Analysis of Short-Term & Long-Term Financial Decisions - Finance

VerifiedAdded on 2022/09/07

|11

|1307

|15

Homework Assignment

AI Summary

This finance assignment provides detailed solutions to various financial decision-making problems. It covers key concepts such as payback period, net present value (NPV), and internal rate of return (IRR) to evaluate investment opportunities. The assignment includes calculations and analysis for different projects, comparing their financial viability and ranking them based on profitability. It also explores the impact of different discount rates and cash flow scenarios on investment decisions. The document analyzes both short-term and long-term financial decisions, considering replacement and expansion decisions, and provides recommendations based on the financial metrics. The assignment also includes references to support the analysis and conclusions.

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

1

SHORT TERM AND LONG TERM FINANCIAL DECISIONS

1

SHORT TERM AND LONG TERM FINANCIAL DECISIONS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

Contents

Question P-10-2...........................................................................................................................................3

Question P-10-10.........................................................................................................................................4

Question P-10-16.........................................................................................................................................5

Question P-10-22.........................................................................................................................................6

Question 11-3..........................................................................................................................................6

Part A).....................................................................................................................................................6

Part B).....................................................................................................................................................7

Question 11-12........................................................................................................................................7

Question 12-2..........................................................................................................................................7

Question 12-4..........................................................................................................................................9

A)............................................................................................................................................................9

B).............................................................................................................................................................9

C).............................................................................................................................................................9

D)..........................................................................................................................................................10

References.................................................................................................................................................11

Contents

Question P-10-2...........................................................................................................................................3

Question P-10-10.........................................................................................................................................4

Question P-10-16.........................................................................................................................................5

Question P-10-22.........................................................................................................................................6

Question 11-3..........................................................................................................................................6

Part A).....................................................................................................................................................6

Part B).....................................................................................................................................................7

Question 11-12........................................................................................................................................7

Question 12-2..........................................................................................................................................7

Question 12-4..........................................................................................................................................9

A)............................................................................................................................................................9

B).............................................................................................................................................................9

C).............................................................................................................................................................9

D)..........................................................................................................................................................10

References.................................................................................................................................................11

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

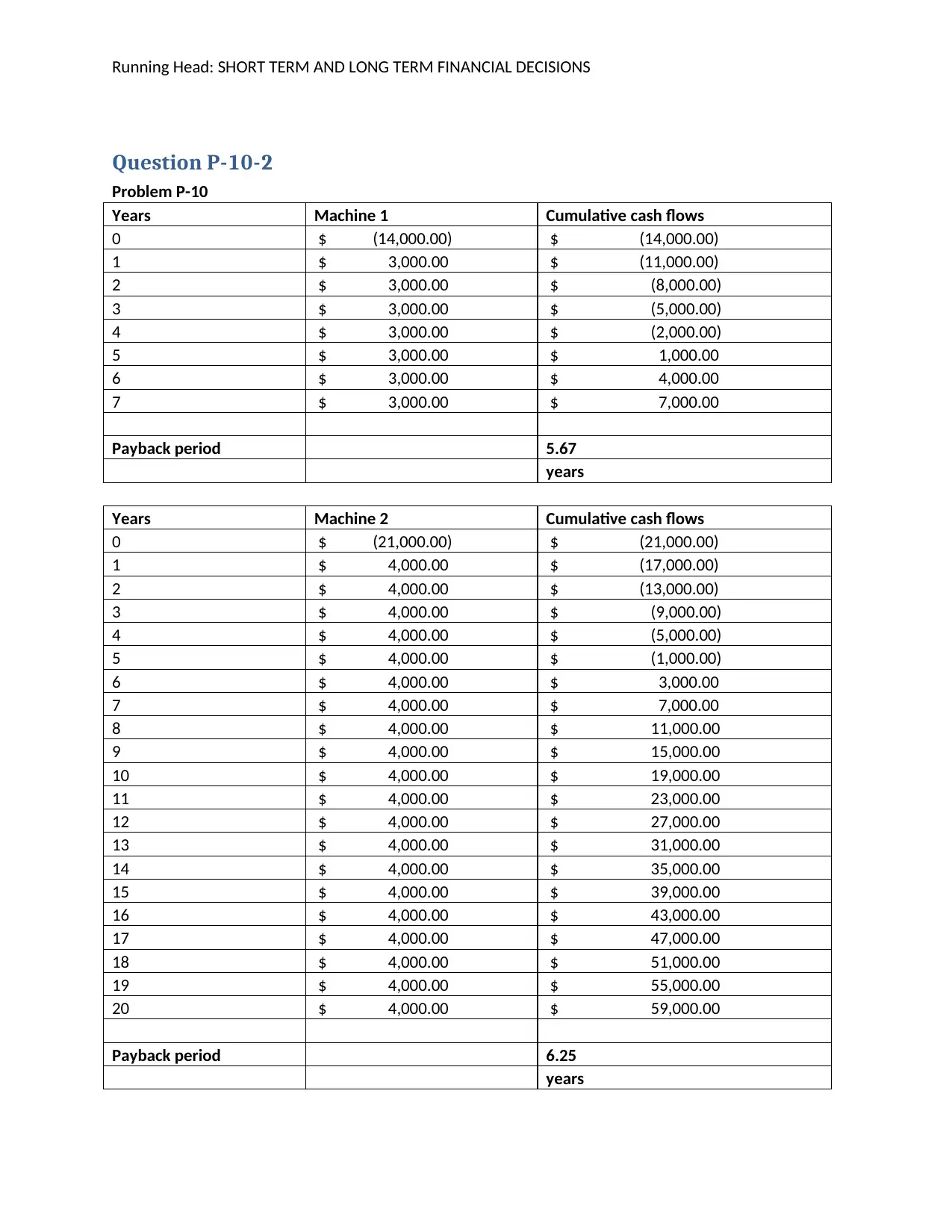

Question P-10-2

Problem P-10

Years Machine 1 Cumulative cash flows

0 $ (14,000.00) $ (14,000.00)

1 $ 3,000.00 $ (11,000.00)

2 $ 3,000.00 $ (8,000.00)

3 $ 3,000.00 $ (5,000.00)

4 $ 3,000.00 $ (2,000.00)

5 $ 3,000.00 $ 1,000.00

6 $ 3,000.00 $ 4,000.00

7 $ 3,000.00 $ 7,000.00

Payback period 5.67

years

Years Machine 2 Cumulative cash flows

0 $ (21,000.00) $ (21,000.00)

1 $ 4,000.00 $ (17,000.00)

2 $ 4,000.00 $ (13,000.00)

3 $ 4,000.00 $ (9,000.00)

4 $ 4,000.00 $ (5,000.00)

5 $ 4,000.00 $ (1,000.00)

6 $ 4,000.00 $ 3,000.00

7 $ 4,000.00 $ 7,000.00

8 $ 4,000.00 $ 11,000.00

9 $ 4,000.00 $ 15,000.00

10 $ 4,000.00 $ 19,000.00

11 $ 4,000.00 $ 23,000.00

12 $ 4,000.00 $ 27,000.00

13 $ 4,000.00 $ 31,000.00

14 $ 4,000.00 $ 35,000.00

15 $ 4,000.00 $ 39,000.00

16 $ 4,000.00 $ 43,000.00

17 $ 4,000.00 $ 47,000.00

18 $ 4,000.00 $ 51,000.00

19 $ 4,000.00 $ 55,000.00

20 $ 4,000.00 $ 59,000.00

Payback period 6.25

years

Question P-10-2

Problem P-10

Years Machine 1 Cumulative cash flows

0 $ (14,000.00) $ (14,000.00)

1 $ 3,000.00 $ (11,000.00)

2 $ 3,000.00 $ (8,000.00)

3 $ 3,000.00 $ (5,000.00)

4 $ 3,000.00 $ (2,000.00)

5 $ 3,000.00 $ 1,000.00

6 $ 3,000.00 $ 4,000.00

7 $ 3,000.00 $ 7,000.00

Payback period 5.67

years

Years Machine 2 Cumulative cash flows

0 $ (21,000.00) $ (21,000.00)

1 $ 4,000.00 $ (17,000.00)

2 $ 4,000.00 $ (13,000.00)

3 $ 4,000.00 $ (9,000.00)

4 $ 4,000.00 $ (5,000.00)

5 $ 4,000.00 $ (1,000.00)

6 $ 4,000.00 $ 3,000.00

7 $ 4,000.00 $ 7,000.00

8 $ 4,000.00 $ 11,000.00

9 $ 4,000.00 $ 15,000.00

10 $ 4,000.00 $ 19,000.00

11 $ 4,000.00 $ 23,000.00

12 $ 4,000.00 $ 27,000.00

13 $ 4,000.00 $ 31,000.00

14 $ 4,000.00 $ 35,000.00

15 $ 4,000.00 $ 39,000.00

16 $ 4,000.00 $ 43,000.00

17 $ 4,000.00 $ 47,000.00

18 $ 4,000.00 $ 51,000.00

19 $ 4,000.00 $ 55,000.00

20 $ 4,000.00 $ 59,000.00

Payback period 6.25

years

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

A)

The payback period is the period that defines the cost of the investment’s time period, a period which is

required to cover the initial costs of the investments. If they are independent projects, the Machine -1

shall be accepted as the project as it would take 5.67 years (Newcomer, Hatry and Wholey, 2015).

B)

Machine 2 shall be accepted.

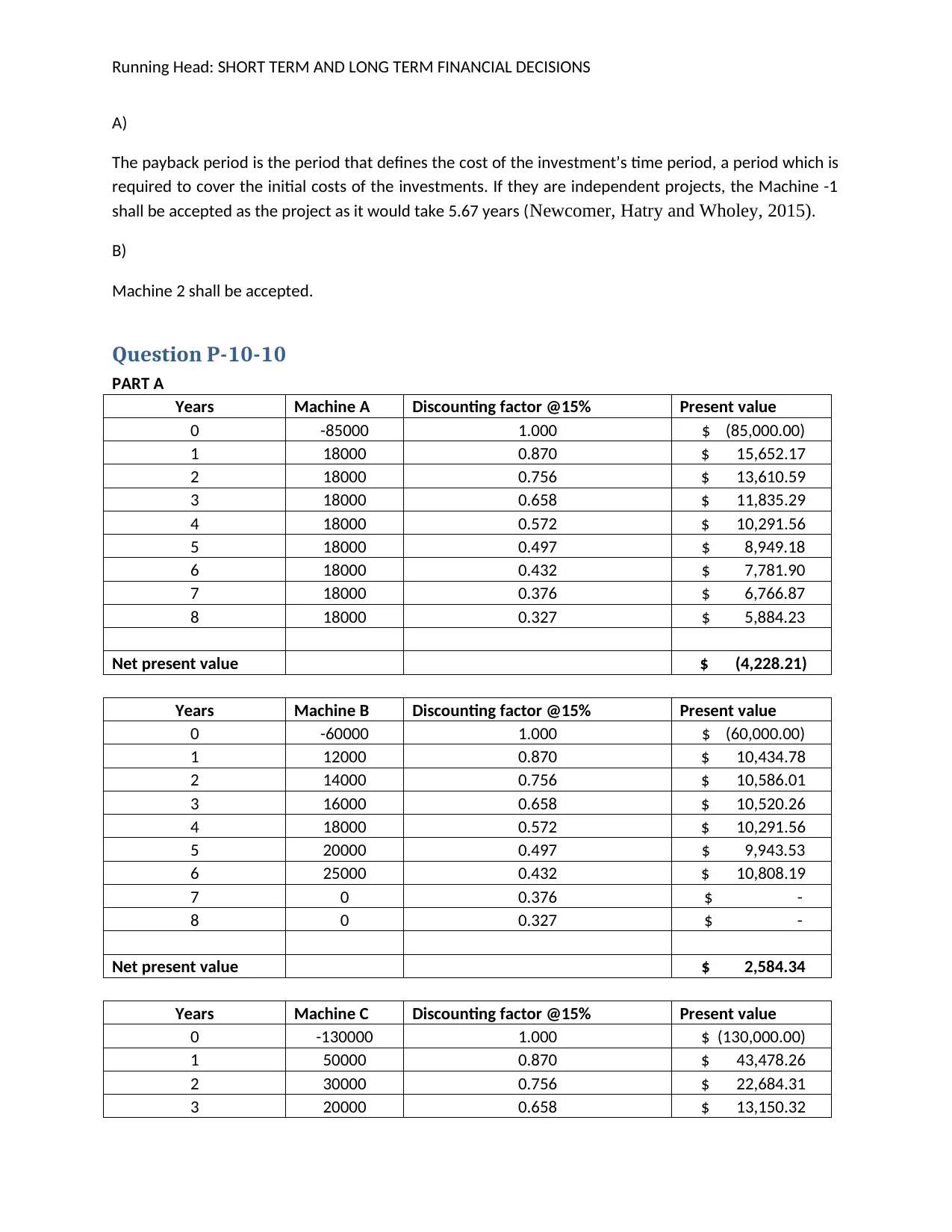

Question P-10-10

PART A

Years Machine A Discounting factor @15% Present value

0 -85000 1.000 $ (85,000.00)

1 18000 0.870 $ 15,652.17

2 18000 0.756 $ 13,610.59

3 18000 0.658 $ 11,835.29

4 18000 0.572 $ 10,291.56

5 18000 0.497 $ 8,949.18

6 18000 0.432 $ 7,781.90

7 18000 0.376 $ 6,766.87

8 18000 0.327 $ 5,884.23

Net present value $ (4,228.21)

Years Machine B Discounting factor @15% Present value

0 -60000 1.000 $ (60,000.00)

1 12000 0.870 $ 10,434.78

2 14000 0.756 $ 10,586.01

3 16000 0.658 $ 10,520.26

4 18000 0.572 $ 10,291.56

5 20000 0.497 $ 9,943.53

6 25000 0.432 $ 10,808.19

7 0 0.376 $ -

8 0 0.327 $ -

Net present value $ 2,584.34

Years Machine C Discounting factor @15% Present value

0 -130000 1.000 $ (130,000.00)

1 50000 0.870 $ 43,478.26

2 30000 0.756 $ 22,684.31

3 20000 0.658 $ 13,150.32

A)

The payback period is the period that defines the cost of the investment’s time period, a period which is

required to cover the initial costs of the investments. If they are independent projects, the Machine -1

shall be accepted as the project as it would take 5.67 years (Newcomer, Hatry and Wholey, 2015).

B)

Machine 2 shall be accepted.

Question P-10-10

PART A

Years Machine A Discounting factor @15% Present value

0 -85000 1.000 $ (85,000.00)

1 18000 0.870 $ 15,652.17

2 18000 0.756 $ 13,610.59

3 18000 0.658 $ 11,835.29

4 18000 0.572 $ 10,291.56

5 18000 0.497 $ 8,949.18

6 18000 0.432 $ 7,781.90

7 18000 0.376 $ 6,766.87

8 18000 0.327 $ 5,884.23

Net present value $ (4,228.21)

Years Machine B Discounting factor @15% Present value

0 -60000 1.000 $ (60,000.00)

1 12000 0.870 $ 10,434.78

2 14000 0.756 $ 10,586.01

3 16000 0.658 $ 10,520.26

4 18000 0.572 $ 10,291.56

5 20000 0.497 $ 9,943.53

6 25000 0.432 $ 10,808.19

7 0 0.376 $ -

8 0 0.327 $ -

Net present value $ 2,584.34

Years Machine C Discounting factor @15% Present value

0 -130000 1.000 $ (130,000.00)

1 50000 0.870 $ 43,478.26

2 30000 0.756 $ 22,684.31

3 20000 0.658 $ 13,150.32

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

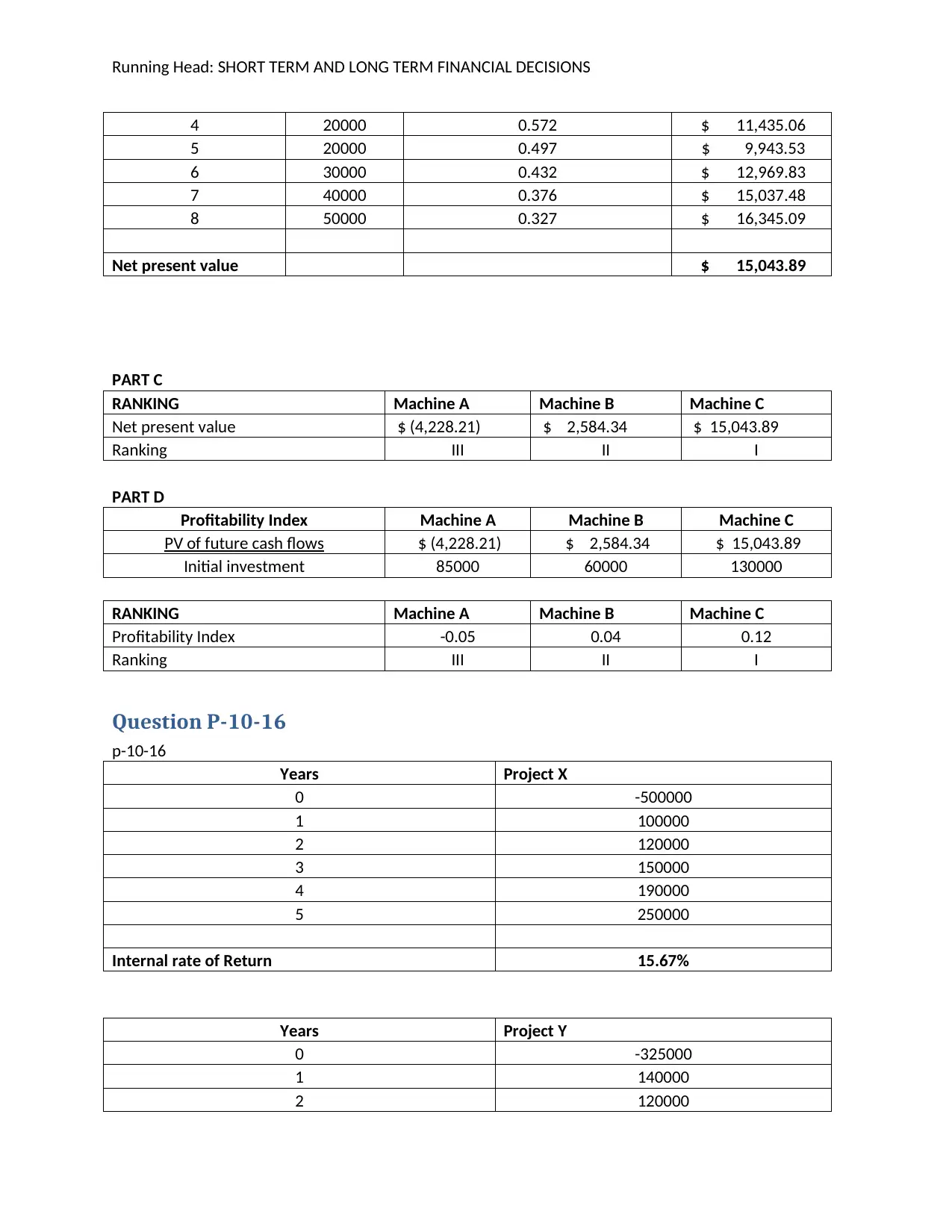

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

4 20000 0.572 $ 11,435.06

5 20000 0.497 $ 9,943.53

6 30000 0.432 $ 12,969.83

7 40000 0.376 $ 15,037.48

8 50000 0.327 $ 16,345.09

Net present value $ 15,043.89

PART C

RANKING Machine A Machine B Machine C

Net present value $ (4,228.21) $ 2,584.34 $ 15,043.89

Ranking III II I

PART D

Profitability Index Machine A Machine B Machine C

PV of future cash flows $ (4,228.21) $ 2,584.34 $ 15,043.89

Initial investment 85000 60000 130000

RANKING Machine A Machine B Machine C

Profitability Index -0.05 0.04 0.12

Ranking III II I

Question P-10-16

p-10-16

Years Project X

0 -500000

1 100000

2 120000

3 150000

4 190000

5 250000

Internal rate of Return 15.67%

Years Project Y

0 -325000

1 140000

2 120000

4 20000 0.572 $ 11,435.06

5 20000 0.497 $ 9,943.53

6 30000 0.432 $ 12,969.83

7 40000 0.376 $ 15,037.48

8 50000 0.327 $ 16,345.09

Net present value $ 15,043.89

PART C

RANKING Machine A Machine B Machine C

Net present value $ (4,228.21) $ 2,584.34 $ 15,043.89

Ranking III II I

PART D

Profitability Index Machine A Machine B Machine C

PV of future cash flows $ (4,228.21) $ 2,584.34 $ 15,043.89

Initial investment 85000 60000 130000

RANKING Machine A Machine B Machine C

Profitability Index -0.05 0.04 0.12

Ranking III II I

Question P-10-16

p-10-16

Years Project X

0 -500000

1 100000

2 120000

3 150000

4 190000

5 250000

Internal rate of Return 15.67%

Years Project Y

0 -325000

1 140000

2 120000

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

3 95000

4 70000

5 50000

Internal rate of Return 17.29%

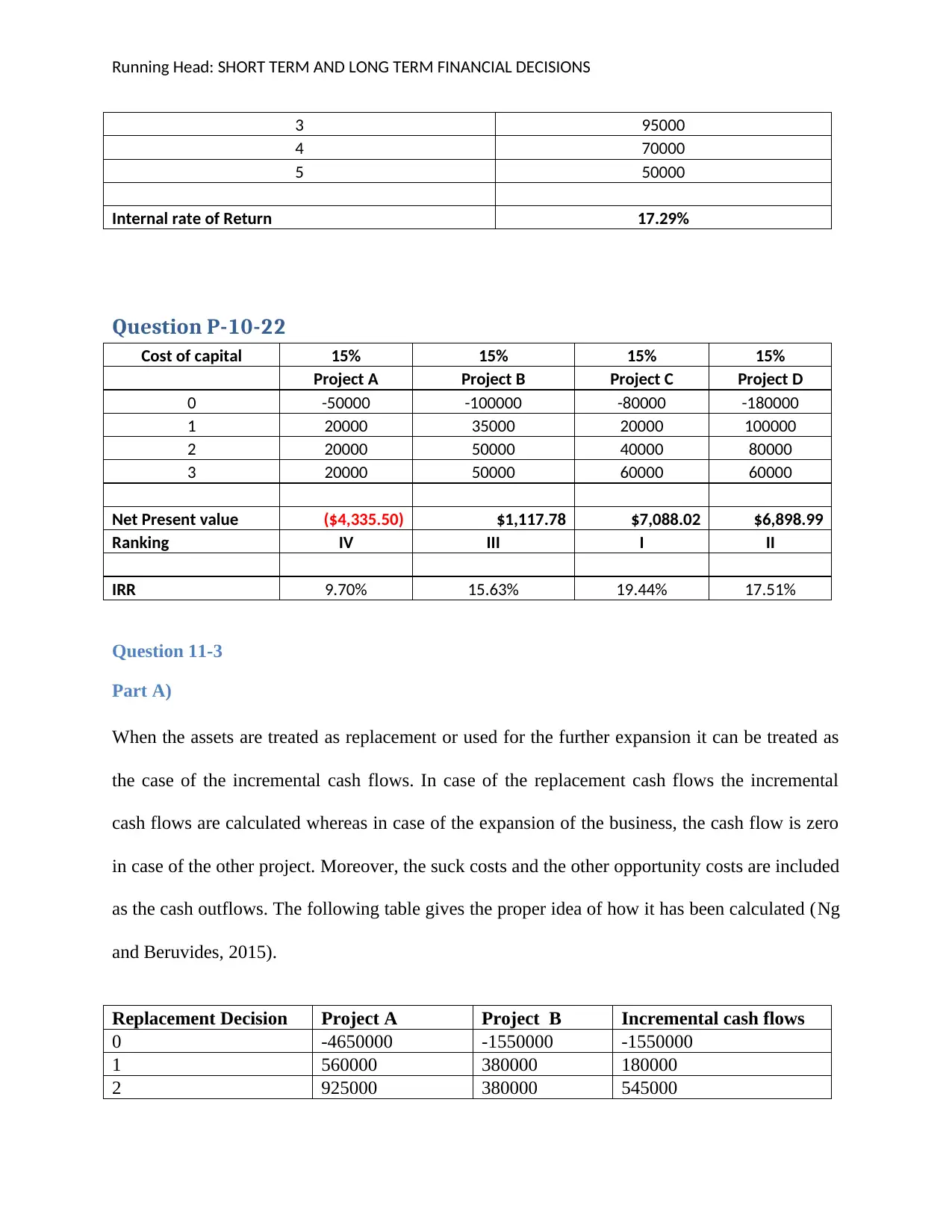

Question P-10-22

Cost of capital 15% 15% 15% 15%

Project A Project B Project C Project D

0 -50000 -100000 -80000 -180000

1 20000 35000 20000 100000

2 20000 50000 40000 80000

3 20000 50000 60000 60000

Net Present value ($4,335.50) $1,117.78 $7,088.02 $6,898.99

Ranking IV III I II

IRR 9.70% 15.63% 19.44% 17.51%

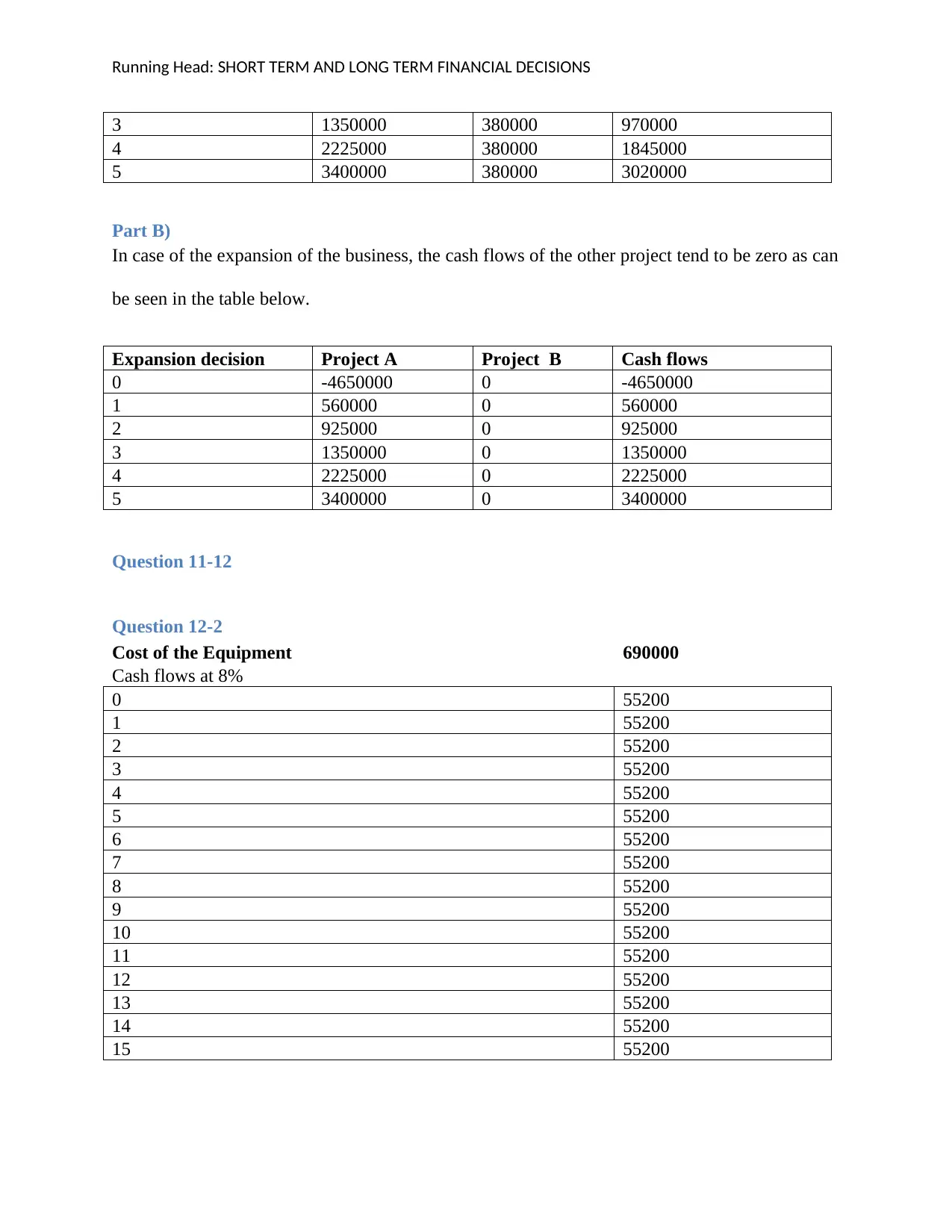

Question 11-3

Part A)

When the assets are treated as replacement or used for the further expansion it can be treated as

the case of the incremental cash flows. In case of the replacement cash flows the incremental

cash flows are calculated whereas in case of the expansion of the business, the cash flow is zero

in case of the other project. Moreover, the suck costs and the other opportunity costs are included

as the cash outflows. The following table gives the proper idea of how it has been calculated (Ng

and Beruvides, 2015).

Replacement Decision Project A Project B Incremental cash flows

0 -4650000 -1550000 -1550000

1 560000 380000 180000

2 925000 380000 545000

3 95000

4 70000

5 50000

Internal rate of Return 17.29%

Question P-10-22

Cost of capital 15% 15% 15% 15%

Project A Project B Project C Project D

0 -50000 -100000 -80000 -180000

1 20000 35000 20000 100000

2 20000 50000 40000 80000

3 20000 50000 60000 60000

Net Present value ($4,335.50) $1,117.78 $7,088.02 $6,898.99

Ranking IV III I II

IRR 9.70% 15.63% 19.44% 17.51%

Question 11-3

Part A)

When the assets are treated as replacement or used for the further expansion it can be treated as

the case of the incremental cash flows. In case of the replacement cash flows the incremental

cash flows are calculated whereas in case of the expansion of the business, the cash flow is zero

in case of the other project. Moreover, the suck costs and the other opportunity costs are included

as the cash outflows. The following table gives the proper idea of how it has been calculated (Ng

and Beruvides, 2015).

Replacement Decision Project A Project B Incremental cash flows

0 -4650000 -1550000 -1550000

1 560000 380000 180000

2 925000 380000 545000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

3 1350000 380000 970000

4 2225000 380000 1845000

5 3400000 380000 3020000

Part B)

In case of the expansion of the business, the cash flows of the other project tend to be zero as can

be seen in the table below.

Expansion decision Project A Project B Cash flows

0 -4650000 0 -4650000

1 560000 0 560000

2 925000 0 925000

3 1350000 0 1350000

4 2225000 0 2225000

5 3400000 0 3400000

Question 11-12

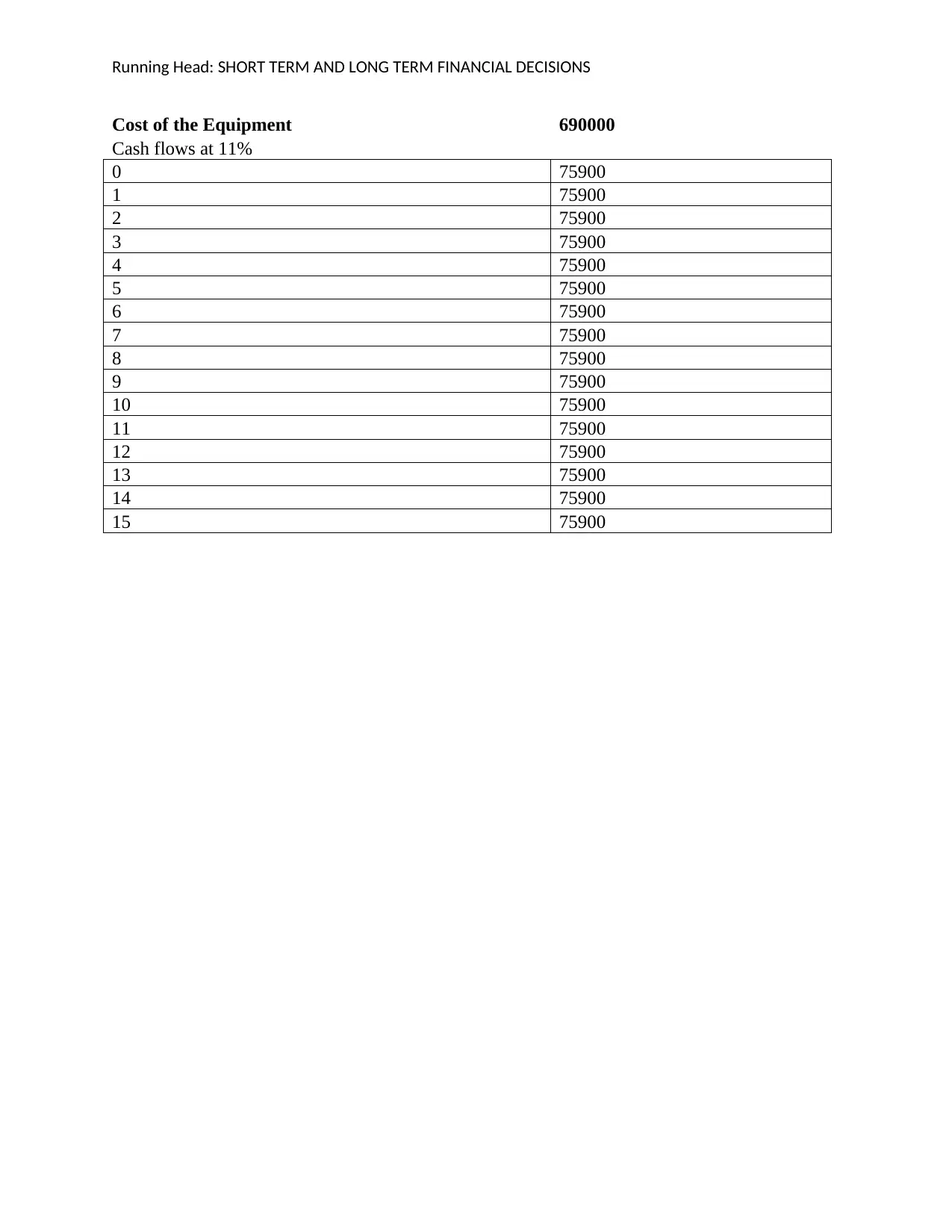

Question 12-2

Cost of the Equipment 690000

Cash flows at 8%

0 55200

1 55200

2 55200

3 55200

4 55200

5 55200

6 55200

7 55200

8 55200

9 55200

10 55200

11 55200

12 55200

13 55200

14 55200

15 55200

3 1350000 380000 970000

4 2225000 380000 1845000

5 3400000 380000 3020000

Part B)

In case of the expansion of the business, the cash flows of the other project tend to be zero as can

be seen in the table below.

Expansion decision Project A Project B Cash flows

0 -4650000 0 -4650000

1 560000 0 560000

2 925000 0 925000

3 1350000 0 1350000

4 2225000 0 2225000

5 3400000 0 3400000

Question 11-12

Question 12-2

Cost of the Equipment 690000

Cash flows at 8%

0 55200

1 55200

2 55200

3 55200

4 55200

5 55200

6 55200

7 55200

8 55200

9 55200

10 55200

11 55200

12 55200

13 55200

14 55200

15 55200

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

Cost of the Equipment 690000

Cash flows at 11%

0 75900

1 75900

2 75900

3 75900

4 75900

5 75900

6 75900

7 75900

8 75900

9 75900

10 75900

11 75900

12 75900

13 75900

14 75900

15 75900

Cost of the Equipment 690000

Cash flows at 11%

0 75900

1 75900

2 75900

3 75900

4 75900

5 75900

6 75900

7 75900

8 75900

9 75900

10 75900

11 75900

12 75900

13 75900

14 75900

15 75900

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

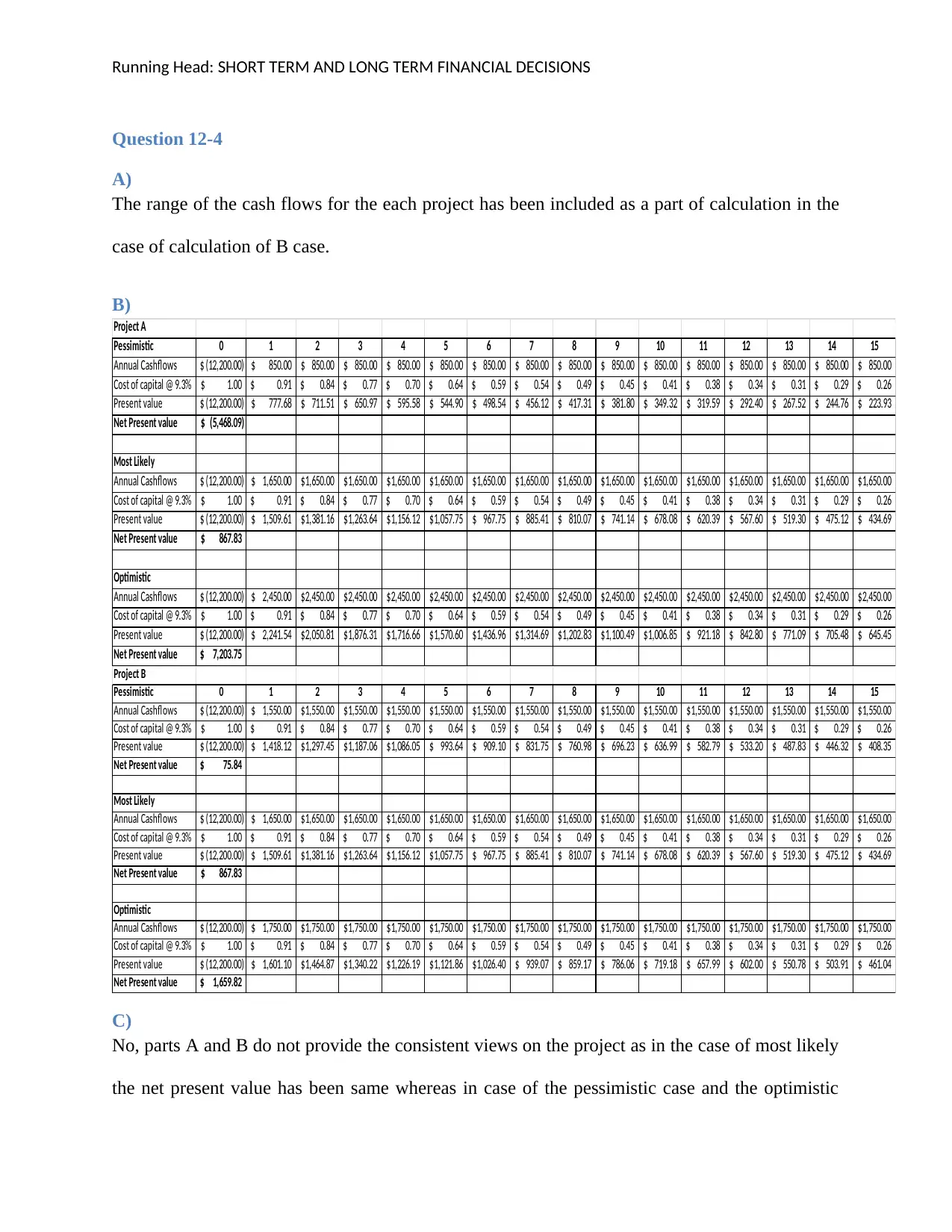

Question 12-4

A)

The range of the cash flows for the each project has been included as a part of calculation in the

case of calculation of B case.

B)

Project A

Pessimistic 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Annual Cashflows (12,200.00)$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 777.68$ 711.51$ 650.97$ 595.58$ 544.90$ 498.54$ 456.12$ 417.31$ 381.80$ 349.32$ 319.59$ 292.40$ 267.52$ 244.76$ 223.93$

Net Present value (5,468.09)$

Most Likely

Annual Cashflows (12,200.00)$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,509.61$ 1,381.16$ 1,263.64$ 1,156.12$ 1,057.75$ 967.75$ 885.41$ 810.07$ 741.14$ 678.08$ 620.39$ 567.60$ 519.30$ 475.12$ 434.69$

Net Present value 867.83$

Optimistic

Annual Cashflows (12,200.00)$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 2,241.54$ 2,050.81$ 1,876.31$ 1,716.66$ 1,570.60$ 1,436.96$ 1,314.69$ 1,202.83$ 1,100.49$ 1,006.85$ 921.18$ 842.80$ 771.09$ 705.48$ 645.45$

Net Present value 7,203.75$

Project B

Pessimistic 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Annual Cashflows (12,200.00)$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,418.12$ 1,297.45$ 1,187.06$ 1,086.05$ 993.64$ 909.10$ 831.75$ 760.98$ 696.23$ 636.99$ 582.79$ 533.20$ 487.83$ 446.32$ 408.35$

Net Present value 75.84$

Most Likely

Annual Cashflows (12,200.00)$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,509.61$ 1,381.16$ 1,263.64$ 1,156.12$ 1,057.75$ 967.75$ 885.41$ 810.07$ 741.14$ 678.08$ 620.39$ 567.60$ 519.30$ 475.12$ 434.69$

Net Present value 867.83$

Optimistic

Annual Cashflows (12,200.00)$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,601.10$ 1,464.87$ 1,340.22$ 1,226.19$ 1,121.86$ 1,026.40$ 939.07$ 859.17$ 786.06$ 719.18$ 657.99$ 602.00$ 550.78$ 503.91$ 461.04$

Net Present value 1,659.82$

C)

No, parts A and B do not provide the consistent views on the project as in the case of most likely

the net present value has been same whereas in case of the pessimistic case and the optimistic

Question 12-4

A)

The range of the cash flows for the each project has been included as a part of calculation in the

case of calculation of B case.

B)

Project A

Pessimistic 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Annual Cashflows (12,200.00)$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$ 850.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 777.68$ 711.51$ 650.97$ 595.58$ 544.90$ 498.54$ 456.12$ 417.31$ 381.80$ 349.32$ 319.59$ 292.40$ 267.52$ 244.76$ 223.93$

Net Present value (5,468.09)$

Most Likely

Annual Cashflows (12,200.00)$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,509.61$ 1,381.16$ 1,263.64$ 1,156.12$ 1,057.75$ 967.75$ 885.41$ 810.07$ 741.14$ 678.08$ 620.39$ 567.60$ 519.30$ 475.12$ 434.69$

Net Present value 867.83$

Optimistic

Annual Cashflows (12,200.00)$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$ 2,450.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 2,241.54$ 2,050.81$ 1,876.31$ 1,716.66$ 1,570.60$ 1,436.96$ 1,314.69$ 1,202.83$ 1,100.49$ 1,006.85$ 921.18$ 842.80$ 771.09$ 705.48$ 645.45$

Net Present value 7,203.75$

Project B

Pessimistic 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Annual Cashflows (12,200.00)$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$ 1,550.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,418.12$ 1,297.45$ 1,187.06$ 1,086.05$ 993.64$ 909.10$ 831.75$ 760.98$ 696.23$ 636.99$ 582.79$ 533.20$ 487.83$ 446.32$ 408.35$

Net Present value 75.84$

Most Likely

Annual Cashflows (12,200.00)$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$ 1,650.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,509.61$ 1,381.16$ 1,263.64$ 1,156.12$ 1,057.75$ 967.75$ 885.41$ 810.07$ 741.14$ 678.08$ 620.39$ 567.60$ 519.30$ 475.12$ 434.69$

Net Present value 867.83$

Optimistic

Annual Cashflows (12,200.00)$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$ 1,750.00$

Cost of capital @ 9.3% 1.00$ 0.91$ 0.84$ 0.77$ 0.70$ 0.64$ 0.59$ 0.54$ 0.49$ 0.45$ 0.41$ 0.38$ 0.34$ 0.31$ 0.29$ 0.26$

Present value (12,200.00)$ 1,601.10$ 1,464.87$ 1,340.22$ 1,226.19$ 1,121.86$ 1,026.40$ 939.07$ 859.17$ 786.06$ 719.18$ 657.99$ 602.00$ 550.78$ 503.91$ 461.04$

Net Present value 1,659.82$

C)

No, parts A and B do not provide the consistent views on the project as in the case of most likely

the net present value has been same whereas in case of the pessimistic case and the optimistic

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

case the net present value have fluctuated. In case of Project A, (5468.09) whereas in case of

project B the same tends to be positive at 75.84 (DeFusco, et al 2015).

D)

The project B is recommended as the net present value in all the cases is positive with respect to

project B. Further, the net present value is the different between the present values of the cash

inflows as well as cash outflows. This also shows that the potential growth will be scored in case

of the project B.

case the net present value have fluctuated. In case of Project A, (5468.09) whereas in case of

project B the same tends to be positive at 75.84 (DeFusco, et al 2015).

D)

The project B is recommended as the net present value in all the cases is positive with respect to

project B. Further, the net present value is the different between the present values of the cash

inflows as well as cash outflows. This also shows that the potential growth will be scored in case

of the project B.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: SHORT TERM AND LONG TERM FINANCIAL DECISIONS

References

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Runkle, D.E. and Anson, M.J., 2015. Quantitative

investment analysis. John Wiley & Sons.

Lam, A.P., 2016. Finance-Economic Analysis and Evaluation of Oil and Gas Industry: A Case

Study of X Oil Field in Nam Con Son Basin (Doctoral dissertation).

Newcomer, K.E., Hatry, H.P. and Wholey, J.S., 2015. Cost-effectiveness and cost-benefit

analysis. Handbook of practical program evaluation, p.636.

Ng, E.H. and Beruvides, M.G., 2015. Multiple internal rate of return revisited: frequency of

occurrences. The Engineering Economist, 60(1), pp.75-87.

References

DeFusco, R.A., McLeavey, D.W., Pinto, J.E., Runkle, D.E. and Anson, M.J., 2015. Quantitative

investment analysis. John Wiley & Sons.

Lam, A.P., 2016. Finance-Economic Analysis and Evaluation of Oil and Gas Industry: A Case

Study of X Oil Field in Nam Con Son Basin (Doctoral dissertation).

Newcomer, K.E., Hatry, H.P. and Wholey, J.S., 2015. Cost-effectiveness and cost-benefit

analysis. Handbook of practical program evaluation, p.636.

Ng, E.H. and Beruvides, M.G., 2015. Multiple internal rate of return revisited: frequency of

occurrences. The Engineering Economist, 60(1), pp.75-87.

1 out of 11

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.