Business Finance Report: Cash Flow Problems and Investment Appraisal

VerifiedAdded on 2020/01/28

|10

|3240

|62

Report

AI Summary

This report, designed for a small-sized business consultancy, delves into critical aspects of business finance. It differentiates between cash and profit, highlighting the importance of managing cash flow effectively to maintain liquidity. The report examines the causes of cash shortages, including low sales, excessive expenses, poor investment decisions, and economic changes, and offers solutions such as promotional strategies and budgeting. Furthermore, it outlines the capital budgeting process, including identifying opportunities, evaluating options, estimating cash flows, project selection, and implementation. The report also details key investment appraisal methods like payback period, NPV, ARR, and IRR, providing a comprehensive guide to making informed investment decisions. This analysis is crucial for businesses seeking to improve their financial management and achieve sustainable growth. The report is a valuable resource for understanding and applying core financial principles to real-world business scenarios.

Business Finance

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction..........................................................................................................................................3

TASK 1.................................................................................................................................................3

Outlining the cash flow problems and methods to deal with it .....................................................3

TASK 2.................................................................................................................................................6

Stating the four main methods of investment appraisal and its process.........................................6

CONCLUSION....................................................................................................................................8

References..........................................................................................................................................10

2

Introduction..........................................................................................................................................3

TASK 1.................................................................................................................................................3

Outlining the cash flow problems and methods to deal with it .....................................................3

TASK 2.................................................................................................................................................6

Stating the four main methods of investment appraisal and its process.........................................6

CONCLUSION....................................................................................................................................8

References..........................................................................................................................................10

2

INTRODUCTION

Business finance consists of the wide range of discipline and activities which is closely

related to the management of money. Finance is the most crucial element of the business. In this,

manager of the firm has accountability to make optimum use of financial resources. Business

finance may be defined as a process in which organization makes focus on the collection of fund

from the low cost of monetary sources. Through this, business organization is able to exert control

on the outflow of the firm to the large extent. This report is based on case scenario company offers

consultancy services to the small sized business organization. The present report will differentiate

the cash and profit. Besides this, it will also shed light on the impact of short of cash on the function

and operations of business organization. Further, it will also discuss the stages which are involved

in the capital budgeting process. It also depicts the various tools which help business unit in making

most profitable investment decisions.

TASK 1

Outlining the cash flow problems and methods to deal with it

On the basis of the cited case scenario, it is advised by the company to two clients or small

sized business organization that they need to manage their cash related activities in an effectual

manner. Moreover, cash and profit is one of the most significant factors which assists corporation in

maintaining the liquidity to the large extent. Nevertheless, cash and profit is highly different from

each other in the following manner:

Difference between the cash and profit: Cash flow includes both inflow and outflow which may

present of the outcome of the business activities. Cash inflow represents the sales revenue which is

generated by the firm during the accounting year. Whereas, outflow contains the expenses such as

salaries of the employees, office and other expenditures etc. Thus, balance of inflow and outflow

clearly presents the condition of deficit and surplus. Position of surplus reflects that company has

made optimum use of their financial resources to the significant level (Lončar, 2011). On the

contrary to it, profit reflects the revenue which is generated by the firm over the expenditures. In

income statement, business unit records all the income and expenses whether they received or

incurred in cash or not. In comparison to this, cash flow entails the income and expenditures which

are received or incurred by the firm in cash. On the basis of this aspect, it can be said that profit

includes both monetary and non-monetary transactions. Whereas, cash flow is completely based on

the cash related activities.

In addition to this, users of cash and profit statement is highly differs to the large extent.

Moreover, shareholders of the firm makes evaluation of the profitability aspect because the

3

Business finance consists of the wide range of discipline and activities which is closely

related to the management of money. Finance is the most crucial element of the business. In this,

manager of the firm has accountability to make optimum use of financial resources. Business

finance may be defined as a process in which organization makes focus on the collection of fund

from the low cost of monetary sources. Through this, business organization is able to exert control

on the outflow of the firm to the large extent. This report is based on case scenario company offers

consultancy services to the small sized business organization. The present report will differentiate

the cash and profit. Besides this, it will also shed light on the impact of short of cash on the function

and operations of business organization. Further, it will also discuss the stages which are involved

in the capital budgeting process. It also depicts the various tools which help business unit in making

most profitable investment decisions.

TASK 1

Outlining the cash flow problems and methods to deal with it

On the basis of the cited case scenario, it is advised by the company to two clients or small

sized business organization that they need to manage their cash related activities in an effectual

manner. Moreover, cash and profit is one of the most significant factors which assists corporation in

maintaining the liquidity to the large extent. Nevertheless, cash and profit is highly different from

each other in the following manner:

Difference between the cash and profit: Cash flow includes both inflow and outflow which may

present of the outcome of the business activities. Cash inflow represents the sales revenue which is

generated by the firm during the accounting year. Whereas, outflow contains the expenses such as

salaries of the employees, office and other expenditures etc. Thus, balance of inflow and outflow

clearly presents the condition of deficit and surplus. Position of surplus reflects that company has

made optimum use of their financial resources to the significant level (Lončar, 2011). On the

contrary to it, profit reflects the revenue which is generated by the firm over the expenditures. In

income statement, business unit records all the income and expenses whether they received or

incurred in cash or not. In comparison to this, cash flow entails the income and expenditures which

are received or incurred by the firm in cash. On the basis of this aspect, it can be said that profit

includes both monetary and non-monetary transactions. Whereas, cash flow is completely based on

the cash related activities.

In addition to this, users of cash and profit statement is highly differs to the large extent.

Moreover, shareholders of the firm makes evaluation of the profitability aspect because the

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

dividend decision of the firm is highly influenced by this factor. Thus, shareholders make

assessment of the profit or loss while they make investment decision. In comparison to this,

management of the firm evaluates the cash flow which helps them in framing competent strategies

and policies which help them in making effective administration of cash. On the basis of all the

above mentioned aspect, it can be said that cash and profit both the factors are separate from each

other and plays a vital role in the growth and success of firm.

Characteristics of the liquidity and profitability

Profitability aspect of the firm presents the high level of revenue which is generated by them

over the expenses. High revenue presents the ability of the firm in relation the management

of the business activities and practices.

Manager can easily evaluate the growth which takes place in the profitability aspect of the

firm through gross, net and operating ratios. It enables company to take strategic decision

which helps them in attaining success in the dynamic business area (Chen and et.al., 2012).

Cash flow is the most effectual measure of liquidity which reflects that business unit has

adequate amount of fund. Further, high level of liquidity also presents that company has

made optimum use of funds to the significant level.

High liquidity indicates that business unit has performed its operating, investing and

financing activities in an appropriate manner.

Besides this, profit and liquidity aspects are highly associated with each other. Nevertheless,

it is possible that business unit who has high level of profitability but still face the problem of

liquidity problems. It may arise because due to the high investment in the projects. Thus, business

organization needs to make balance between their policies and strategies. By this, company is able

to maintain the high level of liquidity to the large extent.

Causes of cash shortage: There are several aspects due to which the problem of cash shortage

arises are enumerated below:

Lower sales are one of the main factors due to which problem of cash shortages are arises.

Moreover, cash flow of the business unit is highly influenced by the revenue which is

generated by them during the accounting year.

Further, when company makes huge expenses as compared to the planned then it may also

cause of the lack of cash. Besides this, if company fails top make proper estimation of the

expenses which they need to incur over the period of time then it may also result into the

cash related problems (Magni, 2013).

Cash related problems are also arises when business unit fails to invest money in the suitable

project. Moreover, company invests money in the varied kind of projects with the aim to

4

assessment of the profit or loss while they make investment decision. In comparison to this,

management of the firm evaluates the cash flow which helps them in framing competent strategies

and policies which help them in making effective administration of cash. On the basis of all the

above mentioned aspect, it can be said that cash and profit both the factors are separate from each

other and plays a vital role in the growth and success of firm.

Characteristics of the liquidity and profitability

Profitability aspect of the firm presents the high level of revenue which is generated by them

over the expenses. High revenue presents the ability of the firm in relation the management

of the business activities and practices.

Manager can easily evaluate the growth which takes place in the profitability aspect of the

firm through gross, net and operating ratios. It enables company to take strategic decision

which helps them in attaining success in the dynamic business area (Chen and et.al., 2012).

Cash flow is the most effectual measure of liquidity which reflects that business unit has

adequate amount of fund. Further, high level of liquidity also presents that company has

made optimum use of funds to the significant level.

High liquidity indicates that business unit has performed its operating, investing and

financing activities in an appropriate manner.

Besides this, profit and liquidity aspects are highly associated with each other. Nevertheless,

it is possible that business unit who has high level of profitability but still face the problem of

liquidity problems. It may arise because due to the high investment in the projects. Thus, business

organization needs to make balance between their policies and strategies. By this, company is able

to maintain the high level of liquidity to the large extent.

Causes of cash shortage: There are several aspects due to which the problem of cash shortage

arises are enumerated below:

Lower sales are one of the main factors due to which problem of cash shortages are arises.

Moreover, cash flow of the business unit is highly influenced by the revenue which is

generated by them during the accounting year.

Further, when company makes huge expenses as compared to the planned then it may also

cause of the lack of cash. Besides this, if company fails top make proper estimation of the

expenses which they need to incur over the period of time then it may also result into the

cash related problems (Magni, 2013).

Cash related problems are also arises when business unit fails to invest money in the suitable

project. Moreover, company invests money in the varied kind of projects with the aim to

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

generate high level of return. Thus, if prediction or estimation of the manager goes wrong

then it negatively hampers the cash position of firm.

Changes in the economic conditions such as inflation or deflation also have high level of

impact on the cash position of the firm. Moreover, during deflation purchasing power of the

customer decreases. In this, business unit is not in condition to generate enough amount of

revenue. This aspect closely affects the cash flow of the corporation in the negative

direction. In addition to this, changing market conditions as well as taste and preferences of

the customers also may cause behind the problem of shortage of cash (Ding and et.al.,

2013).

In addition to this, most of the time accounting personnel records high expenses as

compared to the actual with the aim to make fraud. Thus, scam which is made by an

accountant also may cause of the cash shortage.

Thus, when company does not have sufficient amount of cash then it inhibit the smooth

functioning of the business activities and operations.

Methods to deal with the cash flow related problems: In the strategic business arena, company can

attain success only when they manage their financial resources more effectively and efficiently. In

this, business unit requires to undertake the following actions in order to minimize the problem of

cash shortage which are enumerated below:

In order to enhance the revenue business unit requires to undertake promotional strategies

and campaign which help them in attracting the large number of customers. Thus, by

serving the large number of customers business can maximize its productivity and

profitability to the large extent. Through this, corporation can overcome the problem of

cash shortage (Cheng and et.al., 2011).

Budgeting is the best tool which clients need to adopt for making control on the expenses.

By preparing budget company can provide direction to the personnel in which they need to

spend money. Along with it, by comparing the actual expenses with the budgeted one

business unit can easily assess the deviations which take place in their financial

performance. It enables firm to undertake corrective measure within the suitable time frame

which aid in the success of firm.

In addition to this, by conducting internal audit on a periodical basis firm can easily detect

the errors which are present in the books of accounts. Through this, business unit can

improve the cash position to the significant level (Cheng and et.al., 2011).

Company also needs to undertake investment appraisal techniques which help them in

investing money in the right direction.

5

then it negatively hampers the cash position of firm.

Changes in the economic conditions such as inflation or deflation also have high level of

impact on the cash position of the firm. Moreover, during deflation purchasing power of the

customer decreases. In this, business unit is not in condition to generate enough amount of

revenue. This aspect closely affects the cash flow of the corporation in the negative

direction. In addition to this, changing market conditions as well as taste and preferences of

the customers also may cause behind the problem of shortage of cash (Ding and et.al.,

2013).

In addition to this, most of the time accounting personnel records high expenses as

compared to the actual with the aim to make fraud. Thus, scam which is made by an

accountant also may cause of the cash shortage.

Thus, when company does not have sufficient amount of cash then it inhibit the smooth

functioning of the business activities and operations.

Methods to deal with the cash flow related problems: In the strategic business arena, company can

attain success only when they manage their financial resources more effectively and efficiently. In

this, business unit requires to undertake the following actions in order to minimize the problem of

cash shortage which are enumerated below:

In order to enhance the revenue business unit requires to undertake promotional strategies

and campaign which help them in attracting the large number of customers. Thus, by

serving the large number of customers business can maximize its productivity and

profitability to the large extent. Through this, corporation can overcome the problem of

cash shortage (Cheng and et.al., 2011).

Budgeting is the best tool which clients need to adopt for making control on the expenses.

By preparing budget company can provide direction to the personnel in which they need to

spend money. Along with it, by comparing the actual expenses with the budgeted one

business unit can easily assess the deviations which take place in their financial

performance. It enables firm to undertake corrective measure within the suitable time frame

which aid in the success of firm.

In addition to this, by conducting internal audit on a periodical basis firm can easily detect

the errors which are present in the books of accounts. Through this, business unit can

improve the cash position to the significant level (Cheng and et.al., 2011).

Company also needs to undertake investment appraisal techniques which help them in

investing money in the right direction.

5

Thus, all the above mentioned aspect provide high level of assistance to the firm in

managing cash in the best possible manner.

TASK 2

Stating the four main methods of investment appraisal and its process

Capital budgeting: It may be served as financial or planning tool that assists in evaluating and

ranking the potential investment. By this, personnel of the client assess the profitability and viability

of the proposed investment in an effectual manner.

Process of capital budgeting: It involve five stages which will helps small sized business

organization in evaluating the profitability and worthiness of project. Thus, b taking into account

the following steps manager of two clients are become able to make suitable investment decision. Identification of potential opportunities: In the very first step of capital budgeting, clients

need to make assessment of all the investment opportunities which is available to them.

Moreover, in the present era there are lots of investment opportunities are available to the

business enterprise. In this, manager of the firm needs to identify all the investment option

which proves to be more beneficial for it (Libby and et.al., 2010). Evaluation of the investment options: Once opportunities have identified thereafter

manager of the firm needs to evaluate all the investment option which are highly suite d to

their vision and mission. Moreover, it is not possible for the firm to invest money in all the

project. Thus, manager makes evaluation of the option to determine the extent to which it is

highly realistic in the present time (Advantage and disadvantage of capital budgeting tools,

2016). Estimating the cash flows of benefits: At this stage, manager estimates the cash flow which

they will get by investing money in the particular project. Moreover, growth and success of

the firm is highly dependent on profitability which is earned by them. By keeping this fact in

mind investment manager undertakes several capital budgeting tools and technique. Payback

period, NPV, ARR and IRR are the most effectual techniques which help business

organization in making suitable decision (Libby and et.al., 2010). Selection of the project: In this, personnel makes evaluation of the viability of project on the

basis of the outcomes of different tools or techniques. Thus, in payback period business unit

needs to select the option which have less duration. On the basis of this, company is able is

able to recover the amount within the short span of time. On the contrary to it, in NPV,

ARR and IRR client needs to select the project which offer them high return after the

6

managing cash in the best possible manner.

TASK 2

Stating the four main methods of investment appraisal and its process

Capital budgeting: It may be served as financial or planning tool that assists in evaluating and

ranking the potential investment. By this, personnel of the client assess the profitability and viability

of the proposed investment in an effectual manner.

Process of capital budgeting: It involve five stages which will helps small sized business

organization in evaluating the profitability and worthiness of project. Thus, b taking into account

the following steps manager of two clients are become able to make suitable investment decision. Identification of potential opportunities: In the very first step of capital budgeting, clients

need to make assessment of all the investment opportunities which is available to them.

Moreover, in the present era there are lots of investment opportunities are available to the

business enterprise. In this, manager of the firm needs to identify all the investment option

which proves to be more beneficial for it (Libby and et.al., 2010). Evaluation of the investment options: Once opportunities have identified thereafter

manager of the firm needs to evaluate all the investment option which are highly suite d to

their vision and mission. Moreover, it is not possible for the firm to invest money in all the

project. Thus, manager makes evaluation of the option to determine the extent to which it is

highly realistic in the present time (Advantage and disadvantage of capital budgeting tools,

2016). Estimating the cash flows of benefits: At this stage, manager estimates the cash flow which

they will get by investing money in the particular project. Moreover, growth and success of

the firm is highly dependent on profitability which is earned by them. By keeping this fact in

mind investment manager undertakes several capital budgeting tools and technique. Payback

period, NPV, ARR and IRR are the most effectual techniques which help business

organization in making suitable decision (Libby and et.al., 2010). Selection of the project: In this, personnel makes evaluation of the viability of project on the

basis of the outcomes of different tools or techniques. Thus, in payback period business unit

needs to select the option which have less duration. On the basis of this, company is able is

able to recover the amount within the short span of time. On the contrary to it, in NPV,

ARR and IRR client needs to select the project which offer them high return after the

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

suitable time frame. Thus, by considering this selection criteria client is able to employ fund

in the appropriate project (Bennouna and et.al., 2010).

Implementation of the project: Once the project have been selected, thereafter client

requires to invest money in the specific option. Besides this, manager of the firm also has

accountability to make monitoring of the project that it is performing in the right direction

or not. Moreover, growth and success of the firm is highly associated with the effective

implementation of the project. Hence, by following all these stages business unit is able to

invest money in the best possible manner.

Methods of investment appraisal tools or techniques: According to the given case scenario two

clients of small sized business unit can use the following method while taking investment decisions

are as under:

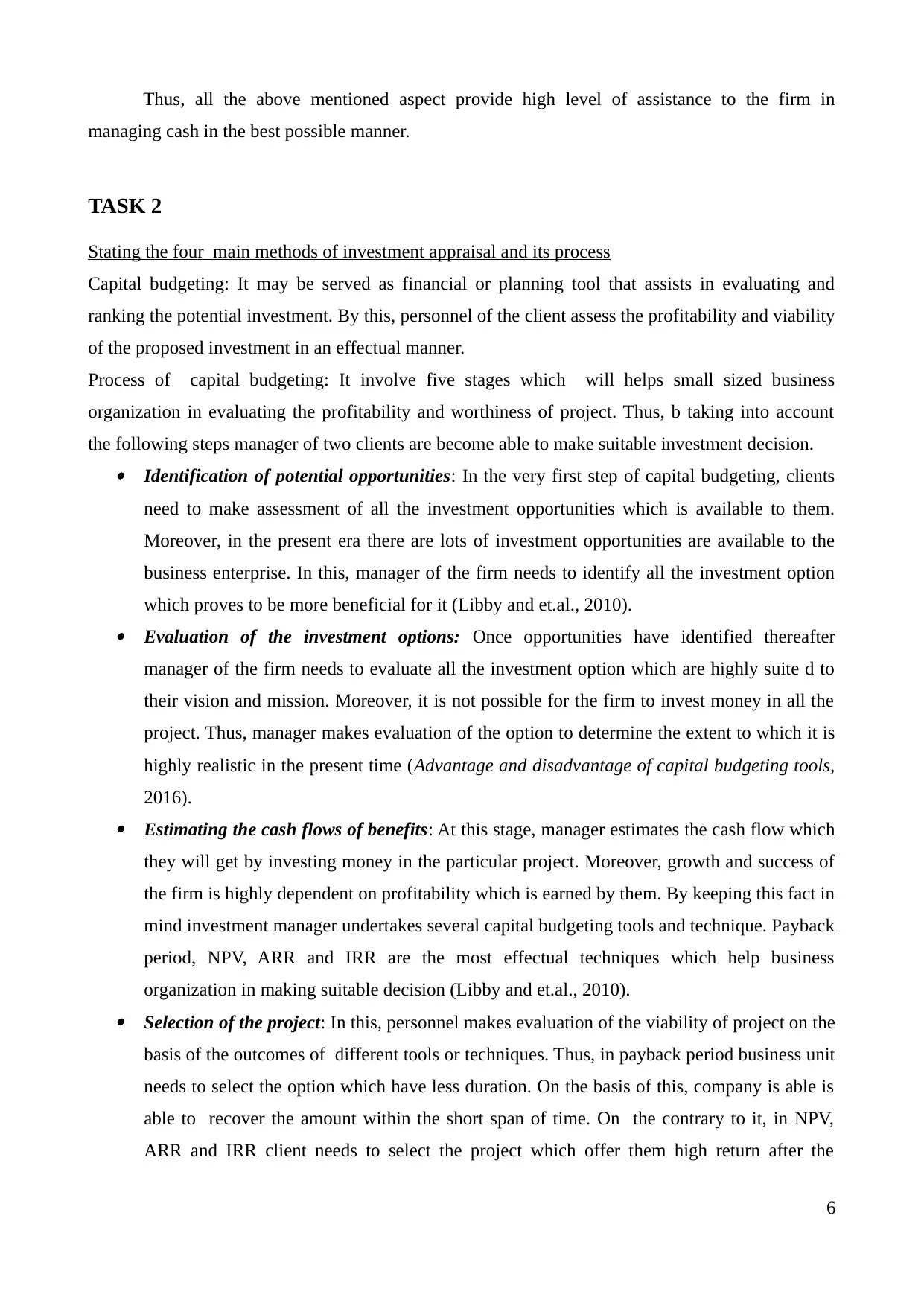

Payback period method: This method of capital budgeting provides deeper insight about the

time period within which business organization is able get back the money invested by them on a

initial basis. Moreover, in the dynamic business arena it is essential for the business entity to assess

the recovery period of the initial investment. It enables firm to make strategic plan which helps

them in getting success in the near future. In this, manager needs top select the project which have

less pay back period.

Advantages Disadvantages

Easy computation is one of the main factors

which encourages business organization to make

use of it for the investment purpose and planning

(Begley, 2013).

This method completely ignores the time value

of money concept which is highly significant for

the present time.

This tool helps in measure the risk to the large

extent. On the basis of this business unit can

prepare the competent strategies and policies.

It does not serve information about the cash flow

that firm will get after the predetermined time

period.

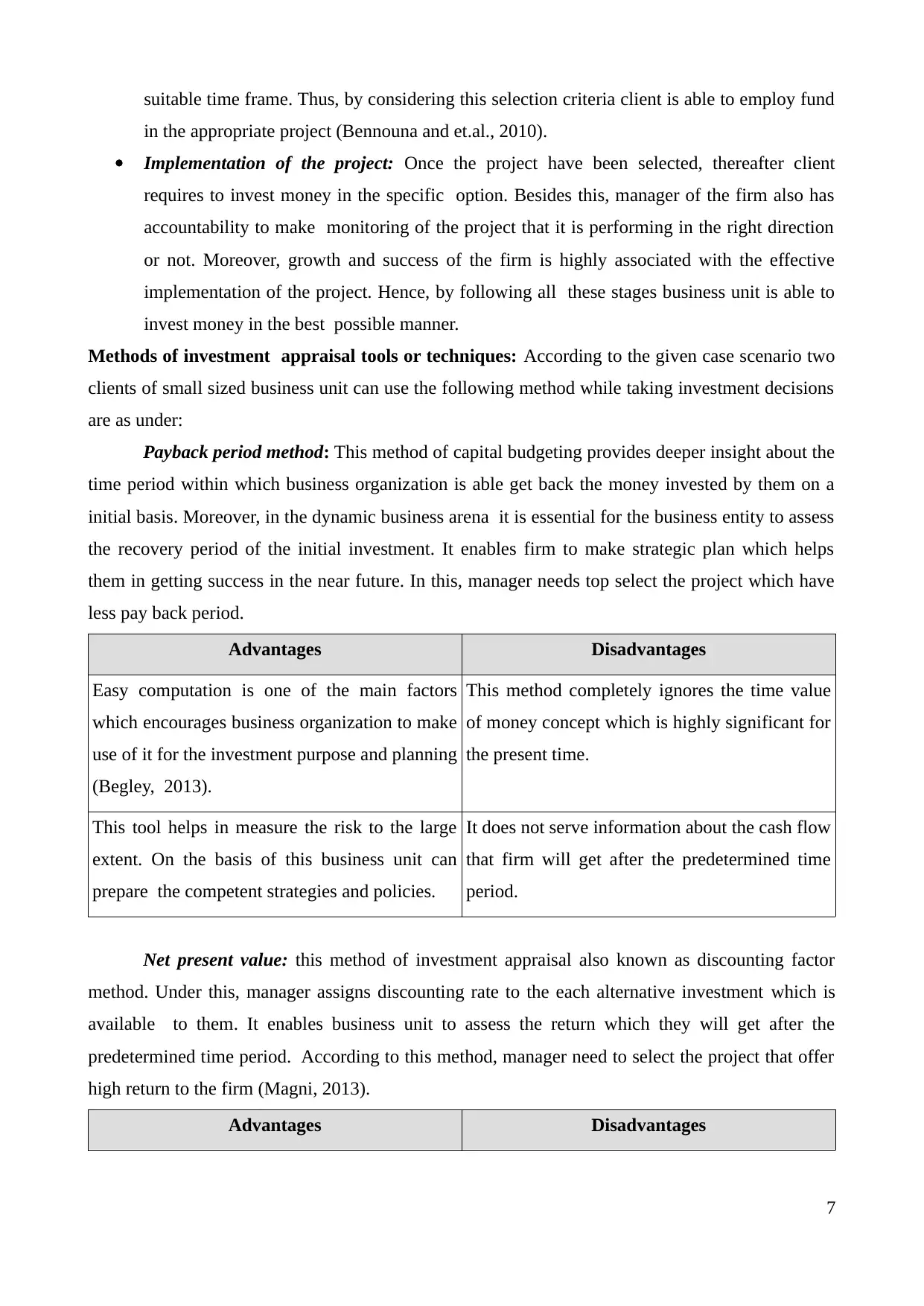

Net present value: this method of investment appraisal also known as discounting factor

method. Under this, manager assigns discounting rate to the each alternative investment which is

available to them. It enables business unit to assess the return which they will get after the

predetermined time period. According to this method, manager need to select the project that offer

high return to the firm (Magni, 2013).

Advantages Disadvantages

7

in the appropriate project (Bennouna and et.al., 2010).

Implementation of the project: Once the project have been selected, thereafter client

requires to invest money in the specific option. Besides this, manager of the firm also has

accountability to make monitoring of the project that it is performing in the right direction

or not. Moreover, growth and success of the firm is highly associated with the effective

implementation of the project. Hence, by following all these stages business unit is able to

invest money in the best possible manner.

Methods of investment appraisal tools or techniques: According to the given case scenario two

clients of small sized business unit can use the following method while taking investment decisions

are as under:

Payback period method: This method of capital budgeting provides deeper insight about the

time period within which business organization is able get back the money invested by them on a

initial basis. Moreover, in the dynamic business arena it is essential for the business entity to assess

the recovery period of the initial investment. It enables firm to make strategic plan which helps

them in getting success in the near future. In this, manager needs top select the project which have

less pay back period.

Advantages Disadvantages

Easy computation is one of the main factors

which encourages business organization to make

use of it for the investment purpose and planning

(Begley, 2013).

This method completely ignores the time value

of money concept which is highly significant for

the present time.

This tool helps in measure the risk to the large

extent. On the basis of this business unit can

prepare the competent strategies and policies.

It does not serve information about the cash flow

that firm will get after the predetermined time

period.

Net present value: this method of investment appraisal also known as discounting factor

method. Under this, manager assigns discounting rate to the each alternative investment which is

available to them. It enables business unit to assess the return which they will get after the

predetermined time period. According to this method, manager need to select the project that offer

high return to the firm (Magni, 2013).

Advantages Disadvantages

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It renders information that project will increase

the value or profitability of the firm or not.

Estimation about the cost of capital impose

problem in front of the investment manager.

NPV method makes use of time value of money

concept which have high level of importance in

the present business arena (Jonker and et.al.,

2014).

It express outcome in the monetary terms rather

than in terms of percentage.

This tool of capital budgeting clearly indicates

the risk in relation to the risk of future cash

flows.

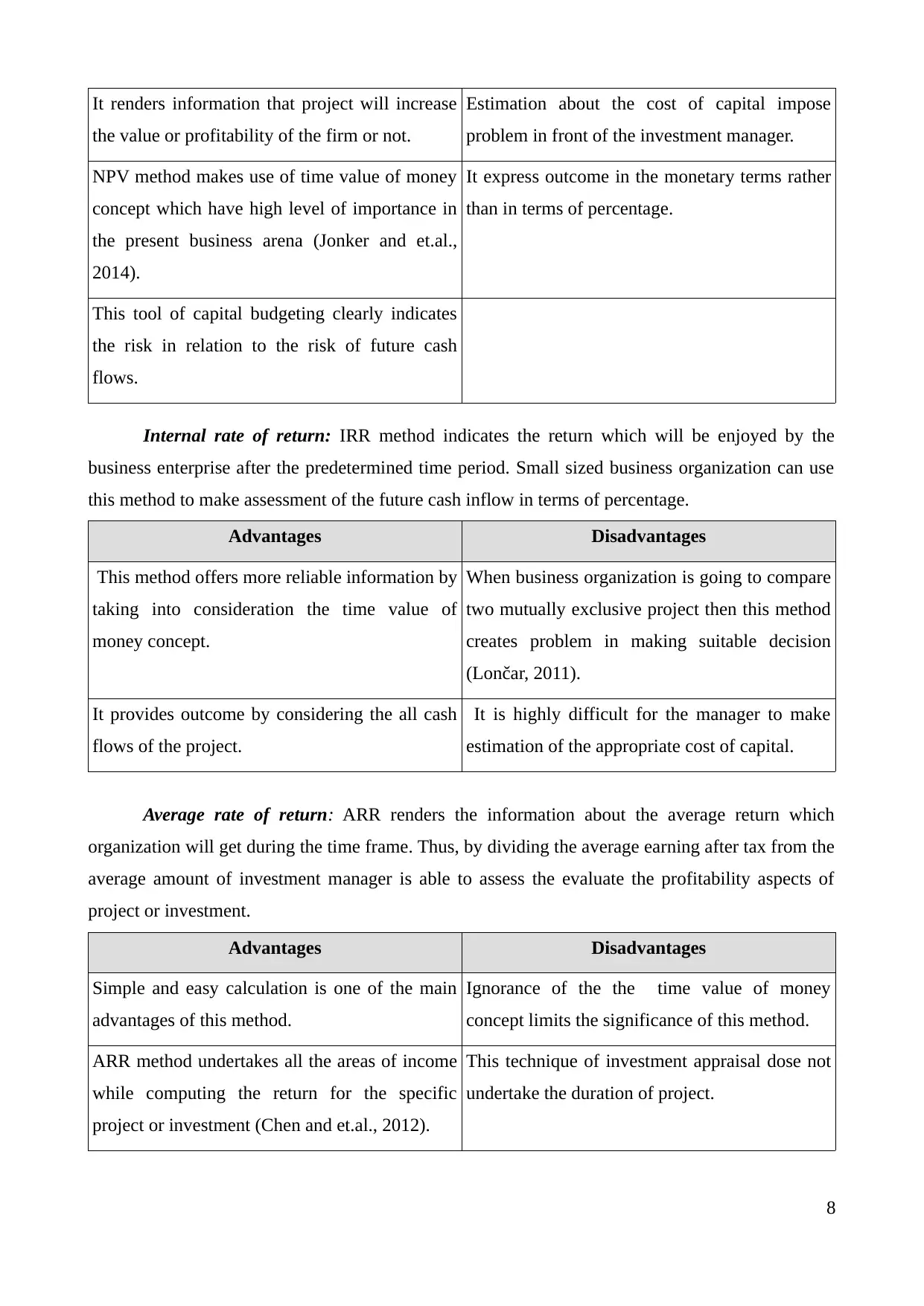

Internal rate of return: IRR method indicates the return which will be enjoyed by the

business enterprise after the predetermined time period. Small sized business organization can use

this method to make assessment of the future cash inflow in terms of percentage.

Advantages Disadvantages

This method offers more reliable information by

taking into consideration the time value of

money concept.

When business organization is going to compare

two mutually exclusive project then this method

creates problem in making suitable decision

(Lončar, 2011).

It provides outcome by considering the all cash

flows of the project.

It is highly difficult for the manager to make

estimation of the appropriate cost of capital.

Average rate of return: ARR renders the information about the average return which

organization will get during the time frame. Thus, by dividing the average earning after tax from the

average amount of investment manager is able to assess the evaluate the profitability aspects of

project or investment.

Advantages Disadvantages

Simple and easy calculation is one of the main

advantages of this method.

Ignorance of the the time value of money

concept limits the significance of this method.

ARR method undertakes all the areas of income

while computing the return for the specific

project or investment (Chen and et.al., 2012).

This technique of investment appraisal dose not

undertake the duration of project.

8

the value or profitability of the firm or not.

Estimation about the cost of capital impose

problem in front of the investment manager.

NPV method makes use of time value of money

concept which have high level of importance in

the present business arena (Jonker and et.al.,

2014).

It express outcome in the monetary terms rather

than in terms of percentage.

This tool of capital budgeting clearly indicates

the risk in relation to the risk of future cash

flows.

Internal rate of return: IRR method indicates the return which will be enjoyed by the

business enterprise after the predetermined time period. Small sized business organization can use

this method to make assessment of the future cash inflow in terms of percentage.

Advantages Disadvantages

This method offers more reliable information by

taking into consideration the time value of

money concept.

When business organization is going to compare

two mutually exclusive project then this method

creates problem in making suitable decision

(Lončar, 2011).

It provides outcome by considering the all cash

flows of the project.

It is highly difficult for the manager to make

estimation of the appropriate cost of capital.

Average rate of return: ARR renders the information about the average return which

organization will get during the time frame. Thus, by dividing the average earning after tax from the

average amount of investment manager is able to assess the evaluate the profitability aspects of

project or investment.

Advantages Disadvantages

Simple and easy calculation is one of the main

advantages of this method.

Ignorance of the the time value of money

concept limits the significance of this method.

ARR method undertakes all the areas of income

while computing the return for the specific

project or investment (Chen and et.al., 2012).

This technique of investment appraisal dose not

undertake the duration of project.

8

CONCLUSION

From this report, it can be articulated that there is significant difference take place in the

cash and profit. Besides this, it can be inferred that huge and unnecessary expenses are one the main

causes due to which the problem of cash shortage occurs in the business organization. It can be seen

in the report that budgeting and auditing is the most effectual tool which help in making effective

use of money to the significant level. Further, it can be concluded that investment appraisal process

helps client in investing money in an appropriate manner. Net present value is the most effectual

capital budgeting tool which helps manager in making highly realistic and profitable investment

decisions.

9

From this report, it can be articulated that there is significant difference take place in the

cash and profit. Besides this, it can be inferred that huge and unnecessary expenses are one the main

causes due to which the problem of cash shortage occurs in the business organization. It can be seen

in the report that budgeting and auditing is the most effectual tool which help in making effective

use of money to the significant level. Further, it can be concluded that investment appraisal process

helps client in investing money in an appropriate manner. Net present value is the most effectual

capital budgeting tool which helps manager in making highly realistic and profitable investment

decisions.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Lončar, D., 2011. Applicative model for appraisal of investment projects based on real options

methodology. Serbian Journal of Management. 6(2). pp.269-282.

Chen, C. and et.al., 2012. Robust constrained optimization of short-and long-term net present value

for closed-loop reservoir management. SPE Journal. 17(03). pp.849-864.

Magni, C.A., 2013. The internal rate of return approach and the AIRR paradigm: a refutation and a

corroboration. The Engineering Economist. 58(2). pp.73-111.

Ding, W. and et.al., 2013. Horizontal mergers with synergies: Cash vs. profit-share auctions.

International Journal of Industrial Organization. 31(5). pp.382-391.

Cheng, M.Y. and et.al., 2011. Evolutionary fuzzy decision model for cash flow prediction using

time-dependent support vector machines. International Journal of Project Management. 29(1).

pp.56-65.

Libby, T. and et.al., 2010. Beyond budgeting or budgeting reconsidered? A survey of North-

American budgeting practice. Management Accounting Research. 21(1). pp.56-75.

Bennouna, K. and et.al., 2010. Improved capital budgeting decision making: evidence from Canada.

Management decision. 48(2). pp.225-247.

Begley, T., 2013. Transition to adult care for young people with long-term conditions. British

Journal of Nursing. 22(9).

Jonker, J.G.G. and et.al., 2014. Carbon payback period and carbon offset parity point of wood pellet

production in the South‐eastern United States. GCB Bioenergy. 6(4). pp.371-389.

Online

Advantage and disadvantage of capital budgeting tools, 2016. [Online]. Available through:

<http://smallbusiness.chron.com/advantages-disadvantages-payback-capital-budgeting-

method-14206.html>. [Accessed on 5 May 2016].

10

Books and Journals

Lončar, D., 2011. Applicative model for appraisal of investment projects based on real options

methodology. Serbian Journal of Management. 6(2). pp.269-282.

Chen, C. and et.al., 2012. Robust constrained optimization of short-and long-term net present value

for closed-loop reservoir management. SPE Journal. 17(03). pp.849-864.

Magni, C.A., 2013. The internal rate of return approach and the AIRR paradigm: a refutation and a

corroboration. The Engineering Economist. 58(2). pp.73-111.

Ding, W. and et.al., 2013. Horizontal mergers with synergies: Cash vs. profit-share auctions.

International Journal of Industrial Organization. 31(5). pp.382-391.

Cheng, M.Y. and et.al., 2011. Evolutionary fuzzy decision model for cash flow prediction using

time-dependent support vector machines. International Journal of Project Management. 29(1).

pp.56-65.

Libby, T. and et.al., 2010. Beyond budgeting or budgeting reconsidered? A survey of North-

American budgeting practice. Management Accounting Research. 21(1). pp.56-75.

Bennouna, K. and et.al., 2010. Improved capital budgeting decision making: evidence from Canada.

Management decision. 48(2). pp.225-247.

Begley, T., 2013. Transition to adult care for young people with long-term conditions. British

Journal of Nursing. 22(9).

Jonker, J.G.G. and et.al., 2014. Carbon payback period and carbon offset parity point of wood pellet

production in the South‐eastern United States. GCB Bioenergy. 6(4). pp.371-389.

Online

Advantage and disadvantage of capital budgeting tools, 2016. [Online]. Available through:

<http://smallbusiness.chron.com/advantages-disadvantages-payback-capital-budgeting-

method-14206.html>. [Accessed on 5 May 2016].

10

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.