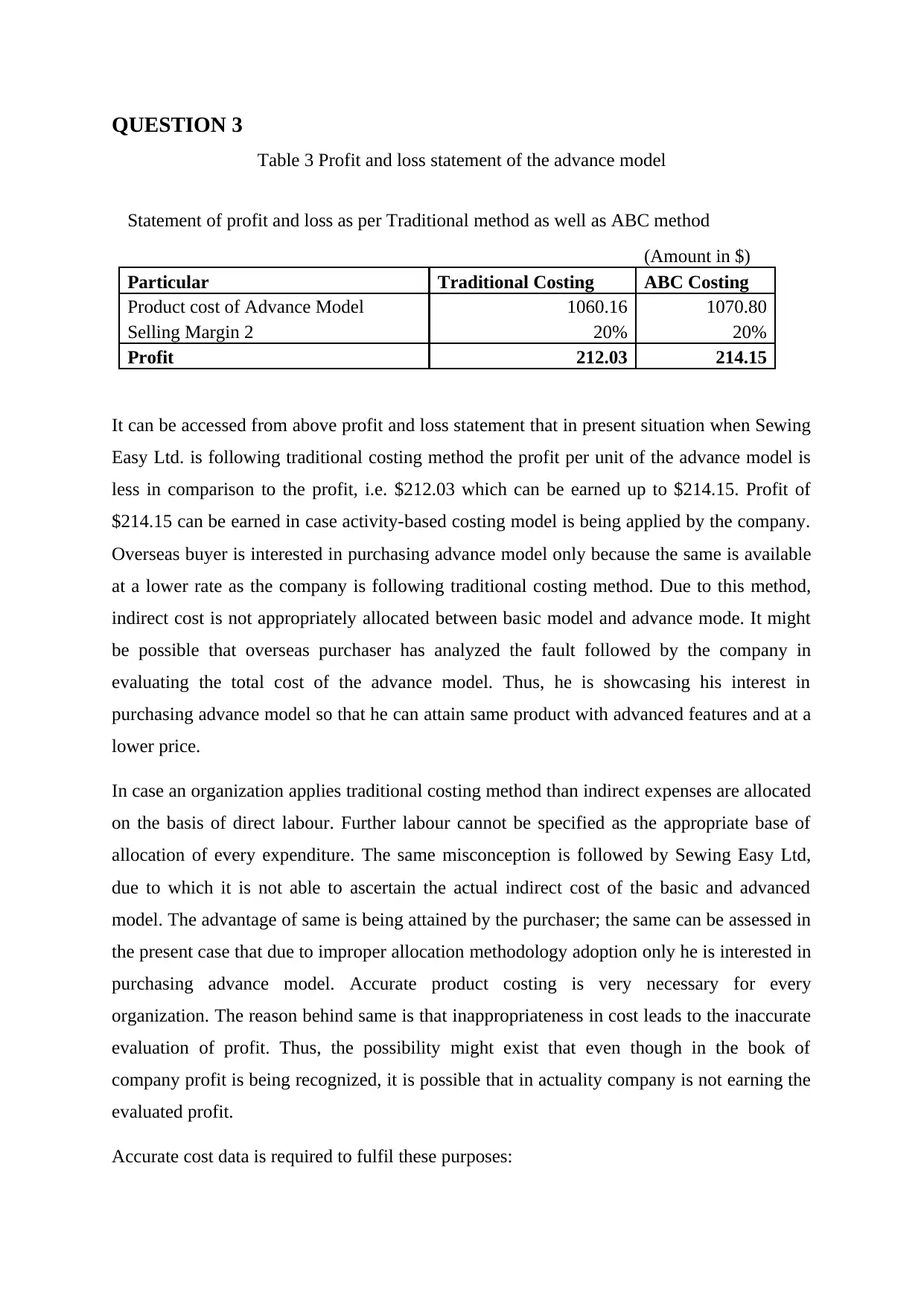

QUESTION 3

Table 3 Profit and loss statement of the advance model

Statement of profit and loss as per Traditional method as well as ABC method

(Amount in $)

Particular Traditional Costing ABC Costing

Product cost of Advance Model 1060.16 1070.80

Selling Margin 2 20% 20%

Profit 212.03 214.15

It can be accessed from above profit and loss statement that in present situation when Sewing

Easy Ltd. is following traditional costing method the profit per unit of the advance model is

less in comparison to the profit, i.e. $212.03 which can be earned up to $214.15. Profit of

$214.15 can be earned in case activity-based costing model is being applied by the company.

Overseas buyer is interested in purchasing advance model only because the same is available

at a lower rate as the company is following traditional costing method. Due to this method,

indirect cost is not appropriately allocated between basic model and advance mode. It might

be possible that overseas purchaser has analyzed the fault followed by the company in

evaluating the total cost of the advance model. Thus, he is showcasing his interest in

purchasing advance model so that he can attain same product with advanced features and at a

lower price.

In case an organization applies traditional costing method than indirect expenses are allocated

on the basis of direct labour. Further labour cannot be specified as the appropriate base of

allocation of every expenditure. The same misconception is followed by Sewing Easy Ltd,

due to which it is not able to ascertain the actual indirect cost of the basic and advanced

model. The advantage of same is being attained by the purchaser; the same can be assessed in

the present case that due to improper allocation methodology adoption only he is interested in

purchasing advance model. Accurate product costing is very necessary for every

organization. The reason behind same is that inappropriateness in cost leads to the inaccurate

evaluation of profit. Thus, the possibility might exist that even though in the book of

company profit is being recognized, it is possible that in actuality company is not earning the

evaluated profit.

Accurate cost data is required to fulfil these purposes:

Table 3 Profit and loss statement of the advance model

Statement of profit and loss as per Traditional method as well as ABC method

(Amount in $)

Particular Traditional Costing ABC Costing

Product cost of Advance Model 1060.16 1070.80

Selling Margin 2 20% 20%

Profit 212.03 214.15

It can be accessed from above profit and loss statement that in present situation when Sewing

Easy Ltd. is following traditional costing method the profit per unit of the advance model is

less in comparison to the profit, i.e. $212.03 which can be earned up to $214.15. Profit of

$214.15 can be earned in case activity-based costing model is being applied by the company.

Overseas buyer is interested in purchasing advance model only because the same is available

at a lower rate as the company is following traditional costing method. Due to this method,

indirect cost is not appropriately allocated between basic model and advance mode. It might

be possible that overseas purchaser has analyzed the fault followed by the company in

evaluating the total cost of the advance model. Thus, he is showcasing his interest in

purchasing advance model so that he can attain same product with advanced features and at a

lower price.

In case an organization applies traditional costing method than indirect expenses are allocated

on the basis of direct labour. Further labour cannot be specified as the appropriate base of

allocation of every expenditure. The same misconception is followed by Sewing Easy Ltd,

due to which it is not able to ascertain the actual indirect cost of the basic and advanced

model. The advantage of same is being attained by the purchaser; the same can be assessed in

the present case that due to improper allocation methodology adoption only he is interested in

purchasing advance model. Accurate product costing is very necessary for every

organization. The reason behind same is that inappropriateness in cost leads to the inaccurate

evaluation of profit. Thus, the possibility might exist that even though in the book of

company profit is being recognized, it is possible that in actuality company is not earning the

evaluated profit.

Accurate cost data is required to fulfil these purposes:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Establishing sales price: the most general method for establishing sales price begins with

cost, and some extent of percentage is added in the same. If the business does not know the

exact of the cost of products, then they can’t set competitive prices, even in the situation of

dictation of sales prices by other variables which is not set by managers. Further, the

managers are required to make a comparison of sales price versus the cost of products and

other related costs that shall be balanced against every source of sales revenue.

Setting a legit defence against the misuse of practices: Most of the states have placed laws

that ban a business from selling products under the cost, exclusive of some situations. If

business even after this does so, then they will be sued according to the federal law for

placing lower prices with the purpose to eliminate competitors from the business. It is

essential for the business to get prepared that their lower prices are placed on the basis of

lower prices and not for the illegal purposes.

QUESTION 4

The over or under application of manufacturing overhead is stated as the variation between

manufacturing overhead costs applicable to work in progress and actual incurrence of

manufacturing overhead cost at a specified period of time (Weygandt, Kimmel and Kieso,

2015).

In a situation where the manufacture overhead cost is applicable to the work in progress is

higher as compared to the actual incurrence of manufacturing overhead cost at a specified

period of time then the variation is referred as over application of manufacturing overhead

(Pleis, 2016). However, in a situation where the cost of manufacturing overhead applicable to

work in progress is lower as compared to the actual incurrence of manufacturing overhead

cost at a specified period of time then the variation is referred as the under application of

manufacturing overhead.

Under absorption of the overhead occur when the total overhead incurred is more than the

total amount of overhead which has been absorbed. Whereas over absorption of the overhead

take place in a situation when the total overhead amount absorbed is more than the total

amount incurred. As per the any one of them or both the two reasons (Cokins, Capusneanu,

and Briciu, 2012) where the under and over absorption of overhead take place are:

cost, and some extent of percentage is added in the same. If the business does not know the

exact of the cost of products, then they can’t set competitive prices, even in the situation of

dictation of sales prices by other variables which is not set by managers. Further, the

managers are required to make a comparison of sales price versus the cost of products and

other related costs that shall be balanced against every source of sales revenue.

Setting a legit defence against the misuse of practices: Most of the states have placed laws

that ban a business from selling products under the cost, exclusive of some situations. If

business even after this does so, then they will be sued according to the federal law for

placing lower prices with the purpose to eliminate competitors from the business. It is

essential for the business to get prepared that their lower prices are placed on the basis of

lower prices and not for the illegal purposes.

QUESTION 4

The over or under application of manufacturing overhead is stated as the variation between

manufacturing overhead costs applicable to work in progress and actual incurrence of

manufacturing overhead cost at a specified period of time (Weygandt, Kimmel and Kieso,

2015).

In a situation where the manufacture overhead cost is applicable to the work in progress is

higher as compared to the actual incurrence of manufacturing overhead cost at a specified

period of time then the variation is referred as over application of manufacturing overhead

(Pleis, 2016). However, in a situation where the cost of manufacturing overhead applicable to

work in progress is lower as compared to the actual incurrence of manufacturing overhead

cost at a specified period of time then the variation is referred as the under application of

manufacturing overhead.

Under absorption of the overhead occur when the total overhead incurred is more than the

total amount of overhead which has been absorbed. Whereas over absorption of the overhead

take place in a situation when the total overhead amount absorbed is more than the total

amount incurred. As per the any one of them or both the two reasons (Cokins, Capusneanu,

and Briciu, 2012) where the under and over absorption of overhead take place are:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(a) The actual expense of overhead is less or more than the expected overhead,

(b) The base of the actual sum of the absorption is different from that of the base of the

expected absorption.

At the year-end, the stability in the account of manufacturing overhead is disposed by

allocation amongst work in progress, ultimate goods or sold goods cost or either with the

transferring the overall amount of cost to good sold to the same account (Keller, 2015).

Further, these two key methods are described as below:

In conducted in three key ways, the over or under-absorbed overhead can be treated in

following ways.

To the account of next period, then the same amount might be carried onward.

To cost in the income statement, there is write off of the amount

To the production, an additional rate might make a sense, and the same would be

applied.

In situations where over several years, the regular cycle of business expands, the initial

methods might be applicable. However this method avoids cost matching, so it cannot result

exactly in regular conditions. If in case, this will be carried forward then the justifications are

required to present by conditions, as per the under or over-absorbed overhead, so it can be

carried forward for the next period for the intent of absorption and shall be moved to the

reserve or suspense account (Hermason, Edwards and Maher, 2016). In such cases, wherein

the over or under-absorption amount is not significant, it is time to apply the second method,

to avoid the disturbance of production cost, to the P&L amount then this minor amount would

be written off.

The third method is applicable in cases, when there is entitlement to the severe error in the

assumption of overhead, an error in the assumption of the recovery rate base, a severe error

while calculating the rate of recovery, a substantial change held in the production system, a

major change in the level of activity and many more. The substantial over or under-

absorption amount is being engaged, According to this method the alteration for he over or

under-absorption amount is conducted by supplementary rates to the values of work in

progress, ultimate goods which are not yet sold or completely finished or sold (Yorgure,

2015). Further, these accounts are put on credit side along with the supplementary rates, if the

(b) The base of the actual sum of the absorption is different from that of the base of the

expected absorption.

At the year-end, the stability in the account of manufacturing overhead is disposed by

allocation amongst work in progress, ultimate goods or sold goods cost or either with the

transferring the overall amount of cost to good sold to the same account (Keller, 2015).

Further, these two key methods are described as below:

In conducted in three key ways, the over or under-absorbed overhead can be treated in

following ways.

To the account of next period, then the same amount might be carried onward.

To cost in the income statement, there is write off of the amount

To the production, an additional rate might make a sense, and the same would be

applied.

In situations where over several years, the regular cycle of business expands, the initial

methods might be applicable. However this method avoids cost matching, so it cannot result

exactly in regular conditions. If in case, this will be carried forward then the justifications are

required to present by conditions, as per the under or over-absorbed overhead, so it can be

carried forward for the next period for the intent of absorption and shall be moved to the

reserve or suspense account (Hermason, Edwards and Maher, 2016). In such cases, wherein

the over or under-absorption amount is not significant, it is time to apply the second method,

to avoid the disturbance of production cost, to the P&L amount then this minor amount would

be written off.

The third method is applicable in cases, when there is entitlement to the severe error in the

assumption of overhead, an error in the assumption of the recovery rate base, a severe error

while calculating the rate of recovery, a substantial change held in the production system, a

major change in the level of activity and many more. The substantial over or under-

absorption amount is being engaged, According to this method the alteration for he over or

under-absorption amount is conducted by supplementary rates to the values of work in

progress, ultimate goods which are not yet sold or completely finished or sold (Yorgure,

2015). Further, these accounts are put on credit side along with the supplementary rates, if the

over-absorption & factory overhead account is on the debit side. However, these accounts are

put on the debit side along with the supplementary rates & factory overhead account been

credited. Based on every cost of direct labour and wages of account, labour and machine

hours or monetary value are calculated by considering the supplementary rate.

QUESTION 5

Activity Based Costing

The activity-based costing is one of the methods of accounting which identifies and allocates

cost to the activities of overhead and then allocate that cost to the products. This system

identifies the connection between the overhead activities, (Dale, and Plunkett, 2017) costs

and manufactured items and by this relation it then assigns the indirect cost to the products

which are less arbitrarily than the traditional techniques.

Advantages of Activity Based Costing

Accurate Product Cost: The ABC costing brings in more reliability and accuracy in

the determination of the product cost by focusing on the cause and the effect of the

relationship of the cost incurrence.

Information about Cost Behaviour: The ABC recognizes the real nature of the

behaviour of the cost and also helps in identifying the activities and reducing its cost

which will not add any value to the product (Hilton, and Platt, 2013). Along with

ABC, the managers are now able to handle most of the fixed cost of overhead by

putting more control on the activities which were the reason for the fixed cost of

overhead.

Tracing of Activities for the Cost Object: The ABC utilizes many of the cost drivers

most of them are based on the transaction instead of the product volume. Furthermore,

the ABC is much more concerned with activities beyond and within the factory so as

to trace the overheads of the items.

Tracing of Overhead Costs: The ABC also traces the costs of areas such as processes,

managerial responsibilities, customers, and the departments excluding the cost of

products (Garrison, et al., 2010).

put on the debit side along with the supplementary rates & factory overhead account been

credited. Based on every cost of direct labour and wages of account, labour and machine

hours or monetary value are calculated by considering the supplementary rate.

QUESTION 5

Activity Based Costing

The activity-based costing is one of the methods of accounting which identifies and allocates

cost to the activities of overhead and then allocate that cost to the products. This system

identifies the connection between the overhead activities, (Dale, and Plunkett, 2017) costs

and manufactured items and by this relation it then assigns the indirect cost to the products

which are less arbitrarily than the traditional techniques.

Advantages of Activity Based Costing

Accurate Product Cost: The ABC costing brings in more reliability and accuracy in

the determination of the product cost by focusing on the cause and the effect of the

relationship of the cost incurrence.

Information about Cost Behaviour: The ABC recognizes the real nature of the

behaviour of the cost and also helps in identifying the activities and reducing its cost

which will not add any value to the product (Hilton, and Platt, 2013). Along with

ABC, the managers are now able to handle most of the fixed cost of overhead by

putting more control on the activities which were the reason for the fixed cost of

overhead.

Tracing of Activities for the Cost Object: The ABC utilizes many of the cost drivers

most of them are based on the transaction instead of the product volume. Furthermore,

the ABC is much more concerned with activities beyond and within the factory so as

to trace the overheads of the items.

Tracing of Overhead Costs: The ABC also traces the costs of areas such as processes,

managerial responsibilities, customers, and the departments excluding the cost of

products (Garrison, et al., 2010).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Disadvantages of Activity Based Costing

Expensive and Complex: The ABC has various pools of costs and multiple drivers of

cost and hence can even be more composite than the traditional system of costing. It,

in turn, proves that managing ABC is a costly affair.

Selection of Drivers: There are some of the issues in executing ABC like, the

selection of the cost drivers, variation in the cost driver rates, and the assignment of

the common costs (DRURY, 2013).

Disadvantages to Smaller Firms: The ABC has many levels of utility for various

businesses as the large firm can utilize it more effectively than the small firms.

Measurement Difficulties: Another limitation is the measurements which is essential

to execute the ABC system. It requires the management to assume the cost of the

activity and then identify and evaluate the cost drivers so as to serve the bases of cost

allocation (Hall, 2010).

CONCLUSION

It can be concluded from above analysis that in the absence of better cost information, a

business would operate ineffectively in gloomy circumstances. It can be referred as second

most significant aspect is the measurement of cost which is done by accountants, just after the

measurement of profits. Further, business is required to effectively do a recording of costs so

that determination of profit at each period, so that the managerial authorities have a better

holding of information to make better decisions. Thus, Sewing Easy Ltd should switch from

traditional method to activity-based costing method so that appropriate costing of products

can be done.

Expensive and Complex: The ABC has various pools of costs and multiple drivers of

cost and hence can even be more composite than the traditional system of costing. It,

in turn, proves that managing ABC is a costly affair.

Selection of Drivers: There are some of the issues in executing ABC like, the

selection of the cost drivers, variation in the cost driver rates, and the assignment of

the common costs (DRURY, 2013).

Disadvantages to Smaller Firms: The ABC has many levels of utility for various

businesses as the large firm can utilize it more effectively than the small firms.

Measurement Difficulties: Another limitation is the measurements which is essential

to execute the ABC system. It requires the management to assume the cost of the

activity and then identify and evaluate the cost drivers so as to serve the bases of cost

allocation (Hall, 2010).

CONCLUSION

It can be concluded from above analysis that in the absence of better cost information, a

business would operate ineffectively in gloomy circumstances. It can be referred as second

most significant aspect is the measurement of cost which is done by accountants, just after the

measurement of profits. Further, business is required to effectively do a recording of costs so

that determination of profit at each period, so that the managerial authorities have a better

holding of information to make better decisions. Thus, Sewing Easy Ltd should switch from

traditional method to activity-based costing method so that appropriate costing of products

can be done.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Cokins, G., Capusneanu, S. and Briciu, S., 2012. Accounting's shift to decision-based

costing. Theoretical & Applied Economics, 19(11).

Dale, B.G. and Plunkett, J.J., 2017. Quality costing. Routledge.

Deegan, C., 2013. Financial accounting theory. McGraw-Hill Education Australia.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Hall, M., 2010. Accounting information and managerial work. Accounting, Organizations

and Society, 35(3), pp.301-315.

Hermason, R., Edwards, J. and Maher, M., 2016. Accounting Principles: Managerial

Accounting.

Hilton, R.W. and Platt, D.E., 2013. Managerial accounting: creating value in a dynamic

business environment. McGraw-Hill Education.

Keller, W.D., 2015. Cost and Managerial Accounting II Essentials (Vol. 2). Research &

Education Assoc..

Pleis, L.M., 2016. Cost Accounting: Linking Necessary Concepts. Business Education

Innovation Journal VOLUME 8 NUMBER 2 December 2016, p.180.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Yorgure, C.S., 2015. Assessing the Significance of Modularizing Contract Manufacturing

Organizations (Doctoral dissertation, Walden University).

Cokins, G., Capusneanu, S. and Briciu, S., 2012. Accounting's shift to decision-based

costing. Theoretical & Applied Economics, 19(11).

Dale, B.G. and Plunkett, J.J., 2017. Quality costing. Routledge.

Deegan, C., 2013. Financial accounting theory. McGraw-Hill Education Australia.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Hall, M., 2010. Accounting information and managerial work. Accounting, Organizations

and Society, 35(3), pp.301-315.

Hermason, R., Edwards, J. and Maher, M., 2016. Accounting Principles: Managerial

Accounting.

Hilton, R.W. and Platt, D.E., 2013. Managerial accounting: creating value in a dynamic

business environment. McGraw-Hill Education.

Keller, W.D., 2015. Cost and Managerial Accounting II Essentials (Vol. 2). Research &

Education Assoc..

Pleis, L.M., 2016. Cost Accounting: Linking Necessary Concepts. Business Education

Innovation Journal VOLUME 8 NUMBER 2 December 2016, p.180.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting.

John Wiley & Sons.

Yorgure, C.S., 2015. Assessing the Significance of Modularizing Contract Manufacturing

Organizations (Doctoral dissertation, Walden University).

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.