Omnipresent PLC Financial Analysis and Investment Appraisal Report

VerifiedAdded on 2023/06/09

|9

|1897

|429

Report

AI Summary

This report presents a comprehensive financial analysis of Omnipresent PLC, encompassing financial ratio calculations for 2021 and 2022, and their interpretation from a shareholder's perspective. It also explores the limitations of ratio analysis. The report differentiates between management ...

Skills of The Manager

Consultant

Consultant

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

MAIN BODY..................................................................................................................................3

Question 1........................................................................................................................................3

A. Calculate the financial ratio for Omnipresent plc for the year 2021 and 2022.......................3

B. Interpret the information from the viewpoint of the shareholders..........................................4

C. Explain the limitations of ratios while evaluating the performance of the business...............4

D. Differentiate between management accounting and financial accounting by using relevant

examples......................................................................................................................................4

Question 3........................................................................................................................................5

A. By using investment appraisal technique appraise the following project...............................5

B. State the project which should be selected among the two proprietor....................................7

C. State the factor which will help in making final decision regarding the project....................7

D. Evaluate the use of Net Present Value of Investment appraisal.............................................7

Question 4........................................................................................................................................7

A. Prepare Cash Budget...............................................................................................................7

B...................................................................................................................................................8

REFERENCES................................................................................................................................9

MAIN BODY..................................................................................................................................3

Question 1........................................................................................................................................3

A. Calculate the financial ratio for Omnipresent plc for the year 2021 and 2022.......................3

B. Interpret the information from the viewpoint of the shareholders..........................................4

C. Explain the limitations of ratios while evaluating the performance of the business...............4

D. Differentiate between management accounting and financial accounting by using relevant

examples......................................................................................................................................4

Question 3........................................................................................................................................5

A. By using investment appraisal technique appraise the following project...............................5

B. State the project which should be selected among the two proprietor....................................7

C. State the factor which will help in making final decision regarding the project....................7

D. Evaluate the use of Net Present Value of Investment appraisal.............................................7

Question 4........................................................................................................................................7

A. Prepare Cash Budget...............................................................................................................7

B...................................................................................................................................................8

REFERENCES................................................................................................................................9

MAIN BODY

Question 1

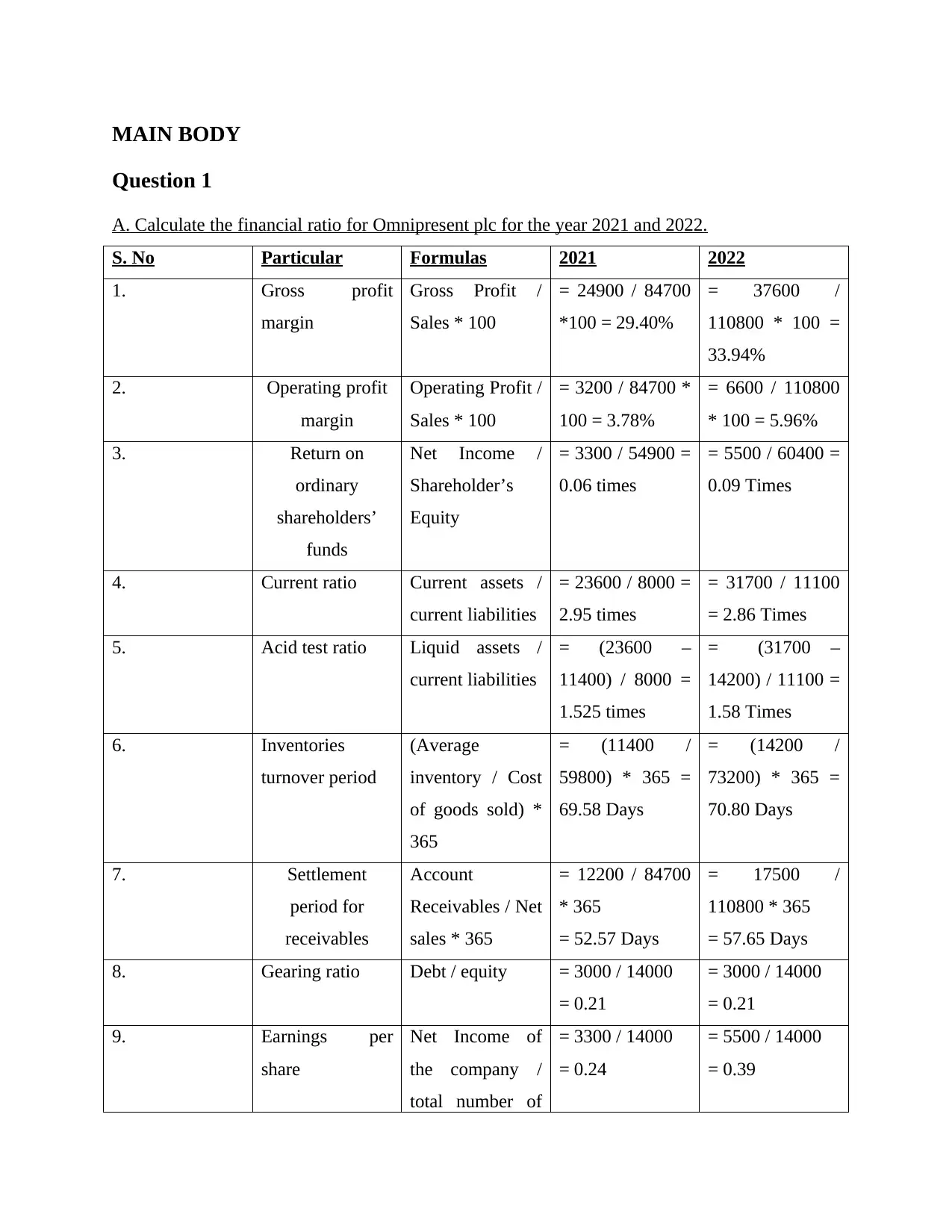

A. Calculate the financial ratio for Omnipresent plc for the year 2021 and 2022.

S. No Particular Formulas 2021 2022

1. Gross profit

margin

Gross Profit /

Sales * 100

= 24900 / 84700

*100 = 29.40%

= 37600 /

110800 * 100 =

33.94%

2. Operating profit

margin

Operating Profit /

Sales * 100

= 3200 / 84700 *

100 = 3.78%

= 6600 / 110800

* 100 = 5.96%

3. Return on

ordinary

shareholders’

funds

Net Income /

Shareholder’s

Equity

= 3300 / 54900 =

0.06 times

= 5500 / 60400 =

0.09 Times

4. Current ratio Current assets /

current liabilities

= 23600 / 8000 =

2.95 times

= 31700 / 11100

= 2.86 Times

5. Acid test ratio Liquid assets /

current liabilities

= (23600 –

11400) / 8000 =

1.525 times

= (31700 –

14200) / 11100 =

1.58 Times

6. Inventories

turnover period

(Average

inventory / Cost

of goods sold) *

365

= (11400 /

59800) * 365 =

69.58 Days

= (14200 /

73200) * 365 =

70.80 Days

7. Settlement

period for

receivables

Account

Receivables / Net

sales * 365

= 12200 / 84700

* 365

= 52.57 Days

= 17500 /

110800 * 365

= 57.65 Days

8. Gearing ratio Debt / equity = 3000 / 14000

= 0.21

= 3000 / 14000

= 0.21

9. Earnings per

share

Net Income of

the company /

total number of

= 3300 / 14000

= 0.24

= 5500 / 14000

= 0.39

Question 1

A. Calculate the financial ratio for Omnipresent plc for the year 2021 and 2022.

S. No Particular Formulas 2021 2022

1. Gross profit

margin

Gross Profit /

Sales * 100

= 24900 / 84700

*100 = 29.40%

= 37600 /

110800 * 100 =

33.94%

2. Operating profit

margin

Operating Profit /

Sales * 100

= 3200 / 84700 *

100 = 3.78%

= 6600 / 110800

* 100 = 5.96%

3. Return on

ordinary

shareholders’

funds

Net Income /

Shareholder’s

Equity

= 3300 / 54900 =

0.06 times

= 5500 / 60400 =

0.09 Times

4. Current ratio Current assets /

current liabilities

= 23600 / 8000 =

2.95 times

= 31700 / 11100

= 2.86 Times

5. Acid test ratio Liquid assets /

current liabilities

= (23600 –

11400) / 8000 =

1.525 times

= (31700 –

14200) / 11100 =

1.58 Times

6. Inventories

turnover period

(Average

inventory / Cost

of goods sold) *

365

= (11400 /

59800) * 365 =

69.58 Days

= (14200 /

73200) * 365 =

70.80 Days

7. Settlement

period for

receivables

Account

Receivables / Net

sales * 365

= 12200 / 84700

* 365

= 52.57 Days

= 17500 /

110800 * 365

= 57.65 Days

8. Gearing ratio Debt / equity = 3000 / 14000

= 0.21

= 3000 / 14000

= 0.21

9. Earnings per

share

Net Income of

the company /

total number of

= 3300 / 14000

= 0.24

= 5500 / 14000

= 0.39

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

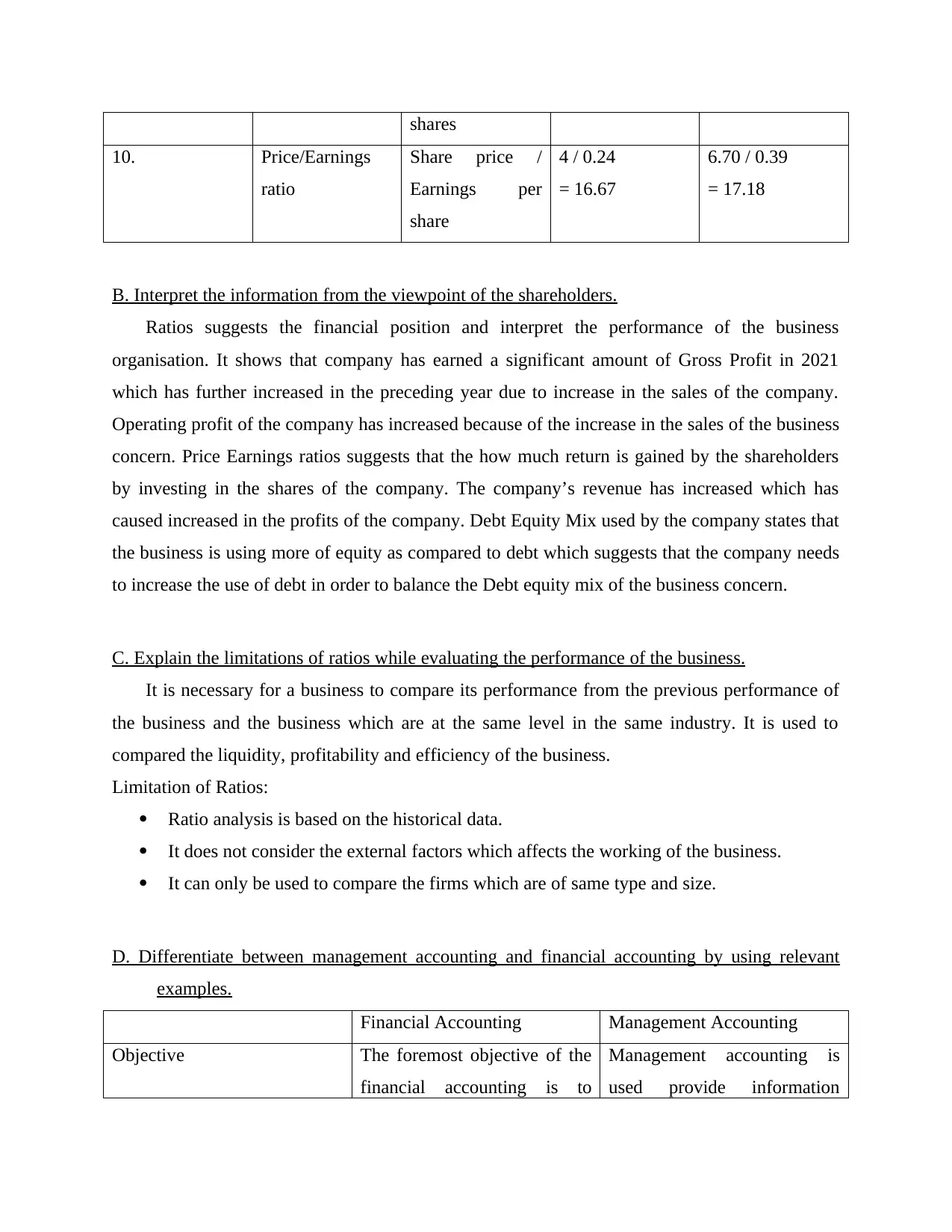

shares

10. Price/Earnings

ratio

Share price /

Earnings per

share

4 / 0.24

= 16.67

6.70 / 0.39

= 17.18

B. Interpret the information from the viewpoint of the shareholders.

Ratios suggests the financial position and interpret the performance of the business

organisation. It shows that company has earned a significant amount of Gross Profit in 2021

which has further increased in the preceding year due to increase in the sales of the company.

Operating profit of the company has increased because of the increase in the sales of the business

concern. Price Earnings ratios suggests that the how much return is gained by the shareholders

by investing in the shares of the company. The company’s revenue has increased which has

caused increased in the profits of the company. Debt Equity Mix used by the company states that

the business is using more of equity as compared to debt which suggests that the company needs

to increase the use of debt in order to balance the Debt equity mix of the business concern.

C. Explain the limitations of ratios while evaluating the performance of the business.

It is necessary for a business to compare its performance from the previous performance of

the business and the business which are at the same level in the same industry. It is used to

compared the liquidity, profitability and efficiency of the business.

Limitation of Ratios:

Ratio analysis is based on the historical data.

It does not consider the external factors which affects the working of the business.

It can only be used to compare the firms which are of same type and size.

D. Differentiate between management accounting and financial accounting by using relevant

examples.

Financial Accounting Management Accounting

Objective The foremost objective of the

financial accounting is to

Management accounting is

used provide information

10. Price/Earnings

ratio

Share price /

Earnings per

share

4 / 0.24

= 16.67

6.70 / 0.39

= 17.18

B. Interpret the information from the viewpoint of the shareholders.

Ratios suggests the financial position and interpret the performance of the business

organisation. It shows that company has earned a significant amount of Gross Profit in 2021

which has further increased in the preceding year due to increase in the sales of the company.

Operating profit of the company has increased because of the increase in the sales of the business

concern. Price Earnings ratios suggests that the how much return is gained by the shareholders

by investing in the shares of the company. The company’s revenue has increased which has

caused increased in the profits of the company. Debt Equity Mix used by the company states that

the business is using more of equity as compared to debt which suggests that the company needs

to increase the use of debt in order to balance the Debt equity mix of the business concern.

C. Explain the limitations of ratios while evaluating the performance of the business.

It is necessary for a business to compare its performance from the previous performance of

the business and the business which are at the same level in the same industry. It is used to

compared the liquidity, profitability and efficiency of the business.

Limitation of Ratios:

Ratio analysis is based on the historical data.

It does not consider the external factors which affects the working of the business.

It can only be used to compare the firms which are of same type and size.

D. Differentiate between management accounting and financial accounting by using relevant

examples.

Financial Accounting Management Accounting

Objective The foremost objective of the

financial accounting is to

Management accounting is

used provide information

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

disclose the end result of the

business.

which helps in making plans

and set goals

Audience The information produced is

used by the external users.

The information so derived is

used by the internal

management for preparation

of future goals of the

company.

Example Annual reports Management reports

Question 3

A. By using investment appraisal technique appraise the following project.

i) Payback period:

Country A

Year Annual

Cash flow

Cumulative

Cash

Inflows

0 4000000 0

1 1000000 1000000

2 1600000 2600000

3 1700000 4300000

4 1100000 5400000

5 500000 5900000

6 600000 6500000

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 2 + (4300000 - 4000000) / 1700000

= 2 + 300000 / 1700000

= 2 + 0.18

= 2.18 years

Country B

business.

which helps in making plans

and set goals

Audience The information produced is

used by the external users.

The information so derived is

used by the internal

management for preparation

of future goals of the

company.

Example Annual reports Management reports

Question 3

A. By using investment appraisal technique appraise the following project.

i) Payback period:

Country A

Year Annual

Cash flow

Cumulative

Cash

Inflows

0 4000000 0

1 1000000 1000000

2 1600000 2600000

3 1700000 4300000

4 1100000 5400000

5 500000 5900000

6 600000 6500000

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 2 + (4300000 - 4000000) / 1700000

= 2 + 300000 / 1700000

= 2 + 0.18

= 2.18 years

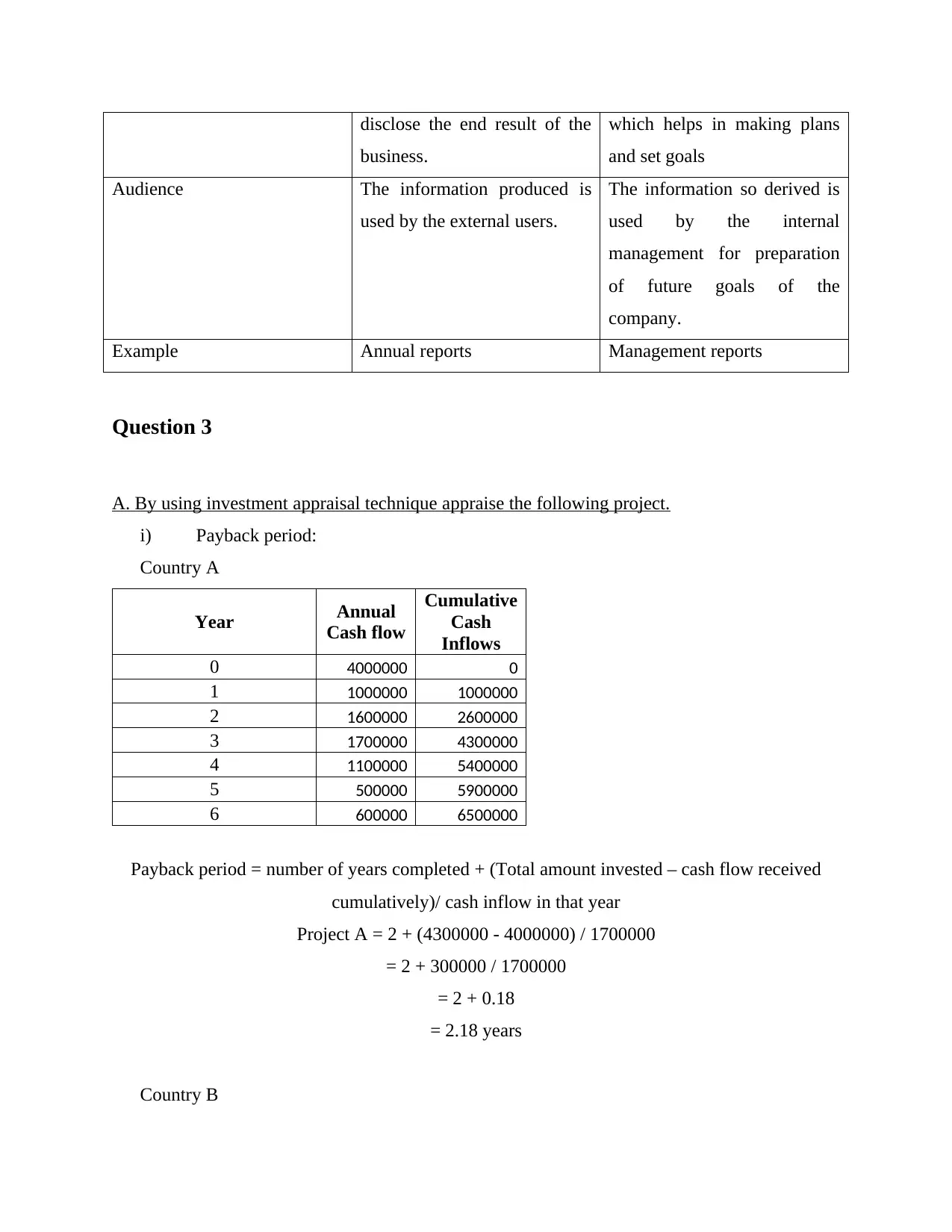

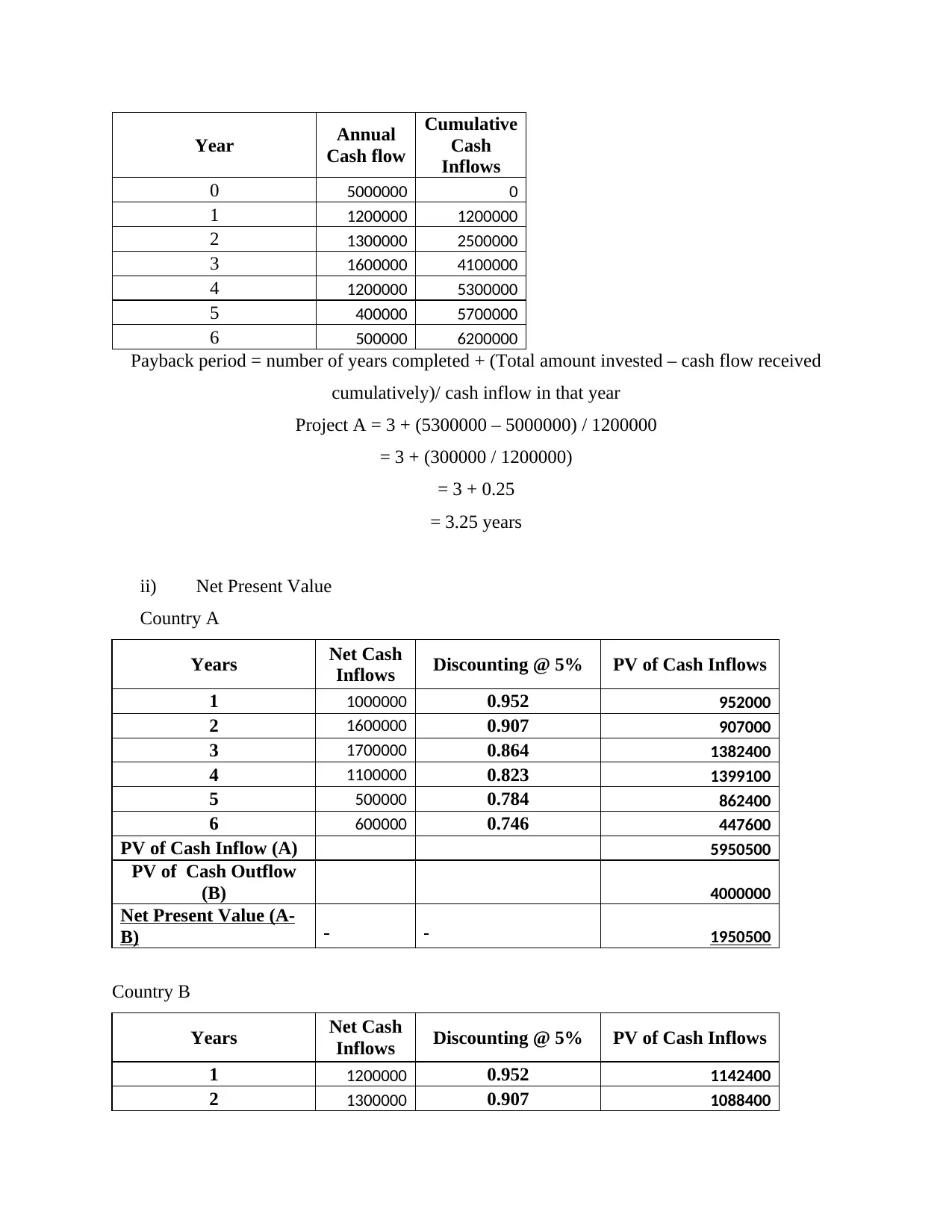

Country B

Year Annual

Cash flow

Cumulative

Cash

Inflows

0 5000000 0

1 1200000 1200000

2 1300000 2500000

3 1600000 4100000

4 1200000 5300000

5 400000 5700000

6 500000 6200000

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 3 + (5300000 – 5000000) / 1200000

= 3 + (300000 / 1200000)

= 3 + 0.25

= 3.25 years

ii) Net Present Value

Country A

Years Net Cash

Inflows Discounting @ 5% PV of Cash Inflows

1 1000000 0.952 952000

2 1600000 0.907 907000

3 1700000 0.864 1382400

4 1100000 0.823 1399100

5 500000 0.784 862400

6 600000 0.746 447600

PV of Cash Inflow (A) 5950500

PV of Cash Outflow

(B) 4000000

Net Present Value (A-

B) 1950500

Country B

Years Net Cash

Inflows Discounting @ 5% PV of Cash Inflows

1 1200000 0.952 1142400

2 1300000 0.907 1088400

Cash flow

Cumulative

Cash

Inflows

0 5000000 0

1 1200000 1200000

2 1300000 2500000

3 1600000 4100000

4 1200000 5300000

5 400000 5700000

6 500000 6200000

Payback period = number of years completed + (Total amount invested – cash flow received

cumulatively)/ cash inflow in that year

Project A = 3 + (5300000 – 5000000) / 1200000

= 3 + (300000 / 1200000)

= 3 + 0.25

= 3.25 years

ii) Net Present Value

Country A

Years Net Cash

Inflows Discounting @ 5% PV of Cash Inflows

1 1000000 0.952 952000

2 1600000 0.907 907000

3 1700000 0.864 1382400

4 1100000 0.823 1399100

5 500000 0.784 862400

6 600000 0.746 447600

PV of Cash Inflow (A) 5950500

PV of Cash Outflow

(B) 4000000

Net Present Value (A-

B) 1950500

Country B

Years Net Cash

Inflows Discounting @ 5% PV of Cash Inflows

1 1200000 0.952 1142400

2 1300000 0.907 1088400

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

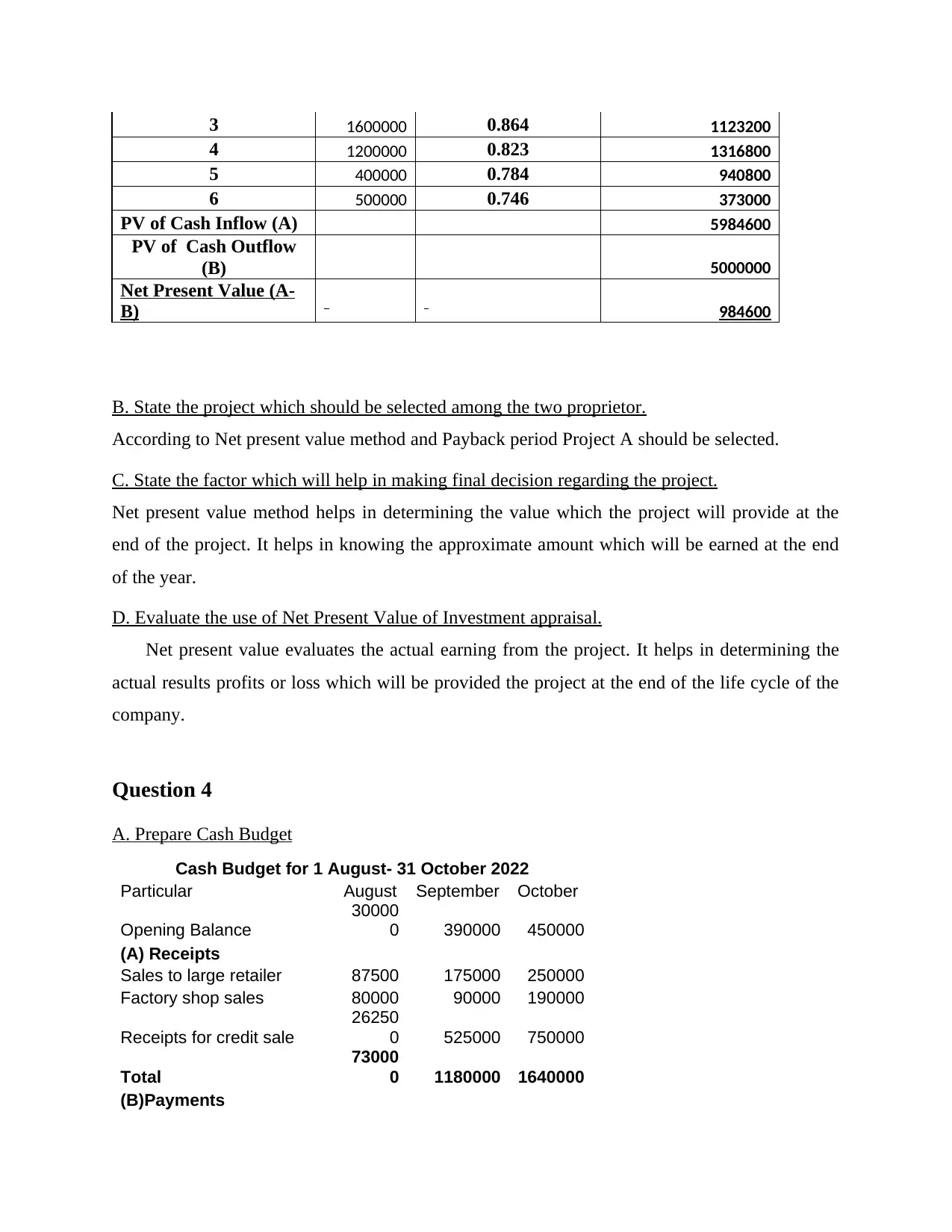

3 1600000 0.864 1123200

4 1200000 0.823 1316800

5 400000 0.784 940800

6 500000 0.746 373000

PV of Cash Inflow (A) 5984600

PV of Cash Outflow

(B) 5000000

Net Present Value (A-

B) 984600

B. State the project which should be selected among the two proprietor.

According to Net present value method and Payback period Project A should be selected.

C. State the factor which will help in making final decision regarding the project.

Net present value method helps in determining the value which the project will provide at the

end of the project. It helps in knowing the approximate amount which will be earned at the end

of the year.

D. Evaluate the use of Net Present Value of Investment appraisal.

Net present value evaluates the actual earning from the project. It helps in determining the

actual results profits or loss which will be provided the project at the end of the life cycle of the

company.

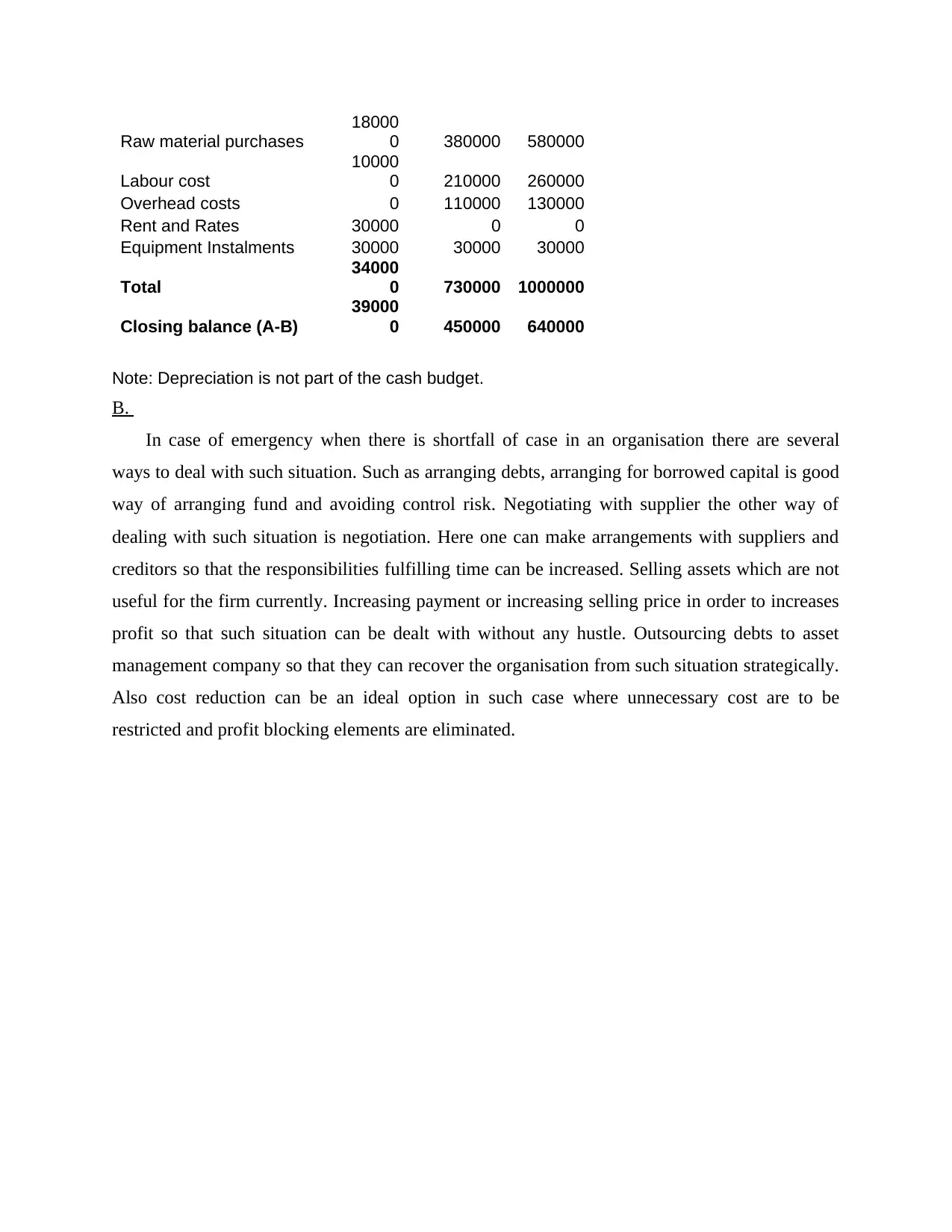

Question 4

A. Prepare Cash Budget

Cash Budget for 1 August- 31 October 2022

Particular August September October

Opening Balance

30000

0 390000 450000

(A) Receipts

Sales to large retailer 87500 175000 250000

Factory shop sales 80000 90000 190000

Receipts for credit sale

26250

0 525000 750000

Total

73000

0 1180000 1640000

(B)Payments

4 1200000 0.823 1316800

5 400000 0.784 940800

6 500000 0.746 373000

PV of Cash Inflow (A) 5984600

PV of Cash Outflow

(B) 5000000

Net Present Value (A-

B) 984600

B. State the project which should be selected among the two proprietor.

According to Net present value method and Payback period Project A should be selected.

C. State the factor which will help in making final decision regarding the project.

Net present value method helps in determining the value which the project will provide at the

end of the project. It helps in knowing the approximate amount which will be earned at the end

of the year.

D. Evaluate the use of Net Present Value of Investment appraisal.

Net present value evaluates the actual earning from the project. It helps in determining the

actual results profits or loss which will be provided the project at the end of the life cycle of the

company.

Question 4

A. Prepare Cash Budget

Cash Budget for 1 August- 31 October 2022

Particular August September October

Opening Balance

30000

0 390000 450000

(A) Receipts

Sales to large retailer 87500 175000 250000

Factory shop sales 80000 90000 190000

Receipts for credit sale

26250

0 525000 750000

Total

73000

0 1180000 1640000

(B)Payments

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Raw material purchases

18000

0 380000 580000

Labour cost

10000

0 210000 260000

Overhead costs 0 110000 130000

Rent and Rates 30000 0 0

Equipment Instalments 30000 30000 30000

Total

34000

0 730000 1000000

Closing balance (A-B)

39000

0 450000 640000

Note: Depreciation is not part of the cash budget.

B.

In case of emergency when there is shortfall of case in an organisation there are several

ways to deal with such situation. Such as arranging debts, arranging for borrowed capital is good

way of arranging fund and avoiding control risk. Negotiating with supplier the other way of

dealing with such situation is negotiation. Here one can make arrangements with suppliers and

creditors so that the responsibilities fulfilling time can be increased. Selling assets which are not

useful for the firm currently. Increasing payment or increasing selling price in order to increases

profit so that such situation can be dealt with without any hustle. Outsourcing debts to asset

management company so that they can recover the organisation from such situation strategically.

Also cost reduction can be an ideal option in such case where unnecessary cost are to be

restricted and profit blocking elements are eliminated.

18000

0 380000 580000

Labour cost

10000

0 210000 260000

Overhead costs 0 110000 130000

Rent and Rates 30000 0 0

Equipment Instalments 30000 30000 30000

Total

34000

0 730000 1000000

Closing balance (A-B)

39000

0 450000 640000

Note: Depreciation is not part of the cash budget.

B.

In case of emergency when there is shortfall of case in an organisation there are several

ways to deal with such situation. Such as arranging debts, arranging for borrowed capital is good

way of arranging fund and avoiding control risk. Negotiating with supplier the other way of

dealing with such situation is negotiation. Here one can make arrangements with suppliers and

creditors so that the responsibilities fulfilling time can be increased. Selling assets which are not

useful for the firm currently. Increasing payment or increasing selling price in order to increases

profit so that such situation can be dealt with without any hustle. Outsourcing debts to asset

management company so that they can recover the organisation from such situation strategically.

Also cost reduction can be an ideal option in such case where unnecessary cost are to be

restricted and profit blocking elements are eliminated.

REFERENCES

Books and Journals

Abdelhady, S., 2021. Performance and cost evaluation of solar dish power plant: sensitivity

analysis of levelized cost of electricity (LCOE) and net present value (NPV). Renewable

Energy. 168, pp.332-342.

Basher, S.A. and Raboy, D.G., 2018. The misuse of net present value in energy efficiency

standards. Renewable and Sustainable Energy Reviews. 96, pp.218-225.

Brotons-Martínez, J.M. And et.al., 2022. The Use of Fuzzy Decoupled Net Present Value in

pepper production. In XX SIGEF Congress-Harnessing Complexity through Fuzzy

Logic (pp. 36-46). Springer, Cham.

Deng, C. And et.al., 2020. Determining the ecological compensation standard based on forest

multifunction evaluation and financial net present value analysis: A case study in

southwestern Guangxi, China. Journal of Sustainable Forestry. 39(7), pp.730-749.

Dusseault, B. and Pasquier, P., 2021. Usage of the net present value-at-risk to design ground-

coupled heat pump systems under uncertain scenarios. Renewable Energy, 173, pp.953-

971.

Fortaleza, E.L.F., Neto, E.P.B. and Miranda, M.E.R., 2020. Production optimization using a

modified net present value. Computational Geosciences. 24(3), pp.1087-1100.

Junior, J.R.B. And et.al., 2022. A comparison of machine learning surrogate models for net

present value prediction from well placement binary data. Journal of Petroleum Science

and Engineering. 208, p.109208.

Rezaei, F. And et.al., 2021. Simulation-based priority rules for the stochastic resource-

constrained net present value and risk problem. Computers & Industrial

Engineering. 160, p.107607.

Sirinanda, K.G. And et.al., 2018. Strategic underground mine access design to maximise the Net

Present Value. In Advances in Applied Strategic Mine Planning (pp. 607-624). Springer,

Cham.

Thiruvady, D., Blum, C. and Ernst, A.T., 2019, January. Maximising the net present value of

project schedules using CMSA and parallel ACO. In International Workshop on Hybrid

Metaheuristics (pp. 16-30). Springer, Cham.

Books and Journals

Abdelhady, S., 2021. Performance and cost evaluation of solar dish power plant: sensitivity

analysis of levelized cost of electricity (LCOE) and net present value (NPV). Renewable

Energy. 168, pp.332-342.

Basher, S.A. and Raboy, D.G., 2018. The misuse of net present value in energy efficiency

standards. Renewable and Sustainable Energy Reviews. 96, pp.218-225.

Brotons-Martínez, J.M. And et.al., 2022. The Use of Fuzzy Decoupled Net Present Value in

pepper production. In XX SIGEF Congress-Harnessing Complexity through Fuzzy

Logic (pp. 36-46). Springer, Cham.

Deng, C. And et.al., 2020. Determining the ecological compensation standard based on forest

multifunction evaluation and financial net present value analysis: A case study in

southwestern Guangxi, China. Journal of Sustainable Forestry. 39(7), pp.730-749.

Dusseault, B. and Pasquier, P., 2021. Usage of the net present value-at-risk to design ground-

coupled heat pump systems under uncertain scenarios. Renewable Energy, 173, pp.953-

971.

Fortaleza, E.L.F., Neto, E.P.B. and Miranda, M.E.R., 2020. Production optimization using a

modified net present value. Computational Geosciences. 24(3), pp.1087-1100.

Junior, J.R.B. And et.al., 2022. A comparison of machine learning surrogate models for net

present value prediction from well placement binary data. Journal of Petroleum Science

and Engineering. 208, p.109208.

Rezaei, F. And et.al., 2021. Simulation-based priority rules for the stochastic resource-

constrained net present value and risk problem. Computers & Industrial

Engineering. 160, p.107607.

Sirinanda, K.G. And et.al., 2018. Strategic underground mine access design to maximise the Net

Present Value. In Advances in Applied Strategic Mine Planning (pp. 607-624). Springer,

Cham.

Thiruvady, D., Blum, C. and Ernst, A.T., 2019, January. Maximising the net present value of

project schedules using CMSA and parallel ACO. In International Workshop on Hybrid

Metaheuristics (pp. 16-30). Springer, Cham.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.