Analysis of Budgeting and Costing: Management Accounting Report

VerifiedAdded on 2020/01/23

|20

|4773

|101

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles, specifically focusing on budgeting, cost classification, and variance analysis within the context of a cloth manufacturing retailer, Smart Looks. The report begins by exploring different types of cost behavior, categorizing costs as fixed, variable, and semi-variable, and providing examples. It then delves into other cost classifications, including direct and indirect costs, as well as factory, administrative, and marketing costs. The report includes calculations of total and unit costs at different production levels, followed by an analysis of cost data and graphical representations of cost behavior. Furthermore, the report examines inventory valuation methods such as FIFO, LIFO, and average cost methods. It also identifies key performance indicators (KPIs) for measuring customer experience, supplier quality, operational efficiency, and cost reduction. Finally, the report discusses strategies for cost reduction, value enhancement, and quality improvement, along with an overview of different budgeting methods and their purposes.

MANAGEMENT

ACCOUNTING

1

ACCOUNTING

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

INTRODUCTION

In the modern era, top level manager plays a crucial role in the business growth and survival

as they make plans, strategies and policies for the successful running. Smart Looks is a cloth

manufacturing retailer that produce variety of clothing goods to satisfy their clients. The present

project report targeted at examining the significance of various budgeting planning and cost

classification with the practical illustrations for aids in decision-making. Moreover, the report will

also analyze the usefulness of variance analysis for taking corrective measures for cost-

minimization and revenue maximization to attain defined targets.

TASK 1

Q.1.

(A) Different types of cost behaviour

Cost accounting is a major field or area of accounting that measures, examine and inspect

the production cost, so that, cost can be computed accurately which aids in rationalized business

decisions (Angelakis, Theriou and Floropoulos, 2010). In the given scenario, it has been stated that

Smart Looks is a cloth manufacturing retailer that produce variety of clothing goods to satisfy their

clients. Cost behaviour indicates that whether particular expenditures will changes with the change

in the production level or not. On the basis of it, cost has been segregated in the following

categories that are enumerated underneath:

As its name, these expenses do not alter at the higher and lower production level and incur

even at nil production level also. In other words, it can be stated that all those expenditures which

remains constant or fixed at distinctive output volume are known as fixed cost i.e. rent.

Variable cost: Unlike the above, expenditures that undertook proportionate change with the

higher and lower production level in the same direction falls in this category. Being a cloth retailer

company, Smart Looks has to buy more quantity of material for exceeding their overall production

units which shows that material is a variable cost (Schaltegger, Gibassier and Zvezdov, 2013).

Semi-variable cost: This also can be referred as mixed costs which comprises both the fixed

& variable elements. To a fixed level, it remains constant and thereafter it changes in the direction

of change in total volume of production. High-low method is often used by the firms to segregate

mixed cost into fixed and variable (Burritt and Schaltegger, 2010).

Expenditures Type of cost

Material for clothes Variable costs

3

In the modern era, top level manager plays a crucial role in the business growth and survival

as they make plans, strategies and policies for the successful running. Smart Looks is a cloth

manufacturing retailer that produce variety of clothing goods to satisfy their clients. The present

project report targeted at examining the significance of various budgeting planning and cost

classification with the practical illustrations for aids in decision-making. Moreover, the report will

also analyze the usefulness of variance analysis for taking corrective measures for cost-

minimization and revenue maximization to attain defined targets.

TASK 1

Q.1.

(A) Different types of cost behaviour

Cost accounting is a major field or area of accounting that measures, examine and inspect

the production cost, so that, cost can be computed accurately which aids in rationalized business

decisions (Angelakis, Theriou and Floropoulos, 2010). In the given scenario, it has been stated that

Smart Looks is a cloth manufacturing retailer that produce variety of clothing goods to satisfy their

clients. Cost behaviour indicates that whether particular expenditures will changes with the change

in the production level or not. On the basis of it, cost has been segregated in the following

categories that are enumerated underneath:

As its name, these expenses do not alter at the higher and lower production level and incur

even at nil production level also. In other words, it can be stated that all those expenditures which

remains constant or fixed at distinctive output volume are known as fixed cost i.e. rent.

Variable cost: Unlike the above, expenditures that undertook proportionate change with the

higher and lower production level in the same direction falls in this category. Being a cloth retailer

company, Smart Looks has to buy more quantity of material for exceeding their overall production

units which shows that material is a variable cost (Schaltegger, Gibassier and Zvezdov, 2013).

Semi-variable cost: This also can be referred as mixed costs which comprises both the fixed

& variable elements. To a fixed level, it remains constant and thereafter it changes in the direction

of change in total volume of production. High-low method is often used by the firms to segregate

mixed cost into fixed and variable (Burritt and Schaltegger, 2010).

Expenditures Type of cost

Material for clothes Variable costs

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

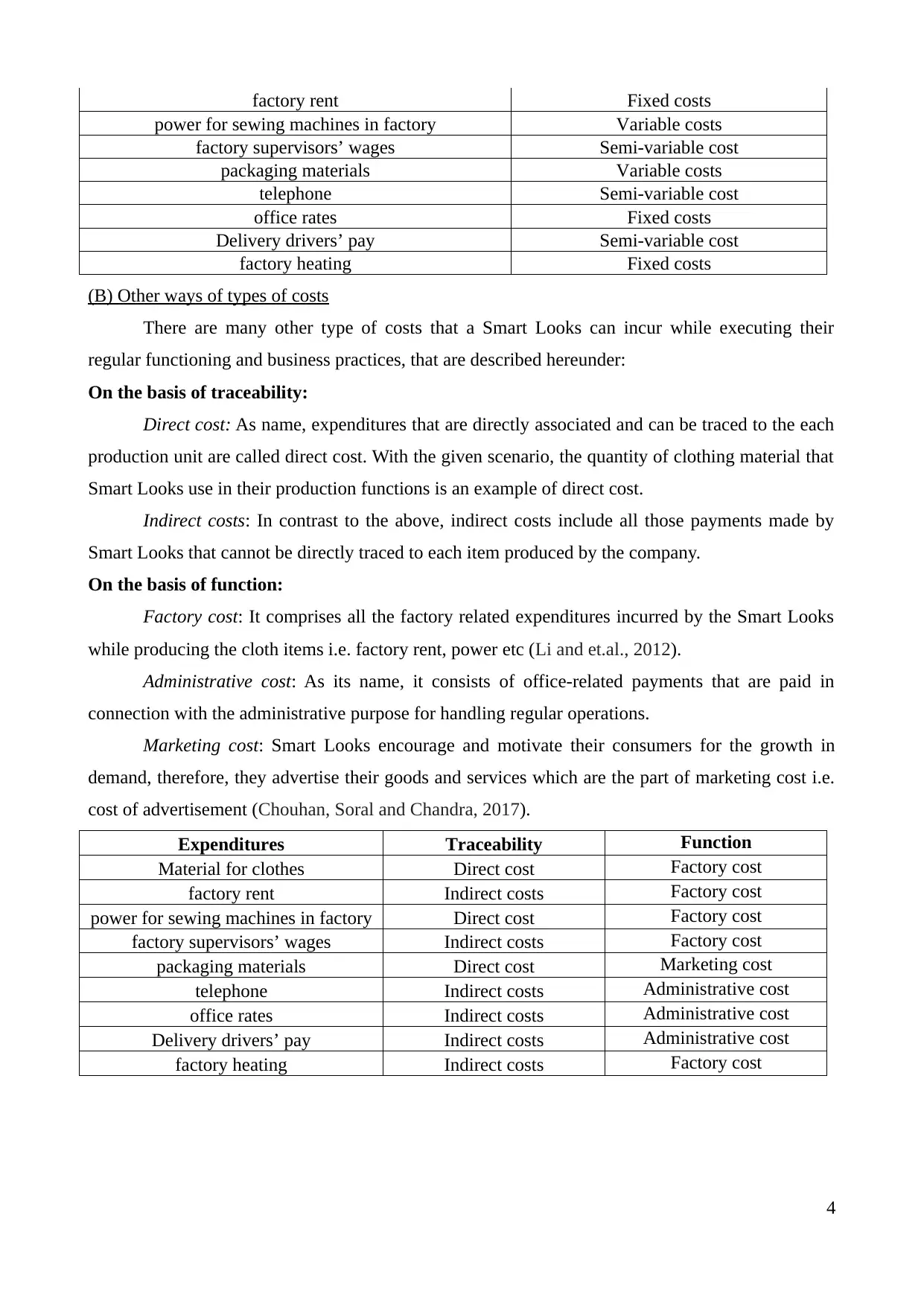

factory rent Fixed costs

power for sewing machines in factory Variable costs

factory supervisors’ wages Semi-variable cost

packaging materials Variable costs

telephone Semi-variable cost

office rates Fixed costs

Delivery drivers’ pay Semi-variable cost

factory heating Fixed costs

(B) Other ways of types of costs

There are many other type of costs that a Smart Looks can incur while executing their

regular functioning and business practices, that are described hereunder:

On the basis of traceability:

Direct cost: As name, expenditures that are directly associated and can be traced to the each

production unit are called direct cost. With the given scenario, the quantity of clothing material that

Smart Looks use in their production functions is an example of direct cost.

Indirect costs: In contrast to the above, indirect costs include all those payments made by

Smart Looks that cannot be directly traced to each item produced by the company.

On the basis of function:

Factory cost: It comprises all the factory related expenditures incurred by the Smart Looks

while producing the cloth items i.e. factory rent, power etc (Li and et.al., 2012).

Administrative cost: As its name, it consists of office-related payments that are paid in

connection with the administrative purpose for handling regular operations.

Marketing cost: Smart Looks encourage and motivate their consumers for the growth in

demand, therefore, they advertise their goods and services which are the part of marketing cost i.e.

cost of advertisement (Chouhan, Soral and Chandra, 2017).

Expenditures Traceability Function

Material for clothes Direct cost Factory cost

factory rent Indirect costs Factory cost

power for sewing machines in factory Direct cost Factory cost

factory supervisors’ wages Indirect costs Factory cost

packaging materials Direct cost Marketing cost

telephone Indirect costs Administrative cost

office rates Indirect costs Administrative cost

Delivery drivers’ pay Indirect costs Administrative cost

factory heating Indirect costs Factory cost

4

power for sewing machines in factory Variable costs

factory supervisors’ wages Semi-variable cost

packaging materials Variable costs

telephone Semi-variable cost

office rates Fixed costs

Delivery drivers’ pay Semi-variable cost

factory heating Fixed costs

(B) Other ways of types of costs

There are many other type of costs that a Smart Looks can incur while executing their

regular functioning and business practices, that are described hereunder:

On the basis of traceability:

Direct cost: As name, expenditures that are directly associated and can be traced to the each

production unit are called direct cost. With the given scenario, the quantity of clothing material that

Smart Looks use in their production functions is an example of direct cost.

Indirect costs: In contrast to the above, indirect costs include all those payments made by

Smart Looks that cannot be directly traced to each item produced by the company.

On the basis of function:

Factory cost: It comprises all the factory related expenditures incurred by the Smart Looks

while producing the cloth items i.e. factory rent, power etc (Li and et.al., 2012).

Administrative cost: As its name, it consists of office-related payments that are paid in

connection with the administrative purpose for handling regular operations.

Marketing cost: Smart Looks encourage and motivate their consumers for the growth in

demand, therefore, they advertise their goods and services which are the part of marketing cost i.e.

cost of advertisement (Chouhan, Soral and Chandra, 2017).

Expenditures Traceability Function

Material for clothes Direct cost Factory cost

factory rent Indirect costs Factory cost

power for sewing machines in factory Direct cost Factory cost

factory supervisors’ wages Indirect costs Factory cost

packaging materials Direct cost Marketing cost

telephone Indirect costs Administrative cost

office rates Indirect costs Administrative cost

Delivery drivers’ pay Indirect costs Administrative cost

factory heating Indirect costs Factory cost

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Q.2.

(A) Calculation of total cost and unit cost

Total cost (TC) refers to the sum of total payments made by the Smart Looks for production

of a defined quantity of clothing goods (Pitkänen and Lukka, 2011). It can be computed using

following equation, provided below:

TC = TFC + TVC

TFC: Total fixed cost

TVC: Total variable cost

However, unit cost is the cost incurred on each item or unit produced by the Smart Looks,

computed through following formula:

Unit cost (UC): Total cost of production/units manufactured

Particulars 15000 units 20000 units 25000 units

Variable costs

Material 75000 100000 125000

Labor 90000 120000 150000

Total variable cost 165000 220000 275000

Total fixed cost 50000 50000 50000

Total costs (TC) 215000 270000 325000

Calculation of unit cost

Total costs (TC) 215000 270000 325000

Number of units 15000 20000 25000

Unit cost 14.33 13.50 13.00

5

(A) Calculation of total cost and unit cost

Total cost (TC) refers to the sum of total payments made by the Smart Looks for production

of a defined quantity of clothing goods (Pitkänen and Lukka, 2011). It can be computed using

following equation, provided below:

TC = TFC + TVC

TFC: Total fixed cost

TVC: Total variable cost

However, unit cost is the cost incurred on each item or unit produced by the Smart Looks,

computed through following formula:

Unit cost (UC): Total cost of production/units manufactured

Particulars 15000 units 20000 units 25000 units

Variable costs

Material 75000 100000 125000

Labor 90000 120000 150000

Total variable cost 165000 220000 275000

Total fixed cost 50000 50000 50000

Total costs (TC) 215000 270000 325000

Calculation of unit cost

Total costs (TC) 215000 270000 325000

Number of units 15000 20000 25000

Unit cost 14.33 13.50 13.00

5

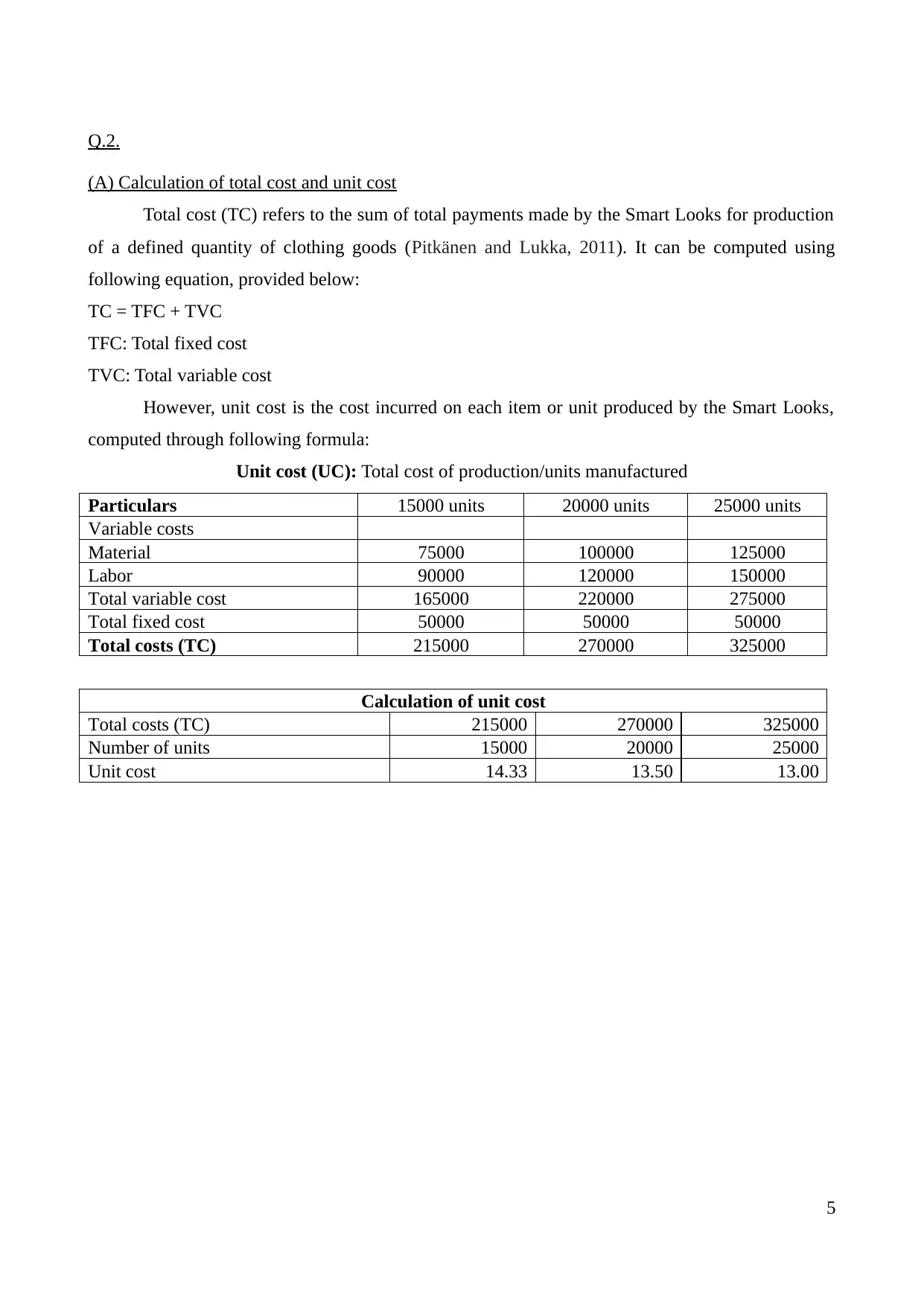

(B) Analysis of cost data

Interpretations: From the graph, it can be visualized that with the higher the production

units, although per unit material and labor cost remains constant still TVC goes increase from

165,000 to 220,000 and 275,000. However, TFC is same for all the production level to 50,000. With

the rising production output, TC goes increase from 215,000 to 270,000 & 325,000 respectively.

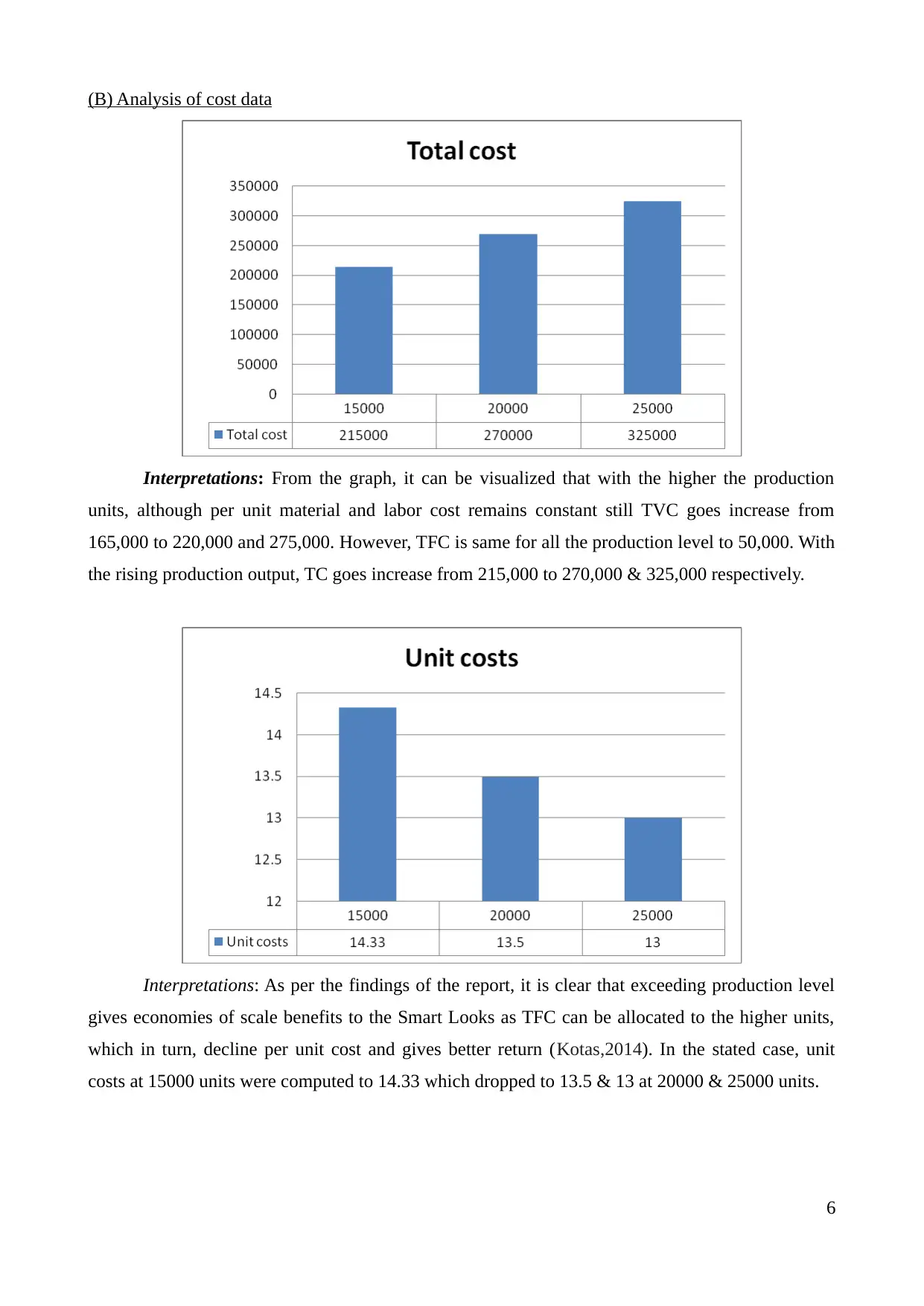

Interpretations: As per the findings of the report, it is clear that exceeding production level

gives economies of scale benefits to the Smart Looks as TFC can be allocated to the higher units,

which in turn, decline per unit cost and gives better return (Kotas,2014). In the stated case, unit

costs at 15000 units were computed to 14.33 which dropped to 13.5 & 13 at 20000 & 25000 units.

6

Interpretations: From the graph, it can be visualized that with the higher the production

units, although per unit material and labor cost remains constant still TVC goes increase from

165,000 to 220,000 and 275,000. However, TFC is same for all the production level to 50,000. With

the rising production output, TC goes increase from 215,000 to 270,000 & 325,000 respectively.

Interpretations: As per the findings of the report, it is clear that exceeding production level

gives economies of scale benefits to the Smart Looks as TFC can be allocated to the higher units,

which in turn, decline per unit cost and gives better return (Kotas,2014). In the stated case, unit

costs at 15000 units were computed to 14.33 which dropped to 13.5 & 13 at 20000 & 25000 units.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

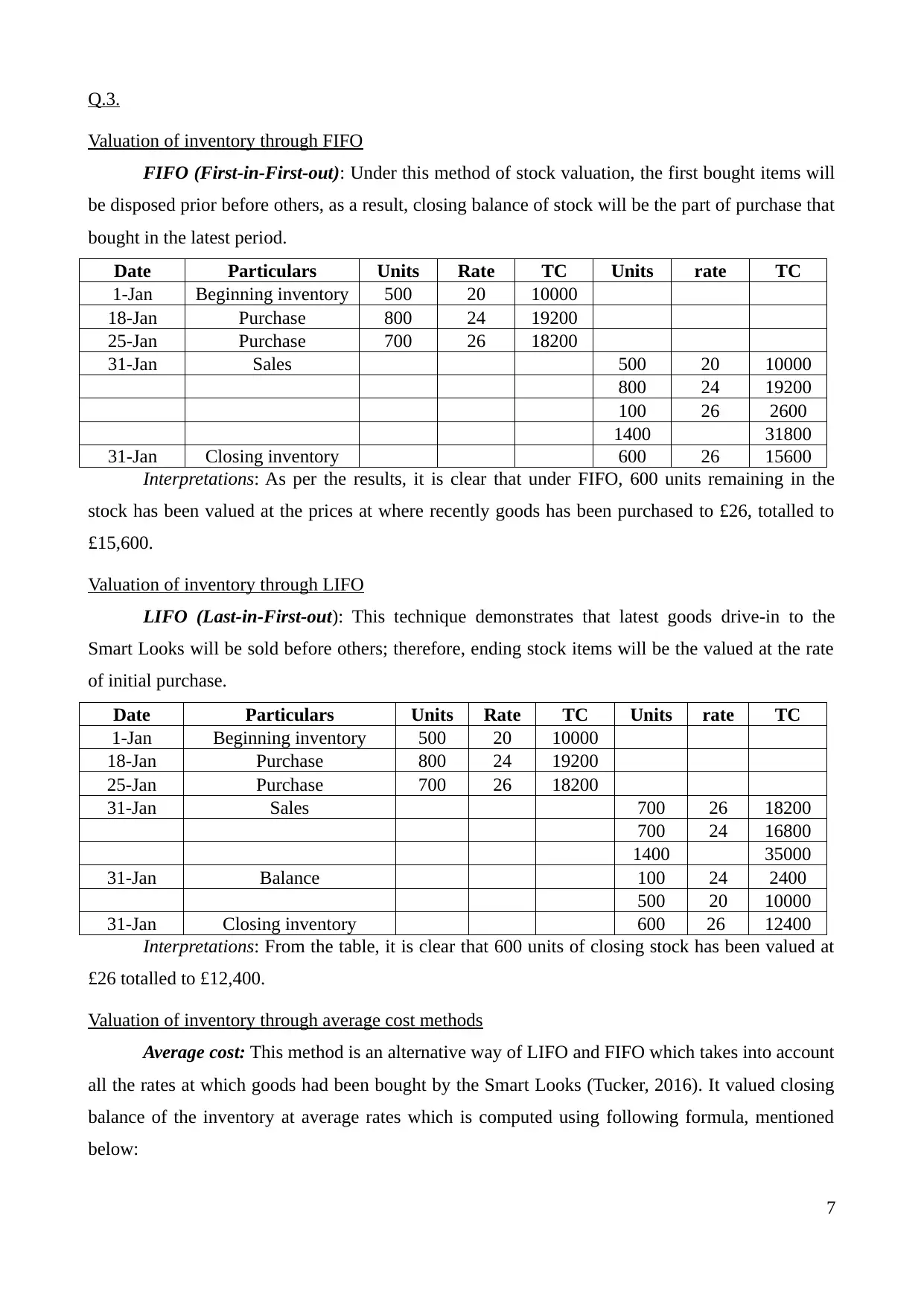

Q.3.

Valuation of inventory through FIFO

FIFO (First-in-First-out): Under this method of stock valuation, the first bought items will

be disposed prior before others, as a result, closing balance of stock will be the part of purchase that

bought in the latest period.

Date Particulars Units Rate TC Units rate TC

1-Jan Beginning inventory 500 20 10000

18-Jan Purchase 800 24 19200

25-Jan Purchase 700 26 18200

31-Jan Sales 500 20 10000

800 24 19200

100 26 2600

1400 31800

31-Jan Closing inventory 600 26 15600

Interpretations: As per the results, it is clear that under FIFO, 600 units remaining in the

stock has been valued at the prices at where recently goods has been purchased to £26, totalled to

£15,600.

Valuation of inventory through LIFO

LIFO (Last-in-First-out): This technique demonstrates that latest goods drive-in to the

Smart Looks will be sold before others; therefore, ending stock items will be the valued at the rate

of initial purchase.

Date Particulars Units Rate TC Units rate TC

1-Jan Beginning inventory 500 20 10000

18-Jan Purchase 800 24 19200

25-Jan Purchase 700 26 18200

31-Jan Sales 700 26 18200

700 24 16800

1400 35000

31-Jan Balance 100 24 2400

500 20 10000

31-Jan Closing inventory 600 26 12400

Interpretations: From the table, it is clear that 600 units of closing stock has been valued at

£26 totalled to £12,400.

Valuation of inventory through average cost methods

Average cost: This method is an alternative way of LIFO and FIFO which takes into account

all the rates at which goods had been bought by the Smart Looks (Tucker, 2016). It valued closing

balance of the inventory at average rates which is computed using following formula, mentioned

below:

7

Valuation of inventory through FIFO

FIFO (First-in-First-out): Under this method of stock valuation, the first bought items will

be disposed prior before others, as a result, closing balance of stock will be the part of purchase that

bought in the latest period.

Date Particulars Units Rate TC Units rate TC

1-Jan Beginning inventory 500 20 10000

18-Jan Purchase 800 24 19200

25-Jan Purchase 700 26 18200

31-Jan Sales 500 20 10000

800 24 19200

100 26 2600

1400 31800

31-Jan Closing inventory 600 26 15600

Interpretations: As per the results, it is clear that under FIFO, 600 units remaining in the

stock has been valued at the prices at where recently goods has been purchased to £26, totalled to

£15,600.

Valuation of inventory through LIFO

LIFO (Last-in-First-out): This technique demonstrates that latest goods drive-in to the

Smart Looks will be sold before others; therefore, ending stock items will be the valued at the rate

of initial purchase.

Date Particulars Units Rate TC Units rate TC

1-Jan Beginning inventory 500 20 10000

18-Jan Purchase 800 24 19200

25-Jan Purchase 700 26 18200

31-Jan Sales 700 26 18200

700 24 16800

1400 35000

31-Jan Balance 100 24 2400

500 20 10000

31-Jan Closing inventory 600 26 12400

Interpretations: From the table, it is clear that 600 units of closing stock has been valued at

£26 totalled to £12,400.

Valuation of inventory through average cost methods

Average cost: This method is an alternative way of LIFO and FIFO which takes into account

all the rates at which goods had been bought by the Smart Looks (Tucker, 2016). It valued closing

balance of the inventory at average rates which is computed using following formula, mentioned

below:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

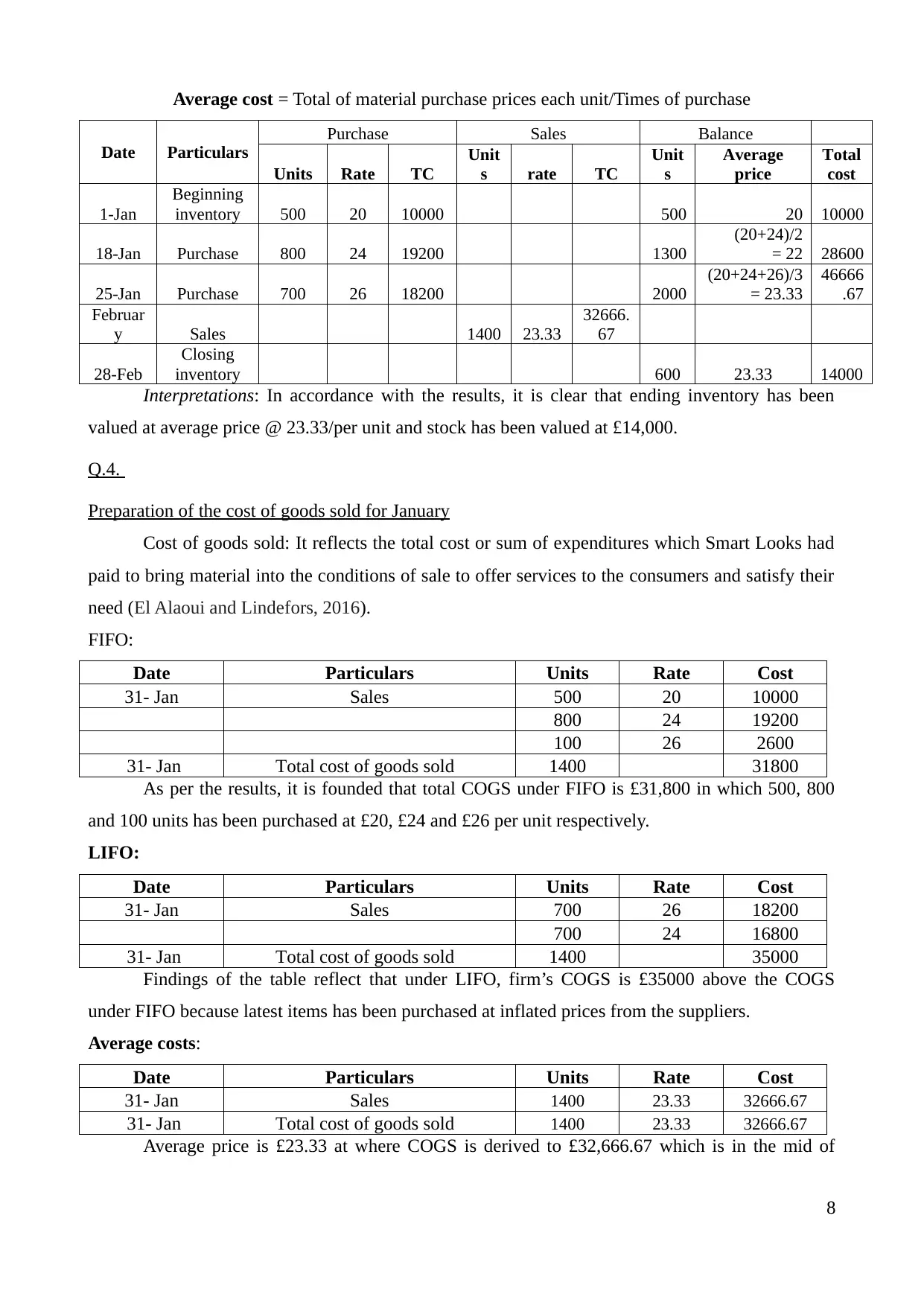

Average cost = Total of material purchase prices each unit/Times of purchase

Date Particulars

Purchase Sales Balance

Units Rate TC

Unit

s rate TC

Unit

s

Average

price

Total

cost

1-Jan

Beginning

inventory 500 20 10000 500 20 10000

18-Jan Purchase 800 24 19200 1300

(20+24)/2

= 22 28600

25-Jan Purchase 700 26 18200 2000

(20+24+26)/3

= 23.33

46666

.67

Februar

y Sales 1400 23.33

32666.

67

28-Feb

Closing

inventory 600 23.33 14000

Interpretations: In accordance with the results, it is clear that ending inventory has been

valued at average price @ 23.33/per unit and stock has been valued at £14,000.

Q.4.

Preparation of the cost of goods sold for January

Cost of goods sold: It reflects the total cost or sum of expenditures which Smart Looks had

paid to bring material into the conditions of sale to offer services to the consumers and satisfy their

need (El Alaoui and Lindefors, 2016).

FIFO:

Date Particulars Units Rate Cost

31- Jan Sales 500 20 10000

800 24 19200

100 26 2600

31- Jan Total cost of goods sold 1400 31800

As per the results, it is founded that total COGS under FIFO is £31,800 in which 500, 800

and 100 units has been purchased at £20, £24 and £26 per unit respectively.

LIFO:

Date Particulars Units Rate Cost

31- Jan Sales 700 26 18200

700 24 16800

31- Jan Total cost of goods sold 1400 35000

Findings of the table reflect that under LIFO, firm’s COGS is £35000 above the COGS

under FIFO because latest items has been purchased at inflated prices from the suppliers.

Average costs:

Date Particulars Units Rate Cost

31- Jan Sales 1400 23.33 32666.67

31- Jan Total cost of goods sold 1400 23.33 32666.67

Average price is £23.33 at where COGS is derived to £32,666.67 which is in the mid of

8

Date Particulars

Purchase Sales Balance

Units Rate TC

Unit

s rate TC

Unit

s

Average

price

Total

cost

1-Jan

Beginning

inventory 500 20 10000 500 20 10000

18-Jan Purchase 800 24 19200 1300

(20+24)/2

= 22 28600

25-Jan Purchase 700 26 18200 2000

(20+24+26)/3

= 23.33

46666

.67

Februar

y Sales 1400 23.33

32666.

67

28-Feb

Closing

inventory 600 23.33 14000

Interpretations: In accordance with the results, it is clear that ending inventory has been

valued at average price @ 23.33/per unit and stock has been valued at £14,000.

Q.4.

Preparation of the cost of goods sold for January

Cost of goods sold: It reflects the total cost or sum of expenditures which Smart Looks had

paid to bring material into the conditions of sale to offer services to the consumers and satisfy their

need (El Alaoui and Lindefors, 2016).

FIFO:

Date Particulars Units Rate Cost

31- Jan Sales 500 20 10000

800 24 19200

100 26 2600

31- Jan Total cost of goods sold 1400 31800

As per the results, it is founded that total COGS under FIFO is £31,800 in which 500, 800

and 100 units has been purchased at £20, £24 and £26 per unit respectively.

LIFO:

Date Particulars Units Rate Cost

31- Jan Sales 700 26 18200

700 24 16800

31- Jan Total cost of goods sold 1400 35000

Findings of the table reflect that under LIFO, firm’s COGS is £35000 above the COGS

under FIFO because latest items has been purchased at inflated prices from the suppliers.

Average costs:

Date Particulars Units Rate Cost

31- Jan Sales 1400 23.33 32666.67

31- Jan Total cost of goods sold 1400 23.33 32666.67

Average price is £23.33 at where COGS is derived to £32,666.67 which is in the mid of

8

LIFO and FIFO because it considered all the prices by taking into account average rates.

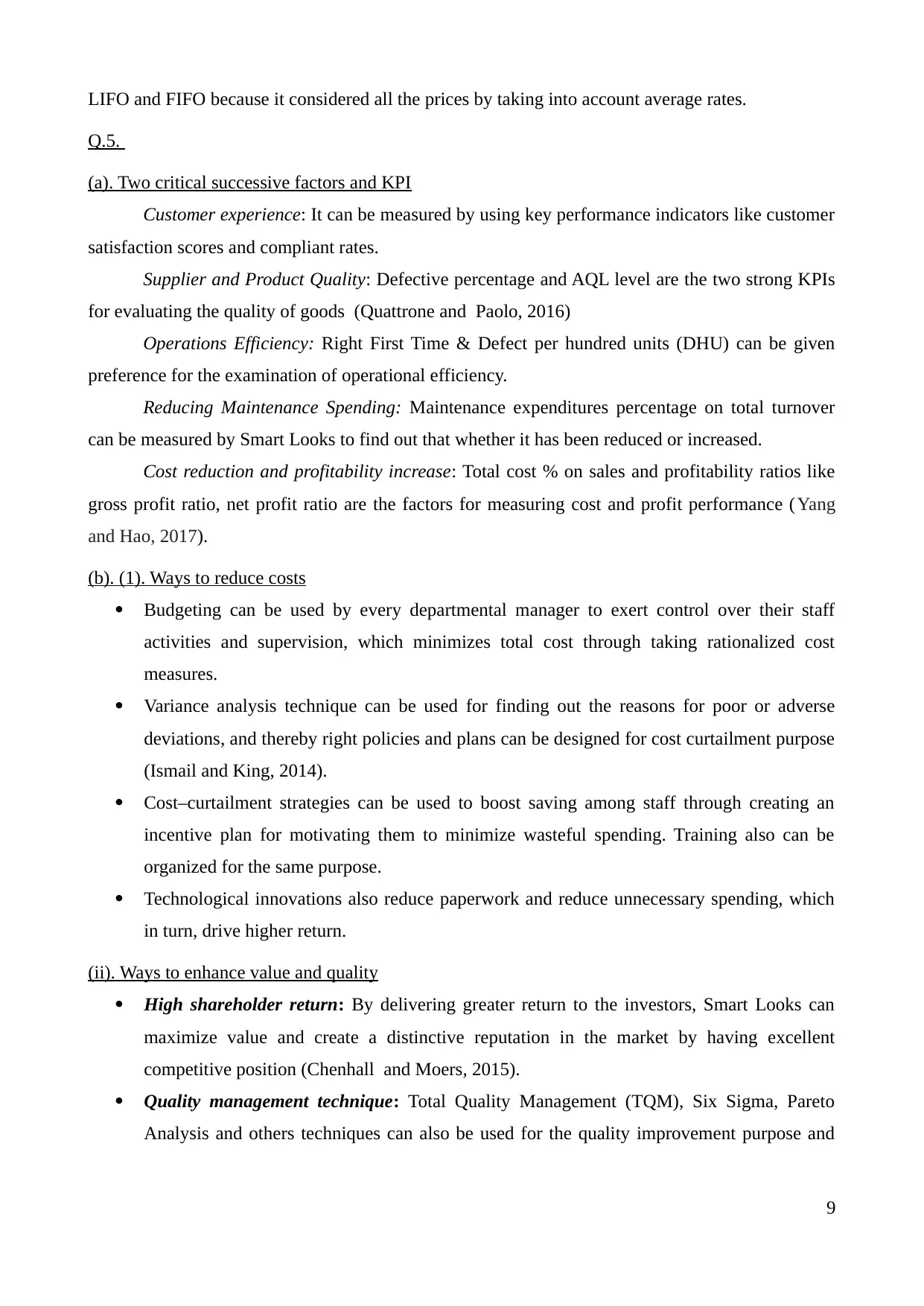

Q.5.

(a). Two critical successive factors and KPI

Customer experience: It can be measured by using key performance indicators like customer

satisfaction scores and compliant rates.

Supplier and Product Quality: Defective percentage and AQL level are the two strong KPIs

for evaluating the quality of goods (Quattrone and Paolo, 2016)

Operations Efficiency: Right First Time & Defect per hundred units (DHU) can be given

preference for the examination of operational efficiency.

Reducing Maintenance Spending: Maintenance expenditures percentage on total turnover

can be measured by Smart Looks to find out that whether it has been reduced or increased.

Cost reduction and profitability increase: Total cost % on sales and profitability ratios like

gross profit ratio, net profit ratio are the factors for measuring cost and profit performance (Yang

and Hao, 2017).

(b). (1). Ways to reduce costs

Budgeting can be used by every departmental manager to exert control over their staff

activities and supervision, which minimizes total cost through taking rationalized cost

measures.

Variance analysis technique can be used for finding out the reasons for poor or adverse

deviations, and thereby right policies and plans can be designed for cost curtailment purpose

(Ismail and King, 2014).

Cost–curtailment strategies can be used to boost saving among staff through creating an

incentive plan for motivating them to minimize wasteful spending. Training also can be

organized for the same purpose.

Technological innovations also reduce paperwork and reduce unnecessary spending, which

in turn, drive higher return.

(ii). Ways to enhance value and quality

High shareholder return: By delivering greater return to the investors, Smart Looks can

maximize value and create a distinctive reputation in the market by having excellent

competitive position (Chenhall and Moers, 2015).

Quality management technique: Total Quality Management (TQM), Six Sigma, Pareto

Analysis and others techniques can also be used for the quality improvement purpose and

9

Q.5.

(a). Two critical successive factors and KPI

Customer experience: It can be measured by using key performance indicators like customer

satisfaction scores and compliant rates.

Supplier and Product Quality: Defective percentage and AQL level are the two strong KPIs

for evaluating the quality of goods (Quattrone and Paolo, 2016)

Operations Efficiency: Right First Time & Defect per hundred units (DHU) can be given

preference for the examination of operational efficiency.

Reducing Maintenance Spending: Maintenance expenditures percentage on total turnover

can be measured by Smart Looks to find out that whether it has been reduced or increased.

Cost reduction and profitability increase: Total cost % on sales and profitability ratios like

gross profit ratio, net profit ratio are the factors for measuring cost and profit performance (Yang

and Hao, 2017).

(b). (1). Ways to reduce costs

Budgeting can be used by every departmental manager to exert control over their staff

activities and supervision, which minimizes total cost through taking rationalized cost

measures.

Variance analysis technique can be used for finding out the reasons for poor or adverse

deviations, and thereby right policies and plans can be designed for cost curtailment purpose

(Ismail and King, 2014).

Cost–curtailment strategies can be used to boost saving among staff through creating an

incentive plan for motivating them to minimize wasteful spending. Training also can be

organized for the same purpose.

Technological innovations also reduce paperwork and reduce unnecessary spending, which

in turn, drive higher return.

(ii). Ways to enhance value and quality

High shareholder return: By delivering greater return to the investors, Smart Looks can

maximize value and create a distinctive reputation in the market by having excellent

competitive position (Chenhall and Moers, 2015).

Quality management technique: Total Quality Management (TQM), Six Sigma, Pareto

Analysis and others techniques can also be used for the quality improvement purpose and

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

exceeding their consumer satisfaction level.

Customer satisfaction: Great quality products in different range exactly as per the user

specification exceed satisfaction level and strengthen competitiveness of the business.

Brand value: Exceptional quality of garments, unique variety goods, and affordable prices

helps to develop an unique reputation and strong corporate image.

Latest and modern technologies: Using advanced machinery, newer and modern

technologies and equipments helps to boost production efficiency and deliver better value.

TASK 2

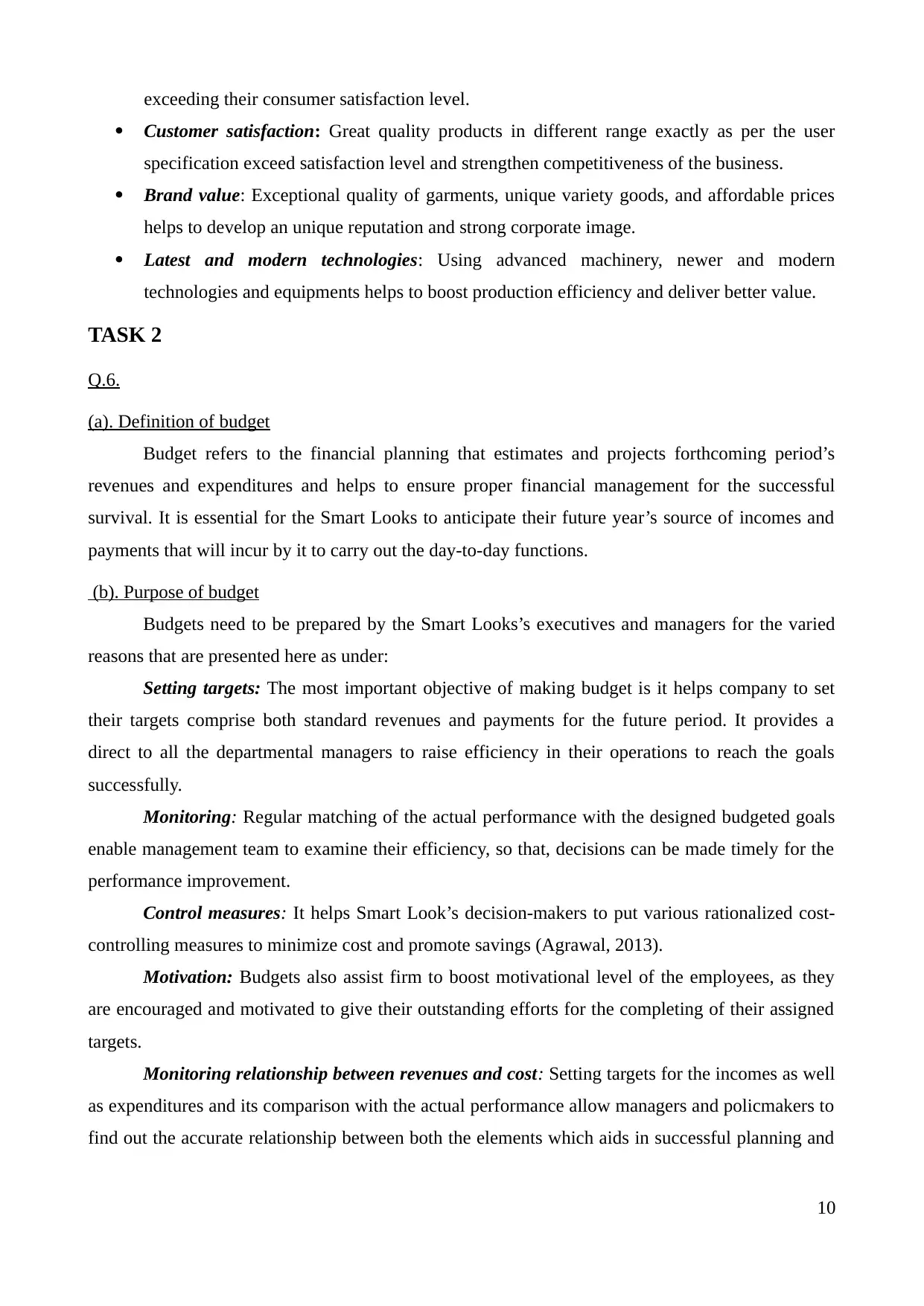

Q.6.

(a). Definition of budget

Budget refers to the financial planning that estimates and projects forthcoming period’s

revenues and expenditures and helps to ensure proper financial management for the successful

survival. It is essential for the Smart Looks to anticipate their future year’s source of incomes and

payments that will incur by it to carry out the day-to-day functions.

(b). Purpose of budget

Budgets need to be prepared by the Smart Looks’s executives and managers for the varied

reasons that are presented here as under:

Setting targets: The most important objective of making budget is it helps company to set

their targets comprise both standard revenues and payments for the future period. It provides a

direct to all the departmental managers to raise efficiency in their operations to reach the goals

successfully.

Monitoring: Regular matching of the actual performance with the designed budgeted goals

enable management team to examine their efficiency, so that, decisions can be made timely for the

performance improvement.

Control measures: It helps Smart Look’s decision-makers to put various rationalized cost-

controlling measures to minimize cost and promote savings (Agrawal, 2013).

Motivation: Budgets also assist firm to boost motivational level of the employees, as they

are encouraged and motivated to give their outstanding efforts for the completing of their assigned

targets.

Monitoring relationship between revenues and cost: Setting targets for the incomes as well

as expenditures and its comparison with the actual performance allow managers and policmakers to

find out the accurate relationship between both the elements which aids in successful planning and

10

Customer satisfaction: Great quality products in different range exactly as per the user

specification exceed satisfaction level and strengthen competitiveness of the business.

Brand value: Exceptional quality of garments, unique variety goods, and affordable prices

helps to develop an unique reputation and strong corporate image.

Latest and modern technologies: Using advanced machinery, newer and modern

technologies and equipments helps to boost production efficiency and deliver better value.

TASK 2

Q.6.

(a). Definition of budget

Budget refers to the financial planning that estimates and projects forthcoming period’s

revenues and expenditures and helps to ensure proper financial management for the successful

survival. It is essential for the Smart Looks to anticipate their future year’s source of incomes and

payments that will incur by it to carry out the day-to-day functions.

(b). Purpose of budget

Budgets need to be prepared by the Smart Looks’s executives and managers for the varied

reasons that are presented here as under:

Setting targets: The most important objective of making budget is it helps company to set

their targets comprise both standard revenues and payments for the future period. It provides a

direct to all the departmental managers to raise efficiency in their operations to reach the goals

successfully.

Monitoring: Regular matching of the actual performance with the designed budgeted goals

enable management team to examine their efficiency, so that, decisions can be made timely for the

performance improvement.

Control measures: It helps Smart Look’s decision-makers to put various rationalized cost-

controlling measures to minimize cost and promote savings (Agrawal, 2013).

Motivation: Budgets also assist firm to boost motivational level of the employees, as they

are encouraged and motivated to give their outstanding efforts for the completing of their assigned

targets.

Monitoring relationship between revenues and cost: Setting targets for the incomes as well

as expenditures and its comparison with the actual performance allow managers and policmakers to

find out the accurate relationship between both the elements which aids in successful planning and

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

decision-making.

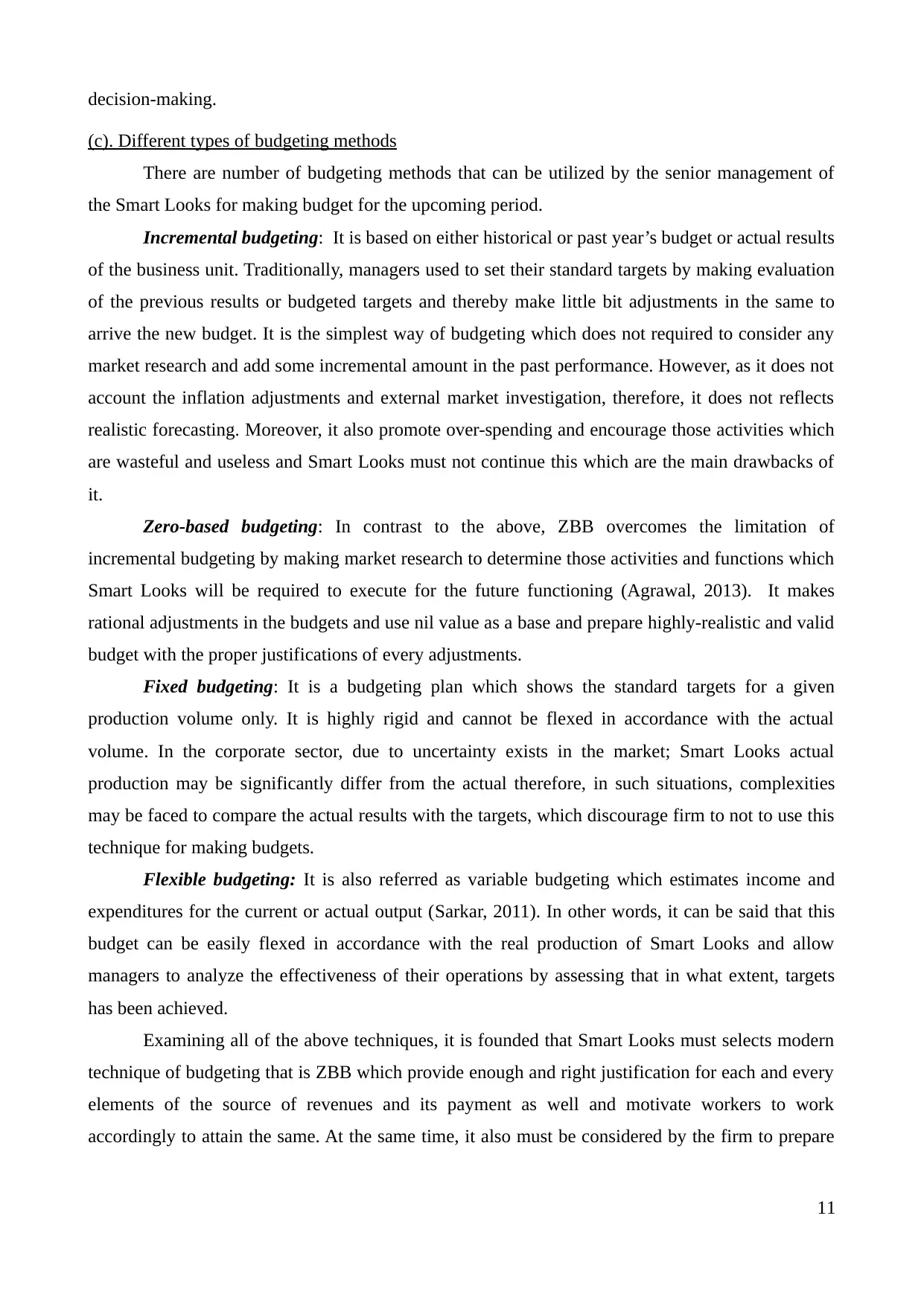

(c). Different types of budgeting methods

There are number of budgeting methods that can be utilized by the senior management of

the Smart Looks for making budget for the upcoming period.

Incremental budgeting: It is based on either historical or past year’s budget or actual results

of the business unit. Traditionally, managers used to set their standard targets by making evaluation

of the previous results or budgeted targets and thereby make little bit adjustments in the same to

arrive the new budget. It is the simplest way of budgeting which does not required to consider any

market research and add some incremental amount in the past performance. However, as it does not

account the inflation adjustments and external market investigation, therefore, it does not reflects

realistic forecasting. Moreover, it also promote over-spending and encourage those activities which

are wasteful and useless and Smart Looks must not continue this which are the main drawbacks of

it.

Zero-based budgeting: In contrast to the above, ZBB overcomes the limitation of

incremental budgeting by making market research to determine those activities and functions which

Smart Looks will be required to execute for the future functioning (Agrawal, 2013). It makes

rational adjustments in the budgets and use nil value as a base and prepare highly-realistic and valid

budget with the proper justifications of every adjustments.

Fixed budgeting: It is a budgeting plan which shows the standard targets for a given

production volume only. It is highly rigid and cannot be flexed in accordance with the actual

volume. In the corporate sector, due to uncertainty exists in the market; Smart Looks actual

production may be significantly differ from the actual therefore, in such situations, complexities

may be faced to compare the actual results with the targets, which discourage firm to not to use this

technique for making budgets.

Flexible budgeting: It is also referred as variable budgeting which estimates income and

expenditures for the current or actual output (Sarkar, 2011). In other words, it can be said that this

budget can be easily flexed in accordance with the real production of Smart Looks and allow

managers to analyze the effectiveness of their operations by assessing that in what extent, targets

has been achieved.

Examining all of the above techniques, it is founded that Smart Looks must selects modern

technique of budgeting that is ZBB which provide enough and right justification for each and every

elements of the source of revenues and its payment as well and motivate workers to work

accordingly to attain the same. At the same time, it also must be considered by the firm to prepare

11

(c). Different types of budgeting methods

There are number of budgeting methods that can be utilized by the senior management of

the Smart Looks for making budget for the upcoming period.

Incremental budgeting: It is based on either historical or past year’s budget or actual results

of the business unit. Traditionally, managers used to set their standard targets by making evaluation

of the previous results or budgeted targets and thereby make little bit adjustments in the same to

arrive the new budget. It is the simplest way of budgeting which does not required to consider any

market research and add some incremental amount in the past performance. However, as it does not

account the inflation adjustments and external market investigation, therefore, it does not reflects

realistic forecasting. Moreover, it also promote over-spending and encourage those activities which

are wasteful and useless and Smart Looks must not continue this which are the main drawbacks of

it.

Zero-based budgeting: In contrast to the above, ZBB overcomes the limitation of

incremental budgeting by making market research to determine those activities and functions which

Smart Looks will be required to execute for the future functioning (Agrawal, 2013). It makes

rational adjustments in the budgets and use nil value as a base and prepare highly-realistic and valid

budget with the proper justifications of every adjustments.

Fixed budgeting: It is a budgeting plan which shows the standard targets for a given

production volume only. It is highly rigid and cannot be flexed in accordance with the actual

volume. In the corporate sector, due to uncertainty exists in the market; Smart Looks actual

production may be significantly differ from the actual therefore, in such situations, complexities

may be faced to compare the actual results with the targets, which discourage firm to not to use this

technique for making budgets.

Flexible budgeting: It is also referred as variable budgeting which estimates income and

expenditures for the current or actual output (Sarkar, 2011). In other words, it can be said that this

budget can be easily flexed in accordance with the real production of Smart Looks and allow

managers to analyze the effectiveness of their operations by assessing that in what extent, targets

has been achieved.

Examining all of the above techniques, it is founded that Smart Looks must selects modern

technique of budgeting that is ZBB which provide enough and right justification for each and every

elements of the source of revenues and its payment as well and motivate workers to work

accordingly to attain the same. At the same time, it also must be considered by the firm to prepare

11

budgets for more than one production level for the variance analysis which aids in smarter business

decisions.

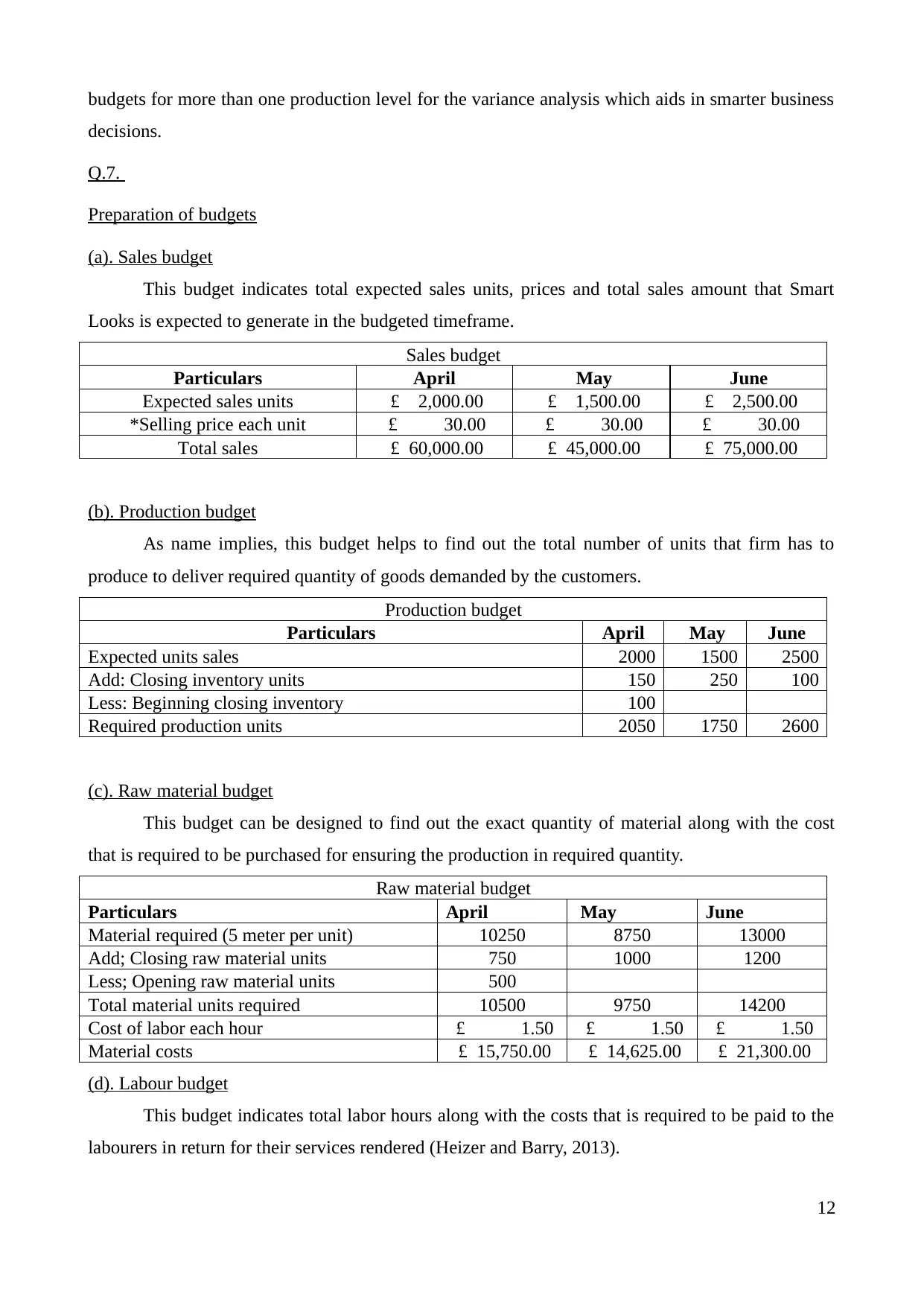

Q.7.

Preparation of budgets

(a). Sales budget

This budget indicates total expected sales units, prices and total sales amount that Smart

Looks is expected to generate in the budgeted timeframe.

Sales budget

Particulars April May June

Expected sales units £ 2,000.00 £ 1,500.00 £ 2,500.00

*Selling price each unit £ 30.00 £ 30.00 £ 30.00

Total sales £ 60,000.00 £ 45,000.00 £ 75,000.00

(b). Production budget

As name implies, this budget helps to find out the total number of units that firm has to

produce to deliver required quantity of goods demanded by the customers.

Production budget

Particulars April May June

Expected units sales 2000 1500 2500

Add: Closing inventory units 150 250 100

Less: Beginning closing inventory 100

Required production units 2050 1750 2600

(c). Raw material budget

This budget can be designed to find out the exact quantity of material along with the cost

that is required to be purchased for ensuring the production in required quantity.

Raw material budget

Particulars April May June

Material required (5 meter per unit) 10250 8750 13000

Add; Closing raw material units 750 1000 1200

Less; Opening raw material units 500

Total material units required 10500 9750 14200

Cost of labor each hour £ 1.50 £ 1.50 £ 1.50

Material costs £ 15,750.00 £ 14,625.00 £ 21,300.00

(d). Labour budget

This budget indicates total labor hours along with the costs that is required to be paid to the

labourers in return for their services rendered (Heizer and Barry, 2013).

12

decisions.

Q.7.

Preparation of budgets

(a). Sales budget

This budget indicates total expected sales units, prices and total sales amount that Smart

Looks is expected to generate in the budgeted timeframe.

Sales budget

Particulars April May June

Expected sales units £ 2,000.00 £ 1,500.00 £ 2,500.00

*Selling price each unit £ 30.00 £ 30.00 £ 30.00

Total sales £ 60,000.00 £ 45,000.00 £ 75,000.00

(b). Production budget

As name implies, this budget helps to find out the total number of units that firm has to

produce to deliver required quantity of goods demanded by the customers.

Production budget

Particulars April May June

Expected units sales 2000 1500 2500

Add: Closing inventory units 150 250 100

Less: Beginning closing inventory 100

Required production units 2050 1750 2600

(c). Raw material budget

This budget can be designed to find out the exact quantity of material along with the cost

that is required to be purchased for ensuring the production in required quantity.

Raw material budget

Particulars April May June

Material required (5 meter per unit) 10250 8750 13000

Add; Closing raw material units 750 1000 1200

Less; Opening raw material units 500

Total material units required 10500 9750 14200

Cost of labor each hour £ 1.50 £ 1.50 £ 1.50

Material costs £ 15,750.00 £ 14,625.00 £ 21,300.00

(d). Labour budget

This budget indicates total labor hours along with the costs that is required to be paid to the

labourers in return for their services rendered (Heizer and Barry, 2013).

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.