Financial Management for Restaurants: Sources, Planning, Statements

VerifiedAdded on 2020/02/05

|20

|4201

|32

Report

AI Summary

This report examines the financial management of a restaurant business, addressing various aspects from identifying funding sources like bank loans, equity, and venture capital, to analyzing their implications and costs. It emphasizes the importance of financial planning, including budgeting and the information needs of internal and external stakeholders. The report also covers the impact of finance sources on financial statements, including profit and loss accounts and balance sheets, providing examples. Furthermore, it delves into projected budgets, unit cost computations, pricing decisions, and the implications of capital budgeting tools. The report concludes with a discussion of main financial statements, their structure, content, and interpretation, offering a comprehensive overview of restaurant financial management.

MANAGING FINANCIAL

RESOURCE DECISIONS

RESOURCE DECISIONS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Identify the sources of finance available to restaurant business...............................1

AC 1.2 Implication of finance sources..................................................................................2

AC 1.3 Evaluation of appropriate source..............................................................................2

TASK 2......................................................................................................................................3

AC 2.1 Cost of each finance source......................................................................................3

AC 2.2 Importance of financial planning..............................................................................3

AC 2.3 Information need of internal and external decision makers......................................3

AC 2.4 Impact of finance sources on the financial statements..............................................4

TASK 3......................................................................................................................................5

AC 3.1 Projected budget for six months................................................................................5

AC 3.2 Computation of unit costs and pricing decisions......................................................6

AC 3.3 Implication of capital budging tools.........................................................................6

TASK 4......................................................................................................................................7

AC 4.1 Main financial statements produced by different organizations...............................7

AC 4.2 Structure, content and details of main financial statements......................................7

AC 4.3 Interpretation of financial statements........................................................................7

CONCLUSION..........................................................................................................................7

REFERENCES...........................................................................................................................7

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Identify the sources of finance available to restaurant business...............................1

AC 1.2 Implication of finance sources..................................................................................2

AC 1.3 Evaluation of appropriate source..............................................................................2

TASK 2......................................................................................................................................3

AC 2.1 Cost of each finance source......................................................................................3

AC 2.2 Importance of financial planning..............................................................................3

AC 2.3 Information need of internal and external decision makers......................................3

AC 2.4 Impact of finance sources on the financial statements..............................................4

TASK 3......................................................................................................................................5

AC 3.1 Projected budget for six months................................................................................5

AC 3.2 Computation of unit costs and pricing decisions......................................................6

AC 3.3 Implication of capital budging tools.........................................................................6

TASK 4......................................................................................................................................7

AC 4.1 Main financial statements produced by different organizations...............................7

AC 4.2 Structure, content and details of main financial statements......................................7

AC 4.3 Interpretation of financial statements........................................................................7

CONCLUSION..........................................................................................................................7

REFERENCES...........................................................................................................................7

Illustration Index

Illustration 1: Balance sheet of sole trader.................................................................................9

Illustration 2: Profitability statement of sole trader..................................................................10

Illustration 3: profitability statement of partnership.................................................................10

Illustration 4: balance sheet of partnership...............................................................................11

Illustration 5: profitability statement of company....................................................................12

Illustration 6: balance sheet of company..................................................................................13

Illustration 1: Balance sheet of sole trader.................................................................................9

Illustration 2: Profitability statement of sole trader..................................................................10

Illustration 3: profitability statement of partnership.................................................................10

Illustration 4: balance sheet of partnership...............................................................................11

Illustration 5: profitability statement of company....................................................................12

Illustration 6: balance sheet of company..................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance is a very crucial element in every business organizations. It is necessary for

establishing new firms and hazard free operating functions. . Without having adequate

amount of funds, business cannot survive in the market. In the present report, Government

provide opportunities to small firms by setting target in which 1£ of every 3£ government

spending will be for small businesses by 2020. The report will discuss the significance of

finance for establishing a small restaurant business in UK. Moreover, financial performance

will be analysed for Sainsbury business organization.

TASK 1

AC 1.1 Identify the sources of finance available to restaurant business

As per the scenario, restaurant owner requires 300000£ for contract bidding while

only 20000£ is available to them. Hence, additional finance requirement can be fulfilled

through following sources:

Bank Loans: Banks assist the restaurant business by providing funds in the way of

loans. UK government's National Loan Guarantee Scheme (NLGS) and Funding for Lending

Scheme (FLS) provide huge assistance to the restaurant owners for getting funds at cheaper

rates. It reduces cost of borrowings for businesses and mitigates their funds requirement for

different time durations (Cassar, Ittner and Cavalluzzo, 2015). Further, it increases unsecured

business lending on the basis of government guarantee. In UK, Scottland, Natwest, Barclays,

Lombard, Santander and Ulstar bank provide funds to small organizations whose annual

turnover lies under the maximum limit of 250£ million.

Equity finance: Restaurant unit can obtain funds in the form of equity. It can start its

restaurant by issuing equity share capital. Government Enterprise Investment Scheme (EIS)

encourages potential investors to invest their funds in small enterprises by providing tax

reliefs. According to the scheme, investors can invest up to 1£ million and they will be

qualified to take tax benefits of 30% of investment cost.

Venture capital: UK government Venture Capital Trust Scheme (VCTS) encourages

capitalists to invest funds in small firms. They can invest funds in the form of equity and

debt. As per the scheme, investors whose total investment is less than 200000£ in each

financial year will be eligible for income tax relief at 30% rate. Moreover, capital gain at the

time of disposal and dividend earnings on such investment are exempted from income tax.

Thus, restaurant business can fulfil their financial need by taking venture capital.

1 | P a g e

Finance is a very crucial element in every business organizations. It is necessary for

establishing new firms and hazard free operating functions. . Without having adequate

amount of funds, business cannot survive in the market. In the present report, Government

provide opportunities to small firms by setting target in which 1£ of every 3£ government

spending will be for small businesses by 2020. The report will discuss the significance of

finance for establishing a small restaurant business in UK. Moreover, financial performance

will be analysed for Sainsbury business organization.

TASK 1

AC 1.1 Identify the sources of finance available to restaurant business

As per the scenario, restaurant owner requires 300000£ for contract bidding while

only 20000£ is available to them. Hence, additional finance requirement can be fulfilled

through following sources:

Bank Loans: Banks assist the restaurant business by providing funds in the way of

loans. UK government's National Loan Guarantee Scheme (NLGS) and Funding for Lending

Scheme (FLS) provide huge assistance to the restaurant owners for getting funds at cheaper

rates. It reduces cost of borrowings for businesses and mitigates their funds requirement for

different time durations (Cassar, Ittner and Cavalluzzo, 2015). Further, it increases unsecured

business lending on the basis of government guarantee. In UK, Scottland, Natwest, Barclays,

Lombard, Santander and Ulstar bank provide funds to small organizations whose annual

turnover lies under the maximum limit of 250£ million.

Equity finance: Restaurant unit can obtain funds in the form of equity. It can start its

restaurant by issuing equity share capital. Government Enterprise Investment Scheme (EIS)

encourages potential investors to invest their funds in small enterprises by providing tax

reliefs. According to the scheme, investors can invest up to 1£ million and they will be

qualified to take tax benefits of 30% of investment cost.

Venture capital: UK government Venture Capital Trust Scheme (VCTS) encourages

capitalists to invest funds in small firms. They can invest funds in the form of equity and

debt. As per the scheme, investors whose total investment is less than 200000£ in each

financial year will be eligible for income tax relief at 30% rate. Moreover, capital gain at the

time of disposal and dividend earnings on such investment are exempted from income tax.

Thus, restaurant business can fulfil their financial need by taking venture capital.

1 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

AC 1.2 Implication of finance sources

Different types of financial sources have some kind of implication to restaurant

business performance which is described as under:

Bank loan: At the initial stage, restaurant unit has to fulfil some legal formalities

required by the banks. They have to give assets as a collateral security for securing their debt.

Moreover, bank provides loans at interest rates which the restaurant is required to pay on

time. Thus, it imposes fixed financial burden to the business (Tan, Lee and Faff, 2015).

However, the advantage is that lenders have no control over the restaurant operations hence;

it does not dilute business control.

Equity finance: Restaurant business has to provide dividend return to the investors

although the rate of dividend is not fixed. Thus, it is not the legal obligation to pay regular

return to the shareholders. Restaurant business can provide dividend in case of having

adequate amount of profits while it does no need to pay dividend in the situation of loss

(Lewis and Tan, 2016.). Equity investors have voting rights which they can access to control

restaurant operations. In other words, dilution on control exists in equity finance.

Venture capital: Venture capitalist invests funds to get maximum amount of return.

Thus, it is important for the restaurant business to provide adequate return to the capitalists.

Thus, if capitalist provide fund in the form of debt then restaurant business has to pay a fixed

amount of interest at a fixed interval. However, if they invest funds in the way of shares, then

it has to pay return to them.

AC 1.3 Evaluation of appropriate source

On the basis of above implications, it can be reported that bank loan will be the most

appropriate source for restaurant unit. The reason behind this is various government schemes

helps to acquire cheaper loans. Thus, it provides assistance to reduce their finance cost.

Furthermore, cheaper loan availability assists the restaurant to reduce their spending and

enhance profitability (Cheng, 2015). Moreover, government guaranteed schemes which

provide help to restaurant to acquire funds without any business security. As per the plan,

banks mitigate restaurant's financial requirement on behalf of guarantee given by

government. Moreover, no diversification of control to lenders assists the owners to control

their operations as per their own desires (Hatten, 2015). On the other hand, equity and

venture capitalist will diversify its business control. In addition, interest obligations on loans

provide tax reliefs to the restaurant unit henceforth, reduce tax obligations and improve

profits.

2 | P a g e

Different types of financial sources have some kind of implication to restaurant

business performance which is described as under:

Bank loan: At the initial stage, restaurant unit has to fulfil some legal formalities

required by the banks. They have to give assets as a collateral security for securing their debt.

Moreover, bank provides loans at interest rates which the restaurant is required to pay on

time. Thus, it imposes fixed financial burden to the business (Tan, Lee and Faff, 2015).

However, the advantage is that lenders have no control over the restaurant operations hence;

it does not dilute business control.

Equity finance: Restaurant business has to provide dividend return to the investors

although the rate of dividend is not fixed. Thus, it is not the legal obligation to pay regular

return to the shareholders. Restaurant business can provide dividend in case of having

adequate amount of profits while it does no need to pay dividend in the situation of loss

(Lewis and Tan, 2016.). Equity investors have voting rights which they can access to control

restaurant operations. In other words, dilution on control exists in equity finance.

Venture capital: Venture capitalist invests funds to get maximum amount of return.

Thus, it is important for the restaurant business to provide adequate return to the capitalists.

Thus, if capitalist provide fund in the form of debt then restaurant business has to pay a fixed

amount of interest at a fixed interval. However, if they invest funds in the way of shares, then

it has to pay return to them.

AC 1.3 Evaluation of appropriate source

On the basis of above implications, it can be reported that bank loan will be the most

appropriate source for restaurant unit. The reason behind this is various government schemes

helps to acquire cheaper loans. Thus, it provides assistance to reduce their finance cost.

Furthermore, cheaper loan availability assists the restaurant to reduce their spending and

enhance profitability (Cheng, 2015). Moreover, government guaranteed schemes which

provide help to restaurant to acquire funds without any business security. As per the plan,

banks mitigate restaurant's financial requirement on behalf of guarantee given by

government. Moreover, no diversification of control to lenders assists the owners to control

their operations as per their own desires (Hatten, 2015). On the other hand, equity and

venture capitalist will diversify its business control. In addition, interest obligations on loans

provide tax reliefs to the restaurant unit henceforth, reduce tax obligations and improve

profits.

2 | P a g e

TASK 2

AC 2.1 Cost of each finance source

On the amount of borrowed funds, restaurant is required to pay periodically interest to

banks. Thus, it will be the cost of bank loans which reduce company's profits. Moreover, the

interest rate may be fixed or fluctuating. Fixed interest rate impose fixed financial burden

contribute to high financial risk. On the contrary, fluctuating interest rate can increase or

decrease restaurant financial obligations and change their cost (DeYoungm and et.al, 2015).

However, cost of equity finance is restaurant has to provide returns in the form of dividend to

the shareholders. Another, venture capital can be in the form of both debt and equity. If the

venture capitalists provide debt funds than its cost will be periodically interest payments and

the restaurant owner has to pay while equity funds imposes cost of dividend. Furthermore,

expenses for issuing prospectus and shares are also included in restaurant unit financial cost.

AC 2.2 Importance of financial planning

The role of monetary planning is very vital for restaurant business success. At the

initial stage, restaurant unit has to determine their capital requirement for establishing. They

have to estimate the cost of construction of building and purchasing furniture, building and

other equipment. Thereafter, alternative finance sources such as debt and equity must be

analysed to select the most suitable source. Moreover, a financial projection of all business

functions must be constructed by the owners (Dunn and Liang, 2015). They have to ascertain

their future sales and payments for purchase, utilities, office expenses, repair and other

operating expenses. It provide assistance to manage organization cash flows and avail better

surplus cash availability to support its operations. It makes restaurant business able to make

effective administration of funds, remove financial difficulties and helps in running

successfully in the market (Gaskill, Van Auken and Kim, 2015).

AC 2.3 Information need of internal and external decision makers

Internal decision makers are the part of the restaurant business while external decision

makers are outsiders such as investors and lenders. Their different information need is

described hereunder:

Managers: They play a significant role in managing overall business functioning of

the restaurant. Thus, they need information about knowing operational as well as financial

performance. They make detailed analysis of restaurant operating activities to maximize their

revenues and minimize their expenditures. This in turn, profitability can be improved to a

3 | P a g e

AC 2.1 Cost of each finance source

On the amount of borrowed funds, restaurant is required to pay periodically interest to

banks. Thus, it will be the cost of bank loans which reduce company's profits. Moreover, the

interest rate may be fixed or fluctuating. Fixed interest rate impose fixed financial burden

contribute to high financial risk. On the contrary, fluctuating interest rate can increase or

decrease restaurant financial obligations and change their cost (DeYoungm and et.al, 2015).

However, cost of equity finance is restaurant has to provide returns in the form of dividend to

the shareholders. Another, venture capital can be in the form of both debt and equity. If the

venture capitalists provide debt funds than its cost will be periodically interest payments and

the restaurant owner has to pay while equity funds imposes cost of dividend. Furthermore,

expenses for issuing prospectus and shares are also included in restaurant unit financial cost.

AC 2.2 Importance of financial planning

The role of monetary planning is very vital for restaurant business success. At the

initial stage, restaurant unit has to determine their capital requirement for establishing. They

have to estimate the cost of construction of building and purchasing furniture, building and

other equipment. Thereafter, alternative finance sources such as debt and equity must be

analysed to select the most suitable source. Moreover, a financial projection of all business

functions must be constructed by the owners (Dunn and Liang, 2015). They have to ascertain

their future sales and payments for purchase, utilities, office expenses, repair and other

operating expenses. It provide assistance to manage organization cash flows and avail better

surplus cash availability to support its operations. It makes restaurant business able to make

effective administration of funds, remove financial difficulties and helps in running

successfully in the market (Gaskill, Van Auken and Kim, 2015).

AC 2.3 Information need of internal and external decision makers

Internal decision makers are the part of the restaurant business while external decision

makers are outsiders such as investors and lenders. Their different information need is

described hereunder:

Managers: They play a significant role in managing overall business functioning of

the restaurant. Thus, they need information about knowing operational as well as financial

performance. They make detailed analysis of restaurant operating activities to maximize their

revenues and minimize their expenditures. This in turn, profitability can be improved to a

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

great extent. Further, they need information about cash earning capacity, liquidity, solvency

and assets using efficiency to make effective balance and improve restaurant's performance.

Employees: They are working with the organization and serve their customers to

attain good monetary and non-monetary benefits. They analyse restaurant's operational

results to determine profits margins (Zager and Zager, 2006). Improved profitability is the

good sign of business performance and satisfies employees need in a great manner.

Investors: They need higher return on their funds hence, require information about

restaurant's profits, leverage, cash flow capacity, investors earning and growth in share

prices. High growth earning businesses are able to attract more investors and eliminate their

financial requirement.

Lenders: They assess restaurant's interest bearing capacity, profit margin, cash

generating ability, manager's efficiency and solvency position (Nowduri, n.d). Rising

profitability, balanced solvency position and good credit rating firms can attract lenders for

investment purpose.

Creditors: They provide funds through analyse restaurant liquidity position and

profitability. Thus, they need information about working capital management, inventory

turnover ratio, and receivable turnover ratio and accounts payable days.

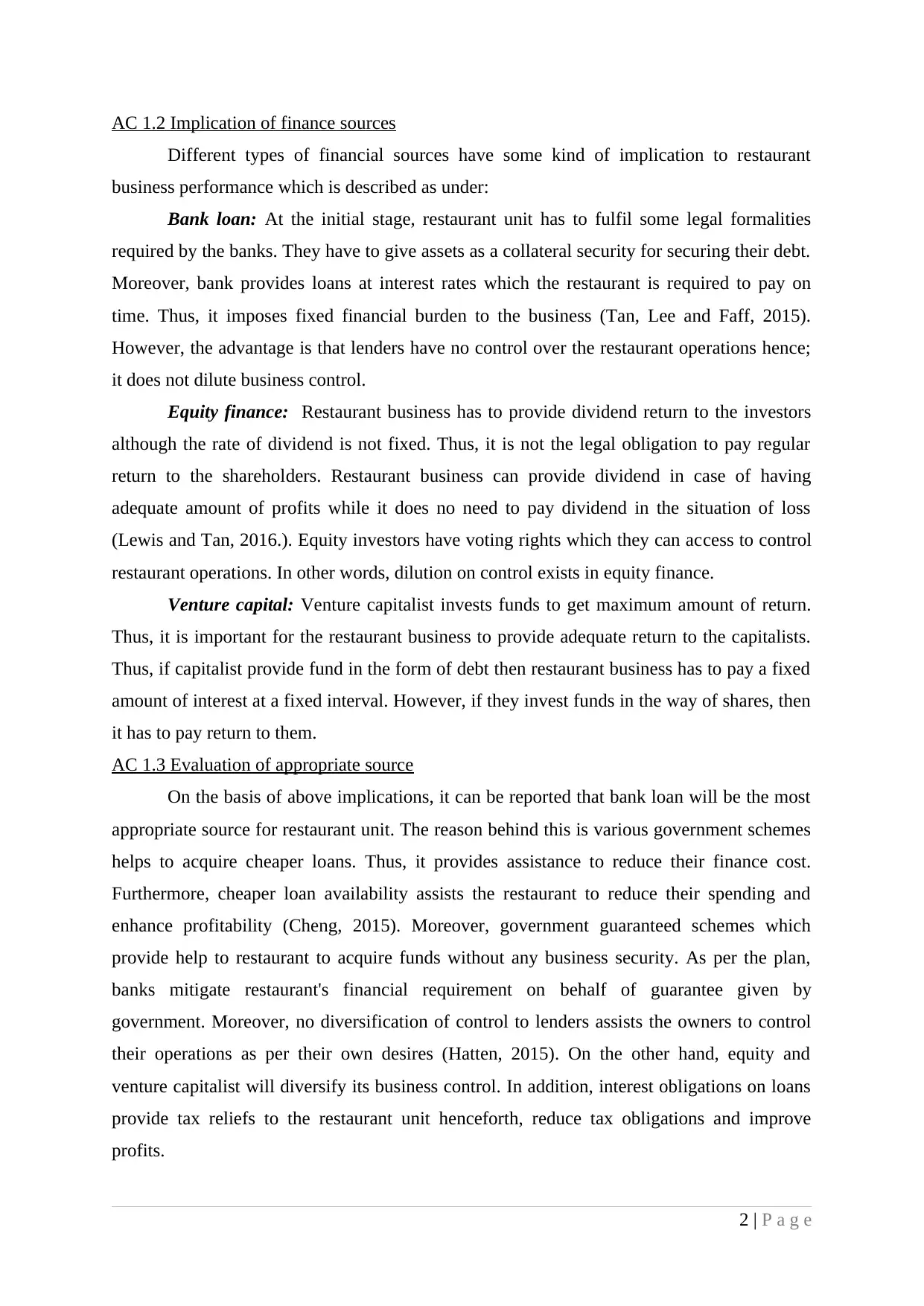

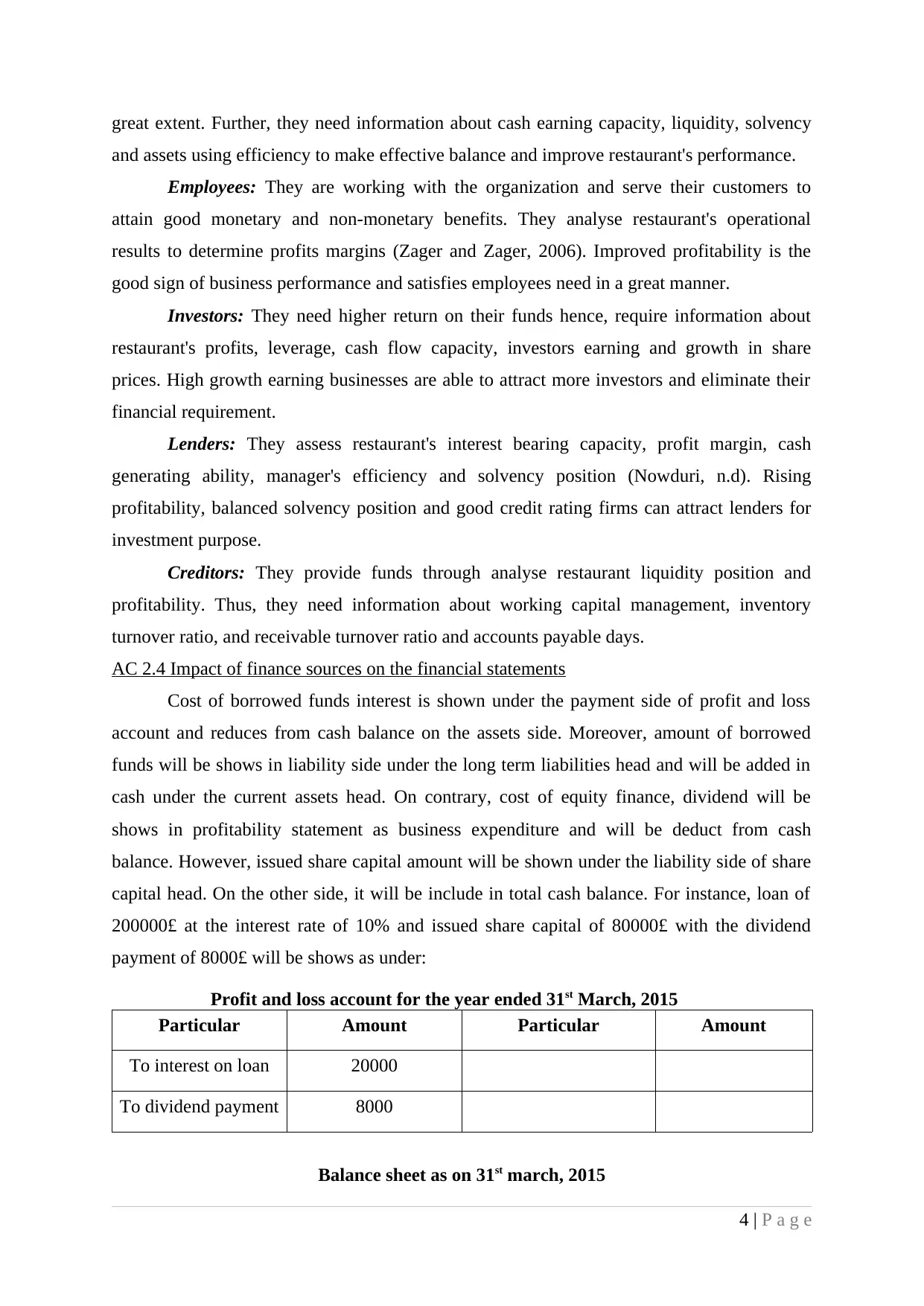

AC 2.4 Impact of finance sources on the financial statements

Cost of borrowed funds interest is shown under the payment side of profit and loss

account and reduces from cash balance on the assets side. Moreover, amount of borrowed

funds will be shows in liability side under the long term liabilities head and will be added in

cash under the current assets head. On contrary, cost of equity finance, dividend will be

shows in profitability statement as business expenditure and will be deduct from cash

balance. However, issued share capital amount will be shown under the liability side of share

capital head. On the other side, it will be include in total cash balance. For instance, loan of

200000£ at the interest rate of 10% and issued share capital of 80000£ with the dividend

payment of 8000£ will be shows as under:

Profit and loss account for the year ended 31st March, 2015

Particular Amount Particular Amount

To interest on loan 20000

To dividend payment 8000

Balance sheet as on 31st march, 2015

4 | P a g e

and assets using efficiency to make effective balance and improve restaurant's performance.

Employees: They are working with the organization and serve their customers to

attain good monetary and non-monetary benefits. They analyse restaurant's operational

results to determine profits margins (Zager and Zager, 2006). Improved profitability is the

good sign of business performance and satisfies employees need in a great manner.

Investors: They need higher return on their funds hence, require information about

restaurant's profits, leverage, cash flow capacity, investors earning and growth in share

prices. High growth earning businesses are able to attract more investors and eliminate their

financial requirement.

Lenders: They assess restaurant's interest bearing capacity, profit margin, cash

generating ability, manager's efficiency and solvency position (Nowduri, n.d). Rising

profitability, balanced solvency position and good credit rating firms can attract lenders for

investment purpose.

Creditors: They provide funds through analyse restaurant liquidity position and

profitability. Thus, they need information about working capital management, inventory

turnover ratio, and receivable turnover ratio and accounts payable days.

AC 2.4 Impact of finance sources on the financial statements

Cost of borrowed funds interest is shown under the payment side of profit and loss

account and reduces from cash balance on the assets side. Moreover, amount of borrowed

funds will be shows in liability side under the long term liabilities head and will be added in

cash under the current assets head. On contrary, cost of equity finance, dividend will be

shows in profitability statement as business expenditure and will be deduct from cash

balance. However, issued share capital amount will be shown under the liability side of share

capital head. On the other side, it will be include in total cash balance. For instance, loan of

200000£ at the interest rate of 10% and issued share capital of 80000£ with the dividend

payment of 8000£ will be shows as under:

Profit and loss account for the year ended 31st March, 2015

Particular Amount Particular Amount

To interest on loan 20000

To dividend payment 8000

Balance sheet as on 31st march, 2015

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Liabilities Amount Assets Amount

Issued share capital Current assets

Share capital 80000 Cash (80000+200000-

20000-8000)

252000

Long term liabilities

Bank loan 200000

TASK 3

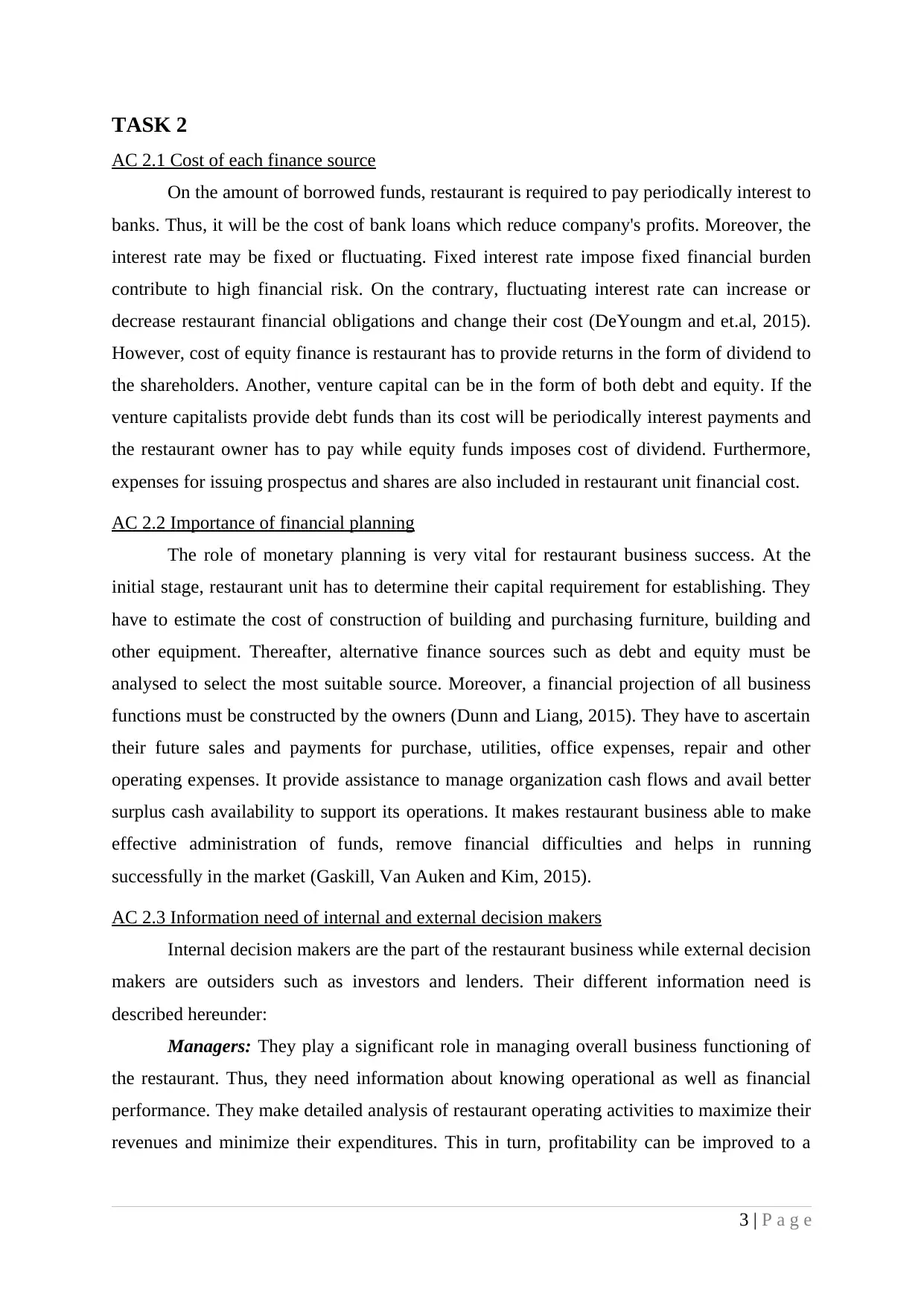

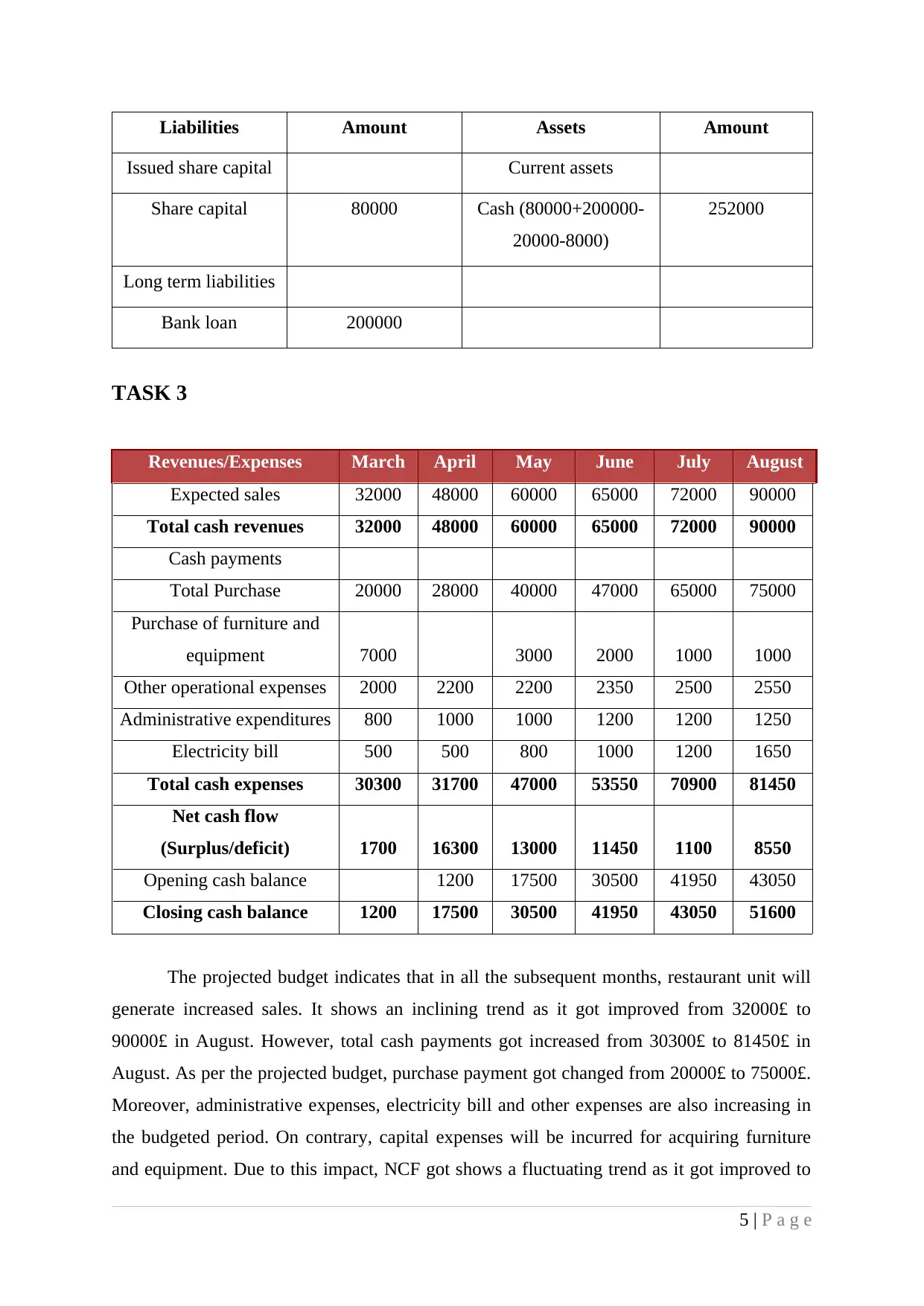

AC 3.1 Projected budget for six months

Revenues/Expenses March April May June July August

Expected sales 32000 48000 60000 65000 72000 90000

Total cash revenues 32000 48000 60000 65000 72000 90000

Cash payments

Total Purchase 20000 28000 40000 47000 65000 75000

Purchase of furniture and

equipment 7000 3000 2000 1000 1000

Other operational expenses 2000 2200 2200 2350 2500 2550

Administrative expenditures 800 1000 1000 1200 1200 1250

Electricity bill 500 500 800 1000 1200 1650

Total cash expenses 30300 31700 47000 53550 70900 81450

Net cash flow

(Surplus/deficit) 1700 16300 13000 11450 1100 8550

Opening cash balance 1200 17500 30500 41950 43050

Closing cash balance 1200 17500 30500 41950 43050 51600

The projected budget indicates that in all the subsequent months, restaurant unit will

generate increased sales. It shows an inclining trend as it got improved from 32000£ to

90000£ in August. However, total cash payments got increased from 30300£ to 81450£ in

August. As per the projected budget, purchase payment got changed from 20000£ to 75000£.

Moreover, administrative expenses, electricity bill and other expenses are also increasing in

the budgeted period. On contrary, capital expenses will be incurred for acquiring furniture

and equipment. Due to this impact, NCF got shows a fluctuating trend as it got improved to

5 | P a g e

Issued share capital Current assets

Share capital 80000 Cash (80000+200000-

20000-8000)

252000

Long term liabilities

Bank loan 200000

TASK 3

AC 3.1 Projected budget for six months

Revenues/Expenses March April May June July August

Expected sales 32000 48000 60000 65000 72000 90000

Total cash revenues 32000 48000 60000 65000 72000 90000

Cash payments

Total Purchase 20000 28000 40000 47000 65000 75000

Purchase of furniture and

equipment 7000 3000 2000 1000 1000

Other operational expenses 2000 2200 2200 2350 2500 2550

Administrative expenditures 800 1000 1000 1200 1200 1250

Electricity bill 500 500 800 1000 1200 1650

Total cash expenses 30300 31700 47000 53550 70900 81450

Net cash flow

(Surplus/deficit) 1700 16300 13000 11450 1100 8550

Opening cash balance 1200 17500 30500 41950 43050

Closing cash balance 1200 17500 30500 41950 43050 51600

The projected budget indicates that in all the subsequent months, restaurant unit will

generate increased sales. It shows an inclining trend as it got improved from 32000£ to

90000£ in August. However, total cash payments got increased from 30300£ to 81450£ in

August. As per the projected budget, purchase payment got changed from 20000£ to 75000£.

Moreover, administrative expenses, electricity bill and other expenses are also increasing in

the budgeted period. On contrary, capital expenses will be incurred for acquiring furniture

and equipment. Due to this impact, NCF got shows a fluctuating trend as it got improved to

5 | P a g e

16300£ in April. Thereafter, it shows a decreasing trend because it got reduced to 8550£in

August. It impact restaurant business operations in an adverse manner (Ross, Laing and Parle,

2015). The reason behind this is lower availability of surplus balance reduce company's cash

generating ability from operations.

Recommendations: Thus, it should be recommended that restaurant managers have to

maintain effective control over the expenditures to reduce their total payments.

Administrative expenses can be reduce through managing staff salaries, office rent, printing

and stationery expenses and management of hiring new staff. Furthermore, electricity bills

can be reduced through using electricity at the time of need. Moreover, by switching off the

lights, energy can be saved. In addition to it, finding new suppliers who supply goods at

cheaper rates without affecting the quality will reduce restaurant purchase cost (Citi, 2013).

Furthermore, food broker contract assist restaurant to negotiate their food prices and take cost

savings benefits. Another, contract with suppliers, equipment contract, cleaning and

marketing contract is helpful for cost reduction. On contrary, effective marketing, stability in

price, improved quality and serving tasty food as per the customer desires bring benefits to

enhance total sales revenues. This in turn, restaurant business will be able to have high NCF

and operate efficiently in the market.

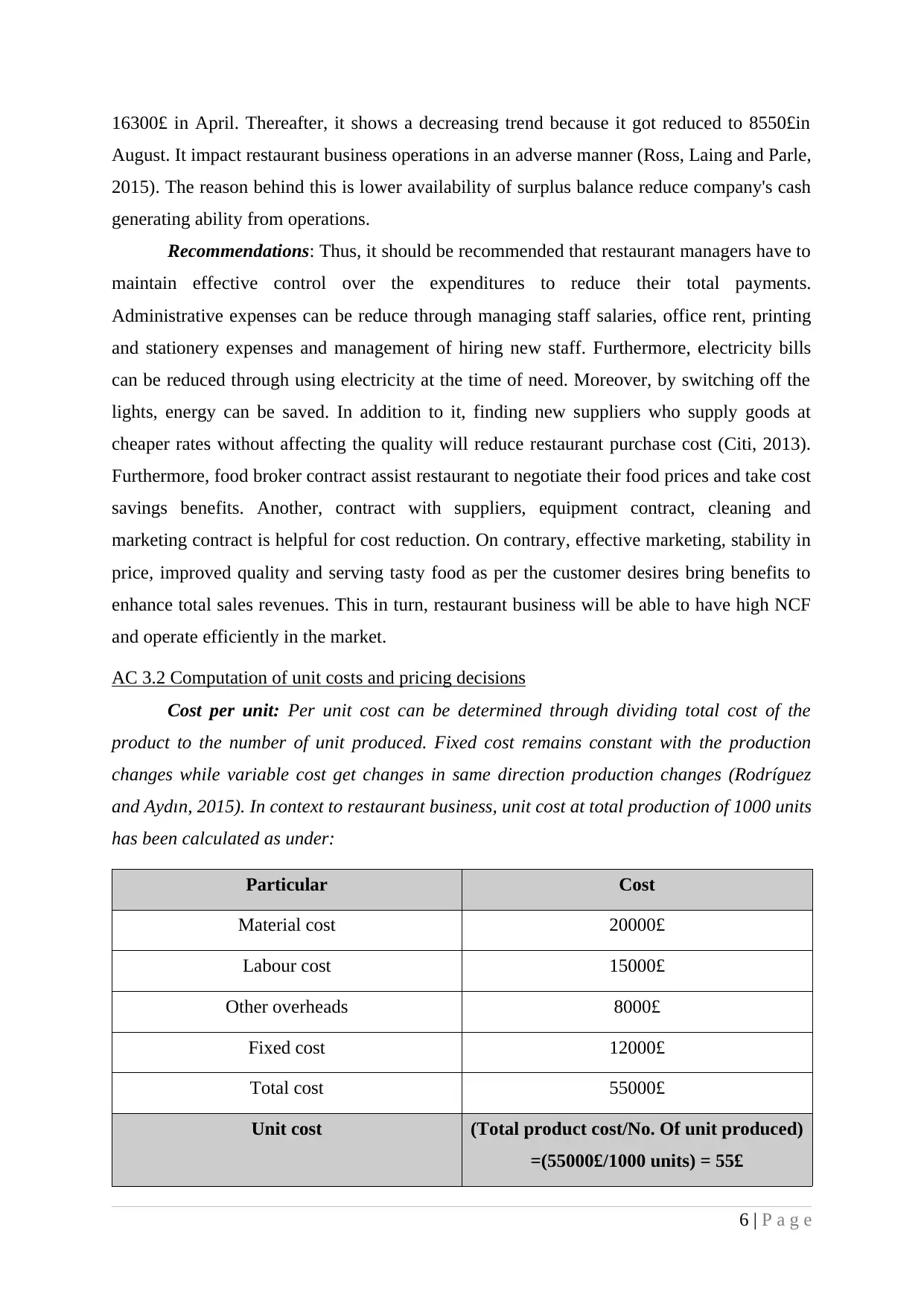

AC 3.2 Computation of unit costs and pricing decisions

Cost per unit: Per unit cost can be determined through dividing total cost of the

product to the number of unit produced. Fixed cost remains constant with the production

changes while variable cost get changes in same direction production changes (Rodríguez

and Aydın, 2015). In context to restaurant business, unit cost at total production of 1000 units

has been calculated as under:

Particular Cost

Material cost 20000£

Labour cost 15000£

Other overheads 8000£

Fixed cost 12000£

Total cost 55000£

Unit cost (Total product cost/No. Of unit produced)

=(55000£/1000 units) = 55£

6 | P a g e

August. It impact restaurant business operations in an adverse manner (Ross, Laing and Parle,

2015). The reason behind this is lower availability of surplus balance reduce company's cash

generating ability from operations.

Recommendations: Thus, it should be recommended that restaurant managers have to

maintain effective control over the expenditures to reduce their total payments.

Administrative expenses can be reduce through managing staff salaries, office rent, printing

and stationery expenses and management of hiring new staff. Furthermore, electricity bills

can be reduced through using electricity at the time of need. Moreover, by switching off the

lights, energy can be saved. In addition to it, finding new suppliers who supply goods at

cheaper rates without affecting the quality will reduce restaurant purchase cost (Citi, 2013).

Furthermore, food broker contract assist restaurant to negotiate their food prices and take cost

savings benefits. Another, contract with suppliers, equipment contract, cleaning and

marketing contract is helpful for cost reduction. On contrary, effective marketing, stability in

price, improved quality and serving tasty food as per the customer desires bring benefits to

enhance total sales revenues. This in turn, restaurant business will be able to have high NCF

and operate efficiently in the market.

AC 3.2 Computation of unit costs and pricing decisions

Cost per unit: Per unit cost can be determined through dividing total cost of the

product to the number of unit produced. Fixed cost remains constant with the production

changes while variable cost get changes in same direction production changes (Rodríguez

and Aydın, 2015). In context to restaurant business, unit cost at total production of 1000 units

has been calculated as under:

Particular Cost

Material cost 20000£

Labour cost 15000£

Other overheads 8000£

Fixed cost 12000£

Total cost 55000£

Unit cost (Total product cost/No. Of unit produced)

=(55000£/1000 units) = 55£

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

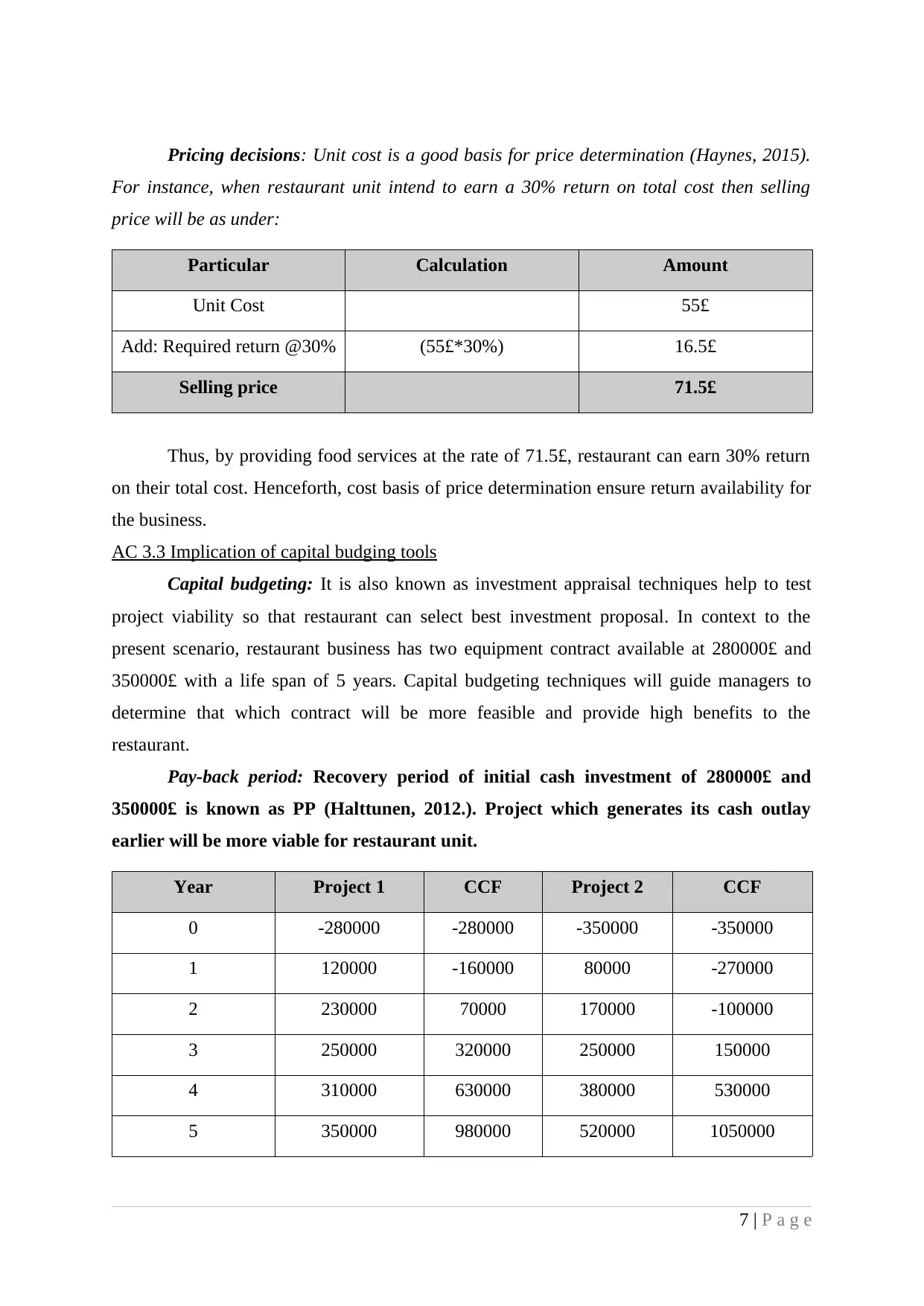

Pricing decisions: Unit cost is a good basis for price determination (Haynes, 2015).

For instance, when restaurant unit intend to earn a 30% return on total cost then selling

price will be as under:

Particular Calculation Amount

Unit Cost 55£

Add: Required return @30% (55£*30%) 16.5£

Selling price 71.5£

Thus, by providing food services at the rate of 71.5£, restaurant can earn 30% return

on their total cost. Henceforth, cost basis of price determination ensure return availability for

the business.

AC 3.3 Implication of capital budging tools

Capital budgeting: It is also known as investment appraisal techniques help to test

project viability so that restaurant can select best investment proposal. In context to the

present scenario, restaurant business has two equipment contract available at 280000£ and

350000£ with a life span of 5 years. Capital budgeting techniques will guide managers to

determine that which contract will be more feasible and provide high benefits to the

restaurant.

Pay-back period: Recovery period of initial cash investment of 280000£ and

350000£ is known as PP (Halttunen, 2012.). Project which generates its cash outlay

earlier will be more viable for restaurant unit.

Year Project 1 CCF Project 2 CCF

0 -280000 -280000 -350000 -350000

1 120000 -160000 80000 -270000

2 230000 70000 170000 -100000

3 250000 320000 250000 150000

4 310000 630000 380000 530000

5 350000 980000 520000 1050000

7 | P a g e

For instance, when restaurant unit intend to earn a 30% return on total cost then selling

price will be as under:

Particular Calculation Amount

Unit Cost 55£

Add: Required return @30% (55£*30%) 16.5£

Selling price 71.5£

Thus, by providing food services at the rate of 71.5£, restaurant can earn 30% return

on their total cost. Henceforth, cost basis of price determination ensure return availability for

the business.

AC 3.3 Implication of capital budging tools

Capital budgeting: It is also known as investment appraisal techniques help to test

project viability so that restaurant can select best investment proposal. In context to the

present scenario, restaurant business has two equipment contract available at 280000£ and

350000£ with a life span of 5 years. Capital budgeting techniques will guide managers to

determine that which contract will be more feasible and provide high benefits to the

restaurant.

Pay-back period: Recovery period of initial cash investment of 280000£ and

350000£ is known as PP (Halttunen, 2012.). Project which generates its cash outlay

earlier will be more viable for restaurant unit.

Year Project 1 CCF Project 2 CCF

0 -280000 -280000 -350000 -350000

1 120000 -160000 80000 -270000

2 230000 70000 170000 -100000

3 250000 320000 250000 150000

4 310000 630000 380000 530000

5 350000 980000 520000 1050000

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

980000 1050000

PP (A) = 1 year + (160000£/230000£) = 1.7 year

PP (B) = 2 year + (100000£/250000£) = 2.4 year

Accounting rate of return: It indicates the overall profit return on initial project

investment. High ARR will be considered more feasible for investment purpose.

ARR (A) = (980000£/5)/280000£*100 = 70%

ARR (B) = (1050000£/5)/350000£*100 = 60%

Net present value and internal rate of return: According to this discounted cash flow

method, difference between discounted cash inflow and outflow is called NPV (McAllister,

n.d). For the given scenario, 10% discount rate has been used for predicting future values.

However, IRR is the rate at which NPV will be zero.

Year Project 1 Project 2 Discount rate

of £1 @ 10%

DCF DCF

0 -280000 -350000 1 -280000 -350000

1 120000 80000 0.909 109080 72720

2 230000 170000 0.826 189980 140420

3 250000 250000 0.751 187750 187750

4 310000 380000 0.683 211730 259540

5 350000 520000 0.621 217350 322920

IRR = 65.77% IRR = 49.51% 635890 633350

Interpretation: Lower PP of 1.7 year indicates that a project will generate its initial

investment earlier than project B. Moreover, ARR, NPV and IRR of this project is higher to

70%, 635890£ and 65.77% indicate that this restaurant business has to accept project A. It

will be more feasible and provide high benefits to restaurant unit.

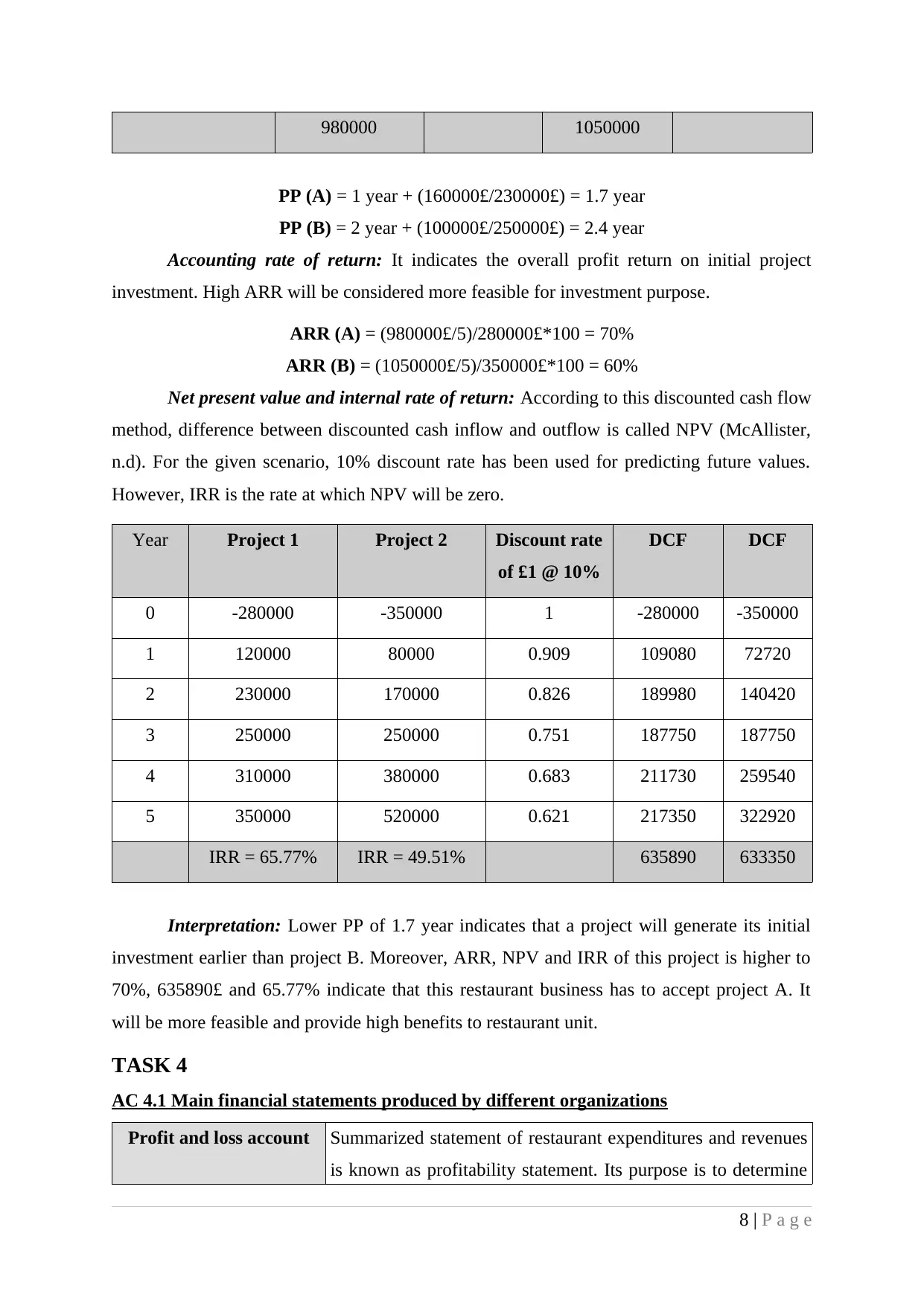

TASK 4

AC 4.1 Main financial statements produced by different organizations

Profit and loss account Summarized statement of restaurant expenditures and revenues

is known as profitability statement. Its purpose is to determine

8 | P a g e

PP (A) = 1 year + (160000£/230000£) = 1.7 year

PP (B) = 2 year + (100000£/250000£) = 2.4 year

Accounting rate of return: It indicates the overall profit return on initial project

investment. High ARR will be considered more feasible for investment purpose.

ARR (A) = (980000£/5)/280000£*100 = 70%

ARR (B) = (1050000£/5)/350000£*100 = 60%

Net present value and internal rate of return: According to this discounted cash flow

method, difference between discounted cash inflow and outflow is called NPV (McAllister,

n.d). For the given scenario, 10% discount rate has been used for predicting future values.

However, IRR is the rate at which NPV will be zero.

Year Project 1 Project 2 Discount rate

of £1 @ 10%

DCF DCF

0 -280000 -350000 1 -280000 -350000

1 120000 80000 0.909 109080 72720

2 230000 170000 0.826 189980 140420

3 250000 250000 0.751 187750 187750

4 310000 380000 0.683 211730 259540

5 350000 520000 0.621 217350 322920

IRR = 65.77% IRR = 49.51% 635890 633350

Interpretation: Lower PP of 1.7 year indicates that a project will generate its initial

investment earlier than project B. Moreover, ARR, NPV and IRR of this project is higher to

70%, 635890£ and 65.77% indicate that this restaurant business has to accept project A. It

will be more feasible and provide high benefits to restaurant unit.

TASK 4

AC 4.1 Main financial statements produced by different organizations

Profit and loss account Summarized statement of restaurant expenditures and revenues

is known as profitability statement. Its purpose is to determine

8 | P a g e

operational results in terms of gross profit, net profit and

operating profit.

Balance sheet Summarized statement of restaurant assets and liabilities is

known as balance sheet (Ormiston and Fraser, 2013). Its

purpose is to determine financial status of restaurant business.

Cash flow statement Its combines cash inflows and outflows from operating,

financing and investing activities. Its purpose is to determine

cash changes between two balance sheet period (Schroeder,

Clark and Cathey, 2013).

AC 4.2 Structure, content and details of main financial statements

Structure, content and details of financial statement of sole proprietorship, partnership

and company are presented here:

In sole proprietorship, all the capital is invested by trader themselves, henceforth, all

the profits and losses are available for him. However, partnership is the combined efforts of

two or more individuals thus; all the profits and losses will be share between all the partners.

However, company's owners are the shareholders therefore; all the profits are distributed to

the shareholders. It prepares its financial statement as per the company act requirements

while partnership constructed their final accounts according to partnership act. On the other

hand, sole trader does not need to follow any specific format for preparing their final

accounts. All the organization prepares profit and losses through combining total

expenditures and incomes while balance sheet includes all the assets and liabilities.

Illustration 1: Balance sheet of sole trader

9 | P a g e

operating profit.

Balance sheet Summarized statement of restaurant assets and liabilities is

known as balance sheet (Ormiston and Fraser, 2013). Its

purpose is to determine financial status of restaurant business.

Cash flow statement Its combines cash inflows and outflows from operating,

financing and investing activities. Its purpose is to determine

cash changes between two balance sheet period (Schroeder,

Clark and Cathey, 2013).

AC 4.2 Structure, content and details of main financial statements

Structure, content and details of financial statement of sole proprietorship, partnership

and company are presented here:

In sole proprietorship, all the capital is invested by trader themselves, henceforth, all

the profits and losses are available for him. However, partnership is the combined efforts of

two or more individuals thus; all the profits and losses will be share between all the partners.

However, company's owners are the shareholders therefore; all the profits are distributed to

the shareholders. It prepares its financial statement as per the company act requirements

while partnership constructed their final accounts according to partnership act. On the other

hand, sole trader does not need to follow any specific format for preparing their final

accounts. All the organization prepares profit and losses through combining total

expenditures and incomes while balance sheet includes all the assets and liabilities.

Illustration 1: Balance sheet of sole trader

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.